ARYAVART GRAMIN BANK › tender_pdf › AGB_Financial... · aryavart gramin bank head office...

Transcript of ARYAVART GRAMIN BANK › tender_pdf › AGB_Financial... · aryavart gramin bank head office...

ARYAVART GRAMIN BANK

HEAD OFFICE

A-2/46, VIJAY KHAND,

GOMTI NAGAR, LUCKNOW

REQUEST FOR PROPOSAL

FOR END TO END

FINANCIAL INCLUSION SOLUTION

Ref: AGB/HO/IT/FIS/01

Date 07-06-2010

Page 2 of 72

RFP – Financial Inclusion

Solution

PART 1: INVITATION TO BID This Request for Proposal (RFP) is to invite proposals from eligible bidders for providing end-to-end solution on per account/per transaction basis for technology based Financial Inclusion Solution (FIS). This is to be implemented in command areas of branches. Bank desires to implement the FIS through single bidder with multiple solutions in different command areas of branches / villages / blocks / districts / cities in Uttar Pradesh as per the terms & conditions of RFP. The proposed solution comprises of the following –

1) Bidder/s should be a total solution provider (System Integrator) having a tested and proven technology, capable of providing an end-to-end solution on turnkey basis for the project including but not limited to providing the required hardware, software, network connectivity, database, Aggregation Server, middleware, firewall. anti-virus, servers, smart cards, hand-held devices, laptops, printers, communication equipments, data cards, mobiles , third party utilities, engaging & managing of Business Correspondents (BCs), Facility Management & management systems for BCs, Smart Card, Management Information System (MIS), enrolment system, etc.; and installation, testing, commissioning, maintenance, providing interface with back-end solution to Bank’s core banking solution (Finacle).

2) The Financial Inclusion Solution should be highly secured Smart Card based and/or

Mobile based.

3) Proposed solutions must be proven field tested and field upgradeable technology.

4) Proposed end-to-end solution (all Hardware, Software etc) should at all time be compliant with current standards / guidelines issued by Government / RBI / IBA / IDRBT authorities and/or other statutory authorities with regard to FIS.

5) Locations :

FIS is required for command areas of different branches / villages / blocks in

Lucknow, Barabanki, Unnao, Harodi, Farrukhabad, Kannauj, and Faizabad

districts of Uttar Pradesh, to be implemented in phases over a period of two years.

(Many of the branches are located in Rural/Semi-Urban areas.)

The Bank reserves the right to change the command areas / locations & number of

branches / villages / blocks / districts / cities for FIS implementation as per Bank’s

requirements.

6) The bidder should commit to provide services for implementation / rolling-out /

support / maintenance of proposed FIS for a minimum period of 5 years. A certificate

to this effect should form a part of the Technical proposal.

The Bidding Document may be obtained from the Bank as under or downloaded from Bank’s website http://www.aryavart-rrb.com/tenders.html and the bid should be submitted on or before the due date and time brought out in the bidding document at the office of Aryavart Gramin Bank, Information Technology Department, Head office, A-2/46, Gomti Nagar, Lucknow - 226010.

Please note that all the information desired needs to be provided. Incomplete information may lead to non-selection.

A two envelope bidding procedure (Technical Bid & Price Bid) will be followed for each solutions (Smart Card based & Mobile based) separately. (Apart from a separate envelope of Bid amount as stated below).

Page 3 of 72

RFP – Financial Inclusion

Solution

All Bids should be accompanied by Bid Security as specified in the Bid document.

A non refundable bid amount of Rs. 10,000/- to be paid by means of a demand draft / pay order favouring "Aryavart Gramin Bank” payable at Lucknow. If bid downloaded from website, the cost of the bid may be paid in a separate envelope while submitting the Bid. Bids are liable to be rejected if the Bid Amount demand draft / pay order is not received.

Date and Time of commencement

of bid

Monday, 07-06-2010 from Bank’s web

site

Last Date and Time for Receipt of

Bids at AGB (Address as given

below)

Monday, 28-06-2010 by 5.30 p.m. on

that day

Date and Time of opening of

Technical Bids

Wednesday, 30-06-2010 at 10.30 a.m.

on that day

Date and time of opening of Price

Bids and technical presentation

Will be advised separately

Contact Person 1) Sri Y. P. Bhadula, Senior Manager,

Planning and MIS

2) Sri Vipul Awasthi, In-Charge,

Information and Technology

Address for Communication and

submission of bid.

Aryavart Gramin Bank,

Head Office,

A-2/46, Vijay Khand, Gomti Nagar, Lucknow - 226010.

Phone Numbers: 0522 – 6455037, 34,

35

Fax Number: 0522 – 2392986

Email: [email protected]

Bid Document Availability

Bidding Document to be downloaded from Bank’s web-site http://www.aryavart-rrb.com/tenders.html

Bank reserves the right to change the dates, timings mentioned above or in the RFP, which will be communicated by placing the same as corrigendum under Tender section on Bank’s web-site.

PART – 2 DISCLAIMER

The information contained in this Request for Proposal (RFP) document or

information provided subsequently to bidder(s) or applicants whether verbally or in

documentary form by or on behalf of Aryavart Gramin Bank (Bank), is provided to

the bidder(s) on the terms and conditions set out in this RFP document and all other

terms and conditions subject to which such information is provided. This RFP is

neither an agreement nor an offer and is only an invitation by Bank to the interested

parties for submission of bids. The purpose of this RFP is to provide the bidder(s)

with information to assist the formulation of their proposals. This RFP does not claim

to contain all the information each bidder may require. Each bidder should conduct

its own investigations and analysis and should check the accuracy, reliability and

completeness of the information in this RFP and where necessary obtain

independent advice. Bank makes no representation or warranty and shall incur no

liability under any law, statute, rules or regulations as to the accuracy, reliability or

completeness of this RFP. Bank may in its absolute discretion, but without being

Page 4 of 72

RFP – Financial Inclusion

Solution

under any obligation to do so, update, amend or supplement the information in this

RFP.

PART-3.: INSTRUCTIONS FOR BIDDERS (IFB)

TABLE CLAUSES

Clause No.

Topic Clause No.

Topic

A. Introduction 3.18 Deadline for Submission of Bids

3.1 General 3.19 Late Bids

3.2 Broad Scope of Work 3.20 Modification & Withdrawal of Bids

3.3 Consortium E. Bid Opening and Evaluation

3.4 Eligibility Criteria 3.21 Opening of Technical Bids by the Bank

3.5 Cost of Bidding. 3.22 Preliminary Examination

B. Bidding Documents 3.23 Technical Evaluation

3.6 Content of Bidding Documents

3.24 Opening of Price Bids

3.7 Clarification of Bidding Documents

3.25 Contacting the Bank

3.8 Amendment of Bidding Documents

F. Award of Contract

C. Preparation of Bids 3.26 Post qualification/ Identification of L1

3.9 Language of Bid 3.27 Bank’s Right to Accept Any Bid and to Reject Any or All Bids

3.10 Format and Signing of Bid 3.28 Award Criteria

3.11 Documents comprising the Bid

3.29 Notification of Award

3.12 Bid Submission 3.30 Signing of Contract

3.13 Bid Prices 3.31 Performance Security

3.14 Bid Currencies 3.32 Form C

3.15 Bid Security 3.33 Pre-Bid Meeting

3.16 Period of Validity of Bids

D. Submission of Bids

3.17 Sealing and Marking of Bids

Page 5 of 72

RFP – Financial Inclusion

Solution

3. INSTRUCTIONS FOR BIDDERS (IFB) A. INTRODUCTION 3.1 General 3.1.1 The Bank is leading Gramin Bank in the state of Uttar Pradesh. The bank is

sponsored by Aryavart Gramin Bank. It has 306 Branches & 6 Regional Offices

operating chiefly in 6 districts, viz., Lucknow, Barabanki, Farrukhabad, Hardoi,

Kannauj, and Unnao of U.P. Few of its branches are also in Faizabad district of U.P.

All the branches are computerised. Bank has 2 branches on Core Banking

platform and remaining Branches (304) of the Bank are going to be migrated on

Core Banking platform by the August 2010. The CBS application software is Finacle

of Infosys Technologies Ltd.

3.1.2 The Bank wishes to extend the banking services in un-banked/under-banked areas

under the Financial Inclusion initiative. The objective is to ensure through financial inclusion the reach of financial services to the excluded segment.

3.1.3 Bank is looking for a cost effective solution to be implemented in different command

areas of branches / villages / blocks / districts / cities / regions under its area of operation as a Financial Inclusion initiative.

