A Bloomber g BNA Business - Constant Contactfiles.constantcontact.com/ec2269c3301/bfec2a03-9b4...12...

Transcript of A Bloomber g BNA Business - Constant Contactfiles.constantcontact.com/ec2269c3301/bfec2a03-9b4...12...

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

see ITC, page 16

February 10, 2017VOLUME 41 NUMBER 6

see TFI, page 15

ITC rules in favor of domestic AS producers

The U.S. International Trade Commission on Feb. 8 voted 5-0 that domestic producers of ammonium sulfate were materially injured or threatened with mate-rial injury by reason of imports from China. This affirmative determination paves the way for the U.S. Department of Commerce (DOC) to issue antidumping and countervailing duty orders on ammonium sulfate imports from China at rates previ-ously set by the DOC. The orders are expected to go into effect by March 13, 2017, and will remain in force for at least five years.

In January, the DOC issued final determinations that Chinese producers sold ammonium sulfate at prices less than fair value in the U.S. market, and that those producers benefited from countervailable subsidies (GM Jan. 13, p. 12). DOC set

Contents2 Yuzhnyy pipeline back up

2 NOLA gran urea prices tighten

3 Mideast, Chinese urea prices retreat

3 Pakistan exports urea

3 NOLA, E.C. UAN move up

6-9 Phosphates firm

9 K barge prices up

9 China contract expected sooner than later

12 Yara reports 4Q loss

13 Compass points to uptick in fert volumes

14 GrowMax touts SOP plant

14 Mosaic 4Q income off 92 percent

TFI conference offers economic outlook, Trump assessment

More than 600 industry representatives gathered in Scottsdale, Ariz., on Feb. 6-8 for The Fertilizer Institute’s 2017 Annual Meeting. While urea and ammonia avail-ability for the spring planting season remained a common theme in discussions, attendees and speakers were also quick to offer opinions on the Trump administra-tion and what to expect in terms of policy.

TFI President Chris Jahn told conference-goers that “rural America and agriculture are front and center in Washington for the first time in a long while,” but warned that Trump’s quick action on multiple fronts “could result in a slew of litigation.”

Jahn also highlighted the industry’s ongoing need to “reposition” itself and “tell a positive story” about safety and environmental responsibility, noting that “the fertilizer industry is twice as safe as the chemical industry.” He cited a Jan. 18 story in the New York Times about Sonny Perdue, President Trump’s pick for USDA

see Agrium, page 16

Agrium 4Q income off 66 percent; Retail posts record quarter, up for year

Agrium Inc. reported fourth-quarter net earnings to equity holders of Agrium of $67 million ($0.49 diluted earnings per share), compared to the year-ago $201 million ($1.45 per share). The company said the reduction was driven primarily by lower year-over-year nutrient pricing.

Fourth-quarter sales were $2.28 billion, down from the year-ago $2.41 billion. “Agrium continued to deliver solid results across our business this quarter, sup-

ported by record fourth-quarter results in our Retail business and strong wholesale operating performance,” said President and CEO Chuck Magro. “We delivered on our promise of value-added growth in 2016 by successfully bringing our Borger expansion to completion and growing retail at a record pace through acquisitions. We have been encouraged by the recent firming in global nutrient markets, and we anticipate solid demand for crop inputs in the coming spring application season.”

Find more than 270 spot fertilizer prices at:

www.FertilizerPricing.com

SPOT BARGE PRICES St/FOB U.S. Gulf

Urea (g) 243-245Potash 212-217DAP 318-332*All prices, see pages 4-5

®

A Bloomberg BNA Business

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

2

Market WatchAMMONIA

U.S. Gulf/Tampa: Nothing new was reported in the Tampa and NOLA markets last week. Some sources speculated that with the ammonia pipeline back up in Yuzhnyy, the flow of am-monia might mean lower prices going forward; others disagreed.

December ammonia imports were up 11 percent, to 414,099 st from the year-ago 374,287 st, according to the U.S. De-partment of Commerce. July-December imports were off 12 percent, however, to 2.33 million st from 2.66 million st.

December saw a jump in ammonia exports, to 79,741 st from the year-ago 14,395 st. July-December exports were up 128 percent, to 206,072 st from the year-ago 90,270 st.

March NYMEX natural gas closed Feb. 9 at $3.141/mmBtu, down slightly from Feb. 2’s $3.187/mmBtu.

Eastern Cornbelt: Sources continued to quote the Eastern Cornbelt ammonia market in the $405-$435/st FOB range for prepay tons, depending on location.

Western Cornbelt: The ammonia market remained at $380-$405/st FOB in Nebraska for prompt or prepay, depending on location. Prepay ammonia out of Iowa terminals ranged from $400-$435/st FOB, with reports of offers out of East Dubuque at the $405/st FOB level.

Production at CF’s new plant at Port Neal, Iowa, was de-scribed by some industry sources as “full bore” and by others as “limping along” in early February. Industry sources were generally in agreement, however, that OCI’s new facility at Wever, Iowa, is not expected to be a “supply force” for the

spring season due to startup delays.Agrium confirmed that its ammonia plant in Borger,

Texas, is currently down to complete some tie-ins for the new urea facility. The company is also taking advantage of the downtime to complete some planned maintenance on the plant.

As a result, some contacts expressed concern about pres-sure levels at more northerly terminals on the pipeline, particularly with demand kicking into gear in Kansas and Missouri. Actual supply outages at pipeline terminals were not confirmed, however.

California: The anhydrous ammonia market was un-changed at $470/st DEL in California, with aqua ammonia referenced at the $133/st FOB level in the state.

Pacific Northwest: Washington sources quoted the low end of the anhydrous ammonia market at $420/st rail-DEL for tons from Canada early in the week, but higher numbers were on the way. Effective Feb. 13, Agrium’s list prices for anhydrous ammonia were slated to firm to $450/st rail-DEL and $470/st truck-DEL in Washington, Oregon, and northern Idaho. One source quoted sales out of Ritzville, Wash., at the $450/st FOB level for new business.

The aqua ammonia market had reportedly ticked up to $112-$115/st FOB in the Pacific Northwest, up some $13-$14/st from last report.

Western Canada: While most of the last prepay ammonia business in Western Canada was reportedly booked in the $650-$680/mt DEL range, sources quoted the current market for spring tons at $700-$730/mt DEL in the region.

Black Sea: Yuzhnyy re-entered the ammonia market late last week with the re-opening of the ammonia pipeline to the seaport. By the end of this week, however, the pumping rate of 5,000 mt/day was halved due to technical problems, plus a dash of political intrigue tossed in. The Clipper Mars is expected to load 40,000 mt Feb. 10-12 for IFFCO in India.

For now, opinions are mixed on the impact that Yuzhnyy’s re-entry in the market will have on prices. Some large buy-ers started arguing on the first day the pipeline opened that prices will now have to come off because more ammonia is entering the market. Others, however, are not so sure. They claim prices will at least stabilize, because the Yuzhnyy tons are merely replacing tons that could have come from the Arab Gulf or Trinidad if those areas were not experiencing production issues that limit their output.

With tonnage moving out of the area, sources now see the price as $300/mt FOB, representing a significant jump from the last deal.

UREAU.S. Gulf: Granular prompt granular barge prices narrowed

last week, trading in the $243-$245/st FOB range compared with the prior week’s $240-$250/st FOB.

Prills continued to be called $245-$250/st FOB.Urea imports were up 21 percent in December, to 772,921

st from the year-ago 637,136 st. July-December imports still lagged 31 percent, or some 1.1 million st, at 2.5 million st, down from the year-ago 3.6 million st.

Despite all the talk of less urea coming out of China, DOC

100

150

200

250UREA UAN st AMMONIUM NITRATE

10-7

-16

10-1

4-16

10-2

1-16

10-2

8-16

11-4

-16

11-1

1-16

11-1

8-16

12-2

-16

12-9

-16

12-1

6-16

1-6-

17

1-13

-17

1-20

-17

1-27

-17

2-3-

17

2-10

-17

11-2

3-16

12-2

3-16

Cornbelt Eastern Canada Tampa

10-7

-16

10-1

4-16

10-2

1-16

10-2

8-16

11-4

-16

11-1

1-16

11-1

8-16

12-2

-16

12-9

-16

12-1

6-16

1-6-

17

1-13

-17

1-20

-17

1-27

-17

2-3-

17

2-10

-17

200

300

400

500

600

700

800

11-2

3-16

12-2

3-16

Ammonia

U.S. Gulf NOLAD

ocum

ent g

ener

ated

for

Geo

rge

Por

vazn

ik, g

eorg

e.po

rvaz

nik@

cgb.

com

on

2017

-02-

10 1

4:35

:58

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

3

statistics show that July-December urea imports were up slightly at 197,567 st from the year-ago 195,257 st. December imports were 95,591 st, up from 69,586 st. The largest laggers YTD appeared to be Qatar, down at 377,659 st from 701,777 st; UAE at 289,603 st versus 435,098 st; and Indonesia at 48,033 st versus 145,989 st.

