ash Ameica EXCLUSIVE LISTING | 3 Portfolio...

Transcript of ash Ameica EXCLUSIVE LISTING | 3 Portfolio...

Cash America | 3 Portfolio LocationsOffering Memorandum

DOUG ARONSONMANAGING DIRECTOR

(954) 514-9477 [email protected]

West Palm Beach, FL Actual Site

EXCLUSIVE LISTINGOffering Memorandum

1

C A L K A I N .C O MC A L K A I N .C O M

Cash America (Three Location Portfolio) | FL & TN

Sold separately or as a portfolio

Cash America | 3 Portfolio LocationsOffering Memorandum

Tenant Overview 3

Portfolio Financial Summary 4

Location Overview 5

West Palm Beach, FL 6

Tampa, FL 10

Murfreesboro, TN (Nashville) 14

About Calkain 18

Contact Us 19

Table of Content

2

Cash America | 3 Portfolio LocationsOffering Memorandum

About Cash AmericaCash America International, Inc. provides specialty financial services to individuals in the United States at more than 900 locations in 20 states. They are the largest provider of secured non-recourse loans, commonly referred to as pawn loans, and operate under the brand names Cash America Pawn, Cashland and Cash America SuperPawn.

They also offer short-term cash advances in many of their locations, under the brand names Cash America Payday Advance and Cashland. In addition, check-cashing services are provided through their franchised and company-owned Mr. Payroll check-cashing centers.

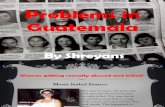

About First Cash - New Corporate ParentOn September 1, 2016 First Cash Financial Services, Inc. merged with Cash America International, Inc. to form FirstCash, Inc. On September 2, 2016 FirstCash began trading on the NYSE. FirstCash has over 2,000 retail and consumer lending locations in the U.S., Mexico, Guatemala and El Salvador making them a leading international operator of pawn stores.

FirstCash focuses on serving cash and credit constrained consumers through its retail pawn locations, which buy and sell a wide variety of jewelry, consumer electronics, power tools, household appliances, sporting goods, musical instruments and other merchandise, and make small consumer pawn loans secured by pledged personal property. Approximately 94% of the Company’s revenues are from pawn operations. FirstCash is a component company in both the Standard & Poor’s SmallCap 600 Index® and the Russell 2000 Index®.

Press Release FirstCash Reports Record Fourth Quarter and Full Year Results; Increases Quarterly Dividend and Issues 2018 Earnings OutlookFort Worth, Texas (February 1, 2018) -- FirstCash, Inc. (the “Company”) (NYSE: FCFS), a leading international operator of over 2,100 retail pawn stores in the U.S. and Latin America, today announced record revenue, net income and earnings per share for the fourth quarter and full year ended December 31, 2017. In addition, the Company announced that the Board of Directors increased the annualized dividend to $0.88 per share, or $0.22 per share quarterly, beginning with the dividend to be paid in February 2018, which represents a 16% increase over the $0.19 per share dividend paid in the first quarter of 2017.

Tenant Snapshot# of Locations

2,000+

Stock SymbolNYSE: FCFS

Credit RatingS&P: BB

3

Tenant Overview

Cash America | 3 Portfolio LocationsOffering Memorandum

Portfolio Financial Summary

Rent Schedule

Tenant City, State AnnualRent

Monthly Rent

Lease Commencement

Lease Expiration Options Increases

Cash America West Palm Beach, FL $149,040 $12,420 07/30/2017 07/29/2022 Two (2), Five (5) Yr 10% Every 5 Yrs

Cash America Tampa, FL $67,200 $5,600 03/01/2018 02/28/2023 Two (2), Five (5) Yr 5.35% - 6.80% Every 5 Yrs

Cash America Murfreesboro, TN $62,832 $5,526 02/01/2017 01/31/2022 One (1), Five (5) Yr 12% Every 5 Yrs

Total $279,072 $23,546

4

Sold separately or as a portfolio

Cash America | 3 Portfolio LocationsOffering Memorandum

A

A 1640 S Military Trail West Palm Beach FL

B 9631 N Nebraska Ave Tampa FL

C 320 SE Broad St Murfreesboro TN

West Palm Beach

C

B

Location Overview

Tampa

Murfreesboro

5

Cash America | 3 Portfolio LocationsOffering Memorandum

1640 S Military Trail | West Palm Beach, FL

Asking Price $1,948,235 | Cap Rate 7.65%

Net Operating Income (NOI) $149,040

Rent/Month $12,420

Rentable Square Feet5,059+/- SF Retail

3,280+/- SF Warehouse

Land Area 0.786+/- Acres

Tenant Name Cash America

Stock Symbol NYSE: FCFS

Credit Rating S&P: BB (Stable)

