ALPHA BANK AD SKOPJE ANNUAL REPORT 2007 banka 2007 A.pdf · DEUT DE FF COBA DE FF LHBI DE FF CRBA...

Transcript of ALPHA BANK AD SKOPJE ANNUAL REPORT 2007 banka 2007 A.pdf · DEUT DE FF COBA DE FF LHBI DE FF CRBA...

ANNUAL REPORT 2007

ALPHA BANK AD SKOPJE

C o n t e n t s

3. ....... Bank's Network

4. ....... Main Correspondents

5. .......

. .......

. .......

. .......

. .......

Administrative Structure

6. ....... Auditor's Report

6

9

10

11

12. .......

14. .......

Financial Statements

Balance sheet

Income statement

Statement of changes in equity

Statement of cash flows

Notes to the financial statement

3

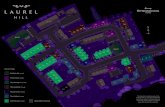

B a n k ' s N e t w o r k

HEAD OFFICE IN SKOPJE

AVTOKOMANDA BRANCH - SKOPJE

BUNJAKOVEC BRANCH - SKOPJE

VLAE BRANCH - SKOPJE

KISELA VODA BRANCH - SKOPJE

LEPTOKARIJA BRANCH - SKOPJE

BITOLA BRANCH

Dame Gruev 1, MK-1000 SkopjeP. O. Box 564Tel.: +389 2 3289 400Fax: +389 2 3135 206; 3116 830Telex: 51758SWIFT: KRSKMK2X

Trifun Hadzijanev, kula 3, MK-1000 SkopjeTel.: +389 2 3175 548Fax: +389 2 3175 537

Partizanski odredi No.25, MK-1000 SkopjeTel.: +389 2 3290 309Fax: +389 2 3290 328

Partizanski odredi No.155 K1-01, MK-1000 SkopjeTel.: +389 2 2050 083Fax: +389 2 2050 084

Ivan Kozarov No.29, MK-1000 SkopjeTel.: +389 2 3239 540Fax: +389 2 3239 435

Partizanska 64A, MK-1000 SkopjeTel.: +389 2 3090 262Fax: +389 2 3090 263

E-mail: [email protected]: www.alphabank.com.mk

Ignat Atanasovski bb, MK-7000 BitolaTel.: +389 47 258 228Fax: +389 47 258 338

KAVADARCI

STRUMICA

TETOVO

GOSTIVAR

GEVGELIJA

SKOPJE

BITOLA

VELES

OHRID

PRILEP

VELES BRANCH

GEVGELIJA BRANCH

GOSTIVAR BRANCH

OHRID BRANCH

PRILEP BRANCH

STRUMICA BRANCH

TETOVO BRANCH

KAVADARCI BRANCH

Marsal Tito no. 33, MK-1400 VelesTel.: +389 43 212 955Fax: +389 43 212 956

Marsal Tito 110, MK-1480 GevgelijaTel.: +389 34 217 801Fax: +389 34 217 882

Major Cede Filipovski bb, MK-1230 GostivarTel.: +389 42 221 601Fax: +389 42 221 607

Makedonski Prosvetiteli bb, MK-6000 OhridTel.: +389 46 230 441Fax: +389 46 230 446

Borka Talevski no. 46, MK-7500 PrilepTel.: +389 48 400 191Fax: +389 48 400 291

Leninova 100, MK-2400 StrumicaTel.: +389 34 330 250Fax: +389 34 344 940

Marsal Tito 120, MK-1200 TetovoTel.: +389 44 334 250Fax: +389 44 338 939

Ploshtad Marsal Tito bb, MK-1430 KavadarciTel.: +389 43 400 388Fax: +389 43 400 386

4

L i s t o f M a i n C o r e s p o n d e n s

A u s t r i a

A u s t r a l i a

D e n m a r k

G e r m a n y

G r e e c e

S w e d e n

S w i t z e r l a n d

U n i t e d K i n g d o m

U n i t e d S t a t e s o f A m e r i c a

Bank Austria, Vienna

Commonwealth Bank of Australia, Sydney

Danske Bank, Copenhagen

Deutsche Bank, Frankfurt

Commerzbank, Frankfurt

LHB Internationale Handelsbank, Frankfurt

Alpha Bank, Athens

Skandinaviska Enskilda Banken, Stockholm

Credit Suisse, Zürich

National Westminster Bank, London

JPMorgan Chase Bank, New York

American Express Bank, New York

Deutsche Bank Trust Co. Americas, New York

EUR

AUD

DKK

EUR

EUR

EUR, USD

EUR, USD

SEK

CHF

GBP

USD

USD

USD

BKAU AT WW

CTBA AU 2S

DABA DK KK

DEUT DE FF

COBA DE FF

LHBI DE FF

CRBA GR AA

ESSE SE SS

CRES CH ZZ 80A

NWBK GB 2L

CHAS US 33

AEIB US 33

BKTRUS 33

5

Christos A. Pozidis

Alpha Bank AD Skopje

Spyros N. Filaretos

Executive General Manager

Alpha Bank AE, Athens

,

-

-

Chairman

President

Members

Risk Management Committee

Auditing Committee

George N. Kontos

Group Financial Reporting Officer

Alpha Bank AE, Athens

Lazaros A. Papagarifallou

Alpha Bank AE Athens

Intrenationational Network Division Manager

Konstantions Derdemezis

AD Titan, Skopje

General Manager

Dushan Tudzarov

AD Replek, Skopje

General Manager

Ioannis G. Papadopoulos, member

Aristotelis Nikolakopoulos, member

Lidija V. Markovska, member

Spiros N. Fialretos

George N. Kontos

Lazaros A. Papagarifallou

Irena Papazova independent member

Branka Stefanovska independent member

Assembly of the Bank

Supervisory Board

A d m i n i s t r a t i v e S t r u c t u r e

Managing board General Managers

Managers of organizational units

Pavlina D. CerepnalkovskaFirst General ManagerAlpha Bank AD Skopje, Skopje

Ioannis G. PapadopoulosSecond General ManagerAlpha Bank AD Skopje, Skopje

Financial DivisionZeljko V. Rakik

International DivisionAleksandar T. Kirovski

Treasury DivisionMilena P. Percinkova

Banking Business DivisionBranko K. Penov

Communication DivisionLidija G. Daceva

Credit DivisionChristos A. Pozidis

Risk Management DivisionLidija V. Markovska

Compliance DivisionVesna T. Trpkovska

Legal and Personnel Matters DivisionDushko V. Krstevski

Sub-Division for Legal and Personnel MattersVanco Z. Andonovski

Sub-Division for EDPPero A. Slavkovski

6

F i n a n c i a l S t a t e m e n t

77

8

2007 2006

12

13

14

15

16

17

18

19

20

21

22

23

24

25

1,026,790

13,373

31,663

4,831,880

870,482

175,934

69,994

9,437

1,885

23,095

1 148 928

4 208 023

9 347

-

24 509

5,390,807

560,160

337,169

82,532

683,865

1,663,726

7,054,533

7,054,533

, ,

, ,

,

,

581,951

559,546

33,542

2,842,497

1,129,928

127,452

29,119

-

-

2,676

5,306,711

680

3,691,592

1,801

7,476

19,847

3,721,396

185,760

337,169

173,151

889,235

1,585,315

5,306,711

These financial statements set out on pages 9 3to 4 were approved by the SupervisoryBoard on 29.05.2008 and were signed on its behalf by:

B a l a n c e S h e e t

As at 31 December

NoteIn thousands of denars

Assets

Cash and cash equivalents

Loans and advances to banks

Assets held for sale

Loans and advances to customers

Investment securities

Property and equipment

Intangible assets

Current tax assets

Deferred tax assets

Other assets

Total assets

Liabilities

Deposits from banks

Deposits from customers

Impairment provisions related to off balance

sheet items

Current tax liabilities

Other liabilities

Total liabilities

Equity

Share capital

Share premium

Retained earnings

Other reserves

Total equity

Total liabilities and equity

Mr. Ioannis Papadopoulos

Second General Manager

Mrs. Pavlina Cerepnalkovska

First General Manager

The notes on pages 9 - 43 are an integral part of these financial statements.

