AB MY (Malaysia edition) – May 2012

description

Transcript of AB MY (Malaysia edition) – May 2012

CPDget verifiable cpd units by reading technical articles

ABmy my.A

B a

cc

ou

ntin

g a

nd

bu

sine

ss 05

/20

12

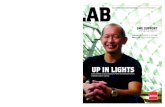

the magazine for business and finance professionals accounting and business malaysia 05/2012

shAreD serviCes

penang forum looks ahead

new frAmework malaysian financial reporting standards

ACCA’s globAl forums Vital roleCPD annual reports

A CAll to CAre accountant turned Volunteer Wong koei onn on helping others

sme suPPort better times ahead?

Deloitte olympics’ adViserPrACtiCe auditor rotation

MY_cover.indd 1 17/04/2012 12:05

KL InternationalAirport

Kuching International Airport

Kota KinabaluInternational Airport

Penang International Airport

LCCT

Kenneth Cole

LeSportsac

Avalanche

Pica Lela

FreyWillie

Ed Hardy

BCBG

Max Azria

Bric’s

PierreCardin

Time Design

MCM

MisakiKipling

Swarovski

Aviator

Toscow

Certified to ISO 9001:2008Cert. No. : AR 1350

SIRIM

Certified to ISO 9001:2008Cert. No. : AR 1350

SIRIM

Certified to ISO 9001:2008Cert. No. : AR 1350

SIRIM

Certified to ISO 9001:2008Cert. No. : AR 1350

SIRIM

TIME TO ROTATE?With calls to introduce mandatory auditor rotation, evidence suggests that it may cause more problems than it solves. Page 40

RIGHT ON TRACKShared services and outsourcing is like a bullet train picking up speed, delegates at an ACCA Accountants for Business Forum heard. Page 54

EXPERT INSIGHTS

Join ACCA and KPMG for a free, one-hour webinar as we explore how the finance transformation agenda is evolving through shared services and outsourcing.www.accaglobal.com/virtual

BIG AMBITIONS?For your next career move check out www.accacareers.com

Wong Koei Onn FCCA freely admits that his decision to embark on a career in accountancy was made in haste. But the practising Buddhist has since put his skills to good use, most recently as a hospice volunteer and voluntary treasurer. See page 12

BUILDING BETTER BOARDSThe Olympus Corp US$1.7bn accounting scandal has been headline news around the world since it blew up last October. Since then, revelations about alleged financial shenanigans by some current and former board members of the Japanese digital camera and electronic equipment maker have made for riveting reading, to say the least.

Closer to home, a couple of listed companies have also recently been in the spotlight for all the wrong reasons, with reports of financial irregularities and moves to remove key board members unnerving stakeholders and investors. Just like in the case of Olympus, the scandals have battered their corporate reputations and share prices. This is not unexpected given the lofty expectations of stakeholders and investors, as well as increasingly stringent scrutiny by regulators. As a consequence, boards of directors are increasingly feeling the heat.

The heightened focus on corporate governance, arising from poor conduct, financial irregularities and rising shareholder activism, demands that boards be extra vigilant. To help optimise performance, the Audit Committee Institute Malaysia recently developed The Directors’ Prism: Building Better Boards, a guide that advises organisations to ask seven key questions to elevate board oversight and corporate governance (see page 36). The Directors’ Prism is a diagrammatic expression of the board and how it relates to other players in the corporate ecosystem. Effective boards are supported by fundamental building blocks; an appropriate structure and foundation; reasonable and well-defined responsibilities; and an understanding of current and emerging issues.

The report describes the board as the pinnacle of the prism. Indeed it is. Apart from a commitment to upholding good corporate governance, companies must ensure that only individuals possessing a wide range of knowledge, skills and personal attributes – sound judgment, integrity and high ethical standards – and the ability and willingness to challenge and probe, be appointed as board members. This may just help reduce the incidence of corporate financial scandals.

Lee Min Keong, [email protected]

3Editor’s choice

MY_B_Edletter.indd 3 16/04/2012 15:54

Audit period July 2009 to June 2010138,255

Features12 A different callingWong Koei Onn FCCA has combined his accountancy skills with his Buddhist beliefs

16 Key to changeWill the SME Masterplan be enough to support businesses?

19 At the coalfaceHow energy company China Shenhua has been transformed

24 Olympic winner As offi cial professional services provider for London 2012, Deloitte is already ahead of the Games

28 Smashing the glass ceiling Gender stereotypying remains a problem for the accountancy profession

30 Vietnamese visionIn an exclusive interview we talk to Vietnam’s minister of fi nance, Professor Dr Vuongh Dinh Hue

VOLUME 15 ISSUE 5

Asia editor Colette [email protected] +44 (0)20 7059 5896

Editor-in-chief Chris [email protected] +44 (0)20 7059 5966

International editor Lesley [email protected] +44 (0)20 7059 5965

Malaysia editor Lee Min Keong [email protected]

Chief sub-editor Eva Peaty

Sub-editors Dean Gurden, Vivienne Riddoch

Design manager Jackie Dollar

Designers Robert Mills, Jane C Reid

Production manager Anthony Kay

Advertising James [email protected] +44 (0)20 7902 1210

Head of publishing Adam Williams

Printing Times Printers

Pictures Corbis

ACCAPresident Dean Westcott FCCADeputy president Barry Cooper FCCAVice president Martin Turner FCCAChief executive Helen Brand OBE

ACCA [email protected] +44 (0)141 582 2000

Accounting and Business is published 10 times per year. All views expressed within the title are those of the contributors.

The Council of ACCA and the publishers do not guarantee the accuracy of statements by contributors or advertisers, or accept responsibility for any statement that they may express in this publication.

Copyright ACCA 2012 Accounting and Business. No part of this publication may be reproduced, stored or distributed without the express written permission of ACCA.

Accounting and Business is published by Certifi ed Accountant (Publications) Ltd, a subsidiary of the Association of Chartered Certifi ed Accountants.

29 Lincoln’s Inn FieldsLondon, WC2A 3EE, UK+44 (0) 20 7059 5000

www.accaglobal.com

ACCA MalaysiaACCA Malaysia Sdn Bhd (473007P)27th Floor, Sunway Tower86 Jalan Ampang50450 Kuala Lumpur1 800 88 [email protected]

ACCA MalaysiaKuching branchUnit #8.01 8th Floor Gateway KuchingNo 9 Jalan Bukit Mata93100 Kuching Sarawak1 800 88 [email protected]

AB MALAYSIA EDITIONCONTENTSMAY 2012

MY_Contents.indd 4 16/04/2012 18:13

ACCA NEWS54 OutsourcingPenang forum looks to the future

56 Global forumsACCA’s Accountancy Futures Academy

60 CPDThe ACCA website now has a new, improved, CPD section

61 Dean WestcottGlobal forums have a vital role to play, says the ACCA president

62 NewsFirst appreciation nights of year a hit; ACCA and Grant Thornton launch report

64 Devanesan EvansonThe ACCA Malaysia Advisory Committee president on shared services and outsourcing

65 CouncilElection time is coming; highlights from the fi rst meeting of 2012

TECHNICAL46 Update The latest from the standard-setters

48 CPD: Uncluttering annual reports Busy annual reports may obscure vital information

51 Convergence clarityDemystifying the new Malaysian Financial Reporting Standards

BRIEFING06 News in pictures A different view of recent headlines

08 News in graphicsWe show a story as well as tell it using innovative graphs

10 News round-upA digest of all the latest news and developments

VIEWPOINT33 Errol Oh Don’t resist the arrival of integrated reporting

34 Cesar Bacani Purchasing power parity tells us much about salaries

35 CORPORATE35 The view from M Nazri of Vector Scorecard Asia-Pacifi c Group, plus news in brief

36 Making boards better Directors must perform more effectively than ever

39 PRACTICE39 The view from Paul Lee of RSM Chio Lim, plus news in brief

40 A rotating debate Auditor rotation is causing a stir in the US...

43 Chilly reception ...and the proposals have met with scepticism in Asia

Regulars

CPDAccounting and Business is a rich source of CPD. If you read it to keep yourself up to date, it will contribute to your non-verifi able CPD. If you read an article, learn something new and apply that learning in some way, it will contribute to your verifi able CPD. Each month, we also publish an article or two with related questions to answer. If they are relevant to your development needs, they can also contribute to your verifi able CPD. One hour of learning equates to one unit of CPD. For more, go to www.accaglobal.com/members/cpd

