AM - Automotive Management October preview

-

Upload

am-automotive-management -

Category

Documents

-

view

216 -

download

2

description

Transcript of AM - Automotive Management October preview

THE ADD-ONS SQUEEZE IS COMING

AUTOMOTIVE MANAGEMENT

www.am-online.com October 2014 £8.00

THE FR A NCHISE GUIDE / P 7 7

Our annual profile of each manufacturer and what they offer dealers

F C A D E A D L I N E / P 6 5

Is your business ready to register for full credit compliance?

D ATA A N A LY S I S / P47

What dealers can learn from Amazon’s approach to upselling

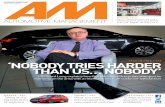

FA C E T O FA C E / P 3 6

Why John Clark is cautious about the market, despite his group’s record results

Manufacturer demands and FCA pressure will change dealers’ profi t models forever. Are you prepared?

THE

UPSELLINGISSUE

A N A LY S I S / P 2 3

Co-sponsors:

To book your place at the AM F&I Compliance Conference visit:

www.amfandicompliance.co.uk

Headline sponsors:

Better understand and evaluate the risk to business after the Financial Conduct

Authority took responsibility for consumer finance on 1st April

Hear from the FCA themselves including an evaluation of the first six months

since the organisation took control of consumer finance

Look at the F&I landscape further; the FCA has been undertaking an

investigation of add-on products with GAP, in particular, coming under scrutiny

Explore specific areas such as marketing and the evolving role of the

business manager

Investigate the positive aspects which the FCA’s arrival has facilitated, mainly

the drive for a more honest and open way of undertaking finance business

The introduction of the Financial Conduct Authority (FCA) is the single biggest issue

to have impacted on automotive retail in recent years after the downturn itself. The

Finance and Leasing Association’s latest figures reveal that a staggering 75% of all

private vehicle sales are funded through finance. Without a healthy finance business,

many dealerships will struggle and even flounder.

By attending the AM F&I Compliance Conference, you will:

18 November 2014 – Oxford Belfry, OX9 2JW

Is your F&Ibusiness secure?

Associate sponsor:

��������������������������������� ������������������

The AM editorial teamEmail: [email protected]: www.am-online.com

Pressures may mean the profits from add-ons become ‘little but often’

Jeremy BennettEditor

Tim RoseManaging editor

welcome

[email protected] am-online.com/linkedinam-online.com @amchatter facebook.com/automotivemanagementUK

hanges are looming that will have a marked impact on the profits franchised dealers earn from selling add-on products to their car-buying customers. Every dealer knows by now that the Financial Conduct Authority (FCA) has put showroom sales of GAP insurance under its spotlight, but what might not be so

clear is the threat from interfering carmakers and smartphone-equipped consumers to the traditional profits generated by non-regulated add-ons.

In an AM-online poll this month (page 54), 60% of dealers indicated they do not expect their earnings from add-on products to increase in the near future. The advice from industry consultants in our analysis piece (page 23) is that dealers may have to take less profit per product but simply sell a broader variety of them to try to make up the shortfall. Some of the UK’s franchised networks seem to understand this already – our poll results showed a third of dealers currently presents five or more ancillary products to each car buyer.

Of course, to stand a chance of offering those add-ons there has to be an attractive, competitive car to sell in the first place, and some manufacturers seem to be doing this far better than others. Our 2014 Franchise Guide (starts page 77) is designed to allow you see which brands could help you to grow your business, and which might be holding it back.

o u R E x p E R T c o n T R i B u T o R s

professor Jim sakerAs director of the

centre of Automotive management at loughborough Univer-sity’s Business School, Saker is a key figure behind the drive for management recogni-tion and skills in the motor retail sector.

This month (p34), he argues that motor retailers need to promote both apprenticeships and formal qualifications.

Hugh Dickerson Google UK’s senior industry head of

automotive and an AM Awards judge, Dickerson is responsible for developing digital brands in the UK.

This month (p61), he points out online marketing opportunities for your aftersales.

Dr Richard parkinAs director of valuations

and analysis, Parkin coordinates the editorial and analysis team at Glass’s. Prior to joining Glass’s in 2012, he was a strategy consultant at ernst & Young, focused on the motor industry.

In this issue (p28), he asks whether free warranty or service plans might be better than giving large discounts.C

am-online.com October 2014 3

Insight

31 How to increase upselling and boost your profits

Products such as GAP insurance and warranty cover provide valuable income for a franchised dealer. Here, experts share their advice on how to sell them.

34 View from the business school

To make progress in this industry we need to promote apprenticeships and formal qualifications as a holistic package, says Prof Jim Saker.

36 Face to face: John Clark Motor Group

Chairman John Clark talks about the group’s pragmatic approach to upselling and why, despite record financial results, he won’t let himself be carried away by the current strength of the car markets.

47 How integrated data can unlock untapped revenue

Dealers can reach the ‘holy grail’ of

In this issue October 2014

Your news

7 News digest This month’s round-up includes the

results of the latest NFDA Dealer Attitude Survey, HR Owen’s CEO steps down, and former F1 champion Nigel Mansell takes on a Mitsubishi franchise.

Market intelligence

12 New car registrationsA 9.4% rise in registrations meant August became the 30th consecutive month of growth.

14 Used car values Average used car values suffered a

slight decline, according to NAMA, as volume reached six figures.

17 Finance The Funding Corporation closes its

retail arm as Stoneacre gets back into sub-prime.

31BOOST YOUR UPSELLINGEXPERT ADVICE ON SELLING ADD-ONS

4 October 2014 am-online.com

36FACE TO FACE

JOHN CLARK GROUPCHAIRMAN JOHN CLARK

20 Economic indicators The CBI warns of slower growth

ahead despite falling unemployment and low inflation.

AnalysisADD-ON PROFIT

23 A changing model for add-on sales

Dealers who depend on add-ons as an revenue stream face a triple challenge from regulators, manufacturers and consumers armed with online information.

28 Lock in car buyers Glass’s Dr Richard Parkin wonders if

free service plans and warranties will replace the deposit contributions offered on PCPs.

RENAULT TWINGOWILL IT BE ‘THIRD TIME LUCKY’?

