Annual Meeting of Shareholders - Bourse Inc... · Alcatel-Lucent Director since 2008 Judith M....

Transcript of Annual Meeting of Shareholders - Bourse Inc... · Alcatel-Lucent Director since 2008 Judith M....

Welcome and Call to Order – Klaus Kleinfeld, Chairman of the Board and

Chief Executive Officer

Introduce Alcoa Directors

Introduce Executive Council

Voting – Donna Dabney, Vice President

Elect Directors

Ratify Auditors

Advisory Approval of Executive Compensation

Eliminate Supermajority Voting Requirement in the Articles of Incorporation

relating to:

• Fair Price Protection

• Director Elections

• Removal of Directors

Phase Out the Classified Board

Permit Shareholder Action by Written Consent

Report of the Chairman and CEO – Klaus Kleinfeld

Questions and Answers

Agenda

3

Directors standing for re-election

4

Kathryn S. Fuller

Chair, Smithsonian National Museum

of Natural History

Director since 2002

Ernesto Zedillo

Director

Yale Center for the

Study of Globalization

Director since 2002

Patricia F. Russo

Former CEO

Alcatel-Lucent

Director since 2008

Judith M. Gueron

Scholar in Residence and

President Emerita

MDRC

Director since 1988

Directors

5

Arthur D. Collins, Jr.

Former Chairman and CEO

Medtronic, Inc.

Director since 2010

Klaus Kleinfeld

Chairman and CEO

Alcoa Inc.

Director since 2003

Michael G. Morris

Chairman and Former President and CEO

American Electric

Power Company, Inc.

Director since 2008

E. Stanley O'Neal

Former Chairman and CEO

Merrill Lynch & Co., Inc.

Director since 2008

Directors

6

James W. Owens

Former Chairman and CEO

Caterpillar Inc.

Director since 2005

Sir Martin Sorrell

Founder, CEO and Director

WPP plc

Director since 2012

Ratan N. Tata

Chairman

Tata Sons Limited

Director since 2007

Executive Council

7As of May 1, 2012

Kevin Anton VP, Chief Sustainability Officer

Nicholas Ashooh

Chris Ayers

VP, Corporate Affairs

EVP & Group President, Global Primary Products

Mike Barriere VP, Human Resources

John Bergen VP, Corporate Projects

Graeme Bottger VP, Controller

Daniel Cruise VP, Public and Government Affairs

Mark Davies EVP & President, Global Business Services

Roy Harvey Chief Financial Officer, Global Primary Products

Olivier Jarrault EVP & Group President, Engineered Products and Solutions

Ray Kilmer EVP, Chief Technology Officer

Klaus Kleinfeld Chairman & Chief Executive Officer

Gerhard Kschwendt Head of Business Excellence and Corporate Strategy

Charles McLane EVP & Chief Financial Officer

Kay Meggers EVP & Group President, Global Rolled Products

Matthias Obermayer

William Oplinger

VP, Business Excellence and Corporate Strategy Projects

Chief Operating Officer, Global Primary Products

Judith Schrecker Chief Financial Officer, Global Rolled Products

Audrey Strauss EVP, Chief Legal and Compliance Officer and Secretary

Tony Thene VP & Chief Financial Officer, Engineered Products and Solutions

Kurt Waldo Executive Vice President

Items of business

8

Elect Directors

Ratify Auditors

Advisory Approval of Executive Compensation

Eliminate Supermajority Voting Requirement in the Articles

of Incorporation relating to:

Fair Price Protection

Director Elections

Removal of Directors

Phase Out the Classified Board

Permit Shareholder Action by Written Consent

Cautionary Statement

Forward-Looking Statements

This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements.Forward-looking statements include those containing such words as “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “outlook,”“plans,” “projects,” “should,” “targets,” “will,” or other words of similar meaning. All statements that reflect Alcoa’s expectations, assumptions,or projections about the future other than statements of historical fact are forward-looking statements, including, without limitation, forecastsconcerning global demand growth for aluminum, end-market conditions, supply/demand balances, and growth opportunities for aluminum inautomotive, aerospace and other applications, trend projections, targeted financial results or operating performance, and statements aboutAlcoa’s strategies, outlook, and business and financial prospects. Forward-looking statements are subject to a number of known andunknown risks, uncertainties, and other factors and are not guarantees of future performance. Important factors that could cause actualresults to differ materially from those in the forward-looking statements include: (a) material adverse changes in aluminum industryconditions, including global supply and demand conditions and fluctuations in London Metal Exchange-based prices for primary aluminum,alumina, and other products, and fluctuations in indexed-based and spot prices for alumina; (b) deterioration in global economic and financialmarket conditions generally; (c) unfavorable changes in the markets served by Alcoa, including automotive and commercial transportation,aerospace, building and construction, distribution, packaging, defense, and industrial gas turbine; (d) the impact of changes in foreigncurrency exchange rates on costs and results, particularly the Australian dollar, Brazilian real, Canadian dollar, euro, and Norwegian kroner;(e) increases in energy costs, including electricity, natural gas, and fuel oil, or the unavailability or interruption of energy supplies; (f)increases in the costs of other raw materials, including calcined petroleum coke, caustic soda, and liquid pitch; (g) Alcoa’s inability to achievethe level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening ofcompetitiveness and operations (including moving its alumina refining and aluminum smelting businesses down on the industry cost curvesand increasing revenues in its Global Rolled Products and Engineered Products and Solutions segments) anticipated from its restructuringprograms and productivity improvement, cash sustainability, and other initiatives; (h) Alcoa's inability to realize expected benefits from newlyconstructed, expanded, or acquired facilities or from international joint ventures as planned and by targeted completion dates, including thejoint venture in Saudi Arabia, the upstream operations in Brazil, and the investments in hydropower projects in Brazil; (i) political, economic,and regulatory risks in the countries in which Alcoa operates or sells products, including unfavorable changes in laws and governmentalpolicies, civil unrest, or other events beyond Alcoa’s control; (j) the outcome of contingencies, including legal proceedings, governmentinvestigations, and environmental remediation; (k) the business or financial condition of key customers, suppliers, and business partners; (l)adverse changes in tax rates or benefits; (m) adverse changes in discount rates or investment returns on pension assets; and (n) the otherrisk factors summarized in Alcoa's Form 10-K for the year ended December 31, 2011 and other reports filed with the Securities andExchange Commission. Alcoa disclaims any obligation to update publicly any forward-looking statements, whether in response to newinformation, future events or otherwise, except as required by applicable law.

Non-GAAP Financial Measures

Some of the information included in this presentation is derived from Alcoa’s consolidated financial information but is not presented in Alcoa’sfinancial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). Certain of these data areconsidered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures andshould not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measuresand management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation and on ourwebsite at www.alcoa.com under the “Invest” section. Any reference during the discussion today to EBITDA means adjusted EBITDA, forwhich we have provided calculations and reconciliations in the Appendix and on our website.

10

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

10.0

Safety first – driving world class performance

12

79% of locations

with Zero Lost

Workdays

in 2011

Total Recordable Incident Rate

Lost Workday Incident Rate

Days Away, Restricted and Job Transfer (DART)

Month of Service:

Increasing rate of employee

participation

16%24%

37%49%

17,179

21,975 22,781

29,341

31,327

2007 2008 2009 2010 2011

56%

Alcoans giving back to their communities

13

2011 Month of Service Community Impact:

Trees planted:

2010: 16,000 → 2011: 34,000 = 113% increase

Children assisted:

2010: 59,000 → 2011: 81,000 = 37% increase

Hours volunteered:

2010: 282,000 → 2011: 378,000 = 34% increase

Community members benefited:

2010: 290,000 → 2011: 890,000 = 207% increase

Increasing Employee Participation in Several Regions

China: Participation has taken off

2009: 39% → 2010: 53% → 2011: 63%

Hungary: Increasing involvement

2009: 33% → 2010: 47% → 2011: 68%

Russia: Steadily increasing participation

2009: 43% → 2010: 50% → 2011: 58%

Spain: Strongest participation, getting stronger

2009: 32% → 2010: 87% → 2011: 95%

Strong Alcoa values recognized externally

Significant Public Recognitions

World & North American Indexes

Reputation

Fortune Most Admired Metals Company

(#1 in Innovation & Social Responsibility)

Ethisphere – 1 of 145 companies promoting

ethical business standards

100 Best Companies to Work for in Brazil –

10th consecutive Year

Sustainability and Climate Change

Dow Jones Sustainability Index –

10th consecutive year

Carbon Disclosure Project names Alcoa to

S&P 500 Disclosure Leadership Index

Exame magazine – recognized for 6th time as

a Model Sustainability Company in Brazil

Maplecroft ranked Alcoa 2nd of 100

companies on Climate Innovation Index

14

2011 Cash Sustainability Financial Targets and Actual Performance

15

Sustaining Capital Growth Capital Saudi Arabia JV

$400

Debt-to-Cap

$ Millions

$197

$ Millions $ Millions %

2010

Actual

2011

Target

2011

Actual

$249

35%35%

2010

Actual

2011

Target

2011

Actual

35%

$500$445

2010

Actual

2011

Target

2011

Actual

$363

$1,000

$570

2010

Actual

2011

Target2011

Actual

$924

Free Cash Flow

$ Millions

$0

$1,246

$906

2010

Actual

2011

Target *

2011

Actual

30%

*Target is to be free cash flow positive. See appendix for Free Cash Flow reconciliation

