Additional Medicare Surtax on Earned Income and Net Investment Income Tax

-

Upload

nationalunderwriter -

Category

Education

-

view

76 -

download

2

Transcript of Additional Medicare Surtax on Earned Income and Net Investment Income Tax

Learn more, by going to www.NationalUnderwriter.com/IncomeTax

ADDITIONAL MEDICARE SURTAX ON EARNED INCOME AND NET INVESTMENT INCOME TAX

(from the NEW edition of The Tools & Techniques of Income Tax Planning)

What You’ll Find Inside:

• WhatistheMedicareSurtax?

• WhatIstheNetInvestmentIncomeTax?

• WhatTypesofIncomesAreSubjecttotheSurtaxes?

• HowDoestheAdditionalMedicareSurtaxWork?

• HowDoestheNIITSurtaxWork?

• HowCanIndividualsMinimizetheNIIT?

• Andsomuchmore!

The National Underwriter Company

Presents...

THE TOOLS & TECHNIQUES OF INCOME TAX PLANNING, 4TH EDITION

This single-volume reference takes you through all theincometaxtopicsyourclientsmayencounter,nomatterwhere they originate, providing easy-to-understand,practicalguidanceforsituationsthatareoftenconfusing.

111

INTRODUCTION

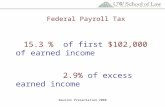

There are two basic ways to increase taxes. The most obvious way is to raise the rate brackets. The other way is to impose a surtax. A surtax is a “tax levied on top of another tax,”1 and is generally triggered when certain income levels are exceeded. The Health Care and Education Reconciliation Act of 20102 enacted two “flat” surtaxes. The “Additional Medicare Surtax” is a 0.9 percent tax on earned income, and the “Net Invest-ment Income Tax” (NIIT) is a 3.8 percent tax on net investment income.

WHAT IS THE MEDICARE SURTAX?

As the name suggests, the Additional Medicare Sur-tax is not a new surtax, but instead increases the surtax rate and extends the tax base of the Health Insurance tax. The Health Insurance tax—itself a previously existing surtax—is also known as the Medicare tax, and is part of the Federal Insurance Contributions Act and Railroad Retirement Tax Act Taxes (“FICA”).3 FICA is imposed on all earned income, including wage-type income (salaries, commissions, etc.) that are typically reported on a W-2, as well as self-employment income (including income from self-proprietors, single-member LLCs taxed as sole proprietors, and general partners’ distributive shares of partnership ordinary income).4

Effective for tax years 2013 and later, there is an Addi-tional Medicare Surtax of 0.9 percent added to the FICA wages and/or self-employment income in excess of the applicable thresholds.5 Once earned income exceeds the applicable threshold, the imposition of the Additional Medicare Surtax increases the overall Medicare tax rate to 3.8 percent (the same percentage as the flat NIIT rate, discussed below). The applicable thresholds for the Medicare surtax are defined in terms of earned income, and vary by filing status:

• $250,000 for a married couple filing jointly;

• $125,000 for a married individual filing separat-ely; and

• $200,000 for all other filing statuses.6

Although the Additional Medicare Tax is not imposed on the employer share of the Medicare tax, the employer is nonetheless obligated to withhold 0.9 percent of an employee’s wages in excess of $200,000 - without regard to whether such employee is actually subject to the tax.7

WHAT IS THE NET INVESTMENT INCOME TAX?

The Net Investment Income Tax (“NIIT”) is the other surtax enacted pursuant to The Health Care and

Chapter 11

ADDITIONAL MEDICARE SURTAX ON EARNED INCOME AND NET INVESTMENT INCOME TAX

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 111 9/18/2014 3:15:09 PM

Income Tax PlannIng

112

Education Reconciliation Act of 2010.8 Unlike the Addi-tional Medicare Surtax that is limited to individuals, estates and many trusts are also subject to the tax.9 For individual taxpayers, the NIIT is a 3.8 percent surtax that is imposed on the lesser of:

• a taxpayer’s net investment income; or

• the amount by which the taxpayer’s adjusted gross income10 exceeds the applicable threshold amounts (which are the same as the Medicare surtax threshold amounts discussed above).11

The threshold amounts for the NIIT are the same as the Additional Medicare Tax thresholds. But these thresholds are based on the taxpayer’s adjusted gross income, not earned income. Additionally, as discussed in more detail later in this Chapter, the threshold amount for trusts and estates is much lower than the thresholds of the individual taxpayers subject to the tax.12

In essence, NIIT is a surtax on net investment income that has already been subject to regular federal income tax. In operation, the computation of net investment income is comparable to the computation of taxable income. With regard to regular taxation, items of gross income comprise the tax base. As discussed in Chapter 3, taxable income equals gross income minus deduc-tions for the expenses necessary for generating that income. Similarly, with regard to NIIT, items of invest-ment income that have already been taxed (i.e., were included in gross income) comprise the NIIT tax base. Thus, similar to the computation of taxable income, net investment income is gross investment income minus deductible expenses properly allocable to such income.

However, the devil is in the details, and the com-plexity of NIIT calculations cannot be underestimated.

The process of computing the NIIT obligation requires several steps:

1. First, identify items included in gross income that fit the Code definition of “investment income.”

2. Second, identify deductions properly allocable to that income to determine the amount of “net investment income.”

3. The final step—assuming the applicable threshold for the imposition of the tax has been crossed—is to multiply the NIIT rate of 3.8 percent by the lesser of:

a. net investment income (as calculated in the second step), or

b. the difference between the taxpayer’s adjusted gross income and the applicable threshold.

Important caveat: Any item of income that is Medicare wage income or self-employment income is never considered net investment income, even if it would otherwise meet the Code definition. In that case, such income may be subject to the Additional Medicare Surtax.13

WHAT TYPES OF INCOMES ARE SUBJECT TO THE SURTAXES?

Each surtax has its own threshold (listed above) and tax base. The threshold is the triggering point of the sur-tax, and the tax base specifies the type of income that is subject to the surtax. The Additional Medicare Surtax threshold is based on the taxpayer’s total amount of earned income (defined to include Medicare wages and/or self-employment income) in excess of the applicable threshold amount, and its tax base is the taxpayer’s earned income.

The NIIT has the same threshold amounts, but it has a different tax base. It is applied to the lesser of either adjusted gross income—not earned income as is the case for the Medicare surtax.14—or net investment income. In other words, if the amount of net investment income is greater than the excess of adjusted gross income over the threshold amount, the NIIT would be imposed on the excess amount of adjusted gross income, rather than net investment income.

Example: Iris, a single taxpayer has adjusted gross income of $208,000, including a net invest-ment income of $10,000. As a single taxpayer she has a threshold amount of $200,000. In Iris’ case, the NIIT would be imposed on the $8,000 in AGI that is beyond the threshold amount—rather than her $10,000 of net investment income—because that is the lesser of the two amounts.

Significantly, any income subject to the Additional Medicare Tax is not also subject to the NIIT.15 This means that wages and self-employment income are never included in the NIIT tax base, and thus are not

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 112 9/18/2014 3:15:09 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

113

subject to the NIIT. On the other hand, if the taxpayer has wages and/or self-employment income as well as net investment income, it is possible to be subject to both surtaxes. The Additional Medicare Tax could be imposed on the wage and self-employment income, while the NIIT could be imposed on the investment income. The example below illustrates the following fact pattern in which a taxpayer is subject to the Additional Medicare Surtax and the NIIT on top of the regular income tax.

Example: In 2014, Ira, a single taxpayer has $410,000 of taxable income which includes wages of $300,000 and net investment income of $110,000. After some preliminary calculations, Ira’s adjusted gross income is determined to be $350,000.

Ira’s regular tax without regard to the surtaxes is $119,476.16 The Additional Medicare Surtax is also imposed because the taxpayer’s earned income of $300,000 exceeds the threshold of $200,000 for a single individual,17 resulting in $900 of Additional Medicare Surtax on the excess $100,000. Finally, the NIIT is also imposed because Ira’s adjusted gross income exceeds the NIIT threshold of $200,000 for a single individual.18

Once the threshold is triggered, the tax would be computed on:

• the lesser of net investment income ($110,000); or

• the excess of adjusted gross income over the threshold amount ($150,000).

