About the Palestine Exchange (PEX) · 2017-05-09 · 2 τ About the Palestine Exchange (PEX)...

Transcript of About the Palestine Exchange (PEX) · 2017-05-09 · 2 τ About the Palestine Exchange (PEX)...

2

τ About the Palestine Exchange (PEX)

Established in 1995 as a private company aimed at promoting investment in Palestine the PEX held its first

trading session in February 1997 In 2010 PEX transformed itself to become the second publicly traded Arab

stock exchange entirely owned by the private sector

Headquartered in Nablus the Palestine Exchange provides investors with a fair transparent and fully automated

trading venue It focuses on attracting a wide range of regional and global investors including those among

the Palestinian Diaspora With paid-up capital of US10$ mn the PEX is financially sound and able to weather

a volatile world as demonstrated by its performance relative to other MENA exchanges during the global

financial crisis

Since inception the Palestine Exchange has leveraged the latest technology to ensure maximum transparency

integrity and investor protection PEX trading is carried out via the HORIZON system and overseen by the

SMART electronic surveillance system Clearing settlement and depository functions are performed by the

Clearing Depository amp Settlement Center (CDS) using the EQUATOR system Both the trading and CDS systems

are NASDAQ OMX products and are tightly coupled The PEX developed and employs its e-disclosure system

2016

2015

2014

2013

2012

2011bull Achieves full membership in the World Federation of Exchanges (WFE)

bull Launches PEX e-IPO system (ldquoEKTITABrdquo)

bull Promoted to frontier market status by index provider FTSE Russell

bull Launches PEX e-disclosure system (ldquoIFSAHrdquo)

bull FTSE adds Palestine to its ldquoWatch Listrdquo for possible upgrade to frontier market category

bull Lists first corporate bond

bull Record USD 484mn trading session

bull Launch of cash settlement system through PEX

bull SampP and MSCI create standalone indices for Palestine

bull Palestine Securities Exchange (PSE) lists on PEX

bull PEX lists a record seven new companies

τ PSE milestones

3

IFSAH and its e-IPO system EKTITAB Four banks act as authorized custodians for securities on behalf of foreign

investors Cairo Amman Bank Bank of Palestine The National Bank and Bank of Jordan

On 31 December 2016 the PEX listed 48 companies with a total market capitalization of some US339$ bn Listed

companies are divided into five sectors banking and financial services insurance investment industry and

services Shares and bonds trade in Jordanian dinars and US dollars On 31 December 2016 eight member

securities companies (brokerage firms) with operations across the West Bank and Gaza Strip operated via the PEX

Classed as Frontier Market by FTSE Russell and as a stand-alone country within both MSCI and SampP indices

The Palestine Exchange maintains an international presence via membership in several key organizations PEX

is a full member of the World Federation of Exchanges (WFE) the Federation of Arab Stock Exchanges the

Federation of Euro-Asian Stock Exchanges (FEAS) the Forum of Islamic Stock Exchanges the Africa amp Middle

East Depositories Association (AMEDA) and the Association of National Numbering Agencies (ANNA)

The PEX is registered with the Companies Controller at the Ministry of National Economy under registration

number (562601187) and operates under the supervision of the Palestinian Capital Market Authority

2010

2009

2007

2006

2005

1997

1996

bull PEX becomes a public shareholding company and acquires a new corporate identity

bull PEX investor protection rated second best among Arab exchanges

bull Online trading commences

bull Investor Education Program launched

bull Al-Quds Index rises 306 percent outperforming all other global markets

bull First trading session

bull PEX incorporates as a private shareholding company

4

والنجـاح مسـتـمـر

55 5

6Overview 2016

14Growth Strategy

16Organizational Structure

20Achievements and Developments

28Technical Performance

35Shareholder Information

44PEX Governance

64Corporate Social Responsibility

67Audited Financial Statements

Contents

6

1

10

9

11

12

2

3

4

5

6

7

8

τ Overview 2016January ς Organized a series of economic and civil

meetings in the Gaza Strip

ς Developed the e-disclosure system laquoIFSAHraquo

for use by brokerage firms

February ς Received the inspection committee of the

World Federation of Exchanges (WFE) to explore

Palestinersquos upgrade to full membership

March ς Published the 8th edition of Palestine

Exchange e-bulletin ldquoPanorama Exchangerdquo

April ς Participated in the annual meeting of Arab

Federation of Exchanges in Jordan

May ς Convened investor relations conference

ς Published the 9th edition of Palestine

Exchange bulletin ldquoPanorama Exchangerdquo

June ς Participated in St Petersburg Economic

Conference Russia

ς Concluded the ninth session of the Trading

Simulation Contest

July ς Published 2015 Technical Report

ς Convened educational workshop on

economic media for staff of Asdaa electronic

media site

ς Concluded task force meetings on the

national strategy for financial inclusion

August ς Met with brokerage firms to update listed

company shareholder registries

ς Published tenth edition of Panorama

Exchange e-Bulletin

September ς Organized training workshop on laquoDigital

marketing and search engine optimizationrdquo

ς FTSE indices upgraded Palestine Stock

Exchange to frontier market status

ς Participated in the Investorsrsquo Relations eight

annual conference organized by Middle East

Investor Relations Association in UAE - CEO

participated as keynote speaker on the future

of investorsrsquo relations in the Middle East

October ς Convened a workshop for family businesses in

Hebron on the theme of ldquoFamily businesses ndash

Sustainability Prospectsrdquo

ς Participated in the annual meeting of the

Organization of Islamic Conference Stock

Exchanges in Turkey

November ς Participated in the 56th annual conference

of the World Federation of Exchanges (WFE)

in Colombia

ς Obtained full membership in WFE

ς PEX elected to the executive council of the

Federation of Euro-Asian Stock Exchange

(FEAS) at its annual meeting in Egypt

ς Participated in the task force of the financial sector

organized by the Ministry of National Economy

ς Published the eleventh edition of Panorama

Exchange e-Bulletin

December ς Launched PEX e-IPO system

ς Convened workshop for family businesses in

Ramallah mdash ldquoFamily Businesses Sustainability

Prospectsrdquo

ς Organized a reception on the occasion of full

membership in WFE

7

$ 0064EPS

+ 73 YOY

$ 0056ROE

+ 60 YOY

$ 984254EBITDA

+ 50 YOY

$ 642895NET PROFIT

+ 72 YOY

8

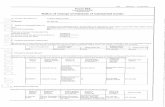

τ PEX Performance Summary

An active year 2016 saw trading volume rise by 33 percent and traded value by 39 percent compared to

2015 The table below details recent years performance

Change20152016

20162015201420132012Indicators

-2044849484948Number of listed companies

13416951079521672754881163779053815641003671523328011Number of subscribed shares

15333901223353339196379318725962432474783852859140375Market capitalization (million USD)

3894445152368320388213353917125340774269273440441Value of traded shares (million USD)

3286232817327175229463181545154202965939147304208Number of traded shares

966340103101441257 4442541442Number of concluded transactions

-041245246245241249Number of trading days

31011373104811081298967Share turnover ()

-0485301653273511775414547759Al-Quds Index (points)

395118169481302391144456014140011098154Average value of traded shares per session

3341950274712315741001842182591583Average number of traded shares per session

1032139126168184166Average number of transactions per session

00088889Number of member companies

335114341110638107755104460100620Number of accounts of (CDS)

Market Capitalization by sector 2016 Al-Quds Index 2012-2016

PSE Annual Report 2016 8

PEX Performance Summary

An active year 2016 saw trading volume rise by 33 percent and traded value by 39 percent compared to 2015 The table below details recent years performance

Change 20152016 2016 2015 2014 2013 2012 Indicators

204- 84 84 84 49 84 Number of listed companies 134 1994915941 199519589441 199595494 199891995 191914911 Number of subscribed shares 153 9491119 949149954 3187259624 9185985494 194491895 Market capitalization (million USD)

3894 88911994 1944911 353917125 895589194 159889881 Value of traded shares (million USD) 3286 119415915 159114989 181545154 11949944 18598914 Number of traded shares 966 891 1918 41257 88981 819881 Number of concluded transactions 041- 18 189 245 181 184 Number of trading days

