Analysys Mason document - MarketResearchCroatia –Pacific Hong Kong Taiwan Emerging Asia–Pacific...

Transcript of Analysys Mason document - MarketResearchCroatia –Pacific Hong Kong Taiwan Emerging Asia–Pacific...

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

Research Forecast Report

FTTx roll-out and capex worldwide: forecasts and

analysis 2014–2019

June 2014

Rupert Wood

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

Contents

8. Executive summary

9. Executive summary

10. Key implications

11. Key implications [1]

12. Key implications [2]

13. Key implications [3]

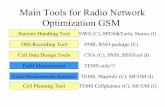

14. Market definition

15. Geographical scope: Forecasts are provided for 57 countries in 7

regions

16. Definitions

17. Forecasts

18. More than two in five premises worldwide will have access to an FTTx

connection by 2019

19. There will be more than 245 million FTTH connections and 235 million

other FTTx connections worldwide by 2019

20. Western Europe: End of 2013

21. Western Europe: Forecast for 2019

22. Central and Eastern Europe: End of 2013

23. Central and Eastern Europe: Forecast for 2019

24. North America and developed Asia–Pacific: End of 2013

25. North America and developed Asia–Pacific: Forecast for 2019

2

26. Key countries in other regions: End of 2013

27. Key countries in other regions: Forecast for 2019

28. Highest levels of coverage, FTTx

29. Highest levels of coverage, FTTH

30. Highest levels of penetration, FTTx and cable

31. Highest levels of penetration, FTTH

32. The highest levels of capex in developed economies will be in Western

Europe

33. Business environment and network options

34. The business environment for fixed NGA has changed a great deal in

the past 12 months

35. Conversion rates on fibre-based services are improving

36. There is a needs-based case for speeds above 30Mbps and up to

1Gbps

37. In Europe, cable broadband is gaining market share of fixed broadband

connections at the expense of telcos

38. FTTx roll-out tends to follow cable

39. In mature markets, larger mobile operators are taking a strategic interest

in fibre access

40. We expect some mobile operators in developing economies to

reconsider investment in fibre access

Slide no. Slide no.

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

Contents

41. Utilities and third entrants are appearing in greater numbers in the FTTx

markets in developed countries

42. LTE solutions for fixed coverage have severe limitations, and some

national broadband plans now recognise this

43. Update on FTTC/VDSL/vectoring

44. Update on FTTB/dp/VDSL

45. Update on G.fast

46. Update on FTTH

47. Maximising coverage for given capex is causing a rethink of old

assumptions

48. Update on capex model

49. Top-level breakdown of the relative costs of FTTx technologies: basic

topologies

50. Top-level breakdown of the relative costs of FTTx technologies:

assumptions for FTTC/VDSL and FTTB/VDSL

51. Top-level breakdown of the relative costs of FTTx technologies:

assumptions for FTTH/GPON and FTTH/PTP

52. Our baseline assumption is that FTTH/GPON costs four times more

to pass and connect than FTTC/VDSL

3

53. The relative cost to pass a premises with FTTH compared to the cost to

pass with FTTC will decline

54. The model considers the increasing incremental costs of roll-out to less-

favourable demographics and topographies

55. However, we recognise that roll-out decisions are increasingly based on

other factors as well as cost

56. The model also takes into account the cost variances between countries

57. The cost to roll out a horizontal FTTH/GPON network varies mainly

according to labour costs

58. The cost to roll out an FTTC/VDSL network varies mainly according to

labour costs and the number of lines per cabinet

59. About the author and Analysys Mason

60. About the author

61. About Analysys Mason

62. Research from Analysys Mason

63. Consulting from Analysys Mason

Slide no. Slide no.