Your sector

WorldwideThere are six different versions of Accounting and Business: China, Ireland, International, Malaysia, Singapore and UK. See them all at www.accaglobal.com/ab

MY_Contents.indd 5 17/04/2012 15:40

01Flower fans flock to see cherry

blossoms in a Tokyo park. The annual spring trek to parks around Japan to take in the ‘sakura’ attracts millions

02 Tokyo Stock Exchange

and Daiwa Securities received the go ahead to help set up a new stock exchange in Myanmar

03The Communist Party in China

suspended former high-flying politician Bo Xilai from its top ranks and named his wife as a suspect in the murder of British businessman Neil Heywood

News in pictures6

AP_newsinpix.indd 6 16/04/2012 12:34

04 Former convenor of the Non-

Official Members of the Executive Council of Hong Kong, Leung Chun-ying, thanked his supporters and called for unity and inclusion after being elected as Hong Kong’s next chief executive on 25 March

05 Myanmar opposition

leader Aung San Suu Kyi will take her seat in parliament for the first time on 23 April, following her milestone election to political office

06 Coca-Cola’s plans to invest US$4bn

in China will come into effect this year. The soft drinks giant wants to take advantage of the country’s increasing middle-class population and urbanisation

07 German luxury carmaker BMW

sold more cars in China than in the US in the first quarter of 2012. The company sold 80,014 cars in China, 37% more than a year ago. It also posted record quarterly sales overall

7

AP_newsinpix.indd 7 16/04/2012 12:34

THE RACE IS ONAccording to a report by HSBC, the emerging economies led by China and India will power global growth over the next four decades. By 2050 China will overtake the US for top position, with Japan pushed back into fourth place. The World in 2050 update also predicts that the Philippines will surge to 16th place.

Economic league table dominated by the US, Japan and some European countries

West’s growth limited by high levels of income per head and weak demographics

US$210BNLosses due to Japan’s earthquake and tsunami in March 2011, according to Swiss Re.

$607BNValue of Chinese grocery sector at the end of 2011, beating the US.

Mon

th

in fi

gur

es

COUNTRIES STILL SLOW TO BRING WOMEN ON BOARDDespite the positive influence of mixed-gender boards, the latest Grant Thornton International Business Report shows that just 21% of senior management roles globally are held by women – little changed from the 2004 figure of 19%. Russia’s exemplary 46% may in part be a legacy of the Soviet Union’s equality ideology.

39%PHILIPPINES

39%THAILAND

27%VIETNAM

15%UAE

33%HONG KONG

25%CHINA

14%INDIA

28%MALAYSIA

2010ECONOMY

2050ECONOMY

2050

2010

24%AUSTRALIA

5%JAPAN

27%TAIWAN

23%SINGAPORE

INDIA: $8.2TR

CHINA: $25.3TR

USA: $22.3TR

JAPAN: $6.4TR

SOUTH KOREA: $2.1TR

SOUTH KOREA: $0.8TR

GERMANY: $3.7TR

INDONESIA: $1.5TR

INDONESIA: $0.3TR

MALAYSIA: $1.2TR

MALAYSIA: $0.1TR

USA: $11.5TR

JAPAN: $5.0TR

CHINA: $3.5TR

GERMANY: $2.1TR

INDIA: $1.0TR

News in graphics8

AP_B_graphics08.indd 8 17/04/2012 12:14

KEY: High risk Moderate risk Little or no risk Don’t know

MIND YOUR STEPThe banana skins index, a measure of anxiety levels in the financial sector, is at its highest since it began 13 years ago. Survey respondents say that the greatest threat facing the sector is the fragility of the world economy. The Banking Banana Skins 2012 survey is produced by the Centre for the Study of Financial Innovation and PwC. Figures for 2010 are in brackets.

MOVING ON UP The role of in-house finance teams is under the microscope again as CFOs look to expand their level of influence and encourage innovation and growth. Although the CFO’s role has developed in recent years, most believe that their focus over the next two years must revolve around day-to-day operations and greater engagement with external stakeholders. Respondents to KPMG’s survey From Keeping Score to Adding Value indicate that a number of challenges stand in the way of creating a more forward-looking and integrated finance department.

Organisational complexity

Professional staffing

Finance IT

Ability to respond to change from within

Ability to respond to change from outside

Relationship with other company groups

FEEL THE HEATAsian cities are challenging the top spots in the rankings for most competitive global city, in a survey by the Economist Intelligence Unit for Citigroup, Hot Spots: Benchmarking Global City Competitiveness. Singapore was the highest ranked Asian city out of a field of 120 global markets. US and European cities however remain the world’s most competitive, despite concerns over ageing, infrastructure and large budget deficits.

RANK 1 (4)MACRO

ECONOMIC RISK

1: NEW YORK 2: LONDON 3: SINGAPORE =4: PARIS =4: HONG KONG6: TOKYO 7: ZURICH 8: WASHINGTON 9: CHICAGO 10: BOSTON

RANK 2 (2)CREDITRISK

RANK 3 (5)LIQUIDITY

RANK 7 (–)PROFITABILITY

RANK 8 (7)DERIVATIVES

RANK 9 (12)CORPORATE

GOVERNANCE

RANK 10 (8)QUALITY OF RISK MANAGEMENT

RANK 4 (6)CAPITAL

AVAILABILITY

RANK 5 (1)POLITICAL

INTERFERENCE

RANK 6 (3)REGULATION

18

102

27% 50% 23% 1%

22% 56% 22% 1%

22% 53% 25% 1%

19% 54% 26% 1%

10% 41% 48% 1%

21% 53% 26% 0%

7

3

=4=4

69

9

INT_B_graphics09.indd 9 17/04/2012 12:58

IMF BORROWING DENIEDThe Malaysian government has denied ever borrowing from the International Monetary Fund (IMF). However, second finance minister Datuk Seri Ahmad Husni Hanadzlah said that the government had fully repaid the loans taken from the World Bank, while a major portion of loans from the Asian Development Bank (ADB) have also been settled. He added that a RM7.93bn (US$2.59bn) loan provided by the World Bank between 1965 and 1999 was fully repaid last year. Another RM3.86bn was borrowed from the ADB between 1968 and 2002, of which only RM372m had not been settled. Ahmad Husni said that the loans were obtained for financing various projects to eradicate poverty and to raise the standard of living.

IFRS PANEL GETS WIDER BRIEF The International Accounting Standards Board (IASB) is to extend the activities of the International Financial Reporting Standards (IFRS) interpretations committee and issue fewer rejection notices, following its most recent meeting. Michael Stewart, director of implementation activities, outlined new proposals agreed by the committee, in response to the trustees’ call for a

more active role in helping implement IFRS. The proposed new tools, agreed by the IASB, include allowing it to propose that application guidance (which has mandatory effect) be added as standard and that it can provide non-mandatory illustrative examples. The IASB stressed that it now expects the interpretations committee to take on more agenda items and, as a result, issue fewer rejection notices.

TAX FILING SIMPLIFIED The Inland Revenue Authority of Singapore (IRAS) is simplifying tax filing for small companies to help them reduce compliance costs and increase overall productivity. Currently, all companies have to report their estimated chargeable income (ECI) within three months of their financial year end. In future, the IRAS says that small companies with turnover not exceeding S$1m (RM2.43m) and with no ECI will no longer need to file the ECI. It added that this waiver will benefit 67,000 companies, or about 42% of all companies with an annual turnover of under S$1m.

AUDIT RULE DEBATE DRAGS ONThe US watchdog for the auditing industry said a debate over possibly

forcing corporations to change auditors every few years would stretch at least into 2013. No potential rule proposal on term limits would be ready this year, the Public Company Accounting Oversight Board (PCAOB) said, as critics and supporters recently descended on Washington to weigh in on the issue. ‘We will be in 2013 before we can reasonably expect to get to any kind of a rule proposal,’ PCAOB chairman James Doty said. The PCAOB first floated the idea last August after uncovering numerous audit deficiencies.

