ANNUAL REPORT 2015... 2015 ANNUAL REPORT L iqu idit y M a nag eme n t C e n t r e B.S. C . ( c ) A...

Transcript of ANNUAL REPORT 2015... 2015 ANNUAL REPORT L iqu idit y M a nag eme n t C e n t r e B.S. C . ( c ) A...

ww

w.lm

cbah

rain

.com

2015

ANNUALREPORT

L i q u i d i t y M a n a g e m e n t C e n t r e B . S . C . ( c ) A n n u a l R e p o r t 2 0 1 5

14

Annual Report2015

Liquidity Management Centre B.S.C. (c) 9th Floor, LMC Building - P.O. Box 11567Seef District, Kigdom of Bahrain

Tel : (973) 17568568 - Fax : (973) 17568569

w w w . l m c b a h r a i n . c o m

Liquidity Management Centre B.S.C. (c) 9th Floor, LMC Building - P.O. Box 11567Seef District, Kigdom of Bahrain

Tel : (973) 17568568 - Fax : (973) 17568569

w w w . l m c b a h r a i n . c o m

His Royal Highness Prince Khalifa Bin Salman Al KhalifaThe Prime Minister of theKingdom of Bahrain

His Majesty KingHamad Bin Isa Al Khalifa The King of the Kingdom of Bahrain

His Royal Highness Prince Salman Bin Hamad Al Khalifa The Crown Prince & Deputy Supreme Commander & First Deputy Prime Minister of the Kingdom of Bahrain

5 | Liquidity Management Centre B.S.C. (c)

Vision and Mission 06

Corporate Profile 08

Chairman’s Message 12

Biographies of BOD 14

CEO’s Message 16

Executive Management 17

Corporate Governance 20

Financial Highlights 22

Shari’a Supervisory Board Report 24

Independent Auditors’ Report 25

Financial Statements 27

Public Disclosure 69CON

TEN

TS

6 | Annual Report 2015

OUR VISION & MISSION

Liquidity Management Centre B.S.C.(c) (LMC) is a Wholesale Islamic Investment Bank incorporated in July 2002 and regulated by the Central Bank of Bahrain. It aims to provide optimal Islamic Financing and Investment solutions which contribute to growth of the Islamic capital market.

7 | Liquidity Management Centre B.S.C. (c)

VISIONTo enable Islamic financial institutions to manage their liquidity mismatch through short and medium term liquid investments structured in accordance with the Shari’a principles.

MISSIONFacilitating the investment of surplus funds with Islamic banks and financial institutions into quality short and medium term financial instruments structured in accordance with Shari’a principles.

LMC is committed to playing a key role in the creation of an active and geographically expansive Islamic inter-bank market which will assist Islamic financial institutions in managing their short-term liquidity. The establishment and depth of such inter-bank market will further accelerate the development process of the Islamic banking sector. In addition, LMC continues to attract assets from governments, financial institutions and corporates in both private and public sectors in key target markets. The sourced assets are also securitized into readily transferable securities or structured into other innovative investment instruments.

8 | Annual Report 2015

Bahrain Islamic Bank:Bahrain Islamic Bank (BIsB) was established in 1979 as the first Islamic commercial

bank in the Kingdom of Bahrain. The Bank has been maintaining its leading

position in the Islamic banking sector through adopting innovative Islamic

investment and financing products, supported by superior retail and corporate

banking services. The Bank is listed on the Bahrain Bourse (previously known

as the Bahrain Stock Exchange). The major shareholders are leading local and

regional financial institutions. The Bank operates under supervision and the

regulatory framework of the Central Bank of Bahrain.

Dubai Islamic Bank:Dubai Islamic Bank, established in 1975, is the world’s first Shariah-compliant

player and the largest Islamic Bank in UAE, with growing international operations

in Asia, Middle East and Africa. The organization is increasingly being recognized

as a formidable force in the area of global Islamic finance and one of the most

progressive Islamic Financial institutions in the world. The bank is also a renowned

player in the Islamic debt capital markets where a number of historic mandates

have been won and successfully delivered.

Islamic Development Bank: The Islamic Development Bank is a multi-national financial institution

established in pursuance of the Declaration of Intent issued by the Conference

of Finance Ministers of Muslim Countries held in Jeddah in Dhul Q’adah 1393H,

corresponding to December 1973. The purpose of the Bank is to foster the

economic development and social progress of member countries and Muslim

communities individually as well as jointly in accordance with the principles of

Shari’a.

Kuwait Finance House Investment Company: Kuwait Finance House Investment Company formerly known as Liquidity

Management House is a wholly owned subsidiary of Kuwait Finance House.

KFHI was established in December 2007 in the State of Kuwait and commenced

its operations in May 2008. The company was launched with a paid up capital

of Kuwaiti Dinars 100 Million (approx US$ 360 million) with the objective to be

market leader in International Debt Capital Market arena.

CORPORATE PROFILESHAREHOLDERS

SHAREHOLDERS COUNTRY SHAREHOLDING (%)

Bahrain Islamic Bank Kingdom of Bahrain 25%

Dubai Islamic Bank United Arab Emirates 25%

Islamic Development Bank Kingdom of Saudi Arabia 25%

Kuwait Finance House Investment Co. State of Kuwait 25%

9 | Liquidity Management Centre B.S.C. (c)

LMC TODAY

LMC plays an active role in the primary and secondary Islamic financing market delivering innovative, adaptable and tradable

Islamic Shari’a compliant short term and medium term financial instruments to Islamic financial institutions. In addition, it

provides Islamic advisory services, including but not limited to the areas of structured finance, project finance and corporate

finance.

With an authorized capital of US$ 200 million and an equity of US$ 70 million as of 31st December 2015, LMC proudly shares

a very close working relationship with each of its shareholders who are renowned in the Islamic Financial Market for their

contribution to the industry, namely, Bahrain Islamic Bank B.S.C. (Kingdom of Bahrain), Dubai Islamic Bank P.J.S.C. (United Arab

Emirates), Islamic Development Bank (Saudi Arabia) and Kuwait Finance House Investment Company (State of Kuwait) each

of whom today hold equal shares in LMC. The Bank has proven to be a leading arranger of sukuk instruments (Islamic bonds)

having issued a number of innovative sukuk with recognised structures that have been reflected in other sukuk issuances in the

region. LMC has also been recognized for their innovation winning an award from Euromoney for the best debt house in Bahrain

“Best Domestic Market Sukuk House” in 2005.

The Bank’s focus has not only been on bringing long term financing opportunities but also developing short term Shari’a

compliant investment opportunities. The Bank has pioneered the structure of its Short Term Sukuk Program, a tradable low

risk liquidity management product which provides investors with opportunity to invest in short term sukuk. The program is

secured by a diverse, high quality and liquid portfolio of asset backed corporate and sovereign sukuk instruments arranged and

administered by LMC and other recognized arrangers with a purchase undertaking from LMC. The Short Term Sukuk Program is

the first such repackaged Sukuk product to be offered into the Islamic banking market.

BUSINESS SERVICES AND PRODUCTS OFFERED

1. Short Term Investment ServicesLMC conducts extensive Sukuk asset sourcing and repacking as part of the offering, placement and administration of its

Short Term Sukuk (STS) Program.

2. Structured Finance ServicesLMC’s structured finance services provide an end-to-end solution tailored to meet the needs of its clients in the international

market place. Comprising services offered include the following:

• Finance Raising:LMC has extensive experience in the structuring, issuance, marketing and post-issuance administration of tradable Islamic

capital markets instruments such as Sukuk. The approach centres on structuring attractive transactions in partnership with

clients. Its role includes being an arranger, structuring advisor, documentation agent and placement agent.

• Private Equity Raising: Conducts and coordinates with its client the modelling of transactions, identifying and resolving prospective legal and

corporate issues arising from equity offerings, prepares offering documents and presentation materials, articulates all

placement related activities, and conducts the offering process. Throughout, LMC is solely focussed on ensuring the

successful completion of the equity raising transaction.

3. Strategic Advisory ServicesThese services revolve around the provision of analysis and advice to clients in relation to their business development activities.

