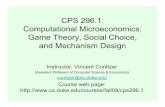

CPS 296.1: Computational Microeconomics: Game Theory, Social ...

Applications of Microeconomics Theory

-

Upload

charlie-g-santiaguel -

Category

Documents

-

view

229 -

download

4

description

Transcript of Applications of Microeconomics Theory

Applications of Microeconomics Theory as a Basis for Understanding the Key Economic Variables Affecting the Business

Applications of Microeconomics Theory as a Basis for Understanding the Key Economic Variables Affecting the BusinessReporters:Leslie Anne T. GandiaCharlie Magne G. SantiaguelLearning ObjectivesUnderstand the significance of microeconomics theory as applied to businessKnow the nature of and the factors affecting the demand for product other than its priceDistinguish between elastic and inelastic demand and how they affect the price of goods and servicesDiscuss the factors affecting the supply of a product other than its priceUnderstand the significance of market equilibrium and pricingKnow the nature of short-run and long-run total costExplain the role of money in the economy and the relationship between its supply and demandUnderstand the nature of interest and how interest rates are determinedMicroeconomicsIt focuses on the behavior and purchasing decisions of individual and firmsRationingIt is an allocation of a limited supply of a good or resource to users who would like to have more of itDemandIt is the quantity of a good or service that consumers are willing and able to purchase at a range of prices at a particular timeIt is actually a schedule of the amount that would be purchased at various prices, with all other variables that affect demand being held constantGraphically, there is an inverse relationship between the price and quantity demandedDemand Curve ShiftA demand curve shifts when demand variables, other than price, changeFactors Affecting the Demand for a Product Other than Its PriceFactorsRelationshipConsumer income and wealthGenerally a direct relationshipPrice of other goods and servicesDirect relationshipPrice of complement productsInverse relationshipConsumer tastesIntermediate relationshipGroup boycottInverse relationshipSize of the marketDirect relationshipExpectations of price increaseDirect relationshipThe Elasticity of DemandPrice Elasticity of Demand is the relationship between percent change in quantity demanded and percent change in pricePerfectly inelastic. Despite an increase in price, consumers still purchase the same amountRelatively inelastic. A percent increase in price results in a smaller percent reduction in salesUnitary elasticity. The percent change in quantity demanded is equal to the percent change in priceRelatively elastic. A percent increase in price leads to a larger percent reduction in purchasesPerfectly elastic. An infinitesimally small change in price results in an infinitely large change in quantity demanded or suppliedSupplyThe Law of Supply is a principle that, there will be a direct relationship between the price of a good and the amount of it offered for saleSupply Curve ShiftA supply curve shift occurs when supply variables, other than price, change.Factors Affecting the Supply of a Product Other than Its PriceFactorsRelationshipPrices of other goodsInverse relationshipNumber of productsDirect relationshipGovernment price controlsServes as a limitationPrice expectationsDirect relationshipGovernment subsidiesDirect relationshipChange in production costs or technological advancesInverse relationshipElasticity of SupplyElasticity of Supply measures the percentage change in the quantity supplied or a product resulting from a change in the product price. It is calculated as follows:

Supply is said to be elastic if Es > 1, unitary elastic if Es = 1, and inelastic if Es < 1Elastic supply means that, a percentage increase in price will create a larger percentage increase in supply