9

6

6

7

7

8

13,15

9

17,18

10

11

393,305

(106,543)

286,762

97,303

(9,658)

87,645

30,224

2,467

32,691

407,098

(95,343)

(98,623)

(10,682)

(21,831)

(89,879)

90,740

(12,329)

78,411

294,807

(53,562)

241,245

90,405

(8,354)

82,051

28,534

29,343

57,877

381,173

(63,003)

(62,980)

(5,757)

(14,808)

(38,059)

196,566

(25,748)

170,818

2007 2006Note

Interest income

Interest expense

Fee and commission income

Fee and commission expense

Net foreign exchange gain

Other operating income

Net impairment loss on financial assets

Personnel expenses

Operating lease expenses

Depreciation and amortisation

Other expenses

Income tax expense

Operating income

In thousands of denars

Net interest income

Net fee and commissions income

Profit before income taxes

Profit for the period

For the year ended 31 December

I n c o m e S t a t e m e n t

The notes on pages are an integral part of these financial statements.9 - 43

10

11

185,760

-

-

-

185,760

185,760

-

-

374,400

-

-

560,160

43,674

-

-

-

43,674

43,674

-

-

-

(43,674)

-

-

108,037

170,818

170,818

(105,704)

173,151

173,151

78,411

78,411

(170,818)

43,674

(41,886)

82,532

337,169

-

-

-

337,169

337,169

-

-

-

-

-

337,169

739,857

-

-

105,704

845,561

845,561

-

-

(203,582)

-

41,886

683,865

1,414,497

170,818

170,818

-

1,585,315

1.585,315

78,411

78,411

-

-

-

1,663,726

Balance at 1 January 2006

Profit for the period

Total recognised income

and expense

Appropriation to statutory

reserve

Balance at 31 December 2006

Balance at 1 January 2007

Profit for the period

Total recognised income

and expense

Increase of share

capital

Appropriation to retained

earnings

Appropriation to statutory

reserve

Balance at 31 December 2007

S t a t e m e n t o f c h a n g e s i n e q u i t y

Share

capital

Share

premium

Statutory

reserve

Revaluation

reserves

Retained

earningsTotal

For the year ended 31 December

In thousands of denars

The notes on pages 9 - 43 are an integral part of these financial statements.

170 818

14 808

(27 250)

(92)

3 343

63 003

630

(241 245)

(70)

25 748

9 693

592 985

(1 328 022)

(4 493)

(1 869)

(5 524)

1 078 501

11 367

352 638

283 537

(51 845)

(16 501)

567 829

,

,

,

,

,

,

,

,

,

, ,

,

,

,

, ,

,

,

,

,

,

,

17,18

13,15

23

78 411

21 831

-

-

105

95 343

7 546

(286 762)

(110)

12 329

(71 307)

545 965

(2 069 701)

1 774

(20 419)

1 142 808

507 837

4 662

41 619

378 052

(92 509)

(31 127)

296 035

,

,

,

,

,

,

,

,

, ,

,

,

, ,

,

,

,

,

,

,

,

Profit for the period

Depreciation and amortisation

Collected previously written-off receivables

Capital gain on sale of property and

equipment

Impairment loss on assets

held sale

Net impairment loss on financial assets

Impairment provision for off-balance sheet items

Net interest income

Dividend income

Income tax expense

Change in loans and advances to banks

Change in loans and advances to

customers

Change in assets for resale

Change in other assets

Change in deposits from banks

Change in deposits from customers

Change in other liabilities

Interest received

Interest paid

Income tax paid

Adjustments for:

2007 2006Note

S t a t e m e n t o f c a s h f l o w s

For the year ended 31 December

In thousands of denars

Cash flows from operating activities

Net cash used in operating activities

The notes on pages 9 - 43 are an integral part of these financial statements.

12

Purchase of property and equipment

Proceeds from the sale of property and equipment

Purchase of intangible assets

Purchase of investment securities

Proceeds from investment securities

Proceeds from issued share capital

Cash and cash equivalents at 1 January

2007 2006Note

S t a t e m e n t o f c a s h f l o w s

For the year ended 31 December

In thousands of denars

The notes on pages 9 - 43 are an integral part of these financial statements.

17 (63,625) (28,690)

- 92

18 (47,563) (27,343)

- (438,571)

259,992 -

148,804 (494,512)

- -

- -

444,839 73,317

12 581,951 508,634

1,026,790 581,951

Cash flows from investing activities

Net cash used in investing activities

Cash flows from financing activities

Net cash from financing activities

Cash and cash equivalents at 31 December

Net increase in cash and cash equivalents

13

Alpha Bank AD Skopje (“the Bank”) is a jointstock company incorporated and domiciledin the Republic of Macedonia.The address of the Bank's registered officeis as follows:

St. Dame Gruev 11000 SkopjeRepublic of Macedonia

The Bank is licensed to perform all bankingactivities in accordance with the law. Themain activities include commercial lending,receiving of deposits, foreign exchangedeals, and payment operation services inthe country and abroad and retail bankingservices.

The financial statements have beenprepared in accordance with the TradingCompanies Law and the AccountingRegulations (Official Gazette No.94/2004,No.11/2005 and No.116/2005).During the period the Group adoptedInternational Financial Reporting Standard(“IFRS”) 7

, which increased the level ofdisclosure in respect of financialinstruments, but had no impact on thereported profits or financial position of theBank. In accordance with the transitionalrequirements of the standard, the Bank hasprovided full comparative information.

The financial statements have beenprepared on the historical cost basis exceptfor the following:- financial instruments held for trading are

measured at fair value;- available-for-sale financial assets are

measured at fair value;- non-current assets held for sale which

are measured at the lower of its carryingamount or fair value less costs to sell.

Financial Instruments:

Disclosures

2007 2006MKD MKD

1 EUR 61.20 61.171 USD 41.66 46.45

The financial statements are presented inMacedonian denars (“MKD”), which is theBank's functional currency. Except asindicated, financial information presented inMKD has been rounded to the nearestthousand.

The accounting policies set out below havebeen applied consistently to all periodspresented in the financial statements.

Transactions in foreign currencies aretranslated to the respective functionalcurrencies of the Bank at exchange rates atthe dates of the transactions. Monetaryassets and liabilities denominated in foreigncurrencies at the reporting date areretranslated to the functional currency at theexchange rate at that date. The foreigncurrency gain or loss on monetary items isthe difference between amortised cost inthe functional currency at the beginning ofthe period, adjusted for effective interestand payments during the period, and theamortised cost in foreign currencytranslated at the exchange rate at the endof the period. Non-monetary assets andliabilities denominated in foreign currenciesthat are measured at fair value areretranslated to the functional currency at theexchange rate at the date that the fair valuewas determined. Foreign currencydifferences arising on retranslation arerecognised in profit or loss.The foreign currencies the Bank deals withare predominantly Euro (EUR) and UnitedStates Dollars (USD) based. The exchangerates used for translation at 31 December2007 and 2006 were as follows:

N o t e s t o t h e f i n a n c i a l s t a t e m e n t s

1. Reporting entity

b) Basis of measurement

2. Basis of preparation

a) Statement of compliance

3. Significant accounting policies

a) Foreign currency transactions

c) Functional and presentation currency

14

Interest income and expense arerecognised in the income statement usingthe effective interest method. The effectiveinterest rate is the rate that exactlydiscounts the estimated future cashpayments and receipts through theexpected life of the financial asset or liability(or, where appropriate, a shorter period) tothe carrying amount of the financial asset orliability.The calculation of the effective interest rateincludes all fees and points paid orreceived, transaction costs, and discountsor premiums that are an integral part of theeffective interest rate. Transaction costs areincremental costs that are directlyattributable to the acquisition, issue ordisposal of a financial asset or liability.Interest income and expense presented inthe income statement include:- interest on financial assets and liabilities

at amortised cost on an effective interestrate basis;- interest on available-for-sale investment

securities on an effective interest basis;Interest income and expense on all tradingassets and liabilities are considered to beincidental to the Bank's trading operationsand are presented together with all otherchanges in the fair value of trading assetsand liabilities in net trading income.

Fees and commission income andexpenses that are integral to the effectiveinterest rate on a financial asset or liabilityare included in the measurement of theeffective interest rate.Other fees and commission income,including financial services provided by theBank in respect of foreign currencysettlements, guarantees, letters of credit,domestic and foreign payment operationsand other services, are recognised as therelated services are performed. When aloan commitment is not expected to result inthe draw-down of a loan, loan commitment

fees are recognised on a straight-line basisover the commitment period.Other fees and commission expense relatesmainly to transaction and service fees,which are expensed as the services arereceived.

