9 - 10 May, 2012 - Marina Bay Sands Conference Centre ... · the Marina Bay Sands Conference Centre...

Transcript of 9 - 10 May, 2012 - Marina Bay Sands Conference Centre ... · the Marina Bay Sands Conference Centre...

EDHEC-Risk Days Asia 2012 Bringing Research Insights to Institutional Investment

and Wealth Management Professionals

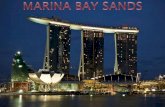

9 - 10 May, 2012 - Marina Bay Sands Conference Centre - Singapore

❝What makes EDHEC-Risk unique is its determined effort to keep on the cutting edge of research that is of operational relevance to investors, particularly those with heavy involvement in alternatives. The debate on how to implement technically superior approaches to old problems will continue for many years to come, and it is critical to have thought-leaders like EDHEC-Risk help investors and the industry re-evaluate the frameworks in which we operate. ❞Gumersindo Oliveros, CEO & CIO,KAUST Investment Management Company

❝EDHEC-Risk is setting up its base in Singapore at a time of great transformation of the economic and financial landscape in Asia. A deep understanding of risks provides the foundation for stability and growth. The research and educational activities of EDHEC-Risk Institute will help enhance our understanding of risks, and the development of talent. We welcome EDHEC-Risk Institute to our research and financial community in Asia. ❞Mr Heng Swee Keat, Managing Director, Monetary Authority of Singapore (January 2011)

Panel discussion of leading scholars and senior industry leaders

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 2

In the middle of the last decade the EDHEC-Risk Institute launched a series of research conferences targeted at the financial services industry which have now become a point of reference in Europe. In the wake of the set up of EDHEC-Risk Institute—Asia, the Institute will be introducing the same concept in the region with the launch of an Asian focused investment conference for traditional and alternative investment managers, private bankers, institutional investors, and family offices. The event will take place in Singapore on the 9th and 10th of May 2012 at the Marina Bay Sands Conference Centre.

EDHEC-Risk Days Asia 2012 Bringing Research Insights to Institutional Investment

and Wealth Management Professionals

With EDHEC-Risk Days Asia 2012, the Institute will create a new type of conference in the region that is aimed at providing professionals with state of the art applied research in investment and risk management. This state of the art research is produced by the professors and researchers from EDHEC-Risk Institute, the premier centre for financial research and its applications to the industry. EDHEC-Risk Days Asia allows research results to be compared with the practices and needs of investment professionals in Asia. Our indepence and academic orientation, the conference format leaving time for both instruction and discussion and the highly selective speaker panel combine to make EDHEC-Risk Days Asia 2012 the must-attend conference

for investment professionals who are concerned about maintaining best practices in technical and conceptual terms.

To ensure the exclusivity of the event, EDHEC-Risk Institute has decided to invite selected delegates to the event; they will be assessed by the Institute to ensure they add value to the conference. The programme format has a mix of plenary sessions, stream sessions, and workshops presented by our sponsors to cater to the needs and interests of end-investors and wealth managers and infuse interaction and dialogue among financial professionals.

1. The Concept: Research for Business

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 3

REGULATORS > Paul Atkins, Commissioner, United States Securities and Exchange Commission

> Sir John Gieve, Deputy Governor, Bank of England > Roy Leighton, Chair, Financial Services Practitioner Panel

> Hector Sants, Chief Executive, Financial Services Authority

> Elemér Terták, Director Financial Institutions Directorate, European Commission

LEADING INSTITUTINAL INVESTORS > Mark Anson, CEO, Hermes Pensions Management > Paul Frentrop, Head of Corporate Governance, APG Investments

> Jaap Maassen, First Vice Chairman, European Federation for Retirement Provision and Director of Pensions and Member of the Executive Board, ABP Investments

> Ronan O’Connor, Head of Risk and Asset Allocation, NTMA

> Gumersindo Oliveros, Director of Pension Plan and Endowments, The World Bank

> Lars Rohde, Chief Executive Officer, ATP > Sung Cheng Chih, Chief Risk Officer, Government of Singapore Investment Corporation

> Wolf Thiel, President and Chairman of the Managing Board, VBL

HEDGE FUND INDUSTRY LEADERS > Andrew Baker, Chief Executive Officer, Alternative Investment Management Association

