$753,055,000 NEW YORK STATE URBAN DEVELOPMENT … · 2013 Bonds”) are special obligations of the...

Transcript of $753,055,000 NEW YORK STATE URBAN DEVELOPMENT … · 2013 Bonds”) are special obligations of the...

NEW ISSUES BOOK-ENTRY ONLYIn the opinion of each of Squire Sanders (US) LLP, and D. Seaton and Associates, Co-Bond Counsel, under existing law (i) assuming continuingcompliance with certain covenants and the accuracy of certain representations, interest on the Series 2013C Bonds is excluded from gross income forfederal income tax purposes and is not an item of tax preference for purposes of the federal alternative minimum tax imposed on individuals andcorporations, and (ii) interest on the Series 2013C Bonds is exempt from personal income taxes imposed by the State of New York and politicalsubdivisions thereof, including The City of New York and the City of Yonkers. Interest on the Series 2013C Bonds may be subject to certain federaltaxes imposed only on certain corporations, including the corporate alternative minimum tax on a portion of that interest. See “PART 13 – TAXMATTERS” herein regarding certain other tax considerations.

[LOGO]

$753,055,000NEW YORK STATE URBAN DEVELOPMENT CORPORATIONSTATE PERSONAL INCOME TAX REVENUE BONDS (GENERAL PURPOSE)

SERIES 2013CDated: Date of Delivery Due: As shown on the inside cover

The New York State Urban Development Corporation State Personal Income Tax Revenue Bonds (General Purpose), Series 2013C (the “Series2013 Bonds”) are special obligations of the New York State Urban Development Corporation (the “Corporation”), doing business as Empire StateDevelopment. The Series 2013 Bonds are secured by a pledge of certain payments (the “Financing Agreement Payments”) to be made to the Trustee onbehalf of the Corporation by the State of New York (the “State”) under a Financing Agreement between the Corporation and the State. FinancingAgreement Payments are payable from amounts legally required to be deposited into the Revenue Bond Tax Fund to provide for the payment of theSeries 2013 Bonds and all other State Personal Income Tax Revenue Bonds (as hereinafter defined). The Revenue Bond Tax Fund receives a statutoryallocation of 25 percent of State of New York personal income tax receipts imposed by Article 22 of the Tax Law (the “New York State PersonalIncome Tax Receipts”) as more fully described herein.

Interest on the Series 2013 Bonds is payable on each March 15 and September 15, commencing March 15, 2014. The Series 2013 Bonds areissuable only as fully registered bonds without coupons, in the principal amount of $5,000 or any integral multiple thereof. The Series 2013 Bonds willbe initially issued under a book-entry only system and will be registered in the name of Cede & Co., as Bondholder and nominee of The DepositoryTrust Company, New York, New York. See “PART 7 – BOOK-ENTRY ONLY SYSTEM” herein. Principal and premium, if any, and interest on theSeries 2013 Bonds will be payable through The Bank of New York Mellon, New York, New York, as Trustee and Paying Agent.

The Series 2013 Bonds are subject to redemption prior to maturity as described herein.The Corporation is one of five Authorized Issuers (hereinafter defined) that can issue State Personal Income Tax Revenue Bonds. All financing

agreements entered into by the State to secure State Personal Income Tax Revenue Bonds shall be executory only to the extent of the revenues availablein the Revenue Bond Tax Fund (as hereinafter defined). The obligation of the State to make financing agreement payments is subject to the StateLegislature making annual appropriations for such purpose and such obligation does not constitute or create a debt of the State, nor a contractualobligation in excess of the amounts appropriated therefor. In addition, the State has no continuing legal or moral obligation to appropriate money forpayments due under any financing agreement. Nothing shall be deemed to restrict the right of the State to amend, repeal, modify or otherwise alterstatutes imposing or relating to the New York State Personal Income Tax.

The Series 2013 Bonds shall not be a debt of the State and the State shall not be liable thereon, nor shall the Series 2013 Bonds be payableout of any funds other than those of the Corporation pledged therefor. Neither the faith and credit nor the taxing power of the State is pledgedto the payment of the principal of, premium, if any, or interest on the Series 2013 Bonds. The Corporation has no taxing power.

_________________________________________________MATURITY SCHEDULE — See Inside Cover_________________________________________________

This cover page contains certain information for general reference only. It is not intended to be a summary of the security or terms of thisissue. Investors are advised to read the entire Official Statement to obtain information essential to the making of an informed investmentdecision.

Sanders (US) LLP, New York, New York, and D. Seaton and Associates, New York, New York, Co-Bond Counsel to the Corporation, and to certainother conditions. It is expected that the Series 2013 Bonds will be available for delivery to The Depository Trust Company in New York, New York onor about September 26, 2013.

September 10, 2013

The Series 2013 Bonds are offered when, as and if issued and delivered to the Initial Purchasers and are subject to approval of legality by Squire

NEW YORK STATE URBAN DEVELOPMENT CORPORATIONSTATE PERSONAL INCOME TAX REVENUE BONDS (GENERAL PURPOSE)

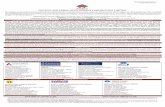

MATURITIES, AMOUNTS, INTEREST RATES, PRICES OR YIELDS AND CUSIP NUMBERS

$753,055,000STATE PERSONAL INCOME TAX REVENUE BONDS (GENERAL PURPOSE)

SERIES 2013C

MaturityMarch 15 Amount

InterestRate Yield

CUSIPNumber†

MaturityMarch 15 Amount

InterestRate Yield

CUSIPNumber†

2015 $24,660,000 5.00% 0.380% 650035A73 2025 $40,165,000 5.00% 3.670%* 650035B982016 25,890,000 5.00 0.690 650035A81 2026 42,175,000 5.00 3.860* 650035C222017 27,185,000 5.00 1.120 650035A99 2027 44,285,000 5.00 4.000* 650035C302018 28,545,000 5.00 1.570 650035B23 2028 46,500,000 5.00 4.120* 650035C482019 29,975,000 5.00 1.960 650035B31 2029 48,825,000 5.00 4.270* 650035C552020 31,470,000 5.00 2.340 650035B49 2030 51,265,000 5.00 4.400* 650035C632021 33,045,000 5.00 2.720 650035B56 2031 53,825,000 5.00 4.480* 650035C712022 34,700,000 5.00 2.990 650035B64 2032 56,520,000 5.00 4.560* 650035C892023 36,430,000 5.00 3.230 650035B72 2033 59,340,000 5.00 4.580* 650035C972024 38,255,000 5.00 3.400* 650035B80

______________________________†CUSIP is a registered trademark of the American Bankers Association. CUSIP Global Services is managed on behalf of the American Bankers Association by S&PCapital IQ, a business line of The McGraw Hill Companies. Copyright © 2013 CUSIP Global Services. The CUSIP numbers listed above are being provided solely forthe convenience of Bondholders only at the time of issuance of the Series 2013 Bonds and neither the State nor the Corporation makes any representation with respect tosuch numbers nor undertakes any responsibility for their accuracy now or at any time in the future. The CUSIP number for a specific maturity is subject to being changedafter the issuance of the Series 2013 Bonds as a result of various subsequent actions including, but not limited to, a refunding in whole or in part of such maturity or as aresult of the procurement of secondary market portfolio insurance or other similar enhancement by investors that is applicable to all or a portion of certain maturities ofthe Series 2013 Bonds.

* Priced at the stated yield to the March 15, 2023 optional redemption date at a redemption price of 100%.

No dealer, broker, salesperson or other person has been authorized to give any information or to makeany representations, other than those contained in this Official Statement, and if given or made, such otherinformation or representations must not be relied upon as having been authorized. This Official Statementdoes not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Series2013 Bonds by any person in any jurisdiction in which it is unlawful for the person to make such offer,solicitation or sale. The information set forth herein has been provided by the Corporation, the State and othersources which are believed to be reliable by the Corporation and with respect to the information supplied orauthorized by the State, is not to be construed as a representation by the Corporation. The information herein issubject to change without notice and neither the delivery of this Official Statement nor any sale madehereunder shall, under any circumstances, create any implication that there has been no change in the affairs ofthe Corporation or the State. This Official Statement is submitted in connection with the sale of the securitiesreferred to herein and may not be reproduced or used, in whole or in part, for any other purpose.