The principal objective is to develop and evaluate strategic plans which meet the client’s needs. Additionally, LMC actively

focuses in ensuring that its clients optimise their capital structures with a view to facilitating access to new and efficient sources

of debt and/or equity and other forms of Islamic compliant financing.

• Portfolio Management:

10 | Annual Report 2015

Advise and manage fixed income investments which include Sukuk in various sectors through valuation tools and factors that

influence sukuk yields. LMC also manages a proprietary equity investment portfolio to maximize returns through carefully

examining markets and companies while adhering to Shari’a principles.

PRIMARY MARKET ARRANGEMENT TRACK RECORD

1. Bahrain – Eskan Bank - Bahrain Property Musharaka Trust BD 40 Million issued in November 2010.

2. Bahrain – Golden Falcon Syndicated Ijara Facility – US $140 million closed in July 2009.

3. Bahrain – BFH Asset Company, Syndicated Investment Agency (Wakala) Facility - AED 367.3 million

closed in December 2008.

4. UAE – Thani Investments Limited Sukuk – US$100 Million issued in November 2007.

5. GCC – Project Finance Sukuk for Cement Plant – US$130 Million issued in September 2007.

6. Kuwait – Lagoon City Sukuk – US$200 Million issued in December 2006.

7. UAE – Bukhatir Investments Limited Sukuk – US$50 Million issued in May 2006.

8. Bahrain - Bahrain Financial Harbour Al Marfa’a Al Mali Sukuk - US$134 Million issued in July 2005.

9. Kuwait - The Commercial Real Estate Company Ijara Sukuk - US$100 Million issued in May 2005.

10. Bahrain - Durrat Khaleej Al Bahrain Sukuk - US$152.5 Million issued in January 2005.

11. Bahrain - FIRSAN Sukuk - Euro76 Million issued in October 2004.

12. UAE - EMAAR Sukuk - US$65 Million issued in June 2004.

13. Bahrain – Bahrain Monetary Agency Ijara Sukuk US$250 Million issued in June 2003.

SECONDARY MARKET DEVELOPMENT ACTIVITIES

LMC plays an active role in the secondary Islamic financing market delivering innovative, adaptable and tradable Islamic

Shari’a compliant short term, medium term and long term financial instruments to Islamic financial institutions. The Bank has

pioneered the structure of its Short Term Sukuk Program, a tradable low risk liquidity management product which actively

promotes the secondary market development activities.

Backed by its strong operating performance, LMC looks forward to maintaining a reasonable growth phase during the current

market conditions. Having said that, LMC foresees itself equipped to harness further activities and expand its services to

include a range of investment banking solutions including debt capital markets, asset management, equity capital markets

and private equity in compliance with Islamic Shari’a principles.

12 | Annual Report 2015

2015 RESULTS AND PERFORMANCE

1. As widely acknowledged 2015 remained a relatively challenging year for the financial markets in the midst of regional political turmoil and falling oil prices. Conservative asset valuations continued to remain the largest factor weighing on profitability for financial institutions. With flight to quality continuing, 2015 witnessed improved risk appetite as financial institutions searched for higher returns. Nevertheless, most of the year saw the investment grade, government and quasi government issuers gaining a much larger share compared to other corporate entities. Despite continuing market volatility, out of Europe and earlier in the Middle East, LMC managed to achieve a net profit of USD 3.56 million for the fiscal year 2015 in comparison to a net profit of USD 4.22 million for the same period in 2014. It is worth noting that the Bank continued to be prudent by implementing aggressive steps to enhance its balance sheet. LMC further maintained the amount of provisions in line with market conditions and requirements. The Bank’s gross operating income stood at USD 10.08 million in 2015 and this was mainly due to:

a) The successful Sukuk investment activities, mainly through the Short Term Sukuk Program (“STS Program“) has proven to be, given current market conditions, a relatively superior instrument offering superior risk-adjusted returns;

b) Despite cautiously booking selected assets and also the capitalization of the portion repaid for the Ijarah facility for the LMC headquarter, the Bank’s total assets decreased from USD 202 million in 2014 to USD 183.39 million in 2015 mainly due to the sizable repayment of the Bank short term obligations;

Chairman’s Message

Mohammed Ahmed Hassan Janahi Chairman of the Board

In the name of Allah, the Most Compassionate, the Most Merciful, Praise be to Allah who takes all things towards perfection; Prayers and peace be upon Mohammed, His Last Prophet.

On behalf of the Board of Directors of Liquidity Management Centre B.S.C. (c) (“LMC“ or the “Bank“) I am pleased to present the Report of the Board of Directors for the year ended 31st December 2015.

13 | Liquidity Management Centre B.S.C. (c)

c) As mentioned above, lack of demand for corporate issuance resulted in a negative impact on fees income from primary issuance however this was offset by fee income from advisory services for prominent restructuring transactions. Moreover, the Bank’s revenue stream benefited from its diversified investment policy;

d) Barring for the ultra low levels of LIBOR during the year 2015, the returns from the Bank’s investments would have been higher.

2. The bank adopted a prudent and conservative approach towards controlling operating expenses which successfully assisted in lowering the operating expenses to USD 5.26 million in 2015 in comparison with USD 5.51 million in 2014.

3. The impairment provisioning during 2015 amounted to USD 832 thousand compared with USD 278 thousand in year 2014 in line with the Bank’s conservative provisioning policy.

4. The Bank continued to further book quality assets and take advantage of market conditions. However, the lack of supply in investment grade issuances that meet the banks criteria coupled with opportunistic Sukuk sales, led to a decrease in the bank’s investment portfolio from USD 145 million in 2014 to USD 97.67 in 2015.

5. The shareholders equity showed a healthy increase from USD 67.48 million in 2014 to USD 70.97 million in 2015 mainly due to net profit achieved during the year. This was a result of the efficient performance of the Bank during challenging economic circumstances.

6. The Board of Directors have decided not to distribute any dividends for the year 2015.

Although economic indicators depict a pessimistic view on the regional economy, we look forward to 2016 with greater confidence as we pursue further diversification through cautiously exploring and engaging in new business lines.

In closing, on behalf of the Board of Directors, I would like to thank the Government of the Kingdom of Bahrain represented by the Central Bank of Bahrain and Ministry of Industry and Commerce for their continued commitment and support to the Islamic Banking sector.

My highest appreciation is also due to our shareholders, Islamic Development Bank, Dubai Islamic Bank, Bahrain Islamic Bank and Kuwait Finance House Investment Co. (a wholly owned subsidiary of Kuwait Finance House - Kuwait), whose commitment was and will continue to be crucial to our success.

Finally, I would also like to thank the management and the staff of the Bank, for their outstanding dedication and performance

Allah the Almighty is the Purveyor of all Success.

Mohammed Ahmed Hassan Janahi Chairman of the Board

Chairman’s Message

14 | Annual Report 2015

Mr. Mohammed Ahmed Hassan Janahi (Chairman of the Board)Mr. Mohammed Ahmed Hassan Janahi is Deputy Chief Executive Officer at Bahrain Islamic Bank (BISB). Mr. Janahi assumed number of senior executive positions previously in Citibank, National Bank of Bahrain (NBB), Baraka Islamic Bank and Gulf Air in Bahrain. Mr. Janahi attended numerous courses on administrative sciences, banking and leadership at renowned universities and institutes in Europe and USA. In addition, he also attended a number of intensive and diversified workshops at leading institutions and banks, including Citibank, Financial Times and the Executive Development Institute in London. Mr. Janahi is a Bahraini national and has vast experience in banking & financial operations over a span of 46 years.

Mr. Farid Masood(Deputy Chairman)Mr. Farid Masood is the Director of Advisory Services and Asset Management at Islamic Corporation for the Development of the Private Sector (ICD), Islamic Development Bank’s private sector arm. He is also a member of the management committee and investment committee of ICD and represents ICD on the board / investment committee of several investee companies and investment funds. Mr. Masood held many positions before joining ICD, he was CEO of KASB Securities (Merrill Lynch) in Pakistan and also he was a Strategy Consultant for PricewaterhouseCoopers in the USA. Farid holds a Bachelors and Masters in Systems and Information Engineering from the University of Virginia (USA) and a Masters from the University of Cambridge (UK). He has over 22 years of professional experience.

