Data Conversion and Import Data Import Process Child Plus Data Import Details.

AB Bank Foreighn Trade Export Import Report

description

Transcript of AB Bank Foreighn Trade Export Import Report

1.1. Introduction:

Bank is a financial institution. The economy is mostly depended on the bank since the

bank facilitates the economic and financial transactions. Every industry large, medium &

small is absorbing the facilities provided by the bank relating to its production to export

and also to import the materials.

The Bank will put reliance on market forces and provide increased inducement to savers to

mobilize savings and hold fast to profitability potential to allocate funds to the users of

such sectors of trade, commerce and industries as may be consistent with the socio-

economic objectives of the nation. Bank is a financial intermediary whose prime function

is to move scarce resources in the form of credit from savers to those who borrow for

consumption and investment. In a modern society, banks are very much important to the

economy because of their ability to create money.

Economy of Bangladesh is in the group of world’s most underdeveloped economies. One

of the reasons may be its underdeveloped banking system. Since 1990, Bangladesh

government has taken a lot of financial sector reforming measures for making financial

sector as well as banking sector more sound and transparent, a formulation and

implementation of this reform activities have also been participated by different

international organization like World Bank, IMF etc.

The government of Bangladesh has been pursuing a liberal policy to attract foreign

exchange business because foreign exchange business is considered as a key to economic

development. Countries like Bangladesh are mostly depended on import of raw materials

to export quality goods.

1.3. Objective of the ReportIn this report the objective is basically to find out all sorts of practical dealings that are

conducted in case of handling various type of banking activities in each department,

specially foreign exchange department, the theoretical aspects, that is what should be the

procedures and requirements maintained from first to last, and actual practices as well as

the ultimate gain for the bank in conducting financial activities are mainly discussed. So

the purpose and objective of this report can be summarized as follows.

To depict the Trade service operations and its impact in the economic development

of Bangladesh from the perspective of AB Bank Ltd.

To know deeply about Import, Export and remittance.

To identify the role of Trade service operations.

To identify some problem in foreign operation.

To identify the factors that must be considered and analyzed in determining Export

and Import policy and procedure.

To apprise Remittance Service with special emphasis on Remittance department.

To analyze the Foreign Exchange performance of AB Bank Ltd.

To identify the problems with Foreign Exchange system and suggested measures.

To state practical Knowledge gathered in the customer service department about

account opening and others.

To state practical knowledge about credit appraisal system and credit management

1.4. Scope of the Study:The report is highlighting the major functional area of foreign exchange department and

procedure of import, export and remittance.

1.5. Methodology: Methodology of the study includes direct observations, face-to-face conversation with the

employees of different desk, study of files, circular and practical deskwork. In conducting

this report basically, there have been two types of data and information used. The name of

those two types and their sources to reveal the information for preparing this report has

been showed in a flow chart.

EXECUTIVE SUMMARY

As a requirement of BBA program from Department of Finance, Stamford University Bangladesh,

I have completed my internship from AB Bank Limited, Motijheel Branch. I have prepared my

report with the objective of finding out how the branch complies with the Bangladesh Bank’s

Foreign Exchange guide line in their policy, process and procedures. I have also analyzed the

export, import, remittance (inward and outward) situation of the branch. Some limitations such as

time constrain and unavailability of data is faced during this study.

AB Bank Limited is the first private sector bank in Bangladesh. At present the Bank operating its

business by 79 branches. The Bank is now providing online banking service to its customers to

have their better services.

This report “PROCEDURE OF FOREIGN TRADE FINANCE OF AB BANK LTD. is

prepared based on the foreign exchange operation of the AB Bank Limited.

There are Seven (7) chapters in this report.

In Chapter 1-Introduction: origin of the report, scope and objective of the study, methodology

and limitation are also discussed here.

In Chapter 2: this chapter includes Organization in focus such as history, organizational and

capital structure, Organizational hierarchy, Change of name and logo, Rating report, Product and

services, Five years performance and key financial indicators, Retail Banking, SME business,

International trade.

In Chapter 3: The overall Trade Financing is describing here. Foreign Exchange department has

three sub-sections. One is foreign remittance section, another is import section and the third one is

export section. Foreign remittance includes all sale and purchase of foreign currencies on account

of Import, Export, Travel and other purposes. However, specifically foreign remittance means sale

& purchase of foreign currencies for the purposes other than export and import. All foreign

remittance transactions are grouped into two broad categories- Outward remittance & Inward

remittance. in import section, import mechanism, source of finance, import procedure, procedures

of opening L/C to import etc are discussed. In export section, export policy, export incentives,

export procedures, export financing, Back to Back Letter of Credit etc are discussed.

In Chapter 4: The Trade Financing by AB Bank Ltd like Inward & Outward Remittance, export

& its procedure, Back to Back L/C, Import & its procedure , Lodgment & Retirement of

Document etc. is described here.

In Chapter 5: SWOT analysis of ABBL, Financial ratio analysis and Performance overview.

In Chapter 6: At the last section of the report includes Ending part- conclusion, findings, &

recommendation are highlighted.

In Chapter 7: Last but not the least in this chapter highlights Bibliography and Appendix part.

Analyzing the performance and operations of the AB Bank Limited I have found that the AB Bank

Limited has continued its growth. The profit of the bank has growth significantly. The deposit

growth concludes the customer satisfaction and their loyalty toward the operation and service of

the AB Bank Limited which turned out as a leading private commercial bank of the country-

Bangladesh. As a proud internee of this bank, I am very much pleased to work in such a reputed

organization like AB Bank Limited- “To be the trend setter for innovative banking with

excellence and perfection.”

1.6. Limitation of the Study: A wholehearted effort was applied to conduct the project paper and to bring a reliable and

fruitful result. In spite of having the wholehearted effort, there exist some limitations,

which acted as a barrier to conduct the conduct the project paper. As the report is prepared

in a short span of time, it could not be made comprehensive and conclusive. Moreover, the

accuracy of the report is largely depended upon the information obtained from the relevant

sources. Greater emphasis was given to collect information from informal sources like

discussion with clients and our officials, which may appear to be an inherent limitation of

the study.

Data & Information

Primary Sources

Bangladesh Bank’s Circular Govt. Act and Order Annual Report Of ABBL AB Bank Operational Manual AB Bank Website Different guidelines of Head

Office, ABBL

Secondary Sources

Interview of the employees Relevant books, Research

papers, Newspapers and Journals.

Personal observation Working experience as an

internee. Internet and Study of selected

reports.

The limitations are:

Sufficient data for prepare a report is not available.

The employees of the bank are so much busy so they cannot provide me to give

information about the foreign exchange such as import, export etc.

As it’s a vast area of business that demands on hand experience for an in depth analysis.

Another limitation was the sensitivity of the data. As it is a highly competitive market, in

some cases management were reluctant to give some specific data.

Limitations of bank’s policy of not disclosing some data and information for obvious

reasons, which could be very much useful. For the sake of confidentiality of the

organization, employees did not disclose much information.

Lack of comprehension of the respondents was the major problem that created many

confusions regarding verification of conceptual question

Confidentiality of data was another important barrier that was confronted during the

conduct of this study. All the concerned personnel of the bank have not been interviewed.

AB Bank Limited is one of the fasted growing banks among all the commercial banks in

Bangladesh. ABBL bears a unique history of its own. The aim of the company was to

mobilize resources from within and invest them in such way so as to develop country’s

industrial and Trade Sector and playing a catalyst role in the formation of capital market as

well. Its membership with the bourse helped the company to a great extent in this regard.

AB Bank Limited, the first private sector bank was incorporated in Bangladesh on 31st

December 1981 as Arab Bangladesh Bank Limited and started its operation with effect from

April 12, 1982.

AB Bank is known as one of leading bank of the country since its commencement 28 years

ago. It continues to remain updated with the latest products and services, considering

consumer and client perspectives. AB Bank has thus been able to keep their consumer’s and

client’s trust while upholding their reliability, across time.

