A presentation on : General Applications of Exchange Traded Funds

description

Transcript of A presentation on : General Applications of Exchange Traded Funds

-

A presentation on:General Applications of Exchange Traded Funds

Justin PascoeDirector of Investments

20. 8. 2002

*

Table of ContentsWhat are ETFsWhy have ETFs become so popularUsers and Applications of ETFGlobal Developments of ETF Developmental ChallengesConclusion

-

What are ETFs?

*

What are ETFs?

Commingled fund structure

Listed on the exchange

Trade like ordinary shares

Passively managed against an index

Usually priced at a fraction of the index e.g: TraHK is 1/1000th, SPDR is 1/10th,QQQ is 1/40th

Contribute and redeem in-kind

*

In-kind Subscription/Redemption InvestorETFCreationRedemptionShare basketUnitsUnitsShare BasketInvestorETFNot as simple as taking a mutual fund and listing it on the exchange

Special in-kind creation and redemption mechanism

*

Importance of in-kind Creation and RedemptionReduces transaction costs borne by the fund that result from investors activitiesThe ordinary mutual fund has to acquire/sell stocks in its portfolio when investors buy into and/or redeem from the fund, thereby incurring transaction costsIn-kind mechanism contributes to the lowering of the expense ratio of the fundFacilitates arbitrage activitiesSpecialists, market makers and arbitrageurs compete to capture pricing discrepancies, which results in the ETF trading at its fair valueHence increases the liquidity of ETFs

*

Arbitrage ActivitiesUnit price >NAV Unit price

-

Why ETF is getting more and more popular?

*

Benefits to the InvestorsVirtues of IndexationIndexation enforces diversificationObtains broad market exposureTransparency Investments & Performance

Advantages of Listing on Stock ExchangeSimple and flexible dealingSmall board lot size (10 shares)Trading throughout the dayCan buy on margin or short-sellCan place limit ordersHighly liquid

Special Features of ETFOnly one transaction to buy a diversified portfolioLow expense ratioFair pricingAdds to market depth, liquidity and efficiency

In KoreaExemption from 0.3% transaction tax on the sale of ETF unitsShort-selling of ETF exempted from the up tick rule

*

Cost is a a Major Consideration Annual Cost Comparison* Annual portfolio turnover =

Expenses ETFActively Managed Mutual Funds in KoreaPortfolio Turnover(A)*5.00 10.00%100.00 200.00%Manager Transaction Costs(B)0.50 1.20%0.50 1.20%Yearly Expenses (A) X (B)0.025 0.12%0.50 2.40%Management Fee0.25%0.50%Other Expenses0.42%1.00%Total0.695 0.79%2.00 3.90%

-

Comparison of ETFs with other Investment Products

*

ETFs vs Active Mutual Funds

ETFActively Managed Mutual FundsExpense Structure200 basis points

PerformanceIn line with IndexPossible outperformance or underperformanceTraded on Stock ExchangeYesNo

Ability to Short/Borrow YesNo

Subscription/RedemptionIn-specieCashAdd/Remove ExposureAny time market openDaily Price

*

ETFs vs Closed-ended Mutual Funds

ETFClosed End FundsExpense Structure200 basis points

Market Price and NAVTracking CloselyLarge discount or premium that can persistTraded on Stock ExchangeYesYes

LiquidityHighLowSubscription/RedemptionIn-specieNoAbility to Short/BorrowYesLimited

*

ETFs vs Open-ended Index Funds

ETFOpen-ended Index FundExpense StructureLowLow

Tracking ErrorMinimalHigher than ETFTraded on Stock ExchangeYesNoAdd/Remove ExposureAny time market openDailyAbility to Short/BorrowYesNoSubscription/RedemptionIn-specieCash

*

ETFs vs Index Futures

ETFIndex FuturesExpense StructureLow Commission cost in rolling positionNeed to Roll PositionNoYes hence roll risk

Margin Calls from Mark-to-MarketNoYes

Margin Accounting ComplexitiesNoneHighDividendsYesNoAbility to ShortYesYesTypes and VolumeManyLessLeverageNo but can create leverage by borrowing to buy ETFYes

-

ETFs Users and Applications

*

ETFs UsersInstitutional InvestorsMarket IntermediariesHedge FundsFinancial AdvisorsRetail Investors

*

Applications of ETFs

Asset Allocation/Sector & Style

Use ETFs to gain country or sector exposure while limiting stock-specific risk avoid frustration of the right country or sector choice, but the wrong stock pickRebalance allocation anytime during market hours and without the hassles of multi-stocks settlementEfficient access to markets which have restrictions on foreign capital participationBuild core portfolio cheaply with broad-based & country ETFs and the satellite portfolio with industry sector ETFs

*

Core/Satellite Asset Allocation StrategyCore InvestmentsIndividual StocksSector FundsGrowthSmall-CapLarge-CapValue Source: MSDW MSDW Equity ResearchHigher Risk/ Higher Reward

Lower Risk/ Lower Reward

Equity Risk PyramidIndividual StocksSector FundsLarge, Mid, Small-Cap FundsGrowth & Value FundsBroad-based Indices

*

Applications of ETFs

Equitize Cash Inflows

Avoid drag of cash position on equity portfolio returnsachieve temporary equity exposure until portfolio manager decides which stocks to buy

*

Applications of ETFs

Use ETFs to create equitized liquidity reserveTo satisfy redemptions or withdrawals, compared to selling individual stocks, the ETF liquidity reserve can be liquidatedQuickerEasierLower transactions costsNo effect on individual stock price

Enhance Management of Cash Outflows

*

Applications of ETFsHedge Equity Portfolio Exposure

Short ETF position can provide hedge against price declinesAlternative to futures and without the roll risk especially attractive for institutions which are not permitted or prefer not to use derivatives Allows the hedging of exposure to specific stock indexes or market segments not available with futures

*

Applications of ETFsManager Transition Trades

Facilitate transition of assets from a terminated investment manager to a new investment managerLiquidate terminated managers portfolio and invest in ETFs to maintain equity exposureWhen new manager is selected, ETFs can be sold to deliver cash or redeemed to deliver component stocks of ETF to new manager

*

Applications of ETFsRelative Value, Long/Short StrategiesStrategies can include:Go Long broad market Indexes, country or sector Indexes expected to outperformGo Short the broad market Indexes, country or sector Indexes expected to underperformPosition can be leveraged by doubling the size of the long position versus the shortAnticipate sector rotations with long or short positions in industry sector ETFs

*

Applications of ETFsPrivatization of Shares Held by Government Innovative use of ETFs designed by SSgA First used by the Hong Kong Government and hence the creation of TraHKGovernment repackaging their shareholdings into ETF units and placing the units to institutional and retail investors through an initial public offeringKey advantages are:Minimal market impactStock neutralDiversifies ownership amongst retail and institutional investorsBroadens the capital markets with the introduction of a new investment productRecently adapted for the unwinding of cross-holdings of Japanese banks But a crucial difference there is a lack of new investors and new sources of liquidity into the Japanese product

-

Trends and Development of ETFs

*

Worldwide ETF Growth in AssetsMidcap SPDRDIAMOND, Sector SPDRsQQQs, iUnits 60, TraHKSPDRLDRs, iShares,streetTRACKSDJ CN 40, Xact OMX,SATRIX 40WEBsDAX, TALI 25, M-S CAC 40, TSE300, XMTCH (SMI)Data as of Dec 31, 2001 (USD millions)Source: SSgA ETF group, AMEXBy 28 June 2002, assets under management reached US$120.6b in 238 ETFs

*

Existing ProductsSSgA manages more than 33% of the ETF assets worldwide, including:

SPDR, Fortune, Select Sector SPDR, DJ Canada 40, StreetTRACKS, & TraHKSource: BloombergData as of Jun 30, 2002 (USD Millions)TraHK3,586QQQ19,040iShares MSCI EAFE3,999OSE Nikkei 2252,687TSE Topix8,024iShares S&P 5003,629MidCap SPDRs5,890SPDRs26,896iShares Russell 20002,742DIAMONDS3,430Others38,072Select Sector SPDR2,805

*

ETFs in the Global MarketTop 10 Global ETFs by Turnover Source: SSgA ETF Group, Bloomberg* Average daily turnover for the year ended 28 June 2002

RankNameSymbolTracking AgainstDaily Turnover (in USD mn)*Manager/Trustee1NASDAQ-100 Index Tracking StockQQQNASDAQ 1002,871.6Bank of New York2SPDRs (Standard & Poors Depository Receipts)SPYS&P 5002,103.5State Street Global Advisors3DIAMONDS Trust DIADow Jones Industrial Average444.5State Street Global Advisors4MidCap SPDRsMDYS&P MidCap 400 Index114.1Bank of New York5iShare Russell 2000IWMRussell 200071.5Barclays Global Investors6DAXEXDAXEX GRGermany DAX Index53.0IndexChange7Master Share CAC 40CAC FPFrance CAC 40 Index42.6Lyxor Asset Management8Select Sector SPDR Financial FundXLFS&P Financial Index40.0State Street Global Advisors9iShare MSCI EAFEEFA USMSCI EAFE Index35.4Barclays Global Investors10iUnits S&P/TSE 60 Index FundXIU CNCanada S&P / TSE 60 Index35.2Barclays Global Investors

*

ETFs in the Global MarketExisting Products AUM : US$120.6b in 238 funds*N AmericaAUM : US$ 93.5 bnNo. Funds : 118Europe & Middle EastAUM : US$ 8.9 bnNo. Funds : 93Asia PacificAUM : US$ 17.6 bnNo. Funds : 24Source: Morgan Stanley Research* Data as of 28 June 2002, not including HOLDRSSTI* Including Singapores first local ETF listed on 17 Apr 2002South AfricaAUM : US$ 0.6 bnNo. Funds : 3

*

U.S. Lead in ETFs - Reasons for dominance of the US market First mover advantageFavorable end-user responseThe number of institutional investors reporting holding one or more US listed ETFs or HOLDR has increased to 1,162 in June 2002 from 911 institutions in June 2001 (Source: Morgan Stanley Research and Thomson Financial)Well developed market infrastructureKey theme is asset growth In the 1st half of 2002, assets have grown by US$5.5 billion to about US$93.5 billion and 1 new ETF was launched

*

ETFs in EuropeETFs are winning investorsSignificant increase in usage of ETFs by European institutions, from 32 institutions in June 2000 to 246 in June 2002 (Source: Morgan Stanley Research)

Rapid product launches In the 1st half of 2002, there were 21 new ETF launches and assets increased by US$2.9 billion to about US$8.5 billion

Cross-listing is commonAs of 28 June 2002, the number of primary listings was 92 but the number of total ETF listings was 154.