IN CONNECTION WITH THIS OFFERING OF THE SERIES 2013 BONDS, AN INITIALPURCHASER MAY OVERALLOT OR EFFECT TRANSACTIONS WHICH STABILIZE OR MAINTAINTHE MARKET PRICE OF SUCH BONDS AT A LEVEL ABOVE THAT WHICH MIGHT OTHERWISEPREVAIL IN THE OPEN MARKET. SUCH STABILIZATION, IF COMMENCED, MAY BEDISCONTINUED AT ANY TIME.

IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWNEXAMINATION OF THE TERMS OF THE OFFERING INCLUDING THE MERITS AND RISKSINVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL ORSTATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THEFOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THEADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINALOFFENSE.

THIS OFFICIAL STATEMENT CONTAINS STATEMENTS WHICH, TO THE EXTENT THEYARE NOT RECITATIONS OF HISTORICAL FACT, CONSTITUTE “FORWARD LOOKINGSTATEMENTS”. IN THIS RESPECT, THE WORDS “ESTIMATE”, “PROJECT”, “ANTICIPATE”,“EXPECT”, “INTEND”, “BELIEVE” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFYFORWARD-LOOKING STATEMENTS. A NUMBER OF IMPORTANT FACTORS AFFECTING THECORPORATION AND THE STATE’S FINANCIAL RESULTS COULD CAUSE ACTUAL RESULTS TODIFFER MATERIALLY FROM THOSE STATED IN THE FORWARD-LOOKING STATEMENTS.

IN CONNECTION WITH OFFERS AND SALES OF SERIES 2013 BONDS, NO ACTION HASBEEN TAKEN BY THE CORPORATION THAT WOULD PERMIT A PUBLIC OFFERING OF THESERIES 2013 BONDS, OR POSSESSION OR DISTRIBUTION OF ANY INFORMATION RELATING TOTHE PRICING OF THE SERIES 2013 BONDS, THIS OFFICIAL STATEMENT OR ANY OTHEROFFERING OR PUBLICITY MATERIAL RELATING TO THE SERIES 2013 BONDS, IN ANY NON-U.S.JURISDICTION WHERE ACTION FOR THAT PURPOSE IS REQUIRED. ACCORDINGLY, THEINITIAL PURCHASERS OF THE SERIES 2013 BONDS ARE OBLIGATED TO COMPLY WITH ALLAPPLICABLE LAWS AND REGULATIONS IN FORCE IN ANY NON-U.S. JURISDICTION IN WHICHTHEY PURCHASE, OFFER OR SELL SERIES 2013 BONDS OR POSSESS OR DISTRIBUTE THISOFFICIAL STATEMENT OR ANY OTHER OFFERING OR PUBLICITY MATERIAL RELATING TOTHE SERIES 2013 BONDS AND WILL OBTAIN ANY CONSENT, APPROVAL OR PERMISSIONREQUIRED BY THEM FOR THE PURCHASE, OFFER OR SALE BY THEM OF SERIES 2013 BONDSUNDER THE LAWS AND REGULATIONS IN FORCE IN ANY NON-U.S. JURISDICTION TO WHICHTHEY ARE SUBJECT OR IN WHICH THEY MAKE SUCH PURCHASES, OFFERS OR SALES ANDTHE CORPORATION SHALL HAVE NO RESPONSIBILITY THEREFOR.

TABLE OF CONTENTS

PART 1 – SUMMARY STATEMENT ........................ iPART 2 – INTRODUCTION.......................................1PART 3 – SECURITY AND SOURCES OF

PAYMENT FOR STATEPERSONAL INCOME TAXREVENUE BONDS.................................3

The Revenue Bond Tax Fund...................................3Series 2013 Bonds....................................................3Certification of Payments to be Set Aside inRevenue Bond Tax Fund......................................4

Set Aside of Revenue Bond Tax Fund Receipts ......5Flow of Revenue Bond Tax Fund Receipts..............6Moneys Held in the Revenue Bond Tax Fund .........7Flow of Revenues.....................................................8Appropriation by the State Legislature ....................9Additional Bonds ...................................................10Parity Reimbursement Obligations ........................10Certain Covenants of the State ...............................10Reservation of State’s Right to Substitute Credit...11

PART 4 – SOURCES OF NEW YORK STATEPERSONAL INCOME TAXRECEIPTS FOR THE REVENUEBOND TAX FUND................................11

General History of the State Personal Income Tax 11Personal Income Tax Rates ....................................12Components of the Personal Income Tax...............14Revenue Bond Tax Fund Receipts .........................14

PART 5 – THE PROJECTS.......................................17PART 6 – DESCRIPTION OF THE SERIES 2013

BONDS ..................................................17General ...................................................................17Redemption ............................................................18Selection of Series 2013 Bonds to be Redeemed;Notice of Redemption ........................................18

PART 7 – BOOK ENTRY ONLY SYSTEM ............19

PART 8 – DEBT SERVICE REQUIREMENTS ...... 23PART 9 – ESTIMATED SOURCES AND USES

OF FUNDS ............................................ 24Series 2013 Bond Proceeds ................................... 24

PART 10 – THE CORPORATION........................... 24General................................................................... 24Economic Development Programs ........................ 25Consolidation......................................................... 25Directors; Corporate Management......................... 26Directors ................................................................ 26Senior Officers....................................................... 26Financial Advisor................................................... 26

PART 11 – AGREEMENT OF THE STATE ........... 27PART 12 – LITIGATION ......................................... 27PART 13 – TAX MATTERS .................................... 27PART 14 – RATINGS OF THE SERIES 2013

BONDS.................................................. 29PART 15 – SALE BY COMPETITIVE BIDDING .. 29PART 16 – LEGALITY OF INVESTMENT............ 30PART 17 – CERTAIN LEGALMATTERS ............. 30PART 18 – CONTINUING DISCLOSURE

UNDER SEC RULE 15c2-12 ................ 30PART 19 – MISCELLANEOUS............................... 31APPENDIX A – Information Concerning the

State of New York ....................... A-1APPENDIX B – Summary of Certain Provisions

of the General Resolution ..............B-1APPENDIX C – Financing Agreement ....................C-1APPENDIX D – Master Continuing

Disclosure Agreement.................. D-1APPENDIX E – Proposed Form of Opinion of

Co-Bond Counsel ..........................E-1

-i-

PART 1 – SUMMARY STATEMENT

This Summary Statement is subject in all respects to more complete information contained in thisOfficial Statement and should not be considered a complete statement of the facts material to making aninvestment decision. The offering of the Series 2013 Bonds to potential investors is made only by means of theentire Official Statement. Capitalized terms used in this Summary Statement and not defined in this SummaryStatement will have the meanings given to such terms elsewhere in this Official Statement.

State Personal IncomeTax Revenue BondFinancing Program

Part I of Chapter 383 of the Laws of New York of 2001, as amended from time totime (the “Enabling Act”), provides for the issuance of, and a source of paymentfor, State Personal Income Tax Revenue Bonds (the “State Personal Income TaxRevenue Bonds”) by establishing the Revenue Bond Tax Fund (the “RevenueBond Tax Fund”) held separate and apart from all other moneys of the State inthe joint custody of the Commissioner of Taxation and Finance and theComptroller of the State (the “State Comptroller”).

The Enabling Act authorizes the New York State Urban DevelopmentCorporation (the “Corporation”), the Dormitory Authority of the State of NewYork, the New York State Environmental Facilities Corporation, the New YorkState Housing Finance Agency and the New York State Thruway Authority(collectively, the “Authorized Issuers”) to issue State Personal Income TaxRevenue Bonds for certain authorized purposes (the “Authorized Purposes”). Allfive Authorized Issuers have adopted one or more general resolutions and haveexecuted financing agreements with the Director of the Division of the Budget ofthe State (the “Director of the Budget”) pursuant to the Enabling Act. Thefinancing agreements and the general resolutions for State Personal Income TaxRevenue Bonds issued by the Authorized Issuers have substantially identicalterms except for applicable references to, and requirements of, the AuthorizedIssuer and the Authorized Purposes. References to financing agreements,financing agreement payments and general resolutions contained in this OfficialStatement mean generically the financing agreements, financing agreementpayments and general resolutions of all Authorized Issuers, including theCorporation.

State Personal Income Tax Revenue Bonds issued by an Authorized Issuer aresecured by a pledge of (i) the payments made pursuant to a financing agreemententered into by such Authorized Issuer with the Director of the Budget and (ii)certain funds held by the applicable trustee or Authorized Issuer under a generalresolution and the investment earnings thereon; which together constitute thepledged property under the applicable general resolution.