3101 15 184 1108 1298 495 Share turnover () 048- 19 15 51177 818 8554 Al-Quds Index (points)

3951 1816948 191941 1444560 1981891 1944918 Average value of traded shares per session 3341 950274 51191 741001 4819141 4194 Average number of traded shares per session 1032 139 119 168 148 199 Average number of transactions per session 000 4 4 8 4 4 Number of member companies 335 118981 11994 107755 18989 1991 Number of accounts of (CDS)

Al-Quds Index 2012-2016

Market Capitalization by sector 2016

410420430440450460470480490500510520530540550560570580590600610

021

201

223

22

012

184

201

26

122

012

068

201

202

10

2012

021

220

1231

12

013

260

320

1320

05

2013

147

201

309

09

2013

101

120

1309

01

2014

050

320

1428

04

2014

230

620

1424

08

2014

211

020

1414

12

2014

100

220

1506

04

2015

010

620

1528

07

2015

200

920

1518

11

2015

130

120

1607

03

2016

280

420

1623

06

2016

210

820

1620

10

2016

151

220

16

3866

3035

1664

990445

ServicesBanks amp Financial ServicesInvestmentIndustryInsurance

PSE Annual Report 2016 8

PEX Performance Summary

An active year 2016 saw trading volume rise by 33 percent and traded value by 39 percent compared to 2015 The table below details recent years performance

Change 20152016 2016 2015 2014 2013 2012 Indicators

204- 84 84 84 49 84 Number of listed companies 134 1994915941 199519589441 199595494 199891995 191914911 Number of subscribed shares 153 9491119 949149954 3187259624 9185985494 194491895 Market capitalization (million USD)

3894 88911994 1944911 353917125 895589194 159889881 Value of traded shares (million USD) 3286 119415915 159114989 181545154 11949944 18598914 Number of traded shares 966 891 1918 41257 88981 819881 Number of concluded transactions 041- 18 189 245 181 184 Number of trading days

3101 15 184 1108 1298 495 Share turnover () 048- 19 15 51177 818 8554 Al-Quds Index (points)

3951 1816948 191941 1444560 1981891 1944918 Average value of traded shares per session 3341 950274 51191 741001 4819141 4194 Average number of traded shares per session 1032 139 119 168 148 199 Average number of transactions per session 000 4 4 8 4 4 Number of member companies 335 118981 11994 107755 18989 1991 Number of accounts of (CDS)

Al-Quds Index 2012-2016

Market Capitalization by sector 2016

410420430440450460470480490500510520530540550560570580590600610

021

201

223

22

012

184

201

26

122

012

068

201

202

10

2012

021

220

1231

12

013

260

320

1320

05

2013

147

201

309

09

2013

101

120

1309

01

2014

050

320

1428

04

2014

230

620

1424

08

2014

211

020

1414

12

2014

100

220

1506

04

2015

010

620

1528

07

2015

200

920

1518

11

2015

130

120

1607

03

2016

280

420

1623

06

2016

210

820

1620

10

2016

151

220

16

3866

3035

1664

990445

ServicesBanks amp Financial ServicesInvestmentIndustryInsurance

22كما ارتفعت قيمة التداول بما نسبته 22 حيث ارتفعت أحجام التداول 6102شهدت البورصة تداوال نشطا خالل العام 6102-6106يلي ملخص األداء الفني للفترة وفيما 6102مقارنة بالعام

2016 2015 1022 1022 1021 المؤشرات التغير10221026

عدد الشركات المدرجة28 49 28 22 28 -204

عدد األسهم المكتتب بها0226222682100 0222220112227 8357377361 8357437623118 0222017226 134

)مليون دوالر أميركي(القيمة السوقية 6282220212272 2262722782282 3187259624 338537 2221066222 153

(أميركي دوالر مليون ) المتداولة األسهم قيمة67222212220 22127722622 353917125 47311348 222026228 3894

عدد األسهم المتداولة02722122618 61622222222 181545154 876344325 626807267 3286

عدد الصفقات المنفذة202226 222262 41257 83782 22101 966

عدد جلسات التداول622 620 245 425 622 -041

معدل دوران األسهم )(227 1298 1108 8721 0272 3101

مؤشر القدس )نقطة(27722 22022 51177 647 22102 -048

معدل قيمة األسهم المتداولة لكل جلسة تداول021282022 022022110 1444560 837438 1816948 3951

معدل عدد األسهم المتداولة لكل جلسة تداول2202282 8262086 741001 784386 950274 3341

معدل عدد الصفقات لكل جلسة تداول 022 082 168 845 139 1032

عدد الشركات األعضاء2 8 8 1 8 000

عدد حسابات مركز اإليداع والتحويل0112261 0122221 107755 0012228 0022220 335

(1026-1021) مؤشر القدس

1026 التداول حسب القطاعات االقتصادية

410420430440450460470480490500510520530540550560570580590600610

021

201

215

22

012

024

201

25

172

012

037

201

216

82

012

041

020

1226

11

2012

161

201

304

03

2013

170

420

1303

06

2013

180

720

1305

09

2013

281

020

1317

12

2013

050

220

1423

03

2014

070

520

1423

06

2014

140

820

1429

09

2014

181

120

1405

01

2015

220

220

1508

04

2015

260

520

1509

07

2015

270

820

1518

10

2015

021

220

1519

01

2016

030

320

1618

04

2016

050

620

1624

07

2016

060

920

1630

10

2016

151

220

16

3866

3035

1664

990 445الخدمات

البنوك

االستثمار

الصناعة

التأمين

9

PSE Annual Report 2016 9

Financial Performance SummaryNet profits rose 72 percent year-over-year driven largely by trading activity Trading Commission revenues increased 38 percent while other revenues grew nine percent Below are key financial indicators

Change 20152016 2016 2015 2014 2013 2012 Indicator

891 12934931 11876356 11480780 11366673 11723148 Total assets

288 1508544 1171021 1128990 1303913 1487110 Total liabilities

67 11426387 10705335 10351790 10062760 10236038 Net equity

-402 2019 3375 1119 113 067 Liquidity ratio

169 408 349 179 5 33 Cash ratio

730 0064 0037 0024 (002) )007( Earnings per share

600 0056 0035 002 (002) )007( Return on shareholder equity

563 005 0032 002 (002) )006( Rate of return on total assets

200 12 10 10 11 13 Total liabilities to total assets

182 13 11 11 13 15 Total liabilities to total equity

497 984254 657423 590673 137219 (331851) EBITDA

Currency (USD)

Operating Revenues amp Expenses (Million USD)

Gains (losses)

316

277

241219

251

196 207 218 206

266

2012 2013 2014 2015 2016

Expenses Revenue

-701201

-219630

243224374655

642895

2012 2013 2014 2015 2016

τ Financial Performance Summary

Net profits rose 72 percent year-over-year driven largely by trading activity Trading Commission

revenues increased 38 percent while other revenues grew nine percent Below are key financial indicators

Change 2015201620162015201420132012Indicator

8911293493111876356114807801136667311723148Total assets

28815085441171021112899013039131487110Total liabilities

671142638710705335103517901006276010236038Net equity

-402201933751119113067Liquidity ratio

169408349179533Cash ratio

730006400370024(002)(007)Earnings per share

60000560035002(002)(007)Return on shareholder equity

5630050032002(002)(006)Rate of return on total assets

20012101011 13Total liabilities to total assets

1821311111315Total liabilities to total equity

497984254657423590673137219(331851)EBITDA

Operating Revenues amp Expenses (Million USD) Profits (losses)

PSE Annual Report 2016 9

Financial Performance Summary

Net profits rose 72 percent year-over-year driven largely by trading activity Commission revenues increased 38 percent while other revenues grew nine percent Below are key financial indicators

Change 20152016 2016 2015 2014 2013 2012 Indicator

891 12934931 11876356 11480780 11366673 119519184 Total assets 288 1508544 1171021 1128990 19941 198459110 Total liabilities 67 11426387 10705335 10351790 1991959 191994 Net equity