During the last 28 years, AB Bank Limited has opened 77 Branches in different Business

Centers of the country, one foreign Branch in Mumbai, India and also established a wholly

owned Subsidiary Finance Company in Hong Kong in the name of AB International

Finance Limited. To facilitate cross border trade and payment related services, the Bank has

correspondent relationship with over 220 international banks of repute across 58 countries of

the World.

In spite of adverse market conditions, AB Bank Limited which turned 28 this year, concluded

the 2009 financial year with good results. AB attained highest ever profitability in the

history of the Bank’s 28 years of existence. The Banks consolidated profit after taxes

amounted to Taka 336.20 crore which is 46.11% higher than that of 2008. The asset base of

AB stood at taka 10691.20 crore (growth of 27 percent) while total capital crossed the

threshold and reached the level of taka 1079.0 crore at the year end

2.2 Organizational Structure of ABBL. AB Bank Ltd. (ABBL) was incorporated on 31st December 1981, under the company’s act-

1913 as a pioneer commercial bank in the private sector in Bangladesh with its Head Office

in Dhaka. The bank started functioning from 12th April 1982 with the approval of

Bangladesh Bank under the guidelines, rules and regulations given for scheduled commercial

banks operating in Bangladesh. It was initially a joint venture commercial bank between

Bangladeshi sponsors and Dubai Bank Ltd. Dubai (U.A.E.) having respective share holdings

as under:

Bangladesh Sponsors 20%

Bangladeshi General Public 15%

Bangladesh Government 05%

Dubai Bank Ltd. 60%

Table 1: Organizational Structure of AB Bank Ltd

Subsequently, the Union Bank of Middle East Ltd. inherited the shares of Dubai Bank Ltd. in

1986 and continued as its shareholder till early 1987, when they decided to offload their

investment in Bangladesh. As per provisions of the bank Articles of Associations, with the

approval of Bangladesh Bank and the controller of Capital issue Government of Bangladesh,

the shares (60%) held by the Union Bank of Middle East (UBME), were purchase by the

Bangladeshi Sponsored Directors, raising total shares of holding to 80% of total share

capital. However, as desired by the government of Bangladesh the sponsors. Directors, who

acquired the 60% shareholdings of Union Bank of Middle East (UBME), unclosed 50% of

share, purchased by them from UBME to the general public of Bangladesh raising the public

share holdings to the 45% of total share capital of the bank.

The Objective of the bank is to undertake all kinds of banking and foreign exchange business

in Bangladesh as well as abroad through its brandies/correspondents.

2.3 Capital Structure of ABBL. The authorized capital of AB Bank Ltd. is taka 600.00 crore divided into 6.00 crore

ordinary shares of taka 100 each, from the existing Tk. 300.00 crore on 05 march, 2009.

The total paid up capital rose to taka 2564.00 million at the end of 2009. At present the

composition of the existing shareholders of the bank is as under:

Bangladeshi sponsors/ Directors 50%

Bangladeshi General Public 49.43%

Govt. of Bangladesh 0.57%

Table 2: Capital Structure of ABBL

2.4 Change of Name and Logo of ABBL.

Arab Bangladesh Bank Ltd. was incorporated on 31st December 1981, under the company’s

act 1913. The bank started functioning from 12th April 1982. It is the first private bank in

Bangladesh. Motijheel Branch is the corporate branch of this bank. The branch has enjoyed

its 28th anniversary during this year.

Arab Bangladesh Bank Ltd. Changed its name to AB Bank Limited (ABBL) with effect from

14 November 2007 vides Bangladesh Bank BRPD Circular Letter No-10 dated 22

November 2007. Prior to that Shareholder of the Bank approved the change of name in the

Extra-Ordinary General Meeting held on 4 September 2007. Effective 1 January 2008, ABBL

changed its Logo as well.

Previous Name & Logo New Name & Logo

Arab Bangladesh Bank Ltd. AB Bank Ltd

Table: Name & Logo of ABBL

2.5 Corporate Information of ABBL.

Legal Form: A public limited company incorporated on 31st December, 1981 under the Companies Act, 1913 and listed in the Dhaka Stock Exchange Ltd and Chittagong Stock Exchange Ltd.

Objective“To exceed customer expectations through innovative financial products & services and

establish a strong presence to recognize shareholders' expectations and optimize their rewards

through dedicated workforce.”

Vision Statement"To be the trendsetter for innovative banking with excellence & perfection"

Mission Statement"To be the best performing bank in the country"

Commencement of Business27th February 1982Registered Office

BCIC Bhaban, 30-31, Dilkusha C/ADhaka 1000, Bangladesh.

Tel: +88-02-9560312Fax: +88-02-9564122, 23

SWIFT: ABBLBDDH E-mail: [email protected]

Web: HYPERLINK "http://www.abbank.com.bd" www.abbank.com.bd

Name of the Branch where completed the Internship Program.

AB Bank Ltd.Corporate Office

Motijheel, Dhaka-1000, Bangladesh.

2.6ORGANIZATIONAL HIERERCHY OF ABBL:

2.7 Rating Report ON ABBL: AB Bank Limited was rate by Credit Rating Agency of Bangladesh Limited (CRAB). CRAB

has affirmed AA3 rating in the long term and ST-1 rating in the short term of AB Bank

Limited based on Audited Financials of 31 December 2009 and other relevant information.

MANAGING DIRECTOR

SENIOR EXE. VICE PRESIDENT

EXECUTIVE VICE PRESIDENT

SENIOR VICE PRESIDENT

VICE PRESIDENT

SENIOR ASST. VICE PRESIDENT

ASSTT. VICE PRESIDENT

SR. PRINCIPAL OFFICER

PRINCIPAL OFFICER

SENIOR OFFICER

OFFICER

The summery of their ratings is given below:

Entity Rating June 2009

Entity Rating December 2009

Definition

Long Term Long Term Commercial Bank rated AA3 in the long term belongs to “Very Strong Capacity & Very High Quality” cohort. Bank has very strong capacity to meet its financial commitments. Bank is judged to be of high quality and is subject to low credit risk.

AA3 AA3

Short Term Short Term Commercial Bank rated ST-1 in the short term is considered to have highest capacity for timely payments of obligations. Bank is characterized with excellent position in terms of liquidity, internal fund generation and access to alternative sources of funds. ST-1 ST-1

Date of Rating 15th June, 2010

Rating Report of AB Bank (Source: AB Bank Annual Report 2009)RATIONALE

Credit Rating Agency of Bangladesh Limited (CRAB) has assigned “AA3” (pronounced

Double A Three) rating in the Long Term and “ST-1” rating in the Short Term to the AB

Bank Limited (ABBL). The present ratings of ABBL based on audited financial statements

up to 31 December 2009 and other relevant information. The rating takes into account both

qualitative and quantitative indicators. Qualitative indicators considered include parameters

such as corporate governance practice, effective asset-liability management, good franchise

value, experienced top level management, diversified product line, risk management practice,

standard IT infrastructure of the Bank etc. However, the ratings are constrained by moderate

asset quality of the Bank. The quantitative analysis concentrated in financial positions like

sound profitability level, adequate capital adequacy, good liquidity position, moderate market

share etc. However, the rating has concern about increase of bank’s non-performing assets,

dependency on high cost fixed deposits, average loan to deposit ratio etc. Commercial bank

rated AA3 in the long term is adjudged to be very strong bank, characterized by good

financials, healthy and sustainable franchises, and a first rate operating environment. This

level of rating indicates very strong capacity for timely payment of financial commitments,

with low likeliness to be adversely affected by Foreseeable events. Bank rated ST-1 in the

short term is characterized by very satisfactory position in term of liquidity, internal fund

generation, and access to alternative sources of funds.

