Acct t103 Ppt Chap19

Transcript of Acct t103 Ppt Chap19

-

8/9/2019 Acct t103 Ppt Chap19

1/45

Introduction toIntroduction to

ManagementManagementAccountingAccounting

Chapter 19Chapter 19

-

8/9/2019 Acct t103 Ppt Chap19

2/45

ObjectivesObjectives Distinguish financial accounting fromDistinguish financial accounting from

management accountingmanagement accounting Describe service, merchandising, andDescribe service, merchandising, and

manufacturing companies, and classify theirmanufacturing companies, and classify theircosts by valuecosts by value--chain elementchain element

Distinguish among direct costs and indirectDistinguish among direct costs and indirectcosts; and full product costs, inventoriablecosts; and full product costs, inventoriableproduct costs, and period costsproduct costs, and period costs

Prepare the financial statements of aPrepare the financial statements of amanufacturing companymanufacturing company

Identify trends in the business environmentIdentify trends in the business environmentand use costand use cost--benefit analysis to make businessbenefit analysis to make businessdecisionsdecisions

Use reasonable standards to make ethicalUse reasonable standards to make ethical

decisionsdecisions

-

8/9/2019 Acct t103 Ppt Chap19

3/45

Planning Acting

Feedback

Controlling

The Functions of ManagementThe Functions of Management

-

8/9/2019 Acct t103 Ppt Chap19

4/45

Management AccountingManagement Accounting vsvs--

Financial AccountingFinancial Accounting

MA: Internal managers of the business

FA: External - Investors, Creditors,Government authorities (IRS, SEC, etc.)

Primary Users

-

8/9/2019 Acct t103 Ppt Chap19

5/45

Management Accounting andManagement Accounting and

Financial AccountingFinancial Accounting

MA: Help managers plan and

control business operations

FA: Help investors, creditors, and others make

investment, credit, and other decisions

Purpose of Information

-

8/9/2019 Acct t103 Ppt Chap19

6/45

Management Accounting andManagement Accounting and

Financial AccountingFinancial Accounting

MA: Relevance, focus on future

FA: Reliability, objectivity, and focus on the past

Focus and Time Dimension

-

8/9/2019 Acct t103 Ppt Chap19

7/45

Management Accounting andManagement Accounting and

Financial AccountingFinancial Accounting

MA: Internal reports not restricted by GAAP,

determined by cost benefit analysis

FA: Financial statements restricted by GAAP

Type of Report

-

8/9/2019 Acct t103 Ppt Chap19

8/45

Management Accounting andManagement Accounting and

Financial AccountingFinancial Accounting

MA: No independent audit

FA: Annual independent audit by CPAs

Verification

-

8/9/2019 Acct t103 Ppt Chap19

9/45

Management Accounting andManagement Accounting and

Financial AccountingFinancial Accounting

MA: Detailed reports on

parts of the company

FA: Summary reports primarily

on the company as a whole

Scope of Information

-

8/9/2019 Acct t103 Ppt Chap19

10/45

Management Accounting andManagement Accounting and

Financial AccountingFinancial Accounting

MA: Concern about how reports

will affect employees behavior

FA: Concern about adequacy of disclosure

Behavioral Implications

-

8/9/2019 Acct t103 Ppt Chap19

11/45

Service, Merchandising, andService, Merchandising, and

Manufacturing CompaniesManufacturing Companies

Service Company:

provides intangible services,rather than tangible products

Merchandising Company:resells products previously

bought from suppliers

-

8/9/2019 Acct t103 Ppt Chap19

12/45

Service, Merchandising, andService, Merchandising, and

Manufacturing CompaniesManufacturing Companies

Manufacturing Company:

uses labor, plant, and equipment to convertraw materials into finished products

Materials inventory

Work in process inventory

Finished goods inventory

-

8/9/2019 Acct t103 Ppt Chap19

13/45

Value ChainValue Chain adds value toadds value to

productproduct

Research and

Development DesignProduction or

Purchases

Marketing Distribution CustomerService

-

8/9/2019 Acct t103 Ppt Chap19

14/45

Value ChainValue Chain

The value chain also adds costs to theThe value chain also adds costs to theproductproduct

Want to manage these costsWant to manage these costs

Want to be able to determine the costs ofWant to be able to determine the costs ofvarious aspects of the value chainvarious aspects of the value chain

-

8/9/2019 Acct t103 Ppt Chap19

15/45

Cost Objects, Direct Costs,Cost Objects, Direct Costs,

and Indirect Costsand Indirect Costs Cost objectsCost objects are anything for which aare anything for which a

separate measurement of costs is desired.separate measurement of costs is desired.