Purpose of Issue;Security for Series 2013Bonds

The Series 2013 Bonds are being issued to enable the Corporation to fund certainprojects relating to (1) reimbursing the State for certain expenditures made or tobe made by the New York State Department of Transportation (the “Departmentof Transportation”) in connection with the State’s current multi-year highway andbridge capital program; and (2) the making of grants to reimburse municipalitiesand other project sponsors throughout the State for qualifying capitalexpenditures for highway, bridge and multi-modal projects. Additionally, theproceeds of the Series 2013 Bonds will be used to pay all or part of the cost ofissuance of the Series 2013 Bonds. Proceeds of the Series 2013 Bonds also maybe used to finance other transportation projects as permitted under the ProjectActs (as hereinafter defined) and the Corporation’s State Personal Income TaxRevenue Bonds (General Purpose) General Bond Resolution. See “PART 5 –THE PROJECTS” for a more complete description of the application of proceeds

-ii-

Purpose of Issue;Security for Series 2013Bonds(continued)

of the Series 2013 Bonds.

At the same time that the Corporation approved the issuance of the Series 2013Bonds, it also approved the issuance of Bonds for the purpose of refunding Bondsand other state-supported debt previously issued by the Corporation and otherAuthorized Issuers in the approximate amount of $500,000,000. As of this date,no determination has been made as to whether such refunding bonds will beissued or if issued, the amount and timing of such issuance although a sale of therefunding bonds could occur as early as the week of September 16, 2013.

The Series 2013 Bonds are special obligations of the Corporation, secured by apledge of the financing agreement payments to be made by the State Comptrollerto the Trustee pursuant to the State Personal Income Tax Revenue Bonds(General Purpose) Financing Agreement entered into by the Corporation with theDirector of the Budget. See APPENDIX C for a conformed copy of suchFinancing Agreement.

The Series 2013 Bonds shall not be a debt of the State and the State shall notbe liable thereon, nor shall the Series 2013 Bonds be payable out of anyfunds other than those of the Corporation pledged therefor. Neither thefaith and credit nor the taxing power of the State is pledged to the paymentof the principal of, premium, if any, or interest on the Series 2013 Bonds.The Corporation has no taxing power.

The Series 2013 Bonds are not secured by the Projects (as hereinafterdefined) or any interest therein.

Sources of Payment andSecurity for StatePersonal Income TaxRevenue Bonds –Revenue Bond TaxFund Receipts

The Enabling Act provides that 25 percent of the receipts from the New YorkState personal income tax, which exclude refunds owed to taxpayers (the “NewYork State Personal Income Tax Receipts”), shall be deposited in the RevenueBond Tax Fund. Legislation, effective April 1, 2007, increased deposits to theRevenue Bond Tax Fund by amending the Enabling Act to provide that depositsto the Revenue Bond Tax Fund be calculated before the deposit of New YorkState personal income tax receipts to the School Tax Relief Fund (the “STARFund”). Prior to such date, New York State Personal Income Tax Receipts werealso net of STAR Fund deposits.

The State Comptroller is required by the Enabling Act to deposit in the RevenueBond Tax Fund all of the receipts collected from payroll withholding taxes (the“Withholding Component”) until an amount equal to 25 percent of the estimatedmonthly New York State Personal Income Tax Receipts has been deposited intothe Revenue Bond Tax Fund (the “Revenue Bond Tax Fund Receipts”).

New York State Personal Income Tax Receipts, the Withholding Component andthe Revenue Bond Tax Fund Receipts for State Fiscal Years State Fiscal Years2011-12 through 2013-14 are as follows:

State Fiscal Year

New York StatePersonal IncomeTax Receipts

WithholdingComponent

Revenue BondTax FundReceipts

($ in billions)2011-12 $38.8 $31.2 $ 9.72012-13 40.2 32.0 10.12013-14* 42.5 33.1 10.6

_________________* As estimated in the FY 2014 Enacted Budget Financial Plan.

-iii-

Sources of Payment andSecurity for StatePersonal Income TaxRevenue Bonds –Revenue Bond TaxFund Receipts(continued)

The Series 2013 Bonds are special obligations of the Corporation, being securedby, among other things, a pledge of financing agreement payments to be made bythe State Comptroller to the Trustee on behalf of the Corporation and certainfunds held by the Trustee under the Corporation’s State Personal Income TaxRevenue Bonds (General Purpose) General Bond Resolution (the “GeneralResolution”).

The Series 2013 Bonds are issued on a parity with all other Bonds which may beissued under the General Resolution. All State Personal Income Tax RevenueBonds (of which $27.3 billion were outstanding as of August 1, 2013) are on aparity with each other as to payments from the Revenue Bond Tax Fund subjectto annual appropriation by the State.

Financing agreement payments are made from certain personal income taxesimposed by the State of New York on a statewide basis and deposited, as requiredby the Enabling Act, to the Revenue Bond Tax Fund. The financing agreementpayments are to be paid by the State Comptroller to the applicable trustees onbehalf of the Authorized Issuers from amounts deposited to the Revenue BondTax Fund. Financing agreement payments are to equal amounts necessary to paythe debt service and other cash requirements on all State Personal Income TaxRevenue Bonds.

All payments required by financing agreements entered into by the State areexecutory only to the extent of the revenues available in the Revenue BondTax Fund. The obligation of the State to make financing agreementpayments is subject to the State Legislature (the “State Legislature”) makingannual appropriations for such purpose and such obligation does notconstitute or create a debt of the State, nor a contractual obligation in excessof the amounts appropriated therefor. In addition, the State has nocontinuing legal or moral obligation to appropriate money for payments dueunder any financing agreement.

The Enabling Act provides that: (i) no person (including the Authorized Issuersor the holders of State Personal Income Tax Revenue Bonds) shall have any lienon amounts on deposit in the Revenue Bond Tax Fund; (ii) Revenue Bond TaxFund Receipts, which have been set aside in sufficient amounts to pay when duethe financing agreement payments of all Authorized Issuers, shall remain in theRevenue Bond Tax Fund (except, if necessary, for payments authorized to bemade to the holders of State general obligation debt) until they are appropriatedand used to make financing agreement payments; and (iii) nothing shall bedeemed to restrict the right of the State to amend, repeal, modify or otherwisealter statutes imposing or relating to the New York State Personal Income Tax.

For additional information, see “PART 3 – SECURITY AND SOURCES OFPAYMENT FOR STATE PERSONAL INCOME TAX REVENUE BONDS”and “PART 4 – SOURCES OF NEW YORK STATE PERSONAL INCOMETAX RECEIPTS FOR THE REVENUE BOND TAX FUND”.

The Series 2013 Bonds shall not be a debt of the State and the State shall notbe liable thereon, nor shall the Series 2013 Bonds be payable out of anyfunds other than those of the Corporation pledged therefor. Neither thefaith and credit nor the taxing power of the State is pledged to the paymentof the principal of, the premium, if any, or interest on the Series 2013 Bonds.The Corporation has no taxing power.

-iv-

Set Aside for Purpose ofMaking FinancingAgreement Payments

The Enabling Act, general resolutions and financing agreements provideprocedures for setting aside Revenue Bond Tax Fund Receipts designed to ensurethat sufficient amounts are available in the Revenue Bond Tax Fund to makefinancing agreement payments to the applicable trustees on behalf of allAuthorized Issuers, subject to annual appropriation by the State Legislature.

The Enabling Act requires the Director of the Budget to annually prepare acertificate (which may be amended as necessary or required) which estimatesmonthly Revenue Bond Tax Fund Receipts anticipated to be deposited to theRevenue Bond Tax Fund and the amount of all set-asides necessary to make allfinancing agreement payments of all the Authorized Issuers. The Director of theBudget has prepared such certificate for the 2013-14 State Fiscal Year.

See “PART 3 – SECURITY AND SOURCES OF PAYMENT FOR STATEPERSONAL INCOME TAX REVENUE BONDS.”

Availability of GeneralFund to Satisfy Set-Aside of Revenue BondTax Fund Receipts

If at any time the amount of Revenue Bond Tax Fund Receipts set aside, ascertified by the Director of the Budget, is insufficient to make all appropriatedfinancing agreement payments on all State Personal Income Tax Revenue Bonds,the State Comptroller is required by the Enabling Act, without furtherappropriation, to immediately transfer amounts from the General Fund of theState to the Revenue Bond Tax Fund sufficient to satisfy the cash requirements ofthe Authorized Issuers.