-402 2019 3375 1119 113 95 Liquidity ratio 169 408 349 179 5 33 Cash ratio 730 0064 0037 0024 (002) (5) Earnings per share 600 0056 0035 002 (002) (5) Return on shareholder equity 563 005 0032 002 (002) (9) Rate of return on total assets 200 12 10 10 11 13 Total liabilities to total assets 182 13 11 11 13 15 Total liabilities to total equity 497 984254 657423 590673 137219 (331851) EBITDA

Operating Revenues amp Expenses (Million USD)

Gains (losses)

316277

241219

251

196 207 218 206

266

2012 2013 2014 2015 2016

Expenses Revenue

-701201

-219630

243224374655

642895

2012 2013 2014 2015 2016

currency USD

10

Dr Farouq Zuai terChai rman of the Board

laquoWe look forward to the challenges and opportunities ahead confident

the Palestine Exchange will build on its achievementsraquo

11

Dear Shareho lders

I would like to welcome you in the annual meeting

aimed to present the accomplishments of our

company and its financial performance in the year

2016

Many positive signs appeared in 2016 predicting

recovery of the global economy following the

financial crises of 2008 Notwithstanding the refugeesrsquo

crisis Brexit and the fluctuation of the oil prices in the

first half of 2016 global economy witnessed a growth

of 27 inflation rates in developed economies

started to rise while interest rates in US marked an

increase of 25 points following improved economic

performance and its expected to rise at equal rates

in 2017 Furthermore oil prices are expected to rise in

2017 following an agreement among oil producing

countries to cut down their production so as to support

their budgets and achieve relative revitalization of

their economies

The national economy marked a 3 growth and is

expected to preserve this trend in 2017 especially if

further funding is obtained for reconstruction efforts

in Gaza and lifting of restrictions on the mobility of

persons and goods as well as the increase of the

number of workers in Israel and continuing flow of

donorsrsquo funding

Regionally Arab stock markets recorded mostly

positive results in 2016 Egyptrsquos market rose 76 percent

Casablanca by 30 percent and Dubai 12 percent

While the Al-Quds index posted a slight decrease

of 048 percent trading in PEX-listed companies

grew 39 percent over 2016 for a total value of 445

million US Dollars Total market capitalization also

increased by 15 percent to reach 339 billion US

Dollars

Meanwhile the Palestine Exchange passed several

key milestones towards fulfillment of its strategic

vision We are most proud of having achieved full

membership in the World Federation of Exchanges

(WFE) and our upgrade to frontier markets status

within FTSE Russell indices As a small exchange

with global ambitions PEX technology initiatives

included the successful launch of its e-IPO

system Finally local investment awareness efforts

continued to reap rewards

We look forward to the challenges and opportunities

ahead confident the Palestine Exchange will

build on its achievements in support of a national

economy primed for exceptional growth I wish

to express my deep gratitude and appreciation

to my colleagues on the Board for all their

valuable contributions I also thank the executive

administration and staff for their unflagging efforts

to realize our strategic vision Finally my sincere

Thanks to our partners in the securities sector

Best wishes of success to all

Dr Farouq ZuaiterChairman of the Board

12

Dear Shareho lders On behalf of the executive management I am pleased to present your companyrsquos 2016 annual report

Despite its challenges the year saw the Palestine Exchange perform well financially and achieve key strategic

goals that position it for future advancement Our performance reflects an economy that grew 3 percent with

listed company profits climbing 7 percent to 287 million US dollars This progress would only accelerate under

improved political conditions

Ahmad AweidahCEO

13

Growth StrategyThe Exchange made substantial progress in a number

of areas but 2016 was marked by the attainment

of two key strategic objectives full membership

in the World Federation of Exchanges (WFE) and

upgrade to frontier market status within the FTSE

Russell indices These accomplishments attest to the

Exchangersquos organizational operational and legal

credibility enhancing its listed companiesrsquo appeal to

international investors Our commitment to providing

a fair and transparent market was underlined by

sponsorship of the first investor relations conference

in cooperation with the Palestine chapter of the

Middle East Investor Relations Association

The Exchange continued to enhance its electronic

environment NotablySanad Construction Resources

Company became the first firm to list using our

internally-developed e-IPO system ldquoEKTITABrdquo The

system connects banks with the CDS to ensure

production of reliable shareholder registries that

better enable companies communicate with their

shareholders It follows the successful introduction

of the ldquoIFSAHrdquo e-disclosure platform developed for

brokerage firms

The year also saw greater outreach to private family-

owned businesses critical players in market and

national development For its part our investment

awareness program was capped off by the ninth

round of the Trading Simulation Competition which

attracted 260 students representing 11 national

universities In addition we hosted 300 students

as part of our ldquoVisit the Exchangerdquo program and

organized regular workshops and awareness sessions

in addition to our electronic publications

OperationsTrading volume increased 33 percent over

2015 to 233 million shares while traded

value rose 39 percent to reach 445 million US Dollars

Daily trading marked a rise of 40 percent scoring 18

million US Dollars The Al Quds Index closed at 53016

off 048 percent Total market value of Palestine

Exchange listed firms reached 339 billion US Dollars

a 15 percent increase over 2015

Financial PerformanceRelatively brisk trading activity had a positive impact

on our financial performance boosting operational

revenues 29 percent over the previous year Other

revenue streams increased 9 percent for a net

revenue rise of 73 percent and net after tax profit of

642895 US Dollars (a 716 percent improvement)

We usher in 2017 with sustained resilience and

determination our hopes for prosperity drawn from

the creativity of our listed companies and the growing

dynamism of the financial securities sector I wish to

thank our shareholders for their highly valued trust

I would also like to express sincere appreciation to

the Board of Directors and to my colleagues at the

Palestine Exchange Lastly thanks and gratitude to the

Palestine Capital Market Authority and all our partners

in the financial securities sector

My best wishes of success to you all

Ahmad AweidahCEO

14

Growth Strategy

15

τ Growth Strategy

1 Strengthen market governance mdash legislation regulation systems operational procedures information

security and management

2 Enhance partnerships with the Palestinian Capital Market Authority (PCMA) brokerage firms and listed

companies

3 Increase market depth liquidity and investor base through

bull Continued listing initiatives focusing on family-owned enterprises

bull Inclusion in MENA frontier market indices such as those provided by MSCI SampP and FTSE

bull Encouraging investment by Diaspora Palestinians

bull Attracting national and regional institutional and retail investors

4 Diversify income streams by

bull Expanding central depository services

bull Developing data dissemination channels and providing an online trading and companies database

5 Strengthen PEX local regional and international relationships

6 Promote good governance and investor relations best practices among listed companies

16

OrganizationalStructure

General Assemply

Board of Directors

Legal AdvisorExternal Audit

Internal Audit

ClearingDepositoryamp Sattlement Center

Public Relations amp invistor Education Dept

Trading Surveillanceamp Members affairs Dept Companies Dept

Systems amp TechnologyDept

Financial ampAdministativeaffairs Dept

Chief ExecutiveOfficer

Deputy ChiefExecutive Officer

Ops Compliance Sec

BOD InvestmentCom

BOD-Remunerationsamp Goverance Com

BOD-Audit amp Risk Com

17

τ Organizational Structure

General Assemply

Board of Directors

Legal AdvisorExternal Audit

Internal Audit

ClearingDepositoryamp Sattlement Center

Public Relations amp invistor Education Dept

Trading Surveillanceamp Members affairs Dept Companies Dept

Systems amp TechnologyDept

Financial ampAdministativeaffairs Dept

Chief ExecutiveOfficer

Deputy ChiefExecutive Officer

Ops Compliance Sec

BOD InvestmentCom

BOD-Remunerationsamp Goverance Com

BOD-Audit amp Risk Com

18

τ Board of Directors

Dr Farouq Zuaiter

ChairmanRepresentative of (PADICO)

Dr Atef Alawneh

Board memberRepresentative of (PADICO)

Mr Ziad Turk

Board memberRepresentative of (PADICO)

Mr Samir Hulileh

Vice ChairmanRepresentative of (PADICO)

Dr Mohammad Shtayyeh

Board memberRepresentative of Al-Sanabel Trad-ing and Investment Company Ltd

Mr Maher Masri

Board memberRepresentative of (PADICO)