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

List of figures

Figure 1: Summary of report coverage

Figure 2: FTTx capex by region, to 2019

Figure 3: FTTH roll-out and take-up by region, 2019

Figure 4: FTTx roll-out and take-up by region, 2019

Figure 5: Countries covered in this report, by region

Figure 6: Definitions used in this report

Figure 7: FTTH coverage, by region, 2011–2019

Figure 8: FTTx coverage, by region, 2011–2019

Figure 9: NGA and non-NGA fixed broadband connections, by technology,

worldwide, 2011–2019

Figure 10: FTTH connections, by region, 2011–2019

Figure 11: FTTx connections, by region, 2011–2019

Figure 12: FTTH roll-out and take-up by country, Western Europe, 2013

Figure 13: FTTx roll-out and take-up by country, Western Europe, 2013

Figure 14: FTTx capex by country, Western Europe, to 2019

Figure 15: FTTH roll-out and take-up by country, Western Europe, 2019

Figure 16: FTTx roll-out and take-up by country, Western Europe, 2019

Figure 17: FTTH roll-out and take-up by country, Central and Eastern

Europe, 2013

Figure 18: FTTx roll-out and take-up by country, Central and Eastern

Europe, 2013

Figure 19: FTTx capex by country, Central and Eastern Europe, to 2019

Figure 20: FTTH roll-out and take-up by country, Central and Eastern

Europe, 2019

4

Figure 21: FTTx roll-out and take-up by country, Central and Eastern

Europe, 2019

Figure 22: FTTH roll-out and take-up by country, North America and

developed Asia–Pacific, 2013

Figure 23: FTTx roll-out and take-up by country, North America and

developed Asia–Pacific, 2013

Figure 24: FTTx capex by country, North America and developed Asia–

Pacific, to 2019

Figure 25: FTTH roll-out and take-up by country, North America and

developed Asia–Pacific, 2019

Figure 26: FTTx roll-out and take-up by country, North America and

developed Asia–Pacific, 2019

Figure 27: FTTH roll-out and take-up, key countries in emerging regions,

2013

Figure 28: FTTx roll-out and take-up, key countries in emerging regions,

2013

Figure 29: FTTx capex by country, key countries in emerging regions, to

2019

Figure 30: FTTH roll-out and take-up, key countries in emerging regions,

emerging markets, 2019

Figure 31: FTTx roll-out and take-up, key countries in emerging regions,

2019

Figure 32: FTTx coverage as a percentage of total premises by country,

worldwide, 2019

Figure 33: FTTH coverage as a percentage of total premises by country,

worldwide, 2019

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019 5

List of figures [2]

Figure 34: FTTx plus cable broadband connections as a percentage of total

premises by country, worldwide, 2019

Figure 35: FTTH connections as a percentage of total premises by country,

worldwide, 2019

Figure 36: FTTx capex by region, to 2019

Figure 37: FTTx capex by region, 2014–2019

Figure 38: Change in fixed broadband and mobile service revenue by region,

worldwide, 2012–2013

Figure 39: CAGR of fixed broadband and mobile service revenue by region,

worldwide, 2013–2019

Figure 40: Conversion rates (premises with active connections / premises

passed), selected operators, 4Q 2013

Figure 41: Selected forecasts of high-end access speeds required based on

services, four scenarios

Figure 42: Change in cable operators’ share of fixed broadband connections

by country, 4Q 2012–4Q 2013

Figure 43: Cable Internet versus FTTx coverage, year-end 2013

Figure 44: Percentage change in revenue by country, Europe, 4Q 2012–

4Q 2013

Figure 45: FTTx plus cable take-up versus GDP per capita by region

Figure 46: Countries where incumbents use FTTC/VDSL as their main NGA

technology, and commercial vectoring status, Europe, June 2014

Figure 45: Old and new models for FTTx deployment

Figure 46: Basic overview of NGA network topologies and elements

Figure 47: Baseline capital unit cost assumptions, FTTC/VDSL and

FTTB/VDSL

Figure 48: Baseline capital unit cost assumptions, FTTH/GPON and

FTTH/PTP

Figure 49: Baseline assumptions on cost per premises passed and

connected, a developed market, 2014

Figure 50: Cost per home passed and per connection by technology, 2012–

2019

Figure 51: Cost to pass a home with FTTC/VDSL, FTTB/VDSL and

FTTH/GPON, by decile of housing density, medium-sized

country, 2014

Figure 52: Example of roll-out modelling from core capex model

Figure 53: Relative costs to roll out a horizontal FTTH/GPON network by

country, worldwide, 2013

Figure 54: Relative costs to roll out an FTTC/VDSL network by country,

worldwide, 2013

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019 6

About this report

Executive summary

Key implications

Market definition

Forecasts

Business environment and network options

Update on capex model

About the author and Analysys Mason

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

About this report

This report provides:

a 5-year forecast of coverage, take-up and capex split by

four FTTx technology options (FTTC/VDSL,

FTTB/dp/VDSL, FTTB/LAN and FTTH), plus DOCSIS3.0+

and VDSL-CO in 57 countries and 7 regions

an assessment of the business environment, the technology

drivers and the cost trends behind our forecasts

key implications and recommendations for operators in the

region.

The forecast levels of capex are what we consider the most

likely outcome based on operators’ current thinking.

The model can serve several other functions beyond the

immediate scope of this report. It can be used to provide the

costs of alternative scenarios, for example: different mixes of

technologies, different demand profiles in different geotypes,

different completion dates. If you wish to explore these

options, please contact the author.