Urea exports were off 67 percent for December at only 9,011 st from the year-ago 27,068 st. They remained up for the July-December period, however, at 116,427 st from 106,980 st.

Eastern Cornbelt: Granular urea pricing remained at $280-$300/st FOB in the Eastern Cornbelt, with the lower numbers reported at Cincinnati, Ohio, and other spot river locations for prompt tons.

Western Cornbelt: The granular urea market remained at $280-$290/st FOB St. Louis, Mo., and up to $295-$300/st FOB at spot terminals in the Iowa market. There were reports of urea business in the Minneapolis, Minn., market concluded at the $285-$290/st FOB level for river open, while the Catoosa, Okla., urea market was pegged in the $275-$280/st FOB range for February tons.

California: Granular urea pricing was quoted at $330-$340/st FOB California terminals, with the low end of the range reflecting a $10/st increase from last report. Rail-delivered urea was pegged in the $350-$360/st range in the state, also up $10/st from mid-January.

Pacific Northwest: The urea market was quoted at $315-$320/st FOB Rivergate, Ore., with the upper end of the range reflecting the updated reference price as of Feb. 10. Delivered tons were quoted at $350-$360/st in the Pacific Northwest, up $5/st from last report, and were reportedly trending to the upper end of that range as the week progressed.

Some sources expressed concerns about urea availability in the region for the spring season, but another vessel has reportedly been secured for Rivergate. One source said urea and UAN volumes should be up this spring due to healthy stands of wheat following the winter’s plentiful precipitation.

Western Canada: Granular urea pricing had reportedly firmed to $500-$520/mt DEL for spring tons in Western Canada, up $10/mt from last report, although some sources said brokered prompt tons could still be had for sub-$500/mt DEL levels on a spot basis.

Middle East: Prices have begun to come off. Sources said nailing $275/mt FOB is no longer the battle it was just a few weeks ago. Likewise, the paper market is now showing $266-$268/mt FOB for March tonnage.

Demand for product has eased following the end of the U.S. buying season in January. Sources said tonnage is still available for shipment this month. Just a week ago, produc-ers were arguing that supplies would be tight until March to justify holding on to their higher pricing idea.

The slide in pricing reflects a similar shift in pricing in China. Sources noted that prices for Arab Gulf product have been matching those from China for some time.

China: Prill and granular prices have started to come off as the domestic season winds down and no major international buyer has stepped up.

Sources put prills at $250-$255/mt FOB, with most of the

discussion focused on the lower end of the scale. Sources added that it would not be surprising to see prices dip below $250/mt FOB before the end of the month. Granular product is now pegged in the low-$260s/mt FOB, with a few claim-ing that some last-minute deals might reflect prices in the upper-$260s/mt FOB.

With the domestic season winding down, producers are now looking for large sales to offshore buyers. The largest single buyer – India – is not expected to come back in with a major urea tender until March. The build-up of product could be a major downward force on prices.

The national production rate remains just at 50 percent. Producers continue to face higher prices for inputs, including electricity to run the plants, as well as stiff fines for excess pollution. The national government has stepped up its anti-pollution campaign. Some plants have been forced to close because they could not meet the new emissions standards.

India: Sources said the reserves on hand are sufficient to hold over the country until the next fiscal year starts on April 1. Industry watchers speculate that a tender will not be called until the second half of March.

The final details for the 2017/18 budget are coming out, and fertilizer subsidies did not get a boost. Urea subsidies for the next fiscal year will remain about Rs50,000 crore (US$7.5 billion).

Indian urea producers remain skeptical of how well that number will work. The government had to go to the treasury for a special fund of Rs10,000 crore (US$1.5 billion) to cover the arrears from the current subsidy payment plan. The gov-ernment said it should have all arrears covered by November.

At the same time, the government is looking to experiment with direct payments of urea subsidies to farmers rather than giving the subsidies to the companies selling the fertilizer. The fertilizer minister told local media that the government plans to institute a direct payment plan to farmers in 16 districts around the country.

Pakistan: The first two cargoes of 300,000 mt of urea marked for export were sold to East African buyers through Keytrade. Sources said the price was in the high-$240s/mt FOB. The price achieved is about $20/mt higher than the official price of $229/mt FOB in the country.

The government agreed to sell the 300,000 mt only if the deals incurred no losses to the national treasury or private companies handling the sales. The full amount is supposed to be sold by the end of April.

NITROGEN SOLUTIONSU.S. Gulf: UAN barge prices continued to move up last

week, with players calling new trades in the $180-$190/st ($5.62-$5.93/unit) FOB range. Most said they did not ex-pect the low end of that range to persist for the next round of trading, however, as suppliers are eyeing $190-$205/st FOB for new business.

Price ideas for the East Coast vessel market were called $200-$205/mt CFR, with sources reporting that those numbers have been achieved.

UAN imports were down 24 percent in December, to 180,125 st from the year-ago 235,923 st. July-December imports were

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

4

AMMONIA 2/10/2017 Year AgoTampa CFR mt 320 310U.S. Gulf NOLA CFR mt 325 315U.S. Gulf NOLA 257 261-271Cornbelt 380-435 360-425Northern Plains 360-390 425-455Northern Plains DEL 325-395 460-485Great Lakes 420-440 420-430South Central 415-425 380-420Southern Plains 340-380 280-340California DEL 470 545Pacific Northwest DEL 420-470 460-520Eastern Canada 635-655 675-705Western Canada DEL 700-730 730-740Black Sea 300 260-265Caribbean 275-280 260-270Middle East 300-302 270-275Western Europe CFR 340-345 320-325

AQUA AMMONIA 2/10/2017 Year AgoCalifornia 133 151Pacific Northwest 112-115 132

UREA 2/10/2017 Year AgoU.S. Gulf NOLA 243-245 213-245U.S. Gulf NOLA import prill 245-250 216-230Cornbelt 280-300 245-270Northern Plains 285-330 250-265Northern Plains DEL 330-350 290-310Great Lakes 300-325 255-275Northeast 285-300 255-260Southeast 295-305 275-280South Central 275-290 245-255Southern Plains 275-285 250-265California 330-340 315-325Pacific Northwest 315-320 325-335Pacific Northwest DEL 350-360 328-340Eastern Canada 435-465 470-485Western Canada DEL 490-520 480-495Black Sea prill 240 185-190Indonesia bulk 230 210-220Middle East granular 270-275 195-200Middle East prill 265-270 195-200

UAN 2/10/2017 Year AgoU.S. Gulf NOLA st 180-190 145-165U.S. Gulf NOLA 5.62-5.93 4.53-5.16Cornbelt 6.41-7.19 6.25-7.19Northern Plains 7.68-8.04 7.07Northern Plains DEL 7.86-8.39 7.68-7.86Great Lakes 6.79-7.86 7.05-7.50Northeast 5.94-7.25 5.31-7.34

UAN 2/10/2017 Year AgoSoutheast 5.84-6.09 5.41-5.56South Central 6.41-7.03 6.25-6.56Southern Plains 6.09-6.88 6.09-6.56California 7.34-7.66 7.34-7.66Pacific Northwest DEL 7.81-8.13 8.19-8.59Eastern Canada 10.00-10.54 11.25-11.36Western Canada DEL 11.07-11.79 11.07-11.61

AMMONIUM NITRATE 2/10/2017 Year AgoU.S. Gulf NOLA 190-195 205-215Cornbelt 245-255 275-280Southeast 225-230 295-300South Central 235-240 250-255Southern Plains 215-235 255-260Eastern Canada 435 460-555

CAN-17 2/10/2017 Year AgoCalifornia 263-273 303-325Pacific Northwest 250 300

AN-20 2/10/2017 Year AgoCalifornia DEL 275 295

AMMONIUM SULFATE 2/10/2017 Year AgoCornbelt 215-265 265-280Northern Plains 235-250 255-260Northern Plains DEL 240-245 275-295Great Lakes 240-270 280-295Northeast DEL 250-270 290-300Southeast 225-235 270-280Southeast DEL 240-270 290-305South Central 210-220 245-260Southern Plains 205-215 240-275California 265-305 270-310Pacific Northwest NA 275Pacific Northwest DEL 255-275 275-285Eastern Canada 365-415 480-495Western Canada DEL 395-420 400-410