Key theme is pan-Europe sector based ETFsIntroduction of EuroInstitutional investors move from country based to sector based allocation

*

ETFs in Asia Pacific

ETFs in Asia PacificHong KongJapanAustraliaSingapore

*

ETFs in Hong KongTracker Fund of Hong Kong (TraHK) was the first ETF listed outside North America in 1999US$4.3 billion IPO the first stage of Hong Kong Governments disposal of shares purchased in events of August 1998Tap Mechanism an on-going disposal mechanism for the Governments remaining holdingsIncentive package with Loyalty Bonuses has resulted in TraHK being less liquid initially than typical ETF of this sizeCurrent assets under management of about US$3.8 billion

Cross-trading iShares in Hong Kong from May 2001Korea & Taiwan the first 2 of a planned 6

Launch of iShares MSCI China Free in Hong Kong in November 2001Current assets under management of about US$38 millions for Hong Kong retail investors

*

Observations from TraHKLocal investors prefer local indicesLow cost and transparency are the major appeal Benefits to the capital market:More investment choices benefits investorsDevelopment of long-term equity holding culture 70% of investors from IPO still retaining their units even after the distribution of all loyalty bonusesIncreased efficiency of index futures pricingIncreased liquidity resulting from arbitrage activities

Active trading of derivatives positive for the development of the product

*

Marketing important aspect especially in the initial stagesTo increase investor awareness and familiarity

Operationally demanding productNeed to interact with numerous partiesImportance of fully integrated systemsExperience is key - steep learning curve and inexperience incurs the risk of developing a flawed product

Extremely profitable business for the stock exchange

Observations from TraHK (Contd)

*

ETFs in JapanJapan mass launch of 5 ETFs in July 2001Indices approved for ETF development increased from 4 to 8:Nikkei 225, Nikkei 300, Topix, S&P Topix 150, MSCI Japan, FTSE Japan, DJ Industrial Average, Nasdaq-100A total of 17 ETFs listed currently, with total assets of about US$14 bn 60% of the ETF assets came from the injection of crossholdings of Mitsubishi Tokyo Financial Group (MTFG) and Meiji Life.No clear evidence of strong institutional use of ETFs except for the unwinding of cross-holdings in the above cases by MTFG and Meiji Life. As these ETF units were created for share unwinding purpose, it has resulted in persistent short futures open interests in the market as well as these ETFs being less liquid than typical ETF of this size.Product design far from satisfactory Different creations and redemptions processes due to different interpretation of the trust law by the ETF issuersTrade basket is typically published more than 1 day prior to the trade date creates uncertainty in the fund management process especially when large corporate actions are pending.

*

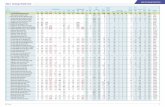

Japan ETFs - Trading Dominated by Proprietary Trading Source: Tokyo Stock Exchange

Diagram

Investment Trends by Investor Category

Units: \ million

ProprietaryBrokerageTotal

Financial InstitutionsInvestment TrustsBusiness CompaniesSecurities CompaniesIndividualsForeigners

Jul-01Sales42,15300224801,53561544,607

Purchases32,1821,07607883887,0032,26843,705ProprietaryBrokerage

Balance-9,9711,07605643085,4681,653-902TotalFinancial InstitutionsInvestment TrustsBusiness CompaniesSecurities CompaniesIndividualsForeigners

Total74,3351,07601,0124688,5382,88388,312Sales356,30189,6819,39306,2225,71553,96114,390

Ratio84.2%1.2%0.0%1.1%0.5%9.7%3.3%-Purchases293,608147,52619,60558,5797,81282,53628,989

Aug-01Sales72,6012803112844,4613,13480,819Balance-62,69357,84510,21252,3572,09728,57514,599

Purchases53,3292,74307611,08714,0237,15679,099Total649,909237,20728,998514,80113,527136,49743,379

Balance-19,2722,71504508039,5624,022-1,720

Total125,9302,77101,0721,37118,48410,290159,918

Ratio78.7%1.7%0.0%0.7%0.9%11.6%6.4%-

Sep-01Sales50,94319208977677,3792,26462,442

Purchases39,5692,26551,8441,40714,6231,35361,066

Balance-11,3742,07359476407,244-911-1,376

Total90,5122,45752,7412,17422,0023,617123,508

Ratio73.3%2.0%0.0%2.2%1.8%17.8%2.9%-

Oct-01Sales41,9241,21301,5011,49111,59173158,451

Purchases44,0831,05905231,3329,1873,37959,563

Balance2,159-1540-978-159-2,4042,6481,112

Total86,0072,27202,0242,82320,7784,110118,014

Ratio72.9%1.9%0.0%1.7%2.4%17.6%3.5%-

Nov-01Sales48,8641,27206237977,46357159,590

Purchases43,6372,27801,5579438,8441,78059,039

Balance-5,2271,00609341461,3811,209-551

Total92,5013,55002,1801,74016,3072,351118,629

Ratio78.0%3.0%0.0%1.8%1.5%13.7%2.0%-

Dec-01Sales30,6161,20007237554,9961,60639,896

Purchases20,1477,12908088688,3602,26939,581

Balance-10,4695,9290851133,364663-315

Total50,7638,32901,5311,62313,3563,87579,477

Ratio63.9%10.5%0.0%1.9%2.0%16.8%4.9%-

Jan-02Sales32,2014,13109725455,8352,25445,938

Purchases27,0811,83201,1521,05911,6691,62644,419

Balance-5,120-2,29901805145,834-628-1,519

Total59,2825,96302,1241,60417,5043,88090,357

Ratio65.6%6.6%0.0%2.4%1.8%19.4%4.3%-

Feb-02Sales36,9991,357097199610,7013,21554,239

Purchases33,5801,22301,1467288,8279,15854,662

Balance-3,419-1340175-268-1,8745,943423

Total70,5792,58002,1171,72419,52812,373108,901

Ratio64.8%2.4%0.0%1.9%1.6%17.9%11.4%-Brokerage

TotalSales356,3019,39306,2225,71553,96114,390445,98289,681

Purchases293,60819,60558,5797,81282,53628,989441,134147,526

Balance-62,69310,21252,3572,09728,57514,599-4,84857,845

Total649,90928,998514,80113,527136,49743,379887,116237,207

Ratio73.3%3.3%0.0%1.7%1.5%15.4%4.9%-0

Sheet4

Jul-01-99711076056430854681653

Aug-01-192722715045080395624022

Sep-01-11374207359476407244-911

Oct-012159-1540-978-159-24042648

Nov-01-52271006093414613811209

Dec-01-1046959290851133364663

Jan-02-5120-229901805145834-628

Feb-02-3419-1340175-268-18745943

Mar-023307-1680596-71-2148-1153

Sheet4

0000000

0000000

0000000

0000000

0000000

0000000

0000000

0000000

0000000

0000000

0000000

Mil yen

Sheet2

Sheet1

Unit: \ Million

IndexCodeNameFund AdministratorListing DateTrading UnitShares OutstandingNet Asset ValueAverage Trading volumeAverage Trading Value

TOPIX1305Daiwa ETF-TOPIXDaiwa Asset Management13-Jul-01100 units65,83672,102141.2149.4

1306TOPIX ETFNomura Asset Management13-Jul-01100 units526,162576,232526.0551.6

1307i Shares TOPIXBarclays Global Investors22-Aug-01100 units15,09016,51269.078.0

1308Nikko Exchange Traded Index Fund TOPIXNikko Asset Management9-Jan-021,000 units19,99321,872138.0142.3

TOPIX Core301310Daiwa ETF TOPIX Core30Daiwa Asset Management29-Mar-02100 units2,4131,96845.837.2

1311TOPIX Core 30 Exchange Traded FundNomura Asset Management3-Apr-02100 units4,0003,25319.215.7

TOPIX Electric Appliances1610Daiwa ETF TOPIX Electric AppliancesDaiwa Asset Management29-Mar-02100 units1,0231,96917.533.5

1613TOPIX Electric Appliances Exchange Traded FundNomura Asset Management3-Apr-02100 units2,0003,84432.163.0

TOPIX Transportation Equipment1611Daiwa ETF TOPIX Transportation EquipmentDaiwa Asset Management29-Mar-02100 units1,0141,5876.910.5

1614TOPIX Transportation Equipment Exchange Traded FundNomura Asset Management3-Apr-02100 units2,0003,1200.81.0

TOPIX Banks1612Daiwa ETF TOPIX BanksDaiwa Asset Management29-Mar-021,000 units10,2002,085152.831.3

1615TOPIX Banks Exchange Traded FundNomura Asset Management3-Apr-02100 units15,0003,03978.715.7

S&P/TOPIX 1501315i Shares S&P/TOPIX 150Barclays Global Investors29-Aug-01100 units4,5004,4060.10.1

Nikkei 2251329i Shares Nikkei 225Barclays Global Investors5-Sep-0110 units8359,5051.211.9

1330Nikko Exchange Traded Index Fund 225Nikko Asset Management13-Jul-0110 units6,63877,567203.52,194.8