Market Equilibrium and PricingA market is an abstract concept that encompasses the forces generated by the buying and selling decisions of economic participantsEquilibrium is a state of balance between conflicting forcesBefore a market equilibrium can be attained, the decisions of consumer and producers must be coordinated. Their buying and selling activities must be brought into harmony with one anotherMarket Equilibrium and PricingShort-run market equilibrium is a time period of insufficient length to permit decision makers to adjust fully to a change in market conditionLong-run market equilibrium is a time period of sufficient length to enable decision makers to adjust fully to a market changeImpact on Equilibrium of Shifts in the Supply and Demand ScheduleMarket prices will bring the conflicting forces of supply and demand into balanceWhen a market is in long-run equilibrium, supply and demand will be in balance and the producers opportunity cost will equal the market priceChanges in consumer income, prices of closely related goods, preferences and expectations as to future prices will cause the entire demand curve shiftImpact on Equilibrium of Shifts in the Supply and Demand ScheduleChanges in input prices, technology and other factors that influence he producers cost of production will cause the entire supply curve to shiftThe constraint of time temporarily limits the ability of consumers to adjust to changes in pricesWhen a price is fixed below the market equilibrium, buyers would want to purchase more than what sellers are willing to supplyWhen a price is fixed above the market equilibrium level, sellers will want to supply a larger amount than buyers are willing to purchase at the current priceShort-run Total CostVariable Cost (VC)Average Fixed Cost (AFC)Average Variable Cost (AVC)Marginal Cost (MC)Average Total Cost (ATC)Fixed Cost (FC)Long-run Total CostIn the long-run, all inputs are available because additional plant capacity can be built. If in the long-run, a firm increases all production factors by a given proportion, there are the following three possible outcomes:Constant returns to scaleIncreasing returns to scaleDecreasing returns to scaleProfitsThere are two different types of profit:Normal profit. The amount of profit necessary to compensate the owners for their capital and/or managerial skills. It is just enough profit to keep the firm in business in the long-runEconomic profit. The amount of profit in excess of normal profit. In a perfectly competitive market, economic profit cannot be experienced in the long-runProductionA good should be produced and sold as long as, the marginal cost (MC) of producing the good is less than or equal to the marginal revenue (MR) from the sale of that goodMarginal ProductThe marginal product is the additional output obtained from employing one additional unit of a resourceTo be competitive, management must produce the optimal output in the most efficient manner. The cost of production in the long-run is minimized when the marginal product (MP) per peso of every input is the sameThe Role of Money in the EconomyMoney is any item or commodity that is generally accepted as a means of payment for goods and services of for repayment of debt, and that serves as an asset to its holderMoney serves three main purposes:Medium of ExchangeStore of ValueStandard Value or Unit of AaccountThe Supply and Demand for MoneyMoney facilitates the flow of resources in the circular model of macroeconomy. Not enough money will slow down the economy, and too much money can cause inflation because of higher price levels.The Money SupplyThe Key Measures for the Money Supply are:M1. The narrowest measure of the money supply. It includes currency in circulation held by the nonblank public, demand deposits, other checkable deposits and travelers checks.M2. This measure includes money held in savings deposits, money market deposit accounts, noninstitutional money market mutual finds and other short-term money market assetsThe Money SupplyM3. This measure includes the financial institutionsL. This measure includes liquid and near-liquid assetsThe Demand for MoneyThe sources of the Demand for Money are:Transaction demand. Money demanded for day-to-day payments through balances held by households and firms. Precautionary demand. Money demanded as a result of unanticipated payments.Speculative demand. Money demanded because of expectations about interest rates in the future.The Impact of MoneyIn the macroeconomic short-run, some prices will be inflexibleThe BSPs monetary policy has an immediate, short-run impact on the economyMonetary policy can be applied in the short-run when the economy faces an inflationary gapIf the economy is at its long-run equilibrium, and the BSP increases the money supply, it will increase aggregate demandThe Quantity Theory of MoneyThe quantity theory of money holds that changes in the money supply (MS) directly influences the economys price level, but nothing else. This theory follows from the equation of exchange:

whereM= quantity of moneyV= velocity of moneyP= price levelY= real GDPInterest RatesThe interest rates link the future to the present. It allows individuals to evaluate the present value (the value today) of future income and costs. In essence, it is the market price of earlier availabilityIn a modern economy, people often borrow funds to finance current investments and consumption.How Interest Rate are DeterminedInterest rates are determined by the demand for and supply of loanable funds.Investors demand finds in order to finance capital assets tat they believe will increase output and generate profit. Simultaneously, consumers demand loanable funds because they have a positive rate of time preferenceDetermining the Interest Rate

Money Market Equilibrium

How Interest Rates are DeterminedAccording to Keynesian theory, the rate of interest is determined as a price in two markets:Investment funds. The rate of interest balances the demand for funds and the supply of fundsLiquid assets. Because borrowers require cash in the long-term, they are willing to compensate lenders for giving up liquidityThe Nominal or Money Rate vs. The Real Rate of InterestDuring a period of inflation, the nominal interest rate or money rate of interest is misleading indicator of how much borrowers are paying and lenders are receivingInterest Rates and RiskThere are many interest rates. There is the mortgage rate, prime interest rate, consumer loan rate and the credit card rate to name a fewInterest rates in the loanable funds market will differ mainly because of differences in the risks associated with the loansInterest Rates and RiskThe money rate of interest on a loan has three components:Pure interest. The real price one must pay for earlier availabilityInflationary-premium. Reflects the expectation that the loan will be repaid with pesos of less purchasing power as the result of inflationRisk-premium. Reflects the probability of defaultEffect of Change in Interest RatesShort-term interest rates are relevant for loans with a relatively short length for repayment while long-term interest rates on the other hand, are relevant for loans such as long-term corporate borrowing and 10-20-30 year fixed rate motgages.