Decisive actions - aggressive financial targets met

Tale of two halves: Returns decline but Alcoa outperforms peers

16Aluminum peers include aluminum and alumina producing companies with a market capitalization of at least $3 billion (as of 2010) and some publicly traded shares: Aluminum Corporation of China Limited, United Company RUSAL, Norsk Hydro ASA, Alumina Limited, National Aluminum Company Limited, and Shandong Nanshan Aluminium Co., Ltd.

2011 Total Shareholder Return

Aluminum Peers Alcoa

Alcoa - 43.3%

Peers - 49.6%

681

131

1st Half 2nd Half

$1,800

$2,000

$2,200

$2,400

$2,600

$2,800

$3,000

2H’11 metal price decline impacts results

17See appendix for Adjusted Income reconciliation

Steep Drop in LME Prices 2011 – A Tale of Two Halves

-81%

Adjusted Income from Ops ($M)

~30% decline from 2011 peak

290 273

253 249 276

226 201

108 119

314 327

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

460 321 336 418 398

784

626

392

(159)

320 301

1,447 1,350

1,433 1,719

1,900

2,570 2,641 2,572

1,664

2,173 2,398

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

10 YR Average ~ $390/MT

62 44 48 68 75

110 104

81

20

47 70

1,4471,350

1,433

1,719

1,900

2,570 2,641 2,572

1,6642,173

2,398

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Solid performance achieved in a turbulent year

18See appendix for Adjusted EBITDA reconciliations

Alumina: Remains Strong

10 Yr Average ~ $66/MT

LMEAdjusted EBITDA/MT

Primary Metals: Margin Compression

LMEAdjusted EBITDA/MT

Global Rolled Products: Continued Strength

Adjusted EBITDA/MT

11%

8%9%

12%11%

12%13%

15%13%

17%18%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Eng. Products & Solutions: Improved Margins

Adjusted EBITDA Margin

10 Yr Average ~ $231/MT

Relentless cash focus delivers stronger financial position

(221)

(477)

(256)

39 9 101 139 96

223 317 364

165

(34)

(409)

(742)

(90)(186)

761

(22)

87 176

1,005

(440)

526

164

656

10,578

10,20510,265

10,0739,819

9,757

9,800

9,3099,165

9,294

9,3489,311

9,37143%

39%

35% 35%

Gross Debt Debt to Cap

Driving Savings to the Bottom Line Improved Free Cash Flow Generation

$1.2b Less Debt and 8% Lower Debt-to-Cap

Adjusted Income (Loss) ($ Millions) ($ Millions)

762

1,131 851

1,066

1,481 1,292

1,344

843

1,543

887

1,260

1,332

1,939

Significant Cash on Hand

($ Millions)

19See appendix for Adjusted Income and Free Cash Flow reconciliations

Outstanding sustainable improvement in days working capital

Alcoa Days Working Capital trend by quarter

43

5550 48

33

4144 43

30

39 38 38

27

10 days

lower

3 days

lower3 days

lower

20

16 Day Reduction =

$1.1 billion Cash

Executing the Alcoa strategy: The three Strategic Priorities

21

Disciplined Execution across all activities

Alcoa Advantagecreating value for

all businesses

– Talent

– Technology

– Customer Intimacy

– Purchasing

– Operating System

Profitable Growthin every business

Business Programs that define:

–3-year aspirations

–Priority levers

–Accountability

Disciplined Execution across all activities

Alcoa Advantagecreating value for

all businesses

– Talent

– Technology

– Customer Intimacy

– Purchasing

– Operating System

Profitable Growthin every business

Business Programs that define:

