AA Corporate 2007b

-

Upload

yiyi-shang-kardos -

Category

Documents

-

view

221 -

download

0

Transcript of AA Corporate 2007b

-

8/3/2019 AA Corporate 2007b

1/148

-

8/3/2019 AA Corporate 2007b

2/148

C O UN TRY O FO P E R ATIO N S

Ma la ys ia AirAs ia w a s

in c o rp o ra t e d o n

2 0 De c e m b e r 19 9 3 .

C u r re n t ly Ma la ys ia

h a s a s t a ff s t e n g t h

o f 3 ,4 74 .

In d o n e s ia AirA s iaw

a s la u n c h e d o n 8 D e c e m b e r 2 0 0 4 .Th is is o u r s e c o n d

a s s o c ia t e in t h ere g io n . C u r re n t lyIn d o n e s ia h a s a

s t a f f s t re n g t h

o f 1,10 0 .

N o w , 6 ye a r s o n , w e 'r e

p ro u d t o h a ve 3 0p re s t ig io u s a w a rd s ,

10 0 ro u t e s , 5 0 m illio ng u e s t s a n d 2 2 5 n e w

A irb u s A3 2 0 s o n o rd e r.

Th a i AirA s iaw as la u n c h e d o n

3 Fe b r ua r y 2 0 0 4a s o u r fi rs t

j oi n t ve n tu re .C u r re n tl y Tha ila n dh a s a s ta ff s te n g th

o f 1,5 3 3 .

-

8/3/2019 AA Corporate 2007b

3/148

C O N TEN TSA N N UA L R EP O RT 2 0 0 7

AIRASIAASIAS LOWCOST LEADERBRINGING ASIA CLOSER

AirAsia flies to over 100 routesacross 11 countries in ASIA

MalaysiaAlor StarBintuluJohor BahruKota KinabaluKuala LumpurKuala TerengganuKuchingLabuanLangkawiMiriPulau PinangSandakanSibuTawau

ThailandBangkok

Chiang MaiChiang RaiHat YaiKrabiNarathiwatPhuketRanongSurat Thani

Ubon RathchathaniUdon Thani

IndonesiaBaliBalikpapanBanda AcehBandungBatamJakartaMedanPadangPalembangPekanbaruSoloSurabayaYogyakarta

ChinaGuangzhouHaikouHong KongMacauShenzhenXiamen

CambodiaPhnom PenhSiem Reap

VietnamHanoiHo Chi Minh

PhilippinesClark

LaosVientiane

MyanmarYangon

Brunei

Singapore

Country of Operations

Vision and Mission

Corporate Profile

Five Year Financial Highlights

Share Performance

Chairmans Statement

Group Chief ExecutiveOfficers Report

Interview with the Group ChiefExecutive Officers Report

Operational Performanceand Peer Group Comparison

Industry Overview

2

4

8

11

12

16

25

26

27

Corporate Social Responsibility

AirAsia X

Major Milestones

Awards & Accolades

AirAsia Group

Corporate Information

Board of Directors

Directors Profile

Senior Management

Statement onCorporate Governance

Audit Committee Report

30

36

38

40

42

43

44

46

52

58

62

Statement on Internal Control

Additional Compliance Information

Financial Statements

Analysis of Shareholdings

List of Properties Held

Notice of AnnualGeneral Meeting

Statement AccompanyingNotice of FifteenthAnnual General Meeting

Airline Terminology Explanation

Form of Proxy

66

68

69

133

137

138

140

141

-

8/3/2019 AA Corporate 2007b

4/148

To be the largest low cost airline in Asia and servingthe 3 billion people who are currently underserved

with poor connectivity and high fares.

VISION

Safety:Adopting a zero tolerance to unsafe practicesand strive for zero accidents through propertraining, work practices, risk management andadherence to safety regulations at all times.

Valuing our People:Committing to our peoples development andwell-being and treating them with respect,dignity and fairness.

Customer Focused:We care and treat everyone in the samemanner that we want to be treated.

VALUESIntegrity:Practicing highest standards of ethicalbehaviour and demonstrate honesty inall our lines of work in order to commandtrust and mutual respect.

Excellence in Performance:Setting goals beyond the best and reinforcinghigh quality performance standards andachieving excellence through implementingbest practices.

-

8/3/2019 AA Corporate 2007b

5/148

To be the best company to work for wherebyemployees are treated as part of a big family

Create a globally recognized ASEAN brand To attain the lowest cost so that everyone can

fly with AirAsia Maintain the highest quality product, embracing

technology to reduce cost and enhance service level

MISSION STATEMENT

AirAsia is committed to excellence. We intend to excel in everything we do by achievingexceptional results. We have set high standards, but no higher than our customersexpectations. Day after day, our people do their best so that we meet these expectations.In all our efforts, there are five fundamental values: Safety, Passion, Integrity, Caring and

Fun. They provide a frame of reference for the AirAsia experience and a corporate culturein which we live and deliver peak performance.

COMMITMENT TO EXCELLENCE

Pahamin Ab. Rajab

Dato Paul Leong

Tony Fernandes

Kamarudin MeranunDato Khadar Merican

Dato Aziz Bakar

Conor Mc Carthy

Datuk Alias Ali

Fam Lee Ee

-

8/3/2019 AA Corporate 2007b

6/148

C O R P O R ATEP R O F ILE

AIRASIABERHAD

4 ANNUAL REPORT2007

hubs located at Low Cost Carrier Terminal (KLIA), JohorBahru, Kota Kinabalu, Kuching, Bangkok (Thailand) andJakarta (Indonesia). AirAsia is fast spreading its wingsto create a bigger and more extensive route networkthrough its associate companies, Thai AirAsia andIndonesia AirAsia. The airline has carried, thus far,over 50 million guests since its first day of operation.

BRINGING ASIA CLOSER

At AirAsia, we are bringing people closer by bridgingboundaries through our philosophy of offering low fares.It has sparked a revolution in travel, as more and morepeople from all walks of life are now able to fly for thefirst time, while many others have made air travel withAirAsia their preferred choice of transport. We areconsistently adding new routes, which include citypairs that never existed before, in our relentless effortsto create a seamless bridge of unity across Asia. It is

AGAINST ALL ODDS

In 2001, Dato Tony Fernandes along with Dato PahaminAb. Rajab (Chairman, AirAsia), Dato Kamarudin binMeranun (Deputy Group Chief Executive Officer, AirAsia)and Abdul Aziz bin Abu Bakar (Director, AirAsia) formeda partnership to set up Tune Air Sdn Bhd and boughtAirAsia for a token sum of RM1.00. With the help ofConor Mc Carthy (Director, AirAsia; Director, formerDirector of Tune Air Sdn Bhd and former Director ofGroup Operations, Ryanair), AirAsia was remodeled intoa low cost carrier and by January 2002, their vision tomake air travel more affordable for Malaysians took flight.

Valued at RM3.3 billion, AirAsia is today an awardwinning and the largest low cost carrier in Asia. Froma two aircraft operation of Boeing 737-300, AirAsiacurrently boasts a fleet of 70 aircraft that flies to over50 domestic and international destinations and operatesover 400 domestic and international flights daily from six

AirAsia Berhad (AirAsia orthe Company) is a namesynonymous with low fares,

quality service and dependability.With over 100 routes across11 countries , AirAsia is trulyAsias leading airline with thewidest route connectivity andlargest customer base. Withthe unmistakable tagline,Now Everyone Can Fly ,AirAsia has made flyingaffordable for more than50 million guests.

-

8/3/2019 AA Corporate 2007b

7/148

CORPORATEPROFILE

AIRASIABERHAD

5ANNUAL REPORT2007

something very close to our hearts as we continuouslystrive to promote air travel and create excitementamongst our guests with our range of innovativeproducts and personalised services.

THE FOUNDATION OF OUR BUSINESS

AirAsias success has taken flight through the continuedconfidence of our guests who prefer a no-frills, hassle-free, low fare and convenient option in air travel. The keyto delivering low fares is to consistently keep cost low.Attaining low cost requires high efficiency in every partof the business and maintaining simplicity. Thereforeevery system process must incorporate best industrypractices. We make this possible through theimplementation of the following key strategies:

Safety First Safety is the single most importantcriteria in every aspect of the operations, an area thatAirAsia will never compromise on. AirAsia complies

with the conditions set by regulators in all thecountries where the airline operates. In addition,AirAsia partners with the worlds most renownedmaintenance providers to ensure that its fleet isalways in the best condition.

High Aircraft Utilisation AirAsias high frequencyflights have made it more convenient for guests totravel as the airline implements a quick turnaround of25 minutes, which is the fastest in the region. This hasresulted in high aircraft utilisation, lower costs andgreater airline and staff productivity.

Low Fare, No Frills AirAsia targets guests whoare prepared to do away with frills such as meals,frequent flyer miles or airport lounges in exchangefor fares lower than those currently offered withoutcomprising on quality and service. Guests havethe choice of buying exclusively prepared meals,snacks and drinks from our in-flight service at anaffordable price.

-

8/3/2019 AA Corporate 2007b

8/148

CORPORATEPROFILE

AIRASIABERHAD

6 ANNUAL REPORT2007

OUR COMMITMENT

Streamline Operations

Making the process as simple aspossible is the key to AirAsiassuccess. We are workingtowards a single aircraft fleet;this greatly reduces duplicatingmanpower requirements as wellas stocking of maintenanceparts. There is only one classseating, i.e. first class, andpassengers are free to sit wherethey choose.