Cost driversCost drivers are any factors that affectare any factors that affectcost.cost.

-

8/9/2019 Acct t103 Ppt Chap19

16/45

Cost Objects, Direct Costs,Cost Objects, Direct Costs,

and Indirect Costsand Indirect CostsWhat are examples of cost objects?What are examples of cost objects?

individual productsindividual products

alternative marketing strategiesalternative marketing strategies

geographic segments of the businessgeographic segments of the business

departmentsdepartments

-

8/9/2019 Acct t103 Ppt Chap19

17/45

Cost Objects, Direct Costs,Cost Objects, Direct Costs,

and Indirect Costsand Indirect Costs Direct vs. Indirect Costs:Direct vs. Indirect Costs:

DirectDirect costscosts are those costs that can beare those costs that can be

specifically traced to the cost object.specifically traced to the cost object. What are indirect costs?What are indirect costs?

Indirect costsIndirect costs are costs that cannot beare costs that cannot be

specifically traced to the cost object.specifically traced to the cost object.

-

8/9/2019 Acct t103 Ppt Chap19

18/45

Inventoriableproduct

costs

Fullproduct

costs

Product CostsProduct Costs

What are product costs?What are product costs?

They are the costs to produce (orThey are the costs to produce (orpurchase) tangible products intended forpurchase) tangible products intended forsale.sale.

There are two types of product costs:There are two types of product costs:

-

8/9/2019 Acct t103 Ppt Chap19

19/45

Full Product CostsFull Product Costs

All costs throughout the value chainAll costs throughout the value chain

-

8/9/2019 Acct t103 Ppt Chap19

20/45

Inventoriable Product CostsInventoriable Product Costs

For external reporting,For external reporting, merchandisersmerchandisersinventoriable product costsinventoriable product costs include onlyinclude only

costs that are incurred in the purchase ofcosts that are incurred in the purchase ofgoods.goods.

Inventoriable costsInventoriable costs are an asset.are an asset.

Period costsPeriod costs flow as operating expensesflow as operating expensesdirectly to the income statement.directly to the income statement.

-

8/9/2019 Acct t103 Ppt Chap19

21/45

Inventoriable Product CostsInventoriable Product Costs

For external reporting,For external reporting, manufacturersmanufacturersinventoriable product costsinventoriable product costs include raw materialsinclude raw materials

plus all other costs incurred in theplus all other costs incurred in themanufacturing process.manufacturing process.

Inventoriable product costs are incurred only inInventoriable product costs are incurred only inthe third element (production) of the valuethe third element (production) of the value

chain.chain.

Costs incurred in other elements of the valueCosts incurred in other elements of the valuechain are period costs.chain are period costs.

-

8/9/2019 Acct t103 Ppt Chap19

22/45

Direct

Materials

Direct

Labor

Indirect

Labor

Indirect

Materials

Other

Indirect

Manufacturing Overhead

Inventoriable Product CostsInventoriable Product Costs

-

8/9/2019 Acct t103 Ppt Chap19

23/45

Revenues Expenses = Operating income

Financial Statements forFinancial Statements for

Service CompaniesService Companies There is no inventory and thus noThere is no inventory and thus no

inventoriable costs.inventoriable costs.

The income statement does not includeThe income statement does not includecost of goods sold.cost of goods sold.