AMTHIO 2/10/2017 Year AgoCornbelt 250-290 295-335Great Lakes 250-280 325-335South Central 265-270 295-305Southern Plains 230-240 295-300California 260-290 275-300Pacific Northwest 275-290 295-310

DAP 2/10/2017 Year AgoCentral Florida 330 360-370U.S. Gulf NOLA 318-332 315-330U.S. Gulf export mt 358-360 380-385

®

A Bloomberg BNA Business

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

5

DAP 2/10/2017 Year AgoCornbelt 350-360 355-370Northern Plains 350-360 365Great Lakes 355-375 365-385Northeast 350-360 380-385South Central 345-355 360-375Southern Plains 355-365 350-360

MAP 2/10/2017 Year AgoCentral Florida 345 370-380U.S. Gulf NOLA 335-350 315-335Cornbelt 360-380 360-375Northern Plains 360-395 370-395Great Lakes 365-395 375-395Northeast 360-375 380-390Southern Plains 365-375 350-360California DEL 440-450 475-510Pacific Northwest DEL 420-440 455-470Eastern Canada 579-590 672-675Western Canada DEL 590-620 755-770

TSP 2/10/2017 Year AgoU.S. Gulf NOLA import 275-285 280-285South Central 310-315 335-355

10-34-0 2/10/2017 Year AgoCornbelt 335-380 475-515Northern Plains 355-365 495Northern Plains DEL 395 495Great Lakes 380-400 510-515Northeast 395-405 510-520Southern Plains 315-345 475-495California 413-418 484-489Pacific Northwest 375-395 461-476

11-37-0 2/10/2017 Year AgoCalifornia 448-453 525-530Pacific Northwest 406-421 502-517

16-20-0 2/10/2017 Year AgoCalifornia 352-362 408-415Pacific Northwest DEL 340-347 390

PHOS. ACID 2/10/2017 Year AgoCalifornia 8.80 10.85California DEL 8.60-8.65 10.65-10.70Pacific Northwest 8.10 10.15Pacific Northwest DEL 8.55-8.60 10.60-10.65India CFR 580 715

PHOS. ROCK 2/10/2017 Year AgoNorth Africa 85-105 97-132

POTASH 2/10/2017 Year AgoU.S. Gulf NOLA 212-217 195-200Cornbelt 245-265 240-260Northern Plains 245-255 260-265Northern Plains DEL 245-265 250-260Great Lakes 260-265 260-270Northeast DEL 260-270 270-280Southeast DEL 268-275 270-275South Central 240-250 260-275Southern Plains 245-250 255-260California 390-400 425-430California DEL 395-405 430-440Pacific Northwest 338-348 368-376Pacific Northwest DEL 348-358 372-380Eastern Canada 400 435-445Western Canada 345-365 450-460Western Canada (mine) 330-340 425-430Carlsbad standard 272 260Carlsbad granular 265 260-267Carlsbad soluble NA 267Saskatchewan standard st 222 210-215Saskatchewan granular st 222-232 215-220Saskatchewan soluble st 227-232 220-225Vancouver granular mt 217-224 311-320Vancouver standard mt 204-209 298-305

POTASSIUM SULFATE 2/10/2017 Year AgoCalifornia 580-590 682-695Eastern Canada 850 901-905

POTASSIUM NITRATE 2/10/2017 Year AgoCalifornia 830-920 950-1020

SOP MAGNESIA 2/10/2017 Year AgoPacific Northwest 302-332 443-463Eastern Canada 505-535 670-715

SULFUR 2/10/2017 Year AgoTampa c lt 75 95Houston DEL c lt 60 80U.S. Gulf NOLA c lt 64 84U.S. Gulf NOLA prill mt 80-82 85West Coast mt 85-87 75-85Alberta mt (-)55-20 (-)27-60Vancouver c mt 87-92 80-90Vancouver s mt 87-92 80-90

PRICE QUOTES DO NOT REFLECT ACTUAL TRANSACTIONS, BUT REPRESENT CURRENT MARKET CONDITIONS AS PERCEIVED BY SELECTED BUYERS AND SELLERS.PRICE NOTES: Prices are based on large transactions involving truckloads or larger volumes. All prices are net of discounts for volume, cash, or prompt payment, if such are offered. Prices listed on an FOB basis are at the producer’s plant gate, terminal, or pipeline point. CFR prices include transportation to the destination port. Delivered (DEL) prices include transportation costs to the retail dealer’s premises or the nearest accessible railhead. All prices are spot unless indicated with a (c) for contract. The notation (mt) denotes metric ton. The notation (lt) denotes long ton. The notation NA (not available) means that a current price is not obtainable. Price spreads shown for a region are attributable to localized price differences or differing sizes of purchase. CORNBELT: Price range includes both Eastern and Western Cornbelt regions. CANADA: Western and Eastern Canada prices are CAD per metric ton. Vancouver prices are USD per metric ton. Saskatchewan prices are USD per short ton. CHINA: Factory prices are CNY per metric ton, as provided by Sunsirs. Other China prices are USD per metric ton. COMMODITY NOTES: UAN: Domestic prices are quoted on the basis of nutrient units; to convert to short ton, multiply the nutrient value (e.g., 28, 30, or 32) by the price shown. UREA: All prices are granular unless indicated as prill, or a bulk which is both prill and granular. PHOSPHORIC ACID: Domestic prices are quoted on the basis of nutrient units; to convert to short ton, multiply the nutrient value (e.g., 54 for MGA, 68 for SPA) by the price shown. SULFUR: Recovered Tampa, New Orleans, and Houston prices are for 1st quarter.REGIONS: Visit www.FertilizerPricing.com/GM-PriceNotation for regional descriptions.

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

6

off 19 percent, to 1.19 million st from 1.48 million st.December UAN exports were up 82 percent, to 94,552 st

from the year-ago 51,895 st. July-December exports were up 130 percent, to 770,360 st from 334,562 st.

Eastern Cornbelt: The UAN-28 market was steady at $180-$200/st ($6.43-$7.14/unit) FOB terminals in Ohio and Indiana, with the low reported for prompt tons in the Cin-cinnati market. Illinois sources quoted the UAN-32 market at $205-$225/st FOB ($6.41-$7.03/unit) in early February, depending on location and time of delivery.

Western Cornbelt: UAN-32 was steady at $205-$230/st ($6.41-$7.19/unit) FOB in the Western Cornbelt, depending on location and time of delivery, with the low reported in Nebraska and the upper end in the Iowa market.

California: UAN-32 was reported at $235-$245/st ($7.34-$7.66/unit) FOB port terminals in California, depending on location and supplier, with the low end of the range reflecting a full $25/st increase from last report. No current rail-DEL UAN prices were confirmed in the region.

Pacific Northwest: The UAN-32 market was pegged at $237-$245/st ($7.41-$7.66/unit) FOB terminals in the Pacific Northwest, up some $5-$7/st from last report. Delivered UAN-32 was quoted at $250-$260/st ($7.81-$8.13/unit) in the region, reflecting a similar increase.

Effective Jan. 24, Agrium reposted UAN-32 at $245/st FOB Kennewick, Wash., up $10/st from the company’s Jan. 20 list price. IRM’s UAN-32 postings moved on Jan. 19 to $245 FOB Pasco, Wash.; $250 FOB Umatilla and Central Ferry, Wash.; and $260 DEL in eastern Oregon and Washington from St. Helens and Portland, Ore.

Western Canada: UAN-28 was quoted at $310-$330/mt ($11.07-$11.79/unit) DEL for spring tons in Western Canada, up some $20/mt from last report.

AMMONIUM NITRATEU.S. Gulf: While the last done ammonium nitrate barges

have been reported at $190-$195/st FOB, sources said last week that domestic producers have raised their NOLA post-ings to $210/st FOB.

December ammonium nitrate imports were off seven per-cent, to 27,135 st from the year-ago 29,261 st. July-December were off 13 percent, to 192,068 st from 219,702 st.

Western Cornbelt: The ammonium nitrate market was unchanged at $245-$255/st FOB in the Western Cornbelt, where available.

California: CAN-17 remained at $263-$273/st FOB port terminals in early February.

AN-20 was steady as well at $275/st DEL in California.Pacific Northwest: The CAN-17 market was reported at

$250/st FOB Kennewick.

AMMONIUM SULFATEU.S. Gulf: Barges were reported at $175-$185/st FOB,up

a bit on the lower end of the range.December imports were off 20 percent, to 22,826 st from

the year-ago 19,086 st. July-December were off 23 percent, to 230,240 st from the year-ago 297,160 st.