SONY TO AXE 10,000 JOBS Sony Corp is cutting 10,000 jobs, about 6% of its global workforce, the Nikkei newspaper reported, as new CEO Kazuo Hirai comes under pressure to return the Japanese consumer electronics and entertainment company to profit after four years in the red. In 2008 Sony announced cuts of 16,000 workers after the global financial crisis hit demand for its products. As of March 2011, Sony had 168,200 employees on a consolidated basis, according to its website.

SANCTIONS COULD EASEThe US is ready to relax some sanctions on Myanmar, and France will urge the European Union (EU) to ease bans, opening the door for foreign investment after Nobel Peace Prize laureate Aung San Suu Kyi’s recent election victory. Her National League for Democracy won 43 out of 45 seats contested in the by-elections, dealing a blow to the ruling military-backed party which won a 2010 election. The US and EU had hinted that they might lift some sanctions – imposed over the past two decades in response to human rights abuses – if elections were free and fair.

TRANSPARENCY PROMISEDChina premier Wen Jiabao pledged to improve the transparency of the government’s operations and create more conditions for the public to supervise the government, at the State Council’s annual conference on anti-corruption work. The reform

MALAYSIA LEADS ASIAN SUKUKThe total global sukuk issuance for both government and corporate is estimated at US$44bn (RM134.9bn) this year, with Malaysia accounting for 60% or close to US$26bn. Last year, the global sukuk issuance totalled US$26.5bn. HSBC Amanah Malaysia CEO Rafe Haneef said that sukuk issuance in Asia is expected to be the highest this year, led by Malaysia. Infrastructure projects in Asia are likely to be a significant driver of sukuk issuances. Haneef added that, while Hong Kong and Singapore’s sukuk market catered for investors looking for alternative sources of financing, Malaysia’s was aimed at investors who demand Islamic solutions.

Infrastructure projects are likely to drive sukuk issuances in Asia

10 News round-up

MY_B_newsroundup.indd 10 16/04/2012 11:32

P24

plans include various institutional arrangements concerning intensified supervision of powers and enhanced transparency. He urged the country to speed up the establishment of a unified electronic platform for government procurement and a national market for project bidding and transactions of public resources.

NON-PROFIT SECTOR WOOEDSingapore has long courted international banks and companies in its drive to become a financial hub but it is also wooing a very different sector – non-profit groups including campaign charities. Singapore has attracted more than 130 ‘international non-profit organisations’ such as the Mercy Relief and World Vision International charities, and aviation lobby group the International Air Transport Association. This is triple the number of regional or global non-profit organisations based in Singapore when a drive to lure them with tax breaks and other incentives started in 2007.

FISCAL DEFICIT TO FALL TO 4.7% The federal government’s fiscal deficit is expected to dwindle to 4.7% of gross domestic product (GDP) this year, according to deputy finance minister Donald Lim Siang Chai. He said that 4.7% is a ‘reasonable target’ given the government’s prudent spending and increasing revenue. ‘Fiscal consolidation efforts will be continued to bring down the fiscal deficit to less than 3% in 2015 as pronounced in the 10th Malaysia Plan,’ he told parliament. In tandem with fiscal consolidation efforts and prudent spending, Lim said that the fiscal deficit has been reduced from 7% in 2009 to 5.6% in 2010 and 5% last year.

HOPES FOR HIGHER COLLECTIONMalaysia’s Inland Revenue Board (IRB) aims to collect RM110bn in taxes this year, higher than the RM109.67bn last year. CEO Datuk Dr Mohd Shukor Mahfar said that every year about 50% of tax receipts come from companies, 25% from petroleum, 17% from individuals and the rest from other

forms of taxes. He said that Petroliam Nasional’s plan to lower its annual dividend to the government is not a concern as revenue will come from new oil exploration areas.

SC GETS TOUGH The Securities Commission (SC) enforcement efforts saw 13 individuals jailed and fines totalling over RM13.7m million imposed – the highest in its

history, according to the regulator in its 2011 Annual Report. It added that significant outcomes have been achieved in terms of deterrent jail sentences for securities offences, including those concerning disclosure of misleading information to the market, fraud involving public-listed companies and market abuses such as short selling.

BOND MARKET APPEALSA shortage of US dollars, new banking regulations and strong investor demand mean that Asian banks are set to help spur long-awaited innovation in the region’s debt capital

markets. Singapore is consulting on new guidelines to help its banks issue covered bonds and Hong Kong plans to study investor appetite for similar products, while banks across Asia are looking at forms of debt previously unseen in the region, such as hybrid or perpetual bonds. Although most Asian banks are flush with local currency retail deposits, many have been struggling to get access to enough US

dollars, so they are looking at new ways of issuing bonds to raise these funds.

SHARE-SWAP PROBE ONGOINGThe investigation into the share-swap agreement between Malaysian Airline System (MAS) and AirAsia is continuing, said Malaysia Competition Commission (MyCC) chairman Tan Sri Siti Norma Yaakob. Previously, Datuk Seri Ismail Sabri Yaakob, minister of domestic trade, cooperatives and consumerism, had said that the MyCC’s probe into the much-criticised share-swap deal would focus on whether it involved an abuse of monopoly or the formation of a cartel.

ECONOMIC GROWTH LIKELYThe Malaysian economy is expected to grow between 4% and 5% in 2012, slower than last year’s 5.1% and behind the government’s projection of 5% to 6% growth in the Budget 2012. In its 2011 annual report, Bank Negara Malaysia (BNM) said that this was ‘premised upon the expectation of a moderation in global growth and the timely and full implementation of measures announced in the 2012 Budget’. The central bank added that the authorities have sufficient flexibility to support the domestic economy and manage international challenges, should conditions warrant it. Domestic demand will continue to be the main driver of growth in 2012, with the rate of expansion remaining resilient at 6.6%, against 2011’s 8.2%. Private sector expenditure is expected to grow at a slower pace of 8.2% against 6.6% in 2011.

11AnalysisTORCH BEARERAs official professional services adviser to the London 2012 Olympic and Paralympic Games, Deloitte has been competing in its own marathon, keeping tabs on 65 projects involving over 550,000 hours of work so far.

MY_B_newsroundup.indd 11 16/04/2012 11:32

12 Interview

MY_F_Wong.indd 12 17/04/2012 12:12

Wong Koei Onn FCCA doesn’t believe in regrets. Perhaps this stems from his Buddhist faith, or his

experience over the last 15 years as a hospice volunteer, that has taught him that life’s too short. This is just as well, as for many years, Wong struggled to balance his personal philosophies with the demands of accountancy – a profession he entered for the wrong reasons.

‘It was after sixth form and I attended a party of a former teacher. He was telling us about a guy who did accounting and was successful at it. After hearing that story, I didn’t know whether I should go to university or not,’ he says, adding that the indecision was exacerbated by the potential strain on the family’s finances had he opted for university. ‘My brother was already studying at a university in Singapore and I didn’t want to burden my father further.’

So without knowing anything about the profession, he applied to an accountancy firm, joining Kassim Chan & Co in 1972 as an audit junior. Wong studied on his own for the ACCA exams and qualified as a fellow member in 1978. In the same year he joined a property development company as its accountant. By the time he left in 2001

for health reasons, he was both group accountant and secretary. During his time there, Wong facilitated the company’s listing on the Main Board of Bursa Malaysia and helped steer it through the Asian financial crisis.

A few months after his departure, he was coaxed out of retirement to help a friend’s son with his new business – serving as the business director before opting to retire for good from corporate life in 2004.

While Wong acknowledges he’s had a successful career, he has never been defined by his job. In fact, he describes himself as being ‘the most “unaccountant” of accountants’. Strangers or new friends, he says, would always be surprised to learn that he was an accountant.

‘Accountants are generally known for being more money-minded or money-conscious, but this was something that I always struggled with. While I would be careful with every sen of the employer’s money, my flaw is that I can be too trusting of others. I was even ripped off by the contractor who built my house,’ he says, matter of factly. While the episode pained him, he was able to put it aside. ‘As a Buddhist I believe in karma, and that to me rationalised the situation and made me feel better,’ he adds.

The Asian financial crisis put further strain on Wong. ‘Things were not looking good at the time, and by the end of the 1990s debts were mounting and I had to deal with the company’s creditors and banks… this was contrary to my own personal philosophy of not owing people money,’ he adds.

