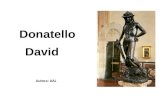

AAL June 2015

-

Upload

azura-international -

Category

Documents

-

view

221 -

download

0

description

Transcript of AAL June 2015

Pressure at the top

End of an era

Sky high growth

HONG KONG / GUANGZHOU

THAILAND

INDIA’S PHARMACEUTICALS

volume 1 • issue 3

JUNE 2015

asiaairlogistics.com

AAL June 2015 cover.indd 1 20/05/2015 21:22

June 2015

EditorRob CoppingerAssistant EditorJustin BurnsReporterJames MuirContributing EditorsTara CraigIsabel LestoHelen Massy-BeresfordLeithen FrancisClive SimpsonSales DirectorRosa BellancaDevelopment DirectorMichael SalesInternational Sales ExecutivesNova AbbottMartin KingwellMarketing Manager Kim Smith Finance Director Dawn JolleyDirectorsNorman Bamford •William Carr • Brian May

AZura InternationalRobert Denholm House,Bletchingley Road, Nutfield,Surrey RH1 4HW,United KingdomT +44 (0) 1737 645777F +44 (0) 1737 645888E [email protected] www.azurainternational.com

© AZura International 2015The views and opinions expressed in this publication are not necessarily those of the publishers. While every care is taken, the publishers cannot be held legally responsible for any errors in articles or advertisements. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by electronic, mechanical, photographic or other means without the prior consent of the publishers. USA: The publishers shall not be liable for losses, claims, damages or expenses arising out of or attributed to the contents of Asia Air Logistics, insofar as they are based on information, presentations, reports or data that have been publicly disseminated, furnished or otherwise communicated to Asia Air Logistics.

Translated by Shanghai Snap Printing Co Ltd.The photo on the front cover was provided by Saudi Arabian Airlines cargo division also known as Saudia Cargo.

NEWS

4 Modest March sets trend Freight tonne kilometres rise 1.6 per cent

6 IATA: Net, operating profit up Airlines’ financials improve in Q1

8 Double-digit rise for MASkargo Good news for Malaysian carrier 9 Changi pins hopes on US and Europe Those big economies speak volumes

10 HACTL sees 9% lower Q1 Chinese imports and exports fall

CONTENTS 3

June 2015 Asia Air logistics

Hong Kong / Guangzhou

Thailand

Air Cargo Handling 2015 preview

12

16

22

India’s pharmaceuticals

19

AAL Contents June 2015.indd 2 21/05/2015 15:40

4 NEWS

Asia Air logistics June 2015

A irfreight volumes grew modestly in March compared to the same month last year, according to the

International Air Transport Association (IATA).The association says freight tonne kilometres

(FTK) rose by 1.6 per cent on March 2015. This was a very different performance to the 11.7 per cent increase registered in February. However, IATA says the Lunar New Year timing and the US West coast sea port dispute skewed February’s results.

Available freight tonne kilometres (AFTK) rose by 3.2 per cent in March. In February, it rose by 7.4 per cent. The freight load factor was 47.9 percentage points in March, which com-pared with 46.5 percentage points in February.

FTK is up 5.3 per cent year-on-year (YOY). AFTK is up 4.7 per cent for the period. The freight load factor is 45.8 percentage points for the first three months of 2015.

IATA says that the performance for the first quarter of the year is, “in line with general glob-al economic trends,” but is slightly higher than the 4.5 per cent FTK growth that it anticipated in its December outlook report.

“The air cargo industry is on a solid but unspectacular growth trend. And there is little evidence today that would point towards an acceleration as the year goes on,” says IATA’s di-rector general and chief executive officer, Tony Tyler. Regions continue to perform at different

rates and Asia Pacific carriers saw two per cent FTK growth in March compared to March 2014, which was a sharp slowdown compared to growth of 20.5 per cent in February. Capacity expanded 3.9 per cent.

European airlines saw FTK decline 2.4 per cent in March on the same month last year as the impact of weak economies and Russian sanctions affected volumes. Capacity grew by 2.3 per cent. North American carriers saw 0.8 per cent FTK growth in March compared to March 2014.

IATA says there should be stronger growth in the region over the coming months. Capacity fell 3.1 per cent.

Middle East airlines continue to lead growth rates and saw FTK surge by 10.6 per cent, driven by network and capacity expansion. Capacity grew by 17.1 per cent.

Latin American carriers saw the biggest FTK fall of 6.4 per cent as Brazil and Argentina continue to struggle. Capacity expanded 3.3 per cent. African saw 2.4 per cent FTK growth. Capacity grew 0.5 per cent.

In the longer-term, IATA is urging govern-ments to remove barriers to trade. “World trade and air cargo are still growing, but only in line with industrial production.

Removing barriers to trade in line with the World Trade Organization Trade Facilitation Agreement would deliver a much needed boost to the global economy,” says Tyler.

THE INTERNATONAL AIR CARGO ASSOCI-ATION (TIACA) has appointed Delhi Interna-tional Airport head of cargo, Sanjiv Edward as its chairman, and Jan de Rijk Logistics chief executive officer, Sebastiaan Scholte as vice chairman. Edward and Scholte will take over from chairman, Oliver Evans, and vice chair-man, Enno Osinga. The chairman and vice chairman are elected by the TIACA Board for two year terms. They stood down at the TIA-CA annual general meeting in Miami (US) on 21 May. Evans is Swiss International Airlines chief cargo officer and Osinga is senior vice president for cargo at Amsterdam Airport Schiphol. Both are retiring in September. Edward says: “I am delighted to be taking up this position.” Scholte says: “TIACA has a vital role to play representing all sectors of the air cargo supply chain.”

HONG KONG INTERNATONAL AIRPORT (HKIA) has seen cargo volumes fall by 8.2 per cent year-on-year (YOY) in March to 364,000 tonnes because of falling exports. The airport says the drop was caused by exports falling 16 per cent YOY, and transshipments were also down by one per cent. Imports rose by two per cent YOY. HKIA says North America was its strongest region. In March 2014 it handled 397,000 tonnes. In January 2015, cargo volumes rose by 1.6 per cent YOY to 356,000 tonnes followed by a 22.6 per cent YOY increase in February to 303,000 tonnes. During the first two months of 2015, exports rose by 12 per cent and transshipments were up by 10 per cent. In the first quarter of 2015, HKIA handled one million tonnes, up 2.9 per cent on the same period of 2014. Since April 2014, it has handled 4.4 million tonnes of cargo, up 5.5 per cent.