Eastern Cornbelt: The ammonium sulfate market re-

mained in a broad range at $225-$265/st FOB in the Eastern Cornbelt, depending on location, with the upper end for do-mestic product out of inland locations, and the low reported at Cincinnati for prompt tons.

Ammonium thiosulfate was unchanged at $250-$280/st FOB in the Eastern Cornbelt, with the low reported in Il-linois and the upper end out of Indiana and Ohio terminals on a spot basis.

Western Cornbelt: Granular ammonium sulfate remained in a broad range at $215-$255/st FOB in the Western Corn-belt, with the upper end for domestic product and the low for imported tons. Pricing out of the Twin Cities market was quoted at the $235/st FOB level, while the Catoosa market was reported at $210-$215/st FOB in early February.

Granular sulfate FOB Freeport, Texas, firmed on Feb. 6 to the $205/st level, up $15/st from the previous list price.

Ammonium thiosulfate was quoted at $265-$290/st FOB in the Western Cornbelt, with the low in Iowa and the upper end in the Missouri market on a spot basis.

California: The ammonium sulfate market was pegged at $265-$275/st FOB port terminals in California, and up to $305/st FOB at inland terminals in the Imperial Valley. Sources said lower-priced tons at the $245/st FOB level are no longer being offered, and some suppliers are scrambling for tons.

Ammonium thiosulfate remained at $260-$290/st FOB in California, with the low for 11-0-0-24 FOB Stockton.

Pacific Northwest: Fueled by tight supply and reports of some regional suppliers pulling out of the market due to an oversold position, ammonium sulfate pricing in the Pacific Northwest has reportedly firmed to $255-$275/st DEL for new business. No current FOB prices were reported in the region in early February.

Western Canada: Granular ammonium sulfate pricing was up in Western Canada, with sources quoting the market at $395-$410/mt DEL for February and up to $420/mt DEL for spring.

China: Demand remains just strong enough to edge prices above $120/mt FOB for caprolactam grade ammonium sulfate.

Sources reported that small lots are being sold throughout Southeast Asia. Industry watchers said the ammonium sulfate market is stabilizing, with a nod to slightly higher prices.

PHOSPHATESCentral Florida: The Central Florida DAP market was

quoted at $330/st FOB for truck-loaded material, up from $325- $330/st FOB at last report. Market players called MAP $345/st FOB, up from the prior week’s $340-$345/st FOB range.

U.S. Gulf: The prompt barge price continued to move higher last week. Sources quoted nearby sales at $330-$332/st FOB, while tons earmarked for March loading commanded up to $335/st FOB. Prior to the run-up, sources noted a smattering of prompt Feb. 3 sales as low as $318/st FOB.

Domestic producers reported no February availability at NOLA. Importers were primed to fill the gap, with several vessels expected for February discharge.

Nearby MAP sales were reported at $335-$350/st FOB, while tons slated for February/March delivery traded as high as $350-$355/st FOB. Like DAP, the low end of the range

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

7

traded earlier in the week.Bulls claimed that strong demand and a generally rosy

outlook for the spring dry fertilizer season were driving the market’s recent firming, pointing to continued tightness at China and a sharp uptick in international market pricing as indicators for NOLA.

PotashCorp echoed that view, forecasting a second con-secutive yearly drop in Chinese phosphate exports for 2017. PotashCorp expected a roughly 26 percent decline from 2015, projecting Chinese offshore cargoes in the 7.0-8.0 million mt range. China sent 10.8 million mt of DAP and MAP offshore in 2015.

Bears, on the other hand, contend that the higher prices are partly the product of loading delays at a number of foreign ports, resulting in traders needing to cover their shortfalls in a hurry.

“(The price increase) is a few traders buying spot to cover the first of delays,” said one market player. “There is very limited demand from the end user. We will see how long the trade can survive on trader-to-trader and trader-to-distributor interest.”

At least two vessels of Russian material are expected at NOLA in February. An OCP boat that unloaded the previous week was said to be tabbed for the buyer’s own distribution network. Chinese cargoes, once described as a lock for spring, are now considered a long shot.

The NOLA barge price firmed to $318-$332/st FOB, up from $315-$320/st FOB at last report. MAP was quoted at $335-$350/st FOB, up from the previous week’s $327-$335/st FOB. TSP firmed to $275-$285/st FOB, compared with $265-$270/st FOB one week earlier.

U.S. Imports: DAP imports were down 32 percent in December, to 40,296 st from the year-ago 59,652 st. They were down eight percent for the July-December period, to 271,796 st from 294,315 st.

MAP/Other imports for December were off 13 percent, to 77,829 st from the year-ago 89,386 st. July-December was up two percent, to 469,171 st from 460,113 st.

Eastern Cornbelt: DAP was quoted at $350-$360/st FOB in the Eastern Cornbelt, with the low end of the range reflect-ing a $5/st increase from last report. MAP was pegged in the $360-$380/st FOB range in the region, depending on location.

10-34-0 was unchanged at $380/st FOB in the Eastern Cornbelt.

Western Cornbelt: DAP was quoted at $350-$360/st FOB in the Western Cornbelt, up $5/st from last report, with the St. Louis market reported at the low end of the range. MAP remained in the $365-$380/st FOB range in the region, depending on location.

The Catoosa market was pegged at $355-$365/st FOB for DAP, with MAP quoted at the $375/st FOB level and in very tight supply in the Southern Plains market.

10-34-0 was steady at $335-$365/st FOB in the Western Cornbelt, with the low reported in the Nebraska market and the upper end in Missouri on a spot basis.

California: MAP pricing in California had reportedly ticked up to $440-$445/st FOB or DEL, up $10/st from mid-January, with at least one supplier moving up another

150

200

250

300China Granular China Prill India CFR

10-7

-16

10-1

4-16

10-2

1-16

10-2

8-16

11-4

-16

11-1

1-16

11-1

8-16

12-2

-16

12-9

-16

12-1

6-16

1-6-

17

1-13

-17

1-20

-17

1-27

-17

2-3-

17

2-10

-17

11-2

3-16

12-2

3-16

International Urea

$5/st on Feb. 10.The TSP (0-45-0) market was quoted at $395/st FOB French

Camp, up $15/st from last report. The 16-20-0 market was higher as well at $352-$362/st FOB in the state, up some $5-$7/st from mid-January.

The phosphoric acid market was unchanged at $8.60-$8.65/unit rail-DEL in California, with Simplot referencing MGA at the $8.80/unit level FOB Lathrop and El Centro. A $0.10/unit increase is reportedly on the books for March 1, however.

10-34-0 remained at $413-$418/st FOB in the state, while 11-37-0 was unchanged at $448-$453/st FOB in California. Both are expected to move up in March, along with the higher acid prices.

Pacific Northwest: While some sources claimed delivered MAP tons were still available in the Pacific Northwest for as low as $420/st due to the presence of some imported Chinese tons at Vancouver, postings from at least one Western Producer had firmed to $430-$440/st FOB or DEL in the region, with a tilt to the upper end of that range taking effect on Feb. 10.

The TSP (0-45-0) price was higher as well at $380/st FOB Pocatello, Idaho, up $15/st from last report. 16-20-0 was quoted at $340-$347/st DEL in the region, up $5-$7/st from mid-January.

The phos acid market remained at $8.10/unit FOB Po-catello and $8.55-$8.60/unit rail-DEL for MGA and SPA in the region. A $0.10/unit increase is scheduled for March 1.

10-34-0 pricing in the Pacific Northwest was pegged at $375-$395/st FOB, while 11-37-0 remained in the $406-$421/st FOB range in the region. An increase for both products is expected in March, following the phos acid

UREA DAP POTASH

200

250

300

350

400

10-7

-16

10-1

4-16

10-2

1-16

10-2

8-16

11-4

-16

11-1

1-16

11-1

8-16

12-2

-16

12-9

-16

12-1

6-16

1-6-

17

1-13

-17

1-20

-17

1-27

-17

2-3-

17

2-10

-17

11-2

3-16

12-2

3-16

Cornbelt

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

8

price increase.Western Canada: MAP was reported at $590-$620/mt

DEL in Western Canada, depending on location.The 10-34-0 market was pegged at $600-$620/mt DEL

in the region.U.S. Export: Domestic producers reported a $358/mt

FOB sale into Latin America early last week. The 15,000 mt DAP cargo was set to ship in March. Late-week DAP and MAP sales totaling 20,000 mt were also reported into Latin America. Those cargoes, scheduled to ship in March, carried $360/mt FOB pricing.

The Gulf export market firmed to $358-$360/mt FOB based on confirmed transactions, an increase from $345-$350/mt FOB one week earlier.