Lean Distribution System

AirAsia offers a wide andinnovative range of distributionchannels to make booking andtraveling easier for its guests.AirAsias ticketless serviceprovides a low cost alternativeto issuing printed tickets.

Point to point network TheLCC model shuns the hub-and-spoke system and adopts thesimple point-to-point network.Almost all AirAsia flights areshorthaul (3 hour flight or less).The underlying business is toget a person from point A to B.

AirAsia has a firm commitment with a purchase orderfor 225 Airbus A320 aircraft (175 firm + 50 options),thus securing our growth pipeline up till 2014. We arecommitted to be a truly Asian airline that operates anextensive route network, fosters economic prosperity,stimulates tourism and promotes stronger culturalintegration. AirAsia is poised to be the largest andyoungest airline in the region.

-

8/3/2019 AA Corporate 2007b

9/148

-

8/3/2019 AA Corporate 2007b

10/148

For the 6

months endedFor the year ended 30 June 31 December

(RM million, unless otherwise stated) 2004 2005 2006 2007 2007

Revenue 393 718 1,071 1,603 1,094Total expenses 332 596 997 1,322 858EBITDAR 116 209 154 490 405EBIT 61 122 74 281 237Associates contributions (0.1) (5.4) (0.5) (3.9) -Profit before tax 58.1 114.6 86.2 278.0 276.7Tax (9.1) (14.3) 115.5 220.0 149.0

Net income * 49.1 100.8 201.7 498.0 425.7

BALANCE SHEETCash & cash equivalent 66 329 426 595 425Total Assets 350 1,123 2,574 4,779 6,448Net Debt (Total Debt Total Cash) 29 (329) 627 1,959 3,272Shareholders' Equity 150 953 1,148 1,662 2,099

CASH FLOW STATEMENTSNet cash from operating activities 29 (38) 282 595 256Cash flow from investing activities (144) (297) (1,249) (1,943) (1,581)Cash flow from financing activities 141 589 1,067 1,509 1,141

Net Cash Flow 26 254 100 161 (184)

CONSOLIDATED FINANCIAL PERFORMANCE (%)Return on total assets 14.0 9.0 7.8 10.4 -Return on shareholders' equity 32.7 10.6 17.6 30.0 -R.O.C.E (EBIT/(Net Debt + Equity)) 33.8 19.6 4.2 7.7 -

EBITDAR margin 29.6 29.1 14.4 30.6 37.1EBIT margin 15.4 17.0 6.9 17.5 21.6Net Income margin 12.5 14.0 18.8 31.1 38.9

CONSOLIDATED OPERATING STATISTICSPassengers carried 2,838,822 4,414,069 5,719,411 8,737,939 5,197,567RPK (million) 2,771 4,881 6,702 9,863 5,930ASK (million) 3,592 6,525 8,646 12,391 7,919Load factor (%) 77 75 78 80 79Aircraft utilisation (hours per day) 12.8 12.1 12.0 12.0 11.9

Average fare (RM) 131 143 174 171 195Yield Revenue per ASK (sen) 10.9 10.2 12.2 12.9 13.8Cost per ASK (sen) 9.4 8.3 10.9 11.2 11.0Cost per ASK excluding fuel (sen) 6.5 4.2 6.1 5.6 5.3

Yield Revenue per ASK (US) 2.87 2.69 3.29 3.64 4.07Cost per ASK (US) 2.47 2.19 2.95 3.16 3.22Cost per ASK excluding fuel (US) 1.72 1.11 1.63 1.57 1.57

Number of Stages 25,106 40,679 48,339 68,195 38,507Average stage length (km) 967 1,024 1,163 1,088 1,183Average fleet size (Malaysia) 9.5 16.3 20.5 27.1 31.6Size of fleet at year end (Malaysia) 13 19 26 34 39Size of fleet at year end (Group) 17 27 42 54 65Number of employees at year end 1,382 2,016 2,224 2,924 3,474Percentage revenue via internet (%) 43 47 60 65 65

* Net income after minorities

F IVE YE A RF IN A N C IA L HIG HLIG HTS

AIRASIABERHAD

8 ANNUAL REPORT2007

-

8/3/2019 AA Corporate 2007b

11/148

-

8/3/2019 AA Corporate 2007b

12/148

-

8/3/2019 AA Corporate 2007b

13/148

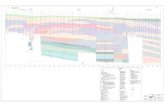

S HA R EP E R F O R MA N C E

AIRASIABERHAD

11ANNUAL REPORT2007

AUG 2007Announcement on 30 August 2007 of the unauditedconsolidated fourth quarter results for the three monthsended 30 June 2007.

NOV 200714th Annual General Meeting (AGM) of the Company washeld on 22 November 2007.

Announcement on 23 November 2007 of the unauditedconsolidated quarter results for the three months ended30 September 2007.

FEB 2008Announcement on 27 February 2008 of the unauditedconsolidated quarter results for the three months ended31 December 2007.

Share Price Volume Traded

AirAsia Share Statistics

Share Price beginning : 162Share Price end : 160Year High : 215Year Low : 140

Volume traded (million) : 1,571Share turnover : 67%

J A N

F E B

M A R

A P R

M A Y

J U N

J U L

A U G

S E P T

O C T

N O V

D E C

50,000

40,000

30,000

20,000

10,000

0

Volume Traded (000) Share Price (RM)

2.50

2.00

1.50

1.00

-

8/3/2019 AA Corporate 2007b

14/148

C HA IR MA N SS TATEME N T

AIRASIABERHAD

12 ANNUAL REPORT2007

OUR PERFORMANCEFOR THE YEAR WASBEYOND EXPECTATIONS.WE CARRIED 15 MILLIONGUESTS, EXPANDED THENETWORK TO 100 ROUTESAND DELIVERED PROFITMARGINS WHICH ARETHE BEST IN THE WORLD.

PAHAMIN AB. RAJABCHAIRMAN

-

8/3/2019 AA Corporate 2007b

15/148

CHAIRMANSSTATEMENT

AIRASIABERHAD

13ANNUAL REPORT2007

DEAR SHAREHOLDERS,

I am proud to report another exciting year of growth and achievements atAirAsia. Simply put, our performance for the year was beyond expectations.We have successfully carried 15 million guests across the Group for the 12months of 2007, expanded our network to a total of 100 routes and deliveredprofit margins which are the best in the world.

Our route network across ASEAN countries is now complete as we havelaunched flights to Laos in December 2007. We are also ecstatic with theopening up of the Kuala Lumpur to Singapore route a sector that we havebeen battling for over the past five years. This signals the wide acceptanceof the low cost carrier industry and the progressive liberation of the airlineindustry.

During the year we experienced significant challenges; fuel prices continuedto move higher and we continue to face difficulties in Thailand and Indonesia.However our business model, based on low cost with care and convenience,continues to prove successful in these challenging times.

PEOPLE

The Board continues to be very grateful for the commitment of our peoplein delivering stellar performances and maintaining AirAsias standards.Every employee was rewarded with a well-deserved bonus, and the Boardwill continue to promote and protect the best interests of our people.

We have always believed that there are no shortcuts in the quest to achieveand maintain the highest quality, and therefore we are investing heavily on

our people. The AirAsia Academy is

in the process of expansion and itwill have more simulators and othertraining facilities. This demonstratesour commitment to sustainingAirAsias well-deserved reputationfor good service.

THE BOARD

Tan Sri Dato (Dr.) R.V. Navaratnam,a long-time member of our Boardof Directors, retired at the Annual

General Meeting in November 2007.Tan Sri Navaratnam has been anoutstanding contributor to theBoard and we will very much misshis wisdom and experience.

At the same time, I was delightedthat Dato Mohamed Khadar BinMerican accepted our invitation to

join the Board as an IndependentNon-Executive Director after anextensive search. Dato Khadar hasan impressive track record and I amcertain that he will be an invaluableaddition to the Board.

-

8/3/2019 AA Corporate 2007b

16/148

CHAIRMANSSTATEMENT

AIRASIABERHAD

14 ANNUAL REPORT2007

Passengers Flown byAirAsia Group (million)

Jun 05 Jun 06 Dec 07

CONCLUSION

We have come a long way tobecome Asias eighth largestairline in just six years. There ismuch more to come. We haveidentified a corporate vision that

by 2014, AirAsia will be amongAsias top three airlines with over50 million passenger carried peryear. We will maintain our industryleading profit margins and provideour guests with a friendly andcaring experience that will changeair travel forever.

The continuous growth of AirAsiasince its inception is testamentto the sturdiness of the low costcarrier business model. Our policy

of striving for continuousimprovement and unrelentingdiscipline to the model gives meconfidence that growth will besustained as we go forward.

Investors can be assured that ourfocus will stay firmly on enhancingrevenue and on the efficientmanagement of the cost base.The creation of value for ourshareholders flows directly from thevalue we deliver to our customers.

We know that the best way to dothat is to bring the strength of ourentire company to our customers,every single time and at everysingle touch point.

Pahamin Ab. RajabChairman

WE HAVE COME A LONG WAY TOBECOME ASIAS EIGHTH LARGESTAIRLINE IN JUST SIX YEARS.

