A Return to Simplicity Paved with Complexity · example, step up instruments, cumulative preferred...

Transcript of A Return to Simplicity Paved with Complexity · example, step up instruments, cumulative preferred...

________________ © 2011 Bloomberg Finance L.P. All rights reserved. Originally published by Bloomberg Finance L.P. in the Vol. 4, No. 1 edition of the Bloomberg Law Reports—Banking & Finance. Reprinted with permission. Bloomberg Law Reports® is a registered trademark and service mark of Bloomberg Finance L.P. This document and any discussions set forth herein are for informational purposes only, and should not be construed as legal advice, which has to be addressed to particular facts and circumstances involved in any given situation. Review or use of the document and any discussions does not create an attorney‐client relationship with the author or publisher. To the extent that this document may contain suggested provisions, they will require modification to suit a particular transaction, jurisdiction or situation. Please consult with an attorney with the appropriate level of experience if you have any questions. Any tax information contained in the document or discussions is not intended to be used, and cannot be used, for purposes of avoiding penalties imposed under the United States Internal Revenue Code. Any opinions expressed are those of the author. Bloomberg Finance L.P. and its affiliated entities do not take responsibility for the content in this document or discussions and do not make any representation or warranty as to their completeness or accuracy.

A Return to Simplicity Paved with Complexity

Contributed by Anna T. Pinedo and James R. Tanenbaum, Morrison & Foerster

Regulatory reform in the United States and internationally seems directed at preventing market participants from making the same mistakes that contributed to the financial crisis. This may sound simple and straightforward; however, avoiding making the same mistakes is, in practice, harder than it sounds. Underlying the regulatory reforms that we discuss below are certain important prevailing views shaped by recent experience: that our financial institutions must maintain higher regulatory capital levels, that financial institutions should limit the use of leverage, that “simpler” financial products with a higher equity content will be more loss absorbent during financial downturns, and that certain activities (i.e., proprietary trading, securities lending, derivatives and securitization) are inherently “risky”. If these are your starting points, it is clear that future financing needs and financing alternatives for banks will change. Financial institutions will be limited in their ability to use leverage, they will face higher regulatory capital requirements, and they will not be able to use many of the funding tools that they relied upon in the past. In this article we review the regulatory capital requirements set forth in the Dodd‐Frank Wall Street Reform and Consumer Protection Act (Dodd‐Frank Act), Pub. L. 111‐203 as well as those included in the Basel III framework and consider how banks are likely to finance their activities going forward.

The Dodd‐Frank Act requires that bank regulators establish heightened prudential standards for risk‐based capital, leverage, liquidity, and contingent

capital. Systemically important institutions, which include the largest bank holding companies, will be subject to more onerous regulatory capital, leverage and other requirements, including a maximum debt‐to‐equity ratio of 15‐to‐1. The Collins Amendment provisions included in the Dodd‐Frank Act require the establishment of minimum leverage and risk‐based capital requirements. These are set, as a floor, at the risk‐based capital requirements and Tier 1‐to‐total assets standard applicable currently to insured depository institutions under the prompt corrective action provisions of the Federal Deposit Insurance Act although final regulatory capital ratios will not be set for some time. The legislation also limits regulatory discretion in adopting Basel III requirements in the United States and raises the possibility that additional capital requirements will be imposed for activities determined to be “risky,” including, but not limited to, derivatives, securitization, and securities lending.

Consistent with the Basel III framework, the Dodd Frank Act no longer permits bank holding companies to include certain hybrids, like trust preferred securities, within the numerator of Tier 1 capital. The legislation applies retroactively to trust preferred securities issued after May 19, 2010. Bank holding companies and systemically important nonbank financial companies will be required to phase‐in these requirements from January 2013 to 2016. Mutual holding companies and thrift and bank holding companies with less than $15 billion in

© 2011 Bloomberg Finance L.P. All rights reserved. Originally published by Bloomberg Finance L.P. in the Vol. 4, No. 1 edition of the Bloomberg Law Reports—Banking & Finance. Reprinted with permission. Bloomberg Law Reports® is a registered trademark and service mark of Bloomberg Finance L.P.

total consolidated assets are not subject to this prohibition. Within 18 months of the enactment of the Dodd‐Frank Act, the Government Accountability Office, pursuant to Section 174, must conduct a study on the use of hybrid capital instruments and make recommendations for legislative or regulatory actions regarding hybrids. For U.S. financial institutions that have long depended on hybrid capital issuances for funding, not having this funding tool at their disposal is a significant change.

Pre‐financial crisis, banks relied on a combination of financing tools, including, but not limited to, issuances of senior and subordinated debt and hybrid securities, short‐term borrowings, Federal Home Loan Bank advances, securitizations, and, to a much lesser extent, the issuance of equity securities. Hybrids were particularly attractive because these securities, which had equity‐like and debt‐like characteristics, were structured to obtain favorable equity treatment from ratings agencies, permit issuers to make tax‐deductible payments, and qualified as Tier 1 capital for bank holding companies. Moreover, there was no dilution for existing equity holders as a result of hybrid issuances. Over time there was significant hybrid product innovation as issuers became interested in securities with longer or bifurcated maturities and modified interest triggers. These enhanced hybrid features improved the “efficiency” of the securities, from the perspective of issuers. Investors who sought attractive yields were active buyers. However, during the financial crisis, many noted that hybrids did not perform as expected. Each group of market participants, or “interest group,” had their own differing expectations. Rating agencies noted that the securities did not provide sufficient loss absorbency for their financial institution issuers. The rating agencies proceeded to revisit their ratings methodology for hybrids, resulting in significant numbers of securities being downgraded. Hybrid investors had become accustomed to purchasing these securities and thinking of them, or treating them, as bonds. Investors assumed that hybrid issuers would exercise early redemption options on hybrids as

they arose. Hybrid issuers surprised the market when they opted not to exercise their option to redeem outstanding hybrids because alternative (or replacement) capital would have been more expensive or unavailable. Other issuers exercised their deferral rights and did not make payments on outstanding hybrids, although they continued to make payments on outstanding debt securities. In some cases, issuers “wrote down” the principal amount on hybrids. One might argue that, in such cases, issuers were availing themselves of the “flexibility” provided by hybrids. Nonetheless, the hybrids we all had become accustomed to are a thing of the past; this view was echoed by international banking regulators putting the final touches on the Basel III framework.

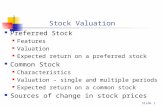

The Basel III framework requires that banks hold additional regulatory capital, after required deductions (e.g., for unrealized losses, goodwill and other intangibles, deferred tax assets above specified minimums, etc.), and narrows the types of instruments that are qualifying instruments. Basel III emphasizes the quality, consistency and transparency of the capital base. Tier 1 capital must consist predominantly of “common equity,” which includes common shares and retained earnings. This new definition of Tier 1 capital is closer to the definition of “tangible common equity.” There are a number of criteria that must be satisfied in order for non‐common equity to be classified as Tier 1. These criteria indicate that a Tier 1 security must be subordinated to depositor and general creditor claims, cannot be secured or guaranteed, must be perpetual with no incentives to redeem, must have fully discretionary non‐cumulative dividends, must be capable of principal loss absorption, and cannot hinder recapitalization. Several “innovative” Tier 1 instruments will be phased out, including, for example, step up instruments, cumulative preferred stock and trust preferred stock. The implementation period will begin in 2013.