In Ira’s case, the NIIT would be $4,180 (3.8 percent of $110,000).

Taxable Income $410,000 Including:

Wages $300,000 Net Investment Income $110,000 Adjusted Gross

Income $350,000

Step 1: Compute Regular Income Tax on $410,000 of taxable income $119,476

Step 2: Compute Additional Medi-care Surtax on wages in excess of $200,000.

0.9% of $100,000 = $900

Step 3: Compute NIIT on $110,000 (the lesser of NII or AGI in excess of the threshold amount) $4,180

This example demonstrates that the two surtaxes are subject to their own thresholds and their own tax rates that are levied on top of the regular income tax. Based on this illustration, the total tax liability with respect to the three taxes would be $124,556—of which $5,080 would be attributable to the two new surtaxes.

HOW DOES THE ADDITIONAL MEDICARE SURTAX WORK?

Although perhaps not the norm, it is possible for a taxpayer to have W-2 wage income as well as self-employment income from a business outside of his or her employment. As stated above, the Additional Medicare Surtax is imposed on any combination of Medicare wages and self-employment income in excess of the applicable threshold. This is a relatively simple calculation, as demonstrated in the example below.

Example: A single taxpayer has Medicare wages of $275,000 and self-employment income of $100,000. Based on the single filing status, the applicable threshold is $200,000, and the total of Medicare wages and self-employment income exceeds the threshold by $175,000. To compute the Additional Medicare Surtax, multiply that amount by the surtax rate of 0.9 percent.

HOW DOES THE NIIT SURTAX WORK?

As stated above, the 3.8 percent NIIT surtax is imposed on “net investment income.” In order to compute “net investment income,” it is necessary to

Medicare wages $275,000

Self-employment income $100,000

Total income subject to Additional Medicare Surtax

$275,000 + $100,000 = $375,000

Threshold for single taxpayer $200,000

Income subject to Additional Medicare Surtax (amount by which Medicare and SE income exceeds threshold)

$375,000 − $200,000 = $175,000

Additional Medicare Surtax rate 0.9%

Additional Medicare Surtax obligation

$175,000 × 0.9% = $1,575

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 113 9/18/2014 3:15:09 PM

Income Tax PlannIng

114

The term “trade or business” is defined the same way for net investment income as it is for regular income in Code section 162.21 With regard to the second require-ment, income “derived in the ordinary course of a trade or business” means the type of income the trade or business was designed to generate. Finally, the third requirement requires the taxpayer to materially partici-pate in the trade or business that generates such income so that the activity is non-passive with respect to the taxpayer. In addition to this general exception, there are other exceptions set forth in the Code and regulations.

Figure 11.1 sets forth each of the five enumerated items of investment income with examples of circum-stances in which they are either included or excluded from the scope of the NIIT. These examples assume that the income is not included in a general partner’s distributive share of ordinary income or reportable on Schedule C for a sole proprietor or single-member LLC that is treated as a disregarded entity.

Income from Passive Business Activity

As discussed above, Code section 1411(c)(1)(A)(i) specifically enumerates five types of income treated as investment income. Conversely, Code section 1411(c)(1)(A)(ii) broadly includes all passive activity business income as net investment income.

However, there are exceptions. Passive activity income would not be considered investment income if:

1. the income was generated in a trade or business;

2. the income was “earned” in the ordinary course of that trade or business; and

3. the trade or business activity generating the income is non-passive with respect to the taxpayer.

An important issue is whether a shareholder of an S corporation must treat his or her distributive share of ordinary income (Line 1 of Schedule K-1 of Form 1120S) as investment income. The exception above can give a curious result. It is possible that the distribu-tive share of the ordinary income of one shareholder may be treated as net investment income whereas the distributive share of another shareholder may be excluded from net investment income because, for an S corporation, the determination of whether an activity is non-passive is made at the shareholder level rather than the entity level.39

determine which items of regular gross income are considered “investment income.” In the most gen-eral terms, Code section 1411(c) defines “investment income” as what would commonly be considered investment income. Beyond that, what else is con-sidered investment income is more complicated. In essence, investment income also includes any passive activity income derived from a trade or business. As discussed in Chapter 3, a passive activity is any trade or business activity in which the taxpayer does not “materially participate.”19 Generally, a taxpayer materi-ally participates in an activity if he is involved in the operations of the activity on a regular, continuous, and substantial basis. By implication, income derived from a trade or business in which a taxpayer materially participates would not be “investment income” for the purposes of the NIIT.

Important caveat: All income of any type gener-ated by a business trading financial instruments or commodities is always treated as investment income, without exception.20

WHAT IS INCLUDED IN NET INVESTMENT INCOME?

Net investment income includes items that are spe-cifically enumerated by the Internal Revenue Code, as well as other items that arise from a taxpayer’s business activities or ownership of interests in corporate entities. These items are discussed in detail below.

Specifically Enumerated Investment Income Items

Section 1411(c)(1)(A)(i) specifically enumerates what most would consider the “traditional” types of invest-ment income: interest, dividends, annuities, royalties and rents. However, there are exceptions. Such income would not be considered investment income if:

1. the income was generated in a trade or business;

2. the income was derived in the ordinary course of that trade or business; and

3. the trade or business activity generating the income is non-passive with respect to the taxpayer.

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 114 9/18/2014 3:15:09 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

115

Figure 11.1

SECTION 1411(c)(1)(A)(i) ITEMSInterest

Included: Interest derived from the investment of working capital set aside for future use by a non-passive trade or business is nonetheless considered investment income.22

Excluded: Tax-exempt interest from a state or local bond is not investment income. (Because NIIT is a surtax on top of the regular income tax, any item excluded from gross income is also excluded from gross investment income.)24

Included: Interest distributed to a beneficiary from a trust or estate to the extent that character of the income would be net investment income.23

Exclude: “Self-charged interest” is interest charged by a taxpayer for lending money to a business that he or she owns and/or where he or she works. Because such taxpayers are generally not be in the trade or business of loaning money, without a specific exception, such interest income would be investment income. However, the regulations pro-vide an exception if the lending taxpayer materially participates in the business. In that case, the inter-est income would not be considered investment income.25

Excluded: Interest earned by a banking business with respect to which the taxpayer materially par-ticipates (so it is a non-passive activity) would not be investment income because it is derived in the ordinary course of business. (Interest is the type of income that a bank is designed to generate.)26

Dividends

Included: All items defined as “dividends” in the Code.27 None excluded. Dividends are always considered net investment income.

Included: Dividends derived from the investment of working capital set aside for future use by a non-passive trade or business are nonetheless considered investment income.28

Included: Dividends distributed to a beneficiary from a trust or estate to the extent that character of the income would be net investment income.29

Annuities

Included: Generally, gross income from annuities as defined by Code sections 72(a), (b) and (e) is considered investment income.30

Excluded: Gross income from annuities paid by an employer as compensation is not considered invest-ment income.31

Excluded: All distributions from retirement plans, in-cluding: qualified pension, profit-sharing and stock bonus plans; qualified annuity plans; annuities for employees of tax-exempt organizations or public schools; IRAs (regular and Roth); and deferred com-pensation plans of governments and tax-exempt organizations.32

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 115 9/18/2014 3:15:09 PM

Income Tax PlannIng

116

her. Although the income meets the first two requirements of being earned in a trade or busi-ness, as a non-participant in the business, it is a passive activity with respect to her because she does not actively work in the business (and thus it fails the third requirement of the exception).

Income from a Pass-through Entity

As discussed earlier in this chapter, “self-employ-ment income” is never treated as net investment income regardless of whether it would otherwise meet the definition for such under the NIIT.40 What can cause some confusion is that a taxpayer can receive some items meeting the definition of “net investment income” via an interest in a pass-through entity such as

Example: Hugh Haule and Frederica Expresso are equal shareholders in an S corporation that delivers packages. Whereas Hugh works in the business on a fulltime basis, Frederick has no involvement in the business. In the current year, their S corporation earns $100,000 of ordinary income allocated $50,000 to each shareholder.

