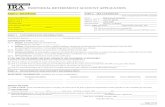

Account Application, IRA - Full Service - Verity Credit Union management IRA...4 Account Information...

Transcript of Account Application, IRA - Full Service - Verity Credit Union management IRA...4 Account Information...

Employer

Specify Occupation(If self-employed, please describe.)

Liquid Net Worth(cash, stocks, mutual funds, etc.) Tax Bracket _____%

# of Dependents _____

$200,000+Annual Income <$15,000 $15,000-24,999 $50,000-99,999 $25,000-49,999 $100,000-199,999

Account Holder Retired? Yes No

Employer Address

<$15,000

$15,000-24,999 $50,000-99,999 $200,000-499,999 $25,000-49,999 $100,000-199,999

$1,000,000+ $500,000-999,999

$1,000,000+Net Worth (excluding home) / Tax Status $15,000-24,999 $200,000-499,999 $25,000-49,999 $100,000-199,999 $500,000-999,999 $50,000-99,999

<$15,000

Business Phone

Account Holder: First Name, Middle Initial Last Name Date of Birth (mm/dd/yyyy) Gender Email Address No Email Address

Primary Address (cannot be P.O. Box) Home Business

Home Phone

City

Mailing Address

Zip/Postal Code Country

Zip/Postal Code Country

State/Province

City

Country of Citizenship U.S. Other __________________________________

Country of Legal Residence (if different from mailing address)

Social Security Number

U.S. Other __________________________________State/Province

Home Business Other

4 Account Information Profile

3

2 Account Registration

1 Plan Type

Account Application, IRA - Full Service

Male Female

SSN TIN __________________________

ID#: (Driver’s Lic., Passport, Alien, Gov’t.) (attach copy if Non-US Citizen) State/Country of Issuance

(If self-employed, a student, or a homemaker, please state. If retired or unemployed please state and state previous occupation.)

Type of Business

City State/Province Zip Code

Address

Length of Employment (yrs)

3-46

Employer Name

Occupation

Source of Funds

Income from Wages Inheritance Retirement Savings Sale of Business Investment Proceeds Gift Other (please describe)

Account Number Rep ID

Employer's TIN

Are you or any member of your family affiliated with or employed by a broker-dealer/RIA, or by a member of a stock exchange, self-regulatory organization (ex: FINRA), or state/federal securities regulator (SEC, State Insurance Division)?Are you a senior officer, director, or 10% shareholder of a public company?

Yes No

Organization/Affiliation:

Yes NoIf yes, Company Name:

If yes, employer authorization may be required.

Traditional IRA IRA Rollover 403(b) (direct business investors only) SEP-IRA Roth IRA SAR-SEP (transfer of existing plan only)Beneficiary IRA - Deceased Benefactor Name: ________________________________________________ Spousal Non-Spousal Date of Birth ____________ Date of Death _____________

Marital Status

Married Widowed Domestic PartnerSingle Divorced

General Investment Knowledge None Limited Moderate Extensive

Does the account holder listed above have a net worth of $50 million or more?

Mobile Phone

Yes No

Yes No Photo ID verified? Yes No Expiration Date

OFAC/FATF Comparison performed

CFS

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 1 of 11

Credit Union Member Number(s) on fileNon-Member

Credit Union Member Number(s)

__________________________________________________

(if more than one CU Member # separate numbers by comma) CFS Registered/Affiliated Person

Related to a CFS Registered/Affiliated Person

No relation to a CFS Registered/Affiliated Person

CUSO F S E R V I C E S , L P

Member FINRA/SIPC

INANCIAL

#2 #3 #5 CAM/STARCommission Schedule #Non-CAM/STAR

Advisory Business

Principal Approval Approval Date

For Rep Use Only

Brokerage Direct Business Direct Company

STAR: STAR II & IV STAR III - Alpha STAR III - VEGA

CAM: Funds Exchange Traded Funds (ETF) Direct Direct II

Active/Passive Unified Managed Assets (UMA) Index Plus 3rd Party StrategistOBS/Symmetry Strategists

3-46

4 Account Information Profile (cont'd)

Conservative Income Growth & Income Growth Aggressive Growth (For definitions of these investment objectives, please refer to the Customer Agreement portion of this application.)

Risk Tolerance Low Medium High

What is your investment time horizon for this account?

Less than 1 year 1-3 years 3-5 years 5-10 years More than 10 years

The ability to quickly and easily convert to cash all or a portion of the investments in this account without incurring significant costs or penalties is:

Important Somewhat Important Low Importance

List all investable assets including those outside of as an approximate percentage of your investable assets (must equal 100%)

Stocks/Options ______% Bonds ______% Mutual Funds ______% Variable Annuities ______%

Fixed Annuities ______% Insurance (non-annuities) ______% Alternative Investments/REITs ______%

Other _________________________ ______%

Investment Experience(Please specify in years of experience. If none, put "0".)