Despite the personal struggle, Wong strived to give and produce his best, and he credits his upbringing for this ethic. ‘We were taught that when you do something you have to respect it and make something out of it. And it was this philosophy that saw me through my career, because I felt that otherwise I would be doing a grave injustice to my employers,’ he adds.

In hindsight, Wong concedes that he might have been better suited to a career in the arts. ‘But I was naïve when I joined the profession and I didn’t receive any career guidance,’ he says, stressing the importance of understanding one’s choice of career. ‘Don’t decide on the profession just for the money, decide after getting a better understanding of what the job entails.’

New callingWong’s involvement in charitable organisations – his second career of sorts – began in 1995 when his parents passed away within three months of

A SEARCH FOR MEANINGWong Koei Onn FCCA wasn’t entirely cut out for accountancy. But, as a hospice volunteer and honorary treasurer, his fi nancial experience and spiritual outlook come together

13

MY_F_Wong.indd 13 17/04/2012 12:12

The CVWong Koei Onn FCCA started his career with Kassim Chan & Co (today Deloitte Malaysia) in Kuala Lumpur, as an auditor.

He was a group accountant and secretary of a public company listed on Bursa Malaysia for more than two decades, and was later the business director of a private company before his retirement in 2004.

Wong was a pioneer volunteer with the hospice services division set up by Losang Dragpa Buddhist Society in 1997.

He became its honorary treasurer when the division was registered as the Kasih Hospice Care Society, Kuala Lumpur and Selangor, in 2005 – a post he continues to hold to this day.

each other. ‘It was a terrible experience because the grieving period was long. I was very attached to my parents especially my mother, and I felt a void in my life after their deaths.

‘I began to think of the meaning of life… we go to work, come home, have our meals, watch television and go to bed, and do the same thing again the next day and the day after. For many people this is life but I felt that there had to be more to it than that.’

A couple of years later, a friend told him about the Losang Dragpa Buddhist Society’s plan to start a community service arm specialising in hospice care. ‘This answered my wish to do something meaningful, so my wife and I registered for the volunteer training course,’ says Wong.

The training sessions were held on weekends and were conducted by a Buddhist monk from Australia, Venerable Pende Hawter, and a

14

MY_F_Wong.indd 14 17/04/2012 12:12

The tips‘If you fear death and are interested in overcoming this fear, and are able to put your mind to the task, then you can consider being a hospice volunteer,’ says Wong Koei Onn.

If you’re someone who is results-oriented, then volunteering is not for you. You won’t get a pat on the back. To succeed as a volunteer you need passion and compassion, a willingness to listen and most important of all, a lot of empathy.’

The basics THE SOCIETYKasih Hospice Care Society is a not-for-profit organisation that provides medical, psychosocial, emotional and spiritual support to people with life-threatening diseases.

In 2011, its medical team served 338 end-of-life home patients, while its non-medical volunteers served a total of 1,650 hours and made 2,420 visits to cancer and AIDS patients in hospitals.

renowned palliative care doctor based in Singapore, Dr Rosalie Shaw.

The pioneer group of volunteers then began their visits to hospitals, starting with the AIDS ward at a hospital in the Klang Valley and later the cancer ward at Kuala Lumpur Hospital. At the time, due to a lack of resources, the volunteers focused on providing moral support. ‘We talked to the patients and kept them company… in this job empathy is important, the fact that you’ve listened and empathise with them is good enough,’ says Wong.

It was after the community service arm was registered as Kasih Hospice Care Society in 2005 that Wong’s accounting experience – as well as his people skills – proved invaluable. As its honorary treasurer, Wong insisted that the organisation’s accounts be professionally audited even though this was not a requirement.

‘In the beginning I had an accountant friend undertake the audit and he did it for free, but later I felt that this was not too independent, so we switched to another firm and insisted on paying [the audit fees].

‘Because we are entrusted with public funds we have to be clean and seen to be clean,’ he adds.

In 2007, he helped establish the Kasih Foundation, a limited company

‘ACCOUNTANTS AREGENERALLY KNOWNFOR BEING MOREMONEY-MINDED ORMONEY-CONSCIOUS,BUT THIS WASSOMETHING I ALWAYSSTRUGGLED WITH’

responsible for the hospice’s fundraising activities, and became a director. In addition, he also conducts training sessions for new hospice volunteers.

Growing supportFollowing registration, the society employed two full-time nurses and secured the services of a volunteer doctor. Today it has one full-time doctor and three nurses, all salaried. ‘With that we were able to offer a more complete hospice care,’ adds Wong. While it does not offer in-patient services – due to a lack of finances and manpower – the medical team provides free palliative care to patients suffering from life-threatening diseases at hospitals and at patients’ homes.

Wong hopes that the society will be able to offer in-patient services in the future. His main concern for the growth of the society is the lack of manpower. ‘Under our current healthcare system, palliative care is still at its infancy. And because it’s not in the mainstream few doctors and nurses specialise in this field,’ he adds. He laments that government support is also ‘not fantastic’, leaving the society reliant on donations from the public.

So has he found meaning in life? Wong ponders before responding candidly. ‘I’m not too sure if I’ve found more meaning in life and I do wonder if the experience will prepare me to face a life-threatening disease. I think this service has helped me more than I help the patients.

‘I see so many patients who are so brave and many tell me that they are not afraid [of dying]. I ask myself if I can be as brave. I hope that I will be able to draw inspiration from these patients.’

Sreerema Banoo, journalist

15

MY_F_Wong.indd 15 17/04/2012 12:12

The SME Masterplan, launched last year, is a reflection of the government’s seriousness in propelling the country’s small

and medium-sized enterprise (SME) sector towards greater heights, and an acknowledgement of its importance to the nation’s economic wellbeing.

Last November, the National SME Development Council (NSDC) endorsed the second phase of the SME Masterplan for the period 2012–20. It included macro targets such as increasing the contribution of SMEs to gross domestic product (GDP) from 32% in 2010 to 41% in 2020, employment share from 59% to 62% and export share from 19% to 25%.

While the masterplan itself is a step in the right direction, commentators say that a plethora of challenges – spanning human capital issues, access to financing and enhanced competitiveness and innovation –remain a thorn in most SMEs’ side.

They agree that the ability to achieve the masterplan’s broad targets is dependent on the proper execution of its initiatives to prime the sector to achieve its full potential and consolidate its role as a major pillar of the economy.

Based on SME Corp’s bi-annual survey, CEO Datuk Hafsah Hashim says that in 2010 and 2011 the three key challenges affecting the SME sector were rising raw materials and input costs, rising overhead costs and cashflow constraints.

PwC Malaysia executive director Farah Rosley notes that SMEs often face difficulties in obtaining loans from financial institutions and

the government due to the lack of knowledge on the channels available, or delays due to the application process. In addition, financial institutions’ interest charges are high, she says: ‘This poses a problem for SMEs both during the startup process and in their efforts to expand further as they may not be able to survive the critical period in the initial years.’

Likewise, Chen Voon Hann, managing partner of accountancy firm CAS & Associates, notes that fast-rising operational costs certainly affect competitiveness of SMEs as not all costs can be passed on to customers immediately.

In addition, Rosley observes that SMEs, due to their smaller size, limited training facilities, resources and managerial skills, face challenges in innovating and continuous improvement. She adds that SMEs may have problems employing professionals or a competent workforce due to cost.

On top of all these challenges, SMEs also need to commit towards enhanced communication with the market, product innovation and quality – elements that really deliver competitive advantage. However, this is easier said than done. ‘Entrepreneurs do not place much importance on research and development (R&D) as it requires a huge investment,’ Hafsah concedes. ‘The utilisation of technology, which

is still relatively low [among SMEs], poses another problem in addition to constraints faced by the entrepreneurs to move forward.’

Innovate to survive A lack of understanding on how to market products also results in SMEs losing out on business opportunities. In terms of being more innovative, Rosley believes that SMEs cannot slack in being relevant to the market or they will be defeated by bigger organisations which have the strength and financial muscle.

‘In a recent global survey conducted by PwC – the 15th Annual Global CEO

Survey – many of the 1,258 CEOs from across the globe indicated that improving the effectiveness of innovation continues to be a major strategic priority,’ she says.

