Acetone Market

-

Upload

rocio-vallejo-valero -

Category

Documents

-

view

219 -

download

0

Transcript of Acetone Market

-

7/27/2019 Acetone Market

1/7

The prices presented herein are strictly the opinion of CMAI and are based on information collected within the

public sector and on assessments by CMAI staff. CMAI MAKES NO GUARANTEE OR WARRANTY ANDASSUMES NO LIABILITY AS TO THEIR USE.

This report is for the exclusive use of the client company. Distribution outside of the client company is

strictly prohibited without the prior written consent of Chemical Market Associates, Inc. (CMAI).

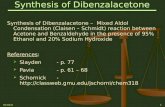

ACETONEMARKET REPORT

January - SUMMARY

CMAI - HOUSTON

Adrian Beale/Marc LaughlinTel: 281-531-4660

CMAI - EUROPE

Alex Lidback/Brian CookeTel: 44-207-930-9818

CMAI - SINGAPORE

Tel: 65-6-226-5363

Copyright CMAI 2008

All Rights [email protected]

United StatesLarge Buyer (1, 3, 6) Q4 2007 47.50 - 47.50 1047.2 - 1047.2 708 - 708Small-Medium Buyer (1, 2, 6) 2H January 55.00 - 60.00 1212.5 - 1322.8 820 - 895Export, USGC (5) 42.00 - 44.00 925.9 - 970.0

West Euro e, $1.478/EuroLarge Buyer (1, 3, 6) 62.4 - 62.4 1374.7 - 1374.7 930 - 930

Distribution Market (1, 2, 6) 45.9 - 48.6 1012.6 - 1071.7 685 - 725Export, ARA (5) 37.9 - 40.8 835.0 - 900.0 n

AsiaChina, Domestic (1), (RMB7.191/US$) 59.0 - 59.4 1300.2 - 1310.6 China, Domestic (Import Equivalent) 46.2 - 46.6 1019.6 - 1028.0 China, Main Port (4) 44.9 - 45.8 990.0 - 1010.0

PROPYLENE INDICES (Acetone*/Propylene) West Europe Asia(e.g. 20.0 cpp acetone/15.0 cpp propylene = 1.33) Contract Export Contract Distribution China NEA

Refinery (Spot) 0.85 0.75Chemical (Spot) 1.01 0.89 1.17 0.86 0.73 #N/APolymer (Spot) 0.79 0.70 1.07 0.79 0.78 #N/A

*Large Buyer Price

SPOT TRADE PRESSURE CALCULATION (positive values suggest profit incentive to move product)

all units are $/ton from: West Europe Asia

to: Freight Pressure Freight Pressure Freight PressureUnited States 85 -99 115 -262

West Europe 105 -185 110 -243Asia 120 -68 110 23

Not settled, previous or quarterly price postedAll Prices are FOB Unless Notes Indicate Otherwise. Changes from last report

n - Not ona pr ce range, no transact ons prices moved lowerPrice Range Covers From First Day of Month Through This Report's Date. prices moved higher

r ces re or e urrent ont n ess ote . - pr ces are unc ange

(1) Delivered or minimum freight allowed (3) Barge delivery (5) FOB

(2) Truck/Rail delivery (4) CFR (6) Excludes Discounts

SPOT

2H-January Cents/Lb. $/Ton /Ton Cents/Lb. $/Ton

PricingNotes

United States

Prices for Period Ending: CONTRACT

United States

2008 2009

Qtr-2 Qtr-3 Qtr-4 Qtr-1

United StatesLarge Buyer (1, 3, 6) cents per pound 47.50 - 47.50 50.00 49.00 46.00 49.67

Small-Medium Buyer (1, 2, 6) cents per pound 55.00 - 60.00 55.75 54.75 51.75 55.42ratio to propylene, refinery spot 0.9 0.92 0.98 0.98 1.10

ratio to propylene, chemical CP 1.0 0.84 0.89 0.89 1.00

West EuropeLarge Buyer (1, 3, 6) Euro per ton 930 - 930 960 905 855 815Distribution Market (1, 2, 6) Euro per ton 685 - 725 737 703 664 640

ratio to propy ene, c emica spot 1.0 1.06 1.03 1.04 1.06

ratio to propylene, polymer CP 0.8 1.03 0.99 1.01 1.02

Exchange Rate US$ per Euro 1.48 1.47 1.46 1.43 1.40

AsiaChina, Main Port (4) US per ton 990 - 1010 990 843 770 760

ratio to propylene, polymer spot 0.8 0.78 0.76 0.75 0.76

The forecasts are the opinion of the ACMR and based solely on information in the public sector

and assessments of CMAI. There is no guarantee as to their use.

