A-C Project

-

Upload

asanjana11 -

Category

Documents

-

view

217 -

download

0

Transcript of A-C Project

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 1/9

1. INTRODUCTION

1.1 Introduction of the Company:

“Legendary Fashion Crafts” is one of the best manufacturer, wholesaler and

exporter of the best and unique man and woman wear garments in Nepal.

It was established on 2nd July 2002 registering to the Government Authorities of

Nepal. It has its own factory and office at Thamel, Kathmandu, Nepal. So,

any customers they are interested for products can visit the factory’s

showroom and make choices themselves with the different designs and

sizes. And, the customized orders are acceptable. Mr. Arjun Thapa was the

Production Supervisor of the company. Along with his Mrs. Soniya Thapa, Mr.

Sandeep Poudel, Mr. Pradeep Kadel and other members are also working as a

staff.

The Legendary Fashion Crafts produces the over all products of both man and woman

wear like Caps, Hats, Gloves, Socks, Shoes, Bags, Mufflers, Shawls, Shirts, Tops,

Trousers, Skirts, Pull over, Jackets, Sweaters and other accessories manufactured in

cotton, woolen, silk and hemp fabrications. The other existing fabulous products of

superb artisans are Bone items, well packed herbal Incenses in sweetness of fragrance

and fine Statues made up of clay and ceramic. These beautiful products are

handcrafted in the Kingdom of Nepal using traditional handloom tools. The fine art

seen in the products are the gifted creation and skilled handy work of its artisans.

Company Philosophy:

The company is very much concentrates on promotion of the Nepalese handmade

products to encourage and develop the skills and lifestyle of the people from the

remote Himalayan parts of the country. They employ as more workers as possible

from the economic level and village women while offering benefits such as health-

care, education to their children and many more. They trust on fair trade leading to

social benefits and do focus on profit selfless and of course 100% free from child-

labor. They select the workers under the strict supervision of the company.

1

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 2/9

Following are the principles of Legendary Fashion Craft services:

* Genuine products

* Items of competitive price

* Wide variety of original items

* Guaranteed on quality & design

Products:

Legendary Fashion Crafts have varieties of quality Nepalese handicrafts such as

fashion garments, Nepali pure woolen sweaters, Caps, Hats, Gloves, Socks, Shoes,

Bags, Mufflers, Shawls, Shirts, Tops, Trousers, Skirts, Pull over, Jackets, Sweaters

and other accessories manufactured in cotton, woolen, silk and hemp fabrications. etc.

to export all over the world. Custom designs are always possible and encouraged to

implement on our products as we believe that designs are based on the imagination.

Raw Material:

Most of our raw materials such as Hemp, Nettle, Cotton, Silk and paper products

come from the mountains and they are made by expert hand locally. The local village

people collets Hemp and Nettles from the source area of mountain regions. They

grows in the wild still collection of these raw materials does not affects to the nature,

thus it is eco friendly too.

Exports:

It exports their products to any part of the world. The number of frequent consumers

from Europe and American continent are using their export facilities.

1. By courier express service: 3-4 working days

2. By air cargo: 7 working days.

3. By water/ship: 30 to 45 days.

Contact Detail:

Telephone: 0977-1-4700253

FAX: 0977-1-4700253

P.O.Box: 11275

Website: http://www.legendaryfashion.com

2

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 3/9

1.2 Introduction of the Managerial Accounting:

Managerial Accounting refers to the process of making essential data available to

company managers who directly responsible for a firm's operations. Managerial

Accounting is also known as 'cost accounting’, which enables decision makers tocreate value for their organization through effective use of resources, efficient actions

and managing people. It is also the process of identifying, measuring, analyzing,

interpreting, and communicating information for the pursuit of an organization's

goals.

The key difference between managerial and financial accounting is that managerial

accounting information is aimed at helping managers within the organization make

decisions. In contrast, financial accounting is aimed at providing information to

parties outside the organization.

1.2.1 Importance of Managerial Accounting

The main aim of managerial accounting is to improve the efficiency and quality of

operations by providing program owners and all others with suitable and applicable

cost based performance information to permit for nonstop improvement in distributing

the output to outcome the stockholders .Managerial accounting has been developed

and used with all from the beginning times to help all the directors to understand the

costs of running a project .Modern managerial accounting is created during the

industrial revolution during the difficulties of running a large scale business which

show the way to the development of scheme for recording and checking costs to help

business proprietors and managers to finalize and make conclusions.