Net trading income comprises gains lesslosses related to trading assets andliabilities, and includes all realised andunrealised fair value changes, interest,dividends and foreign exchangedifferences.

Dividend income is recognised when theright to receive income is established.Dividends are reflected as a component ofnet trading income, or dividend incomebased on the underlying classification ofthe equity instrument.

Payments made under operating leases arerecognised in profit or loss on a straight-linebasis over the term of the lease. Leaseincentives received are recognised as anintegral part of the total lease expense, overthe term of the lease.

Income tax expense comprises current anddeferred tax. Income tax expense isrecognised in the income statement exceptto the extent that it relates to itemsrecognised directly in equity, in which caseit is recognised in equity.Current tax is the expected tax payable onthe taxable income for the year, using taxrates enacted or substantively enacted atthe balance sheet date, and any adjustmentto tax payable in respect of previous years.Deferred tax is provided using the balancesheet method, providing for temporarydifferences between the carrying amounts

b) Interest

f) Lease payments made

g) Income tax expense

e) Dividends

c) Fees and commission

d) Net trading income

15

of assets and liabilities for financialreporting purposes and the amounts usedfor taxation purposes. Deferred tax is notrecognised for the following temporarydifferences: the initial recognition of assetsor liabilities in a transaction that is not abusiness combination and that affectsneither accounting nor taxable profit, anddifferences relating to investments insubsidiaries and jointly controlled entities tothe extent that they probably will not reversein the foreseeable future.Deferred tax is measured at the tax ratesthat are expected to be applied to thetemporary differences when they reverse,based on the laws that have been enactedor substantively enacted by the reportingdate.A deferred tax asset is recognised only tothe extent that it is probable that futuretaxable profits will be available againstwhich the asset can be utilised. Deferredtax assets are reviewed at each reportingdate and are reduced to the extent that it isno longer probable that the related taxbenefit will be realised.

The Bank initially recognises loans andadvances, deposits and borrowings on thedate that they are originated. All otherfinancial assets and liabilities are initiallyrecognised on the trade date at which theBank becomes a party to the contractualprovisions of the instrument.

The Bank derecognises a financial assetwhen the contractual rights to the cashflows from the asset expire, or it transfersthe rights to receive the contractual cashflows on the financial asset in a transactionin which substantially all the risks andrewards of ownership of the financial assetare transferred. Any interest in transferred

financial assets, if any that is created orretained by the Bank is recognised as aseparate asset or liability.The Bank derecognises a financial liabilitywhen its contractual obligations aredischarged or cancelled or expire.

Financial assets and liabilities are set offand the net amount is presented in thebalance sheet when, and only when, theBank has a legal right to set off the amountsand intends either to settle on a net basis orto realise the asset and settle the liabilitysimultaneously.Income and expenses are presented on anet basis only when permitted by theaccounting standards, or for gains andlosses arising from a group of similartransactions such as in the Bank's tradingactivity.

The amortised cost of a financial asset orliability is the amount at which the financialasset or liability is measured at initialrecognition, minus principal repayments,plus or minus the cumulative amortisationusing the effective interest method of anydifference between the initial amountrecognised and the maturity amount, minusany reduction for impairment.

The determination of fair values of financialassets and financial liabilities is based onquoted market prices for financialinstruments traded in active markets. For allother financial instruments fair value isdetermined by using valuation techniques.Valuation techniques include net presentvalue techniques, the discounted cash flowmethod, comparison to similar instrumentsfor which market observable prices exist,and valuation models.

h) Financial assets and liabilities

(I) Recognition

(II) Derecognition

(III) Offsetting

(IV) Amortised cost measurement

(V) Fair value measurement

16

At each balance sheet date the Bankassesses whether there is objectiveevidence that financial assets not carried atfair value through profit or loss are impaired.Financial assets are impaired whenobjective evidence demonstrates that a lossevent has occurred after the initialrecognition of the asset, and that the lossevent has an impact on the future cashflows on the asset that can be estimatedreliably.The Bank considers evidence of impairmentat both a specific asset and collective level.All individually significant financial assetsare assessed for specific impairment. Allsignificant assets found not to bespecifically impaired are then collectivelyassessed for any impairment that has beenincurred but not yet identified. Assets thatare not individually significant are thencollectively assessed for impairment bygrouping together financial assets (carriedat amortised cost) with similar riskcharacteristics.Objective evidence that financial assets(including equity securities) are impairedcan include default or delinquency by aborrower, restructuring of a loan or advanceby the Bank on terms that the Bank wouldnot otherwise consider, indications that aborrower or issuer will enter bankruptcy, thedisappearance of an active market for asecurity, or other observable data relating toa group of assets such as adverse changesin the payment status of borrowers orissuers in the group, or economicconditions that correlate with defaults in thegroup.In assessing collective impairment the Bankuses statistical modelling of historical trendsof the probability of default, timing ofrecoveries and the amount of loss incurred,adjusted for management's judgement as towhether current economic and creditconditions are such that the actual lossesare likely to be greater or less thansuggested by historical modelling. Default

rates, loss rates and the expected timing offuture recoveries are regularlybenchmarked against actual outcomes toensure that they remain appropriate.Impairment losses on assets carried atamortised cost are measured as thedifference between the carrying amount ofthe financial assets and the present value ofestimated cash flows discounted at theassets' original effective interest rate.Losses are recognised in profit or loss andreflected in an allowance account againstloans and advances. Interest on theimpaired asset continues to be recognisedthrough the unwinding of the discount.When a subsequent event causes theamount of impairment loss to decrease, theimpairment loss is reversed through profit orloss.Impairment losses on available-for-saleinvestment securities are recognised bytransferring the difference between theamortised acquisition cost and current fairvalue out of equity to profit or loss. When asubsequent event causes the amount ofimpairment loss on an available-for-saledebt security to decrease, the impairmentloss is reversed through profit or loss.However, any subsequent recovery in thefair value of an impaired available-for-saleequity security is recognised directly inequity. Changes in impairment provisionsattributable to time value are reflected as acomponent of interest income.

Cash and cash equivalents include cashbalance on hand, demand deposits withbanks, cash deposited with the NationalBank of the Republic of Macedonia(“NBRM”) and highly liquid financial assetswith original maturities of less than threemonths, which are subject to insignificantrisk of changes in their fair value, and areused by the Bank in the management of itsshort-term commitments.Cash and cash equivalents are carried atamortised cost in the balance sheet.

i) Cash and cash equivalents

(VI) Identification and measurement of impairment

17

Loans and advances are initially measuredat fair value plus incremental directtransaction costs, and subsequentlymeasured at their amortised cost using theeffective interest method.

Investment securities are initially measuredat fair value plus incremental directtransaction costs and subsequentlyaccounted for depending on theirclassification.

Held-to-maturity investments are assets withfixed or determinable payments and fixedmaturity that the Bank has the positive intentand ability to hold to maturity.Held-to-maturity investments are carried atamortised cost using the effective interestmethod. Any sale or reclassification of asignificant amount of held-to-maturityinvestments not close to their maturitywould result in the reclassification of allheld-to-maturity investments as available-for-sale, and prevent the Bank fromclassifying investment securities as held-to-maturity for the current and the followingtwo financial years.

Available-for-sale investments are financialassets that are not held for trading, ororiginated by the Bank, nor are held-to-maturity. Available-for-sale investmentsinclude treasury bills, government bills andequity securities.Unquoted equity securities whose fair valuecannot be reliably measured are carried atcost, less impairment losses. All otheravailable-for-sale investments are carried atfair value.Interest income is recognised in profit orloss using the effective interest method.Dividend income is recognised in profit or

Non-current assets that are expected to berecovered primarily through sale rather thanthrough continuing use are classified asheld for sale. Immediately beforeclassification as held for sale, the assets arere-measured in accordance with the Bank'saccounting policies. Thereafter generallythe assets are measured at the lower oftheir carrying amount and fair value lesscost to sell. Impairment losses on initialclassification as held for sale andsubsequent gains or losses on re-measurement are recognised in profit orloss. Gains are not recognised in excess ofany cumulative impairment loss.