Mr. Abdul Wahab Essa Al Rushood (Director)Mr. Al Rushood is the Group Chief Treasury Officer in Kuwait Finance House (Kuwait). He is currently holds board memberships in Kuwait Finance House (KFH), Bahrain; Development Enterprises Holding Co., Kuwait & Aviation, Lease and Finance Co. (ALAFCO), Kuwait. Mr. Al Rushood is a Kuwaiti national who holds a B.Sc. degree in Mathematics and Computer Science from Western Oregon State College, USA and has completed specialized Strategic Leading Management Program at Harvard Business School, USA. He has over 29 years of professional experience.

Dr. Adnan Chilwan (Director)Dr. Adnan Chilwan is the Group Chief Executive Officer of Dubai Islamic Bank (DIB). He has an extensive career spanning two decades with reputed conventional and Islamic banks in the region. He also represents DIB in boards of various strategic investments, subsidiaries and associates including Tamweel PJSC; DIB Capital; Deyaar PJSC; Liquidity Management Centre Bahrain and Dar Al Shari’a Consultancy. He is also on the advisory council of Higher Colleges of Technology (HCT), UAE. Dr. Chilwan is an Indian national who holds a PhD and MBA in Marketing. He is a Certified Islamic Banker (CeIB), a Post Graduate in Islamic Banking & Insurance and an Associate Fellow Member in Islamic Finance Professionals Board. He has over 20 years of banking experience in the gulf region.

BIOGRAPHIES OF BOARD OF DIRECTORSCORPORATE PROFILESHAREHOLDERS

15 | Liquidity Management Centre B.S.C. (c)

Mr. Khalid M. Al Doseri (Director) Mr. Khalid Mohammed Al Doseri is Chief Financial Officer (CFO) at Bahrain Islamic Bank (BISB). He was previously a Board Member and Managing Director of the Islamic Bank of Yemen. Mr. Al Doseri, a Bahraini national, is a Certified Public Accountant (CPA) from Oregon Board of Accountants, an MBA from the University of Glamorgan, and is a graduate of the Executive Management Development Program from the University of Virginia, Darden. He has over 32 years of professional experience.

Mr. Mohamed S. Al Sharif (Director)Mr. Al Sharif is currently the Chief of Investment Banking in Dubai Islamic Bank (DIB). He holds several Chairmanships and Board memberships on publicly traded companies and financial services firms on behalf of DIB Group. Starting his career with the UAE Central Bank, Al Sharif held many positions in the Financial Control and Banking Supervision departments and later transitioned to Dubai Islamic Bank where he held the position of CFO for 11 years. Mr. Al Sharif is a UAE national who is a Certified Public Accountant (CPA) from Virginia, USA; and a Master’s degree in Accounting. He is a registered accounting and banking expert by UAE Courts. Al Sharif is a banking professional with 29 years of experience in Islamic Banking and Central Banking.

Mr. Nawaf Al Menayekh (Director)Mr. Al Menayekh is the Senior Vice President of Investment Banking at Kuwait Finance House Investment in Kuwait. Mr. Al Menayekh is a Kuwaiti national who holds an MBA (International Banking & Finance) from The University of Birmingham, UK and has completed the Program for Leadership Development at Harvard University, USA. He has over 18 years of professional experience.

Mr. Seedy Mohammad Njie (Director)Mr. Seedy Mohammad Njie is a Senior Investment Specialist at the Islamic Development Bank (Jeddah). He was previously Senior Credit Risk Specialist with the same bank and Assistant Audit Manager with Deloitte - Gambia. Mr. Njie, a Gambian national, who holds MBA from School of Oriental and African Studies (University of London) and Certified Islamic Banker (CIBAFI). He is a Fellow with the Association of Chartered Certified Accountants - UK (FCCA), Chartered Management Accountant with the Chartered Institute of Management Accountants – UK. He has over 15 years of professional experience.

BIOGRAPHIES OF BOARD OF DIRECTORS

16 | Annual Report 2015

Ahmed AbbasChief Executive Officer

In the name of Allah, the Most Compassionate, the Most Merciful, Praise be to Allah who takes all things towards perfection; Prayers and peace be upon Mohammed, His Last Prophet.

Falling oil prices, regional political turmoil and subdued economic growth marked the close of the 2015. The year was filled with key events such as a 12 year low in oil prices, China’s devaluation of the Yuan and negative economic outlook for the GCC economies. The prevailing market conditions further subdued global Sukuk issuances which stood at USD 35.4 Billion for the year in comparison to USD 49.5 Billion for 2014. As the GCC continue to diversify their economies amidst falling oil prices and downgrades; addressing the fiscal budgets and deficit funding will become the key challenges during coming year along with asset valuations which have been the backdrop for a risk-averse environment.

The current economic environment resulted in LMC taking preventative measures and aggressive steps towards enhancing its financial position with a balanced approach and proactive risk management. However, despite the state of the global economy, LMC was still able to achieve a net profit of USD 3.56 million amid the Bank’s conservative approach toward impairment provisioning reflecting in a return on capital of 6.3% for the fiscal year 2015.

The Bank’s operating income stood at USD 10.08 million in comparison to USD 10.11 million in 2014. Net income before fair value changes and impairment provision stood at USD 4.82 million for the year 2015 in comparison to USD 4.60 million for the year 2014. During these trying times, the Bank booked assets selectively while utilizing excess liquidity to manage the repayment of short term obligations resulting in

the total assets declining from USD 202.00 million in 2014 to USD 183.39 million in 2015.

Fewer global issuances came to market during 2015 compared to 2014. The Bank’s involvement in the primary and secondary markets remained a core business area and given its cautious investment approach the Bank was able to maintain its net profit margins. Corporate clients remained risk averse and reluctant to come to capital markets finding the conditions not conducive however the Bank continued to focus on securing advisory mandates.

The current economic conditions and financial markets are expected to further slowdown due to the reduction in oil prices putting pressure on the GCC fiscal budgets for 2016. Given our track record and strong team here at LMC, we remain cautious and watchful to capitalize on opportunities should they arise in the coming future.

In summation, 2015 continued to be another challenging year for investors and despite all efforts, the market conditions limited us from achieving higher returns. However, we remain cautious and prepared for an evolving economic environment. We would like to take the opportunity to thank our team members, clients and more so our Shareholders and strategic partners for their continued support.

Ahmed AbbasChief Executive Officer

CEO’s Message

17 | Liquidity Management Centre B.S.C. (c)

Ahmed AbbasChief Executive Officer

Amer SadiqExecutive Vice President

Structured Finance

Hussain MerzaSenior Vice President

Financial Controls

EXECUTIVE MANAGEMENT

20 | Annual Report 2015

CORPORATE GOVERNANCE

LMC acknowledges the importance of Corporate Governance

as an application of the best management practices that are

directed towards achievement of corporate values, goals and

objective and enhancing shareholders value coupled with

high transparency and corporate responsibility. During 2015,

the Board conducted a thorough review of the Bank’s high

level policies for corporate governance, internal control, risk

management and compliance with the latest regulations and

guidelines of the Central Bank of Bahrain (CBB).

THE BOARD OF DIRECTORSThe Board is nominated by the shareholders of the Bank in

accordance with the provisions of the Article of Association

of the Bank and CBB approvals. The Board has eight

directors representing the interest of the Bank and is highly

responsible for the Management and its performance, and

provides directions and applies policies in order to ensure

strategic guidance of the Bank.

Board’s ResponsibilitiesThe Board of Directors is delegated with the responsibility to

oversee that the Bank is carrying out its duties, and enhance

the effectiveness of the Board. It serves in monitoring the

Management to ensure that the policies and processes are

in the right place to show that it is operating effectively and

taking the responsibility with regard to the financial report,

internal control and the process of monitoring compliance

with applicable laws and regulations. Each Director is

appointed for a three years term renewable at an Annual

General Meeting of the shareholders of the Bank, subject to

CBB approval.

Board MeetingsIn accordance with the applicable CBB regulations and the

Article of Association of the Bank, the Board of Directors is

required to meet at least four times per year. On a regular

basis, the Board have close contact with The Management

and are required to act within their given authority for the

benefit of the Bank.

