ANNUAL REPORT 2004 - KU Leuven · Business model and risk management 089 Tables 090 Annual accounts...

Transcript of ANNUAL REPORT 2004 - KU Leuven · Business model and risk management 089 Tables 090 Annual accounts...

F

AN

NU

AL

REP

OR

T20

04

E

A N N U A L R E P O R T 2 0 0 4

Table of contents

Message from Gérard Mestrallet and Jean-Pierre Hansen 001

General Management 003

Electrabel today 004

Highlights 006

Shareholders’ guide 008

Key consolidated figures 009

Directors’ report 016

Main developments 018

Financial situation 022

Corporate governance 031

Members of the Board and Auditors 041

Regulatory background 042

Business management 050

Sales of energy and services 052

Electricity generation 060

Trading and Portfolio Management 067

Management of distribution networks 070

Corporate management 074

Branding 076

Human resources 078

Health and safety at work 081

Environment 083

Research and development 087

Business model and risk management 089

Tables 090

Annual accounts 094

Consolidated annual accounts 096

Annual accounts Electrabel S.A. 133

Glossary 138

Information 140

Sites in Europe

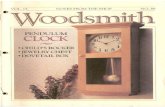

The making of ...Play EnergyThe pictures in this Annual Reportinvite you to share the energy of acurious child. Inventive and eager tolearn, the child explores the worldthrough play, and by making contact with others. Electrabel is curious to know what itscustomers want, eager to meet theirrequirements ever more closely. It is inventive in finding solutions,day after day. Our energy is bothfunctional and creative.

ç

BelgiumElectrabel S.A.Boulevard du Régent 81000 BRUSSELS, BELGIUMwww.electrabel.beTel. + 32 2 518 61 11

The NetherlandsElectrabel Nederland N.V.Dr. Stolteweg 928025 AZ ZWOLLE, THE [email protected]. + 31 38 427 29 00

LuxembourgTwinerg S.A.201, route d’Ehlerange 4108 ESCH-SUR-ALZETTE, LUXEMBOURG Tel. + 352 26 55 49 1

FranceElectrabel France S.A.Le César20 Place Louis Pradel69001 LYON, [email protected]. + 33 4 72 98 23 80

ItalyElectrabel Italia S.p.A.Via Orazio 3100193 ROMA, [email protected]. + 39 06 68 30 18 27

AceaElectrabel S.p.A.Piazzale Ostiense 200154 ROMA, ITALYwww.aceaelectrabel.itTel. + 39 06 57 99 66 91

SpainElectrabel España S.A.General Castaños 43a Planta28004 MADRID, [email protected]. + 34 91 310 62 70

GermanyElectrabel Deutschland AGFriedrichstraße 20010117 BERLIN, [email protected]. + 49 30 72 61 53 500

PolandElectrabel Polska Sp. z o.o.ul. Duleby 540-833 KATOWICE, [email protected]. + 48 32 358 89 99

Electrabel Elektrownia im. Tadeusza Kosciuszki Spólka Akcyjna w Polancu28-230 POLANIEC, [email protected]. + 48 15 865 65 65

HungaryDunamenti Eromu Rt.c/o Electrabel Magyarország Kft.Csenterics u. 82440 SZÁZHALOMBATTA, [email protected]. + 36 23 544 164

Colophon

This Annual Report was produced

by the Corporate and Marketing

Communications department.

Graphic design and production by

OgilvyOne Worldwide.

Editor activity report: Marc Magain

Models: Inarea and Silvio

Pasquarelli, Rome

Photographs highlights:

Raf Beckers, Grupo Generg,

JC Decaux Nederland, Alain Pierot

Printing: Antilope, Lier (Belgium)

Responsible editor: Fernand Grifnée,

Boulevard du Régent 8,

1000 Brussels, Belgium

ELEC

TRA

BEL

200

4M

ES

SA

GE

001

Message from Gérard Mestrallet and Jean-Pierre Hansen

2004 was an important year for Electrabel. The company took advantage of increasing liberalisation in Europe

to build on the positions it had established in its new key markets; and it successfully fought off competition in

its traditional market. Electrabel has always maintained growth within very strict profitability criteria, and so is

now poised to strengthen its position amongst Europe’s leading European energy companies.

For the first time ever, more than half of the company's electricity sales wereachieved in markets outside Belgium.

Passing this milestone is symbolic, marking as it does the transformation of Electrabel into a European company.

It is all the more important since in 2004 the company also surpassed its target of doubling its level of sales

compared with 1999. Electrabel has successfully met the challenge of the liberalised energy markets.

The company is now well established in Europe. It has worked carefully, staying in line with its profitability

criteria, but has also acted firmly, without being deflected by the problems of growth and internationalisation.

This gradual process is producing results. Because it had done the groundwork, Electrabel was able to make the

most of the phase of liberalisation for all non-household customers in Europe, which took effect in July 2004.

Its range of products and services, which continues to expand and improve to meet users' specific expectations,

has attracted more than five million customers across the continent.

Electrabel also managed liberalisation successfully in its traditional

market, where the public authorities advanced the timeframe laid

down by European directives. The company developed a pro-active,

commercial approach, drawing on its previous success, which was

closely targeted to customers and their needs. In 2004, the first full

year of liberalisation for all consumers in Flanders, those customers

who made a choice opted mainly for Electrabel, thus endorsing the

commercial approach adopted by the company.

Electrabel can set new targets for profitablegrowth.

Electrabel wants to go further. Its priority is still to ensure profitable

growth, reflected every year in the steady and regular increase in the

company’s current operating result and dividend.

To achieve this, the company has developed a sound business model based

on effective generating resources and the synergy between electricity and

natural gas, and intends to extract the maximum potential from this model.

ELEC

TRA

BEL

200

4M

ES

SA

GE

002

Jean-Pierre HansenChief Executive Officer

Gérard MestralletChairman of the Board of Directors

Electrabel is aiming to expand at a faster rate than the market, and will therefore concentrate on increasing sales

faster than its generating capacity. Its target is to expand generating capacity to 35 000 MW by 2009, or by around

4 % annually; and to increase sales to 200 TWh by the same date, or by 5 % a year. Given the limited potential for

expansion in the company's traditional market, these targets are ambitious, as were the previous ones, but they are

realistic.

The company is well equipped to maintain its competitive position and its strength in its traditional market. As in

the past, it will respect its commitments and it expects everyone to do the same. Electrabel has made a positive

contribution to liberalisation, which today is proving that it works.

The company has the strengths and the arguments to support its ambitions.

Electrabel's development in the various European markets has been based on sound operational foundations,

in terms of both generating facilities and sales.

The company is well placed to take advantage of the increasing ‘carbon constraint’ regulations. Greenhouse gas

emissions trading became a reality in 2005. Electrabel geared itself up to get the most from its strong position:

41 % of its generation capacity is nuclear, hydraulic or wind based, and is CO2-free; priority is given to the most

environmentally friendly fossil fuel, natural gas; and studies are being undertaken to improve the yield and

performances of coal-fired stations.

Besides its own internal strengths, Electrabel also benefits from the synergy it derives from being part of the

SUEZ group.

The company is constantly motivated to enhance its relationship with the customer.

Finally, Electrabel celebrates its centenary in 2005, and one great strength of that maturity is that the company

recognises that nothing can ever be taken for granted. This is particularly true in an open market, where

customers' needs and expectations are continually changing. This change runs very deep and is fast increasing

in pace. Electrabel will only succeed if it can anticipate, listen to and respond to market signals.

Electrabel knows it can count on the motivation of its staff to meet the demand created by liberalisation and

market competition. More than ever, each and every staff member is an ambassador for the company and the

Group; and more than ever each is aware that the company's ability to adapt and change can only stem from

the will and the dedication of the men and women it comprises.