109

For the latest motor retail industry news, visit am-online.comSign up to get AM news daily by email: am-online.com/newsletter

Coming soon In November’s issue Star cars of the Paris Motor Show,

a look at showroom design features and the technology that can support

the showroom experience.

118

77THE 2014 FRANCHISE GUIDE

Showroom

106 BMW 2 Series Active Tourer

BMW’s first MPV is a break from the brand’s tradition.

109 Renault Twingo The new city car that makes more space for occupants by keeping the engine at the rear.

110 Volkswagen Golf The award-winning, strong-selling

hatch joins AM’s long term test fleet.

112 Seat Ibiza We take a personal interest after

Seat gets mauled in recent surveys.

am-online.com October 2014 5

ADP Dealer Services ........................47

ASE .........................................................10

AutosOnShow ......................................10

BCA .....................................................9, 14

Cambria Automobiles ..........................9

Capgemini .............................................47

Carrs .........................................................9

Codeweavers .......................................65

Eastern Western Motor Group ......32

Experian ............................................9, 48

Firs Garage ..........................................32

FLA .....................................................9, 18

Frontline Solutions .............................65

GForces .................................................48

Halfords ....................................................7

Honda ........................................................9

HR Owen ...............................................10

John Clark Motor Group ..................36

Manheim ...........................................9, 14

Mapfre Abraxas ..................................68

Marks & Spencer ...............................71

Marshall Motor Group .........................9

Mercedes-Benz Brooklands ..........32

MotoNovo Finance .............................18

NAMA .....................................................14

NFDA .........................................................7

Nigel Mansell..........................................7

Nissan .......................................................9

Pinewood ..............................................48

Skurrays ................................................32

SMMT .....................................................12

Stoneacre ..............................................18

Swansway ................................................7

The Funding Corporation ................17

Vantage Motor Group ........................31

Vic Young ..................................................7

Volvo .......................................................10

D E A L E R S A N D S U P P L I E R S I N T H I S I S S U E :

organic upselling by extracting and analysing information they already hold on a customer’s purchasing history and preferences.

52 AM Poll The majority of dealers expect

add-on profits to suffer.

61 View from Google There are opportunities online to win with aftersales.

65 F&I Dealers need to be ready for their regulatory ‘landing slots’ from October 1.

77 The 2014 Franchise Guide Our annual profile of each car manufacturer and what opportunities they offer dealers.

am-online.com October 2014 7

F O R D A I LY N E W S , V I S I T: w w w . a m - o n l i n e . c o m

T O g E T A M ’ S F R E E D A I LY N E W S L E T T E R , V I S I T:w w w . a m - o n l i n e . c o m / n e w s l e t t e r

NEWS DIGEST9 Cambria forecast

Dealer group Cambria has said its full-year results are likely to be ahead of current market forecasts.

Dealer profitabilityThe average UK motor dealership made £3,800 in July, down from £6,400 in July 2013.

10

T H E N E W S Y O U C A N ’ T A F F O R D T O H A V E M I S S E D

S U R V E Y

Average dealer satisfaction hits two-year low, says NFDADealer opinions of the value in holding franchises have reached their lowest level for two years.

There are suggestions that dealers’ inability to improve profits during the booming new car market may contribute to this negativity as well as increasing unhap-piness at the level of investment expected in franchise standards.

According to the latest biannual National Franchised Dealer Association Dealer (NFDA) Attitude Survey, when asked the overall value of their franchises on a score of 1 to 10 the average for all respondents was 6.6.

This is the lowest score for this question since the summer of 2012 and was 0.6 points down on surveys taken last winter and in summer 2013.

Thirteen of the 29 networks surveyed recorded below average scores for the question, with 15 scoring above average. Land Rover received the highest score, Honda the lowest.

The average score for the question “how satisfied are you with the current profit return by representing your franchise?” is 6.1. This is down 0.6 points since the winter survey and lower than a year ago.

“The score would suggest most dealers are fairly neutral about the profit performance of their franchise,

N I g E L M A N S E L LFormer Formula One world champion Nigel Mansell has acquired a Mitsubishi franchise for his car dealership in Jersey.

The British motor racing legend, who won the 1992 Formula One World Championship and the 1993 CART IndyCar World Series, opened the Mitsubishi franchise on September 16 at his family-run deal-ership in St Helier, which will be managed by his son and managing director, Leo.

(L-R) Lance Bradley, Mitsubishi Motors UK MD, Nigel Mansell and his son, Leo

H A L F O R D SHalfords has relaunched its car parts business with a same-day delivery service, with an increased range of more than 130,000 products.

Branded as Car Parts Direct, the service will allow customers to order any product in-store, online or via the Halfords mobile app with next working day delivery or better – 66% of in-store orders will be delivered within 90 minutes.

Customers can choose to have parts delivered to their nearest Halfords store for collection, or to their home or place of work, seven days a week.

Car Parts Direct manager Paul Tomlinson said: “With an ageing UK car fleet stimulating demand for replacement parts, the timing is right for Halfords to reassert itself in the marketplace.

“The average age of cars on UK roads is at a 30-year high, which we anticipate will drive demand for major replacement parts such as steering, suspension and clutch components. Cars around three years old sustain demand for consumable items like filters, spark plugs, brake pads and discs.”

I N B R I E F

U S E D C A R C O N F E R E N C EThe AM Used Car Market Conference on October 21 offers one day of expert input from a spectrum of speakers that will give dealers an all-important extra edge to make their offers stand out.

Full details, including speakers and schedule, can be found at www.usedcarconference.co.uk.

V I C Y O U N gAn award-winning company in the North-East has become the latest dealer to join the Mitsub-ishi network. Vic Young Mitsub-ishi opened its doors this month at the company’s site in Newcastle Road, South Shields. Young has more than 40 years’ experience in the motor trade.

S W A N S W AYSwansway Group has taken on the Jeep franchise for the first time, adding the 4x4 brand to its multi-franchise site in Chester.Jeep SUVs will be added to the Huntington site which already retails Citroën, Fiat and Abarth.

F R E E F C A W E B I N A R Dealers looking for clarification on what is required to ensure they meet the Financial Conduct Authority’s rules on motor finance selling are invited to take part in a free webinar.