No board member holds an executive position within the PEXAll board members have Palestinian nationality except Dr Farouq Zuaiter and Mr Ziad Turk who hold Jordanian nationalityBoard of Directors permanent Committees bull Audit amp Risk Committeebull Governance and Remuneration Committeebull Investment Committee 19

Legal Advisor

Al-Zubi Law Office

Independent External Auditor

Ernst amp Young

Mr Khaled Jian

bull Deputy Chief Executive Officer

bull Manager of Financial and

Administrative Affairs Department

bull Secretary of the Board of Directors

Mrs Nagham Salameh

Manager of Trading

Surveillance and Member

Affairs Department

Mr Khalid Hamdan

Manager of Clearing

Depository amp Settlement

Center (CDS)

Mr Mohammad Khraim

bull Manager of Public Relations

amp Investor Education

bull Chairman of the Palestine

Investor Relations Chapter

Joined PEX in 01122016

Mr ldquoAhmad Samehrdquo Aweidah

Chief Executive Officer

Mr Ahmad Aker

Chief of Operations

Mr Mohammad Hijaz

Manager of Companies

Department

Mr Mohammad Obeid

Manager of Systems and

Technology Department

τ Executive Management

20

Achievements and Developments

21

τ Achievements and Developments

Full Membership in the World Federation of Exchanges (WFE)In November the World Federation of Exchanges (WFE) awarded Palestine Exchange full membership The

upgrade announced at the Federationrsquos 56th General Assembly in Colombia followed an in-depth onsite

review and evaluation International investors regard WFE membership as an important indicator of financial

market standards Since 2009 Palestine Exchange has adhered to WFE guidelines as a corresponding member

and from 2011 as an affiliate member

A Frontier Market at FTSE Russell IndicesIn September FTSE Russell upgraded Palestine Exchange to frontier markets status Underscoring the Exchangersquos

operational regulatory and legal achievements the new classification marks a milestone in improving visibility

and credibility in international markets

New e-IPO ServiceIn December Sanad Construction Resources Company became the first firm to list using the Exchangersquos

internally-developed ldquoEktitabrdquo e-IPO program The online service lets investors subscribe in companies without

the use of paper documents It seamlessly and securely connects banks with the CDS platform to ensure an

accurate shareholder registry and quality investor communications

بيان صحفي للنشر الفوري06112016 التاريخ

(WFE)

-

(World Federation of Exchanges)

201556

24112016

22

Family Business OutreachPalestine Exchange stepped up engagement with private family businesses reaching out with a series field visits

along with two workshops titled laquoFamily Business Sustainability prospectsraquo in Hebron and Ramallah The workshops

featured representatives from international accounting firms explain the advantages and responsibilities of a

public listing

IFSAH e-disclosure systemMember broker firms joined the ldquoIFSAHrdquo e-disclosure system at the beginning of 2016 streamlining financial

statement disclosure

Gaza Strip MeetingsIn January the Palestine Exchange concluded a round of meetings in the Gaza Strip with the visit of its delegate

Mr Mohammad Hijaz Director of Companiesrsquo Department Mr Hijaz held discussions with representatives

from listed and non-listed companies family-owned businesses and member brokerage firm branches The

round also included visits to partner universities the Chamber of Commerce and Industry in Gaza and the

Businessmenrsquos Association

Termination of HSBC Custodian Bank AgreementAs of 30 June 2016 following correspondence with the HSBC the Custodian Bank Agreement was terminated

following closure of HSBCrsquos offices in Palestine Based on the mechanism agreed upon with the bank all

customer accounts were closed and their shares transferred to the custodian of their choice

23

PSE Annual Report 2016 18

Compliance and Risk Management Operational compliance aims to enhance internal control over the Exchangersquos daily operations either through auditing or compliance verification This effort coincided with ratification by the Palestine Exchangersquos Board of Directors of the compliance and risk management and anti-money laundering policies Implementation of the instructions issued by the National Committee to Combat Money-Laundry and Terrorism Funding relating to the Exchange activities has started Explanatory notes were prepared to identify the duties and mandate of every agency of the capital market institutions relating to implementing the requirements of the UN Security Council lists Work was done to update the applications of opening accounts for natural and legal persons to produce forms consistent with internationally applicable criteria Annexes were drafted to identify customers including stakeholders users delegates and politically disposed persons in addition to the requirements of American Citizen Security Indicators and rules of dealings via a third party

Human Resources PEX employed 44 people at the end of 2016 one more than 2015 Employee data

- Staff distribution by education

- Staff distribution by age

- Staff distribution by Gender

bull Training and Development The Palestine Exchange believes in building the capacities of its staff and providing them with the necessary expertise to fulfill their tasks To this end it organizes a variety of internal and external training programs workshops conferences and symposia Last year activities included

- Training workshop on managing interest rates and FX risk- Three employees - Seminar on Islamic bonds Sukuk in Jordan organized by the Islamic Bank for

Development- Two employees - Course on data analysis and economic report preparation in Jordan organized by

PECDAR- One employee - Course on digital marketing and social media optimization- Three employees - Course toward Certified Management Accountant certification- One employee

Investment Awareness

- Media education workshop for Asdaa e-media site

18

52

14

16MasterBADiplomaHigh school

18

34

39

9

59-50

49-40

39-30

Less than 3066

34Male

Female

PSE Annual Report 2016 18

Compliance and Risk Management Operational compliance aims to enhance internal control over the Exchangersquos daily operations either through auditing or compliance verification This effort coincided with ratification by the Palestine Exchangersquos Board of Directors of the compliance and risk management and anti-money laundering policies Implementation of the instructions issued by the National Committee to Combat Money-Laundry and Terrorism Funding relating to the Exchange activities has started Explanatory notes were prepared to identify the duties and mandate of every agency of the capital market institutions relating to implementing the requirements of the UN Security Council lists Work was done to update the applications of opening accounts for natural and legal persons to produce forms consistent with internationally applicable criteria Annexes were drafted to identify customers including stakeholders users delegates and politically disposed persons in addition to the requirements of American Citizen Security Indicators and rules of dealings via a third party

Human Resources PEX employed 44 people at the end of 2016 one more than 2015 Employee data

- Staff distribution by education

- Staff distribution by age

- Staff distribution by Gender

bull Training and Development The Palestine Exchange believes in building the capacities of its staff and providing them with the necessary expertise to fulfill their tasks To this end it organizes a variety of internal and external training programs workshops conferences and symposia Last year activities included

- Training workshop on managing interest rates and FX risk- Three employees - Seminar on Islamic bonds Sukuk in Jordan organized by the Islamic Bank for

Development- Two employees - Course on data analysis and economic report preparation in Jordan organized by

PECDAR- One employee - Course on digital marketing and social media optimization- Three employees - Course toward Certified Management Accountant certification- One employee

Investment Awareness

- Media education workshop for Asdaa e-media site

18

52

14

16MasterBADiplomaHigh school

18

34

39

9

59-50

49-40

39-30

Less than 3066

34Male

Female

Compliance and Risk ManagementOperational compliance aims to enhance internal control over the Exchangersquos daily operations either

through auditing or compliance verification This effort coincided with ratification by the Palestine

Exchangersquos Board of Directors of the compliance and risk management and anti-money laundering policies

Implementation of the instructions issued by the National Committee to Combat Money-Laundry and Terrorism

Funding relating to the Exchange activities has started Explanatory notes were prepared to identify the duties

and mandate of every agency of the capital market institutions relating to implementing the requirements of

the UN Security Council lists Work was done to update the applications of opening accounts for natural and

legal persons to produce forms consistent with internationally applicable criteria Annexes were drafted to

identify customers including stakeholders users delegates and politically disposed persons in addition to the

requirements of American Citizen Security Indicators and rules of dealings via a third party

Human ResourcesPEX employed 44 people at the end of 2016 one more than 2015 Employee data

Staff distribution by educationStaff distribution by ageStaff distribution by Gender