Brussels, 4 March 2005

General Management – Situation on 07.03.2005

Jean-Pierre Hansen (4)

Chief Executive Officer

Alfred Becquaert (8)

General Manager Human Resources

Eric Bosman (7)

General Manager Trading and Portfolio Management

Sophie Dutordoir (1)

General Manager Marketing & Sales

Alfred Hofman (5)

General Manager North-East Europe

Jacques Hugé (10)

General Manager South Europe

Philippe Lermusieau (3)

General Manager France-Switzerland

Walter Peeraer (6)

General Manager Strategy,Communications, Administration

Nicolas Tissot (9)

Chief Financial Officer(Until 14.05.2005: Robin Leyssens)

Xavier Votron (2)

General Manager Generation, Distribution, IT

General organisationElectrabel is organised around an integrated General Management comprising geographical, operational and functional directorates-general. Under the leader-ship of the Chief Executive Officer, the General Managers have the mission ofimplementing the company's strategy, based on sustainable growth and Europeandevelopment in line with strict profitability criteria.

ELEC

TRA

BEL

200

4 G

EN

ER

AL

MA

NA

GE

ME

NT

003

1 2 3 4 5 6 7 8 9 10

004

ELEC

TRA

BEL

200

4E

LE

CT

RA

BE

L T

OD

AY

004

Electrabel today

Electrabel is a leading European energy company and number one on the Benelux market. The company

pursues sustainable growth on its key markets, in line with strict profitability criteria. Electrabel offers its

residential, professional, business and industrial customers high-quality, added-valued energy solutions com-

bined with local convenience. The company fully exploits the many synergies between electricity and natural

gas. All its strategic options build in the environmental factor. The company gears each decision and action

to its four core values: customer-orientation, performance, attention to staff, and sense of responsibility. It has

a solid foundation based on a strong financial structure, high-level expertise, a clear business model and an

integrated risk management. Electrabel is part of SUEZ, an international industrial and services group that is

active in energy and the environment.

Sales: GWh electricity

Trading activities only

Sales: 30 724 GWh Generation: 4 711 MW Staff: 833

Sales: 75 988 GWh Generation: 12 976 MWDistribution networksStaff: 11 187

Sales: 2 789 GWh Generation: 376 MWStaff: 19

Sales: 5 429 GWh Generation: 4 818 MWStaff: 78

Sales: 3 GWh Generation: under constructionStaff: 16

Generation: 74 MW

Sales: 7 271 GWh Generation: 255 MWStaff: 150

Sales: 8 003 GWh Generation: 1 654 MWStaff: 1 473

Sales: 4 459 GWh Generation: 2 068 MWStaff: 449

Sales: 10 355 GWh Generation: 1 261 MWStaff: 1 068

Core business

Sales of electricity, natural gas and energy products and services

Electrabel provides comprehensive and tailor-made energy solutions for

industrial enterprises. It offers small businesses and residential customers a

quality, locally-based offer that meets all their specific expectations. On top of

these basic products, it provides value-adding services. To cover its

customers' needs more closely, Electrabel has built up a European network

of subsidiaries and partnerships with local operators. Sales outside Belgium

(including wholesale) account for more than 50 % of total volume. The com-

pany is striving to achieve a volume of sales of 200 TWh by 2009.

Electricity generation

Electrabel is strengthening its local geographical presence with generating

activities in a number of regions of Europe. Its diversified generating

equipment totalling 28 200 MW is managed with constant concern for

the environment. These European facilities are primarily made up of natural

gas power stations (more than 5 600 MW of high energy yield gas turbines,

of which 1 500 MW combined heat and power) and of extremely

reliable nuclear facilities. The share of renewable energy rises wherever

possible. 50 % of generation is CO2-emission free. It is Electrabel's ambition

to reach generating capacity of 35 000 MW by 2009.

Trading of electricity and natural gas

Electrabel engages in trading activities on all of Europe's energy markets,

from Scandinavia to Spain and from Benelux to Poland. Its trading activities

form an integral part of its comprehensive energy offer and play a key role

in its European strategy. Trading helps optimise the company's overall

energy position on the markets.

Management of electricity and natural gas distribution networks

In Belgium, Electrabel is responsible for the technical operation, mainte-

nance and development of the electricity and natural gas distribution

systems, on behalf of independent system operators. Electrabel's network

activities are geographically limited to Belgium but can be a real asset in rela-

tion to European expansion projects.

ELEC

TRA

BEL

200

4E

LE

CT

RA

BE

L T

OD

AY

005

Key figures

Sales

Electricity

Total sales GWh 145 059

Benelux 109 501

Europe outside Benelux 35 558

Number of final customers 5 554 507

Benelux 3 820 678

Europe outside Benelux 1 733 829

Natural gas

Total sales GWh 111 858

Number of final customers 2 108 778

Cable TV

Number of final customers 529 516

Water

Number of final customers 605 959

Generation

Electricity

Net generation capacity MW 28 193

Benelux 18 063

Europe outside Benelux 10 130

Net generation GWh 131 707

Benelux 90 191

Europe outside Benelux 41 516

Heat

Net generation GWh 12 109

Benelux 7 129

Europe outside Benelux 4 980

Staff

Number of employees 15 278

Benelux 12 039

Europe outside Benelux 3 239

Environment

Net capacity CO2-emission free % 41.0

Benelux 36.2

Europe outside Benelux 49.6

Net generation CO2-emission free % 49.7

Benelux 46.1

Europe outside Benelux 57.5

Finance e million

Turnover 12 148

EBITDA 2 167

Net current result (100 %) 1 133

ELEC

TRA

BEL

200

4 H

IGH

LIG

HT

S

006

Increased liberalisation and a market functioning effectively

1 July 2004: the electricity and natural gas market

in the European Union is fully open for non-

household customers.

For the first time in its history, Electrabel is selling

more than half its electricity outside Belgium.

85 % of its total electricity sales volume in Belgium

is supplied to the liberalised market. 55 % of house-

hold customers in Flanders choose an electricity

supplier; 81 % of them opt for Electrabel.

The Competition Council designates Electrabel

as the standard supplier for eligible customers of

the mixed intermunicipal companies in Brussels

and Wallonia. The mandatory separation of net

operation and sales activities thus becomes a

reality throughout the country.

In Belgium, Electrabel launches four new auctions

of virtual production capacity (VPP).

Following the adaptation of their agreements, EDF

from now on disposes of a share in the Tihange

plant capacity in the Belgian market and Electrabel

disposes of a share in the Tricastin plant capacity in

the French market.

Competing successfully in the energy market

Electrabel has doubled its total electricity sales

volumes over the last five years. The breakthrough

in markets outside Belgium leads to considerable

growth in sales of natural gas.

Electrabel offers all its customers in Belgium new,

more transparent prices for electricity and natural gas.

AlpEnergie and Electrabel Green are two products that

enable customers, in France and Belgium respectively,

to buy electricity from renewable energy sources.

AceaElectrabel and ASM Terni launch a joint

venture that will sell electricity and natural gas to

eligible customers in the Umbria region.

Highlights

ELEC

TRA

BEL

200

4 H

IGH

LIG

HT

S

007

Advertising campaigns and sponsorship everywhere

reinforce Electrabel's image of stimulating proximity.

In the Netherlands, Spark Energy is brought within

the Electrabel brand. And in the French market,

the company presents itself under the brand

‘Electrabel, Group SUEZ’.

Outstanding generating facilities –environmentally friendly too

The construction of CCGT power stations in

Belgium, Italy and Spain is nearly finished. Work

starts on the new CCGT station in Rosignano, Italy.

An agreement with SNCF (French Railways) enables

Electrabel to acquire 80 % of SHEM in the long term.

SHEM operates 49 hydraulic power units in France.

The replacement of the steam generators at the

Doel 2 nuclear unit increases its generating capacity

by 10 %.

In Poland, the Polaniec station begins generating

electricity from biomass.

Work is underway to extend the life cycle of the

Gelderland plant in the Netherlands and to repower

units in Italy and Germany.

In Belgium, the Netherlands and Portugal, the

company commissions new wind farms totalling

more than 40 MW.

Electrabel concludes a new environmental branch

agreement with the Flemish authorities to cut emis-

sions of SO2 and NOx from its power stations still

further.

Advanced know-how in trading

Electrabel is ready for the decentralised manage-

ment of its portfolio of CO2 emissions rights from

the beginning of 2005.

The company takes part in the Italian Power

Exchange, which began operations in April 2004.

ELEC

TRA

BEL

200

4 S

HA

RE

HO

LD

ER

S’

GU

IDE

008

Shareholders’ guide

Dividend payment

Amount of the dividend less withholding tax

e 11.8200 per share

e 13.3960 per share accompanied by a VVPR coupon strip

Dividend payments from 24 May 2005 onwards

On presentation of coupon No 16, accompanied, if applicable, by VVPR coupon strip No 16.