6 . 3

9 . 3

1 5 . 3

Load Factor (%)

Jun 05 Jun 06 Dec 07

7 4

. 8

7 7

. 5

7 8

. 6

-

8/3/2019 AA Corporate 2007b

17/148

-

8/3/2019 AA Corporate 2007b

18/148

AIRASIABERHAD

16 ANNUAL REPORT2007

TONY FERNANDESGROUP CHIEF EXECUTIVE OFFICER

GRO UP CHIEFEXECUTIVEO FFICERS REPO RT AIRASIAS INTRODUCTIONTO THE AVIATION INDUSTRYAS AN INNOVATOR HASGROWN TO THE EXTENT ITIS NOW A LEADER THATSETS THE BENCHMARK.

-

8/3/2019 AA Corporate 2007b

19/148

GROUP CHIEF EXECUTIVEOFFICERS REPORT

AIRASIABERHAD

17ANNUAL REPORT2007

DEAR SHAREHOLDERS,

It gives me great joy to reflect upon and comment on our 2007 results and Iconsider this as one of the best privileges a CEO can ask for. This was indeeda fantastic year for our airline, highlighted by robust growth, record profits,industry leading performance and award winning standards.

Last year the industry experienced some difficult economic i ssues, not theleast of which was the spiraling cost of crude oil. Yet we have been able toperform well through these cycles because AirAsias approach to our businessis extremely disciplined. We concentrate on geographic markets where wealready have a strong market position or where the business fundamentalsoffer attractive entry opportunities and growth.

For the 12 months of 2007, the Group carried a total of 15 million passengerswhich represents a growth of 28% over the previous year. We introduced 18new routes and added Laos to our list of countries.

It has been a year filled with numerous industry awards. We have been votedas The Best Low Cost Airline in Asia 2007 by Skytrax Research of Londonand clinched The Airline of the Year award from Centre of Asia Pacific

Aviation. This award is especiallygratifying as it represents thehighest level of recognition andhonour for AirAsias outstandingachievements and strategiccontribution over the previousyear. AirAsias introduction to theaviation industry as an innovatorhas grown to the extent it is now aleader that sets the benchmark.

I would like to personally thankour staffs who have made thismilestone possible. These resultsare indeed undeniable testimony totheir passion, dedication and lovefor their job and company. I neverhad a doubt that we have the beststaff and it is such a delight to beworking alongside the 6,000 plusfantastic AirAsians.

Routes ServedBy AirAsia Group

Jun 05 Jun 06 Dec 07

5 2

6 5

8 6

-

8/3/2019 AA Corporate 2007b

20/148

-

8/3/2019 AA Corporate 2007b

21/148

-

8/3/2019 AA Corporate 2007b

22/148

GROUP CHIEF EXECUTIVEOFFICERS REPORT

AIRASIABERHAD

20 ANNUAL REPORT2007

AIRASIA BRAND

AirAsia continues to be one of the most high profile sports sponsors in theairline world with its portfolio listing many world famous names such as

Manchester United, AT&T Williams Formula 1 and English Premier Leaguereferees. Apart from mainstream sports, AirAsia is also actively involved incommunity and amateur sporting events such as MyTeam and City SlickersBasketball Team.

Sports marketing proved to be an effective platform to promote our brand andraise awareness of the airline. In the 2007 Malaysian Formula 1 Grand Prix, weunveiled the AT&T Williams aircraft, truly one of a kind, and it was the star ofthe show. The AirAsia brand was telecast all over the world and appeared onthe front covers of numerous magazines, proof of the newsworthiness of the

OUR BRAND

worlds fastest growing airline. InAsia, we again outscored all othercarriers when it came to positivecoverage.

These investments will pave theway for strong brand awarenessin markets we currently serve andmarkets that we plan to serve. Astrong brand commands superiorproduct differentiation, encouragesrepeat customers and customerloyalty, and is important for raisingprofitability.

-

8/3/2019 AA Corporate 2007b

23/148

GROUP CHIEF EXECUTIVEOFFICERS REPORT

AIRASIABERHAD

21ANNUAL REPORT2007

INDUSTRY OUTLOOK

The Asia Pacific aviation industry is enjoying strong passenger demand.According to the International Civil Aviation Association, passenger numbersin the Asia Pacific region grew in excess of 12% in 2007. This strong passengergrowth is attributed to the rising economies and increased disposable incomeof the Asian people. Furthermore, there are significant commercial and

business activities between Asian countries which are driving business travel.Passenger growth in Asia Pacific is expected to continue in 2008, albeit at aslower pace.

Despite the industry enjoying brisk passenger growth, profitability has largelybeen absent. This is due to the challenging operating conditions that theindustry is facing; fuel prices and aircraft cost are at record high levels, pilotand engineers are short in supply and access to credit is tight.

Many in the aviation industry are concerned about a possible global economicslowdown and softer consumer demand. We have not seen any evidence tosubstantiate that claim in our markets. We continue to enjoy strong passengergrowth, market share expansion and expansion of our route network with

a high success ratio. However, I must say that these threats are justifiablebecause the airline industry is inherently cyclical and a downturn is inevitableat some point of time.

These are industry risks that we have long prepared for. We have persistentlyreduced our cost to become the lowest cost base airline in the world, and webelieve there are further cost reductions to be had. Our balance sheet is wellcapitalised with just under half a billion Ringgit of cash and the business isgenerating strong cash flow. With these strong business foundations coupledwith our proven business model, AirAsia is poised to do well in both good andless favourable times.

AIRASIA X:

In the second half of the year,we have completed a commercialservices agreement and brandingagreement with AirAsia X therevolutionary long-haul low costairline. The Board has agreed toexercise our options and acquire16% of AirAsia X at a price ofRM27 million.

AirAsia X is enjoying good responseon its Gold Coast and Hangzhouroutes and we are very happy withthe passenger profile on AirAsia X.Many long-haul passengers are usingAirAsia to connect their flightsto their final destinations. Thiseffectively strengthens our routenetwork and expands our clientelelist. I am confident that with moreroutes soon to be launched withthe addition of more aircraft, KualaLumpur will be the low cost gatewayto South-east Asia.

-

8/3/2019 AA Corporate 2007b

24/148

GROUP CHIEF EXECUTIVEOFFICERS REPORT

AIRASIABERHAD

22 ANNUAL REPORT2007

The principal challenge for the year is the soaring fuel price. Fuel continues to break new heights and thevolatility is making it very difficult to get any sense of direction for hedging.

Due to the unpredictability in fuel prices, we have decided to accelerate the retirement of our olderBoeing 737-300 aircraft from our fleet. In 2008, we will retire a minimum of nine Boeing 737-300 aircraftand may retire up to a further seven. This fleet rejuvenation will structurally reduce our cost base as thenew Airbus A320 aircraft are more fuel-efficient and deliver greater productivity. This exercise will extendour competitive edge by enhancing our customer service delivery and enriching the value proposition toour customers.

Competitive pressure is generally abating. With the surge in fuel prices and other operational challenges,the industry is forced to be more rational and efficient. However, we expect some airlines to implementsporadic sales campaigns to compete on price and trade incentives over the course of the year. We arevigilant about our low fares and make sure that we always offer the best customer value and protect theAirAsia brand. In addition, we know we must sustain the pace of innovation that has been a key driver toAirAsias success.

These are some of the challenges we face. There will be other challenges that we cannot predict. The keyis for us to have the leanest cost structure, most efficient operations and financial agility to respond evenwhen unexpected issues arise.

CHALLENGES TO GROW TH

We do not see a downturn as a threat, but rather as an opportunity. Adownturn is an opportune time to rapidly open new markets with our low fares,win market share from our competitors and expedite the process of routedomination. We believe 2008 will be a big year for us to extend our leadershipand for the marginal players to either consolidate or disappear altogether.

-

8/3/2019 AA Corporate 2007b

25/148

-

8/3/2019 AA Corporate 2007b

26/148

GROUP CHIEF EXECUTIVEOFFICERS REPORT

AIRASIABERHAD

24 ANNUAL REPORT2007

GOING FORWARDGrowing a company the size of AirAsia is challenging. Nevertheless we have proven that with clear strategies, corestrengths, a balanced approach to growth, and the benefits of good leadership, we can press on with nocompromise in quality.

From making flights affordable to people of all walks of li fe; and to creating a truly global brand that places Asiain the altitude of international acclaim, our thrust comes from setting and achieving towering goals. In six years,we have come far. And we will ascend to new heights in the coming years.

I wish to thank all shareholders, staff, the management, the Board and our business partners who have helped usstake our place at the forefront of developments in the aviation industry. I look forward to your continuedcontributions as we embark on new, exciting journeys in the year ahead.

Tony FernandesChief Executive Officer

WE HAVE PROVEN THATWITH CLEAR STRATEGIES,CORE STRENGTHS, ABALANCED APPROACH TOGROWTH, AND THE BENEFITSOF GOOD LEADERSHIP, WECAN PRESS ON WITH NOCOMPROMISE IN QUALITY.

-

8/3/2019 AA Corporate 2007b

27/148

IN TE RVIE W W ITH THE G R O UP C HIE FE XEC UTIVE O F F IC ER S R E P O R T

AIRASIABERHAD

25ANNUAL REPORT2007

Q : Why should investors choose AirAsia?A : Firstly, you will be participating in a long term secular

growth industry. AirAsia is geographically situated ina population catchment area of three billion people,roughly half the worlds population. Despite the vastpopulation, majority of the people never flew before

because air travel is cost prohibitive. That is whereAirAsia bridges the gap, with fares as low as ours,everyone can really fly! Secondly, we are disciplinedto the low cost carrier business model. This is abusiness model that has proven itself many timesover trough various economic cycles in the USA andEurope. True to form, our cost base is the lowest inthe world and we are in the position to extend ourcost leadership going forward. We have invested afortune to build a solid business foundation. Our fleetis one of the youngest and most efficient in Asia. Ourpeople are highly trained professionals with passionand desire to be the best. I could go on and write a

book on why you should invest in AirAsia, but if Iwas to summarise it in one sentence and withoutsounding too much of a hard sell, I truly believeAirAsia is trading significantly below its intrinsicvalue.