Subject to annual appropriation, amounts so transferred to the Revenue Bond TaxFund will be applied to pay the required financing agreement payments.

Moneys Held inRevenue Bond TaxFund if State Fails toAppropriate or PayRequired Amounts

In the event that (i) the State Legislature fails to appropriate all amounts requiredto make financing agreement payments on State Personal Income Tax RevenueBonds to all Authorized Issuers or (ii) having been appropriated and set asidepursuant to a certificate of the Director of the Budget, financing agreementpayments have not been made when due on any State Personal Income TaxRevenue Bonds, the Enabling Act requires that all of the receipts from theWithholding Component shall continue to be set aside in the Revenue Bond TaxFund until amounts on deposit in the Revenue Bond Tax Fund equal the greaterof 25 percent of annual New York State Personal Income Tax Receipts or sixbillion dollars ($6,000,000,000). Other than to make financing agreementpayments from appropriated amounts, the Enabling Act prohibits the transfer ofmoneys in the Revenue Bond Tax Fund to any other fund or account or use ofsuch moneys by the State for any other purpose (except, if necessary, forpayments authorized to be made to the holders of State general obligation debt)until such time as the required appropriations and all required financingagreement payments have been made to the trustees, on behalf of eachAuthorized Issuer, including the Corporation.

After the required appropriations and financing agreement payments have beenmade, excess moneys in the Revenue Bond Tax Fund are paid over anddistributed to the credit of the State’s General Fund. See “PART 3 – SECURITYAND SOURCES OF PAYMENT FOR STATE PERSONAL INCOME TAXREVENUE BONDS – Moneys Held in the Revenue Bond Tax Fund.”

-v-

Additional Bonds andDebt Service Coverage

As provided in each of the general resolutions, additional bonds may be issuedonly if the amount of Revenue Bond Tax Fund Receipts for any 12 consecutivecalendar months ended not more than six months prior to the date of suchcalculation, as certified by the Director of the Budget, is at least 2.0 times themaximum Calculated Debt Service on all outstanding State Personal Income TaxRevenue Bonds, additional State Personal Income Tax Revenue Bonds proposedto be issued and any additional amounts payable with respect to parityreimbursement obligations.

Subject to (i) statutory limitations on the maximum amount of bonds permitted tobe issued by Authorized Issuers for Authorized Purposes and (ii) the additionalbonds test described above, the Corporation and other Authorized Issuers mayissue additional State Personal Income Tax Revenue Bonds. In accordance withthe additional bonds test above, Revenue Bond Tax Fund Receipts ofapproximately $10.6 billion are available to pay financing agreement paymentson a pro forma basis, which amount represents approximately 4.2 times themaximum annual Debt Service for all outstanding State Personal Income TaxRevenue Bonds, including the debt service on the Series 2013 Bonds. As notedabove, however, additional bonds may not be issued unless the additional bondstest under the respective general resolution has been met. See “PART 3 –SECURITY AND SOURCES OF PAYMENT FOR STATE PERSONALINCOME TAX REVENUE BONDS – Additional Bonds.”

As of August 1, 2013, approximately $27.3 billion of State Personal Income TaxRevenue Bonds were outstanding.

Continuing Disclosure In order to assist the Initial Purchasers of the Series 2013 Bonds in complyingwith Rule 15c2-12 promulgated by the Securities and Exchange Commission, allAuthorized Issuers, the State and each applicable trustee, including the Trustee,have entered into a Master Continuing Disclosure Agreement. See “PART 18 –CONTINUING DISCLOSURE UNDER SEC RULE 15c2-12” and “APPENDIXD – Master Disclosure Agreement.”

NEWYORK/162677.1

THIS PAGE INTENTIONALLY LEFT BLANK

1

OFFICIAL STATEMENT

Relating to

$753,055,000NEW YORK STATE URBAN DEVELOPMENT CORPORATIONSTATE PERSONAL INCOME TAX REVENUE BONDS (GENERAL PURPOSE)

SERIES 2013C

PART 2 – INTRODUCTION

The purpose of this Official Statement, including the cover page, the inside cover page andappendices, is to set forth certain information concerning the New York State Urban Development Corporation(the “Corporation”), a body corporate and politic constituting a public benefit corporation of the State of NewYork (the “State”), doing business as Empire State Development (“ESD”), in connection with the offering bythe Corporation of its $753,055,000 State Personal Income Tax Revenue Bonds (General Purpose), Series2013C (the “Series 2013 Bonds”). The interest rates, maturity dates, and prices or yields of the Series 2013Bonds being offered hereby are set forth on the inside cover page of this Official Statement.

This Official Statement also summarizes certain information concerning the provisions of the StateFinance Law with respect to the issuance of State Personal Income Tax Revenue Bonds (the “State PersonalIncome Tax Revenue Bonds”), including the Series 2013 Bonds, and the statutory allocation of 25 percent ofthe receipts from the New York State Personal Income Tax imposed by Article 22 of the New York State TaxLaw (“Tax Law”) which, pursuant to Section 171-a of the Tax Law (the “New York State Personal IncomeTax Receipts”), are required to be deposited in the Revenue Bond Tax Fund (the “Revenue Bond Tax Fund”)to provide for the payment of State Personal Income Tax Revenue Bonds. Such New York State PersonalIncome Tax Receipts currently exclude refunds owed to taxpayers.

The State expects that State Personal Income Tax Revenue Bonds, together with the State Sales TaxRevenue Bonds will be the primary financing vehicles for financing State-supported programs over the currentfinancial plan period.

The Series 2013 Bonds are authorized to be issued pursuant to Part I of Chapter 383 of the Laws ofNew York of 2001, as amended from time to time (the “Enabling Act”), and the New York State UrbanDevelopment Corporation Act, Chapter 174 of the Laws of New York of 1968, as amended and supplemented(the “UDC Act”) and the provisions of State law that authorize the Projects described under “PART 5 – THEPROJECTS” herein (the “Project Acts”). The Enabling Act authorizes the Corporation, the DormitoryAuthority of the State of New York, the New York State Environmental Facilities Corporation, the New YorkState Housing Finance Agency and the New York State Thruway Authority (collectively, the “AuthorizedIssuers”) to issue State Personal Income Tax Revenue Bonds for certain purposes for which State-supportedDebt (as defined by Section 67-a of the State Finance Law and as limited by the Enabling Act) may be issued(“Authorized Purposes”). The Enabling Act, together with the Project Acts and the UDC Act, constitute the“Authorizing Legislation.”

The Series 2013 Bonds are additionally authorized under (i) the Corporation’s State Personal IncomeTax Revenue Bonds (General Purpose) General Bond Resolution, adopted by the Corporation onNovember 16, 2009 (the “General Resolution”), (ii) the Corporation’s Supplemental Resolution AuthorizingState Personal Income Tax Revenue Bonds (General Purpose), Series 2013C, adopted by the Corporation onSeptember 9, 2013 (the “Series 2013C Supplemental Resolution”), and (iii) the Corporation’s Bond FinancingCommittee Resolution Concerning the Sale and Issuance of State Personal Income Tax Revenue Bonds(General Purpose), Series 2013, adopted by the Corporation on September 9, 2013 (the “Series 2013C BondFinancing Committee Resolution”, and together with the General Resolution and the Series 2013 SupplementalResolution being herein, except as the context otherwise indicates, called the “Resolution” and any bonds

2

issued pursuant to the General Resolution, including the Series 2013 Bonds, being herein referred to as the“Bonds”).

The Series 2013 Bonds, and any additional series of bonds which have heretofore been issued or mayhereafter be issued under the General Resolution, will be equally and ratably secured thereunder.

The Series 2013 Bonds and all other State Personal Income Tax Revenue Bonds issued by anAuthorized Issuer are secured by a pledge of: (i) the payments made pursuant to one or more financingagreements entered into by such Authorized Issuer with the Director of the Division of the Budget of the State(the “Director of the Budget”); and (ii) certain funds held by the applicable trustee or Authorized Issuer undera general resolution and the investment earnings thereon; collectively the “Pledged Property”. The financingagreements and the general resolutions for State Personal Income Tax Revenue Bonds adopted by theAuthorized Issuers have substantially identical terms except for applicable references to, and requirements of,the Authorized Issuer and the Authorized Purposes. The financing agreement payments are to equal amountsnecessary to pay the debt service and other cash requirements on all State Personal Income Tax RevenueBonds. The making of financing agreement payments to the Authorized Issuers is subject to annualappropriation by the State Legislature.