–3-year aspirations

–Priority levers

–Accountability

Driving profitable growth to accelerate shareholder value

22

Upstream

2015 Cost Curve Changes

Refining Cost Curve Position

Smelting Cost Curve Position

Midstream

2013 Revenue TargetsDownstream

2013 Revenue Targets

2010Strategy Executed

30th

25th

Pe

rce

nti

le

2010Strategy Executed

50th

45th

Pe

rce

nti

le

40th

30th

23rd

51st

41st

20th

Alumina: Improve performance through cost and price focus

Source: CRU Spot and Australia export - ABARE, Baltic Exchange, CRU, Metal Bulletin, PACE, Alcoa estimate

Driving Down the Cost Curve – 7 points

Aligning Prices With Market Fundamentals

– Optimize refinery portfolio (2-3 pts)

– Move to less expensive energy (1pt)

– Saudi Arabia JV, lowest cost refinery (2 pts)

– Sustain cost reductions (1-2 pts)

~33% of

customers on

API or spot

basis

Wagerup – Refinery Pinjarra – Refinery

Restructuring High Cost Assets

Refining: Flow optimization to reduce output

Targeted

digester

curtailments

based upon cost

& strategic

situation

Full

curtailment of

selected plants

Permanent

shutdowns of

selected plants

Slowdown Production

Digester

Curtailments

Full Plant Curtailments

Permanent Shutdowns

– Record production in 2011 ~ 400 tpd better than 2010

– ATOI increased 23% in 2011

– No capital cost production increases

Creeping Production at Lower Cost Facilities

23

0

100

200

300

400

500

600

700 CRU SpotAustralia export

Aluminum: Achieve low cost position and optimize margins

Driving Down the Cost Curve – 10 points

Optimizing Cast House Profitability

– Restructure smelting portfolio (3-5 pts)

– Modernize operations (2-3 pts)

– Saudi Arabia JV, lowest cost smelter (2 pts)

– Productivity improvements (1-2 pts)

Restructuring High Cost Assets

Profiting Through Modernization

Billet Slab T-Bar

Foundry Rod

$262M Margin*

in 2011

PortovesmeDependent on business conditions

La CoruñaAvilés

Smelting: Utilize inventory to reline, but do not restart pots

Targeted smaller curtailments based upon cost & strategic situation

Full curtailment of selected plants

Permanent shutdowns of selected plants

Stop ReliningPartial

CurtailmentsFull Plant

CurtailmentsPermanent Shutdowns

Baie Comeau, Canada Massena East, USA

2-3 pointsdown cost curve

Repowers Quebec

smelters

until 2040

Agreement provides 30-40

years of competitive cost

power

24

TennesseeRockdale (2 lines)

* Margin refers to incremental value added product margin over P1020 primary aluminum

GRP Targets for 2013

GRP: Capture growth from key markets and innovative products

25

$6.3 $6.3 $8.8

2010 2011 2013Target

Achieved 55% of 2013 Revenue Growth Target In Year One

290 273 253 249 276

226 201

108 119

314 327

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Adjusted EBITDA/MT

10 Yr Average ~ $231/MT

Adjusted EBITDA/MT Well Above Historical Average

*~ $1.5B Revenue Growth From the Market and ~ $1.0B Revenue Growth From New Products and Share Gains

55% of

Growth

Target

*

$1.4

$ Billions

See appendix for Adjusted EBITDA reconciliation

EPS Targets for 2013

*

11%

8%9%

12%11%

12%13%

15%13%

17%18%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Achieved 44% of 2013 Revenue Growth Target in Year One

$4.6 $4.6 $6.2

2010 2011 2013Target

Adjusted EBITDA Margin

Margins Exceeding Historical Levels

26

EPS: Strong markets and innovation drive profitable growth

*~ $600M Revenue Growth From the Market and ~ $1.0B Revenue Growth From New Products and Share Gains

$0.7

$ Billions

See appendix for Adjusted EBITDA reconciliation

44% of

Growth

Target

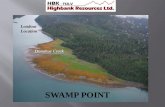

Saudi investments drive profitable growth

Carbon Plant Area

Port – Liquid Pitch Tanks

Potline

Hot Reversing Mill Coolant Pit

On Time

AND

On Budget

27

Alcoa soars in aerospace: Aluminum in the frame for the future

28

A320Neo

B737-MAX

Improving Performance…

~50% lower fuel use per

seat than last

generation1

15 to 16% lower fuel use

per seat than current

generation2

Demonstrated market

appeal -- 1,700+ orders /

commitments already

captured

…Great for Aluminum & Alcoa

Aluminum proprietary alloys

specified for both models

Meets/exceeds all

performance requirements

regarding weight, strength, and

maintenance goals

At far less risk to schedules,

budgets, and technical

complexity

Alcoa continues to grow its

per-platform content

Content on nearly every

major aircraft

Developed 90% of aerospace

alloys in use

Best-Selling Aircraft

1MD-80, 737-Classic 2A320, B737-NG

27.2

35.5

54.5

2011 2016 2025

Changing regulations drive Al consumption in automotive

Source: The Aluminum Association, Ducker Research / Alcoa Analysis

Changing Regulations…

31%

increase

…To Invest in Future Growth

29

100%

increase

White House

Proposal

US Corporate Average

Fuel Economy (MPG)Global Auto Body Sheet

Consumption (KMT)