Basel III sets the minimum common equity requirement at 4.5 percent of risk‐weighted asset, the minimum Tier 1 capital requirement at 6

© 2011 Bloomberg Finance L.P. All rights reserved. Originally published by Bloomberg Finance L.P. in the Vol. 4, No. 1 edition of the Bloomberg Law Reports—Banking & Finance. Reprinted with permission. Bloomberg Law Reports® is a registered trademark and service mark of Bloomberg Finance L.P.

percent and the minimum total capital requirement at 8 percent. For each category, there will be a 2.5 percent capital conservation buffer. The capital conservation buffer must be met with equity. If an institution “uses up” the capital conservation buffer and approaches any of the previously specified capital requirements, it will become subject to progressively more stringent constraints on dividend declarations and on executive compensation. Likely, this means that most institutions will calculate the minimums with the conservation buffer as they will not want to become subject to operating restrictions associated with “eating into” the buffer. These basic requirements will be phased in between 2013 and 2015 and the buffer will be phased in from 2016 to 2018.

The requirements set out in the Dodd‐Frank Act, taken together with the Basel III requirements, has many banks and their advisers working to understand which types of instruments, other than common stock and preferred stock (the issuance of which would result in dilution and would be expensive from a funding perspective), might be useful funding tools going forward. Many speculate that mandatory or exchangeable instruments, mandatory equity units and REIT preferred securities may work, though additional analysis is needed.

The Dodd‐Frank Act raises the possibility that “contingent capital” instruments may be a partial solution to the funding dilemma. Regulators usually have referred to contingent capital instruments as hybrid debt that is “convertible into equity when (1) a specified financial company fails to meet prudential standards. . . and (2) the [regulatory agency] has determined that threats to. . . financial stability make such conversion necessary.” There are a variety of different types of contingent capital—for example, contingent capital may include mandatorily convertible debt securities with a regulatory trigger, a market value trigger, or a double trigger; a security with a principal write‐down feature; funded or collateralized “insurance” policies; or committed funding arrangements using

forward purchase contracts. As part of the Basel III framework, the Basel Committee on Banking Supervision (BCBS) released a consultative document for comment that contained a proposal to require that the contractual terms of capital instruments issued by banks provide for write‐off or conversion to common equity at the discretion of regulators in the event that the bank issuer is unable to support itself in the private markets (referred to as a “gone‐concern proposal”). The BCBS is expected to finalize its views regarding this loss absorbent gone‐concern capital, as well as its views regarding going‐concern contingent capital before year‐end. Given that there has been limited market experience with contingent capital instruments, there are many questions that remain to be answered before these instruments become useful. In the United States, there are a number of adverse tax consequences associated with contingent capital instruments that convert into equity. In addition, rating agencies, which have only just begun to consider these instruments, have expressed concerns about whether they would provide ratings for those that convert into equity. Most important, perhaps, is that it is not clear whether there would be willing investors for securities that morph during their term from debt to equity and that require that holders bear the risk of moving down in the issuer’s capital structure during stress scenarios. The quest for simplicity may take a big detour when it comes to structuring attractive contingent capital instruments. Bank issuers and their advisers will have to work diligently to structure instruments that are at once “qualifying” and loss‐absorbent, high quality, capable of being rated by rating agencies, and appealing to investors.

Thus far, we have focused only on one “side” of the funding dilemma. Another essential lesson of the financial crisis is that banks should de‐lever and minimize their reliance on short‐term funding. Both the Dodd‐Frank Act and the Basel III framework address these concerns. The Dodd‐Frank Act sets forth the prospect of leverage limits and for larger systemically important institutions raises the

© 2011 Bloomberg Finance L.P. All rights reserved. Originally published by Bloomberg Finance L.P. in the Vol. 4, No. 1 edition of the Bloomberg Law Reports—Banking & Finance. Reprinted with permission. Bloomberg Law Reports® is a registered trademark and service mark of Bloomberg Finance L.P.

possibility of limitations on short‐term funding. In the United States, the SEC has been focused on enhanced disclosures by financial institutions of their short‐term funding levels, fearing that financial institutions engaged in “window dressing” control their debt levels around quarter end and earnings reports. Basel III addresses leverage and liquidity through a number of different measures, some of which are still to be finalized. BCBS has agreed to test a global minimum Tier 1 leverage ratio (Tier 1 capital to average consolidated assets) of 3 percent beginning in 2011. In addition, the Basel III framework introduces a liquidity coverage ratio and a net stable funding ratio, both of which are intended to address shorter term borrowings and leverage. These are still to be finalized.

To the extent that financial institutions have relied on securitization as a financing tool, both the Dodd‐Frank Act and other regulations will result in significant changes. The Dodd‐Frank Act includes a number of provisions that affect the securitization market. These focus on “credit risk retention” and require originators and securitizers of financial assets to retain a portion of the credit risk of securitized financial assets or, in more popular terms, to have “skin in the game.” The Dodd‐Frank Act generally requires credit risk retention of 5 percent of any asset included in a securitization, or less than 5 percent if the assets meet underwriting standards established by regulation. Risk retention requirements also will be required for collateralized debt obligations, securities collateralized by collateralized debt obligations, and similar instruments collateralized by other asset‐backed securities. The Dodd‐Frank Act prohibits a securitizer from directly or indirectly hedging or otherwise transferring the credit risk that the securitizer is required to retain with respect to an asset unless regulations to be adopted specify otherwise. The “costs” of securitization also, of course, have been affected by accounting changes and other regulatory developments and will be affected as well by Basel. Many observers noted that in large measure the popularity of securitization could be attributed to the fact that

securitization permitted the “recycling” of capital as banks were able to sell loans to securitization trusts and free up their balance sheets to originate new loans. That will no longer be the case.

Financial institutions will have to look to supplement their securitization activities with other funding alternatives in order to fund their loan originations. Many have suggested that covered bonds might provide a partial answer. Covered bonds are debt instruments that have recourse either to the issuing entity or to an affiliated group to which the issuing entity belongs or both. If an issuer defaults, there is then recourse to a pool of collateral (the cover pool) separate from the issuer’s other assets. The cover pool usually consists of residential mortgage loans, but may consist of commercial mortgage loans. The assets in the cover pool are subject to strict criteria and must be replaced if they no longer satisfy that criteria. Typically, the cover pool provides for overcollateralization to preserve the value of the covered bond holders’ claim in the event of the issuer’s insolvency.

In some format, covered bonds have been used in Europe, beginning with the pfandbrief in Germany, since the 18th century. The market for these securities has been well‐established and generally stable. Covered bonds have significant benefits. Covered bond holders have dual recourse, with a claim against the issuer, and also a privileged or preferential claim (embodied in statute) against the cover pool in the event of the issuer’s insolvency. Covered bonds are secured by high quality, historically low risk assets. Covered bonds usually are issued by depositary institutions that are regulated entities subject to supervision by domestic banking authorities, which ensures regulators would step in if a safety and soundness issue were to arise.

The covered bond market has grown rapidly in recent years to an estimated $3 trillion in outstanding notes. In Europe, depository institutions seeking to diversify their funding

© 2011 Bloomberg Finance L.P. All rights reserved. Originally published by Bloomberg Finance L.P. in the Vol. 4, No. 1 edition of the Bloomberg Law Reports—Banking & Finance. Reprinted with permission. Bloomberg Law Reports® is a registered trademark and service mark of Bloomberg Finance L.P.

sources find that the covered bond market provides a relatively cheap (compared to securitization) and accessible funding alternative. Covered bond investors include central banks, pension funds, insurance companies, asset managers and bank treasuries that are attracted by covered bonds’ liquidity, credit ratings and covenants. Covered bonds appeal to investors seeking low risk yield‐bearing products having long maturities. This means that bank issuers of covered bonds are able to attract new investors that are not the same investors that usually purchase RMBS or CMBS. From a funding perspective, the long maturities of covered bonds allow bank issuers to match assets and liabilities over the long term. However, there are a number of obstacles for covered bonds in the United States. Until legislation (which is currently pending) is passed in the United States that provides a statutory framework for the issuance of covered bonds and creates a first‐priority interest in the cover pool for covered bond holders, the market for covered bonds issued by U.S. institutions will remain limited.