Training and DevelopmentThe Palestine Exchange believes in building the capacities of its staff and providing them with the necessary

expertise to fulfill their tasks To this end it organizes a variety of internal and external training programs

workshops conferences and symposia Last year activities included

bull Training workshop on managing interest rates and FX risk- Three employees

bull Seminar on Islamic bonds Sukuk in Jordan organized by the Islamic Bank for Development- Two employees

bull Course on data analysis and economic report preparation in Jordan organized by PECDAR- One employee

bull Course on digital marketing and social media optimization- Three employees

bull Course toward Certified Management Accountant certification- One employee

Less than 30

24

Investment Awareness

ཌ Media education workshop for Asdaa e-media site

A workshop held in July was attended by 20 media practitioners working on the website to introduce them to

the Palestine Exchangersquos operations and its data and information dissemination services

ཌ Student visits

Despite school interruptions the Exchange played host to more than 300 students as part of its ldquoVisit the

Palestine Exchangerdquo program The initiative aims to familiarize students with the Palestine Exchange and the

Palestinian financial securities sector

Stock Market Simulation ContestThe competitionrsquos ninth round saw more than 260 students from 11 Palestinian universities compete for prizes in a

virtual trading environment The Arab Palestinian Investment Company (APIC) sponsored the 2016 tournament

Training Courses ཌ Digital marketing and social media optimization

Twenty professionals from listed and non-listed firms attended a three-day course organized by the Exchange

on integrating social media into corporate marketing PR and investor relations

25

ཌ Financial brokering

Delivered via videoconference the course provided employees of Wasata brokerage firm in Gaza with a

detailed explanation of the theoretical and practical aspects of CDS and trading procedures Successful

completion of the course is required for certification by the Palestine Capital Market Authority as well as the

Chartered Institute for Securities and Investment (CISI)

Media Presence and Dissemination of Informationbull Media activity The Palestine Exchange continued to be a source for information and comment on

developments at PEX and in the Palestinian securities sector

bull Networking with local media The Palestine Exchange held meetings with local media aimed at

joint cooperation and greater news coverage The following organizations were visited Al-Hayat

Newspaper Al-Ayyam Newspaper Palestine Economic Portal Birzeit University Media Center WAFa-

Palestine Official News Agency PBC-Palestine Broadcasting Corporation and Al-Hadath Newspaper

bull Reception following WFE membership upgrade Held at the Movenpick Hotel in Ramallah the

December 19th event attracted senior government and private sector officials academics and the

media

bull Data dissemination The PEX expanded its data dissemination to local and external agencies

26

Electronic Publications ཌ Technical Report

Covers listed company status performance and governance indicators in 2015 It is published in a pdf

e-version The report has particular importance for many groups for the reason of the information it provides

on the public equities listed and their application of governance

ཌ Panorama Exchange E-Bulletin

A quarterly e-bulletin ldquoPanoramardquo features in-depth coverage of issues affecting the Palestinian securities

sector It can be found here httpwwwpexpspanorama

ཌ Monthly Trading Bulletin

Provides statistical data of the trading indicators and the changes over the month and other data and news

related to market activity

ཌ Monthly Investor Bulletin

A summary of market data and company news

ཌ Monthly CDS Report

Presents data on investors shares and CDS operations

ཌ Quarterly Members Report of Financial Securities Companies

Displays statistical data and charts on the performance of member brokerage firms

Palestine Chapter of Middle East Investors Relations Association ndash MEIRAMEIRArsquos Palestine chapter held four meetings to discuss ongoing issues and events Significant chapter activities

included

bull Investor Relations Conference Held in May the conference was jointly organized by MEIRA-Palestine

chapter MEIRA-UAE and the PEX It brought together some 80 participants and featured a distinguished

group of local and foreign speakers It was widely covered by local media

bull Updating shareholder database For this purpose a meeting was held in August attended by

representatives from MEIRA-Palestine chapter the PEX as well as brokerage firms The meeting discussed

possible mechanisms to employ update and amend shareholder databases in cooperation with relevant

agencies

27

Regional and International PresenceThe Palestine Exchange enhanced its regional and international profile via participation in a variety

of forums including

bull The annual meeting of the Federation of Euro-Asian Stock Exchanges (FEAS) in Sharm El-Sheikh Egypt

during which Palestine Exchange was elected to FEASrsquos Executive Board

bull The 56th annual conference of the World Federation of Exchanges (WFE) in Cartagena Colombia during

which PEX was upgraded to full membership

bull The meeting of financial markets of the Organization of the Islamic Conference (OIC) in Istanbul

bull The eighth annual conference of the Middle East Investor Relations Association (MEIRA) in Dubai in which

the CEO delivered a keynote address

bull The St Petersburg Economic Conference upon invitation of the Ministry of National Economy in St

Petersburg Russia

bull The annual meeting of the Federation of Arab Exchanges in Jordan

Local participationbull The meetings of the national strategy task forces on financial inclusion under the presidency of the Palestine

Capital Market Authority (PCMA) and the Palestinian Monetary Authority (PMA) noting that the Palestine

Exchange is a member of the strategyrsquos advisory and technical committees

bull The committee of the financial sector held by Palestine Capital Market Authority (PCMA) and Palestinian

Monetary Authority (PMA) invited by the Ministry of National Economy to join Beirut round of services sector

28

Technical Performance

29

τ Technical Performance Al Quds Index

The PEXrsquos Al-Quds index closed the year at 53016 points a 048 percent decline from 2015 The drop largely

reflected the 694 percent fall of the services sector index The indexs peak value during 2016 was 53695

points The Al-Quds Index closed the first quarter at 50628 points a decline of 496 percent compared with

2015 The decline continued in the second quarter reaching a low of 48839 points The third quarter index

retrieved at the end of the third quarter at a rise of 294 percent from second quarter At the end of 2016 the

index increased 2627 points from first half a rise of 523 percent

The graph below shows year-over-year performance of Arab markets

PSE Annual Report 2016 22

PEX Technical Performance

Al Quds Index

The PEXrsquos Al-Quds index closed the year at 53016 points a 048 percent decline from 2015 The drop largely reflected the 694 percent fall of the services sector index The indexs peak value during 2016 was 53695 points The Al-Quds Index closed the first quarter at 50628 points a decline of 496 percent compared with 2015 The decline continued in the second quarter reaching a low of 48839 points The third quarter index retrieved at the end of the third quarter at a rise of 294 percent from second quarter At the end of 2016 the index increased 2627 points from first half a rise of 523 percent

The graph below shows year-over-year performance of Arab markets

48504875490049254950497550005025505050755100512551505175520052255250527553005325535053755400

030

120

1612

01

2016

200

120

1628

01

2016

070

220

1615

02

2016

230

220

1602

03

2016

100

320

1620

03

2016

280

320

1605

04

2016

130

420

1621

04

2016

020

520

1611

05

2016

190

520

1629

05

2016

060

620

1614

06

2016

220

620

1630

06

2016

130

720

1621

07

2016

310

720

1608

08

2016

160

820

1624

08

2016

010

920

1618

09

2016

260

920

1605

10

2016

131

020

1623

10

2016

311

020

1608

11

2016

171

120

1627

11

2016

051

220

1614

12

2016

221

220

16

-150-100

-500050

100150200250300350400450500550600650700750800

EGYPT

DAMASCUS

CASABLANCA

DUBAI

TUNIS

MUSCAT

SUDAN

ABU DHABI

SAUDI

BEIRUT

KUWAIT

AMM

AN

BAHRAIN

QATAR

PALESTINE

IRAQ

53016

PSE Annual Report 2016 22

PEX Technical Performance

Al Quds Index

The PEXrsquos Al-Quds index closed the year at 53016 points a 048 percent decline from 2015 The drop largely reflected the 694 percent fall of the services sector index The indexs peak value during 2016 was 53695 points The Al-Quds Index closed the first quarter at 50628 points a decline of 496 percent compared with 2015 The decline continued in the second quarter reaching a low of 48839 points The third quarter index retrieved at the end of the third quarter at a rise of 294 percent from second quarter At the end of 2016 the index increased 2627 points from first half a rise of 523 percent

The graph below shows year-over-year performance of Arab markets

48504875490049254950497550005025505050755100512551505175520052255250527553005325535053755400