Hugh’s distributive share of ordinary income is not treated as net investment income because it was earned in the ordinary course of busi-ness (meeting the first two requirements listed above), and—because Hugh actively works as a material participant in the business—it is a non-passive activity with respect to him (meeting the third requirement listed above). Conversely, Frederica’s distributive share of ordinary income is net investment income to

Figure 11.1 (cont’d)

SECTION 1411(c)(1)(A)(i) ITEMSRoyalties

Included: Gross income from royalties—including min-eral, oil, and gas royalties—as well as amounts received for the privilege of using patents, copyrights, secret pro-cesses and formulas, goodwill, trademarks, tradebrands, franchises and other like property.33

None excluded. Royalties are always considered net investment income.

Rents

Included: Rents distributed to a beneficiary from a trust or estate to the extent that character of the income would be net investment income.34

Excluded: Rental income from a rental activity of a real estate professional. Generally, all rental income is considered passive, and is treated as investment income even if it was derived in the ordinary course of business. There is a safe harbor for “real estate professionals”35 who participated in that rental activity for more than 500 hours during that year or more than five of any of the ten years immediately preceding that year.36

Excluded: “Self-charged rent.” Similar to self-charged interest, self-charged rent is rental income derived from renting property to a trade or busi-ness in which the taxpayer materially participates. According to the passive loss regulations, such income is treated as non-passive.37 The final regula-tions extend the same treatment of self-charged rent as being non-passive if it would be treated as non-passive pursuant to the passive loss regula-tions, or if the taxpayer elects to group such rental activity with other rental trades or business (which is another way to convert rental income from passive to non-passive income).38

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 116 9/18/2014 3:15:09 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

117

includes gains from the disposition of property that the taxpayer owns directly, as well as property that “flows through” to the taxpayer by virtue of an ownership interest in the entity disposing of the property.

Code section 1411(c)(1)(A)(iii) treats net gains from the disposition of property as net investment income if the property is held in a trade or business that is a passive activity with respect to the taxpayer. The word “disposition” is broadly defined as a “sale, exchange, transfer, conversion, cash settlement, cancellation, ter-mination, lapse, expiration, or other disposition.”50 If the gain meets those requirements, it must be included in gross income under Code section 61(a)(3).51

Importantly, some “dispositions” can occur over long periods of time, leading to questions about when income from the gain of the disposition is realized by the taxpayer. Deferred or excluded gains such as gain from an installment sale,52 like-kind exchanges,53 involuntary conversions54 and the sale of a principal residence55 are not considered investment income unless and until they are included in regular gross income.56

In order for a gain from the disposition of property not to be treated as net investment income, the two fol-lowing requirement must be met:

1. the gains were derived from property held in a trade or business; and

2. the trade or business activity generating the gain is non-passive with respect to the taxpayer.

3. The following two examples demonstrate how gain from the sale of property held by a

a partnership, LLC, or S corporation.41 In some instances, the nature of the taxpayer’s interest in the pass-through entity would cause such income to be treated as self-employment income.

In addition to the income of a sole proprietor, self-employment income also includes a general partner’s distributive share of ordinary income and any item of income reported on Schedule C for a single-member LLC that is treated as a disregarded entity. For that reason, such income would be subject to the Additional Medicare Surtax even if it would otherwise meet the Code definition of net investment income.

On the other hand, with some exceptions, certain types of income, such as dividends, interest, gains from the disposition of property, and rent are generally not treated as self-employment income regardless of the tax-payer’s interest in the entity.42 Consequently, in most of those instances, such income would be subject to NIIT.

Figure 11.2 sets forth the various ownership inter-ests in which the nature of the ownership interest may dictate whether the flow-through income would be characterized as self-employment income or potentially net investment income.

Gain from the Sale of Property Held by a Business

Unlike a general partner’s distributive share of ordi-nary income or the income of a sole proprietor, gains from the disposition of property (other than inven-tory) are specifically excluded from self-employment income.49 This provision applies across the board, and

Figure 11.2

Ownership Interest How the Income is ReportedTreated as Self-Employment

Income?

General partner interestDistributive share of partnership ordinary income.43 Always self-employment income.44

Sole proprietor (not a flow-through entity) Reported on Schedule C. Always self-employment income.45

Single-member LLC treated as a disregarded entity

Reported on Schedule C as if a sole proprietor. Always self-employment income.46

Limited partner interestDistributive share of ordinary Income.

Not self-employment income (potentially net investment income.)47

Shareholder of S corporationDistributive share of any type of S corporation Income.

Not treated as self-employment income (potentially net investment income.)48

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 117 9/18/2014 3:15:10 PM

Income Tax PlannIng

118

would generate gain or loss to the selling shareholder or partner. From the entity’s perspective this is not a taxable event in and of itself, as one shareholder/partner is merely substituted for another shareholder/partner.

Code section 1411(c)(4) specifically addresses the extent to which the gain from the sale of an interest in a pass-through entity taxed as an S corporation (or a partnership) is to be treated as net investment income. In addition to “conventional” S corporations and part-nerships, the section also addresses sales of interests in LLCs electing to be taxed as either one of those entities.58

First, section 1411(c)(4) creates a “fictional” pass-through scenario by recasting the transaction as if the entity had sold all of its assets for their fair market value, and the selling shareholder/partner was allocated his or her share of the gain or loss based on his or her ownership interest.

Second—in the same way as determining whether a shareholder/partner’s distributive share of real gain from the sale of an entity asset would be excluded from net investment income—the two following require-ments must be met in order to exclude the gain from net investment income:

• the gains were derived from property held in a trade or business; and

• the trade or business activity generating the gain is non-passive with respect to the taxpayer.

The application of this test with regard to the sale of an interest in an S corporation or partnership can be problematic. The question of whether a shareholder/partner’s distributive share of gain from the sale of a single entity asset is to be treated as net investment income depends on whether the asset was used in a trade or business activity that was passive or non-passive with respect to the taxpayer. What about a hypothetical sale of all the assets owned by the entity? Moreover, it is possible that any given entity may engage in more than one distinct business activity in which dif-ferent assets are employed. It is equally possible that a shareholder/partner’s participation in those distinct activities may vary.

For these reasons, the proposed regulations take an activity-by-activity approach. Based on the level of a shareholder/partner’s participation in the distinct business activities, some of the gain from the hypo-thetical sale of entity assets may be characterized as net

business may (or may not) be excluded from net investment income.

Example 1: Iris owns a boat in her own name and rents it to Ira for $100,000 per year. Iris’ rental activity fails to meet both exclusion requirements because her rental activity does not reach the level of a trade or business, and because rental activities are always considered passive. As-sume Iris sells the boat to Ira in a subsequent year and recognizes a taxable gain of $500,000. Having failed the requirements for exclusion in the prior year, Iris must include such gain as investment income.57

Example 2: Hugh Haule and Frederica Expres-so are equal owners of a partnership engaged in the moving business. Hugh is involved in day-to-day operations, Frederica devotes all of her time to another endeavor. In 2014, the busi-ness sells a facility it had used to store furniture, recognizing a gain of $200,000 that is evenly allocated to both shareholders. Because the property was used in the S corporation’s trade or business, and Hugh materially participates in the business, his share of the gain meets both exclusion requirements, and is not treated as investment income. Because Frederica does not materially participate in the business, she fails the second part of the test, and her allocable share of the gain would be treated as investment income for the purposes of the NIIT.

Gain from the Sale of an S Corporation or a Partnership

To this point in the discussion, the determination of whether income generated by pass-through entities such as S corporations and partnerships was treated as net investment income was based on the taxpayer’s participation in the business. If the individual materially participated in the business, the income was not treated as net investment income. If the taxpayer’s participation in the business was passive, the income was included as net investment income.

