Agnico Eagle update

-

Upload

mining-on-top -

Category

Economy & Finance

-

view

795 -

download

0

description

Transcript of Agnico Eagle update

Agnico Eagle

Update

Mining on Top: Stockholm

November 27, 2013 Ingmar Haga

FORWARD LOOKING STATEMENTS

The information in this document has been prepared as at November 21, 2013. Certain statements contained in this document constitute

“forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward looking

information under the provisions of Canadian provincial securities laws. When used in this document, the words “anticipate”, “expect”,

“estimate”, “forecast”, “will”, “planned”, and similar expressions are intended to identify forward-looking statements or information.

Such statements include without limitation: statements regarding timing and amounts of capital expenditures and other assumptions; estimates

of future reserves, resources, mineral production, optimization efforts and sales; estimates of mine life; estimates of future internal rates of

return, mining costs, cash costs, minesite costs and other expenses; estimates of future capital expenditures and other cash needs, and

expectations as to the funding thereof; statements and information as to the projected development of certain ore deposits, including estimates

of exploration, development and production and other capital costs, and estimates of the timing of such exploration, development and

production or decisions with respect to such exploration, development and production; estimates of reserves and resources, and statements and

information regarding anticipated future exploration; the anticipated timing of events with respect to the Company’s mine sites and statements

and information regarding the sufficiency of the Company’s cash resources. Such statements and information reflect the Company’s views as at

the date of this document and are subject to certain risks, uncertainties and assumptions, and undue reliance should not be placed on such

statements and information. Many factors, known and unknown could cause the actual results to be materially different from those expressed or

implied by such forward looking statements and information. Such risks include, but are not limited to: the volatility of prices of gold and other

metals; uncertainty of mineral reserves, mineral resources, mineral grades and mineral recovery estimates; uncertainty of future production,

capital expenditures, and other costs; currency fluctuations; financing of additional capital requirements; cost of exploration and development

programs; mining risks; community protests; risks associated with foreign operations; governmental and environmental regulation; the volatility

of the Company’s stock price; and risks associated with the Company’s byproduct metal derivative strategies. For a more detailed discussion of

such risks and other factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements

contained in this document, see the Company’s Annual Report on Form 20-F for the year ended December 31, 2012, as well as the Company’s

other filings with the Canadian Securities Administrators and the U.S. Securities and Exchange Commission. The Company does not intend,

and does not assume any obligation, to update these forward-looking statements and information. Alain Blackburn, a Qualified Person and the

Company’s Senior Vice-President, Exploration, reviewed the technical information disclosed herein. For a detailed breakdown of the Company’s

reserve and resource position see the February 13, 2013 press release on the Company’s website. That press release also lists the Qualified

Persons for each project.

agnicoeagle.com 2

NOTES TO INVESTORS

Note Regarding the Use of Non-GAAP Financial Measures

This document presents estimates of future “total cash cost per ounce”, “minesite cost per tonne”, and “all-in sustaining cost per ounce of gold

produced” that are not recognized measures under United States generally accepted accounting principles (“US GAAP”). This data may not be

comparable to data presented by other gold producers. These future estimates are based upon the total cash costs per ounce and minesite

costs per tonne that the Company expects to incur to mine gold at the applicable sites and do not include production costs attributable to

accretion expense and other asset retirement costs, which will vary over time as each project is developed and mined. It is therefore not

practicable to reconcile these forward-looking non-GAAP financial measures to the most comparable GAAP measure. A reconciliation of the

Company’s total cash cost per ounce and minesite cost per tonne to the most comparable financial measures calculated and presented in

accordance with US GAAP for the Company’s historical results of operations is set forth in the notes to the financial statements included in the

Company’s Annual Information Form and Annual Report on Form 20-F, for the year ended December 31, 2012, as well as the Company’s other

filings with the Canadian Securities Administrators and the SEC.

Note Regarding Production Guidance

The gold production guidance is based on the Company’s mineral reserves but includes contingencies and assumes metal prices and foreign

exchange rates that are different from those used in the reserve estimates. These factors and others mean that the gold production guidance

presented in this disclosure does not reconcile exactly with the production models used to support these mineral reserves.

agnicoeagle.com 3

Agnico Eagle Mines Limited Milestones

• 56 years of operating history, dating back to

1957 - Agnico Mines

• 1972, Agnico Mines merged with gold

exploration company Eagle Gold Mines Limited

to form today’s AEM

• 1994, AEM listed on the New York Stock

Exchange

• 2000, LaRonde’s Penna Shaft, the deepest

single-lift shaft in the Western Hemisphere

• 2005-2006, acquires the Suurikuusikko gold

deposit in Finland and the Pinos Altos property

in Mexico

• 2009 -10 Meadowbank mine and Meliadine

project in Nunavut

• 2012 La India property in Mexico

For many years, we have

adhered to a consistent,

low-risk strategy for

strengthening our gold

mining business and

creating shareholder

value.