Q: What is AirAsia doing to differentiate itselfin the highly competitive airline industry?

A : Since day one, we have persistently remaineddisciplined to the low cost business model. We havesuccessfully stayed the path whereas others haveveered off. So it appears that we are not doinganything different, but rather the competitors are

doing us a favour by changing their game plan.Something we work at every day is to see air travelfrom our customers vantage point rather than ourown. This way, we can work at taking away thecomplexity that comes with the airline industry.This is where we are different.

Q : Where do you see your opportunitiesin Asia?

A : There are growth opportunities everywhere in Asia.We are focusing to expand our route network beyondthe Malaysian border for this year. I am not implying

that there is no more growth in Malaysia; ourdomestic Malaysia passenger numbers grew by27% in 2007. However, the rate of growth in theinternational sectors are much higher and there aremany new opportunities waiting to be unlocked.

Q : Has your appetite for risk changed as aresult of a more challenging economicclimate and higher fuel price?

A : The definitive answer is no. AirAsia has longpursued a disciplined, consistent and prudentapproach to business risk management. This meansour risk appetite remains consistent whether theeconomy is growing or slowing. Its an approach thatdelivers better and more predictable returns for ourshareholders. And peace of mind for our customers,who know they can count on AirAsia to meet theirtravel needs through the ups and downs of theeconomic cycle.

Q : Has there been any change in AirAsiasstrategy?

A : Our focus and strategic direction has not changed.We continue to develop our core Malaysianbusinesses and our joint ventures in Thailand andIndonesia. What has changed is the pace of growth.We have decided to accelerate the retirement ofBoeing 737-300 aircraft in order to structurallyreduce cost and enhance customer service. Thisexercise underpins our doctrine for quality and riskaversion.

Q : What satisfied you most about the year and whatdisappointed you most?A : The best moment for me was when the government

announced the opening up of the Kuala Lumpurto Singapore route. To me, this is a great sign ofprogress. The airline industry is increasingly beingliberated from legacy anti competitive regulations.But I am also quite disappointed with the slow paceof negotiations with airport authorities. While weare wasting time negotiating with the airportauthorities, we both are missing out on greatereconomic potential.

At AirAsia, our commitment to transparency and accountabilitybegins at the top. In the following Question & Answers, AirAsiaCEO Tony Fernandes takes the opportunity to answer questionsthat matter the most to our shareholders.

-

8/3/2019 AA Corporate 2007b

28/148

O P E R ATIO N A L P E R F O R MA N C E A N DP E E R G R O UP CO MPA R IS O N

AIRASIABERHAD

26 ANNUAL REPORT2007

Our Performance

Fuel consumed per 100 ASK AirAsias average fuel consumed

per 100 ASK is 2.89 liters. Fuel consumption has consistently

improved due to the induction offuel efficient Airbus A320 aircraftinto the fleet since 2005.

Aircraft Utilisation AirAsias average utilisation is

12.0 block hours per day. The aircraft utilisation is relatively

constant as this is the optimalutilisation rate for our operations.

Unit Cost (Cost/ASK) AirAsias unit cost for 2007 is

3.20 US cents/ASK. Unit cost has been increasing

for the past three years. The higher fuel price is the

contributor to higher unit cost.

Yield (Revenue/ASK) AirAsias yields for 2007 is

4.03 US cents/ASK. Yields have been increasing

for the past three years. Better yield management and

growth in ancillary income hascontributed to yield growth.

Jun 05 Jun 06 Dec 07

3 . 5

2

3 . 3

1

2 . 8

9

Fuel consumed per 100 ASK 1

The peer groups average fuelconsumed per 100 ASK is 3.38 liters.

AirAsia has the best fuel consumptionrate due to a young fleet age, highseat density configuration andefficient operations.

Aircraft Utilisation 2

The peer groups average utilisation

is 12.4 block hours per day. AirAsias utilisation rate is lower thanpeer group because AirAsia does notoperate late night flights.

Unit Cost (Cost/ASK) The peer groups average unit cost

is 6.35 US cents/ASK. AirAsias unit cost increase is

significantly lower than the peergroup. This signifies our superiorcost containment measures.

Yield (Revenue/ASK) The peer groups average yields is

7.12 US cents/ASK. The lower yield than the peer group

reflects the low yield operatingconditions in Asia.

AirAsias yield growth has outpacedthe peer group for the past three years.

Peer Group Performance *

3.44 3.38

Jun 05 Jun 06 Dec 07

1 2 . 0

1 2 . 0

1 2 . 0

12.7 12.4

Jun 05 Jun 06 Dec 07

2 . 9

5

3 . 1

6 3

. 2 0

5.60 5.796.35

Jun 05 Jun 06 Dec 07

3 . 2

9

3 . 6

4

4 . 0

3

6.29 6.847.12

12.7

Notes:Peer group includes other prominent low cost carriers around the world such as; Air Arabia, AirTran, EasyJet, GOLAirways, JetBlue Airways, Virgin Blue, Southwest Airlines, Ryanair and WestJet.

* Peer group information are obtained from the latest available annual reports by each respective Company.1 AirTran and Ryanair are excluded from this comparison.2 AirArabia, VirginBlue and Ryanair are excluded from this comparison.

AirAsia Peer Group

3.35

-

8/3/2019 AA Corporate 2007b

29/148

IN D US TRYO VE RVIE W

AIRASIABERHAD

27ANNUAL REPORT2007

World Domestic CAGR = 3.2%World International CAGR = 5.8%Total World CAGR = 4.1%

1,600

1,400

1,200

1,000

800

600

400

200

0

Million passengers

WORLD AIR TRAVEL PASSENGERS

Air travel continued to enjoy buoyant growth in 2007. According to the International Civil Aviation Organization (ICAO),

2.2 billion passengers were carried on scheduled services around the world in 2007. This represents a 6% growth ratecompared to 2006, thus significantly outpacing the long-term average growth rate of 4.1%.

Overall, the aviation industry performed strongly in 2007. The estimated profit produced by the industry was USD16.3billion, up by 26% from the year before. In general, traffic growth outpaced the increase in available seat capacity. Theglobal load passenger load factor in 2007 reached a record of 76.5%. Yields have also increased across the board withprice increases in the premium classes and economy class.

Asia Pacific recorded the second most impressive growth after the Middle East. Total passenger load for the Asia Pacificregion was roughly 617 million passengers. This represents a growth of 12.7% (or 70 million passengers) over the previousyear.

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007F

Source: ICAO (December 2007)

Domestic

International

-

8/3/2019 AA Corporate 2007b

30/148

-

8/3/2019 AA Corporate 2007b

31/148

-

8/3/2019 AA Corporate 2007b

32/148

CORPORATE SOCIALRESPONSIBILITY

AIRASIABERHAD

30 ANNUAL REPORT2007

ENVIRONMENTThe aviation industry is a contributor to air pollution in the form ofnoise and harmful emissions such as carbon dioxide, nitrogen oxides,hydrocarbons and dust particles. Whilst achieving zero pollution level isimpossible, there are ways to mitigate the impact on the environment.

As a relatively new airline, AirAsia has been able tocraft a business plan that included enlightened aspectsof running an airline that would contribute to a cleanerenvironment. Our goal is to ensure that our existingbusiness is as efficient as possible, both in the air and onthe ground and to continue to find ways to minimise ourenvironmental footprint.

There is no established measure or regulation for anairlines environmental efficiency. In the absence of sucha measure, AirAsia has set itself the target of being aleading environmentally efficient and responsible airline.The strategies that we implement are listed below:

1. INVESTMENT IN THE LATEST TECHNOLOGY

AirAsias policy is to grow its fleet using the latesttechnology aircraft whilst retiring older models. Weare motivated by the fact that todays aircraft aretypically 70% cleaner (per passenger kilometre) and75% quieter than their 1960s counterparts.

New technology aircraft are more fuel-efficient thanolder models due to technological advancementsin aerodynamic efficiency, the use of advancedlightweight materials (such as composite materials)and fuel-efficient engines. This will also lower theamount of harmful emissions, a byproduct of fuelburn.

2. EFFICIENT USE OF AIRCRAFT

Our standard aircraft is the Airbus A320. The typicalseating configuration of an Airbus A320 is 150 seats

(source: Airbus). However, we have configured ourAirbus A320 with 180 seats thus achieving 20%more seats per flight than the standard configuration.

Our no-frills service allows us to reduce the spaceand weight inside the plane devoted to galleys,lavatories and storage. In addition, we have furnishedour fleet with lightweight seats, carpets and othercomponents. The reduced weight of the aircrafttranslates to lower fuel consumption and air pollution.

3. POINT TO POINT NETWORK

Conventional airlines operate networks based ona hub and spoke system. In these networks, themajority of passengers will take two flights to reachtheir destination, connecting through the hub.AirAsia only flies direct with no connecting services.A direct service between two points will producelower emissions than two flights via a hub.

