AdMob Mobile Metrics SEAsia Q110

-

Upload

edmond-wong -

Category

Documents

-

view

229 -

download

0

Transcript of AdMob Mobile Metrics SEAsia Q110

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

1/14

AdMob Mobile Metrics Report - Southeast Asia

Q1 2010

Find other reports at metrics.admob.com.

AdMob serves ads for more than 18,000 mobile Web sites and applications around the world. AdMob stores and analyzes the data from everyad request, impression, and click and uses this to optimize ad matching in its network. This report offers a snapshot of its data to provide insightinto trends in the mobile ecosystem in Southeast Asia.

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

2/14

AdMob Mobile Metrics Report - Southeast AsiaQ1 2010

New and Noteworthy

This Mobile Metrics Highlights Report breaks down, by country, trended manufacturer share across all mobile devices, smartphone OS share, and the top handsets and smartphones in the AdMob Southeast Asia network.

Highlights from the Report include:

* Over the past six months, Singapore has seen a dramatic uptake of iPhone OS devices. The number of unique iPhone OS devices in the country has increased close to 200%.

The iPhone OS is most dominant in Australia, Singapore and Hong Kong with a respective March 2010 market share of 88%, 89% and 78%. The 3 countries are responsible for 82% of the region's iPhone traffic.

The top 3 countries, India, Indonesia and Australia generated over 74% of traffic in the region in Q1 2010, while the bottom 3 countries, Malaysia, Thailand and Hong Kong accounted for almost 7% of traffic.

Within Southeast Asia, Nokia had the leading manufacturer share (47%), followed by Apple (16%) and SonyEricsson (11%) based on Q1 2010 traffic. The remaining manufacturers accounted for 26% of traffic.

Traffic from smartphone devices in Southeast Asia represented 38% of overall traffic in Q1 2010. Singapore had the highest traffic from smartphone devices at 84% of Q1 2010 traffic and Vietnam had the lowest at 20%.

Symbian OS is the most popular operating system in the region and accounted for 62% of smartphone traffic in Q1 2010. The iPhone OS came in second at 33% of Q1 2010 smartphone traffic. Combined, they represented

95% of smartphone traffic in Southeast Asia.

The Nokia N70 smartphone continues to be the most popular Symbian handset in Southeast Asia. Traffic from the handset has grown 26% quarter-over-quarter. In the Philippines and India, the N70 is the most popular

smartphone device.

Overall AdMob Southeast Asian traffic for Q1 2010 is up 51% quarter-over-quarter. AdMob received more than one billion ad requests from India in March 2010.

* Visit our metrics blog at metrics.admob.com for more commentary on the Mobile Metrics Report or to sign up for future reports.

AdMob publishes the Mobile Metrics Report to provide a measure of mobile Web and application usage from our network of more than 18,000 mobile Web sites and applications. AdMob share is calculated by the percentage ofrequests received from a particular handset; it is a measure of relative mobile W eb and application usage and does not represent handset sales. Please visit this blog post for more information on how to interpret the Metricsreport: http://metrics.admob.com/2009/10/placing-admob-metrics-in-context/.

AdMob's definition of a Smartphone is a phone that has an identifiable Operating System. Although it runs the iPhone OS, the Apple iPod touch is not included in the definition because it is not a phone.

Contents

Feature Section - Growth of iPhone OS

Southeast Asia Overview

India: Handset Data

Indonesia: Handset Data

Australia: Handset Data

Philippines: Handset Data

Thailand: Handset Data

Vietnam: Handset Data

Malaysia: Handset Data

Singapore: Handset Data

Hong Kong: Handset Data

Methodology

Find previous reports and sign up for future report notifications at m etrics.admob.com. 2

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

3/14

AdMob Mobile Metrics Report - Southeast AsiaQ1 2010

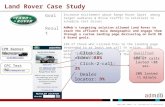

Featured: Growth of iPhone OS

Notes

This feature section examines the growth of the iPhone OS in Singapore, Malaysia, Hong Kong, Australia and Thailand. The countries have the greatest number of unique users ofiPhone OS devices in Southeast Asia and have experienced significant traffic growth from the platform over the past six months. The charts below break out the growth over the pastsix months by unique users and traffic.

* Over the past six months, Singapore has seen a dramatic uptake of iPhone OS devices. The number of unique iPhone OS devices in the country has increased close to 200%.