2.8 Products and Services Of ABBL:

2.9 FIVE YEARS AT A GLANCE:

2.9 FIVE YEARS AT A GLANCE:Figure in Million Taka

BUSINESS BANKING Term Loan Trade Finance Trust Receipt Facility Working Capital Financing Bill Discounting Letter of Guarantee Loan Syndication &

Structured Finance

TREASURY & FOREIGN EXCHANGE PRODUCT

Money Market: Overnight (Call) Repo SWAP Term Reverse Repo

FX Market: Spot Forward

RETAIL PRODUCTS Personal Loan (Unsecured) Personal Loan (Secured) Home and Office Renovation

Loan Education Loan Auto Loan Easy Loan for Executive Gold grace Credit Card Debit Card

ISLAMI BANKING Deposit Product:

Al-Wadia Current Deposit Mudaraba Term Deposit Mudaraba Saving Deposit Mudaraba Shot Notice Deposit Mudaraba Pension Deposit

Scheme Mudaraba Quarterly Profit Paying

Scheme Mudaraba Probable Millionaire

Scheme Mudaraba Hajj Deposit Scheme

Investment Product: Bai-Murabha Bai-Muajjal Hire-Purchase under Shirkatul

Melk(HPSM)

DEPOSIT ACCOUNTS Saving Account Current Account Short Term Deposit Fixed Term Deposit Foreign Currency Account NFCD RFCD School

ABBL FOUNDATION Brokerage Service

SERVICE PRODUCTS 24 Hour ATM access Online Banking Western Union SWIFT

SMALL & MEDIUM ENTERPRISE (SME) LOAN

Choto Puji Rin Proshar Digun Uddog Goti Awparajita Sati

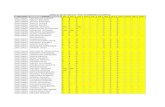

Particulars 2005 2006 2007 2008 2009

Operating Profit (PBP & T)755.03 710.69 3325.29 4298.39 5802.35

Net Operating Profit (PBT)407.45 532.19 2817.99 3600.62 5270.61

Profit after Tax (PAT)162.45 532.19 1903.49 2300.62 3417.19

Authorized Capital 8000 2000 2000 3000 6000

Paid-up Capital 520 572 743 2230 2564

Statutory & Other Reserves 650 773 1357 2066 3101

Shareholders’ Equity1526.88 2582.76 4511.59 6722.51 10086.52

Deposits27361.44 42077.00 53375.35 68560.47 83082.63

Loans & Advances21384.63 31289.25 40915.35 56708.77 72063.26

Investments 4061 6281 8885 11396 16369

Fixed Assets 370 1148 2381 2445 2441

Total Assets33065.40 47989.34 63549.86 84053.61 106912.31

Import Business 23151 42860 48441 70041 65956

Export Business 12595 17876 20677 28937 30640

No. of Branches 67 68 71 72 77

No. of Employees 1525 1590 1725 1804 1952

KEY PERFORMANCE INDICATORS

Particulars 2005 2006 2007 2008 2009

Earnings per Share (Taka) 31.26 93.08 256.10 103.18 131.13

Price Earnings Ratio (Times) 57.41 43.02 34.50 9.16 8.97

Book Value per Share (Tk.) 269.62 240.96 251.22 293.76 451.74

Return on Equity-ROE (%) 10.64 20.61 42.19 40.96 40.01

Return on Assets-ROA (%) 00.50 01.11 03.41 3.12 3.52

Capital Adequacy Ratio 09.17 09.23 10.75 12.84 13.78

NPL as % of Advances 08.21 04.02 04.31 2.99 2.75

Advance Deposit Ratio (%) 78.16 74.36 76.66 82.71 84.32

Assets Utilization Ratio (%) 59.19 62.58 67.12 72.60 76.79

2.10 PROFITABILITY:

Key business areas registered growth, which was reflected in the bottom line growth of over

30 percent in Net Operating Profit. AB bank was also able to off-set “un-reconciled

entries” worth Tk.95.07 crore which would definitely contribute towards consolidation of

financial health of the institution besides bringing in transparency in deliverables in the

future. Bank could also add significantly towards shareholders value addition as the Earnings

per Share (EPS) stood at Tk.131.13 the year-end which is three times over the last year’s

figure at the same cut-off date.

Return on Assets (ROA) at 3.52 percent Return on Equity (ROE) at 40.01 percent and Asset

Utilization Ratio at 76.79 percent underlines the magnitude of ABBL performance for the

year 2009

In 2009 ABBL diluted some of its investment portfolio thereby generating capital gain worth

Tk.76.09 crore signifying the role and prospects of Portfolio / Investment Banking wing

towards meeting Bank’s strategic needs.

2.11 RETAIL BANKING:

AB Bank started its retail banking operations in the year 1997 (re-launched in the year

2002) with the setting up of the Consumer Credit Division. Consumer banking in AB Bank is

high volume personal banking and exclusive service to high net worth individuals,

professionals, businessmen among others. Over the years, this particular Division identified

and explored the various avenues of customer lending and developed several products suiting

to the need of the prevailing market. Today AB Bank’s clientele base comprises over 6700

customers having a portfolio size worth Tk.325.00 crore approximately. In the year 2009

consumer credit experienced nearly 26 percent growth over last year and contributed to the

bottom line of the Bank.

CONSUMER CREDIT PRODUCTS

- Personal Loan – Secured / Unsecured - Auto Loan

- Personal Overdraft – Secured - Easy Loan for Executives

- Jewelry Loan (Gold Grace) - House / Office Furnishing &

- Education Loan - Renovation Loan

- Home Loan

2.12 SME BUSINESS:

Small and Medium Enterprise has emerged as the cornerstone on economic development of

Bangladesh in terms of job creation, income generation, and development of forward and

backward industrial linkage besides catering to the local demand mitigation. AB Bank has

always been a SME focused institution as nearly 64 percent of the Loan portfolio are liked to

this particular Business segment. AB is actively present in the following segment of SME

Sector – Agri-Machinery, Animal Feed, Poultry, Dairy Products, Clinics & Hospitals,

Electric Appliances, Fruit Preservation, and Garment Accessories etc. The core strength

of AB in this segment is its widening reach and online Banking throughout. Judging the

potentialities of the Sector a separate SME Business Unit is being shaped to director banking

services at the door step of SME customers.

2.13 INTERNATIONAL TRADE:

International Trade is an important component of foreign exchange business of the Bank. In

2006, this particular wing of the Bank registered remarkable growth through strengthening

the trade finance areas and providing value added services in this area.

2.13.1 IMPORT BUSINESS:

Import business kept the growth momentum and reaped business worth Tk.65,956 crore at

2009 registering little decrease but at the end of the year it increased business level. Major

import finance were in the areas of capital machinery, industrial raw materials like edible oil,

crude edible oil, textiles, fabrics, milk powder, scrap vessels etc.

2.13.2 EXPORT BUSINESS:

Export business registered growth in 2009. Total Export business volume reached Tk.30640

crore showing an increase over the previous year. Concentrations of export business were in

the area of readymade garments, frozen fish and other products.

2.13.3 REMITTANCE BUSINESS:

Remittance business reached US$260 million registering growth over 2009. Bank has

drawing arrangements with the Exchange Houses situated at important locations of the globe

depending on the concentration of the expatriate Bangladeshis. AB Bank is exploring

possibility of expanding its network to augment the flow of inward remittance business

through dedicated personalized services to beneficiaries.

3.1 Export Section:

Foreign exchange department is international department of the bank. It deals with globally

and facilitates international trade through its various modes of services. It deals with globally

and facilitates international trade through its various modes of services. It bridges between

importers and exporters. These banks are known as authorized Dealers. If the branch is

authorized dealer in foreign exchange market, it can remit foreign exchange from local

country to foreign country. This department mainly deals with foreign currency. This is why

this department is called foreign exchange department.

Some national and international laws regulate functions of this department. Among these,

Foreign exchange Act, 1947 is for dealing in foreign exchange business, and import and

export control Act, 1950 is for documentary credits. Governments’ import & export policy is

another important factor for import and export operation of banks. Also UCPDC 600 and

URC 522 both of them are very important guideline.

Creation of wealth in any country depends on the expansion of production and increasing

participation in international trade. By increasing production in the export sector we can

improve the employment level of such a highly populated country like Bangladesh,

Bangladesh exports a large quantity of goods and services to foreign households. Readymade

textile garments (both knitted and woven), Jute, Jute-made products, frozen shrimps, tea are

the main goods that Bangladeshi exporters export to foreign countries. Garments sector is the

largest sector that exports the lion share of the country's export. Bangladesh exports most of

its readymade garments products to U.S.A and European Community (EC) countries.