BOARD COMMITTEESBoard of DirectorsThe Board of Directors is responsible for the conduct of the

general operations of the Bank and exercises all the powers

delegated by the Articles of Association of the Bank. The

Board has created four sub-committees to assist in carrying

out its duties.

Executive CommitteeThe Executive Committee is responsible for reviewing

investment proposals and implementing the Bank's strategy

and policies agreed by the Board of Directors. It also proposes

new strategies and policies to the Board of Directors and

acts as the principal forum in which members liaise through

their representatives with Management.

Audit CommitteeThe Audit Committee is responsible for the integrity of the

Bank’s financial statements, financial reporting process and

the Bank’s systems of internal accounting and financial

controls; reviewing internal control, internal audit and

external audit. In addition, the committee is responsible

for the compliance of the Bank with legal and regulatory

requirements, including the Bank’s disclosure of controls and

procedures.

Nomination, Remuneration & Corporate Governance CommitteeThe Nomination, Remuneration & Corporate Governance

Committee enables the Board to fulfill its responsibilities

in setting the appropriate composition and evaluating the

performance of the Board, individual directors and senior

management. Moreover, the Committee is responsible

for recommending remuneration policies and special

compensation plans for review and approval by the Board

of Directors. The committee also takes a leadership role in

shaping corporate governance policies and practices, leads

the Board in its annual review of the Board’s performance,

and recommends to the Board of Directors candidates for

appointment in each committee.

Risk Management CommitteeThe Risk Management Committee is responsible for identifying,

monitoring and approving the risk management policies

of the Bank to establish the appropriate approval level of

decisions. The committee also provides a forum for "big-picture"

analysis of future risks and critically assesses the Bank’s

business strategies and plans from a risk perspective.

SHARI’A SUPERVISORY BOARDThe Shari’a Supervisory Board is entrusted to ensure the

compliance aspects of the Bank’s products and instruments.

They are also responsible for monitoring and approving

the operations, investments and activities carried out by

the Bank without violating the principles and provisions

of Islamic Shari’a. The views of the Shari’a advisor shall be

binding in the specific area of supervision.

21 | Liquidity Management Centre B.S.C. (c)

Shari’a Board Members1. Dr. Hussain Hamed Hassan

2. Dr. Abdul Sattar Abu Ghuddah

3. Shaikh Adnan Al Qattan

MANAGEMENTLMC boasts significant achievements in a span of thirteen

years with a sound track record, acknowledged by industry

leaders around the world. LMC is led by Mr. Ahmed

Abbas, the Chief Executive Officer, and supported by a

professional technical and structured finance team and

a highly experienced and qualified management team.

The Management in LMC is responsible for working in an

effective manner combining legal and ethical manners in

its aim to increase teamwork, commitment, and to achieve

a successful decision making process through its staff and

business units in the Bank.

ORGANIZATIONAL STRUCTUREAs LMC cares about updating and maintaining its track

record, The Board has defined the organization structure

responsibilities and authorities for the Management team

and staff where they mainly respond to the changes and

needs of the Bank during the year and ensure the proper

segregation of responsibilities, accountabilities. and duties

of the staff, at all levels.

COMPLIANCELMC conducts its business with separate compliance

functions in handling its works under the regulatory

requirements stipulated by the CBB. The Bank complies

under many key regulations such as, Shari’a Compliance,

Legal Compliance, Financial Accounting Standards and the

CBB's Regulations and Guidelines.

Status of Compliance with the CBB Rules - Corporate Governance Guidelines (High Level Controls Module)Liquidity Management Centre “LMC” regularly reviews its

compliance with the governance requirements stipulated in

the High Level Control Module (HC) issued by the Central

Bank of Bahrain.

During 2015, LMC fully complied with the requirements

of the CBB’s High Level Control Module except for the

following:

Rule HC-1.3.4:Each individual Board member must attend at least 75% of

all Board meetings in a given financial year.

LMC’s Explanation: During 2015, the Bank’s Board of Directors met the

attendance requirement with an exception of two

Members. The Bank would like to highlight that meetings

were scheduled in advance and the Bank provided an

appropriate amount of notice for each meeting. The Bank

also offered Members the option of attending meetings

via conference calls. Currently one of the above mentioned

Members has resigned and lengthy discussions have been

made with the remaining Member who has assured us that

the attendance requirement will be met in the current year.

Rule HC-1.4.4, HC-1.4.8, HC-3.2.1, HC-4.2.2 & Guidance HC-1.4.5, HC-1.4.6, HC-1.8.2, HC-5.3.2, HC-9.2.4:The Bank must appoint at least one Independent Director,

majority of Independent Directors in the Audit Committee

and Nomination should be Independent, and the Chairman

must not be an Executive Director.

LMC’s Explanation: As of 31st December 2015, the Bank has 8 Dependent

- Executive Directors, representing the four institutional

Shareholders equally. These Directors are appointed by

the Shareholders and hold managerial positions in their

respective institutions but are not currently involved in the

daily management of LMC.

In order to comply with HC-1.4.4, the Nomination,

Remuneration and Corporate Governance Committee is in

the process of setting a selection criteria and methodology

to evaluate and appoint a suitable independent Director.

Furthermore, although the Chairman is an Executive Director

as per the definition of the CBB since he is in a management

position at one of the Bank’s Shareholder, he is not involved

in the daily management of LMC.

The Bank continues to be committed to adopting banking

practices to ensure the best corporate governance and

will continue to endeavor to be in compliance with the HC

Module of the Central Bank of Bahrain.

22 | Annual Report 2015

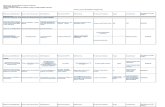

2015 2014 2013 2012 2011 2010

Balance Sheet Position

Total Assets 183,394 202,003 221,045 213,645 184,657 237,196

Total Liabilities 112,427 134,524 158,088 154,871 129,193 181,773

Total Equity 70,967 67,479 62,957 58,774 55,464 55,423

Profit & Loss Statement

Operating Income 10,079 10,113 10,567 8,060 7,349 7,740

Net profit before unrealized fair value change and impairment provision 4,817 4,604 4,849 3,155 1,498 634

Net Profit/(Loss) 3,558 4,224 3,577 3,069 325 (9,570)

Cash Flow Statement

Operating cash flow 28,169 (6,836) (12,419) 24,324 3,147 (6,874)

Investing cash flow (4,454) (4,328) (5,739) (2,549) (4,305) (7,561)

Financing cash flow - - - - - -

Performance Ratios (%)

Return on average assets (%) 1.85 2.00 1.65 1.54 0.15 (3.56)

Return on average equity (%) 5.14 6.48 5.88 5.37 0.59 (16.12)

Liquidity Ratio (%)

Liquid asset Ratio (%)* 18.25 3.4 20.4 35 7.3 10

Capital Adequacy Ratio (%)

Capital adequacy (%)** 31.44 36.38 29.94 33.13 34.73 25.02

*Total of Cash, Short term balances with banks, Short term Murabaha and Mudharaba as a percentage of total assets.

** Capital Adequacy Ratio for the year ended 31st December 2015 was calculated as per Basel III requirements whereas Basel II

was applied for previous years.

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

70,9

67

237,

196

184,

657

213,

645

221,

045

202,

003

183,

394

67,4

79

62,9

57

58,7

74

55,4

64

55,4

23

31.4

4

36.3

8

29.9

4

33.1

3

34.7

3

25.0

2

(9,5

70)

325

3,06

9

3,57

7

4,22

4

3,55

8

2010 2011 2012 2013 2014 2015

1.85

2.00

1.65

1.54

0.15

6.48

5.14

5.88

5.37

0.59

(3.5

6)

(16.

12)

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

70,9

67

237,

196

184,

657

213,

645

221,

045

202,

003

183,

394

67,4

79

62,9

57

58,7

74

55,4

64

55,4

23

31.4

4

36.3

8

29.9

4

33.1

3

34.7

3

25.0

2

(9,5

70)

325

3,06

9

3,57

7

4,22

4

3,55

8

2010 2011 2012 2013 2014 2015

1.85

2.00

1.65

1.54

0.15

6.48

5.14

5.88

5.37

0.59

(3.5

6)

(16.