4. SIMPLE AIRPORT INFRASTRUCTURE

AirAsia has simple airport infrastructurerequirements. As a short-haul point-to-point airlinewith one class of service, AirAsia has no need forsegregated check-in areas or for complex baggagehandling systems and facilities to transfer passengersbetween flights. Wherever possible, AirAsia usesbasic steps, staircases and ramps rather thanenergy-consuming aero bridges.

-

8/3/2019 AA Corporate 2007b

33/148

CORPORATE SOCIALRESPONSIBILITY

AIRASIABERHAD

31ANNUAL REPORT2007

The fuel consumption rate per seat has improved by 18% since 2005. This improvement is due to the induction of brandnew Airbus A320 aircraft into the fleet (first Airbus A320 aircraft delivered December 2005) and the move to the lowcost terminal in March 2006. The fuel consumption rate is expected to improve further in 2008 as we phase off the olderBoeing 737-300 completely in the Malaysian operations.

AirAsia Fuel Consumption Rate (liters per 100 ASK)

2004

3.54

2005

3.52

2006

3.31

2007

2.89

Youngest and one of thecleanest fleet in Asia

Flying directreduces emissions

Simple infrastructureenhances efficiency

Saves energyby using steps

-

8/3/2019 AA Corporate 2007b

34/148

CORPORATE SOCIALRESPONSIBILITY

AIRASIABERHAD

32 ANNUAL REPORT2007

YOUR WORK MAKES YOU OUTSTANDING

Nothing else is a factor in recognizing and rewardingthe work of any one of our staff. Not race, creed, age,disability, nationality, religion or sexual orientation. AtAirAsia, being an equal opportunities employer is a pillarof the companys identity.

TEACHING SKILLS FOR A LIFETIME

AirAsias training and development programmes aredesigned to take very good people and give them theskills necessary to safely operate an airline. The AirAsiaAcademy pursues an in-depth and rigorous programmefor ongoing development of our pilots, cabin crew,engineers, contact centre, and management andadministrative staff. Alongside these job skills, employeesare trained to invest and believe in our brand propositionof safety, fun, friendly, caring and passion. Inevitablythis training transforms our employees in their personaland social lives too, making them stand out as capableand dedicated people.

CORPORATE CULTURE

AirAsia has a clear communications strategy that unifiesall our employees across Asia in reaching businessachievements and goals. Our flat management structureenables the management to communicate directlywith all employees, via intranet and forums to discussany developments that are pertinent to AirAsia. Thisopen communication channels ensures high employeesatisfaction and engagement levels.

STAFF REWARDS AND RECOGNITION

AirAsia continues to deliver staff appreciation initiativessuch as food subsidies, free staff travel, generousmedical insurance coverage for staff and seminars onpersonal health and wellbeing. All of which are part ofthe caring environment that we believe will motivateand take our staff to ever-higher levels of excellence.

PEOPLE

Team AirAsia

The airline that believed it could, and did that has been the mindsetthat has propelled us into the imagination of the public and into theranks of award-winning airlines. To keep the momentum going, we havecreated a work environment that is liberating and supportive; thatproduces champions; and that inspires each member of the team todeliver outstanding performance to internal and external customers.

-

8/3/2019 AA Corporate 2007b

35/148

-

8/3/2019 AA Corporate 2007b

36/148

-

8/3/2019 AA Corporate 2007b

37/148

-

8/3/2019 AA Corporate 2007b

38/148

A IR A S IA X AIRASIABERHAD36 ANNUAL REPORT2007

BRING THE WORLD TOASIA AND TAKE ASIATO THE WORLD.

Another tradition has been consigned to thehistory books by the AirAsia brand. This time,AirAsia X, has questioned the very nature ofexpensive long haul flights by bringing itsdiscipline of low cost principles to this onceprivileged category of air travel.

-

8/3/2019 AA Corporate 2007b

39/148

AIRASIA XAIRASIABERHAD

37ANNUAL REPORT2007

AirAsia X will deliver fares as much as 50% lower than

incumbent airlines by utilizing a new operating modelbased on its blueprint of high aircraft utilisation,point-to-point services and single aircraft type withoptimised seat configuration.

HISTORY IN THE MAKING

AirAsia X was introduced in January 2007 and set upas a separate company with its own operating licenseand capital structure. This enables AirAsia X to pursueits own sources of equity to support debt for its fleetof wide-body aircraft.

In February 2008 AirAsia X had raised RM375 milliongaining the confidence of prominent local andinternational investors including Richard BransonsVirgin Group, Orix of Japan, Manara of the Middle East,and certain individual founders of AirAsia. AirAsia Berhadholds a 16% interest via redeemable preference shares.

LAUNCHING A GLOBAL NETWORK

AirAsia X secured its first leased A330-300 aircraft andcommenced commercial operations in November 2007to Gold Coast, Australia. This was followed by Hangzhou,China in February 2008. AirAsia X pioneered thesedestinations with their first direct flights from SoutheastAsia in line with the model of stimulating new markets.

We have secured our growth pipeline with the acquisitionof 25 new Airbus A320-300 for phased delivery from2008 to 2013. When the full fleet is eventually in placeover the next five years, AirAsia X wil l be providingservices to over 25 destinations across Australia, China,India, Japan, Korea and the Middle East. We are alsoplanning to introduce London as our maiden Europeandestination. Currently, efforts are underway to secure asuitable aircraft to ply this route. We hope to launch thishighly anticipated flight later in 2008.

INNOVATING THE LONG-HAUL IN-FLIGHT XPERIENCE

Given the nature of long haul flights, AirAsia X hasbeen pioneering new services to ensure greater comfortfor its guests. Priority is given to quality seating with

the trademark AirAsia black leather seats, a seat pitch

comparable to full-service carriers, and an innovativefixed-back shell design. We have also introduced the XLseat, a premium wider seat with ample legroom pricedat the same rate as an economy seat on a legacy carrier,but with the spaciousness that rivals seats in traditionalbusiness class.

The new aircraft will be fitted with a state-of-the-art,in-flight entertainment system. Guest will thus enjoy awide array of movies, TV programmes and music, aswell as interactive features that allow the convenienceof ordering food, beverages and duty free items.

SYNERGIES WITH AIRASIA

There are significant benefits and synergies betweenAirAsia and AirAsia X. By exploring the long-haul sector,the AirAsia brand will extend its reach globally and boostthe brand building process. The route network will havemore city pairing options and promote flow through oflong-haul passengers to AirAsias short-haul network.AirAsia is the most geographically connected airline inSouth-east Asia, a compelling trait that makes KualaLumpur the low cost gateway to South-east Asia.

The second synergy is to help stabilise yields. Demand forair travel is inherently seasonal. However the seasonalitydiffers from country to country. By linking Malaysia to therest of the world, we can overlap the weak season witha strong season or vice-versa. This will help to stabiliseyields and reduce seasonality spikes over the year.

However, both AirAsia and AirAsia X derive scalebenefits by leveraging AirAsias brand, infrastructure,and resources through brand license and commercialservices agreements.

FUTURE OUTLOOK

Barely a few months into its operations, AirAsia Xis enjoying brisk demand and is poised to turn in apositive operating cash flow. The future looks bright asAirAsia X extends the amazing AirAsia experience acrossthe world, living up to its tagline: Now Everyone CanFly Xtra Long.

-

8/3/2019 AA Corporate 2007b

40/148

MA J O RMILE S TO N E S

AIRASIABERHAD

38 ANNUAL REPORT2007

YEAR 2007

7 September 2007AirAsia was recognised for its human capitaldevelopment, Awarded the 2007 Frost & SullivanIndustrial Technologies awards.

31 August 2007AirAsia signed a letter of intent with Vietnamshipbuilding industry group (Vinashin) for a newbudget airline in Vietnam.

30 August 2007AirAsia completed a record year: Annual revenueincreased by 52%, pretax profit soared to RM278 millionwith EBITDAR margins of 31%.

28 August 2007Iskandariah Development Region gets a boost fromAirAsia with enhanced connectivity. AirAsia celebratedits first Airbus in Johor base with flights to Macauand Palembang.

24 August 2007AirAsias sponsored the Road Flyers-Merdeka MillenniumEndurance Race 2007 supporting local motorsport racingtalents.

15 August 2007AirAsia's In-flight magazine launched...Travel 3Sixty.

4 August 2007

15 August 2007

4 August 2007Enchanced facilities for greater mobility AirAsiaimproved amenities for the comfort of its disabled guests.

2 August 2007AirAsia announced sponsorship of English PremierLeague Referees.

30 July 2007AirAsia bagged the 2007 Asia's Best Low-Cost Airlineaward by Skytrax.

20 July 2007AirAsia and FlyAsianXpress (now known as AirAsia X)sign the Brand License Agreement.

16 July 2007Inaugural KUALA LUMPUR SHENZHEN flight!

11 July 2007Citibank and AirAsia tie the knot! Citibank AirAsiaco-branded credit card was launched.

5 July 2007AirAsia is the only airline to serve direct flights toKrabi from KL.

2 August 2007 16 July 2007

-

8/3/2019 AA Corporate 2007b

41/148

-

8/3/2019 AA Corporate 2007b

42/148

AW A R D S &AC CO LA D ES

AIRASIABERHAD

40 ANNUAL REPORT2007

AirAsia received the Ministers Award at the Malaysia Tourism Awards2005/2006.

The Asean leader in affordable asian travel andan award-winning low cost carrier.

2007

AirAsia was voted as Asias Best Budget Airline by SmartTravelAsia.com under

the Best In Travel Poll 2007.

AirAsia was awarded the Airline Human Capital Development Strategy Award for the Asian Commercial Pilot Training Market by Frost & Sullivan.