Current Prices

QUARTERLY PRICE FORECAST

January 31, 2008

Issue: 98

-

7/27/2019 Acetone Market

2/7

Acetone Market Report

January 31, 2008/Issue No. 98 Page 2

0

10

20

30

40

50

60

70

Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08

Large Buyer CP Refinery Propylene, Spot

Chem Propylene, CP ~

U.S. Acetone Raw MaterialsCents Per Pound

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

Q1-02 Q1-03 Q1-04 Q1-05 Q1-06 Q1-07 Q1-08

U.S. Acetone to Propylene Ratio

Acetone/Spot Refinery Grade Propylene

~

Ratio

Acetone 1H-December 2H-December 1H-January 2H-JanuaryDelivered cts/lb 55.00 - 58.00 56.00 - 60.00 56.00 - 60.00 55.00 - 60.00

US$/MT 1213 - 1279 1235 - 1323 1235 - 1323 1213 - 1323

U.S. Small-Medium Buyer Market Price History

UNITED STATES

The large buyer contract discussions

for Q1 2008 are off a slow start with

no real price discussion range in the

public domain. A few operational is-

sues on both sides of the table have not

been helping the matter. As mentioned

in previous reports, a major phenol/

acetone producer had experienced

operational issues after their planned

maintenance outage of 3 weeks that

led to them taking another unplanned

outage of approximately 7 days. Now

a major buyer is experiencing issues

at one of its facilities; this just ahead

of their planned 20 day maintenance

outage in February. It is our under-standing that this major acetone buyer

has reduced their acetone consumption

so far for January and February by a

total of approximately 6,000 metric

tons.

A major phenol/acetone producer

is still planning to go forward with

private and confidential monthly

contract pricing in the larger buyer

market segment; however, no largebuyer has conrmed that they have

agreed to this and clearly there is some

resistance. We will monitor the situ-

ation closely and comment on it as it

becomes clearer.

The small to medium buyer market has continued to diverge. We are seeing a bit of price softening from the

beginning of the month with some producers reducing their January 1st price increase mid month and there is

some competitively priced material in a few spots throughout the country around 55 cents per pound. It should

be noted that a few producers are keeping their prices rm on the upper end of the range of 58-60 cents perpound. Supplies are understood to be readily available and for some demand seems to be a bit weaker than this

time last year while others are experiencing better business than they had expected.

-

7/27/2019 Acetone Market

3/7

Acetone Market Report

January 31, 2008/Issue No. 98 Page 3

On trade, we continue to see weak imports

and decent exports. The per month aver-

age imports for the months of January thru

November (the latest trade data available)

for 2005, 2006 and 2007 are 6.2, 3.7 and 3.4

metric tons, respectively. In likewise fashion,

exports for those years are 27.4, 23.5 and 25.6

metric tons, again respectively.

EUROPE

There has been little to no progress on the rst

quarter acetone price settlement. The two

sides remain very far apart and it appears that

negotiations will continue to linger well into

the rst quarter. As you may recall, produc-

ers would like to increase prices in conjunc-

tion with the 57 per ton increase for the Q1propylene price. Buyers, conversely, would

like to press for a rollover to only a marginal

increase - hence, the stalemate.

Both sides are adamant about their position.

Lets start with the production side. Producers

have struggled to keep pace with propylene

throughout 2007, despite all the acetone out-

ages, which has made acetones contribution

detrimental to the phenol/acetone business.

Depending on where negotiations settle outin the rst quarter, the industry is looking at

one of the lowest, if not the lowest acetone

to propylene ratio in history. Please consider

that is based on applying a net price assuming

known discounts on the quarterly price which

tend to be quite generous.

The buy side position, on the other hand, is pushing for little to no increase. They point to various dynamics.

The spot price has shown little change relative to December partly because demand in January has yet to show

the full seasonal upswing. In addition, MMA producers are trying to increase Q1 prices and they are strugglingto do so. Therefore, they are pushing back because of the large increase they absorbed because of methanol.