For at least three years, U.S. banks have been forced to deal with challenges and uncertainties of historic proportion. The Dodd‐Frank Act and Basel III represent a domestic and global effort to address some of these challenges. Though much of the detail will be forthcoming, we already know that, as a general matter, balance sheet risk will be discouraged and financing simplicity will be the order of the day (at least for some time). While the ability to refrain from making the same mistakes twice is a virtue of the wise, it is not wise to assume that risk avoidance and financing simplicity will not give rise to a whole new set of challenges for financial institutions.

Anna Pinedo, a partner at Morrison & Foerster, has concentrated her practice on securities and derivatives. She represents issuers, investment banks/financial intermediaries, and investors in financing transactions, including public offerings and private placements of equity and debt securities, as well as structured notes and other

structured products. Ms. Pinedo may be contacted at [email protected].

James Tanenbaum, a partner at Morrison & Foerster, serves as chair of the firm's Global Capital Markets practice. Mr. Tanenbaum has concentrated his practice on corporate finance and the structuring of complex domestic and international capital markets transactions. He represents issuers, including some of the nation's largest financial institutions, underwriters, agents, and other financial intermediaries, in public and private offerings of securities as well as issuers, investment banks, and purchasers in hybrid, mortgage‐related, and derivative securities transactions. He has developed some of the most widely used hybrid techniques for the placement and distribution of securities. Mr. Tanenbaum may be contacted at [email protected].

SPECIALREPORT

REPRINT | FW October 2010 | www.financierworldwide.com

Dodd-Frank and the capital marketsBY ANNA T. PINEDO AND JAMES R. TANENBAUM

The Dodd-Frank Act does not directly ad-dress market regulation and trading issues;

however, that by no means should lead one to conclude that the Act will not effect dramatic changes in the capital markets. Like any re-form legislation, the Act targets the perceived capital markets related evils that presumably were root causes of the financial crisis. Under-lying the various measures we discuss below are certain important prevailing views: that our financial institutions must maintain higher regulatory capital levels; that financial insti-tutions should limit the use of leverage; that ‘simpler’ financial products with a higher eq-uity content will be more loss absorbent during financial downturns; that certain financing ac-tivities, including proprietary trading, securi-ties lending, derivatives and securitisation, are inherently ‘risky’; and that market participants should be subject to greater oversight, espe-cially in respect of their interactions with retail investors. If this is the point of departure for regulatory reform, it is clear that the resulting legislation necessarily will affect the capital markets and the effects will be most acute for financial institutions. The Act also introduces a number of new agencies and regulators, in-cluding the Bureau of Consumer Financial Protection. Financial institutions already are consumed with assessing the impact on their business operations of the Act. Significant re-sources will continue to be devoted to regula-tory compliance for at least the next 12 to 24 months as many of the most important details of regulations will not be revealed until addi-tional rule-making is undertaken or mandated studies are completed. This heightened regula-tory focus will, of course, have its own special impact on capital markets activity.

Although the capital markets as a whole will be affected by the Act, for operating compa-nies (not financial institutions) the effects will be more indirect – bank loans may be more difficult to obtain and may be more expensive; they may face higher costs as derivatives end users, they may find that there is less interest on the part of financial intermediaries in fi-nancing companies farther down in the pecking order; and private equity may be less available and so on. Individuals will be directly affected in their access to consumer financial products and in their interactions with financial services intermediaries, including investment advisers and broker-dealers. Below, we focus on the as-pects of the Act which relate most directly to the capital markets.

Financing needs and financing alternatives for banks will change. Financial institutions will be limited in their ability to use lever-age, they will face higher regulatory capital requirements and they will not be able to use the same funding tools that they relied upon in the past. The Act requires that bank regulators establish heightened prudential standards for risk-based capital, leverage, liquidity and con-tingent capital. Systemically important institu-tions, which include the largest bank holding companies, will be subject to more onerous regulatory capital, leverage and other require-ments, including a maximum debt-to-equity ratio of 15-to-1. The Collins amendment pro-visions included in the Act require the estab-lishment of minimum leverage and risk-based capital requirements. These are set, as a floor, at the risk-based capital requirements and Tier 1 to total assets standard applicable cur-rently to insured depository institutions under the prompt corrective action provisions of the Federal Deposit Insurance Act. Final regulato-ry capital ratios will not be set for some time. The legislation limits regulatory discretion in adopting Basel III requirements in the United States and raises the possibility of additional capital requirements for activities determined to be ‘risky’, including, but not limited to, de-rivatives, securitisation and securities lending.

Consistent with the emerging guidance relat-ing to the Basel III framework, the Act no lon-ger permits bank holding companies to include certain hybrids, like trust preferred securities, within the numerator of Tier 1 capital. The leg-islation applies retroactively to trust preferred securities issued after 19 May 2010. Bank holding companies and systemically important nonbank financial companies will be required to phase-in these requirements from Janu-ary 2013 to 2016. Mutual holding companies and thrift and bank holding companies with less than $15bn in total consolidated assets are not subjection to this prohibition. Within 18 months of the enactment of the legislation, the General Accounting Office must conduct a study on the use of hybrid capital instruments and make recommendations for legislative or regulatory actions regarding hybrids. For US financial institutions that have long depended on hybrid capital issuances for funding, this is a significant change. Financial institutions also will be watching closely as additional de-tails of the Basel III framework are finalised. These proposals emphasise the quality, consis-tency and transparency of the capital base. We

already know that Tier 1 capital must consist predominantly of ‘common equity’, which in-cludes common shares and retained earnings. This new definition of Tier 1 capital is closer to the definition of ‘tangible common equity’. Financial institutions and their advisers will be required to analyse the types of securities is-suances that will meet these new requirements and provide cost-efficient funding.

The Act raises the possibility that ‘contingent capital’ instruments may be a partial solution to the funding dilemma. Regulators usually have referred to contingent capital instruments as hybrid debt that is “convertible into equity when (1) a specified financial company fails to meet prudential standards…and (2) the [regu-latory agency] has determined that threats to…financial stability make such conversion necessary”. It is likely that quite a number of different formulations of contingent capital instruments, including instruments with prin-cipal write-down features, may be considered; however, many tax and other questions relat-ing to these products remain unanswered.

The Act also subjects transactions between certain affiliates of banks to more onerous re-strictions. The Act amends Section 23A and Section 23B of the Federal Reserve Act, which establish parameters for a bank to conduct ‘covered transactions’ with its affiliates, with the goal of limiting risk to the insured bank in order to prevent the bank from transferring to its affiliates the benefits of its to the federal ‘safety net’. The Act broadens the definition of ‘affiliate’ and expands ‘covered transactions’ to include, among other things, derivatives transactions and securities lending transac-tions. Covered transactions will be subject to enhanced collateral requirements and tight-ened qualitative safeguards. These new restric-tions will serve to limit a financial institution’s flexibility and may limit their participation in certain markets.