…Create Opportunities…

$300M investment at

Davenport to meet rising US

auto demand

Capturing 7.5x increase in

auto sheet demand 2011-

2020

200

800

1,500

2011 2016 2020

7.5X

increase

Davenport Rolling Mill

ArmX Blast Shield is the benchmark

for lightweight, survivable underbody

armor

7085 ArmX panels ~ 30% lighter than

high hardness steel with superior blast

performance

Rapid field deployment; production

delivery in 10 weeks from the start of

production

Alcoa armor plate “…saved my life…”

High strength, lightweight military solutions

Oshkosh Defense™ HEMTT A4

30

Littoral Combat Ship is fast and agile

Anti-submarine, anti-mine, anti-surface combat ship

Flexibility

Reconfigurable mission

packages– manned and unmanned

vehicles

Supports all Navy and Joint

Forces rotary winged aircraft

Speed

127-meter trimaran hull

Top speed ~ 45 knots (84 km/h)

Maneuverability

Jet propulsion ~ agility at all

speeds

Shallow draft expands field of

operation

31

“The 50” is back in business

32

Strategic to national defense and Alcoa’s

competitiveness

Manufactures large aluminum and titanium

structural die forgings for F-35 Joint Strike Fighter

Builds parts for nearly every military aircraft and

combat vehicle from 1950s through today

$100 million

investment

Delivering profitable growth through disciplined execution

33

Meeting Our Targets Proven Performance

■ Repositioning Upstream

■ Growing profitably in the

mid and downstream

■ Met financial targets for

third consecutive year

■ Midstream achieved 55%

of revenue growth target

in 2011

■ Downstream achieved

44% of revenue growth

target in 2011

■ Sustainable days working

capital reduction

Executing Our Strategy

2011 Cash Sustainability Financial Targets and Actual Performance

Sustaining Capital Growth Capital Saudi Arabia JV

$400

Debt-to-Cap

$ Millions

$197

$ Millions $ Millions %

2010

Actual

2011

Target

2011

Actual

$249

35%35%

2010

Actual

2011

Target

2011

Actual

35%

$500$445

2010

Actual

2011

Target

2011

Actual

$363

$1,000

$570

2010

Actual

2011

Target

2011

Actual

$924

Free Cash Flow

$ Millions

$0

$1,246

$906

2010

Actual

2011

Target *2011

Actual

30%

$6.3 $6.3 $8.8

2010 2011 2013Target

$2.5B Revenue Growth Versus 2010

55% of

Growth

Target

$ Billions

$1.6B Revenue Growth Versus 2010

$4.6 $4.6 $6.2

2010 2011 2013Target

44% of

Growth

Target

$ Billions

36

Reconciliation of Free Cash Flow

(in millions) Quarter ended Year ended

March 31, 2011

June 30, 2011

September 30, 2011

December 31, 2011

December 31,

2010

December 31, 2011

Cash from

operations

$ (236) $ 798 $ 489 $ 1,142 $ 2,261 $ 2,193

Capital

expenditures

(204)

(272)

(325)

(486)

(1,015)

(1,287)

Free cash

flow

$ (440)

$ 526

$ 164

$ 656

$ 1,246

$ 906

Free Cash Flow is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews cash flows generated from operations after taking into consideration capital expenditures due to the fact that these expenditures are considered necessary to maintain and expand Alcoa’s asset base and are expected to generate future cash flows from operations. It is important to note that Free Cash Flow does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure.

37

Reconciliation of Free Cash Flow, continued

(in millions) Quarter ended

December 31,

2008

March 31, 2009

June 30, 2009

September 30, 2009

December 31,

2009

March 31, 2010

June 30, 2010

September 30, 2010

December 31, 2010

Cash from

operations

$ 608 $ (271) $ 328 $ 184 $ 1,124 $ 199 $ 300 $ 392 $ 1,370

Capital

expenditures

(1,017)

(471)

(418)

(370)

(363)

(221)

(213)

(216)

(365)

Free cash

flow

$ (409)

$ (742)

$ (90)

$ (186)

$ 761

$ (22)

$ 87

$ 176

$ 1,005

Free Cash Flow is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews cash flows generated from operations after taking into consideration capital expenditures due to the fact that these expenditures are considered necessary to maintain and expand Alcoa’s asset base and are expected to generate future cash flows from operations. It is important to note that Free Cash Flow does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure.