AirAsia was ranked as one of Asia's Best Emerging Companies withregards to Corporate Governance by The Asset.

AirAsia was awarded as the Best Low Cost Airline in Asia bySkytrax Research of London.

AirAsia, Asias leading low fare airline has bagged yet another prestigiousaward, The Brand Laureate 2006-07 for brand excellence in the Airlines-Low Cost Carrier Category at the inaugural Brand Laureate Awards by Asia PacificBrands Foundation (APBF).

AirAsia was awarded as the Airline of the Year 2007 by the Centrefor Asia Pacific Aviation.

AirAsia was awarded as Malaysias Best Managed-Mid Cap Company by Asia Money magazine.

-

8/3/2019 AA Corporate 2007b

43/148

-

8/3/2019 AA Corporate 2007b

44/148

A IR A S IAG R O UP

AIRASIABERHAD

42 ANNUAL REPORT2007

AirAsia Berhad(284669-W)

as at 31 March 2008

100%AA International

Ltd

100%AirAsia

(Mauritius)Ltd

100%Crunchtime

Culinary ServicesSdn Bhd

100%Airspace

CommunicationsSdn Bhd

100%AirAsia

Go HolidaySdn Bhd

39.9%AirAsia

PhilippinesInc

100%AirAsia

(Hong Kong)Ltd

49%AirAsia

Go HolidayCo. Ltd

49%AirAsiaPte Ltd

49%Thai AirAsia

Co. Ltd

49%PT Indonesia

AirAsia

100%AA Capital

Ltd

100%AirAsia (B)

Sdn Bhd

100%Thai AirAsia

Hong Kong Ltd

51%Thai Crunch Time

Co. Ltd

49%

-

8/3/2019 AA Corporate 2007b

45/148

C O R P O R ATEIN F O R MATIO N

AIRASIABERHAD

43ANNUAL REPORT2007

BOARD OF DIRECTORS

Dato' Pahamin Ab. RajabChairman/Non-Executive Director

Dato Anthony Francis FernandesGroup Chief Executive Officer

Dato Kamarudin bin MeranunDeputy Group Chief Executive Officer

AUDITORS

PricewaterhouseCoopersLevel 10, 1 SentralJalan Travers, Kuala Lumpur Sentral50706 Kuala LumpurTel : (603) 2173 1188Fax : (603) 2173 1288

REGISTERED OFFICE

AirAsia Berhad(Company No. 284669-W)25-5, Block H, Jalan PJU 1/37Dataran Prima, 47301 Petaling JayaSelangor Darul Ehsan, MalaysiaTel : (603) 7880 9318Fax : (603) 7880 6318E-mail : [email protected] : www.airasia.com

SHARE REGISTRAR

Symphony Share Registrars Sdn BhdLevel 26, Menara Multi-PurposeCapital SquareNo. 8 Jalan Munshi Abdullah50100 Kuala Lumpur, MalaysiaTel : (603) 2721 2222Fax : (603) 2721 2530/1

AUDIT COMMITTEE

Dato Leong Khee SeongFam Lee EeDatuk Alias bin AliDato Mohamed Khadar bin Merican

REMUNERATION COMMITTEE

Datuk Alias bin AliDato Leong Khee SeongFam Lee Ee

NOMINATION COMMITTEE

Dato' Pahamin Ab. RajabDatuk Alias bin AliFam Lee Ee

OPERATIONS SAFETY COMMITTEE

Conor Mc CarthyDato Abdel Aziz @

Abdul Aziz bin Abu Bakar

COMPANY SECRETARY

Jasmindar Kaur A/P Sarban Singh(Maicsa 7002687)

Fam Lee EeIndependent Non-Executive Director

Datuk Alias bin AliIndependent Non-Executive Director

Dato Mohamed Khadar bin MericanIndependent Non-Executive Director

Dato Abdel Aziz @Abdul Aziz bin Abu Bakar

Non-Executive Director

Conor Mc CarthyNon-Executive Director

Dato Leong Khee SeongIndependent Non-Executive Director

SOLICITORS

Messrs Logan Sabapathy & Co.

PRINCIPAL BANKERS

CIMB Bank BerhadCitibank BerhadMalayan Banking BerhadRHB Bank BerhadStandard Chartered Bank

Malaysia Berhad

CORPORATE BROKER

ECM Libra Berhad

CORPORATE ADVISOR

Credit Suisse

STOCK EXCHANGE LISTING

Main Board of Bursa MalaysiaSecurities Berhad

(Listed since 22 November 2004)(Stock code: 5099)

-

8/3/2019 AA Corporate 2007b

46/148

AIRASIABERHAD

44 ANNUAL REPORT2007

B O A R D O F D IR E C TO R S1. Dato Mohamed Khadar

bin Merican4. Dato Anthony Francis Fernandes2. Conor Mc Carthy

3. Dato Kamarudin bin Meranun

from left to right

-

8/3/2019 AA Corporate 2007b

47/148

AIRASIABERHAD

45ANNUAL REPORT2007

5. Dato' Pahamin Ab. Rajab

6. Dato Abdel Aziz @Abdul Aziz bin Abu Bakar

9. Datuk Alias bin Ali7. Dato Leong Khee Seong

8. Fam Lee Ee

-

8/3/2019 AA Corporate 2007b

48/148

D IR E C TO R S P R O F ILE

AIRASIABERHAD

46 ANNUAL REPORT2007

DATO' PAHAMIN AB. RAJAB ,

Malaysian, aged 62, an Advocate andSolicitor of the High Court of Malaya,was appointed Non-ExecutiveChairman of the Company on14 December 2001. He is also theChairman of the NominationCommittee. Prior to joining theCompany, he worked in severalministries and government agenciesin Malaysia over a 30-year periodand held various key positions,including as Director General ofRoad Transport Department at theMinistry of Transport from 1974 to

1998, Secretary-General of theMinistry of Domestic Trade andConsumer Affairs from 1998 to 2001and Chairman of the Patent Boardand the Controller of Copyrightfrom 1998 to 2001. He is recognisedinternationally as an expert inintellectual property laws by theWorld Intellectual PropertyOrganisation and, in 2000, wasawarded the prestigious CyberChampion International Award bythe Business Software Alliance inWashington. He received a B.A.

degree in History from the Universityof Malaya in 1970, a postgraduateDiploma in Shariah Law and Practicefrom the International IslamicUniversity, Malaysia in 1991, a lawdegree (LL.B) from the Universityof London in 1990, and a Mastersof Arts (Public Policy andAdministration), majoring inEconomic Development, from theUniversity of Wisconsin in 1978.He is also the Chairman ofSEG International Berhad andLNG Resources Berhad.

DATO' PAHAMIN

AB. RAJAB

-

8/3/2019 AA Corporate 2007b

49/148

-

8/3/2019 AA Corporate 2007b

50/148

DIRECTORSPROFILE

AIRASIABERHAD

48 ANNUAL REPORT2007

DATO KAMARUDIN BIN MERANUN , Malaysian, aged 47, was appointed Director of theCompany on 12 December 2001. In January 2004, he was appointed Executive Directorand on 8 December 2005, he was redesignated to Group Deputy Chief Executive Officer.

He is also the Chairman of the Employee Share Option Scheme Committee of the Board.Prior to joining the Company, he worked in Arab-Malaysian Merchant Bank from 1988 to1993 as a Portfolio Manager, managing both institutional and high net-worth individualclients investment funds. In 1994, he was appointed Executive Director of InnosabahCapital Management Sdn Bhd, a subsidiary of Innosabah Securities Sdn Bhd. Hesubsequently acquired the shares of its joint venture partner of Innosabah CapitalManagement Sdn Bhd, which was later renamed Intrinsic Capital Management Sdn Bhd.He received a Diploma in Actuarial Science from University Technology MARA (UiTM)and was named the Best Actuarial Student by the Life Insurance Institute of Malaysiain 1983. He received a B.Sc. degree with Distinction (Magna Cum Laude) majoring inFinance in 1986, and an MBA in 1987 from Central Michigan University.

DATO ABDEL AZIZ @ ABDUL AZIZ BIN ABU BAKAR , Malaysian, aged 55, wasappointed as Non-Executive Director of the Company on 20 April 2005. He is also amember of the Operational Safety Committee of the Board. Prior to this, he served asan Alternate Director of the Company to Dato' Pahamin Ab. Rajab since 11 October2004. He also served earlier as a Director of the Company from 12 December 2001 to11 October 2004. He is currently the Executive Chairman of VDSL Network Sdn Bhd.He is also the Chairman of PAIMM (Academy of Malaysian Music Industry Association)and PRISM (Performance and Artists Rights Malaysia Sdn. Bhd.), a music performerscollection body. From 1981 to 1983 he was Executive Director of Showmasters (M) SdnBhd, an artiste management and concert promotion company. He subsequently joinedBMG Music and was General Manager from 1989 to 1997 and, Managing Director from1997 to 1999. He received a Diploma in Agriculture from Universiti Pertanian Malaysiain 1975, his BSc in Agriculture Business from Louisiana State University, USA in 1978,and an MBA from the University of Dallas, USA in 1980.