Trading assets and liabilities are thoseassets and liabilities that the Bank acquiresor incurs principally for the purpose ofselling or repurchasing in the near term, orholds as part of a portfolio that is managedtogether for short-term profit or positiontaking.Trading assets and liabilities are initiallyrecognised and subsequently measured atfair value in the balance sheet withtransaction costs taken directly to profit orloss. All changes in fair value arerecognised as part of net trading income inprofit or loss. Trading assets and liabilitiesare not reclassified subsequent to theirinitial recognition.

Loans and advances originated by theBank are loans and receivables created bythe Bank providing money to a debtor otherthan those created with the intention ofshort-term profit taking. Loans andadvances originated by the Bank areconsisted of loans and advances to banksand other customers

l) Loans and advances originated by the Bank

(I) Held-to-maturity

m) Investment securities

(II) Available-for-sale

k) Trading assets and liabilities

j) Non-current assets held for sale

18

loss when the Bank becomes entitled to thedividend. Foreign exchange gains or losseson available-for-sale debt securityinvestments are recognised in profit or loss.Other fair value changes are recogniseddirectly in equity until the investment is soldor impaired and the balance in equity isrecognised in profit or loss.

Items of property and equipment aremeasured at cost less accumulateddepreciation and impairment losses.Cost includes expenditures that are directlyattributable to the acquisition of the asset.Purchased software that is integral to thefunctionality of the related equipment iscapitalised as part of that equipment.

The cost of replacing part of an item ofproperty or equipment is recognised in thecarrying amount of the item if it is probablethat the future economic benefits embodiedwithin the part will flow to the Bank and itscost can be measured reliably. The costs ofthe day-to-day servicing of property andequipment are recognised in profit or lossas incurred.

Depreciation is recognised in profit or losson a straight-line basis over the estimateduseful lives of each part of an item ofproperty and equipment.Depreciation rates, based on the estimateduseful lives for the current and comparativeperiods are as follows:

Software and licenses acquired by the Bankis stated at cost less accumulatedamortisation and accumulated impairmentlosses.

Subsequent expenditure on intangibleassets is capitalised only when it increasesthe future economic benefits embodied inthe specific asset to which it relates. Allother expenditure is expensed as incurred.

Amortisation is recognised in profit or losson a straight-line basis over the estimateduseful life of the software, from the date thatit is available for use.The amortisation rates based on theestimated useful lives for the current andcomparative periods are as follows:

Leases in terms of which the Bank assumessubstantially all the risks and rewards ofownership are classified as finance leases.Upon initial recognition the leased asset ismeasured at an amount equal to the lowerof its fair value and the present value of theminimum lease payments. Subsequent toinitial recognition, the asset is accounted forin accordance with the accounting policyapplicable to that asset.Other leases are operating leases and theleased assets are not recognised on theBank's balance sheet.

n) Property and equipment

(I) Recognition and measurement

o)Intangible assets

(I)Recognition and measurement

(II) Subsequent expenditure

(II) Subsequent costs

(III) Depreciation

Buildings

Leasehold improvementFurniture and equipment

%

2.520

10-25

%

Software 25

Licences 20

(III) Amortisation

p) Leased assets lessee

19

The carrying amounts of the Bank's non-financial assets are reviewed at eachreporting date to determine whether there isany indication of impairment. If any suchindication exists then the asset'srecoverable amount is estimated.An impairment loss is recognised if thecarrying amount of an asset or its cash-generating unit exceeds its recoverableamount. If it is not possible to estimate therecoverable amount of the individual asset,an entity shall determine the recoverableamount of the cash-generating unit to whichthe asset belongs (the asset's cash-generating unit).A cash-generating unit is the smallestidentifiable asset group that generates cashflows that largely are independent fromother assets and groups. Impairment lossesare recognised in profit or loss.The recoverable amount of an asset orcash-generating unit is the greater of itsvalue in use and its fair value less costs tosell. In assessing value in use, theestimated future cash flows are discountedto their present value using a pre-taxdiscount rate that reflects current marketassessments of the time value of moneyand the risks specific to the asset.Impairment losses recognised in priorperiods are assessed at each reportingdate for any indications that the loss hasdecreased or no longer exists. Animpairment loss is reversed if there hasbeen a change in the estimates used todetermine the recoverable amount. Animpairment loss is reversed only to theextent that the asset's carrying amountdoes not exceed the carrying amount thatwould have been determined, net ofdepreciation or amortisation, if noimpairment loss had been recognised.

Deposits, debt securities issued and

subordinated liabilities are the Bank'ssources of debt funding.The Bank classifies capital instruments asfinancial liabilities or equity instruments inaccordance with the substance of thecontractual terms of the instrument.Deposits, debt securities issued andsubordinated liabilities are initially measuredat fair value plus transaction costs, andsubsequently measured at their amortisedcost using the effective interest method,except where the Bank chooses to carry theliabilities at fair value through profit or loss.

A provision is recognised if, as a result of apast event, the Bank has a present legal orconstructive obligation that can beestimated reliably, and it is probable that anoutflow of economic benefits will be requiredto settle the obligation. Provisions aredetermined by discounting the expectedfuture cash flows at a pre-tax rate thatreflects current market assessments of thetime value of money and, where appropriate,the risks specific to the liability.A provision for onerous contracts isrecognised when the expected benefits tobe derived by the Bank from a contract arelower than the unavoidable cost of meetingits obligations under the contract. Theprovision is measured at the present value ofthe lower of the expected cost of terminatingthe contract and the expected net cost ofcontinuing with the contract. Before aprovision is established, the Bankrecognises any impairment loss on theassets associated with that contract.

The Bank contributes to its employees' postretirement plans as prescribed by thenational legislation. Contributions, based onsalaries, are made to the nationalorganisations responsible for the payment ofpensions.

q) Impairment of non-financial assets

r) Deposits, debt securities issued and

subordinated liabilities

t) Employee benefits

(I) Defined contribution plans

s) Provisions

20

There is no additional liability in respect ofthese plans. Obligations for contributions todefined contribution pension plans arerecognised as an expense in profit or losswhen they are due.

Short-term employee benefit obligations aremeasured on an undiscounted basis andare expensed as the related service isprovided.A provision is recognised for the amountexpected to be paid under short-term cashbonus or profit-sharing plans if the Bank hasa present legal or constructive obligation topay this amount as a result of past serviceprovided by the employee and theobligation can be estimated reliably.

Ordinary shares are classified as equity.Incremental costs directly attributable to theissue of ordinary shares and share optionsare recognised as a deduction from equity.

When share capital recognised as equity isrepurchased, the amount of theconsideration paid, which includes directlyattributable costs and is recognised as adeduction from equity. Repurchased sharesare classified as treasury shares and arepresented as a deduction from total equity.When treasury shares are sold or reissuedsubsequently the amount received isrecognised as an increase on equity, andthe resulting surplus or deficit of thetransaction is transferred to/from sharepremium.

Dividends are recognised as a liability in theperiod in which they are declared.

For more appropriate presentation oftransactions, classification of certain items ina current year financial statements differfrom a prior year. Consequently presentationof prior year financial statement has beenchanged where necessary.

The Bank has exposure to the following risksfrom its use of financial instruments:- credit risk- liquidity risk- market risks

This note presents information about theBank's exposure to each of the above risks,the Bank's objectives, policies andprocesses for measuring and managing risk,and the Bank's management of capital.

The Supervisory Board (“the Board”) hasoverall responsibility for the establishmentand oversight of the Bank's riskmanagement framework. The Board hasestablished the Asset and LiabilityCommittee (“ALCO”), Credit Committee andRisk Management Committee, which areresponsible for developing and monitoringBank's risk management policies in theirspecified areas.The Bank's risk management policies areestablished to identify and analyse the risksfaced by the Bank, to set appropriate risklimits and controls, and to monitor risks andadherence to limits. Risk managementpolicies and systems are reviewed regularlyto reflect changes in market conditions,products and services offered. The Bank,through its training and procedures andpolicies for management, aims to develop aconstructive control environment, in which allemployees understand their roles andobligations.

