Africa Attractiveness Survey 2013 AU1582

-

Upload

kapinga-gaudence -

Category

Documents

-

view

222 -

download

0

Transcript of Africa Attractiveness Survey 2013 AU1582

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

1/76

Ernst & Youngs attractiveness survey

Africa 2013

Getting down to business

Growing Beyond

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

2/76

Cover:Durban, South Africa

Ernst & Youngs attractiveness surveys

Ernst & Youngs attractiveness surveys are widely recognized by our clients, the media and major

public stakeholders as a key source of insight on foreign direct investment (FDI). Examining the

attractiveness of a particular region or country as an investment destination, the surveys are

designed to help businesses to make investment decisions and governments to remove barriers

to future growth. A two-step methodology analyzes both the reality and perception of FDI inthe respective country or region. Findings are based on the views of representative panels of

international and local opinion leaders and decision-makers.

Emerging Markets Center

The Emerging Markets Center is Ernst & Youngs

Center of Excellence that quickly and effectively

connects you to the worlds fastest-growing

economies. Our continuous investment in them

allows us to share the breadth of our knowledge

through a wide range of initiatives, tools and

applications, thus offering businesses in both mature

and emerging markets an in-depth and cross-border

approach, supported by our leading and highly

globally integrated structure.

For further information on emerging markets,

please visit: emergingmarkets.ey.com

A

ttr

act

ivenes

s

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

3/76

02

04

26

8

40

50

64

Contents

RealityThe FDI numbers: glass half empty or full? Trends in economic activities, with a marked shift toward

investment in more value-added activities.

ContextAfrica's growth is real and sustainable Economy has trebled and a critical mass of economies ispoised to drive structural transformation.

Conclusion

PerceptionInvestor perceptions: the persistent gap Positive in relation to other regions with a shift in sector focus;the shift is from "why" to "how" for doing business.

ActionsGetting down to business How Africa can move forward; the principles for action forbusiness and government.

Africa2013 Foreword

Executive summary

Getting down to business 1

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

4/76

Welcome to the third annual edition of

Ernst & Youngs Africa attractiveness

survey. We release this at a time of ongoing

uncertainty in the global economy, with the

Eurozone in particular continuing to struggle.

In contrast, economic growth across much

of Africa has remained robust, with a

number of our economies still among the

fastest growing in the world. This continuesa remarkable decade of growth and

development, with not only economic, but

also social and political indicators all trending

in the right direction.

Despite the ongoing growth story, the

situation for FDI was a mixed one this

year. Overall, project numbers were down,

reversing the growth trend we saw last

year. This is disappointing and somewhat

surprising to us, particularly given the levels

of interest we experience from a range of

international companies in doing business

in Africa. It does reveal to us, though, that

the perception gap does remain a factor,

and that while many potential investors are

irting with the idea of Africa, work must

still be done on bridging the gap.

Having said that, there are a critical mass

of companies already doing business on the

continent that are very positive about the

continents current and future prospects.

These companies, many of which have been

doing business across Africa for decades,understand the real risks and opportunities,

and are investing in and for growth.

We are ourselves among these investors,

not simply analyzing from the sidelines,

but, in our 163rd year of doing business

on the continent, actively driving our

growth and integration journey. Last year

alone, we opened new ofces in Cameroon,

Chad and South Sudan, bringing to 33 the

number of African countries in which we

now have a physical presence. In addition,we are utilizing our Africa Investment Plan

to expand our senior level capacity and

capabilities in key markets such as Nigeria,

Angola, Kenya and South Africa, and to

continue the process of integrating our

people across the continent into a tightly

knit, coordinated and responsive

pan-African network.

As we look forward, there are clearly many

challenges that must still be addressed if the

African growth story is going to be sustainedover the coming decades. First and foremost,

solutions to these challenges will start with

Africans themselves from a growing self-

belief and condence in the future of the

continent, and the outstanding leaders that

are emerging across government, business

and civil society. There are, however, an

increasing number of multinational investors

that are believers and actively investing

for long-term growth in Africa. These, too,

should be viewed as critical partners and

enablers of Africas future.

This years report reinforces the point that

those already doing business in Africa

are overwhelmingly condent about the

continents progress and prospects. They are

growing their investments and operations,

expanding into ever-more diverse activities,

and supporting the long-term growth and

developmental agendas of an increasing

number of African economies. It is our view

that, in this context, it's time for a shift of

emphasis and mindset away from trying

to persuade the Afro-skeptics toward justgetting down to business and promoting

the successful growth of private enterprise

across the continent. The emphasis should

be on what needs to be prioritized in order to

further improve conditions for those already

doing business in these economies and

across the continent.

We have no doubt that, with a critical mass

of us pulling in the same direction, and with

collaborative leadership across governments

and those already doing business on thecontinent, Africa will continue its rise and will

become an investment destination of choice

in the decades to come.

Jay NibbeArea Managing

Partner,

EMEIA Markets,

Ernst & Young

Ajen SitaChief Executive

Ofcer,

Ernst & Young, Africa

Investing for long-term growth

Foreword

The sounding of the battle drumis important; the erce waging ofthe war itself is important; and thetelling of the story afterwards eachis important in its own way. I tell youthere is not one of them we could do

without. But if you ask me which ofthem takes the eagle feather, I willsay boldly: the story So why doI say that the story is chief amonghis fellows? ... Because it is only thestory that can continue beyond thewar and the warrior. It is the storythat outlives the sound of the wardrums and the exploits of bravewarriors. It is the story, not theothers, that saves our progeny fromblundering like blind beggars into the

spikes of the cactus fence. The storyis our escort, without it we are blind.Extract from Chinua Achebe.

Anthills of the Savannah.

Ernst & Youngs attractiveness survey Africa 20132

Foreword

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

5/76

Seeking the opportunity,managing the risk

tanarCharterehas a uniue prole in frica. ur usiness

is alanceacross markets in ast, est anouthern

frica - incluing countries in which we have a full presence

as a sustantial local ank, anin which we operate on a

transaction asis. his provies a varieinvestment portfolio

for our clients ancovers of uaharan . frica has

een central to tanarCharterefor over years, ut the

opportunity anthe gloal focus now feels palpaly ifferent.

hen I visit our clients in other parts of the worlparticularly

sia the rst thing they want to talk aout is frica.

he growth opportunities in frica are increasingly evient:

y , the continent will have the worls largest workforce,

with over half of the population currently under the age

of the past years have seen vast improvements in

macroeconomic staility, and a urgeoning and fast-growing

outh-outh trade and investment ow with over

illion of trade with China alone. frica presents a signicant

opportunity across multiple sectors with .trillion

of revenue epected y across resources, agriculture,

consumer and infrastructure, of which .trillion will e

in consumer industries alone. he rapid emergence of a middle

class, already equal in size to India, makes consumption a major

driver of economic growth across the region, and is one of the

most interesting yet less eplored opportunities across frica.

e are often asked aout the risks of operating in frica. hile the

existence of corruption, poverty and limited infrastructure mean

that the continent can still e a challenging place to do usiness,

we are seeing steady progress across most markets. ver the

last years, governance and political staility have improved

signicantly. lthough the levels of education, employment

and skills vary sustantially across the continent, there are

increasingly deep talent pools in a numer of key markets.