DATO KAMARUDINBIN MERANUN

DATO ABDEL AZIZ @ABDUL AZIZ BIN ABU BAKAR

-

8/3/2019 AA Corporate 2007b

51/148

DIRECTORSPROFILE

AIRASIABERHAD

49ANNUAL REPORT2007

CONOR MC CARTHY

CONOR MC CARTHY , Irish, aged 46, was appointedNon-Executive Director of the Company on 21 June 2004. Heheads the Operational Safety Committee of the Board. He isManaging Director of PlaneConsult, a leading aviation businesssolutions provider which he set up in 2000 which specialises inadvising and establishing Low Cost Carriers Prior to establishingPlaneConsult, Conor was the Director of Group Operations atRyanair from 1996 to 2000. Before joining Ryanair, he wasthe CEO of Aer Lingus Commuter. Prior to that, he was GeneralManager/SVP for Aer Lingus in the Marketing and StrategicPlanning divisions. He spent 18 years with Aer Lingus in allareas of the airline business from Engineering, Operations andMaintenance to Commercial Planning, Marketing and RouteEconomics to Finance, Strategic Management, Fleet Planningand General Management. He is a qualified Avionics Engineerand holds a First Class Honours degree in Engineering fromTrinity College Dublin.

DATO LEONG KHEE SEONG

DATO LEONG KHEE SEONG , Malaysian, aged 69, wasappointed Independent Non-Executive Director of theCompany on 8 October 2004. He is Chairman of the AuditCommittee and a member of the Remuneration Committee ofthe Board. He was Deputy Minister of Primary Industries from1974 to 1978, Minister of Primary Industries from 1978 to 1986 anda Member of Parliament from 1974 to 1990. Prior to this, he wasa substantial shareholder of his familys private limited companies,which were principally involved in general trading. He wasthe Chairman of the General Agreement on Tariffs and TradesNegotiating Committee on Tropical Products (1986 to 1990)and was the Chairman of the Group of 14 on ASEAN EconomicCooperation and Integration (1986 to 1987). He graduated with adegree in Chemical Engineering in 1964 from University of NewSouth Wales, Australia. He is an Executive Chairman of NanyangPress Holdings Berhad and Independent Non-Executive Directorof TSH Resources Berhad.

-

8/3/2019 AA Corporate 2007b

52/148

DIRECTORSPROFILE

AIRASIABERHAD

50 ANNUAL REPORT2007

FAM LEE EE , Malaysian, aged 47, was appointed Independent Non-Executive Director of

the Company on 8 October 2004. He is also a member of the Audit, Remuneration andNomination Committees of the Board. He received his BA (Hons) from the University ofMalaya in 1986 and an LLB (Hons) from the University of Liverpool, England in 1989. Heobtained his Certificate of Legal Practice in 1990 and has been practising law since 1991and currently is the senior partner at Messrs YF Chun, Fam & Yeo. He also serves as aDirector of M-Mode Berhad.

DATUK ALIAS BIN ALI , Malaysian, aged 60, was appointed Independent Non-ExecutiveDirector of the Company on 23 September 2005. He is also the Chairman of theRemuneration Committee and a member of the Audit and Nomination Committees ofthe Board. Prior to this, he had a long and distinguished career with the Governmentwhich began soon after his graduation from the University of Malaya in 1970. He startedas an Administration Trainee Officer in the Statistics Department. He subsequently

joined the Prime Ministers Department as Administration Development Officer. Whilststill with the department, he completed his Master in Business Management andassumed the position of Head of Department (Consultancy) at the National Instituteof Public Administration (INTAN) in 1975. Over the next 15 years with the Government,he held various senior positions in several Ministries and Department including asDeputy Director of Training (Operations) in the Public Services Department, UnderSecretary (Establishment and Services) in the Ministry of Works and Director ofIndustrial Development Division in the Ministry of Trade and Industry. He moved backto the Prime Ministers Department in 1990 as Cabinet Under Secretary. In June 2000,he was appointed Secretary General of the Ministry of Health, a post he held until hisretirement in March 2004. He received a Master in Business Management from the AsianInstitute of Management, Philippines in 1975 and a Bachelor of Economics (Honours)from the University of Malaya in 1970. He is also presently a Director of FIMA CorporationBerhad, CCM Duopharma Biotech Bhd. and Melati Ehsan Holdings Bhd.

FAM LEE EE

DATUK ALIAS BIN ALI

-

8/3/2019 AA Corporate 2007b

53/148

DIRECTORSPROFILE

AIRASIABERHAD

51ANNUAL REPORT2007

DATO MOHAMED KHADAR BIN MERICAN , Malaysian, aged 52, was

appointed Independent Non-Executive Director of the Company on10 September 2007. He is also a member of the Audit Committee of theBoard. He has had more than 20 years experience in financial and generalmanagement. He has been an auditor and a management consultant withan international accounting firm, before joining a financial services groupin 1986. Between 1988 and April, 2003, Dato Khadar held several seniormanagement positions in Pernas International Holdings Berhad (now knownas Tradewinds Corporation Berhad), a company listed on the Main Board ofBursa Malaysia Securities Berhad, including as President and Chief OperatingOfficer. He is a member of both the Institute of Chartered Accountants inEngland and Wales and the Malaysian Institute of Accountants. He is alsopresently a Director of Rashid Hussein Berhad, RHB Capital Berhad, RHBInvestment Bank Berhad (formerly known as RHB Sakura Merchant BankersBerhad), RHB Investment Management Berhad and ASTRO All Asia

Networks PLC.

DATO MOHAMEDKHADAR BIN MERICAN

Notes:

1. Family Relationship with Director and/or Major ShareholderNone of the Directors has any family relationship with any director and/or majorshareholder of AirAsia.

2. Conflict of InterestNone of the Directors has any conflict of interest with AirAsia Group.

3. Conviction for OffencesNone of the Directors has been convicted for offences within the past 10 years otherthan traffic offences, if any.

4. Attendance of Board MeetingsThe attendance of the Directors at Board of Directors' Meetings is disclosed in theCorporate Governance Statement.

-

8/3/2019 AA Corporate 2007b

54/148

S E N IO RMA N AG EME N T

AIRASIABERHAD

52 ANNUAL REPORT2007

DATO TONY FERNANDES

DATO KAMARUDIN MERANUN

TASSAPON BIJLEVELD

ASHOK KUMAR

LAU KIN CHOY

JOYCE LAI LIH YIN

MEGAT KAMARRUDDINMEGAT SHAMSUDDIN

KATHLEEN TAN

DHARMADI

-

8/3/2019 AA Corporate 2007b

55/148

SENIORMANAGEMENT

AIRASIABERHAD

53ANNUAL REPORT2007

SAIDULKHADRI HAMZAH

ROZMAN OMAR

CAPTAIN CHIN NYOK SAN NASSER KASSIM

TAN HOCK SOON

CAPTAIN WONG KAM WENG

AZHARI DAHLAN

BO LINGAM

CAPTAIN ADRIAN JENKINS

-

8/3/2019 AA Corporate 2007b

56/148

SENIORMANAGEMENT

AIRASIABERHAD

54 ANNUAL REPORT2007

DATO TONY FERNANDESGroup Chief Executive Officer

Details of Dato Tony Fernandes are disclosed in theDirectors Profile on page 47 of this Annual Report.

DATO KAMARUDIN MERANUNDeputy Group Chief Executive Officer

Details of Dato Kamarudin Meranun are disclosed in theDirectors Profile on page 48 of this Annual Report.

TASSAPON BIJLEVELDChief Executive Officer, Thai AirAsia

Tassapon joined Thai AirAsia in 2003 as Chief ExecutiveOfficer and is entrusted with the responsibility ofoverseeing all aspects of the airlines operations as wellas driving growth in Thailand. Tassapon has more than12 years experience in the consumer products industry,having worked in various countries in South East Asiaand Indo China for two Fortune 500 companies Adams

(Thailand) Co. Ltd (a division of Warner Lambert) andMonsanto (Thailand) Co. Ltd. Prior to joining AirAsia hewas Managing Director of Warner Music(Thailand) Co.Ltd for 5 years.

DHARMADIChief Executive Officer, Indonesia

Dharmadi joined Indonesia AirAsia December 2007as Chief Executive Officer. He received Bachelor Degreein Technical Engineering Education in Indonesia and

a Master Management in an International MarketingManagement from PPM Business School, Indonesia.Dharmadi has more than 32 Years working experiencein Garuda Indonesia Airlines with several Managerialposition such as Manager Flight Crew Training, Directorof Training Center, Senior Vice President Procurementand Executive Vice President Operations. Prior to AirAsia,he was also serving as a Captain Pilot B747-400 FlightCrew in Asiana Airline, Korea from 2005-2007.

ROZMAN OMARRegional Head, Finance

Rozman Omar has been the Regional Head for Financesince August 2006. Rozman was part of the keymanagement team that spearheaded the flotationof AirAsia Berhad on Bursa Malaysia. He was also oneof the key personnel involved in the formation ofAirAsias joint ventures in Thailand and Indonesia. Uponcompletion of the Companys flotation in November2004, he was made the CFO of PT Indonesia AirAsiaresponsible for all the financial and corporate legalaspects of the Company. Rozman has over 22 years ofextensive corporate finance experience. Upon completionof his ACCA examinations in 1984, Rozman joined Arab-Malaysian Merchant Bank Berhad for six years and thenmoved on to join some other financial institutions beforerejoining back to Arab-Malaysian Merchant Bank Berhadas General Manager, Corporate Finance from 1994 to1996. Rozman later joined Innosabah Corporate ServicesSdn. Bhd. as the Managing Director until 1999 beforeventuring out with InCAM Consulting Sdn. Bhd. until2003.