Bangladesh exports about 40% of its readymade garments products to U.S.A. Most of the

exporters who export through ABBL are readymade garments exporters, They open export

L/Cs here to export their goods, which they open against the import L/C opened by their

foreign importers.

Export L/C operation is just reverse of the import L/C operation. For exporting goods by the

local exporter, bank may act as advising banks and collecting bank (negotiable bank) for the

exporter.

3.1.1Export policy:

Export policies formulated by the Ministry of Commerce, GOB provide the overall guideline

incentives for promotion of exports in Bangladesh. Export policies also set out commodity-

wise annual target. It has been decided to formulate these policies to cover a five-year period

to make them contemporaneous with the five-year plans and to provide the policy regime.

The export-oriented private sector, through their representative bodies and chambers a

consulted in the formulation of export policies and are also represented in the various export

promotion bodies set up by the government.

3.1.2 Export Incentives:

A. Financial Incentives:

Restructuring of Export Credit Guarantee Scheme

Convertibility of Taka in current account;

Exporters can deposit 40% of FOB value of their export earnings in own account

in dollar and pound sterling;

Export Development Fund;

Expansion of export credit period from 180 days to 270 days;

50% tax rebate on export earnings;

Duty draw back;

Bonded warehouse facilities to 100% export oriented firms

Duty free import of capital equipment for 100%export oriented firms

B. General incentives:

National Export Trophy to successful exporters

Training course on external trade;

Arrangement of international trade fairs, commodity-based exhibitions in the

country and participation in foreign trade fairs.

C. Other incentives:

Assistance in improvement of quality and packaging of exportable items;

Simplification of exports procedures.

3.1.3 Export Procedures:

The import and export trade in our country are regulated by the Import and Export (Control)

Act, 1950.

Under the export policy of Bangladesh the exporter has to get valid Export registration

Certificate (ERC) from Chief Controller of Import & Export (CCI&E). The ERC is

required to renew every year. The ERC number is to incorporate on EXP forms and other

papers connected with exports.

Registration of Exporters:

For obtaining ERC, intending Bangladeshi exporters are required to apply to the controller/

Joint Controller/ Deputy Controller/ Assistant Controller of Imports and Exports, Dhaka/

Chittagong/ Raishahi/ Mymensingh/ Sylhet/ Comilla/ Badshal/ Bogra/ Rangpur/ Dinajpur in

the prescribed form along with the following documents:

Nationality and Assets Certificate-

Memorandum and Article of Association and Certificate of Incorporation in case of

Limited Company-,

Bank Certificate

Income Tax Certificate

Trade License etc.

Securing the Order:

After getting ERC Certificate the exporter may proceed to secure the export order. He

can do this by contacting the buyers directly or through agent.

In this purpose the exporter may get help from:

License Officer

Buyers Local Agent

Export Promoting Organization

Bangladesh Mission Abroad

Chamber of Commerce (local & foreign)

Trade Fair etc

Signing the Contract:

After communicating buyer, exporter has to get contracted (writing or oral) for exporting

exportable items from Bangladesh detailing commodity, quantity, price, shipment, insurance

and marks, inspection and arbitration etc.

Receiving Letter of Credit:

After getting contract for sale, exporter should ask the buyer for Letter of Credit (L/C) clearly

stating terms and conditions of export and payment.

The following are the main points to be looked into for receiving/ collecting export proceeds

by means of Documentary Credit-.

The terms of the L/C are in conformity with those of the contract"

The L/C is an irrevocable one, preferably confirmed by the advising bank;

The L/C allows sufficient time for shipment and negotiation.

(Here the regulatory framework is UCPDC-600, ICC publication)

Terms and conditions should be stated in the contract clearly in case of other mode of

payment:

Cash in advance-,

Open account,

Collection basis (Documentary/ Clean)

(Here the regulatory framework is URC-522, ICC publication

Procuring the Materials:

After making the deal and on having the L/C opened in his favor, the next step for the

exporter is to set about the task of procuring or manufacturing the contracted merchandise.

Shipment Of Goods:

Then the exporter should take the preparation for export arrangement for delivery of goods as

per L/C, prepare and submit shipping documents for Payment/ Acceptance/ Negotiation in

due time.

Documents for shipment :

i. EXP form,

ii. ERC (valid),

iii. L/C copy,

iv. Customer Duty Certificate,

v. Shipping Instruction,

vi. Transport Documents,

vii. Insurance Documents,

viii. Invoice

ix. Other Documents,

x. Bills of Exchange (if required) Certificate of Origin,

xi. Inspection Certificate

Quality Control Certificate,

xii. G.S.P. Certificate,

xiii. Phyto-sanitary Certificate.

Final Step: Submission of the documents to the bank for negotiation.

3.1.4 Procedure of collection of Export bill:

3.1.5 Export Financing:

Financing exports constitutes an important part of a bank's activities. Exporters require

financial services at four different stages of their export operation. During each of these

phases exporters need different types of financial assistance depending on the nature of the

export contract.

Pre-shipment credit

Post-shipment credit

Pre-shipment credit:

Pre-shipment credit, as the name suggests, is given to finance the activities of an exporter

prior to the actual shipment of the goods for export. The purpose of such credit is to meet

working capital needs starting from the point of purchasing of raw materials to final shipment

of goods for export to foreign country. Before allowing such credit to the exporters the bank

takes into consideration about the credit worthiness, export performance of the exporters,

together with all other necessary information required for sanctioning the credit in accordance

with the existing rules and regulations. Pre-shipment credit is given for the following

purposes-

Cash for local procurement and meeting related expenses.

Procuring and processing of goods for export.

Packing and transporting of goods for export.

Payment of insurance premium.

Inspection fees.

Freight charges etc.

An exporter can obtain credit facilities against lien on the irrevocable, confirmed and

unrestricted export letter of credit in form of the followings-.

Export cash credit (Hypothecation)

Export cash credit (Pledge)

Export cash credit against trust receipt.

Packing credit.

Back to back letter of credit.

Credit against Red-clause letter of credit.

Export cash credit (Hypothecation):

Under this arrangement, a credit is sanctioned against hypothecation of the raw materials or

finished goods intended for export. Such facility is allowed to the first class exporters. As

the bank has got no security in this case, except charge documents and lien on exports UC or

contract, bank normally insists on the exporter in furnishing collateral security. The letter of

hypothecation creates a charge against merchandise in favor of the bank. But neither r the

ownership nor the possession is passed to it.

Export cash Credit (Pledge):

Such Credit facility is allowed against pledge of exportable goods or raw materials. In this

case cash credit facility are extended against pledge of goods to be stored in the god own

under bank's control by signing letter of pledge and other pledge documents. The exporter

surrenders the physical possession of the goods under banks effective control as security for

payment of bank. In the event of failure of the exporter to honor his commitment, the bank

can sell the pledged merchandise for recovery the advance.

Export Cash Credit against Trust Receipt:

In this case, credit limit is sanctioned against trust receipt (TR). Here also unlike pledge,

the Exportable goods remain in the custody of the exporter. It is required to execute a

stamped export trust receipt in favor of the bank, he holds wherein a declaration is made that

goods purchas4ed with financial assistance of bank in trust for the bank. This type of credit

is granted when the exporter wants to utilize the credit for processing, packing and rendering

the goods in exportable condition and when it seems that exportable goods cannot be taken

into bank's custody. This facility is allowed only to the first class party and collateral security

is generally obtained in this case.

Packing Credit:

Packing Credit is essentially a short-term advance granted by a Bank to an exporter for

assisting him to buy, process, manufacture, pack and shipment of the goods. Generally for

movement of goods from the hinterland areas to the pots of shipment the Banks provide

interim facilities by way of packing credit.

This type of credit is sanctioned for the transitional period starting from dispatch of goods till

the negotiation of the export documents. Practically except for single transaction, most of the

pre-shipment credits are allowed in the form of limits duly sanctioned by Bank in favor of

regular exporters for a particular period. The drawings are required to be adjusted fully once

within a period of 3 to 6 months. Suiting to the breed and nature of export, sometimes an

exporter may also be allowed to avail a combined Cash Credit and Packing Credit limit with

fixed ceiling on revolving basis. But in no case the borrower would be allowed to exceed

individual credit limit fixed for the purpose. The drawings under Export Cash Credit limits

are generally adjusted by the drawing in packing credit limit, which is, in turn liquidated by

the negotiation of export documents.