U.S. phosphate exports tumbled in December, according to data provided by The Fertilizer Institute (TFI). Offshore DAP and MAP sales combined for 89,317 st, a 56.4 percent reduction from the 204,763 st in December 2015, and also lower than the 221,775 st reported for November 2016.

Canada led the market with 25,591 st received, a 47.7 percent decline from the year-ago 48,896 st. Brazil was the second-largest buyer of U.S. phosphate with 14,117 st, a drop of 66.7 percent from last year’s 42,420 st, and Aus-tralia’s 13,181 st was good for third place, despite a 62.0 percent tumble from the 34,720 st purchased by Australia in December 2015.

All but one market exhibited softer December demand. A total of 11 countries either reduced orders or abstained from the marketplace entirely in December. Peru was the sole exception, importing 8,672 st for the month after buying zero tons during the same period last year.

Brazil dominated the 2016 calendar year with 641,727 st, a 26.9 percent jump from 2015’s 505,854 st. Brazilian demand was more than double that of second-place Canada, which firmed to 313,285 st from 311,225 st, a 0.7 percent difference. India was the third-largest destination for U.S. product with 279,919 st received, a 20.1 percent drop from last year’s 350,276 st.

Total calendar-year 2016 sales were down versus 2015 thanks to the weak December, while robust November num-bers temporarily pushed 2016 ahead of the year-ago pace. U.S. sellers concluded 2016 with 2,015,500 st, a 4.8 percent reduction from 2015’s 2,116,810 st. Strong demand from Brazil was undercut by India and TFI’s “Other Countries” basket of traditionally small markets, which combined for 187,770 st in lost sales versus 2015.

Domestic phosphoric acid suppliers reported no new move-ment in first-quarter negotiations for the price of phos acid to India. International sellers are said to be operating under a $580/mt CFR contract for Q4, a number that some observers claim is likely to fall $20-$30/mt in the first quarter.

Brazil: Market players quoted sales in the $375-$380/mt CFR range, up from $350-$355/mt CFR at last report. Sources called new Brazil offers $390/mt CFR, and quoted recent offers into Argentina at $389/mt CFR.

China: Producers are asking $365/mt FOB for DAP. Sources said deals have been done in the low-$360s/mt FOB. One observer said sub-$360/mt FOB might be possible with a firm bid, but the conditions of the deal would have to be very favorable to break that barrier.

One source pointed out that many of the latest deals are completions of contracts signed late last year and last month.

The domestic market in China remains strong enough to keep producers happy to move tons inland instead of to the ports. One producer noted that vessels are lining up at the ports to pick up tonnage for Southeast Asian buyers. The lineup is caused by limited tonnage at the ports.

Tonnage remains tight as some producers have been forced to shut down because their plants are violating the new tough emission control laws. At the same time, producers face higher prices for ammonia and sulfur, further cutting into their available cash.

Once the domestic season starts to slow down in another month or so, the producers will be looking to complete their sales in the region and turn instead to large purchases by Indian buyers. Sources expect talks between the buyers and producers to kick off by mid-March.

India: The current tenders that are expected to close next week and at the end of the month are seen mostly as trying to work out pricing ideas for the upcoming season. Sources said the tenders will most likely be scrapped once firm prices are placed on the table.

Chinese producers are looking forward to selling to India to ease pressure that could build on reserves once the Chinese domestic season winds down. Those producers will need to compete, however, with other major DAP suppliers from the U.S. to Saudi Arabia.

For now, sources reported that the Indians are looking at a landed price equal to the FOB price. One trader said there

100

200

300

400Carlsbad mine New Orleans barge Saskatchewan mine

10-7

-16

10-1

4-16

10-2

1-16

10-2

8-16

11-4

-16

11-1

1-16

11-1

8-16

12-2

-16

12-9

-16

12-1

6-16

1-6-

17

1-13

-17

1-20

-17

1-27

-17

2-3-

17

2-10

-17

11-2

3-16

12-2

3-16

250

300

350

400Central Florida New Orleans barge U.S. Gulf Export

10-7

-16

10-1

4-16

10-2

1-16

10-2

8-16

11-4

-16

11-1

1-16

11-1

8-16

12-2

-16

12-9

-16

12-1

6-16

1-6-

17

1-13

-17

1-20

-17

1-27

-17

2-3-

17

2-10

-17

11-2

3-16

12-2

3-16

DAP

PotashD

ocum

ent g

ener

ated

for

Geo

rge

Por

vazn

ik, g

eorg

e.po

rvaz

nik@

cgb.

com

on

2017

-02-

10 1

4:35

:58

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

9

is still time to work things out.Subsidies for phosphates and potash are slated to remain

the same in the next fiscal year. The government said it is planning to set aside Rs20,000 crore ($US3 billion) for P and K subsidies in fiscal year 2017/18.

POTASHU.S. Gulf: Prompt barges saw higher numbers last week

at $212-$217/st FOB, with most sources right in the middle at $215/st FOB.

MOP imports were up 18 percent in December, to 952,540 st from the year-ago 810,210 st. July-December imports were up 7 percent, to 5.02 million st from 4.71 million st.

While imports from Canada appear to be about level with year-ago numbers, the largest uptick in YTD came from Be-larus at 266,607 st, up from 42,346 st, and Israel at 117,884 st versus 57,104 st.

Eastern Cornbelt: The potash market remained at $245-$265/st FOB in the Eastern Cornbelt, with the low quoted out of Cincinnati and other river locations, and the upper end at inland warehouses.

Western Cornbelt: Potash remained at $245-$260/st FOB in the Western Cornbelt, with the St. Louis market quoted at $245-$250/st FOB in early February. The potash market FOB Catoosa was steady at $245-$250/st FOB for the week.

California: The California potash market was steady at $390-$400/st FOB and $395-$405/st rail-DEL. One source said all the winter precipitation has likely flushed chlorides out of the soil, which bodes well for potash rates this year.

Sulfate of potash (SOP) remained at $580-$590/st FOB in the state, with rail-DEL tons quoted at the $595/st level in the Central Valley.

Crystalline potassium nitrate was unchanged at $830/st FOB for bulk tons and $920/st FOB for 50-pound bags in California.

Pacific Northwest: Sources quoted the 60 percent potash market at $338-$348/st FOB in the Pacific Northwest, with rail-DEL tons roughly $10/st higher. Potash postings FOB mine locations at Moab and Wendover, Utah, remained at $290/st for 60 percent granular and $285/st FOB for 60 percent standard.

The sulfate of potash (SOP) market was steady at $560-$570/st FOB in the Pacific Northwest.

SOP Magnesia remained at $302-$322/st FOB regional terminals.

Western Canada: Potash was steady at $330-$340/mt FOB Saskatchewan mines, with regional warehouse pric-ing reported in the $345-$365/mt FOB range, depending on location.

China: With the country’s Lunar New Year celebrations now finished, negotiations for new supply contracts are anticipated to get underway shortly, and according to some sources, likely will start during the current month.

Some international suppliers are disinclined to speculate about the new China contract, but BPC is among those that believe the new supply contract will be “another [positive] step in the development of the market,” according to Belta,

Sulphur & Sulphuric Acid Summit, May 8, GA

IFA Annual Conference, May 22-24, Morocco

SW Fertilizer Conference, July 15-19, TX

Join Green Markets at these upcoming conferences

quoting the company’s press service.Some analysts are taking bullish positions. Russia’s VTB

Capital believes potash suppliers could secure as much as a 14 percent price increase with Chinese buyers, taking the new price to as high as $250/mt CFR, according to a Bloomberg report, citing VTB analyst Elena Sakhnova. Sakhnova noted improving spot prices on China’s domestic market, as well as an improved global supply-demand picture, as supporting the bullish outlook.

China’s potash inventories are also lower than at this time last year. Suppliers and the Chinese Buying Consortium last year finally settled on $219/mt CFR after delaying signed contracts until July and August. The 2016 contract price was a 30 percent reduction from the 2015 contract price of $315/mt CFR and the lowest in 12 years.

Some other sources talk of a possible $15-$20/mt CFR increase this year. Generally, a more timely settlement is expected for the 2017 seaborne import contract compared with last year.

China imported 1.034 million mt of potash in December, topping the one million mt mark for only the sixth time on record, according to The Mosaic Co.’s China NPK Statisti-cal Update, citing Chinese Customs. Imports for the full 12 months fell 28 percent, however, to 6.83 million mt from 2015’s 9.44 million mt. Import volumes from all sources, except Russia, were lower in 2016.