So, to conclude, for any business unit starting from the smallest business activity to

the largest multinational business to be succeeded requires the use of managerial

accounting concept and practices. This accounting provides data to owners for

preparation and scheming of rating products and services for customers too. The main

focus of managerial accounting is to help the managers for making better decisions.

Because of all these reasons, businesses and organizations hire on managerial

accountants and thereby, they are becoming integral persons of decision making

teams instead of just data providers.

3

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 4/9

1.2.2 Purpose of Managerial Accounting:

Managerial accounting is all about providing financial information to company

management to assist them in taking decisions regarding growth, development,

expansion and other strategic and financial decisions. The following major activities

that management accountants undertake:-

Allocation of various costs

Analyzing rates and quantities (especially in case of manufacturing concerns)

Preparing annual budgets and related reports

Preparing business metrics, such as returns on investments, EBIT, etc.

Forecasting sales, revenue and financial expenses and gains

Price Modeling

Strategic planning and management advise

Various reporting based upon industrial, geographical and client based

variables

Analysis of cost, cost-volume and cost-volume-profit statements

Capital Budgeting

Calculating and analyzing profitability of product or venture

Life cycle cost analysis

Sales Managements Scorecards

IT Cost transparency

Besides the above, a management accountant may also be responsible for performing

analysis related to land/ building/ plant purchasing vs. leasing, client profitability

analysis and prepare reports and presentations for internal financial discussions,

meetings and communications, etc.

4

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 5/9

2. INTRODUCTION OF THE MANAGEMENT TOOL

2.1 Cost Volume Profit (CVP) Analysis:

Cost-Volume-profit (CVP), in managerial economics is a form of cost accounting. It

is a simplified model, useful for elementary instruction and for short-run decisions.

Cost-volume-profit (CVP) analysis expresses the relationship between a company’s

expenses, its volume of business, and the resulting profit or net income. It is a

systematic method of examining the relationship between changes in activity (output)

and changes in total sales revenue, expenses and net profit. It is supplementary tool of

profit planning. It tells many things about the relation ship between the business

variables.

Cost-volume-profit (CVP) analysis expands the use of information provided by

breakeven analysis. A critical part of CVP analysis is the point where total revenues

equal total costs (both fixed and variable costs). At this breakeven point (BEP), a

company will experience no income or loss. This BEP can be an initial examination

that precedes more detailed CVP analysis.

Cost-volume-profit analysis employs the same basic assumptions as in breakeven

analysis. The assumptions underlying CVP analysis are:

The behavior of both costs and revenues is linear throughout the relevant range of

activity. (This assumption precludes the concept of volume discounts on either

purchased materials or sales.) Costs can be classified accurately as either fixed or

variable. Changes in activity are the only factors that affect costs. All units produced

are sold (there is no ending finished goods inventory). When a company sells more

than one type of product, the sales mix (the ratio of each product to total sales) will

remain constant.

The components of Cost-Volume-Profit Analysis are:

Level or volume of activity

Unit Selling Prices

5

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 6/9

Variable cost per unit

Total fixed costs

Sales mix

CVP assumes the following:

Constant sales price;

Constant variable cost per unit;

Constant total fixed cost;

Constant sales mix;

Units sold equal units produced.

These are simplifying, largely linearizing assumptions, which are often implicitly

assumed in elementary discussions of costs and profits. In more advanced treatments

and practice, costs and revenue are nonlinear and the analysis is more complicated,

but the intuition afforded by linear CVP remains basic and useful.

One of the main Methods of calculating CVP is Profit volume ratio: which is

(contribution /sales)*100 = this gives us profit volume ratio.

Contribution stands for Sales minus variable costs.

Therefore it gives us the profit added per unit of variable costs.

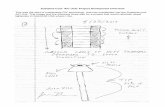

Basic graph

Basic graph of CVP, demonstrating relation of Total Costs, Sales, and Profit and

Loss.