Charge Documents for P.C.

Banker should obtain the following charge documents duly stamped prior to disbursement:

Demand Promissory Note

Letter of Arrangement

Letter of Lien of Packing Credit (On special adhesive stamp)

Letter of Disbursement

Packing Credit Letter

Additional Document for P.C.

Letter of Partnership along with Registered Partnership Deed in case of Partnership

Accounts.

Resolution of the Board of Directors along with Memorandum & Articles of association

in case of Accounts of Limited Companies. In case of Corporation, Resolution of the

Board Meeting along with Charter.

Personal Guarantee of all the Partners in case of Partnership Accounts and a=of all the

Directors in case of Limited Companies.

An undertaking from the Directors of the Public Limited Company to obtain prior

clearance from the Bank before declaring any intend/final dividend.

Back to Back Letter of Credit (BTB):

Bangladesh is a developing country. After receiving order from the importer, very frequently

exporters face problems of scarcity of raw material. Because of some raw materials are not

available in the country. These have to be collected from abroad. In that case, exporter gives

lien of export L/C to bank as security and opens an L/C against it for importing raw materials.

This L/C is called Back To Back L/C. In back to back L/C, ABBL keeps no margin.

Sometimes there is provision in the export UC that the importer can use the certain portion of

the export L/C amount for importing accessories that are necessary for the making of the

product. Only in that case, BTB is opened.

Payment of Back to Back LC:

Client gives the payment of the BTB L/C after receiving the payment from the importers.

But in some cases, client sells the bills to the ABBL. But if there is discrepancy, the ABBL

sends it for collection.

In case of BTB L/C, ABBL gives the payment to the beneficiary after receiving the payment

from the UC of the finished product (i.e. exporter). Bank gives the payment from DFC

Account (Deposit Foreign Currency Account) where Dollar is deposited in national rate.

For BTB L/C, opener has to pay interest at LIBOR rate (London Inter Bank Offering

Rate). Generally LIBOR rate fluctuates from 3% to 5%.

A schedule named Payment Order; Forwarding Schedule is prepared while making the

payment. This schedule is prepared when the payment of UC is made. This schedule contains

the followings:

Reference number of the beneficiary's bank and date.

Beneficiary's name.

Bill value.

Payment order number and date.

Equivalent amount in Taka.

Advance against Red-clause Letter of Credit:

Under Red clause letter of credit, the opening bank authorizes the Advising Bank/Negotiating

Bank to make advance to the beneficiary prior to shipment to enable him to procure and store

the exportable goods in anticipation of his effecting the shipment and submitting a bill under

the L/C. as the clause containing such authority is printed in red ink, the L/C is called Red

clause and Green clause respectively. Though it is not prohibited, yet very rare in

Bangladesh.

Post Shipment Credit:

This type of credit refers to the credit facilities extended to the exporters by the banks after

shipment of the goods against export documents. Necessity for such credit arises as the

exporter cannot afford to wait for a long time for without paying manufacturers/suppliers.

Before extending such credit, it is necessary on the part of banks to look into carefully the

financial soundness of exporters and buyers as well as other relevant documents connected

with the export in accordance with the rules and regulations in force. Banks in our country

extend post shipment credit to the exporters through-.

Negotiation of documents under L/C

Foreign Documentary Bill Purchase (FDBC)

Advances against Export Bills surrendered for collection;

Negotiation of documents under L/C:

The exporter presents the relative documents to the negotiating bank after the shipment of the

goods; a slight deviation of the documents from those specified in the L/C may raise an

excuse to the issuing bank to refuse the reimbursement of the payment already made by the

negotiating bank. So the negotiating bank must be careful prompt, systematic and indifferent

while scrutinizing the documents relating to the export.

Foreign Documentary Bill Purchase (FDBC):

Sometimes the client submits the bill of export to bank for collection and payment of the

BTB L/C. In that case, bank purchases the bill and collects the money from the exporter.

ABBL subtracts the amount of bill from BTB and gives the rest amount to the client in cash

or by crediting his account or by the pay order.

For this purpose, ABBL maintains a separate register named FDBC Register. This register

contains the following information:

Date

Reference number (FDBC)

Name of the drawer

Name of the collecting bank

Conversion rate

Bill amount both in figure & in Taka.

Export form number

Export L/C number

Advances against Export Bills surrendered for collection:

Banks generally accept bills for collection of proceeds when they are not drawn under an L/C

or when the documents, even though drawn against an L/C contain some discrepancies. The

bank generally negotiates bills drawn under L/C, without any discrepancy in the documents,

and the exporter gets the money from the bank immediately. However, if the bill is not

eligible for negotiation, the exporter may obtain advance from the bank against the security

of export bill. In addition to the export bill, banks may ask for collateral security like a

guarantee by a third party and equitable/registered mortgage of property.

3.1.6 Export Documents Checking :

General verification: -

L/C restricted or not.

Exporter submitted documents before expiry date of the credit.

Shortage of documents etc.

Particular verification:

Each and every document should be verified with the L/C.

3.2 Import Section:

Imports of goods into Bangladesh is regulated by the ministry of commerce and industry in

terms of the Import and Export (Control) Act, 1950, with import policy orders issued by

annually, and Public Notices issued from time to time by the office of the Chief Controller of

Import and Export (CCI & E). Through the process of import some vital but which are

inadequate in our country products are imported to meet the local needs of the people.

3.2.1 Import Mechanism

To import, a person should be competent to be an 'importer. According to Import and Export

(Control) Act, 1950, the officer of Chief Controller of Import and Export provides the

registration (IRC) to the importer. After obtaining this, the person has to secure a letter of

credit authorization (LCA) from Bangladesh Bank. And then a person becomes a qualified

importer. His requests o instructs the opening bank to open an L/C.

Import may be allowed under the following sources of finance:

(a) Cash-

i. Cash foreign exchange (balance of the foreign exchange reserve of Bangladesh

Bank;

ii. Foreign currency accounts maintained by Bangladeshi National working/living

abroad.

(b) External economic aid.

(c) Commodity exchange.

Procedures:-

An importer is required to have the following to import through ABBL-

i. Applicant has to apply for opening LC by a prescribed form.

ii. Applicant has to submit the Letter of Intent or Letter of Proforma Invoice.

Letter of Intent: Many sellers have their agent in seller’s country. If the

contract of buying is made between the buyers and the agent of the sellers then

Letter of Intent is required.

Letter of Performances Invoice: If the contract is made directly between the

buyer and the sellers then Letter of Performances Invoice is needed.

iii. Applicant has to submit IRC (Inventors Registration Certificate). It is a

certificate being renewed every year. This certificate is necessary if the

contract is made between the buyers and the agents of the sellers. IRC is of

two types - COM and IND. COM is given for commerce purpose and IND is

given for industrial purpose.

iv. Applicant has to submit LCAF (Letter of Credit Authorization Form).

v. Applicant has to submit insurance document.

vi. Applicant has to prepare FORM-IMP.

vii. Recently, there has been made a provision to give a certificate named TIN

(Tax Payers Identification Number).Taxation department issues this

certificate.

viii. Then after proper scrutiny bank will open an L/C. While opening L/C,

importer must keep certain percentage of the document value in the bank as

margin.

3.2.2 Procedure to Open an L/C:-

To open an L/C, the requirements of an importer are:

He must have an account in ABBL.

He must have Importers Registration Certificate (IRC).

Report on past performance with other bank. ABBL collects this report from Bangladesh

Bank.

CIB (Credit Information Bureau) report from Bangladesh Bank.

A proposal approved by the meeting of executive committee of the bank. It is necessary

only when the L/C amount is small or there is no limit.

If the L/C amount is large or there is a limit, then an approval from Bangladesh Bank is

needed. Usually this approval is needed for amount more than one crore.