030

120

1612

01

2016

200

120

1628

01

2016

070

220

1615

02

2016

230

220

1602

03

2016

100

320

1620

03

2016

280

320

1605

04

2016

130

420

1621

04

2016

020

520

1611

05

2016

190

520

1629

05

2016

060

620

1614

06

2016

220

620

1630

06

2016

130

720

1621

07

2016

310

720

1608

08

2016

160

820

1624

08

2016

010

920

1618

09

2016

260

920

1605

10

2016

131

020

1623

10

2016

311

020

1608

11

2016

171

120

1627

11

2016

051

220

1614

12

2016

221

220

16

-150-100

-500050

100150200250300350400450500550600650700750800

EGYPT

DAMASCUS

CASABLANCA

DUBAI

TUNIS

MUSCAT

SUDAN

ABU DHABI

SAUDI

BEIRUT

KUWAIT

AMM

AN

BAHRAIN

QATAR

PALESTINE

IRAQ

53016

30

Sector IndicesThe general index encompassing all listed companies closed the year up 309 points to 28517 points a 110

percent increase over 2015

All sector indices except services saw upticks The banking and financial services index increased 056 percent

to close at 14438 points The insurance index rose 3658 percent and closed at 6706 points The industry

sector index increased 1186 percent to close at 7817 points The investment sector increased 980 percent

to close at 2633 points The services sector declined 694 percent to close at 4503 points

Changeopenclose Sector

() Point

-048-2575327353016Al-Quds

1103092820828517General

0560811435714438Banking and financial services

118682969887817Industry

3658179649106706Insurance

98023523982633Investment

-694-33648394503Services

The following graph compares the insurance sector index the highest with Al-Quds index in 2016

PSE Annual Report 2016 23

Sector Indices

The general index encompassing all listed companies closed the year up 309 points to 28517 points a 110 percent increase over 2015 All sector indices except services saw upticks The banking and financial services index increased 056 percent to close at 14438 points The insurance index rose 3658 percent and closed at 6706 points The industry sector index increased 1186 percent to close at 7817 points The investment sector increased 980 percent to close at 2633 points The services sector declined 694 percent to close at 4503 points

The following graph compares the insurance sector index the highest with Al-Quds index in 2016

485

490

495

500

505

510

515

520

525

530

535

540

48

50

52

54

56

58

60

62

64

66

68

03012016

18012016

01022016

15022016

29022016

14032016

28032016

11042016

25042016

11052016

25052016

08062016

22062016

11072016

25072016

08082016

22082016

05092016

26092016

11102016

25102016

08112016

23112016

07122016

Al-Q

uds

Inde

x

Insu

ranc

e Se

ctor

Inde

x

Change open close

Sector () Point

-048 -257 53273 53016 Al-Quds 110 309 28208 28517 General 056 081 14357 14438 Banking and financial services

1186 829 6988 7817 Industry 3658 1796 4910 6706 Insurance 980 235 2398 2633 Investment -694 -336 4839 4503 Services

Al-Quds Index Insurance Sector Index

31

Trading ActivityThe PEX held 245 trading sessions in 2016 in which 232817327 shares valued at USD 445152368

were traded through 34010 contracts

Total listed company market capitalization reached USD 3390122335 a 153 percent rise over 2015 The

value of traded shares increased 3894 percent over 2015 amounting to USD 445152368

The Banking amp Financial Services sector accounted for 4155 percent of total trading followed by the

investment sector with 2574 percent and the services sector at 2341 percent

Value of traded shares (USD million)

Volume of Traded Shares( million)

25

دوالرا أمريكيا 22220262228سهما بقيمة 62628072267 تم خاللها تداول 6102العام تداول خالل ةجلس 245تم عقد شهر كانون فقد بلغت القيمة السوقية ألسهم الشركات المدرجة نهاية وفيما يتعلق بحجم السوق عقدا 222101نفذت من خـالل

العام نهاية نفس الفترة من عن 022نسبته بلغت بارتفاع دوالر أمريكي 2222120662222 حوالي 6102أول من العام واستحوذ 6102العام عن 2822ه نسبتبارتفاع بلغت دوالرا 22220262228المتداولة األسهم في حين بلغت قيمة 6102

حيث شكلت قيمة األسهم 6102قطاع البنوك والخدمات المالية على النصيب األكبر من قيمة األسهم المتداولة خالل العام من 6220استحوذ قطاع االستثمار على نسبة نمن إجمالي قيمة التداوالت خالل العام في حي 2022ا نسبته المتداولة م

من إجمالي قيم التداول 6220قيمة التداوالت تاله في المرتبة الثالثة قطاع الخدمات بنسبة

)قيمة األسهم المتداولة )مليون دوالر

دوالر(عدد األسهم المتداولة )مليون

25 69150 189

74 45 58201

2096

1067

813

1185

500 451366

273341 354 320

445

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

10 17

6993

3319

40

104

370

223

299

339

239 231

185

147

203182 175

233

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

25

دوالرا أمريكيا 22220262228سهما بقيمة 62628072267 تم خاللها تداول 6102العام تداول خالل ةجلس 245تم عقد شهر كانون فقد بلغت القيمة السوقية ألسهم الشركات المدرجة نهاية وفيما يتعلق بحجم السوق عقدا 222101نفذت من خـالل

العام نهاية نفس الفترة من عن 022نسبته بلغت بارتفاع دوالر أمريكي 2222120662222 حوالي 6102أول من العام واستحوذ 6102العام عن 2822ه نسبتبارتفاع بلغت دوالرا 22220262228المتداولة األسهم في حين بلغت قيمة 6102

حيث شكلت قيمة األسهم 6102قطاع البنوك والخدمات المالية على النصيب األكبر من قيمة األسهم المتداولة خالل العام من 6220استحوذ قطاع االستثمار على نسبة نمن إجمالي قيمة التداوالت خالل العام في حي 2022ا نسبته المتداولة م

من إجمالي قيم التداول 6220قيمة التداوالت تاله في المرتبة الثالثة قطاع الخدمات بنسبة

)قيمة األسهم المتداولة )مليون دوالر

دوالر(عدد األسهم المتداولة )مليون

25 69150 189

74 45 58201

2096

1067

813

1185

500 451366

273341 354 320

445

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

10 17

6993

3319

40

104

370

223

299

339

239 231

185

147

203182 175

233

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

32

Trading by Sector

SectorListed Com-

paniesVolume Value (USD)

No of Transac-tions

Market Cap (USD)

Banking amp Financial Services 7 99518768 184960320 9482 1028988015

Insurance 7 11871187 29288370 618 150912500Investment 9 88912257 114562485 10505 564056509

Industry 13 4807320 12133927 2135 335468324Services 12 27707795 104207267 11270 1310696987

Total 48 232817327 445152369 34010 3390122335bull Percentage value of traded shares per sector

bull Percentage of traded shares per sector

PSE Annual Report 2016 25

Trading by Sector

Sector

Listed Companies Volume Value (USD) No of

Transactions Market Cap

(USD)

Banking amp Financial Services 7 99518768 184960320 9482 1028988015 Insurance 7 11871187 29288370 618 150912500 Investment 9 88912257 114562485 10505 564056509 Industry 13 4807320 12133927 2135 335468324 Services 12 27707795 104207267 11270 1310696987 Total 48 232817327 445152369 34010 3390122335

Percentage value of traded shares per sector

Percentage of traded shares per sector

BNK4155

INS658

INV2574

IND273

SRV2341

BNK4275

INS510

INV3819

IND206

SRV1190

PSE Annual Report 2016 25

Trading by Sector

Sector

Listed Companies Volume Value (USD) No of

Transactions Market Cap

(USD)

Banking amp Financial Services 7 99518768 184960320 9482 1028988015 Insurance 7 11871187 29288370 618 150912500 Investment 9 88912257 114562485 10505 564056509 Industry 13 4807320 12133927 2135 335468324 Services 12 27707795 104207267 11270 1310696987 Total 48 232817327 445152369 34010 3390122335

Percentage value of traded shares per sector

Percentage of traded shares per sector

BNK4155

INS658

INV2574

IND273

SRV2341

BNK4275

INS510

INV3819

IND206

SRV1190

33

Trading by Nationality

SectorListed

CompaniesVolume Value (USD)

No of Transactions

Market Cap (USD)

Banking amp Financial Services 7 99518768 184960320 9482 1028988015

Insurance 7 11871187 29288370 618 150912500Investment 9 88912257 114562485 10505 564056509