As we discuss above, the Act targets activi-ties viewed as ‘risky’ and markets perceived to have been lacking in transparency and suffer-ing from insufficient regulatory oversight. In this context, the Act implements the Volcker Rule, which imposes certain prohibitions on proprietary trading and on fund activities. Ex-cept for certain permitted activities, a ‘bank-ing entity’ cannot: (i) engage in proprietary trading; or (ii) acquire or retain any equity, partnership or other ownership interest in, or sponsor, a hedge fund or private equity fund (collectively ‘fund activities’). A ‘nonbank 8

REPRINT | FW October 2010 | www.financierworldwide.com

SPECIALREPORT

8

financial company’ supervised by the Federal Reserve may engage in proprietary trading or fund activities, but, to the extent that it does so, it will be subject to additional capital require-ments and quantitative limits, that will be es-tablished by rule. A banking entity may make and retain an investment in a fund that the banking entity organises and offers, provided that its investment is within the ‘de minimis’ standards set out in the rule. A banking entity also may engage in a specified list of ‘permit-ted activities’. Fiduciary, or asset management, activities are within this exclusive list. While there are certain areas of ambiguity in con-nection with the Volcker Rule provisions, it is clear that the intent is to remove banking enti-ties from proprietary trading. It is not difficult to predict the adverse effect that removing sig-nificant market participants (banking entities) from certain parts of the market (through the prohibition on proprietary trading) will have on pricing and liquidity, and, it is difficult to anticipate whether other entrants (for example, hedge funds) will supplant the banking entities in certain markets.

The Act creates a new regulatory structure for OTC derivatives over which the SEC and the CFTC share oversight responsibilities. The Act requires registration of swap dealers and major swap participants; subjects most swaps to central clearing; subjects swap deal-ers and major swap participants to heightened margin requirements; imposes new minimum capital requirements; establishes broader posi-

tion limits; and creates new business conduct standards for participants in this market. The Act also includes the Lincoln ‘swaps push out’ provisions, which provide that no federal as-sistance will go to an insured depository in-stitution unless it limits its swap activities to certain permitted activities, which include hedging and risk mitigation activities and swap activities involving certain rates and reference assets, such as foreign exchange, precious metals, government and GSE obli-gations and investment grade corporate debt. Financial institutions, traditionally the largest and most active ‘derivatives dealers’, also will be keeping a close eye on the changes to be effected by the Basel III framework that will affect their derivatives activities. Basel III incentivises banks to use derivatives that are centrally cleared and ‘penalises’ banks (by making these more costly) for using bespoke, non-cleared derivatives.

To the extent that financial institutions and other market participants have relied on secu-ritisation as a financing tool, the Act also will result in significant changes. The Act includes a number of provisions that affect the secu-ritisation market. These focus on ‘credit risk retention’ and require originators and securi-tisers of financial assets to retain a portion of the credit risk of securitised financial assets or, in more popular terms, to have ‘skin in the game’. The Act generally requires credit risk retention of 5 percent of any asset included in a securitisation, or less than 5 percent if the

assets meet underwriting standards established by regulation. Risk retention requirements also will be required for collateralised debt obliga-tions, securities collateralised by collateralised debt obligations, and similar instruments col-lateralised by other asset-backed securities. The Dodd-Frank Act prohibits a securitiser from directly or indirectly hedging or other-wise transferring the credit risk that the secu-ritiser is required to retain with respect to an asset unless regulations to be adopted specify otherwise. The ‘costs’ of securitisation also, of course, have been affected by accounting changes and other regulatory developments and will be affected as well by Basel.

We have not commented on the investor protection measures included in the Act, such as the possible imposition of a fiduciary duty standard of care for broker-dealers, but these also will have an effect on the capital markets. Any assessment of the impact of the Act on capital markets needs to be infused with a large dose of humility. There are a staggering number of variables, having little or nothing to do with this legislation, that will have at least as much impact on the health and stability and competitiveness of the US capital markets.

Anna T. Pinedo and James R. Tanenbaum are partners at Morrison & Foerster. Ms Pinedo can be contacted on +1 (212) 468 8179 or by email: [email protected]. Mr Tanenbaum can be contacted on +1 (212) 468 8163 or by email: [email protected].

Provisions of Dodd-Frank affecting fund managementBY DONALD V. MOOREHEAD, LARRY MAKEL AND COURTNEY C. NOWELL

The Dodd-Frank Wall Street Reform and Consumer Protection Act contains a

broad range of provisions that will impact ad-visers, including non-US advisers, to private investment funds. Many advisers previously exempt from registration will now be required to register with the Securities and Exchange Commission (SEC) and new data collection requirements will be imposed on both reg-istered and unregistered advisers. Advisers will also need to be alert to other provisions of Dodd-Frank including, for example, those governing systematically significant non-bank financial companies and derivatives trading, and the so-called Volcker Rule.

Adviser registrationTitle IV of Dodd-Frank, entitled the ‘Private Fund Investment Advisers Registration Act of 2010’, amends the Investment Advisers

Act of 1940 (the ‘Advisers Act’) by repeal-ing the so-called ‘private adviser exemption’, which generally exempts from SEC registra-tion those advisers to private funds that have fewer than 15 clients. This exemption has been relied upon by many advisers, including non-US advisers, to private funds, including hedge funds and private equity funds, and its repeal will significantly expand the universe of advisers that will be required to register with the SEC. While many US advisers have voluntarily registered with the SEC, the con-sequences of registration under Dodd-Frank will significantly expand the supervisory au-thority of the SEC.

The new registration requirements are gen-erally to become effective in July 2011 and are intended not merely to protect investors, but to enable the SEC and the new Financial Stability Oversight Council to assess risks that

the large number of private investment funds could present to the US financial system.

In general, advisers with less than $100m in assets under management (AUM) will be sub-ject to supervision, where applicable, in the state or states where they conduct business and not by the SEC. Advisers with more than $100m in AUM will be required to register with the SEC unless the adviser can qualify under one of five new statutory exemptions described below. Also, an adviser with $100m to $150m in AUM may benefit from an ex-emption the SEC is required to prescribe for advisers that advise only private funds and have assets under management in this range. It should be noted that an adviser that quali-fies for this exemption will still be subject to certain record retention and reporting require-ments. A ‘private fund’ includes any fund that would be an ‘investment company’ but for the

CHAPTER xx I EUROMONEY HANDBOOKS

1

A requiem for hybrids?by Anna T. Pinedo and James R. Tanenbaum, Morrison & Foerster LLP

In unison, the Group of Central Bank Governors and Heads

of Supervision agreed that the Basel Committee on

Banking Supervision (BCBS) should raise the issue of “the

quality, consistency and transparency of Tier 1 capital.” As

we discuss in this chapter, the proposed Basel III

framework restricts the types of instruments that would

qualify for Tier 1 treatment. Similarly, financial regulatory

reform legislation in the US, referred to as the Dodd-Frank

Act, implements various measures that together will limit

the types of instruments that may be counted for Tier 1

capital purposes. Financial institutions will be left with

fairly limited capital raising options. The options are even

fewer if financial institutions seek a tax-efficient

instrument. Regulators have indicated that they will

consider mandating a contingent capital requirement for

financial institutions. Contingent capital instruments have

been hailed as a form of loss-absorbing, high quality

capital that will serve as a ‘cushion’ for financial

institutions in all of the same ways that hybrids were

expected to have functioned. In fact, contingent capital

may prove to be just the reincarnation of the hybrid. So,

should we start working on an overture instead?

Below we provide some background on hybrid capital, an

update on rating agency and regulatory developments, and

some preliminary thoughts on contingent capital instruments.

A brief review

Hybrid securities are tax-efficient, regulatory and rating

agency-qualifying capital that lower an issuer’s cost of

Is it time to start composing a requiem for hybrid securities? Reading recentheadlines and studying recently adopted legislation makes fans of hybridsecurities mournful. Critics of hybrid securities were quick to note thatthese financial instruments did not perform as expected during the financialcrisis and failed to absorb losses or provide financial institutions withmuch-needed flexibility during a period of stress. Regulators, who werealready well on their way to revisiting ‘innovative’ hybrids before the worstdays of the financial crisis were upon us, have joined in a dirge.

