ACCT 3563 Assignment

Transcript of ACCT 3563 Assignment

-

8/16/2019 ACCT 3563 Assignment

1/28

"

Word count: 2180"

Chosen companies: 1. TNG Limited (Australia) 2. Hoeft & Wessel AG Hannover#

(German)$

1.1 Introduction%

The purpose of this report is to assess whether companies in Australia and Germany are&

impacted in their compliance with IAS 37 as well as IAS 19 by country-level and'

firm-level difference. This report consists of a general picture for each class of provision(

in the chosen companies, assessing the companies’ level of compliance with IAS 37 and)

analyzing impact of country level and firm level cultural difference. In the end, the report*

provides a strategy that is instrumental to users in evaluating the financial report prepared"+

under IFRS by different countries.""

"#

2.1 Background about companies’ provisions"$

Australian company German company Reference

Total value

of provisions

146,076 (AUD) 14,800,000 (EUR) Appendix

9&10

Total value

of provisions

as percentage

of total asset

146,076/23,982,893=0.

61%

14,800,000/44,314,000=33

.34%

Descending 1 st Liability for long 1 st Staff-related provisions Appendix

-

8/16/2019 ACCT 3563 Assignment

2/28

#

order of the

types of

provisions

according to

their book

values

service leave

2nd Defined

contribution

superannuation fund

provision

2nd Staff–related

accrued/deferred liabilities

3rdProvisions for

contingent loss

4th provision for warranties

5th provision for

subsequent costs and

conventional penalties

2&4&5

Descending

order of the

most frequent

types of

provision

1st Defined superannuation fund provision = pension

provision (Both of them are post employment

benefit, and thus they are counted as twice.)

2nd All the provision that are not post-employment

benefit.

Which

company that

has the most

Based on the given data, German company has the most IAS 37 and

IAS 19 provisions.

-

8/16/2019 ACCT 3563 Assignment

3/28

$

IAS 37 and

IAS 19

provisions?

"

2.2 Correlation between number of employees & value of employee related provisions#

$

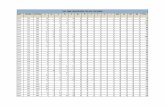

German company 2014 2013 Australian

company

2014 2013

Average number of

employees

416 410 Appendix 8 13 * 15*

Total value of

employee-related

provisions

12,250,0

00

9,946,00

0

Appendix 4 146,706 82,826

Increase/(decrease)

as percentages

23.17% NA 69.88% NA

(Refer to appendix 8&11, *Estimate number of employees = total employment expense /%

mining industry average)&

'

The figures in table above demonstrate different results about whether the change in the(

value of employee related provisions is positively related to the change in the number of)

-

8/16/2019 ACCT 3563 Assignment

4/28

%

employee. Referring to appendix 2, this could be explained by the fact that 2014 is the"

first year that the Australian company start to recognize the provision for long-service#

leave. Consequently, the value of the employee related provision in the Australian$

company significantly increased with a slight decrease in the number of employees.%

Therefore, change in the value of employee related provisions is positively related to the&

change in the number of employees.'

(

3.3 Provisions: compliance level with relevant standard & disclosure of measurement and)

assumptions*

3.31 Australian company"+

Referring to appendix1, the Australian company disclosed the basis of measurement for its""

provisions but it did not disclose the assumptions used to derive the pre-tax discount rate."#

"$

Referring to appendix 2, the Australian company uses a table to show the change in"%

provisions during the year, which satisfies all requirements in paragraph 84 of IAS 37,"&

except for the requirement of 84-(e). Besides, the company did not disclose any listed item"'

under the paragraph 85 of IAS 37."(

")

3.32 German company"*

Referring to appendix 4.1, the basis of measurement for each class of provision is#+

disclosed under the notes. Referring to appendix 4 and appendix 4.1, the German company#"

-

8/16/2019 ACCT 3563 Assignment

5/28

&

disclosed several assumptions used in staff-related provisions including actuarial"

assumptions. Referring to appendix 5, except provision for warranties, the company did#

not disclose any assumption used in the product-related provisions.$

%

Referring to appendix 4&5, the company satisfied most of requirements under paragraph&

84 of IAS 37. In order to comply with the 84-(e) requirement, the company used'

revaluation method to adjust value of staff-related provisions. The company did not(

disclose information about the 84-(4) for product related provisions. Referring to appendix)

4&5, the company disclose brief descriptions its staff-related-provisions but the company*

did not comply any other requirements under paragraph 85 of IAS 37."+

""