> Antonio Borges, Chairman, Hedge Fund Standards Board

> Stanley Fink, Deputy Chairman, Man Group > David Harding, Founder and Managing Director, Winton Capital Management

> Ana Haurie, Chief Executive Officer, Dexion Capital > Omar Kodmani, Senior Executive Officer, Permal Investment Management Services

> Blaine Tomlinson, Founder and Chairman, FRM Group

> Two exceptional foraAsian Investment Forum (Day One)On 9 May, the conference will open with the Asia Investment Forum whose theme this year will be: “Central banks and financial markets stability: is regulatory intervention required?” Following an academic presentation given by Professor Raman Uppal of EDHEC Business School, a senior panel of regulators and investment industry figures will discuss smart regulation in Asia looking at what tools the regulatory authorities can use to reduce volatility and promote markets stability without inflicting too much damage on the competitiveness of the financial industry and on economic efficiency.

High Frequency Trading Forum (Day Two)On 10 May, the conference will open with the High Frequency Trading Forum which will focus on “The market impact and economic consequences of high frequency trading”. On the basis of an academic presentation by Professor Ekkehart Boehmer, senior regulators and executives from leading hedge funds, investment banks, and ETF providers will discuss the regulation of high frequency trading activities and their impact on liquidity, volatility and informational efficiency of prices.

2. Organisation EDHEC-Risk Days Asia 2012 will take place on 9-10 May at the Marina Bay Sands Conference Centre in Singapore.

On 9 May, the conference will focus on equity investment management, incorporating portfolio construction and risk management, indexing and passive investment, and equity structured products.

On 10 May, the conference will focus on global asset allocation and alternative investment (hedge funds, commodities, private equity, real estate, and emerging alternative asset classes) for institutional investors and private wealth managers.

Each day will open with a forum which will feature a keynote presentation by a leading scholar followed by a panel discussion bringing together senior industry participants. The goal of the fora is to allow for in-depth discussions of a key topic for the financial services industry. Each forum will be moderated by the editorial team from major media partners. Previous conferences included partnerships with CNBC, the International Herald Tribune, and the Wall Street Journal.

Previous EDHEC-Risk Instittute fora have been co-organised with the following media groups:

The keynote speakers and panellists from previous fora include:

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 4

A selection of previous sponsor-led workshops in multiclass investing, benchmarking, and equity indices

Sponsor Theme

Amundi ETF A cost-benefit analysis of ETFs from an institutional investor’s perspective

db x-trackers Active management with passive products

EasyETF Analysing ETFs as an asset allocation tool

Invesco PowerShares Intelligent ETFs: from beta to alpha generation

iShares How to optimise the use of fixed-income ETFs

Lyxor Asset Management What ETFs can contribute in the context of the financial crisis

NYSE Euronext ETFs in practice

SG CIB How to select ETFs and optimise execution

Multiclass investing and benchmarking > Presenting the results of EDHEC Risk Institute first Asian survey on indices and passive management

Equity Indices > Assessing the quality of the major equity indices in Asia > Alternatives to cap-weighted indices

This two day-event will explore the latest research advances and best industry practices in investment and risk management via a mix of plenary sessions, stream sessions, and workshops. Plenary and stream sessions will be organised around EDHEC-Risk Institute presentations of the most recent results of the Institute’s research projects in asset allocation and portfolio construction and management.

Workshops (one hour) will allow conference sponsors to present their new approaches of investment and risk management to institutional investors and private bankers.

The main topics addressed by EDHEC-Risk Days Asia 2012 are: i) Indexing and passive investment, ETFs, and product innovations in Asia, ii) Investment and risk management techniques for institutional investors and private wealth managers, and iii) Hedge funds and alternative investments.

Alternative classes > A new class of volatility indices for Asia > Capturing the commodities futures premium

Indexing and passive investment, ETFs, and product innovations in AsiaThe topics addressed through plenary and stream sessions are as follows:

> An in-depth look at the latest insights in investment, ETFs, and risk management

The tables below show a selection of related sponsor-led workshops from past EDHEC-Risk Institute conferences.