For the complete data set, see the accompanying Excel file

at www.analysysmason.com/FTTx-2014.

7

Geographical

coverage

Individual countries

added in this update

Data series

Regions modelled:

North America (NA)

Western Europe

(WE)

Central and Eastern

Europe (CEE)

Developed

Asia–Pacific (DVAP)

Emerging

Asia–Pacific (EMAP)

Latin America

(LATAM)

Middle East and

Africa (MEA)

Countries added in this

update:

Central and

Eastern Europe

Croatia

Developed Asia–Pacific

Hong Kong

Taiwan

Emerging Asia–Pacific

Thailand

Middle East and Africa

Algeria

Kuwait

Morocco

Oman

Qatar

South Africa

Premises passed

Premises passed as

a proportion of total

premises

Premises connected

Premises connected

as a proportion of

premised passed

and total premises

Capex (cumulative):

total, network and

connections

All data is split by six

technologies:

DOCSIS3.0+

FTTB/LAN

FTTB/dp/VDSL

FTTC/VDSL

FTTH

VDSL-CO

See the ‘Geographical scope’ slide for a complete

list of the individual countries covered.

Figure 1: Summary of report coverage [Source: Analysys Mason, 2014]

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019 8

About this report

Executive summary

Key implications

Market definition

Forecasts

Business environment and network options

Update on capex model

About the author and Analysys Mason

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

Highest levels of coverage, FTTx

28

Figure 32: FTTx coverage as a percentage of total premises by country, worldwide, 2019 [Source: Analysys Mason, 2014]

Developed Asia–Pacific North America Western Europe

The Middle East and Africa Emerging Asia–Pacific Latin America

Central and Eastern Europe

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

UA

EQ

ata

rS

inga

po

reIs

rael

UK

Sou

th K

ore

aB

elg

ium

Icela

nd

Ta

iwa

nJa

pa

nIr

ela

nd

De

nm

ark

Sw

itze

rla

nd

Ho

ng

Kon

gC

ana

da

Ne

the

rla

nds

Italy

Germ

any

Lithu

ania

Kuw

ait

Fra

nce

Sw

ede

nF

inla

nd

Port

ug

al

Ch

ina

Ro

ma

nia

US

AT

urk

ey

No

rwa

yR

ussia

Esto

nia

Austr

alia

Slo

ven

iaC

roa

tia

Bulg

aria

Spa

inL

atv

iaM

ala

ysia

Pola

nd

Slo

vakia

Arg

en

tin

aG

reece

Austr

iaS

au

di A

rab

iaB

razil

Th

aila

nd

Cze

ch R

ep

ub

licIn

do

ne

sia

Me

xic

oM

oro

cco

Hu

ng

ary

Ukra

ine

Om

an

Sou

th A

fric

aIn

dia

Alg

eri

aE

gyp

t

Pe

rcen

tage o

f pre

mis

es

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

The business environment for fixed NGA has changed a great deal in the

past 12 months

The general economic environment has improved in key

regions such as Europe. Revenue trends for fixed

broadband, particularly NGA, are strong, and significantly

stronger than those of mobile (see Figure 36). We forecast

stronger growth in fixed broadband than mobile in every

region until 2019 (see Figure 37). (Mobile revenue is

nevertheless about four times greater than broadband.) For

incumbent operators, cable is an ever-increasing threat

creating greater incentive to invest.

In North America and developed Asia–Pacific, the

environment is different. Fixed investment among integrated

plays was a low priority until recently. In the USA, Google

Fiber is causing AT&T and Tier 2 incumbents to invest in

fixed access. In developed Asia–Pacific, FTTB and FTTH

coverage is already high, and future investment may be

limited to upgrades from FTTB to FTTH and from earlier

lower-capacity PONs to next-generation PONs.

Investment in fixed infrastructure has tended to be a low

priority in emerging markets. Some of the negative trends

that affect mobile in Europe are also emerging, and some

operators see opportunities in developing fibre, particularly

where new-build and a growing middle class improve the

business case. Several high-profile roll-outs, such as the

HSBB project in Malaysia, indicate that take-up can be very

good.