38

Reconciliation of Adjusted Income

(in millions) Quarter ended Year ended

March 31, 2011

June 30, 2011

September 30, 2011

December 31, 2011

December 31, 2010

December 31, 2011

Net income (loss) attributable to Alcoa

$ 308

$ 322

$ 172

$ (191)

$ 254

$ 611

(Loss) income from

discontinued operations

(1)

(4)

–

2

(8)

(3)

Income (loss) from

continuing operations attributable to Alcoa

309

326

172

(193)

262

614

Restructuring and

other charges

5

16

5

155

130

181

Discrete tax items* – – (10) 12 40 2 Other special items** 3 22 (2) (8) 127 15

Income (loss) from

continuing operations attributable to Alcoa – as adjusted

$ 317

$ 364

$ 165

$ (34)

$ 559

$ 812

Income (loss) from continuing operations attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax items, and other special items (collectively, “special items”). There can be no assurances that additional special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both Income (loss) from continuing operations attributable to Alcoa determined under GAAP as well as Income (loss) from continuing operations attributable to Alcoa – as adjusted.

* Discrete tax items include the following:

for the quarter ended December 31, 2011, charges for a tax rate change in Hungary and a tax law change regarding the utilization of net operating losses in Italy ($8), a charge

related to the 2010 change in the tax treatment of federal subsidies received related to prescription drug benefits provided under certain retiree health benefit plans ($7), and a net benefit for other miscellaneous items ($3); and,

for the quarter ended September 30, 2011, a net benefit for adjustments made related to the filing of 2010 tax returns in various jurisdictions ($5) and a net benefit for other miscellaneous items ($5).

** Other special items include the following:

for the quarter ended December 31, 2011, a gain on the sale of land in Australia ($18), uninsured losses, including costs related to flood damage to a plant in Pennsylvania caused by Hurricane Irene, ($14), a net favorable change in certain mark-to-market energy derivative contracts ($8), and the write off of inventory related to the permanent closure of a smelter in the U.S ($4);

for the quarter ended September 30, 2011, a net favorable mark-to-market change in certain energy derivative contracts ($13) and uninsured losses, including costs related to flood damage to a plant in Pennsylvania caused by Hurricane Irene, ($11);

for the quarter ended June 30, 2011, a net charge comprised of expenses for the early repayment of Notes set to mature in 2013 due to the premiums paid under the tender

offers and call option and gains from the termination of related “in-the-money” interest rate swaps ($32) and a net favorable mark-to-market change in certain energy derivative contracts ($10); and,

for the quarter ended March 31, 2011, costs related to acquisitions of the aerospace fastener business of TransDigm Group Inc. and full ownership of carbothermic smelting

technology from ORKLA ASA ($8) and a net favorable mark-to-market change in certain energy derivative contracts ($5).

39

Reconciliation of Adjusted Income, continued

(in millions) Quarter ended

December 31, 2008

March 31, 2009

June 30, 2009

September 30, 2009

December 31, 2009

March 31, 2010

June 30, 2010

September 30, 2010

December 31, 2010

Net (loss) income attributable to Alcoa

$ (1,191)

$ (497)

$ (454)

$ 77

$ (277)

$ (201)

$ 136

$ 61

$ 258

(Loss) income from

discontinued operations

(262)

(17)

(142)

4

(11)

(7)

(1)

–

– (Loss) income from

continuing operations attributable to Alcoa

(929)

(480)

(312)

73

(266)

(194)

137

61

258

Restructuring and other charges

614

46

56

1

49

119

20

(1)

(8)

Discrete tax items* 65 (28) – – (82) 112 (16) (38) (18) Other special items** 29 (15) – (35) 308 64 (2) 74 (9)

(Loss) income from

continuing operations attributable to Alcoa – as adjusted

$ (221)

$ (477)

$ (256)

$ 39

$ 9

$ 101

$ 139

$ 96

$ 223

Income (loss) from continuing operations attributable to Alcoa – as adjusted is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of Alcoa excluding the impacts of restructuring and other charges, discrete tax items, and other special items (collectively, “special items”). There can be no assurances that additional special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both Income (loss) from continuing operations attributable to Alcoa determined under GAAP as well as Income (loss) from continuing operations attributable to Alcoa – as adjusted.