However, the sale of an interest in a pass-through entity to a third party does not generate any income or loss to the underlying entity. Similar to the sale of any individually-owned asset, the sale of an entity interest

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 118 9/18/2014 3:15:10 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

119

Assume that in 2014 Iris sells all of her stock in the S corporation to a third party and recognizes a capital gain of $200,000. The process of calcu-lating Iris’ net investment income from the sale using the first formula involves multiple steps.

Step 1 – Identify the different business activities within the entity. As stated above, the S corpo-ration is engaged in a moving business and a telephone answering business.

Step 2 – Determine which business activities are passive and non-passive with respect to the selling taxpayer. Based on Iris’ level of participation in the respective businesses, the moving business is non-passive and the telephone answering business is passive.

Step 3 – Identify what the proposed regula-tions define as “section 1411 property” with respect to the selling taxpayer. “Section 1411 property” includes:

• Property that is associated with a business activity that was passive with respect to the taxpayer; and

• any marketable securities.61

By that definition, the telephone answering equipment and the marketable securities are section 1411 property. The storage warehouse is not section 1411 property because it is used in a business activity which is non-passive with respect to Iris.

Step 4 – Determine Iris’ distributive share of gain from a hypothetical sale of the section 1411 property at FMV. The hypothetical sale of the telephone answering equipment would generate a $10,000 loss. Because Iris owns 50 percent of the

investment income and some may not. The proposed regulations also allow the use of two different formulas to determine a portion of the shareholder/partner’s gain from the sale of his or interest would be similarly characterized.59 Bear in mind that at the time of publi-cation, these were only proposed regulations that were not final and are subject to change.

If the taxpayer does not materially participate in any of the business activities of the entity, the gain from the sale of the entity is all passive with respect to the taxpayer. Under these circumstances, there is no need to apply any formula, and the taxpayer’s entire gain from the disposition of the interest would be treated as net investment income.

Equally obvious, if the taxpayer materially partici-pates in all the business activities of the entity, they are all non-passive with respect to the taxpayer. In this instance, the taxpayer’s entire gain from the disposition of the interest would not be treated as net investment income.60

Finally, if the taxpayer materially participates in only some of the business activities of the entity, one of the two formulas from the proposed regulations would be applied to determine how much of the taxpayer’s gain on the sale of the entity interest would be treated as net investment income.

Problematically, the first formula requires the selling shareholder/partner to gather a significant amount of information regarding the underlying assets of the entity that may not be readily accessible. The second formula—the “optional simplified method”—requires much less information, all of which would be found on the taxpayer’s Form K-1. However, it is only available to taxpayers who meet certain criteria.

The First Formula

The best way to understand the first formula is to walk through an example that shows the steps required and the information that needs to be gathered to follow those steps.

Example: Iris owns 50 percent of an S corpora-tion engaged in two distinct business activities: a moving business and a telephone answering business. Iris works exclusively in the moving business and has no involvement in the tele-phone answering business. The S corporation has three assets:

Assets of Iris’ S Corporation

Asset

Fair Market Value (FMV)

Basis (amount paid for the assets

by Iris’ S Corp)

Telephone Answering Equipment $126,000 $136,000

Storage Warehouse $150,000 $75,000

Marketable Securities $50,000 $8,000

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 119 9/18/2014 3:15:10 PM

Income Tax PlannIng

120

S corporation, Iris’ distributive share of the loss would be $5,000. The hypothetical sale of the marketable securities would yield a $42,000 gain, of which Iris’ distributive share would be $21,000. Thus, Iris’ net distributive share of the net gain would be $16,000 ($21,000 gain minus $5,000 loss).

Step 5 – Determine the amount of gain treated as net investment income. This amount is the lesser of:

• the overall regular income tax gain ($200,000); or

• the shareholder’s hypothetical distributive share of the entity gain as computed in Step 4 ($16,000).

Here, Iris’ regular income tax gain was $200,000 and her hypothetical distributive share of S corporation gain from the sale of section 1411 assets was $16,000. As a result, Iris’ net investment income from the sale using the first formula would be $16,000 with the balance of the gain, $184,000, excluded from net invest-ment income.

Optional Simplified Method

The optional simplified method contained in the proposed regulations allows the taxpayer to compute net investment income from the sale or disposition of an S Corporation by multiplying the gain from the sale by a simple ratio.62 One definition is key to understat-ing the optional simplified method: the “section 1411 holding period,” which is defined as the current year plus the last two years.

Property FMV BasisGain/ Loss

Iris Share Gain/Loss

Telephone Answering Equipment $126,000 $136,000 ($10,000) ($5,000)

Marketable Securities $50,000 $8,000 $42,000 $21,000

Total $176,000 $144,000 $32,000 $16,000

Importantly, not all taxpayers may use the optional simplified method. In order to do so, the taxpayer must qualify by satisfying one of two tests.

Test 1: The first test has two requirements:

1. The sum of net investment income, gain, loss and deduction (loss and deduction added as a positive numbers for purposes of this calcu-lation) allocated to the selling taxpayer over the section 1411 holding period is less than 5 percent of the sum of all items of income, gain, loss and deduction (again, with loss and deduction added as positive numbers for purposes of this calculation), allocated to the selling taxpayer during the section 1411 holding period; and

2. the total amount of gain recognized for regular income tax purposes with regard to the sale of the entity interest must be less than $5 million.

Test 2: Test 2 is simpler, and requires only that the total amount of gain recognized on the sale of the interest in the entity be less than $250,000.

Under the optional simplified method, the net invest-ment income is computed by multiplying the gain from the sale of an interest in an S corporation or a partner-ship by a ratio that must be computed for each sale. The ratio is calculated by dividing the sum of net investment income, gain, deduction, or loss allocated to the seller by the sum of all items of income, gain, deduction, or loss allocated to the seller. Both values are calculated over the section 1411 holding period.

Multiplying the total gain from the sale by the ratio described above gives the amount of gain from the sale that is treated as net investment income. Stated dif-ferently, the amount of gain treated as net investment income is based on the percentage of the shareholder/partner’s distributive share of net investment income over all income of the entity during the section 1411 holding period. Again, an example is helpful.

Example: Hugh Haule sells his S corporation stock to a third party and recognizes a gain of $500,000. The S corporation has two distinct businesses, a moving business in which Hugh materially participates, and a telephone answer-ing business in which he does not materially participate.

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 120 9/18/2014 3:15:10 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

121

In this case, approximately 1.7 percent of all S corporation income allocated to Hugh over the section 1411 holding period was net invest-ment income. Multiplying that percentage by the gain from the sale of his stock ($500,000), Hugh calculates that approximately $8,600 of the gain is included in net investment income, and the balance of $491,400 is excluded from net investment income.

How Is Net Gain Calculated?

Significantly, Code section 1411(c)(1)(A)(iii) refers to “net gain”—meaning that gains are netted against losses, as both terms are defined in the section. In a taxpayer-friendly provision, the final regulations pro-vide for the treatment of capital gains and losses for net investment income purposes that parallels their treatment for regular income tax purposes. For regular income tax purposes, capital losses are deductible to the extent of capital gains plus $3,000 of any excess being deductible against other income. The unused excess loss is carried over to subsequent tax years subject to being netted against capital gains generated in such years. Similarly, a taxpayer may use the same netting rules to reduce investment income net gain to zero, with $3,000 of any excess reducing other investment income. Any unused excess capital loss is carried over to subsequent years to be re-employed in the same manner.63

Total Amounts over Section 1411 Holding Period

Hugh’s Distributive Share of Income Attributable from Non-Passive Moving Business $2,000,000

Hugh’s Distributive Share of Dividend Income $50,000

Hugh’s Distributive Share of Loss from Passive Telephone Answering Service ($15,000)

First, Hugh must determine whether he qualifies for the optional simplified method. Hugh’s recognized gain of $500,000 clearly fails Test 2, so he must pass Test 1 in order to use the optional simplified method. To do so, the sum of his distributive share of net investment in-come, gain, loss and deduction (all added as a positive numbers) over the section 1411 holding period must be less than 5 percent of the sum of his distributive share of all income, gain, loss and deduction (all added as a positive numbers) over that same period.