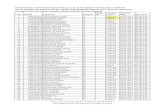

3.1.4 Bank’s FI Road Map -

FIS is required for command areas of different branches / villages / blocks / districts /

cities / regions to be implemented in phases over two years. Most of the branches

are located in Rural / Semi-Urban areas. Bank proposes to open accounts and

provide basic banking services including credit linkage to the excluded population as

under:

Year Estimated Number of existing customers to be transferred to BCs from branches

Proposed opening of accounts to be achieved

Estimated Total accounts of GCC/SCC/JLG to be achieved

Micro Insurance Products

Estimated No. of Financial Transactions per year (approx. 24 Transactions per a/c per year)

Estimated Number of Rural/Semi-Urban Branches in command areas

2010-2011

5,00,000 3,50,000 15,000 10,000 2,10,00,000 306

2011-2012

6,00,000 5,00,000 15,000 10,000 4,80,00,000 333

3.2. Broad Scope of Work:

1) Bidder/s should be a total solution provider (System Integrator) having a tested and

proven technology, capable of providing an end-to-end solution on turnkey basis for the project including but not limited to providing the required hardware including Test and Development Server, software, network connectivity, database, Aggregation Server, middleware, firewall, anti-virus, servers, smart cards, hand-held devices, laptops, printers, communication equipments, data cards, mobiles , third party utilities, customization, engaging & managing of Business Correspondents (BCs), Facility Management & management systems for BCs, Smart Card, Management Information System (MIS), enrollment system, etc.; and installation, testing, commissioning, maintenance, providing interface with back-end solution to Bank’s core banking solution (Finacle).

Page 6 of 72

RFP – Financial Inclusion

Solution

2) The Financial Inclusion Solution should be highly secured Smart Card based and/or Mobile based.

3) FIS implementation should be on turnkey basis providing end-to-end solutions including supply, install, operation, maintain, support of all necessary infrastructure (Hardware / Software / Aggregation Server / Smart Card / Management Services, etc.) and engaging / managing of Business Correspondent for successful implementation of proposed FIS and achieving Bank’s FI road map well in time.

4) FIS will be OPEX (Operating Expenses) based model where Bank would pay charges, based on –

a. Per transfer of existing customer to BCs (Considering customer enrolment procedure as per the Bank’s requirement

which includes capturing of KYC data, photo / image of the identified customer, his/her figure prints of all fingers of both hands, Mobile Registration, Upload the enrolment data at Aggregation Server etc)

And

b. per new customer enrolment (Considering identifying of potential customer, Complete the customer

enrolment procedure as per the Bank’s requirement which includes filling of account opening forms, verification of primary information/data, capturing of KYC data, photo / image of the identified customer, his/her figure prints of all fingers of both hands, De-duplication, Mobile Registration, Upload the enrolment data at Aggregation Server etc)

And

c. per financial transaction happened through Delivery Channels .i.e. Handheld Devices like Point-of-Terminal (POT) etc.

(Considering cost of all hardware/software/applications/ devices etc. & BCs / Facility Management etc. activities at Field (for BCs) / DC / DRC, Charges of BCs, etc., associated with end-to-end implementation of FIS) (Financial transactions are other than the Balance Enquiry and Mini Statement which are part of the service.)

And

d. The cost of the Smart Card will be paid by the Bank separately. (Considering procurement, supply, issue, personalization with fingerprints, digital photo, other data, deliver of Smart Card to respective customer in person, Card/Key Management etc.)

5) Smart Card based FIS should consist of Delivery Channels i.e. Handheld Devices like Point-of-Terminal (POT) etc. (both online & offline) , Printer, Web/Digital-Camera, Smart Card (Contact-Less) Reader, Biometric Scanner/Reader & Authentication, SIM, Data Card, Aggregation Server, Communication Equipments, Supply / Issue / Personalization / Delivery of Smart Card ( Contact-Less), Customer Enrollment, BC Engagement & Management, Card Management, Facility Management, MIS / Report Tools & Management, etc.

6) Mobile based FIS should consist of Delivery Channels like Mobile Set, Printer, Enrolment Kit, SIM, Aggregation Server, Communication Equipments, Customer Enrollment preferably with Biometrics Authentication, Mobile Registration, BC Engagement & Management, Facility Management, MIS/Report Tools & Management, etc.

7) Both Smart Cards based and Mobile based FIS would be evaluated separately. Bank reserves the right to select either Smart Card based FIS or Mobile based FIS or both the FIS for implementation as per Bank’s requirements.

Page 7 of 72

RFP – Financial Inclusion

Solution

8) Bidder to maintain Aggregation Server capable of accepting enrollment details (KYC Data, fingerprints, etc.) and transaction from various devices deployed for FIS. Data Centre and Data Recovery Centre is to be provided and maintained by the bidder.

9) The Bidder should provide the required structure, systems-architecture and processes with requisite hardware and software resources for the proposed FIS.

10) Proposed solutions must be proven field tested and field upgradeable inter-operable technology.

11) Proposed FIS should be capable to support multiple products including deposits, loans, third party products like insurance, Government Payments (Pension, wages under National Rural Employment Guarantee Scheme) etc.

12) Proposed FIS should support multiple banking activities like

Opening of Deposit accounts including NO FRILL accounts

Balance Enquiry, Mini statement etc.

Cash deposit

Cash withdrawal

Multiple Debits / Credits Transfer facility

Remittance, Funds Transfer

Pension Payments

Any other functions like disbursal of pensions, NREGA Payments, other government disbursals etc.

Account closure etc

Bulk Uploading /downloading facility for accounts/transactions

General Purpose Credit Card (GCC), Samanya Card, Joint Liability Groups, Kissan Credit Cards (KCC) etc.

Loan/OD A/c opening, disbursement, repayment, recovery etc.

Sale & servicing of Insurance products

13) Bidder to provide a proper MIS to capture data in respect of number and names of

villages covered, number of beneficiaries provided with smartcards/biometric access/mobile phones, number of persons receiving government payments through RBI proposed Electronic Benefit Transfer (EBT), level of credit dispensation, recovery, transactions, savings etc. on periodical basis. The MIS will be used for effective monitoring, undertaking mid-term correction, if required, for achievement of planned target. Distinctive feature of MIS in FIS is that it will be upstream where required reports will be generated at the level of monitoring and controlling authorities.

14) Bidder to customize / parameterize the solution / software to meet the Bank’s requirements including MIS, Accounting & Settlement procedures.

15) Bidder should be ready to implement & support proposed FIS at any command areas of identified branches / villages / blocks / districts / cities in Uttar Pradesh, as per the Bank’s requirements from time to time.

16) Bidder should have own franchisee / support service centres with requisite technical support & technical personal to provide prompt and efficient service. This should in particular be available at the rural/semi-urban areas, villages, blocks, districts, cities identified by Bank where the Bidder is required to implement the proposed FIS.

17) Proposed FIS should be scalable to meet Bank’s FI road map and take care of customer & transaction growth during the contract period. Proposed FIS should be inter-operable across technologies and solutions. It should be Device-agnostic and network-agnostic.

18) Proposed FIS should support both On-line and Off-Line mode transactions.

Page 8 of 72

RFP – Financial Inclusion

Solution

19) The most complex transaction under peak load should be completed within reasonable time not exceeding 5 seconds, with the resource utilization not crossing 70%.

20) Bidder to procure & maintain inventory of Smart Cards, issue Smart Cards, personalization of Smart Card, delivery of Smart Card, Card Management, Key Management, etc.

21) Bidder to issue, personalize, deliver new smart card as a replacement, in case of loss / damage / non-functioning etc. of existing cards only after the prior approval of Bank and proper card management. No card charges will be paid by Bank for such replacement.

22) Bidders are required to identify, engage and maintain Business Correspondents (BCs) for field level activities like Identify potential customer, enrolment of customers, customer transactions, etc.

23) Bank reserves the right to engage BCs to expedite in achieving volume of Bank’s FI road map. Bidder to provide all necessary hardware / handheld devices / communication equipments / software / application / connectivity / assistance / training / smart card etc. to such Bank appointed BCs for their enrolment & field level activities.

24) In addition to transactions through BCs, customers may be allowed to transactions through the handheld devices /machines at the branches as well. Bidder to provide all necessary hardware / handheld devices / communication equipments / software / application / connectivity / assistance / training / smart card etc. to branches of Bank at no extra cost to the Bank.

