AAA FOCUS PMS Aug 21

Transcript of AAA FOCUS PMS Aug 21

PROTECT CAPITAL,

CREATE WEALTH

AAA FOCUS PMS PLAN

Investor Presentation - AAA Focus PMS PLAN

August 2021

3M StockSelectionApproach- Market Size- Market Share- Margin of Safety

AAA PMS Themes

Prudent Risk Management- Diversification - Staggered Investments - Defined Exit Strategy

PerformanceSuperior risk adjusted returns

World ClassInvestor ServicesStrategic tie-ups with thebest service providers

Formalisation ofeconomy

China+1 Strategy

Play on Automationand Innovation

Why AAA?What separates us fromcompetitors? What makes usahead of pack?

0 5 10 15 20

AAA

BSE 500

15.7%

13.1%

India - Ready forNext Leap ofGrowth Reforms & Digitalisation =Powerful combination

WHY AAA?

Rajesh Kothari, Founder of the firm is CIO of AAA PMS. Prior to AAA, Rajesh was Fund Manager with DSP MF & Partner with Voyager Investment Advisors (FII). Received CNBC TV18 - CRISIL Mutual Fund of the Year Award & Platinum Fund Manager Award for DSPEQUITY FUND.No risk of change in guards for the client which ensures 100% commitment and alignment of interest withinvestors.

Founders areFund Managers

AAA is only into PMS & Investment advisory and not into other businesses like broking, wealth management,etc. Hence, no conflict of interest for the clients. AAA clients enjoys the benefits of directly communicating with the founder, thereby ensuring enhancedunderstanding. AAA clients includes family offices, UHNIs and AAAPMS product is presently distributed by well knownnational distributors.

AAA PMS is one of the few players in the industry which has completed 10 years. During the last 10+ years, AAA IOP PMS delivered 19.9% CAGR vs 12.7% CAGR reported by BSE 500 Index. AAA IOP PMS received Best 10 year Performance Award (rank 3) in the country for delivering superior riskadjusted returns across categories by PMSAIF World (Feb21)(data analysed by IIM Ahmedabad).

Superior TrackRecord

Client centricBusinessModel

THE TEAM

272727YEARSYEARSYEARS

Founder &

Managing

Director

DirectorHead of

Operations

Rajesh Kothari Govind Agrawal Bhushan Koli

252525YEARSYEARSYEARS

252525YEARSYEARSYEARS

252525YEARSYEARSYEARS

THE TEAM

During his tenure, fund Outperformed the benchmark

indices significantly

The schemes delivered annualized return of 55% (Equity

Fund) & 62% (Top100 Fund) outperforming benchmark

indices by more than 20% & 10% respectively

The equity schemes maintained its “1st Quartile Ranking”

consistently during his tenure

- Rich experience of more than 25 years in Indian capital market

with expertise in both Long Only & Long Short investment

strategy

- Former Director with Voyager Investment Advisors

(US$500m) – USA based India dedicated fund

- Former Fund Manager with DSP Merrill Lynch Fund Managers

(DSP MF) for more than four years

Achievements

- Received CMA Young Achiever Award 2014

- Rated as “Platinum Fund Manager” by Economic Times for DSP ML

Equity Fund on a risk-adjusted return basis (Jul 2006)

- Received CNBC TV18 - CRISIL Mutual Fund of the Year Award 2006

for DSPML Equity Fund and Lipper India Fund Awards 2006 for best

equity fund group for 3 years

- Invited at Maharashtra Economic Summit to present views on Indian

Infrastructure

- Invited by Institute of Directors to present views on Governance

Deficit

- Actively involved with Arham Yuva Group - philanthropic initiative

Founder & Managing Director

(Grad CWA, MBA)

Rajesh Kothari

THE TEAM

Director(FCA - Chartered Accountant, LLB)

Reliance Emergent India Fund (USD 100m offshore fund)

outperformed benchmark indices by 35% since its inception.

Played instrumental role in setting up Macro Economic

Research desk

Played key role in establishing institutional equity broking

business, systems and processes

- Rich experience of 26 years in Indian capital market

- Former Fund Manager with Reliance Capital Asset Management

Company (USD 20bn) for over four years.

- Former Executive Director with UBS Securities India Pvt Ltd for 4

years as India Account Manager for large FIIs and guided the

portfolio managers for right country, sectors and stocks allocation

- Former Senior VP – Equity Sales with Motilal Oswal Securities Ltd

for 10 years

Achievements

- Represented Reliance AMC on international platforms and panel

discussion on Emerging Markets and Indian Equity Market

- Addressed investors’ meet and the private banking teams of large

banks in Middle East, Asia, London, Europe and in India

- At UBS, was voted as the “Best Equity Sales Person‐Mega Funds

category, Asia Money 2006”

- Won several awards at Motilal Oswal for consistently contributing to

Institutional Equity Sales

Achievements

We buy the companies which are leaders in theirsector as they are best positioned to navigate upturnand downturn of the economy.