KATHLEEN TANRegional Head, Commercial

Kathleen Tan joined AirAsia as Senior Vice-President forGreater China in August 2004. Kathleen was instrumentalin securing AirAsias entry to China and launched the firstroute to Xiamen, making AirAsia the first low cost carrierto operate in China. As Head of Commercial, Kathleen isresponsible for driving route revenue, sales anddistribution, marketing, brand building and ancillaryincome within the AirAsia network. Prior to AirAsia, shewas Managing Director of Warner Music Singapore for 7years and Regional Marketing Director of Warner Music

Asia Pacific in Hong Kong for 3 years. Kathleen startedher career in the advertising industry, and has gained awealth of experience in brand marketing and strategyexecution. She was the brainchild behind the success ofthe Guess label in Southeast Asia as well as Gucci, Coachand Fendi.

-

8/3/2019 AA Corporate 2007b

57/148

SENIORMANAGEMENT

AIRASIABERHAD

55ANNUAL REPORT2007

CAPTAIN CHIN NYOK SANHead of Business Development

Captain Chin Nyok San was one of the pioneers ofAirAsia, then under the DRB HICOM. Captain Chin hasover 30 years of illustrious career in the airline industryencompassing the whole aspect of the industry. He is alicensed pilot for multiple types of aircraft, an authorisedexaminer, training Captain and served as the flightoperations manager. He obtained his Commercial PilotsLicense in 1976 and Airline Transport Pilots License in1985 from the Department of Civil Aviation Malaysia. Healso obtained an Airline Transport Pilots License fromthe Federal Aviation Administration in 1994. CaptainChin has been the Head of Business Development sinceJanuary 2005. His team single handedly establishedThai-AirAsia aircraft operating certificateand effectivelyreactivated Indonesia AirAsia's aircraft operatingcertificate and recommenced the business unit.

BO LINGAMRegional Head, Operations

Bo Lingam has worked extensively in the publication

and music industry at various production houses. He joined AirAsia in November 2001 as Ground OperationsManager. Prior to his current appointment as RegionalHead of Operations, Bo held several other key roles atAirAsia including as Regional Director Guest Services,Senior Manager Purchasing & Supplies before he wasseconded to Thai AirAsia to oversee and assist in theinitial set-up of Thai AirAsia operations in Bangkok.

ASHOK KUMARRegional Head, Strategic Planning and Airport Policy

Ashok Kumar has been Regional Director, Airport andPublic Policy of the Company since January 2005. Priorto that, Ashok was Regional Director, Government andBusiness Relations from October 2004. He has had 37years experience in the airline industry, having workedat Malaysia-Singapore Airlines as ManagementTrainee/Marketing Executive from 1970 to 1972 andMalaysia Airlines from 1972 to 2003, where he heldvarious key positions, including as Assistant GeneralManager, Operations Planning, before joining theCompany in 2003 as Senior Manager, CommercialPlanning and Strategy. Ashok received a Bachelor ofApplied Economics (Hons) from the University ofMalaya in 1970.

CAPTAIN WONG KAM WENGRegional Head, Flight Safety

Captain Wong served as Regional Director, Group QualityManagement System until his recent appointment asRegional Head of Flight Safety. Captain Wong joined

AirAsia in September 1996, initially as Captain of theBoeing 737 and later as Instructor and Examiner. CaptainWong currently serves as Captain, Instructor, Examinerand is a member of AirAsia's aircraft acceptance testteam. Captain Wong started his career in the aviationindustry with Pelangi Air as co-pilot. He wassubsequently promoted to Captain and Instructor andlater as Fleet Captain of the Fokker 50. He has flownvarious aircraft including the Airbus 330, Airbus 320,Boeing 737, Fokker 50, Dornier 228 and Twin Otter DHC6and has accumulated over 14,000 flying hours.

-

8/3/2019 AA Corporate 2007b

58/148

SENIORMANAGEMENT

AIRASIABERHAD

56 ANNUAL REPORT2007

LAU KIN CHOYRegional Head, Information Technology

Lau Kin Choy has been Regional Head, InformationTechnology & E-Commerce since July 2004 and waspreviously Chief Information Officer from August 2002.Prior to joining the Company, Lau was the GeneralManager of WEB Distribution Services Sdn Bhd, a jointventure music distribution and logistic center for WarnerMusic, EMI Malaysia and BMG Music, from 1998 to 2002.Lau was a finalist for Pikoms 2006 CIO RecognitionAward.

JOYCE LAI LIH YINRegional Head, Communications

Joyce Lai Lih Yin is one of the companys pioneerteam members. Joyce started out as Senior Manager,Media in December 2001. She was promoted to ChiefCommunications Officer before her appointment asRegional Director, Marketing and Communications inJuly 2004. Joyce was instrumental in building theAirAsia brand name in Malaysia and the region, andraising its international profile. Joyce also held other

positions from 2005 - 2007, namely Regional Director,Corporate Culture & Service Quality and later RegionalDirector, AirAsia Academy. Prior to AirAsia, Joyceheld key positions in music industry with renownedcompanies such as Warner Music Malaysia and BMGMusic Malaysia from 1994 to 2001.

AZHARI DAHLANRegional Head, Engineering

Azhari Dahlan has been Regional Director of Engineeringsince September 2004 overseeing the Groups airlineengineering functions in Malaysia, Indonesia and Thailand.Prior to that, Azhari was Manager, Planning and Logisticsfrom 1996 to 2004. He started his career in the aviationindustry with Malaysia Airlines as Licensed AircraftEngineer from 1981 to 1992, Aircraft Check Foreman from1992 to 1994 and Production Inspector from 1994 to1995. From 1995 to 1996, he was with Transmile Airinitially as a Licenses Aircraft Engineer and subsequently,as Quality Assurance Engineer. Azhari i s a LicensedAircraft Engineer by profession, and has undergonetraining at Leonard Isitt Training School, Christchurch,New Zealand and Malaysia Airlines Technical TrainingSchool, Subang, Selangor.

CAPTAIN ADRIAN JENKINSRegional Head, Flight Operations

Captain Adrian joined AirAsia in 1996 when the airlinewas then under DRB HICOM. Prior to his appointment

as Regional Head for Flight Operations in September2006, he served AirAsia in various positions including asInstructor and Company Check Airman, Assistant ChiefPilot Training and Standards and Assistant Chief Pilot 0perations. He also helped in the setting up of ThaiAirAsias flight operations and pilot training.

-

8/3/2019 AA Corporate 2007b

59/148

-

8/3/2019 AA Corporate 2007b

60/148

-

8/3/2019 AA Corporate 2007b

61/148

STATEMENT ONCORPORATE GOVERNANCE

AIRASIABERHAD

59ANNUAL REPORT2007

Supply of Information

Seven (7) days prior to the Board Meetings, all Directorswill receive the agenda and a set of Board paperscontaining information for deliberation at the BoardMeetings. Management is required to explain in theevent that the timeline cannot be observed.

As a Group practice, any Director who wishes to seekindependent professional advice in the furtherance ofhis duties may do so at the Groups expense. Directorshave access to all information and records of the Groupand also the advice and services of the CompanySecretary, who also serve in that capacity in the variousBoard Committees.

Appointments to the Board

The Group has implemented procedures for thenomination and election of Directors via the NominationCommittee. Comprising mainly of independentNon-Executive Directors, the Nomination Committee isresponsible for identifying and recommending to theBoard suitable nominees for appointment to the Boardand Board Committees. On appointment, Directors areprovided with information about the Group and attendan induction programme. The Company Secretary willensure that all appointments are properly made, that all

information necessary is obtained, as well as all legal andregulatory obligations are met.

Directors Training

During the financial period ended 31 December 2007, allDirectors have attended and completed the MandatoryAccreditation Program as required under the ListingRequirements of Bursa Malaysia.

The Directors are encouraged to attend programmes andseminars whether in-house or external to help them inthe discharge of their duties and to keep updated withemerging trends in the industry of Low Cost Carriers.

Re-election of Directors

The Articles of Association of the Company providethat at least one-third of the Directors are subject toretirement by rotation at each Annual General Meeting(AGM) and that all Directors shall retire once in everythree years, and are eligible to offer themselves for

re-election. The Articles of Association also provide that

a Director who is appointed by the Board in the courseof the year shall be subject to re-election at the nextAGM to be held following his appointment. Directors overseventy years of age are required to submit themselvesfor re-appointment annually in accordance with Section129(6) of the Companies Act, 1965.

Board Committees

The Audit Committee comprises four Independentand Non-Executive Directors. During the financial periodended 31 December 2007, a Non-Executive Director wasappointed as an additional member and the ExecutiveDirector ceased to be a member of the Audit Committee.

During the period under review, the Committee heldthree meetings and the details of Members attendancesare set out in the Audit Committee Report.

At all meetings the Group Regional Head of Finance andinternal auditors were in attendance. The Committee alsomeets with the external auditors in private at least twicein the year under review.

The Committee reviews all published financialstatements and post audit findings, focusing inparticular on accounting policies, compliance,

management judgement and estimates. It also monitorsthe Groups internal control and risk managementframework (including the effectiveness of the internalaudit function) and financial reporting. Any significantfindings or identified weaknesses are closely examinedso that appropriate action can be taken, monitored andreported to the Board.

The Committee meets routinely at least five times a yearwith additional meetings held where necessary. TheGroup Regional Head of Finance, senior managementstaff, the internal and external auditors attend suchmeetings by invitation and provide reports as requiredby the Committee.