Stocks ______ Margin Trading _____ Bonds ______ Options Trading ______

Mutual Funds ______Annuities ______ REITs / Alternatives ______

First Name Last Name

Address

City Zip/Postal CodeState/Province Relationship

Email Address No Email Address

Home Phone Mobile Phone

First Name Last Name

Address

City Zip/Postal CodeState/Province Relationship

Email Address No Email Address

Home Phone Mobile Phone

Alternate Contacts

Please provide us with individual(s) not named above (account holders) that the firm can contact if we are unable to reach you in a timely manner and/or we have concerns regarding activity in your account (for example, but not limited to: possible unauthorized activity or returned mail). By providing us the following contact information and your signature on this application, you are providing your consent for the firm's associated persons to provide non-public information regarding your accounts including, but not limited to, balances and account activity to the following named individuals. These individuals will not have access to withdraw funds or affect transactions in your account. Your consent will remain in effect until you provide a request to revoke the authority.

CFS

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 2 of 11

Investment Objective

CFS

If you are married and designate anyone other than your spouse as your sole, primary Beneficiary, your spouse must sign this form below. In addition, if required in your state, the form must be signed in the presence of a Notary Public. I am the spouse of the above-named account holder. I acknowledge that I have received a fair and reasonable disclosure of my spouse's property and financial obligations. Due to the important tax consequences of giving up my interest in this IRA. I have been advised to see a tax professional. I hereby give the account holder any interest I have in the funds or property deposited in this IRA and consent to the Beneficiary designation(s) indicated above. I assume full responsibility for any adverse consequences that may result. No tax or legal advice was given to me by the Custodian.

Spousal Consent 6

PRINTED NAME OF SPOUSE SIGNATURE OF SPOUSE DATE

1

As required in AZ, CA, ID, LA, NV, NM, TX, WA, WI, but only for accounts where Pershing LLC is the custodian - not for "Direct Business "accounts.

Please check Primary or Contingent for each individual beneficiary. If neither is checked, the individual will be deemed to be a primary beneficiary.

The following shall be my beneficiary or beneficiaries of this IRA. If I designate more than one primary or contingent beneficiary, but do not specify the percentage to which such beneficiary or beneficiaries is entitled, payment will be made to the surviving beneficiary or beneficiaries in equal shares.

Primary beneficiaries receive IRA proceeds upon your death. Contingent beneficiaries may receive IRA proceeds if there are no surviving primary beneficiaries.

First Name Last Name Street Address City State Zip Birthdate SSN # Relationship Type of Beneficiary Share %

* Total of all primary beneficiaries must equal 100%; total of all contingent beneficiaries, if designated, must total 100%.

I understand that if no beneficiary is set forth or if none of the beneficiaries named by me are living at my death, my Pershing LLC IRA Custodial Account established pursuant to this Application will pass pursuant to the terms of the governing custodial agreement.

Primary

Contingent

Primary

Contingent

Primary

Contingent

Primary

Contingent

Primary

Contingent

Primary

Contingent

Primary

Contingent

Primary

Contingent

same as Account Holder

same as Account Holder

same as Account Holder

same as Account Holder

same as Account Holder

same as Account Holder

same as Account Holder

same as Account Holder

5 IRA Beneficiary Designation (Required only for accounts where Pershing LLC is the Custodian - not for “Direct Business” accounts.)

3-46

By signing below, I understand the eligibility requirement for the type of IRA deposits I make and I state that I qualify to make the deposit. I have received a copy of the Pershing LLC Individual Retirement Custodial Account Plan and Disclosure Statement. I understand that the terms and conditions which apply to this Individual Retirement Account are contained in this Pershing LLC Individual Retirement Custodial Account Plan and Disclosure Statement. I agree to be bound by those terms and conditions. If I elect to make a rollover contribution to this account, I hereby certify that I understand the rollover rules and conditions as they pertain to this IRA and I have met the requirements for making a rollover. Due to the important tax consequences of rolling over funds or property I have been advised to consult with a tax professional. All information provided by me is true and correct and may be relied upon by the Custodian. I assume full responsibility for establishing this IRA and for rollover transactions and will not hold the Custodian liable for any adverse consequences that may result. I hereby irrevocably designate the rollover of funds or other property as rollover contributions. I HEREBY ADOPT THE PERSHING LLC INDIVIDUAL RETIREMENT CUSTODIAL PLAN. I ACKNOWLEDGE THAT THE PERSHING LLC RETIREMENT CUSTODIAL ACCOUNT PLAN CONTAINS A PREDISPUTE ARBITRATION AGREEMENT. A copy of this completed application should be retained by the investor.

7 IRA Certification (Required only for accounts where Pershing LLC is the Custodian - not for “Direct Business” accounts.)

CFS

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 3 of 11

8 Disclosure and Agreement

TAXPAYER CERTIFICATION: Under penalties of perjury, I certify that: (1) the number shown on this form is my correct Social Security Number or Taxpayer Identification Number (or I am waiting for a number to be issued to me); (2) I am not subject to backup withholding because (a) I am exempt from backup withholding or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; (3) I am a U.S. Citizen or other U.S. person (defined below); and (4) the FATCA code(s) entered here (if any) indicating that I am exempt from FATCA reporting is correct. You must cross out Item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For accounts exempt from backup withholding (if you are unsure, ask us for a complete set of IRS instructions), write the words “Exempt Payee” here:

Definition of a U.S. person. For federal tax purposes, you are considered a U.S. person if you are:

• An individual who is a U.S. citizen or U.S. resident alien, • A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States, • An estate (other than a foreign estate), or • A domestic trust (as defined in Regulations section 301.7701-7).

I am not a U.S. person and have attached Form W-8BEN to this application.