Industry 13 4807320 12133927 2135 335468324Services 12 27707795 104207267 11270 1310696987

Total 48 232817327 445152369 34010 3390122335bull Investments at the PEX (USD million)

bull Share ownership by nationality amp type bull Shareholders by nationality amp type

PSE Annual Report 2016 26

Trading by Nationality

Sector

Listed Companies Volume Value (USD) No of

Transactions Market Cap

(USD)

Banking amp Financial Services 7 99518768 184960320 9482 1028988015 Insurance 7 11871187 29288370 618 150912500 Investment 9 88912257 114562485 10505 564056509 Industry 13 4807320 12133927 2135 335468324 Services 12 27707795 104207267 11270 1310696987 Total 48 232817327 445152369 34010 3390122335

Investments at the PEX (USD million)

Share ownership by nationality amp type Shareholders by nationality amp type

125

231

163

317

100

200

62

114

Volume Value Volume Value

Sell Buy

Palestinian

Foreign

Local Individual 2353

Local Company 4212

Foreign Individual 1246

Foreign Company 217

NA 019

Local Individual 952

Local Company 072

Foreign Individual 331

Foreign Company 026

NA 051

PSE Annual Report 2016 26

Trading by Nationality

Sector

Listed Companies Volume Value (USD) No of

Transactions Market Cap

(USD)

Banking amp Financial Services 7 99518768 184960320 9482 1028988015 Insurance 7 11871187 29288370 618 150912500 Investment 9 88912257 114562485 10505 564056509 Industry 13 4807320 12133927 2135 335468324 Services 12 27707795 104207267 11270 1310696987 Total 48 232817327 445152369 34010 3390122335

Investments at the PEX (USD million)

Share ownership by nationality amp type Shareholders by nationality amp type

125

231

163

317

100

200

62

114

Volume Value Volume Value

Sell Buy

Palestinian

Foreign

Local Individual 2353

Local Company 4212

Foreign Individual 1246

Foreign Company 217

NA 019

Local Individual 952

Local Company 072

Foreign Individual 331

Foreign Company 026

NA 051

PSE Annual Report 2016 26

Trading by Nationality

Sector

Listed Companies Volume Value (USD) No of

Transactions Market Cap

(USD)

Banking amp Financial Services 7 99518768 184960320 9482 1028988015 Insurance 7 11871187 29288370 618 150912500 Investment 9 88912257 114562485 10505 564056509 Industry 13 4807320 12133927 2135 335468324 Services 12 27707795 104207267 11270 1310696987 Total 48 232817327 445152369 34010 3390122335

Investments at the PEX (USD million)

Share ownership by nationality amp type Shareholders by nationality amp type

125

231

163

317

100

200

62

114

Volume Value Volume Value

Sell Buy

Palestinian

Foreign

Local Individual 2353

Local Company 4212

Foreign Individual 1246

Foreign Company 217

NA 019

Local Individual 952

Local Company 072

Foreign Individual 331

Foreign Company 026

NA 051

34

2

الشركات المدرجة

والتي نفذت بنك فلسطين على أثر عملية االندماج معشطب إدراج أسهم البنك التجاري الفلسطيني 2116تم خالل العام قيمتهابلغت شركة 28هو 6102جة نهاية العام وبذلك يكون عدد الشركات المدر 6102خالل شهر أيلول من العام

وال يزال 6102العام نهاية نفس الفترة من عن 022نسبته بلغت بارتفاع دوالر أمريكيمليار 2221 حواليالسوقية يليه قطاع البنوك والخدمات 2822بر من إجمالي القيمة السوقية بنسبة قطاع الخدمات يستحوذ على الحصة األك

من إجمالي القيمة 2122المالية في المرتبة الثانية بنسبة

عدد الشركات المدرجة

)مليون دوالر أمريكي( القيمة السوقية أرباحتوزيعات )الشركات )مليون دوالر

48

49

48

49

48

2012 2013 2014 2015 2016

2859

32473187

33393390

2012 2013 2014 2015 2016

140155

172 171180

2012 2013 2014 2015 2016

2

الشركات المدرجة

والتي نفذت بنك فلسطين على أثر عملية االندماج معشطب إدراج أسهم البنك التجاري الفلسطيني 2116تم خالل العام قيمتهابلغت شركة 28هو 6102جة نهاية العام وبذلك يكون عدد الشركات المدر 6102خالل شهر أيلول من العام

وال يزال 6102العام نهاية نفس الفترة من عن 022نسبته بلغت بارتفاع دوالر أمريكيمليار 2221 حواليالسوقية يليه قطاع البنوك والخدمات 2822بر من إجمالي القيمة السوقية بنسبة قطاع الخدمات يستحوذ على الحصة األك

من إجمالي القيمة 2122المالية في المرتبة الثانية بنسبة

عدد الشركات المدرجة

)مليون دوالر أمريكي( القيمة السوقية أرباحتوزيعات )الشركات )مليون دوالر

48

49

48

49

48

2012 2013 2014 2015 2016

2859

32473187

33393390

2012 2013 2014 2015 2016

140155

172 171180

2012 2013 2014 2015 2016

140155

172 172 180

2012 2013 2014 2015 2016

Listed CompaniesIn September PEX delisted Commercial Bank of Palestine following its merger with Bank of Palestine As of

31 December 2016 PEX listed 48 companies with a total market value of USD 339$ bn a 153 percent

increase over 2015 The services sector remained the largest in terms of market capitalization representing

3866 percent of the total The banking and financial sector ranked second at 3035 percent

Listed Companies

Dividends of listed companies (USD Million) Market Capitalization (USD Million)

35

Shareholder Information

36

τ Shareholder InformationShares and Shareholders

On 31 December 2016 the PEX had 23 shareholders that owned a total of 10 million shares The table below

provides a breakdown of shareholders and shares

ཌ Shareholders According to Volume of ShareholdingShareholding

volumeNo of

shareholdersPercentage of shareholders

Volume of shares Percentage of shares

2016 2015 2016 2015 2016 2015 2016 2015

1-5000 7 7 3043 3043 9362 9362 009 009

5001-10000 4 4 1739 1739 34332 34332 034 034

10001-50000 5 5 2174 2174 213200 213100 213 213

50001-100000 2 2 870 870 110700 110800 111 111

100001 amp above 5 5 2174 2174 9632406 9632406 9633 9633

TOTAL 23 23 100 100 10000000 10000000 100 100

ཌ Shareholders by nationality

ཌ Type of ShareholdersNo of Shareholders Volume of Shares Percentage of Shares

2016 2015 2016 2015 2016 2015

Individuals 4 4 23000 23000 023 023

Institutions

Companies 14 13 9759126 9259126 9759 9264

Brokerage companies 1 1 44100 44100 044 044

Banks 2 2 172674 172674 173 168

Funds 2 3 1100 501100 001 501

TOTAL 23 23 10000000 10000000 100 100

PSE Annual Report 2016 28

On 31 December 2016 the PEX had 23 shareholders that owned a total of 10 million shares The table below provides a breakdown of shareholders and shares

Shareholders According to Volume of Shareholding

Shareholding volume No of shareholders

Percentage of shareholders

Volume of shares Percentage of shares

2016 2015 2016 2015 2016 2015 2016 2015 1-5000 7 7 3043 3043 9362 9362 009 009 5001-10000 4 4 1739 1739 34332 34332 034 034 10001-50000 5 5 2174 2174 213200 213100 213 213 50001-100000 2 2 870 870 110700 110800 111 111 100001 amp above 5 5 2174 2174 9632406 9632406 9633 9633

TOTAL 23 23 100 100 10000000 10000000 100 100

Shareholders by nationality

Type of Shareholders

No of Shareholders

Volume of Shares Percentage of Shares

2016 2015 2016 2015 2016 2015Individuals 4 4 23000 23000 023 023Institutions

Companies 14 13 9759126 9259126 9759 9264 Brokerage companies 1 1 44100 44100 044 044 Banks 2 2 172674 172674 173 168 Funds 2 3 1100 501100 001 501