25) It is the sole responsibility of the Bidder to impart necessary technical / functional training to BCs as well as Bank’s Staff to handle FIS & devices. Bidder to provide user manual, training material etc. during the training.

26) Bidder should take adequate insurance policy from time to time against theft/misappropriation etc., committed by BCs and should be assigned in favour of Bank.

27) Data pertaining to enrolment process, transaction process as well as the data that is stored at various points need to be appropriately secured as per minimum standard 128 Bit 3 DES encryption.

28) Bidder should possess proper licenses, wherever applicable, for hardware / software / third party utilities etc., provided to the Bank for end-to-end FIS. Licenses including corporate licenses should also be for rolling out the proposed end-to-end FIS in any locations and number of identified branches / zones / villages / blocks / cities / districts with no upper limit either for locations or for equipments.

29) Proposed end-to-end solution (all Hardware, Software etc) should at all time be compliant with standards / guidelines issued by Government / RBI / IBA / IDRBT authorities and/or other statutory authorities with regard to FIS.

30) The bidder should commit to provide services for implementation, roll-out, support, maintenance etc. for the proposed FIS for a Contract Period of minimum 5 years. A certificate to this effect should form a part of the Technical proposal. Continuing the services / maintenance for the proposed FIS beyond 5 years is at the sole discretion of the Bank.

31) Successful Bidder/s to do Pilot Project initially in command areas of two centres of branches / villages / blocks / districts / cities identified by Bank to show application functionality & capabilities of proposed FIS, at Bidder’s cost. During the Pilot Project Bidder to demonstrate all applications, services, associated features & functionalities mentioned in RFP to be delivered to the Bank. The tenure of pilot project will be 3 months.

Page 9 of 72

RFP – Financial Inclusion

Solution

32) During the pilot project the Bank may review the technical/functional/procedural aspects of FIS requested in this RFP and come out with changes / customization which Bidder has to address / resolve / change during the period of Pilot Project without any extra cost to the Bank. All requirements of the Bank should be complied in Pilot Project itself.

33) After successful completion of Pilot Project by Bidder and its acceptance by Bank, Bank would issue work order for implementing / rolling-out FIS (Smart Card based / Mobile based as the case may be) in command areas of identified branches / villages / blocks / districts / cities as per the Bank’s requirements and as per the terms & conditions of RFP.

34) Contract Period for implementation / roll-out / support / maintenance of proposed end-to-end FIS would start from the date of completion of Pilot Project successfully by the Bidder and its acceptance by the Bank.

35) Bidder to ensure that faults / issues / defects etc. and failures intimated by Bank through any mode of communication like call / e-mail / fax etc. are to be set right as under –

1) At Aggregation Server (at DC & DR):

a) Bidder has to maintain “Mean Time To Restore”(MTTR)

of 2 hours 2) At Field Activities for BCs etc: a) Same day; if reported before or during business hours of the branch/office

b) Otherwise, it should be before the start of business of the next working day.

36) Bank will review and evaluate the performance of the Bidder on all aspects of implementation of proposed end-to-end FIS during Pilot Project as well as Contract Period. In case the Bank is not satisfied with the performance of the Bidder and /or with the services being provided by Bidder, Bank reserves the right to impose penalty on the Bidder or cancel the contract and/or invoke Bid Security / Performance Guarantee.

37) Bank reserves its right to take over from Bidder the activities relating to Card Management, BC Management and/or hand over the same to any other specialized agencies at cost to the bidder, in case the Bank is not satisfied with the services being provided by the bidder.

38) Bank reserves the right to review every six months, the cost of the FI product / services / components like smart card, transaction cost etc. available in the market and if the market price of product / services / components have been on the lower side, the benefit will have to be passed on to the Bank.

39) Financial transaction happening through Delivery Channels, .i.e., Handheld Devices like Point-of-Terminal (POT) etc., will be monitored by Bank to ascertain the accommodating transactions. No transaction charges will be paid by Bank for such transactions.

40) Bidder to agree to keep source code of proposed FIS with approved / recognized escrow agency under escrow arrangements acceptable to the bank, at bidder’s cost.

41) During the contract period Bidder to provide latest technology (Hardware/Software etc.) for FIS to the Bank to keep pace with technological changes / upgrades, at no extra cost to the Bank. Bidder should continuously improvise its FIS (Hardware/Software/Services etc.) taking full advantage of the technological & infrastructure developments. This includes online customer authentication with Aggregation Server at DC / DRC, customer authentication with the authentication facility provided by Unique Identity Authority of India (UIDAI), deploy of shared

Page 10 of 72

RFP – Financial Inclusion

Solution

ATMs, inter-operability amongst the Banks, switching over from Smart Card based to Mobile based FIS / Identity Number or Identity Card based FIS etc.

42) Bank reserves the right to switch over from Smart Card based solution to Mobile / Identity Card / UID / ATM etc., based solution on any future date without any extra cost to the Bank.

43) The charges stipulated in the price bid would be applicable only after acceptance by the Bank of successful implementation of Pilot Project by Bidder.

44) The sizing of all Hardware including Application / Test / Development Server, software, application software, other equipments at Aggregation Server & for BCs, number of engaging BCs etc. under proposed end-to-end FIS should be suitable and scalable to achieve Bank’s FI road map and take care of customer & transaction growth during the contract period.

45) Bidder can spread the sizing in fair, transparent & appropriate manner in two years in tune of Bank’s FI road map. The sizing calculations and implementation regarding upgradation to be submitted as part of Technical Proposal. However, Bidder should avoid under sizing at any given point of time considering Bank’s FI road map & customer / transaction growth during the Pilot Project / Contract Period. If under sizing leads to any loss to the Bank, the same would attract imposition of penalty on Bidder by Bank.

46) It is the sole responsibility of the Bidder to provide all necessary infrastructures (Hardware / Software etc.) including engaging sufficient number of BCs for successfully implementation of his FIS and achieving various achievements of RFP, well in time to avoid penalty.

47) All bidders have to submit complete technical, functional, system, architecture etc. details of their proposed end-to-end FIS, in Technical Bid.

48) Bidder also to provide user documentation, system administration manuals, training material, disaster recovery plan and user acceptance test reports etc. as and when requested by the Bank.

3.3 Consortium 3.3.1 The short listed system integrator may have a tie-up with any solution provider for

providing an end-to-end FIS. However, the system integrator should have a relationship with the FIS provider as an authorized reseller, distributor, and should have a back-to-back agreement to ensure that the total solution proposed is as a turnkey solution.

3.3.2 If the Bidder is not a manufacturer (Hardware / Software) he should provide

documentary evidence (e.g. Manufacturers’ Authorisation Form) for having tied up with the main participating agencies.

3.3.3 Bidder should have back-to-back support relation with the OEM’s whose products

are offered by the Bidder to the Bank. 3.3.4 The Bidder will be the one point contact to provide the solution to the Bank. 3.4 Pre-Eligibility Criteria:

1) Bidder should be a registered company in India under Companies Act 1956 and should have been in operation for a period at least three years as on date of RFP.

2) Bidder should have implemented the Smart Card Based and / or Mobile based

FIS as an end-to-end turnkey project in at least one Public Sector bank /

Page 11 of 72

RFP – Financial Inclusion

Solution

government and currently supporting / managing the same successfully for last 6 months.

3) The FI solution now offering to the Bank as a end-to-end turnkey project –

a) In case of Smart Card based solution, the same should have been implemented

as an end-to-end turnkey project in at least one Public Sector bank / government and currently running successfully for last 6 months.

b) In case of Mobile based solution the same has been implemented in one of the

Public Sector bank or its Proof-of-Concept (POC) should have been successfully completed in one of the Public Sector banks / government.

4) Minimum annual turnover out of Indian operations should be not less than Rs.20

crores in the last financial year as per audited financial statements.

5) Bidder should have made Net Profit (after all taxes etc.) during the last three financial years.

6) Bidder should have presence and experience in working in Uttar Pradesh at least for one year.

7) The prime bidder or the consortium partners should not be blacklisted by the central / any state government / any bank.

