American Airlines Case Study

-

Upload

niveditadaga11 -

Category

Documents

-

view

109 -

download

2

description

Transcript of American Airlines Case Study

American airlines case study – Strategy formulation

Submitted by

Archi GuptaAastha KapoorMegha MauryaNivedita DagaPraveenkumarSujit Pallithara

Vishaka Dhiman

Topics covered under Strategy-Formulation Analytical Framework

• Input stage – Internal Factor Evaluation

Matrix (IFE)– External Factor Evaluation

Matrix (EFE)– Competitive Profile Matrix

(CPM)• Matching stage – SWOT Matrix– SPACE Matrix– BCG Matrix

VISION

“To be the number one destination carrier in the world”.

Mission

“AMR Corporation is committed at providing every citizen of the world with the highest quality air travel to the widest selection of destinations possible. AMR will continue to modernize its fleet while maintaining its position as the largest air carrier in the world, with a goal of becoming the most profitable airline. AMR is the airline that treats every employee with equal care and respect and believes that its employees are the key to the airlines success By investing in newer technologies and by following a strict adherence towards environmental regulations, AMR demonstrates its commitment to the world environment”.

Internal Factor Evaluation Matrix

S. No.

Key Internal Factors - Strengths Weight Rating Weighted score

1 The largest airline in the world 0.08 4 0.32

2 Employee support (the BODs & CEO volunteered to work without pay)

0.07 4 0.28

3 Global Alliances ( with other airlines, hotels, car rental companies, banks, etc.)

0.07 4 0.28

4 Govt. assistance 0.04 3 0.12

5 Services to customers (planning & booking of tickets online, flight status information, online travel resources , travel info centre, etc.)

0.05 4 0.2

6 Marketing techniques 0.03 3 0.09

7 Recipient of awards & recognition 0.01 3 0.03

8 Fuel hedging program (reduced firm’s fuel expenses by approx. $ 29 million & $ 545 million in 2001 & 2000 respectively)

0.07 4 0.28

9 Collaboration with Orbitz (lower fares than other airline agents)

0.04 3 0.12

10 Strong online presence ( 10 million site visits each month in 2001)

0.02 3 0.06

S. No.

Key Internal Factors - Weaknesses Weight Rating Wt. Score

1 Unable to compete with Delta in regional Jet market due to scope clause

0.06 2 0.12

2 Unable to match the standards of Southwest in terms of low cost operating structure & profitability route schedule)

0.06 2 0.12

3 Average aircraft age went down to 9.9 years in 2002 from 10.8 years in 2001

0.03 2 0.06

4 Weak financial position (decline in revenue led to negative income & increase in debt agreements & secured mortgage)

0.08 1 0.08

5 Inadequate strategic plans 0.07 1 0.07

6 Closure of 105 travel centres, 8 Admiral’s clubs & 5 platinum centres)

0.04 2 0.08

7 Cut in flight food & beverages 0.07 1 0.07

8 Sale of aircrafts 0.03 2 0.06

9 Lay off of 20,000 employees 0.05 1 0.05

10 Unprofitable routes 0.03 2 0.06

TOTAL 1 2.55

External Factor Evaluation Matrix

S.No

Key External factors – opportunities WeightIn %

Rating Wt.score

1 Online ticket booking, electronic ticket system (online booking charges $1 per ticket, whereas it takes $8 for agent booking)

.08 2 .16

2 Mail and cargo transport (38% of overall revenue comes from this )

.02 2 .04

3 Venturing into regional jets ( delta ) .07 1 .07

4 Unrestricted code sharing between international carriers .06 3 .18

5 Sale of in-flight alcoholic beverages , various amenities and services

.03 1 .03

6 Furloughing employees .04 4 .16

7 Reducing advertising expenses/ changing the face of campaigns

.03 1 .03

8 Fuel hedging program (increase in fuel price doesn’t affect the company)

.06 4 .24

9 Changing the operating structure, profitable route schedule and high efficiency system (south west )

.09 2 .18

10 Mandatory retirement / international and leisure travel .02 3 .06

S.No

Key External factors – Threats WeightIn %

Rating Wt.score

1 Terrorism / safety concerns – decline in business .07 2 .14

2 Increased airfare price competition (airlines loosing $ 10-15 million per day) reduced price because of deregulation

.08 3 .24

3 Weak economy (decline in both business and vacation air travel)

.06 2 .12

4 Foreign government restricting a slot allotment .04 3 .12

5 Airlines being identified as Potentially responsible party .03 1 .03

6 Cancelling of new orders/ selling current aircrafts .05 1 .05

7 Rising labor cost (34.9 of overall expenses in 2000, 48% in 2001)

.05 2 .10

8 Maximum fixed cost in operation .06 2 .12

9 Competition from automobile, buses and Amtrak rail system .04 3 .12

10 Enhanced security measures results in increased operating cost

.02 3 .06

TOTAL 1 2.25

S W

T O

SO1. S10,O7- ONLINE ADVERTISEMENT.2. S1,S5,O1- INCREASE THE E-TICKETING TO

80%3. S6,S10,O2

WO1. NEGOTIATE LOWER WAGE RATE S WITH UNIONS TO IMPROVE COST STRUCTURE.