4

Agnico Eagle Strategy Deliver meaningful per share growth in operating and financial metrics

Grow gold reserves and production in mining friendly

regions

Be a low-cost leader

• Goal is to move back into the industry’s lowest cost quartile

Acquire small, think big

• Buy early, add value through exploration and mine building

Maintain a solid financial position

• $1.05 B of available bank lines

• Only 173 M shares outstanding after 56 years of operating history

5

Agnico Eagle Today

>Million ounce gold producer

Focused on delivering total shareholder return

Lower risk

• Mature operations

• Low political risk jurisdictions

• Measured production growth

• Free cash flow generator

Committed to dividends - 30 consecutive years

6

Agnico Eagle Today

• Seven mines in three countries

• Mineral exploration in Canada, USA, Mexico and Scandinavia

LaRonde (Canada) 1988–2023

Goldex (Canada) 2008–(2017)

Kittilä (Finland) 2009–2037

Lapa (Canada) 2009–2015

Pinos Altos (Mexico) 2009–2028

La India 2013 -

Meadowbank (Canada) 2010–2019

AGNICO EAGLE – DELIVERING RESULTS IN A CHALLENGING

ENVIRONMENT

► Record quarterly gold production (Q3’13) of 315,828 oz at a total cash cost of

$591/oz

► 2013 Production guidance increased to approximately 1,060,000 oz of gold

► 2013 Total cash cost guidance reduced to approximately $690/oz

► 2013 all-in sustaining cost estimate is reduced to $1,025/oz (from $1,100/oz)

► Goldex and La India contributing to ~20% production growth through 2015

8

AGNICO EAGLE – MANAGEABLE, SOLID BUSINESS Full year 2013 production revised higher to 1,060,000 moz gold

YTD 2013

EXPECTED

PRODUCTION1

Production

Total

Cash Cost 2014 2015

(Gold oz) ($/oz) (Gold oz) (Gold oz)

LaRonde 130,445 $801 215,000 250,000

Goldex 1,505 N/A 49,000 85,000

Kittila 104,711 $564 165,000 160,000

Lapa 74,407 $687 96,000 65,000

Meadowbank 307,180 $828 367,000 350,000

Northern Business 618,248 $760 892,000 910,000

Pinos Altos 135,283 $402 136,000 161,000

Creston Mascota 23,361 $511 52,000 55,000

La India 40,000 81,000

Southern Business 55,043 $428 228,000 297,000

AEM Total 776,892 $692 1,120,000 1,207,000

1.As per Feb 14, 2013 press release.

CANADA 62%

FINLAND 13%

MEXICO 25%

Agnico Eagle 2015E Production

Profile By Country

9

IMPROVEMENTS IN CASH FLOW GENERATION Adjusting the business to the current gold price environment

2013

Reduction in capital and operating costs (announced Q2/13) $50 million

Reduction in exploration spending (announced Q2/13) $20 million

Estimated positive net impact on cash flow $70 million

2014

Reduction in capital costs (announced Q2/13) $200 million

Reduction in exploration spending (announced Q2/13) $50 million

Reduction in Labour and G&A costs (announced October 23, 2013) $40 million

Estimated positive net impact on cash flow $290 million

10

PROJECTED CAPITAL SPENDING

$0

$200 000

$400 000

$600 000

$800 000

$1 000 000

$1 200 000

2008A 2009A 2010A 2011A 2012A 2013E 2014E

Actual Estimate

Capital Expenditures (US$ 000’s)

11

FINANCIAL POSITION Adequate cash balance with financial flexibility

Long-Term Debt Maturities

2017 2020 2022 2024

Notes Outstanding (millions) $115 $360 $225 $100

Coupon 6.13% 6.67% 5.93% 5.02%

ALL AMOUNTS ARE IN US$, (unless otherwise indicated) Sep. 30, 2013

CASH AND CASH EQUIVALENTS (millions) $142

LONG TERM DEBT (millions) $950

AVAILABLE CREDIT FACILITIES $1.05 Billion

COMMON SHARES OUTSTANDING, BASIC (Q3’13 Weighted average, millions) 173.1

COMMON SHARES OUTSTANDING, FULLY DILUTED (Q3’13 Weighted average, millions) 173.5

12

KITTILÄ MINE

FINLAND

KITTILÄ MINE – Finland Production positively impacted by high-grade pit pillar

Record quarterly gold production on

increased throughput, and

recoveries

Good SAG mill performance and

simplified autoclave operation

following the Q2 2013 relining

750 tpd mill expansion remains on

budget and schedule

Remains Agnico Eagle’s largest

reserve asset, with significant

exploration and expansion potential

P&P GOLD RESERVES (million oz) 4.8

AVERAGE GOLD RESERVE GRADE (g/t) 4.5

Indicated resource (million oz)

(7.8 M tonnes @ 2.65 g/t) 0.7

Inferred resource (million oz)

(19.0 M tonnes @ 3.88 g/t) 2.4

Estimated LOM (years) 25

See AEM Feb 13, 2013 press release for detailed breakdown of reserves and resources.