Note : 1) Appropriate documentary proofs with necessary details should be attached for all

above requirements 2) Copy of Audited financial statement for last three years to be enclosed. Self

certified copy of financial statement for 2009-10, if yet to be audited. 3) Letter from the concerned organization confirming successful implementation /

POC with successful results of a proposed FIS with them, to be submitted with following details -

Name of the client

Number of Locations

Type of Project : Smart Card based / Mobile based

Nature of Project

Whether Implementation / Proof of Concept (POC)

Scope of Project

Project Deliverables

Hardware and Software environment of the project

Architecture of the solution implemented

Date of award of Contract

Date of commencement of the Project

Date of successful commissioning of the Project

Name of the person who can be referred to from Clients' side, with Name, Designation, Postal Address, Contact Phone and Fax numbers, E-Mail IDs, etc., (Attach copies of purchase orders)

POC result details : The Bank reserves the right to inspect such installations while evaluating the

Technical Bid.

3.5 Cost of Bidding

Page 12 of 72

RFP – Financial Inclusion

Solution

3.5.1 The Bidder shall bear all costs associated with the preparation and submission of its Bid, and the Bank will in no case be responsible or liable for these costs, regardless of the conduct or outcome of the Bidding process.

B. THE BIDDING DOCUMENTS

3.6 Content of Bidding Document 3.6.1. The products required, Bidding procedures, and contract terms are prescribed in the

Bidding Documents. The Bidding Documents include: (a) PART 1 - Invitation to Bid (ITB) (b) PART 2 – Disclaimer (c) PART 3 - Instruction for Bidders (IFB) (d) PART 4 - Terms and Conditions of Contract (TCC) (e) PART 5 - Technical & Functional Specifications (TFS) (f) PART 6 - Bid Forms, Price Schedules and other forms (BF) (g) PART 7 - Other Terms and Conditions. (OTC) 3.6.2 The bidder is expected to examine all instructions, forms, terms and specifications in

the Bidding Document. Failure to furnish all information required by the Bidding Document or to submit a Bid not substantially responsive to the Bidding Document in every respect will be at the Bidder’s risk and may result in the rejection of the Bid.

3.7 Clarification of Bidding Document 3.7.1 Bidder requiring any clarification of the Bidding Document may notify the Bank in

writing at the address or by e-mail indicated in Invitation to Bid on or before 12/06/2010 up to 02.00 p.m..

3.7.2 E-mail is considered as one of the valid mode of communication. 3.8 Amendment of Bidding Document 3.8.1 At any time prior to the deadline for submission of Bids, the Bank, for any reason,

whether, at its own initiative or in response to a clarification requested by a prospective Bidder, may modify the Bidding Document, by amendment.

3.8.2 Notification of amendments will be put up on the Bank’s Website and will be binding

on all Bidders. 3.8.3 In order to allow prospective Bidders reasonable time in which to take the

amendment into account in preparing their Bids, the Bank, at its discretion, may extend the deadline for a reasonable period as decided by the Bank for the submission of Bids.

C . PREPARATION OF BIDS 3.9 Language of Bid 3.9.1 The Bid prepared by the Bidder, as well as all correspondence and documents

relating to the Bid exchanged by the Bidder and the Bank and supporting documents and printed literature shall be written in English.

3.10 Format and Signing of Bid 3.10.1 Each bid shall be in two parts (each for Smart Card based and Mobile based

FIS ) :- Part I- Technical Proposal.

Page 13 of 72

RFP – Financial Inclusion

Solution

Part II- Price Proposal. The two parts should be in two separate covers, each super-scribed with the name

of the Project as well as “Technical Proposal” and “Price Proposal” as the case may be.

3.10.2 The Bid shall be typed or written in indelible ink and shall be signed by the Bidder or

a person or persons duly authorized to bind the Bidder to the Contract. The person or persons signing the Bids shall initial all pages of the Bids, except for un-amended printed literature.

3.10.3 Any inter-lineation, erasures or overwriting shall be valid only if they are initialled by

the person signing the Bids. The Bank reserves the right to reject bids not confirming to above

3.11 Documents Comprising the Bid 3.11.1 Documents comprising the Technical Proposal Envelope, should contain following [

For both FIS ( Smart Card based & Mobile based) two separate Technical Proposal Envelopes should be prepared with separate set of documents] :

a. Organizational Profile as per Format 6.10

b. Conformity to compliance of Broad Scope of Work mentioned in clause 3.2 of Part 3 ( in Format 6.17 - Please ensure to cover all sub-clauses in compliance chart)

c. Conformity to compliance of Pre-Eligibility Criteria mentioned in clause 3.4 of Part 3 ( in Format 6.17 - Please ensure to cover all sub-clauses in compliance chart)

d. Conformity to compliance of TECHNICAL & FUNCTIONAL SPECIFICATIONS (TFS) mentioned in Part 5 – 5.1 to 5.6 ( in Format 6.17 - Please ensure to cover all sub-clauses in compliance chart)

e. Bid Form as per Format 6.1.1 and duly signed by the Bidder.

f. Non-Disclosure Agreement as per Format 6.2

g. Bid Security deposit of Rs. 5 lac/- (Rs. Five Lac only) as specified in Clause 3.15. ( One single Bid security for Both Smart Card and/or Mobile FIS)

h. Manufacturer’s / Producers’ authorization form as per Format 6.8 wherever applicable.

i. Service Support Details form as per Format 6.11.

j. Undertaking as per Format 6.14 regarding Service Support during contract period.

k. Bidders undertaking for consortium support services as per Format 6.15

l. A Complete Bill of Material (details of smartcard, hand-held devices, account opening devices, data processing & storing devices, hardware/software, monitoring/managing tools, interfaces etc.) with Name of the Component, Make & Model No, Principal Vendor / Manufacturer etc., as per Format 6.13- 6.13.1,6.13.2. Please note that no price should be mentioned in this Format.

m. Masked Price Bid listing all the components as listed in the Price Schedule without indicating the Price.

n. A full description of the Technical Solution and its compliance which should provide an acceptable solution as described in PART 5 Technical & Functional Specifications in the form of literature, drawing and data.

Page 14 of 72

RFP – Financial Inclusion

Solution

While submitting the Technical Bid, literature on the software / hardware if any, should be segregated and kept together in one section / lot. The other papers like Bid Security, Forms as mentioned above etc., should form the main section and should be submitted in one lot, separate from the section containing literature and annual accounts.

Any Technical Proposal not containing the above will be rejected. The Technical Proposal should not contain any price information, such proposal will be rejected.

3.11.2 Documents comprising Price Proposal Envelope, should be : [ For both FIS ( Smart Card based & Mobile based) two separate Price Proposal Envelopes should be prepared with separate set of documents]:

a) The Proposal Form as per Format 6.1.2 as furnished in the Bidding

documents duly signed by the Bidder and completed.

b) A Full Price Schedule of the Solution indicating all the components of the solution and services (refer Format 6.3 – 6.3.1, 6.3.2).

c) Price bids containing any deviations or similar clauses will be summarily rejected.

3.12 Bid Submission 3.12.1 The Bidder shall complete both (Technical Proposal and Price Proposal) the

Envelopes of the Bid Form furnished in the Bidding Document separately for both the solutions (Smart Card based and Mobile based) submit them simultaneously to the Bank. Bids are liable to be rejected if only one (i.e. Technical Proposal or Price Proposal) is received.

3.12.2 As mentioned on page 3 of the RFP, please note to submit the non refundable bid

amount of Rs. 10,000/- by means of a demand draft/pay order favouring “Aryavart Gramin Bank” payable at Lucknow, in a separate envelope while submitting the Bid. Bids are liable to be rejected if the same is not received.

3.13 Bid Prices (Financial bid) 3.13.1 The prices indicated in the Price Schedule shall be entered in the following manner:-

a) The total price quoted should be inclusive of applicable taxes, duties, levies, charges etc., as also cost of incidental services such as transportation, insurance etc. But exclusive of Sales Tax/VAT/Service Tax/Octroi or entry-tax payable to Local Government / Municipal Authorities which will be reimbursed upon production of original receipts.

b) Price quoted in the Price Schedule as per Format 6.3 – 6.3.1, 6.3.2 shall be valid for a minimum period of Contract Period (i.e. 5 years) from the date of issue of work order for roll-out after successful implementation of Pilot Project.

3.13.2. Prices quoted by the Bidder shall be fixed during the Bidder’s performance of the

Contract and shall not be subject to variation on any account, including exchange rate fluctuations, changes in taxes, duties, levies, charges etc. A Bid submitted with an adjustable price quotation will be treated as non-responsive and will be rejected.

3.13.3 However during the contract period if the market price of product / services have been on the lower side, the benefit will have to be passed on to the Bank.