12)

FINANCIAL HIGLIHTSFinancial performance of Liquidity Management Centre for the year ended on 31st December, 2015

TOTAL ASSETS USD millions

TOTAL EQUITYUSD millions

23 | Liquidity Management Centre B.S.C. (c)

EXTERNAL FACTORS AFFECTING THE BANK’S PERFORMANCE

There are many factors that affect the Bank’s business and the results of its operations, some of which are beyond the control of the bank. The following is a description of some of the important factors that may cause the actual results of the Bank’s operations in the future periods to differ materially from those currently expected or desired.

1. The Bank’s future growth rates and success are in-part dependent on continued growth and success of international markets. Although the Bank’s dealings are concentrated in areas that are deemed very safe, as is the case with most international operations, the success and profitability of the bank’s international business can be subject to numerous risks and uncertainties such as local economic and labour conditions, stage of the business cycle, political instability, a change in tax laws, new monetary policies affecting exchange rates along with other economic structures, overall business sentiment, and newly introduced or amended local and national government regulations.

2. Due to Bank’s diversified portfolio, the profit margins realized by the bank can vary somewhat among these products and services, its clientele and its geographic markets. Consequently, the overall profitability of the Bank’s operations for any given period is partially dependent on the product, clientele and geographic mix reflected in that period’s revenues.

3. A sharp downfall in oil prices can put a strain on local economies where the Bank concludes most of its business. Although oil prices seem to have stabilized, there is no guarantee that a further deterioration in the global economy will manage to keep oil prices stable to comfortably service these economies.

4. A sudden deterioration in liquidity of the global economy and local banking institutions can cause further depreciation in asset prices, deleveraging and de-equitization which can affect the Bank’s balance sheet.

5. The Bank’s profitability will be highly dependent on the upcoming economic performance and its recovery. Three key prerequisites for sustained economic rebound internally are further enhancement of regulatory environment, a stabilization of real-estate activities and a stable political environment. Fiscal stimulus if conducted by local economies may temporarily boost GDP, but without these prerequisites, sustained economic expansion can be affected.

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

70,9

67

237,

196

184,

657

213,

645

221,

045

202,

003

183,

394

67,4

79

62,9

57

58,7

74

55,4

64

55,4

23

31.4

4

36.3

8

29.9

4

33.1

3

34.7

3

25.0

2

(9,5

70)

325

3,06

9

3,57

7

4,22

4

3,55

8

2010 2011 2012 2013 2014 2015

1.85

2.00

1.65

1.54

0.15

6.48

5.14

5.88

5.37

0.59

(3.5

6)

(16.

12)

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

2010 2011 2012 2013 2014 2015

70,9

67

237,

196

184,

657

213,

645

221,

045

202,

003

183,

394

67,4

79

62,9

57

58,7

74

55,4

64

55,4

23

31.4

4

36.3

8

29.9

4

33.1

3

34.7

3

25.0

2

(9,5

70)

325

3,06

9

3,57

7

4,22

4

3,55

8

2010 2011 2012 2013 2014 2015

1.85

2.00

1.65

1.54

0.15

6.48

5.14

5.88

5.37

0.59

(3.5

6)

(16.

12)

NET PROFIT / (LOSS)USD millions

RETURN ON AVERAGE ASSETS (%)

CAPITAL ADEQUACY (%)

RETURN ON AVERAGE EQUITY (%)

24 | Annual Report 2015

SHARI’A SUPERVISORY BOARD REPORTOn the Liquidity Management Centre activities for the year ended on 31st December, 2015

In the name of Allah, the most compassionate and the most

merciful

To M/s: The stakeholders of Liquidity Management Centre

B.S.C. (Closed)

Thanks to all mighty Allah and prayers and peace be upon

our last prophet Mohammed and his relatives and comrades.

Based on the standard principles and the assigning of Fatwa

and Shari’a Supervisory Board to supervise the group’s

activities and investments, the Fatwa and Shari’a Supervisory

Board presents the following report:

1. Fatwas and Resolutions:

The Board has answered the queries and questions received

from the group’s management, and accordingly, the Board

issued the suitable fatwas and resolutions required, which

the group abided to eventually.

2. Structured Finance and Documents Preparation:

The Board has approved all the group’s structured financing

related transactions, and has reviewed and approved the

contracts and documents related to it.

3. Approval of Amendments to Sukuk & Syndicated Facilities:

The Board has reviewed the group’s preparations /co-

preparations for the amendments to investment sukuk and

syndicated facilities and has accordingly approved those

transaction documents.

4. Product Development:

The Board, in co-operation with the group’s management is

developing a number of products.

5. Compliance and Legislative Auditing:

The Board has legislatively audited some of the group’s

accomplished transactions within the said year, and has

commented on them accordingly.

6. Reviewing of Books and Records:

The Board reviewed a set of the group’s books, records and

documents based on its own demand, and has received

the data and information in terms of enabling the board to

perform the duty of supervisory and legislative auditing.

7. Reviewing the Balance Sheet:

The Board has reviewed the group’s balance sheet, the

related statements and detailed notes. Accordingly, the

board concluded that this balance sheet, based on the data

and information provided by the group’s management truly

represents the group’s assets and income.

8. Zakat:

The management is not authorized to pay the Zakat on

behalf of the shareholders, and as such the responsibility

for payment of the Zakat lies with the shareholders in

accordance with the Zakat calculation approved by the

Sharia Supervisory Board, which is USD 0.02649 per share.

The Board Overall Conclusion:

The Board confirm that the group has abided towards the

compliance of Shari’a and committing on executing the

Boards’ fatwas within all the group’s activities, and based

on the received transactions, collected data, auditing,

commenting and truthful response by the group in terms of

abiding to the Board comments, the Board according to its

authorization has concluded that the group’s accomplished

activities and transactions within the said year are in total

compliance with Islamic sharia’a terms as well as the Board’s

fatwas.

We all call to Allah the almighty to realize for us the right

guidance and the good achievements as he likes and

accepts.

Peace be upon all of you, as well as God’s mercy and

blessings.

Dr. Shaikh Hussain Hamed HassanHead of Shari’a Supervisory Board

Dr. Shaikh Abdul Sattar Abu GhuddahMember

Shaikh Adnan AlqattanMember

25 | Liquidity Management Centre B.S.C. (c)

INDEPENDENT AUDITOR'S REPORTTo the Shareholders of Liquidity Management Centre B.S.C. (c)

We have audited the accompanying consolidated financial

statements of Liquidity Management Center B.S.C. (c) (the

“Bank“) and its subsidiary (the “Group“) which comprise

the consolidated statement of financial position as at 31

December 2015, and the related consolidated statements of

income, cash flows and changes in owners’ equity for the

year then ended. These consolidated financial statements

and the Group’s undertaking to operate in accordance with

Islamic Shari’a Rules and Principles are the responsibility of

the Group’s Board of Directors. Our responsibility is to express

an opinion on these consolidated financial statements

based on our audit.

We conducted our audit in accordance with Auditing

Standards for Islamic Financial Institutions issued by the

Accounting and Auditing Organisation for Islamic Financial

Institutions (“AAOIFI“). Those standards require that we plan

and perform the audit to obtain reasonable assurance about

whether the consolidated financial statements are free of

material misstatement. An audit includes examining, on a test

basis, evidence supporting the amounts and disclosures in

the consolidated financial statements. An audit also includes

assessing the accounting principles used and significant

estimates made by management, as well as evaluating the

overall consolidated financial statements presentation. We

believe that our audit provides a reasonable basis for our

opinion.

Opinion

In our opinion, the consolidated financial statements

present fairly, in all material respects, the financial position

of the Group as of 31 December 2015 and the results of its

operations, cash flows and changes in owners’ equity for the

year then ended in accordance with Financial Accounting

Standards issued by AAOIFI.

Other Matters

As required by the Bahrain Commercial Companies Law and

the Central Bank of Bahrain (CBB) Rule Book (Volume 2), we

report that:

a) The Bank has maintained proper accounting records

and the consolidated financial statements are in agreement

therewith; and

b) The financial information contained in the Report of

the Board of Directors is consistent with the consolidated

financial statements.