Anna T. Pinedo, Partner

tel: +1 212 468 8179

e-mail: [email protected]

James R. Tanenbaum, Partner

tel: +1 212 468 8163

e-mail: [email protected]

Anna T. Pinedo James R. Tanenbaum

Morrison-Foerster_DCM_2010 4/8/10 09:33 Page 1

CHAPTER xx I EUROMONEY HANDBOOKS

2

capital and that, in times of financial distress, are intended

to conserve cash for the issuer. Hybrids have some equity

characteristics and some debt characteristics. The

securities are structured to obtain favourable equity

treatment from ratings agencies, permit issuers to make

tax-deductible payments, and qualify as Tier 1 capital for

bank holding companies. Generally, the more equity-like the

hybrid, the more favourable the rating agency treatment for

the issuer and the more significant the investment risks for

holders. The more debt-like the hybrid, generally, the more

favourable the tax treatment for the issuer. From the

perspective of financial ratios, issuing a long-dated security

that is treated like equity by ratings agencies, makes a

hybrid less ‘expensive’ for the issuer. From a ratings agency

perspective, a longer maturity makes a hybrid more akin to

common equity than debt. This is so because it provides

greater financial flexibility for the issuer as it poses no

refinancing risk, or at least the refinancing risk is far out in

the future. The analysis also considers the issuer’s ongoing

payment obligations in respect of the securities, including

the issuer’s ability to defer payments and the holder’s rights

to enforce payment obligations. In order to obtain debt for

tax treatment, a security must represent an “unconditional

obligation to pay a sum certain on demand or at a fixed

maturity date that is in the reasonably foreseeable future.”

Tier 1 capital, or core capital, for bank holding companies

includes, among other things, common stock and non-

cumulative perpetual preferred securities – or securities

having no ‘maturity’.

There was significant hybrid product innovation in recent

years as issuers became interested in securities with

longer or bifurcated maturities and modified interest

triggers. These enhanced features improve the ‘efficiency’

of the securities, from the perspective of issuers.

Investors who sought attractive yields were active buyers.

However, with increasing complexity came less

transparency. It became more difficult to compare various

hybrid products. Moreover, from a bank regulatory

perspective, there was no standardised approach to the

treatment of hybrid capital instruments. The Basel

framework did not address the features of hybrid

instruments. The only available guidelines for banks and

regulators were contained in the Sydney Press Release

issued by the Basel Committee on Banking Supervision on

October 27, 1998. Of course, a lot had changed since then,

leaving regulators essentially on their own with respect to

formulating assessments, occasionally one-off

assessments, of hybrid capital instruments.

Hybrids during the financial crisis

It may be too early to reach any conclusion regarding the

performance of hybrids during the financial crisis. There

have been many empassioned debates, but few empirical

studies. Now, it seems that mandated studies will take place

only after regulatory action has already determined the fate

of these securities. In any case, commentators noted that

hybrids did not perform as expected and rating agencies

observed that the securities did not provide sufficient loss

absorbency for their financial institution issuers.

A lot turned on expectations. Hybrid investors had become

accustomed to purchasing these securities and thinking of

them, or treating them, as bonds. Investors assumed that

hybrid issuers would exercise early redemption options on

hybrids as they arose. Hybrid issuers surprised the market

when they opted not to exercise their option to redeem

outstanding hybrids because alternative (or replacement)

capital would have been more expensive or unavailable.1

Other issuers exercised their deferral rights and did not

make payments on outstanding hybrids, although they

continued to make payments on outstanding debt

securities. In some cases, issuers ‘wrote down’ the

principal amount on hybrids. One might argue that, in such

cases, issuers were availing themselves of the ‘flexibility’

provided by hybrids. However, rating agencies and

regulators would likely counter that these were isolated

occurrences and that financial institutions, as a general

matter, were reluctant to exercise payment deferral

options. From an issuer’s perspective, exercising a deferral

or principal writedown option might send negative signals

and reduce investor confidence in the institution. For

banks, for which preserving investor confidence is

essential, this would be detrimental. We saw the lack of

investor confidence in certain institutions play itself out

Morrison-Foerster_DCM_2010 4/8/10 09:33 Page 2

CHAPTER xx I EUROMONEY HANDBOOKS

during the financial crisis to alarming results. Investor

confidence and expectations also remain relevant to the

discussion of contingent capital instruments.

Governments intervened in the banking sector to restore

investor confidence, and, in certain cases, conditioned

capital injections or other emergency assistance on the

deferral by the issuers of payments on their outstanding

hybrids. Rating agencies downgraded a number of hybrids

– noting increased risk of deferral and of losses. The

downgrades created their own domino-effect. Investors

were left to wonder whether these securities had been

mispriced all along (with insufficient attention paid to

deferral and extension risk). Investors became quite

focused on ‘tangible common equity’ levels, driving

financial institutions that needed to bolster capital levels

to resort to common stock issuances. It is difficult to factor

out all of these dynamics and objectively conclude that

hybrids were less able to absorb losses during periods of

financial stress than common equity.

Rating agency and regulatorydevelopments

Rating agenciesAs noted above, during the financial crisis, rating agencies

downgraded the ratings of a number of hybrids. In 2009,

the rating agencies announced changes to the notching

methodology for hybrids – essentially removing systemic

and regional support from hybrid ratings, providing for

wider notching among different classes of bank hybrids

and providing flexibility to position hybrid ratings based on

case specific and country specific considerations. Earlier

this year, one of the rating agencies announced proposed

revisions to its ‘basket’ approach for assigning equity

credit to hybrids.2

European regulatorsBefore the financial crisis, in April 2007, the European

Commission invited the Committee of European Banking

Supervisors (CEBS) to harmonise the treatment of hybrid

capital instruments in the EU. The CEBS issued a draft

proposal for a common EU definition of Tier 1 hybrids in

December 2007 (the CEBS Proposal).3 Also in December

2007, the UK’s Financial Services Authority (FSA) issued a

consultation paper on the definition of capital, which

included a discussion of the criteria for hybrid capital

instruments. The final CEBS Proposal was released in

March 2008. The European Commission began a public

consultation in 2008 and published a proposal to amend

the Capital Requirements Directive (which sets out

regulatory capital requirements for financial institutions in

the EU) (CRD) in October 2008. The European Parliament

and Council adopted changes to the CRD in May 2009,4 in

order, among other things, to agree common definitions

and descriptions of hybrid capital instruments that would

be regarded as ‘innovative’ Tier 1 capital. The CEBS has

been focused on providing more detailed guidelines for

national bank supervisors in Europe to follow in connection

with their supervision of banks’ use of hybrid instruments

for regulatory capital purposes.

In September 2009, amendments to the CRD were passed

that revised the definition of ‘capital’ and introduced

criteria for assessing which hybrids are eligible to be

included within a financial institution’s ‘own funds.’5 In

December 2009, the CEBS published final guidelines on

hybrids. In June 2010, the CEBS published its

implementation guidelines on other capital instruments

(referred to as the Article 57(a) Guidelines).6 The guidance

as it relates to hybrid and other capital instruments

focuses on an assessment of an instrument’s permanence,

redemption provisions, payment flexibility, including the

inclusion of alternative coupon settlement mechanisms,

and loss absorbency features. This analysis is consistent

with the framework set out in the Basel III proposals;

however, EU members are required to incorporate the CRD

provisions into national law by October 2010 and

implement them beginning on December 31, 2010 – before

there is any certainty regarding the Basel III capital

requirements.