Note: As of April 5, 2002

Balance Graph

Balance Graph

-4215332182-9971

-7260153329-19272

-5094339569-11374

-41924440832159

-4886443637-5227

-3061620147-10469

-3220127081-5120

-3699933580-3419

-43133464403307

&A

Page &P

Purchase

Sales

Balance

mil yen

Sale

Purchase

Balance

Sheet7

010761076

-2827432715

-19222652073

-12131059-154

-127222781006

-120071295929

-41311832-2299

-13571223-134

-25622393-168

&A

Page &P

Sale

Purchase

Balance

Sheet1 (2)

-153570035468

-4461140239562

-7379146237244

-115919187-2404

-746388441381

-499683603364

-5835116695834

-107018827-1874

-1332311174-2148

&A

Page &P

Sale

Purchase

Balance

Graph

-61522681653

-313471564022

-22641353-911

-73133792648

-57117801209

-16062269663

-22541626-628

-321591585943

-37632609-1153

&A

Page &P

Sale

Purchase

Balance

Graph (2)

SalePurchaseBalanceSalePurchaseBalanceSalePurchaseBalanceSalePurchaseBalanceSalePurchaseBalanceSalePurchaseBalanceSalePurchaseBalance

Jul-01-4215332182-9971010761076000-224788564-80388308-153570035468-61522681653

Aug-01-7260153329-19272-2827432715000-311761450-2841087803-4461140239562-313471564022

Sep-01-5094339569-11374-19222652073055-8971844947-7671407640-7379146237244-22641353-911

Oct-01-41924440832159-12131059-154000-1501523-978-14911332-159-115919187-2404-73133792648

Nov-01-4886443637-5227-127222781006000-6231557934-797943146-746388441381-57117801209

Dec-01-3061620147-10469-120071295929000-72380885-755868113-499683603364-16062269663

Jan-02-3220127081-5120-41311832-2299000-9721152180-5451059514-5835116695834-22541626-628

Feb-02-3699933580-3419-13571223-134000-9711146175-996728-268-107018827-1874-321591585943

Mar-02-43133464403307-25622393-168000-26843280596-12991228-71-1332311174-2148-37632609-1153

Sheet1 (3)

IndexCodeNameFund AdministratorListing DateManagement FeeNAVAverage Trading Value

TOPIX1305Daiwa ETF-TOPIXDaiwa Asset Management13-Jul-0122bp72,102149.4

1306TOPIXTOPIX ETFNomura Asset Management13-Jul-0122bp576,232551.6

1307i Shares TOPIXBGIBarclays Global Investors22-Aug-0122bp16,51278.0

1308TOPIXNikko Exchange Traded Index Fund TOPIXNikko Asset Management9-Jan-0211bp21,872142.3

S&P/TOPIX 1501315/i Shares S&P/TOPIX 150BGIBarclays Global Investors29-Aug-0129bp4,4060.1

Nikkei 2251329i Shares Nikkei 225BGIBarclays Global Investors5-Sep-0121.5bp9,50511.9

1330Nikko Exchange Traded Index Fund 225Nikko Asset Management13-Jul-0122.5bp77,5672,194.8

On OSE1320225OSE) Daiwa ETF-Nikkei225Daiwa Asset Management13-Jul-0122bp86,1401,707.4

1321225OSE) Nikkei 225 ETFNomura Asset Management13-Jul-0122bp372,3571,975.0

(\mil) 200245Note: As of April 5, 2002

IndexCodeNameFund AdministratorListing DateManagement FeeNet Asset ValueAverage Trading Value

TOPIX Core30131030Daiwa ETF TOPIX Core30Daiwa Asset Management29-Mar-0222bp1,96837.2

1311TOPIX Core 30 TOPIX Core 30 Exchange Traded FundNomura Asset Management3-Apr-0222bp3,25315.7

TOPIXElectric Appliances1610Daiwa ETF TOPIX Electric AppliancesDaiwa Asset Management29-Mar-0222bp1,96933.5

1613TOPIX Electric Appliances Exchange Traded FundNomura Asset Management3-Apr-0222bp3,84463.0

TOPIXTransportation Equipment1611Daiwa ETF TOPIX Transportation EquipmentDaiwa Asset Management29-Mar-0222bp1,58710.5

1614TOPIX Transportation Equipment Exchange Traded FundNomura Asset Management3-Apr-0222bp3,1201.0

TOPIXBanks1612Daiwa ETF TOPIX BanksDaiwa Asset Management29-Mar-0222bp2,08531.3

1615TOPIX Banks Exchange Traded FundNomura Asset Management3-Apr-0222bp3,03915.7

(\mil) 200245Note: As of April 5, 2002

Sheet2 (2)

Sheet2 (2)

-99711076056430854681653

-192722715045080395624022

-11374207359476407244-911

2159-1540-978-159-24042648

-52271006093414613811209

-1046959290851133364663

-5120-229901805145834-628

-3419-1340175-268-18745943

\ Million

Proprietary

Financial Institutions

Investment Trusts

Business Companies

Securities Companies

Individuals

Foreigners

Sheet3

Sheet3

28998

5

14801

13527

136497

43379

Breakdown of Brokerage

July 2001 to February 2002

NAV

649909

237207

Proprietary/Brokerage

225NAV

(/10)TOPIXS&P/TOPIX150TOPIX Core30(x10)TOPIX-Type ETFNikkei 225-type ETFTOPIXCore30ETFETFETFETF

2001.07.1312,355.151,235.521,244.021,089.46951.092,012.841,707.25286.732867.32,5162,6920000

2001.07.1612,343.371,234.341,242.211,090.00950.792,004.321,717.10288.132881.33695200000

2001.07.1712,128.571,212.861,223.911,073.17933.961,961.971,707.22282.082820.82739750000

2001.07.1811,892.581,189.261,199.671,049.59908.121,922.151,677.01276.372763.74931,8180000

2001.07.1911,908.391,190.841,195.251,045.53900.691,925.881,671.85271.342713.44972,7210000

2001.07.2311,609.631,160.961,163.761,018.80868.831,886.711,644.99258.742587.45291,3070000

2001.07.2411,883.251,188.331,179.861,032.45884.651,920.171,665.31265.252652.52991,4450000

2001.07.2511,891.611,189.161,189.111,041.74895.201,936.411,662.25269.662696.62991,5260000

2001.07.2611,858.561,185.861,192.251,040.61895.171,921.871,660.69274.822748.22923,4500000

2001.07.2711,798.081,179.811,184.231,029.82879.011,849.481,671.74271.932719.31,12715,6150000

2001.07.3011,579.271,157.931,168.511,015.48867.131,790.131,661.71268.2026827774,7720000

2001.07.3111,860.771,186.081,190.311,036.91889.321,862.491,677.09274.432744.32482,0590000

2001.08.0111,959.331,195.931,206.851,049.60908.651,897.241,672.88281.872818.72383,3530000

2001.08.0212,399.201,239.921,235.261,077.45934.241,990.791,684.51289.392893.95535,1460000

2001.08.0312,241.971,224.201,219.921,064.37919.041,972.221,649.27283.842838.42092,7200000

2001.08.0612,243.901,224.391,218.641,063.28914.151,953.471,651.71281.162811.63102,3890000

2001.08.0712,319.461,231.951,224.381,069.64916.051,966.661,658.28279.172791.72073,0840000

2001.08.0812,163.671,216.371,217.921,062.94912.971,932.271,658.21278.112781.11373,2200000

2001.08.0911,754.561,175.461,184.941,032.70881.501,868.161,632.51273.432734.32633,4760000

2001.08.1011,735.061,173.511,182.491,029.74878.181,861.011,624.43270.552705.54114,2350000

2001.08.1311,477.561,147.761,167.091,014.79866.141,792.141,619.56269.192691.92822,6810000

2001.08.1411,917.951,191.801,198.861,045.66898.561,845.171,625.81286.042860.41,4242,9480000

2001.08.1511,755.401,175.541,194.331,040.26890.931,839.821,614.39282.912829.15712,1260000

2001.08.1611,515.021,151.501,175.071,021.70866.061,775.491,570.10277.052770.51,1642,5320000

2001.08.1711,445.541,144.551,169.811,015.08855.981,743.241,556.51277.322773.24052,0040000

2001.08.2011,257.941,125.791,155.151,003.59845.131,716.991,535.22273.562735.64081,9280000

2001.08.2111,280.381,128.041,158.821,005.60848.951,719.911,522.01282.122821.22561,5300000

2001.08.2211,396.431,139.641,165.541,014.53855.171,726.231,530.29287.342873.45,4262,0930000

2001.08.2311,126.921,112.691,147.39997.10834.171,676.111,518.94285.642856.42,2122,5760000

2001.08.2411,166.311,116.631,145.34996.58836.331,688.451,523.52283.632836.34,0052,5440000

2001.08.2711,275.011,127.501,155.171,004.72848.741,730.581,512.70292.272922.76971,2940000

2001.08.2811,189.401,118.941,150.251,001.22844.591,743.901,504.65295.692956.91,2531,5270000

2001.08.2910,979.761,097.981,126.86980.73823.121,726.731,479.59284.342843.41,4192,6870000

2001.08.3010,938.451,093.851,114.58968.95815.151,722.951,473.01279.332793.31,0782,5440000

2001.08.3110,713.511,071.351,103.67957.77807.341,675.221,449.68280.892808.91,1392,2650000

2001.09.0310,409.681,040.971,071.73930.61782.511,602.331,413.52274.882748.89351,8020000

2001.09.0410,772.591,077.261,100.13959.17818.451,682.191,453.50289.242892.41,1604,0800000

2001.09.0510,598.791,059.881,087.72948.89806.491,648.221,457.64287.1028718501,9210000

2001.09.0610,650.331,065.031,090.74951.42812.281,636.691,478.65293.432934.34292,7590000

2001.09.0710,516.791,051.681,080.83941.59804.061,604.291,474.27295.742957.43102,1650000

2001.09.1010,195.691,019.571,055.98920.04783.431,566.731,464.49286.452864.54462,6680000

2001.09.1110,292.951,029.301,058.12923.89785.771,591.581,469.84284.452844.56211,9170000

2001.09.129,610.10961.01990.80866.03733.321,480.721,367.41267.082670.81,8204,6440000