* Hong Kong was the leading country with the greatest monthly iPhone OS traffic growth over the past six months (3.4x). Singapore was a close second with 3.3x growth, followed byMalaysia with 2.1x.

* The iPhone OS is most dominant in Australia, Singapore and Hong Kong with a respective March 2010 market share of 88%, 89% and 78%. The 3 countries are responsible for 82%of traffic generated from the platform in Southeast Asia.

In Q1 2010, AdMob received 1.1 billion requests from iPhone OS devices in Southeast Asia.

For this report, Southeast Asia includes India, Indonesia, Australia, Philippines, Thailand, Vietnam, Malaysia, Singapore and Hong Kong.

0% 100% 200%

Thailand

Australia

Hong Kong

Malaysia

Singapore

Percentage increase in users, Sep 2009 - Mar 2010

iPhone and iPod touch User Growth,AdMob network

1.0

1.5

2.0

2.5

3.0

3.5

Se p-09 Oct -09 Nov-09 De c-09 Jan-10 Fe b-10 Ma r-10

TrafficRelativetoSep2009

Monthly iPhone OS Traffic Growth Since Sep 2009,

AdMob network

Australia Hong Kong Singapore Malaysia Thailand

Find previous reports and sign up for f uture report notifications at metrics.admob.com. 3

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

4/14

Southeast Asia Overview - Q1 2010Requests: -

Country Requests % of Requests % Share Change(1)

India 2,838,123,410 39.4% 3.2%

Indonesia 1,872,212,993 26.0% -0.7%

Australia 655,465,149 9.1% -0.8%

Philippines 649,675,098 9.0% -0.6%

Vietnam 403,511,099 5.6% 1.0%

Singapore 298,434,017 4.1% 1.6%

Hong Kong 185,281,968 2.6% 0.2%

Malaysia 161,466,291 2.2% -0.5%

Thailand 133,062,972 1.8% -3.4%

Total 7,197,232,997 100.0%

Notes(1)Share change calculated as percent of Q1 2010 requests less percent of Q4 2009 requests.

Other includes unclassified impressions and other manufacturers with < 1% share.

For t his report, Southeast Asia includes India, Indonesia, Australia, Philippines, Thailand, Vietnam, Malaysia, Singapore and Hong Kong.

Ad Requests by Country, Southeast Asia

1.0

2.0

3.0

4.0

5.0

6.0

TrafficRelativetoMar2009

Monthly Growth in Traffic Since Mar 2009,

Southeast Asia

Australia

Hong Kong

Indonesia

India

Malaysia

Philippines

Singapore

Thailand

Vietnam

47%

16%

11%

5%

1%

1%

19%

Handset Manufacturer Share, Southeast Asia

All Devices, Q1 2010

Nokia

AppleSonyEricsson

Samsung

LG

Motorola

Other

62%

33%

2% 1% 1% 1%

Operating System Share, Southeast Asia

Smartphone Only, Q1 2010

Symbian OS

iPhone OS

Android

RIM OS

Windows Mobile OS

Other

Find previous reports and sign up for future report notifications at metrics.admob.com. 4

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

5/14

India Handset Data - Q1 2010

Top Devices, March 2010

Brand Model % of Requests Share Chg %(1)

Nokia 3110c 5.6% -0.8%

Nokia 5130 5.4% -0.4%

Nokia 7210 3.5% 0.1%Nokia N70 3.4% -0.7%

Nokia N2700 Classic 3.2% 1.1%

Nokia N80 2.4% -0.2%

Nokia 6300 2.2% -0.3%

Nokia N73 2.2% -0.3%

Nokia 6233 1.8% -0.4%

Nokia 2626 1.5% -0.3%

Total 31.2%

Top Smartphones, March 2010

Brand Model % of Requests Share Chg %(1)

Nokia N70 13.0% -1.4%

Nokia N80 9.0% 0.2%

Nokia 6300 8.6% -0.3%

Nokia N73 8.4% -0.4%

Nokia N72 5.4% -0.2%

Nokia 5800 XpressMusic 4.3% 1.1%

Apple iPhone 4.0% -1.2%

Nokia 6600 3.9% -0.8%

Nokia 7610 3.3% -0.3%

Nokia N95 3.2% 0.1%

Total 63.1%

Notes

Other includes unclassified impressions and other manufacturers with < 1% share.