3.2.3 Letter of Credit:

Foreign trade can be easily defined as a business activity, which crosses national boundaries.

These may be between parties or government ones. Trade among nations is a common

occurrence and normally benefits both the exporters and importers.

Foreign trade can usually be justified on the principle of comparative advantage. According

to this economic principle, it is economically profitable for the country to specialize in

production of that commodity in which the producer country has the grater comparative

advantage and to allow the other country to produce that commodity in which it has the lesser

comparative advantage. It includes the spectrum of goods, services, investment, technology

transfer etc. These trades among various countries calls for lose linkage between the parties

dealing in trade. The banks, which provide such transactions, are referred to as rendering

international banking operations. International trade demands a flow of goods from seller to

buyer and of payment from buyer to seller. And this flow of goods and payment are done

through letter of credit (LC).

Letter of Credit:

Letter of credit (L/C) can be defined as a "Credit Contract" whereby the buyer’s bank is

committed (on behalf of the buyer) to place an agreed amount of money at the seller’s

disposal under some agreed conditions. Since the agreed conditions include, amongst other

things, the presentation of some specified documents, the letter of credit is called

Documentary Letter of Credit. The Uniform Customs & Practices for Documentary

Credit (UCPDC) published by international Chamber of Commerce (1993) Revision;

Publication No. 600 defines Documentary Credit:

Any arrangement however named or described whereby a bank (the "issuing bank") acting

at the request and on the instructions of a customer (the "Applicant") or on its own behalf.

To make a payment or to the order of a third party(the beneficiary) or is to accept

and pay bills of exchange(Drafts)drawn by the beneficiary, or

Authorizes another bank to effect such payment or to accept and pay such bills of

exchange (Drafts)

Authorizes another bank to negotiate against stipulated documents provide that

terms and conditions are complied with.

3.2.4 Types of Documentary Credits

Documentary Credits may be either:

(i) Revocable or, (ii) Irrevocable.

Revocable credit: A revocable credit is a credit that can be amended or cancelled by the

issuing bank at any time without prior notice to the seller.

In case of seller (beneficiary), revocable credit involves risk, as the credit may be amended or

cancelled while the goods are in transit and before the documents are presented, or although

presented before payments has been made. The seller would then face the problem of

obtaining payment on the other hand revocable credit gives the buyer maximum flexibility, as

it can be amended or cancelled without prior notice to the seller up to the moment of payment

buy the issuing bank at which the issuing bank has made the credit available, In the modern

banking the use of revocable credit is not widespread.

Irrevocable credit: An irrevocable credit constitutes a definite undertaking of the issuing

bank (since it cannot be amended or cancelled without the agreement of all parties thereto),

provided that the stipulated documents are presented and the terms and conditions are

satisfied by the seller. This sort of credit is always preferred to revocable letter of credit.

Sometimes, Letter of Credits is marked as either 'with recourse to drawee@ or 'without

recourse to drawer'.

3.2.5 Parties for Letter of Credit:

The parties are:

The Issuing Bank,

The Confirming Bank, if any, and

The Beneficiary.

Other parties that facilitate the Documentary Credit are:

The Applicant,

The Advising Bank,

The Nominated Paying/ Accepting Bank, and

The Transferring Bank, if any.

1. Importer - Seller who applies for opening the L/C.

2. Issuing Bank - It is the bank which opens/issues a L/C on behalf of the importer.

3. Confirming Bank - It is the bank, which adds its confirmation to the credit and it is don

at the request of issuing bank. Confirming bank may or may not be advising bank.

4. Advising / Notifying Bank - is the bank through which the L/C is advised to the

exporters. This bank is actually situated in exporter’s country. It may also assume the

role of confirming and / or negotiating bank depending upon the condition of the credit

5. Negotiating Bank - is the bank, which negotiates the bill and pays the amount of the

beneficiary. The advising bank and the negotiating bank may or may not be the same.

Sometimes it can also be confirming bank.

6. Paying / Accepting Bank - is the bank on which the bill will be drawn (as per condition

of the credit). Usually it is the issuing bank.

7. Reimbursing bank - is the bank, which would reimburse the negotiating bank after

getting payment - instructions from issuing bank.

3.2.6 Some Important Documents of L/C:

Forwarding: Forwarding is the letter given by the advising bank to the issuing bank.

Several copies are sent to the issuing bank. All copies including original should be kept in

the bank.

Bill of Exchange: According to the section 05, Negotiable Instruments (NI) Act-1881, A

"bill of exchange" is an instrument in writing containing an unconditional order signed by

the maker, directing a certain person to pay [on demand or at fixed or determinable future

time] a certain sum of money only to or to the order of a certain person or to the bearer of

the instrument. It may be either at sight or certain day sight. At sight means making

payment whenever documents will reach in the issuing bank.

Invoice: Invoice is the price list along with quantities. Several copies of invoice are given.

Two copies should be given to the client and the other copies should be kept in the bank. If

there is only one copy, then its photocopy should be kept in the bank and the original copy

should be given to the client. If any original invoice contains the custom's seal, then it

cannot be given to the client.

Packing List: It setter describing the number of packets and their size. If there are several

copies, then two copies should be given to the client and the remaining should be kept in the

bank. But if there is only one copy, then the photocopy should be kept in the bank and the

original copy should be given to the client.

Bill of Lading: Bill of Lading is the bill given by shipping company to the client. Only one

copy of Bill of Lading should be given to the client and the remaining copy should be kept

in the bank.

Certificate of Origin: Certificate of origin is a document describing the producing country

of the goods. One copy of the certificate of origin should be given to the client and the

remaining copy should be kept in the bank. But if there is only one copy, then the

photocopy should be kept in the bank and the original should be given to the client.

Shipment Advice: The copy mentioning the name of the insurance company should be

given to the client and the remaining copies should be kept in the bank. But if only one

copy is given, then the photocopy should be kept in the bank and the original copy should

be given to the bank.

3.2.7 Form - IMP

This form is prepared for maintaining account of the money, which goes out side the country

for the purpose of payment. This form is required by Bangladesh Bank. It is an application

for permission under 4/5 of the Foreign Exchange Regulation Act, 1947 to purchase

foreign currency for the payment of import.

IMP - FORM has four copies:

Original copy for Bangladesh Bank.

Duplicate copy for authorized dealers. It is issued for processing Exchange Control Copy of

bill of entry or certified invoice.

Triplicate copy for authorized dealers' record.

Quadruplicate copy for submission to the bank in case of imports where

documents are retired.

Following documents are sent with FORM-IMP:

Letter of Credit Authorization Form(LCAF),

One copy of invoice,

Indent copy / performances invoice.

The following Information is included in the FORM-IMP:

Name and address of the authorized dealer,

Amount of foreign currency in words and figures,

Names and address of the beneficiary,

L/C Authorization Form number and date,

Registration number of L/C Authorization Form with Bangladesh Bank, and

Description of the goods.

Accounting Treatment for Opening LIC.

For opening L/C, importer will apply to the issuing bank. In that case, importer is called

applicant or opener. After opening an L/C bank will create a contingent liability. In that

case, the accounting posting will be the following-.

Customers liability Dr.Contingent Liability Cr. Generally L/C is opened against some margin.

While paying the money by the issuing bank, issuing bank will reverse the above entry and the entry will be-

Contingent Liability Dr. Customers Liability Cr.

Then the issuing bank will give another entry-

Payment Against Document (PAD)

Dr.

AB General Account Cr.Exchange Gain Cr.

PAD will debit because the bank will pay the money against some documents’ General

Account is a miscellaneous account. It will be credited because by this entry ABBL creates a

liability. He has to pay the money to the advising bank. And the gain made by the

transaction is shown at Exchange Gain Account.

All these entries are made after receiving some documents from the exporters. The above

procedure is called Lodging.

After giving the above entry, ABBL will inform the clients for collecting the documents from

the bank.

Importers will pay the due to the bank and collects the documents. In that case, the entry

will be –

Party Account Dr.

PAD Account Cr.

After opening the L/C, ABBL (issuing bank) must receive the documents for any other proceedings. These documents are ---

i. Bill of Lading,

ii. Invoice,

iii. Packing List,

iv. Country of Origin.

