AMENDED RETURN YEAR OF ASSESSMENT TP AMENDED … · Tax / Additional Tax Charged (E1 - E2) Amended...

Transcript of AMENDED RETURN YEAR OF ASSESSMENT TP AMENDED … · Tax / Additional Tax Charged (E1 - E2) Amended...

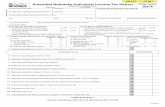

INLAND REVENUE BOARD OF MALAYSIA

UNDER SECTION 77B OF THE INCOME TAX ACT 1967

AMENDED RETURN FORM OF A DECEASED PERSON’S ESTATE

CP 6H – Pin 2014

TP

AMENDED RETURN FORM

YEAR OF ASSESSMENT

2014

<>>>>>>>>>>>>>>>>>>>>>>>>>? <>>>>>>>>>>>>>>>>>>>>>>>>>?

<>>>>>>>>?

PART A

TP

1

2

1

This form is prescribed under section 152 of the Income Tax Act 1967

[Declare in Ringgit Malaysia (RM) currency]

Amount / Amount of Additional Chargeable

Income Tax / Additional Tax Charged Total Tax Charged

3 Telephone No. <>>>>>>>>>>>?

<>_>>_>>_>>?

<>>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>>>?

<>>>?

B1

B2

B3

<>>>>>>>>? <>>>>>>>>? <>>>>>>>>?

<>_>>_>>_>>?

<>_>>_>>_>>? <>_>>_>>_>>?

<>_>>_>>_>>?

B7

B4

B5

B6

B7

BAHAGIAN B: PENDAPATAN BERKANUN, JUMLAH PENDAPATAN DAN

JUMLAH CUKAI YANG DIKENAKAN

D

D

D

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

<>_>>_>>_>>?

<>_>>_>>_>>?

B8

B9

B8

B9 , , ,

, , ,

B10 B10 <>_>>_>>_>>?

, , ,

PARTICULARS OF DECEASED PERSON'S ESTATE

Income Tax No.

Name of Deceased Person's Estate

Statutory Income From Business

Business Code

Amount (RM)

Business 1

Business 2

Business 3 + 4 and so forth (if any)

Note: Fill in Part B if the taxpayer is DOMICILED in Malaysia at the time of his demise

PART B : STATUTORY INCOME, TOTAL INCOME AND

TOTAL TAX CHARGEABLE

[Declare amount in Ringgit Malaysia (RM) currency]

Income Tax No.

Statutory Income From Partnership

Partnership 1

Partnership 2

Partnership 3 + 4 and so forth (if any)

Aggregate statutory income from businesses (B1 to B6)

LESS: Business losses brought forward (Restricted to amount in B7) TOTAL (B7 - B8)

Dividends

STATUTORY INCOME FROM OTHER SOURCES

B11

B12

B13

B14

B15

B16

B17

B18

B19

B11

B12

B13

B14

B15

B16

B17

B18

B19

2

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

<>>>>>>>>?

<>_>>_>>_>>?

B20

B21

B22

B23

B24

B26

B23

B25

B22

B20

B21

B24

<>_>>_>>_>>? <>_>>_>>_>>?

<>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>?

, , ,

, , ,

, , ,

, , ,

, , ,

B24A

<>_>>_>>_>>?

, , ,

<>_>>_>>_>>?

, , ,

<>_>>_>>_>>?

, , ,

, , ,

B29

B27

B30

B27

B29

B30

B31

<>_>>_>>_>>?

<>_>>_>>_>>?

, , ,

, , ,

<>_>>_>>_>>?

, , ,

<>_>>_>>_>>?

, , ,

B31

B28 B28 <>_>>_>>_>>?

, , ,

Interest and discounts

Rents, royalties and premiums

Annuities and other periodical payments

Other gains or profits

Additions pursuant to paragraph 43(1)(c)

Aggregate statutory income from other sources

(B10 to B15)

AGGREGATE INCOME (B9 + B16)

LESS: Current year business losses (Restricted to amount in B17) TOTAL (B17 - B18)

Name of Deceased Person's Estate

TOTAL (B19 - B20) (Enter '0' if value is negative) LESS :

LESS : Other expenditure

Total donations and gifts (B24 to B30)

TOTAL (B21- B22) (Enter '0' if value is negative) LESS : Donations and Gifts

Annuities payable / periodical payments

Gift of money to the Government / State Government

Gift of artefacts, manuscripts or paintings

Gift of money for the provision of library facilities or to libraries

Gift of paintings to the National Art Gallery or any state art gallery

Business zakat (restricted to 2.5% of aggregate income in B17)

Gift of money or contribution in kind for any approved sports activity or sports body

Gift of money or contribution in kind for any project of national interest approved by the Minister of finance

Gift of money to the local authorities or approved institutions and organisations

Qualifying prospecting expenditure - Schedule 4 and paragraph 44(1)(b)

Restricted to 7% amount in B17

Income Tax No.

