ADR and GDR- CF ppt

-

Upload

loveabhin22 -

Category

Documents

-

view

4.566 -

download

38

Transcript of ADR and GDR- CF ppt

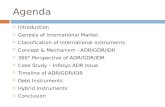

ADR & GDR

Submitted by:

Santiago – 2941

Appaiah – 2949

Desmond – 2957

Maria – 2965

Swathi – 2973

What is ADR

• ADR- American Depositary ReceiptsA negotiable certificate issued by a U.S. bank Represents a specified number of shares of a

foreign company ADRs are denominated in U.S. dollars.

How does ADR/GDR work ?

• Let us take Infosys example – trades on the Indian stock at around Rs.2000/-

• This is equivalent to US$ 40 – assume for simplicity • Now a US bank purchases 10000 shares of Infosys and issues them in

US in the ratio of 10:1• This means each ADR purchased is worth 10 Infosys shares. • Quick calculation means 1 ADR = US $400• Once ADR are priced and sold, its subsequent price is determined by

supply and demand factors, like any ordinary shares.

ADR RATIO

• Single

1 ADR = 1 SHARE

ADR Ratio = 1:1

• Multiple

1 ADR = 5 SHARES

ADR Ratio = 1:5

• Fraction

1 ADR = ½ SHARE

ADR Ratio = 2:1

ADR

TYPES of ADR : ADR listing :• Unsponsored ADR NASDAQ• Sponsored ADR AMEX

Level 1 NYSE Level 2 Level 3

Advantages of ADR

• It is an easy and cost effective way to buy shares of a foreign company• Reduces administrative costs and avoids foreign taxes on every

transaction• Helps companies which are listed to tap the American equity markets• Any foreigner can purchase these securities• The purchaser has a theoretical right to exchange shares ( non- voting

right shares for voting rights)

A bank certificate issued in more than one country for shares in a foreign company

Offered for sale globally through the various bank branches

Shares trade as domestic shares

GDR – Global Depositary Receipts

GDR – CUSTODIAN BANK – DEPOSITORY BANK

• Custodian Bank located in same country• Works with the Depository Bank and follows instructions

from the depository bank.• Collects, remits dividends and forwards notices

received from the depository bank.

GDR MARKET

• GDRs can be created or cancelled depending on demand and suply• When shares are created, more corporate stock is placed in the

custodian bank in the depositary bank account• The depositary bank then issues the new GDRs

• Factors governing GDR prices are company track record, analysts recommendations, relative valuations, market conditions and also international status of the company

GDR Listing

• London Stock Exchange• Luxembourg Stock Exchange• DIFX• Singapore Exchange• Hong Kong Exchange

GDR- Advantages and Dis-advantages

• GDRs allow investors to invest in foreign companies without worrying about foreign trading practices, laws

• Easier trading, payments of dividends are in the GDR currency• GDRs are liquid because they are based on demand and supply which

is regulated by creating or cancelling shares• GDR issuance provides the company with visibility, more larger and

diverse shareholder base and the ability to raise more capital in international markets

• However, they have foreign exchange risk i.e. currency of issuer is different from currency of GDR

In Simple terms - ADR / GDR ISSUE

COMPANY SHARE

DEPOSITARY BANK

INVESTOR

Difference between ADR and GDR

• Both ADR and GDR are depository receipts, and represent a claim on the underlying shares. The only difference is the location where they are traded.

• Depositary receipts traded in USA – ADR

• Depositary receipts traded in a country other than USA - GDR

India- ADR and GDR

• ADRs and GDRs are an excellent means of investment for NRIs and foreign nationals wanting to invest in India

• By buying these, they can invest directly in Indian companies without going through the hassle of understanding the rules and working of the Indian financial market – since ADRs and GDRs are traded like any other stock

• NRIs and foreigners can buy these using their regular equity trading accounts

COMPANY ADR GDR Bajaj Auto No YesDr. Reddys Yes YesHDFC Bank Yes YesHindalco No YesICICI Bank Yes YesInfosys Technologies Yes YesITC No YesL & T No YesMTNL Yes YesPatni Computers Yes NoRanbaxy Laboratories No YesTata Motors Yes NoState Bank of India No YesVSNL Yes YesWIPRO Yes Yes

Indian Companies using ADR/GDR