In this case, innovation does not just mean from the end product or services customers will buy. It can also mean taking costs out of processes or forming strategic alliances to collaborate, enhancing SME competitiveness, says Rosley.

While the SME Masterplan maps out the strategic direction for the development of the sector, the government has sought to give it a boost through various initiatives covering microenterprises, rural SMEs and women entrepreneurs,

KEY TO PROSPERITYThe Malaysian government’s SME Masterplan has acknowledged the importance of the sector to the economy. But can it open the door to better times for smaller businesses?

*SME MASTERPLAN – HIGH-IMPACT PROGRAMMES

WHILE THE MASTERPLAN ITSELF IS A STEP IN THE RIGHT DIRECTION, A PLETHORA OF CHALLENGESREMAIN A THORN IN MOST SMES’ SIDE

16

MY_F_SMEs.indd 16 13/04/2012 11:07

SME Corp’s Hafsah says. These include new financing schemes such as the RM2bn sharia-compliant SME Financing Fund; a RM100m SME revitalisation fund offering a second chance to genuine entrepreneurs to revive their businesses; and a RM10m emergency fund to help SMEs face natural disasters.

As an implementation agency, SME Corp has developed and implemented programmes aimed at assisting SMEs in gaining greater market access, improving their capacity and capability, encouraging better adoption and utilisation of technology, and enhancing their overall competitiveness, Hafsah adds.

Some of these include the Business Accelerator Programme (BAP) and

1 Integration of registration and licensing of business establishments to create a single registration point through interfacing of the current National Business Registration System (MyCOID) and the National Business Licensing System (BLESS).

2 Introduction of a technology commercialisation platform to promote innovative ideas right through from proof of concept to the commercialisation stage.

3 The SME Investment Programme will provide early-stage financing through the development of investment companies which would invest in potential SMEs in the form of debt, equity or a hybrid of both.

4 The Going Export (GoEx) Programme offers customised assistance to new exporters and SMEs venturing into new markets.

5 The Catalyst Programme will create homegrown champions through a targeted approach with financing, market access and human capital development support.

6 Inclusive Innovation is specifically designed to empower the bottom 40% of the income group to leverage on innovation to promote transformation of communities, including microenterprises in rural areas through handholding and technical and management support.

For more information, visit www.smeinfo.com.my

*SME MASTERPLAN – HIGH-IMPACT PROGRAMMES

17

MY_F_SMEs.indd 17 13/04/2012 11:07

Enhancement and Enrichment Programme (E2) which enable SMEs to be assisted through an integrated approach with guidance, including strengthening their core business, building capacity and capability, and facilitating access to financing.

All in the executionBoth Rosley and Chen agree that effective execution of the initiatives contained in the masterplan are what will determine whether the country achieves its SME sector goals by 2020.

‘With clear and proper implementation, the aspirations of the masterplan are achievable as it covers all the critical issues facing SMEs,’ Rosley says. ‘These critical issues – the need for funding, resources, market opportunities, capacity building, innovation and logistics support – are included in the masterplan and the implementation of the plan, in two phases, has been properly drawn out.’

While there are many incentives and measures outlined by the government from time to time, the main challenge is about the effective implementation of those policies and incentives, Chen says. Although the public sector plays a supporting role to assist SMEs reap the benefits from the measures, joint efforts from both the public and private sectors are needed to make the masterplan a success, he adds.

To ensure the goals are met, Rosley says, all parties involved – including SMEs, government authorities, relevant agencies, financial institutions and other stakeholders – should play an active role and create a value chain.In addition to the initiatives, she also suggests the establishment of better cooperation between SMEs and government-linked companies.

There is also a need to simplify processes and enhance transparency and equality in the distribution of resources such as funding, loans and grants, as well as government procurement process.

In July 2009, the International Accounting Standards Board (IASB) published the IFRS for SMEs, designed for the financial reporting needs of entities that do not have public accountability and publish general purpose financial statements for external users including existing and potential creditors, and credit rating agencies. The standard is available for any jurisdiction to adopt, whether or not it has adopted full IFRS.

In ensuring the standard’s relevance, the IASB plans to initiate a review in the second half of 2012, expected to include a request for public comments on possible amendments. More information is available at the IFRS for SMEs segment at www.ifac.org

Currently in Malaysia, SMEs adhere to the Private Entity Reporting Standards (PERS), a set of standards issued by the Malaysian Accounting Standards Board (MASB) for application by all private entities.

PERS are an alternative mechanism for private entities to present their annual financial statements without compliance with international accounting standards. They remove certain disclosure requirements in accordance with the information required for decision-making at a non-public interest entity. The regulators have yet to announce any tentative date for the adoption of the IFRS for SMEs.

*FINANCIAL REPORTING FOR SMES

Syed Zed al-Qudsy, CEO of financing firm SME Factors, says that the government could look into promoting the private financing sector for SMEs. ‘With greater participation, we believe that accessibility to financing [for SMEs] will be enhanced,’ he says. ‘One possible option that the government may implement to promote this is to provide tax incentives to these private financing companies.’

Although the masterplan has been announced, nothing is carved in stone and there will be a need to constantly review the policies to ensure relevance. ‘The masterplan is aligned to the overall national policy and will be fine-tuned in line with the changes in the environment. It is running

until 2020, so it has to be flexible,’ says Hafsah.

She adds that the targets set are based on typical characteristics of a developed economy and ‘we hope to be able to meet them by 2020, which is when Malaysia is set to achieve developed nation status’.

It is clear that the path ahead for SME sector development lies in collective effort from different stakeholders through innovative approaches. This is not something to be achieved by SMEs alone; the entire ecosystem has to form a chain to support the growth of the industry.

Asha Gopalan, journalist

Something’s cooking: Kuala Lumpur’s street vendors are among the SMEs that could benefit from government support

18

MY_F_SMEs.indd 18 13/04/2012 11:07

The global economic environment has changed significantly since the global financial crisis. Comprehensive

risk management has become an imperative and is a pressing issue faced by all executives and scholars. Under this environment, an internal control system based on comprehensive risk management has been pioneered by the world’s largest coal producer, China Shenhua.

The company, which has operations across a complete coal sector value chain, is representative of large state-owned enterprises (SOEs) that are of significant importance to the Chinese economy. Sales revenue and total profit stood at 208.197 billion yuan and 65.093 billion yuan in 2011 respectively, more than five times of that in 2004 (39.2 billion yuan and

11.8 billion yuan respectively). Shenhua has 56 subsidiaries

operating worldwide. Amid rapid economic growth and swift corporate expansion, our team confronted an unprecedented risk management challenge: how to strike a balance between rapid economic growth and risk control. I believe a study of Shenhua’s risk management and internal control system will provide useful insights for other large enterprises both in China and abroad.

Comprehensive systemSince its initial public offering on the Hong Kong Stock Exchange in 2004, Shenhua has been progressively

developing a tailored, comprehensive risk-oriented internal control system. This push comes as a response to external regulation and also specific internal control challenges that Chinese firms generally face. The system was literally built from scratch and was an organisation-wide effort that drew valuable lessons from international experience.

Shenhua’s internal controls and risk management are not affiliated with any single department or subsidiary, but

are essential to the company’s overall operations. Senior management has spared no effort in integrating internal control and risk management into the corporate culture and operations with the aim of achieving a self-learning, self-organised, self-adaptable, and self-optimising system in which risk awareness is embedded in daily operations and management.

As a result, Shenhua is enjoying healthy growth.

In order to implement internal controls, Shenhua evaluates each of the major risks each year, sets in process the risk control points, and defines the corresponding control measures and standards to ensure that control activities are arranged to each risk point. Key risk indicators were designed for monitoring the status of risks simultaneously, thereby accomplished effective risk management. In the following sections, Shenhua’s four major risk management experiences in 2010 are highlighted and discussed.

Branch management risksThe number of Shenhua’s subsidiaries (and branches) continues to rise through asset growth, mergers and acquisitions and restructuring, creating an increasingly complex organisational structure and management system. Ambiguous management systems and an imbalance of management controls over subsidiaries (and branches) by the head office prevented effective top-down communication. Resource sharing and coordination between departments also proved problematic.