Guarantor Corporate

Ownership Type Fee Simple

Lease Type NNN

Landlord Responsibilities None

Store Opened 1990

Rent Commencement July 30, 2017

Lease Expiration July 29, 2022

Increases 10% Every 5 Years

Options Two (2), Five (5) Year

Rent Schedule

Term Increases Annual Rent Monthly Rent7/12/2012-7/29/2017 - $129,600 $10,800

7/30/2017-7/29/2022 15% $149,040 $12,420

7/30/2022-7/29/2027 (Option 1)

10% $163,944 $13,662

7/30/2027-7/29/2032 (Option 2)

10% $180,336 $15,028

Investment Highlights • South Florida asset with strong visibility

• Successful location for tenant (since 1990)

• Publicly traded company (NYSE: FCFS)

• Retail and warehouse building included

• Strong population density (123,441 households within 5 miles)

• High traffic count (42,500 VPD)

6

Financial Summary | West Palm Beach

Address1640 S Military Trail | West Palm Beach, FL

Subject Site

Cash America | 3 Portfolio LocationsOffering Memorandum

S Mili

tary

Trl 4

2,50

0 VP

D

Forest Hill Blvd 43,400 VPD

95

Palm Beach International Airport

West Palm Beach Golf Course

Forest Hill Community High School

S Con

gres

s Ave

36,

780

VPD

8

Cash America | 3 Portfolio LocationsOffering Memorandum

Radius 1 Mile 3 Miles 5 MilesPopulation2017 Population 29,203 144,925 330,339

2022 Population 31,019 152,720 349,902

2010-2017 Annual Rate 1.19% 1.01% 1.17%

2017-2022 Annual Rate 1.21% 1.05% 1.16%

2017 Male Population 48.7% 49.8% 49.6%

2017 Female Population 51.3% 50.2% 50.4%

2017 Median Age 34.2 36.2 37.8

Households2017 Total Households 10,268 50,485 123,441

2022 Total Households 10,831 52,871 130,151

2010-2017 Annual Rate 0.95% 0.72% 0.95%

2017-2022 Annual Rate 1.07% 0.93% 1.06%

2017 Average Household Size 2.84 2.81 2.64

Median Household Income2017 Median Household Income $38,535 $40,649 $41,846

2022 Median Household Income $41,476 $44,753 $47,052

2017-2022 Annual Rate 1.48% 1.94% 2.37%

Average Household Income2017 Average Household Income $49,327 $54,791 $59,278

2022 Average Household Income $56,186 $62,357 $67,901

2017-2022 Annual Rate 2.64% 2.62% 2.75%

Per Capita Income2017 Per Capita Income $17,539 $19,455 $22,426

2022 Per Capita Income $19,842 $21,941 $25,498

2017-2022 Annual Rate 2.50% 2.43% 2.60%

9

Demographics

Cash America | 3 Portfolio LocationsOffering Memorandum

9631 N Nebraska Ave | Tampa, FL 33612

Asking Price $896,000 | Cap Rate 7.50%

Net Operating Income (NOI) $67,200

Rent/Month $5,600

Rentable Square Feet3,960+/- SF Retail

3,895+/- SF Warehouse

Land Area 0.528+/- Acres

Tenant Name Cash America

Stock Symbol NYSE: FCFS

Credit Rating S&P: BB (Stable)

Guarantor Corporate

Ownership Type Fee Simple

Lease Type NN

Landlord Responsibilities Roof & Parking Lot

Store Opened 1990

Rent Commencement March 1, 2018

Lease Expiration February 28, 2023

Increases 5.35% - 6.80% Every 5 Years

Options Two (2), Five (5) Year

Investment Highlights • Tampa, Florida asset with strong visibility

• Successful location for tenant (since 1990)

• Publicly traded company (NYSE: FCFS)

• Retail and warehouse building included

• Strong population densisty (131,379 households within 5 miles)

• Traffic count (23,120 VPD)