2001.09.139,613.09961.311,003.51874.35739.811,476.631,309.95270.182701.88044,6450000

2001.09.1410,008.891,000.891,033.81898.87765.141,524.161,311.51282.312823.17492,6650000

2001.09.179,504.41950.44996.45863.41742.931,428.111,251.23273.622736.28812,1400000

2001.09.189,679.88967.991,013.09876.75753.201,457.871,238.30273.382733.81,5261,9560000

2001.09.199,939.60993.961,038.06899.81782.451,500.361,226.24285.132851.39551,6890000

2001.09.209,785.16978.521,024.92885.74775.061,477.471,153.99293.132931.35273,0460000

2001.09.219,554.99955.50998.20858.28742.281,436.291,081.10282.522825.21,3212,3160000

2001.09.259,693.97969.401,009.30869.26753.651,457.701,158.27267.392673.94041,9200000

2001.09.269,641.70964.17998.28854.35736.091,431.921,133.67264.942649.42181,4210000

2001.09.279,696.53969.651,003.78860.35742.631,421.571,171.34261.202612911,2130000

2001.09.289,774.68977.471,023.42876.09753.281,423.161,206.25260.392603.92743,0650000

2001.10.019,972.28997.231,047.03892.92769.481,420.371,271.21266.282662.84942,4520000

2001.10.0210,136.561,013.661,067.63911.47784.571,431.641,300.51272.872728.72521,9140000

2001.10.039,924.23992.421,050.35892.93761.641,416.271,267.17267.312673.14072,3000000

2001.10.0410,205.481,020.551,071.19914.17784.541,485.011,315.72270.032700.32614,6050000

2001.10.0510,205.871,020.591,070.45916.93790.431,522.621,326.55262.612626.13102,0600000

2001.10.0910,011.771,001.181,043.00892.85759.691,498.911,256.12252.482524.83352,2290000

2001.10.109,964.88996.491,031.17882.41743.571,478.591,252.08240.412404.11231,4280000

2001.10.1110,347.011,034.701,064.66916.94779.531,575.301,309.58245.182451.83602,4200000

2001.10.1210,632.351,063.241,087.48940.25805.831,653.671,331.77252.812528.18433,9430000

2001.10.1510,452.541,045.251,071.78923.20785.231,596.141,293.61252.232522.31639270000

2001.10.1610,637.821,063.781,078.16930.06786.691,606.681,283.27249.622496.21932,2770000

2001.10.1710,755.451,075.551,087.60941.22796.931,667.261,276.53247.832478.31773,5930000

2001.10.1810,474.851,047.491,068.48922.27780.121,621.801,271.86245.422454.23721,8000000

2001.10.1910,538.791,053.881,070.65925.35778.961,637.931,260.41243.152431.52821,1580000

2001.10.2210,565.411,056.541,072.98928.02779.241,638.841,256.86241.232412.3421,3280000

2001.10.2310,861.561,086.161,095.74950.06798.601,684.861,296.41245.432454.33881,9840000

2001.10.2410,802.151,080.221,100.22950.74806.701,666.481,309.50252.932529.31,2743,3700000

2001.10.2510,880.101,088.011,107.83955.57809.381,661.671,315.17256.752567.56713,7480000

2001.10.2610,795.161,079.521,101.22946.93803.861,636.131,292.73257.3025731,1363,0070000

2001.10.2910,612.311,061.231,082.65929.75789.581,611.381,280.04250.572505.77221,6430000

2001.10.3010,512.821,051.281,067.76916.35772.911,559.881,272.11246.262462.68431,8230000

2001.10.3110,366.341,036.631,059.37906.46762.791,530.981,248.67246.712467.11,4011,3500000

2001.11.0110,347.281,034.731,055.88909.28767.441,555.641,258.91244.732447.39861,3460000

2001.11.0210,383.781,038.381,053.68909.63767.191,589.051,261.79241.832418.36843,5630000

2001.11.0510,447.541,044.751,054.04912.61764.411,616.121,287.54239.922399.21778960000

2001.11.0610,633.721,063.371,063.56923.19772.071,657.561,288.40238.712387.15571,3580000

2001.11.0710,284.981,028.501,038.52896.30745.161,605.811,261.12228.952289.57912,1500000

2001.11.0810,431.791,043.181,046.45906.51754.221,620.931,283.19234.562345.64891,8490000

2001.11.0910,215.711,021.571,030.78895.46743.711,615.471,282.36224.552245.51,0302,3850000

2001.11.1210,081.561,008.161,021.11884.72736.781,596.671,247.84223.232232.31,0912,4500000

2001.11.1310,030.561,003.061,016.48879.20734.911,577.161,236.77220.812208.11,5282,5050000

2001.11.1410,086.761,008.681,019.10882.63739.401,613.581,238.53219.842198.42,1313,1020000

2001.11.1510,489.891,048.991,044.56909.91764.271,698.001,263.07220.482204.81,8473,2230000

2001.11.1610,649.091,064.911,053.03919.93780.471,768.521,263.62225.5022553,1894,6030000

2001.11.1910,727.941,072.791,064.99933.66799.131,781.611,328.72230.362303.64802,0530000

2001.11.2010,575.621,057.561,055.58927.00787.851,733.901,336.93226.0022603591,6200000

2001.11.2110,661.081,066.111,058.64928.52787.741,725.621,342.57232.042320.45002,1400000

2001.11.2210,696.821,069.681,062.47931.39792.141,740.721,323.24235.742357.44452,2700000

2001.11.2611,064.301,106.431,088.77954.94814.721,804.141,347.16238.872388.74233,7570000

2001.11.2710,948.891,094.891,079.59948.07806.251,809.861,332.16235.382353.82512,2710000

2001.11.2810,624.811,062.481,053.29923.47781.761,756.901,299.25224.122241.23152,1260000

2001.11.2910,655.961,065.601,048.50920.87776.931,729.561,315.74223.5022357802,1710000

2001.11.3010,697.441,069.741,050.22924.38778.651,747.231,299.04221.252212.53771,9270000

2001.12.0310,370.621,037.061,029.41905.48762.821,713.001,286.48214.7021478922,6960000

2001.12.0410,452.651,045.271,028.50904.36757.541,719.591,265.23207.192071.93431,4100000

2001.12.0510,713.811,071.381,047.34924.70781.061,791.221,301.05211.892118.93491,3990000

2001.12.0610,857.281,085.731,058.03935.48791.431,853.011,322.05213.3021331,0413,4270000

2001.12.0710,796.891,079.691,045.69926.49780.351,847.001,309.16207.532075.35527930000

2001.12.1010,571.011,057.101,023.34905.12757.571,807.261,283.46198.251982.57848880000

2001.12.1110,473.911,047.391,014.69899.57753.881,785.141,275.67197.231972.34021,2890000

2001.12.1210,801.521,080.151,036.17921.70771.211,841.341,290.35205.532055.33062,0730000

2001.12.1310,433.451,043.351,012.93896.95746.201,793.031,257.42199.171991.76062,1410000

2001.12.1410,511.651,051.171,006.76896.78740.661,765.761,268.05194.331943.39422,0030000

2001.12.1710,323.351,032.34988.98879.77728.661,739.211,256.86189.341893.41,1069560000

2001.12.1810,432.171,043.22992.61886.82732.901,766.961,272.02187.271872.79531,2430000

2001.12.1910,471.931,047.19996.66892.58741.441,766.411,275.00193.181931.84961,3620000

2001.12.2010,434.521,043.451,012.47903.01754.731,756.331,287.08202.792027.94931,1150000

2001.12.2110,335.451,033.551,007.52895.17746.741,699.191,304.75202.842028.41611,3830000

2001.12.2510,254.811,025.481,002.82890.41743.221,687.901,317.51201.422014.29416660000

2001.12.2610,192.571,019.26994.01884.96736.791,677.061,317.14200.062000.62407470000

2001.12.2710,457.611,045.761,013.73905.91753.721,725.631,347.02200.132001.32879250000

2001.12.2810,542.621,054.261,032.14921.51772.451,745.831,373.78207.052070.58411,0300000

2002.01.0410,871.491,087.151,053.96947.50799.371,846.091,428.04207.462074.64581,6340000

2002.01.0710,942.361,094.241,055.14948.91800.441,855.981,409.11212.152121.53043,1710000

2002.01.0810,695.601,069.561,031.77928.64782.891,808.961,393.64206.152061.54781,0320000

2002.01.0910,663.981,066.401,025.01923.11778.361,814.811,406.33202.4020247436830000

2002.01.1010,538.431,053.841,010.17910.89767.681,803.541,403.57199.491994.95611,0670000

2002.01.1110,441.591,044.16999.94902.74756.851,787.981,415.48192.971929.79631,0720000

2002.01.1510,208.051,020.81980.32882.25737.301,720.351,380.77193.351933.51,1381,7160000

2002.01.1610,177.581,017.76987.61886.70745.091,697.631,400.91199.381993.89721,3980000

2002.01.1710,128.181,012.82984.90882.71740.311,685.481,374.81203.072030.78261,6590000

2002.01.1810,293.321,029.331,007.64901.92755.991,723.151,410.94206.222062.29291,3970000

2002.01.2110,280.251,028.031,005.83897.93748.501,716.751,424.51202.532025.38936500000

2002.01.2210,050.981,005.10985.13878.19731.791,675.261,400.04198.021980.21,0821,6410000

2002.01.2310,040.911,004.09975.20869.70721.841,671.271,397.39193.571935.71,3921,4540000

2002.01.2410,074.051,007.41980.44877.12730.851,692.021,438.43192.311923.11,2711,9620000

2002.01.2510,144.141,014.41985.84885.46739.041,721.501,459.95188.961889.65051,5970000

2002.01.2810,220.851,022.09997.04894.26750.791,719.181,483.48190.841908.41,1911,2880000

2002.01.2910,026.031,002.60978.74874.19728.811,681.821,426.60187.991879.94206810000

2002.01.309,919.48991.95964.75858.76712.771,643.791,395.63184.641846.41,7753,3030000