References to financing agreements, financing agreement payments and general resolutions containedin this Official Statement mean generically the financing agreements, financing agreement payments andgeneral resolutions of all Authorized Issuers, including the Corporation. Descriptions of the provisions of theEnabling Act contained in this Official Statement are of the Enabling Act as it exists on the date of this OfficialStatement.

All State Personal Income Tax Revenue Bonds are on a parity with each other as to payments from theRevenue Bond Tax Fund, subject to annual appropriation by the State. As of August 1, 2013, approximately$27.3 billion of State Personal Income Tax Revenue Bonds were outstanding. (See “PART 3 – SECURITYAND SOURCES OF PAYMENT FOR STATE PERSONAL INCOME TAX REVENUE BONDS – Series2013 Bonds” and “– Additional Bonds.”)

The Series 2013 Bonds are being issued for the purposes of financing Authorized Purposes (as suchterm is defined in the Resolution). The projects being financed by the Series 2013 Bonds relate to: (1)reimbursing the State for certain expenditures made or to be made by the New York State Department ofTransportation (the “Department of Transportation”) in connection with the State’s current multi-year highwayand bridge capital program; and (2) the making of grants to reimburse municipalities and other projectsponsors throughout the State for qualifying capital expenditures for highway, bridge and multi-modalprojects. Additionally, the proceeds of the Series 2013 Bonds will be used to pay all or part of the cost ofissuance of the Series 2013 Bonds. Proceeds of the Series 2013 Bonds also may be used to finance othertransportation projects as permitted under the Project Acts and the Corporation’s State Personal Income TaxRevenue Bonds (General Purpose) General Bond Resolution. See “PART 5 – THE PROJECTS” for a morecomplete description of the application of proceeds of the Series 2013 Bonds.

Pursuant to the Authorizing Legislation, the Corporation and the State entered into a financingagreement dated as of December 1, 2009 (the “Financing Agreement”). See “APPENDIX C — FINANCINGAGREEMENT.” The Series 2013 Bonds are not secured by the Projects or any interest therein.

The Series 2013 Bonds shall not be a debt of the State and the State shall not be liable thereon,nor shall the Series 2013 Bonds be payable out of any funds other than those of the Corporation pledgedtherefor. Neither the faith and credit nor the taxing power of the State is pledged to the payment of theprincipal of, premium, if any, or interest on, the Series 2013 Bonds. The Corporation has no taxingpower.

At the same time that the Corporation approved the issuance of the Series 2013 Bonds, it alsoapproved the issuance of Bonds for the purpose of refunding Bonds and other state-supported debt previouslyissued by the Corporation and other Authorized Issuers in the approximate amount of $500,000,000. As of thisdate, no determination has been made as to whether such refunding bonds will be issued or if issued, the

3

amount and timing of such issuance although a sale of the refunding bonds could occur as early as the week ofSeptember 16, 2013.

Capitalized terms used herein unless otherwise defined have the same meaning as ascribed to them inthe General Resolution. See “APPENDIX B – Summary of Certain Provisions of the General Resolution –Certain Defined Terms.”

PART 3 – SECURITY AND SOURCES OF PAYMENT FORSTATE PERSONAL INCOME TAX REVENUE BONDS

The Revenue Bond Tax Fund

The Enabling Act provides a source of payment for State Personal Income Tax Revenue Bonds byestablishing the Revenue Bond Tax Fund for the purpose of setting aside New York State Personal IncomeTax Receipts sufficient to make financing agreement payments to Authorized Issuers. The Enabling Actestablishes the Revenue Bond Tax Fund to be held in the joint custody of the State Comptroller (the “StateComptroller”) and the Commissioner of Taxation and Finance (the “Commissioner”) and requires that allmoneys on deposit in the Revenue Bond Tax Fund be held separate and apart from all other moneys in thejoint custody of the State Comptroller and the Commissioner. The source of the financing agreementpayments is a statutory allocation of 25 percent of the receipts from the New York State Personal Income Taximposed by Article 22 of the New York State Tax Law, which exclude refunds owed to taxpayers, and which,pursuant to Section 171-a of the Tax Law, are deposited in the Revenue Bond Tax Fund. Legislation, effectiveApril 1, 2007, increased deposits to the Revenue Bond Tax Fund by amending the Enabling Act to provide thatdeposits to the Revenue Bond Tax Fund be calculated before the deposit of New York State Personal IncomeTax Receipts to the School Tax Relief Fund (the “STAR Fund”). Prior to such date New York State PersonalIncome Tax Receipts were net of refunds and deposits to the STAR Fund. See “PART 4 – SOURCES OFNEW YORK STATE PERSONAL INCOME TAX RECEIPTS FOR THE REVENUE BOND TAX FUND –Revenue Bond Tax Fund Receipts.”

Financing agreement payments made from amounts set aside in the Revenue Bond Tax Fund aresubject to annual appropriation for such purpose by the State Legislature. The Enabling Act provides that: (i)no person (including the Authorized Issuers or the holders of State Personal Income Tax Revenue Bonds) shallhave any lien on amounts on deposit in the Revenue Bond Tax Fund; (ii) Revenue Bond Tax Fund Receipts,which have been set aside in sufficient amounts to pay when due the financing agreement payments of allAuthorized Issuers, shall remain in the Revenue Bond Tax Fund (except, if necessary, for payments authorizedto be made to the holders of State general obligation debt) until they are appropriated and used to makefinancing agreement payments; and (iii) nothing shall be deemed to restrict the right of the State to amend,repeal, modify or otherwise alter statutes imposing or relating to the taxes imposed by Article 22 of the TaxLaw.

Series 2013 Bonds

The Series 2013 Bonds are special obligations of the Corporation, secured by and payable solely fromFinancing Agreement Payments payable by the State Comptroller to The Bank of New York Mellon, asTrustee and Paying Agent (the “Trustee” or “Paying Agent”) on behalf of the Corporation in accordance withthe terms and provisions of a Financing Agreement by and between the Corporation and the Director of theBudget, subject to annual appropriation by the State Legislature, and the Funds and accounts established underthe General Resolution (other than the Rebate Fund and other Funds as provided in such Resolutions). TheSeries 2013 Bonds are entitled to a lien, created by a pledge under the General Resolution, on the PledgedProperty.

The Enabling Act permits the Corporation and the other Authorized Issuers to issue additional StatePersonal Income Tax Revenue Bonds subject to statutory limitations on the maximum amount of bondspermitted to be issued by Authorized Issuers for Authorized Purposes and the additional bonds test describedherein included in each of the general resolutions authorizing State Personal Income Tax Revenue Bonds. Inaccordance with the additional bonds test described herein, Revenue Bond Tax Fund Receipts of

4

approximately $10.6 billion are available to pay financing agreement payments on a pro-forma basis, whichamount represents approximately 4.2 times the maximum annual Debt Service for all Outstanding StatePersonal Income Tax Revenue Bonds, including the debt service on the Series 2013 Bonds. As noted above,however, additional bonds may not be issued unless the additional bonds test under the respective generalresolution has been met. See “–Additional Bonds” below.

The revenues, facilities, properties and any and all other assets of the Corporation of any name andnature, other than the Pledged Property, may not be used for, or, as a result of any court proceeding, otherwiseapplied to, the payment of State Personal Income Tax Revenue Bonds, any redemption premium therefor orthe interest thereon or any other obligations under the General Resolution, and under no circumstances shallthese be available for such purposes. See “PART 10 – THE CORPORATION” for a further description of theCorporation.

Certification of Payments to be Set Aside in Revenue Bond Tax Fund

The Enabling Act, the general resolutions and the financing agreements provide procedures for settingaside amounts from the New York State Personal Income Tax Receipts deposited to the Revenue Bond TaxFund to ensure that sufficient amounts will be available to make financing agreement payments, when due, tothe applicable trustees on behalf of the Corporation and the other Authorized Issuers.

The Enabling Act provides that:

1. No later than October 1 of each year, each Authorized Issuer must submit its StatePersonal Income Tax Revenue Bond cash requirements (which shall includefinancing agreement payments) for the following State Fiscal Year and, as requiredby the financing agreements, each of the subsequent four State Fiscal Years to theDivision of the Budget.