Here, Hugh passes Test 1 because $65,000 divided by $2,065,000 is approximately 3.15 percent, which is less than 5 percent required for the test. Therefore Hugh may use the optional simplified method.

Next, Hugh must determine the amount of gain that is treated as net investment income. To make that determination, he first calculates the ratio of the total distributive share of net income divided by the total distributive share of all items of income (again, all figures are for the section 1411 holding period). He then multiplies that ratio by the total gain from the sale to determine the amount of the gain that is included in net investment income.

Test 2

Sum of net investment gain, loss, and deduction

Sum of all income, gain, loss, and deduction

Ratio of net investment income over all income must be less than 5%

$50,000 $$+ 15 000

65 000,

,=$$$

$

2 000 00050 00015 000

2 065 000

, ,,,, ,

++

=$

$65 000

2 065 0003 15

,, ,

. %=

Calculation of Net Investment Income from Sale

Total distributive share of net income (net investment dividend income minus passive loss)

$50,000 $15,000 $ 0−( )= 35 00,

Total distributive share of all income (non-passive income plus net in-vestment dividend income, minus passive loss)

$ $ $

$

2 000 000 50 000 15 000

2 035 000

, , , ,

, ,

+ −( )=

Ratio $$

35 0002 035 000

1 7,

, ,. %=

Ratio multiplied by total gain from sale yields net in-vestment income from sale

1 7 8 600. % ,´$500,000 $=

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 121 9/18/2014 3:15:19 PM

Income Tax PlannIng

122

Example: In 2014, Iris, a single taxpayer has the following items of income and loss: a $40,000 capital loss and a $10,000 capital gain from the sale of publicly traded stock, $300,000 of wage income and $5,000 of interest income. For regular income tax purposes, capital gain and loss are netted resulting in a net capital loss of $30,000, of which $3,000 can be used as a deduction against other income. The balance of the net capital loss, $27,000, would be carried over to subsequent tax years.

Viewing the example from a net investment income perspective, the two items of net invest-ment income are:

1. the interest income of $5,000;64 and

2. the gain generated from the stock sale of $10,000.65

The process of determining the “net gain” for investment income is the same as it is for regular income; the capital gain ($10,000) and capital loss ($40,000) are netted, but only to the extent of zero-ing out the capital gain. Of the resulting $30,000 of net capital loss, $3,000 of it can be used reduce the $5,000 of interest income included as net in-vestment income. Thus, Iris’ 2014 net investment income would be $2,000, with a $27,000 capital loss to be carried over to subsequent tax years.

Now assume that Iris recognizes a capital gain of $30,000 in 2015 from the sale of publicly

traded stock. For regular income tax purposes, the $27,000 capital loss carryover from 2014 is netted against the 2015 capital gain, resulting in a net capital gain of $3,000. Similarly, for purposes of computing net gain under Code section 1411(c)(1)(A)(iii), the same netting oc-curs to reduce the 2015 net gain included in net investment income to $3,000.66

Which Deductions Can Be Applied to Net Investment Income?

Up to this point the terms “net investment income” and “investment income” have been used interchange-ably. Inherent in the term “net investment income,” how-ever, is the notion that certain deductions be allowed. Indeed, per Code section 1411(c)(1)(B), in arriving at “net investment income,” investment income is reduced by “the deductions allowed by this subtitle which are properly allocable to such gross income or net gain.” Figure 11.3 sets forth the list of deductions that are taken into account in determining net investment income.

It is important to note that deductions from invest-ment income are subject to the same limitations as deductions for regular income tax. In other words, a taxpayer would not be entitled to a greater deduc-tion from investment income than he or she would be entitled to for regular tax. For that reason, it is important to understand the hierarchy of deductions for regular income tax purposes.

Figure 11.3

AVAILABLE DEDUCTIONS AGAINST NET INVESTMENT INCOMEDeductions allocable to gross income from rents and royalties

Deductions allocable to gross income from trades or business to the extent not taken into account in determin-ing self-employment income

Penalty on early withdrawal of savings

Net operating losses properly allocable to determining net investment income for any taxable year

Investment interest expenses as defined in Code section 163(d)(3)

Investment expenses as defined in Code section 163(d)(4)(c)

Taxes described in Code section 164(a)(3)

Investment expenses described in Code section 212(3)

Amortizable bond premium under Code section 171(a)(1)

In the case of a trust or estate, fiduciary expenses deductible under Code section 212

Losses allowed per Code section 165

Excess losses under Code section 642(h) upon termination of a trust or estate

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 122 9/18/2014 3:15:19 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

123

• the taxpayer’s regular income tax NOL for the loss year.

Like regular NOLs, unused section 1411 NOLs can be carried over to subsequent tax years. The example in the final regulations—presented here in a simplified form—is helpful in understanding this technique.

Example: Assume that in 2014, the taxpayer’s NOL for regular income tax purposes was $1,000,000 and the section 1411 NOL (taking into account only net investment income and deductions) was $200,000. Because the taxpayer had a net loss (and therefore no income) for 2014, the $1,000,000 NOL and $200,000 section 1411 NOL are available to be carried forward to subsequent tax years.

However, there is a bit of a twist. Although the taxpayer is entitled to an overall section 1411 NOL of $200,000, in subsequent years, when applying the section 1411 NOL to from 2014 to later tax years the taxpayer must multiply his or her regular income tax NOL carried over to that subsequent year by the ratio of the section 1411 NOL generated in 2014 divided by the regular

Above-the-Line Investment Income Deductions

As discussed in Chapter 4, “above-the-line” deduc-tions used to calculate adjusted gross income are usually the most beneficial deductions to the taxpayer. This is because they are not typically subject to restrictions that would otherwise limit their deductibility. Taken “off the top,” they reduce the amount of taxable income, dollar-per-dollar. For net investment income purposes, the above-the-line regular income tax deductions properly allocable to rent and royalty income, losses from the sale or exchange of property, net operating losses as well as the deduction for the penalty on early withdrawal of savings provide a similar tax benefit.67

Net Operating Losses

The final regulations allow a taxpayer to use a por-tion of his or her net operating loss (NOL) to reduce net investment income as an above-the-line deduction.68 This special net operating loss—referred to as a “section 1411 NOL” in the regulations—is the lesser of:

• a NOL for the loss year computed by including only items of investment income gross income less only properly allocable net investment income deductions; or

Figure 11.4

2014: No taxable income

Regular income tax NOL avail-able for subsequent years

Section 1411 NOL available for sub-sequent years

2014 ratio of regular NOL to section 1411 NOL

$1,000,000 $200,000 $$2 000 0001 000 000

0 2, ,, ,

.

=

2015: $540,000 in taxable income

2014 regular taxable income NOL carried to 2015

Carried over 2014 NOL multiplied by 2014 ratio

2014 section 1411 NOL used to reduce 2015 net investment income

$540,000 $540,000 × 0.2 = $108,000

2016: Taxable income greater than $460,000

2014 regular taxable income NOL carried to 2016

Carried over 2014 NOL multiplied by 2014 ratio

2014 section 1411 NOL used to reduce 2016 net investment income

$460,000 $460,000 × 0.2 = $92,000

2017: 2014 Regular income tax NOL and section 1411 NOL exhausted

$$

2000 0001 000 000

0 2,

, ,.

=

$540,000 × 0.2 = $108,000

$460,000 × 0.2 = $92,000

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 123 9/18/2014 3:15:21 PM

Income Tax PlannIng

124

income tax NOL generated in 2014. Here, that ratio is 0.2 ($200,000 divided by $1,000,000)

To illustrate this point, assume that in 2015 the taxpayer is has $540,000 in income and elects to use $540,000 of his 2014 NOL to reduce taxable income. For purposes of reducing the taxpayer’s net investment income for that year, the carried over section 1411 NOL is limited to 20 percent of $540,000, or $108,000. Thus, going into 2016, the taxpayer has a remaining section 1411 NOL of $92,000 ($200,000 minus $108,000).

