APRIL2019 Orlando Metro · Lake Nona Central 2.5% South Eola 2.7% South Orange 2.8% How do we...

Transcript of APRIL2019 Orlando Metro · Lake Nona Central 2.5% South Eola 2.7% South Orange 2.8% How do we...

www.zillow.com/research/

APRIL2019 Orlando Metro

National Rents

Current: $1,477Monthly Change: 0.2%Annual Change: 2.6%

Orlando Metro Rents

Current: $1,536Monthly Change: 0.3%Annual Change: 6.4%

Breakeven Horizon1.4 years

Major Cities - Rents

OrlandoCurrent: $1,432Monthly Change: 0.1%Annual Change: 7%Breakeven Horizon: 1.5 years

KissimmeeCurrent: $1,378Monthly Change: 0.4%Annual Change: 3.7%Breakeven Horizon: 1.3 years

ApopkaCurrent: $1,561Monthly Change: 0.5%Annual Change: 6.8%Breakeven Horizon: 1.4 years

SanfordCurrent: $1,399Monthly Change: 0.4%Annual Change: 5.3%Breakeven Horizon: 1.2 years

OviedoCurrent: $1,850Monthly Change: 0.4%Annual Change: 6.2%Breakeven Horizon: 1.8 years

Esri, HERE, DeLorme, MapmyIndia, © OpenStreetMap contributors, and the GIS user community

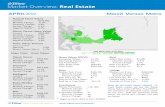

City ZRI Year-over-Year2.1% - 3.9% 4.0% - 5.3% 5.4% - 6.4% 6.5% - 7.5% 7.6% - 11.1%

Metro Cities: Top/Bottom by Annual Rent AppreciationTop:Tangelo Park 11.1%

Sky Lake 9.1%

Clermont 8.7%

Oak Ridge 8.2%

Christmas 8.2%

Bottom:Paisley 2.1%

Astor 2.3%

Altoona 2.7%

Eustis 3.4%

Windermere 3.5%

Metro Neighborhoods: Top/Bottom by Annual Rent AppreciationTop:Lake Frendrica 11%

Mariners Village 10.2%

Dover Shores West 9.7%

Florida Center North 9.2%

Rosemont North 8.9%

Bottom:Florida Center 0.8%

Baldwin Park 1.6%

Lake Nona Central 2.5%

South Eola 2.7%

South Orange 2.8%

How do we measure rents? To track rents, we use the Zillow Rent Index (ZRI). The

ZRI is the midpoint of estimated rents in a given region. Half the estimated rental prices

are above this number and half are below.

What is the Breakeven Horizon? The Breakeven Horizon in the number of years you

must live in a home before owning the same home becomes more financially advantageous

than renting the home. For example, if ’City X’ had a Breakeven Horizon of 5.5 years,

it is financially better for you to rent in ’City X’ unless you plan on living there for more

than 5.5 years.

APRIL2019

*Top cities and neighborhoods by size within the metro are listed. Additional counties, cities, neighborhoods and zip codes may be available online at

www.zillow.com/research/data or by emailing [email protected]

Zillow Research:Zillow R© is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the placethey call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics andanalytics bureau led by Zillow’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housingdata and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price ExpectationsSurvey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow HomeValue Index over the next five years. Zillow also sponsors the bi-annual Zillow Housing Confidence Index (ZHCI) which measures consumer confidence inlocal housing markets, both currently and over time. Launched in 2006, Zillow is owned and operated by Zillow Group (NASDAQ: Z), andheadquartered in Seattle.

www.zillow.com/research/

Largest Cities Covered by Zillow

Bre

akev

enH

oriz

on(y

rs)

Ren

ts(Z

RI)

All

Hom

es($

)

Ren

ts(Z

RI)

YoY

(%)

Med

ian

ren

tlis

tpr

ice

($)

Ren

tes

tim

ate/

sq.

ft.

($)

Altamonte Springs 1.2 1,333 4.9 1,200 1Apopka 1.4 1,561 6.8 1,680 0.9Casselberry 1.2 1,500 5.3 1,550 1Citrus Ridge 1.7 1,521 6.4 1,660 0.9Clermont 1.6 1,631 8.7 1,730 0.9Conway 1.6 1,688 6.6 1Eustis 1.2 1,362 3.4 0.9Fruitland Park 1.1 1,293 4.1 0.9Groveland 1.4 1,420 6.3 0.8Kissimmee 1.3 1,378 3.7 1,550 1Lady Lake 1.5 1,543 7.5 1Lake Mary 1.8 1,800 3.9 1,710 1Leesburg 1.2 1,310 4.5 1,280 0.8Lockhart 1,355 7.3 1Longwood 1.6 1,788 5.7 1,700 1

Bre

akev

enH

oriz

on(y

rs)

Ren

ts(Z

RI)

All

Hom

es($

)

Ren

ts(Z

RI)

YoY

(%)

Med

ian

ren

tlis

tpr

ice

($)

Ren

tes

tim

ate/

sq.

ft.

($)

Maitland 1.7 1,778 5.1 1,600 1.1Mount Dora 1.4 1,462 6 1,490 1Oak Ridge 1,333 8.2 1.1Ocoee 1.5 1,633 6.9 1,890 0.9Orlando 1.5 1,432 7 1,600 1.1Oviedo 1.8 1,850 6.2 1,850 0.9Pine Hills 1,278 6.7 1,300 0.9Poinciana 1,346 7.9 1,360 0.8Saint Cloud 1.5 1,511 6 1,650 0.9Sanford 1.2 1,399 5.3 1,400 1Tavares 1.3 1,354 4.2 0.9Windermere 2 2,403 3.5 2,250 1.1Winter Garden 1.8 1,752 8.1 2,050 0.9Winter Park 1.6 2,076 5.8 1,750 1.4Winter Springs 1.8 1,664 4.7 1,600 1

Largest Neighborhoods Covered by Zillow

Bre

akev

enH

oriz

on(y

rs)

Ren

ts(Z

RI)

All

Hom

es($

)

Ren

ts(Z

RI)

YoY

(%)

Med

ian

ren

tlis

tpr

ice

($)

Ren

tes

tim

ate/

sq.

ft.

($)

Airport North 1.1 1,377 6.4 1.1Alafaya 1.8 1,750Artisan Park 2.1Azalea Park 1.2 1,373 8 1.1Baldwin Park 2.2 2,423 1.6 1.3College Park 1.9 1,739 3.8 1,600 1.3East Village 2.1Engelwood Park 1,264 6 1.1Florida Center 1.6 1,798 0.8 1Florida Center North 1,248 9.2 1,300 1.2

Bre

akev

enH

oriz

on(y

rs)

Ren

ts(Z

RI)

All

Hom

es($

)

Ren

ts(Z

RI)

YoY

(%)

Med

ian

ren

tlis

tpr

ice

($)

Ren

tes

tim

ate/

sq.

ft.

($)

Hunters Creek 1.5 1,859 4 1,850 1Lake Frendrica 1,091 11 1.4Meadow Woods 1.5 1,625 7.1 1,800 1Metro West 1,401 7.4 1,350 1.1Millenia 1,308 5.1 1.1Northlake Park at La 2.2 1,996 5.4 1Rosemont 1,253 6.3 0.9South Semoran 1,142 8 1,050 1.2Union Park 1.3 1,491 4.9 1Vista East 1.5 1,701 6 1,580 0.9