Modest March sets trend

n n n

AAL news June 2015.indd 1 21/05/2015 19:42

Asia Air logistics June 2015

6 NEWS

THE Thailand airfreight industry is set to speed up its adoption of electronic air way-bills (e-AWB), according to organisers of an e-freight workshop held in Bangkok in April. Bangkok Flight Services (BFS) and Worldwide Information Network say the event was attended by airlines, and independent and multinational forwarder members of local as-sociations. These included the Thai Airfreight Forwarders Association (TAFA) and the Thai International Freight Forwarders Association (TIFFA). The workshop focused on steps each participant can take this year to move Thailand up the ranks to become a leader in e-AWB adoption. BFS general manager, David Ambridge, says the workshop attracted more than 50 attendees and has prompted de-mand for a second session to accommodate the level of interest. He adds: “Collaboration like this is the future not only for e-AWB but for many other issues we face in the air cargo industry.

THE National Association of Freight Logis-tics (NAFL) has signed a memorandum of understandings (MoU) with the Federation of Freight Forwarders Associations in India and the Association of Multimodal Transport Operators of India, to help trade between In-dia and the United Arab Emirates. The MoUs were signed at the International Federation of Freight Forwarders Associations Region Africa and Middle East (RAME) conference in Dubai. The agreements are designed to create a framework of cooperation between India and the UAE and expand trade. It is based on the trade corridor between the In-dian subcontinent and Africa, via the Middle East. NAFL president, David Phillips says: “This trade corridor is vibrant and exciting. RAME is by itself a very vibrant business corridor. India is now a trade power house.”

Emirates SkyCargo was expecting to conclude deals with global freight forwarder players and was seeking

airlines for partnerships at the seventh Air Cargo Europe exhibition and conference in Munich (Germany) in early May.

The United Arab Emirates carrier spoke to freight forwarders and business partners at the show. Emirates’ divisional senior vice president for cargo, Nabil Sultan (see picture), about the airline’s plans for the show and beyond. He

says: “We expect a couple of deals that we’ll sign with key partners.” He adds that he is seek-ing special prorate agreemment partnerships with, “a couple of airlines,” n some routes.

One objective was to convey to pharma shippers that Emirates’ facilities at Dubai World Central (DWC) can protect sensitive medical products from the region’s high temperatures. Sultan also spoke to freight forwarders who deal with automotive and other industries to eplxain to them the capabilities of SkyCargo’s new freight facility. Contact with German freight forwarders during Air Cargo Europe week was another goal.

In May 2014, Emirates move its cargo opera-tiosn to DWC. Sultan refers to the facility there as, “superb,” and says his airline has already started accepting and delivering cargo for the local market. The facility can handle 750,000 tonnes annually. The goal is to increase its annual capacity to about one million tonnes .

Airline financial performance is “improving strongly” at both an operating and net profit level, according to the International Air

Transport Association (IATA).The association has published its March-April

Airlines Financial Monitor report, in which it sampled the initial first quarter (Q1) financial and operating performances of 25 airlines across the globe.

The carriers sampled posted a combined operating profit of $5.7 billion and net post-tax profit of $3.9 billion in Q1. This compares with operating profit of $256 million and a net post-tax profit of minus $1 billion in Q1 2014. IATA says: “This was driven by North American airlines, where consolidation and cost cutting has resulted in a significant boost to profita-bility and lower fuel costs. Asia Pacific airlines have also improved on a year ago. Chinese carriers have recorded solid Q1 2015 profit results, owing to strong demand and improved operational efficiency.”

The 12 North America airlines sampled had a net post-tax profit of $356 million. The six

carriers in Asia Pacific had a net post-tax profit of $230 million. But, the two airlines sampled in Latin America had a net post-tax profit of mi-nus $35 million and the five carriers in Europe had a net post-tax profit of minus $1.5 billion. The report says, worldwide, airline shares fell 1.5 per cent in April, which was in response to the strength of the US dollar, but are still up 23 per cent on a year ago. IATA says crude oil prices also rose 20 per cent in May, compared to the March low of around $50 a barrel, which has impacted financial performance. As report-ed last week in Air Cargo Week, the monitor re-port says volumes rose steadily in March after a surge in February due to temporary factors, but still above the figures in January. IATA explains that in March, freight tonne kilometres (FTKs) rose by 1.6 per cent compared to March 2014. This was a significant drop on the 11.7 per cent rise in February this year. The association says capacity decreased in March, which was con-sistent with the moderation in FTK volumes. Available freight tonne kilometres increased 3.2 per cent on March 2014 compared to the 7.4 per cent rise in February.

Emirates seeks prorate deal

IATA: Net, operating profit up

n n n

AAL news June 2015.indd 3 21/05/2015 19:42

Asia Air logistics June 2015

8 NEWS

Cathay Pacific Cargo is the latest carrier to ban shipments of UN3480 lithium ion (li-ion) batter-ies, because of safety concerns, from 15 April.

The airline’s decision follows Qantas Freight, American Airlines Cargo, United Cargo, Delta Air Lines and Emirates SkyCargo, who have all banned the batteries over the last few months. Cathay Pacific has suspended the carriage of UN3480 lithium ion (li-ion) batteries on both passenger and cargo aircraft. This change it says will not affect cargo containing batteries and equipment UN 3481 and UN 3091.

The airline explains: “Safety is our number one priority, and we will continuously assess the risk of articles we accept and load on board our aircraft and implement any necessary mitigation measures.” Cathay Pacific says it has made the decision after considering a paper that was submitted by the International Coordination Council for Aerospace Industry Association and International Federation of Air-line Pilots Association to the International Civil Aviation Organisation. The paper recommend-ed the banning of UN3480 li-ion batteries until such time as improved packing and shipping requirements can be developed.

MASkargo’s airfreight throughput at Kuala Lumpur International Airport increased by 11.5 per cent in the first quarter of 2015.The operator says volumes

climbed to 154,000 tonnes of cargo in the first three months of the year, which compares to the 138,254 that was recorded in the first quarter of 2014.