3.14 Bid Currencies 3.14.1 Bids are to be quoted in Indian Rupees only.

Page 15 of 72

RFP – Financial Inclusion

Solution

3.15 Bid Security 3.15.1 The Bidder shall furnish, as part of its Bid, a Bid security as given in Format 6.4. 3.15.2 The Bid security is required to protect the Bank against the risk of Bidder’s conduct,

which would warrant the security’s forfeiture. 3.15.3 The Bid security shall be denominated in Indian Rupees and shall be in one of the

following forms:

a) a Bank guarantee issued by a Public Sector / Private Sector Bank in India (Other than Aryavart Gramin Bank), acceptable to the Bank, in the form as per Format 6.4 provided in the Bid, valid for forty-five (45) days beyond the validity of the Bid.

OR

b) a Banker’s Cheque / Demand Draft, issued by a Scheduled Commercial Bank in

India, drawn in favour of Aryavart Gramin Bank payable at Lucknow and valid for a period of six months.

3.15.4 Any Bid not secured, as above, will be rejected by the Bank, as non-responsive. 3.15.5 Unsuccessful Bidders’ Bid security will be discharged or returned as promptly as

possible but not later than sixty (60) days after the expiration of the period of Bid validity.

3.15.6 The successful Bidder’s Bid security will be discharged upon the Bidder signing the

Contract as per Format 6.5 and furnishing the Performance Security as per Format 6.6.

3.15.7 The Bid security may be forfeited:

a) if a Bidder withdraws its Bid during the period of Bid validity specified by the Bidder on the Bid Form; or

b) if a Bidder makes any statement or encloses any form which turns out to be false/incorrect at any time prior to signing of Contract; or

c) in the case of a successful Bidder, if the Bidder fails;

(i) to sign the Contract;

or

(ii) to furnish Performance Security as mentioned in Clause 3.31 herein.

or

(iii) failed to perform in implementation of FIS as per the terms & conditions of the contract

3.16 Period of Validity of Bids 3.16.1 Bids shall remain valid for a period mentioned in Clause 7.2, from the date of

opening of the Bid. A Bid valid for a shorter period may be rejected by the Bank as non-responsive.

3.16.2 In exceptional circumstances, the Bank may seek the Bidders’ consent to an extension of the period of validity. The request and the responses thereto shall be made in writing. The Bid security provided shall also be suitably extended. A Bidder may refuse the request without forfeiting its Bid security.

Page 16 of 72

RFP – Financial Inclusion

Solution

D. SUBMISSION OF BIDS 3.17 Sealing and Marking of Bids 3.17.1 The Bidders shall seal the envelopes of “Technical Bid” and “Price Bid” separately

for both the FIS (Smart Card based and Mobile based) and the two envelopes (Technical & Price Bid) of each FIS shall be enclosed and sealed in an outer envelope separate for Smart Card & Mobile based FIS. The Bidder should additionally submit soft copies of the Technical Bid documents & Specifications in the form of CD separately for Smart Card based & Mobile based FIS.

3.17.2 The inner and outer envelopes shall: a) be addressed to the Bank at the address given; and b) bear the Project Name

For Smart Card based FIS: "Aryavart Gramin Bank - RFP- For End-To-End Solution For Financial Inclusion

–Smart Card Based - Technical Bid Ref: AGB/HO/IT/FIS/01 dated 07/06/2010” and “Aryavart Gramin Bank - RFP- For End-To-End Solution For Financial Inclusion – Smart Card Based – Price Bid Ref: AGB/HO/IT/FIS/01 dated 07/06/2010” in separate envelopes.

For Mobile based FIS: "Aryavart Gramin Bank - RFP- For End-To-End Solution For Financial Inclusion

– Mobile Based - Technical Bid Ref: AGBI/HO/IT/FIS/01 dated 07/06/2010” and “Aryavart Gramin Bank - RFP- For End-To-End Solution For Financial Inclusion – Mobile Based – Price Bid Ref: AGB/HO/IT/FIS/01 dated 07/06/2010” in separate envelopes.

c) All envelopes should indicate on the cover the name and address, contact person

name, telephone, mobile, e-mail of the Bidder. 3.17.3 If the outer envelope is not sealed and marked, the Bank will assume no

responsibility for the Bid’s misplacement or premature opening. 3.18 Deadline for Submission of Bids 3.18.1 Bids should be received by the Bank at the address specified, no later than the date

& time specified in the Invitation to Bid. 3.18.2 The Bank may, at its discretion, extend this deadline for the submission of Bids by

amending the Bid Documents, in which case, all rights and obligations of the Bank and Bidders previously subject to the deadline will thereafter be subject to the deadline as extended.

3.19 Late Bids 3.19.1 Any Bid received after the deadline for submission of Bids prescribed, will be

rejected and returned unopened to the Bidder. 3.20 Modification and Withdrawal of Bids

Page 17 of 72

RFP – Financial Inclusion

Solution

3.20.1 The Bidder may modify or withdraw its Bid after the Bid’s submission, provided that written notice of the modification, including substitution or withdrawal of the Bids, is received by the Bank, prior to the deadline prescribed for submission of Bids.

3.20.2 The Bidder’s modification or withdrawal notice shall be prepared, sealed, marked and dispatched. A withdrawal notice may also be sent by Fax, but followed by a signed confirmation copy, postmarked, not later than the deadline for submission of Bids.

3.20.3 No Bid may be modified after the deadline for submission of Bids. 3.20.4 No Bid may be withdrawn in the interval between the deadline for submission of Bids

and the expiration of the period of Bid validity specified by the Bidder on the Bid Form. Withdrawal of a Bid during this interval may result in the Bidder’s forfeiture of its Bid security.

E. Opening and Evaluation of Bids 3.21 Opening of Technical Bids by the Bank 3.21.1 Bids for Smart Card based & Mobile based FIS will be opened & evaluated

separately. 3.21.2 The Bidders’ names, Bid modifications or withdrawals and the presence or absence

of requisite Bid Security and such other details as the Bank, at its discretion, may consider appropriate, will be announced at the time of technical Bid opening. No bid shall be rejected at bid opening, except for late bids, which shall be returned unopened to the Bidder.

3.21.3 Bids (and modifications sent) that are not opened at Bid Opening shall not be

considered further for evaluation, irrespective of the circumstances. Withdrawn bids will be returned unopened to the Bidders.

3.22 Preliminary Examination 3.22.1 The Bank will examine the Bids to determine whether they are complete, required

formats have been furnished, the documents have been properly signed, and the Bids are generally in order.

3.22.2 The Bank may, at its discretion, waive any minor infirmity, non-conformity, or

irregularity in a Bid, which does not constitute a material deviation. 3.22.3 The Bank will first examine whether the Bid and the Bidder is eligible in terms of

Clause 3.4 3.22.4 Prior to technical evaluation, the Bank will determine the responsiveness of each Bid

to the Bidding Document. For purposes of these Clauses, a responsive Bid is one, which conforms to all the terms and conditions of the Bidding Document without material deviations. Deviations from, or objections or reservations to critical provisions, such as those concerning Bid Security, Applicable Law, Performance Security, Qualification Criteria, Insurance, Warranty, AMC and Force Majeure will be deemed to be a material deviation.

3.22.5 The Bank’s determination of a Bid’s responsiveness will be based on the contents of

the Bid itself, without recourse to extrinsic evidence. 3.22.6 If a Bid is not responsive, it will be rejected by the Bank and may not subsequently

be made responsive by the Bidder by correction of the non-conformity. 3.23 Technical Evaluation

Page 18 of 72

RFP – Financial Inclusion

Solution

3.23.1 Only those Bidders and Bids who have been found to be in the conformity of the

eligibility terms and conditions during the preliminary evaluation would be taken up by the Bank for further detailed evaluation. Those Bids who do not qualify the eligibility criteria and all terms during preliminary examination will not be taken up for further evaluation.

3.23.2 The Bank may use the services of external consultants for technical evaluation. 3.23.3 The Bank reserves the right to evaluate the bids on technical & functional

parameters including visit to inspect live site/s of the bidder and witness demos of the system and verify functionalities, response times, etc.

3.23.4 Bank will evaluate the technical and functional specification of all the equipments

quoted by the Bidder. 3.23.5 Bank reserves the right to waive any of the Technical and Functional Specification

during technical evaluation if in the Bank’s Opinion it is found to be minor/deviation or acceptable deviation.

3.23.6 Bill of Materials (with Masked Price Schedule) submitted along with Technical Bid

will be evaluated .If the Bank, during the evaluation, deems it fit, may request bidder to revise the bill of materials submitted, within a reasonable time which Bank may advise later on.