A selection of previous sponsor-led workshops in alternative investment indexing

Sponsor Theme

Lyxor Asset Management The use of hedge fund indices in the context of the UCITS Directive - a case study

Liffe Using futures on listed real estate to diversify a portfolio

NYSE Euronext Hedge funds in the ETF world

Panel discussions and Q & A sessions with the audience foster a rich dialoge betweenresearchers, industry figures, and a high quality gathering of attendees

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 5

A selection of previous sponsor-led workshops in asset allocation and risk management techniques

Sponsor Theme

BNP Paribas Investment Partners New focus for asset and liability management in view of the recent market conditions

BNP Paribas Securities Services Assessing regulatory impact on governance and reporting

Federal Finance Using momentum to improve asset allocation

NYSE Euronext Identifying execution venues best practices post MiFID

RiskData Cross asset class risk budgeting

SG CIB Integrating structured products into asset allocation

Sinopia Managing liabilities: the need to go beyond LDI to achieve performance

Sparinvest Adding value to strategic asset allocation

Unigestion Assessing hidden risks in traditional and alternative asset classes

Vanguard Chasing the efficient frontier: The opportunity, risks, and challenges

Vontobel Asset Management Global trend investing: identifying and replicating future growth themes

Asset allocation and risk management techniques > A post-crisis framework for investment management > Private wealth management in Asia: shifting from old-money preservation to new-money revenue diversification

> Estimating the cost of capital for sovereign wealth funds and other long term investors

Equity investment and equity risk management > Optimising equity portfolio construction > Structured equity investment strategies for long-term Asian investors

> How to protect equity investments against sovereign risks

Investment and risk management techniques for institutional investors and private wealth managersThe topics addressed through plenary and stream sessions are as follows:

The tables below show a selection of related sponsor-led workshops from past EDHEC-Risk Institute conferences.

A selection of previous sponsor-led workshops in equity investment and equity risk management

Sponsor Theme

BNP Paribas Equity and Derivatives Hunting for returns with quantitative asset management

BNY Mellon Asset Management A thematic global approach for alpha generation in equities

F&C Investments The sources of alpha are many – Asia Pacific equities

Halbis Exploiting the profitability/valuation relationship to generate alpha in an equity portfolio

Oddo&Cie Building alpha in European equities

State Street Global Advisors Integrating developed and emerging market equities in a bottom up stock picking process

Threadneedle Investments The benefits of a stock picking approach in challenging markets

Vontobel Asset Management Stock picking in a world of lower expected returns

Marina Bay Sands Conference Centre at night

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 6

A selection of previous sponsor-led workshops in alternative investment

Sponsor Theme

Amundi Investment Solutions How alternative managed accounts could contribute to shape the future of the alternative investment industry

BNP Paribas Equities and Derivatives

The secret to alternatives: Volatility strategies uncovered

Invesdex Revisiting managed futures & commodities trading

Morgan Stanley Investment Management

Pension funds: Adopting commodities as part of a strategic asset allocation strategy

NYSE Euronext The future of CDSs: Challenges and opportunities

PricewaterhouseCoopers European alternative investment funds: A changing environment

Sinopia Absolute return and alpha overlay: Turning theory into reality – a practitioner’s experience

SGAM Volatility: Total return, decorrelation and overlay

UFG-LFP Integrating SRI criteria into real estate investment

> The market impact and economic consequences of high frequency trading

> A new class of volatility indices for Asia > Skewness as an asset class

> Allocating to hedge funds > Capturing the commodities futures premium > New evidence on the performance of private equity

Hedge funds and alternative investmentsThe topics addressed through plenary and stream sessions are as follows:

The tables below show a selection of related sponsor-led workshops from past EDHEC-Risk Institute conferences.

A selection of previous sponsor-led workshops in hedge fund investing

Sponsor Theme

Deutsche Bank Has investing in hedge funds become mainstream?

Fortis Prime Fund Solutions Fund of hedge funds financing

Lyxor Asset Management Hedge funds in the UCITS III space

NewFinance Capital Macro environment and hedge fund investing

Riskdata Portable beta for portfolios of hedge funds

Riskmetrics Group Capturing risk in hedge funds - moving from positions to strategies

Societe Generale Securities Services

Operational challenges faced by hedge funds and fund administrators to price complex derivatives

State Street Global Advisors Building hedge fund portfolios capable of generating absolute returns within stressful market environments

Unigestion The challenges of measuring the risk and performance of hedge funds

❝EDHEC has demonstrated in a very short time a level of commitment to, and excellence in, the research of alternative assets. (…) EDHEC pushes me to maintain my professional skills at the highest level.❞Mark Anson,President and Executive Director, Investment Service, Nuveen Investments

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 7

The final programme, including the list of panellists, will be made available in December 2011 when registrations will open and invitations will be sent. The programme will include forty speakers and panellists who will be both academics and professionals.

