Assignment Bill French

-

Upload

rahulchohan2108 -

Category

Documents

-

view

216 -

download

0

Transcript of Assignment Bill French

-

8/14/2019 Assignment Bill French

1/5

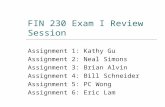

Aggregrate A B

Sales at Full capacity (units) 2000000

actual sales volume (units) 1500000 600000 400000

unit sale price($) 1.2 1.67 1.5

Total sales revenue($) 1800000 999999.96 600000Variable cost per unit($) 0.75 1.25 0.625

Total variable cost($) 1125000 750000 250000

Fixed costs($) 520000 170000 275000

Net profit($) 155000 80000 75000

Ratios:

Variable Cost to sales 0.63 0.75000003 0.42

Variable income to sales 0.37 0.24999997 0.58

Utilization of capacity(%) 75% 30% 20%

Contribution Margin 0.45 0.42 0.88

Break even point 1155556 404762 312500

Q2 Sales Volume of C increase by 450000 units

Sales Price of C increase by 100%

Fixed Cost increases by $ 10000 per month

A sales becomes 2/3

a)

Aggregrate A B

Sales at Full capacity (units) 2000000actual sales volume (units) 1750000 400000 400000

unit sale price($) 1.158 1.67 1.5

Total sales revenue($) 2026667 666667 600000

Variable cost per unit($) 0.56 1.25 0.625

Total variable cost($) 987500 500000 250000

Fixed costs($) 640000 170000 275000

Net profit($) 399167 -3333 75000

Ratios:

Variable Cost to sales 0.49 0.76 0.42

Variable income to sales 0.51 0.24 0.58

Utilization of capacity(%) 88% 20% 20%Contribution Margin 0.59 0.42 0.88

Break even point 1077787.00 408001.00 314286.00

b) Profit ($) 25000

Dividends ($) 50000

Extra Dividends ($) 25000

Income After Tax ($) 100000

Product Lines

Product Lines

-

8/14/2019 Assignment Bill French

2/5

Selling Price per unit ($) 1.158

Variable Cost per unit ($) 0.56

Contribution Margin per unit ($) 0.59

Income Before Tax ($) 200000

Total Fixed Cost ($) 840000

No. of Units to Be produced 1414595

c)

Aggregrate A B

Sales at Full capacity (units) 2000000

actual sales volume (units) 1750000 400000 400000

unit sale price($) 1.158 1.67 1.5

Total sales revenue($) 2026667 666667 600000

Variable cost per unit($) 0.61 0.264 0.641667

Total variable cost($) 1072866.67 105600 256666.7

c) Profit ($) 25000

Dividends ($) 50000

Income After Tax ($) 75000

Selling Price per unit ($) 1.158

Variable Cost per unit ($) 0.61

Contribution Margin per unit ($) 0.55

Income Before Tax ($) 150000

Total Fixed Cost ($) 790000

No. of Units to Be produced 1449465

d) Profit ($) 25000

Dividends ($) 50000

Extra Dividends ($) 25000

Income After Tax ($) 100000

Selling Price per unit ($) 1.158

Variable Cost per unit ($) 0.61

Contribution Margin per unit ($) 0.55

Income Before Tax ($) 200000

Total Fixed Cost ($) 840000

No. of Units to Be produced 1541204

Q3

Product Lines

Yes break even analysis can help in deciding if company should

alter the existing product emphasis by checking which all

products are giving least contribution margin to cover their

fixed cost

-

8/14/2019 Assignment Bill French

3/5

No. of units produced of C 950000

Sales Price ($) 0.8

Sales Revenue ($) 760000

Variable cost ($) 0.25

Total Variable Cost ($) 190000

Contribution Margin ($) 0.55

Fixed Cost ($) 195000Investment that can be done ($) 375000

Q4

The break even analysis helps understand and formulate the

relationship between costs (fixed and variable), output and

profit. The technique can be used to set sales targets and/or

prices to generate target profits. In a wide product range, the

analysis helps to find out which products are performing well

and which are leading to losses

-

8/14/2019 Assignment Bill French

4/5

C

500000

0.4

2000000.25

125000

75000

0

0.625

0.38

25%

0.15

500000

C

950000

0.8

760000

0.25

237500

195000

327500

0.32

0.68

48%0.55

354546.00

-

8/14/2019 Assignment Bill French

5/5

C

950000

0.8

760000

0.748

710600