3.23.7 During evaluation of the Bids, the Bank, at its discretion, may ask the Bidder for

clarification of its Bid. The request for clarification and the response shall be in writing, and no change in the prices or substance of the Bid shall be sought, offered or permitted.

3.23.8 Bidders may be called to give presentation of their solutions with its capabilities at

their own cost, which will be taken into account for technical evaluation of the Bidders.

3.23.9 Bank will finalise appropriate and suitable technologies on the basis of proposed

architectures. Bank has the right to modify the architecture proposed by the Bidders and finalise the technical requirements for the FIS.

3.24 Opening of Price Bids 3.24.1 Only those bids which are found to be technically responsive will be informed of the

date / time / Venue of opening of price bids. 3.24.2 The Technical Bids will be evaluated as per eligibility criteria. Thereafter the Bank

reserves the right of selection of Vendor by Opening of Commercial Bids of Bidders who are found eligible after evaluation of Technical Bids.

3.24.3 In Case of Opening of Commercial Bids – 1) After opening of price bids and declaring the prices, the Bank will evaluate

and compare the Price bids. 2) Arithmetical errors will be rectified on the following basis. If there is a

discrepancy between the unit price and the total price that is obtained by multiplying the unit price and quantity, the unit price shall prevail, and the total price shall be corrected. If the Successful Bidder does not accept the correction of the errors, its Bid will be rejected, and its Bid security may be forfeited. If there is a discrepancy between words and figures, the amount in words will prevail.

Page 19 of 72

RFP – Financial Inclusion

Solution

3.24.4 L1 will be decided on the basis of the total price quoted in the Price Schedule Format 6.3 – 6.3.1, 6.3.2 separately for Smart Card based solution and Mobile based solution.

3.24.5 Though the Bidder might have considered entire FIS project for bidding and quoting

his competitive price for L1, actual work order may be at a lower scale. The Bank’s decision in this regard will be final and binding on Bidders.

3.24.6 The Bank’s evaluation of a Price Bid will take into account, in addition to the Bid price

quoted, one or more of the following factors:

a) Deviations in payment schedule & Delivery Schedule from that specified;

b) Deviation in prices quoted;

c) Other specific criteria indicated in the Bid and/or in the Technical & Functional Specifications & Price schedule.

3.24.7 For factors retained in the Bid, one or more of the following quantification methods

will be applied: (a) Payment schedule. The TCC Clause 4.18 stipulates the payment schedule offered by the Bank. (b) Delivery Schedule: The products and/or Systems and/or Services covered under this bid are to

be supplied, installed and commissioned within the period mentioned in 7.14. No credit will be given to early deliveries. For delayed deliveries an adjustment of 0.5% of the Bid price per week or part thereof will be added to the price bid for evaluation of Bids.

(c) Quotation of Prices for all Items. The Bidder should quote for complete consignment of items proposed/listed

in this Bid. In case, prices are not quoted by any Bidder for any specific item / Product / service, for the purpose of evaluation, the highest of the prices quoted by other Bidders participating in the bidding process will be reckoned as the notional price for that product /service, for that Bidder. However, if selected, at the time of award of Contract, the lowest of the price(s) quoted by other or Bidders (whose Price Bids are also opened) for that product /service will be reckoned. This shall be binding on all the Bidders. However, the Bank reserves the right to reject all such incomplete bids.

3.25 Contacting the Bank 3.25.1 No Bidder shall contact the Bank on any matter relating to its Bid, from the time of

opening of Price Bid to the time the Contract is awarded. 3.25.2 Any effort by a Bidder to influence the Bank in its decisions on Bid evaluation, Bid

comparison or contract award may result in the rejection of the Bidder’s Bid. F. Award of Contract 3.26 Post-qualification / Identification of L1 3.26.1 All the Price bids after their evaluation on the parameters mentioned above would be

arranged in ascending order and the L1 Bidder would be identified as one whose bid has been evaluated to be the lowest.

Page 20 of 72

RFP – Financial Inclusion

Solution

3.27 Bank’s right To Accept Any Bid and to reject any or All Bids. 3.27.1 The Bank reserves the right to accept or reject any Bid in part or in full, and to cancel

the Bidding process and reject all Bids at any time prior to contract award, without thereby incurring any liability to the affected or Bidder or Bidders or any obligation to inform the affected Bidder or Bidders of the grounds for the Bank’s action.

3.27.2 After identification of L1 Bidder, Bank will follow the internal procedure for necessary

approvals and thereafter proceed with notification of award to L1 as the case may be.

3.28 Award Criteria

3.28.1 The Bank will award the Contract to the successful Bidder who has been determined to qualify to perform the Contract satisfactorily, and whose Bid has been determined to be responsive, and is the lowest evaluated Bid.

3.29 Notification of Award 3.29.1 Prior to expiration of the period of Bid validity, the Bank will notify the successful

Bidder/s in writing or by e-mail, that its Bid has been accepted. 3.29.2 The notification of award will constitute the formation of the Contract. 3.29.3 Upon notification of award to the L1 Bidder the Bank will promptly notify each

unsuccessful Bidder and will discharge its Bid security. 3.30 Signing of Contract 3.30.1 At the same time as the Bank notifies the successful Bidder that it’s Bid has been

accepted, the Bank will send the Bidder/s the Contract Form as per Format 6.5. 3.30.2 Within the period prescribed in clause 7.4, from the date of receipt of the Form of

contract, the successful Bidder/s shall sign and date the Contract and return it to the Bank.

3.31 Performance Security 3.31.1 Performance Security in the required format to be submitted by the successful bidder

as per Clause 4.6 3.31.2 Failure of the successful Bidder to comply with the requirement of Clause 3.30.1,

3.30.2 shall constitute sufficient grounds for the annulment of the award and forfeiture of the Bid security.

3.32 FORM-C Bank will not provide Form-C. 3.33 Pre-Bid Meeting : It has been decided to hold a Pre-Bid Meeting on 15/06/2010 at 3.00 p.m., at our

office (Head Office, IT Department – address given in the 3rd

page of RFP). Bidders are requested to send their queries relating to RFP to our office by e-mail (e-mail addresses given in 3

rd page) well in advance (latest by 12/06/2010 upto 2.00 p.m.),

so that the same could be addressed during the Pre-Bid meeting with interested Bidders or clarifications will be given by way of addendum to RFP and placed on Bank’s web-site as additions/corrigendum to RFP.

Page 21 of 72

RFP – Financial Inclusion

Solution

Note: Notwithstanding anything said above, the Bank reserves the right to reject the contract or cancel the entire process without assigning reasons thereto.

************************

Page 22 of 72

RFP – Financial Inclusion

Solution

PART - 4. TERMS AND CONDITIONS OF CONTRACT (TCC) TABLE OF CLAUSES

TABLE OF CLAUSES

Clause No.

Topic Clause No.

Topic

4.1 Definitions 4.21 Contract Amendments

4.2 Country of Origin 4.22 Assignments

4.3 Standards 4.23 Delay in Supplier’s Performance

4.4 Use of Contract Documents and Information

4.24 Liquidated Damages

4.5 Patent Rights 4.25 Termination for Default

4.6 Performance Security 4.26 Force Majeure

4.7 Inspection & Quality Control Tests

4.27 Termination for Insolvency

4.8 System & Other Software 4.28 Termination for Convenience

4.9 Acceptance Procedure 4.29 Resolution of Disputes

4.10 Packing of Products 4.30 Governing Language

4.11 Delivery & Documents 4.31 Applicable Law

4.12 Insurance 4.32 Addresses for Notices

4.13 Transportation 4.33 Taxes and Duties

4.14 Incidental Services 4.34 Supplier Integrity

4.15 Warranty 4.35 Supplier’s obligations

4.16 Maintenance Services 4.36 Patent Rights/ Intellectual Property Rights

4.17 Training 4.37 Site Preparation and Installation

4.18 Payment 4.38 Commissioning of the Solution

4.19 Prices 4.39 Technical Documentation

4.20 Change Orders 4.40 Right to use defective product

4.41 Repeat Orders

Page 23 of 72

RFP – Financial Inclusion

Solution

4.1 Definitions In this Contract, the following terms shall be interpreted as indicated: 4.1.1 “Solution” means a package of end-to-end Financial Inclusion solution application

required for the Bank, all interfaces to Core Banking software and other software, system software, database, third party utilities, middleware, etc., all hardware as proposed by the Supplier, all seamlessly integrated to work together on the Banks network to meet the Technical and functional requirements of the Bank indicated in Part 5 of this document.