Organised by AM, in association with Alphera Financial Services, the webinar takes place on October 9 from 11am until noon.

Compliance and readiness specialists at Alphera will outline their interpretation of the FCA’s principle-based rules and answer dealers’ questions. The webinar will be chaired by AM editor Jeremy Bennett.

Register to attend the webinar – and submit questions - at http://r.thought.co.uk/UQfByn.

and that they are not seeing the situation improve,” said Louise Wallis, NFDA head of business development.

“This is a little concerning at a time of a growing new car market and suggests that registration growth is not bringing financial growth to the networks at the same rate.”

Ov er a ll fr a nchise va lueABOVE AVERAGE BELOW AVERAGE Brand Summer ‘14 Winter ‘13 Brand Summer ‘14 Winter ‘13

Land Rover 8.8 9.6 Citroën 6.6 6.6Mercedes 8.7 8.3 Jaguar 6.5 7.1Kia 8.6 9.1 Ford 6.4 7.7Audi 8.5 9.1 Peugeot 6.1 6.5Suzuki 8.4 8.2 Mitsubishi 6.1 6.5Mini 8.1 8.3 Alfa Romeo 5.9 3.9BMW 8.0 8.8 Nissan 5.8 6.8Lexus 7.5 6.9 Subaru 5.8 5.9Mazda 7.4 7.5 Renault 5.5 4.0Fiat 7.4 6.9 Škoda 5.4 7.8VW 7.1 8.4 Seat 5.2 5.7Chrysler 7.1 8.4 Toyota 5.1 6.9Jeep 7.1 7.3 Volvo 4.7 5.4Hyundai 7.0 7.6 Honda 4.6 5.6Vauxhall 7.0 6.8 Average 6.6 7.2 So

urce

: NFD

A

NEWS DIGEST

VA N TA g E M O T O R g R O U PVantage Motor group has opened its fourth Hyundai dealership in the North West, making it the biggest Hyundai dealer in the region.

The newly built site at Kings Reach Business Park in Stockport, next to junction 1 of the M60 motorway, represents a £2.5 million investment and will create up to 25 jobs.

It is one of the first Hyundai dealerships in the UK to showcase the brand’s new corporate iden-tity, which features an open showroom with high ceilings and floor-to-ceiling glazing topped by a bronze fascia including a silver Hyundai logo.

Currently, the Hyundai dealer network is blue, but the new design and use of bronze is intended to make it stand out. It is Hyundai’s first brand refresh in around five years.

H O N D AHonda is primed to make a strong return in new car retailing, says its dealer council chairman. David Cox, who is also managing director of Cox Motor group, said dealer confidence had been dented by a lack of new models, its “forcing of the market” and the resultant erosion of profitability. Honda’s market share is at a 10-year low and regis-trations are less than half their 2007 levels.

But Cox said: “Given the line-up arriving in 2015 (Jazz, Civic Type R, NSX sports car and a new small SUV), it would have been easy to wait for a silver bullet. But the past couple of years have been dedicated to ensuring the underlying strength of the brand is improved.

“The focus on catching up with the market on PCP is starting to bear fruit and a relentless focus on five-year service plans will make the brand unbeatable in terms of customer loyalty. Add this to the line-up rejuvenation and we have a very exciting future – but it cannot come quickly enough.”

am-online.com October 2014 9

T O R E A D A M ’ S D A I LY N E W S L E T T E R , V I S I T: w w w . a m - o n l i n e . c o m / n e w s l e t t e r

C A R R SCarrs Škoda has built a £1.5 million site that adopts the manufacturer’s latest corporate identity.

Bisset Adams, which acts as design and implementation consultants for Škoda UK, was

project architects for the Carrs Škoda development, which took seven months, in North Petherton, Bridgwater.

Bisset Adams said it is one of the first Škoda sites in the UK to adopt the brand’s new CI scheme being rolled out globally.

O N L I N E R E S E A R C H Drivers aged between 18 and 24 are the least likely to use the internet as the first source of information before buying a car.

According to research from Experian, the information services company, only one third of younger car buyers would use the internet for information, preferring instead to consult friends and family or talk to a dealership sales person.

More than 1,000 UK drivers were surveyed to under-stand where they bought their car and why.

The majority, (74%), made their car purchases through dealerships (both manufacturer and independent).

One in 10 respondents purchased their current car from a private seller and only one in 20 bought their last car from a car supermarket.

The survey revealed that car buyers preferred to go to a dealership because they felt it was less risky (24%), but more importantly, they could go back to the dealer if there were any problems with the car (46%). Some 20% felt dealerships offered better knowledge of the market and the vehicles.

C A M B R I A A U T O M O B I L E SDealer group Cambria has said its full-year results are likely to be ahead of current market forecasts and it continues to “perform well”.

Its trading update said: “Trading in the first 11 months of the 2013/14 financial year has been substantially ahead of the corresponding period in 2012/13.

“New vehicle unit sales, excluding the recently acquired Land Rover and Jaguar business in Barnet, increased by 15.7%, outperforming the overall market, which rose by 10.6%, and margins remained strong. Used vehicle sales also performed well; unit sales were 3.2% ahead of the same period in the prior year with a gross profit per unit improvement of 5.9%.

“Growth in the group’s aftersales operations also continued with a profit increase of 4.3% year-on-year.”

P E O P L E N E W S

J A M I E C R O W T H E RMarshall Group has appointed Jamie Crowther, formerly MD at Peter Vardy, as operations director. He will report to Marshall chief executive Daksh Gupta and will be responsible for “driving the operational performance” of the group.

E L A I N E A S H W O R T HElaine Ashworth, formerly director of the AM award- winning Peter Vardy Academy is launching a consultancy and training business, Automotive Business Results.

P A U L H A R R I S O N Paul Harrison, the Finance and Leasing Association’s head of motor finance, is to leave the FLA after eight years to become head of finance at Auto Trader on November 24. His new role will involve direct liaison with dealers.

A N D Y P A L M E RAndy Palmer is leaving Nissan after 23 years to take the post of chief executive at Aston Martin. Palmer was chief planning officer, executive vice- president and member of the executive committee at Nissan Motor Company. He will be replaced at Nissan by Philippe Klein.