RICHER SEAMSChina Shenhua’s CEO Dr Ling Wen explains how he introduced a comprehensive risk management system that transformed the coal-based energy company

THE SYSTEM WAS BUILT FROM SCRATCH AND WASAN ORGANISATION-WIDE EFFORT THAT DREWLESSONS FROM INTERNATIONAL EXPERIENCE

19

AP_F_Shenhua.indd 19 12/04/2012 13:12

Cranes unload imported coal from a ship at Lianyungang Port

Since 2008, Shenhua has been successively integrating its subsidiaries on a business sector basis. Strategically and economically, the integration of Shendong Coal Group was one of the most important milestone events in Shenhua’s history as it involveed four subsidiaries and branches in the Shendong Mining Area, Shenhua’s principal coal production unit. In the initial stage of integration, the management of the four subsidiaries and branches were decentralised. Due to a lack of supporting facilities and specialised management team, the company’s basic coal-related services provided by Shendong could not meet market requirements. To solve this problem, Shenhua enhanced internal and external communication channels, increased sharing of resources among subsidiaries, and strengthened audit/oversight functions.

After the strategic integration and restructuring of Shendong Coal Group, the subsidiary’s 17 underground coal mines and five surface supporting production units were included in the intrinsic safety management

system with uniform supervision and assessment. The head office is able to take tighter control over its subsidiaries and branches, as well as 17 mega mines thanks to the enhanced communication efficiency. The consolidation also significantly reduces cost, achieves economies of scale, improves resource utilisation, and reinforces risk supervision and control.

One year after restructuring, Shendong Coal Group continued to lead the world with the lowest mortality rate, and the unit production cost per tonne was 3.71 yuan lower than planned. Indicators related to security, output, efficiency and cost meet leading international standards and top domestic counterparts. Its output of coal accounts for 6% of China’s total, compared with 4.8% previously.

Coal market risksCoal market risk is an inherent risk for coal companies. On the policy front, the development of high-energy consumption industries is confined amid tighter macroeconomic policy modulation and energy-saving and emission-reduction policies. The

development of renewable energy and clean energy sources may reduce coal consumption. On the supply and demand front, the company is dependent on its key accounts due to a concentration of sales that gives buyers some bargaining power. Meanwhile, many power companies have begun to adopt vertical integration strategies and gradually integrated upstream coal production sectors to minimise costs in external purchase of coal.

Both policy and demand factors contribute to an increased number of coal producers, resulting in fierce competition for market share and quality resources. Combined with fluctuations in market prices, Shenhua’s operation performance has been directly affected.

In response, Shenhua accelerated the transformation of its sales methods by formulating a ‘mega-sales’ strategy and established the Shenhua Coal Trading Group based on the Coal Distribution Center in 2011, to manage coal sales and market risks centrally. Specific initiatives in this area included further consolidation of the multi-sector

20

AP_F_Shenhua.indd 20 12/04/2012 13:12

China Shenhua Energy Company was incorporated in Beijing, China on 8 November 2004. H-shares and A-shares were listed on the Hong Kong Stock Exchange and Shanghai Stock Exchange in June 2005 and October 2007 respectively.

China Shenhua is a world-leading coal-based integrated energy company, with principal businesses covering coal production and sales, railway, port and shipping of coal-related materials, as well as power generation and sales. With the largest coal reserves, is the largest coal supplier in China. The company’s large-scale, effective, and safe production mode has become a model in China’s coal industry.

Being both the largest coal producer domestically and internationally, it is very representative of large centrally administrated enterprises in China that are of significant importance in the Chinese national economy. Its market capitalisation stood at US$84bn on 16 March 2012, with 4.52 times more net assets that when the company was established (US$18.58bn). It is the largest among all listed coal companies, or the fourth among all listed integrated mining companies worldwide. China Shenhua has 56 subsidiaries in more than 10 provinces and cities in China, and other countries and regions such as Australia and Indonesia.

In 2011, the company saw another rise in its businesses. The sales volume of commercial coals reached 387.3 million tonnes, representing a year-on-year growth of 23.7%. The total power output dispatch reached 167.61 billion kWh, representing a year-on-year increase of 27.3%. The revenues of 2011 amounted to 208.197 billion yuan and profit attributable to equity shareholders of the company for the year was 45.677 billion yuan. Basic earnings per share were 2.296 yuan.

*CHINA SHENHUA ENERGY COMPANYintegrated business model by securing both domestic and international supply and distribution channels, centralisation of corporate resources and decision-making, and increased attention to the recruitment and retention of highly qualified personnel.

Following integration, Shenhua Coal Trading Group has transitioned from production-based sales to production and operation-based sales. Economic belts of distribution; mining areas, areas along railway networks and coastal regions have gradually formed. Its distribution network has also extended to inland regions along the Yangzi River and thus expanded to the entire country. The creation of a large distribution network gives Shenhua an enormous advantage in gathering market information, allowing the company to seize business opportunities and attract new domestic and foreign customers. It also generates more timely feedback on the latest policies and market information to be transmitted to senior levels. As a result, the head office, more capable in recognising and managing market risks, can make effective and efficient strategic decisions.

For product sales, Shenhua Coal Trading Group focuses on product segments and differentiated operations: low-quality coal is strategically subjected to local consumption while high value-added products are sold using innovative sales such as pricing mechanism reforms, secondary distribution, electronic trading of lump coal and auction sales. After launching the new pricing mechanism, company sales increased year on year by 32.9% in the first half of 2011. Market risk has been successfully eliminated from the top 10 risks in its comprehensive risk management assessment of 2011.

Safety management risksThe coal, railway, port, shipping and coal liquefaction chemical sectors that Shenhua engages in all pose significant safety risks. As a state-owned enterprise

and the largest global coal dealer, Shenhua is entrusted with the crucial role of stabilising the coal market. Major accidents may disrupt Shenhua’s integrated operations, and adversely affect its competitive advantages.

Shenhua strives to ‘put an end to serious accidents, reduce general accidents, eliminate fatal accidents, and target zero mortality per million tons of raw coal production’. A production safety management mechanism has been set up for such a purpose, and it is under continuous refinement and upgrading. The five components of this system are risk management, personnel management, safety management, assessment management and information management.

Through mechanised operations and other technological reforms, Shenhua aims to drive sustainable and healthy development. Shenhua is actively promoting technology as a safeguard for production. It has actively upgraded its mechanised levels in coal mining to

reduce injuries. On 31 December 2009, the world’s first seven-metre long wall work face with high-seam thickness was put into place and Shendong’s Bulianta mine is expected to bring enormous economic and social benefits to the company.

In recent years, Shenhua has maintained a good safety record, and ranked as a leading player in the coal industry in terms of scale, efficiency and production safety. In 2010, its fatality rate per million tonne of raw coal was 0.0123, lower than the industry average in China and a leading level in the world. Fourteen coal mines were accredited as China 2009 Premium Safe and Highly Efficient Mines by the China Coal Industry Association, representing approximately 70% of Shenhua’s coal mines in production.

Overseas investment risksShenhua strives to fully utilise its capital funds through diversified

21

AP_F_Shenhua.indd 21 12/04/2012 13:12

A China Shenhua dock at Tianjin Port

investments to spread out risks and to improve its management and consolidate existing markets. I have repeatedly stressed the expansion necessity and acquisition strategy through domestic integration and overseas assets selection.

Given the larger scale and scope of overseas investments, investment risks are increasingly prominent. In order to mitigate these risks, China Shenhua has accelerated training of staff engaged in overseas assignments, strengthened public and government relation channels in foreign countries, and applied analytic frameworks to support overseas investment decisions.

In November 2011, Shenhua established Shenhua Overseas Development & Investment Co, split from Shenhua International, to focus on developing overseas markets and seeking international investment opportunities. As an independent investment company, it can rely on China Shenhua’s mega distribution network, obtain market information

and use the previous investment platform and experience of Shenhua International in expanding overseas businesses. It can also form highly qualified investment teams to gather information, make model-based calculations, formulate strategies and execute projects. Professional investment analysis and risk controls bring higher investment quality and yield, and help China Shenhua to pursue its ‘going-out’ strategy.