Brazil: Positive agricultural fundamentals continue to support potash demand in the Brazil market. Sources said prices are getting a boost from talk of low inventories.Delivered prices were higher this week, certainly at the top end of the range. At least two major suppliers said they recently achieved $250/mt CFR on some sales of granular tons. Among them was Canpotex, which said on its website that it has finalized pricing for “some smaller volumes” at the $250/mt CFR level.

Another major supplier put the current market for delivered tons in the $245-$250/mt CFR range, but it remains unclear if tons can still be secured at sub-$245/mt CFR levels.

Western Europe: Sources report that granular potash is being offered at up to €250/mt CIF, but this level is not believed to have been widely achieved. Amid limited new business, the Northwest Europe granular range was quoted within the €235 to low-€240s/mt CIF range.

Belarus: Belarusian Potash Co. (BPC) and Belaruskali exported 9.5 million mt of potash fertilizers last year, some three percent more than the 9.2 million mt shipped in 2015, according to Belta, citing BPC.

According to Bloomberg, the Belarus potash exporter’s share of the potash export market last year was about 20 percent. However, Belarus potash revenues were down by roughly a quarter from 2015, according to BelaPan. The rev-enue drop reflected lower potash prices, the low purchasing

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

10

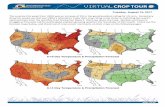

Crops/WeatherGrain Futures: As of 4 p.m. on Feb. 9, corn, soybeans,

and wheat traded higher than the week before.Corn for March 2017 was $3.695/bushel, up from

$3.675/bushel at last report. The May 2017 corn price firmed to $3.7725/bushel from the prior week’s $3.75/bushel, while December 2017 corn contracts checked in at $3.9575/bushel, up from $3.945/bushel the previous week.

The March 2017 soybean price was $10.505/bushel, up from $10.3725/bushel the week before. Soybeans for May 2017 firmed to $10.615/bushel from the previous week’s $10.4725/bushel, while soybeans for November 2017 were posted at $10.26/bushel, up from $10.185/bushel at last report.

Wheat for March 2017 was $4.5125/bushel, up from the prior week’s $4.435/bushel. May 2017 wheat firmed to $4.635/bushel from $4.56/bushel the week before, while July 2017 wheat contracts traded at $4.75/bushel, up from $4.6825/bushel at last report.

Eastern Cornbelt: The Eastern Cornbelt saw a mix of weather conditions in early February. The week began with thunderstorms, gusty winds, and 60-degree temperatures in central Indiana, but colder temperatures and snow showers were reported there at midweek.

Northern Ohio also saw chilly temperatures as the week progressed, but much warmer weather was in store for the weekend. Parts of central Illinois were blanketed with 2-4 inches of snow at midweek.

Western Cornbelt: Although much of central Iowa was blanketed by 2-4 inches of wet snow at midweek, other parts of the Western Cornbelt were seeing steady fieldwork. Sources said ammonia continued to move briskly on preplant corn

power of key customers, and the late signing of several major contracts, the news agency reported, citing Ivan Golovaty, Belaruskali’s general director.

Actual 2016 revenues have yet to be disclosed. As previ-ously reported, BPC said it is fully committed for the first quarter, as a number of other potash exporters have reported. While the export organization sees the 2017 potash market as “positive,” it does not believe the market is yet in a con-dition to allow Belarus to boost its potash exports above 10 million mt this year, according to a Bloomberg report, citing Russia’s VTB Capital.

BPC said it supplied some 350,000 mt of potash to Amer-ican customers in 2016, according to Belta, citing the potash exporter’s press service. The company said it has not yet gained a firm foothold in the American market and is pursu-ing a policy of “gradual restoration of traditional volumes,” according to the news agency.

Belarus shipped around 178,000 mt of potash to the U.S. in 2015. No volumes were believed to have been exported from the country to the U.S. in 2014.

Canada: Canpotex has previously said it is fully committed through the first quarter. According to Mosaic Executive Vice President and CFO Richard Mack in the company’s Feb. 7 earn-ings call, the Canadian potash export organization is scheduling a “very robust shipment schedule” in the first half of 2017.

SULFURTampa: Little movement was reported in the domestic

molten market. The first-quarter contract was valued at $75/lt DEL, up from $69.55/lt in Q4.

Refinery utilization fell for the week, according to the U.S. Energy Information Administration (EIA). Refiners operated at 87.7 percent capacity for the week ending Feb. 3, a 0.5 percent decline from the prior week’s 88.2 percent. The rate nevertheless kept ahead of both the year-ago 86.1 percent and five-year average of 87.1 percent.

The EIA noted reduced daily crude inputs as well. Refiners processed an average 15.893 million barrels/d, a decline of 54,000 barrels/d from the 15.947 million barrels/d reported one week earlier.

U.S. Gulf: Sources noted recent data points in the low-$80s/mt FOB, an increase from $75-$77/mt FOB at last report. Rumors described a formed sulfur cargo loading at NOLA and priced at $100/mt CFR Brazil. The vessel, believed to be destined for Vale SA, was left without buyer confirmation on Feb. 9. If confirmed, the $100/mt CFR pricing would translate to approximately $80/mt FOB NOLA, sources estimated.

Local media reported a fire at the 135,000 barrel/d Valero Energy Corp. refinery at Meraux, La., on Feb. 8. The blaze was confined to a compressor located in an area rarely fre-quented by workers.

U.S. Imports: Imports were up 11 percent in December, to 153,078 st from the year-ago 137,607 st. They were off three percent for July-December, however, to 809,077 st from 833,761 st.

Vancouver: Observers continued to describe both the Vancouver export and Chinese import markets as “slow”

due to the Lunar New Year celebration at China, calling both markets flat at $87-$92/mt FOB and $101-$107/mt CFR, respectively.

Alberta netbacks ran (-)$55-$20/mt FOB for the week, unchanged from the previous report.

SULFURIC ACIDU.S. Gulf: Price ideas on sulfuric acid vessels imported

to the Gulf of Mexico were quoted in the $40-$45/mt CFR range, unchanged from the previous week. Last-done Brazil was called $45-$50/mt CFR. Both markets were traced to $5-$10/mt FOB pricing reported at smelters located in Northwest Europe. Chile was called $40-$45/mt CFR.

In the domestic markets, sellers noted sales in the $80-$90/t DEL range for Midwest tons, and firming predicted for first-half 2017 in the West Coast market has yet to nudge prices from the last-reported $100-$110/t DEL level. Material destined for Gulf delivery fell in an $85-$95/t DEL range.

U.S. Imports: Imports were up two percent in December, to 307,122 st from the year-ago 301,212 st. They were off 13 percent for July-December, however, to 1.78 million st from 2.04 million st.

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

11

TransportationU.S. Gulf: Shippers reported fog delays in the Gulf, East

Canal, and West Canal last week, which caused navigation delays of up to eight hours.

Sources reported Algiers Lock delays in the 8-19 hour range, and wait times at Industrial Lock were noted at 11-16 hours on Feb. 8. Port Allen Lock required up to 10 hours to pass, and navigation through Bayou Sorrel Lock was clocked at 7-9 hours. Calcasieu Lock delays were quoted at 10 hours on Feb. 8.

Shippers reported transit restrictions in the West Canal’s Matagorda Bay area (Mile 471), with navigation limited to 6:00 a.m. to 10:00 a.m. on Feb. 3-9 to allow workers to bury an exposed natural gas pipeline. Sources estimated transit delays of approximately one day through the site.

Tentative 60-day shutdowns are scheduled at Harvey Lock and Bayou Boeuf Lock beginning in August. The Corps noted that the Bayou Boeuf closure could still be rescheduled for 2018.

Lower Mississippi River: Southbound tows were limited to 35 barges south of Cairo, Ill., shippers said. Dike work in the Lake Providence area was scheduled to conclude on Feb. 10.

Upper Mississippi River: Intermittent fog delays slowed vessels by 5-8 hours on several occasions last week, shippers said. The conditions, combined with elevated river levels and difficult weather conditions, contributed to barge reductions on southbound tows at Cairo. Vessels were capped at 35 barges per tow, leading to delays of 4-5 days.

Transit through the Madison Railroad Bridge (Mile 389.3) was unavailable Feb. 6-10 due to bridge repairs. Navigation was slated to resume over the weekend before closing again on Feb. 13-17.

“We are frozen, wet, and have had an abundant snowfall,” said one contact last week, adding that growers in his area might not turn a wheel for three more months.

Southern Manitoba was hit with 25 cm of snow on Feb. 6, which was followed by wind chills down to -45 in some locations. Southern Saskatchewan was also blanketed with 20-30 cm of snow over the weekend, followed by wind chills in the -30s. The region’s largest snowfall was reported in Al-berta, however, where higher elevations in southern areas of the province received up to 120 cm of snow over three days. Calgary posted 15-26 cm of snow from the storm.