At the counter at the following establishments in Belgium: Bank Degroof, Dexia Bank België,

Fortis Bank, ING België, KBC Bank, Petercam.

ShareQuotation

Euronext Brussels (ELEB – ISIN: BE0003637486)

Reuters (ELCBt.BR)

Bloomberg (ELEB.BB)

The share is included in the following stock exchange indexes

BEL20

Euronext TOP 100

DJ Euro STOXX Utilities

FTSE Eurotop 300

FTSE E 300 Utilities Index

FTSE E 300 Electricity Index

Presence in the Bel20 (March 2005)

Weight: 10.2 %

Market capitalisation on Euronext Brussels (March 2005)

e 18.1 billion

Share: 9 %

Total number of shares and voting rights on 31 December 2004

54 878 197

AgendaFinancial year 2004

04.03.2005 Meeting of the Board of Directors to adopt the annual accounts 2004, followed by a press release

20.04.2005 The Annual report 2004 is available on www.electrabel.com

12.05.2005 Annual General Meeting and circulation of the Annual report 2004

24.05.2005 Dividend payment for financial year 2004

Financial year 2005

03.05.2005 Press release about sales of the first quarter 2005

02.09.2005 Meeting of the Board of Directors to adopt the half-year accounts, followed by a press release and the circulation of an information sheet

02.11.2005 Press release about sales of the first three quarters 2005

11.05.2006 Annual General Meeting and circulation of the Annual report 2005

Key consolidated figures

FROM TURNOVER TO NET CURRENT RESULT – e million

2004 2003 2002 1 2001 2000

OPERATING INCOME (1 = 2 + 3) 12 458 10 987 9 627 12 716 8 514 Turnover (2) 12 148 10 845 9 390 12 580 8 409

Evolution 12.0 % 15.5 % - 49.6 % 33.1 %Electricity 7 893 6 740 5 781 6 638 5 001 Natural gas 2 125 1 641 1 315 3 741 1 403 Other fuels 20 37 29 83 75 Heat 196 181 170 156 58 Water 1 10 9 9 17 Other activities 1 913 2 236 2 086 1 953 1 855 Other operating income (3) 310 142 237 136 105

OPERATING CHARGES (4)(excluding depreciation, provisions and write off) -10 824 -9 511 -8 156 -11 081 -6 901

OPERATING RESULT BEFORE DEPRECIATION, PROVISIONS AND WRITE OFF (5 = 1 + 4) 1 634 1 476 1 471 1 635 1 613 Dividends and other financial results (6) 84 30 126 58 66 Share in the current pre-tax result of the intermunicipal companies (7) 341 445 447 435 437 Current pre-tax result of other equity method companies (8) 108 109 74 22 22

EBITDA (9 = 5 + 6 + 7 + 8) 2 167 2 060 2 118 2 150 2 138 Evolution 5.2 % -2.8 % -1.5 % 0.6 % 6.9 %

Depreciation and amounts written off (10) -521 -465 -717 -803 -763 Provisions (11) -270 -426 -245 -256 -213

EBIT (12 = 9 + 10 + 11) 1 376 1 169 1 156 1 091 1 162 Evolution 17.7 % 1.1 % 6.0 % -6.2 % 2.9 %

Debt charges (13) -162 -162 -194 -190 -185 Other financial result (14) 229 261 245 200 217

CURRENT RESULT (15 = 12 + 13 + 14) 1 443 1 268 1 207 1 101 1 194 Current income taxes (16) -310 -269 -258 -186 -244

NET CURRENT RESULT (17 = 15 + 16) 1 133 999 949 915 950 Evolution 13.4 % 5.3 % 3.6 % -3.6 % 13.8 %

SHARE OF THE GROUP IN THE NET CURRENT RESULT 1 019 882 809 805 848

Evolution 15.5 % 9.1 % 0.5 % -5.0 % 1.6 %

1 To give a more accurate picture of the Group’s operating activities and financial performance, the turnover from electricity and fuel trading now only comprises sales of excess energyproduction and fuel purchases, together with optimisation margins (sales – purchases) achieved in connection with these operations. From 2003 on the transport costs for energy andfuels are included in the purchases and not in services and other goods. The figures for the financial year 2002 have been restated in a similar way.

ELEC

TRA

BEL

200

4 K

EY

CO

NS

OL

IDA

TE

D F

IGU

RE

S

009

RESULTS – e million

2004 2003 20021 2001 2000

Operating income 12 458 10 987 9 627 12 716 8 514 Operating charges 11 544 10 399 9 045 12 141 7 877 Operating result 914 588 582 575 637 Financial income 686 774 850 758 786 Financial charges 265 202 299 254 251Financial result 421 572 551 504 535

CURRENT PROFIT OF FULLY CONSOLIDATED COMPANIES AND SHARE IN THAT OF THE INTERMUNICIPAL COMPANIES 1 335 1 160 1 133 1 079 1 172 Share in the current profit of companies at equity, except intermunicipal companies 108 108 74 22 22

PRE-TAX CURRENT PROFIT OF THE GROUP 1 443 1 268 1 207 1 101 1 194 Exceptional income 743 194 1 302 130 79Exceptional charges 664 76 923 158 25Share in the exceptional result of companies at equity -156 29 -15 28 0

EXCEPTIONAL PRE-TAX RESULT OF THE GROUP -77 147 364 0 54

PRE-TAX PROFIT FOR THE YEAR OF THE CONSOLIDATED COMPANIES AND OF COMPANIES AT EQUITY 1 366 1 415 1 571 1 101 1 248 Tax on profit 307 290 290 191 244

CONSOLIDATED PROFIT 1 059 1 125 1 281 910 1 004

Minority interests share in the profit for the year 114 118 180 112 102Group share in the profit for the year 945 1 007 1 101 798 902

1 To give a more accurate picture of the Group’s operating activities and financial performance, the turnover from electricity and fuel trading now only comprises sales of excess energyproduction and fuel purchases, together with optimisation margins (sales – purchases) achieved in connection with these operations. From 2003 on the transport costs for energy andfuels are included in the purchases and not in services and other goods. The figures for the financial year 2002 have been restated in a similar way.

ELEC

TRA

BEL

200

4 K

EY

CO

NS

OL

IDA

TE

D F

IGU

RE

S

010

BALANCE SHEET – e million

2004 2003 2002 2001 2000

FIXED ASSETS 12 119 12 289 12 280 12 986 12 997Formation expenses 4 10 12 21 23Goodwill 1 383 1 475 1 295 1 642 1 533Intangible assets 132 79 23 38 0Tangible assets 4 767 4 666 4 277 6 412 6 174Financial assets 5 833 6 059 6 673 4 873 5 267

CURRENT ASSETS 10 376 10 951 7 870 5 192 3 976Amounts receivable after more than one year 386 471 454 621 638Stock and contracts in progress 548 576 547 587 593Amounts receivable within one year 3 234 3 046 2 759 2 138 1 781Short-term investments 4 484 5 219 3 643 1 438 593Cash and cash equivalents 231 177 170 229 239Prepayments and accrued income 1 493 1 462 297 179 132

TOTAL ASSETS 22 495 23 240 20 150 18 178 16 973

CAPITAL AND RESERVES 5 282 5 179 5 110 4 766 4 652Capital 2 073 2 066 2 066 2 063 2 061Share premiums 928 905 902 892 889Revaluation reserves 710 743 787 760 689Reserves 1 341 1 264 1 079 772 741Goodwill 257 264 284 280 272Translation differences -27 -63 -8 -1 0Investment grants 0 0 0 0 0

MINORITY INTERESTS 1 507 1 846 1 954 2 066 1 965

PROVISIONS AND DEFERRED TAXES 5 952 5 579 5 079 4 910 4 434

AMOUNTS PAYABLE 9 754 10 636 8 007 6 436 5 922Amounts payable after more than one year 1 547 1 293 2 456 2 579 2 699Amounts payable within one year 6 559 7 661 3 852 3 243 2 611Accruals and deferred income 1 648 1 682 1 699 614 612