Market size determines size of opportunity. We prefercompanies which are targeting large market size togenerate exponential returns.

INVESTMENT PHILOSOPHY - GENERATE ALPHATHROUGH 3M INVESTMENT APPROACH

Margin of Safety

Market Size

Price is what you pay. Value is what you get. We buythe companies which are available at reasonablevaluations.

Market Share

RightGovernance

RightManagement

RightBalanceSheet

We have a disciplined Exit strategy. We sell/reduce due to rebalancingof the portfolio, change in growth assumption of our portfolio company,expensive valuations.

Three important risks : Governance, Technology and Business cycle -can be reduced only by Diversification. We invest across market cap,sectors, and companies to reduce company/sector specific risk. Diversification

Defined Exit Strategy

We build the portfolio over a period of time. We do not follow Modelportfolio approach.

Staggered InvestmentApproach

PRUDENT RISK MANAGEMENT

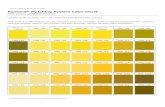

BSE 500Index

Benchmark

Index

Maximum

number of

stocks

Mid/Small

cap

ExposureLarge Cap

Exposure

Max

Weightage

in one stock

30

60-100%

10%

AAA FOCUS PLAN FEATURES

Max

Weightage

in one sector

Max

Weightage in

top 10 stocks

40%70%

0-40%

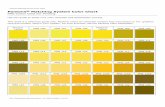

AAA FOCUS PMS has a stellar track record of delivering ~15.7% CAGRcompared with BSE 500 Index CAGR of ~13.1% during last 5+ years.

AAA FOCUS PMS plan is a portfolio of 30 companies which are Market leaders with strong corporategovernance and high growth potential with investment horizon of 3-5 years.

China+1 Strategy

Purchase Price Exit price / Market price

AAA IOP INVESTMENT SUCCESS STORIES

Honeywell Auto

Bajaj Finance

5.4x

Timken India

Purchase Price Exit price / Market price

2.9x

Purchase Price Exit price / Market price

SRF Ltd

Whirlpool India

2.6x

Shree Cement

3.1x

Purchase Price Exit price / Market price

7.3x

Purchase Price Exit price / Market price

2.5x

Purchase Price Exit price / Market price

AAA FOCUS CHARACTERISTICS

Large Cap69.9%

Mid Cap21.6%

Cash 5.3%

Superior ROE16% AAA PMS

vs 12% Nifty (FY21)

Strong EarningsGrowth

23% AAA PMSvs

21% Nifty (FY20-FY23E)

Multicap

SectoralLeaders

3M stock selection

approach

Cash rich Balance sheet

- 92% of portfolio cos haveZERO NET DEBT- 8% of portfolio cosD/E <1x

Large ProfitSize

- 100% of portfoliocompanies Rs.100cr+ NP(74% above Rs.500cr+)

AAA PMS Nifty

AAA PMS Nifty

23% 21%

16%12%

Demon,

GST,

RERA ,

IBC

Structural

Reforms 2.0

Formalisation

of the economyDigital ization

Stronger

Banking

systems

Jan Dhan,

UPI

1 2 3 4

Advantage

Organised

sector

5

Incentives

for

Mfg.

Make in

India.

PLI

scehme

Lean

Balance

sheet

Stronger Economic Recovery

408%

615%

840%

75%

157%

186%

1

126%

135%

112%

BSE Sensex Return

BSE Midcap Index Return

BSE Smallcap Index Return

Timeframe 2003 -2008 2009 -2014 2013 -2018

GDP Growth 7.7% 3.9% 6.4% 3.1% 7.0% 5.5%

Economic Recovery - results in

stronger market returns

-5%0% 20%

Trent

Other

-2.5%0% 10

%

TCI Express

Other

0% 20%

40%

DMart

Other

0% 5% 10%

Britannia

Other

0% 15%

Ultratech

Other

INDUSTRY SIZE(Rs.)