Importantly, while many of these challenges facing usinesses

in key frican markets are no more signicant than elsewhere in

the world, the rewards on offer are sustantial. Critically, it is this

risk-reward equation that makes frican investment so compelling

the returns remain among the highest in the world, while risks

are diminishing and can e effectively managed.

tandard Chartered has found a numer of factors helpful

in harnessing this opportunity and managing the risks. he

rst is commitment: frica rewards those who invest with a

long-term agenda, oth in respect of time and in conscious

contriution to the economy and society. econd is local

understanding: these are markets where critical information

is not pulished or uniformly accessile and taking the timeto uild local relationships and teams is key of our staff

in frica are frican and many of our client relationships are

multi-generationaloth key to giving us a differentiated risk

understanding. hird is people: ensuring that you hire, and more

critically train, the est in the market can e transformational.

Fourth is portfolio: although the growth trend for frica is

unequivocally positive, there will e more umps in the road than

in the case of sian growth, and having the aility to alance

risk across a numer of markets can e extremely helpful.

Investors who take the time to understand the nuances, risks and

opportunities in frica will e rewarded.

Standard Chartered is a leading international banking group. It has

operated for over 150 years in some of the worlds most dynamic

Africa and the Middle East.

By 2035, the continent will have

the worlds largest workforce,

with over half of the population

currently under the age of 20.

Diana ayeldAfrica CEO, Standard Chartered

Getting down to business 3

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

6/76

1 Africas riseis realfricas rise over the past decade has een

very real. hile skeptics still aound, and

there are people who still seek to deate the

point, the evidence of the continents clear

progress over the past decade is irrefutale.

ver this period, a critical mass of frican

economies have grown at high and sustained

ratesso much so that, despite the impact

of the ongoing gloal economic situation,

the size of the frican economy has more

than tripled since . he outlook also

appears positive, with many parts of the

region forecast to continue experiencing

relatively high growth rates and a numer

of frican economies predicted to remain

among the fastest growing in the world for

the foreseeale future.

he skeptics will most often point to the

widespread perception that most of this

growth has een driven y natural resources.

ue to the volatile nature of commodity

prices, an over-dependency on a few key

sectors clearly raises questions aout the

sustainaility of growth. he su-text of such

skepticism, though, is also often one tainted

y negative historical eliefs aout frica

as a conict-ridden, politically unstale,

hopelessly corrupt asket case.

However, a far more positive story

has emerged in the post-Cold ar and

post-partheid era: one of signicant

economic, political and social reforms

of a process of democratization that has

taken root across much of the continent

of ongoing improvements to the usiness

environmentof exponential growth in

trade and investmentand of sustantial

improvements in the quality of human

life. hese fundamental improvements

have provided a platform for the economic

growth that a large numer of frican

economies have experienced over the

past decade. nd, despite perceptions

to the contrary, less than one-third of

fricas growth has come from natural

resources. he rest has come from a range

of other sectors, including agriculture,

manufacturing, construction, and, in

particular, services.

here is, therefore, good reason to pause

and celerate the progress that frica has

made. t the same time, though, individual

countries and the region as a whole still need

to address signicant challenges in order

to sustain this progress, and to emulate the

kind of developmental path we have seen

in places like outheast sia over the past

years. e are of the view that FI

will play a key role in this process as oth a

source of capital, ut, more importantly, as a

catalyst for jocreation, skills development,

technology transfer, and ultimately,

the longer-term diversication and

transformation of key frican economies.

Executive summary

Ernst & Youngs attractiveness survey Africa 20134

Executive summary

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

7/76

2 owever, FDI numbers do not fully reectthe broader growth storyespite the ongoing growth and progress,

greeneld FI projectsinto frica dropped

year on year in . lthough this is

oviously disappointing, it should e noted

that the decline occurred in a context in

which there were sustantial declines in FI

projects gloally. In fact, the gloal situation

was such that frica actually grew its overall

share of FI project ows from .to ..

Nonetheless, investment from developed

markets in particular was disappointing.

lthough FI projects from the grew,

those from the and France, the other

two leading developed market investors

in frica, were consideraly down. In

contrast, greeneld investments from

emerging markets into frica grew once

. Our primary source of FDI data is the fDi Markets database.This tracks greeneld (i.e., a form of foreign investment wherea parent company invests in establishing a completely newenterprise) and signicant expansion (browneld) FDI projects,and does not include mergers and acquisitions (MandA), jointventures (JVs) or other forms of equity investments. There is nominimum size for a project to be included, but every project hasto create new direct jobs.

again in , continuing the trend of

the past three years. In the period since

, this category of investment from

emerging markets into frica has grown at

a healthy compound rate of over ., in

comparison to investment from developed

markets, which has grown at only ..

Intra-frican investment has eenparticularly impressive over this period

since , growing at a .compound

rate. outh frica has een at the forefront

of growth in intra-frican and roader

emerging market investment, and was,

notaly, the single largest investor in FI

projects in frica outside of outh frica

itself in . his underlines a roader

trend of growing condence and optimism

among fricans themselves aout the

continents progress and future.

here has also een an important shift in

emphasis in investment into the continentover the past few years, in terms of oth

destination markets and sectors. hile

investment into North frica has largely

stagnated mainly due to recent political

dynamics, FI projects into su-aharan

frica have grown at a compound rate of

since . mong the star performers

attracting growing numers of projects

have een hana, Nigeria, enya, anzania,

amia, ozamique, auritius and outh

frica.

t the same time, the trend of growing

diversication continues, with an

ever-increasing emphasis on services,

manufacturing and infrastructure-related

activities. o illustrate the point, in ,

extractive activities represented .of

FI projects and .of capital invested

in fricain , it was a mere .of

projects and of capital. In comparison,

services accounted for .of projects

in up from .in , and

manufacturing activities accounted for

.of capital invested in up from.in .

3 The perception gap remains a barrierfor new investorsur Africa attractiveness survey

shows some progress in terms of investor

perceptions since our inaugural survey in

. he majority of respondents are

positive aout the progress made in and theoutlook for frica. frica has also gained

ground relative to other gloal regions:

whereas, in , it was only ranked ahead

of two other regions, this year, it was ranked

ahead of ve other regions the former oviet

states, astern urope, estern urope, the

iddle ast and Central merica.

However, the ig take away for us from

this years survey is the stark and enduring

perception gap etween those respondents

who are already doing usiness in frica

versus those that have not yet invested inthe continent. hose with an estalished

usiness, who understand the real rather

than perceived risks of operating in frica,

who have experienced the progress made

and see the opportunities for growth, are

overwhelmingly positive. ome of these

usiness leaders elieve that fricas

attractiveness as a place to do usiness will

continue to improve, and they rank frica

as the second most attractive regional

investment destination in the world, after

sia.

In contrast, those with no usiness presence

in frica are far more negative aout fricas

progress and prospects. nly of these

respondents elieve fricas attractiveness

will improve over the next three years, and

they rank frica as the least attractive

investment destination in the world.