B32

->>_>>_>>?

->>_>>_>>?

<?

B36

3

B35

B35a

->>?

B33

B32

B34

, 9 0 0 0

<>_>>_>>_>>? <>_>>_>>_>>? ->>_>>_>>_>?

->>_>>_>>_>?

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

.

.

, , , . ->>_>>_>>_>?

B35b

B34

B36

<>>>>>>>>?

<>>>?

<>_>>_>>_>>?

<>>>>>>>>?

C7

C8

C9

C8

C9

C4

C5

C6

C7

C1

C2

C3

D

D

D

<>>>?

<>>>?

<>_>>_>>_>>?

<>_>>_>>_>>? <>>>>>>>>?

<>>>>>>>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

C10

C11

C12

C10

C11

C12

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

, , ,

, , ,

, , ,

C13 C13 <>_>>_>>_>>?

, , ,

C14

C15

C16

C14

C15

C16

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

, , ,

, , ,

, , ,

, , ,

TOTAL INCOME (B23 – B31)

Tax on the first

Tax on the balance

TOTAL TAX CHARGEABLE (B35a + B35b)

At Rate (%)

LESS : Personal relief

COMPUTATION OF TAX CHARGEABLE (Refer to the tax rates schedule provided)

( Enter '0' if value is negative )

(Enter '0' if value is negative) CHARGEABLE INCOME (B32 - B33)

Income Tax No.

Name of Deceased Person's Estate

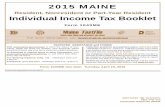

Note: Fill in Part C if the taxpayer is NOT DOMICILED in Malaysia at the time of his demise

PART C : STATUTORY INCOME, TOTAL INCOME AND

TOTAL TAX CHARGEABLE Statutory Income From Business

Income Tax No. Statutory Income From Partnership

Business 3 + 4 and so forth (if any)

Partnership 1

Partnership 2

Partnership 3 + 4 and so forth (if any)

LESS: Business losses brought forward (Restricted to amount in C7)

Dividends

TOTAL (C7 - C8)

STATUTORY INCOME FROM OTHER SOURCES

Rents and premiums Annuities and other periodical payments

Other gains or profits Additions pursuant to paragraph 43(1)(c)

Discounts

Aggregate statutory income from businesses (C1 to C6)

[Declare amount in Ringgit Malaysia (RM) currency]

Business Code Amount (RM)

Business 1

Business 2

Aggregate statutory income from other sources (C10 to C15)

4

<>>>>>>>>? C17

C18

C19

C20

C17

C18

C19

C20

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>?

, , ,

, , ,

, , ,

, , ,

C21 C21 TOTAL (C19 - C20)

(Enter ‘0’if value is negative) <>_>>_>>_>>?

, , ,

<>_>>_>>_>>?

C22

C23

C22

C23

LESS :

TOTAL (C21 - C22)

Annuities payable / periodical payments

(Enter ‘0’ if value is negative) <>_>>_>>_>>?

, , ,

C24

C31

C32

C33a

C33b

C33c

C33d

C34

C30

C24

C26

C27

C29

C31

C25

C32

C33

C33a

C33b

C33c

C33d

C34 TOTAL INCOME / CHARGEABLE INCOME (C32 to C33d)

TOTAL (C23 – C31)

Gross income subject to tax at other rates

Royalties

Interest

Special classes of income under section 4A

Other income (please specify )

LESS :

Total donations and gifts (C24 to C30)

Donations and Gifts

(Enter ‘0’ if value is negative)

<>_>>_>>_>>?

<>_>>_>>_>>?

<>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>?

, , ,

<>_>>_>>_>>?

, , , , , ,

<>_>>_>>_>>?