2002.01.319,997.80999.78971.77868.75721.841,663.341,416.35186.061860.64441,2910000

2002.02.019,791.43979.14956.26852.89708.261,620.551,421.31181.181811.81,1782,9130000

2002.02.049,631.93963.19943.51842.33699.561,592.981,409.19177.161771.69761,3280000

2002.02.059,475.60947.56926.27826.83683.471,569.251,355.92176.231762.31,6092,8460000

2002.02.069,420.85942.09922.51822.60675.151,566.981,355.69172.021720.29491,2000000

2002.02.079,583.27958.33941.24840.27698.481,595.061,379.33186.131861.31,0591,4530000

2002.02.089,686.06968.61949.97849.94702.441,608.491,392.84188.051880.58468650000

2002.02.129,877.99987.80974.10869.74722.771,664.041,434.33193.271932.77751,2600000

2002.02.139,968.35996.84983.18876.78732.111,669.311,463.59196.131961.31,0561,5830000

2002.02.1410,081.091,008.11984.04879.08730.071,701.711,432.44192.271922.71,2622,0690000

2002.02.1510,048.101,004.81982.50878.37730.261,694.441,446.75194.6019468818310000

2002.02.1810,093.251,009.33981.68878.25726.411,693.551,445.53193.321933.29755870000

2002.02.199,847.16984.72959.96858.18708.541,669.621,393.62185.3018537319100000

2002.02.209,834.13983.41956.91854.65702.131,647.031,389.91185.291852.96557710000

2002.02.2110,295.421,029.54988.89885.88728.061,715.271,449.78190.191901.91,7152,3540000

2002.02.2210,356.781,035.68989.19886.83727.731,728.191,439.40190.691906.99082,3010000

2002.02.2510,296.471,029.65987.12884.64727.321,724.271,439.12192.141921.41,0549050000

2002.02.2610,202.631,020.26983.82880.85723.511,720.591,426.53189.071890.72931,1200000

2002.02.2710,573.091,057.311,007.18900.76733.791,759.411,458.03195.731957.31,5193,3610000

2002.02.2810,587.831,058.781,013.80907.48741.061,775.381,479.99198.321983.21,6364,0790000

2002.03.0110,812.001,081.201,030.17924.64755.791,810.561,492.76201.652016.56812,4180000

2002.03.0411,450.221,145.021,079.04972.39801.341,908.411,570.84214.742147.42,2107,0520000

2002.03.0511,348.451,134.851,075.31967.38802.461,908.051,554.60217.2021721,1992,8880000

2002.03.0611,358.531,135.851,073.36967.62807.801,906.811,568.09211.762117.65641,9540000

2002.03.0711,648.341,164.831,098.33989.85838.051,971.681,586.02222.262222.69691,6630000

2002.03.0811,885.791,188.581,108.13998.18841.172,006.661,532.53223.992239.91,0872,8280000

2002.03.1111,919.301,191.931,125.431,011.18852.142,019.201,555.00230.242302.49522,0590000

2002.03.1211,607.331,160.731,098.56984.10827.331,954.201,546.78223.552235.59662,3750000

2002.03.1311,415.311,141.531,075.70965.80809.761,906.921,549.46212.892128.91,1251,8590000

2002.03.1411,568.821,156.881,083.88975.87820.141,932.641,553.96213.792137.91,0933,7370000

2002.03.1511,648.011,164.801,097.24987.23828.481,957.891,570.01215.152151.51,0513,4410000

2002.03.1811,498.381,149.841,088.14976.34818.261,932.481,566.56212.682126.81,2202,0270000

2002.03.1911,792.821,179.281,112.791,002.39840.642,007.961,621.34215.882158.87661,6100000

2002.03.2011,526.781,152.681,097.85985.24825.961,971.971,590.44210.132101.35352,7400000

2002.03.2211,345.081,134.511,076.63966.27810.211,952.741,559.39201.962019.64151,8990000

2002.03.2511,261.091,126.111,073.20961.31807.581,912.101,559.95204.752047.52401,9800000

2002.03.2611,207.921,120.791,064.15953.68798.571,904.151,544.76202.312023.16711,7930000

2002.03.2711,323.681,132.371,077.32963.00807.861,914.851,568.43205.582055.87891,2390000

2002.03.2811,333.111,133.311,082.43971.79820.101,921.671,585.52207.722077.26681,0590000

2002.03.2911,024.941,102.491,060.19949.08800.251,881.001,531.98201.672016.71,1682,4301671154097

2002.04.0111,028.701,102.871,053.46945.25795.271,880.971,548.25199.891998.98621,7411025323

2002.04.0211,204.491,120.451,068.69963.78811.191,937.541,557.05198.821988.22279931514011

2002.04.0311,400.711,140.071,084.36978.03822.161,968.501,560.97199.921999.27302,12914124440

2002.04.0411,379.201,137.921,091.63981.91824.481,961.861,556.68200.812008.19851,28742501532

2002.04.0511,335.491,133.551,087.71974.94813.541,922.501,559.46202.492024.99631,4222262432

225NAV

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

/10

TOPIX

S&P/TOPIX150

TOPIX Core30

TOPIX-Type ETF

Nikkei 225-type ETF

TOPIXCore30ETF

ETF

ETF

ETF

(/10)

TOPIX

S&P/TOPIX150

TOPIX Core30

(x10)

Sheet8

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

0000000000000

TOPIX-Type ETF

Nikkei 225-type ETF

TOPIXCore30ETF

ETF

ETF

ETF

(/10)

TOPIX

S&P/TOPIX150

TOPIX Core30

(x10)

TOPIXNAV

TOPIXS&P/TOPIX150225TOPIX Core 30

ETFTPX(1305)TOPIX(1306)i Shares TOPIX(1307)TOPIX(1308)i Shares S&P/TOPIX150(1315)i Shares 225(1329)225(1330)1310TOPIXCore301311161016131611161416121615