Getting down to business 5

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

8/76

4 Focus on enabling those alreadydoing business in Africahe fact that there are a numer of

companies with an already-estalished

presence in frica that are very positive

aout the continents growth prospects

and are getting down to usiness is crucial.

hese are elievers in the frica growthstory, who do not need convincingthey are

growing their investments, creating new

jos and focusing on long-term, sustainale

growth opportunities across the continent.

he numers also indicate that these

companies, many of which have een doing

usiness on the continent for decades,

are expanding their operations in frica,

increasing their investments in greeneld

projects, reinvesting their local earnings,

strengthening local supply chains and

enterprise, developing local skills, and

generally focusing on long-term growth infrica. hese companies are already deeply

committed to the future of the continent, oth

nancially and emotionally.

e elieve it is, therefore, time for a shift of

emphasis and mindset away from trying to

persuade the skeptics toward promoting and

enaling those already investing and doing

usiness in frica.

ur survey highlights two key constraints

that these companies face in doing usiness

across the continent, and for which solutions

should e prioritized:

Transport and logistics infrastructurehere remains a signicant decit inphysical transport infrastructure roads,

rail, ports, etc.in frica, and this clearly

needs to e addressed. However, he orld

anks ogistics erformance Index I

illustrates that the quality of infrastructure

is only one of several factors contriuting

to transport and logistics cost and

inefciencies. he I analysis indicates

that the inefciency of customs and order

management, for example, is as important

a factor in the relative underperformance of

many frican countries.

Countries, such as orocco, that are making

sustantial improvements in transport and

logistics, are the ones that have implemented

long-term and comprehensive reforms

and investments across the transport and

logistics supply chain. hile there is no cut-

and-paste approach, case studies indicate

that, as important as investment in physical

infrastructure is for improving transport and

logistics in most frican countries, so too

is related improvements in customs, order

management and regional facilitation and

integration.

Anti-bribery and corruption initiatives

erceptions are often that corruption isrife across frica. he facts, though, tell

us that the extent to which it is a major

issue varies widely, with several frican

countries enchmarking well against other

emerging markets. Nevertheless, people

doing usiness on the continent clearly

identify riery and corruption as a key

constraint. In terms of addressing this

constraint from a government perspective,

the gap is argualy less in developing

relevant anti-riery and anti-corruption

Clegislation as it is in the effective

implementation thereof. nd, of course,

riery and corruption are not issues forgovernment aloneattention also needs

to e given to addressing the role of the

private sector. rawing on work of the

frican evelopment ank, Cand

ransparency International, we provide

some thoughts for improvements in

addressing the challenge of riery and

corruption.

Ernst & Youngs attractiveness survey Africa 20136

Executive summary

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

9/76

Principles for action

Five critical success factors, developed by Ernst & Young for the Strategic Growth Forum Africa 2013.

etting down to usiness implies a ias to actionwe need to see a

shift toward moving on and getting things done. However, we also

need to ensure that government, usiness, the donor community

and roader civil society are all working together toward achieving

the same long-term ojectives of economic growth and social

development. his does happen, ut often haphazardly and to

a greater or lesser extent across different parts of frica. o

accelerate our progress, we need a more systemic and joined-up

approach to working together to increase private investment,

create more sustainale jos, transfer new technologies and skills,

and realize fricas true economic and human potential over the

next few decades.

ut effective action needs to e grounded in an intellectual and

emotional framework that ensures we are all on the same page.

e elieve it is, therefore, important to consciously frame a set

of principles aout doing usiness in frica, not as a philosophical

inquiry, ut rather ecause our principles critically inuence

how we ehave as individuals and organizations. hey lead us to

participate or sit on the sidelines, to e old or meek, to uild or topull downa clear set of principles provides a framework for elief,

which, in turn, helps provide the condence and courage to act.

hile we do not pretend to have all the answers, ased on our own

experience of growing an frican practice across countries, and of

engaging with numerous private and pulic sector clients developing

and executing strategies for growth in frica, we suggest a set

of ve key principles. hese, we elieve, provide a framework

for action for usiness and government, and for supporting the

productive and mutually enecial expansion of private investment

in and across frica.

Perspective: assuming a glass-half-full perspective that

focuses rst on opportunity, and only then on the risks that

need to e managed.

Partnerships: investing in uilding strong collaorative

partnerships across government, usiness and communities.

Planning: adopting careful long-term planning, and patience

persistence and exiility in implementing those plans.

Places: emracing fricas diversity, ut ensuring the whole isgreater than the sum of the parts.

People: celerating, nurturing and developing fricas human

talentargualy the continents greatest resource.

Getting down to business 7

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

10/76

ContextDiverse African economies outperforming other regions in the world

Nairoi,Kenya.

Ernst & Youngs attractiveness survey Africa 20138

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

11/76

fricas growth is real

and sustainale

Key points

1 espite some ongoing skepticism,the past decade has een one of roustand sustained economic growth in frica.

2 In the period since , and inthe face of a tough gloal economy, theoverall size of the frican economy hasmore than treled.

3 High growth rates of individualeconomies are set to continue, withthe IF forecasting that of the fastest-growing economies in the worldthrough to will e in frica.

4wenty-seven frican countries

have already attained middle incomestatus, and at current growth rates, asmany as i.e., of countries onthe continentcould reach that statusy .

5 he directional trend of severaleconomic, political and social factorsgive us condence that a critical massof frican economies are poised todrive the structural transformationrequired over the coming decades to

not only sustain, ut even accelerate,growth and development.

In last yearsAfrica attractiveness report

(Building bridges), we highlighted the

perception gap between negative historical

beliefs about the continent and the positive

reality of Africas growth over the past

decade. In recent months, we have noted

some commentary that criticizes the

irrational exuberance associated with the

Africa growth story, suggesting that the

growth comes from a low base, is mainly

driven by commodity prices and is not likely

to be sustainable.

Skepticism, and the outdated image of

Africa as a poverty-stricken, disease - and

conict-ridden basket case that informs

this skepticism, still runs deep. And there

is, unfortunately, still enough bad news in

Africa to reinforce the negative stereotypes.

The reality of such a vast and diverse

continent is that as much as we may want

to celebrate the many economic success

stories from Botswana to Mozambique, to

Zambia, to Rwanda, to Angola, to Nigeria,

to Ghana, and so on there are also

Africas economic output(GDP, US$b)

2000 2004 2007 2009 2011 2012 2013 2015 2017

344.1

251.7

560.9

287.1

877.2

449.8

949.5

527.7

1295.8

618.7

1334.2

692.6

1415.7

741.2

1607.6

798.7

1844.6

899.9

Sources: IMF World Economic Outlook Database; Ernst & Young analysis.

North AfricaSubSaharan Africa

Multiplesince 2002

CAGR200212

CAGR200712

u-aharan frica x. . .

North frica x . .

frica x. . .

Getting down to business 9

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

12/76

several states that remain fragile. Despite

the progress of many, there continue to

be failures. Unfortunately, though, it is

too often the failures increasingly the

exception rather than the norm that

dominate the news headlines and reinforce

outdated stereotypes.

The reality is that a diverse range of African

countries have now experienced consistent

and robust growth for over a decade

certainly the longest period of sustained

growth since most countries attained

independence in the early 1960s. In the

period since 2002, the size of the overall

African economy has more than trebled

(and grown at twice the population growth

rate) over this period, the size of the sub-Saharan African (SSA) economy has grown

well over three-and-a-half times. What

makes this economic performance all the

more remarkable is that half of that decade

has been marked by a deeply troubled

global economy. Although many African

economies have been negatively impacted

by the situation in key trading partners

in Europe and North America, most have

remained remarkably resilient.

Whichever way one analyzes it, the

numbers tell us that a diverse and critical

mass of African economies are consistently

outperforming those in other, more

celebrated regions of the world:

According to research conducted by

Renaissance Capital, 11 African countries

grew at an annual rate of 7% or more

between 2000 and 2009.