EDHEC-Risk Institute has considerable experience with internationally renowned speakers.

The following is a preliminary programme that identifies the sessions led by EDHEC-Risk Institute researchers.

3. Conference Programme

Day One: New Forms of Equity InvestmentOPENING PLENARY SESSION09:15–11:00 Asian Investment Forum - Central banks and financial market stability: is regulatory intervention required?Evaluating the direct and indirect impact of competing measures aimed at reducing stock market volatility and ensuring orderly financial markets. Includes welcome address and senior panel discussion.

11:00-11:30 Morning Break

11:30-12:30 Sponsor-led WorkshopsWorkshop 1Theme and organiser to be determined.

Workshop 2Theme and organiser to be determined.

Workshop 3Theme and organiser to be determined.

Workshop 4Theme and organiser to be determined.

12:30-13:45 Lunch Break

STREAM SESSIONS13:45-14:45 First round of stream sessionsA post-crisis framework for investment management.

Presenting the results of EDHEC-Risk Institute’s first Asian survey on indices and passive management. Includes panel discussion.

14:45-15:45 Second round of stream sessionsOptimising equity portfolio construction. Assessing the quality of the major equity indices in Asia.

Includes panel discussion.

15:45-16:30 Afternoon break

16:30-17:30 Third round of stream sessionsStructured equity investment strategies for long-term Asian investors.

Alternatives to cap-weighted indices.

AFTERNOON PLENARY SESSION17:30-18:30 How to protect equity investments against sovereign risk

18:30 Cocktail reception

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 8

Day Two: Global Asset Allocation and Alternative InvestmentMORNING PLENARY SESSION09:00–10:30 High Frequency Trading Forum - The market impact and economic consequences of high frequency tradingEvaluating the impact of high-frequency trading on liquidity, volatility, and the informational efficiency of prices.Includes welcome address and senior panel discussion.

10:30-11:30 Sponsor-led WorkshopsWorkshop 5Theme and organiser to be determined.

Workshop 6Theme and organiser to be determined.

Workshop 7Theme and organiser to be determined.

11:30-12:00 Morning Break

STREAM SESSIONS12:00-13:00 Fourth round of stream sessionsSkewness as an asset class. New evidence on the performance of

private equity. Includes panel discussion.

Private wealth management for Asia: Shifting from old-money preservation to new-money revenue diversification.

13:00-14:15 Lunch Break

14:15-15:15 Fifth round of stream sessionsCapturing the commodities futures premium.

Allocating to hedge funds. Includes panel discussion.

Estimating the cost of capital for sovereign wealth funds and other long-term investors.

15:15-16:00 Afternoon Break

CLOSING PLENARY SESSION16:00-17:00 A New Class of Volatility Indices for Asia

17:00 End

❝Over the years, EDHEC-Risk Institute has demonstrated a one-of-a-kind commitment to advancing research, providing useful innovations for the industry, and promoting higher professional standards through its research and executive education activities.❞Philippe Teilhard de Chardin, Global Head of the Prime Brokerage Group, Newedge

❝By consistently delivering academic work with remarkable added value for the industry, EDHEC-Risk Institute has established itself as the premier centre for applied financial research.❞Alain Dubois,Chairman, Lyxor Asset Management

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 9

EDHEC-Risk Days Asia will benefit from EDHEC-Risk Institute’s credibility and widespread recognition in the area of investment and risk management. Since EDHEC-Risk Institute is not an organiser of sales conferences but an academic institution it maintains close links with the financial services industry.

The tried and tested EDHEC-Risk conference format provides an unrivalled platform for industry practitioners and academic representatives to meet and exchange views on the current topics of most relevance to the investment and risk management industry.

> Invitations The conference will be widely promoted to representatives from all the parties to institutional investment and wealth management in Asia (pension and sovereign wealth funds, endowments, insurance companies, corporations, traditional and alternative asset managers, private banks, and family offices) and it will have a significant international dimension with an audience of 400-500 decision-makers targeted.