R O B E R T H A z E L W O O DBCA has appointed Robert Hazelwood as commercial director. Hazelwood joins from Volkswagen Group UK, where he held a number of senior positions, including VW brand director and heading the VW Commercial Vehicles and Škoda brands.

M I C H A E L B U x T O N

Manheim has promoted current chief operating officer, Michael Buxton (pictured),

to the role of UK chief executive.

NEWS DIGEST R E A D A M I N Y O U R I N B O x : a m - o n l i n e . c o m / n e w s l e t t e r

10 October 2014 am-online.com

D E A L E R P R O F I TA B I L I T YThe average UK motor dealership made a profit of £3,800 in July, down from £6,400 in July 2013.

Mike Jones, ASE chairman, said: “In financial terms, we have now seen the total dealership rolling 12-month profit broadly static for the past five months at around £225,000.

“This would appear to be the new norm for average dealer returns and we are likely to see a continued fall in the return on sales percentage as dealers process increased registrations whilst still making the same profit levels.”

While used vehicle return on investment has increased slightly during the month, ASE said it saw a rise in used car stand in values.

This represents a combination of the disposal of low-value vehicles traded in during June, the general rise in used vehicle prices and more self-registered vehicles, it said.

“This is a trend we will be watching closely to ensure dealers’ stock profiles aren’t skewed too much towards self-registrations.”

Aftersales has continued its steady, if very slow, improvement with another gain in labour efficiency reported during July.

“August typically produces the largest loss of any month and we will be watching the results closely to gain an insight into the extent to which the current healthy registra-tion levels are being forced with dealers counting the cost later.”

Just over a year ago, the NFDA took a controlling interest in Trusted Dealers. This means the NFDA can offer our members low-cost used car leads and also a consumer-facing platform to promote the benefits of buying from and

maintaining a car or van at a trusted, franchised dealer.Following previous successful NFDA Driving Digital

events, we are pleased to announce ‘Driving Digital 4’, which is open to existing and potential NFDA members. This will take place at 9.30am on Thursday, November 6, 2014, at the Forest of Arden Hotel in Meriden.

Driving Digital is intended to help franchised dealers make the most of their online presence and improve the customer experience to gain increased sales and margin. The event will include an update of the work we have been doing to promote dealer standards and the added value of using a franchised dealer.

We are pleased to confirm a strong line-up of speakers for the event, including:Andy Bruce, Lookers chief executive, will talk about the challenges and opportunities facing large dealer groups in the emerging digital landscape and give his take on what is next.Scott Sinclair, google UK industry manager, will explain the latest online car buyer behaviours and offer practical advice on how dealers can capitalise on these trends.Jim Holder, editor-in-chief, What Car? magazine , will give the motorists’ view on their relationship with franchised dealers. NFDA director Sue Robinson will host the event and outline the NFDA’s recent activity in promoting franchised dealers’ interests, the new used car and aftersales standards and the developing relationship between NFDA, Trusted Dealers and the consumer.

Then I will exclusively reveal the “Ten P’s” of the digital marketing mix.

We will close the meeting with a Marketing Power Panel, in which a number of digital and marketing experts will give tips, their take on digital and engage in a Q&A session with the audience.

Come and join us for an enjoyable mental workout as we explore practical steps to take today as well as gaze into the crystal ball of emerging trends.■ To book your place, email [email protected], call 01423 506272 or visit www.driving-digital.co.uk

By Neil Addley, MD of Trusted Dealers, the advertising website owned by dealers & the NFDA

BY Dealers fOr Dealers…

For more information, call 01423 506272 or email [email protected]

A M P R O M O T I O N

H R O W E NHR Owen has bought Bentley Hadley green from Lookers.

Lookers had owned the business in High Street, Barnet, since its acquisi-tion of the Colbornes Group in March. Under HR Owen, the dealer-ship has been re-named Bentley Hertfordshire and has relocated to the former Hadley Green Jaguar showroom on Barnet High Street.

Two weeks following the acquisi-tion, HR Owen chief executive Joe Doyle resigned , leaving chairman Mehmet Dalman and an executive committee running the group.

HR Owen has also begun trading on Sundays for the first time in its history.

A U T O S O N S H O WDealer and fleet video service AutosOnShow has been acquired by auction and remarketing group BCA.

BCA said the acquisition is a key part of its digital strategy and will broaden its customer proposition and deliver value-added services to the automotive sector.

BCA also announced that it has acquired Tradeouts, a technology company behind the Tradeouts.com dealer-to-dealer online application that enables its customers to buy and sell used vehicles.

V O LV O x C 9 0Volvo’s first all-digital car sale saw all 1,927 individually numbered, limited First Edition models of the new xC90 sell out in 47 hours.

Most of the cars were reserved within one hour from the start of the sale, which ran simultaneously in 32 countries. At its peak, seven cars were sold every minute.

UK customers secured 55 of the First Edition models, which will be delivered in April 2015.

market intelligence T H E n E W S I n D E P T H

14 17Used cars

the latest national data shows used values have taken a dip as auction volumes rise.

financeSub-prime business appears to be a renewed opportunity as lenders refocus their strategy.

nEED TO knOW ■ 34,857 private cars registered■ fleet sector registers 35,632 cars

n E W c a r M a r k E T

August registrations 9.4% ahead of 201372,163 new cars registered in 30th consecutive month of growth

tBy Tim Rose

here were 72,163 new cars registered in august, a 9.4% rise on august 2013 and the 30th consecutive month of growth.

there were 34,857 new cars regis-tered in the private market, and 35,632 in the fleet sector.

Year-to-date registrations have passed 1.5 million units – up 10.1% – however the Society of motor manufacturers and traders said some levelling off is expected in the coming months.