The well-documented fact, based on IMF

data, that 6 of the 10 fastest-growing

economies in the world over the period20012010 were in Africa, adds further

substance to a story of robust and

sustained growth.

. Charles Robertson, Yvonne Mhango and Nothando Ndebele,Africa: The bottom billion becomes the fastest billion,Renaissance Capital, July 2011.

The story looks set to continue through

this year, with The World Bank, among

various other notable institutions,

forecasting growth for SSA (excluding

South Africa) of 6%, with a full third of

countries in the region growing at or

above 6%.

Looking forward, and according to the

IMFs most recent forecasts, 11 of the

worlds 20 fastest-growing economies

through 2017 will be African.

As of today, 22 SSA countries (45% of

the total), as well as ve North African

countries, have attained middle income

status as dened by The World Bankand,

if current growth rates are sustained,

13 more could reach middle income

status by 2025.

. Based on IMF estimates from the World Economic OutlookDatabase, October 2012.. The World Banks criterion for classifying economies is grossnational income (GNI) per capita. A country is classied as "middleincome if it has GNI of between US$1,026 and US$12,475. Wehave counted Equatorial Guinea as middle income, although it is,in fact, the rst African country to be classied as high income(i.e., GNI per capita in excess of US$12,475).. Shantayanan Devarajan and Wolfgang Fengler, Is Africasrecent economic growth sustainable?, Institut franais desrelations internationals, October 2012.

Asia

Source: Renaissance Capital.

Africa CIS Middle East Latin Americaand Caribbean

CEE

Africa accelerates past AsiaWith the highest number of countries that grew at 7% pa on average over 200009

198089 199099 200009

12

10

8

6

4

2

0

Ernst & Youngs attractiveness survey Africa 201310

Context

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

13/76

Projected GDP growth rate(% change year to year 201217)

Algeria4.29

Mali4.06 Chad

3.5

Ethiopia6.3

Kenya4

Tanzania6%

Rwanda6.5%

Uganda5.8%

South Sudan5.7%

Tunisia5.5%

Zimbabwe5.3%

Cameroon5%

Senegal4.7%

Ghana4.5%

DRC

6.2%

Zambia6.2

Botswana5.63

Mozambique6.88

Malawi7%

South Africa4.21

CAR4.5

Angola6.5

Namibia3.75

Niger4

Nigeria5.1

Morocco4.7

Libya4 Egypt

5.58

Source: Oxford Economics; Ernst & Young Growing Beyond Borders.2.5% to 3% 3% to 4% 4% to 5%5%

Getting down to business 11

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

14/76

Source: adapted from Shantayanan Devarajan and Wolfgang Fengler, Is Africas recent economic growth sustainable?, World Bank classications.

Sierre Leone

Senegal

Liberia

Cted'Ivoire

Niger

Nigeria

Benin

Togo

Ghana

Chad

Central AfricanRepublic

Cameroon

AlgeriaMorocco

Libya

Tunisia

Eritrea

Madagascar

Comoros

Seychelles

Mauritius

Reunion

Egypt

Ethiopia

Somalia

Djibouti

Kenya

Tanzania

Uganda

Rwanda

BurundiDemocratic

Republicof the Congo

Angola

Zambia

Mozambique

Malawi

Namibia

Botswana

South AfricaLesotho

Swaziland

Zimbabwe

GabonCongo

MaliMauritania

Cape Verde

GuineaGuinea-Bissau

Gambia

Sao Tome

and Principe

Equatorial Guinea

BurkinaFasso

Sudan

South Sudan

Likely middle income by2025

Possibly middle income by 2025

Unlikelymiddleincomeby 2025

Already middle income

Africa's rise to middle income

Ernst & Youngs attractiveness survey Africa 201312

Context

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

15/76

uring a trip to hana in , I had

reakfast with a senior anker. I highlighted

the challenges of an estalished hanaian

software usiness to secure a loan at the

prevailing interest rate of , a concern

echoed y several successful companies. He

explained that many other investments that

the ank was nancing deliver signicantly

higher rates of return. ranting the loan

at that interest rate was simply nancially

less attractive to the ank. His oservation

epitomises what we found in our research

at xford niversity Now is the time to

invest in Africa, Harvard Business Review,

: prots across a large sample of

rms in frica exceed those of similar rms

in sia and atin merica, ut investment

is scarce.

oday, the opportunities frica offers

for attractive commercial returns are

increasingly appreciated in oardrooms

around the world, and frequently touted in

the nancial press. s of pril , the

CI Frontier arkets frica Index gained

over the preceding months, more

than four times the gains of the and

Index. he hanaian stock exchange, as an

example, delivered this year to date.

Investment ows, however, remain

relatively small compared with other

regions, and are often concentrated in

sectors that do not have a sufcient jo-

creating impact. nemployment is argualy

the continents single iggest challenge

going forward. he frican conomicutlook reports that of the continents

million unemployed youths, million

have given up on nding a jo, many of

them women. he jos gap is much wider

once underemployment low-paying self-

employment and family work are taken

into account.

rolonged periods of joless growth pose

grave risks to fricas promise of staility

and prosperity. Investors have historically

avoided esta

lishing major manufacturingfacilities in su-aharan frica that could

serve as sustained drivers of employment.

here are, however, encouraging

gloal trends that increase the regions

competitiveness in manufacturing and

services, with prospects to create millions

of new jos.

ur analysis of gains in political staility,

deep investments in infrastructure and

improved environments for doing usiness

in select geographic regions in frica

suggests that the time for large-scale

manufacturing clusters is ripe. hese trends

are further amplied y fricas expanding

consumer market, with the worlds fastest

growing middle class and recent data on

wage ination and exchange rate pressures

in China and other sian manufacturing

hus.

In light of the shift in political and

economic fundamentals, fricas top

performing economies now have a credile

opportunity to aggressively pursue

diversied investments that draw young

talent into an expanding workforce.

Jean-Louis WarnholzCo-founder and Managing Director, Fastafrica

There are, however,encouragingglobal trends thatincrease the regionscompetitivenessin manufacturing

and services, withprospects to createmillions of new jobs.

Interview

Africa offers attractivecommercial returns

Getting down to business 13

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

16/76

One would expect these numbers to

speak for themselves. Indeed, if the focus

were on Asia, or even Latin America, we

suspect that the validity of the economic

growth story would be considered self-

evident. At the very least, it should give us

reason enough to pause and celebrate the

remarkable progress of a continent that was

dismissed at the beginning of the 2000s as

the hopeless continent.That said, it is

important, too, that we do not get caught

up in a latter-day gold rush mentality.Most African countries still have a long way

to go to emulate Asias sustained meteoric

growth. In many respects, Africa is today

at a point where many of the east Asian

economies were in the 1970s, and the likes

of India, Mexico and Turkey were in the

1980s. However, while there is no

. The reference is to a 2001 cover story in the Economist.In fairness, and given the signicant progress since that storywas published, the Economist has done an about turn, andmore recently published two far more positive cover storiesdocumenting the Africa growth story ("Africa Rising," December2011, and "Aspiring Africa," February 2013).

cut-and-paste answer to effective

economic growth and industrial policy,

we strongly believe that a critical mass of

African economies are poised to drive the

structural transformation required over

the coming decades. This will not only

sustain, but even accelerate, the growth and

development we have seen over the past

decade.