3.4 Contingent liabilities: Compliance level with paragraph 86 of IAS"#

"$

3.41 Australian"%

Referring to appendix 6, except the constructive claim, the financial effects of other"&

contingent liabilities were disclosed as the requirements under paragraph 86 of IAS 37"'

because the financial effect of the constructive claim cannot be reliably measured."(

According to the statement in the first graph of appendix 6, the company disclosure the")

uncertainties relating to the amount and timing of outflow for all the provisions. Overall"*

the company shows high level of compliance with paragraph 86 of IAS 37.#+

#"

-

8/16/2019 ACCT 3563 Assignment

6/28

'

3.42 German"

Referring to appendix 7, the only sort of contingent liabilities of the company has is bond.#

Bond in here means companies have obligation to make payments to third parties when$

companies do not perform as agreement. The financial effect of bond is likely to be%

pre-determined in the contracts rather than estimates. The company did not disclose&

uncertainties relating to the amount or timing of outflow for its bonds.'

(

3.43 Comparison between the chosen companies)

Referring to appendix 6&7, in the end of 2014, the value of contingent liabilities amounts*

to 2.57% of total assets and 81.54% of total liabilities in Australian company. As for the"+

German company, contingent liabilities amounts to 13.91% of total assets and 18.74% of""

total liabilities. To be more comparable, we only focus on the ratio of contingent liabilities"#

versus total asset because the Australian company merely has low level of current"$

liabilities. Thus, the Australian company does not have more contingent liabilities than the"%

German company."&

"'

3.5 Examination: whether the level of compliance with IAS 37 and IAS 19, and levels of"(

provisions are influenced by cultural difference at country and firm level.")

3.51 Country level factor"*

-

8/16/2019 ACCT 3563 Assignment

7/28

(

At country-level, difference in the size of equity market is identified as influential factor"

that affects companies’ compliance level with IAS 37. According to statistic from World#

Bank Group in 2014, the ratio of market capitalization of listed domestic companies$

versus GDP in Australia is 88.6% while the ratio is 44.9% in German. As one of possible%

factors, weak investor protection indicates low stock market capitalization (Cameron,&

2007 p. 7). The fundamental function of capital market is to allocate capital efficiently,'

which act as main engine of economic growth (Bekaert & Harvey, 1998. P4). Therefore, a(

bigger proportion of equity market in GDP demand strengthening in investor protection in)

order to protect economic growth from equity market collapse. The level of compliance*

with IAS 37 and IAS 19 could be an indicator of the strength of inventor protection."+

Referring to appendix 6&7, the Australian company presents a detail disclosure about its""

constructive claim including its history, shows higher level of compliance with IAS 37"#

that the German company."$

"%

The other culture factor at the country level is identified as difference between Australian"&

financing system and German financing system. The financing system in German is"'

classified as credit-based system in which the stock market is small, so firms heavily rely"(

on banks (Zysman,1983). In contrast, the financing system in Australia is classified as")

capital market based system that is built in competitive market (Zysman,1983). The"*

importance of banks in Germany could be an incentive to being more conservative in#+

producing financial reports because bankers put more emphasis on rock-bottom figure#"

-

8/16/2019 ACCT 3563 Assignment

8/28

)

with the purpose of securing their long-term loans (Nobes & Parker 2012, p. 42)."

Furthermore the split between creditor and equity holder results difference sorts of#

objectives for financial reporting (Nobes 1998, p. 8). From equity holders’ perspective,$

they may focus on the performance and assessment of future cash flow for the purpose of%

assisting decision-making processes while from creditor perspective, they may emphasize&

on the calculation of reliable and distributable profit (Nobes 1998, p. 8). Consequently, the'

bank-oriented financing results German company’s high level of conservatism in reporting.(

Referring to appendix 9&9.1, its liabilities due to bank amounts to nearly half of the)

German company’s total non-current liabilities, and its total liabilities overwhelm its total*

asset resulting negative equity. Whereas, the Australian company does not have liability"+

related to banks, and it is mainly financed by equity. Higher level of conservatism might""

be expected in country like Germany, and making unnecessary provision is a approach to"#

be conservative because these can be reversed in bad years (Nobes & Parker 2012, p. 51)."$

This is likely to explain why that the German company has much higher level of"%

provisions than the Australian company."&

"'

3.52 Firm level factor"(

At firm level, difference in firm size is identified as influential factors affecting")

compliance level with IAS 37 and IAS 19. Company size can be considered as a"*

delegation for heterogeneity and the amount of financial statement users (Eierle & Haller#+