Basel III frameworkOn December 17, 2009, the BCBS announced far-reaching

proposals for comment, referred to as the Basel III

framework.7 The Basel III proposals emphasise the quality,

3

Morrison-Foerster_DCM_2010 4/8/10 09:33 Page 3

CHAPTER xx I EUROMONEY HANDBOOKS

consistency and transparency of the capital base; provide

for enhanced risk coverage through the implementation of

enhanced capital requirements for counterparty credit risk;

introduce changes to a non-risk adjusted leverage ratio,

and incorporate measures designed to improve the

countercyclical capital framework.8 To rectify perceived

deficiencies relating to regulatory capital, the Basel

proposals emphasise that: Tier 1 capital must help a bank

remain a going concern; regulatory adjustments must be

applied to the common equity component of capital;

regulatory capital must be simple and harmonized for

consistent application across jurisdictions; and regulatory

capital components must be clearly disclosed by financial

institutions in order to promote market discipline.

Tier 1 capital must consist predominantly of ‘common

equity’, which includes common shares and retained

earnings. The new definition of Tier 1 capital is closer to the

definition of ‘tangible common equity’. The proposals set

out criteria that must be satisfied in order for non-common

equity to be classified as Tier 1. These criteria indicate that

a Tier 1 security must be subordinated to depositor and

general creditor claims, cannot be secured or guaranteed,

must be perpetual with no incentives to redeem, must have

fully discretionary non-cumulative dividends, must be

capable of principal loss absorption and cannot hinder

recapitalisation. Several ‘innovative’ Tier 1 instruments will

be phased out, including, for example, step up instruments,

cumulative preferred stock and trust preferred stock. The

grandfathering period is uncertain, as is the actual

implementation period. Given the strong reactions of

national bank regulators, it is now likely that the capital

provisions will be phased in over an extended period.

The Dodd-Frank ActRecently adopted financial regulatory reform legislation in

the US, the Dodd-Frank Act,9 also addresses regulatory

capital. In many respects consistent with the proposed

Basel III framework, the Dodd-Frank Act will have the effect

of raising the required level of Tier 1 for banks, as well as

the proportion of Tier 1 capital that must be held in the

form of tangible common equity. The Dodd-Frank Act

requires that the new Financial Stability Oversight Council

(Council) make recommendations to the Federal Reserve

regarding the establishment of heightened prudential

standards for risk-based capital, leverage, liquidity and

contingent capital. For the very largest institutions – those

considered systemically important and that have total

consolidated assets equal to or greater than US$50bn –

the Federal Reserve must establish stricter requirements,

including a maximum debt-to-equity ratio of 15-to-1. The

Collins amendment provisions incorporated in the

Dodd-Frank Act and applicable to all financial institutions

require the establishment of minimum leverage and

risk-based capital requirements. These are set, as a floor,

at the risk-based capital requirements and Tier 1 to total

assets standard applicable currently to insured depository

institutions under the prompt corrective action provisions

of the Federal Deposit Insurance Act. In addition, the

legislation limits regulatory discretion in adopting Basel III

requirements in the US and raises the specter of additional

capital requirements for activities determined to be ‘risky’,

including, but not limited to derivatives.

By virtue of applying the prompt corrective action

provisions for insured depository institutions to bank

holding companies, certain hybrids, like trust preferred

securities, will no longer be included in the numerator of

Tier 1. The legislation applies retroactively to trust

preferred securities issued after May 19, 2010. Bank

holding companies and systemically important nonbank

financial companies will be required to phase-in these

requirements from January 2013 to January 2016. Mutual

holding companies and thrift and bank holding companies

with less than US$15bn in total consolidated assets are not

subjection to this prohibition. Within 18 months of the

enactment of the legislation, the General Accounting Office

must conduct a study on the use of hybrid capital

instruments and make recommendations for legislative or

regulatory actions regarding hybrids.

Pre-financial crisis, financial institutions were accustomed to

relying on the issuance of hybrid securities as a significant

component of their capital-raising plans. Now, these

institutions face a fair bit of uncertainty. Financial institutions

have been waiting on the sidelines, holding back on any new

offerings of hybrid instruments, until there was regulatory

4

Morrison-Foerster_DCM_2010 4/8/10 09:33 Page 4

CHAPTER xx I EUROMONEY HANDBOOKS

certainty. With the passage of this legislation, US financial

institutions have some clarity as it relates to trust preferred

securities, but must continue to wait for leverage and capital

requirements to be adopted and to reconcile these

requirements with the final Basel III requirements.

Contingent capitalBasel III and the Dodd-Frank Act still leave open the door

to certain hybrid instruments. In addition, both raise the

possibility of permitting financial institutions to use

contingent capital instruments. Contingent capital

instruments have received many endorsements by

regulators. These may be premature.

In their discussions, regulators usually have referred to

contingent capital instruments as hybrid debt that is

“convertible into equity when (1) a specified financial

company fails to meet prudential standards…and (2) the

[regulatory agency] has determined that threats

to…financial stability make such conversion necessary.”10

This is but one formulation. The basic premise of a

contingent capital instrument is that financial institutions

will offer securities that constitute high quality capital

during good times, which will provide a ‘buffer’ or

enhanced loss absorbency and payment flexibility during

times of stress when the financial institution requires, but

may not be able to raise, additional capital. Academics that

form part of the Squam Lake Group have suggested a

number of ‘contingent capital’ arrangements for financial

institutions.11 Professor Raghuram G. Rajan has suggested

that contingent capital is “like installing sprinklers….when

the fire threatens, the sprinklers will turn on.”

Although many discussions focus on instruments that are

effectively mandatorily convertible debt securities with

regulatory triggers, it is possible to envision a number of

other forms of securities. For example, a financial

institution might issue a security that has a principal write

down feature, or enter into a ‘contingent’ committed

funding facility, like those used by certain insurance

companies. Another version of contingent capital would

require a systemically important financial institution to buy

a fully collateralised insurance policy that will infuse

capital into the institution during periods of financial

stress. Thus far, there have been only two recent issuances

of contingent capital instruments.

In November 2009, the HM Treasury announced12 that Royal

Bank of Scotland (RBS) and Lloyds Banking Group, both

recipients of substantial capital injections from the UK

government in the form of preference shares, would offer

holders of subordinated debt, contingent convertibles/

mandatory convertible notes to raise capital in the private

sector and reduce their exposure to the UK Government’s

Asset Protection Scheme.13 Lloyds completed an exchange

offer in which it issued £7.5bn of Enhanced Capital Notes,

which are fixed rate debt securities with a 10-year term

that convert into a fixed number of common shares if

Lloyd’s core Tier 1 ratio falls below a trigger. In March 2010,

Rabobank issued €1.25bn of its 6.875% Senior Contingent

Notes, which are senior unsecured notes with a 10-year

term, the principal of which are subject to a write down on

the occurrence of a regulatory capital trigger event.

A number of questions remain concerning contingent

capital instruments. Indeed, these securities may provide

an institution with high quality capital at issuance, but

upon exercise of the relevant ‘trigger’, the securities do not

provide new capital. In most formulations of these

instruments, the regulatory capital deck just gets

reshuffled once the trigger is breached. It is true that the

securities provide loss absorbency and that by setting

triggers at the outset and making these mandatory, a

financial institution issuer does not have to make the

painful deferral determination that would be required if it

had issued a conventional hybrid. As we noted, financial

institutions have proven reluctant to deferring payments

given that a deferral would provoke a loss of confidence.

A mandatory trigger changes the dynamic. However, with

a contingent capital instrument, you have another equally

tricky dynamic. It is not clear how one would determine the

contingency. If it is set to be tripped early as a stress

scenario is just emerging, so that the issuer receives the

maximum benefit, it could be argued that investors will be

put off. For convertible instruments, it is also difficult to

strike the right balance in order to avoid having the

security take on a ‘death spiral’ element.

5

Morrison-Foerster_DCM_2010 4/8/10 09:33 Page 5

CHAPTER xx I EUROMONEY HANDBOOKS

Of course, there are more practical questions. If the

instrument converts to equity, will a rating agency provide a

rating? Will there be an investor base for such instruments?