EDHEC-Risk Institute will invite senior representatives of the top Asian institutional investors (chairpersons, chief executive officers, chief investment officers, chief financial officers) and the chief executive and chief investment officers of top investment firms, funds of funds, and single managers. These and senior investment staff of institutional investors will attend on a complimentary basis. Sponsors will also receive invitations for their clients and prospects.

Attendance will be by personal invitation only and will require the payment of a participation fee. The cost will

4. Marketing Plan be 1,500 SGD (excl. GST). This price has been chosen to reflect our desire to differentiate ourselves from commercial conferences but still support the funding of the high-standard facilities and services offered in this content-rich event.

Priority for the invitations will be given to firms from the following countries:

We target a list of attendees representing the following activities:

Priori%y of invita%ons, by country or region

Singapore -‐ 25%

Asean (ex Singapore) -‐ 15%

Australia / New Zealand -‐ 15%

Hong Kong -‐ 15%

China / Taiwan -‐ 10%

Japan / Korea -‐ 5%

India -‐ 5%

Other -‐ 10%

Ac#vi#es and roles of a0endees

Tradi&onal / Alterna&ve Asset Managers -‐ 40%

Private Bankers and Wealth Managers -‐ 30%

Ins&&tu&onal Investors and Family Offices -‐ 25%

Others -‐ 5%

❝Speakers and attendees alike showed a very high-level of financial sophistication and a genuine interest in their subject.❞Benedicte Gravrand, News Editor, Opalesque

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 10

> Media Plan Professional Media PartnershipsEDHEC-Risk Institute has long-standing historical ties with a number of weekly and monthly magazines in the financial industry. For EDHEC-Risk Days Asia 2012, EDHEC-Risk Institute will strengthen existing partnerships and establish new relationships with media partners that have very high levels of credibility and are widely respected by Asian asset managers, private bankers, institutional investors, and hedge fund managers.

EDHEC-Risk Institute NewsletterFor the three months before the conference and the two months following it, EDHEC-Risk Days Asia 2012 will benefit from extensive coverage in the monthly EDHEC-Risk Institute newsletter.

This newsletter is sent every month to close to one million decision-makers in the international investment industry, including some 270,000 in Asia.

EDHEC-Risk Days Asia 2012 will seek to benefit from a major promotional media plan in the Asian professional press with advertisements and web banners in numerous publications.

Our partnerships contribute directly to the conference and also allow research results to be reported in the form of editorial content and promoted throughout the year.

Past EDHEC-Risk conferences benefited from a major media plan in the professional press with advertisements and web banners.

Previous sponsors also benefited from the support of international scientific journals:

EDHEC-Risk Institute conferences have also received endorsements from worldwide professional associations and international institutional investor’s associations:

Moreover, the EDHEC-Risk Institute website will include a section devoted to EDHEC-Risk Days Asia 2012 in which conference sponsors will feature prominently.

The following is a selection of past media sponsors:

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 11

There will be three main sponsor packages offered for the EDHEC-Risk Days Asia 2012. EDHEC-Risk Institute is seeking to have participation by partners enhancing the value of the programme. Packages are as follows:

5. Partnership Policy for Sponsors

> Gold SponsorGold Sponsors of the EDHEC-Risk Days Asia 2012 will enjoy the following advantages:

Conference > Chairmanship of stream session or panel participation (depending on availability)

> 5 entry passes for staff and 1 entry Pass to the VIP section > 15 complimentary invitations

Exhibition > 6m2 stand in exhibition area

Branding > Logo to appear on the invitation programme > Logo to appear on all event advertisements > Logo to appear on the on-site signage > Logo and corporate presentation text to appear in conference brochure

Cost: 30,000 SGD (GST excl.)

> ExhibitorAn exhibitor receives the following advantages:

Conference > 3 entry passes for staff and 1 entry Pass to the VIP section > 5 complimentary invitations

Exhibition > 6m2 stand in exhibition area

Branding > Logo and corporate presentation text to appear in conference brochure

Cost: 20,000 SGD (GST excl.)

> Global Event Partner Global event partners of the EDHEC-Risk Days Asia 2012 will enjoy the following advantages:

Conference > Workshop or chairmanship of a stream session > 5 entry passes for staff and 3 entry passes to the VIP section > 25 complimentary invitations

Exhibition > 8m2 stand in exhibition area

Branding > Priority positioning of logo to appear on the invitation programme

> Priority positioning of logo to appear on all event advertisements

> Priority positioning of logo to appear on the on-site signage > Priority positioning of logo and corporate presentation text to appear in conference brochure

Cost: 50,000 SGD (GST excl.)

