Alexander Consulting Enterprise 1/10/2016 The European Union and the EURO.

Transcript of Alexander Consulting Enterprise 1/10/2016 The European Union and the EURO.

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

The European Union and

the EURO

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

European Union

1. What does it mean:

- Free Movement of People- Free Movement of Goods- Mutual Recognition of National Standards

but also

- Different Cultures- Different Languages- National Governments- National Laws

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

2. Objectives- Economic - Social- Political

3. Who Participates?

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

EU Member Countries

-Old MembersAustria €Belgium €DenmarkFinland €France €Germany € Greece €Ireland €Italy €Luxembourg €Netherlands €Portugal €Spain €SwedenUK

-New MembersCyprus €Czech RepublicEstonia €HungaryLatviaLithuaniaMalta €Poland Slovak Republic €Slovenia €RumaniaBulgariaCroatia

-In NegotiationsTurkey

€ Countries that adopted the EURO

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

EC Institutions

European CommissionEuropean Commission

Council of MinistriesCouncil of Ministries

European ParliamentEuropean Parliament

European Court of JusticeEuropean Court of Justice

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

Euro Crisis?

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

EMU

1.What is EMU?Acronym for Economic and Monetary Union

2. How Does it Work?All national currencies of member states convert into the EURO atan irrevocably fixed rate. The EURO floats freely against other main currencies (yen, $). National banknotes ceased to be legal on 1 July 2002.

3. What is the role of the ECB?The Governing Council of the European Central Bank (ECB) consistsof six executive board members responsible for current business andthe 11 ministers of the National Central banks. The ECB isresponsible for the money supply in Euroland.

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

4. Does the EMU lead to a loss of sovereignty of its member states?A nation’s currency symbolizes national autonomy. Monetary policy

is a powerful economic instrument, that has an impact on inflation, interest rates, governmental debt, short term unemployment, and economic cycle

5. What are potential benefits of the EMU?•Lower cost of managing cash for companies operating across national borders within Euroland

•Elimination of currency risk in Euroland

•Lower cost of hedging currency risk between EURO and non-EURO currencies

•Bigger markets. Customers will more readily purchase across national boundaries, unimpeded by the complexities of different currencies

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

The exchange rate weapon is ruled out. There is no redistribution effect of federal taxes (For example: If one part of the U.S. moves into recession, its tax payments (linked to income and sales) will fall and federal benefit payments will rise). Adjustments in the EMU will have to take place through:- Relocation of workers- Relocation of businesses- Change of wages- Transfer payments between EMU member states

6. What happens if the economic cycles in different EMU member states are out of synch?

European Debt Crisis Indicators

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

Greek Crisis

Greece joins currency union in 2001

Low interest rates, low inflation, access to capoital markets

Economic boom financed with cheap money

No currency devaluation to counteract increasing ULC

Domestic businesses are increasingly loosing competitiveness

1. Timeline of the Crisis

Hay fire of cheap money is burnt out. Economy is not competitive

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

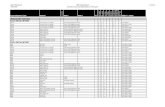

Increasing Loss of CompetitivenessHarmonised competitiveness indicators based on unit labour costs indices for the total economy: 2009 Q4 (period averages; index 1999 Q1=100)

The purpose of harmonised competitiveness indicators (HCIs) is to provide consistent and comparable measures of euro area countries' price and cost competitiveness that are also consistent with the real effective exchange rates (EERs) of the euro. The HCIs are constructed using the same methodology and data sources that are used for the euro EERs. While the HCI of a specific country takes into account both intra and extra-euro area trade, however, the euro EERs are based on extra-euro area trade only.

Euro area

BE DE IE GR ES FR IT CY LU MT NL AT PT SI SK FI

1. Period average 108.1 107 89.6 125.3 112.6 113.3 104.5 113.1 112.8 117.7 109.8 112.7 95.1 · 107.7 176.7 105.7

2. Percentage change versus previous period

1.4 1.2 0.5 2.4 -1.0 1.1 0.8 -0.4 1.7 2.0 1.4 0.3 0.3 · -0.2 -1.8 0.6

3. Percentage change versus previous year

6.3 2.4 3.8 -0.3 4.5 0.2 2.3 2.3 3.9 2.9 4.2 4.5 3.4 · 4.3 3.1 4.8

4. Percentage change since 1998 Q4

4.0 5.9 -13.0 17.4 12.9 12.9 3.8 10.9 10.9 14.7 9.9 10.4 -5.2 · 7.6 78.7 3.9

http://www.ecb.int/stats/exchange/hci/html/hci_ulct_2009-10.en.html

2015 Numbers

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

Governmental spending to counteract increasing unemployment, low consumption, and failing companies

Public debt explodes

Investors slowly start to react and buy less Greek bonds and increasingly take out Credit Default Swaps to get insurance against default

Price of bonds falls and interest rate increases.

“Bad” speculators refuse to buy bonds despite skyrocketing interest rates. Price of Credit Default Swaps goes through the roof and markets start to

freeze

1. Timeline of the Crisis cont.

Hay fire of cheap money is burnt out. Economy is not competitive

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

1. Timeline of the Crisis cont.

Greece receives first (2010) and second bailout (2012) from EU, ECB, and IMF (Troika) worth Euro 250 billion. Conditions of the bailouts were austerity

measures and structural reforms.

Greece does not fulfill conditions, runs out of money, and votes for radical left Syriza party

Third bailout (2015) from EU and ECB worth Euro 100 billion. Syriza agrees to more austerity measures and structural reforms.

If Greece were to exit the Euro and default on its debt, ECB and EU would potentially loose more than Euro 600 billion

Here's What Membership in the Euro Did for Greece

Greek Yield Curve Shows Concern Over Default Starting to Ease

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

2. Potential Solutions

1. Quasi Permanent Transfer Payments(Model East Germany) Greek economy does not become competitive. Long-term transfer payments (€ 60 billion per year?) are necessary to keep up the standard of living.

2. Structural ReformsThis is the favorite model by European politicians. Debt relief coupled with severe structural reforms to make the Greek economy more competitive. This would lead to a drastic decrease of the standard of living for years to come.

Alexander Consulting EnterpriseAlexander Consulting Enterprise 04/22/2304/22/23

3. Exit the Currency UnionInvestors of Greek bonds get a haircut. New currency will be heavily devaluated.

Economy becomes competitive. Exports, tourism, and production for domestic consumption increase.

Access to international capital markets is obstructed. High interest rates. Drastic increase of import prices. Temporary decrease of standard of living. Danger of inflation.

4. ?

2. Potential Solutions cont.