Just when an investor would want the full range of senior

security holder creditors’ rights, the investor would be

relegated to being an equity holder. In the US, this issue

raises a tax issue. An issuer may not be able to claim a

deduction for interest payable on a contingent capital

instrument that converts into equity.

ConclusionThe BCBS has said that further studies will be conducted

on contingent capital instruments. The Dodd-Frank Act

requires that the Council must conduct a study on

contingent capital within two years of enactment and make

recommendations to the Federal Reserve. Given all of these

moving pieces and the need on the part of financial

institutions to raise capital efficiently, it is safe to predict

that we are only just starting in on a new overture in the

world of capital instrument symphonics.

Notes:

1. For example, in February 2009, Deutsche Bank was among the first

issuers to announce that it would not call an outstanding hybrid

security on its first call date.

2. See for example, Moody’s Investors Service, "Proposed Changes to

Moody’s Hybrid Tool Kit" and ‘Frequently Asked Questions:

Proposed Changes to Moody’s Hybrid Tool Kit’, March 2010.

3. See further, ‘Defining Hybrid Capital’, Morrison & Foerster LLP,

August 15, 2008.

4. Proposal for a Directive amending Directives 2006/48/EC and

2006/49/EC as regards banks affiliated to central institutions,

certain own funds items, large exposures, supervisory

arrangements, and crisis management (October 1, 2008),

http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:

2008:0602:FIN:EN:PDF.

5. See further, ‘What Counts? An Update on the Debate Concerning

Regulatory Capital’ Morrison & Foerster LLP, November 18, 2009.

6. See further ‘CEBS Guidelines for Equity Capital Requirements of

Financial Institutions’, Morrison & Foerster LLP, July 7, 2010.

7. BCBS Consultative Document: Strengthening the resilience of the

banking sector (December 17, 2009), http://www.bis.org/publ/

bcbs164.pdf?noframes=1, and BCBS Consultative Document:

International framework for liquidity risk measurement, standards

and monitoring (December 17, 2009),

http://www.bis.org/publ/bcbs165.pdf?noframes=1.

8. For an overview of the Basel III framework, see ‘More, More, More:

A Summary of the Basel Proposals’, Morrison & Foerster LLP,

February 2, 2010.

9. The Dodd-Frank Wall Street Reform and Consumer Protection Act,

Pub. L. No. 111-203, 124 Stat. 1376.

10. The Wall Street Reform and Consumer Protection Act of 2009

(HR 4173) included this formulation of ‘contingent capital’.

11. See Written Statement by Raghuram G. Rajan to the Senate Banking

Committee Hearings on May 6, 2009, as well as the Squam Lake

Group’s proposal at http://www.cfr.org/publication/19001/

reforming_capital_requirements_for_financial_institutions.html.

12. HM Treasury press notice: Implementation of Financial Stability

Measures for Lloyds Banking Group and Royal Bank of Scotland

(November 3, 2009), http://www.hm-treasury.gov.uk/

press_99_09.htm.

13. Under EU state aid rules the European Commission has granted

approval to national support schemes on condition of the banks not

paying dividends or coupons on Core Tier 1 capital instruments.

6

Contact us:

Morrison & Foerster LLP

1290 Avenue of the Americas, New York,

NY 10104, US

tel: +1 212 468 8000

web: www.mofo.com

Morrison-Foerster_DCM_2010 4/8/10 09:33 Page 6

US capital marketsMorrison & FoersterNew York

Contingent capitalinstruments

Since the outbreak of the subprimecrisis in mid 2007, the world’sfinancial markets have suffered

unprecedented turmoil. Many banks, evenlarge institutions that had previously beenconsidered icons of stability, failed or hadto be rescued or nationalised by theirgovernments. The financial crisis hasprompted regulators in the US andEurope to reexamine how much capital isenough capital for banks. Regulatorsgenerally agree that banks were too highlyleveraged and that, in the future, banksshould be required to have more capital.Discussion has turned to contingentcapital (another form of hybrid capital) asa necessary component of capital goingforward.

Contingent capital instruments areintended to provide a buffer for thefinancial institution issuers during times ofstress. Commentators note that traditionalhybrid securities, which were importantfinancing tools for banks during the lastdecade, failed to absorb losses effectivelyduring the crisis. Moreover, during times ofstress, banks and other financial institutionsfound it difficult to access the market inorder to bolster regulatory capital levels.Contingent capital instruments areintended to have loss-absorbing features.These instruments may take a variety offorms.

So far though, we have seen only oneform, the Lloyd’s Enhanced Capital Notes.The Lloyds instruments are debt securitiesthat convert into equity if certain capitalratio levels are breached. Presumably thetrigger would be low so that the instrumentwould convert early on in a crisis,mitigating the need for state intervention.In the Lloyds offering, the contingentcapital instruments were offered as part ofan exchange. So it is not clear how a newoffering of contingent capital instrumentswould be received by investors and theyield that investors would exact in exchangefor being subordinated (to equity) during acrisis.

There are a number of other open issuesrelating to contingent capital instruments.Regulators in the US and Europe are stillformulating their views regarding the

components of regulatory capital.Treatment accorded to contingent capitalinstruments will surely be a factor in thesedebates. Tax, accounting and rating agencytreatment also will be importantdeterminants that affect the future marketfor these products. As ever, the devil is inthe details.

INTERNATIONAL BRIEFINGS

2 IFLR/February 2010 www.iflr.com

Butterworths Journal of International Banking and Financial Law February 2010 67

Spotlight

SPOTLIG

HT

Is it a bird? A plane? Exploring contingent capital

Mythology is rich with creatures that had some characteristics of humans

and some of animals, or, sometimes, some of different animals. Griffins and centaurs come to mind. They defied definition. Often, their incredible strength was awe-inspiring, but, just as easily, they could inspire terror. While less colourful, and certainly less fearsome, for quite some time now, many financial instruments that were engineered to provide financial institutions with high-quality regulatory capital also defied easy categorising. Financial institutions had come to rely on hybrid securities (securities that had some features of equity securities, and some features of debt securities) to raise capital and bolster their regulatory capital ratios. Now, after a year of unprecedented, almost epic dislocation and disarray, investors, regulators and rating agencies are questioning the adequacy and utility of various financial instruments as components of regulatory capital.

In the last year, many banks, even institutions that had previously been considered icons of stability, failed or had to be rescued or nationalised by their governments. The financial crisis has prompted US and European regulators to re-examine how much capital is enough capital for banks. Regulators generally agree that banks were too highly leveraged and that, going forward, banks should be required to have more capital. Policymakers also agree that there should be greater ‘uniformity’ across jurisdictions as to bank regulatory capital requirements and as to the treatment accorded to specific financial instruments. They reason that if regulatory capital standards and product definitions were harmonised, there would be fewer opportunities for ‘arbitrage’ by banks. But that’s about as far as regulators have got in coming to a common understanding.

Regulators face many challenges as they formulate frameworks to implement these principles. Actually, the dialogue concerning

regulatory capital long preceded the financial crisis. The financial crisis simply brought more attention to the occasionally arcane subject of regulatory capital requirements and has introduced many new participants, with their respective political agendas, to the debate. Regulators tend to react sharply following crises. Many have noted that the most valuable (from the perspective of withstanding stress scenarios) forms of capital are common stock and preferred stock. Of course, these also may be the most expensive. Investors, who faced unprecedented losses from investments in financial institutions, are sceptical about financial engineering. They have become mistrustful of Tier 1 regulatory capital calculations and have begun to rely instead on ‘tangible common equity’ calculations. Rating agencies, themselves facing more scrutiny than ever, have reviewed the performance of various financial products during the financial crisis and concluded that several did not perform as anticipated. In particular, rating agencies have noted that hybrids did not have sufficient loss absorbency features and, as a result, have adjusted their analysis of these securities. Banks, investors, and, even regulators, agree that it would be quite costly for banks to be constrained to common and preferred stock as the only elements of regulatory capital. An unlikely instrument has been advanced as a solution – contingent capital securities. Contingent capital securities are being hailed as an important regulatory capital component for financial institutions. As we discuss, if one were to put these securities into a ‘generic’ category, they would be just another hybrid.