Western Canada sources quoted higher fertilizer prices in the region last week, but some suppliers had reportedly filled their spring order books and were sold out through March. One source speculated that roughly 98 percent of the region’s spring volumes have already been purchased, with a few tons still being offered for April and May.

Sources continued to talk about higher spring volumes in the region, however, with the increase driven in part by a switch to grains over pulse crops. One contact also noted that fall application volumes were down in Western Canada, so the expectation is for a brisk spring pace as long as the weather cooperates.

ground in Kansas and southern Missouri in early February, with applications starting to pick up in central and northern areas of Missouri as well.

The early start left many regional contacts feeling upbeat about the spring application season, although with some concerns about urea and ammonia supply. One source ac-knowledged that the “demand side of the equation is a bit unknown,” but the “timing of spring demand is a big factor” in terms of in-season supply.

California: Additional precipitation in California in early February triggered mudslides and flash flood warnings in some parts of the state, and continued California’s remarkable recovery from more than four years of drought.

Heavy rainfall and rapidly thawing snow in the Sierra Nevada resulted in flooding in areas of northern California and the Central Valley during the week. The surplus water flow damaged the spillway at Oroville Dam and caused an earthen dam to fail north of Montello on Feb. 8, while residents along the Russian River north of San Francisco were forced to sandbag to prevent flooding. Another round of storms was in the weekend forecast, resulting in flood watches throughout northern and central California.

The Feb. 7 U.S. Drought Monitor map showed only a small sliver of extreme drought persisting along coastal ar-eas of south-central California, with no areas of exceptional drought reported in the state. A sizable chunk of central and southern California remained in moderate to severe drought last week, but more rain is on the way. Authorities reported that nearly all of California’s major reservoirs are currently above historical average levels, with the state’s two largest reservoirs, Oroville and Shasta, currently at 126 percent and 124 percent, respectively.

Regional sources said the plentiful moisture will result in a big fertilizer year in California, but also a later start to the spring season. One source said the application tail will extend well into summer, with growers opting to plant silage corn as a forage crop behind early grains. The only downside to fertilizer demand is an expected reduction in tomato acres.

Pacific Northwest: Flood watches and warnings were in effect for parts of Washington, Oregon, and Idaho at midweek due to heavy rains and melting snow.

Western Oregon was expecting 1-2 inches of rainfall as the week progressed, while western Washington started the week with a layer of wet, slushy snow on Feb. 6. Forecasts called for 1-3 inches of rain in eastern Oregon and southern and central Idaho through Feb. 9, prompting a rapid snow melt at higher elevations in several counties.

Mountain snowpack remains at healthy levels throughout the region, which bodes well for summer irrigation. The wet weather will delay the start of spring fieldwork in many areas, however. One Washington contact said spreading activity would normally be underway in his trade area, but fieldwork will likely be a month behind normal in some lo-cations. The result, he said, will be a “late and compressed” application season.

Western Canada: The Canadian prairies were hit with snow and cold during the second week of February, prompting some regional sources to predict a late start to spring planting.

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

12

Yara reports 4Q loss on increased volumes

Oslo—Yara International ASA reported fourth-quarter net income after non-controlling interests of negative NOK333 mil-lion (NOK1.22 per share), compared with a positive NOK434 million (NOK1.58 per share) a year earlier. Revenues and other income totaled NOK22,327 million for the quarter, down from NOK25,722 million. “Yara reports a weaker result than a year earlier, reflecting lower fertilizer prices as the global nitrogen price floor was tested during the quarter,” said President and CEO Svein Tore Holsether. “But our operational performance improved significantly, with fertilizer sales and production up 15 percent and 11 percent, respectively.” Total deliveries for the quarter were 9.14 million mt, up from the year-ago 8.35 million mt. Fertilizer deliveries were 6.86 million mt, up from

News Briefs

Lock 21 transit restrictions in effect through Feb. 28 limited travel to overnight hours only. In addition, tows are subject to a 70-foot width restriction, necessitating triple-wide tows to stage barges and make multiple passes. Tow haulage equipment is unavailable while work is underway, shippers warned, necessitating the use of assist vessels on entry and exit.

Locks closed for the winter navigation season will begin reopening on March 3-4. Actual transit availability will be dependent on a number of river factors, shippers cautioned.

Sources estimated Thebes, Ill., rock removal operations could restart in mid-to-late February. The project has been idle due to river levels exceeding the Corps’ 15-foot depth prerequisite required for work to resume. The Cape Girardeau, Mo., gauge was clocked at 22.16 feet and falling on Feb. 8.

Illinois River: River levels in the Havana and Beardstown areas receded below flood stage for the week. Fog interrupted operations on the Illinois Waterway, triggering sporadic delays of 4-8 hours.

Marseilles Lock delays ran up to seven hours for the week, and Starved Rock Lock reported 10-hour waits. The Peoria and LaGrange Locks remained offline, allowing boats to pass freely.

Ohio River: The National Weather Service (NWS) reported a rapid rise in Ohio River levels, starting at Cincinnati and flowing south. Daily increases of 2-4 feet were forecast at Cincinnati, McAlpine Lock, and Evansville. Levels remained significantly below flood stage as of Feb. 8, but shippers were warned of potential delays should gauge readings continue to rise.

The auxiliary chamber at New Cumberland Lock closed for maintenance on Feb. 6. The work is scheduled to continue through March 17, when the main chamber will also experi-ence intermittent shutdowns. The Markland Lock auxiliary chamber will close March 6 through April 26.

Locks 52 and 53 did not lock for the week, allowing ves-sels to pass freely.

The Cumberland River will close to transit for approxi-mately 72 hours starting on Feb. 14, sources said, due to construction on the Henry R. Lawrence Bridge (Miles 63-64). Channel dredging and maintenance at Miles 102-104 is scheduled through March 31. Navigation delays have been reported.

The Monongahela River’s Braddock Lock and Dam con-tinued operating without the use of its river chamber, sources said, forcing traffic to pass via the land chamber instead. Shippers speculated that a lock closure scheduled for March 27 through April 28 would return the lock to full operation.

A hydraulic leak responsible for shuttering the Allegh-eny River’s Lock 6 currently has no scheduled repair date, sources said. The shutdown has effectively closed the river to commercial transit.

Erosion control work at the Tennessee River’s Mile 244 is in progress through April 14. Planned maintenance will limit Kentucky Lock transit to overnight hours on March 7-16, followed by sporadic four-hour closures on March 17-30. Wilson Lock is due for intermittent 10-hour shutdowns running between April 17 and June 8.

Management BriefsThe Fertilizer Institute’s (TFI) board of directors on Feb. 7

elected Chuck Magro, president and CEO of Agrium, and Tony Will, president and CEO of CF Industries, to serve two-year terms as the board’s chairman and vice chairman, respectively.

Corrine Ricard has been named senior vice president of commercial at The Mosaic Co., stepping into Rich McLel-lan’s previous role. He was named senior vice president for Brazil after it was announced that Mosaic was buying major assets of Vale SA (GM Dec. 23, 2016). Ricard most recently headed up Mosaic’s human resources department, and before that spent many years in Mosaic’s commercial business.

Sackett-Waconia, Baltimore, reports that Kelvin Feist has accepted the role of managing director, Canada. He brings 29 years of agriculture experience, most recently as senior vice president of sales and marketing for Intrepid Potash Inc. He can be reached at his Bragg Creek, Alba., office at 403.949.8448, or mobile phone at 303.319.9028.

Paine & Partners LLC, San Mateo, Calif., a global private equity investment firm focused on sustainable food chain investing, on Feb. 9 announced the firm has changed its name to Paine Schwartz Partners LLC. In addition, Dexter Paine, a founding partner and previous chairman and CEO, will con-tinue in the role of chairman, and Kevin Schwartz, a founding partner and previous president, has been appointed CEO.

Paine and Schwartz will continue to co-lead the strategy, investment activity, and operations of the firm. They are sup-ported by partners Angelos Dassios and David Buckeridge and the firm’s 25 investment and operating professionals.

The company’s investments in the ag input sector over recent years have included Verdesian Life Sciences LLC, QC Corp., AgBiTech, Suba Seeds, and Brotherton Seeds.