The best perfoming month was March when 58,211 tonnes were handled. In February, the figure was 48,512 and in January it was 47,485. Other airports across Malaysia, which MASkar-go handles cargo at, also saw volumes rise during the year’s first quarter.

Penang International Airport’s MASkargo volumes increased to 21,480 tonnes for the first quarter, an eight per cent rise on the 20,000 that was registered in the same period in 2014. At Kota Kinabalu International Airport MASkargo handled 4,902 tonnes in the first three months of the year. This was a 21 per cent surge on the 3,900 tonnes that was

handled during the quarter in 2014. Kuching International Airport also saw an increase to 3,702 tonnes for MASkargo, which was a 17 per cent rise on the 3,200 processed in the same quarter in 2014. Senai International Airport handled 430 tonnes, on behalf of MASkargo, down on the 510 last year. This year, MASkargo says that it, along with industry partners, led the expansion of the International Air Transport Association’s (IATA) secure freight programme; an initiative to promote global air cargo supply chain security standards.

This, it explains, aims to develop a secure supply chain programme and to strengthen air cargo security across countries in the South East Asian region. As MASkargo is the cargo division of Malaysia Airlines, it operates sched-uled freighter services and bellyhold capacity. MASkargo operates four Airbus A330-200 Freighters and two Boeing 747-400 Freight-ers. At its 108-acre complex in Kuala Lumpur, MASKargo has the capacity for one million tonnes a year.

Double-digit rise for MASkargo

Cathay bans lithium-ion batteries

QATAR AIRWAYS CARGO is focusing its growth strategy on building both its freighter and bellyhold cargo volumes rather than just one like some operators.

The carrier’s chief officer for cargo, Ul-rich Ogiermann, says it allows the airline to reach every market where there are opportunities. “We have global coverage by increasing freighter and bellyhold. If you only operate bellyhold capacity you are cutting yourself off from certain markets. Freighters are needed to some markets,” he explains.

Examples of where the carrier is seeing strong demand for freighters he says are in moving aircraft engines, and transporting animals such as horses to equestrian events.

The key market Ogiermann says for Qatar is Asia, and China is going through a “restructuring phase” and growth rates have slowed. He says there are oppor-tunities in Africa, and Lagos (Nigeria) and Accra (Ghana) are performing well. “We are looking at more destinations in Africa and by using the Airbus A330 we can open up new markets,” he explains. Qatar started a freighter service to Los Angeles International Airport in April, which Ogiermann says is performing strongly. The carrier is growing its bel-lyhold routes to the US and on Monday May 4 announced it will operate flights to Los Angeles, Boston and Atlanta next year. He says the airline is also thinking of upgrading capacity on the freighter route into Basel (Switzerland), which was launched in January, as the pharma-fo-cused route has been a success.

Another change Ogiermann says has benefitted the carrier is a new sales tac-tic, by moving away from using general sales agents (GSA) in some markets. “We changed the way we did things in some markets last year and did it ourselves.”

Dual bellyhold, freighter strategy

AAL news June 2015.indd 5 21/05/2015 19:42

June 2015 Asia Air logistics

NEWS 9

Changi Airport is expecting its April volume figures to be better than March, when cargo fell 4.2 per cent to 162,700 tonnes, because its partners at the gateway are reporting an improvement in traffic.Speaking at the seventh Air Cargo Europe exhibition and

conference in Munich (Germany) in early May, Changi Airport Group cargo, logistics development assistant vice president, James Fong (see picture), spoke about the traffic growth and his teams’ work at the show.

“April should be slightly better. Looking at the first quarter we had positive growth, we are happy with that.” Fong sees the US as key to stabilising future growth and he hopes that the demand seen from the US economy continues, beyond the distortion caused by the West coast sea port dispute. “The US economy is driving consumption. The economy is doing well. The port situation was temporary,” Fong adds.

He also has hopes for the European economy. “Look at the long term,” he says, “in the next 12 to 18 months we expect Europe to come back with its consumption power. Sooner or later Europe will come back.”

Changi’s traffic results have showed that Australia, Thailand and the

US are strong sources of demand. Fong says that growth from Australia was five to 10 per cent. The shipments range from consumer electronics going to Australia to live cattle and meat and vegetables from the South-ern continent. From Thailand, Fong sees growth that is only returning the country’s exports and imports to what they had been. Because of the country’s political turmoil with the miltary coup last year, traffic from the nation had shrunk. He adds that, meanwhile, the intra-Asian traffic is doing, “relatively well”. Changi is also benefitting from demand from North East Asia and South East Asia.

Changi Airport pins hopes on US and Europe

WWW.AVIATIONPLUS.AERO

YO U R I N D E P E N D E N T G S S A

We are a dynamic team of local professionals, providing our clients with advanced market intelligence, and our target is to perform beyond customer satisfaction. AviationPlus, Your Plus in Aviation.

HEAD OFFICEAviationPlus B.V. • Amsterdam Airport

Uiverweg 21118 DS AmsterdamThe Netherlands

T +31 (0)20 648 4861F +31 (0)20 648 [email protected]

OFFICESAmsterdam • Brussels • Budapest • CopenhagenFrankfurt • London • Malmö • Milan • Oslo • ParisStockholm

AAL news June 2015.indd 6 21/05/2015 19:42

Asia Air logistics June 2015

10 NEWS

ASIA PACIFIC airlines have seen freight tonne kilometres (FTK) growth slow to 1.7 per cent in March after two months of strong surges, according to the Association of Asia Pacific Airlines (AAPA).

In March, the FTKs reached 5.9 billion, up on the same month in 2014 when the region saw 5.8 billion. Last March, the available freight tonne kilometres (AFTK) increased by 2.4 per cent to 8.6 billion, compared to the same month last year when it was 8.4 billion. This FTK increase resulted in a 0.4 percentage point decline in the average international freight load factor to 68.3 per cent, compared to March 2014.

In March, the FTK was up on the 4.8 billion that was recorded in February. The 8.6 billion AFTK was up on the 7.4 billion in February. The March load factor was an increase of 3.1 percentage points on the 65.2 per cent in February. However, March growth was slower than the February FTK result, when it surged by 20.6 per cent, compared to the same month in 2014, and in January, when FTK increased by six per cent on the beginning of 2014. For the first two months of the year airfreight demand rose by a total of 12.6 per cent. AAPA says that for the first quarter, FTKs reached 16 billion, an 8.4 per cent increase on the 14.7 billion posted in the same period in 2014. The AFTK figure for the first quarter was 24.5 billion, which was a 6.1 per cent rise on the 23.1 billion in the first three months of 2014. The average load factor for the first quarter was 65.1 per cent, 1.4 percentage points up on the 63.7 per cent for the same period in 2014.