Rent Schedule

Term Increases Annual Rent Monthly Rent3/1/2018-2/28/2023 - $67,200 $5,600

3/1/2023-2/28/2028 (Option 1)

5.35% $70,800 $5,900

3/1/2028-2/28/2033 (Option 2)

6.80% $75,600 $6,300

10

Financial Summary | Tampa

Address9631 N Nebraska Ave | Tampa, FL 33612

Subject Site

Cash America | 3 Portfolio LocationsOffering Memorandum

N Ne

bras

ka A

ve 2

3,12

0 VP

D

I-275

139

,500

VPD

E Busch Blvd 47,000 VPD

ChamberlainHigh School

41

275

12

Cash America | 3 Portfolio LocationsOffering Memorandum

Radius 1 Mile 3 Miles 5 MilesPopulation2017 Population 17,616 131,613 330,825

2022 Population 18,779 139,529 350,686

2010-2017 Annual Rate 1.03% 0.88% 0.90%

2017-2022 Annual Rate 1.29% 1.17% 1.17%

2017 Male Population 50.2% 48.8% 48.3%

2017 Female Population 49.8% 51.2% 51.7%

2017 Median Age 34.2 34.7 34.6

Households2017 Total Households 6,226 50,226 131,379

2022 Total Households 6,612 53,131 139,057

2010-2017 Annual Rate 0.89% 0.75% 0.82%

2017-2022 Annual Rate 1.21% 1.13% 1.14%

2017 Average Household Size 2.78 2.53 2.45

Median Household Income2017 Median Household Income $32,030 $35,694 $37,010

2022 Median Household Income $34,131 $38,338 $40,238

2017-2022 Annual Rate 1.28% 1.44% 1.69%

Average Household Income2017 Average Household Income $43,445 $50,337 $54,198

2022 Average Household Income $49,365 $57,592 $62,087

2017-2022 Annual Rate 2.59% 2.73% 2.76%

Per Capita Income2017 Per Capita Income $16,159 $20,008 $22,093

2022 Per Capita Income $18,164 $22,698 $25,146

2017-2022 Annual Rate 2.37% 2.55% 2.62%

13

Demographics

Cash America | 3 Portfolio LocationsOffering Memorandum

320 SE Broad St | Murfreesboro, TN 37130

Asking Price $837,760 | Cap Rate 7.50%

Net Operating Income (NOI) $62,832

Rent/Month $5,236

Rent/SF $13.31

Rentable Square Feet 4,720+/- SF Retail

Land Area 0.471+/- Acres

Tenant Name Cash America

Stock Symbol NYSE: FCFS

Credit Rating S&P: BB (Stable)

Guarantor Corporate

Ownership Type Fee Simple

Lease Type NN

Landlord Responsibilities Roof & Structure

Store Opened 2007

Rent Commencement February 1, 2017

Lease Expiration January 31, 2022

Increases 12% Every 5 Years

Options One (1), Five (5) Year

Rent Schedule

Term Increases Annual Rent Monthly Rent2/1/2007-1/31/2012 - $51,000 $4,250

2/1/2012-1/31/2017 10% $56,100 $4,675

2/1/2017-1/31/2022 (Option 1)

12% $62,832 $5,236

2/1/2022-1/31/2027 (Option 2)

12% $70,368 $5,864

Investment Highlights • Publicly traded company (NYSE: FCFS)

• Nashville MSA

• 12% rent bumps in options

• Successful location for tenant (since 2007)

• Population density (50,723 households within 5 miles)

• Excellent visibility on US-41 (33,210 VPD)