Private and fleet registrations both displayed similar increases in the month, with the former making the greater gains in the year-to-date (See graph, right).

august is one of the year’s quietest months for new car registrations,

v O l U M E S P l I T

august Total diesel Petrol aFV Private Fleet Business2014 72,163 35,931 34,974 1,258 34,857 35,632 1,6742013 65,937 32,903 32,108 926 31,608 32,382 1,947% change 9.4% 9.2% 8.9% 35.9% 10.3% 10.0% -14.0%Mkt share ‘14 49.8% 48.5% 1.7% 48.3% 49.4% 2.3%Mkt share ‘13 49.9% 48.7% 1.4% 47.9% 49.1% 3.0%

Year-to-date Total diesel Petrol aFV Private Fleet Business2014 1,532,335 770,128 734,320 27,887 735,235 726,001 71,0992013 1,391,788 685,938 687,065 18,785 660,572 671,688 59,528% change 10.1% 12.3% 6.9% 48.5% 11.3% 8.1% 19.4%Mkt share ‘14 50.3% 47.9% 1.8% 48.0% 47.4% 4.6%Mkt share ‘13 49.3% 49.4% 1.3% 47.5% 48.3% 4.3%

12 October 2014 am-online.com

r E G I S T r aT I O n S 2 0 0 7 T O D aT E ( r O l l I n G Y E a r S ) v S P r E - r E c E S S I O n av E r a G E

P r I vaT E v S f l E E T/ B U S I n E S S O v E r T H E P a S T 3 0 M O n T H S

typically accounting for about 3% of the annual market. in comparison, September usually makes up about 18% of the year’s registrations.

Mike Hawes, SMMT chief executive, said: “new car registra-tions reached two-and-a-half years of consecutive monthly growth in august, as confident private and fleet

consumers continued to snap up enticing deals on a wealth of advanced new products.

“the Uk’s performance in the context of europe is particularly impressive, with growth consistently

ahead of the rest of the eU for the past two years.

“as the Uk market starts to find its natural level, we expect to see the growth level off during coming months.”

increasing consumer confidence has been evident across the market, with strong growth in private, fleet and business sectors. However, the greatest surge has been in private registrations, which have grown from about 840,000 units in the year before march 2012 to 1.15 million cars in the past 12 months.

attractive finance deals are a significant factor behind the growth in private demand, with consumers able to take advantage of Personal contract Purchase offers (PcPs). the Smmt also pointed out that the number of Uk citizens in employment rose by more than one million between Q1 2012 and Q1 2014, giving greater numbers of buyers the confidence to commit to new cars.

am-online.com October 2014 13

market intelligence New car registrations

B I G G E S T f a l l E r S

Y E a r T O D aT E

The fallers are few and far between, but the likes of Honda, Smart and Mini will be pleased when their new models finally get some traction.

among the risers, the success of Jeep, SsangYong and Mitsubishi shows the consumer

appetite for 4x4s is not waning. for more on each carmaker, see the franchise Guide on Page 77.

Brand YTd (%)10 Mia 0.009 Honda -1.698 Smart -5.557 Aston Martin -9.086 Mini -11.025 Chrysler -20.164 Chevrolet -65.053 Saab -66.672 Perodua -86.111 Proton -93.33

B I G G E S T G r O W E r S

Y E a r T O D aT E

Brand YTd (%)1 MG 777.512 Maserati 261.613 SsangYong 147.674 Jeep 83.925 Dacia 69.756 Renault 62.147 Mitsubishi 36.278 Infiniti 34.649 Lexus 29.0110 Škoda 26.02

1 0 -Y E a r M a r k E T T r E n D S a v a I l a B l E : w w w . a m - o n l i n e . c o m / a m in E W c a r r E G I S T r aT I O n S

august Year-to-date

Marque 2014 % market 2013 % market % 2014 % market 2013 % market % share share change share share changeFord 11,231 15.56 8,940 13.56 25.63 208,432 13.60 197,933 14.22 5.30Vauxhall 8,817 12.22 8,242 12.50 6.98 169,182 11.04 159,047 11.43 6.37Volkswagen 6,127 8.49 6,086 9.23 0.67 130,810 8.54 121,432 8.72 7.72audi 5,159 7.15 3,904 5.92 32.15 100,952 6.59 88,432 6.35 14.16BMW 3,552 4.92 4,401 6.67 -19.29 88,629 5.78 78,005 5.60 13.62Mercedes-Benz 3,444 4.77 3,058 4.64 12.62 75,714 4.94 65,368 4.70 15.83Peugeot 3,280 4.55 3,231 4.90 1.52 67,553 4.41 66,859 4.80 1.04Citroën 3,003 4.16 2,575 3.91 16.62 52,272 3.41 51,091 3.67 2.31nissan 2,956 4.10 3,566 5.41 -17.11 84,340 5.50 74,422 5.35 13.33Hyundai 2,665 3.69 2,599 3.94 2.54 50,699 3.31 46,731 3.36 8.49Škoda 2,631 3.65 1,890 2.87 39.21 49,395 3.22 39,196 2.82 26.02Kia 2,386 3.31 2,374 3.60 0.51 49,246 3.21 45,579 3.27 8.05Toyota 1,968 2.73 1,916 2.91 2.71 58,823 3.84 55,919 4.02 5.19Fiat 1,901 2.63 1,887 2.86 0.74 41,634 2.72 35,920 2.58 15.91Mini 1,609 2.23 1,415 2.15 13.71 26,588 1.74 29,882 2.15 -11.02renault 1,587 2.20 921 1.40 72.31 37,739 2.46 23,275 1.67 62.14Seat 1,526 2.11 1,289 1.95 18.39 33,017 2.15 26,970 1.94 22.42Honda 1,511 2.09 1,454 2.21 3.92 34,460 2.25 35,052 2.52 -1.69Suzuki 1,381 1.91 1,291 1.96 6.97 23,361 1.52 20,150 1.45 15.94Mazda 994 1.38 1,000 1.52 -0.60 23,307 1.52 18,838 1.35 23.72Land rover 827 1.15 806 1.22 2.61 34,568 2.26 34,385 2.47 0.53Volvo 694 0.96 539 0.82 28.76 23,554 1.54 19,593 1.41 20.22dacia 680 0.94 575 0.87 18.26 15,060 0.98 8,872 0.64 69.75Mitsubishi 454 0.63 172 0.26 163.95 7,635 0.50 5,603 0.40 36.27Jaguar 276 0.38 260 0.39 6.15 11,454 0.75 10,073 0.72 13.71Smart 272 0.38 140 0.21 94.29 3,214 0.21 3,403 0.24 -5.55Jeep 176 0.24 41 0.06 329.27 2,082 0.14 1,132 0.08 83.92Porsche 160 0.22 141 0.21 13.48 5,461 0.36 4,773 0.34 14.41alfa romeo 151 0.21 141 0.21 7.09 3,450 0.23 3,304 0.24 4.42Lexus 136 0.19 231 0.35 -41.13 6,498 0.42 5,037 0.36 29.01MG 76 0.11 13 0.02 484.62 1,483 0.10 169 0.01 777.51Chrysler 73 0.10 56 0.08 30.36 1,283 0.08 1,607 0.12 -20.16abarth 50 0.07 31 0.05 61.29 955 0.06 838 0.06 13.96Subaru 49 0.07 48 0.07 2.08 1,523 0.10 1,235 0.09 23.32Maserati 38 0.05 17 0.03 123.53 763 0.05 211 0.02 261.61SsangYong 34 0.05 22 0.03 54.55 852 0.06 344 0.02 147.67Bentley 24 0.03 67 0.10 -64.18 954 0.06 794 0.06 20.15Lotus 24 0.03 9 0.01 166.67 153 0.01 131 0.01 16.79Infiniti 20 0.03 14 0.02 42.86 377 0.02 280 0.02 34.64aston Martin 19 0.03 31 0.05 -38.71 551 0.04 606 0.04 -9.08Chevrolet 0 0.00 434 0.66 -100.00 2,761 0.18 7,899 0.57 -65.05Mia 0 0.00 0 0.00 0.00 5 0.00 0 0.00 0.00Perodua 0 0.00 15 0.02 -100.00 25 0.00 180 0.01 -86.11Proton 0 0.00 0 0.00 0.00 1 0.00 15 0.00 -93.33Saab 0 0.00 0 0.00 0.00 1 0.00 3 0.00 -66.67Other British 52 0.07 65 0.10 -20.00 561 0.04 568 0.04 -1.23Other Imports 150 0.21 30 0.05 400.00 958 0.06 632 0.05 51.58Total 72,163 65,937 9.44 1,532,335 1,391,788 10.10