AAPA director general, Andrew Herd-man, says: “Airlines remain very focused on carefully managing costs, whilst optimising their route networks to better serve faster growing markets. For many airlines, restoring profitability is the key to sustaining contin-ued investment for the future.” In 2014, AAPA says the FTK in the region rose on 2013 by 5.4 per cent to 63.2 billion.

C hangi Airport has seen cargo volumes increase by 0.8 per cent to 450,400 tonnes in the first quarter of 2015,

despite a 4.2 per cent decline in March.Ths year cargo volumes were highest in

March, handling 162,700 tonnes, but this was also the biggest year-on-year (YOY) decline, of 4.2 per cent from 169,700 tonnes.

This follows YOY increases of one per cent to 150,300 tonnes in January, and of 7.3 per cent in February to 136,000 tonnes. Changi says there was a 4.7 per cent increase in traffic to South Asia.

Changi Airport Group (CAG) assistant vice president of cargo and logistics development, James Fong says: “Across the board, air cargo movements at most major hubs in Asia Pacific saw declines in March 2015.

“In tandem, air cargo volumes between

Singapore and our key trading countries also dipped, with the exception of Australia, USA and Thailand.”

Changi is to extend its rebates until 31 March 2016. The rebates are to encourage new and existing operators to use the airport. The airport extended the 50 per cent rebate for freighters until 30 September, after this it will be 30 per cent until 31 March 2016.

It says it will extend incentives for cargo agents at the Changi Airfreight Centre until 31 March 2016.

The 50 per cent parking fee and 15 per cent aerobridge fee rebate will be extended to 31 March 2017.

The airport also says it will reduce landing fees by five per cent for larger aircraft weighing over 360 tonnes, such as the Airbus A380 from 1 May 2015.

This year started tracking 2014 in terms of volumes through Hong Kong Air Cargo Terminal (HACTL), but March and April saw a slow down, according to HACTL chief

executive, Mark Whitehead.This slow down means that the first quarter

is about nine per cent lower than 2014. Whitehead sees this as due to Chinese imports and exports and linked to the timing of the country’s Lunar New Year celebrations, which fell in February.

He says, “this is not anything to be con-cerned about,” explaining that its linked to actions by the Chinese government and that China’s migrant worker population leaves the cities. They go back to the countryside for a holiday of about two weeks.

After the demand peak that occurs just before the New Year holiday, the migration and time in the countryside leads to a demand fall off. Whitehead refers to this as the, “regional fall off”. This year, the late February New Year meant that that holiday extended into March.

Whtehead also points to the purchasing managers index, which he says has dipped below 50 points. This is the first time it has been below 50 for some time”. The fall in this

indicator for demand, Whitehead, hopes, is, “just a dip”. Another factor may be the reduced annual growth levels the Chinese government has announced, with predictions of seven per cent per year instead of the historic 10 per cent. Whitehead points to the World Bank’s calculation that Chinese annual growth will be more like six per cent.

Beyond China, Whitehead says that the US economy, “has held up”, while European, “trade flows...are down. Volumes to and from Europe are not in growth territory.”

While China has apparently had an import and export slow down, Whitehead still identi-fies mainland Chinese carriers as airlines doing well. “We are seeing increased tonnage for Gulf carriers and mainland Chinese carriers,” he says.

Turning away from the macroeconomic situation, Whitehead spoke about, “maximising efficiencies.” HACTL has developed a smart-phone app that allows truck drivers to get flight details and loadng dock areas on their handsets. “It makes it more efficient,” he says. “We still employ 120 [information technology] IT experts and we had 180,” when the airport was developing the latest version of its IT platform.

HACTL sees 9% lower Q1

First quarter rise of 0.8% for Changi

n n n

Slower March for Asia Pacific

AAL news June 2015.indd 7 21/05/2015 19:42

Asia Air logistics June 2015

12 FEATURE HONG KONG / GUANGZHOU

Hong Kong International Airport is the world’s busiest air cargo gateway. However, other Chinese airports are growing their freight and Guangzhou and Shenzhen airports are expanding their footprint.

Hong Kong International Airport (HKIA) has been the world’s busiest cargo airport in terms of total tonnage since 2010. Last year, it handled 4.38 million tonnes of cargo and more than 390,000 flight movements. Since the modern gateway commenced operations in 1998, the upward curve of its air cargo throughput has been dramatic: traffic growth has soared by nearly 170 per cent over the past 16 years. It is connected to about 180 destinations worldwide, including 45 links on the Chinese mainland, and it handles about 1,100 flights a day operated by over 100 airlines.

The air cargo that passes through HKIA represents a large proportion of the city’s trade. In 2013, air cargo constituted less than two per cent of Hong Kong’s total freight volume by weight, but accounted for nearly 40 per cent of its total value. And when, last year, HKIA handled record air cargo volumes, this throughput accounted for 39 per cent of the total value of Hong Kong’s external trade, or 3,062 billion Hong Kong dollars ($395 billion).

Furthermore, HKIA’s aviation demand is expected to continue growing over the next 20 years. According to IATA Consulting’s forecasts, HKIA air cargo throughput will reach 8.9 million tonnes by 2030, boosted by an average annual growth rate of about four per cent.

This year’s air cargo traffic growth has been just a little slower. In March, volumes were down by 8.2 per cent year-on-year to 364,000 tonnes, as export traffic fell. However, cargo throughput over the course of the first quarter of 2015 was up by 2.9 per cent over the same period of 2014, reaching a million tonnes.