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

C29

C30 <>_>>_>>_>>?

, , , <>_>>_>>_>>?

, , ,

C282

C28 <>_>>_>>_>>?

, , ,

C24A

<>_>>_>>_>>?

, , ,

<>_>>_>>_>>?

, , , C272

<>_>>_>>_>>?

, , ,

AGGREGATE INCOME (C9 + C16)

LESS : Current year business losses (Restricted to amount in C17) TOTAL (C17 - C18)

LESS : Other expenditure Qualifying prospecting expenditure - Schedule 4 and paragraph 44(1)(b)

Income Tax No.

Name of Deceased Person's Estate

Gift of money to the Government / State Government

Gift of artefacts, manuscripts or paintings

Gift of money for the provision of library facilities or to libraries

Gift of paintings to the National Art Gallery or any state art gallery

Business zakat (restricted to 2.5% of aggregate income in B17)

Gift of money or contribution in kind for any approved sports activity or sports body

Gift of money or contribution in kind for any project of national interest approved by the Minister of finance

Gift of money to the local authorities or approved institutions and organisations

Restricted to 7% amount in C17

5

<>>>>>>>>?

->>_>>_>>_>?

D8

D4

D5

D1

PART D : TAX PAYABLE

D6

D7

D8

LESS :

D5

D4

D1 ,

->>_>>_>>_>? ->>_>>_>>_>?

->>_>>_>>_>?

, , ,

, , ,

, , ,

, ,

.

.

.

->>_>>_>>_>?

, , , .

.

TOTAL TAX CHARGEABLE (from B36 or C36)

Restricted to D1

->>_>>_>>_>?

, , , .

D6

D7

E2

E3

E4

E2

E3

->>_>>_>>_>?

, , ,

->>_>>_>>_>?

, , ,

.

.

E4a

E4b

E4a

E4b

->>_>>_>>_>?

, , ,

->>_>>_>>_>?

, , ,

.

.

->>_>>_>>_>?

E5 , , , E5 .

->>_>>_>>_>?

E1 , , , E1 .

D3 TOTAL (D1 + D2)

ADD : Tax previously repaid (from D7 of original Form TP)

D3 ->>_>>_>>_>?

, , , .

->>_>>_>>_>?

D2 D2 , , , .

, , ,

->>_>>_>>_>?

<>_>>_>>_>>?

<_?

25

5

8

10

12

15

C35

C35a

C35b

C35c

C35d

C35e

C35f

Gross income subject to tax at other rates

COMPUTATION OF TAX CHARGEABLE

Chargeable Income Rate (%) Tax Chargeable

C36

Division of chargeable income according to the rate applicable

<>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>? <>_>>_>>_>>?

->>_>>_>>_>? ->>_>>_>>_>? ->>_>>_>>_>? ->>_>>_>>_>? ->>_>>_>>_>? ->>_>>_>>_>? ->>_>>_>>_>?

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

, , ,

.

.

.

.

.

.

.

.

.

, , ,

TOTAL TAX CHARGEABLE (C35a to C35g)

C35g

C36

Income Tax No.

Name of Deceased Person's Estate

Tax deduction under section 51 of Finance Act 2007 (dividends)

Section 132 tax relief

Section 110 tax deduction (others)

Section 133 tax relief

TAX PAYABLE [D3 - (D4 + D5 + D6 + D7)]

Tax payable (from D8)

PART E: COMPUTATION OF INCREASE IN TAX AND TOTAL TAX PAYABLE

LESS: Previous tax payable (from D6 of original Form TP)

Increase in Tax under section 77B of the Income Tax Act 1967 in respect of:-

Tax / Additional Tax Charged (E1 - E2)

Amended return form furnished within a period of 60 days after the due date (E3 x 10%)

Amended return form furnished after the period of 60 days from the due date but not later than 6 months from the due date [E3 x 10%] + [{E3 + (E3 x 10%)} x 5%]

OR

Total tax payable [(E3 + E4a) or (E3 + E4b)]

PARTICULARS OF BUSINESS INCOME (Part G of original Form TP)

Item No. * LOSSES

Amount absorbed Balance carried forward

CAPITAL ALLOWANCES

Allowances absorbed Balance carried forward

PARTICULARS OF WITHHOLDING TAXES

Total gross amount paid Total tax withheld and remitted to LHDNM

SPECIAL DEDUCTION, FURTHER DEDUCTION AND DOUBLE DEDUCTION (Part H of original Form TP)

Item No. * Claim Code Amount

INCENTIVE CLAIM (Part J of original Form TP)

Item No. * Amount Absorbed Balance Carried Forward

FINANCIAL PARTICULARS OF DECEASED PERSON’S ESTATE (Part K of original Form TP)

Item No. * Item Amount

PARTICULARS OF EXEMPT INCOME (Part L of original Form TP)

Item No. * Item Amount

6

I

<>>>>>>>>>>?