We are not aware of any violations of the Bahrain Commercial

Companies Law, the Central Bank of Bahrain and Financial

Institutions Law, the CBB Rule Book (Volume 2 and

applicable provisions of Volume 6) and CBB directives or the

terms of the Bank’s memorandum and articles of association

having occurred during the year ended 31 December

2015 that might have had a material adverse effect on the

business of the Bank or on its financial position. Satisfactory

explanations and information have been provided to us by

management in response to all our requests. The Bank has

also complied with the Islamic Shari’a Rules and Principles as

determined by the Shari’a Supervisory Board of the Group.

Partner’s registration no: 145

17 February 2016

Manama, Kingdom of Bahrain

27 | Liquidity Management Centre B.S.C. (c)

FIN

AN

CIA

L ST

ATEM

ENTS

Consolidated Statement of Financial Position 24

Consolidated Statement of Income 25

Consolidated Statement of Cash Flows 26

Consolidated Statement of Changes in Owners’ Equity 27

Notes to the Consolidated Financial Statements 28

28 | Annual Report 2015

CONSOLIDATED STATEMENT OF FINANCIAL POSITIONAt 31 December 2015

Notes2015

US$ '0002014

US$ ‘000

ASSETS

Cash and bank balances 5,451 3,736

Due from banks and financial institutions 3 22,000 -

Mudaraba receivables 4 6,026 3,186

Financing receivables 5 8,434 9,038

Investment in sukuks 6 97,665 145,009

Investment in equities and funds 6 12,513 15,194

Investment in real estate 7 29,181 23,780

Equipment 135 119

Other assets 8 1,989 1,941

TOTAL ASSETS 183,394 202,003

LIABILITIES AND OWNERS' EQUITY

Liabilities

Due to short term sukuk investors and banks 9 108,292 130,793

Staff payables 3,670 2,840

Other liabilities 10 465 891

Total liabilities 112,427 134,524

Owners' Equity

Share capital 11 56,228 53,550

Reserves 11 9,694 9,408

Retained earnings 5,045 4,521

Total owners' equity 70,967 67,479

TOTAL LIABILITIES AND OWNERS' EQUITY 183,394 202,003

Mohammed HassanChairman

Khalid Al DossariDirector

Ahmed AbbasChief Executive Officer

•

The attached notes 1 to 26 from part of these consolidated financial statements

29 | Liquidity Management Centre B.S.C. (c)

CONSOLIDATED STATEMENT OF INCOMEFor the year ended 31 December 2015

Notes2015

US$ '0002014

US$ '000

INCOME

Income from:

Investments in sukuk 12 6,803 8,586

Investments in equities and funds 841 249

Due from banks and financial institutions 5 99

Financing receivables 412 496

Mudaraba receivables 187 342

Gain on investments at fair value through statement of income 187 9

Less: Return to Short Term Sukuk - investors and banks (1,720) (2,377)

6,715 7,404

Investment banking fees 13 1,647 896

Ijarah income 1,553 1,547

Foreign exchange gain 16 93

Other income 148 173

OPERATING INCOME 10,079 10,113

EXPENSES

Staff costs 14 3,056 3,016

Ijarah expense 125 308

Depreciation 651 602

General and administrative expenses 15 1,430 1,583

OPERATING EXPENSES 5,262 5,509

NET PROFIT FOR THE YEAR BEFORE UNREALISED FAIR VALUE CHANGE AND IMPAIRMENT PROVISION 4,817 4,604

Unrealised fair value loss on investment in funds (427) (102)

Impairment provision 16 (832) (278)

NET PROFIT FOR THE YEAR 3,558 4,224

Mohammed HassanChairman

Khalid Al DossariDirector

Ahmed AbbasChief Executive Officer

The attached notes 1 to 26 from part of these consolidated financial statements

30 | Annual Report 2015

Notes2015

US$ '0002014

US$ '000

OPERATING ACTIVITIES

Net profit for the year 3,558 4,224

Adjustments for:

Depreciation 651 602

Amortisation of discount on investments (93) (97)

Restructuring investments in funds (554) -

Unrealised fair value loss on investments through statement of income - funds - 102

Unrealised fair value gain on investments through statement of income - funds 187 (133)

Net gain from sale of investments at amortised cost 12 (2,457) (2,399)

Unrealised fair value losses (gains) on investment through statement of income 427 -

Impairment provision / (writeback) - net 343 278

Collective impairment provision 489 31

Operating profit before changes in operating assets and liabilities 2,551 2,608

Changes in:

Mudaraba receivables (2,840) 26,984

Financing receivables 604 2,633

Other assets (48) 685

Due to short term sukuk investors and banks (22,501) (23,992)

Staff payables 830 -

Other liabilities (546) 428

Purchase of investments at amortised cost (40,565) (61,821)

Sale/ redemption proceeds of investments at amortised cost 89,804 46,337

Purchase of investment at fair value through equity (592) (964)

Sale/ redemption proceeds of investment at fair value through equity 1,255 213

Sale/ redemption of investment at fair value through statement of income - net 217 53

Net cash from (used) in operating activities 28,169 (6,836)

INVESTING ACTIVITIES

Investment in real estate (4,431) (4,431)

Sale / (Purchase) of equipment (23) 103

Net cash used in investing activities (4,454) (4,328)

NET MOVEMENT IN CASH AND CASH EQUIVALENTS 23,715 (11,164)

Cash and cash equivalents at 1 January 3,736 14,900

CASH AND CASH EQUIVALENTS AT 31 DECEMBER 27,451 3,736

Cash and cash equivalents at year end comprise of:

Cash and balances with banks 5,451 3,736

Due from banks and financial institutions with original maturity of ninety days or less 22,000 -

27,451 3,736

CONSOLIDATED STATEMENT OF CASH FLOWSFor the year ended 31 December 2015

The attached notes 1 to 26 from part of these consolidated financial statements

31 | Liquidity Management Centre B.S.C. (c)

CONSOLIDATED STATEMENT OF CHANGES IN OWNERS' EQUITYFor the year ended 31 December 2015

Reserves

Paid-upShare

capitalUS$ '000

Statutoryreserve

US$ '000

Generalreserve

US$ '000

Investmentfair value

reserveUS$ '000

Totalreserves

US$ '000

RetainedearningsUS$ '000

Totalowners'

equityUS$ '000

Balance at 1 January 2015 53,550 3,313 2,226 3,869 9,408 4,521 67,479

Cumulative changes in fair value - - - (70) (70) - (70)

Net profit for the year - - - - - 3,558 3,558

Total income recognised directly in equity - - - (70) (70) 3,558 3,488

Transfer to paid-up capital (note 11) 2,678 - - - - (2,678) -

Transfer to statutory reserve - 356 - - 356 (356) -

Balance at 31 December 2015 56,228 3,669 2,226 3,799 9,694 5,045 70,967

Balance at 1 January 2014 51,000 2,891 2,226 3,571 8,688 3,269 62,957

Cumulative changes in fair value - - - 298 298 - 298

Net profit for the year - - - - - 4,224 4,224

Total income recognised directly in equity - - - 298 298 4,224 4,522

Transfer to paid-up capital (note 11) 2,550 - - - - (2,550) -

Transfer to statutory reserve - 422 - - 422 (422) -

Balance at 31 December 2014 53,550 3,313 2,226 3,869 9,408 4,521 67,479

The attached notes 1 to 26 from part of these consolidated financial statements

32 | Annual Report 2015

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2015

1. INCORPORATION AND ACTIVITIES

Liquidity Management Centre B.S.C. (c) (the “Bank“) is a closed joint stock entity incorporated in the Kingdom of Bahrain on 31 July 2002 under Commercial Registration number 49092. The Bank operates under a wholesale banking license issued by the Central Bank of Bahrain (the “CBB“). The Bank's registered office is Building 852, Road 3618, Block 436, Seef District, Kingdom of Bahrain.

The principal activities of the Bank and its wholly owned subsidiary (the “Group“) include the following:

• Facilitating the creation of an Islamic inter-bank money market that will allow Islamic Financial Services Institutions (“IFSI“) to effectively manage their assets and liabilities.

