Annual Returns for Key Indices Rank ed in Order of Performance (1997–2016) 1/2

Click here to load reader

-

Upload

ian-beckett -

Category

Business

-

view

17 -

download

1

Transcript of Annual Returns for Key Indices Rank ed in Order of Performance (1997–2016) 1/2

Knowledge. Experience. Integrity. © 2017 Callan Associates Inc.

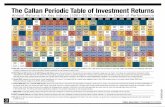

The Callan Periodic Table of Investment ReturnsAnnual Returns for Key Indices Ranked in Order of Performance (1997–2016)

S&P 500

33.36%

S&P 500

28.58%

S&P 500

21.04%

S&P 500

-9.11%

S&P 500

-11.89%

S&P 500

-22.10%

S&P 500

28.68%

S&P 500

10.88%

S&P 500

4.91%

S&P 500

15.79%

S&P 500

5.49%

S&P 500

-37.00%S&P 500

26.47%

S&P 500

15.06%

S&P 500

2.11%

S&P 500

16.00%

S&P 500

32.39%

S&P 500

13.69%

S&P 500

1.38%

S&P 500

11.96%

GrowthS&P 500

36.52%

GrowthS&P 500

42.16%

GrowthS&P 500

28.24%

GrowthS&P 500

-22.08%

GrowthS&P 500

-12.73%

GrowthS&P 500

-23.59%

GrowthS&P 500

25.66%

GrowthS&P 500

6.13%

GrowthS&P 500

4.00%

GrowthS&P 500

11.01%

GrowthS&P 500

9.13%

GrowthS&P 500

-34.92%

GrowthS&P 500

31.57%

GrowthS&P 500

15.05%

GrowthS&P 500

4.65%

GrowthS&P 500

14.61%

GrowthS&P 500

32.75%

GrowthS&P 500

14.89%

GrowthS&P 500

5.52%

GrowthS&P 500

6.89%

ValueS&P 500

29.98%

ValueS&P 500

14.69%

ValueS&P 500

12.73%

ValueS&P 500

6.08%

ValueS&P 500

-11.71%

ValueS&P 500

-20.85%

ValueS&P 500

31.79%

ValueS&P 500

15.71%

ValueS&P 500

5.82%

ValueS&P 500

20.81%

ValueS&P 500

1.99%

ValueS&P 500

-39.22%

ValueS&P 500

21.17%

ValueS&P 500

15.10%

ValueS&P 500

-0.48%

ValueS&P 500

17.68%

ValueS&P 500

31.99%

ValueS&P 500

12.36%

ValueS&P 500

-3.13%

ValueS&P 500

17.40%

2000Russell

22.36%

2000Russell

-2.55%

2000Russell

21.26%

2000Russell

-3.02%

2000Russell

2.49%

2000Russell

-20.48%

2000Russell

47.25%

2000Russell

18.33%

2000Russell

4.55%

2000Russell

18.37%

2000Russell

-1.57%

2000Russell

-33.79%

2000Russell

27.17%

2000Russell

26.85%

2000Russell

-4.18%

2000Russell

16.35%

2000Russell

38.82%

2000Russell

4.89%

2000Russell

-4.41%

2000Russell

21.31%

Growth2000

Russell

12.95%

Growth2000

Russell

1.23%

Growth2000

Russell

43.09%

Growth2000

Russell

-22.43%

Growth2000

Russell

-9.23%

Growth2000

Russell

-30.26%

Growth2000

Russell

48.54%

Growth2000

Russell

14.31%

Growth2000

Russell

4.15%Growth2000

Russell

13.35%

Growth2000

Russell

7.05%

Growth2000

Russell

-38.54%

Growth2000

Russell

34.47%

Growth2000

Russell

29.09%

Growth2000

Russell

-2.91%

Growth2000

Russell

14.59%

Growth2000

Russell

43.30%

Growth2000

Russell

5.60%Growth2000

Russell

-1.38%

Growth2000

Russell

11.32%

2000 ValueRussell

31.78%

2000 ValueRussell

-6.45%

2000 ValueRussell

-1.49%

2000 ValueRussell

22.83%

2000 ValueRussell

14.02%

2000 ValueRussell

-11.43%

2000 ValueRussell

46.03%

2000 ValueRussell

22.25%

2000 ValueRussell

4.71%

2000 ValueRussell

23.48%

2000 ValueRussell

-9.78%

2000 ValueRussell

-28.92%

2000 ValueRussell

20.58%

2000 ValueRussell

24.50%

2000 ValueRussell

-5.50%

2000 ValueRussell

18.05%

2000 ValueRussell

34.52%

2000 ValueRussell

4.22%

2000 ValueRussell

-7.47%

2000 ValueRussell

31.74%

EAFEMSCI

1.78%

EAFEMSCI

20.00%

EAFEMSCI

26.96%

EAFEMSCI