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

13

solutions. Excluding a purchase accounting adjustment and other acquisition-related costs, adjusted operating earnings total $16.4 million. The overall average price was $587/st, with the ag price at $713/st and chemical at $372/st. Compass full-year net earnings, excluding special items, were $111.2 million ($3.27 per share) on sales of $1.14 billion, down from the year-ago $159.2 million ($4.69 per share) and $1.1 billion, respectively. Full-year Plant Nutrition North America operating earnings were $21.1 million on sales of $203 mil-lion, down from the prior year’s $57.9 million and $238.4 million, respectively. Fertilizer volumes were up slightly at 313,000 st from 311,000 st, while average prices were down at $648/st from $765/st.

Central Garden reports strong 1Q

Walnut Creek, Calif.—Central Garden & Pet reported that favorable fall weather positively impacted the company’s business, and the strong results exceeded expectations. Net income attributable to the company for the first quarter ending Dec. 24, 2016, was a positive $7.64 million ($0.15 per diluted share) on sales of $419.5 million, up from a year-ago loss of $8.6 million ($0.18 per share) on sales of $359.8 million. The Garden segment also pulled into the black with first-quarter operating income of $2.7 million on sales of $115.4 million, compared to a year-ago loss of $3.2 million on sales of $111.1 million, respectively. Increased sales were attributed to higher sales of other manufacturers’ products and gains on grass seed and wild bird feed. Branded product sales were $86.5 million, down 1.7 percent from the year-ago period due to the exit from the holiday décor business. Some $2 million of the Garden amount was a net gain on the sale of a distribution facility in South Carolina. The sales price on the property was put at approximately $5 million. The Garden segment plans the launch of two new fertilizer related products: a reformulated Pennington Ultragreen fertilizer that reduces the need for watering and maintains nutrients in the soil, and Pennington Smart Seed, also with reduced water needs and a coating with a biostimulus to improve seed establishment. Central Garden is projecting fiscal 2017 guidance of $1.34 or higher, an increase of six percent or more from 2016. The estimate excludes the distribution facility sale, and the company noted that fiscal 2017 will include 53 weeks, versus 52 for 2016. However, it expects the extra week will only account for $0.01 per share.

EuroChem results down on higher volumes

Zug—EuroChem Group AG reported a 30 percent fall in EBITDA, to $1.1 billion on revenues of $4.38 billion for the year 2016, down from the year-ago $1.58 billion and $4.54 billion, respectively. Cash from operations in 2016 increased four percent, to $1.11 billion from 2015’s $1.06 billion. Euro-Chem attributed the decline in revenues to substantially lower market prices for fertilizer products, which overshadowed a 20 percent year-on-year growth in nitrogen and phosphates fertilizer volumes. The group said the gradual appreciation of the Russian rouble in 2016 – a reversal of the previous

6.15 million mt, while industrial were 1.77 million mt, up from 1.76 million mt, and ammonia at 507,000 mt, up from 450,000 mt. Full-year net income was NOK6,360 million on revenues of NOK97,170 million, down from 2015’s NOK8,083 million and NOK111,897 million, respectively. Full-year deliveries were 36.2 million mt, up from 2015’s 35.7 million mt. Fertilizer deliv-eries were 27.2 million mt, up from 26.5 million mt. Industrial deliveries were down at 6.9 million mt from 7 million mt, while ammonia deliveries were off slightly at 2.04 million mt from 2.1 million mt. The Yara board is recommending a dividend of NOK10 per share for 2016, down from 2015’s NOK15.

Vale expects a $1.2 B Q4 fert impairment

Rio de Janeiro—Vale SA expects to record a US$1.2 billion after-tax impairment (with no cash effect) on its fertilizer business for the fourth quarter of 2016, the company said in a regulatory filing Feb. 6. The charge arises from the agreement announced in December to sell the bulk of its fertilizer assets to The Mosaic Co. for US$2.5 billion (GM Dec. 23, 2016). Vale expects to report its fourth-quarter and full-year 2016 results on Feb. 23. Under the agreement with Mosaic, which remains subject to the customary regulatory approvals and the carve-out of the Cubatão-based nitrogen and non-phosphate business from Vale Fertilizantes, the Brazilian mining major expects to receive US$1.25 billion in cash and approximately 42.3 million shares of Mosaic’s common stock. Vale also will have the potential to earn an additional US$260 million, to be paid in cash over a two-year period following the transaction’s close, if certain financial metrics are met. It expects to complete the sale to Mosaic in late 2017. Vale said it will seek buyers for the Cubatão assets this year.

Compass 4Q earnings off 21 percent

Overland Park, Kan.—Compass Minerals reported fourth-quarter net earnings, excluding special items, of $46.1 mil-lion ($1.35 per diluted share) on sales of $443.2 million, down from the year-ago $58.4 million ($1.72 per share) and $289.3 million, respectively. Net earnings were $97.6 mil-lion, including approximately $51.5 million in a net after-tax benefit, or $1.52 per share. This included a $59.3 million gain on the company’s equity investment in Produquímica Indústria e Comércio SA (Produquímica), a Brazilian spe-cialty plant nutrition company, and was partially offset by a partial write-down of the Wolf Trax trade name. The com-pany called the results solid, saying they were driven by a resilient performance in the Salt segment, improved demand for potassium sulfate in North America, and the addition of the Produquimica business in Brazil. Plant Nutrition North America operating earnings were $8 million on sales of $62.6 million, down from the year-ago $11.5 million and $50.5 million, respectively. However, sales volumes were up at 95,000 st from the year-ago 62,000 st, while average prices were down at $657/st from $805/st. Plant Nutrition South America fourth-quarter operating earnings were $8 million on sales of $113.5 million. Sales volumes were 194,000 st, with 122,000 st going to agriculture and 72,000 st as chemical

Doc

umen

t gen

erat

ed fo

r G

eorg

e P

orva

znik

, geo

rge.

porv

azni

k@cg

b.co

m o

n 20

17-0

2-10

14:

35:5

8

Green Markets® February 10 © 2017 Kennedy Information, LLC, A Bloomberg BNA Business All Rights Reserved. Reproduction Prohibited by Law.

www.FertilizerPricing.com

14

Mosaic 4Q income off 92 percentThe Mosaic Co. reported fourth-quarter 2016 net earn-

ings of $12 million ($0.03 per diluted share), down from $155 million ($0.44 per share) in the fourth quarter of 2015. Mosaic’s net sales in the fourth quarter were $1.86 billion, down from $2.16 billion last year, with lower prices more than offsetting higher phosphate volumes. EPS included a negative $0.23 impact from notable items.

Operating earnings during the quarter were $73.6 million, down from $204.3 million a year ago, driven by lower phos-phate and potash prices, partially offset by lower phosphate raw materials costs and cost management.

“Our fourth-quarter results reflect strong market demand for potash and phosphates driven by improving market sentiment, as well as benefits from significant operational improvements,” said Joc O’Rourke, president and CEO. “Our cash production costs in Potash and our fourth-quarter SG&A were at the lowest level in almost a decade. While we are confident the market bottom is behind us, the pace of improvement is expected to be gradual. As a reflection of our commitment to investors to maintain a strong financial position, we have reduced our an-nual dividend payout to $0.60 per share.” The annual dividend payout was reduced by $0.50.

Phosphate fourth-quarter gross margins were $84 million on net sales of $896 million, down from the year-ago $121 million and $1 billion, respectively. Average DAP prices for the quarter were $317/mt on sales volumes of 2.5 million mt, compared to the year-ago $410/mt and 2.2 million mt, respectively. Production was at 2.5 million mt, or 84 percent, up from the year-ago 2.2 million mt, or 76 percent.

imported into the country at a price over $600/mt. The current design envisions the production of kainite and carnallite from evaporation ponds covering 50 hectares. Along with the SOP, some 185,000 mt/y of salt would be produced. GrowMax said project capex is US$19.8 million. The company’s 2017 bud-get includes a work program to advance the pilot by securing necessary environmental permits and government approvals required to initiate construction of the ponds in second-half 2017, with the construction of the SOP plant starting in 2018. The company said these plans will run parallel with its initia-tives to pursue different fertilizer products, including SSP and the development of phosphate rock mining assets at Bayovar.

Court orders temporary shutdown of Haifa tank

Haifa, Israel—A Haifa Municipal Court has ordered Haifa Chemicals’ ammonia storage facility shut down until Sunday, Feb. 12, when it will hand down a decision regarding the facility. The judge issued a temporary shutdown of opera-tions at the facility Feb. 8 pending the decision. The safety of the 12,000 mt facility has long been an issue in light of terrorist threats against it. A recent report, criticized by Haifa Chemicals, further heightened those concerns (GM Feb. 3, p. 15). Plans were for the facility to be replaced by a new ammonia plant in southern Israel, however, a recent tender for that plant attracted no bids (GM Nov. 18, 2016).