(II) Short-term benefits

u) Share capital and reserves

(I) Ordinary shares

(II) Repurchase of share capital

(III) Dividends

4. Financial risk management

a) Introduction and overview

(IV) Comparative information

Risk management framework

21

The Bank's Audit Committee is responsiblefor monitoring compliance with the Bank'srisk management policies and procedures,and for reviewing the adequacy of the riskmanagement framework in relation to therisks faced by the Bank. The Bank's AuditCommittee is assisted in these functions byInternal Audit. Internal Audit undertakesboth regular and ad-hoc reviews of riskmanagement controls and procedures, theresults of which are reported to the AuditCommittee.

Credit risk is the risk of financial loss to theBank if a customer or counterparty to afinancial instrument fails to meet itscontractual obligations, and arisesprincipally from the Bank's loans andadvances to customers and other banksand investment securities. For riskmanagement reporting purposes, the Bankconsiders and consolidates all elements ofcredit risk exposure (such as individualobligor default risk, country and sector risk).

The Supervisory Board has delegatedresponsibility for the management of creditrisk to its Credit Committee that approves allcredit exposures less 10% of the Bank'sown funds. All credit exposures grater than10% of the Bank's own funds must beapproved by the Risk ManagementCommittee. Separate Bank's Creditdepartments (Department for CorporateLending and Department for Retail Lending)are responsible for oversight of the Bank'scredit risk, including:

, coveringcollateral requirements, credit assessment,- Formulating credit policies

risk grading and reporting, documentaryand legal procedures, and compliance withregulatory and statutory requirements.

Credit departments assess all creditexposures in excess of designated limits,prior to facilities being committed tocustomers.

togeographies and industries (for loans andadvances), and by issuer, credit ratingband, market liquidity and country (forinvestment securities).

in order tocategorise exposures according to thedegree of risk of financial loss faced and tofocus management on the risks. The riskgrading system is used in determiningwhere impairment losses may be required.The current risk grading framework consistsof six grades reflecting varying degrees ofrisk of default and the availability ofcollateral.

with agreedexposure limits, including those forindustries, country risk and product types.Regular reports for the credit exposure, riskgrading and allowance for impairment areprovided to the Risk ManagementCommittee, and appropriate correctiveaction is taken.Credit departments are required toimplement credit policies and proceduresand are responsible for the quality andperformance of its credit portfolio and formonitoring and controlling all credit risks inits portfolios.Regular audits of Credit departments'processes are undertaken by Internal Audit.

- Reviewing and assessing credit risk.

- Limiting concentrations of exposure

- Banks's credit risk gradings

- Reviewing compliance

b) Credit risk

Management of credit risk

22

Exposure to credit risk

Carrying amount

Individually impaired

Grade A

Grade B

Grade C

Grade D

Grade E

Gross amount

Allowance for impairment

Carrying amount

Neither past due nor impaired

Grade A

Carrying amount

Total carrying amount

13,373

1,700

-

-

-

-

1,700

(17)

1,683

11,690

11,690

13,373

13,15,16 559,546

-

-

-

-

-

-

-

-

559,546

559,546

559,546

4,831,880

4,097,988

597,893

97,358

132,695

60,974

4,986,908

(261,488)

4,725,420

106,460

106,460

4,831,880

2,842,497

318,648

456,774

74,647

58,372

66,334

974,775

(166,233)

808,542

2,033,955

2,033,955

2,842,497

870,482

-

-

-

-

-

-

-

-

870,482

870,482

870,482

1,129,928

-

-

-

-

-

-

-

-

1,129,928

1,129,928

1,129,928

Impaired loans and securities are loans andsecurities for which the Bank determinesthat it is probable that it will be unable tocollect all principal and interest dueaccording to the contractual terms of theloan / securities agreement(s). These loansare graded A to E in the Bank's internalcredit risk grading system.

Loans and securities where contractualinterest or principal payments are past duebut the Bank believes that impairment is not

appropriate on the basis of the level ofsecurity / collateral available and / or thestage of collection of amounts owed to theBank.

Loans with renegotiated terms are loansthat have been restructured due todeterioration in the borrower's financialposition and where the Bank has madeconcessions that it would not otherwiseconsider. Once the loan is restructured itremains in this category independent ofsatisfactory performance after restructuring.

Impaired loans and securities

Past due but not impaired loans

Loans with renegotiated terms

In thousands of denars Note

Loans and advancesto banks

2007 2006

Loans and advancesto customers

2007 2006

Investmentsecurities

2007 2006

23

The Bank establishes an allowance forimpairment losses that represents itsestimate of incurred losses in its loanportfolio. The main components of thisallowance are a specific loss componentthat relates to individually significantexposures, and a collective loan lossallowance established for groups ofhomogeneous assets in respect of lossesthat have been incurred but have not beenidentified on loans subject to individualassessment for impairment.

The Bank writes off a loan / security balance(and any related allowances for impairment)

when the Supervisory Board determinesthat the loans / securities are uncollectible.This determination is reached afterconsidering information such as theoccurrence of significant changes in theborrower / issuer's financial position suchthat the borrower / issuer can no longer paythe obligation, or that proceeds fromcollateral will not be sufficient to pay backthe entire exposure. The Bank can also writeoff a loan / security balance (and anyrelated allowances for impairment) on thebase of a court decision when all othermeans for collection had expired.Set out below is an analysis of the grossand net (of allowances for impairment)amounts of individually impaired assets byrisk grade.

31 December 2007

1,700 1,683 4,097,988 4,047,951

- - 597,893 538,103

- - 97,358 73,018

- - 132,695 66,348

- - 60,974 -

1,700 1,683 4,986,908 4,725,420

31 December 2006

- - 318,648 312,275

- - 456,774 411,096

- - 74,647 55,985

- - 58,372 29,186

- - 66,334 -

- - 974,775 808,542

Allowances for impairment

Write-off policy

Grade A

Grade B

Grade C

Grade D

Grade E

Total

Grade A

Grade B

Grade C

Grade D

Grade E

Total

In thousands of denars

Loans and advances to banks

Gross Net

Loans and advances to customers

Gross Net

24

The Bank holds collateral against loans andadvances to customers in the form ofmortgage interests over property, otherregistered securities over assets, andguarantees. Estimates of fair value arebased on the value of collateral assessed atthe time of borrowing. Collateral generally isnot held over loans and advances to banks.Collateral usually is not held against

Concentration by location for loans andadvances is measured based on thelocation of the borrower. Concentration bylocation for investment securities ismeasured based on the location of theissuer of the security.

Liquidity risk is the risk that the Group willencounter difficulty in meeting obligationsfrom its financial liabilities.

The Bank's approach to managing liquidity

investment securities, and no suchcollateral was held at 31 December 2007 or2006.

The Bank monitors concentrations of creditrisk by sector and by geographic location.An analysis of concentrations of credit riskat the reporting date is shown below:

is to ensure, as far as possible, that it willalways have sufficient liquidity to meet itsliabilities when due, under both normal andstressed conditions, without incurringunacceptable losses or risking damage tothe Bank's reputation.

Treasury Division and International Divisionreceive information from other departmentsregarding the liquidity profile of theirfinancial assets and liabilities and details ofother projected cash flows arising fromprojected future business. Treasury Divisionand International Division then maintain aportfolio of short-term liquid assets, largelymade up of short-term liquid investment

13,373 559,546 4,831,880 2,842,497 870,482 1,129,928

- - 2,148,741 1,516,518 - -

- - - - 269,261 404,192

13,373 559,546 - - 601,221 725,736

- - 2,683,139 1,325,979 - -

13,373 559,546 4,831,880 2,842,497 870,482 1,129,928

13,373 559,546 - 24,618 - -

- - 4,831,880 2,817,879 870,482 1,129,928

- - - - - -

13,373 559,546 4,831,880 2,842,497 870,482 1,129,928

13,15,16Carrying amount

Concentration by sector

Corporate

GovernmentBank and other financial

institutions

Retail

Concentration by location

EU countries

Republic of Macedonia

Other

In thousands of denars Note

Loans and advancesto banks

2007 2006

Loans and advancesto customers

2007 2006

Investmentsecurities

2007 2006

c) Liquidity risk

Management of liquidity risk

25

securities, loans and advances to banksand other inter-bank facilities, to ensure thatsufficient liquidity is maintained within theBank.The daily liquidity position and marketconditions are regularly monitored. Allliquidity policies and procedures aresubject to review and approval by ALCO.Daily reports cover the liquidity position ofthe Bank. Liquidity reports are submittedmonthly to the NBRM.