That positive long term trend, combined with a slight slowdown in the first months of 2015, is also being witnessed by HKIA-headquartered airfreight handler Hong Kong Air Cargo Terminals Limited (HACTL). Air cargo volumes passing through its its SuperTerminal 1, which can handle up to 3.5 million tonnes of cargo a year, over the first two months of this year were similar to those of 2014. February was a better month in 2015 due to the timing of Chinese New Year, which fell towards the end of that month. A fundamental contributor to the airport’s freight traffic is Cathay Pacific and, says director cargo James Woodrow, the carrier has seen a pretty positive start to this year. “For the trans-Pacific trade lanes, the slowdown in work through the US West coast ports has helped us start the year well,” he observes. “The effects of this are continuing in the second quarter on a diminishing scale, but we hope that the underlying strength of the US economy can ensure a good year for our trans-Pacific business.” From a regional perspective, intra-Asia volumes are still holding up well, although tough competition is continuing to put pressure on

rates. There has been particularly fierce competition on routes from Asia to Europe, and the overall weakness of European economies harnessed to a depreciating euro has put pressure on Asian exports to Europe. However, on the return leg European exports have been assisted by the weakened currency. Moreover, the lower fuel price that has helped boost the profitability of many airlines, has also had its positive effect on Cathay Pacific, Woodrow notes.

The long term forecasts are positive, but, there is a potential for traffic to be diverted away to those expanding mainland China gateways. And as HACTL’s chief executive, Mark Whitehead, warns, because of the fact that, with very few exceptions, the major long haul carriers already fly to Hong Kong. Still, the airport and its stakeholders continue to invest in growth. Cathay Pacific, for example, opened the 2.7 million tonne capacity Cathay Pacific Cargo Terminal (CPCT) in September 2013 and this facility has further added to the capabilities of HKIA.

CPCT is operated by Cathay Pacific Services Limited (CPSL), a subsidiary of Cathay Pacific. Over the course of 2014, CPSL’s first full year of operations, it handled 1.4 million tonnes of cargo, the freight of Cathay Pacific, Dragonair and Air Hong Kong, as well as new customers introduced beyond the Cathay family. These are, the AirAsia airline group and Royal Brunei. In January this year, it began handling the cargo of EVA Air in the CPCT facility, while it has also begun ramp handling for some of Cathay Pacific’s and FedEx’s freighters at HKIA. CPSL has played its part in handling the increasing freight volumes being processed at HKIA and CPSL chief executive Kelvin Ko is confident that last year’s cargo recovery will continue for the foreseeable future. The first quarter of this year has been, “a good start, very promising”, he suggests.

Pressure at the

TOP

KO

A good start, very promising [for 2015]

AAL June HK Guangzhou feature pp12-13.indd 1 19/05/2015 14:54

Asia Air logistics June 2015

14 FEATURE HONG KONG / GUANGZHOU

Key to continuing to expand capacity will be further investment in facilities and infrastructure at HKIA, and plans to build a third runway. The growth of freighter services and general cargo throughput at HKIA now requires what the Airport Authority Hong Kong (AAHK) describes as, “an expedited development of the associated airport infrastructure, including a timely expansion of cargo aprons to address the ever-growing parking demands of freighters.” Due to the growth, HKIA’s capacity is expected to be reached between 2016 and 2017, one to three years earlier than forecast, the airport authority predicts.

A total of 28 new parking stands at the western side of the apron had already been added by February, along with a new tunnel under the South runway that connects to the existing cargo terminals, while HKIA’s Midfield development is underway. Midfield will see a new passenger concourse with 20 parking stands added by the end of 2015 and, in the long run, the authority’s plan is to transform HKIA into a three-runway system (3RS). The authority’s hope is that the 3RS will allow the gateway to handle the 8.9 million tonnes of cargo and 607,000 flight movements predicted for 2030.

The Hong Kong government’s director of environmental protection has approved the environmental impact assessment report and issued an environmental permit for the proposed expansion. With the government’s executive council affirming the need for expanding the airport into a 3RS on 17 March, the airport authority says it is continuing the preparatory work, with the aim of having the runways fully operational by 2023.Woodrow says: “The final piece in the jigsaw is the much-needed third runway.”

Whitehead adds: “The third runway is vital to Hong Kong’s continuing success. If carriers start to feel that their growth is being inhibited, or that their passengers are inconvenienced by holding for landing slots at peak times, then we could see carriers defecting to alternatives in the Pearl River Delta (PRD). That would be disastrous for the Hong Kong economy, where the logistics business as a whole and HKIA are one of the four key industry sectors.”

HACTL is not the only enterprise offering road feeder service connections. CPSL is supporting HKIA’s role in handling cargo consolidation for shipments moving through the entire region by providing of its own trucking service into Shenzhen and further inland. Called Cross-Border Express (CBX) and launched in January this year, customers pay per kilo rather than by truckload. Guangzhou, once known as Canton, lies about

120 kilometres to the North of Hong Kong, up the Zhujiang, better known as the Pearl River. It is the capital and largest city of Guangdong province and its primary airport, Guangzhou Baiyun International, located north of the city, is the country’s third busiest airfreight gateway. But, it is only one of two serving the city and surrounding area. Between Guangzhou city centre and Hong Kong is Shenzhen, which is itself served by a busy airport, Shenzhen Bao’an International. Both these airports are welcoming new operators, and they have also been chosen to play host to a number of large Chinese carriers, whether bellyhold or freighter operators.

HKIA has chosen to work with these airports, as well as to compete with them. For example, in 2009, five regional airports, HKIA, Shenzhen, Guangzhou, Zhuhai and Macau, all signed the action agenda for greater Pearl River delta region airports, to implement the framework for PRD’s development and reform planning.

Equally important is co-operation between the air traffic controllers managing air space over Hong Kong and southern China, Whitehead insists. Meanwhile, other transport links continue to improve connectivity between these gateways. The Hong Kong to Zhuhai and Macau bridge is scheduled to open in 2017, and it will open up the western part of the PRD and improve the transport links from the western PRD to Hong Kong. That should further facilitate cross border trucking and the cargo feeding from southern China into Hong Kong.

Another significant development has been the creation of the Guangdong Free Trade Zone (FTZ), which came into existence in the first quarter of this year. The FTZ, coupled with the province’s improving infrastructure, means that there will be much more flexibility within the region in terms of what is produced and where, and how traffic arrives in and departs from major production centres, Whitehead suggests. Point-to-point traffic to locations such as these three, alongside Guangzhou and Shenzhen as well as to the even bigger airports at Shanghai and Beijing, is likely to continue to grow as the Chinese population and economy expand. Some of those airports are well able to handle transshipment traffic destined for further afield, but none have the connectivity and the frequencies of HKIA, CPSL’s Ko notes. Given the efficiency for which HKIA is well known, it may be some time yet before it is ready to give up that number one position in the international air cargo standings.