Conclusion and outlook Prior to its risk management reforms, Shenhua experienced unbalanced and ineffective management controls over its subsidiaries, inefficient resource sharing and coordination, inflexible pricing mechanisms, dispersed sales function, weak distribution and supply chain networks, and lax overall budget control and supervision on safety of projects. With a comprehensive risk-based internal control system in place, the company greatly enhanced its market risk response capability and facilitated prompt communications,

efficient resource sharing and business process optimisation.

Looking forward, Shenhua will continue to enhance its comprehensive risk management by integrating internal controls and risk management into production and operations.

Globalisation is a path that enterprises must take to become world-class while international competition will inevitably bring globalisation risks as well. As such, effective response to risks alongside globalisation is also one of the company’s major strategic missions. With the objective of developing into ‘the most competitive, dynamic and world-leading integrated energy enterprise’, Shenhua will continue its management innovation for the incorporation of risk management approaches into the company’s globalisation process.

Dr Ling Wen, who holds a PhD in engineering, is director and vice president of Shenhua Group Corporation. Dr Ling is also the executive director, president and CEO of China Shenhua Energy Company, which is listed in Hong Kong and Shanghai. He also serves as the general director of Shenhua Charity Fund.

GLOBALISATION IS A PATH THAT ENTERPRISESMUST TAKE WHILE INTERNATIONAL COMPETITIONWILL BRING GLOBALISATION RISKS AS WELL

22

AP_F_Shenhua.indd 22 12/04/2012 13:17

CTP_AD_250x192.indd 1 05/03/2012 4:04 PM

Adverts_May12.indd 2 16/04/2012 12:08

Wheels of fortune: Olympic qualifying event at Stratford Velodrome

Number of tickets to Olympics/Paralympics

Number of Olympic sports taking place

Number of venues for Olympic events

Number of Olympic athletes competing

Number of Paralympic athletes competing

Number of sports kit items sourced by Locog

Area in sq km of Olympic Park

Number of nails needed to construct Velodrome

10.8M

26

34

10,500

4,200

1M

2.5

300,000

*2012 IN FIGURES

24

AP_F_Olympics.indd 24 12/04/2012 13:11

Staging the greatest show on earth is fraught with all kinds of difficulty. There is rich potential for budget overruns,

urban gridlock, athletes turning up at the wrong time in the wrong place and with the wrong equipment, security meltdowns and plenty more. But there is also the opportunity for London, the UK and all involved to shine, and this is very much the hope of Deloitte, in its wide-ranging role as adviser-in-chief to the 2012 Olympic and Paralympic Games.

The London venue became a reality in 2005 when, amid great fanfare, the city beat Paris for the right to host the 2012 Games. Deloitte’s own Olympics journey began in earnest two years later, when it was appointed official professional services provider, giving partners and staff a once-in-a-generation chance to be involved in an event that is both hugely exciting yet daunting in its scale and organisational complexity.

Deloitte provides tax, management consulting and financial support services to the London Organising Committee for the Olympic and Paralympic Games (Locog), and is planning and coordinating no fewer than 65 separate Games projects.

The eight-year secondmentThe Deloitte partner with the biggest Olympics profile is Neil Wood, the man charged with ensuring the Games runs within budget. He became Locog’s CFO in 2005 and by the time the Games end he will have been seconded for a staggering eight years.

Indeed, around 130 of Deloitte’s UK staff have been seconded to work on

Locog. An estimated 550 staff and 45 partners at the firm will be able to put the Games on their CVs in one way or another.

Deloitte’s broader Games delivery work includes keeping the Games and the city moving and building capability right across the major organisations involved with the Games. Efficient organisation is an event that doesn’t feature in any Olympics calendar but shining at it will be the equivalent of gold for Deloitte.

Event organisation skills are in increasing demand globally, and the expertise demonstrated in 2012 can be exported to other organising committees and major event hosts. At the time of writing, Deloitte had put in

a staggering 550,000 hours of work for the 2012 Games across a number of the ‘Olympic Family’ including Locog, the British Olympic Association, Greater London Authority and Olympic Park Legacy Company.

As a ‘tier-two’ sponsor, Deloitte is thought to be paying in the region of between £20m and £30m for the privilege of doing the work for Locog which accounts for the vast majority of the hours delivered. It is, the firm says, an investment which generates a return through the way in which the sponsorship is activated – particularly in building client relationships and by impacting

recruitment and retention of star performers.

Much as athletes put their all into getting to the Olympics, a large number of Deloitte staff have been vying to work on the 2012 project.

Heather Hancock, Deloitte’s global lead partner for London 2012, says: ‘Sport is about commitment, passion and an endless focus on getting the big and the small things right. I am delighted to be working to help ensure this same commitment, passion and detail filters right through the delivery efforts of the British Olympic Association.’ The BOA selects, leads and manages Britain’s athletes for the Games and, along with the sports minister and the mayor of London, is

one of Locog’s three key stakeholders. There are three parts to Hancock’s

remit: service delivery, sponsorship activation, and integration with the firm’s global activities. ‘All the secondments we make to Locog, the advisory work we provide and our wider contributions to the Olympic and Paralympic family come under my oversight,’ she explains. ‘I’m also managing partner for innovation and brand, so I have executive responsibility for our sponsorship of London 2012 and how we activate that across the UK.’

Hancock also coordinates the worldwide Olympic sponsorship

With around 130 of its staff seconded and over 550,000 hours on the clock so far, Deloitte is at the heart of preparations for London 2012. We catch up on the current state of play

‘EVERY BUSINESS IS SEEKING THAT SAME ABILITY TO TACKLE COMPLEX CHALLENGES IN PRESSING TIMESCALES WITH TIGHT BUDGETS’

With around 130 of its staff seconded and over 550,000 hours on the clock so far, Deloitte OLYMPIC DRIVE

25

AP_F_Olympics.indd 25 12/04/2012 13:11

Field of dreams: the Olympic Stadium *UNDER BUDGET?

relationships that the other Deloitte firms are delivering.

Deloitte’s support for the BOA’s preparations has focused on helping to create the framework for managing the hugely complex task of mobilising and managing hundreds of athletes through preparation, qualification and competition programmes.

One such project is final Team GB camp at Loughborough University. Over a seven-week period across June and July, every single Team GB athlete will pass through Loughborough.

One of the significant milestones of the Loughborough camp will be the allocation of kit to each athlete. This is the moment when competing at London 2012 becomes very real and where athletes connect receiving their kit with the fact that they are one of 550 chosen to represent their country this summer.

The camp requires the coordination of the athletes and thousands of items

UK sports minister Hugh Robertson claims the Olympics is likely to come in under budget after revealing the event will probably not need to tap its entire £9.3bn public funding package.

Latest quarterly accounts show £527m of unspent contingency budget remaining, with the most recent assessment of likely risks showing that more than £100m is likely to remain unspent and will be returned to the Treasury.

This is in contrast to recent revelations claiming the cost of staging the event had spiralled to more than £12bn. The government’s public sector budget for the Games has already risen substantially from the £2.37bn quoted in 2005 when London won the right to stage the 2012 Games.

Sky News had reported that an extra £2.4bn had been added to public sector spending as a consequence of further spending in areas such as additional anti-doping control officers, paying London Underground workers not to strike, governmental operational costs and legal bills over the controversial Olympic Stadium tenancy decision.

Sky said that additional costs would further swell this figure, with the police being allocated £1.1bn in counter-terrorism funding and a £4.4bn budget for the security and intelligence services. The extra cost of 12,000 police officers on duty during the Games and the £6.5bn being spent on transport upgrades could bring the ultimate cost of the 2012 Olympics to more than £24bn.

However, Robertson says he is increasingly confident that the project will come in under budget and that the government would ‘not quite empty the piggy bank’, adding: ‘It is fair to say we are increasingly confident we can land this on time and within budget. It is enormously encouraging that we are 96% complete and still have £500m in the budget.’

26

AP_F_Olympics.indd 26 12/04/2012 13:11

‘THERE IS SUCH A BUZZ. TO BE PART OF THE HOME TEAM AT THE GREATEST SHOW ON EARTH IS AN AMAZING EXPERIENCE AND OPPORTUNITY’

of equipment tailored for each one. Some athletes will attend as individuals, others as part of a team, some for a few hours, others for days; all will have the opportunity to train at the camp.

Deloitte has helped plan and cost the operation, manage the associated risks and ensure that all parts of the organisation are working together to deliver a memorable experience.