TOTAL 23 23 10000000 10000000 100 100

Major Shareholders

Share Volume in Share Volume in Name of Shareholding Company

4

19

7274744

2725256

Palestinian Foreigner

37

ཌ Major Shareholders

Share Volume in

31122015Share Volume in

31122016Name of Shareholding Company

7471747134474717471344Palestine Development amp Investment PADICO Holding1

170017000001700 1700000Al-Sanabel Trading and Investment Company Ltd2

500500000500 500000Capital Trust Investments Limited 3

9671967134496719671344TOTAL

ཌ Major Shareholder Overview

Palestine Development amp Investment PADICO Holding

PADICO is a limited public holding company established on 14 October 1994 according to the Liberian

nonresident company law

Among its corporate purposes is the development and promotion of investments in various sectors including

industry real estate tourism housing and services In addition it conducts technical research and provides

consultancy services through the establishment of subsidiaries or projects managed either wholly or partially

by it or through its subsidiaries

Al-Sanabel Trading and Investment Company Limited

A private limited liability shareholding company with a share capital of USD 3 mn registered in Palestine

with the Companies Controller under registration number (562482216) on 17 February 2009 Its registered

headquarters is in Ramallah City and it may establish sub-offices in Palestine and abroad in accordance with

the law

Capital Trust Investments Limited

Established and registered in 1993 in Guernsey A subsidiary of Capital Trust Group (founded in 1985) CTG

is a private equity real estate and corporate finance advisory firm operating in the UK Europe USA the

Middle East and North Africa The Group has managed nine funds to date and has offices in London Beirut

Washington and New York

38

ཌ PSE Trading ActivityThe table below shows PSE share trading activity

20152016Item

4862300Number of traded shares

240671485Value of traded shares

23Number of executed transactions

0049 000003 Share average turnover

23Number of share trading sessions

4950000049500000Companyrsquos market value on 31 December 2012

536 536 Percentage of free shares

495495Highest trading price in 2012 (USD)

495495Lowest trading prices in 2012 (USD)

495495Closing prices on 31 December 2012 (USD)

Quarterly share price details were as follows

4th Quarter 3rd Quarter 2nd Quarter 1st QuarterStatement

495495495495Highest price (USD)

495495495495Lowest price (USD)

495495495495Closing price (USD)

ཌ Information dissemination to shareholdersThe PEX adheres to a shareholder communication policy which guarantees accurate clear and transparent

information dissemination to its shareholders and the investment community in general The PEX utilizes

available platforms including its website e-mail regular mail and landline to communicate with shareholders

PEX communication policy is available at wwwpexps under Investor Relations

39

ཌ Dividend Distribution The PEX dividend policy depends upon profitability and the availability of sufficient reserves to

distribute dividends to shareholders Dividend distribution is not guaranteed The following table

shows dividends distributed from 2005-2008

DividendShareValue of Distributed DividendsDistribution type Fiscal year

0191900000Cash2008

0202000000Cash2007

0313112709Cash2006

2537171000Free shares2005

ཌ PEX Competitive Featuresbull Palestinian Securities Exchange successful development rests on several qualities including

bull Since inception the PEX has leveraged modern technology it was the first fully automated electronic

Arab financial market

bull PEX listed companies are among the largest and most innovative in Palestine contributing enormously

to the Exchangersquos success and evolution

bull Prospects are good for increasing the number of listed companies based on the provisions of the

Securities Law No 12 for the year 2004

bull A vital component of any economy the Exchange is a primary capital raising source for public firms

and provides investment opportunities for a multitude of investors including bank portfolios

bull The Exchange is favored by investors who seek swift and easy trading governed by clear and

transparent rules

bull The Exchange serves small and large investors alike Any amount of capital investment is possible in

a diverse range of companies

ཌ Investment PolicyThe Investment Committee of the PEX Board of Directors develops and monitors the investment policy of

the companyrsquos assets in line with the Committeersquos guidelines Most global stock markets including the PEX

depend largely on trading returns to drive revenue However the PEX strives to diversify income streams and

reduce its dependence on fees and trading commissions PEX may carry out measured investment activities

in order to upgrade and promote the efficiency of financial assets utilization and enhance its role in serving

both shareholders and the Palestinian economy

The investment policy maintains a disciplined investment philosophy based on the preservation of capital

while seeking opportunities to maximize returns Balancing investment objectives with risk analysis it seeks

40

safe liquid and long-term opportunities It avoids speculation and gives priority to promising and practical

domestic investments that serve national economic development

Areas of investment include capital productivity and service companies monetary market and debt tools

and real estate Note that PEX holds previous investments which amounted to the following as at 20161231

Investment Amount

A Financial Assets at fair value from statement of complehensive income

V Tel Co 157500

(Rawan) portfolio 955444

Dubai Financial Market 4135

B Financial Assets at amortization 7000000

ཌ Risks and ChallengesMajor risks faced by the PEX are those commonly associated with political risks the Palestinian internal

situation as well as domestic regional and international economic crises While it is difficult to find any risk-free

investment and in addition to the general familiar risks just mentioned there are special potential risks that

PEX might face which should be accommodated for irrespective of the possibility of their occurrence Nor may

they be the only risks to take into account since there could be other risks unknown to us at the moment or

risks that are intangible The realization of any of the risks mentioned below could have a substantial negative

impact on our work the outcomes of our operations and financial position

Risks of Legislation

The Exchange is supervised by the Palestinian Capital Market Authority (PCMA) and the instructions it issues

The PCMA regulates the non-banking financial sector including the securities industry securities advisors and

other persons working in the securities sector Any changes to the rules and regulations issued by the PCMA

might affect the activities of the Exchange Note that the PCMA receives fees assessed as a percentage of the

Exchangersquos commissions being the main source of income for the Exchange

Competitive Edge

Like other countries in the region except the UAE Palestine has one exchange only Considering that most other

countries have only one exchange and considering the limited number of public shareholding companies

operating in the West Bank and Gaza Strip it is not expected that a second exchange will be established

The real competition lies in nearby markets particularly Jordan Egypt and the UAE which sometimes drain

considerable local liquidity The banking sector is also considered a competing market

41

Political and Economic Trends

The Exchange is registered in Palestine with headquarters in the city of Nablus Palestine has been

influenced by political fluctuations in past years especially the Intifada which have adversely

affected the economy causing high unemployment rates leading to poverty and limited investment

Stock Price Volatility

Despite controls placed on share trading following listing prices are subject to market fluctuations There will

be no guarantee that the value of the shares will rise or that the share price does not fall

Risk of Legal Action

The Exchange has no pending legal actions Foreseeable potential legal risks that we may be exposed to

may arise from third party claims in relation to multi-party trading

ཌ Changes and Future Expected IndicatorsFuture indicators are difficult to predict given the exceptional nature of PEX work which is tightly correlated with

prevailing political and economical conditions Thus any improvement in these conditions will have a direct

impact on trading the PEXrsquos main source of income PEX income is expected to rise through new listings and

the provision of additional services

ཌ PrivilegesEven though Palestine has only one Exchange as is the case in most countries PEX has no exclusive privileges

or government protection under the Securities Act or any other laws or regulations Moreover it has no patents

or rights of excellence

ཌ Research and DevelopmentWhile PEX does not provide any products or services that require setting a written policy on research and

development it periodically allocates financial resources to update its electronic infrastructure In addition

various research initiatives are conducted through internal teams specialized committees and external

parties

ཌ Procedures and Legal IssuesThe lawsuit that was pending on PEX and other parties was lift by the plaintiff There are no pending legal

actions from previous years either taken by the PEX or held against it

42

ཌ Resolutions of Financial ImpactThere is no resolution with material impact on PEX activities

ཌ Issues Referred to Voting by ShareholdersDuring its ordinary meeting on 29032016 the General Assembly unanimously approved the Board of Direc-

torsrsquo report of PEX operations the Financial Statements and Auditorrsquos Report of 2015 The General Assembly

also re-elected Ernst amp Young as external auditors and delegated the Board of Directors to set their fees

ཌ Assets The following table shows PEX main assets on 31 December 2016 distributed between Nablus

and Ramallah

Amount (USD)Assets

1855558Real estate1

132915Decorations and leasehold improvement2

125040Furniture and office equipment3

17335Computers4