7/13706.48781,316.81,638216.632,6922,239.835,208

7/1650.262247.930742.20520340.30889

7/1778.796144.717780.41975303.811,248

7/18113.1136295.6357152.211,818560.912,311

7/1993.4111324.1386228.562,721646.063,218

7/2396.9113356.9416112.011,307565.811,836

7/2499.7116157.3183123.441,445380.441,744

7/2576.390176.2209128.061,526380.561,825

7/2617.020229.0272290.313,450536.313,742

7/2733.239917.01,0881,322.0615,6152,272.2616,742

7/3048.256616.0721408.554,7721,072.755,549

7/3145.253165.5195174.792,059385.492,307

8/161.673137.3165282.303,353481.203,591

8/290.7111358.7442419.605,146869.005,699

8/342.952128.6157221.232,720392.732,929

8/630.837225.2273195.582,389451.582,699

8/718.422152.9185252.523,084423.823,291

8/829.73682.8101263.653,220376.153,357

8/980.896140.6167292.793,476514.193,739

8/1052.962294.5349359.374,235706.774,646

8/1363.073179.4209232.832,681475.232,963

8/14585.2700607.1724251.042,9481,443.344,372

8/1537.544443.5527181.142,126662.142,697

8/16556.4652436.1512220.022,5321,212.523,696

8/1741.848304.6357174.392,004520.792,409

8/20111.8129240.9279170.891,928523.592,336

8/2163.473158.3183135.741,530357.441,786

8/22273.53181,095.21,2753,294.13,833184.272,0934,847.077,519

8/2344.050614.37091,251.81,453228.952,5762,139.054,788

8/24208.6239744.38522,539.32,914227.962,5443,720.166,549

8/2729.333296.7343277.7321114.311,294718.011,991

8/28111.3127428.9491553.9635137.361,5271,231.462,780

8/29431.9488475.9538347.13921.41243.582,6871,499.884,106

8/30413.6458432.2479126.21392.32233.882,5441,208.183,622

8/31242.8268506.2558284.93130.60210.842,2651,245.343,404

9/3255.2276550.860053.4581.81170.451,8021,031.652,737

9/4150.8162838.590190.2961.01388.714,0801,469.215,240

9/543.647478.8519260.42822.7239.03409143.601,512968.132,771

9/699.1108293.83201.010.2019.85211239.412,548653.363,188

9/749.052240.62580.300.9020.04210186.841,955497.682,475

9/10160.6170259.22751.210.300.232258.482,666680.013,114

9/1181.085298.7315210.02210.200.020186.781,917776.702,538

9/12393.83881,450.91,4258.170.301.7716487.264,6282,342.136,464

9/13341.3338469.54660.200.300.282484.924,6431,296.505,449

9/14301.5306435.54420.501.6112.15119260.692,5461,011.943,414

9/17343.3341543.45400.501.002.0319222.062,1211,112.293,021

9/18556.0564580.7593362.83690.400.000199.071,9561,698.973,482

9/19418.1432506.25230.000.005.0850164.911,6391,094.292,644

9/2065.967453.54600.000.000.090312.153,046831.643,573

9/21446.2443862.985820.5200.100.161243.942,3151,573.803,637

9/25115.0117282.72870.300.1011.34110185.101,810594.542,324

9/2634.134185.11840.500.000.020147.401,421367.121,639

9/2716.11675.7750.000.100.424125.111,209217.431,304

9/2882.985184.51890.000.000.656310.263,059578.313,339

10/188.091390.54030.000.000.000249.982,452728.482,946

10/265.669174.71830.300.201.0010190.461,904432.262,166

10/357.261322.83451.010.100.060228.002,300609.162,707

10/442.645202.52160.000.100.000453.024,605698.224,866

10/582.188207.42220.000.000.191202.742,059492.432,370

10/958.861260.12740.000.000.636220.682,223540.212,564

10/1044.64674.4770.000.000.000142.921,428261.921,551

10/11133.5141208.12190.000.001.6516235.052,404578.302,780

10/12283.4307435.047160.2650.0011.72124361.623,8191,151.944,786

10/1524.926128.41370.000.400.00088.44927242.141,090

10/1624.025151.61635.050.000.000214.952,277395.552,470

10/1728.631135.51460.000.300.131335.793,592500.323,770

10/1832.735314.63370.000.000.000170.301,800517.602,172

10/1925.927238.82550.000.000.000109.881,158374.581,440

10/228.3832.1340.000.000.000125.461,328165.861,370

10/23119.6130237.52580.000.000.141184.331,983541.572,372

10/24338.8374814.28973.430.000.535308.853,3651,465.784,644

10/25225.8251376.54181.820.107.1979334.693,669946.084,419

10/26341.5380680.97560.000.200.090275.383,0071,298.074,143

10/29325.8356335.83660.000.100.000152.941,643814.642,365

10/30167.8179623.36640.000.000.000173.701,823964.802,666

10/31498.2530793.884426.0270.000.959128.461,3411,447.412,751

11/1128.2136797.98500.000.000.000129.091,3461,055.192,332

11/2153.1162491.15220.000.105.2354335.103,509984.634,247

11/535.337133.21400.100.000.00086.13896254.731,073

11/686.892438.54650.000.000.000128.311,358653.611,915

11/7105.0109651.06820.600.000.040205.042,150961.682,941

11/858.561412.04280.000.000.000178.481,849648.982,338

11/9112.4117884.09130.300.100.000231.102,3851,227.903,415

11/1276.778985.41,0130.000.002.2522237.982,4281,302.333,541

11/1390.1911,418.21,4361.510.100.494249.792,5011,760.184,033

11/14185.01901,834.21,88060.4610.200.000304.683,1022,384.485,233

11/15212.82191,585.31,6280.000.200.000312.113,2232,110.415,070

11/16121.51282,904.03,0610.000.000.000430.944,6033,456.447,792

11/1958.762392.54180.000.000.000190.732,053641.932,533

11/2066.570271.22890.000.000.000152.031,620489.731,979

11/2149.652424.94480.000.000.010200.342,140674.852,640

11/22105.1111267.328250.1520.005.0052208.982,218636.482,715

11/26114.5124275.12990.000.001.5416340.413,741731.554,180

11/2733.336198.12150.200.000.070204.692,271436.362,522

11/2844.347252.42671.510.000.121196.682,125495.002,441

11/2995.6100640.367010.0100.000.030204.792,171950.722,951

11/3024.125336.13520.000.000.000180.981,927541.182,304

12/353.555802.88370.000.000.202256.662,6941,113.163,588

12/4128.1131207.02120.000.001.5616133.621,394470.281,753

12/521.922313.73270.500.000.010131.631,399467.741,748

12/692.498884.79430.000.001.5216310.883,4111,289.504,468

12/720.921506.35310.000.000.00073.09793600.291,345

12/1061.763698.07210.200.000.82882.68880843.401,672

12/11138.8141256.12610.000.200.000122.371,289517.471,691

12/1272.674225.82320.000.100.101194.462,072493.062,379

12/13355.4362239.72440.000.000.050203.192,141798.342,747

12/14406.3409529.85330.000.000.202191.732,0011,128.032,945

12/17277.6276833.38300.000.100.00092.169561,203.162,062

12/18255.6254698.86981.610.000.151118.651,2421,074.802,196

12/19139.0137361.13590.000.000.000130.661,362630.761,858

12/20211.2211281.42820.000.400.000106.701,115599.701,608

12/2127.127134.61340.100.000.040134.151,383295.991,544

12/2591.692846.28490.000.100.12164.796651,002.811,607

12/2682.982119.811939.7390.000.02072.99747315.41987

12/27176.4176111.61110.000.000.00089.91925377.911,212

12/28370.8379450.44620.000.000.09098.111,030919.401,871

1/4253.2264185.61940.000.100.000151.871,634590.772,092

1/790.695199.32090.000.000.141291.073,170581.113,475

1/8111.2115348.93630.000.200.11195.801,031556.211,510

1/9223.5229240.22460.002622680.000.00063.91683789.611,426

1/10180.3182192.91950.501821840.000.444100.481,063656.621,628

1/11423.9425454.84560.0082820.104.895197.031,0211,062.722,035

1/15206.4203788.67794.741551520.100.000166.821,7161,321.622,854

1/16294.8290527.15180.001671640.000.000137.341,3981,126.242,370

1/17122.4120570.75610.201481450.100.000163.371,6591,004.772,485

1/18108.3107459.54560.103693660.000.000136.591,3971,073.492,326

1/21131.9132414.641610.0103343351.000.01063.33650954.841,543

1/22125.2124845.28420.001171160.000.000161.491,6411,248.892,723

1/23286.0281968.69500.001651610.000.000143.911,4541,563.512,846

1/24193.6190833.1817163.91591081050.000.000193.401,9621,492.003,233

1/2591.890319.63130.101051020.000.010158.251,597674.762,102

1/28184.8183760.475555.7552001980.000.030125.671,2881,326.602,479

1/2981.780281.62770.2064630.000.00067.32681494.821,101

1/30354.63411,320.11,2710.001701630.100.000333.863,3032,178.665,078

1/31137.5133244.92370.0077740.000.000129.531,291588.931,735

2/1272.6260872.58340.1089840.000.000296.702,9131,530.904,091

2/4259.3246750.07120.0020180.000.040136.841,3281,166.182,304

2/5172.81611,438.81,3390.101171090.000.100297.702,8462,026.504,455

2/695.288887.28230.1041380.000.100126.121,2001,149.722,149

2/747.143996.39313.0290830.000.000152.051,4531,288.452,512

2/835.133753.57150.50104980.000.01089.64865982.751,711

2/12101.899631.461621.02041400.000.000127.231,260922.432,035

2/13123.7122782.177010.5101571540.000.000158.881,5831,232.182,639

2/14114.61141,118.51,1140.0035340.100.191203.762,0681,472.153,331

2/1587.185780.77660.0031300.000.00082.46831981.261,712

2/1841.340936.09190.0017160.200.01058.345871,052.851,562

2/1964.562642.06210.0050480.000.00091.34910847.841,641

2/2023.322631.06040.0031290.000.00078.54771763.841,426

2/2141.0391,416.51,3820.003022940.000.000232.312,3541,991.814,069

2/2226.626853.08440.0039380.000.000223.592,3011,142.193,209

2/2512.1121,045.01,0380.20540.000.00087.369051,149.661,959

2/2650.650239.82360.00870.000.000108.541,120406.941,413

2/27200.22001,213.61,2150.301051040.000.000321.053,3611,840.154,880

2/28115.01171,311.41,3390.801771800.000.010382.324,0791,986.535,715

3/151.552488.44980.001301310.000.000225.912,418895.813,099

3/4230.52451,763.81,8822.7277810.000.161627.507,0512,701.669,262

3/5123.6133868.59410.701161250.000.121251.672,8871,360.594,087

3/6127.2137304.03270.30931000.000.080170.311,954694.892,518

3/7223.9244595.86500.0069750.000.000143.271,6631,031.972,632

3/8269.2298635.17020.0079870.000.414238.942,8241,222.653,915

3/1185.996645.37243.531151290.000.748172.312,0511,022.753,011

3/12312.1348449.25000.001071180.000.121201.622,3741,070.043,341

3/13165.2180549.25990.903183460.000.020160.361,8591,193.682,984

3/1432.935279.33000.007067580.000.556325.503,7311,344.254,830

3/1530.933624.36820.003093360.000.040295.743,4411,259.984,492

3/1864.671466.651310.5115696250.000.040174.562,0271,285.303,247

3/19134.9148382.34220.001771960.000.000137.431,610831.632,376

3/2064.170377.74170.1044480.000.030235.572,740721.503,275

3/2286.593244.42650.0053570.000.030166.211,899550.142,314

3/2527.129171.41830.0026280.100.050176.081,980400.732,220

3/26136.7146339.63650.001501600.000.000157.771,793784.072,464

3/2756.861611.76620.8062660.100.202108.961,237840.562,028

3/2829.331318.4346122.21321471590.000.00093.531,059710.431,727

3/29102.3109577.862245.5493613880.000.222216.972,428202.116759.6115.024.940.045997.02,049.394,017

4/1264.6282462.64912.2283870.000.000156.801,74113.41013.225.02.13.011423.01,111.902,664

4/29.39189.12020.7015160.000.00088.8399319.6157.414.00.40.05611.0386.331,260

4/38.28471.651243.8471511630.000.000188.012,12914.8122.628.817.054.4107.03.24.00.10.014729.056.911.01,150.413,041

4/4150.2163588.664630.0321321440.000.000112.301,28714.41137.8315.510.020.140.07.912.01.93.07114.088.618.01,260.302,411

4/58.39844.89240.0028300.000.000124.801,42210.2817.11410.420.021.942.02.74.00.50.07014.090.718.01,229.402,505

25,273.726,74194,159.098,73010,485.311,8618,2818,53920.68166.001,69036,421.82392,869274.522357.547104.9201.096.4189.041.263.02.53.0917188.0236.247.0176,537.62541,3990