In this article, we review the hybrid capital market, discuss regulatory and rating agency developments affecting hybrids, and consider contingent capital alternatives.

HYBRID SECURITIESHybrid securities are tax-efficient, regulatory and rating agency-qualifying capital that lower an issuer’s cost of capital and that, in times of financial distress, are intended to conserve cash for the issuer. These securities are structured to obtain favourable equity treatment from ratings agencies, permit issuers to make tax-deductible coupon payments, and qualify as Tier 1 capital for US bank holding companies. (Under US law a bank holding company is an entity that directly or indirectly owns, controls or has the power to vote 25 per cent or more of a class of securities of a US bank. They are required to register with the Board of Governors of the Federal Reserve Bureau.) The benefits of a hybrid depend on its ‘equity-like’ or ‘debt-like’ characteristics. From a ratings agency perspective, the more equity-like the hybrid, generally, the more favourable the treatment for the issuer. From a tax perspective, the more debt-like the hybrid, generally, the more favourable the tax treatment for the issuer.

Since 2005, there was certainty, from a ratings agency perspective, about the elements of a hybrid. That year Moody’s revamped its ‘Tool Kit,’ in which it identified a continuum of five baskets, from the A basket, which is 0 per cent equity treatment (or 100 per cent debt), at one extreme, to the E basket, which is 100 per cent equity (or 0 per cent debt), at the other extreme. Standard & Poor’s followed suit with its pared down ‘minimal equity content’, ‘intermediate equity content’ and ‘high equity content’ categories. Recently, ratings agencies have re-evaluated their analysis of hybrids. On the tax side, there is less clear-cut guidance, but some widely shared views on the part of tax practitioners based, at least in part, on IRS

KEY POINTS There are more questions than answers about contingent capital instruments. The trigger may provoke unintended behaviours. There are questions regarding disclosure of the trigger. Regulators should clarify these issues at the same time as they put forward guidance

regarding regulatory capital.

In this Spotlight article, the authors review the hybrid capital market, discuss regulatory and rating agency developments affecting hybrids, and consider contingent capital alternatives.

Authors Thomas A Humphreys and Anna T Pinedo

February 2010 Butterworths Journal of International Banking and Financial Law68

SPO

TLIG

HT

Spotlight

Notice 94-47 that identifies factors associated with debt versus equity.

Historically, ratings agencies have measured a hybrid against common equity and, in so doing, evaluate: the security’s maturity date (if any), or permanence; the issuer’s ongoing payment obligations in respect of the security; and the priority of payments relative to those associated with other securities and the corresponding rights to enforce payment obligations. The tax analysis focuses more sharply on the rights of the hybrid security holders: do hybrid security holders have rights akin to those of equity holders, or more like those of debt holders?

From the perspective of financial ratios, issuing a long-dated security that is treated like equity by ratings agencies, makes a hybrid less ‘expensive’ for the issuer. In order to replicate equity securities, hybrids have long maturities or are perpetual. A longer maturity makes a hybrid more akin to common equity than debt and provides the issuer with greater financial flexibility because it poses no refinancing risk, or at least the refinancing risk is far in the future. In order to obtain debt for tax treatment, a security must represent an ‘unconditional obligation to pay a sum certain on demand or at a fixed maturity date that is in the reasonably foreseeable future.’ Tier 1 capital, or core capital, for bank holding companies includes, among other things, common stock and non-cumulative perpetual preferred securities – or securities having no ‘maturity.’ Trust preferred securities are also treated as Tier 1 capital provided that they are subordinated to all subordinated debt, have a minimum five-year interest deferral, and the longest feasible maturity; however, US bank holding companies are limited in the amount of trust preferred securities that they may include within Tier 1 capital.

LOSS ABSORBENCY AND SUBORDINATIONRatings agencies believed that in times of stress, hybrids would provide ‘loss absorption’ for financial institution issuers, since hybrids are deeply subordinated instruments with payment deferral provisions. A deferral feature (optional or mandatory) permits the issuer to defer interest or dividend payments. An issuer has no obligation to pay dividends on its

common stock; whereas, an issuer generally is contractually bound to make interest payments on debt securities. By including a deferral feature, a hybrid becomes more ‘equity-like’ from a ratings agency perspective. Theoretically, the longer an issuer can defer payments, the greater its financial flexibility.

Issuers were able to increase the equity content of hybrid securities by making payment deferrals mandatory, or automatic, upon reaching triggers that were considered meaningful given the issuers’ financial positions. Using a formulaic approach to payment deferrals, rather than retaining issuer discretion, generated higher equity credit – assuming payments in respect of the hybrids are non-cumulative or may be settled in stock. As we note below, contingent capital instruments incorporate a formulaic approach of this sort. Rating agencies evaluated the issuer’s payment obligations (cumulative versus non-cumulative payments) in conjunction with the other payment characteristics of the security, including the presence of a mandatory or optional deferral provision.

Hybrids also generally are deeply subordinated within the issuer’s capital structure. Like an equity security, non-payment of distributions does not result in an event of default (at least for a very long time). In fact, a hybrid security holder has limited rights against the issuer for deferred interest payments. Some hybrids limit a security holder’s right to proceed against the issuer to recoup deferred payments. In certain structures, deferred interest may be permanently cancelled if certain conditions are satisfied and, as a result, the holder of the security may forfeit its claim for deferred interest amounts. In other structures, the treatment of deferred payments is bifurcated. After some deferral period, the issuer must pay deferred interest through the issuance of capital (an alternate payment mechanism) up to a cap. In bankruptcy, however, the security holder’s claim is limited to a maximum deferred interest amount.

PRODUCT INNOVATION AND LACK OF CONSISTENCYFrom 2006 to early 2008, there was a fair bit of product innovation as financial engineers introduced new features for hybrid securities, like longer maturities, bifurcated maturities,

and interest deferral triggers. These features were intended to ensure that the hybrid securities received equity credit, while preserving debt for tax treatment. During this period, financial institutions relied heavily for funding on hybrid issuances that incorporated these elements. While these innovations or enhancements provided value for issuers, they also resulted in a lack of transparency in the hybrid capital market. Issuers and investors found it difficult to distinguish between the ‘new and improved’ structures, especially with their additional bells and whistles. Complexity made comparisons and valuations of different securities difficult. The opaqueness of some structural enhancements also caused consternation for the ratings agencies, which reacted by refining their guidelines in order to cut through some of this clutter.

From a bank regulatory perspective, there has not been a standardised approach to the treatment of hybrid capital instruments. The Basel framework did not address the features of hybrid instruments. The only available guidelines were contained in the Sydney Press Release issued by the Basel Committee on Banking Supervision (‘BCBS’) on 27 October 1998. Of course, a lot has changed since then, leaving regulators essentially on their own with respect to formulating assessments of hybrid capital instruments. Many regulators and policymakers have argued that, at least in part, the lack of consistent standards for the various elements that may comprise regulatory capital led to financial institutions attempting to ‘game’ the system.

HYBRIDS DURING THE FINANCIAL CRISISIt is beyond the scope of this article to analyse the performance of hybrid capital instruments during the financial crisis. It is safe to say that there is a consensus that hybrids did not perform as expected, but then again, nothing performed as expected.