Subsequently, in 2016, assume the taxpayer is able to use the balance of his 2014 NOL ($460,000) to reduce that year’s taxable income. Again, for purposes of reducing the taxpayer’s net investment income for that year, the carried over section 1411 NOL is limited to 20 percent of $460,000, or $92,000.

Below-the-Line Investment Income Deductions

Many of the deductions against investment income—such as state and local taxes, investment interest, profes-sional fees and investment advisory fees—are treated for regular income tax as itemized deductions. These are known as “below-the-line” deductions. Unlike above-the-line deductions, below-the-line deductions are subject to limitations that often impact their ultimate deductibility.

For regular income tax purposes, some below-the-line deductions are treated as “miscellaneous item-ized deductions”69—as opposed to “regular” itemized deductions—and are subject to a “floor” of 2 percent of adjusted gross income. This means that miscellaneous itemized deductions are deductible only to the extent they exceed 2 percent of a taxpayer’s AGI.70

In addition, for tax year 2014, taxpayers with adjusted gross income in excess of $254,200 for single filers ($305,050 for joint filers) are subject to a reduction of the value of their miscellaneous itemized deductions equal to 3 percent of the amount by which their adjusted gross income exceeds the applicable threshold.71 This is known as a “section 68 phase-out” reduction.

Both of these limitations apply to the computation of net investment income. The miscellaneous item-ized deduction “floor” is applied to the miscellaneous itemized deductions first. The taxpayer must then

determine if the section 68 phase-out will further reduce the miscellaneous itemized deductions that apply to the calculation of net investment income.72

With regard to the floor for net investment income miscellaneous itemized deductions, the regulations provide that the amount of miscellaneous itemized deductions tentatively deductible against net invest-ment income is the lesser of:

• the amount of miscellaneous itemized deductions; or

• all miscellaneous itemized deductions (including those allocable to net investment income) that exceed the 2 percent of adjusted gross income floor.73

The following example illustrates how these rules work.

Example: Iris is a single taxpayer with the following items of income and miscellaneous itemized deductions:

Applying the special rule on net investment income miscellaneous itemized deduction rules to Iris, the amount deductible is the lesser of:

• her net investment income miscellaneous itemized deduction unreduced by the 2 percent floor ($35,000); or

• all miscellaneous itemized deduction after the applying the 2 percent floor ($20,000).

Thus, Iris’ tentative miscellaneous itemized deduction against net investment income—subject to the potential section 68 phase-out of itemized deductions discussed below—is the $20,000 of investor advisor fees.

After determining the tentative amount of al-lowable miscellaneous deductions, the next step is

Income

Adjusted Gross Income $500,000

Investment Income (included in adjusted gross income) $150,000

Miscellaneous Itemized Deductions

Investor Advisor Fees $35,000

Other Non-Investment Income Miscel-laneous Itemized Deductions $15,000

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 124 9/18/2014 3:15:21 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

125

Based on the foregoing itemized deduction scenario, the total of Iris’ net investment income itemized deductions would be $110,000, and the total of all itemized deductions subject to the section 68 phase-out would be $200,000. Ap-plying the section 68 phase-out will reduce Iris’ total itemized deductions by an amount equal to 3 percent of the difference between adjusted gross income ($500,000) and the threshold for a single taxpayer ($254,200), or $7,374. Subtract-ing this number yields $192,626 as the amount of itemized deductions allowed after applying the phase-out. Because Iris’ investment income itemized deductions ($110,000) would be less than her regular itemized deductions after ap-plying the phase out ($192,626), she would be entitled to deduct the former amount—meaning there would be no further reduction of Iris’ net investment itemized deductions form the sec-tion 68 phase-out.

Using Excess Losses to Reduce Net Investment Income

In the discussion regarding the computation of “net gain” pursuant to Code section 1411(c)(1)(A)(iii), it was noted that the deductibility of loss was limited to the amount of gain, so a “net investment loss” would not be allowed for the purposes of the NIIT. In spite of that limitation, the final regulations allow those section 1411(c)(1)(A)(iii) losses to be used to reduce other net investment income provided those losses had been taken as a deduction in the computation of regular income tax.74

Example: Iris, a single taxpayer, has the fol-lowing income sources:

For regular income tax purposes, the $125,000 of interest and dividend income and the $50,000 of long-term capital gain are included in gross income. The $60,000 of ordinary loss is totally

Interest and dividends $125,000

Ordinary losses from a trade or busi-ness trading in financial instruments or commodities $60,000

Long-term capital gain from the sale of undeveloped land $50,000

to apply the special rules for the section 68 phase-out of itemized deductions. The phase-out reduces total miscellaneous itemized deductions against regular income by 3 percent of the amount by which the taxpayer’s adjusted gross income exceeds the threshold ($254,200 for single taxpayers).

• If the taxpayer’s miscellaneous itemized deductions against net investment income (after applying the 2 percent AGI floor discussed in the previous step) are less than the total amount of miscellaneous itemized deductions against regular income permitted under the section 68 phase-out, then the net investment deductions remain unchanged.

• If the net investment income miscellaneous itemized deductions exceed what is permissible under the section 68 phase-out, the taxpayer may only take miscellaneous itemized deductions against net investment income up to the section 68 phase-out limit.

For purposes of this example, assume Iris has the following itemized deductions:

State income taxes properly allocable to net investment income (regular itemized deduction)

$40,000

Investment interest expense properly allocable to net investment income (regular itemized deduction)

$50,000

Deductible investor advisor fees (miscellaneous itemized deduction)

$20,000

Total itemized deductions against net investment income

$110,000

Additional miscellaneous itemized deductions against regular income

$90,000

Total Itemized Deductions Subject to the section 68 phase-out (including those not properly allocable to net investment income)

$200,000

Section 68 phase-out reduction (3% of difference between threshold and AGI)

($500,000 – $254,200)×3% = $7,374

Total itemized deductions after section 68 phase-out

$200,000 – $7,374 = $192,626

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 125 9/18/2014 3:15:21 PM

Income Tax PlannIng

126

estates that are subject to the provisions Subchapter J of the Internal Revenue Code are also subject to NIIT.76 The impact of NIIT on trusts and estates cannot be understated. Because trusts tend to remain in existence far longer than estates, the overall tax consequences of this surtax on trusts is likely to be even more profound, and the following discussion will focus mainly on trusts.

In operation, the 3.8 percent NIIT surtax is imposed on trusts and estates on the lesser of:

• “undistributed net investment income”; or

• the excess of adjusted gross income over the amount of the highest regular income tax bracket in effect for such taxable year.77

Compared to the thresholds for individual taxpayers that are based on adjusted gross income, the threshold for trusts and estates is based on the highest tax bracket of those entities. Though the threshold for trusts and estates is indexed for inflation (unlike the thresholds for individual taxpayers), that is of little comfort to fiduciaries and beneficiaries. The highest regular income tax bracket for trusts and estates (above which the NIIT surtax is imposed) begins at an amount that is signifi-cantly lower than the NIIT thresholds for individuals.78

For example, for tax year 2014, the highest regular income tax bracket for trusts and estates (39.6 percent) begins with taxable income in excess of $12,150. The unindexed thresholds for individual taxpayers (e.g. $250,000 for married taxpayers who are filing jointly) are much higher. Moreover, by their nature, most trusts and estates are likely to have only net investment income. This means that trusts and estates with relatively small amounts of net investment income may nonetheless be in the highest income tax bracket and be subject to the 3.8 percent NIIT.

As mentioned above, The NIIIT tax base of trusts and estates is “undistributed net investment income.” In simple terms, undistributed net investment income is any net investment income—as defined by Code section 1411(c)(1)(A)—that is retained by a trust or an estate.79 Distributions retain their characterization as net investment income when distributed to a beneficiary. If the trust has net investment income that is distributed to a beneficiary, it will be considered net investment income for beneficiary (as opposed to regular income).80

The two types of trusts most impacted by NIIT are “simple trusts” and “complex trusts.” A simple trust is

deductible without limitation—unlike capital loss, which is deductible to the extent of capital gain plus $3,000.) Ignoring itemized deductions and personal exemptions, Iris’ regular taxable income would be $115,000 ($175,000 in interest, dividends, and long-term capital gain, minus $60,000 in business losses).