6

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 7/9

The assumptions of the CVP model yield the following linear equations for total

costs and total revenue (sales):

Total cost = Total Fixed Costs + Total Variable Cost

Total Revenue= Sales Price * Number of Units

In symbols:

TC = FC + VC

TR = P* Q

= ((P-V) +V)*Q

= (C+V)*Q

The break-even point may be calculated as:

BEP (units) = fixed cost / (Net sales price per unit - variable costs per unit)

= FC / CMPU

BEP (dollars) = BEP (units) x selling price

3. APPLICATION OF MANAGERIAL ACCOUNTING

TOOL IN THE BUSINESS

3.1 Products & Price:Legendary Fashion Crafts Pvt. Ltd. produces various products. But here for our

analysis we have only taken three products for our simplicity.

Variable Costs & Fixed cost:

Type of Products

manufactured

materials needed to manufacture a

product Rate

1.Cotton Jacket Fabric-Canvass cotton(3M) 150/Metr

Polar inner Lining(1/2kg) 450/KG

Zipper, Thread 40/Pcs

Accessories 50/Pcs

7

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 8/9

2. Cotton Dress Fabrics- Fine Cotton(2.5M) 100/Metr

Embroider 30/Pcs

Thread 20/Pcs

Accessories 35/Pcs

3.Cotton Trouser Fabrics- Shyama Cotton(3.5M) 90/Metr

Zipper, Thread 40/Pcs

Accessories 60/Pcs

Fixed costs Amount(Rs.)

Salary & Wages 840000

Rent Expenses 12,00,00

Electricity & Telephone charge 48,000

Total Fixed Cost 888000

Particular

Units produce per

year

Selling Price Per

unit

sales unit in a

year

1.Cotton Jacket 5000 Pcs Rs 1020 3500pcs

2. Cotton Dress 12000 Pcs Rs 485 9000Pcs

3.Cotton Trouser 10000 Pcs Rs 600 7000pcs

3.2 Break Even Analysis:

Yearly Break Even Analysis For Legendary Fashion Craft Pvt.ltd.Particular Cotton Jacket Cotton Dress Cotton Trouser Total

Selling Price Per Unit 1020 485 600 2105

Selling Unit Per Year 3500 9000 7000 19500

Sales Revenue 3570000 4365000 4200000 12135000

Variable Cost Per Unit 765 185 190 1140

Total variable cost 2677500 1665000 1330000 5672500

Contribution Margin 892500 2700000 2870000 6462500

Less: Fixed Cost 888000

Net Income 5574500

Calculation of the weighted average contribution margin per unit

Items Sales Mix CM WACM WACMPU

Cotton Jacket 25% 892500 223125 63.75

Cotton Dress 50% 2700000 1350000 150

Cotton Trouser 25% 2870000 717500 102.5

Total WACMPU 316.25

Calculation Of Break Even Analysis

Particular

Cotton

Jacket

Cotton

Dress

Cotton

Trouser Total

8

8/7/2019 A-C Project

http://slidepdf.com/reader/full/a-c-project 9/9

Break Even Analysis In Units 13929.41176 5920 8663.414634 28512.8264

Break Even Analysis In Rupees 14208000 2871200 5198048.78 22277248.78

BEP in units= Fixed costs/ WACMPU

3.3 Sensitivity Analysis:

Sensitivity Analysis When Selling Price Per Unit Changed by 10%

Particular

Cotton Jacket Cotton Dress Cotton Trouser10%Increasein SP

10%Decreasein SP

10%Increasein SP

10%Decreasein SP

10%Increase inSP

10%Decreasein SP

Selling Price Per unit 1122 918 533.5 436.5 660 540less: Variable costPer unit 765 765 185 185 190 190Contribution MarginPU 357 153 348.5 251.5 470 350

Break Even inUnits

2487.39496

5803.921569

2548.06313

3530.81511

1889.361702

2537.143

Break Even inRupees

2790857.14 5328000

1359391.68

1541200.8

1246978.723

1370057

Sensitivity Analysis When Variable Cost Changed by 10%

Particular

Cotton Jacket Cotton Dress Cotton Trouser10%Increasein VC

10%Decreasein VC

10%Increasein VC

10%Decreasein VC

10%Increasein VC

10%Decrease in VC

Selling Price Per unit 1020 1020 485 485 600 600less: Variable cost Perunit 841.5 688.5 203.5 166.5 209 171Contribution MarginPU 178.5 331.5 281.5 318.5 391 429

Break Even in Units4974.78

9922678.733

0323154.52

9312788.069

072271.099

7442069.9

3Break Even inRupees

5074285.71

2732307.692

1529946.71

1352213.5

1362659.847

1241958

9