-14.17%

EAFEMSCI

-21.44%

EAFEMSCI

-15.94%

EAFEMSCI

38.59%

EAFEMSCI

20.25%

EAFEMSCI

13.54%

EAFEMSCI

26.34%

EAFEMSCI

11.17%

EAFEMSCI

-43.38%

EAFEMSCI

31.78%

EAFEMSCI

7.75%

EAFEMSCI

-12.14%

EAFEMSCI

17.32%

EAFEMSCI

22.78%

EAFEMSCI

-4.90%

EAFEMSCI

-0.81%

EAFEMSCI

1.00%

AggBarclays

Bloomberg

9.64%

AggBarclays

Bloomberg

8.70%

AggBarclays

Bloomberg

-0.82%

AggBarclays

Bloomberg

11.63%Agg

BarclaysBloomberg

8.43%

AggBarclays

Bloomberg

10.26%

AggBarclays

Bloomberg

4.10%Agg

BarclaysBloomberg

4.34%Agg

BarclaysBloomberg

2.43%Agg

BarclaysBloomberg

4.33%

AggBarclays

Bloomberg

6.97%

AggBarclays

Bloomberg

5.24%

AggBarclays

Bloomberg

5.93%Agg

BarclaysBloomberg

6.54%

AggBarclays

Bloomberg

7.84%

AggBarclays

Bloomberg

4.21%

AggBarclays

Bloomberg

-2.02%

AggBarclays

Bloomberg

5.97%

AggBarclays

Bloomberg

0.55%

AggBarclays

Bloomberg

2.65%

MarketsEmerging

MSCI

-11.59%Markets

EmergingMSCI

-25.34%

MarketsEmerging

MSCI

66.42%

MarketsEmerging

MSCI

-30.61%

MarketsEmerging

MSCI

-2.37%

MarketsEmerging

MSCI

-6.00%

MarketsEmerging

MSCI

56.28%Markets

EmergingMSCI

25.95%Markets

EmergingMSCI

34.54%Markets

EmergingMSCI

32.59%Markets

EmergingMSCI

39.78%

MarketsEmerging

MSCI

-53.18%

MarketsEmerging

MSCI

79.02%

MarketsEmerging

MSCI

19.20%

MarketsEmerging

MSCI

-18.17%

MarketsEmerging

MSCI

18.63%

MarketsEmerging

MSCI

-2.27%

MarketsEmerging

MSCI

-1.82%

MarketsEmerging

MSCI

-14.60%

MarketsEmerging

MSCI

11.60%

High YieldBarclays

Bloomberg

12.76%

High YieldBarclays

Bloomberg

1.87%

High YieldBarclays

Bloomberg

2.39%

High YieldBarclays

Bloomberg

-5.86%

High YieldBarclays

Bloomberg

5.28%

High YieldBarclays

Bloomberg

-1.41%

High YieldBarclays

Bloomberg

28.97%High YieldBarclays

Bloomberg

11.13%

High YieldBarclays

Bloomberg

2.74%

High YieldBarclays

Bloomberg

11.85%High YieldBarclays

Bloomberg

1.87%

High YieldBarclays

Bloomberg

-26.16%High YieldBarclays

Bloomberg

58.21%

High YieldBarclays

Bloomberg

15.12%

High YieldBarclays

Bloomberg

4.98%

High YieldBarclays

Bloomberg

15.81%

High YieldBarclays

Bloomberg

7.44%High YieldBarclays

Bloomberg

2.45%High YieldBarclays

Bloomberg

-4.47%

High YieldBarclays

Bloomberg

17.13%

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

The Callan Periodic Table of Investment Returns conveys the strong case for diversification across asset classes (stocks vs.

bonds), investment styles (growth vs. value), capitalizations (large vs. small), and equity markets (U.S. vs. non-U.S.). The Table

highlights the uncertainty inherent in all capital markets. Rankings change every year. Also noteworthy is the difference between

absolute and relative performance, as returns for the top-performing asset class span a wide range over the past 20 years.

A printable copy of The Callan Periodic Table of Investment Returns is available on our website at www.callan.com.

Barclays Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities of at least oneyear.

Barclays High Yield Bond Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporatebonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excludingemerging market debt.

MSCI EAFE is a Morgan Stanley Capital International Index that is designed to measure the performance of the developed stock marketsof Europe, Australasia, and the Far East.