Gross national income per capita(2005 PPP US$)

Note: PPP is purchasing power parity.Source:

1990

2,100

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012

Ernst & Youngs attractiveness survey Africa 201314

Context

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

17/76

he Irahim Index of frican

overnance ranked auritius rst in good

governance. lso in , auritiuss

sovereign credit rating was increased to ,

with a stale outlook, y oodys Investors

ervice. his positive momentum and

roust growth can e attriuted largely to

the close partnership etween its pulic and

private sector.

Breaking the arriers to improve the ease

of doing usiness has seen auritius reak

through many frican stereotypes. If I had to

pinpoint a key factor in our success, it would

e the reforms that we enacted in the s.

his was when personal and income taxes

were halved, and we enacted legislation to

attract foreign direct investment from sia

for our exports. e empowered laor laws to

ensure our people do minimum overtime, so

that companies can e protale. directed

lending policy was adopted anks were

oliged to lend to our export processing zone

at rates lower than elsewhere. auritius

focused on growing key sectors of its

economy, such as tourism. t this time,

when other countries in the region were

focused on centrally managed economies, we

opted for a very different approach to ring

us the outcomes we were looking to achieve.

oday, the country is in a strong position.

Having maintained reasonale growth rates

through the years of the nancial crisis, it

also has excellent economic fundamentals,

such as a .udget decit. e have

continually een ale to reduce taxes, while,

at the same time, still receiving increases

in tax revenues. e are also looking into

moving to new sectors, such as nancial

services, as weelieve in supporting ourdifferent sectors of the economy. Further,

to simplify the ease of doing usiness,

we are streamlining regulations and the

permit process.

ll of these reforms and initiatives

have placed auritius in good stead and

have forced many usiness people across

the world to reconsider their perceptions

of frica. I elieve that our region can

e prosperous. he winds of change are

sweeping across frica, aleit at different

rates, ut I am optimistic aout the future.

Hon. Xavier-Luc Duval Vice Prime Minister, Mauritius

The positive momentumin Mauritius and itsrobust growth can beattributed largely tothe close partnershipbetween its public and

private sector.

Interview

Improving the environmentfor doing business in Africa

Getting down to business 15

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

18/76

There is no one overriding factor that

makes us condent about the sustainability

of Africas growth trajectory. Instead, there

are a number of economic, social and

political factors that are all moving in the

right direction; it is this directional trend

since the end of the Cold War and Apartheid

that is critically important. Among the more

important factors for us are the following:

1 Sound macroeconomicmanagementWe do not feel that it is an exaggeration

to suggest that a large number of African

economies have been better managed over

the past decade than their developed market

counterparts. Economic reforms that began

being implemented in the 1990s have laid

a foundation for the sustained growth that

we have subsequently seen. Signicantly

reduced budget decits and debt levels, for

example, have been a key factor. In a sampleof 15 SSA countries,the debt burden

measured as the stock of external debt to

. Analysis by Skolkovo Institute for Emerging Markets. Averageshave been calculated for the following 15 countries: Botswana,Burkina Faso, Cameroon, Ethiopia, Ghana, Kenya, Mauritius,Mozambique, Nigeria, Rwanda, Senegal, South Africa, Tanzania,Uganda and Zambia.

gross national income (GNI) decreased

from an average of 120% in 1994 to 21%

in 2011.While many developed markets

continue to struggle with massive debt

burdens, many African governments have

had far greater exibility to invest in growth.

Our own calculations9also show that

Africas ability to cover its total debt service

through export earnings has strengthened

on average fourfold since 2007, when

compared with 1990 levels. Similarly, and

despite growth rates, ination levels havedramatically improved over the past decade.

. World Development Indicators, World Bank, 2012.9. Using export income from goods and services and takingits ratio against total debt service. World Bank DevelopmentIndicator gures.

Improvement in macroeconomic indicators Ination External debt or GNI

1980s 1990s 2000s 2011 1980s 1990s 2000s 2010

Botswana . . . .9 . . . .

Burkina Faso . . . . .9 . . .

Cameroon 9. . . .9 . 9. . .

thiopia . . .9 . . . . .

hana . . . . . 9. . .

enya . . .9 . . 9. . .9

auritius . . . . . . . .

ozamique . . . . . . . .

Nigeria .9 . . . . . . .

Rwanda . . . .9 . . . .

Senegal .9 . . . . . . .

South frica n/a 9.9 . . n/a . . .

anzania . . . . 9.9 . . .

ganda . . . . . . . .9

amia 9. . . . 9. . . .

verage . . . . 9. 9. . .

Source: World Development Indicators (2012), The World Bank

Ernst & Youngs attractiveness survey Africa 201316

Context

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

19/76

2 Diversication of sources ofgrowthThere is a fairly common view that Africas

growth over the past decade has been

driven by natural resources. However,

while they are and will continue to be an

important contributor to growth, resources

have contributed less than a third of Africas

growth since 2000. The rest has come

from a range of other sectors, including

agriculture, manufacturing, construction

and, in particular, services. These growthpatterns are reected in the overall

structure of Africas total GDP (which is

this year forecast to break the US$2 trillion

mark). During a period in which the size of

Africas GDP has tripled, natural resources

(excluding agriculture) have made an

average contribution of less than 20%,

while services are moving ever closer to

accounting for 60% of value added.

3Growth and diversi

cation oftrading partnersGrowth in Africas trade with the rest of the

world has grown over fourfold since 2000

and has been another key driver of Africas

sustained economic growth. The EU as a

bloc remains Africas largest trading partner,

and trade between Africa and the EU has

grown at a compound rate close to 10% since

2000. However, the EUs relative share of

trade with Africa has shrunk considerably

over that period from over 50% in 2000

to around about 30% today as growth

in trade with other markets, particularlythose in the emerging world, has picked up.

Standard Bank, for example, estimates that

that BRICS (Brazil, Russia, India, China and

South Africa) total trade with Africa reached

US$340 billion in 2012 (i.e., Africas total

trade with the rest of the world in 2000),

representing a more than 10-fold increase

over the course of a decade.

. Simon Freemantle and Jeremy Stevens, BRICS trade isourishing, and Africa remains a pivot, Standard Bank Research,February 2013.

Source: adapted from Standard Bank Research.

2015 (est)

500

2000

11.3%

2010

22.9%

2000

27.9

2010

220.2

2012

340 201229%

BRICS Africa bilateral tradeBRICS Africa total trade

(US$ billion)

BRICS of Africa total trade

(%)60%China-Africaproportion of BRICStrade with Africa.

25%China-Africa trade wasroughly US$220 billion in2012, up to 25% year onyear.

x2Since the 2007 globalnancial crisis,the trade between BRICS

and Africa doubled.

12,3%

Sub-Saharan Africas contribution to GDP(%)

2000 2002 2004 2006 2008 2010 2011 Average

(200011)

Source: The World Development Indicators, World Bank, 6 Feb 2013.

Agriculture

Natural resources

Manufacturing

Services

16,3%19,7%

17,1% 16,1% 13,2% 12,1% 15,7%

13,4%11,6%

15,4% 18,6%22,5% 17,0% 18,1%

15,9%

14,9%13,7% 13,7% 12,8% 13,5%

12,4% 11,8%13,5%

54,2% 50,3% 52,0% 52,3% 55,2% 57,7% 58.0%53,9%

Getting down to business 17

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

20/76

fricans have known for more than years that infrastructure

should e a key priority. So why nowhy are we focusing on this

frican growth has generated greater demand. e have

huge demographic shifts creating higher expectations, as well

as increasing uranization, which means that of fricans

are projected to live in cities y . nd, since , intra-

frican trade has increased from aout Sillion a year to

over Sillion a year. gain, what has not kept pace is the

infrastructure itself. oday, countries are affected y chronic

power prolems. ransportation costs are on the up increasing

the costs of goods y at least in some landlocked countries. ealso know that only of frican is invested in infrastructure,

compared with aout in China. If we can close the gap, we will

add two additional percentage points to frican .