* Discrete tax items include the following:

for the quarter ended December 31, 2010, a benefit for the reversal of the remaining valuation allowance related to net operating losses of an international subsidiary ($16) (a portion was initially reversed in the quarter ended September 30, 2010) and a net benefit for other small items ($2);

for the quarter ended September 30, 2010, a benefit for the reversal of a valuation allowance related to net operating losses of an international subsidiary that are now realizable due to a settlement with a tax authority ($41), a charge for a tax rate change in Brazil ($11), and a benefit for the recovery of a portion of the unfavorable impact included in the quarter ended March 31, 2010 related to unbenefitted losses in Russia, China, and Italy ($8);

for the quarter ended June 30, 2010, a benefit for a change in a Canadian provincial tax law permitting tax returns to be filed in U.S. dollars ($24), a charge based on settlement discussions of several matters with international taxing authorities ($18), and a benefit for the recovery of a portion of the unfavorable impact included in the quarter ended March 31, 2010 related to unbenefitted losses in Russia, China, and Italy ($10);

for the quarter ended March 31, 2010, charges for a change in the tax treatment of federal subsidies received related to prescription drug benefits provided under certain retiree health benefit plans ($79), unbenefitted losses in Russia, China, and Italy ($22), interest due to the IRS related to a previously deferred gain associated with the 2007 formation of the former soft alloy extrusions joint venture ($6), and a change in the anticipated sale structure of the Transportation Products Europe business ($5);

for the quarter ended December 31, 2009, a benefit for the reorganization of an equity investment in Canada ($71), a charge for the write-off of deferred tax assets related to operations in Italy ($41), a benefit for a tax rate change in Iceland ($31), and a benefit for the reversal of a valuation allowance on net operating losses in Norway ($21);

for the quarter ended March 31, 2009, a benefit for a change in a Canadian national tax law permitting tax returns to be filed in U.S. dollars; and,

for the quarter ended December 31, 2008, a charge for non-cash tax on repatriated earnings. ** Other special items include the following:

for the quarter ended December 31, 2010, a net favorable mark-to-market change in certain energy derivative contracts;

for the quarter ended September 30, 2010, a net unfavorable mark-to-market change in certain energy derivative contracts ($29), recovery costs associated with the São Luís, Brazil facility due to a power outage and failure of a ship unloader in the first half of 2010 ($23), restart costs and lost volumes related to a June 2010 flood at the Avilés smelter in Spain ($13), and a net charge comprised of expenses for the early repayment of Notes set to mature in 2011 through 2013 due to the premiums paid under the tender offers and call option and gains from the termination of related “in-the-money” interest rate swaps ($9);

for the quarter ended June 30, 2010, a net favorable mark-to-market change in certain energy derivative contracts ($22), a charge for costs associated with the potential strike and successful execution of a new agreement with the United Steelworkers ($13), and a charge related to an unfavorable decision in Alcoa’s lawsuit against Luminant related to the Rockdale, TX facility ($7);

for the quarter ended March 31, 2010, charges related to unfavorable mark-to-market changes in certain energy derivative contracts ($31), power outages at the Rockdale, TX and São Luís, Brazil facilities ($17), an additional environmental accrual for the Grasse River remediation in Massena, NY ($11), and the write off of inventory related to the permanent closures of certain U.S. facilities ($5);

for the quarter ended December 31, 2009, charges related to the European Commission’s ruling on electricity pricing for smelters in Italy ($250), a tax settlement related to an equity investment in Brazil ($24), an estimated loss on excess power at the Intalco smelter ($19), and an environmental accrual for smelters in Italy ($15);

for the quarter ended September 30, 2009, a gain on an acquisition in Suriname;

for the quarter ended March 31, 2009, a gain on the Elkem/SAPA AB swap ($133) and a loss on the sale of Shining Prospect ($118); and,

for the quarter ended December 31, 2008, charges for environmental reserve ($26), obsolete inventory ($16), and accounts receivable reserve ($11), and a refund of an indemnification payment ($24).