34

Figure 38: Change in fixed broadband and mobile service revenue by region,

worldwide, 2012–2013 [Source: Analysys Mason, 2014]

Figure 39: CAGR of fixed broadband and mobile service revenue by region,

worldwide, 2013–2019 [Source: Analysys Mason, 2014]

–10%

–5%

0%

5%

10%

15%

20%

NA

WE

CE

E

DV

AP

EM

AP

LA

TA

M

ME

A

World

wid

e

Perc

enta

ge c

hange

2012

–2013

Fixed broadband

Mobile

–10%

–5%

0%

5%

10%

15%

20%

NA

WE

CE

E

DV

AP

EM

AP

LA

TA

M

ME

A

World

wid

e

CA

GR

2013

–2019

Fixed broadband

Mobile

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019 59

About this report

Executive summary

Key implications

Market definition

Forecasts

Business environment and network options

Update on capex model

About the author and Analysys Mason

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

About the author

Rupert Wood (Principal Analyst) is the lead analyst for Analysys Mason’s Fixed Networks research programme. His

primary areas of specialisation include next-generation networks, long-term industry strategy and forecasting the

dynamics of convergence and substitution across fixed and mobile platforms. Rupert regularly contributes to the

international press on a wide range of telecoms subjects and has been quoted by The Times, The Economist,

Business Week, Telecommunications Online and La Tribune. Rupert has a PhD from the University of Cambridge,

where he was a Lecturer before joining Analysys Mason.

60

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

About Analysys Mason

Knowing what’s going on is one thing. Understanding how to take advantage of events is quite another. Our ability to understand the

complex workings of telecoms, media and technology (TMT) industries and draw practical conclusions, based on the specialist

knowledge of our people, is what sets Analysys Mason apart. We deliver our key services via two channels: consulting and research.

61

Consulting

Our focus is exclusively on TMT.

We support multi-billion dollar investments, advise clients on

regulatory matters, provide spectrum valuation and auction support,

and advise on operational performance, business planning and strategy.

We have developed rigorous methodologies that deliver tangible

results for clients around the world.

For more information, please visit www.analysysmason.com/consulting.

Research

We analyse, track and forecast the different services accessed by

consumers and enterprises, as well as the software, infrastructure

and technology delivering those services.

Research clients benefit from regular and timely intelligence in

addition to direct access to our team of expert analysts.

Our dedicated Custom Research team undertakes specialised and

bespoke projects for clients.

For more information, please visit www.analysysmason.com/research.

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

Research from Analysys Mason

62

We provide dedicated coverage of developments in the telecoms, media and technology (TMT) sectors,

through a range of research programmes that focus on different services and regions of the world.

Alongside our standardised suite of research programmes, our Custom Research team undertakes specialised, bespoke research

projects for clients. The dedicated team offers tailored investigations and answers complex questions on markets, competitors and

services with customised industry intelligence and insights.

To find out more, please visit www.analysysmason.com/research.

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

Consulting from Analysys Mason

For more than 25 years, our consultants have

been bringing the benefits of applied intelligence

to enable clients around the world to make

the most of their opportunities.

63

Our clients in the telecoms, media and technology (TMT)

sectors operate in dynamic markets where change is

constant. We help shape their understanding of the future

so they can thrive in these demanding conditions. To do

that, we have developed rigorous methodologies that

deliver real results for clients around the world.

Our focus is exclusively on TMT. We advise clients on

regulatory matters, help shape spectrum policy and develop

spectrum strategy, support multi-billion dollar investments,

advise on operational performance and develop new

business strategies. Such projects result in a depth of

knowledge and a range of expertise that sets us apart.

We help clients solve their most pressing problems,

enabling them to go farther, faster and achieve their

commercial objectives.

To find out more, please visit

www.analysysmason.com/consulting.

© Analysys Mason Limited 2014

FTTx roll-out and capex worldwide: forecasts and analysis 2014–2019

Published by Analysys Mason Limited • Bush House • North West Wing • Aldwych • London • WC2B 4PJ • UK

Tel: +44 (0)20 7395 9000 • Fax: +44 (0)20 7395 9001 • Email: [email protected] • www.analysysmason.com/research • Registered in England No. 5177472

© Analysys Mason Limited 2014. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means – electronic, mechanical,

photocopying, recording or otherwise – without the prior written permission of the publisher.

Figures and projections contained in this report are based on publicly available information only and are produced by the Research Division of Analysys Mason Limited independently of any client-

specific work within Analysys Mason Limited. The opinions expressed are those of the stated authors only.

Analysys Mason Limited recognises that many terms appearing in this report are proprietary; all such trademarks are acknowledged and every effort has been made to indicate them by the normal UK

publishing practice of capitalisation. However, the presence of a term, in whatever form, does not affect its legal status as a trademark.

Analysys Mason Limited maintains that all reasonable care and skill have been used in the compilation of this publication. However, Analysys Mason Limited shall not be under any liability for loss or

damage (including consequential loss) whatsoever or howsoever arising as a result of the use of this publication by the customer, his servants, agents or any third party.