10

6

Ticketsfrom £149

+vat

������ ��������� ���� ���

Developing a customer-focused used car sales modelToday’s customers fnd their cars online, very often between 9pm and 10pm. They are armed with more information than many salespeople and see ashowroom visit merely as a fnal emotional check of a car and a dealer. So what must dealers do to address this?

The customer experienceMike Dalloz, managing director, Performance in People

Performance in People works with some of the world’s leading brands to improve customer service, sales andcustomer experiences.

Dalloz will explain ‘The Model of Excellence’ used by thesebrands to deliver the highest levels of customer service and hewill outline six key behaviours that will help dealers capture andretain more used car buyers and enhance their reputation.

Breaking the traditional dealer sales model - if we don’t redefine it, the customer willNick King, market research director, Auto Trader

Digital age consumers and their buying habits are driving most of thechanges in the used car sector. But are dealers ready for this?

King will emphasise the importance of used car retailers embracing adigital strategy and will share insights from Auto Trader’s research toshow them how they can engage customers and stand out in anincreasingly national market.

Online strategies for Gen X & Gen YHeather Yaxley, Bournemouth University & director of theMotor Industry Public Affairs Association

Generation Y consumers (born 1977-1994) are expected to buy16% more cars in the US this year than they did in 2013, whilevolumes bought by Generation X-ers (born 1965-1976) areexpected to increase by just 6%. A similar picture can beexpected in the UK.

Understanding generational buying habits can infuence usedcar sales. Gen Y buyers are often ‘digital natives’, often see carsas a pragmatic transport platform and are more likely to bemotivated by technologies within the car and how it cansupport their lifestyle. Yaxley will explain how dealers can offer‘different strokes for different folks’ online.

From gut instinct to science – the analytics of car salesIan Godbold, marketing & CRM director, Cambria Automobiles

A successful website is not necessarily one a dealer thinks looks good,nor one with ‘bells and whistles’. It is one that works, and in a way thatcan be measured.

Cambria’s website received national recognition as ‘best in class’ forcombining customer tools, showcasing its full selection of products andservices, and measuring and reacting to its customers’ online searchingand buying habits. Godbold will outline how a scientifc approach canbeneft used car activity.

Tuesday 21 OctoberTelford International Centre, TF3 4JH

The traditional model of used car sales faces a number of threats today, including changing buyerhabits, the rise of digital and mobile devices and an increased need to comply with regulation.

������������ ����������������������������

For more details, or to book visit www.usedcarconference.co.uk

■ Identify new retailstrategies

■ Acquire new skills andbest practice techniques

■ Discover how toincrease profitability inkey business areas

■ Find out about currentand future trends andhow to exploit them

■ Gain a betterunderstanding ofconsumer buyingbehaviours and attitudes

■ Transform the way youmanage your customerrelationships

■ Uncover how to usefuture regulation to youradvantage

Who should attend?

Those with strategic responsibility for used car sales in theshowroom and those responsible for digital strategies andmanufacturer and supplier partners.

Why attend?

Products, processes and peopleThe traditional proft model in the used car market is under threat. Customers armed with mobile devices and price comparison websites are supported by increased consumer regulation and used cars face an increased risk of commoditisation. The challenges are clear, but how do car retailers turn threat to opportunity?

FCA regulation and used carsMotoNovo

The Financial Conduct Authority (FCA) haschanged the regulatory framework for fnance andinsurance (F & I ) products and the watchdogestimates that 20% of the businesses it coversmay withdraw from offering credit. Dealers need todevelop processes and controls to be compliantwith the new rules and change their F&I salesmodels to provide the ‘good consumer outcomes’the FCA demands.

MotoNovo will go through the changes andinnovations it feels dealers need to develop andimplement with a special emphasis on fnance as amarketing tool to drive sales.

Creating a holistic customer experience before and aftera sale – online, on the phone and in the showroomNeil Pursell, managing director, Martec Europe

This session will look at the importance of placing the customer at the centre of adealer’s used car approach and of engaging sales, aftersales and marketing to increasesales, customer satisfaction and retention.