-

8/9/2019 Acct t103 Ppt Chap19

24/45

Financial Statements forFinancial Statements for

Merchandising CompaniesMerchandising Companies

Purchases of

Inventory plus

Freight-In

Inventory

Sales Revenue

Cost of

Goods Sold

INCOME STATEMENT

Operating

Expenses

Inventoriable

Costs

BALANCE SHEET

equals Operating Income

whensalesoccur

deduct

equals Gross Margin

deduct

Period

Costs

-

8/9/2019 Acct t103 Ppt Chap19

25/45

Financial Statements forFinancial Statements for

Manufacturing CompaniesManufacturing Companies

Materials

InventoryFinished

Goods

Inventory

Sales Revenue

Cost of

Goods Sold

INCOME STATEMENT

Operating

Expenses

Inventoriable

Costs

BALANCE SHEET

equals Operating Income

whensalesoccur

deduct

equals Gross Margin

deduct

Work in

Process

Inventory

Period

Costs

-

8/9/2019 Acct t103 Ppt Chap19

26/45

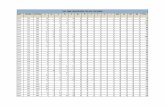

Manufacturing Company ExampleManufacturing Company Example

Kendall Manufacturing Company:Kendall Manufacturing Company:

Beginning and ending workBeginning and ending work--inin--processprocessinventories were $20,000 and $18,000.inventories were $20,000 and $18,000.

Direct materials used were $70,000.Direct materials used were $70,000.

Direct labor was $100,000.Direct labor was $100,000.

Manufacturing overhead incurred wasManufacturing overhead incurred was$150,000.$150,000.

-

8/9/2019 Acct t103 Ppt Chap19

27/45

Manufacturing Company ExampleManufacturing Company Example

What is the cost of goods manufactured?What is the cost of goods manufactured?

Beginning work in process $Direct labor $

Direct materials $

Mfg. overhead $ $Ending work in process $ ________

Cost of goods manufactured $

-

8/9/2019 Acct t103 Ppt Chap19

28/45

Manufacturing Company ExampleManufacturing Company Example

Kendall Manufacturing CompanysKendall Manufacturing Companysbeginning finished goods inventory wasbeginning finished goods inventory was

$60,000 and its ending finished goods$60,000 and its ending finished goodsinventory was $55,000.inventory was $55,000.

How much is the cost of goods sold?How much is the cost of goods sold?

-

8/9/2019 Acct t103 Ppt Chap19

29/45

Manufacturing Company ExampleManufacturing Company Example

Beg. finished goods inventory $+ Cost of goods manufactured $________

= Cost of goods available for sale $

Ending finished goods $________

= Cost of goods sold $

-

8/9/2019 Acct t103 Ppt Chap19

30/45

Manufacturing Company ExampleManufacturing Company Example

Kendall Manufacturing Company had salesKendall Manufacturing Company had salesof $627,000 for the period.of $627,000 for the period.

How much is the gross margin?How much is the gross margin?

Sales $

Cost of goods sold $________ = Gross margin $

-

8/9/2019 Acct t103 Ppt Chap19

31/45

Manufacturing Company ExampleManufacturing Company Example

Kendall Manufacturing Company hadKendall Manufacturing Company hadoperating expenses as follows:operating expenses as follows:

Sales salaries and commissionsSales salaries and commissions $$80,000 Delivery expense80,000 Delivery expense10,000 Administrative expenses10,000 Administrative expenses30,00030,000 TotalTotal$120,000$120,000

What is Kendalls operating income?What is Kendalls operating income?

-

8/9/2019 Acct t103 Ppt Chap19

32/45

Manufacturing Company ExampleManufacturing Company Example

Gross margin $

Operating expenses $_________

= Operating income $

-

8/9/2019 Acct t103 Ppt Chap19

33/45

Flow of Costs through aFlow of Costs through a

Manufacturers AccountsManufacturers Accounts Direct MaterialsDirect Materials

InventoryInventory Beginning inventoryBeginning inventory

++ Purchases and freightPurchases and freight--inin

== Direct materialsDirect materials

availableavailable for usefor use Ending inventoryEnding inventory== Direct materials usedDirect materials used