WHITEHEAD

The third runway is vital to Hong Kong’s continuing success

AAL June HK Guangzhou feature pp14-15.indd 1 20/05/2015 21:27

Asia Air logistics June 2015

16 FEATURE THAILAND

These are turbulent times for Thai Airways and despite its slogan all is not “as smooth as silk”. Thailand’s flag carrier, once hailed as among the best in Asia, is going through a rough patch. At the end of March, Thai Airways gave up its cargo business, the latest setback for a company which many around the world regarded as the face of Thailand.

As part of its restructuring plans, the airline terminated its remaining freight service from Bangkok to Delhi, Frankfurt and Amsterdam. In the face of growing competition in the cargo business Thai scaled back its operations and in the last couple of years only used two Boeing 747-400 converted freighters. Earlier when the freight business was brisk Thai supplemented its cargo fleet with Boeing 777 Freighters. The exit from the freighter sector comes at a time of big losses for the company. There was more bad news for the flagship carrier, which found itself in debts of about $5.9 billion, the highest in the region, and it has seen seven consecutive months of losses.

Thai Airways was once a big hitter in the cargo market, but the economic downturn has taken a toll as airfreight exports have declined. Bangkok Flight Services states that exports were down four per cent in February year-on-year.

With the last global financial crisis, mounting losses and with Thailand’s military coup last year, along with its struggling economy, it all amounted to the slow demise of the airline’s cargo market. Across the board, cargo traffic fell by 4.2 per cent on 2014 figures. The average freight load factor was 50.5 per cent, a decrease from last year’s 51.1 per cent. Revenue totalled just over $5 billion, which is an 8.7 per cent drop. But that, and the axing of the cargo business, are not the only blows for the Thai carrier.

The International Civil Aviation Organisation (ICAO) raised safety concerns over non-compliance and the issue of operators’ certificates in Thailand. The ICAO report resulted in China, South Korea and Japan ordering bans on new charter and scheduled flights from Thailand.

However, the loss-making carrier plans to boost its finances. Thai Airway’s president, Charamporn Jotikasthira, has said that the airline plans to cut costs and capacity of its fleet by around 20 per cent, adding that finances should improve after more cost cuts in 2016. The next step for Thai Airway will to be adjusting its fleet by decommissioning ageing aircraft, and reducing the number of types from 11 to eight. The airline will stop Airbus A340-600 services and decommission its four Airbus A330-300s as it plans to sell 22 aircraft by July.

There are also plans to restructure its routes during the year, a process which started on 29 March. The airline suspended its Bangkok to Moscow

and Phuket (Thailand) to Seoul routes and it also halted loss making routes, such as day flights to London and Frankfurt (Germany). There are plans to suspend operations to Madrid on 5 September. The most intense competition is on the Asia to Europe routes, forcing Thai Airways earlier to stop flights to Moscow and Madrid and reduce frequencies to London. Competition from Gulf carriers has been blamed. Buoyed by oil money, airlines operated by the Gulf states are posing a major challenge to their Asian counterparts. And Thai Airways had minimal presence in North American, compared to other Asian pacific freight divisions. Thai Airways could re-enter the freighter sector if future market conditions call for an increase in demand.

But, Thai Airways decision to stop its freight services, which was once a large regional carrier, will give other competitors the edge as other airlines are seeing healthy profits in the region. For example, Hong Kong’s Cathay Pacific has invested heavily in cargo and Cathay has seen a 20 per cent increase of profit. Cargo revenues were up in the middle of 2014, which provided the company with a strong fourth quarter. The Changi Airport Group reports that in the first quarter airfreight movements rose by a nominal 0.8 per cent to reach 450,400 tonnes. Overall, Changi added that traffic was weaker across most regions, although the South Asia Pacific region stood out in the quarter with a 4.7 per cent increase. Regional peers such as Singapore Airlines operate more dedicated freighters and also have a much larger presence with passenger flights. Australia’s Qantas Airways has a well-established customer base with freight services in Thailand since 2008.

Qantas Freight’s freight executive manager, Ali Webster, points out that his carrier has demonstrated a long-standing commitment to the Thai market, operating bellyhold services to the region for more than 60 years. “We have a stable and committed customer base and look forward to fostering these partnerships into the future,” Webster says. Their air cargo services uses the bellyhold capacity of Qantas and low cost airline Jetstar. This includes 11 services a week from Australia to Bangkok and six services per week from Australia to Phuket. Webster adds: “We also market the belly space capacity on Jetstar Asia services, with multiple services operating from Singapore to Bangkok and Phuket each week.”

eraEnd of an

AAL June Thailand feature pp16-17.indd 1 19/05/2015 19:45

Asia Air logistics June 2015

18 FEATURE THAILAND

(Continued from page 17) As well as freight capacity on bellyhold services, Qantas Freight operates two Boeing 747 Freighter services from Australia to Bangkok per week and these services continue onwards to China, USA and Australia.

However, German carrier Lufthansa’s cargo wing is taking a cautious approach to the Thai market, despite seeing good business opportunities this year. “We are confident that 2015 will be a good year for us in Thailand,” says Lufthansa’s South East Asia regional director, Frank Beilner, “However, we are not fooled to believe that success will come easily in times where competition is as tough as it has ever been.”

The German airline says volumes were up from the previous year, adding that it is confident that it is able to draw in customers especially in the premium and specials segments of the market. Beilner points out that Lufthansa Cargo has been serving customers in the Thai market for decades and it remains committed to this history of service. He is certain that it will be one of the stable and reliable partners to the air cargo industry in Thailand. Germany’s flagship carrier’s freight arm adds that it doesn’t operate regular freighters in the Thai market since the influx of belly capacity into these markets makes regular freighter operations commercially unsustainable in their eyes.

Beilner notes that there are severe challenges in the Thai market and regarding Thai Airways, he says: “We respect Thai Airways as a serious competitor and still believe their extensive belly network is a factor to look out for in the market.” Lufthansa Cargo reported an annual

operating profit of $106 million for 2014, up 26.6 per cent compared to an operating profit of 79 million euros for 2013. But, overall in the Asia Pacific region, freight volumes were flat year-on-year, falling by 0.1 per cent. Capacity was cut by 1.4 per cent and cargo tonne kilometres fell by 2.4 per cent

Meanwhile, EVA Air Cargo, is expanding out to Thailand after launching its EVA Pharmacare Service in collaboration with Envirotainer, a company that manufactures and leases active, temperature controlled containers. Initial services will also include cities in Europe and Asian markets such as Singapore and Taiwan.