We received 2.8 billion requests from India in Q1 2010. In March 2010, smartphone traffic share was 26%. Please see page 14 for our definition of a smartphone.

(1)Share change calculated as percent of March 2010 requests less percent of December 2009 requests.

91% 89% 91% 93%

5%5%

5% 4%4%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Sh

are

ofRequests

Operating System Share, India

Smartphone Only

Other

Windows Mobile OS

iPhone OS

Symbian OS

Q1, Q2, Q3, Q4

60% 60% 59% 56%

7% 7% 9%9%

10% 9% 10% 9%

21% 21% 20% 23%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Device Manufacturer Share, India

All Devices

Other

LG

Apple

SonyEricsson

Samsung

Nokia

Find previous reports and sign up for future report notifications at m etrics.admob.com. 5

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

6/14

Indonesia Handset Data - Q1 2010

Top Devices, March 2010

Brand Model % of Requests Share Chg %(1)

Nokia E63 4.2% 1.8%

Nokia 5130 3.4% 0.7%

Nokia N70 3.1% -1.2%Nokia 6300 2.5% 0.1%

Nokia 6600 2.4% -0.5%

Nokia 3110c 2.2% -0.1%

Nokia E71 2.1% 0.5%

SonyEricsson W200i 2.0% -0.3%

Nexian NX G922 1.9% 1.1%

Nokia 7610 1.8% -0.5%

Total 25.6%

Top Smartphones, March 2010

Brand Model % of Requests Share Chg %(1)

Nokia E63 12.7% 5.6%

Nokia N70 9.3% -3.4%

Nokia 6300 7.6% 0.3%

Nokia 6600 7.2% -1.3%

Nokia E71 6.4% 1.7%

Nokia 7610 5.5% -1.5%

Nokia N73 4.6% -0.9%

Nokia 6120c 4.2% -0.5%

Nokia 3230 3.6% -1.1%

Nokia 5320 2.7% 0.1%

Total 63.7%

Notes

Other includes unclassified impressions and other manufacturers with < 1% share.

We received 1.9 billion requests from Indonesia in Q1 2010. In March 2010, smartphone traffic share was 32%. Please see page 14 for our definition of a smartphone.

(1)Share change calculated as percent of March 2010 requests less percent of December 2009 requests.

92% 93% 93% 93%

3% 3% 3% 3%3% 3%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Sh

are

ofRequests

Operating System Share, Indonesia

Smartphone Only

Other

iPhone OS

RIM OS

Symbian OS

Q1, Q2, Q3, Q4

57% 57% 56% 57%

24% 24% 23% 20%

3% 3%

15% 14% 16% 17%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Device Manufacturer Share, Indonesia

All Devices

Other

RIM

Samsung

Nexian

SonyEricsson

Nokia

Find previous reports and sign up for future report notifications at m etrics.admob.com. 6

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

7/14

Australia Handset Data - Q1 2010

Top Devices, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 59.2% -8.6%

Apple iPod touch 24.1% 3.7%

Nokia N97 1.5% 1.3%Nokia E63 0.9% 0.6%

LG KS360 0.8% 0.5%

Nokia 6300 0.8% 0.3%

Nokia E71 0.5% 0.2%

Nokia N95 0.5% 0.0%

Nintendo DSi 0.5% 0.4%

Sony PlayStation Portable 0.4% 0.0%

Total 89.2%

Top Smartphones, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 87.9% -5.4%

Nokia N97 2.2% 1.9%

Nokia E63 1.3% 1.0%

Nokia 6300 1.2% 0.5%

Nokia N95 0.8% 0.1%

Nokia E71 0.8% 0.3%

Nokia E63-3 0.6% 0.3%

Nokia 6120c 0.5% -0.1%

HTC Magic 0.5% 0.1%

HTC Hero 0.4% 0.0%

Total 96.1%

Notes

Other includes unclassified impressions and other manufacturers with < 1% share.

We received 655.4 million requests from Australia in Q1 2010. In March 2010, smartphone traffic share was 67%. Please see page 14 for our definition of a smartphone.

(1)Share change calculated as percent of March 2010 requests less percent of December 2009 requests.