The Olympic experienceFor Deloitte staff, taking part in organising the 2012 event has been an unforgettable experience. Staff on secondment at the BOA will return to the firm after the Games and have opportunities to translate the experience of delivering results in a high-pressure, complex environment to other clients. They will be more experienced consultants, will have worked client-side for a considerable time and developed their skills in delivering highly complex programmes.

One former Deloitte employee who won’t be returning to the firm after the Games is Kate O’Sullivan. She joined the BOA as Olympic programme director permanently in 2011, following

her work on leading programme management for the Vancouver 2010 Winter Olympics. She remained at the BOA to lead programme management for London 2012.

O’Sullivan says: ‘I started at Deloitte through the graduate scheme and working there laid the foundations for everything that has followed and presented me with incredible opportunities. Before I was seconded to the BOA, I experienced a whole host of roles in different clients and in-depth training that has been the bedrock of what I do every day.’

Deloitte’s work has clearly impressed other Olympic organisations, with numerous enquiries received about how Deloitte and the BOA has gone

about the work. While there has been much

consideration of the legacy the Olympics will leave in London, Deloitte’s expertise will have a lasting BOA legacy of its own in the shape of programme controls, greater focus on the value of detailed plans,

budgets and improved communication across the organisation. Hancock says: ‘The BOA has been hungry to learn and tailor techniques for its own requirements. It will be ahead of its rivals in Rio in 2016. Other organisations want to learn from the BOA and observe its work.’

Robust portfolioFrom the firm’s point of view, its work with the BOA and the Games has been fantastic for showcasing its skills to potential clients. After all, whether you’re the CEO or a new recruit, sport is an attention-grabber.

Hancock adds: ‘It’s such an interesting and exciting platform to explain what we can achieve. And every

business is seeking that same ability to tackle complex challenges in pressing timescales with tight budgets.’

With the opening ceremony edging ever closer, the pressure and excitement continues to build.

O’Sullivan says: ‘We’re really into the countdown to London 2012 now and there’s such a buzz of excitement. This is an event that will touch a huge percentage of the British population and resonate around the world. To be part of the home team at the greatest show on earth is an amazing experience and opportunity.

‘A home Games only happens once in a generation, possibly a lifetime, so it’s hard to predict what it will throw up for the host country. There are 26 sports over two weeks – but outside that everything is fluid.

‘The vast range of domestic and international stakeholders makes it even more challenging and complex. That means that our plans need to be agile enough to respond to change on an ongoing basis right up to the end of the closing ceremony.’

It is difficult to imagine a bigger, more challenging or more prestigious stage to be on – and that doesn’t just apply to the athletes.

Alex Miller, journalist

Heather Hancock: passion and detail

27

AP_F_Olympics.indd 27 12/04/2012 13:12

According to the Gender Diversity Survey 2011, the first of its type on the extent of gender inequalities in the

financial sectors of Asia Pacific, four in 10 (39%) financial professionals from Hong Kong and China believe that they have been discriminated in the workplace or are aware of others being discriminated.

Conducted in November 2011 by global online recruitment firm eFinancialCareers in partnership with The Women’s Foundation, the survey polled 374 financial professionals from Hong Kong and China. Fifty-four per cent of the respondents were male and the rest were female.

Over half (53%) of the finance professionals surveyed said that there is a gender income gap in the financial services industry. Male-female income disparity appears more prevalent in higher-powered positions – 51% said there is a significant gap in pay in top managerial positions.

Forty-two per cent believe being a man makes it easier to get promoted. And 34% sensed a gender bias in the recruitment process.

‘Do I think equality in financial services is a problem? Yes, I do,’ says Kay McArdle, board chair of The Women’s Foundation, a charity dedicated to improving the lives of Hong Kong’s females. ‘The results further support that women are not represented, despite being successful from a financial perspective.’

China ranked 61 in the sixth annual World Economic Forum Global Gender Gap Report 2011. Iceland, Norway, Finland and Sweden have maintained their top global rankings in the last five years, she says.

In Hong Kong, the Sex Discrimination Ordinance was introduced in December 1996. But, according to Community Business, a not-for-profit group which champions the role of women in the Asian corporate world, women make up just 2% of the CEOs and 9% of board members of companies listed on the Hang Seng Index.

‘Gender stereotyping which works against women is still prevalent, both in the upper sector of the job market and at home. Such biases, though perhaps more subconscious than explicit, hold back capable women from advancing as far as their abilities allow, says Lam Woon-Kwong, chairperson of the Equal Opportunities Commission (EOC).

The EOC received 24 job-related sex discrimination complaints up to November 2011, up from 16 in 2010. By stereotyping and confining female staff from contributing their best, companies waste talents and missed business opportunities, Lam says.

McArdle agrees, saying that women within financial services have proven themselves to be a ‘real asset’.

‘A firm which has some women in its highest leadership ranks will have higher earnings per share, a higher return on equity, and stock prices than competitors with few or no senior women. And that’s been held up by research,’ McArdle says.

Male bravadoGeorge McFerran, head of Asia Pacific of eFinancialCareers, spearheaded the survey after receiving more enquiries from his clients on how to retain talent. The survey shed light on the root causes of gender bias: 57% of respondents believe that men are more likely to put themselves forward for promotions.

‘They believe that men are more aggressive when it comes to pushing for opportunities and pay rises. That perhaps explained why the gap exists,’ McFerran says.

Without a study, the extent of gender equality in the accountancy sector is unknown and the EOC do not break down complaints by industries.

But according to professor Judy Tsui, chair professor of accounting at the Hong Kong Polytechnic University (PolyU), men still dominate the partnership ranks of accountancy firms.

‘Though there is an increasing trend that more women make it to the partnership ranks, the top ranks are still predominantly male,’ Tsui says. ‘

‘In a Chinese society like Hong Kong, the prescribed gender role for women is still very much for them to take up childcare and domestic responsibilities, making it hard for women to make advances in career as they have to juggle family responsibilities and career aspirations,’ Tsui says.

EOC founding chairperson Fanny Cheung Mui-ching agrees, adding that a lack of work-life balance in the accountancy industry is also a factor.

‘People in accounting work long hours until late evening. It makes it difficult for women because most of them have to care for their family,’ says Cheung, director of the Gender Research Centre of the Chinese University of Hong Kong. ‘If they choose to spend more time to take care of their family, they must give up career advancement as it requires a lot more involvement from them.’

Rosanna Choi, immediate past chairman of ACCA Hong Kong and partner of accountancy firm CWCC, says ‘gender inequality still exists’ in the local accountancy sector. She notes

A MORE EFFECTIVE MIXDespite more women now entering the accountancy profession than men, gender stereotyping is still holding them – and the whole profession – back

28

AP_F_gender.indd 28 12/04/2012 13:11

caption style

however that gender bias in Hong Kong’s accountancy sector is less than in mainland China.

‘On the mainland, the situation is better in multinational corporations. In traditional firms, more senior positions tend to be held by men,’ Choi says.

But according to legislative councillor for accountancy Paul Chan, ‘gender inequality is not so serious’ in the sector.

‘It is true that more men hold senior positions than women. It was because the total male population was much more than women in the past,’ says Chan, who is also past president of ACCA Hong Kong. ‘But in the past 10 years, there have been more women coming to the trade. The female population to male in the profession is almost 50:50.’

He says that women have taken up many senior positions in recent years, including director of accounting

services, deputy director of audit, and the chief

executive of the HKICPA.‘Many senior partners in the Big

Four are women,’ he adds.Choi observes that gender inequality

is changing, because female accounting graduates have outnumbered males in recent years.

At PolyU, out of the 176 students admitted to the 2011–12 BBA accountancy programme at the School of Accounting and Finance, 94 are female, according to Tsui.

Paternity issuesMcFerran says that gender stereotyping affects men too. ‘Hong Kong doesn’t offer paternity leave. Australia offers up to 18 weeks paternity leave. And the UK offers up to 20 weeks,’ he says.

Women are also not given enough time to spend with their newborns, causing some to quit their jobs. The average maternity leave in developed countries is 13 weeks on full pay. But women in Hong Kong have just 10

weeks’ maternity leave and are paid fourth-fifths of their monthly salary.