> Marketing ContactContact Jeremiah Cai for sponsorship requests and additional information.

Phone > +65 6631 8578

Email > [email protected]

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 12

> Summary of Benefits

Global Event Partner Gold ExhibitorCost (SGD) 50,000 30,000 20,000

Stand 8m2 6m2 6m2

Entry passes 5 5 3

Access to the VIP Section 3 passes 1 pass 1 pass

Invitations 25 15 5

Workshop 1 (if no chairman) No No

Stream session chair Yes (if no workshop) Yes No

Panel participation No Yes No

Logo on the invitation programme Yes Yes Yes

Logo on advertisements Yes Yes No

Corporate text in programme Yes Yes Yes

Over 75% of our sponsors have been involved in more than one event, demonstrating that the overall sponsorship experience was considered to be more than satisfactory

both in terms of image and in terms of commercial and networking success.

> Past EDHEC-Risk Institute conferences have been sponsored by the following organisations:

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 13

EDHEC-Risk Institute is part of EDHEC Business School, one of Europe’s leading business schools and a member of the select group of academic institutions worldwide to have earned the triple crown of international accreditations (AACSB, EQUIS, Association of MBAs). Established in 2001, EDHEC-Risk Institute has become the premier centre for financial research and its applications to the investment industry.

In partnership with large financial institutions, its team of 90 permanent professors, engineers and support staff implements six research programmes and fourteen research chairs and major research projects focusing on asset allocation and risk management in the traditional and alternative investment universes. The results of the research programmes and chairs are disseminated through the three EDHEC-Risk Institute locations in London, Nice, and Singapore.

EDHEC-Risk Institute validates the academic quality of its output through publications in leading scholarly journals, implements a multifaceted communications policy to inform investors and asset managers on state-of-the-art concepts and techniques, and forms business partnerships to launch innovative products. Its executive education arm helps professionals to upgrade their skills with advanced risk and investment management seminars and degree courses, including the EDHEC-Risk Institute PhD in Finance.

EDHEC Risk Institute—Asia serves as a platform for generating and disseminating academic insights into investment management issues of global importance and particular relevance for investors and institutions in Asia. With the support of the financial industry, EDHEC Risk Institute—Asia aims to become a leading institution fostering innovation and high professional standards in the Asian investment industry and globally.

Industry surveys: comparing researchadvances with industry best practicesEDHEC-Risk Institute regularly conducts surveys on the state of the asset management industry in Asia, Europe, and North America. These look specifically at the application of recent research advances within investment management companies and at best practices in the industry. Survey results receive considerable attention from professionals and are extensively reported on by the international financial media.

Recent industry surveys conducted by EDHEC-Risk Institute

Executive education activitiesEDHEC-Risk Institute provides a range of executive courses in investment management and joint seminars with CFA Institute. EDHEC-Risk Institute is registered with CFA Institute as an Approved Provider of the Continuing Education programme.

EDHEC-Risk Institute also offers a PhD in Finance designed for professionals who aspire to higher intellectual levels and aim to redefine the investment banking and asset management industries. Drawing its faculty from the world’s best universities and enjoying the support of the research centre with the greatest impact on the financial industry, the EDHEC-Risk Institute PhD in Finance creates an extraordinary platform for professional development and industry innovation. The programme is ofered in Europe, from London and Nice, and in Asia from Singapore.

www.edhec-risk.comThe EDHEC-Risk Institute website puts EDHEC-Risk’sanalyses and expertise in the field of asset management and asset-liability management at the disposal of professionals. The site examines the latest academic research from a business perspective, and provides a critical look at the most recent industry trends.

Please contact Jeremiah Cai for sponsorship requests and additional informationPhone: +65 6631 8578Email: [email protected]

EDHEC-Risk Institute393 promenade des Anglais

BP 3116 - 06202 Nice Cedex 3 — France

EDHEC Risk Institute—Europe10 Fleet Place - Ludgate

London EC4M 7RB - United Kingdom

www.edhec-risk.com

EDHEC Risk Institute—Asia1 George Street - #07-02

Singapore 049145

EDHEC-Risk Days Asia 2012 - 9-10 May 2012 - Singapore - Marina Bay Sands Conference Centre 14