2. No later than thirty (30) days after the submission of the Executive Budget inaccordance with Article VII of the State Constitution, the Director of the Budgetshall prepare a certificate which sets forth an estimate of:

(a) 25 percent of the amount of the estimated monthly New York StatePersonal Income Tax Receipts to be deposited in the Revenue BondTax Fund pursuant to the Enabling Act during that State FiscalYear; and

(b) the monthly amounts necessary to be set aside in the Revenue BondTax Fund to make the financing agreement payments required tomeet the cash requirements of the Authorized Issuers.

3. In the case of financing agreement payments due semi-annually, Revenue Bond TaxFund Receipts shall be set aside monthly until such amount is equal to not less thanthe financing agreement payments for State Personal Income Tax Revenue Bonds ofall Authorized Issuers in the following month as certified by the Director of theBudget.

4. In the case of financing agreement payments due on a more frequent basis, monthlyRevenue Bond Tax Fund Receipts shall be set aside monthly until such amount is, inaccordance with the certificate of the Director of the Budget, sufficient to pay therequired payment on each issue on or before the date such payment is due.

In addition, the general resolutions and the financing agreements require the State Comptroller to setaside, monthly, in the Revenue Bond Tax Fund, amounts such that the combined total of the (i) amountspreviously set aside and on deposit in the Revenue Bond Tax Fund and (ii) amount of estimated monthly NewYork State Personal Income Tax Receipts required to be deposited to the Revenue Bond Tax Fund as provided

5

in 2(a) above, are not less than 125 percent of the financing agreement payments required to be paid by theState Comptroller to the trustees on behalf of the Authorized Issuers in the following month.

The Director of the Budget may amend such certification as shall be necessary, provided that theDirector of the Budget shall amend such certification no later than thirty (30) days after the issuance of anyState Personal Income Tax Revenue Bonds, including refunding bonds, or after the execution of any interestrate exchange (or “swap”) agreements or other financial arrangements which may affect the cash requirementsof any Authorized Issuer.

The Enabling Act provides that on or before the twelfth day of each month, the Commissioner shallcertify to the State Comptroller the actual New York State Personal Income Tax Receipts for the prior monthand, in addition, no later than March 31 of each State Fiscal Year, the Commissioner shall certify suchamounts relating to the last month of the State Fiscal Year. At such times, the Enabling Act provides that theState Comptroller shall adjust the amount of estimated New York State Personal Income Tax Receiptsdeposited to the Revenue Bond Tax Fund from the Withholding Component to the actual amount certified bythe Commissioner.

Set Aside of Revenue Bond Tax Fund Receipts

As provided by the Enabling Act, the general resolutions, the financing agreements and the certificateof the Director of the Budget, the State Comptroller is required to:

1. Beginning on the first day of each month, deposit all of the daily receipts from theWithholding Component to the Revenue Bond Tax Fund until there is on deposit inthe Revenue Bond Tax Fund an amount equal to 25 percent of estimated monthlyNew York State Personal Income Tax Receipts.

2. Set aside, monthly, amounts on deposit in the Revenue Bond Tax Fund, such that thecombined total of the (i) amounts previously set aside and on deposit in the RevenueBond Tax Fund and (ii) amount of estimated monthly New York State PersonalIncome Tax Receipts required to be deposited to the Revenue Bond Tax Fund in suchmonth, are not less than 125 percent of the financing agreement payments required tobe paid by the State Comptroller to the trustees on behalf of all the AuthorizedIssuers in the following month.

The Enabling Act provides that Revenue Bond Tax Fund Receipts which have been set aside insufficient amounts to pay, when due, the financing agreement payments of all Authorized Issuers shall remainin the Revenue Bond Tax Fund (except, if necessary, for payments authorized to be made to the holders ofState general obligation debt) until they are appropriated and used to make financing agreement payments.

Subject to appropriation by the State Legislature, upon receipt of a request for payment from anyAuthorized Issuer pursuant to a financing agreement, the State Comptroller shall pay over to the trustee, onbehalf of such Authorized Issuer, such amount. In the event that Revenue Bond Tax Fund Receipts areinsufficient to meet the debt service and other cash requirements of all the Authorized Issuers as set forth in thecertificate of the Director of the Budget, the State Comptroller is required by the Enabling Act, without furtherappropriation, to immediately transfer amounts from the General Fund of the State to the Revenue Bond TaxFund. Amounts so transferred to the Revenue Bond Tax Fund can only be used to pay financing agreementpayments (except, if necessary, for payments authorized to be made to the holders of State general obligationdebt).

6

Flow of Revenue Bond Tax Fund Receipts

The following chart summarizes the flow of Revenue Bond Tax Fund Receipts.

On or Before October 1Authorized Issuers submit State Personal Income Tax Revenue Bond cashrequirements (which include financing agreement payments) for the followingState Fiscal Year and four subsequent State Fiscal Years to the Division of theBudget

No later than 30 Days after Budget Submission(Mid February)Director of the Budget submits certificate to State Comptroller which estimatesfor the following fiscal year:*

• 25% of monthly State Personal Income Tax Receipts to be depositedin Revenue Bond Tax Fund

• Monthly set asides for financing agreement payments and other cashrequirements (for outstanding bonds and projected issuances)

Beginning on the First Day of Each Month100% of daily receipts from the Withholding Component flow to Revenue BondTax Fund until 25% of estimated monthly New York State Personal Income TaxReceipts has been deposited**

State Personal Income Tax Receipts, which have been set aside to make financingagreement payments and meet other cash requirements, are required to remain inRevenue Bond Tax Fund until appropriated and paid to the Trustee on behalf ofthe Authorized Issuers

After the monthly amounts necessary to make financing agreement payments andmeet other cash requirements have been set aside, and assuming appropriationshave been enacted and any required payments have been made by the StateComptroller, excess moneys in Revenue Bond Tax Fund flow to the GeneralFund

12th Day of the following MonthCommissioner of Taxation and Finance certifies to the State Comptroller 25% ofactual New York State Personal Income Tax Receipts for prior month and theState Comptroller adjusts deposits to the Revenue Bond Tax Fund accordingly

____________________* The Director of the Budget can amend the certification at any time to more precisely account for a revised New York State Personal Income

Tax Receipts estimate or actual debt service and other cash requirements, and to the extent necessary, shall do so not later than thirty daysafter the issuance of any State Personal Income Tax Revenue Bonds.

** The State can certify and set aside New York State Personal Income Tax Receipts in excess of the next month’s financing agreementpayment requirements to ensure amounts previously set aside and on deposit in the Revenue Bond Tax Fund together with 25 percent ofestimated monthly New York State Personal Income Tax Receipts to be deposited in such month are not less than 125 percent of allfinancing agreement payments due in the following month.

7

Moneys Held in the Revenue Bond Tax Fund

The Enabling Act prohibits the State Comptroller from paying over or distributing any amountsdeposited in the Revenue Bond Tax Fund (except, if necessary, for payments authorized to be made to theholders of State general obligation debt) other than to the Corporation and other Authorized Issuers (which arepaid to the applicable trustees on behalf of the Corporation and the other Authorized Issuers), unless tworequirements are met. First, all payments as certified by the Director of the Budget for a State Fiscal Yearmust have been appropriated to the Corporation and other Authorized Issuers for the payment of financingagreement payments (including debt service) in the full amount specified in the certificate of the Director ofthe Budget. Second, each certified and appropriated payment for which moneys are required to be set aside asprovided in the Enabling Act must have been made to the trustees on behalf of the Corporation and otherAuthorized Issuers when due.

If such appropriations have been made to pay all annual amounts specified in the certificate of theDirector of the Budget as being required by the Corporation and all other Authorized Issuers for a State FiscalYear and all such payments to the applicable trustees on behalf of the Corporation and all other AuthorizedIssuers are current, then the State Comptroller is required by the Enabling Act to pay over and distribute to thecredit of the General Fund of the State (the “General Fund”), at least once a month, all amounts in the RevenueBond Tax Fund, if any, in excess of the aggregate amount required to be set aside. The Enabling Act alsorequires the State Comptroller to pay to the General Fund all sums remaining in the Revenue Bond Tax Fundon the last day of each State Fiscal Year, but only if the State has appropriated and paid to the applicabletrustees on behalf of the Corporation and all other Authorized Issuers the amounts necessary for theCorporation and all other Authorized Issuers to meet their cash requirements for the current State Fiscal Yearand, to the extent certified by the Director of the Budget, set aside any cash requirements required for the nextState Fiscal Year.