TOTAL EQUITY AND LIABILITIES 22 495 23 240 20 150 18 178 16 973EL

ECTR

AB

EL 2

004

KE

Y C

ON

SO

LID

AT

ED

FIG

UR

ES

011

ELEC

TRA

BEL

200

4 K

EY

CO

NS

OL

IDA

TE

D F

IGU

RE

S

012CASH FLOW – e million

2004 2003 2002 2001 2000

OPERATION (1) 497 1 064 871 1 499 884Cash flow 1 760 1 856 2 020 1 982 1 858Change in working capital requirements -310 111 -301 352 -95Dividends and directors' fees distribued -953 -903 -848 -835 -879

INVESTMENTS (2) -252 873 -499 270 2 412Formation expenses and intangible assets 19 30 3 50 14Tangible assets 470 446 300 410 394Financial assets 84 831 1 070 637 2 878Divestments in tangible and financial assets -750 -367 -1 860 -808 -783Change in receivables after one year -75 -67 -12 -19 -91

FINANCING (3) -774 -424 -6 -217 288Variation in capital -296 -50 -5 10 22Variation in loans -478 -374 -1 -227 266

VARIATION IN CONSOLIDATION SCOPE AND EXCHANGE RATE DIFFERENCES (4) 101 46 724 119 92

CASH FLOW CHANGE (1 - 2 + 3 + 4) 76 -187 2 088 1 131 -1 148Change in short-term investments and cash -681 1 584 2 146 834 -1 142Change in short-term financial debts 757 -1 771 -58 297 -6

TANGIBLE INVESTMENTS BY THE ELECTRABEL GROUP 470 446 300 410 394Electricity and heat generation 418 409 157 231 199 Electricity interconnection and transmission 0 2 84 94 96 Electricity distribution 24 9 27 40 36 Natural gas distribution 7 7 8 9 6Cable TV and other activities 21 19 24 36 57

ELEC

TRA

BEL

200

4 K

EY

CO

NS

OL

IDA

TE

D F

IGU

RE

S

013SHARE ON THE EXCHANGE

2004 2003 2002 2001 2000

MARKET PRICE – in e

Highest for the yearOrdinary share 332.30 249.20 256.00 257.30 334.90VVPR strip 3.00 3.00 1.60 0.80 0.24Lowest for the yearOrdinary share 246.40 208.00 218.00 210.50 216.50VVPR strip 1.66 1.21 0.42 0.12 0.10On last exchange day of the yearOrdinary share 328.00 249.20 231.50 234.00 240.80

NUMBER OF SHARES 1– in thousands

Ordinary share 54 878 54 719 54 697 54 620 54 594VVPR strip 10 235 10 076 10 054 9 977 9 951

NUMBER OF SHARES TRADEDEuronext Brussels 12 847 064 13 636 498 13 938 664 14 418 795 19 306 083

MARKET CAPITALISATION 1– e million 18 000 13 636 12 662 12 781 13 146

1 On 31 December of the year.

ELEC

TRA

BEL

200

4 K

EY

CO

NS

OL

IDA

TE

D F

IGU

RE

S

014FINANCIAL PER-SHARE FIGURES – e

2004 2003 2002 2001 2000

GROSS DIVIDENDAll shares 15.76 15.00 14.47 14.00 13.53

WITHHOLDING TAXOrdinary share 3.94 3.75 3.62 3.50 3.38Ordinary share with VVPR strip 2.36 2.25 2.17 2.10 2.03

NET DIVIDENDOrdinary share 11.82 11.25 10.85 10.50 10.15Ordinary share with VVPR strip 13.40 12.75 12.30 11.90 11.50

CASH FLOW 1 32.07 33.93 36.93 36.31 34.03NET CURRENT PROFIT 1 18.57 16.13 14.79 14.75 15.53PROFIT FOR THE YEAR 1 17.22 18.41 20.12 14.61 16.52

RETURN 37.2 % 12.9 % 3.3 % 1.4 % -23.0 %PRICE/EARNINGS 19.05 13.5 11.5 16.0 14.6

1 Number per share calculated based on the number of shares yielding dividend of the financial year.

ELEC

TRA

BEL

200

4 K

EY

CO

NS

OL

IDA

TE

D F

IGU

RE

S

015

016

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

D I R E C T O R S ’ R E P O R T

Directors’ report

Main developments p. 018

Financial situation p. 022

Corporate governance p. 031

Members of the Board and Auditors p. 041

Forging ahead and building up

our presence on the market.

017

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

Main developments

The proportion of electricity sales outside Belgium reached more than 50 % for the first time in 2004.

In 2004, the Electrabel group's electricity sales stood at 145.1 TWh, an increase of 5.7 % on the previous

year. Of this, 56 % was realised in the Benelux countries, 9 % in the France-Italy-Iberia region and 13 % in

the Germany-Poland-Hungary region. The balance, 22 %, was realised in the wholesale markets.

Taking into account sales by equity consolidated companies in which the Group owns a significant share

– Compagnie Nationale du Rhône for example – total sales were 155 TWh, of which more than half (51 %)

were realised outside Belgium, confirming the Group's status as a truly European operator. The target of

doubling volume over the period 2000-2004 compared with 1999 has been fully achieved.

In Belgium, the quantity of electricity sold in an increasingly deregulated market was down by 2.3 % in 2004,

while national consumption increased by 2 %. This change represents a loss of market share in the household

and non-household categories following the opening up of the market to competition since 2003, primarily in

Flanders. Sales to industrial customers, however, increased by 4.2 % compared with the previous year. This

increase is primarily due to general changes in economic activity.

The Group's natural gas sales in 2004 increased by 20.4 % to 111.9 TWh. In Belgium, where the proportion

of sales to the segments that are not yet deregulated now only represents 30 % compared to 70 % in 2003,

the growth rate is 1.4 %, which is in line with market growth of 1.7 %.

Electrabel reinforces its presence in Europe.

The electricity and natural gas markets in the European Union have been fully deregulated for all non-

household customers since 1 July 2004. In France, a key market for Electrabel's growth, the market has been

opened up for more than two million customers, representing 3.5 million sites. In Belgium, this development

marked a significant step forward for market deregulation in Wallonia and Brussels; the market in Flanders has

been fully open to competition since 1 July 2003. In the Netherlands, 1 July 2004 marked the date of the

total opening of the market to competition. In Italy, a further seven million customers became eligible on

1 July 2004, joining some 150 000 companies that were already eligible.

In line with its strategy of developing integrated positions in the markets in which it is active, the company

continued to develop both its generation facilities and sales activities in Europe.

018

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

MA

IN D

EVEL

OPM

ENTS

In the Benelux, Electrabel re-commissioned the Flevo and Awirs 5 power stations in order to meet market

demand. Nuclear capacity was increased by 40 MW following the replacement of the steam generators at

Doel 2. In late 2004, the company announced investments of e 50 million to extend the working life of

the Eems, Harculo and Bergum power stations, bringing total investments planned by Electrabel for its

facilities in the Netherlands up to e 100 million; this figure includes work announced previously in Gelderland.

Today, Electrabel is the leader in the Benelux market, which it regards as its domestic market. The 109.5 TWh

sold here can be divided up into 70.3 TWh sold in the deregulated bilateral market, 11.6 TWh sold in the

still-regulated market (only in Belgium) and the rest (27.6 TWh), which represents the company's wholesale.

In France, 2004 will be remembered as the year when the contracts with SNCF on Société Hydroélectrique

du Midi (SHEM) were concluded. Today, Electrabel holds a 40 % stake in this company, a figure which will

increase to 80 % as from 2007. The peak hydropower capacities of SHEM complement perfectly the basic

hydro and nuclear generation facilities that the Group operates in France; that is also the reason why

Electrabel showed its interest in participating in the development of the EPR nuclear project. To ensure maxi-

mum reputation and credit in France, the Group conducts its business activities in that country under the

brand name ‘Electrabel, Group SUEZ’. Sales currently total 14.5 TWh, to compare to 9.1 TWh sold by

Compagnie Nationale du Rhône.