It has een well estalished that frica needs to spend

approximately S9illion a year for the next decade to upgrade

and maintain its infrastructure. e have nancing for aout

Sillion a year, so the decit each year is estimated aout

Sillion. e will also need to focus on the maintenance and

rehailitation of existing infrastructure, where a huge funding gap

also exists. Clearly, the need is urgent, and innovative and old

approaches are required a usiness-as-usual approach will not

sufce.

e are seeing a trend where frican leaders are now prioritizing

visile infrastructure programs and opportunities across different

regions of the continent. ere also seeing new sources of nancing

developing. he reliance on overseas development aid has fallen

ack since the nancial crisis, and infrastructure nancing must

look eyond aid. his wont e straightforward, ecause if you

divide up the project life cycle of nancing and look at it in terms of

preparation, construction and operation, in the rst phase we dont

see a lot of private sector activity it tends to e reliant on aid.

e now have to look to different ows of capital, such as fricas

foreign exchange reserves invested aroad, pension funds, domestic

issued and diaspora onds, remittances and sovereign wealth funds,

all of which can catalyze private sector investment in infrastructure.In addition, were also seeing massive quantitative easing programs in

urope and the S. So there are a lot emerging market funds that are

seeking yields elsewhere. e think a lot of these funds will try to nd a

home in frica.

But, of course, there is competition. For example, astern

urope needs over trillion for its infrastructure over the next

decade. his means we need to move from having a wishlist of

investale projects to having ankale projects. stalishing

ankaility and making it easier for the private sector to come

in is a key priority. hat we need now is an area conducive

usiness environment and projects that are transformative, and

commercially viale, that inspire investor condence and have a

catalytic role on the economy. From a regional and continental

infrastructure development perspective, the rogramme for

Infrastructure evelopment in frica Ialready provides good

candidates with high-level consensus.

The African Development Bank (AfDB) is a regional multilateral

economic development and social progress of African countries.

Ebrima FaalRegional Director, African Development Bank

We need to move from having awishlist of investable projects tohaving bankable projects.

Interview

The infrastructure de

citand opportunities in Africa

Ernst & Youngs attractiveness survey Africa 201318

Context

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

21/76

4 Investment in infrastructureInfrastructure gaps, particularly relatingto logistics and electricity, are consistentlycited as the biggest challenges by those

doing business in Africa. At a macro level,

too, Africas growth will be inherently

constrained until the infrastructure decit

is bridged. The ip side of this challenge,

though, is that strong growth has been

occurring despite such infrastructure

constraints consider the potential not only

to sustain, but to accelerate, growth as the

gap is narrowed. And the facts tell us that

the gap is being narrowed:

Our analysis indicates that, in

2012, there were over 800 active

infrastructure projects across different

sectors in Africa, with a combined value

in excess of US$700 billion.

South Africa had the most infrastructure

projects (with a combined value of close to

US$130 billion). The South African Ministerof Finance also recently announced that

approximately US$100 billion has been

allocated in the Governments budget for

spending on infrastructure projects over

the next three years.

Nigeria is next, with 106 infrastructure

projects with a value of close to US$100

billion. The East African countries of

Kenya, Uganda and Tanzania, together

with Mozambique, are also all in the top

10 in terms of number of infrastructureprojects, while Angola has the 4th highest

capital value overall.

The large majority of the total

infrastructure projects are related to

power (37%) and transport (41%).

Source: Africa Project Access, Business Monitor International; Ernst & Young analysis.

37% 299 projects 36% 293 projects 27% 225 projectsConceptual to feasibility Financial closure to

early implementation

In progress and near

completion

Number of projects(% share of total projects)

Top 10 African destination

countries for infrastructureprojects, up to February2013

Number ofprojects

Sum of capitalinvested

(US$ million)

South frica 9,9.

Nigeria 9,.

gypt ,.

ganda ,.

enya ,.

lgeria ,.

ozamique ,.

iya 9 ,.

anzania 9 ,.

Cameroon ,.

Source: Africa Project Access, Business MonitorInternational; Ernst & Young analysis.

Power plants andtransmission grids

Source: Africa Project Access, Business Monitor International; Ernst & Young analysis.

Roads and bridges Rail Water Airports Ports

Commercialconstruction

Industrialconstruction

Oil and gaspipelines

Housing Health care Residentialconstruction

Education

24.9%

Africa's infrastructure projects up to February 2013% share of total number of projects and capital invested by different sector activity (ranked by most projects)

Share of totalcapital invested

Share of totalprojects

37.0%

11.5%

17.6%

4.7%

10.3%

3.3%

4.6%

2.6%

4.7%

1.5%

9.6%

0.9%

0.4% 0.7%

0.9%0.2%

0.1%

10.6%

20.9%

7.3%

3.1%

7.2%

1.8%

6.4%

7.3%

Transport and logisticssectors account for:

42% of projects(as % of the total)

41.5%of capital invested

Getting down to business 19

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

22/76

5 Democracy has taken rootFrom the early days of independencein the 1960s right through the 1980s,

almost every African country was ruled

by some form of dictator.However, the

democratic elections in Namibia in 1989

symbolized a turning point in Africas

political development. Within months after

the Berlin Wall had fallen, Nelson Mandela

had been released from jail, and an era of

political reform and democratization had

. Between 1960 and the fall of the Berlin Wall in 1989, onlyve African countries held elections on any kind of regular basis.Of those, there was only a single instance in Mauritius of apeaceful, democratic transfer of power.

begun. Looking back on almost 25 years of

slow but steady progress, Africas political

landscape has changed dramatically. Some

form of regular democratic elections has

become increasingly the norm across most

parts of Africa. Although the process is

often not perfect, and there is still a long

way to go in many countries, the process

is very real and substantial. To illustrate

the point, between 1960 and the fall of

the Berlin Wall in 1989, only ve African

countries held elections on any kind ofregular basis, and there was only a single

instance in Mauritius of a peaceful,

democratic transfer of power. In contrast,

since 1990, we have seen well over 30

ruling parties or leaders changing through

a democratic process Kenyas presidential

elections in March this year being the

most recent example. Anyone with an

appreciation of history will know that it

took centuries for democracy to evolve and

stabilize in Western Europe. In this context,

Africas trajectory over the past 20 years is

remarkable.

Source: "African Elections Calendar 2011,"African Democracy Encyclopedia, The Electoral Institute for Sustainable Democracy in Africa website,www.eisa.org.za, accessed 15 April 2013.