3.2.8 Lodgment of documents:

After receiving the documents from the exporters, at first ABBL write it in the PAD

Registrar. PAD Register contains date, PAD number, L/C number, name of the drawer, name

of the drawee, amount, number of copies of various documents, name of the imported items.

This written procedure is called Lodgment.

Accounting Application:

While doing lodgment, ABBL makes the following entries-

Payment Against Document (PAD)

Dr.

AB General Account Cr.

Exchange Gain Cr.

ABBL makes the payment to the reimbursing bank against the documents. That's why, it

debts the PAD Account.

For payment, ABBL deposits the money at the miscellaneous account @69.35 (current rate).

And sends an Inter Branch Credit Advice (IBCA) to credit the amount to a nostro account

maintained in a bank of exporters' country from which payment will be made. By this

transaction, ABBL makes a profit @O. 1 5 per dollar.

3.2.9 Retirement of Documents:-

The process of collecting documents from bank by the importer is called retirement of the

documents. The importer gives necessary instructions to the bank for retirement of the

import bills or for the disposal of the shipping documents to clear the imported goods from

the customs authority. The importer may instruct the bank to retire the documents by

debiting his current A/C.

3.3 FOREIGN REMITTANCES SECTION (INWARD & OUTWARD)

Foreign remittance, in simple terms, means money remitted in foreign currency. More

precisely, it is termed as remittances in foreign currency that are received in & made out

abroad. Conceptual Issues International remittances are defined as the portion of migrant

workers’ earnings sent back from the country of employment to the country of origin (ILO,

2000). Remittance can also be sent in kind. Transfers that take place in kind is quite difficult

to measure.

Remittances can be individual and it can also be collective. When, individuals send

remittance to his/her household or kith and kin that can be termed as individual remittance.

When a group of migrants, their associations or professional bodies oblige resource together

and send for collective or community programs that can be termed as collective remittance.

Individual remittances are mostly geared towards the family whereas collective remittances

are generally used for community development.

Transfer of remittances takes place through different methods. 46% of the total volume of

remittance has been channeled through official sources, around 40% through hundi, 4.61%

through friends and relatives, and about 8 percent of the total was hand carried by migrant

workers themselves when they visited.

TYPES:-

Two types of Foreign remittance:-

1. Foreign Inward Remittance

2. Foreign Outward Remittance

Wage Earners Remittance Inflows (Monthly)

Year/MonthRemittances

In million US dollar In million Taka2008-2009 April 781.71 53609.70 March 808.72 55445.80 February 689.26 47269.50 January 710.74 48742.50 December 635.34 43571.60 November 617.39 42383.80 October 559.05 38406.70 September 590.67 40579.00 August 470.95 32307.20 July 567.11 38926.40

2007-2008 June 516.38 35599.40 May 557.02 38495.70 April 543.74 37485.40 March 537.29 37040.80 February 500.32 34532.10 January 462.55 32235.10 December 555.08 38555.90 November 598.73 41857.20 October 377.34 25315.70 September 466.00 30310.20 August 471.22 32806.30 July 412.80 28751.502006-2007 June 429.13 29888.90 May 487.24 33829.00 Source : Foreign Exchange Policy Department, Bangladesh Bank

From the trend analysis of wage earners remittance inflow we can see that the remittance is increasing day by day. In the month of July(FY’2006-07) the remittance inflow was 412.80 million dollar where as in the month of July(FY’2007-08) the inflow was 567.11 million dollar.

Wage Earners Remittance Inflows (Yearly)

Year/MonthRemittances

In million US dollar In million Taka 2007-08* 6430.94 441242.202006-07 5998.47 412985.292005-06 4802.41 322756.802004-05 3848.29 236469.702003-04 3371.97 198698.002002-03 3061.97 177288.202001-02 2501.13 143770.302000-01 1882.10 101700.10

1999-2000 1949.32 98070.301998-1999 1705.74 81977.801997-98 1525.43 69346.001996-97 1475.42 63000.401995-96 1217.06 49704.001994-95 1197.63 48144.701993-94 1088.72 43549.00

1992-93 944.57 36970.401991-92 849.66 32414.501990-91 763.91 27256.20

*: data up to month of April of financial year 2007-2008. Source : Foreign Exchange Policy Department, Bangladesh Bank

WAGE EARNERS REMITTANCE INFLOW(IN DOLLAR)

01000200030004000500060007000

200

7-08

2005

-06

2003

-04

2001

-02

1999

-200

0

1997

-98

1995

-96

1993

-94

1991

-92

YEAR

INCO

ME

3.3.1 Foreign Inward Remittance 3.1 FOREIGN INWARD REMITTANCE

DEFINITION:The remittance of freely convertible foreign currencies which we are receiving from abroad against

which the Authorized Dealers making payment in local currency to the beneficiaries may be termed as

Foreign Inward Remittance.

MODE OF INWARD REMITTANCES (Also Outward Remittance):The following are the mode of Inward/Outward Remittances.

i) TT = Telegraphic Transfer.

ii) MT = Mail Transfer.

iii) FD = Foreign Drafts.

iv) PO = Payment Order.

v) TC = Travelers’ Cheque.

vi) EFT = Electronic Fund Transfer

vii) FCN = Foreign Currency Notes.

viii) OLR = on line Remittances.

A remitter abroad simply has to approach a bank branch there with certain amount to be

deposited beneficiary in Bangladesh either in foreign currency or in equivalent Taka

currency. The Branch so approached abroad usually should have agency arrangement with

the paying banks in Bangladesh. However, in the absence of any such agency arrangement,

remittance may also be made by transferring cover value of the remittance to the paying

bank’s account abroad by the remitting bank.

SOURCE OF INWARD REMITTANCE:-

i) Expatriate Bangladeshis.

ii) Exporters.

iii) Visitors.

PURPOSE OF REMITTANCE:

In short, remittances are being sent from abroad for the following purposes:-

Family maintenance

Indenting Commission

Recruiting Agents Commission

Realization of Export Proceeds

Donation

Gift

Export broker’s Commission etc.

PURCHASE OF DRAFTS & CHEQUES:

Authorized Dealer may purchase Drafts & Cheques which are not drawn on AB Bank at the

request of the beneficiary.

COLLECTION PROCEDURES:

To make entry in foreign bills Collection Register

To prepare forwarding schedule.

To prepare vouchers on realization.

PAYMENT OF FOREIGN CURRENCY NOTES:

Authorized branches of the bank are to make payment of F.C. notes in equivalent Taka

currency at the prevailing rate (T.T. Clean buying rate).

Generally, three foreign currencies namely U.S. Dollar, Pound Sterling and Euro are being

bought and sold along with two other currencies like K.S.A. Riyal & Kuwaiti Dinar.

3.3.2 FOREIGN OUTWARD REMITTANCE

DEFINITION:

The remittances in foreign currency which are being made from our country to abroad is

known as foreign outward remittance.

PURPOSE OF OUTWORD REMITTANCE:-

To settle Import Payment.

To meet Travel Expenses/Medical Expenses/Educational Expenses etc.

APPROVAL OF BANGLADESH BANK

Bangladesh is always in a scarcity of foreign exchange and foreign exchange business is

restricted and controlled by the Central Bank of the country. For this reason Bangladesh

Bank’s prior permission is required for any remittance to be made to outside the country.

Bangladesh Bank provides permission/approval for outward remittances to the applicants

who are to lodge an application for the purpose on the following prescribed forms with an

Authorized Dealer who forwarded the same to Bangladesh Bank for approval.

i) The IMP form (cover remittances for importers)

ii) Form T/M (Traveling & Miscellaneous)

Other than these two prescribed forms, Bangladesh Bank sometimes issue

permits know as Bangladesh Bank permit.

CANCELLATION OF FD:

For cancellation of any foreign draft which was issued earlier by the branch the following

formalities to be observed:

To receive an application from the purchaser.

To discharge on the reverse of the FD with Revenue Stamp by the purchaser.

“Received payment by cancellation”

The draft should be treated as a debit voucher & payment will be made by

debit to concern Foreign Bank

To advise drawee bank/reimbursing bank regarding cancellation of Draft.