-

8/16/2019 ACCT 3563 Assignment

9/28

*

2009). This means that larger companies are connected with larger amount of users of"

financial report, and thus more detailed and comprehensive are required in financial#

statement. Furthermore, larger firms probably are exposed to stronger public inspection$

and political pressures than smaller companies, which cause them to have greater%

motivations to fully comply with accounting standard required by law (Watts &&

Zimmerman 1990). In contrast, smaller companies generally suggest concentrated'

pyramid ownership structure, which enable their shareholders to have direct access to(

information. Consequently, there is less demand for public released information and less)

user of financial report. Referring to appendix 9&10, the size of the German company is*

about 2.6 times as much as that of Australian company. Base on the previous analysis, the"+

German company doe shows higher compliance level with IAS 37 and IAS 19. Referring""

to appendix 4, the German company discloses extensive and detailed information for its"#

provision with the highest book value, which show higher level of compliance with under"$

the paragraph 84&85 of IAS 37. Referring to appendix 4&8, in order to obtain higher"%

accuracy, the company hired a qualified actuary to carry out a detailed valuation of its"&

staff-related obligation, which is encouraged but not required under paragraph 56&57 of"'

IAS 19."(

")

The other culture factor at the firm level is identified as difference in audit choice of two"*

chosen companies. Referring to appendix 12, the Australian company’s independent#+

auditor report are prepared by one of the Big four firms while the German company’s#"

-

8/16/2019 ACCT 3563 Assignment

10/28

"+

report are prepared by a non-Big four firm. The general level of compliance with IAS is"

positively correlated to companies that are audited by Big four (Street & Gray 2002).#

According to Glaum & Street’s research, average compliance level of auditing performed$

by Big four is distinctly higher than that of auditing performed by non-big four (Glaum &%

Street 2003). Compared with smaller, regionally oriented auditors, auditors from Big four&

are more professional, and they have stronger incentives to minimize downward risks in'

order to defend their reputation. Due to the size of big four, they are able to invest more in(

training and in audit system with less reliant on individual clients, as well as greater)

motivation to protect their reputation (Francis & Wang 2008). Referring to appendix 6&7,*

compared with German company, Australian company shows relatively higher level of"+

compliance with IAS 37 in disclosing contingent liabilities.""

"#

Conclusion & Strategy"$

The persistence of international accounting difference in conversion to IFRS not only can"%

be found in the chosen companies but it also can be found in a border level. In German,"&

compared with the largest company, small listed companies are more tend to remain their"'

traditional practices in convergence with IFRS (ACCA 2011, P. 6). Unlike Australia,"(

German has retained national rules alongside IFRS, which may encourage persistence of")

traditional practices. Under IFRS, provision should be recognized only when there is a"*

liability to third at the balance sheet date while the correspondent requirement under#+

German GAAP is relatively loose (Nobes & Parker 2012, p. 46). It is possible for German#"

-

8/16/2019 ACCT 3563 Assignment

11/28

""

companies to establish discretionary provisions in profitable year so that they can offset"

loss in bad year by reversing this process. Investor should be vigilant to small listed#

German companies with large portion of income that is not from ordinary business$

because their may create false image about companies’ profitability by manipulating%

provisions. Although, Australian Accounting Standards Board amends IAS in various&

ways, it is designed to fully comply with IFRS. (ACCA 2011, P. 17). Therefore, compared'

with German company, investors who are interested in Australian companies could have(

less concern with issues of manipulating provisions.)

*

Comment to the PRF"+

I really appreciate the responsible feedback provided that is extremely beneficial to me in""

revising the report. Based on the comment for criteria K1, I revised some references in"#

order to be more identifiable to the marker. According to the comment for criteria K2 &"$

C2, I actually rewrote partial analysis of cultural difference strengthening my statements"%

with additional references. I also draw evidences from the analysis corresponded to Q"&

(e)-(h) in order to conduct evaluation from the perspective of chosen companies. To"'

respond comment for C3, I rewrite the conclusion and add a strategy that is aim to help"(

users of financial report. As for the comment for written communication, I tried my best to")

correct all the spelling and grammatical errors in the report."*

Based on the comment for criteria K1, I changed the original approach of references in the#+

table into a more identifiable way.#"

##

-

8/16/2019 ACCT 3563 Assignment

12/28

"#

5.1 Appendix 1: significant accounting policy (Australian company)"

#

5.2 Appendix 2: Note 17 provisions (Australian company)$

%

&

5.3 Appendix 3: Accounting and valuation principle (Australian company)'

(

)