I hereby irrevocably elect to treat my contributions to my Pershing LLC Traditional Individual Retirement Custodial Account (“Traditional IRA”) as a rollover contribution under the Internal Revenue Code. Due to the importance of this election, I have been advised to consult with tax and legal professional advisors. I hereby direct Pershing LLC to take all actions necessary with respect to my contribution in accordance with this election. I represent and warrant to Pershing LLC that my contribution is eligible for rollover treatment under the Internal Revenue Code. In addition, if I am over age 70½ this year, I certify that I will NOT rollover this year’s required minimum distribution.

ThE IRS DOES NOT REqUIRE YOUR CONSENT TO ANY PROvISION OF ThIS DOCUmENT OThER ThAN ThE CERTIFICATION REqUIRED TO AvOID BACkUP WIThhOlDINg.

3-46

PRINTED NAME OF INVESTMENT REPRESENTATIVE SIGNATURE OF INVESTMENT REPRESENTATIVE DATE

I am introducing this application for approval. I have provided all required information, including a prospectus (if applicable):

PRINTED NAME OF ACCOUNT HOLDER SIGNATURE OF ACCOUNT HOLDER DATE

2

3

*Certain brokered certificates of deposit may be FDIC insured, if available through at this location.

This Section Intentionally Left Blank

I understand that you will supply my name to issuers of any securities held in my account so that I might receive any important information regarding them, unless I notify you in writing not to do so.

CFS

I Am AWARE ThAT ThE CUSTOmER AgREEmENT CONTAINS AN AgREEmENT TO ARBITRATE DISPUTES lOCATED ON PAgE 6 AND PARAgRAPh 20, AND ThAT ThE CUSTOmER AgREEmENT CONTAINS mY CONSENT TO ThE EXChANgE OF CONFIDENTIAl INFORmATION BETWEEN ThE CREDIT UNION, ITS AFFIlIATED ENTITIES, CFS AND PERShINg. I hAvE READ AND ACkNOWlEDgE ThE IRA CERTIFICATION IN SECTION 7 OF ThIS FUll SERvICE IRA FORm.

CFS

I understand that CFS and Pershing may perform identity verification prior to opening my account.

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 4 of 11

I wish to receive my Privacy Policy via: Email US Postal Service

SIgNATURE: I am of legal age to contract. I acknowledge that I have read and completely understand the Account Application, IRA - Full Service, the Disclosures, and the Customer Agreement below, and have had all of my questions regarding the same answered to my full satisfaction. In consideration of the acceptance of the new account, I agree to the terms of the Customer Agreement below. I have received a copy of the Account Application, IRA - Full Service, the Disclosures (which have also been provided orally), and the Customer Agreement.

Customer Agreement3-46

1. mEANINg OF WORDS IN ThIS AgREEmENT. The words I, me, my, we, and us refer to each customer who signs this agreement. The words you and your refer to

2.

3.

4. FORCE mAJEURE. You shall not be liable for loss or delay caused directly or indirectly by war, natural disasters, government restriction, exchange or market ruling, or other conditions beyond your control.

5. RECORDINg CONvERSATIONS. For our mutual protection, I agree that any telephone conversation between or among the following may be tape-recorded by any of them, you, and anyone acting in your behalf, me, and anyone acting on my behalf.

6.

7.

8. mARgIN lOANS. I understand and agree that margin loans, if any, provided me will be made by Pershing and that I will comply with all requirements that Pershing may impose with respect to such loans. Margin loans will be subject to the provisions in section 9 below.

9. INDEBTEDNESS. Upon the purchase or sale of any security, if you are unable to settle the transaction by reason of my failure to make payment or deliver

securities in good form, I authorize you to take any steps necessary to complete or cancel the transaction to minimize your loss. I will reimburse you for any and all costs, losses, or liabilities incurred by you, including any collection fees and attorney’s fees you incur in minimizing your loss. In the event that I become indebted to you in the operation of this account, I will repay the indebtedness upon demand. If I fail to pay the indebtedness, including any margin call, you may close my account and/or liquidate any assets in my account, or otherwise held by you, in an amount sufficient to pay my indebtedness. You shall have sole discretion to determine which assets shall be sold or which account closed to satisfy my indebtedness. I am responsible for all costs of collection and attorney’s fees for any indebtedness, however incurred.

10. RESTRICTED SECURITIES. I will not buy or sell any securities of a corporation of which I am an affiliate, or sell any restricted securities, except in compliance with applicable laws and regulations. If I violate this pledge, I shall hold

12. RISk TOlERANCE DEFINITIONS.

A. low: I want to preserve my initial principal in this account, with minimum risk, even if it means this account does not generate significant income or returns and may not keep pace with inflation.

B. medium: I am willing to accept some risk to my initial principal and tolerate some volatility to seek higher returns, and understand I could lose a portion of the money invested.

C. high: I am willing to accept high risk to my initial principal, including high volatility, to seek high returns over time, and understand I could lose a substantial amount of the money invested.