REPORTING TO BANGLADESH BANK REGARDING CANCELLATION:

In the event of any remittance-which has already been reported to the Bangladesh Bank on

the prescribed return being subsequently cancelled either in full or in part, the authorized

dealer must report the cancellation of the remittance. The return in which the reversal of the

transaction is reported should be supported by a letter giving the following particulars:

The date of the return in which the inward remittance was reported.

The name and address of the beneficiary.

The amount of the purchase as effected originally.

The amount cancelled.

Reasons for cancellation.

Main Flow

Currently, Saudi Arabia, UAE, Kuwait, Qatar, Oman, Iraq, Libya, Bahrain, Iran, Malaysia,

South Korea, Singapore, Hong Kong and Brunei are some of the major countries of

destination. Saudi Arabia alone accounts for nearly one half of the total number of workers

who migrated from Bangladesh. Labour market of Bangladeshi workers is not static. During

the 1970s Saudi Arabia, Iraq, Iran and Libya were some of the major destination

countries. While the position of Saudi Arabia remains at the top, Malaysia and UAE became

important receivers. In mid-1990s, Malaysia became the second largest employer of

Bangladeshi workers. However, since the financial crisis of 1997, Bangladeshis migrating to

Malaysia dropped drastically. Now UAE has taken over its place.

Over the past 25 years labor migration from Bangladesh has registered a steady increase.

From 1990 onwards on an average 3,25,000 Bangladeshis are migrating on short-term

employment, mostly to 13 countries. In the past the bulk of the migrants consisted of

professional and skilled labor. However, the recent trend is more towards semi- and unskilled

labor migration. Due to increase in the flow of unskilled and semi- skilled labor, remittance is

increasing at a much lower rate than the labor flow. Remittance is crucial for Bangladesh’s

economy. It constitutes almost one-third of the foreign exchange earning. About 25 percent

of remittance senders were students when they went abroad and another 25 percent were

living off their own land. A large segment of them were working as construction laborers

overseas, another group worked as agricultural laborers. UAE, Saudi Arabia and Singapore

constituted the most of important destinations of these migrants.

One survey comments that if the migrant workers’ total income abroad and the present

family income from other sources is combined and then compared with the pre- migration

family income, it registers an increase in total income by 119 percent. On an average, the

interviewee households annually received about Tk.72,800 as remittance. This means that a

typical migrant remits 55.65 percent of his income. Remittance constitutes 51.12 percent of

the total income of these families. Transfer of remittances takes place through different

methods. 46 percent of the total volume of remittance has been channeled through official

sources, around 40% through hundi, 4.61 percent through friends and relatives, and about 8

percent of the total was hand carried by migrant workers themselves when they visited.

Contribution of Remittance to the national economy labour migration plays a vital role in the

economy of Bangladesh. Bangladesh has a very narrow export base. Readymade garments,

frozen fish, jute, leather and tea are the five groups of items that

Account for four-fifths of its export earnings. Currently, garments manufacturing is treated as

the highest foreign exchange earning sector of the country (US $ 4.583 billion in 2003).

However, if the cost of import of raw material is adjusted, then the net earning from migrant

workers’ remittances is higher than that of the garments sector. In 2 003, net export earning

from RMG should be between US$2.29-2.52 billion, whereas the earning from remittance is

net US$3.063 billion. In fact, since the 1980s, contrary to the popular belief, remittances sent

by the migrants played a much greater role in sustaining the economy of Bangladesh than the

garments sector.8 for the last two decades, remittances have been at levels of around 35% of

export earnings, making it the single largest source of foreign currency earner for the country.

This has been used in financing the import of capital goods and raw materials for industrial

development. In the year 1998-99, 22 percent of the official import bill was financed by

remittances (Afsar, 2000; Murshed, 2000 and Khan, 2003). The steady flow of remittances

has resolved the foreign exchange constraints, improved the balance of payments, and helped

increase the supply of national savings (Quibria 1986). Remittances also constituted a very

important source of the country’s development budget. In certain years in the 1990s

remittances’ contribution rose to more than 50 percent of the country’s development budget

Government of Bangladesh treats Foreign aid (confessional loan and grants) as an important

resource base of the country. However, remittances that Bangladesh received last year was

twice that of foreign aid. Remittances have played a major role in reducing the extent of the

country’s dependence on foreign aid.

The contribution of remittance to GDP has also grown from a meager 1 percent in 1977-

1978 to 5.2 percent in 1982-83. During the 1990s the ratio hovered around 4 percent.

However if one takes into account the unofficial flow of remittances, its contribution to GDP

would certainly be much higher. Murshed (2000) finds that an increase in remittance by

Taka 1 would result in an increase in national income by Tk 3.33. Following the expiry of

multi-fiber agreement (MFA), Bangladesh will face steep competition in export of RM.

The country will cease to enjoy any special quota. It is apprehended that Bangladesh’s RMG

export will decline sharply. This will result in loss of job of many workers and shortfall in

foreign exchange earnings. Potential of retaining employment and export earnings through

export of frozen fish, jute, leather and tea seems rather bleak.

It is in this context labor migration has become key sector for earning foreign exchange and

creating opportunities for employment. Therefore, the importance of migrant remittance to

the economy of Bangladesh can hardly be over emphasized. Methods of Transfer Migrants

use different methods in sending remittance involving both official and unofficial channels.

Officially, transfer of remittance takes place through

i) TT = Telegraphic Transfer.

ii) MT = Mail Transfer.

iii) FD = Foreign Drafts.

iv) PO = Payment Order.

v) TC = Travelers Cheque.

vi) EFT = Electronic Fund Transfer

ix) Foreign Currency Notes.

x) On line Remittances.

Hundi/ Money Courier is the most common among the unofficial channels of transfer. Hundi

refers to illegal transfer of resource outside the international or national legal foreign

currency transfer framework. Organized groups based in diverse cities such as London, New

York, Dubai, Kuala Lumpur and Singapore conducts hundi operation through their partners

in Bangladesh or From some countries remittances are sent by money gram. Besides this,

other unofficial methods are, sending remittance through departing friends and relatives;

personally hand carried by the senders themselves without declaration, and in the form of

visa/ work permit for sell or family use.

3.3.3 Role of different institutes and instruments involved in foreign remittance

Ministry of Finance

Ministry of Finance (MOF) is the prime policy making body regarding banking and

remittance. Macro-economic policies that affect exchange rate, monetary and fiscal

mechanisms, foreign exchange reserve etc. are regulated by this ministry. Bangladesh Bank

Bangladesh Bank (BB) is the central bank of Bangladesh. Among other powers and

functions, BB regulates scheduled bank activities, acts as a clearing-house, maintains foreign

exchange

Reserves and monitors floating exchange rate mechanism in the current accounts.

Bangladesh Bank encourages the nationalized and private banks to link up with foreign

banks and exchange houses in the destination countries. It has a separate department for

regulating and monitoring remittance entitled Foreign Exchange Policy Department

(FEPD). It also generates analyses, interprets and distributes data on inflow of remittance.

Nationalize Commercial Banks Nationalized Commercial Banks (NCBs) of Bangladesh

make direct banking facilities available at the doorsteps of Bangladeshi emigrants

especially in those countries where a large number of Bangladeshis are employed. Four

NCBs are deeply involved in remittance transfer. These are Sonali Bank, Janata Bank,

Agrani Bank and Bangladesh Krishi Bank (BKB). Among the NCBs, BKB is solely

targeted towards agricultural development in rural areas. Within Bangladesh these four

NCBs have 2945 branches.

Through them they can disburse remittances even in distant areas. Besides their own

branches, NCBs have opened exchange houses in joint collaboration with different banks and

financial institutions in different countries of the world. Private Commercial Banks Private

Commercial Banks (PCBs) is also involved in remittance transfer. Of the PCBs, Islami

Bank of Bangladesh Ltd. has been found to be most proactive in the area of migrants’

remittance. National Bank, International Finance and Investment Corporation (IFIC), Prime

Bank and Uttara Bank are other private banks involved in remittance transfer. Most of their