*

-

8/16/2019 ACCT 3563 Assignment

13/28

"$

5.4 Appendix 4: note 17 provision for services after termination of the employment"

relationship (German company)#

$

-

8/16/2019 ACCT 3563 Assignment

14/28

"%

"

#

-

8/16/2019 ACCT 3563 Assignment

15/28

"&

"

#

-

8/16/2019 ACCT 3563 Assignment

16/28

"'

"

#

-

8/16/2019 ACCT 3563 Assignment

17/28

"(

Appendix 4.1: Accounting and valuation principle (German company)"

#

$

%

-

8/16/2019 ACCT 3563 Assignment

18/28

-

8/16/2019 ACCT 3563 Assignment

19/28

"*

"

-

8/16/2019 ACCT 3563 Assignment

20/28

#+

"

5.7 Appendix 7: note 23 contingent liabilities (German country)#

$

%

-

8/16/2019 ACCT 3563 Assignment

21/28

#"

5.8 Appendix 8: note 25 personnel expense (German company)"

From 2014 annual report#

$

From 2013 annual report%

&

'

-

8/16/2019 ACCT 3563 Assignment

22/28

##

5.9 Appendix 9: consolidated balance sheet as of 31/12/2014 (German company)"

#

$

-

8/16/2019 ACCT 3563 Assignment

23/28

#$

Appendix9.1 Financial liability (German)"

#

5.10 Appendix 10: consolidated statement of financial position (Australian company)$

-

8/16/2019 ACCT 3563 Assignment

24/28

#%

"

5.11 Appendix 11: industry average of salaries#

2014 Australian mining industry average annual wage: $129,714$

2013 Australian mining industry average annual wage: $137,100%

&

-

8/16/2019 ACCT 3563 Assignment

25/28

#&

"

https://www.livingin-australia.com/salaries-australia/ #

$

https://www.hays.com.au/cs/groups/hays_common/@au/@content/documents/digitalasset%

-

8/16/2019 ACCT 3563 Assignment

26/28

#'

/hays_115075.pdf "

5.12 Appendix 12 Choice of auditor#

Australia Commpany (KPMG)$

%

German company&

• '

(

-

8/16/2019 ACCT 3563 Assignment

27/28

#(

• 6 References"

• Bekaert, G & Harvey, CR n.d., 1998, 'Emerging equity market volatility', SSRN#

Electronic Journal , , ISSN; 1556-5068.$

• Cameron, L 2007, Investor protection and the New Zealand stock market — the%

treasury publication - New Zealand Treasury Policy Perspectives Paper 07/02 ,&

accessed 24 April 2016,'

.(

• Eierle, B & Haller, A 2009, 'Does size influence the suitability of the IFRS for small)

and medium-sized entities? – empirical evidence from Germany', Accounting in*

Europe , vol. 6, no. 2, pp. 195–230, ISSN; 1744-9480."+

• Francis, JR & Wang, D 2008, 'The joint effect of investor protection and big 4 audits

""

on earnings quality around the world', Contemporary Accounting Research , vol. 25,"#

no. 1, pp. 157–91, ISSN; 0823-9150. "$

• Glaum, M & Street, DL 2003, 'Compliance with the disclosure requirements of"%

Germany’s new market: IAS versus US GAAP', Journal of International Financial"&

Management and Accounting , vol. 14, no. 1, pp. 64–100, ISSN; 0954-1314."'

• International variations in IFRS adoption and practice 2011, published by ACCA"(

accessed 8 May 2016,")

-

8/16/2019 ACCT 3563 Assignment

28/28

• Nobes, C 1998, 'Towards a general model of the reasons for international differences"

in financial reporting', Abacus , vol. 34, no. 2, pp. 162–187, ISSN; 0001-3072.#

• Nobes, CW & Parker, RH 2012, Comparative international accounting (12th edition) ,$

12th edn, Financial Times Prentice Hall, Harlow, England.%

• Street, DL & Gray, SJ 2002, 'Factors influencing the extent of corporate compliance&

with international accounting standards: Summary of a research monograph', Journal'

of International Accounting, Auditing and Taxation , vol. 11, no. 1, pp. 51–76, ISSN;(

1061-9518.)

• Watts, RL & Zimmerman, JL 1990, 'Positive accounting theory: A Ten year*

perspective', The Accounting Review , vol. 65, no. 1, pp. 131–156, accessed 25 April"+

2016, , ISSN; 00014826.""

• Zysman, J 1983, Governments, markets and growth: Financial systems and the"#

politics of industrial change , Blackwell Publishers, Oxford."$