The Bank has access to a diverse fundingbase. Funds are raised using a broad range

of instruments including deposits,borrowings and share capital. Thisenhances funding flexibility, limitsdependence on any one source of fundsand generally lowers the cost of funds. TheBank strives to maintain a balance betweencontinuity of funding and flexibility throughthe use of liabilities with a range ofmaturities. The Bank continually assessesliquidity risk by identifying and monitoringchanges in funding required to meetbusiness goals and targets set in terms ofthe overall Bank strategy.In addition the Bank holds a portfolio ofliquid assets as part of its liquidity riskmanagement strategy.

Exposure to liquidity risk

Residual contractual maturities of financial

liabilities

21 1,148,928 ( )1,148,928 (536,912) - (612,016) - -

22 4,208,023 ( )4,208,023 (3,103,198) (363,650) (673,173) (68,002) -24 24,509 ( )24,509 (24,509) - - - -

5,381,460 ( )5,381,460 (3,664,619) (363,650) (1,285,189) (68,002) -

277,287 (277,287) (277,287) - - - -

5,658,747 (5,658,747) (3,941,906) (363,650) (1,285,189) (68,002) -

21 680 (680) (680) - - - -

22 3,691,592 (3,691,592) (3,461,064) (140,170) (90,358) - -

24 19,847 (19,847) (19,847) - - - -

3,712,119 (3,712,119) (3,481,591) (140,170) (90,358) - -

- - - - - -

-3,712,119 (3,712,119) (3,481,591) (140,170) (90,358) -

In thousands of denars Note

31 December 2007

31 December 2006

Non-derivativeliabilities

Non-derivativeliabilities

Deposits from banksDeposits fromcustomersOther liabilities

Credit cards commitments

Deposits from banksDeposits fromcustomersOther liabilities

Credit cards commitments

Carryingamount

Morethan

5 yearsLess than

1 month1-3

months

Grossnominalinflow /

(outflow)3 monthsto 1 year

1-5years

26

The previous table shows the undiscountedcash flows on the Bank's financial liabilitiesand unrecognised loan commitments on thebasis of their earliest possible contractualmaturity. The Bank's expected cash flowson these instruments vary significantly fromthis analysis. For example, demanddeposits from customers are expected tomaintain a stable or increasing balance.The Gross nominal inflow / (outflow)disclosed in the previous table is thecontractual, undiscounted cash flow on thefinancial liability or commitment.

Market risk is the risk that changes inmarket prices, such as interest rate, equityprices, foreign exchange rates and creditspreads (not relating to changes in theobligor's / issuer's credit standing) will affectthe Bank's income or the value of itsholdings of financial instruments. Theobjective of market risk management is tomanage and control market risk exposureswithin acceptable parameters, whileoptimising the return on risk.

The Bank's operations are subject to the

risk of interest rate fluctuations to the extentthat interest-earning assets and interest-bearing liabilities mature or reprice atdifferent times or in differing amounts. In thecase of floating rate assets and liabilities,the Bank is also exposed to basis risk,which is the difference in reprisingcharacteristics of the various floating rateindices, such as the savings rate, LIBORand different types of interest.Risk management activities are aimed atoptimising net interest income, given marketinterest rate levels consistent with theBank's business strategies.Asset-liability risk management activities areconducted in the context of the Bank'ssensitivity to interest rate changes. Ingeneral, the Bank is asset sensitivebecause of the majority of the interest-earning assets and liabilities, the Bank hasthe right simultaneously to change theinterest rates. In decreasing interest rateenvironments, margins earned will narrowas liabilities interest rates will decrease witha lower percentage compared to assetsinterest rates. However the actual effect willdepend on various factors, includingstability of the economy, environment andlevel of the inflation.A summary of the Bank's interest rate gapposition on non-trading portfolios is asfollows:

d) Market risks

Management of market risksExposure to interest rate risk non-tradingportfolios

27

12 1,026,790 1,026,790 - - - -

13 13,373 13,373 - - - -

15 4,831,880 278,335 287,967 1,442,971 2,170,712 651,895

16 870,482 629,691 168,689 54,295 14,907 2,900

20 23,095 23,095 - - - -

6,765,620 1,971,284 456,656 1,497,266 2,185,619 654,795

21 (1,148,928) (536,912) - (612,016) - -22 (4,208,023) (3,103,198) (363,650) (673,173) (68,002) -24 (24,509) (24,509) - - - -

(5,381,460) (3,664,619) (363,650) (1,285,189) (68,002) -

1,384,160 (1,693,335) 93,006 212,077 2,117,617 654,795

12 581,951 581,951 - - - -

13 559,546 552,337 - 2,142 5,067 -

15 2,842,497 117,649 246,993 889,662 1,201,364 386,829

16 1,129,928 797,780 257,030 47,482 24,846 2,790

20 2,676 2,676 - - - -

5,116,598 2,052,393 504,023 939,286 1,231,277 389,619

21 (680) (680) - - - -

22 (3,691,592) (3,461,064) (140,170). (90,358) - -

24 (19,847) (19,847) - - - -

(3,712,119) (3,481,591) (140,170) (90,358) - -

1,404,479 (1,429,198) 363,853 848,928 1,231,277 389,619

The management of interest rate risk againstinterest rate gap limits is supplemented bymonitoring the sensitivity of the Bank'sfinancial assets and liabilities to various

standard and non-standard interest ratescenarios. Standard scenarios include a 1%parallel fall or rise in all yield curves.

In thousands of denars NoteCarryingamount

Morethan

5 yearsLess than

1 month1-3

months3-12

months1-5

years

31 December 2007

Cash and cashequivalents

Cash and cashequivalents

Loans and advancesto banks

Loans and advancesto banks

Loans and advances

Loans and advances

to customers

to customers

Investment securities

Investment securities

Other assets

Other assets

Deposits from banks

Deposits from banks

Deposits from customers

Deposits from customers

Other liabilities

Other liabilities

31 December 2006

28

An analysis of the Bank's sensitivity to anincrease or decrease in market interestrates (assuming no asymmetrical movement

The Bank is exposed to currency riskthrough transactions in foreign currencies.The Bank ensures that the net exposure iskept to an acceptable level by buying orselling foreign currency at spot when

in yield curves and a constant balancesheet position) is as follows:

necessary to address short-termimbalances. The Denar is pegged to theEuro and the monetary projections envisagestability of the exchange rate of the Denaragainst Euro.

47,469

(47,469)

(25,947)

25,947

44,095

(44,095)

(27,880)

27,880

2007

2006

Effect in thousands of denars

(Loss) / profit forthe period

Interest income (1% increase)

Interest income (1% decrease)Interest expense (1% increase)

Interest expense (1% decrease)

Interest income (1% increase)

Interest income (1% decrease)

Interest expense (1% increase)

Interest expense (1% decrease)

Exposure to currency risk non-tradingportfolios

29

MKD

MKD

EUR

EUR

USD

USD

Other

Other

Total

Total

530,914 359,018 95,781 41,077 1,026,790

181,720 338,709 19,849 41,673 581,951

- 2,142 11,231 - 13,373

- 147,951 232,319 179,276 559,546

2,255,292 2,576,588 - 4,831,880

812,055 2,030,442 - - 2,842,497

870,482 - - - 870,482

1,129,928 - - - 1,129,928

18,719 4,376 - - 23,095

2,552 119 5 - 2,676

3,675,407 2,942,124 107,012 41,077 6,765,620

2,126,255 2,517,221 252,173 220,949 5,116,598

2 1,148,886 33 7 1,148,928

- 47 633 - 680

2,529,273 1,554,535 107,449 16,766 4,208,023

1,314,665 2,129,103 226,407 21,417 3,691,592

9,209 15,300 - - 24,509

4,087 15,760 - - 19,847

2,538,484 2,718,721 107,482 16,773 5,381,460

1,318,752 2,144,910 227,040 21,417 3,712,119

1,136,923 223,403 (470) 24,304 1,384,160

807,503 372,311 25,133 199,532 1,404,479

(753,084) (151,360) (1,491) - (905,935)

(242,234) (402,731) (3,196) - (648,161)

383,839 72,043 (1,961) 24,304 478,225

565,269 (30,420) 21,937 199,532 756,318

2006

2007

Loans and advances to banks

Loans and advances to banks

Loans and advances to customers

Loans and advances to customers

Deposits from banks and other

Deposits from banks and other

Commitments and contingencies

Commitments and contingencies

Monetary assets

Monetary assets

Cash and cash equivalents

Cash and cash equivalents

Investment securities

Investment securities

Other assets

Other assets

Monetary liabilities

Monetary liabilities

financial institutions

financial institutions

Deposits from customers

Deposits from customers

O

O

ther liabilities

ther liabilities

Net position

Net position

Net FX position

Net FX position

30

The table below sets out the Group'sclassification of each class of financial

assets and liabilities, and their fair values(excluding accrued interest).