MSCI Emerging Markets is a Morgan Stanley Capital International Index that is designed to measure the performance of equity marketsin 23 emerging countries around the world.

Russell 2000 measures the performance of small capitalization U.S. stocks. The Russell 2000 is a market-value-weighted index of the2,000 smallest stocks in the broad-market Russell 3000 Index.

Russell 2000 Value and Russell 2000 Growth measure the performance of the growth and value styles of investing in small cap U.S.stocks. The indices are constructed by dividing the market capitalization of the Russell 2000 Index into Growth and Value indices, usingstyle “factors” to make the assignment. The Value Index contains those Russell 2000 securities with a greater-than-average valueorientation, while the Growth Index contains those securities with a greater-than-average growth orientation. Securities in the Value Indexgenerally have lower price-to-book and price-earnings ratios than those in the Growth Index. The indices are market-capitalization-weighted. The constituent securities are not mutually exclusive.

S&P 500 measures the performance of large capitalization U.S. stocks. The S&P 500 is a market-value-weighted index of 500 stocks.The weightings make each company’s influence on the Index performance directly proportional to that company’s market value.

S&P 500 Growth and S&P 500 Value measure the performance of the growth and value styles of investing in large cap U.S. stocks.The indices are constructed by dividing the market capitalization of the S&P 500 Index into Growth and Value indices, using style“factors” to make the assignment. The Value Index contains those S&P 500 securities with a greater-than-average value orientation,while the Growth Index contains those securities with a greater-than-average growth orientation. The indices are market-capitalization-weighted. The constituent securities are not mutually exclusive.

Callan’s Periodic Table of Investment Returns depicts annual returns for 10 asset classes, ranked from best to worst

performance for each calendar year. The asset classes are color-coded to enable easy tracking over time. We describe the

well-known, industry-standard market indices that we use as proxies for each asset class in the text below.

Callan was founded as an employee-

owned investment consulting firm in

1973. Ever since, we have empowered

institutional clients with creative,

customized investment solutions that are

uniquely backed by proprietary research,

exclusive data, ongoing education and

decision support. Today, Callan advises

on more than $2 trillion in total assets,

which makes us among the largest

independently owned investment

consulting firms in the U.S. We use a

client-focused consulting model to serve

public and private pension plan

sponsors, endowments, foundations,

operating funds, smaller investment

consulting firms, investment managers,

and financial intermediaries. For more

information, please visit www.callan.com.

Corporate Headquarters

San Francisco 800.227.3288

Regional Consulting Offices

Atlanta 800.522.9782

Chicago 800.999.3536

Denver 855.864.3377

Summit 800.274.5878

www.callan.com

The Callan Periodic Table of Investment Returns 1997–2016