Sierre Leone

Senegal

Liberia

Cted'Ivoire

Niger

Nigeria

BeninTogo

Ghana

Chad

Central AfricanRepublicCameroon

AlgeriaMoroccoLibya

Tunisia

Eritrea

Madagascar

Comoros

Seychelles

Mauritius

Reunion

Egypt

Ethiopia

Somalia

Djibouti

Kenya

Tanzania

Uganda

Rwanda

BurundiDemocratic

Republicof the Congo

Angola

Zambia

Mozambique

Malawi

NamibiaBotswana

South AfricaLesotho

Swaziland

Zimbabwe

GabonCongo

MaliMauritania

Cape Verde

GuineaGuinea-Bissau

Gambia

Sao Tomeand Principe

BurkinaFasso

Sudan

South SudanSierre Leone

Senegal

Liberia

Equatorial GuineaEquatorial Guinea

Cted'Ivoire

Niger

Nigeria

BeninTogo

Ghana

Chad

Central AfricanRepublicCameroon

AlgeriaMoroccoLibya

Tunisia

Eritrea

Madagascar

Comoros

Seychelles

Mauritius

Reunion

Egypt

Ethiopia

Somalia

Djibouti

Kenya

Tanzania

Uganda

Rwanda

BurundiDemocratic

Republicof the Congo

Angola

Zambia

Mozambique

Malawi

NamibiaBotswana

South AfricaLesotho

Swaziland

Zimbabwe

GabonCongo

MaliMauritania

Cape Verde

GuineaGuinea-Bissau

Gambia

Sao Tomeand Principe

BurkinaFasso

Sudan

South Sudan

No elections 2011

No elections held

Elections 2011

No elections 2012

No elections held

Elections 2012

African elections calendar 201112Updated May 2012

Updated December 2012

Ernst & Youngs attractiveness survey Africa 201320

Context

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

23/76

African election calendar 2013Updated April 2013

Country Election Date

Cameroon National ssemly, Senate and communes pr postponed from ul

Cte d'Ivoire ocal Fe

jiouti National ssemly Fe

gypt House of Representatives postponed from pr in four stages, endingin undate uncertain

Shura Council Second half of

thiopia ocal arly

House of the Federation indirect

resident indirect ct

quatorial uinea House of eople's Representatives and local ay

amia ocal pr

uinea National ssemly ostponed to un from ay

uinea-Bissau eople's National ssemly and local postponed from

enya residential, National ssemly and local ar postponed from ug

iya Constitutional referendum

residential, parliamentary and local , after referendum

adagascar residential rst round ostponed to ul from ay

residential second round and National ssemly ostponed to Sep from ul

ocal ct

Senate indirect ct or Nov , after local

ali residential, National ssemly and local ul

auritania Senate /memers, National ssemly, regional and local postponed indenitely from ay

auritius resident indirect Sep

ozamique ocal Nov

Rwanda Chamer of eputies

Somaliland House of Representatives ay

Swaziland House of ssemly and rural local ate

ogo National ssemly and local ar postponed from ct

unisia residential, parliamentary and local ate

residential second round ul

imawe Constitutional referendum ar

residential, National ssemly, Senate and local , after referendum

Source: "African Election Calendar 2013,"African Democracy Encyclopedia, The Electoral Institute for Sustainable Democracy in Africa website,www.eisa.org.za, accessed 15 April 2013

Getting down to business 21

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

24/76

very country has a unique history, is

coming from a different place and has a

different set of aspirations, ut actually,

when you cut across orders, a lot of the

countries are facing common challenges.

here are several frican countries that

have risen up the ranks of the orld Banks

oing Business indicators. auritius is a

leader numer 9 in the most recent

assessment. South frica is in the s, and

Rwanda is another up-and-coming country.

But there are still a numer of frican

countries that are clustered in the lower

ranks, and this rings the average for frica

down, which is still pretty low.

e know what the frontier is it is a

question of how to get governments to cut

through the red tape and make it easier

to do usiness. he recent successes

of auritius reak through so many

stereotypes, such as the notion that a lot of

frican countries are small and, therefore,

cannot grow. auritius has dispelled that

y going gloal and opening up its orders.

nother notion is that frican countries are

stuck in a trap of undiversied economies

and are not creating jos ut auritius

has shown that jos can e created,

particularly for youth and women. his is

particularly important.

I can think of several ways to uild trust

etween governments and the private

sector. First, countries need to start y

developing a common vision for their

future. hese can ring people together

as they pursue common goals, such as

ghting poverty, inequalities and creating

jos. Second, there also needs to e strong

institutions judiciary, free press and civil

service, as they are the interface

etweenthe private sector and the state. hird,

there needs to e a consistency in the tax

regime. Fourth, there needs to e clear

communication etween the two sectors

and, nally, transparency, which is essential

around pulic nances, procurement and

the government-usiness relationship.

hese are all extremely important to uild

trust with the private sector.

Asad AlamRegional Director, World Bank

Mauritius has dispelledmany stereotypesby going global andopening up its borders.

Interview

Improving the environmentfor doing business in Africa

Ernst & Youngs attractiveness survey Africa 201322

Context

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

25/76

Global best practices in Africa by Doing Business topic

Practice Examples

aking it easy tostarta usiness

Having no minimum capital requirement enya, adagascar,orrocco, Rwanda

Having a one-stop shop Burkina Fasso

aking it easy todeal withconstructionpermits

Having comprehensive uilding rules enya

sing risk-ased uilding approvals auritius

Having a one-stop shop Rwanda

aking it easy tootain anelectricityconnection

Streamlining approval processes utility otainsexcavation permit or right of way if required

Benin

Reducing the nancial urden of security deposits fornew connections

ozamique

aking it easy toregister property

Setting xed transfer fees Rwanda

aking it easy toget credit

llowing a general description of collateral Nigeria, Rwanda

aintaining a unied registry hana

istriuting data on loans elow of income percapita

enya, unisia

istriuting oth positive and negative creditinformation

South frica

istriuting credit information from retailers, tradecreditors or utilities as well as nancial institutions

Rwanda

rotectinginvestors

llowing rescission of prejudicial related-partytransactions

auritius, Rwanda

Requiring external review of related-party transactions gypt

aking it easyto pay taxes

llowing self-assessment Rwanda

llowing electronic ling and payment auritius, unisiaHaving one tax per tax ase Namiia

aking it easyto trade acrossorders

sing risk-ased inspections orrocco, Nigeria

roviding a single window hana

aking it easy toenforce contracts

aking all judgments in commercial cases yrst-instance courts pulicly availale in practice

Nigeria

aintaining specialized commercial court, division orjudge

Burkina Fasso, ieria,Sierra eone

llowing electronic ling of complaints Rwanda

aking it easyto resolveinsolvency

Requiring professional or academic qualications forinsolvency administrators y law

Namiia

Specifying time limits for the majority of insolvencyprocedures

esotho

Source: World Bank/IFC Doing Business 2013.

6 It is getting easier to do businessWhile Africas size, diversity andfragmented economies make it an

inherently complex place to do business,

conditions have signicantly improved

over the past decade. Using The World

BanksDoing Businessresearch as one

key indicator of trends, many African

economies have made substantial

progress. Focusing only on SSA, the World

Banks research shows that 45 out of the

46 sub-Saharan economies they track haveimproved their regulatory environments

for doing business since 2005. In fact,

among the 50 economies that have made

the biggest improvements over that

period, the largest share 19, or well over

a third is in Africa. Of these, Rwanda

has made the most progress overall, with

the Government pursuing a systematic

program to improve the environment

for doing business and promote private

sector growth. However, several others,

including Mauritius (the highest-ranked

African country, and also ranked above the

likes of Germany, Japan, Switzerland, the

Netherlands and France), Ghana, Nigeria,

Angola, Senegal, Egypt and Morocco, have

all made substantial progress.