For the purposes of computing net investment income, recall that all income, gain, or loss from a business that trades in financial instruments or commodities is treated as net investment income regardless of whether the activity is non-passive with respect to the taxpayer. For Iris, the $125,000 of interest and dividend in-come and the $50,000 of long-term capital gain are clearly included in net investment income. However, the $60,000 loss is deductible only to the extent of the $50,000 gain. In other words, since the final regulations do not allow a “net” loss under Code section 1411(c)(1)(A)(iii), the regular income tax rule allowing such a loss would appear to be inapplicable. Thus, without further relief, the “net” $10,000 loss would not be allowed, resulting in $125,000 of interest and dividends included in net investment income rather than $115,000.

However, the final regulations allow Iris to use that otherwise useless loss to reduce her other net investment income. This is possible because the net $10,000 loss:

• was deductible for regular income tax purposes; and

• would have been allowed as reduction of net gain under Code section 1411(c)(1)(A)(iii) but for the net loss limitation.

Thus, Iris’ investment income of $125,000 would be reduced by the $10,000 excess loss deduction resulting in $115,000 of net invest-ment income.75

APPLICATION OF NIIT TO TRUSTS AND ESTATES

To this point in the chapter, the discussion of NIIT has focused exclusively on individual taxpayers. However, unless otherwise specifically excluded, all trusts and

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 126 9/18/2014 3:15:21 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

127

Step 1: Determine the DNI of the trust. Code section 643(a) provides that the DNI of a trust is tentative taxable income ($105,000) minus capital gain. Excluding the $5,000 of capital gain, the DNI of the trust is $100,000.

Step 2: Determine the trust’s distribution de-duction. According to Code section 661(a), the distribution deduction of a complex trust is equal to the amount distributed (here, $10,000).

Step 3: Determine the extent to which the amount distributed is deemed to be net investment income. Code section 661(b) provides that the character of the amount distributed to the beneficiary “shall be treated as consisting of the same proportion of each class of income entering into the computa-tion of distributable net income.” In this example, the distribution of $10,000 is equal to 10 percent of $100,000, the total amount of DNI. Thus, the beneficiary is deemed to have received 10 percent of each type of income included in DNI.

Step 4: Determine the amount of net investment income in DNI that is retained by the trust. In this case, most of the retained income is net invest-ment income. The only exception is the IRA distribution. Pursuant to Code section 1411(c)(5), distributions from IRAs are excluded from net investment income.

Step 5: Determine the total amount of net invest-ment income retained by the trust. This should

Trust Income 2014

Income in DNIRetained by

TrustNet Investment

Income

Dividend Income $13,500 $13,500

Interest Income $9,000 $9,000

IRA Distribution $67,500 $0

Total $90,000 $22,500

required to distribute all of its current fiduciary account-ing income (FAI) to its beneficiaries.81 FAI is income derived from principal such as interest and dividends (as opposed to capital gains derived from the sale or disposition of principal). Since a simple trust is required to distribute all of its FAI to its beneficiaries each year, its undistributed net investment income is limited to the capital gain it generates.

A complex trust is not required to make mandatory distributions to its beneficiaries.82 Instead, complex trusts generally make discretionary distributions of FAI (and sometimes principal) to beneficiaries. A complex trust is likely to have a mix of net investment income that includes dividends, interest and capital gains. This income may or may not be retained by the trust.

In order to understand how to compute the undis-tributed net investment income of a trust, it is neces-sary to comprehend the meaning of distributable net income (DNI). Essentially, the DNI of a trust is the taxable income of a trust, with certain modifications.83 Distributions to beneficiaries are not included in DNI,84 effectively shifting the obligation to pay tax on the distributed income from the trust to the beneficiaries.

Similarly, for net investment income purposes, DNI that is distributed to a beneficiary is included in the beneficiary’s net investment income, and is subject to the NIIT. Conversely, undistributed investment income included in DNI—as well undistributed investment income not included in DNI—is included in the net investment income tax base of the trust. The most notable exclusion of income from the computation of DNI is capital gain.

The following example from the regulations85 dem-onstrates how to compute net investment income for a complex trust, including calculations of DNI.

Example: Assume that in 2014 the trustee of this complex trust makes a discretionary FAI distribution of $10,000 to Beneficiary A.

Trust Income 2014

Dividend Income $15,000

Interest Income $10,000

Capital Gain $5,000

IRA Distribution $75,000

Total Trust Income $105,000

Trust Income 2014

Income in DNIRetained by

TrustDistributed

to Beneficiary

Dividend Income $13,500 $1,500

Interest Income $9,000 $1,000

IRA Distribution $67,500 $7,500

Total $90,000 $10,000

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 127 9/18/2014 3:15:21 PM

Income Tax PlannIng

128

include any undistributed item of net investment income not included in DNI. Here, the $5,000 of capital gain excluded from DNI (clearly net investment income) is added to the $22,500 of net investment income retained by the trust. Thus, the total amount of undistributed net investment income is $27,500.

Step 6 – Compute the NIIT. The 3.8 percent NIIT surtax is imposed on the lesser of:

• undistributed Net Investment Income ($27,500): or

• $92,850, which is the excess of the adjusted gross income ($105,000) over the amount of the highest regular income tax bracket ($12,150).

In this example $27,500 is less than $92,850, so the NIIT would be 3.8 percent of $27,500, or $1,045.

HOW CAN INDIVIDUALS MINIMIZE THE NIIT?

1. Create tax-exempt income. Any investment type income that is excluded from gross income is also excluded from the NIIT base. Consequently, an investment in state and local bonds would yield income that is exempt from both regular and net investment taxes.

2. Use life insurance. A whole life insurance policy has an insurance component and an investment com-ponent. The growth of the investment component would depend on the amount of the premium and how it is invested. Investments earnings within the policy grow tax deferred and are therefore do have to be currently included in gross income. Moreover, some insurance policies allow the owner to borrow the “earnings” generated by the policy. Since borrowed funds are generally excluded from gross income, they would not be considered net investment income. Using life insurance in this way allows the owner to enjoy the benefit of policy earnings without being subject to regular income tax or NIIT.

3. Materially participate in a business activity. Income from a business in which is the taxpayer materi-ally participates (i.e. “non-passive”) would not be

included in net investment income. If a taxpayer was to materially participate in a business activ-ity that was otherwise passive to him, he would effectively exclude the income from that business from the NIIT tax base. This strategy only works if materially participating in the business does not convert such income into self-employment income that is subject to the Additional Medicare Surtax. Although this technique would not work for a gen-eral partner, it would be effective for the shareholder of an S corporation.

4. Increase voluntary contributions to a qualified retire-ment plan. Many qualified retirement plans, such as a 401(k), allow for deductible voluntary con-tributions of a participant’s wages. Although the amount of such contributions may vary from plan to plan, the regular income tax deductible limit for 2014 is $17,500 ($23,500 for taxpayers over forty-nine years old). Note that voluntary contributions are not deductible from Medicare wages subject to the Additional Medicare Surtax.86 However, distributions from those plans (presumably upon the taxpayer’s retirement) are excluded from net investment income,87 and the earnings generated in the plan are tax-free until distributed. Compared to investing in vehicles that produce net investment income, investing additional amounts in a quali-fied retirement plan effectively converts future net investment income into excluded qualified plan distributions.

5. Consider installment sales of property. If a taxpayer sells property qualifying for reporting gain on the installment method, his or her gain is reportable on a ratable basis.88

Example: Assume in December 2014, Iris—a single taxpayer—has the opportunity to sell undeveloped land with a basis of $100,000 for $300,000. If Iris receives the entire selling price in 2014, her adjusted gross income would be increased by the total amount of the gain ($200,000). Assuming that her taxpayer’s ad-justed gross income for 2014 apart from the sale was $100,000; the additional $200,000 of adjusted gross income would increase her adjusted gross income to $300,000 and subject her to an addi-tional $3,800 of NIIT (3.8 percent of $100,000).