In the event that (i) the State Legislature fails to appropriate all amounts required to make financingagreement payments on State Personal Income Tax Revenue Bonds to all Authorized Issuers or (ii) havingbeen appropriated and set aside pursuant to a certificate of the Director of the Budget, any financing agreementpayments have not been made when due on State Personal Income Tax Revenue Bonds, the Enabling Actrequires that all of the receipts from the Withholding Component shall continue to be set aside in the RevenueBond Tax Fund until amounts on deposit in the Revenue Bond Tax Fund equal the greater of 25 percent ofannual New York State Personal Income Tax Receipts or six billion dollars ($6,000,000,000). Other than tomake financing agreement payments from appropriated amounts, the Enabling Act prohibits the transfer ofmoneys in the Revenue Bond Tax Fund to any other fund or account or use of such moneys by the State forany other purpose (except, if necessary, for payments authorized to be made to the holders of State generalobligation debt) until such time as the required appropriations and all required financing agreement paymentshave been made to the trustees on behalf of each Authorized Issuer, including the Corporation.

The Enabling Act provides that no person (including the Authorized Issuers or the holders of StatePersonal Income Tax Revenue Bonds) shall have any lien on moneys on deposit in the Revenue Bond TaxFund and that the State’s agreement to make financing agreement payments shall be executory only to theextent such payments have been appropriated.

8

Flow of Revenues

25% of New York State Personal IncomeTax Receipts (2012-13 = $10.1 billion)

If, after appropriation, there are insufficient fundsto make a financing agreement payment, the StateComptroller is immediately required to transferfunds from the General Fund to make up anydeficiency.

Financing agreement payments paid atleast 5 days prior to debt service paymentdate.

New York State PersonalIncome Tax Receipts

Revenue Bond Tax Fund

General Resolution(held by Trustee)

Bondholders

AdministrativeFund

SubordinatedPayment Fund

Debt Service Fund

General Fund

Revenue Fund

Provided appropriations have been made sufficientto pay all required financing agreement paymentsand all payments are current, excess moneys whichhave not been set aside in the Revenue Bond TaxFund are transferred each month to the GeneralFund.

In the event appropriations have not been made orif the financing agreement payments required to bemade have not been made when due, then all of thereceipts from the Withholding Component shallcontinue to be set aside until the greater of 25% ofannual New York State Personal Income TaxReceipts or $6 billion has been deposited to theRevenue Bond Tax Fund. Such moneys shall beheld in the Revenue Bond Tax Fund and cannot betransferred to any fund or used by the State for anyother purpose until the required appropriations andpayments have been made (except, if necessary, forpayments authorized to be made to the holders ofState general obligation debt).

9

Appropriation by the State Legislature

The State may not expend money without an appropriation, except for the payment of debt service ongeneral obligation bonds or notes issued by the State. An appropriation is an authorization approved by theState Legislature to expend money. The State Constitution requires all appropriations of State funds, includingfunds in the Revenue Bond Tax Fund, to be approved by the State Legislature at least every two years. Inaddition, the State Finance Law generally provides that appropriations shall cease to have force and effect,except as to liabilities incurred thereunder, at the close of the State Fiscal Year for which they were enactedand that to the extent of liabilities incurred thereunder, such appropriations shall lapse on the succeeding June30th or September 15th depending on the nature of the appropriation. See “– Moneys Held in the RevenueBond Tax Fund” in this section.

The Corporation expects that the State Legislature will make an appropriation from amounts ondeposit in the Revenue Bond Tax Fund sufficient to pay financing agreement payments when due. RevenueBond Tax Fund Receipts are expected to exceed the amounts necessary to pay financing agreement payments.In addition, in the event that the State Legislature fails to provide an appropriation, the Enabling Act requiresthat all of the receipts from the Withholding Component shall continue to be deposited in the Revenue BondTax Fund until amounts on deposit in the Revenue Bond Tax Fund equal the greater of 25 percent of theannual New York State Personal Income Tax Receipts or six billion dollars ($6,000,000,000). The EnablingAct prohibits the transfer of moneys in the Revenue Bond Tax Fund to any other fund or account or the use ofsuch moneys by the State for any other purpose (other than to make financing agreement payments fromappropriated amounts, and except, if necessary, for payments authorized to be made to the holders of Stategeneral obligation debt) until such time as the required appropriations and all required financing agreementpayments have been made to the trustees on behalf of each Authorized Issuer. The State Legislature may notbe bound in advance to make an appropriation, and there can be no assurances that the State Legislature willappropriate the necessary funds as anticipated. Nothing shall be deemed to restrict the right of the State toamend, repeal, modify or otherwise alter statutes imposing or relating to the taxes imposed pursuant toArticle 22 of the Tax Law.

All payments required by financing agreements entered into by the State shall be executory only to theextent of the revenues available in the Revenue Bond Tax Fund. The obligation of the State to make financingagreement payments is subject to the State Legislature making annual appropriations for such purpose andsuch obligation does not constitute or create a debt of the State, nor a contractual obligation in excess of theamounts appropriated therefor. In addition, the State has no continuing legal or moral obligation to appropriatemoney for payments due under any financing agreement.

State Personal Income Tax Revenue Bonds shall not be a debt of the State and the State shallnot be liable thereon, nor shall State Personal Income Tax Revenue Bonds be payable out of any fundsother than those pledged therefor. Neither the faith and credit nor the taxing power of the State ispledged to the payment of the principal of, premium, if any, or interest on State Personal Income TaxRevenue Bonds.

Pursuant to the Enabling Act, Revenue Bond Tax Fund Receipts which have been set aside to paywhen due the financing agreement payments of all Authorized Issuers shall remain in the Revenue Bond TaxFund until they are appropriated and used to make financing agreement payments. However, the Enabling Actalso provides that the use of such Revenue Bond Tax Fund Receipts by the State Comptroller is “subject to therights of holders of debt of the state” (i.e., general obligation bondholders who benefit from the faith and creditpledge of the State). Pursuant to Article VII Section 16 of the State Constitution, if at any time the StateLegislature fails to make an appropriation for general obligation debt service, the State Comptroller is requiredto set apart from the first revenues thereafter received, applicable to the General Fund, sums sufficient to paydebt service on such general obligation debt. In the event that such revenues and other amounts in the GeneralFund are insufficient to so pay general obligation bondholders, the State may also use amounts on deposit inthe Revenue Bond Tax Fund to pay debt service on general obligation bonds.

The Division of the Budget is not aware of any existing circumstances that would cause RevenueBond Tax Fund Receipts to be used to pay debt service on general obligation bonds in the future. The Director

10

of the Budget believes that any failure by the State Legislature to make annual appropriations as contemplatedwould have a serious impact on the ability of the State and the Authorized Issuers to issue State-supportedbonds to raise funds in the public credit markets and, as a result, on the ability of the State to meet its non-debtobligations.

Additional Bonds

Pursuant to each general resolution, additional bonds may be issued by the related Authorized Issuer,provided that the amount of Revenue Bond Tax Fund Receipts for any 12 consecutive calendar months endednot more than six months prior to the date of such calculation, as certified by the Director of the Budget, is atleast 2.0 times the maximum Calculated Debt Service on all Outstanding State Personal Income Tax RevenueBonds, the State Personal Income Tax Revenue Bonds proposed to be issued, and any additional amountspayable with respect to parity reimbursement obligations, as certified by the Director of the Budget.

For additional information, see “APPENDIX B – SUMMARY OF CERTAIN PROVISIONS OF THEGENERAL RESOLUTION – Summary of Certain Provisions of the State Personal Income Tax RevenueBonds Standard Resolution Provisions – Special Provisions for Additional Bonds” and “ – Refunding Bonds.”

Parity Reimbursement Obligations

An Authorized Issuer, including the Corporation, may incur Parity Reimbursement Obligationspursuant to the terms of the general resolution which, subject to certain exceptions, would be secured by apledge of, and a lien on, the pledged property on a parity with the lien created by the related general resolutionwith respect to bonds issued thereunder. A Parity Reimbursement Obligation may be incurred in connectionwith obtaining a Credit Facility and represents the obligation to repay amounts advanced under the CreditFacility. It may include interest calculated at a rate higher than the interest rate on the related State PersonalIncome Tax Revenue Bond and may be secured by a pledge of, and a lien on, pledged property on a parity withthe lien created by the general resolution for the State Personal Income Tax Revenue Bonds only to the extentthat principal amortization requirements of the Parity Reimbursement Obligation are equal to the amortizationrequirements for the related State Personal Income Tax Revenue Bonds, without acceleration. See“APPENDIX B – SUMMARY OF CERTAIN PROVISIONS OF THE GENERAL RESOLUTION”.