Easy

100

Source: World Bank/IFC Doing Business 2013.

Doing businessThe regulatory environment for doing business

is improving

Doing business is

South Africa

Mauritius

Namibia

Kenya

Ghana

Swaziland

Ethiopia

Uganda

Lesotho

Gambia, the

Nigeria

Madagascar

Comoros

Cameroon

Rwanda

Benin

Senegal

TogoMauritiana

Mali

Angola

Guinea-Bissau

Congo, Rep.

Burkina Fasso

Congo, Dem. Rep.

Chad

Complex

0

Getting down to business 23

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

26/76

7 The quality of human life isimprovingImprovements in the quality of life are

not only a key indicator of the ultimate

impact of economic growth, but also of

long-term sustainability. While there is

obviously still a long way to go, the trends

point to signicant progress not only in

raising income levels, but in areas of health,

education and general welfare in many

parts of Africa:

According to The World Bank, the poverty

rate in Africa has been falling by one

percentage point a year since 1995. They

estimate that the proportion of Africans

living beneath the poverty line will have

reduced from 60% in 1995 to 38% in 2015.

At the same time, based on UNESCO

data, average literacy rates in Africa

have improved from 52% in the 1990s to

almost 65% today.

Reduction in the annual rate of child

mortality is accelerating (averaging over

3% for sub-Saharan Africa since 2000,

according to UNICEF data).

An analytical study by Xavier Sala-i-Martin

and Maxim Pinkovskiy backs up the view

that the quality of life in Africa is steadily

improving. In their paper,African Povertyis Falling Much Faster than You Think!

they reveal that there has been a sharp

and widespread reduction in poverty and

income inequality in Africa since 1995.

Source: uman Development Report Ofce (DRO) calculations, UNDP.

Source: uman Development Report Ofce (DRO) calculations, UNDP.

Human developmentSustained improvement in the UNs uman Development Index (DI)for African countries (0worst, 1best)

0.371

0.405

0.437

0.468

0.4960.523

1980 1990 2000 2005 2010 2012

Overall health levels are improvingSub-Saharan Africa DI ealth Index (0worst, 1best)

0.5

0.530.54

0.56

0.60 0.61

1980 1990 2000 2005 2010 2012

142.5

96.4

Source: uman Development Report Ofce (DRO)calculations, UNDP.

Sub-Saharan Africa under5 mortality(Deaths per 1,000)

1990 2010

Notes: The Education Index is one of the three pillars on which the overall HDIis built. The Education Index comprises two indices; 1. expected years of schooling(children), and 2. mean years of schooling (adults).

Source: Human Development Report Ofce (HDRO) calculations, UNDP.

Steady progress in education levelsHDI educational index for Africa

(0=worst, 1=best)

0.249

0.324

0.3970.419

0.445 0.445

1980 1990 2000 2005 2010 2011

Ernst & Youngs attractiveness survey Africa 201324

Context

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

27/76

A 30-year journey?

No right-minded person is suggesting that frica has een

transformed into an economic powerhouse in the space of a

few short years. here are still many challenges ahead, not

least of which is a roust structural transformation required

across many economies that will not only lessen dependencyon commodities, ut also expand the private sector, increase

productivity levels and, most of all, create jos. However, with

an increasingly solid foundation of economic, political and social

reform, together with resilient growth rates, we are condent

that the continent as a whole is on a sustainale upward

trajectory. his direction of travel, rather than the current

destination, is what is most important.

critical mass of frican economies will continue on this

journey. espite the fact that there will undoutedly e umps

in the road, there is a strong proaility that a numer of these

economies will follow the same developmental paths that some

of the sian economies, as well as economies such as exicoand urkey, have over the past years. By the s, we have

no dout that the likes of Nigeria, hana, ngola, gypt, enya,

thiopia and South frica will e considered among the growth

powerhouses of the gloal economy.

Getting down to business 25

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

28/76

ctoerBridge and River Nile in Cairo.

RealityFDI in Africa today

p.28 Greeneld investmentsinto Africa declined in 2012

p.29 But UNCTAD FDI datashows an increase in FDIcapital ows

p.31 There has been agrowing focus on key sub-Saharan African markets

p.34 Emerging marketscontinue to grow their shareof investment into Africa

p.36 South Africa emergesas a leading investor in thecontinent

p.37 ngoing diversicationof economic activities

Ernst & Youngs attractiveness survey Africa 201326

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

29/76

he FI numers:

glass half emptyor full

This time the continent really is on the rise theengines of development are still going strong. Democraticgovernance, political participation and economicmanagement look set to improve further. Many reformsalready introduced have yet to take full effect. Newinfrastructure, better technology, growing urbanizationand the return of emigrants will keep fueling business.

Some economists believe that Africas GDP numbers, ifanything, underestimate its real growth."Cheerleaders and naysayers, The Economist, March 2013.

Key points

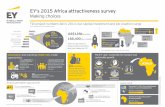

1 reeneld FI projects into thecontinent were down y year onyear, reversing the strong growth inprojects during .

2 his decline, however, occurred ina context in which gloal project owsshrunk y year on year.

3 In fact, as a proportion of gloalows, greeneld projects into fricaactually grew from .to .year on year.

4 Furthermore, according topreliminary FI data from thenited Nations Conference on rade andevelopment NC, capital owsinto frica actually increased y .last year in a context in which capitalows declined in every one of the BRICS,except for South frica.

5 group of su-Saharan economies,including hana, Nigeria, enya, anzania,amia, ozamique, auritius andSouth frica, have een among thegrowth leaders in terms of attractingFI projects in the period since .

6 hile FI projects from developedmarkets into frica declined markedlywith the exception of the , emergingmarkets continued to grow theirinvestments.

7 he stand-out performer in termsof emerging markets investment intothe rest offrica was South frica,sustaining the trend of roust intra-frican investment.

8 Intra-frican contriutions toFI projects continue a strong upwardtrend, recording a high compound rate

of .since , compared withCR for non-fricanemergingmarkets project investment into frica,and only .for developed marketsover the same period.

9 iversication of greeneld FIprojects also continued apace, withservices accounting for more than of projects in and .of capitaleing invested into manufacturing andinfrastructure-related activities acrossall sectors.

Getting down to business 27

www.ey.com/attractiveness

-

8/12/2019 Africa Attractiveness Survey 2013 AU1582

30/76

We are seeing a trend whereAfrican leaders are now prioritizingvisible infrastructure programsand opportunities across differentregions of the continent. Were also

seeing new sources of

nancingdeveloping.Ebrima Faal, Regional Director, African

Development Bank

Greeneld investments into Africa declined in 2012

At face value, 2012 was a disappointing

year, in that it reversed the year-on-year

growth we experienced in 2011, and

somewhat dampened our expectations of

steady growth in FDI projects. Having said

that, we do need to put these trends in

perspective:

Globally, green eld projects were down

by over 15% year on year in 2012,

so the background is one of decline

across the board.

In this context, Africas proportional share

of global greeneld projects actually

grew, continuing a trend that has seen

this share grow, in the course of a decade,

from 3.5% of the global total in 2003 to

5.6% in 2012.

It is also worth noting that the 764 new

greeneld projects this year is still higher

than the 678 in 2010, and signicantly

higher than anything that preceded the

peak of 2008.

Global FDI trend for number of new projects

2003 2007 2008 2011 2012

Africas total Africas share of global totalRest of the world total

9 212

12 652