ST

1. ENCOURAGE ONLINE BOOKING TO REDUCE THE TICKET FARE.

WT1. AVOID UNPROFITABLE ROUTES TO IMPROVE

THE FINANCIAL POSITION

Industry Analysis: Competitive Profile Matrix (CPM)

• Identifies firm’s major competitors and their strengths & weaknesses in relation to a sample firm’s strategic positions.

•American Airlines had 2 major competitors•Delta Air Line•United

Critical Success Factors• Financial Position• Cost Structure• Information Technology• Partnerships• Fleet

American Airlines

Delta Airlines

United

Critical Success Factors Wt Rating

Wt Score Rating

Wt Score

Rating

Wt Score

Rating

Wt Score

Financial Position 0.1 1 0.1 1 0.1 2 0.2 4 0.4Information Technology 0.2 3 0.6 3 0.6 3 0.6 4 0.8

Partnerships 0.25 4 1 3 0.75 4 1 1 0.25

Fleet 0.15 3 0.45 4 0.6 2 0.3 3 0.45

E-Commerce 0.3 3 0.9 4 0.6 3 0.6 4 1

Total 1 3.05 2.65 2.7 3.1

Total 1 3.05 2.65 2.7 3.1

Competitive Profile Matrix

Industry Analysis CPM

• Just because one firm receives a 3.05 rating and another receives a 2.65 rating, it does not follow that the first firm is 20 percent better than the second.

AMR Corp.- Business Divisions

• AMR Investments• American Cargo• AMR Training Group• American Airlines• American Eagle

Mainline Jet Service Industry in early 2000s- Decline

• Combating SARS, 9/11 terrorist attacks, wars, rising oil prices

• There was a decline in both business and international travel

• The industry faced losses of $22 billion (6%) between 2001-2002

• On September 10, 2001, US airports handled 38,047 flights. On September 12, they handled 252 commercial flights.

• US passenger traffic, measured by revenue passenger kilometres (RPM) declined 5.9% in 2001 (compared to 2000) and a further 1.4% in 2002.

• Most US airlines faced a liquidity crisis and applied for bankruptcy reorganisation

Source: http://www.iata.org/pressroom/documents/impact-9-11-aviation.pdf

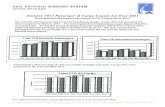

American Airlines (AMR)

Market share (Revenue)

Carrier revenue (in $billion)

American AirlinesUnited Air-linesDelta Air-lines Inc.

Carrier revenue (in %)

Anerican AirlinesUnited Air-linesDelta Air-lines Inc.Others

1658

12

141913.9

16.1

American Airlines (contd.)

• Market share (Passenger Traffic RPM)

• Relative market share position for AMR = 0.93:1

RPM (in $bn)

United AirlinesAmerican AirlinesDelta Airlines Inc.

97.3 116.6

108.4

Regional Jet Service Industry in early 2000s - Growth

• By the end of 2001, some 800 regional jets were operational in US, an up by 83% since less than a decade back

• 946 regional jets were on firm or conditional order while 1193 jets were under option (RASI reports)

• Regional jets have supplemented regional service (44%), create new nonstop regional air service (33%), replace mainline jet service (15%), replace turboprop service (8%)

• Advantages: Low purchase and operating costs, comfortable, meets off-peak demand, 50% load factor, boon for business travellers

American Eagle

Market share

• Delta (market leader) – In 2000, it acquired regional airline company Comair and Atlantic Southeast Airlines (ASA)

• American Eagle (close competitor) – owns the largest carrier and is a holding company for Executive Airlines, Flagship Airlines, Simmons Airlines & Wings West Airlines (regional players)

• Scope clauses – Delta must limit its seating capacity to 70 in all its jets, while the limit for American Eagle is 45

AMERICAN AIRLINES (AMR)

AMERICAN EAGLE

Copyright 2007 Prentice Hall Ch 6 -25

SPACE MatrixFS

+6

+1

+5+4+3

+2

-6

-5

-4

-3

-2

-1-6 -5 -4 -3 -2 -1 +1 +2 +3 +4 +5 +6

ES

CA IS

Conservative Aggressive

Defensive Competitive