11. INvESTmENT OBJECTIvE DEFINITIONS. A. Conservative: Investors who seek investments designed with emphasis placed on the prevention of capital loss with secondary concentration in current income. B. Income: Investors who seek investments primarily focused on the continued receipt and steady stream of income. C. growth & Income: Investors who seek investments where emphasis is placed on modest growth with some focus on the generation of income. D. growth: Investors who seek investments primarily focused on achieving high capital appreciation with little emphasis on the generation of current income. E. Aggressive growth: The most aggressive objective. Investors who seek investments focused on maximizing capital appreciation and not concerned with the generation of current income. Aggressive Growth investments will assume high market risks for potentially high returns.

NO DISCRETION. I understand that neither you nor any other person who is not a joint owner of this account will exercise investment discretion over this account, except to the extent that you have the discretion described in section 9 below. I understand that a separate agreement is required to allow investment discretion activity in my account.

CFS

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 5 of 11

CFS and/or Pershing harmless from liability.

CUSO Financial Services, L.P. (“CFS”) and/or Pershing LLC. (“Pershing”).

EXChANgE OF INFORmATION. I agree that the Credit Union, its affiliated entities, CFS and/or Pershing may, where permitted by law, request or exchange personal, financial, credit, or other confidential information regarding me with others in connection with the creation or operation of my brokerage account. CFS and/or Pershing is not responsible for forwarding information to me concerning my account if such information is not readily accessible, including information concerning class actions or other issuer, or transfer agent-related matters. Information concerning my account with CFS and/or Pershing and information concerning the resolution of any dispute between myself and CFS and/or Pershing will be confidential. I will not disclose to any third party, other than regulatory or law enforcement officials exercising appropriate jurisdiction, any confidential information. CFS and/or Pershing is authorized to respond to any subpoena or court order requesting information related to my account. Additionally, CFS and/or Pershing is authorized to respond to any request for information related to my account from regulatory or law enforcement officials exercising appropriate jurisdiction.

CREDIT INvESTIgATION. You may exchange credit information about me with others. You may request a credit report on me and, if I ask, you will tell me the name and address of the consumer reporting agency that furnished it. If you update, renew, or extend my credit, you may request a new credit report without notifying me.

AUThORITY AND OWNERShIP. I have the required legal capacity, am authorized to enter into this agreement, and have obtained and will provide you with all necessary authorizations from third parties or other necessary documents to open accounts and effect transactions in securities under this agreement. You have the right to refuse activity in my account until all necessary documentation is received. I understand that CFS and/or Pershing may refuse to open an account for me or to price any transaction that I may wish to effect now or hereafter. I also understand that if I fail to abide by all terms and conditions applicable to my account, CFS and/or Pershing, at its discretion, may close my account and remit to me any balances therein, or take any other action concerning my account that CFS and/or Pershing considers reasonable. I will be the owner of all securities purchased, held, and sold by me through CFS and/or Pershing. I understand that CFS and/or Pershing will execute and clear all brokerage transactions under this agreement.

Customer Agreement (cont'd) 3-46

14. AmENDmENTS AND TERmINATION. You may amend this agreement at any time, in any respect, without notice to me. You may, at your discretion, terminate this agreement at any time. I understand that if you choose to terminate this agreement for any reason, it will be my responsibility to accept delivery of any and all security positions in kind or in cash, or to arrange for the timely transfer of such positions. I will continue to be responsible for any obligation incurred by me prior to termination.

15. CASh BAlANCES. I understand my account will be set up to sweep cash balances automatically into insured bank deposit accounts or taxable money market funds, depending on my account type, when my account is opened. I acknowledge that I will receive an Insured Deposit Program Disclosure booklet or prospectus, as applicable. With my signature on this document, I agree, that my sweep option may be changed, including changes between money market funds and bank deposit products, with prior notification to me.

16. AFFIRmATION. I affirm that the information filled in on this form, including all pages, is true, correct, and complete.

17. gOvERNINg lAW AND vENUE. (A) If a dispute between Pershing and me, arising out of this agreement, is not submitted to arbitration as provided in section 20, the dispute will be resolved before a competent forum in New Jersey. (B) If a dispute between is not submitted to arbitration as provided in section 20, the dispute will be resolved before a competent forum in the State of

18. ChANgE OF NAmE. The rights and obligations established by this agreement shall remain in full force and effect despite any subsequent change of name by you or me.

19. UNClAImED FUNDS. Funds in my account may be considered unclaimed after two months under certain circumstances as specified by law (generally, a failure to exercise control over the funds or communicate with Pershing), Pershing is required to pay any unclaimed funds to my last known state of residence.

20. ARBITRATION. This agreement contains a predispute arbitration clause. By signing an arbitration agreement the parties agree as follows:

(1) All parties to this agreement are giving up the right to sue each other in court, including the right to a trial by jury, except as provided by the rules of the arbitration forum in which a claim is filed.

(2) Arbitration awards are generally final and binding; a party’s ability to have a court reverse or modify an arbitration award is very limited.(3) The ability of the parties to obtain documents, witness statements and other discovery is generally more limited in arbitration than in

court proceedings.(4) The arbitrators do not have to explain the reason(s) for their award unless, in an eligible case, a joint request for an explained decision

has been submitted by all parties to the panel at least 20 days prior to the first scheduled hearing date.(5) The panel of arbitrators will typically include a minority of arbitrators who were or are affiliated with the securities industry.(6) The rules of some arbitration forums may impose time limits for bringing a claim in arbitration. In some cases, a claim that is ineligible

for arbitration may be brought in court.(7) The rules of the arbitration forum in which the claim is filed, and any amendments thereto, shall be incorporated into this agreement.