93% 93% 92%88%

5% 5% 5%10%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Sh

are

ofRequests

Operating System Share, Australia

Smartphone Only

Other

RIM OS

Android

Symbian OS

iPhone OS

Q1, Q2, Q3, Q4

88% 89% 87%83%

5% 4% 5%7%

5% 5% 5% 6%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Handset Manufacturer Share, Australia

All Devices

Other

LG

Samsung

Nokia

Apple

Find previous reports and sign up for future report notifications at m etrics.admob.com. 7

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

8/14

Philippines Handset Data - Q1 2010

Top Devices, March 2010

Brand Model % of Requests Share Chg %(1)

Nokia N70 8.1% -1.1%

Nokia 6630 4.2% -0.7%

Apple iPod touch 3.7% 0.8%Apple iPhone 2.8% -0.2%

Nokia 3110c 2.5% 0.0%

Nokia 6680 2.3% -0.6%

Nokia 6120c 2.0% -0.8%

Nokia N73 2.0% -0.2%

Nokia 6300 2.0% -0.1%

Nokia N80 1.7% 0.0%

Total 31.3%

Top Smartphones, March 2010

Brand Model % of Requests Share Chg %(1)

Nokia N70 20.0% -0.2%

Nokia 6630 10.4% -0.5%

Apple iPhone 6.9% 0.4%

Nokia 6680 5.6% -0.7%

Nokia 6120c 4.9% -1.2%

Nokia N73 4.9% 0.2%

Nokia 6300 4.9% 0.4%

Nokia N80 4.1% 0.4%

Nokia 6600 3.7% -0.8%

Nokia 5800 XpressMusic 3.6% 1.1%

Total 69.1%

Notes

Other includes unclassified impressions and other manufacturers with < 1% share.

We received 649 million requests from Philippines in Q1 2010. In March 2010, smartphone traffic share was 39%. Please see page 14 for our definition of a smartphone.

(1)Share change calculated as percent of March 2010 requests less percent of December 2009 requests.

92% 92% 92% 91%

7% 6% 6% 7%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Sh

are

ofRequests

Operating System Share, Philippines

Smartphone Only

Other

iPhone OS

Symbian OS

Q1, Q2, Q3, Q4

65% 62% 63% 59%

7% 12% 7%7%

6%6%

6%7%

3%4%

4%4%

18% 16% 19% 22%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Device Manufacturer Share, Philippines

All Devices

Other

Sony

Samsung

Apple

SonyEricsson

Nokia

Find previous reports and sign up for future report notifications at m etrics.admob.com. 8

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

9/14

Thailand Handset Data - Q1 2010

Top Devices, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 37.7% 18.7%

Apple iPod touch 7.1% 3.8%

Nokia N70 4.5% -6.5%Nokia 5130 2.5% -0.3%

Nokia 5800 XpressMusic 2.3% -0.9%

Nokia 6300 2.2% -0.8%

Nokia 5530 XpressMusic 1.5% -0.2%

Nokia N73 1.4% -1.2%

Nokia N80 1.3% -2.4%

Nokia N72 1.2% -1.6%

Total 61.7%

Top Smartphones, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 56.0% 27.8%

Nokia N70 6.7% -9.6%

Nokia 5800 XpressMusic 3.4% -1.3%

Nokia 6300 3.3% -1.1%

Nokia 5530 XpressMusic 2.2% -0.3%

Nokia N73 2.1% -1.8%

Nokia N80 2.0% -3.6%

Nokia N72 1.8% -2.3%

Nokia N81 1.5% -1.9%

Nokia E63 1.4% 0.0%

Total 80.3%

Notes

Changes in AdMob's publisher mix affected smartphone operating system share in Thailand.

Other includes unclassified impressions and other manufacturers with < 1% share.

We received 133.1 million requests from Thailand in Q1 2010. In March 2010, smartphone traffic share was 65%. Please see page 14 for our definition of a smartphone.

(1)

Share change calculated as percent of March 2010 requests less percent of December 2009 requests.