5. Financial assets and liabilities

Accounting classifications and fair values

1,026,790 - - 1,026,790 1,026,790

13,373 - - 13,373 13,373

4,831,880 - - 4,831,880 4,831,880

- 870,482 - 870,482 870,482

23,095 - - 23,095 23,095

5,895,138 870,482 - 6,765,620 6,765,620

- - 1,148,928 1,148,928 1,148,928

- - 4,208,023 4,208,023 4,208,023

12

12

13

13

15

15

16

16

20

20

21

21

22

22

24

24

- - 24,509 24,509 24,509

- - 5,381,460 5,381,460 5,381,460

581,951 - - 581,951 581,951

559,546 - - 559,546 559,546

2,842,497 - - 2,842,497 2,842,497

- 1,129,928 - 1,129,928 1,129,928

2,676 - - 2,676 2,676

3,986,670 1,129,928 - 5,116,598 5,116,598

- - 680 680 680

- - 3,691,592 3,691,592 3,691,592

- - 19,847 19,847 19,847

- - 3,712,119 3,712,119 3,712,119

In thousands of denars Note

31 December 2007

31 December 2006

Loans and

receivablesAvailable-

-for-sale

Other

amortisedcost

Totalcarryingamount Fair value

Cash and cash equivalents

Cash and cash equivalents

Loans and advancesto banks

Loans and advancesto banks

Loans and advancesto customers

Loans and advancesto customers

Investment securities

Investment securities

Other assets

Other assets

Deposits from banks

Deposits from banks

Deposits from customers

Deposits from customers

Other liabilities

Other liabilities

31

6. Net interest income

2006

2006

12 2,639 1,768

13 20,346 27,355

15 319,191 224,748

16 51,129 40,936

393,305 294,807

21 17,959 1,877

22 88,584 51,685

106,543 53,562

286,762 241,245

24,217 24,329

43,523 37,220

23,289 23,068

6,274 5,788

97,303 90,405

6,492 6,426

3,166 1,928

9,658 8,354

87,645 82,051

2007

2007

NoteIn thousands of denars

In thousands of denars

Interest income

Cash and cash equivalents

Loans and advances to banks

Loans and advancesto customers

Investment securities

Total interest income

Interest expense

Deposits from banks

Deposits from customers

Total interest expense

Net interest income

7. Net fee and commission income

Fee and commission income

Payment operations in the country

Payment operations abroad

Letters of credit and guarantees

Other

Total fee and commission income

Fee and commission expense

Payment operations within the country

Payment operations abroad

Total fee and commission expense

Net fee and commission income

32

- 27,250

421 419

17 - 92

16 110 70

1,936 1,512

2,467 29,343

57,547 37,011

26,630 16,551

5,676 2,333

8,770 7,085

98,623 62,980

24,738 14,949

24,362 2,198

15,617 6,984

7,546 630

4,932 3,264

2,451 890

2,020 1,839

105 3,343

8,108 3,962

89,879 38,059

Other staff costs comprise of allowances for food, transportation of employees etc.

Income from collected previously written-off

receivables

Income from renting safes

Capital gain on sale of propertyand equipment

Dividends on available-for-saleequity securities

Other

Wages and salariesCompulsory contributions

Compensation benefits

Other staff costs

Service expenses

Marketing expenses

Material expenses

Impairment provisions related to off balance sheet items

Insurance premiums for deposits

Representation and donationsComputer maintenance

Impairment of assets held for sale

Other

2006

2006

2006

2007

2007

2007

NoteIn thousands of denars

In thousands of denars

In thousands of denars

8. Other operating income

9. Personnel expenses

10. Other expenses

33

2006

2006

20062006

2007

2007

20072007

14,214 25,748

14,214 25,748

19 (1,885) -

12,329 25,748

% 90,740 % 196,566

12.00 10,889 15.00 29,485

1.63 1,478 1.79 3,512

(0.04) (38) (3.69) (7,249)

13.59 12,329 13.10 25,748

At 31 December 2007 cash and cashequivalents included MKD 164,660thousand (2006: MKD 118,746 thousand) asobligatory reserve requirement in MKD andMKD 267,832 thousand (2006: MKD 228,238

thousand) as obligatory reserve in foreigncurrency requirement. Funds fromobligatory reserve in foreign currency arenot available for the Bank's daily business.

11. Income tax expenses

Recognised in the income statement

12. Cash and cash equivalents

Reconciliation of effective tax rate

NoteIn thousands of denars

In thousands of denars

In thousands of denars

Current tax expense

Current year

Deferred tax income

Origination and reversal of temporary differences

Total income tax expense inthe income statement

Profit before income tax

Income tax using the domestic corporation

tax rate

Non-deductible expenses

Tax exempt income

Total income tax expense in income

statement

Cash on hand

Balances with the National Bank of Republic of Macedonia

Current accounts with foreign banks

Current accounts with local banks

Other short term highly liquid investments

178,681

726,639

117,476

499

3,495

1,026,790

118,109

383,099

77,409

212

3,122

581,951

34

13,390 559,546

(17) -

13,373 559,546

- -

17 -

17 -

30,158 31,931

1,505 1,611

31,663 33,542

Assets held for sale represent assetsacquired through collection of the pledgedcollateral on extended loans. For theseassets the Bank prepares a plan of sellingthe asset including the selling price, alloweddeviation from the selling price, method ofselling and period of implementing the saleand the activities for finding a buyer.During June 2007 the Bank sold buildings

realizing capital loss in the amount of MKD110 thousand (2006:none) (see note 10).An impairment loss of MKD 105 thousand(2006: MKD 3,343 thousand) on theremeasurement of the assets to the lower ofits carrying amount and its fair value lesscosts to sell has been recognised in otherexpenses (see note 10).

2006

2006

2006

2007

2007

2007

4,831,880 2,842,497

4,831,880 2,842,497

Loans and advances to customersat amortised cost

In thousands of denars

In thousands of denars

In thousands of denars

Loans and advances to banks

Less specific allowances for impairment

Specific allowances for impairment

Balance at 1 January

Impairment loss for the year:

Charge for the year

Balance at 31 December

Buildings

Equipment

13. Loans and advances to banks

14. Assets held for sale

15. Loans and advances to customers

35

16. Investment securities

Loans and advances to customers at amortised cost

Allowances for impairment

Available-for-sale investment securities

980,016 616,627

1,101,807 183,637

128,178 48

555,577 535,859

2,327,790 1,672,559

5,093,368 3,008,730

(261,488) (166,233)

4,831,880 2,842,497

166,233 104,306

95,326 63,003

(71) (1,076)

261,488 166,233

870,482 1,129,928

870,482 1,129,928

598,321 722,946

228,040 378,952

41,221 25,240

2,900 2,790

870,482 1,129,928

2006

2006

2006

2006

2007

2007

2007

2007

Retail customers:

Mortgage lending

Consumer loans

Credit cards

Other

Corporate customers:

Mortgage lending

Less specific allowances for impairment

Specific allowances for impairment

Balance at 1 January

Impairment loss for the year:

Charge for the year

Write -offs

Balance at 31 December

Available-for-sale investment securities

Treasury Bills

Government Bills

Government Bonds

Unquoted equity securitiesat cost

In thousands of denars

In thousands of denars

In thousands of denars

In thousands of denars

36

109,851 20,634 92,355 17,604 240,444

- - - 63,625 63,625

- 25,972 41,880 (67,852) -

- - (562) - (562)

109,851 46,606 133,673 13,377 303,507

15,302 18,277 79,413 - 112,9922,745 2,947 9,451 - 15,143

- - (562) - (562)

18,047 21,224 88,302 - 127,573

94,549 2,357 12,942 17,604 127,452

91,804 25,382 45,371 13,377 175,934

12,917 5,032

36,853 17,496

- 241

49,770 22,769

As at 31 December 2007 the Bank does not have any property pledged as collateral (2006:none).