No person shall bring a putative or certified class action to arbitration, nor seek to enforce any pre-dispute arbitration agreement against any person who has initiated in court a putative class action; or who is a member of a putative class who has not opted out of the class with respect to any claims encompassed by the putative class action until: (i) the class certification is denied; or (ii) the class is decertified; or (iii) the customer is excluded from the class by the court. Such forbearance to enforce an agreement to arbitrate shall not constitute a waiver of any rights under this agreement except to the extent stated herein.

21. SECURITIES INvESTOR PROTECTION CORPORATION. SIPC protects securities customers of its members up to $500,000 (including $100,000 for claims for cash). SIPC protection applies if the brokerage firm fails and does NOT protect my account against declines in value such as those that may result from changes in market conditions. An explanatory brochure on SIPC coverage is available upon request.

22. FEE SChEDUlE. I agree to the terms of your fee schedule. The fee schedule, which is incorporated into this agreement by reference, explains the fees such as service fees, transfer fees, and maintenance fees that may apply to my account. The fee schedule also explains the basis upon which the fees apply. I understand a copy of the fee schedule is available to me on request

23. APPlICABlE RUlES AND REgUlATIONS. All transactions in my account shall be subject to the constitution, rules, regulations, customs, and uses of the exchange or market, and its clearing house, if any, where the transactions are executed by Pershing or its agents, including Pershing’s subsidiaries and affiliates. Also, where applicable, the transactions shall be subject to the provisions of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and to the rules and regulations of the Securities and Exchange Commission (SEC), the Board of Governors of the Federal Reserve System, and any applicable self-regulatory organization.

13.

CFS

CFS and me, arising out of this agreement,

and is available on your website at

CFS and Pershing are members of the Securities Investor Protection Corporation (“SIPC”).

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 6 of 11

ARBITRATION ClAUSE: ACCOUNT hOlDER(S) AgREE(S) ThAT All ClAImS AND CONTROvERSIES, WhEThER SUCh ClAImS OR CONTROvERSIES AROSE PRIOR, ON OR SUBSEqUENT TO ThE DATE hEREOF BETWEEN ThE ACCOUNT hOlDER(S) AND CFS, PERShINg, AND/OR ANY OF ITS PRESENT OR FORmER OFFICERS, DIRECTORS, AgENTS AND/OR EmPlOYEES (COllECTIvElY, ThE “PARTIES”) CONCERNINg OR ARISINg FROm (I) ANY ClIENT ACCOUNT WITh CFS, (II) ANY TRANSACTION INvOlvINg ThE PARTIES WhEThER OR NOT SUCh TRANSACTION OCCURRED IN SUCh ACCOUNT OR ACCOUNTS, OR (III) ThE CONSTRUCTION, PERFORmANCE OR BREACh OF ThIS OR ANY OThER AgREEmENT BETWEEN ThE PARTIES, ANY DUTY ARISINg FROm ThE BUSINESS OF CFS OR OThERWISE ShAll BE DETERmINED BY ARBITRATION IN ACCORDANCE WITh ThE RUlES ThEN IN EFFECT OF ThE FINANCIAl INDUSTRY REgUlATORY AUThORITY.

ORDER FlOW PAYmENT. In some circumstances, CFS and/or Pershing may receive a per-share monetary payment from brokers, dealers, and market makers to which it routes customer orders for execution. The policy regarding receipt of these monetary payments is to always attempt to get the best available national bid or offer for the customer, regardless of whether CFS and/or Pershing will receive remuneration from the market maker or exchange to which the order is routed. The nature of this compensation is a per-share monetary payment. Customer orders can be executed at prices superior to the national best bid or offer in some circumstances. Where possible, CFS and/or Pershing routes orders to obtain such superior pricing subject to market conditions and activity. The achievement of a price superior to the national best bid or offer is not guaranteed.

California, County of San Diego.

I understand that any TPM I may select if I am an investment advisory client will charge its own, separate fees according to its own fee schedule.

Customer Agreement (cont'd)3-46

24. CUSTOmER’S RESPONSIBIlITY REgARDINg CERTAIN SECURITIES. Certain securities may grant the holder thereof valuable rights that may expire unless the holder takes action. These securities include, but are not limited to, warrants, stock purchase rights, convertible securities, bonds, and securities subject to a tender or exchange offer. I am responsible for knowing the rights and terms of all securities in my account. Pershing is not obligated to notify me of any upcoming expiration or redemption dates, or to take any other action on my behalf, without specific instructions from me, except as required by law and applicable rules of regulatory authorities. However, if any such security is about to expire worthless or be redeemed for significantly less than its fair market value, and you have not received instructions from me, Pershing may, at its discretion, sell the security and credit my account with the proceeds. Similarly, I am responsible for knowing about reorganizations related to securities that I hold, including but not limited to stock, splits and reverse stock splits. Pershing is not obligated to notify me of any such reorganizations. If, due to a reorganization, I sell more shares of a security than I own, or if I become uncovered on an options position, or if I become otherwise exposed to risk requiring Pershing to take market action in my account, Pershing will not be responsible for any losses I incur.