In Italy, the Group – together with Acea – is currently in the process of developing several projects with a view

to increasing the generation facilities available to it: the project to repower the Tirreno Power thermal power

stations, construction of two 370 MW CCGT plants (Voghera and Roselectra). Another CCGT is planned for

Leinì; Electrabel has all the required administrative permits. These investments will allow the Group to double

its generating capacity whilst favouring technologies that respect the environment. Sales in Italy – again,

mainly in partnership with Acea – totalled 10.8 TWh. A joint venture by the name of Umbria Energy S.p.A

was established with ASM Terni for the purpose of marketing electricity and natural gas in the Umbria region.

Electrabel is continuing to establish itself on the Iberian market. Work continued on the construction of the

760 MW Castelnou plant in 2004; it is due to be commissioned at the beginning of 2006. The Carreco-

Outeiro wind farm (9 x 2.3 MW) came online in late 2004. The Group has also made a promising start in 2005:

Electrabel has received new environmental licences to build a 1 200 MW cogeneration plant in Morata de

Tajuña and has concluded an agreement with the manufacturer Gamesa to take over a wind farm consisting

of 40 wind turbines of 2 MW each in Fafe, Portugal.

Finally, in Germany and Central Europe, work has started on the repowering of the Römerbrücke cogene-

ration station; by mid 2005 the station should be generating 110 MW. A co-combustion biomass facility has

been installed in the Polaniec plant. The Group sold almost 21 TWh in this region: 8.1 in Germany, 8 in Poland

and 4.5 in Hungary.

019

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

MA

IN D

EVEL

OPM

ENTS

Electrabel is firmly committed to sustainable development and continues tocontribute towards achieving the Kyoto targets.

15 % of the Group's generation facilities (over 4 000 MW) are powered by renewable energy sources:

hydraulic, wind power or biomass.

Since 1990, Electrabel has reduced its CO2/kWh emissions by over 22 % in Belgium. Today, 41 % of its

generating facilities do not produce any CO2 emissions since they use nuclear fuel, hydroelectric power or

wind power.

In this respect, Electrabel is one of the leading European energy companies, taking account of the CO2 issue

in all of its investment projects. Given its large-scale wind projects in Portugal, Italy, France and the Benelux

countries, the dominant position of natural gas in its thermal power stations and the studies carried out to

lessen the impact of coal-based technology on the environment, this situation is sure to continue to improve

in the future.

Its status as the largest generator of electricity from renewable sources in Belgium – wind, hydro and biomass

– has recently enabled Electrabel to meet the demand for a green product voiced by a large proportion of its

residential and non-residential customers. By launching 'Electrabel Green' in late 2004 – energy which is

generated 100 % from renewable sources in Belgium – and by pledging to reinvest the entire amount of the

price paid by the customer in renewable generation facilities, Electrabel confirms that green energy is truly in

its nature. This product will complement its renewable product range elsewhere in Europe: AlpEnergie in

France (in partnership with CNR), Energia Naturale in Italy and Groene Elektriciteit® in the Netherlands.

The market works in Belgium. It is part of the Benelux market and isinterconnected with the French market.

The opening of the generation market, which began in 2003, continued in 2004. Everything seems to

indicate that this trend will increase further in 2005.

Even without taking account of the facilities made available by the interconnection capacities between the

Netherlands and Belgium, Electrabel's competitors had access to over 25 % of the available generation

facilities in Belgium at the end of 2004. SPE and EDF have their own capacities and can, like others, take part

in virtual power plant (VPP) auctions organised by Electrabel. In 2005, the share held by RWE (192 MW) in the

Zandvliet power station, Electrabel's commitment to ensure a specific degree of liquidity on the Belpex

exchange (100 MW) and the additional transmission capacities on the Franco-Belgian border (1 400 MW inter-

connection) will be added to these existing facilities.

This trend is also visible in terms of electricity and natural gas sales.

In 2004, Electrabel, faced with fierce competition, developed a highly productive business policy. Over a period

of approximately 20 months, more than 50 % of customers chose a supplier in the household market; 80 %

of these customers opted for Electrabel, thereby justifying the company's business decisions. At the start of 2005,

Electrabel’s share of the residential Flemish market was 70 % for electricity and 77 % for natural gas.

020

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

MA

IN D

EVEL

OPM

ENTS

These results have been achieved despite the fact that the prices charged to household customers and

similar types of customers are far more favourable than the average prices in the neighbouring countries.

Against this backdrop, the company's financial performance, which has remained profitable on its domestic

market, has been excellent. This is due to a business model which meets the realities of the market; diverse

and flexible generation facilities with one of the highest rates of availability; business policies which correspond

to the expectations of its customers; and continuous efforts to improve productivity and cost management.

Research and development focuses on the deregulated market.

Electrabel's research and development projects focus on two key areas. Firstly, Electrabel offers its customers

new products and services that enrich sales of energy. Secondly, within Electrabel, research into technical and

environmental efficiency contributes significantly to competitiveness in a liberalised market. Laborelec is the

company's technical and scientific competence centre.

Electrabel in 2004: preparing for the future.

The need for new generation facilities by 2030 is currently estimated at 600 000 MW for the EU-15 alone.

Electrabel is keen to consolidate its status as a leading power generator and intends to play a major role in

this regard.

At the end of 2004, the Board of Directors finalised its strategic guidelines for the period 2005-2009.

The company is aiming to achieve generating capacity of 35 000 MW and sales of 200 TWh by 2009. Based

on the currently stable situation in the Belgian market, in concrete terms, this corresponds to a major increase

in generation facilities and in sales volumes outside Belgium by 2009.

In view of the company's strengths, advantages and the projects currently on the drawing board, these aims

might seem ambitious, but they are nevertheless realistic.

Electrabel develops and deploys its commercial activities within the context of this European outlook. First of

all, the company capitalises on the flexibility of its portfolio by distributing its positions between wholesale

and retail sales. Secondly, it ensures that each customer segment – heavy industry, business customers and

residential customers – benefit from a specific approach. But a common thread runs through everything: the

company's commitment to offer real solutions that meet the customer's specific energy requirements.

In Europe, growing numbers of customers are becoming aware of the benefits of purchasing energy on a

larger scale. Electrabel is meeting this need and seizing opportunities for cross-selling. So far, Electrabel has

47 customers to whom it supplies energy for at least two sites in Europe, making a total of 18 TWh.

021

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

MA

IN D

EVEL

OPM

ENTS

Summary of the consolidated results

e million unless otherwise stated 2004 2003 Variation in %

CONSOLIDATED TURNOVER 12 148 10 845 12.0

FULLY CONSOLIDATED RESULTSOperating result 914 588 55.4Financial result 80 126 -36.2Current result of companies consolidated by the equity method (before taxes) 449 554 -18.9Current result 1 443 1 268 13.8Extraordinary result -77 147 -Result for the year before taxes 1 366 1 415 -3.5Income taxes 1 -307 -290 5.6Result for the financial year after taxes 1 059 1 125 -5.8

Current net result 2 1 133 999 13.4Extraordinary net result 2 -74 126 -

EBIT 3 1 376 1 169 17.7EBITDA 4 2 167 2 060 5.2

CONSOLIDATED CASH FLOWCash flow 5 1 760 1 856 -5.1Net investments (- = expenditures) 252 -873 -Net financing (- = repayments) -774 -424 82.6

CONSOLIDATED RESULTS (GROUP'S SHARE)Result for the financial year 945 1 007 -6.2

Net current result 1 019 882 15.5Net extraordinary result -74 125 -

RESULTS PER SHARE 6 – in eNet current result (Group's share) 18.57 16.13 15.1Result for the financial year (Group's share) 17.22 18.41 -6.5Cash flow after taxes 32.07 33.93 -5.5Gross dividend 15.76 15.00 5.1

1 Including the Group's share in taxes of companies consolidated by the equity method, i.e. e 25 million in 2004 and e 64 million in 2003.2 After allocating the various tax charges according to those elements in the result to which these charges are linked.3 EBIT = earnings before interests and taxes, i.e. operating result plus the dividends received from non-consolidated companies, together with the share

in the results of companies consolidated by the equity method.4 EBITDA = EBIT before depreciation, amortisation, provisions and amounts written off.5 Cash flow = net result before amortisation, provisions, amounts written off, and capital gains and losses.6 Based on the number of shares giving entitlement to a dividend for each period, amounting to 54 878 197 in 2004 and 54 697 196 in 2003.