4.1.2 “Supplier” is the successful Bidder who has been determined to qualify to perform

the Contract satisfactorily, and whose Bid has been determined to be substantially responsive, and is the lowest evaluated Bid.

4.1.3 “The Contract” means the agreement entered into between the Bank and the

Supplier, as recorded in the Contract Form signed by the parties, including all attachments and appendices thereto and all documents incorporated by reference therein;

4.1.4 “The Contract Price” means the price payable to the Supplier under the Contract for

the full and proper performance of its contractual obligations; 4.1.5 “The Product” means all of the software, all hardware, database, middleware,

operating systems, equipments and / or material which the Supplier is required to supply to the Bank under the Contract;

4.1.6 “The Services” means those services ancillary to the supply of the Products, such as

transportation and insurance, installation, commissioning, customization, provision of technical assistance, training, Maintenance and other such obligations of the Supplier covered under the Contract;

4.1.7 “TCC” means the Terms and Conditions of Contract contained in this section; 4.1.8 “The Project” means supply, installation and commissioning of a comprehensive,

integrated Financial Inclusion Solution for the Bank based on the terms & conditions laid down in RFP.

4.1.9 “L1” means the bidder whose price as per the commercial bid is the lowest.

4.1.10 “L2”means the bidder whose price as per the commercial bid is the second lowest.

4.1.11 “L3” means the bidder whose price as per the commercial bid is the third lowest.

4.1.12 “L4”means the bidder whose price as per the commercial bid is the fourth lowest.

4.1.13 “L5” means the bidder whose price as per the commercial bid is the fifth lowest. 4.1.14 “Successful Bidder” is the Bidder whose technical bid has been accepted and whose

price as per the commercial bid is the lowest and notification of award has been given by Bank.

4.1.15 “BC” means Business Correspondent who is a authorized individual / Firm / NGOs

etc., appointed by the Bank/Vendor to carry out customer related activities at field level.

4.1.16 “Designated Branch” means any branch of the Bank with whom the settlement

account of Bidder / vendor / BC / Sub-Agent is maintained.

Page 24 of 72

RFP – Financial Inclusion

Solution

4.1.17 “Command Area” means the geographical areas under the jurisdictions of Bank’s branches/ Regional Offices for providing banking services in the districts of Lucknow, Barabanki, Hardoi, Unnao, Farrukhabad, Kannauj, and Faizabad of Uttar Pradesh.

4.1.18 “Accommodating Transactions” means the transactions which are taken place just to

increase the transaction count without really necessitating them. In case of a difference of opinion on the part of the Bidder in comprehending and/or interpreting any Clause / Provision of the Bid Document after submission of the Bid, the interpretation by the Bank shall be binding and final on the Bidder.

4.2. Country of Origin / Eligibility of Goods & Services 4.2.1 All goods and related services to be supplied under the Contract shall have their

origin in eligible source countries, as per the prevailing Import Trade Control Regulations in India.

4.2.2 For purposes of this clause, “origin” means the place where the goods are mined,

grown, or manufactured or produced, or the place from which the related services are supplied. Goods are produced when, through manufacturing, processing or substantial and major assembly of components, a commercially-recognized product results that is substantially different in basic characteristics or in purpose or utility from its components.

4.3 Standards 4.3.1 The Goods supplied under this Contract shall conform to the standards mentioned in

the Technical Specifications, and, when no applicable standard is mentioned, to the authoritative standards appropriate to the Goods’ country of origin. Such standards shall be the latest issued by the institution concerned.

4.4. Use of Contract Documents and Information 4.4.1 The Supplier shall not, without the Bank’s prior written consent, disclose the

Contract, or any provision thereof, or any specification, plan, drawing, pattern, sample or information furnished by or on behalf of the Bank in connection therewith, to any person other than a person employed by the Supplier in the performance of the Contract. Disclosure to any such employed person shall be made in confidence and shall extend only as far as may be necessary for purposes of such performance.

4.4.2 The Supplier shall not, without the Bank’s prior written consent, make use of any

document or information for purposes of performing the Contract. 4.4.3 Any document, other than the Contract itself, shall remain the property of the Bank

and shall be returned (in all copies) to the Bank on completion of the Supplier’s performance under the Contract, if so required by the Bank.

4.4.4 The bidder shall sign a non disclosure agreement as per Format 6.2. Successful

Bidders to submit a non-disclosure agreement as per Format 6.2 on non-judicial stamp paper of appropriate value before signing the contract.

4.5. Patent Rights 4.5.1 In the event of any claim asserted by a third party of infringement of copyright,

patent, trademark, industrial design rights, etc., arising from the use of the Goods or any part thereof in India, the Supplier shall act expeditiously to extinguish such claim. If the Supplier fails to comply and the Bank is required to pay compensation to a third party resulting from such infringement, the Supplier shall be responsible for the compensation to claimant including all expenses, court costs and lawyer fees. The Bank will give notice to the Supplier of such claim, if it is made, without delay. The supplier shall indemnify the Bank against all third party claims.

Page 25 of 72

RFP – Financial Inclusion

Solution

4.6 Performance Security 4.6.1 Within the period prescribed under Clause 7.3 from Date of receipt of notification of

Contract award, the Supplier shall furnish to the Bank, the Performance Security for an amount as per Clause 7.6 valid upto the period specified in Clause 7.5.

4.6.2 The proceeds of the Performance Security shall be payable to the Bank as

compensation for any loss resulting from the Supplier’s failure to complete its obligations under the Contract.

4.6.3 The Performance Security shall be denominated in Indian Rupees and shall be by

way of Bank Guarantee issued by a Public / Private Sector Bank in India (Other than Aryavart Gramin Bank), acceptable to the Bank in the Format 6.6 provided in the Bid.

4.6.4 The Performance Security will be discharged by the Bank and returned to the

Supplier not later than the period specified in Clause 7.11, following the date of completion of the Supplier’s performance obligations under the Contract.

4.6.5 In the event of any contract amendment, the Supplier shall, within the period

mentioned in Clause 7.3 after receipt of such amendment, furnish the amendment to the Performance security, rendering the same valid for the duration of the Contract, as amended for further specified in Clause 7.3. In the event of any correction of defects or replacement of defective software/products/equipment/system during the contract/warranty period, the warranty for the corrected / replaced software/products/equipment/system shall be extended to a further period mentioned in Clause 7.7. The performance guarantee for a proportionate value shall be extended by the period mentioned in Clause 7.10 over and above the extended contract/warranty period.

4.7 Inspection and Quality Control Tests 4.7.1 The Bank reserves the right to carry out pre-shipment inspection by a team of Bank

officials, of any of the existing live installations of the Supplier referred to in the Technical Bid or demand a demonstration of the solution proposed on a representative model in bidder’s office.

4.7.2 The Bank’s right to inspect, test and where necessary reject the products after the

products arrival at the destination shall in no way be limited or waived by reason of the products having previously being inspected, tested and passed by the Bank or its representative prior to the products shipment from the place of origin.

4.7.3 Nothing stated hereinabove shall in any way release the supplier from any warranty

or other obligations under this contract. 4.7.4 Manuals / Documentation 4.7.4.1 Before the products / system is / are taken over by the Bank, the Supplier shall

supply technical / systems Manuals for all the Systems supplied and for all required interfaces. Operation and maintenance Manuals for all the systems and applications covering the operations needed to start, run, other operations, transfer to fall back system / site including business continuity plan to be provided by the vendor. User manuals for Administrative Office / Zones / branches for all the models shall be provided by the vendor. The manuals shall be in English.

4.7.4.2 Unless and otherwise agreed the products and equipment shall not be considered to

be completed for the purpose of taking over until such manuals have been supplied to the Bank.

4.7.4.3 The Supplier shall provide one set of Design Manual, System Manual, User manual

and Security Manual for all the supplied products. The Supplier shall also provide

Page 26 of 72

RFP – Financial Inclusion

Solution

one soft copy of each of the manuals. Soft and hard Copy Manuals shall commensurate with number of installations of Products in the Bank.

4.7.4.4 Documentation should be comprehensive & include: Product Literature. Operating manuals. General Specifications. Operator Reference manuals for each operator task. Messages manuals. Documentation on troubleshooting. 4.8 For the System & other Software, the following will apply: The supplier shall provide complete and legal documentation of all subsystems,

licensed operating systems, licensed system software, licensed utility software and other licensed software. The supplier shall also provide licensed software for all software products whether developed by it or acquired from others. There shall not be any default in this regard.