Using its extensive experience in retail and leisure, Martec works to help dealersenhance their customer focus, before, during and after sales by encouraging teamworkwithin the showroom.

Unlock the secrets of your DMSto create a better customerexperienceThe dealership management system (DMS) canand should be the engine of a modern dealership,managing all your information and helping to drivecustomer relations and sales activities.

In an age where differences in the communicationpreferences and needs of consumer groups aremore pronounced than ever, the DMS canpositively affect how a dealership manages itscustomer contact.

This session will share how dealers can releasetheir DMS’ potential and access tools that manymay be unaware of.

Improving stock management – the ‘time to cash’Dealers need a used stock range that refects their market positioning, but ideally wantthis inventory to be ‘on stock’ for as little time as possible.

The challenges include; a large range of high-value, yet depreciating assets; the needto offer part-exchange facilities; and the time and cost of preparing vehicles ready toretail.

The fast-moving consumer goods (FMCG) sector can teach automotive retailing somekey lessons about purchasing, the use of technology, stock management andmarketing that can help dealers improve their ‘time to cash’.

10 ways to maximise the value of used car buyers –customer lifetime value (LTV)and retentionLouise Wallis, National Franchised Dealers Association

The NFDA will present 10 top ideas that dealers can adapt to maximise the value ofused car buyers.

In an era where the hunt is always on for the next ‘big idea,’ this session will share acombination of new and proven initiatives that have worked effectively in some of theUK’s largest dealer groups.

■ Chairmen, chiefexecutives, generalmanagers

■ Dealer principals■ Managing directors■ Sales directors

■ Operational managers■ Aftersales directors and

managers■ Manufacturers: Dealer

development directors/managers and franchisedoperational executives

Dealers need to adapt rapidly to develop a sustainable approach built around the customer. Thisconference will provide the latest in best practice advice and case studies from a panel of experts.

AMUC14_DPS_FPAD 22/09/2014 10:29 Page 2

106 October 2014 am-online.com

SHOWROOM t h e C a r s d r i v i n G y o u r B u s i n e s s

112seat ibiza

After Seat dealers and the Seat franchise itself get a mauling in recent studies, we get a chance to live the customer experience.

110volkswagen Golf

It has won awards and notched up thousands of sales, and now the seventh generation Golf has joined AM’s long-term test fleet.

BMW’s brand breakaway

109renault twingo

The French brand has put the engine at the rear of its latest city car to provide more interior space despite its smaller dimensions.

F i r s t d r i v e B m w 2 s e r i e s a C t i v e t o u r e r – o n s a l e s e p t e m B e r 2 7

“We can’t rely on people

coming into the dealership.

We have to put the car

in front of people”

BMW’s first people carrier is a departure for the brand and an attempt to attract new custom

swagen Golf SV on their consideration list, have a compelling reason to visit their local BMW showroom. With a PCP finance offer starting at about £300 a month and strong residual values, this model range, which starts at £21,345, could pinch custom from the mainstream brands as well as its premium rival, the Mercedes-Benz B-Class.

Bmw product manager alex morgan said the crucial target customers for the 2 Series Active Tourer include ‘empty nesters’, who desire a premium car that can transport their grandchildren. This customer bracket values aspects such as comfort and practicality.

Small families are another key market to capture and Morgan suggested a smaller target could be independent professionals, such as photographers, who need space for their kit.

Marketing is already under way, with a heavy experiential focus. “We can’t rely on people coming into the dealership. We have to put the car in front of people,” Morgan said.

In August, the car was displayed at high-footfall English

the 2 series active tourer is Bmw’s first front-wheel drive car in decades

By Tim Rosehe arrival of the 2 Series Active Tourer is as mould-breaking for BMW as its i3 electric car, launched earlier this year. While the i3 is far more techno-logically advanced, the 2 Series Active Tourer is the first car in decades to depart from the BMW brand’s

association with rear-wheel drive and longitudinally mounted engines. It is also the premium brand’s first people-carrier.

Until this month, I had never heard a BMW executive talk proudly about a new model’s cup holders, storage bins or sliding rear seat. But now those car buyers concerned with such things, who may have had a Renault Scenic or a Volk-

T

Cabin equipment, even on the entry-level trim, is extensive

am-online.com October 2014 107

F o r m o r e r e v i e w s v i s i t: w w w . a m - o n l i n e . c o m / r o a d t e s t s

speCiFiCationPrice £21,345-£30,900Engine 218i 1.5-litre, 135bhp; 218d 2.0-litre: 148bhpPerformance 0-62 mph 8.9-9.2 secs, top speed 124-127 mph Transmission 6sp man, 6sp auto, 8sp autoEfficiency 57.6-68.9mpg, 109-115g/km CO2

RV 3yr/30k TBCRivals Ford C-Max, Mercedes-Benz B-Class, VW Golf SV

what Car?if you’re in the market for an mpv because space and practicality are paramount, then there are better choices. the Citroën C4 picasso is bigger inside, quite a bit more versatile, and cheaper. it’s also worth bearing in mind that the Golf sv is equally spacious, even sharper to drive with a more flexible engine, and is cheaper. it also comes similarly well equipped to the Bmw, although the boot in the 2 series is better designed than in the sv – and easier to manhandle into different configura-tions.

however, if you just need more space than a family hatchback and want an mpv that remains good to drive, is refined and cheap to run, the active tourer is definitely worth considering.

what your Customers

will Be readinG aBout

the 2 series aCtive tourer

plenty of overtaking power available, although the steering response lacks the immediacy and directness enjoyed by most BMWs. The 218d will appeal to company car drivers thanks to its 109g/km CO2 emissions and 68.9mpg efficiency.

From November, more variants will join the range: 220i and 225i petrol units and 216d and 220d units, with all-wheel drive available for the highest-powered models.