On the other hand, if she received $150,000 of the sales price in December 2014 and $150,000

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 128 9/18/2014 3:15:21 PM

ADDITIONAL MEDICARE SURTAX CHAPTER 11

129

subject to the 2 percent of adjusted gross income floor. Also, the taxation of social security benefits could be triggered by an increase in adjusted gross income.90 There are many other examples of similar adverse tax consequences potentially triggered by an increase in adjusted gross income.91

FREQUENTLY ASKED QUESTIONS

Question – Do the regulations provide a means of allocating deductible state and local taxes between net investment income and non-net investment income?

Answer – The final regulations are very vague on this issue, providing that “in the case of a properly allo-cable deduction [such as state and local taxes] … that is allocable to both net investment income and excluded income, the portion of the deduction that is properly allocable to net investment income may be determined by using any reasonable method.”92

Without endorsing any one method, the regula-tions provide examples of “reasonable methods.” One method outlined is to allocate the state and local expense to net investment income based on the percentage of the taxpayer’s net investment included in the taxpayer’s total gross income.93

Example: In 2014, Hugh Haule has $600,000 of wages and $400,000 of interest income on which Hugh paid state income taxes of $100,000. Since 40 percent of Hugh’s income is net invest-ment income, Hugh could reasonably deduct $40,000 of the state income taxes paid against the $400,000 of net investment income.

Question – Is there another alternative to decrease the undistributed net investment income of a trust other than a distribution of money to a beneficiary?

Answer – Yes. The trustee could make in in-kind distri-bution of trust assets.

Example: Assume a trust has appreciated stock with a fair market value of $30,000 and a basis of $10,000. If the trustee were to sell the stock for $30,000, there would be taxable capital gain

of the sales price in January 2015, her $200,000 gain would be spread equally over the two tax years (meaning her adjusted gross income would be increased by the $100,000 of gain reported in each tax year). Thus, in 2014, because her adjusted gross income would not exceed the $200,000 threshold (it would be exactly that amount), there would be no NIIT. Moreover, as-suming the same adjusted gross income amount in 2015, she would avoid NIIT for that year as well. By converting an immediate sale into an installment sale that spans two “years,” Iris could save $3,800 in NIIT obligations.

HOW CAN TRUSTS MINIMIZE THE NIIT?

1. Allocate indirect expenses to undistributed net invest-ment income. The regulations allow for the allocation of the deduction of items indirectly attributable to any particular type of income to be allocated in any way, including the total allocation of the deduction to capital gain.89 For example, by allocating all or part of trustee fees to capital gain not distributed by the trust, the amount of undistributed net income subject to NIIT would also be reduced.

2. Make discretionary distributions of net investment income items to beneficiaries who are not subject to the NIIT. Assuming a trustee is aware of the amounts of adjusted gross income of the trust beneficiaries, discretionary distributions of net investment net income could be made in amounts that would not cause the recipient beneficiary’s adjusted gross income to exceed the applicable threshold and thus not be subject to NIIT. By doing so, the trustee could reduce NIIT within the trust without subjecting the beneficiary to the surtax.

However, the trustee must be mindful to not make distributions that would be contrary to the terms of the trust or otherwise be considered a breach of his or her fiduciary obligations. More-over, even if the distribution would not cause the beneficiary’s adjusted gross income to exceed the applicable NIIT threshold, the increase in income may deprive the taxpayer of some other tax benefits.

For example, a higher adjusted gross income would reduce or potentially eliminate the deduct-ibility of miscellaneous itemized deductions

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 129 9/18/2014 3:15:21 PM

Income Tax PlannIng

130

retaining the income in the trust effective as of the end of the prior tax year.

Although, the final regulations do not directly acknowledge the application of the sixty-five-day rule with regard to distributions of net investment income, it was applied in Example 3 of Treas. Reg. §1.1411-3(e). In that example, a section 663(b) elec-tion was effectively made by the executor of an estate. Since the sixty-five-day rule applies equally to trusts and estates, there is no reason to believe such an election would not be effective if made by a trustee of a trust.

CHAPTER ENDNOTES1. “Definition of ‘Surtax,’” Available at: www.investopedia.com/

terms/s/surtax.asp.

2. P.L. 111-152, 124 Stat. 1029.

3. The other “FICA” tax is the old-age, survivors, and disability insurance tax (OASDI) also known as the social security tax.

4. Reported on Schedule SE of Form 1040.

5. Patient Protection and Affordable Care Act. P.L. No. 111-148.

6. I.R.C. §§3101(b)(2)(a), 1401(b)(2)(A).

7. I.R.C. §3102(a).

8. P.L. 111-152, 124 Stat. 1029.

9. Not all trusts are subject to the NIIT. Those not subject to the tax include charitable trusts, qualified retirement plan trust, grantor trusts, real estate investment trusts and common trust funds. Treas. Reg. §1.1411-3(b); I.R.C. §1411(e)(2).

10. The term used in Code section 1411(a)(1)(B) is “modified adjusted gross income” rather than “adjusted gross income.” Throughout this Chapter, the term “adjusted gross income” will be utilized because modified adjusted gross income is only relevant to the few taxpayers who claim the foreign earned income exclusion. Pursuant to Code section 1411(d), modified adjusted gross income is computed by adding the amount of the foreign earned income exclusion over the amount of any disallowed deduc-tions or exclusions taken account in computing adjusted gross income pursuant to Code section 991(a)(1). For most taxpayers this modification would not be applicable, and the Code section 1411(a)(1)(B) amount would be adjusted gross income.

11. I.R.C. §1411(b)(1)-(3).

12. See I.R.C. §1411(a)(2).

13. I.R.C. §1411(c)(6).

14. I.R.C. §1411(b).

15. See I.R.C. §1411(c)(6).

16. Rev. Proc. 2013-35, IRB 2013-47. For a single individual, the income tax on $410,000 of taxable income is computed as fol-lows: $118,189 on taxable income of $406,750 plus 39.6 percent of $3,250 ($410,000 - $406,750), or $1,287, for a total tax of $119,476.

17. I.R.C. §3101(b)(2)(C).

18. I.R.C. §1411(b)(3).

19. I.R.C. §469(c).

of $20,000. Even if trustee distributed the entire $30,000 to the beneficiary, the $20,000 of gain deemed to be retained by the trust would be treated as undistributed net investment income subject to NIIT.94

In the alternative, the trustee could make a discretionary in-kind distribution of the stock. Such a distribution would not trigger taxable capital gain to the trust; and, thus, no undistrib-uted investment income subject to NIIT.

The amount of the distribution to the ben-eficiary is the lesser of the stock’s fair market value or basis in the hands of the trust.95 In this example, the lesser number is the stock’s $10,000 basis.

There is, however, an additional potential downside to the beneficiary. Because the benefi-ciary would take a carryover basis of $10,000 in the stock,96 if the beneficiary were to sell the stock for $30,000, he or she would recognize a $20,000 capital gain that would be included as net invest-ment income.

Question – Does the “sixty-five-day rule” apply with regard to a distribution of net investment income to a beneficiary?

Answer – Apparently, yes. Pursuant to Code section 663(b), by making an appropriate election, a trust can make a distribution to a beneficiary within sixty-five days after the end of the tax year and it will be considered to have been made on the last day of the preceding year. If the trustee makes this election, the deemed distribution would reduce the DNI remaining in the trust and shift the income tax consequences from the trust to the beneficiary. This rule allows the trustee to use the benefit of hindsight to determine whether a distribution would be in the best interest of the trust and/or beneficiary in the prior tax year.

Obviously, the use of the sixty-five-day rule would provide a similar benefit to a trustee in determining whether to make a distribution of net investment income effective for the preceding tax year. This would allow the trustee more time to evaluate the relative merits of making a distribu-tion of net investment income to a beneficiary or

BK-SBM-04TTINCOMETAX-140349-Chp11.indd 130 9/18/2014 3:15:21 PM