<>>>>>>>>>>>>>>>>>>>>>>>>>>? <>>>>>>>>>>>>>>>>>>>>>>>>>>?

<>>>>>>>>>>>>>>>>>>>>>>>>>>? <>>>>>>>>>>>>>>>>>>>>>>>>>>?

<>>>>>>?

- -

<>>>>>>>>? PART F: PARTICULARS FOR OTHERS AMENDMENT

EXECUTOR'S DECLARATION

Identity / Passport No. *

hereby declare that the information regarding the income and claim for deductions as given by me in this Amended Return Form and in any document attached is true, correct and complete.

*Delete whichever is not relevant

Designation

Signature

Date Day Month Year

Income Tax No.

Name of Deceased Person's Estate

* For items amended, please indicate the item number as in the original return form. Fill in relevant items only.

Please furnish attachment as per the above format in case of insufficient space.

GUIDE NOTES ON AMENDED RETURN FORM TP FOR YEAR OF ASSESSMENT 2014

As provided under section 77B of the Income Act 1967 (ITA 1967), a deceased person’s estate is allowed to make amendment to the Return Form which has been furnished to the Director General of Inland Revenue.

I RULES

A deceased person’s estate which has furnished a Return Form in accordance with subsection 77(1) of ITA 1967, is allowed to make amendment to the Return. Tax / Additional tax shall be charge on the chargeable income of the deceased person’s estate as a result of the amendment made.

A deceased person’s estate which intends to make the amendment is required to complete a form prescribed under section 152 of ITA 1967 (known as the ‘Amended Return Form’).

The amendment shall only be made once for a year of assessment.

No amendment is allowed if the Director General of Inland Revenue has made additional assessment under section 91 of ITA 1967 within a period of 6 months after the date specified for furnishing the return Form.

For the purpose of section 77B of ITA 1967, the Amended Return Form shall:-

(a) specify the amount / additional amount of chargeable income (amount B34 / C34 Amended Return Form less amount B34 / C34 Form TP);

(b) amount of tax / additional tax payable on that chargeable income (amount E3);

(c) specify the amount of tax payable on the tax which has or would have been wrongly repaid (amount E5);

(d) specify the increased sum ascertained in accordance with subsection 77B(4) of ITA 1967; or

(e) contain such particulars as may be required by the Director General of Inland Revenue.

II RATE AND COMPUTATION OF INCREASE IN TAX

The tax or additional tax payable is subject to an increase in tax under paragraph 77B(4)(a) and 77B(4)(b) of ITA 1967.

If the amended Return Form is furnished:

within a period of 60 days after the date specified in section 77(1) of ITA 1967, the amount of increase in tax charged shall be 10% of the amount of such tax payable or additional tax payable.

After the period of 60 days but not later than 6 months from the date specifed in section 77(1) of ITA 1967, the amount of increase in tax charged shall be determined in accordance with the following formula:-

B + [(A + B) x 5%]

where: A = the amount of such tax payable or additional tax payable; and B = 10% of the amount of such tax payable or additional tax payable (A x 10%)

A deceased person’s estate making the amendment is required to compute and enter the amount of increase in tax at item E4(a) or E4(b) on page 6 of the Amended Return Form.

III DEEMED ASSESSMENT

An Amended return Form furnished in accordance with section 77B of ITA 1967 shall be deemed to be a notice of assessment or notice of additional assessment, and that notice shall be deemed to have been served on the day on which the Amended Return Form is furnished.

IV DECLARATION

This section must be affirmed and duly signed.

V SUBMISSION OF AMENDED RETURN FORM

An Amended Return Form which has been completed, affirmed and duly signed must be sent to the LHDNM branch handling the file of the relevant association.