Equipment on the entry SE trim includes rear parking sensors, DAB radio, Bluetooth, a 6.5in colour screen, dual- zone climate control and keyless start. For a £1,250 premium, buyers get Sport specification with 17in alloys, sports seats and upgraded trim and upholstery, while a £2,000 premium gets a Luxury specification with leather upholstery, wood trim and chrome exterior details. The range-topping M Sport trim, available from November for a £3,000 premium, boasts 18in alloys, leather upholstery, M Sport stiffer suspension, runflat tyres and aluminium interior trim.

A range of options, including head-up display, adaptive LED headlamps, active cruise control and park assist, give BMW dealers’ product geniuses plenty of technology to talk about.

Compared with established rivals such as the Renault Scénic and Ford C-Max, the 2 Series Active Tourer feels slightly lacking in absolute practicality and comfort. But the BMW badge and its crucial premium quality mean many buyers will forgive that.

Heritage properties, while at Camp Bestival, the family-orientated festival in Dorset, it featured in a BMW picnic area. A test-drive initiative was also conducted at Longleat Safari Park and BMW dealers have been displaying at county shows. A digital campaign may be followed by TV exposure later. Demonstrators are already going out to fleet and leasing companies.

BMW UK has relatively modest sales expectations – about 5,000 units annually, split equally between private buyers and company car drivers – because this is unknown territory for the brand.

“There is probably much more potential for this car, but because it is new to us we are being quite conservative,” Morgan said. He hopes three-quarters of sales will be bringing new customers into the BMW brand.

This month’s launch line-up comprises two powertrain variants: the 218i turbocharged three-cylinder 1.5-litre petrol and the 218d 2.0-litre turbodiesel. Both drive superbly, with

Bmw hopes three-quarters of sales will bring new customers into the brand

daily teleGraphGood first attempt at a front-drive Bmw that ticks most of the boxes for buyers in this sector, while not actually doing anything better than the non-premium alternatives.

118 October 2014 am-online.com

IN NOVEMBER’S ISSUE PUBLISHED OCTOBER 24 AM, Media House, Lynch Wood,

Peterborough PE2 6EA Email: [email protected]

If you or someone you know are aged 16-24 and are interested in work

experience opportunities at Bauer Media go to www.gothinkbig.co.uk

Editor Jeremy Bennett 01733 468261 Managing editor Tim Rose 01733 468266Industry editor Tony Willard

AM productionHead of publishingLuke Neal 01733 468262Production editor Finbarr O’Reilly 01733 468267 Designer Erika Small 01733 468312

Contributors Hugh Dickerson, Debbie Kirlew, Jonathan Mitchell, Dr Richard Parkin, Prof Jim Saker, Richard Yarrow

AM advertising Commercial director Sarah Crown 01733 366466Group advertisement managerSheryl Graham 01733 366467Project managers Leanne Patterson 01733 468332Kerry Unwin 01733 468327Angela PriceLucy Peacock 01733 468338Account managers Julie Howard 01733 468141Sara Donald 01733 366474Richard Kerr 01733 366473Kelly Crown 01733 366364Recruitment enquiriesRichard Kerr 01733 366473 AM publishingManaging directorTim Lucas 01733 468340Office managerVicky Meadows 01733 468319Group managing director Rob Munro-HallChief executive officerPaul Keenan

Subscriptions 01635 588494. Annual UK subscription £99, two years £168, three years £238. Overseas one year/12 issues £149, two years £253, three years £358. AM is published 12 times a year by Bauer Consumer Media Ltd, registered address 1 Lincoln Court, Lincoln Road, Peterborough, PE1 2RF. Registered number 01176085.No part of the magazine may be reproduced in any form in whole or in part, without prior permission of the publisher. All material published remains the copyright of Bauer Consumer Media Ltd.We reserve the right to edit letters, copy or images submitted to the magazine without further consent. The submission of material to Bauer Media whether unsolicited or requested, is taken as permission to publish in the magazine, including any licensed editions throughout the world. Any fees paid in the UK include remuneration for any use in any other licensed editions.We cannot accept any responsibility for unsolicited manuscripts, images or materials lost or damaged in the post. Whilst every reasonable care is taken to ensure accuracy, the publisher is not respon-sible for any errors or omissions nor do we accept any liability for any loss or damage, howsoever caused, resulting from the use of the magazine.

Printing: Headley Brothers Ltd, Kent

C O N TA C T U S

Dealership design We examine whether the role of the physical showroom is changing in line with contemporary consumer behaviour, with analysis of what the design requirements and features of new generation showrooms could be and how they might make the best impact on the customer experience.

A D V E R T I S E R S ’ I N D E X

Adria Concessionaires ...........102-103Alphera Financial Services .............46Armchair Answercall ........................49ASE ........................................................29Autoclenz ............................................104Barclays Partner Finance ........2 & 73Blacks Outdoor Retail .......................25Blue Sky Interactive ..........................35

British Car Auctions ...............33 & 105Car Care Plan .....................................69Chris Eastwood Automotive .........113Codeweavers .......................................97DFSK ................................................82-83DSG Financial Services ..............66-67FISC.........................................................70Fiat ...................................................86-87FMG .......................................................116GForces ..........................78-79 & 98-99IMI ..........................................................111iVendi ......................................................30

Jardine Motors Group .....................115Kawasaki ...............................................97Lawdata ...............................................104Lloyds Banking Group ......................16MG ....................................................90-91Manheim Retail Services ........15 &21Mapfre Abraxas ..........................8 & 64Marsh Finance .....................................49Mercedes-Benz .................................113MHA MacIntyre Hudson ............50-51Northridge Finance ............................22Paragon Automotive ......................108

Pentana Solutions ..............................35RAB .........................................................11Revive Auto Innovations .................119SsangYong ......................................94-95Supagard ...........................74-75 & 105Symco Training ....................................52Tracker Network Systems ................6Trader Publishing .............39/41/43/44 ........................................................&53-60Trusted Dealers ..................................10Volkswagen Financial Services ...117Wms Group ..........................................62

Property problems Automotive property experts advise dealers how to overcome the challenges of planning and completing showroom refurbishments and relocations.

Technology and the showroom experience How dealerships can use modern technology, from Wi-Fi and tablet PCs to interactive screens, to engage and entice showroom visitors.

The Paris Motor Show

A look at the newest cars that will provide your sales opportunities in the

months ahead.