25. INTRODUCED ACCOUNTS. If the account has been introduced to Pershing and is carried by Pershing only as a clearing broker, I agree that Pershing is not responsible for the conduct of the introducing broker and that Pershing’s only responsibilities to me relate to the execution, clearing and bookkeeping of transactions in my account(s).

26. SEvERABIlITY. If any provision of this agreement is held to be invalid, void, or unenforceable by reason of any law, rule, administrative order, or judicial decision, that determination shall not affect the validity of the remaining provisions of this agreement.

27. PERShINg AS AgENT. I understand that Pershing is acting as my agent unless Pershing notifies me, electronically or in writing, before the settlement date for the transaction that Pershing is acting as a dealer for its own account or as agent for some other person.

28. POWER OF ATTORNEY. I agree and hereby irrevocably appoint Pershing, with full power, my true and lawful attorney-in-fact, to the full extent permitted by law, for the purpose of carrying out the provisions of this agreement and taking any action and executing any instrument that Pershing deems necessary or advisable to accomplish the purposes of this agreement.

29. ImPORTANT INFORmATION ABOUT PROCEDURES FOR OPENINg A NEW ACCOUNT. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for me: When I open an account, you will ask for my name, address, date of birth and other information that will allow to identify me. You may also ask to see my driver’s license or other identifying documents. Until I provide the information or documents you need, you may not be able to open an account or effect any transactions for me.

30.

31.

32. PROhIBITED ACTS. I have the obligation to protect myself from the following Acts: I should not make payments to any entity other than Pershing,

33. COmPlAINTS. I acknowledge that I may direct any complaints regarding the handling of my account to my Investment Representative and

34.

35. UPDATES TO INFORmATION. I acknowledge that the information in this application is correct and complete. Should I have any changes to the provided information I will contact my Investment Representative

CFS

CFS

CFS, the custodian of my TPM account (if any), my TPM (if any), a mutual fund or variable product sponsor, or partnership escrow agent as instructed in an offering memorandum; I should not pay cash or other cash equivalent; I should not lend to or borrow from my Investment Representative; I should not obtain credit or otherwise borrow money to purchase securities except through a properly approved margin account; I should not accept any commission rebate or other inducement with respect to the purchase or sale of securities; I should not buy or sell securities directly from or to my Investment Representative; I should not participate in any other business relationship with my Investment Representative including but not limited to, helping to capitalize or finance any business of my Investment Representative.

DISClOSURE OF PAYmENTS BY PRODUCT SPONSORS: CFS may receive revenue sharing compensation from select product providers that support our marketing and sales force education and training efforts. For complete details, please refer to our websiteCFS investment representatives do not receive any part of these payments.

TRADINg. If CFS, in its sole discretion, determines that the trading activity in the account is excessive or violates applicable rules and regulations, CFS reserves the right to restrict trading in the account.

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 7 of 11

NON-INvESTmENT ADvICE. I acknowledge that CFS will not provide me with any legal, tax or accounting advice, that CFS employees are not authorized to give any such advice and that I will not solicit or rely upon any such advice from CFS or its employees whether in connection with transactions in or for any of my accounts or otherwise. In making legal, tax or accounting decisions with respect to transactions in or for my accounts or any other matter, I will consult with and rely upon my own advisors and not CFS, and CFS shall have no liability therefore.

.

to the CFSCFS will respond promptly to my concerns.Compliance Department at

Customer Agreement (cont'd)3-46

37. ImPORTANT INFORmATION WhEN CONSIDERINg AN IRA ROllOvER. If I terminate employment with my employer who sponsors a retirement plan, I understand that my options with respect to plan assets include one or more of the following: (i) Remain invested under the plan (generally, if balance is $5,000 or greater), (ii) Transfer Plan assets to a defined contribution plan of my new employer (if applicable), (iii) Transfer plan assets to an IRA with a financial institution, or (iv) Withdraw assets directly which would be subject to federal and applicable state and local taxes and possibly be subject to the IRS penalty of 10% if under age 59 ½. If I transfer assets out of the Plan and into an IRA I understand that: (i) Those assets will no longer be subject to the protections of ERISA, (ii) I alone will be making investment decisions about those assets and will not be able to rely on the plan sponsor or any other person with ERISA fiduciary responsibilities, (iii) depending on the investments and services selected for the IRA, I may pay more in transaction costs than when the assets are in the Plan, and (iv) if I am between the age of 55 and 59 ½, I would lose the ability to potentially take penalty-free withdrawals from the plan, (v) if I continue working past age 70 ½ and transferred my plan assets to my new employer’s plan, I would not be subject to required minimum distribution, and (iv) if I hold appreciated company stock, I understand any potential tax benefits that may have been available to me (e.g., net unrealized appreciation). If I transfer Plan assets into an IRA with you, and arrange for your investment representative to provide services with respect to the IRA, I understand that the investment representative: (i) will provide services that are different from the services that you received as a participant in the Plan, (ii) may receive more compensation for the services related to my IRA account, and (iii) will receive more or less compensation depending on which services or investments I select for the IRA. I acknowledge that this may present a conflict of interest because the investment representative could have an incentive to recommend one service or investment over another. Before I elect to open an IRA account and engage your investment representative, I agree to review all account agreements and disclosure documents related to my IRA and the services to be provided under any new relationship with you and your investment representative and to consult with a qualified tax advisor as I deem appropriate.