28% 31%

58% 56%

69% 65%

36% 39%

4% 3%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Sh

are

ofRequests

Operating System Share, Thailand

Smartphone Only

Other

RIM OS

Windows Mobile OS

Android

Symbian OS

iPhone OS

Q1, Q2, Q3, Q4

22% 23%

49%45%

62% 61%

35%37%

5% 5% 3%4%

7% 7% 8% 8%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Handset Manufacturer Share, Thailand

All Devices

Other

HTC

SonyEricsson

i-mobile

Samsung

Nokia

Apple

Find previous reports and sign up for future report notifications at m etrics.admob.com. 9

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

10/14

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

11/14

Malaysia Handset Data - Q1 2010

Top Devices, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 29.8% 6.7%

Apple iPod touch 5.9% 1.6%

Nokia N70 2.8% -1.4%Nokia 5800 XpressMusic 2.5% 0.3%

Nokia N95 2.0% -0.9%

SonyEricsson W910i 1.4% -0.6%

SonyEricsson W705 1.3% 0.4%

Nokia N80 1.3% -1.1%

SonyEricsson K770i 1.3% 0.0%

Nokia N81 1.2% -0.8%

Total 49.5%

Top Smartphones, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 52.0% 11.6%

Nokia N70 4.9% -2.4%

Nokia 5800 XpressMusic 4.4% 0.4%

Nokia N95 3.4% -1.6%

Nokia N80 2.3% -1.9%

Nokia N81 2.1% -1.4%

Nokia N82 1.7% -0.5%

Nokia N73 1.7% -1.1%

Nokia N97 1.6% 0.6%

Nokia E71 1.6% -0.2%

Total 75.6%

Notes

Other includes unclassified impressions and other manufacturers with < 1% share.

We received 161.4 million requests from Malaysia in Q1 2010. In March 2010, smartphone traffic share was 57%. Please see page 14 for our definition of a smartphone.

(1)Share change calculated as percent of March 2010 requests less percent of December 2009 requests.

40% 42%50% 52%

57% 56%47% 44%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Operating System Share, Malaysia

Smartphone Only

Other

RIM OS

Windows Mobile OS

Android

Symbian OS

iPhone OS

Q1, Q2, Q3, Q4

27% 28%35% 36%

38% 37%

34% 32%

21% 22%19% 20%

13% 13% 12% 12%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Handset Manufacturer Share, Malaysia

All Devices

Other

SonyEricsson

Nokia

Apple

Find previous reports and sign up for future report notifications at m etrics.admob.com. 11

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

12/14

Singapore Handset Data - Q1 2010

Top Devices, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 74.9% 8.4%

Apple iPod touch 10.8% -1.8%

Sony PSP 0.9% -0.4%HTC Hero 0.7% -0.3%

Nokia E63 0.6% -0.3%

Google Nexus One 0.6% 0.6%

RIM BlackBerry 9000 0.5% -0.7%

Opera Mini 4 0.5% 0.5%

Motorola CLIQ 0.4% 0.4%

Nokia E71 0.4% -0.2%

Total 90.4%

Top Smartphones, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 89.3% 5.5%

HTC Hero 0.9% -0.5%

Nokia E63 0.7% -0.4%

Google Nexus One 0.7% 0.7%

RIM BlackBerry 9000 0.6% -0.9%

Motorola CLIQ 0.5% 0.5%

Nokia E71 0.5% -0.3%

Nokia 5800 XpressMusic 0.4% -0.2%

Nokia N73 0.4% 0.0%

HTC Magic 0.4% -0.7%

Total 94.5%

Notes

Other includes unclassified impressions and other manufacturers with < 1% share.

We received 298.4 million requests from Singapore in Q1 2010. In March 2010, smartphone traffic share was 84%. Please see page 14 for our definition of a smartphone.

(1)Share change calculated as percent of March 2010 requests less percent of December 2009 requests.

84% 86%91% 89%

9%9% 4% 5%

3%2% 4% 4%3%2% 1% 1%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Operating System Share, Singapore

Smartphone Only

Other

Windows Mobile OS

RIM OS

Android

Symbian OS

iPhone OS

Q1, Q2, Q3, Q4

79% 82%88% 86%

9%

9%4%

4%3%

3% 3% 3% 4%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Handset Manufacturer Share, Singapore

All Devices

Other

Samsung

RIM

SonyEricsson

HTC

Nokia

Apple

Find previous reports and sign up for future report notifications at m etrics.admob.com. 12

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

13/14

Hong Kong Handset Data - Q1 2010

Top Devices, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 57.4% 4.3%

Apple iPod touch 14.2% 2.2%

Google Nexus One 2.8% 2.8%HTC Hero 2.3% -1.3%

Motorola Milestone 1.4% 1.4%

HTC Magic 1.1% -1.4%

SonyEricsson W595 0.8% -0.5%

Nokia 6120c 0.8% -0.8%

Nokia 5800 XpressMusic 0.8% -0.1%

SonyEricsson W705 0.7% -0.1%

Total 82.5%

Top Smartphones, March 2010

Brand Model % of Requests Share Chg %(1)