Yes, producers say that has nothing to do with acetone but it has created a large incentive to push back where

possible. Furthermore, buyers feel that time is on their side as more capacity is scheduled to come on line in

Acetone 1H-December 2H-December 1H-January 2H-January

Delivered cts/lb 44.5 - 47.1 45.5 - 48.1 45.9 - 48.6 45.9 - 48.6

/Ton 680 - 720 680 - 720 680 - 720 685 - 725

Exchange rate: $1.443/Euro $1.474/Euro $1.488/Euro $1.478/Euro

West Europe Distribution Market Price History

Ratio Acetone to Propylene

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08

U.S. Large Buyer

Europe Large Buyer

NE Asia

~

0

100

200

300

400

500

600

700

800

900

1000

Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08

0.9

1.0

1.1

1.2

1.3

1.4

1.5

1.6

Ratio Acetone to Poly C3 Large Buyer

~

West Europe Acetone and Propylene Ratio

Euro per Ton Ratio

Forecast

-

7/27/2019 Acetone Market

4/7

Acetone Market Report

January 31, 2008/Issue No. 98 Page 4

Acetone 9-Jan-08 16-Jan-08 23-Jan-08 30-Jan-08

CFR China cts/lb 43.54 - 44.45 n 43.54 - 45.36 44.45 - 45.36 n 45.36 - 46.27

US$/MT 960 - 980 n 960 - 1000 980 - 1000 n 1000 - 1020n = notional posting

China Price History

0

200

400

600

800

1000

1200

1400

Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08

PG Propylene NEA Spot Acetone CFR China

China Acetone vs Propylene

Dollars Per Metric Ton

~

the rst quarter (see below) suggesting there

is little incentive to settle early.

One of the questions arising from such a stale-

mate is how to handle invoicing? What are

the alternative mechanisms in contracts? All

of these issues are being closely analyzed.

In operational news, earlier in the month Ineos

Phenol successfully started its number one unit

at Antwerp. The second unit, which recently

was scheduled to restart on January 21, has

been pushed back to sometime in the middle

of February. As you may recall, the second

unit will come on stream with an additional

130,000 tons of acetone capacity which is a

reason why some buyers feel time is on their

side. This will clearly help their balancesbut they will begin efforts to prepare for their

turnaround in April at Gladbeck. At this point,

there have been no announced changes to the

force majeureand the sales allocation of 70 per

cent of previous volumes remains in place.

In the distribution market, demand has started

the New Year fairly slowly making it difcult

to raise prices. Consequently and as noted

above, increases have been marginal, on aver-

age, around 5 per ton to 685-725 per tondelivered. Within this range, the lower prices

have generally been for direct producer-to-

consumer deliveries. Most distributor busi-

ness has been at the higher end of the range

delivered Germany or France. At the end of

the day, demand needs to improve to see more upward price pressure. One should expect sellers to be even

more aggressive as in their eyes they have catching up to do on margins as they absorbed the entire propylene

increase with only minimal increases for acetone.

Europes acetone export market is rather difcult these days as prices in Asia have been rather stable and low.In addition, the market has been quiet. The effect from this is that the netbacks are very, very low and not at-

tractive to sellers. Therefore, the spot market is fairly quiet.

Regional Acetone Prices

0

200

400

600

800

1,000

1,200

1,400

1,600

Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08

Dollars per Ton

U.S. Large Buyer

Europe Large Buyer

NE Asia

~

-

7/27/2019 Acetone Market

5/7

Acetone Market Report

January 31, 2008/Issue No. 98 Page 5

ASIA

Aided by the increases in import prices, domestic sellers continued with their efforts to keep their price levels

up. Lower market inventories are also helping. On the other hand, Chinese demand remains gloomy due to

more extensive shutdowns taking place in the derivative sectors ahead of the Lunar New Year holidays. In

East China, the mainstream spot transactions improved slightly to RMB9,350-RMB9,450 per ton depending

on location. Current notional spot prices are estimated in a range of $1,000-$1,030 per ton CFR.

FORECAST

U.S. Price Forecast

Concerning acetone demand, a major MMA producer has a turnaround scheduled for approximately 20 days

in February at one of its units; however they are currently experiencing operational issues. In the near term

we expect that acetone prices will remain at due to feedstock costs, but offset a bit by the aforementioned

demand dynamics. Further out we expect acetone prices to decline due to a more well supplied global acetone

market.

In January, CMAI began reporting a new propylene marker entitled Renery Grade Propylene Weighted Aver-

age Acquisition, following the demise of the Renery Grade Propylene (RGP) contract price. This price is the

weighted combination of spot and contract RGP transactions for the current month. The CMAI 1st half January

Weighted Average Acquisition price for RGP is 56.64 cents per pound. As previously advised, for January we

will still use the start-month spot weighted average RGP price for our cumene contract price, but we will con-

sider which RGP price to use in future calculations based on how the industry adopts the new marker prices.