Financial situation – on 31 December 2004

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

022

023

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

Consolidation scope

The only major change in the consolidation scope since 2003 concerns Compagnie Nationale du Rhône (CNR)

in which the Group acquired a 47.88 % holding between June and December 2003. Following the purchase

of additional shares, this holding increased to 49.95 % in 2004, entitling the Electrabel group to 48.08 %

of the votes.

The sale of Aquinter to intermunicipal water distribution company TMVW in 2004 led to a drop in turnover

of e 23 million, without any significant impact on the net current result.

Turnover

The Group’s turnover amounted to e 12 148 million in 2004, a 12 % increase compared with 2003. The

breakdown is as follows:

e million 2004 2003 Variation in %

Electricity sales to end customers 6 653 5 842 13.9Benelux 1 4 994 4 251 17.5Europe outside Benelux 1 659 1 591 4.2Natural gas sales to end customers 1 614 1 359 18.8Benelux 1 540 1 298 18.6Europe outside Benelux 74 61 22.4Wholesale of electricity and fuel 1 1 773 1 217 45.7Miscellaneous goods and services 2 2 108 2 427 -13.1

TURNOVER 12 148 10 845 12.0

1 Supplies to certain counter-parties (distributors in the Netherlands) are from now on contained under wholesale. Sales for 2003 were restated by e 93 million in order to allow comparison.

2 Mainly on behalf of the network operators in Belgium.

Electricity

Turnover in Belgium increased by e 745 million. This increase is primarily due to the gradual deregulation of

the market: turnover includes sales to the deregulated market segments (household and non-household

customers) that have gradually been replaced by supply of primary energy to distributors (intermunicipal

companies) since 2002. This change is not reflected in the operating results because costs associated with the

marketing of these sales are not recharged to intermunicipal distribution companies (see below).

In the Netherlands and Luxembourg, turnover remained stable despite a slight drop in sales (down 0.5 TWh).

If changes in currency rates are excluded, the growth in turnover outside the Benelux countries increased to 4.7 %.

Natural gas

Turnover was up significantly, since, as in the electricity industry, Electrabel now supplies deregulated end cus-

tomers directly, without going via the mixed intermunicipal companies. The lower average price for natural

gas imported during the first three quarters of the year did nevertheless cushion this effect to some extent.

Services

Turnover from services, which primarily included the technical services on behalf of the network operators, fell

by e 319 million, the main reason being the impact of deregulation on the Belgian and Dutch markets. Costs

for marketing the energy in sectors open to competition in Belgium are gradually no longer being charged to

intermunicipal distribution companies. In the Netherlands, costs for accessing and using the networks will be

charged directly to the customer by system operators and not via the Group units.

Current result

The current result (fully consolidated) amounts to e 1 443 million. When taxes are taken into account, the

current net result amounts to e 1 133 million, an increase of 13.4 % compared with 2003.

e million 2004 2003 Variation in %

EBITDA (OPERATING CASH FLOW) 2 167 2 060 5.2Benelux 1 896 1 850 2.5Generation and sales of energy 1 1 493 1 323 12.8Transmission of energy in Belgium 2 62 82 -24.7Distribution in Belgium 3 341 445 -23.5Europe outside Benelux 4 271 210 29.0

Amortisation of goodwill -60 -60 0.4Other depreciations, amortisations and write-downs -461 -405 13.8Provisions for contingencies and charges -270 -426 -36.7

EBIT (OPERATING RESULT) 1 376 1 169 17.7Debt charges -162 -162 0.3Other financial elements 5 229 261 -12.1

CURRENT RESULT BEFORE TAXES 1 443 1 268 13.8Taxes on the current result 6 -310 -269 15.4

CURRENT RESULT AFTER TAXES 1 133 999 13.4

1 Generation, trading and marketing of energy and related products for the deregulated segment of the market and to the distribution system operators.2 The federal transmission system operator's (ESO/Elia's) share in the result.3 Share in the results of the intermunicipal companies in which Electrabel is a partner (managing the regional transmission networks and supplying

energy to the segment of the market that is not yet deregulated).4 Generation and sales of energy in Germany, Poland, Hungary, France, Italy, Spain and Portugal.5 Including the result of cash management and the cost of instruments for managing financial risks.6 Including taxes of companies consolidated by the equity method.

The operating result before depreciation, amortisation, provisions and other write-downs (EBITDA), saw a

general increase of 5.2 %. This result includes, in particular, a non-recurring dividend of e 71 million paid out

in 2004 by NEA, a company that groups together the Dutch electricity producers and which, inter alia, owned

the country's main power grid before it was transferred to the public authorities.

This element aside, operating cash flow generated by energy generation and sales activity in the Benelux

increased by e 99 million as a result, in particular, of the general increase in prices in the electricity market and

the recovery of a significant portion of the margins for marketing energy realised in the segments of the

market eligible for competition since 1 July 2003. These margins were previously realised by the intermunicipal

distribution companies, which explains the drop in income from these companies noted elsewhere.

024

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

The loss of market share in the retail sector in Belgium has been offset by continued development of synergy

in the management of generation facilities and the portfolio of supply contracts between Belgium and the

Netherlands; and decreases in costs generated by the streamlining programmes implemented in these two

countries. This share of the market actually dropped from approximately 76 % at the end of 2003 to 70 %

by 31 December 2004.

Outside Benelux, operating cash flow increased by e 61 million in 2004 (e 62 million if the changes in

currency rates are left out of consideration). This positive development is due to improved margins in Germany

and, above all, to the development of activities in Italy and France.

The amount of other depreciation, amortisation and write-downs increased by e 56 million compared

with the previous year. The Group actually recorded significant write-downs of its trade debtors in order to

take account of the credit risks inherently linked to supplying energy to segments of the Belgian market that

are progressively being deregulated.

In 2004, net amounts for provisions for contingencies and charges decreased by e 156 million. Provisions

for pension commitments had to be increased by e 50 million in 2003, whilst a withdrawal of e 18 million

was recorded in 2004. The amounts for provisions for dismantling nuclear installations and managing irradiated

fuels were reduced to take account of an extraordinary change in these provisions that took effect on

1 January 2004 (see extraordinary result below).

Interest and other debt charges remained stable in 2004 at e 162 million. The balance of the financial result

includes revenue from net financial position, which generally remained highly positive during the financial

year; and changes in currency rates which were less favourable than the previous year.

Taxes calculated for the current result increased by e 41 million from the previous year. This increase of

15.4 % primarily reflects the increase in the current result before taxes.

Expressed as the Group's share, the net current result increased by 15.5 % in 2004 to e 1 019 million

compared with e 882 million in 2003. The third-party share in the net current result of e 114 million fell by

2.8 % compared with 2003.

Extraordinary result

The extraordinary result for the financial year totals e -77 million (fully consolidated as the Group's share).

When extraordinary taxes are taken into account, this result is e -74 million compared with e 126 million

(e 125 million as the Group's share) in 2003.

Under the Law of 11 April 2003 concerning provisions for dismantling nuclear power stations and the

management of irradiated nuclear fuels at these power stations, the Group's provisions were amended to

conform to the principles approved by the independant Follow-up Committee set up in 2004 in application of this

legislation. These adjustments are the result of the revision of certain calculation parameters, including the

lowered discount rates, and, where plant dismantling is concerned, the fact that calculations will now be

based on the current total value of future payments, whereas provisions used to be established

gradually. These changes took effect on 1 January 2004 and resulted in an extraordinary charge of e 233 million.

025

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

The Group's share in the estimated supplementary pension and comparable charges related to staff providing

services on behalf of distribution system operators in Belgium was reviewed to take into account the changes

that led to the restructuring of the sector following the opening up of the market. This results in a net charge

of e 19 million.

These extraordinary charges were offset in part by the release of e 144 million of surpluses in the portfolio,

primarily consisting of e 120 million generated by the disposal of almost all securities held by the Group in

Total and the write-back of a e 15 million write-down in our stake in Union Fenosa.

The remaining net extraordinary result consists of various write-backs of depreciations, amortisations and

provisions, and the taxation effects of these different elements.