Apple iPhone 77.9% 2.1%

Google Nexus One 3.8% 3.8%

HTC Hero 3.1% -2.1%

Motorola Milestone 1.9% 1.9%

HTC Magic 1.6% -2.1%

Nokia 6120c 1.1% -1.2%

Nokia 5800 XpressMusic 1.1% -0.3%

HTC Tattoo 0.7% 0.2%

Nokia 6300 0.6% -0.3%

Nokia N80 0.6% -1.2%

Total 92.4%

Notes

Other includes unclassified impressions and other manufacturers with < 1% share.

We received 185.3 million requests from Hong Kong in Q1 2010. In March 2010, smartphone traffic share was 73%. Please see page 14 for our definition of a smartphone.

(1)Share change calculated as percent of March 2010 requests less percent of December 2009 requests.

76%

68% 70%

78%

10%

13%

17%

13%

12%15%

10%7%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Operating System Share, Hong Kong

Smartphone Only

Other

Windows Mobile OS

RIM OS

Symbian OS

Android

iPhone OS

Q1, Q2, Q3, Q4

65%

55%61%

72%

12%

15%12%

8%

9%12% 8%

6%

7%7%

7%

5%

7% 9% 7% 5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Dec-09 Jan-10 Feb-10 Mar-10

Share

ofRequests

Handset Manufacturer Share, Hong Kong

All Devices

Other

Motorola

Google

HTC

SonyEricsson

Nokia

Apple

Find previous reports and sign up for future report notifications at m etrics.admob.com. 13

-

8/9/2019 AdMob Mobile Metrics SEAsia Q110

14/14

AdMob Mobile Metrics Report - Southeast AsiaQ1 2010

About AdMob

AdMob is one of the world's largest mobile advertising networks, serving billions of mobile banner and text ads a month across a wide range of leading mobileWeb sites and applications. AdMob helps advertisers connect with a relevant audience of consumers on mobile devices and gives publishers the ability to

effectively monetize their mobile traffic. Incorporated in April 2006, AdMob provides the tools, data, and business models fueling the explosive growth of

mobile media in more than 160 countries and territories worldwide.

About AdMob Mobile Metrics

AdMob serves ads for more than 18,000 mobile Web sites and applications around the world. AdMob stores and analyzes the data from every ad request,

impression, and click and uses this to optimize ad matching in its network. AdMobs monthly report offers a snapshot of its data to provide insight into trends inthe mobile ecosystem.

Methodology

For every ad request AdMob analyzes information available in the users mobile browser. From this, AdMob determines device capabilities and more using

open source tools and a variety of proprietary techniques. The result is a snapshot of the devices viewing the more than 10 billion monthly ad requests and

impressions that flow through AdMobs network. We believe this data will be valuable in identifying and tracking trends, evaluating market readiness andmore. AdMob also serves mobile ads into iPhone and Android applications. The traffic from these applications is included in the Metrics report.

There is no standard industry definition of a smartphone. AdMob's definition is based on Wikipedia: "A smartphone is a phone that runs complete operatingsystem software providing a standardized interface and platform for application developers" (http://en.wikipedia.org/wiki/Smartphone). AdMob classifies a

phone as a smartphone when it has an identifiable operating system and we continually update our list as new phones enter the market. Despite running theiPhone OS, the iPod touch is not a phone, and thus not considered a smartphone based on this definition.

Limits of this Data

Representativeness- AdMob does not claim that this information will be necessarily representative of the mobile Web as a whole or of any particular country-

market. AdMobs traffic is driven by publisher relationships and may be influenced accordingly. Because the data is pulled across ads served on more than15,000 sites and applications, we feel the data will be useful and may help inform business decision making.

Ad Request Classification - For some handsets and operator networks, it is difficult to collect full handset data. AdMob categorizes these requests as"unclassified" and does not serve targeted ads to these requests.

Please visit this blog post for more details on interpreting this report: http://metrics.admob.com/2009/10/placing-admob-metrics-in-context/

Questions

Email [email protected] if you have any questions or feedback for future reports.

Email [email protected] to sign up for future reports. Find previous reports and other resources at metrics.admob.com. 14