ETF

ETF

251626921235.5151244.02

3695201234.3371242.21

2739751212.8571223.91

49318181189.2581199.67

49727211190.8391195.25

52913071160.9631163.76

29914451188.3251179.86

29915261189.1611189.11

29234501185.8561192.25

1127156151179.8081184.23

77747721157.9271168.51

24820591186.0771190.31

23833531195.9331206.85

55351461239.921235.26

20927201224.1971219.92

31023891224.391218.64

20730841231.9461224.38

13732201216.3671217.92

26334761175.4561184.94

41142351173.5061182.49

28226811147.7561167.09

142429481191.7951198.86

57121261175.541194.33

116425321151.5021175.07

40520041144.5541169.81

40819281125.7941155.15

25615301128.0381158.82

542620931139.6431165.54

221225761112.6921147.39

400525441116.6311145.34

69712941127.5011155.17

125315271118.941150.25

141926871097.9761126.86

107825441093.8451114.58

113922651071.3511103.67

93518021040.9681071.73

116040801077.2591100.13

85019211059.8791087.72

42927591065.0331090.74

31021651051.6791080.83

44626681019.5691055.98

62119171029.2951058.12

18204644961.01990.8

8044645961.3091003.51

74926651000.8891033.81

8812140950.441996.45

15261956967.9881013.09

9551689993.961038.06

5273046978.5161024.92

13212316955.499998.2

4041920969.3971009.3

2181421964.17998.28

911213969.6531003.78

2743065977.4681023.42

4942452997.2281047.03

25219141013.6561067.63

4072300992.4231050.35

26146051020.5481071.19

31020601020.5871070.45

33522291001.1771043

1231428996.4881031.17

36024201034.7011064.66

84339431063.2351087.48

1639271045.2541071.78

19322771063.7821078.16

17735931075.5451087.6

37218001047.4851068.48

28211581053.8791070.65

4213281056.5411072.98

38819841086.1561095.74

127433701080.2151100.22

67137481088.011107.83

113630071079.5161101.22

72216431061.2311082.65

84318231051.2821067.76

140113501036.6341059.37

98613461034.7281055.88

68435631038.3781053.68

1778961044.7541054.04

55713581063.3721063.56

79121501028.4981038.52

48918491043.1791046.45

103023851021.5711030.78

109124501008.1561021.11

152825051003.0561016.48

213131021008.6761019.1

184732231048.9891044.56

318946031064.9091053.03

48020531072.7941064.99

35916201057.5621055.58

50021401066.1081058.64

44522701069.6821062.47

42337571106.431088.77

25122711094.8891079.59

31521261062.4811053.29

78021711065.5961048.5

37719271069.7441050.22

89226961037.0621029.41

34314101045.2651028.5

34913991071.3811047.34

104134271085.7281058.03

5527931079.6891045.69

7848881057.1011023.34

40212891047.3911014.69

30620731080.1521036.17

60621411043.3451012.93

94220031051.1651006.76

11069561032.335988.98

95312431043.217992.61

49613621047.193996.66

49311151043.4521012.47

16113831033.5451007.52

9416661025.4811002.82

2407471019.257994.01

2879251045.7611013.73

84110301054.2621032.14

45816341087.1491053.96

30431711094.2361055.14

47810321069.561031.77

7436831066.3981025.01

56110671053.8431010.17

96310721044.159999.94

113817161020.805980.32

97213981017.758987.61

82616591012.818984.9

92913971029.3321007.64

8936501028.0251005.83

108216411005.098985.13

139214541004.091975.2

127119621007.405980.44

50515971014.414985.84

119112881022.085997.04

4206811002.603978.74

17753303991.948964.75

4441291999.78971.77

11782913979.143956.26

9761328963.193943.51

16092846947.56926.27

9491200942.085922.51

10591453958.327941.24

846865968.606949.97

7751260987.799974.1

10561583996.835983.18

126220691008.109984.04

8818311004.81982.5

9755871009.325981.68

731910984.716959.96

655771983.413956.91

171523541029.542988.89

90823011035.678989.19

10549051029.647987.12

29311201020.263983.82

151933611057.3091007.18

163640791058.7831013.8

68124181081.21030.17

221070521145.0221079.04

119928881134.8451075.31

56419541135.8531073.36

96916631164.8341098.33

108728281188.5791108.13

95220591191.931125.43

96623751160.7331098.56

112518591141.5311075.7

109337371156.8821083.88

105134411164.8011097.24

122020271149.8381088.14

76616101179.2821112.79

53527401152.6781097.85

41518991134.5081076.63

24019801126.1091073.2

67117931120.7921064.15

78912391132.3681077.32

66810591133.3111082.43

116824301102.4941060.19

86217411102.871053.46

2279931120.4491068.69

73021291140.0711084.36

98512871137.921091.63

96314221133.5491087.71

Nikkei 225 /10

Unit: \ Million

Unit: Point

TOPIX

TOPIX-Type ETF

Nikkei 225-type ETF

(/10)

TOPIX

Sheet3 (2)

Return Diffrential=NAV(per Unit)-Index

Sheet3 (2)

9972.289997.8220260679-0.0001123724

10136.5610162.5062030372-0.0000016597

9924.239949.5339507999-0.0000097179

10205.4810231.3449995443-0.000015685

10205.8710231.2568180841-0.0000468335

10011.7710036.5731878963-0.0000098533

9964.889989.82225057240.0000254298

10347.0110372.6793570487-0.0000229605

10632.3510658.4651911086-0.0000252636

10452.5410477.9345857639-0.0000261722

10637.8210663.2898481565-0.0000357778

10755.4510781.36115727730.0000149739

10474.8510499.7794982688-0.0000283508

10538.7910563.7826452606-0.0000084789

10565.4110590.47700713290.0000010633

10861.5610887.1218720044-0.0000196183

10802.1510827.2708177855-0.0000276691

10880.110905.85762471570.0000420726

10795.1610820.3294214936-0.0000354961

10612.3110637.10241008560.0000045573

10512.8210536.952040116-0.0000402311

10366.3410390.1242464046-0.0000010962

10347.2810370.8888560321-0.0000126716

10383.7810407.4006772084-0.0000068903

10447.5410471.1041168324-0.0000193708

10633.7210657.75496644110.0000048635

10284.9810307.9882428555-0.0000223763

10431.7910454.867370852-0.0000251549

10215.7110238.1746913604-0.0000128805

10081.5610103.5797146854-0.0000146487

10030.5610052.80001893610.0000328296

10086.7610109.0234146331-0.0000100681

10489.8910513.06473749170.0000021305

10649.0910671.7881240024-0.0000787901

10727.9410751.02353172160.000020366

10575.6210598.51619948460.0000130609

10661.0810683.756509397-0.0000381856

10696.8210719.4113505932-0.0000150864

11064.311087.5763273769-0.0000085014

10948.8910972.48309229710.000050467

10624.8110642.0748662532-0.0005130913

10655.9610671.6724847039-0.0001506284

10697.4410713.0818803566-0.0000123474

10370.6210386.0312643680.0000230805

10452.6510468.074405508-0.0000104717

10713.8110729.4862158785-0.0000127597

10857.2810873.20836991390.0000039361

10796.8910806.4712155252-0.0005755944

10571.0110581.35053610030.0000888142

10473.9110484.4252513530.0000254881

10801.5210812.2045800588-0.0000152201

10433.4510443.85172022830.0000075124

10511.6510521.9061230067-0.0000214058

10323.3510333.234583024-0.0000178501

10432.1710442.0288323885-0.0000125755

10471.9310481.6213016254-0.0000196423

10434.5210444.40139621050.000021439

10335.4510344.6984194289-0.0000516218

10254.8110265.95497724310.0001903116

10192.5710203.6234305908-0.0000023285

10457.6110469.06858376180.0000115379

10542.6210553.8064153998-0.0000348947

10871.4910882.4670471092-0.0000529023

10942.3610953.1113204807-0.0000273178

10695.610706.31781598960.0000190765

10663.9810674.6587654637-0.0000006879

10538.4310549.04609030420.0000059064

10441.5910451.9567810284-0.0000143857

10208.0510218.0321236458-0.0000146184

10177.5810187.4960839096-0.0000035471

10128.1810137.8280996526-0.0000215807

10293.3210302.6962167432-0.000042336

10280.2510289.4372052463-0.0000171903

10050.9810060.03232655670.0000068045

10040.9110049.95556296030.0000002292

10074.0510082.6905606954-0.0000432696

10144.1410153.09462728940.0000251867

10220.8510231.05470475410.0001164534

10026.0310035.9203655229-0.0000117121

9919.489929.1405586694-0.0000124252

9997.810007.3022934357-0.0000236215

9791.439800.87494782240.0000138695

9631.939641.1706708307-0.0000051446

9475.69484.570571198-0.0000124591

9420.859429.7486311798-0.0000021201

9583.279591.9450316274-0.0000399816

9686.069694.99752755980.0000176656

9877.999886.6563627487-0.0000462365

9968.359977.21071794460.0000116398

10081.0910089.839410543-0.0000212003

10048.110057.82416104170.0000994449

10093.2510102.7579827069-0.0000258379

9847.169856.1273595173-0.0000305662

9834.139843.19515119730.0000111258

10295.4210304.8580467135-0.0000053157

10356.7810366.0625188581-0.0000205513

10296.4710307.25316007020.0001499794

10202.6310213.63713938680.0000312649

10573.0910584.1402250037-0.0000349128

10587.8310598.95150097590.0000052787

1081210823.2289995106-0.0000120739

11450.2211459.610440859-0.0002311134

11348.4511358.47625121250.0000627659

11358.5311368.3719759381-0.0000170076

11648.3411658.1521386013-0.0000247136

11885.7911896.0345743940.000019936

11919.311929.4055927191-0.000014111

11607.3311617.1250000565-0.0000038639

11415.3111424.454032542-0.0000420869

11568.8211577.9237326089-0.000014291

11648.0111657.091437355-0.000007308

11498.3811507.42706602710.0000070591

11792.8211801.7551958829-0.0000298537

11526.7811535.52212821170.0000007207

11345.0811353.4219801485-0.0000227422

11261.0911269.3167599148-0.000004709

11207.9211253.17013214520.0032887722

11323.6811369.2737494278-0.0000109964

11333.1111379.04813327230.0000269511

11024.9411070.86146260660.0001083113

11028.711076.42302618670.0001613156

11204.4911251.9777292084-0.000089918

11400.7111448.7726847856-0.0000228119

11379.211427.50341205180.0000289471

11335.4911383.4757327125-0.0000115629

11352.8911400.3988945497-0.0000483593

11114.4911161.46983775110.0000411025

11218.5811265.6075839877-0.0000351416

11147.2711193.6388682722-0.0000319369

10962.9811009.14142740530.0000499519

&A

Page &P

yen

NIKKEI 225 index

NAV (per Unit)