In 2003, the extraordinary result mostly comprised the capital gain from disposing of the remainder of the

Group's stake in Iberdrola (e 60 million), and a positive result of e 61 million which was recorded for assets

held by the Group, directly or indirectly, in Telenet following the setting up of financing to acquire all the cable

TV distribution activities from the Flemish mixed intermunicipal companies.

Consolidated net result

Taking these extraordinary elements into consideration, the fully consolidated net result for 2004 fell by 5.8 %

in 2004 to e 1 059 million compared with e 1 125 million in 2003. The e 175 million increase in the current

result is actually more than offset by the drop in the extraordinary result (e -224 million), and taxes increased

by e 17 million. In terms of the Group's share, the consolidated net result fell by 6.2 % to e 945 million

compared with e 1 007 million the previous year.

Consolidated balance sheet

Summary of consolidated balance sheet

e million 2004 2003 Variation

Fixed assets 12 119 12 289 -170Current assets 10 376 10 951 -575Total assets 22 495 23 240 -745

Equity 5 282 5 179 103Minority interests 1 507 1 846 -339Provisions and deferred taxes 5 952 5 579 373Debts 9 754 10 636 -882Total liabilities 22 495 23 240 -745

The balance is shown after appropriation of the result.

026

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

Fixed assets

The main movements affecting the Group's fixed assets in 2004 can be summarised as follows:

e million

Intangible fixed assets (including formation costs) 47

Goodwill -92Acquisitions 1 -32Amortisation for the financial year -60

Tangible fixed assets 101Investments 2 470Disposals (at book value) -94Depreciation for the financial year -348Changes in the consolidation scope (at book value) 19Translation differences 54

Financial assets (including accounts receivable) -226Investments 3 63Disposals 4 -591Write-downs (including write-backs) 12Changes in consolidation scope, transfers and miscellaneous 290

TOTAL MOVEMENT -170

1 Net decrease mainly due to the definitive appropriation to other assets and liabilities of the goodwill recorded for Polaniec, Tirreno Power and CNR.2 Including e 418 million for construction and upgrading of electricity generation facilities. 3 Mainly CNR.4 Settlement of loans and sale of securities.

Current assets

The e 575 million drop in current assets in 2004 is essentially due to changes in the Group's treasury position

which fell by e 680 million. e 383 million of this decrease was due to the disposal of Total shares and must be

considered along with the reduction of e 756 million of the short-term financial debts in the liabilities of the

balance sheet.

Equity

Changes in the Group's equity in 2004 were as follows:

e million

Shareholders' equity on 31 December 2003 5 179

Capital increase and share issue premiums 29Change in revaluation surpluses, goodwill and translation differences -4Consolidated profit for the financial year (Group's share) 945Dividends and directors' fees payable by Electrabel S.A. -867

Shareholders' equity on 31 December 2004 5 282

The capital increase and the share issue premiums resulted from the decision by the Board of Directors on

10 October 2003 to enable the personnel of Electrabel and certain subsidiaries to invest in the company, in

accordance with the conditions for the authorised capital laid down in the Articles of Association. The

operation was carried out in two phases, in December 2003 and February 2004.

During the first subscription round, 22 070 shares were subscribed for a total of e 4 million. At the end of the

second round, 158 931 additional shares had been subscribed for a total of e 29 million. At the end of this

operation the unsubscribed portion of the authorised capital amounted to e 243 million.

027

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

028

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

Provisions and deferred taxes

Overall, provision for contingencies and losses rose from e 5 517 million in 2003 to e 5 844 million at the end

of 2004, an increase of e 327 million. e 153 million was withdrawn for pension commitments to cover an

equivalent one-off payment into the pension funds, whilst the provisions related to nuclear generation (dismantling

and management of the fuel cycle) were increased overall by e 522 million, particularly as a result of the adjustment

to the increase of e 233 million recorded in the extraordinary result. Provisions for dismantling of non-nuclear

sites were also increased by e 35 million to take into account environmental restrictions with which the Group

has to comply. Finally, e 52 million was withdrawn for provisions for restructuring and other expenses linked

to the opening up of the market.

Debts

The Group's debt decreased by e 1 250 million. Net debt remains not only negative but actually increased by

e 570 million.

e million 2004 2003 Variation

Financial debts 2 723 3 973 -1 250Long term 1 446 1 206 240Current portion of long-term debt 124 858 -734Short term 1 153 1 909 -756

Short-term investments and cash at bank and in hand -4 716 -5 396 680

NET DEBT POSITION -1 993 -1 423 -570

Long-term debt fell following repayment of the convertible loan in Total shares which became due in 2004.

This decrease was partially compensated for by the use of new long-term credit lines. Short-term debts essen-

tially include bank advances and 'commercial paper'.

The Group's financial debts, 42 % of which are at fixed interest rate (compared with 52 % in 2003) are, to a

very large extent, still denominated in euros. The average maturity is 2.5 years compared with 2 years on

31 December 2003. The average current cost of debt has remained stable at 4.2 %.

The Group's cash flow is managed centrally by Electrabel Finance and Treasury Management, a Luxembourg-

based branch of Electrabel S.A.

Market risks and financial instruments

The Electrabel group uses financial instruments to cover the risk of fluctuating interest rates, exchange rates

and energy prices. These instruments are used to cover assets, liabilities and cash flow.

The Group's exposure to fluctuations in the market prices of electricity and gas is managed centrally using firm

or optional derivatives on organised markets (exchanges) or privately.

Exposure to energy trading is measured and managed permanently in accordance with the limits and

management policy set out by General Management.

The Group partially covers its investments in non-euro zone currencies by taking out financing in the same

currency.

The Group also uses hedging instruments (interest rate swaps, etc.) to reduce its exposure to rate risks and

optimise the fixed rate/variable rate structure of its debts. Given these hedging instruments, 42 % of

financial debts accrue interest at a fixed rate (compared to 52 % at end 2003).

The Group's exposure to credit risks is, where appropriate, limited by obtaining letters of credit and guaran-

tees. With regard to trading, credit limits are set according to the rating of the counterparties; netting

agreements complete the arrangement.

Consolidated cash flow statement

e million 2004 2003 Variation

Cash flow 1 760 1 856 -96Variation in working capital requirements -310 111 -421Payment of dividends -953 -903 -50Net operations 497 1 064 567

Investments -573 -1 307 734Disposals of assets 825 434 391Net investments 252 -873 1 125

Movements in capital -296 -50 -246New borrowings and repayments -478 -374 -104Net financing -774 -424 -350

Changes in consolidation scope and translation differences 101 46 55

CHANGE IN NET TREASURY POSITION 1 76 -187 263

1 Short-term investments, cash at bank and in hand and short-term financial debts.

Summary of non-consolidated results of Electrabel S.A.

e million unless otherwise stated 2004 2003 Variation in %

Turnover 8 616 7 523 14.5Operating result 728 678 7.3Financial result 443 499 -11.2Gross current result 1 171 1 177 -0.5Taxes -142 -184 -22.5Net current result 1 029 993 3.5Extraordinary result 1 -73 1 074 -Net result for the financial year 956 2 067 -53.7Transfer to untaxed reserves 1 5 -1 082 -Profit available for appropriation 961 985 -2.4

Net result per share – in e 17.42 37.79 -53.9Current net result per share – in e 18.74 18.16 3.2

1 The demerger and absorption of CPTE generated a large capital gain, corresponding essentially to the untaxed reserves of that company. These reserves were reconstituted within the acquiring company.

Appropriation of the profits

In e 2004 2003

Gross dividend for the financial year 15.7600 15.0000Net dividend for the financial year 11.8200 11.2500Net dividend with VVPR strip 13.3960 12.7500

Number of shares bearing dividends 54 878 197 54 697 196

029

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

030

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

FIN

AN

CIA

L SI

TUA

TIO

N

The profit available for appropriation by Electrabel S.A. amounts to e 961 million.

The Board will propose to the General Meeting of shareholders that an amount of e 75 million should be

appropriated to the available reserves, and that the result carried forward should be increased by e 18 million.

If this proposal is accepted, a net unit dividend of e 11.82 will be paid to shareholders, representing an increase

of 5.07 % compared with the net dividend for 2003. The net dividend payable to shares accompanied by a

VVPR strip (giving entitlement to a reduced 15 % rate of withholding tax) would then be e 13.396.