UNORGANISEDINDUSTRY SHARE

ORGANISEDINDUSTRY SHARE

REVENUE CAGR 5YRS(%)

1364 B

73%

27%

35 B

100%

66 T

92.5%

7.2 T

97%

3%

CEMENT BISCUIT FASHION RETAIL RETAIL GROCERY LOGISTICS

3500 B

7.5%

0% 30%

70%

Source: Bloomberg, AAA research

ACCELERATION OF FORMALISATION

PLAY SECTORAL LEADERS

1

2

3

4

Increasingenviornmentalcompliance

Supply chaindisruption

Geo-politicalissuses - Worldanger

China + 1 Strategy

FY01-05 FY05-10 FY10-FY15 FY15-FY20

400

300

200

100

0

CAPEX PHARMA IND (RS B)

FY01-05 FY05-10 FY10-FY15 FY15-FY20

1,000

750

500

250

0

CAPEX CHEMICAL IND (RS B)

FY14 FY19 FY25E

12,500

10,000

7,500

5,000

2,500

0

MOBILE HANDSET MFG (RS B)

1

2

3

4

Rapidly reducinginfra deficit

Land & Labourreforms

New incentiveschemes

Technicalcompetence

Push Factors Pull Factors

High dependanceof global firms onChina

AUTOMATION &INNOVATION

Average increase in

company growth

Average increase in

process efficiency

Average decrease in

operational costs

RoboticsArtificial

Intelligence

Machine

Learning

Cloud

computing

Average improvement

in time to market21%

20%

19%

16%

68%

79%

94%

99%

Mail carrier

Logging worker

Drill press operator

Insurance underwriter

Pro

bab

ility

of

auto

mat

ion

AUTOMATION & INNOVATION

E-Way Bills(July-21)

6.4crs

GST Collections (July-21)

1.16LCr (33% yoy)

Diesel Consumption(July-21)

+11.5% yoy

Thermal PLF(July-21)

56.7%

Passenger Vehicle(July-21)

3.17 Lakh + units

Cement Production(July-21)

Approx 29 MMT

PMI Index(July-21)

49.2

Steel Production (July-21)

Approx 8.8 MMT

Indian Eco - Fast frequency data indicators

AAA IOP PMS Performance Insights

A A A V S B S E M I D C A P

0 5 10 15 20

AAA

BSE 500

0 5 10 15 20

AAA

BSE MidCap

A A A V S S M A L L C A P0 5 10 15 20

AAA

Nifty

0 5 10 15 20

AAA

BSE SmallCap

A A A V S N I F T YA A A V S B S E 5 0 0

15.7%

13.1%

15.7%15.7%

15.7%

12.3%

14.2% 14.5%

AAA FOCUS Plan Performance since inception Dec 2014

(Performance is after all expenses and fees from April 2018. Prior to 2018 the Performance is after all expenses and Fixed management fees. Index performance is calculated as per Total Return Indices as per SEBI Guidelines). Returns ofindividual clients may differ depending on time of entry in the Strategy. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. Performance related informationprovided herein is not verified by SEBI.

$*(7 December 2014– 31 August 2021) (Performance is after all expenses and fees from April 2018. Prior to 2018 the Performance is after all expenses and Fixedmanagement fees. Index performance is calculated as per Total Return Indices as per SEBI Guidelines).Note: Returns of individual clients may differ depending on time of entry in the Strategy. Past performance may or may not be sustained in future and should not beused as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

AAA FOCUS Plan Performance Insights

AAA FOCUS Plan Performance Insights

*(7 December 2014– 31 August 2021) (Performance is after all expenses and fees from April 2018. Prior to 2018 the Performance is after all expenses andFixed management fees. Index performance is calculated as per Total Return Indices as per SEBI Guidelines).Note: Returns of individual clients may differ depending on time of entry in the Strategy. Past performance may or may not be sustained in future and shouldnot be used as a basis for comparison with other investments. Performance related information provided herein is not verified by SEBI.

STRATEGIC PARTNERSHIPS

CUSTODIAN & FUND ACCOUNTANT

DEPOSITORY PARTICIPANTS

All clients have an option to invest in the AAAPMSdirectly, without intermediation of persons

engaged in distribution services.

DIRECT ONBOARDING ROUTE

AAAIOP PMS

received

Award for

Best 10 Years

Performance

across

categories on

Risk adjusted

Returns Basis

by PMS AIF -

2020

AWARDS & RECOGNITIONS

Dr. Jitendra

Singh, Union

Minister of

State (I/C),

Prime Minister

Office, giving

Certificate of

Merit – CMA

Young

Achiever

Award – 2014Rajesh was recognized as the platinum fund manager

by Economic Times during his time at DSP MF.

THANK YOUAlfAccurate Advisors Pvt. Ltd

503, B Wing, Naman Midtown, Elphinstone Road, Mumbai - 400 013, India

T : +91 22 42360300; F : +91 22 42360333 [email protected] www.alfaccurate.com

Rajesh KothariT : +91 22 4236 [email protected]

Govind AgrawalT : +91 22 4236 [email protected]