Work in ProcessWork in ProcessInventoryInventory

Beginning inventoryBeginning inventory++ Direct materials usedDirect materials used++ Direct laborDirect labor++ Manufacturing overheadManufacturing overhead== Total manufacturingTotal manufacturing

costscoststo account forto account for

Ending inventoryEnding inventory== Cost of goodsCost of goods

manufacturedmanufactured

-

8/9/2019 Acct t103 Ppt Chap19

34/45

Flow of Costs through aFlow of Costs through a

Manufacturers AccountsManufacturers Accounts

Finished Goods InventoryFinished Goods Inventory

Beginning inventory+ Cost of goods manufactured

= Cost of goods available for sale

- Ending inventory

= Cost of goods sold

-

8/9/2019 Acct t103 Ppt Chap19

35/45

Trends in Todays BusinessTrends in Todays Business

EnvironmentEnvironment Service EconomyService Economy

Global MarketplaceGlobal Marketplace

Time Based CompetitionTime Based Competition

QualityQuality

-

8/9/2019 Acct t103 Ppt Chap19

36/45

Shift to a Service EconomyShift to a Service Economy

In the U.S., 55% of the workforce

is employed in service companies.

Service Ind stries ther

-

8/9/2019 Acct t103 Ppt Chap19

37/45

-

8/9/2019 Acct t103 Ppt Chap19

38/45

Enterprise Resource PlanningEnterprise Resource Planning

Enterprise resource planning (ERP) isEnterprise resource planning (ERP) issoftware that can integrate all of thesoftware that can integrate all of the

companys functions, departments, andcompanys functions, departments, anddata into a single system.data into a single system.

Advantages of ERP include:Advantages of ERP include:

Streamlined operations, quicker responseStreamlined operations, quicker responsetime to changes, and the replacement oftime to changes, and the replacement ofhundreds of separate software systemshundreds of separate software systems

-

8/9/2019 Acct t103 Ppt Chap19

39/45

Supply Chain ManagementSupply Chain Management

Companies exchange information withCompanies exchange information withsuppliers and customers to reduce costs,suppliers and customers to reduce costs,

improve quality, and speed delivery ofimprove quality, and speed delivery ofgoods and services from suppliers,goods and services from suppliers,through the company itself, and on tothrough the company itself, and on to

customers.customers. EE--commercecommerce

-

8/9/2019 Acct t103 Ppt Chap19

40/45

JustJust--inin--TimeTime

JIT philosophy means that the companyJIT philosophy means that the companyschedules productionschedules productionjust in timejust in time to satisfyto satisfy

needs.needs. Speeding up of the production processSpeeding up of the production process

reducesreduces throughput timethroughput time..

Throughput time is the time betweenThroughput time is the time betweenbuying raw materials and selling thebuying raw materials and selling thefinished products.finished products.

-

8/9/2019 Acct t103 Ppt Chap19

41/45

Total Quality ManagementTotal Quality Management

The goal of total quality management (TQM) isThe goal of total quality management (TQM) isto please customers by providing them withto please customers by providing them with

superior products and services.superior products and services. TQM emphasizes educating, training, and crossTQM emphasizes educating, training, and cross--

training employees.training employees.

Quality improvement programs cost moneyQuality improvement programs cost money

today.today.

The benefits usually do not occur until later.The benefits usually do not occur until later.

-

8/9/2019 Acct t103 Ppt Chap19

42/45

Total Quality ManagementTotal Quality Management

Initial benefits

and costs $170 million $200 million

Additional

expected benefits 68 million

Total $238 million $200 million

Total Benefits Total Cost

-

8/9/2019 Acct t103 Ppt Chap19

43/45

Professional Ethics forProfessional Ethics for

Management AccountantsManagement Accountants In many situations the ethical path is notIn many situations the ethical path is not

so clear.so clear.

The Institute of Management AccountantsThe Institute of Management Accountants(IMA) has developed standards to help(IMA) has developed standards to helpmanagement accountants deal with thesemanagement accountants deal with these

situations.situations.

-

8/9/2019 Acct t103 Ppt Chap19

44/45

Standards of Ethical Conduct forStandards of Ethical Conduct for

Management AccountantsManagement Accountants

Confidentiality

Integrity

Objectivity

Competence

-

8/9/2019 Acct t103 Ppt Chap19

45/45

ReviewReview

Management AccountingManagement Accounting

Value ChainValue Chain

Cost Objects, Direct Costs, Indirect CostsCost Objects, Direct Costs, Indirect Costs

Product Costs (full, inventoriable)Product Costs (full, inventoriable)

Period CostsPeriod Costs

Cost of Goods ManufacturedCost of Goods Manufactured Todays Business EnvironmentTodays Business Environment

EthicsEthics