Non-cancellable operating lease rentals are payable as follows:

The Bank leases a number of branch andoffice premises under operating leases. The

leases are non-cancellable and typically runfor a period of up to 5 years.

20062007

Total

Cost

Balance at 1 January 2007Acquisitions

TransfersDisposals

Balance at 31 December 2007

Depreciation

Balance at 1 January 2007Depreciation for the periodDisposals

Balance at 31 December 2007

Carrying amounts

Balance at 31 December 2006

Balance at 31 De 2007cember

Less than one year

Between one and five years

More than five years

17. Property and equipment

Operating leases

In thousands of denars

In thousands of denars

BuildingsLeasehold

improvementFurniture &equipment

Assets underconstruction

37

21,247 26,306 - 47,553

- - 47,563 47,563

1,300 - (1,300) -

22,547 26,306 46,263 9 5,116

18,434 - - 18,434

1,426 5,262 - 6,688

19,860 5,262 - 25,122

2,813 26,306 - 29,119

2,687 21,044 46,263 69,994

1,885 - 1,885 - - -

1,885 - 1,885 - - -

2007

- 1,885 - 1,885

- 1,885 - 1,885

Deferred tax assets and liabilities are attributable to the following:

Software Licences

Assets under

development Total

Cost

Balance at 1 January 2007

Acquisitions

Transfer

Balance at 31 December 2007

Amortisation

Balance at 1 January 2007

Amortisation for the period

Balance at 31 December 2007

Carrying amounts

Balance at 31 December 2006

Balance at 31 December 2007

Assets Liabilities Net Assets Liabilities Net2007 2006

Loans and advances to

customers

Net tax assets (liabilities)

Opening

balance

Recognised in

profit or loss

Recognised

in equity

Closing

balance

Loans andadvances to

customers

In thousands of denars

In thousands of denars

In thousands of denars

18. Intangible assets

19. Deferred tax assets and liabilities

Recognised deferred tax assets and liabilities

Movements in temporary differences duringthe year

38

Note

11,983 764

9,546 -

827 1,283

739 629

23,095 2,676

1,466 680

1,147,462 -

1,148,928 680

Receivables from other banks represent withdrawn funds from the Bank's ATMs, by credit cardholders with other banks.

1,801 1,171

10 7,546 630

26 9,347 1,801

2006

2006

2006

2007

2007

2007

In thousands of denars

other banks

g the year

20. Other assets

21. Deposits from banks

22. Deposits from customers

23. Impairment provisions related to off balance sheet items

Petty inventory

Receivables fromPrepaid expenses

Other

Domestic banks

Current deposits

Foreign banks

Current deposits

468,000 265,436

523,208 313,717

1,700,858 2,028,503

1,515,957 1,083,936

4,208,023 3,691,592

20062007

In thousands of denars

In thousands of denars

In thousands of denars

Retail customers:

Term deposits

Current deposits

Corporate customers:

Term deposits

Current deposits

Balance at 1 January

Provisions made durin

Balance at 31 December

39

17,516 18,920

- 62

1,163 680

5,830 185

24,509 19,847

Ordinary shares

1,548 1,548

3,120 -

4,668 1,548

In number of shares

2006

2006

2007

2007

At 31 December 2007 the authorised sharecapital comprised 4,668 ordinary shares(2006: 1,548). Ordinary shares have a parvalue of MKD 120,000 (2006: MKD120,000). All issued shares are fully paid.The holders of ordinary shares are entitledto receive dividends as declared from timeto time and are entitled to one vote pershare at meetings of the Bank. All sharesrank equally with regard to the Bank'sresidual assets.The Bank is fully owned by Alpha Bank A.E.Athens.

The revaluation reserve relates to intangibleassets and property, and equipment andcomprises the cumulative increasedcarrying value based on the increase of theproducers' price index on the date of the

revaluation. In 2007 the revaluation reservewas transferred to retained earnings.

Under local statutory legislation, the Bank isrequired to set aside 15 percent of its netprofit for the year in a statutory reserve untilthe level of the reserve reaches 1/5 of thecourt registered capital. Until achieving theminimum required level the statutory reservecould only be used for loss recovery. Whenthe minimum level is reached the statutoryreserve can also be used for distribution ofdividends, based on a decision of theshareholders' meeting, but only if theamount of the dividends for the currentbusiness year has not reached the minimumfor distribution as prescribed in the TradeCompany Law or by the Bank's Statute.

Suppliers payable

Fee and commission

Advances received

Other

On issue at 1 January

Issued by transfer from statutory reserves

and retained earnings

On issue at 31 December

24. Other liabilities

25. Capital and reserves

Share capital

In thousands of denars

Revaluation reserve

Statutory reserve

40

475,797 242,234

109,531 94,173

43,320 311,754

277,287 -

23 (9,347) (1,801)

896,588 646,360

The Bank provides financial guarantees andletters of credit to guarantee theperformance of customers to third parties.These agreements have fixed limits and

generally extend for a period of up to oneyear. Expirations are not concentrated inany period.The contractual amounts of commitmentsand contingent liabilities are set out in thefollowing table by category.

Note 20062007

These commitments and contingentliabilities have off balance-sheet credit riskbecause only organisation fees andaccruals for probable losses are recognisedin the balance sheet until the commitmentsare fulfilled or expire. Many of thecontingent liabilities and commitments willexpire without being advanced in whole orin part. Therefore, the amounts do notrepresent expected future cash flows.

According to the Bank's Articles of

Association, the supreme body is theassembly of the Bank, constituted of all theholders of the Bank's registered shares.The overall control of the Bank is with thenon-executive Supervisory Board who isappointed by shareholders.The Bank is fully owned by Alpha BankA.E. Athens which is the ultimate parentcompany of the Alpha Group.

The volumes of related-party transactions,outstanding balances at the year-end, andrelating expense and income for the yearare as follows:

26. Contingencies

27. Related parties

Payment guarantees

in MKD

in foreign currency

Letters of credit

in foreign currency

Credit cardcommitmentsProvisions

In thousands of denars

41

74,631

9.581,505

(9,644,887)

11,247

2,766

116,287

8,729,282

(8,770,937)

74,631

4,964

4,960

6,178

(2,570)

8,568

101

79

576

2,009

4,382

(1,431)

4,960

21

21

202

2006

2006

2007

2007

The Bank's policy is to require suitablecollateral to be provided by the customersprior to the disbursement of approved loansand advances. Collateral for loans and

advances is usually obtained in the form ofcash, immovable property, inventory orother property.

(I) Loans and advances to related banks

(II) Loans and advances to related parties

Parent

Deposits outstanding at 1 January

Deposit issued during the year

Deposit repayments during the year

Deposit outstanding at 31 December

Interest income earned

Key management personnel of theBank and with them related parties

Loans outstanding at 1 January

Loans issued during the year

Loan repayments during the year

Loans outstanding at 31 December

Specific allowance for impairment losses

Net impairment losses

Interest income earned

In thousands of denars

In thousands of denars

42

Parent and with it related parties

Parent and with it related parties

1,156 8,978

16 124

38,557 50,775

37 8

23 10

21,079 15,263

21,079 15,263

2006

2006

2006

2007

2007

2007

According to the amendments of theIncome Tax Law and Personnel Income TaxLaw published in the Official Gazette

Number 139, the tax rate as of 1 January2008 is 10% (2007:12%).

(III) Deposits from related parties

(V) Key management personnel

compensation

28. Subsequent events

(IV) Other transactions with related parties

In thousands of denars

In thousands of denars

In thousands of denars

Deposits at 1 January

Deposits received during the year

Deposits repaid during the year

Deposits at 31 December

Interest expense on deposits

Cash and cash equivalents

Other assets

Off-balance sheet credit exposure

Fee end commission income

Fee end commission expense

Short-term employee benefits

-

69,730,462

(68,581,060)

1,149,401

17,733

-

2,175,162

(2,175,162)

-

1,858

43

Dame Gruev 1, MK - 1000 Skopje

P.O. Box 564

Tel.: 389 2 3289 400

Fax: 389 2 3135 206, 3116 830

Telex: 51758

SWIFT: KRSKM2X

Internet: www.alphabank.com.mk

e-mail: [email protected]