European Price Forecast

CMAIs price forecast for acetone contract prices in Europe is based on our forecasts for propylene price de-

velopments. Therefore our forecast calls for gross acetone contract prices to roughly follow propylene pricedevelopments over time. However, it appears acetone prices in the rst quarter will separate themselves from

propylene to historical levels, on the low end. Obviously this is not good news for producers but it shows the

global glut of acetone. Our forecast calls for net acetone prices be slightly under 80 percent of the value of

propylene for the near future. Please note that CMAI is applying a heavily discounted acetone price to correctly

represent market conditions. We expect this ratio to hover around this level in the near term and we believe it

will remain slightly under 80 percent due to global length and as new capacity enters the market. The possibil-

ity exists for it to fall further if propylene prices rise and domestic and export phenol demand is exceptionally

strong. It will be interesting if phenol exports are strong but sellers are reluctant to ramp up rates due to the

acetone market. From a phenol producers point of view, acetone has been the culprit for the poor margins

despite a tightly balanced phenol market. It is worth noting that efforts to increase phenol prices relative tobenzene to help overall protability have seen some success.

There are players in the acetone market who would like to see the current acetone pricing structure completely

overhauled as discounts have grown dramatically in recent years creating a disparity between gross and net

contract levels. This suggests that a possible rebasing may be launched by a player but at this point there is no

clear indication whether this will be tackled soon. CMAI is considering all avenues to better reect the market

in the coming months and we would welcome your comments.

-

7/27/2019 Acetone Market

6/7

Acetone Market Report

January 31, 2008/Issue No. 98 Page 6

2008 United States Acetone Operating Schedule

(000 Metric Tons) Annual CapacitCompany Location Process Capacity Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

UNITED STATES

Dow Institute IPA dehydro 77 - - - - - - - - - - - -

Oyster Creek Phenol co-product 183 - - 6 - - - - - - - - -

Eastman Kingsport Other 11 - - - - - - - - - - - -

Georgia Gulf Plaquemine Phenol co-product 141 3 - 4 - - - - - - - - -

Goodyear Bayport Other 7 - - - - - - - - - - - -

Ineos Phenol Mobile Phenol co-product 335 - - - - - - - - - - - -JLM Industries Blue Island Phenol co-product 28 - - - - - - - - - 1 - -

Lyondell Bayport Other 30 - - - - - - - - - - - -

MtVernon Phenol Mount Vernon Phenol co-product 217 - - - - - - - - - - - -

Shell Chemical Deer Park Phenol co-product 162 3 - - - - - - - - - - -

Deer Park Phenol co-product 210 4 - - - - - - - - - - -

Sunoco Frankford Phenol co-product 220 - - - - - - - - - - - -

Frankford Phenol co-product 127 - - - - - - - - - - - -

Haverhil l Phenol co-product 78 - - - - - - - - - - - -

Haverhil l Phenol co-product 109 - - - - - - - - - - - -

Total U.S. 1,935 10 - 10 - - - - - - 1 - -

North American Capacity 1,935 164 153 164 159 164 159 164 164 159 164 159 164

North American Capacity Lost 20 10 - 10 - - - - - - 1 - -

North American Capacity Lost: Others/Estimates - - - - - - - - - - - - -

North American % Capacity Lost 1.0% 6% 0% 6% 0% 0% 0% 0% 0% 0% 0% 0% 0%

Where necessary CMAI has estimated operations. Capacities are prorated for new plants/expansions.

2008 West Europe Acetone Operating Schedule(000 Metric Tons) Annual Capacity

Company Location Process Capacity Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

BelgiumIneos Phenol Antwerp Phenol co-produc t 146 4 - - - - - - - - - - -

Antwerp Phenol co-product 265 15 - - - - - - - - - - -

Total Belgium 411 19 - - - - - - - - - - -

FinlandBorealis Poly Porvoo Phenol co-product 118 - - - - - - - - - - - -

Total Finland 118 - - - - - - - - - - - -

France

NOVACAP Roussil lon Phenol co-product 78 - - - - - - - 2 - - - -Roussil lon Phenol co-product 19 - - - - - - - 1 - - - -

Total France 97 - - - - - - - 3 - - - -

GermanyDOMO Chemicals Leuna Phenol co-product 47 - - - - - - - - - - - -

Leuna Phenol co-product 47 - - - - - - - - - - - -Ineos Phenol Gladbeck Phenol co-product 409 - - - 34 - - - - - - - -

Total Germany 503 - - - 34 - - - - - - - -

Italy

Polimeri Europa Mantova Phenol co-produc t 186 - - - - - - - - - - - -Syndial Porto Torres Phenol co-product 112 - - - - - - - - - - - -