In case the supplier is providing software which is not his proprietary software then

the supplier should submit evidence in the form of agreement he has entered into with the software vendor which includes support from the software vendor for the proposed software for the full period required by the Bank.

4.9 Acceptance Procedure: 4.9.1 The acceptance criteria for the proposed solution is given under item 7.17. 4.9.2 On successful completion of installation, commissioning, acceptability test, receipt of

deliverables etc., and after the solution runs successfully after going live and Bank is satisfied with the working on the system, the acceptance certificate (as mutually decided and approved by the Bank) signed by the Supplier and the representative of the Purchaser will be issued. The date on which such certificate is signed shall be deemed to be the date of successful commissioning of the systems as per Bank’s Format 6.9.

4.10 Packing of Products 4.10.1 The Supplier shall provide such packing of the products as is required to prevent

their damage or deterioration during transit to their final destination. The packing shall be sufficient to withstand, without limitation, rough handling during transit and exposure to extreme temperature, salt and precipitation during transit and open storage. Size and weights of packing case shall take into consideration, where appropriate, the remoteness of the Products final destination and the absence of heavy handling facilities at all transit points.

4.10.2 Packing Instructions: The Supplier will be required to make separate packages for

each Consignment. Each package will be marked on three sides with proper / indelible ink with the following:

(i) Project; (ii) Contract No.; (iii) Country of Origin of products; (iv) Supplier’s Name; (v) Packing List reference number.

4.11 Delivery and Documents 4.11.1 Delivery of the Products shall be made by the supplier in accordance with the system

approved / ordered. The details of the documents to be furnished by the Supplier are specified hereunder:-

(i) 2 copies of Supplier’s Invoice showing Contract number, Products

description, quantity, unit price and Total amount.

Page 27 of 72

RFP – Financial Inclusion

Solution

(ii) Delivery Note or acknowledgement of receipt of Products from the Consignee or in case of products from abroad original and two copies of the negotiable clean Airway Bill.

(iii) 2 copies of packing list identifying contents of each package.

(iv) Insurance Certificate.

(v) Manufacturer’s / Supplier’s warranty certificate.

(vi) Certificate of Origin.

The above documents shall be received by the Bank before arrival of Products (except where it is handed over to the Consignee with all documents) and if not received the Supplier will be responsible for any consequent expenses.

4.12 Insurance 4.12.1 The insurance shall be in an amount equal to 110 percent of the value of the

Products from “Warehouse to final destination” on “All Risks” basis including Theft, War Risks and Strikes, valid for a period not less than 3 months after installation and commissioning and issue of acceptance certificate by the Bank.

4.12.2 Should any loss or damage occur, the Supplier shall:-

a. initiate and pursue claim till settlement and

b. promptly make arrangements for repair and / or replacement of any damageitem irrespective of settlement of claim by the underwriters.

4.13 Transportation 4.13.1 Supplier is required under the Contract to transport the Goods to a specified place of

destination within India, defined as the Project Sites, transport to such place of destination in India, including insurance and storage, as shall be specified in the Contract, shall be arranged by the Supplier, and the related costs shall be included in the Contract Price.

4.14 Incidental Services 4.14.1 The incidental services to be provided are as under:-

a. Furnishing Manuals for each appropriate unit of the Supplied Products as mentioned under Clauses 4.7.4, 4.8 and 4.39 of TCC;

b. Maintenance and software updates of the supplied Products, Technical support

thereof for a period as specified in Clause 7.13 after expiry of the contract/warranty provided that this service shall not relieve the Supplier of any contract/warranty obligations under this contract.

4.15 Contract Period / Warranty / Uptime 4.15.1 The Supplier warrants that the products supplied under the Contract are of the most

recent version and that they incorporate all recent improvements in design and / or features. The Supplier further warrants that all the Products supplied under this Contract shall have no defect, arising from design or from any act of omission of the Supplier, that may develop under normal use of the supplied products in the conditions prevailing in India

4.15.2 The minimum contract / warranty period shall be the period as per Clause 7.7. The

Supplier shall in addition comply with the performance guarantee specified under the Contract. If, for reasons attributable to the Supplier, these guarantees are not attained in whole or in part the Supplier shall make such changes, modifications and

Page 28 of 72

RFP – Financial Inclusion

Solution

/ or additions to the Products or any part thereof as may be necessary in order to attain the contractual guarantees specified in the Contract at its own cost and expense and to carry out further performance tests.

4.15.3 The Bank shall promptly notify the Supplier in writing of any claims arising under this

contract/warranty. 4.15.4 Upon receipt of such notice the Supplier shall with all reasonable speed, repair or

replace the defective products or part thereof without cost to the Bank. 4.15.5 If the Supplier, having been notified, fails to remedy the defect(s) within the period

specified in Clause 7.9, the Bank may proceed to take such remedial action as may be necessary, at the Supplier’s risk and expense and without prejudice to any other rights, which the Bank may have against the supplier under the Contract.

4.15.6 Warranty for Hardware/System Software/off-the-shelf Software will be provided to

the Bank as per the general conditions of sale of such software. 4.16 Maintenance Service 4.16.1 The Supplier shall provide free maintenance services during the period of

contract/warranty specified in Clause 7.13. Professionally qualified personnel who have expertise in the hardware and system software supplied by the vendor will provide these services.

4.16.2 During Contract/Warranty Period, Supplier guarantees an Uptime of 99.5 % on

quarterly basis for the entire/core solution proposed, with a Mean Time Before Failure (MTBF) of 90 days. Accordingly it is expected that necessary spares are available for all critical components whether software or hardware. Please refer to Clause 7.18 for details of uptime required by the Bank.

4.16.3 The supplier shall repair or replace worn out or defective part including all plastic

parts of the equipments and all consumables at no extra cost to the Bank. 4.16.4 The Supplier shall ensure that faults/issues/defects etc. and failures intimated by

Bank through any mode of communication like call/e-mail/fax etc. are to be set right as under –

1) At Aggregation Server ( at DC & DR) :

a. Bidder has to maintain “Mean Time To Restore” (MTTR) of 2 hours 2) At Field Activities for BCs etc:

a. Same day; if reported before or during business hours of the branch/office

b. Otherwise, it should be before the start of business of the next working day.

4.16.5 Bidder has to provide Warranty and Support Service/AMC during the contract period

on comprehensive onsite basis inclusive of repairs and replacement of spare parts including consumables & plastic parts etc., without any extra cost to the Bank.

4.17 Training 4.17.1 The Supplier is required to train the designated Bank’s technical, BC and end-user

personnel to enable them to effectively operate and perform administration of the total system. User Manuals, System Procedure Manual etc., to be provided.

4.18. Payment 4.18.1 Payment shall be made in Indian Rupees, as per Clause 7.16. 4.18.2 Any component has not been delivered or if delivered is not operational, will be

deemed / treated as non-delivery thereby excluding the Bank from all payment

Page 29 of 72

RFP – Financial Inclusion

Solution

obligations under the terms of this contract. Partial delivery of products is not acceptable and payment would be released as per terms only after full delivery

4.18.4 Payment against Bank Guarantees:

I. For all the payments to be made against Bank guarantees, the Bank guarantees shall be issued by a public/ private sector Bank in India (other than Aryavart Gramin Bank), acceptable to the Bank .

II. Bank guarantees for advance payment shall be released not later than 30 days after the date of completion of installation / commissioning of the products/system at their final destination.

4.19 Prices 4.19.1 Prices payable to the Supplier as stated in the Contract shall be firm and not subject

to adjustment during performance of the Contract, irrespective of reasons whatsoever, including exchange rate fluctuations, changes in taxes, duties, levies, charges etc.

4.19.2 The Bidder will pass on to the Bank, the benefit of discounts if any announced in

respect of the cost of the items for which orders have been placed during that period. 4.20 Change Orders 4.20.1 The Bank may, at any time, by a written order given to the Supplier, make changes

within the general scope of the Contract in any one or more of the following: (a) Method of shipment or packing; (c) Place of delivery; (d) Technical and functional specifications (e) Services to be provided by the Supplier.

4.20.2 If any such change causes an increase or decrease in the cost of, or the time

required for the Supplier’s performance of any provisions under the Contract, an equitable adjustment shall be made in the Contract Price or delivery schedule, or both, and the Contract shall accordingly be amended. Any claims by the Supplier for adjustment under this clause should be asserted within thirty (30) days from the date of Supplier’s receipt of Bank’s change order.