The focus will be on high value goods, including biologicals, pharmaceuticals, vaccines, healthcare products, high-end foods and high-tech semiconductor components.

Other moves freight industries in Thailand are doing what they can to get business to invest in e-freight. Companies such as the Thai Airfreight Forwarders Association and the Thai International Freight Forwarders Association took up workshops and seminars organised by air cargo handler Bangkok Flight Services and technology specialist Worldwide Information Network to look into adopting electronic air waybills.

The workshops held in Bangkok were hailed a success, attracting more than 50 attendees and more seminars will be held, which shows the level of interest into global connectivity for freight forwarders. Bangkok Flight Services, a handler at Bangkok Airport, predicts more collaboration in the future, not just in connectivity, but also on other challenges faced by the air cargo industry. Bangkok Flight Services is expecting a couple of European airlines to join its workshops as well.

So what is next for the region? The International Air Transport Association found a modest growth in the airfreight market in March, but overall Asia Pacific carriers should be cautious.

Carriers in the Asia Pacific region recorded a slowdown in March, according to the association, with a rise of just two per cent. February saw a 20.5 per cent rise, but one reason was that month coincided with the Lunar New Year holiday.

The association says the drop also reflects economic weakness in Europe, which impacts demand for manufactured goods shipped by Asia Pacific carriers. It predicts that the robust trend for Asia Pacific cargo could come under downward pressure from weakness in regional trade volumes, which appears to be reversing after strong gains in late 2014.

AAL June Thailand India feature pp18-19.indd 1 19/05/2015 21:48

India boasts the world’s third largest pharmaceuticals market in terms of volume, and the thirteenth largest in terms of value, according to IBEF, the India Brand Equity Foundation. As the country’s fourth largest export sector, behind IT, IT-enabled services, telecommunications and electronic, it holds enormous potential for the air cargo business.

And the figures are encouraging. In the financial year 2014, India’s annual pharmaceutical exports were worth $14.9 million, slightly ahead of the country’s domestic pharma market, which accounted for $14 million, according to Pharmexil, the Pharmaceutical Exports Promotion Council of India.

Last year saw year-on-year growth of two per cent. Pharma exports have increased by 14 per cent from 2009 to 2010 and from 2013 to 2014, Pharmexil tells Asia Air Logistics. Indian pharma is especially strong in the field of generics. “Indian manufacturers have been among the first to synthesise generic alternatives to the old drugs as they came off patent, and have rapidly established themselves as major players in the global pharmaceutical industry”, explains IAG Cargo India and Asia Paciifc regional commercial manager, John Cheetham. “As a result we have seen strong flows from India to destinations around the world and between 2013 and 2014, constant climate volumes in India increased by over 50 per cent.”

The closely related biotechnology sector is also booming in India. IBEF says that it is growing at an annual rate of 20 per cent, and is expected to be worth S7 billion by the end of 2016. Bio-pharma accounts for 62 per cent of total biotechnology revenue. The traditional pharmaceutical sector in India is extremely fragmented, with more than 20,000 registered firms, of varying sizes. Indian pharma benefits from a skilled and qualified workforce, and has already made inroads globally in the supply of generic drugs, in particular.

Government backing has helped the sector at every level. In March, the minister of state in the Ministry of Commerce and Industry, Nirmala Sitharaman, announced that the government is, “taking measures to promote exports by small and medium pharmaceutical manufacturers.”

This help includes financial assistance and market access initiative schemes. Also adding to growth and potential development is the trend for mergers and acquisitions, the most recent being Sun Pharma’s merger with Ranbaxy, announced on 25 March.

Established Western pharma and biotech firms are also acquiring India businesses. They are investing in plants, infrastructure and safety standards there, and not only increasing the volume of exports, but expanding their geographical reach. According to IBEF, “the total cumulative foreign direct investment in the sector $10.3 billion during the period April 2000 to March 2013’.”

While the flow of products is primarily from East to West, Amsterdam Schiphol Airport’s business development director Bart Pouwels tells Asia Air Logistics that airfreight capacity from India to western Europe is twice that in the opposite direction. “Source airports are (in order of ranking) Delhi, Mumbai and Madras,” Pouwels adds.

Indian pharmaceutical products are already exported to more than 200 countries. The top destination is North America, which accounts for 28 per cent, followed by Africa and Europe, which account for 19 per cent and 18.5 per cent, respectively.

John Cheetham adds Latin America to the list, saying that it, “has quickly emerged as one of the major destinations for Indian pharmaceutical products over the past few years, as these high growth markets are particularly susceptible to the low price points of generics.”

To cater for this, IAG Cargo has significantly boosted its constant climate network in the region. It now boasts 15 stations, making it one of the most extensive in Latin America.

The network was created specifically, “to support the trade in temperature sensitive pharmaceuticals”. Its newest constant climate stations are at José Joaquín de Olmedo International Airport and Mariscal Sucre International Airport.

for Indian pharmaSky high growth

June 2015 Asia Air logistics

FEATURE INDIA’S PHARMACEUTICALS 19

AAL June Thailand India feature pp18-19.indd 2 19/05/2015 21:48

Asia Air logistics June 2015

20 FEATURE INDIA’S PHARMACEUTICALS

“Indian pharmaceutical companies can connect to Latin America and other global pharmaceutical markets through any of our five widebody gateways out of India, Mumbai, Hyderabad, Chennai, Delhi and Bangalore. These gateways connect with our London hub, home to our constant climate centre, which is dedicated to high-value pharmaceuticals, Cheetham adds.

Despite its size, ambitions, and the rate at which it is growing, the air cargo sector has yet to fully capitalise on the potential of India’s pharmaceutical industry. According to Pharmexil, at present just 45 per cent of India’s pharma exports are transported by air. There are various factors to consider too. Pharmexil cited the lack of cold chain facilities at major airports as a factor for pharma exporters preferring sea freight. The Indian bureaucracy can also be disadvantagous. The country is considered so difficult to do business with that it sits at 142nd place on the World Bank’s ease of doing business with index for 2014. To put that into context, India lags behind El Salvador, Lesotho and Honduras.