International accounting standards

Throughout 2004, the Group continued to prepare for the switchover to IFRS (International Financial Reporting

Standards). Financial information on the consolidated results for the 2005 financial year, including half-yearly

results, will be finalised and published in accordance with this new accounting system. To enable a relevant

comparison to be made with the results from 2004, a consolidated opening balance sheet, finalised on

1 January 2004, was drawn up in line with the new standards.

Applying the IFRS standards to the financial situation on 1 January 2004 resulted in a reduction of e 26 million

in consolidated shareholders' equity and had no impact on the Group's financial debt.

The options chosen for the switchover to the IFRS system, the adopted accounting methods, the opening

balance sheet on 1 January 2004, the accounts for the 2004 financial year and the necessary cross-checking

with accounts established in line with Belgian standards are presented in more detail in a brochure that forms

an integral part of this annual report.

Remuneration of the College of statutory auditors

The remuneration of the College is currently set at e 141 750 per year, non-indexed, for the auditing of the

statutory accounts. It amounts to e 375 000 for the auditing of the consolidated accounts. To these amounts

were added in 2004 for the Electrabel group a remuneration of e 1 959 250 associated primarily with the

introduction of IAS/IFRS standards and efforts to bolster audit-related constraints.

Prospects

In the deregulated Benelux market, Electrabel is now recognised as a prominent player, both in terms of its

market share and the quality of its services. In Belgium, where 2004 was the first complete financial year in a

market that is now largely open to competition, the Group's position remains and will continue to remain

highly dependent on a background that is extremely complex and unstable in terms of institutions and regula-

tions. Here, the Group is also increasingly exposed to the greater interaction between the national market and

markets in neighbouring countries. The gradual emergence of a genuine European energy market is the source

of new development opportunities but also an additional risk factor.

The Group has already clearly demonstrated its ability to seize such opportunities whilst respecting strict

profitability criteria and working towards a long-term vision of sustainable development. It will therefore continue

to develop and renew its production facilities and its supply sources in a diverse and balanced way, whilst

ensuring that it has a customer base that allows it to make the most of its technical expertise and the high-

quality services it offers. To achieve this, it can rely on its highly skilled staff and a sound financial basis which will

be further enhanced by selling a large proportion of its holding in Elia.

Changes in market prices for electricity, natural gas and other fuels will of course be one of the main factors that

will shape future results.

Brussels, 4 March 2005

The Board of Directors

Corporate governance – situation on 04.03.2005

Electrabel has closely observed the work of the Corporate governance Commission, which was

created on the initiative of the Federation of Enterprises in Belgium, Euronext Brussels, and the

banking, finance and insurance Commission. The Corporate governance Commission has brought

together in a single Code – the Belgian Corporate governance Code – all the Belgian and European

recommendations in the area of corporate governance.

On 28 September 2004 the Board of Directors set up a working group entrusted with examining the

measures needed to adapt the company's and governing bodies' current functioning, bearing in mind the best

practices, the above-mentioned Code, as well as the specificities of the company. This working group

comprises three directors: Jean-Pierre HANSEN, Lutgart VAN den BERGHE and Baron VANDEPUTTE.

The Electrabel Corporate governance Charter is now in course of preparation, with a view to publication in the

course of 2005. The Board of Directors has been kept regularly informed of the drafting work and has given its

approval where necessary. As the draft stands at the moment, the Charter should include provisions governing rela-

tions with shareholders and in particular the controlling shareholder, together with the respective roles of the Board

of Directors, the Chairman of the Board and the CEO. It should also redefine the missions of the bodies external

to the Board of Directors, in particular the one in charge of executive management. As regards the provisions for

remunerations, the company will apply the recommendations of the Corporate governance Code.

The Board of Directors

Composition

The Articles of Association state that the Board of Directors shall comprise at least five members, appointed

by the General Meeting. They hold office for a maximum period of six years and may be relieved of their duties

or re-elected by the General Meeting.

Conforming the Board’s internal rules, the term of office of the Chairman and the members of the Board shall

end no later than the ordinary General Meeting immediately following their 70th birthday.

The Board of Directors, on the proposal of the Remuneration and Appointments Committee, has agreed a

derogation to this rule for Baron CROES, independent director and Chairman of the Audit Committee. This

derogation is justified by the fact that, thanks to his expertise and know-how, he makes a significant contri-

bution to the work of the Audit Committee, of which he has been Chairman since its creation in 2003.

The Board of Directors has seventeen members and is made up of five categories of directors:

1. Seven directors are linked to the controlling shareholder

Gérard MESTRALLET, Chairman

Emmanuel van INNIS, Vice-Chairman

Patrick BUFFET

Jean-Pierre DEPAEMELAERE

Yvan DUPON

Gérard LAMARCHE

Jacques LAURENT

031

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

CO

RPO

RA

TE G

OV

ERN

AN

CE

032

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

CO

RPO

RA

TE G

OV

ERN

AN

CE

2. Two directors belong to the management

Jean-Pierre HANSEN, Vice-Chairman and Chief Executive Officer

Xavier VOTRON

3. Two directors are linked to the municipalities

(with which Electrabel is associated via the mixed intermunicipal companies)

Luc HUJOEL

Geert VERSNICK

4. Four directors are independent

Baron CROES

Lutgart VAN den BERGHE

Baron VANDEPUTTE

Baron van GYSEL de MEISE

These four directors are qualified as independent under the terms of Article 524 of the Company Code.

The independent directors are called upon to issue an opinion to the Board of Directors prior to certain

decisions or operations involving an associated company (with the exception of subsidiaries), unless they

concern ordinary decisions or operations taking place under normal market conditions or representing

less than one percent of the consolidated net assets.

5. Two other directors

Pierre DRION

Jean-Pierre RUQUOIS

The Secretary to the Board of Directors and to the Committees created by the Board (see below) is

Patrick van der BEKEN (until 04.03.2005: François DESCLÉE de MAREDSOUS).

Decision making

The Board of Directors meets under the direction of the Chairman or, if he is prevented from doing so, a

Vice-Chairman, or in absence, by a director appointed by his colleagues.

The Board of Directors can deliberate and take decisions only if a majority of its members is present or repre-

sented. Each director can represent a maximum of two of his colleagues.

All decisions by the Board of Directors are taken by a majority vote of its members present or represented. If there

is tie, the Chairman has the casting vote. In practice, nearly all decisions are taken by consensus.

Over and above these statutory provisions, there is no rule governing the decision-making method of the Board

of Directors.

Remuneration

In accordance with Article 32 of the Articles of Association, a maximum of one per cent of the period’s profits

available for appropriation is made available to the Board of Directors, which may share it among its members in

accordance with its internal rules.

As in past years, the Board of Directors voluntarily limited the directors’ share of profits to an overall amount of

e 2 427 800, an increase of 5 % in relation to the preceding period. The share of profits for the directors who were

either appointed or who submitted their resignation during the year is calculated on a prorata basis.

The Board of Directors may allocate supplementary remuneration to a director who renders particular services

for the company. Such remuneration, in the form of an attendance fee, is granted to the members of the Audit

Committee and the Remuneration and Appointments Committee.

032

ELEC

TRA

BEL

200

4 D

IRE

CT

OR

S’

RE

PO

RT

CO

RPO

RA

TE G

OV

ERN

AN

CE

Honorary members receive no remuneration.

The company has not made loans to the directors nor granted benefits in kind, share options, credits or

advances. The directors have not entered into any unusual transactions with the company.

Activities

In 2004, the Board of Directors met eight times. Apart from the usual supervisory duties, the Board of

Directors ratified the half-yearly and the annual accounts, approved the budgets and prepared the 2004

General Meetings. At every Board meeting, the Chief Executive Officer reports on the financial situation, the

treasury, sales and operations.

Other noteworthy topics that were taken up in 2004 or that the Board of Directors debated include the

following:

- changes on the European market and Electrabel’s development strategy on that market;

- completion of the examination of the possible takeover of a number of European assets of SUEZ-Tractebel;

- investments relating to tangible and financial assets;

- IT security;

- the CO2 issue;

- examination of the listing on the stock exchange of Elia System Operator (ESO);

- the programme for converting the accounts to IAS/IFRS standards;

- the Belgian Code on corporate governance;