• Providing short-term liquid, tradable asset backed treasury instruments (Sukuk) based on Islamic Shari’a principles where IFSI can invest their surplus liquidity.

• Providing short-term investment opportunities based on Islamic Shari’a principles.

The Bank is regulated by the CBB and supervised by the Shari’a Supervisory Board for compliance with Shari’a rules and principles. As of 31 December 2015, the total number of employees employed by the Bank was 23 (2014: 23).

The consolidated financial statements were approved for issue by the Board of Directors on 17 February 2016.

2. ACCOUNTING POLICIES

2.1 Basis of preparationThe consolidated financial statements have been prepared in accordance with Financial Accounting Standards (“FAS“) as issued by the Accounting and Auditing Organisation for Islamic Financial Institutions (“AAOIFI“), the Islamic Shari’a rules and principles as determined by the Shari’a Supervisory Board of the Group, the Bahrain Commercial Companies Law, the Central Bank of Bahrain and Financial Institutions Law and the CBB regulations (as combined in Volume 2 and applicable provisions of Volume 6 of the CBB rulebook). In accordance with the requirements of AAOIFI, for matters which are not covered by AAOIFI standards, the Group uses relevant International Financial Reporting Standards (“IFRS“) as issued by the International Accounting Standards Board (the “IASB“).

Statement of ComplianceThe consolidated financial statements have been prepared on a historical cost basis, except for equity type instruments carried at fair value through equity and at fair value through statement of income that have been measured at fair value. The consolidated financial statements have been presented in United States Dollar (“US$“), being the reporting and functional currency of the Group’s operations. All values are rounded to the nearest thousand (US$’000) unless otherwise indicated. Basis of consolidationThe consolidated financial statements comprise the financial statements of the Bank and its subsidiary as at and for the year ended 31 December of each year. The financial statements of the subsidiary are prepared for the same reporting year as the Bank, using consistent accounting policies. All intra-group balances, transactions, income and expenses and profits and losses resulting from intra-group transactions are eliminated in full.

The Bank's subsidiary is fully consolidated from the date of acquisition, being the date on which the Group obtained control, and continues to be consolidated until the date that control ceases. Control is achieved where the Group has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities.

33 | Liquidity Management Centre B.S.C. (c)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2015

2. ACCOUNTING POLICIES (continued)

2.1 Basis of preparation (continued)

Basis of consolidation (continued)

The consolidated financial statements comprise the financial statements of the Bank and its following subsidiary:

Ownership and Voting Power Year of Country of Nature of

2015 2014 incorporation business

Held directly by the Bank

The Short Term

Sukuk Centre B.S.C. (c) 100% 100% 2003 Kingdom of Bahrain

Dynamic management of sukuks portfolio

2.2 Summary of significant accounting policies The accounting policies adopted in the preparation of the consolidated financial statements are consistent with those of the previous year and are as follows: a. Cash and cash equivalents Cash and cash equivalents as referred to in the consolidated statement of cash flows comprise cash and balances with banks and amounts due from banks and financial institutions with original maturities of 90 days or less.

b. Due from banks and financial institutions These comprise international commodity murabaha and wakala contracts, which are trade transaction agreements stated at cost net of deferred profit and provision for impairment.

c. Mudaraba receivables A mudaraba receivable is a partnership in which the Group contributes capital. These contracts are stated at the fair value of the consideration given less provision for impairment. d. Financing receivables These represent wakala and murabaha financing to projects and are stated at the fair value of the consideration given less provision for impairment. e. Investments These are classified as either equity type instruments carried at fair value through the statement of income or fair value through equity or debt type instruments carried at amortised cost. Initial recognitionAll investments are recognised on the acquisition date and are recognised initially at their fair value plus transaction costs, except for investments carried at fair value through the statement of income. Transaction costs relating to investments carried at fair value through the statement of income are charged to the consolidated statement of income when incurred. Equity type instruments carried at fair value through the statement of income Investments held for trading and designated at fair value through the statement of income are subsequently remeasured at fair value. All related realised and unrealised gains or losses are reported in the consolidated statement of income. Equity type instruments carried at fair value through equityInvestments designated at fair through equity are subsequently remeasured at fair value and the resultant fair value gain or loss is directly reported in equity under ‘investment fair value reserve’ until the investment is sold, realised or deemed to be impaired, at which time the realised gain or loss is reported in the consolidated statement of income. Losses arising from impairment of such investments are recognised in the consolidated statement of income in “impairment losses“ and removed from the investment fair value reserve. Impairment losses recognised in the consolidated statement of income for an equity instrument classified as fair value through equity are not reversed through the consolidated statement of income.

34 | Annual Report 2015

2. ACCOUNTING POLICIES (continued)

2.2 Summary of significant accounting policies (continued)

e. Investments (continued)Debt type instruments carried at amortised costThese instruments are managed on a contractual yield basis and are not held for trading and have not been designated at fair value through the statement of income. Such investments are carried at amortised cost, less provision for impairment in value. Amortised cost is calculated by taking into account any premium or discount on acquisition. Any gain or loss on such investments is recognised in the consolidated statement of income when the investment is de-recognised or impaired. f. Fair valueFair value is determined for each investment individually in accordance with the valuation policies set out below: (i) For investments that are traded in organised financial markets, fair value is determined by reference to the quoted

market bid prices prevailing on the consolidated statement of financial position date.

(ii) For unquoted investments, fair value is determined by reference to recent significant buy or sell transactions with third parties that are either completed or are in progress. Where no recent significant transactions have been completed or are in progress, fair value is determined by reference to the current market value of similar investments. For others, the fair value is based on the net present value of estimated future cash flows, or other relevant valuation methods.

(iii) For investments that have fixed or determinable cash flows, fair value is based on the net present value of estimated future cash flows determined by the Group using current profit rates for investments with similar terms and risk characteristics.

(iv) Investments which cannot be remeasured to fair value using any of the above techniques are carried at cost, less provision for any impairment.

g. OffsettingFinancial assets and financial liabilities are only offset and the net amount reported in the consolidated statement of financial position when there is a legal or religious enforceable right to set off the recognised amounts and the Group intends to either settle on a net basis, or to realise the asset and settle the liability simultaneously.

h. Derecognition of financial instrumentsFinancial assetsA financial asset (or, where applicable a part of a financial asset or part of a group of similar financial assets) is derecognised when:

(i) The right to receive cash flows from the asset have expired;

(ii) The Group retains the right to receive cash flows from the asset, but has assumed an obligation to pay them in full without material delay to a third party under a 'pass through' arrangement; or

(iii) The Group has transferred its rights to receive cash flows from the asset and either (a) has transferred substantially all the risks and rewards of the asset, or (b) has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset.

Financial liabilitiesA financial liability is derecognised when the obligation under the liability is discharged, cancelled or expires.

i. ProvisionsProvisions are recognised when the Group has a present obligation (legal or constructive) arising from a past event and it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount of obligation.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2015

35 | Liquidity Management Centre B.S.C. (c)

2. ACCOUNTING POLICIES (continued)2.2 Summary of significant accounting policies (continued)

j. Revenue recognitionIncome from investments, due from banks and financial institutions and financing receivables.Income is recognised on a time-apportioned basis over the period of the investment. sIncome that is 90 days or more overdue is suspended until it is received in cash.

Dividend income Dividends are recognised when the right to receive payment is established.

Ijarah income Ijarah income is accounted for on a straight line basis over the ijarah terms.

Income from Mudaraba receivablesIncome on mudaraba receivables is recognised when the right to receive payment is established or on distribution by the mudarib.

Investment banking feesThese comprise fees for structuring, arranging and underwriting deals. Investment banking fees are recognised when the services are provided and income is earned. This is usually when the Bank has performed all significant acts in relation to a transaction and it is highly probable that the economic benefits from the transaction will flow to the Bank. Significant acts in relation to a transaction are determined based on the terms agreed in the private placement memorandum/contracts for each transaction.

k. Return to short term sukuk investorsReturn to short term sukuk investors is recognised in accordance with the underlying contracts.

l. Foreign currenciesTransactions in foreign currencies are recorded at the rate ruling at the date of the transaction. Monetary assets and liabilities denominated in foreign currencies are retranslated into US Dollars at the rate of exchange ruling at the reporting date. All differences are taken to the consolidated statement of income at the entity level.