14

Kittilä Mine

Agnico Eagle Finland

All amounts are in Euros, unless otherwise indicated

Full year 2012

Full year 2011

Revenues (millions) 184 163

Operating profit (millions) 96 57

Key numbers

Gold production (ounces) 176,000 144,000

Ore production (tons) 1,220,000 1,030,000

Exploration drilling (kilometers) 66 76

Other drilling (kilometers) 33 46

Kittilä Mine Location - Infrastrucure

• 55 km north of Kittilä

• 900 km north of Helsinki

• Excellent infrastructure: roads, airports, communication

• Mining license 857 ha

KITTILÄ MINE History

1986 First gold finding by the Geological Survey of Finland (GTK)

1998 Exploration by Swedish Riddarhyttan Recources AB

2002 Environmental permit for mining

2003 Mining license

2005 Agnico-Eagle Mines Limited became the sole owner of Riddarhyttan

2006 Completion of final feasibility study and decision to build the Mine

2008 Ore production started in May, milling in September

2009 The first gold pour in January

2010 Stable production

2012 Open pit mining ended, solely underground mining >

Areal view of the Kittilä mine

From exploration to gold bullion

Kittilä – Focused Exploration Builds Long Term Value

Ore reserves and resources As December 31, 2012

Au (g/t) Tonnage (000’s t) Au (000’s oz)

Proven/Probable Reserve 4.49 33,123 4,782

Indicated Reserve 2.65 7,854 700

Inferred Resource 3.88 18,966 2,366

KITTILÄ MINING

Mine Development

Underground Mine Design

Underground Development

5,268 m in 2006–2008

4,232 m in 2009

5,045 m in 2010

6,439 m in 2011

7,518 m in 2012

5.3 m

5.5

m

Gradient 1:7

Typical ramp profile

Underground Main Level 350 M

Fuel Bay

Washing Bay

Maintenance

Shop

Electrical

Station

Warehouse

Ventilation

Raise (Intake)

Cafeteria

Emergency Exit

Underground Main Level 350 M

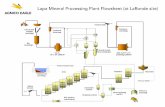

KITTILÄ ORE PROCESSING

Milling

Crushing – Grinding – Flotation – Pressure oxidation – Leaching – Electrowinning

Mill Process Flow Sheet

Sulphur

Flotation

Autoclave

CCD Circuit

Process Water

Acid Water

Sulphur

Concentrate

Doré

Bars

(CIL)

Leaching

Acid Wash &

Carbon

Stripping

CIL Tailings Disposal

SAG

Mill

Surge

Bin

Crushing

Oxygen Plant

Sulphur Flotation Tailings

Carbon

Flotation

Carbon

Concentrat

e

Grinding

Flotation Tailings Disposal

INFILTRATION FIELD

Cyclones

Carbon Reactivation Kiln

Electrowinning

Cell

Flotation Tailings

Thickener

Smelting

Concentrate

Thickener

CCD

Feed Tank

Mill

Water

Tank

Process

Water Tank Flash

Tank

Storage

Tank

Autoclave

Teed Tank

Column

Paste

Backfill

Plant

Paste

UNDERGROUND

MINE Neutralization

Cyanide

Destruction

KITTILÄ ENVIRONMENT

Kittilä Mine – Leader in Environmental Protection • Human and financial resources

• Good cooperation with Municipality,

tourist industry, authorities, local people

and associations - “Social License” to

operate

• In full compliance with environmental

legislation and permits

• Water treatment – maintaining the

ecological state of the Seurujoki river

• Process water - closed circuit - cyanide

destruction

31

TAILINGS FACILITY

Tailings Area

• Total area ~110 ha

• All ponds are lined with waterproof bitumen liners.