CFS

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 8 of 11

CFS

CFS

36. INvESTmENT ADvISORY SERvICES. If I have hired you to provide investment advisory services, then I acknowledge that you have provided me a copy of your Firm's ADV Part 2A and your ADV Part 2B. In that case I understand that these ADVs are incorporated into and have become an integral part of this Agreement. In addition, I represent that I have read the ADVs and understand that it includes material terms of this Agreement, including terms with respect to the investment advisory services you will provide, the advisory fees you will charge, my selection of a third-party manager (“TPM”) (if any), the extent to which the TPM may have discretionary authority to initiate securities transactions in my account, the amount of any prepaid fees that will be returned upon termination of the Agreement, and custody of my account. If I select a TPM, I will enter into a separate contract with the TPM and will consult the TPM’s ADV for information about the TPM’s methods, costs, fees, risks, etc. The Agreement may not be assigned (within the meaning of the Advisers Act) by without your consent. We may obtain your consent to an assignment in any manner permitted by the Advisers Act. You agree that, to the extent permitted by the Advisers Act, you will have given your consent to an assignment if you receive written notice from us of a pending assignment and you do not, within 30 days, object in writing to the assignment. This is known as a “negative consent” procedure. If applicable, agrees to provide notice to you when there is a change in our General Partners.

3-46CFS

CUSO Financial Services, L.P. Business Continuity PlanningCUSO Financial Services, L.P. Business Continuity Plan

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 9 of 11

CUSO Financial Services, L.P. (“CFS”) has developed and tested a Business Continuity Plan on how we will respond to events that significantly disrupt our business. Since the timing and impact of disasters and disruptions is unpredictable, we will have to be flexible in responding to actual events as they occur. With that in mind, we are providing you with this information on our business continuity plan.

CFS headquarters and Staff – CFS headquarters including our operations, trading, service center and back office support is located in San Diego, California. CFS has representatives, program managers, and sales support staff located throughout the country. Data for CFS customers regarding account balances, trading activity and documentation is maintained in geographically diverse centers including Pershing, LLC in New Jersey and Orcas Net, Inc. in Washington State.

Contacting Us and Access to Your Funds – If after a significant business disruption you cannot contact CFS as you usually do atyou should go to our website at If you cannot access us through either of those means, you should contact our clearing firm, Pershing, LLC, P.O. Box 2065, Jersey City, New Jersey 07303-2065; or 201-413-3635, for instructions on how it may process limited trade-related transactions, cash disbursements, and security transfers for brokerage accounts. For direct business accounts customers may contact the appropriate advisory, insurance or mutual fund company that holds the account. Contact information for the direct business provider can be found on the account statement. Our Business Continuity Plan – We plan to quickly recover and resume business operations after a significant business disruption and respond by safeguarding our employees and property, making a financial and operational assessment, protecting the firm’s books and records, and allowing our customers to transact business. In short, our business continuity plan is designed to permit our firm to resume operations as quickly as possible, given the scope and severity of the significant business disruption. Our business continuity plan addresses: data backup and recovery; all mission critical systems; financial and operational assessments; alternative communications with customers, employees, and regulators; alternate physical location of employees; critical supplier, contractor, bank and counter-party impact; regulatory reporting; and assuring our customers prompt access to their funds and securities if we are unable to continue our business.

Our clearing firm, Pershing, LLC, backs up our important records in a geographically separate area. While every emergency situation poses unique problems based on external factors, such as time of day and the severity of the disruption, we have been advised by our clearing firm that its objective is to restore its own operations and be able to complete existing transactions and accept new transactions and payments within 4 hours. Your orders and requests for funds and securities could be delayed during this period.

varying Disruptions – Significant business disruptions can vary in their scope, such as only our firm, a single building housing our firm, the business district where our firm is located, the city where we are located, or the whole region. Within each of these areas, the severity of the disruption can also vary from minimal to severe. In a disruption to only our firm or a building housing our firm, we will transfer our operations to a local site when needed and expect to recover and resume business within 4 hours. In a disruption affecting our business district, city, or region, we will transfer our operations to a site outside of the affected area, and recover and resume business within 24 to 48 hours. In either situation, we plan to continue in business, transfer operations to our clearing firm if necessary, and notify you through our website or our customer emergency number, how to contact us. If the significant business disruption is so severe that it prevents us from remaining in business, we will assure our customer’s prompt access to their funds and securities.

Important Disclosures – CFS will adhere to the procedures described in its Business Continuity Plan. There are however, circumstances beyond the control of CFS. Therefore, CFS, in its sole discretion, reserves the right to flexibly respond to any disruption in a situation-specific and prudent manner. Additionally, if parts of our plan are dependent upon third parties, we will have no control over the success or failure of the third party.

For more information – If you have questions about our business continuity planning, you can contact us at

CFS

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 10 of 11

This notice describes the privacy practices of CUSO Financial Services, L.P. ("CFS") and its affiliate, CUSO Financial Services, Inc. (collectively referred to as “we” and “us”). Protecting your privacy is very important to us. We value your trust and we want you to understand what information we collect, how we protect it, and how we use it. Our Privacy Policy treats your nonpublic personal information (“personal information”) with care, integrity and respect for your privacy.

credit union, your credit union's credit union service organizations or other financial service providers that perform services on our behalf. The above disclosures are permitted under the Regulations of the Securities and Exchange Commission. There may be some states in which we do business that would prevent us from disclosing personal information in one or more of the situations described above, without a right to opt-out or a requirement to opt-in. We will respect the state requirements as they may apply to our affected customers.