• 2 miles to Middle Tennessee State University

14

Financial Summary | Nashville MSA

Address320 SE Broad St | Murfreesboro, TN

Subject Site

Cash America | 3 Portfolio LocationsOffering Memorandum

SE Broad St 33,210 VPD

Stones River Mall

McFadden School of Excellence

41

24

16

Cash America | 3 Portfolio LocationsOffering Memorandum

Radius 1 Mile 3 Miles 5 MilesPopulation2017 Population 9,022 63,590 131,050

2022 Population 9,708 68,697 145,739

2010-2017 Annual Rate 1.14% 1.13% 1.94%

2017-2022 Annual Rate 1.48% 1.56% 2.15%

2017 Male Population 49.7% 50.2% 49.4%

2017 Female Population 50.3% 49.8% 50.6%

2017 Median Age 30.9 28.6 32.0

Households2017 Total Households 4,090 25,182 50,723

2022 Total Households 4,419 27,282 56,458

2010-2017 Annual Rate 1.22% 1.18% 1.96%

2017-2022 Annual Rate 1.56% 1.61% 2.17%

2017 Average Household Size 2.10 2.36 2.50

Median Household Income2017 Median Household Income $24,219 $37,591 $53,195

2022 Median Household Income $25,592 $41,549 $59,937

2017-2022 Annual Rate 1.11% 2.02% 2.42%

Average Household Income2017 Average Household Income $38,483 $54,730 $70,513

2022 Average Household Income $44,318 $63,886 $81,053

2017-2022 Annual Rate 2.86% 3.14% 2.83%

Per Capita Income2017 Per Capita Income $18,489 $22,614 $27,691

2022 Per Capita Income $21,147 $26,208 $31,704

2017-2022 Annual Rate 2.72% 2.99% 2.74%

17

Demographics

Cash America | 3 Portfolio LocationsOffering Memorandum

DOUG ARONSONMANAGING DIRECTOR

(954) 514-9477 [email protected]

Who Are We? Calkain Companies LLC is a national commercial real estate firm that provides consulting and brokerage services to both private and institutional clientele with an expertise on triple net lease investments. We pride ourselves on being a world class leader by providing our clients a full array of commercial real estate investment brokerage and asset management solutions, including advisory, research, estate planning and wealth management.

We have built solid relationships throughout our decades of experience and innovation, implementing long-term allocation within the context of each client’s particular risk tolerance and identifying how best to acquire and dispose of income producing properties for each entities’ specific set of investment criterion. At Calkain, our foresight and past performance are leading the net lease investment industry.

Our HistoryLike most success stories, Calkain was formulated from humble beginnings. Jonathan W. Hipp, President and CEO, took the initiative to build upon his decades of experience and performance and left a large international brokerage firm to become an independent and innovative leader within the triple net lease investment community. Armed with a sole employee and a single office, the firm has grown exponentially since its infancy in 2005.

With the growth in staff, seasoned professionals have been attracted to Calkain’s model of innovation, entrepreneurship and the fostering of long-lasting and meaningful relationships. Industry experts have joined Calkain in the hopes of implementing the skills they have honed in complementary aspects of real estate investment.

Through a tremendous endeavor, tireless hours have been committed to continually prove that Calkain is America’s Net Lease Company®. Its countless accolades received from the world’s leading business publications, including Forbes™, Fortune™ and the New York Times™ have confirmed that Calkain is a true leader in triple net lease investing services.

Client Testimonial

“USRA has worked with Calkain on numerous occasions. They have always been meticulous in their work ethic, providing superior service and extremely prompt attention to our needs. I highly recommend them.

- Jack Genende, Partner | U.S. Realty Advisors, LLC. (USRA)

$11.5 Billion in Closed Transactions

$350 Million

in Active Listings

18

C A L K A I N .C O MC A L K A I N .C O M

About Calkain

DISCLAIMER: The information contained in this document is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Calkain and its subsidiaries, and should not be made available to any other person or entity without the written consent of Calkain. This document has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property(s). The information contained herein is not a substitute for a thorough due diligence investigation. Calkain and its subsidiaries have not made any investigation, and make no warranty or representation, with respect to the income or expenses for the subject property(s), the future projected financial performance of the property, the size and square footage of the property(s) and improvements, the presence or absence of contaminating substances, PCB’s or asbestos, the compliance with State and Federal regula-tions, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property(s). The information contained in this document has been obtained from sources we believe to be reliable; however neither Calkain and its subsidiaries nor the Seller have verified, and will not verify, any of the information contained herein, nor has Calkain and its subsidiaries or the Seller conducted any investigation regarding these matters and make no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein.

Corporate Headquarters Washington, DC12930 Worldgate Drive | Suite 150 Herndon, VA 20170 T: (703) 787-4714 • F: (703) 787-4783

Fort Lauderdale200 SW 1st Avenue | Suite 880 Fort Lauderdale, FL 33301 T: (813) 282-6000

Atlanta111 Village Parkway, Building 2 | Suite 202 Marietta, GA 30067 T: (404) 900-5629

Boston101 Federal Street | Suite 1900 Boston, MA 02110 T: (617) 261-8584

CALKAIN.COM

Contact Us