KITTILÄ MINE DEVELOPMENT

Kittilä Mine Expansion

Expansion project

• Expanding production from current rate of 3,000 ore tons per day to 3,750 ore tons per day

• Construction in 2013–2014

• Increased production start-up 2015

• Investment approximately EUR 80 million over three years

Feasibility study underway on underground ore

hoisting via shaft

• Objective: ore hoisting start-up in 2017-18

KITTILÄ 2013

Kittilä Mine – Workforce

36

The Mine employs directly close to 600 professionals

• 420 are Agnico Eagle own employees

• over 55% from Kittilä and 90% from Finnish Lapland

• Construction; 160 contractor employees

• 15% from Kittilä and 41% from Lapland

• Average age 39.3 years

• 11.7% of the workforce are women

KITTILÄ MINE - SUMMARY

• Kittilä Mine steady state operations

• Running at, or above designed capacity

• Recoveries above planned

• Dilution better than planned

• Cost control measures successful

• Aggressive Regional and Mine Site

exploration programs

• Mine Expansion is ongoing

• FS on shaft for ore hoisting

agnicoeagle.com 37

Kittilä Mine Development

Cash Flows 2006 - 2012

AGNICO-EAGLE FINLAND 755 M€

516 M€ 239 M€

526 M€ 98 M€

101 M€

Taxes ? Taxes 32 M€

Employees

State/Society

Gold Sales AEM Financing

63 M€

Foreign Suppliers Domestic Suppliers

AGNICO EAGLE

SUSTAINABLE DEVELOPMENT

AGNICO EAGLE – Sustainable Development Policy

Our Commitment Four fundamental values of our Sustainable Development Policy: operate safely, protect the environment, and treat our employees and communities with respect.

Respect for our Employees

We aim to maintain a safe and healthy workplace that is based on mutual respect, fairness and integrity.

Protect the Environment

We aim to minimize the effects of our operations on the environment and maintain its viability and its diversity

Operate Safely

We believe that all loss due to accidents/incidents is preventable. We aim to operate a safe and healthy work place that is injury and fatality free. We believe that if we all work together, we can achieve zero accidents in the work place and enhance the well-being of employees, contractors and communities.

Respect for our Communities

We aim to contribute to the social and economic development of sustainable communities associated with our operations

40

AGNICO EAGLE – Responsible Mining

PROMOTING A CULTURE OF ACCOUNTABILITY AND LEADERSHIP

Implementing a formal Health, Safety, Environment and Social

Acceptability Management System – a fully integrated management

system, the Responsible Mining Management System (RMMS).

Aim to further promote a culture of accountability and leadership

encouraging our employees to continuously improve their skills as well as

our sustainability performance.

System to be consistent with the ISO 14001 Environmental Management

System and the OHSAS 18001 Health and Safety Management System.

Will also integrate other industry standards such as the Mining

Association of Canada TSM Initiative and the Cyanide Management

Code. Application of the E3Plus Principles for Responsible Exploration

41

AGNICO EAGLE – 2012 Making a Different with our Employees

81% OF OUR EMPLOYEES COME FROM THE REGION SURROUNDING THE MINE

Training and development Opportunities

• Ensure employees have the tools and skills they need to perform their jobs efficiently and safely and to achieve their full potential by providing training that enhances employees’ personal and career development opportunities.

• Place a particular emphasis on health and safety training

Maximizing local employment

Goal to hire 100% of the workforce, including our management teams, directly from the local region in which the operation is located.

• Mexico, 99.9% of the Pinos Altos workforce is from Mexico.

• Finland, 99.9% from Finland

• Northern Canada, focus on creation of sustainable jobs and careers in mining for the Inuit population. Ongoing IIBA (Inuit Impact and Benefit Agreement) negotiations for the Meliadine project. Approximately 32% of the local mine workforce is from Inuit of the Kivalliq region of Nunavut.

42

AGNICO EAGLE – 2012 Making a Different in Our Communities

PAID $243 MILLION IN TAXES TO ALL LEVELS OF GOVERNMENT, INVESTED $4.9 MILLION IN THE COMMUNITIES IN WHICH WE OPERATE AND PROVIDED OVER $363 MILLION IN WAGES AND BENEFITS TO OUR GLOBAL WORKFORCE

Generating Employment and Economic Benefits

$363 million in global employee compensation, up from $308.8 million in 2011.

Through wages and benefits contributed:

$162 million to the economy of the Abitibi region of Quebec, Canada

$33 million to the economy of Finland

$91 million to the economy of Nunavut, Canada

$31 million to the economy of Chihuahua State in Mexico.

Taxes and royalty payments

Direct and indirect economic impact of employee wage spending on local goods and services is an important factor in overall contribution to host economies. Various payments in taxes and royalties to governments at all levels totaling US$243 million:

$87 million was paid in taxes and royalties in Quebec, Canada

$44 million in taxes and royalties to the economy of Nunavut, Canada

$42 million in taxes and royalties to the economy of Finland

$70 in taxes and royalties to the economy of Mexico.

Tax contributions 13% of total revenue .

Buying locally to support communities, stimulating the local economy and minimizing environmental impact of transporting materials from distant locations to sites. Continue to increase overall level of local spending at minesites.

Making a difference in our communities

Goal is to provide both Agnico Eagle and host communities with maximum returns on our investments in strategic health, education and capacity-building initiatives.

43

agnicoeagle.com