Keeping your information secure is one of our most important responsibilities. We restrict access to non-public personal information about you to those employees and agents who need to know the information in order to provide products or services to you. We maintain physical, electronic and procedural safeguards that comply with federal standards to guard your non-public personal information. We also have procedures to ensure that requests to correct inaccurate or incomplete information are acted upon in a timely manner.

with whom we have a financial services agreement to offer financial products and services to you, including your credit union and its affiliates. We have entered into a written agreement with your credit union to jointly offer financial services whereby the credit union agrees to comply with applicable Privacy Regulations to protect your confidential information.

• Disclosures made pursuant to a written agreement that prohibits the third-party from disclosing or using the information for purposes other than those in the agreement.

• Disclosures that are necessary to effect, administer or enforce a transaction for a financial service or product that the client requests or authorizes.

• Disclosures to credit agencies.

• Disclosures permitted or required by law in order to prevent fraud, control risk, resolve complaints or as otherwise required by law.

• Your

Although privacy regulations generally prohibit the sharing of personal information, we may share the following information pursuant to specific exceptions:

• Information about your transactions from us, our affiliates (including your credit union or its affiliates) or non-affiliated third parties such as our clearing firm, mutual fund companies, insurance companies, money managers, and/or your prior brokerage firm (in the case of an account transfer);

We are dedicated to offering competitive high quality services to you through our relationship with your credit union. Our relationship with credit unions is structured to protect your personal information. For example, we do not release or sell customer information to telemarketing companies. We maintain physical, electronic and procedural safeguards that comply with federal standards to guard your personal information. We protect your account information by placing it on the secure portion of our website. Our servers have been enabled with Secure Sockets Layer (SSL) technology to prevent unauthorized parties from viewing your personal information. In addition, we employ GeoTrust digital certificate services to authenticate that you are connecting to our server(s). Access to your personal information is limited to those employees, investment representatives and agents who may need to know that information to provide products or services to you. They are required to maintain the confidentiality of all customer information.

Information We Collect We collect and retain information about you to identify and communicate with you, to provide you with products and services that you have requested and to help us respond to your questions. We collect nonpublic personal information from the following sources:

• Information we receive from you on applications and other forms (for example, name, address, social security number, assets, and income);

• Information obtained when verifying the information you provide on an application or other forms (this may be obtained from other institutions where you conduct financial transactions); and

• In some cases, we may collect information from consumer reporting agencies.

We have procedures to ensure that your information is maintained in a commercially reasonable manner so that it is accurate, current, and complete.

Disclosure of Personal Information to Non-Affiliated Third Parties We do not disclose or sell personal information about you or our former customers to non-affiliated third parties, except as permitted or required by law or regulation. We may disclose all of the information we collect to companies

Disclosure of Personal Information in Other Circumstances

YOUR PRIVACY IS IMPORTANT TO US

Privacy Policy3-46

When we share confidential information with a third party, these companies are contractually obligated to keep the information that we provide to them confidential and use the information only for the services required and as allowed by applicable law or regulation, and are not permitted to share or use the information for any other purpose. That is, we require such third parties to agree to safeguard personal information regarding our customers in accordance with our own privacy policies.

Availability of Disclosure of Privacy PolicyOur Privacy Policy is available at our branch office and our privacy website at: We will reaffirm this policy annually, in writing, unless you agree to receive it electronically through our website. We reserve the right to make changes to this policy at any time. We will notify you in writing before we make changes that affect the way we collect or share your information.

If you have any questions, you may contact our Legal and Compliance Department at

CFS

2003-2015 CUSO Financial Services, L.P. Member FINRA/SIPC. All Rights Reserved. Page 11 of 11

Anti-Money Laundering Requirements

The USA PATRIOT ACT

The USA PATRIOT Act, signed by President Bush on October 26, 2001 is designed to detect, deter, and punish terrorists in the United States and abroad. The Act imposes anti-money laundering requirements on brokerage firms and financial institutions.

To help you understand these efforts, we want to provide you with some information about money laundering and our steps to implement the USA PATRIOT Act.

What is money laundering?

Money laundering is the process of disguising illegally obtained money so that the funds appear to come from legitimate sources or activities. Money laundering occurs in connection with a wide variety of crimes, including illegal arms sales, drug trafficking, robbery, fraud, racketeering, and terrorism.

how big is the problem and why is it important?

The use of the U.S. financial system by criminals to facilitate terrorism or other crimes could well taint our financial markets. According to the U.S. State Department, one recent estimate puts the amount of worldwide laundering activity at $1 trillion a year.

What are we required to do to eliminate money laundering?

Under the rules required by the USA PATRIOT Act, our anti-money laundering program must designate a special compliance officer, set up employee training, conduct independent audits, and establish policies and procedures to detect and report suspicious transactions and ensure compliance with the new laws.

As part of our required program, we may ask you to provide various identification documents or other information. Until you provide the information or documents we need, we may not be able to open an account or effect any transactions for you.

If you have any questions, you may contact our Compliance Department at

3-46