The issues cannot all be laid at the door of the government and the air cargo sector, however. Indian pharma manufacturers must shoulder some of the blame. They will not truly be in a position to capitalise on demand for their products until they have acquired all of the necessary licenses.

“In India, as elsewhere, the pharmaceuticals air cargo industry is quite rightly heavily regulated. This is to ensure that drugs get to the people that need them with their stability, purity and potency intact,” Cheetham says. “Airfreight carriers who are committed to providing a high quality service will invest in the right infrastructure to deliver on that promise. It is an absolutely essential part of achieving success in this market”.

Despite the inherent difficulties, the Indian pharmaceutical sector is a lucrative one. A number of air cargo stakeholders have been involved with it for a number of years. Among them is Amsterdam Airport Schiphol. “Schiphol Cargo has been actively encouraging Indian pharma manufacturers to use the airport as their gateway to Europe for some time,” the airport’s business development director, Bart Pouwels, says.

The process began, he explains, with a careful analysis of manufacturers’ needs, based on a series of trade missions and meetings. A recent example of fact gathering involved Schiphol Cargo sponsoring masters students from Amsterdam’s VU University to visit India and research and report on the local pharma market. “We have invested considerable time and effort in visiting manufacturers in India, understanding their businesses,

and guiding them on potential improvements to their supply chains,” Pouwels adds. Schiphol Cargo’s efforts include setting up a lifescience and pharma logistics steering group, in a bid to get the industry and users together. The company has driven the adoption of best practices, such as good distribution practices. In what Pouwels says is a worldwide first, Schiphol Cargo has, “made logistics facilities available to major 3PLs which have direct airside access, in order to reduce the time taken from aircraft to temperature controlled storage; this is a first anywhere in the world.”

The company has also tackled head-on one of the main barriers to working with India. Pouwels explains: “Schiphol has also worked with Dutch customs to remove a major trade barrier: the traditional customs interception of Indian pharma shipments. This was one of the joint initiatives from the lifescience and pharma logistics steering group in 2011.”

Among the airlines investing heavily in the Indian pharma sector is Lufthansa Cargo. The German carrier’s Hyderabad International Airport pharma hub for temperature sensitive airfreight has been in operation since 2011. Lufthansa Cargo and Hyderabad Airport operator, the GMR Group, undertook to jointly develop the airport into the key hub in South Asia for the transport of temperature sensitive pharmaceuticals.

Hyderabad is regarded as India’s pharmaceutical capital, its genome valley is home to more than 100 companies, and stretches for more than 600 square kilometres. The airport is becoming increasingly popular with cargo airlines, benefiting from a dedicated cargo apron, adjacent to the freight terminal and capable of accommodating three Boeing 747 Freighters. The fast growing Qatar Airways Cargo is among those using Hyderabad Airport. Qatar has just announced plans to expand the specialist container options for its QR Pharma service. The service launched in January 2014 and has already handled 14,100 tonnes of pharmaceutical products.

The carrier has said that it is growing its pharmaceutical business faster than expected. Ulrich Ogiermann, chief officer cargo at Qatar Airways, told Asia Air Logistics: “India is an important market for Qatar Airways Cargo. The demand for air cargo transportation has increased significantly over the last few years due to shorter product life cycles and increased demand for rapid delivery. In 2014, 2,500 tonnes of QR Pharma cargo were transported from India to global destinations including Africa and the US”.

CHEETHAM

In India, as elsewhere, the pharmaceuticals air cargo industry is quite rightly heavily regulated

AAL June India feature pp20-21.indd 1 21/05/2015 14:07

Asia Air logistics June 2015

22 FEATURE AIR CARGO HANDLING 2015 PREVIEW

Taking place at the Shangri-La Hotel, on the bank of the Chao Phraya River, in the centre of Bangkok, the conference starts on 1 September and ends on the third. While subject to change, its sessions include, quality and standards, demand patterns from customers, airport community initiatives, security, processes and technology, interfaces between cargo handlers, ramp handlers and customs authorities.

These sessions will see many questiojns on many topics, from how can the industry improve the unit load device (ULD) supply chain and ULD recovery times, to what are the latest trends and developments in ULD management, technology, tracking, and efficiency? Part of that tracking will involve electronic messaging. More questions to be addressed include, what is the latest in terms of messaging adoption and when will airlines and agents be ready to use any related new electronic standards?

Airlines, the customers of handlers, and their priorities are another topic for discussion. What are the airlines’ priorities and how well are handlers fulfilling them? What are the key performance indicators airlines have been using? And with all the talk of e-freight, where are the many airlines when it comes to the operational challenges of the likes of electronic air waybills (e-AWB)? Can handlers support e-AWB implementation?

Technology is another topic with e-freight being such a prominent issue and questions around, what essentially is, IT could include, what is in the pipeline and what savings or productivity improvements have operators achieved? Linked to e-freight and IT systems is security. Located in Bangkok, this handling conference will address the issues

of the latest security and customs initiatives and regulations affecting Asian markets. What are the implications of the formation of the Asian Economic Community for air cargo operations, for example, for handling, and road feeder services?

All this handling takes place at airports and gateway cargo operation streamlining is another topic, with best practice examples to be given. Conference participants can expect to hear about which airport cargo communities in Asia are leading the way in streamlining and what initiatives are they pursuing. Streamlining, faster, more efficient, higher throughput, seamless electronics, are all goals and buzzwords handlers can expect to hear in Bangkok this September.

Freight handlers will come together in September in Bangkok for the 2015 Air Cargo Handling Conference to discuss the issues the industry faces with panel discussions, workshops, and focused presentations.

Sending the freight on itsway with care

AAL June Air Cargo Handling preview pp22-IBC.indd 1 21/05/2015 13:36

![ทัศนศิลป์ ม.4-6academic.obec.go.th/textbook/web/images/book/1003317_example.pdf · R.N. (aal]amn) (aal]amn), ('Maiutaamqanffl), (aal]anffi), (Art Education), Ph.D](https://static.fdocuments.in/doc/165x107/5e4198ce8356095930752553/aaaaaaaaaoe-a4-rn-aalamn-aalamn-maiutaamqanffl.jpg)