Total Italy 298 - - - - - - - - - - - -

NetherlandsShell Chem Neth Pernis IPA dehydro 150 - - - - - - - - - - - -

Total Netherlands 150 - - - - - - - - - - - -

SpainErtisa Huelva, HL Phenol co-product 130 - - - - - - - - - - - -

Huelva, HL Phenol co-product 99 - - - - - - - - - - - -

Huelva, HL Phenol co-product 125 - - - - - - - - - - - -IQA Tarragona, TG IPA dehydro 9 - - - - - - - - - - - -

Total Spain 363 - - - - - - - - - - - -

United Kingdom

Total United Kingdom - - - - - - - - - - - - -

West Europe Capacity 1,940 164 154 164 159 164 159 164 164 159 164 159 164

West Europe Lost 56 19 - - 34 - - - 3 - - - -

West Europe % Capacity Lost 2.9% 12% 0% 0% 21% 0% 0% 0% 2% 0% 0% 0% 0%Where necessary CMAI has estimated operations. Capacities are prorated for new plants/expansions.

-

7/27/2019 Acetone Market

7/7

Acetone Market Report

January 31, 2008/Issue No. 98 Page 7

2008 Asia Acetone Operating Schedule(000 Metric Tons) Annual Capacity

Company Location Process Capacity Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

CHINA

Blue Star Harbin, Heilong. Phenol co-product 75 - - - - - - - - - - - -Jilin Chemical Jil in, Jil in Phenol co-product 47 - - - - - - - - - - - -Kingboard Huizhou, Guangdo Phenol co-product 77 - - - - - - - - - - - -Shanghai Pac Caojing, Shanghai Other 5 - - - - - - - - - - - -Sinopec Gao Qiao Caojing, Shanghai Phenol co-product 78 - - - - - - - - - - - -

Gaoqiao, Shanghai Phenol co-product 22 - - - - - - - - - - - -

Gaoqiao, Shanghai Phenol co-product 24 - - - - - - - - - - - -Tongliao ChemicalShanghai, ShanghaOther 3 - - - - - - - - - - - -Yanshan PC Fangshan, Beijing Phenol co-product 31 - - - - - - - - - - - -

Fangshan, Beijing Phenol co-product 62 - - - - - - - - - - - -

Total China 122 - - - - - - - - - - - -

JAPAN

Chiba Phenol Chiba, Phenol co-product 143 - - 12 2 - - - - - - - -Mitsub. Chemical Kashima, Phenol co-product 155 - - - - 4 13 - - - - - -Mitsui Chemicals Chiba, Phenol co-product 118 - - - - - - - - - - 10 2

Sakai, Phenol co-product 124 - - - - - 10 2 - - - - -Sumitomo Chem. Oita, Other 12 - - - - - - - - - - - -

Total Japan 552 - - 12 2 4 23 2 - - - 10 2

KOREA

Kumho P&B Yeosu, Phenol co-product 62 - - - - - - - - - - - -Yeosu, Phenol co-product 19 - - - - - - - - - - - -Yeosu, Phenol co-product 120 - - - - - - - - - - - -

LG Chemical Yeosu, Phenol co-product 123 - - - - - 9 - - - - - -

Total Korea 324 - - - - - 9 - - - - - -

TAIWAN

Chang Chun PC Kaohsiung, Phenol co-product 124 - - - - - - - - - - - -FCFC Mai Liao, Phenol co-product 124 - - 10 3 - - - - - - - -

Mai Liao, Phenol co-product 124 - - 10 3 - - - - - - - -Lee Chang Yung Lin Yuan, Kaohsiun IPA dehydro 30 - - - - - - - - - - - -Tai Prosperity Lin Yuan, KaohsiunPhenol co-product 138 - - - - - - - - - - - -

Total Taiwan 540 - - 20 7 - - - - - - - -

SINGAPORE

Mitsui Phenols Pulau Sakra, Phenol co-product 186 - - - - - 11 - - - - - -

Total Singapore 186 - - - - - 11 - - - - - -

ASIA Capacity 2,079 168 157 168 162 168 162 176 186 180 186 180 186

ASIA Capacity Lost 101 - - 32 9 4 43 2 - - - 10 2

ASIA Capacity Lost: Others/Estimates - - - - - - - - - - - - -

ASIA % Capacity Lost 4.9% 0% 0% 19% 5% 3% 26% 1% 0% 0% 0% 5% 1%

Where necessary CMAI has estimated operations. Capacities are prorated for new plants/expansions.