Acct 505 Practice Quiz 1

Transcript of Acct 505 Practice Quiz 1

ACCT505 Practice Quiz #1

1. For which of the following businesses would the job order cost system be appropriate?a. Auto repair shop.b. Crude Oil refinery.c. Drug Manufacturer.d. Root beer producer.

2. Which of the following companies would most likely use job costing?a. Paper manufacturer.b. Paint Producer.c. Breakfast cereal maker.d. Advertising agency.

3. An equivalent unit of conversion costs is equal to the amount of conversion costs required to:a. Start a unit.b. Start and complete a unit.c. Transfer a unit in.d. Transfer a unit out.

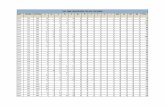

4. Job 655 was recently completed. The following data has been recorded on its job cost sheet:Direct materials $ 78,000Direct labor costs 45,000Number of units completed 4,000

The company applies manufacturing overhead on the basis of direct labor costs. The predetermined overhead rate is 75% of direct labor costs.

Required:

Compute the unit product cost that would appear on the job cost sheet for this job:

5. Prepare the necessary journal entries from the following information for Kingston Company:a. Purchased raw materials on account, $ 45,000.b. Raw materials requisitioned for use in production. Direct Materials $ 23,000; Indirect

materials, $ 12,000.c. Salaries and wages cost incurred:

Direct Labor cost, $ 47,000; Indirect Labor Cost, $ 15,000.

d. Depreciation on Factory Equipment, $ 12,000.

e. Depreciation on Office Equipment, $ 5,000.f. Manufacturing Overhead was applied at a rate of 80% of direct labor costs.g. Goods costing $ 75,000 were completed during the period.h. Goods costing $ 36,000 were sold on account for $ 48,000.

6. Ulmer Company uses the weighted-average method in its process-costing system. The Framing Department of Ulmer Company reported the following information for the month of September: Percentage Complete with Units Respect to ConversionWork In Process, September 1 5,000 70%Units Started 26,000Completed and Transferred Out 22,000Work in Process, September 30 9,000 40%

Costs for September: Materials ConversionWork in Process, September 1 $ 37,200 $ 48,640Added during the month $161,200 $ 192,000

All materials are added at the beginning of the process.

Required:

Compute the following items using the weighted-average method:

a. The equivalent units of production for conversion costs.b. The cost per equivalent unit for conversion costs.c. The total cost assigned to units transferred out the Framing Department for

September.d. The cost assigned to work in process inventory as of September 30.

7. The Simmons Company manufactures a product for which materials are added at the beginning of the manufacturing process. A review of the company’s inventory and cost records for the most recently completed year revealed the following information:

Units Materials Conversion

Work In Process, March 1 ( 60% complete With respect to conversion costs) 80,000 $ 200,000 $ 291,200Units started into production 170,000Costs added during the year: Materials $ 600,000 Conversion $ 582,400Units completed during the year 190,000

The company uses the weighted-average cost method in its process costing system. The ending inventory is 30% complete with respect to conversion costs.

Required:

a. Compute the equivalent units of production and the cost per equivalent units for materials and for conversion costs.

b. Determine the cost transferred to finished goods..c. Determine the amount of cost that should be assigned to the ending work-in-process inventory.

8. XYX Corporation has provided the following data for the month of January:

Inventories Beginning EndingRaw materials $21,000 $15,000

Work In process $7,000 $9,000

Finished goods $33,000 $30,000

Additional Information

Raw material purchases $35,000

Direct labor costs $55,000 Manufacturing overhead cost incurred $27,000

Indirect materials included in manufacturing overhead costs incurred $2,500

Manufacturing overhead cost applied to work in process $30,000

Prepare a Schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold in good form.