Annual Shareholders Meeting 27 October 2005. Wayne Boyd, Chairman.

-

Upload

buddy-wilkins -

Category

Documents

-

view

214 -

download

0

Transcript of Annual Shareholders Meeting 27 October 2005. Wayne Boyd, Chairman.

Annual Shareholders Meeting

27 October 2005

Wayne Boyd, Chairman

Agenda

Chairman’s introduction

Managing Director’s review and trading update

Resolutions

General Highlights

• All subsidiaries have delivered profitable growth

• Archive acquisition performed fully to expectation

• Approximately 7,000 retail and institutional shareholders

• 90% of shares held in New Zealand

Financial Highlights

2005 2004 variance

$000 $000 %

Operating revenue 233,725 214,498 9%

EBITDA 54,996 45,618 21%

EBITA 50,539 40,714 24%

NPAT 21,991 16,137 36%

NPATA 26,948 21,081 28%

Earnings per share (NPAT) 17 cents 13 cents 30%

Dividends

Jun-05 Dec-04 Jun-04 Dec-03

Dividend declared $10.7m $9.45m $8.55m $7.25m

Cents per share 8.50 7.50 6.90 5.85

Full year (cps) 16.00 12.75

Key points:• Increase of 26% compared to 2004• Fully Imputed• Paid 30 September 2005

Dean Bracewell, Managing Director

Review and Trading Update

Managing Director’s Presentation

Industry overview and business description

Business strategy

Trading update

Outlook

Express Package Industry Overview and Business Description

Express Package Industry

• Two segments to Express Package industry– Network couriers 90% of industry revenue– Point-to-point couriers 10%

• Services embedded in supply chains of businesses

• Consolidated industry structure

• Growth underpinned by demand for Just in Time supply

Business Description - Strengths

• Experienced people

• Network of independent contractors

• Operational excellence and profit culture

• Dedicated express package linehaul network

• Established multi-brand strategy

Multi-Brand Strategy

Price

Service

Three major brands:

– Differentiated by price and service

– Captures growth across entire market

Freightways’ Network Courier Brands

Information Management and Business Mail Industry Overview and

Business Description

• Total information management solution

• Records management growth opportunity

• Integrated with Freightways express package operations

Information Management

Business Mail

• Niche player in deregulated postal services industry

• Growth opportunities in business mail segment

• Integrated with Freightways express package operations

Business Strategy

Strategy

• Investing for growth - people, infrastructure and IT

• Continued development of growth opportunities in Freightways’ existing three markets

• Positioning, People, Performance, Profit

• Explore complementary acquisition and alliance opportunities

Trading Update

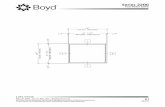

• 9% revenue growth compared to 2004

• 5-year compound average annual revenue growth of 7%

Operating Revenue

-

50

100

150

200

250

Jun99 Jun00 Jun01 Jun02 Jun03 Jun04 Jun05

Year Ended

$M 2nd Half

1st Half

EBITA

• 24% EBITA growth compared to 2004

• 5-year compound average annual EBITA growth of 19%

-

10

20

30

40

50

Jun99 Jun00 Jun01 Jun02 Jun03 Jun04 Jun05

Year Ended

$M 2nd Half

1st Half

Current Financial Performance

Qtr ended 30 September

2005 2004 variance

$000 $000 %

Operating revenue 62,445 57,069 9%

EBITDA 14,416 12,943 11%

EBITA 13,236 11,849 12%

NPAT 6,109 5,037 21%

NB: September YTD numbers are drawn from management accounts

and are unaudited

Outlook

Outlook

• A less buoyant economy is expected

• Characteristics of competitive environment expected to remain unchanged

• Consistent application of proven market strategies

• Positive outlook for shareholders and all other stakeholders

Summary

Strong successful business

Positioned to deliver continuing earnings growth

Delivering an attractive dividend yield

Questions

Resolutions

Re-election of Directors

Authority to fix Auditors’ remuneration

Annual Shareholders Meeting

27 October 2005