Return Differentual

225Nikko Exchange Traded Index Fund225

OTC

1047.031050.46-0.01

1067.631071.220.01

1050.351053.51-0.03

1071.191074.60.02

1070.451073.810

10431046.430.01

1031.171034.4-0.02

1064.661067.84-0.01

1087.481090.32-0.04

1071.781075.070.05

1078.161081.460

1087.61090.920

1068.481071.49-0.02

1070.651073.730.01

1072.981076.01-0.01

1095.741098.6-0.02

1100.221103.290.02

1107.831110.62-0.03

1101.221104.270.02

1082.651085.45-0.02

1067.761070.660.01

1059.371062.19-0.01

1055.881058.950.02

1053.681056.61-0.01

1054.041057.230.02

1063.561066.42-0.03

1038.521041.22-0.01

1046.451049.140

1030.781033.720.03

1021.111024.010

1016.481019.460.01

1019.11021.93-0.02

1044.561047.33-0.01

1053.031055.910.01

1064.991067.65-0.02

1055.581058.440.02

1058.641061.60.01

1062.471065.3-0.01

1088.771091.6-0.01

1079.591082.680.03

1053.291056-0.03

1048.51051.460.02

1050.221053.20

1029.411031.84-0.05

1028.51030.920

1047.341050.240.04

1058.031060.65-0.03

1045.691048.420.01

1023.341026.140.01

1014.691017.28-0.02

1036.171038.890.01

1012.931015.26-0.03

1006.761009.240.02

988.98991.570.02

992.61995.430.02

996.66998.94-0.06

1012.471015.320.05

1007.521009.57-0.08

1002.821005.410.05

994.01996.710.01

1013.731016.08-0.04

1032.141034.870.03

1053.961056.38-0.04

1055.141057.950.04

1031.771034.620.01

1025.011027.61-0.02

1010.171013.10.04

999.941002.31-0.05

980.32983.160.05

987.61990.06-0.04

984.9987.40.01

1007.641010.270.01

1005.831008.610.02

985.13987.49-0.04

975.2977.48-0.01

980.44982.860.01

985.84988.580.03

997.04999.840

978.74981.3-0.02

964.75967.16-0.01

971.77974.80.06

956.26958.52-0.07

943.51945.890.02

926.27928.690.01

922.51924.71-0.02

941.24943.910.05

949.97952.690

974.1976.59-0.03

983.18985.80.01

984.04986.70

982.5985.09-0.01

981.68984.360.01

959.96962.540

956.91959.35-0.01

988.89991.15-0.03

989.19991.740.03

987.12989.640

983.82986.40.01

1007.181009.890.01

1013.81016.620.01

1030.171033.030

1079.041081.82-0.02

1075.311078.240.01

1073.361075.79-0.05

1098.331101.080.02

1108.1311110.01

1125.431128.410.01

1098.561101.32-0.01

1075.71078.1-0.03

1083.881086.890.05

1097.241100.340

1088.141091.11-0.01

1112.791115.970.01

1097.851100.79-0.02

1076.631079.50

1073.21076.450.04

1064.151070.860.32

1077.321084.090

1082.431089.670.04

1060.191067.270

1053.461061.420.09

1068.691075.71-0.1

1084.361091.28-0.02

1091.631098.45-0.01

1087.711095.160.06

1090.161097.31-0.03

1071.661079.070.03

1078.091085.21-0.03

1069.071076.150

1056.291063.420.01

&A

Page &P

point

%

TOPIX Index

NAV (per Unit)

Return Differentual

TOPIXTOPIX ETF

ToSTNeT

200109289,774.680.00%9,800.800.00%0.00%6,068,23759,473,549,451

NIKKEI 225 indexDaily ReturnNAV (per Unit)Daily ReturnReturn DifferentualUnit outstandingNAV

200110019,972.282.02%9,997.822.01%-0.01%6,068,23760,669,153,538

2001100210,136.561.65%10,162.511.65%-0.00%6,068,23761,668,496,154

200110039,924.23-2.09%9,949.53-2.10%-0.00%6,068,23760,376,130,053

2001100410,205.482.83%10,231.342.83%-0.00%6,068,23762,086,226,286

2001100510,205.870.00%10,231.26-0.00%-0.00%6,068,23762,085,691,180

2001100910,011.77-1.90%10,036.57-1.90%-0.00%6,068,23760,904,304,772

200110109,964.88-0.47%9,989.82-0.47%0.00%5,764,41857,585,511,198

2001101110,347.013.83%10,372.683.83%-0.00%5,764,41859,792,459,594

2001101210,632.352.76%10,658.472.76%-0.00%5,764,41861,439,848,600

2001101510,452.54-1.69%10,477.93-1.69%-0.00%5,764,41860,399,194,729

2001101610,637.821.77%10,663.291.77%-0.00%6,198,61866,097,660,392

2001101710,755.451.11%10,781.361.11%0.00%6,198,61866,829,539,334

2001101810,474.85-2.61%10,499.78-2.61%-0.00%6,198,61865,084,122,194

2001101910,538.790.61%10,563.780.61%-0.00%6,198,61865,480,853,253

2001102210,565.410.25%10,590.480.25%0.00%6,198,61865,646,321,405

2001102310,861.562.80%10,887.122.80%-0.00%6,198,61867,485,109,604

2001102410,802.15-0.55%10,827.27-0.55%-0.00%6,198,61867,114,115,782

2001102510,880.100.72%10,905.860.73%0.00%6,198,61867,601,245,378

2001102610,795.16-0.78%10,820.33-0.78%-0.00%6,198,61867,071,088,718

2001102910,612.31-1.69%10,637.10-1.69%0.00%6,198,61865,935,334,467

2001103010,512.82-0.94%10,536.95-0.94%-0.00%6,198,61865,314,540,581

2001103110,366.34-1.39%10,390.12-1.39%-0.00%6,198,61864,404,411,176

2001110110,347.28-0.18%10,370.89-0.19%-0.00%6,198,61864,285,178,339

2001110210,383.780.35%10,407.400.35%-0.00%6,632,81869,030,394,545

2001110510,447.540.61%10,471.100.61%-0.00%6,632,81869,452,927,866

2001110610,633.721.78%10,657.751.78%0.00%6,632,81870,690,948,981

2001110710,284.98-3.28%10,307.99-3.28%-0.00%6,632,81868,371,009,961

2001110810,431.791.43%10,454.871.42%-0.00%6,632,81869,345,232,485

2001110910,215.71-2.07%10,238.17-2.07%-0.00%6,632,81867,907,949,380

2001111210,081.56-1.31%10,103.58-1.31%-0.00%6,632,81867,015,205,396

2001111310,030.56-0.51%10,052.80-0.50%0.00%6,632,81866,678,392,916

2001111410,086.760.56%10,109.020.56%-0.00%6,632,81867,051,312,467

2001111510,489.894.00%10,513.064.00%0.00%6,632,81869,731,245,026

2001111610,649.091.52%10,671.791.51%-0.01%6,198,65466,150,722,142

2001111910,727.940.74%10,751.020.74%0.00%6,198,65466,641,875,019

2001112010,575.62-1.42%10,598.52-1.42%0.00%6,198,65465,696,534,834

2001112110,661.080.81%10,683.760.80%-0.00%6,198,65466,224,910,022

2001112210,696.820.34%10,719.410.33%-0.00%6,198,65466,445,922,046

2001112611,064.303.44%11,087.583.43%-0.00%6,198,65468,728,049,352

2001112710,948.89-1.04%10,972.48-1.04%0.01%6,198,65468,014,626,210

2001112810,624.81-2.96%10,642.07-3.01%-0.05%6,198,65465,966,539,938

2001112910,655.960.29%10,671.670.28%-0.02%6,198,65466,150,005,334

2001113010,697.440.39%10,713.080.39%-0.00%6,198,65466,406,687,850

2001120310,370.62-3.06%10,386.03-3.05%0.00%6,198,65464,379,414,241

2001120410,452.650.79%10,468.070.79%-0.00%6,198,65464,887,971,286

2001120510,713.812.50%10,729.492.50%-0.00%6,198,65466,508,372,650

2001120610,857.281.34%10,873.211.34%0.00%6,198,65467,399,256,555

2001120710,796.89-0.56%10,806.47-0.61%-0.06%6,198,65466,985,576,026

2001121010,571.01-2.09%10,581.35-2.08%0.01%6,198,65465,590,130,826

2001121110,473.91-0.92%10,484.43-0.92%0.00%6,198,65464,989,324,522

2001121210,801.523.13%10,812.203.13%-0.00%6,198,65467,021,115,169

2001121310,433.45-3.41%10,443.85-3.41%0.00%6,198,65464,737,823,241

2001121410,511.650.75%10,521.910.75%-0.00%6,198,65465,221,655,477

2001121710,323.35-1.79%10,333.23-1.79%-0.00%6,198,65464,052,145,881

2001121810,432.171.05%10,442.031.05%-0.00%6,198,65464,726,523,790

2001121910,471.930.38%10,481.620.38%-0.00%6,638,25469,579,664,532

2001122010,434.52-0.36%10,444.40-0.36%0.00%6,638,25469,332,589,346

2001122110,335.45-0.95%10,344.70-0.95%-0.01%6,858,15470,945,534,844

2001122510,254.81-0.78%10,265.95-0.76%0.02%6,858,15470,405,500,191

2001122610,192.57-0.61%10,203.62-0.61%-0.00%6,858,15469,978,020,845

2001122710,457.612.60%10,469.072.60%0.00%6,858,15471,798,484,584

2001122810,542.620.81%10,553.810.81%-0.00%6,858,15472,379,629,683

2002010410,871.493.12%10,882.473.11%-0.01%6,858,15474,633,634,909

2002010710,942.360.65%10,953.110.65%-0.00%6,858,15475,118,124,215

2002010810,695.60-2.26%10,706.32-2.25%0.00%6,858,15473,425,576,355

2002010910,663.98-0.30%10,674.66-0.30%-0.00%6,858,15473,208,453,711

2002011010,538.43-1.18%10,549.05-1.18%0.00%6,638,38170,028,587,134