40

Reconciliation of Alumina Adjusted EBITDA

($ in millions, except per metric ton amounts)

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

After-tax operating income (ATOI)

$ 471

$ 315

$ 415

$ 632

$ 682

$ 1,050

$ 956

$ 727

$ 112

$ 301

$ 607

Add: Depreciation, depletion, and amortization

144

139

147

153

172

192

267

268

292

406

444

Equity (income) loss

(1)

(1)

–

(1)

–

2

(1)

(7)

(8)

(10)

(25)

Income taxes 184 130 161 240 246 428 340 277 (22) 60 179 Other (17) (14) (55) (46) (8) (6) 2 (26) (92) (5) (44) Adjusted EBITDA $ 781 $ 569 $ 668 $ 978 $ 1,092 $ 1,666 $ 1,564 $ 1,239 $ 282 $ 752 $ 1,161 Production (thousand metric tons) (kmt)

12,527

13,027

13,841

14,343

14,598

15,128

15,084

15,256

14,265

15,922

16,486

Adjusted EBITDA/Production ($ per metric ton)

$ 62

$ 44

$ 48

$ 68

$ 75

$ 110

$ 104

$ 81

$ 20

$ 47

$ 70

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

41

Reconciliation of Primary Metals Adjusted EBITDA

($ in millions, except per metric ton amounts)

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

After-tax operating income (ATOI)

$ 905

$ 650

$ 657

$ 808

$ 822

$ 1,760

$ 1,445

$ 931

$ (612)

$ 488

$ 481

Add: Depreciation, depletion, and amortization

327

300

310

326

368

395

410

503

560

571

556

Equity (income) loss (52) (44) (55) (58) 12 (82) (57) (2) 26 (1) 7 Income taxes 434 266 256 314 307 726 542 172 (365) 96 92 Other (8) (47) 12 20 (96) (13) (27) (32) (176) (7) 2 Adjusted EBITDA $ 1,606 $ 1,125 $ 1,180 $ 1,410 $ 1,413 $ 2,786 $ 2,313 $ 1,572 $ (567) $ 1,147 $ 1,138 Production (thousand metric tons) (kmt)

3,488

3,500

3,508

3,376

3,554

3,552

3,693

4,007

3,564

3,586

3,775

Adjusted EBITDA/Production ($ per metric ton)

$ 460

$ 321

$ 336

$ 418

$ 398

$ 784

$ 626

$ 392

$ (159)

$ 320

$ 301

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation,

depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

42

Reconciliation of Global Rolled Products Adjusted EBITDA

($ in millions, except per metric ton amounts)

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

After-tax operating income (ATOI)

$ 253

$ 225

$ 222

$ 254

$ 278

$ 233

$ 178

$ (3)

$ (49)

$ 220

$ 266

Add: Depreciation, depletion, and amortization

167

184

190

200

220

223

227

216

227

238

237

Equity loss 2 4 1 1 – 2 – – – – 3 Income taxes 124 90 71 75 121 58 92 35 48 92 104 Other (5) (8) (5) 1 1 20 1 6 (2) 1 1 Adjusted EBITDA $ 541 $ 495 $ 479 $ 531 $ 620 $ 536 $ 498 $ 254 $ 224 $ 551 $ 611 Total shipments (thousand metric tons) (kmt)

1,863

1,814

1,893

2,136

2,250

2,376

2,482

2,361

1,888

1,755

1,866

Adjusted EBITDA/Total shipments ($ per metric ton)

$ 290

$ 273

$ 253

$ 249

$ 276

$ 226

$ 201

$ 108

$ 119

$ 314

$ 327

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

43

Reconciliation of Engineered Products and Solutions

Adjusted EBITDA

($ in millions) 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 After-tax operating income (ATOI)

$ 189

$ 63

$ 124

$ 156

$ 271

$ 365

$ 435

$ 533

$ 315

$ 415

$ 539

Add: Depreciation, depletion, and amortization

186

150

166

168

160

152

163

165

177

154

158

Equity loss (income)

–

–

–

–

–

6

–

–

(2)

(2)

(1)

Income taxes 61 39 55 65 116 155 192 222 139 195 260 Other – 35 11 106 (11) (2) (7) 2 1 – (1) Adjusted EBITDA $ 436 $ 287 $ 356 $ 495 $ 536 $ 676 $ 783 $ 922 $ 630 $ 762 $ 955 Total sales

$ 4,141

$ 3,492

$ 3,905

$ 4,283

$ 4,773

$ 5,428

$ 5,834

$ 6,199

$ 4,689

$ 4,584

$ 5,345

Adjusted EBITDA Margin

11%

8%

9%

12%

11%

12%

13%

15%

13%

17%

18%

Alcoa’s definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. The Other line in the table above includes gains/losses on asset sales and other nonoperating items. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.