Translation gains or losses on non-monetary items are included in equity as part of the fair value adjustment.

m. Impairment of financial assetsAn assessment is made at each statement of financial position date to determine whether there is objective evidence that a specific financial asset or a group of financial assets may be impaired. If such evidence exists, the estimated recoverable amount of that asset is determined and any impairment loss, based on the assessment by the Group of the estimated cash equivalent value, is recognised in the consolidated statement of income. Specific provisions are created to reduce all impaired financial contracts to their realisable cash equivalent value. Financial assets are written off only in circumstances where effectively all possible means of recovery have been exhausted. Impairment is determined as follows:

(i) For assets carried at fair value, impairment is the difference between cost and fair value, less any impairment loss previously recognised in the consolidated statement of income.

(ii) For assets carried at cost, impairment is the difference between carrying value and the present value of future cash flows discounted at the current market rate of return for a similar financial asset.

(iii) For assets carried at amortised cost, impairment is the difference between carrying amount and the present value of future cash flows discounted at the original effective profit rate.

Impairment losses on investments at fair value through equity are not reversed through statement of income. Any gains post impairment will be recognised in the statement of equity.

n. ZakahIn accordance with its Articles of Association, the Group is not required to pay Zakah on behalf of its shareholders.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2015

36 | Annual Report 2015

2. ACCOUNTING POLICIES (continued)

2.2 Summary of significant accounting policies (continued)

o. Fiduciary assets Assets held in a fiduciary capacity are not treated as assets of the Group. p. Employees’ end of service benefits Provision is made for end of service indemnity payable under the Bahraini Labour Law applicable to non-Bahraini employees’ accumulated periods of service at the statement of financial position date. In addition, provision for indemnity is also made for Bahraini employees in accordance with the Bank’s policy. Bahraini employees of the Bank are covered by contributions made to the Social Insurance Organization of the Kingdom of Bahrain as a percentage of the employees’ salaries. The Bank’s obligations are limited to these contributions, which are expensed when due. q. Earnings prohibited by Shari’a The Group is committed to avoid recognising any income generated from non-Islamic sources. Accordingly, all non-Islamic income is credited to a charity account where the Group uses these funds for various social welfare activities. r. Dividends Dividends to shareholders are recognised as a liability when they are approved by the shareholders. s. Trade and settlement date accounting All “regular way“ purchases and sales of financial assets are recognised on the trade date, i.e. the date that the Group commits to purchase or sell the asset. t. Investment in real estate Properties held for rental, or for capital appreciation purposes, or both, are classified as investment in real estate. Investments in real estate are initially recorded at cost, being the fair value of the consideration given and acquisition charges associated with the property. Subsequent to initial recognition, an entity has the option to adopt either the fair value model or the cost model and shall apply that policy consistently to all of its investment in real estate. The Group has opted to use the cost model.

Investment in real estate remeasured using the cost model is stated at cost less depreciation and any impairment provisions. Depreciation is the systematic allocation of the cost of an asset over its estimated useful life. Major expenditure incurred by the entity related to additions to and improvements in real estate subsequent to its acquisition shall be added to the carrying amount of investment in real estate in the consolidated statement of financial position, provided that the entity expects that such expenditure will increase the future economic benefits to the entity from the real estate. However, if such economic benefits are not expected to occur, the entity shall recognise this expenditure in the consolidated statement of income in the financial period in which it is incurred.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2015

37 | Liquidity Management Centre B.S.C. (c)

2 ACCOUNTING POLICIES (continued)

2.3 Estimates and judgements

In the process of applying the Group’s accounting policies, management has made estimates and judgements in determining the amounts recognised in the consolidated financial statements. The most significant use of estimates and judgements are as follows:

Going concern The Group’s management has made an assessment of the Group’s ability to continue as a going concern and is satisfied that the Group has the resources to continue in business for the foreseeable future. Furthermore, management is not aware of any material uncertainties that may cast significant doubt upon the Group’s ability to continue as a going concern. Therefore, the consolidated financial statements continue to be prepared on the going concern basis.

Impairment The Group assesses at each statement of financial position date whether there is objective evidence that a specific asset or a group of assets may be impaired. An asset or a group of assets is deemed to be impaired if, and only if, there is objective evidence of impairment as a result of one or more events that have occurred after the initial recognition of the asset (an incurred “loss event“) and that loss event(s) has an impact on the estimated future cash flows of the asset or the group of the assets that can be reliably estimated. Collective impairment provision Impairment is assessed collectively for losses on Islamic financing facilities that are not individually significant and for individually significant facilities and investments in sukuk where there is not yet objective evidence of individual impairment. Collective impairment is evaluated at each reporting date with each portfolio subject to a separate review. Fair valuation of investments The determination of fair values of unquoted investments requires management to make estimates and assumptions that may affect the reported amount of assets at the date of the consolidated financial statements. The valuation of such investments is based on the fair value criteria explained above. The actual amount that is realised in a future transaction may differ from the current estimate of fair value and may still be outside management estimates, given the inherent uncertainty surrounding valuation of unquoted investments. Liquidity The Group manages its liquidity through consideration of the maturity profile of its assets and liabilities which is set out in the liquidity risk disclosures in note 18 (b). This requires judgment when determining the maturity of assets and liabilities with no specific maturities.

In the process of applying the Group’s accounting policies, management has made the following judgments, apart from those involving estimations, which affect the amounts recognised in the consolidated financial statements. Classification of investments Management decides on acquisition of a equity type financial asset whether it should be classified as “equity-type instruments at fair value through the statement of income“ or “equity-type instruments at fair value through equity“. A similar decision is taken by management on acquisition of a debt type financial asset as to whether it should be classified as a “debt-type instrument through the statement of income“ or a “debt-type instrument at amortised cost“.

2.4 Shari’a Supervisory BoardThe Group’s Shari’a Supervisory Board consists of four members appointed by the general assembly. They review the Group’s compliance with general Shari’a principles and specific fatwas, rulings and guidelines issued. Their review includes examination of evidence relating to the documentation and procedures adopted by the Group to ensure that its activities are conducted in accordance with Islamic Shari’a principles.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2015

38 | Annual Report 2015

3. DUE FROM BANKS AND FINANCIAL INSTITUTIONS

2015US$ '000

2014US$ '000

Wakala contracts 22,000 -

All balances have original maturities of 90 days or less.

4. MUDARABA RECEIVABLES

2015US$ '000

2014US$ '000

Banks and financial institutions 6,026 3,186

5. FINANCING RECEIVABLES

2015US$ '000

2014US$ '000

Wakala receivable* 5,138 5,738

Murabaha receivable 3,296 3,300

8,434 9,038

* This represents a syndicated financing transaction based on an investment agency (wakala) agreement entered into by the Bank in order to finance a project in the Kingdom of Bahrain. The facility is collaterised against four plots of land. The facility was restructured during 2015 with the maturity being extended to 3 September 2019 bearing a profit rate of 6% p.a. As at 31 December 2015, the fair value of the collateral against the wakala receivable was US$ 88 million for a total transaction value of US$ 34 million ( 2014: US$123 million for a total transaction value of US$ 38 million).

6. INVESTMENTS

2015

Amortisedcost

US$ '000

Fair valuethrough

equityUS$ '000

Fair valuethrough the

statementof income

US$ '000Total

US$ '000

Debt typeQuoted investments - Sukuk

104,463 - - 104,463

Equity typeQuoted investments - Equity shares

- 4,727 - 4,727

Unquoted investments - Funds - 8,355 4,935 13,290

104,463 13,082 4,935 122,480

Less: Impairment provision (note 16) (6,798) (5,504) - (12,302)

At 31 December 2015 97,665 7,578 4,935 110,178

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSAt 31 December 2015

39 | Liquidity Management Centre B.S.C. (c)

6. INVESTMENTS (continued)

2014

Amortisedcost

US$ '000

Fair valuethrough