Certain Covenants of the State

Pursuant to the general resolutions, the State pledges and agrees with the holders of State PersonalIncome Tax Revenue Bonds, Bond Anticipation Notes, Parity Reimbursement Obligations or other obligationsissued or incurred thereunder that the State will not in any way impair the rights and remedies of holders ofsuch State Personal Income Tax Revenue Bonds, Bond Anticipation Notes, Parity Reimbursement Obligationsor other obligations until such State Personal Income Tax Revenue Bonds, Bond Anticipation Notes, ParityReimbursement Obligations or other obligations issued or incurred thereunder, together with interest thereon,with interest, if any, on any unpaid installments of interest and all costs and expenses in connection with anyaction or proceeding by or on behalf of the holders are fully met and discharged.

Pursuant to the Enabling Act and the general resolutions, nothing shall be deemed to restrict the rightof the State to amend, repeal, modify or otherwise alter statutes imposing or relating to the State personalincome taxes imposed pursuant to Article 22 of the Tax Law. An Event of Default under the generalresolutions would not occur solely as a result of the State exercising its right to amend, repeal, modify orotherwise alter the statutes imposing or relating to such taxes. However, the Director of the Budget believesthat any materially adverse amendment, modification or alteration of, or the repeal of, statutes imposing orrelated to the State personal income tax imposed pursuant to Article 22 of the Tax Law could have a seriousimpact on the flow of New York State Personal Income Tax Receipts to the Revenue Bond Tax Fund, theability of the Authorized Issuers to issue Additional Bonds and the marketability of outstanding State PersonalIncome Tax Revenue Bonds.

11

Reservation of State’s Right to Substitute Credit

Pursuant to the Enabling Act, the State reserves the right, upon amendment of the State Constitution topermit the issuance of State Revenue Bonds, which may be payable from or secured by revenues that mayinclude the Revenues pledged under the general resolutions, (i) to assume, in whole or in part, State PersonalIncome Tax Revenue Bonds, (ii) to extinguish the existing lien on the pledged property created under thegeneral resolutions, and (iii) to substitute security for State Personal Income Tax Revenue Bonds, in each caseonly so long as the assumption, extinguishment and substitution is accomplished in accordance with either oftwo provisions of the general resolutions. (For these purposes, any State Personal Income Tax Revenue Bondspaid or deemed to have been paid in accordance with the applicable general resolution on or before the date ofany assumption, extinguishment and substitution are not to be taken into account in determining compliancewith those provisions.) The first provision of the general resolutions is intended to permit an assumption,extinguishment and substitution, without any right of consent of Bondholders or other parties, if certainconditions are satisfied. The second provision of the general resolutions permitting such an assumption,extinguishment and substitution is intended to permit a broader range of changes with the consent of issuers ofCredit Facilities and the consent of certain Bondholders. It provides that any such assumption, extinguishmentand substitution may be effected if certain conditions are satisfied.

In the event a constitutional amendment becomes a part of the State Constitution, there can be noassurance that the State will exercise its rights of assumption, extinguishment, and substitution with respect toState Personal Income Tax Revenue Bonds. There can be no assurance that the Corporation or any otherAuthorized Issuer would be the issuer of any such State Revenue Bonds upon any such assumption,extinguishment and substitution and, if not the Corporation or any other Authorized Issuer, the issuer of suchState Revenue Bonds could be the State or another public entity.

See “APPENDIX B – SUMMARY OF CERTAIN PROVISIONS OF THE GENERALRESOLUTION – Summary of Certain Provisions of the State Personal Income Tax Revenue Bonds StandardResolution Provisions – Reservation of State Rights of Assumption, Extinguishment and Substitution.”

PART 4 – SOURCES OF NEW YORK STATE PERSONAL INCOMETAX RECEIPTS FOR THE REVENUE BOND TAX FUND

General History of the State Personal Income Tax

In 1919, New York State became the seventh state to enact a personal income tax. The present systemof conformity to Federal tax law with respect to income and deductions was adopted in 1960. The personalincome tax is New York’s largest source of tax revenue and consistently accounts for more than one-half of allState tax receipts.

The State’s personal income tax structure adheres closely to the definitions of adjusted gross incomeand itemized deductions used for Federal personal income tax purposes, with certain modifications, such as:(1) the inclusion of investment income from debt instruments issued by other states and municipalities and theexclusion of income on certain Federal obligations; and (2) the exclusion of pension income received byFederal, New York State and local government employees, private pension and annuity income up to $20,000($40,000 for married couples filing jointly), and any Social Security income and refunds otherwise included inFederal adjusted gross income.

Changes in Federal tax law from time to time may positively or negatively affect the amount ofpersonal income tax receipts collected by the State. State Tax Law changes may also impact personal incometax receipts by authorizing a wide variety of credits against the personal income tax liability of taxpayers.

Major tax credits include: Empire State Child Credit (enacted and effective in 2006); Earned IncomeTax Credit; Child and Dependent Care Credit; Household Credit; College Tuition Credit; Long-term CareInsurance Credit; Investment Credits; and, Empire Zone Credits.

12

Personal Income Tax Rates

Taxable income equals New York adjusted gross income (“AGI”) less deductions and exemptions.The tax provides separate rate schedules for married couples, single individuals and heads of households. Forthe 1989 through 1994 tax years, the State income tax was imposed at rates ranging from 4.0 percent to 7.875percent on the taxable income of individuals, estates and trusts. For taxpayers with $100,000 or more of AGI,the savings from graduated marginal tax rates is recaptured through a supplementary mechanism in effect since1991. Beginning in 1995, a major personal income tax cut program was phased in over three years which cutthe top State personal income tax rate from 7.875 to 6.85 percent. For tax years 1997 through 2002, New Yorkimposed a graduated income tax with rates ranging between 4.0 and 6.85 percent of taxable income.Legislation enacted with the 2003-04 Budget temporarily added two additional top brackets for the 2003through 2005 tax years. For tax years 2006 through 2008, the rate schedules reverted to the rate schedule ineffect for the 2002 tax year. For tax years 2009 through 2011, a temporary tax rate increase applied, whichadded two additional rates and brackets. The following tables set forth the rate schedules for tax years 2013through 2017 and for tax years after 2017 which revert to the rate schedule in effect for the 2008 tax yearexcept that the tax brackets are permanently indexed for cost of living adjustments starting in tax year 2013.

REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

13

New York State Personal Income Tax Rates for Tax Years 2013 through 2017*Married Filing Jointly and QualifiedWidow(er) Tax†Taxable Income:Not over $16,450.................................................................................................................. 4% of taxable incomeOver $16,450 but not over $22,600.............................................................................. $658 plus 4.50% of excess over $16,450Over $22,600 but not over $26,750.............................................................................. $935 plus 5.25% of excess over $22,600Over $26,750 but not over $41,150.............................................................................. $1,153 plus 5.90% of excess over $26,750Over $41,150 but not over $154,350 ........................................................................... $2,002 plus 6.45% of excess over $41,150Over $154,350 but not over $308,750......................................................................... $9,304 plus 6.65% of excess over $154,350Over $308,750 but not over $2,058,550 ..................................................................... $19,571 plus 6.85% of excess over $308,750Over $2,058,550 ................................................................................................................... $139,433 plus 8.82% of excess over $2,058,550

Single, Married Filing Separately, Estates and TrustsTaxable Income:Not over $8,200 .................................................................................................................... 4% of taxable incomeOver $8,200 but not over $11,300................................................................................. $328 plus 4.50% of excess over $8,200Over $11,300 but not over $13,350.............................................................................. $468 plus 5.25% of excess over $11,300Over $13,350 but not over $20,550.............................................................................. $575 plus 5.90% of excess over $13,350Over $20,550 but not over $77,150.............................................................................. $1,000 plus 6.45% of excess over $20,550Over $77,150 but not over $205,850 ........................................................................... $4,651 plus 6.65% of excess over $77,150Over $205,850 but not over $1,029,250 ..................................................................... $13,209 plus 6.85% of excess over $205,850Over $1,029,250 ................................................................................................................... $69,612 plus 8.82% of excess over $1,029,250

Head of HouseholdTaxable Income:Not over $12,350.................................................................................................................. 4% of taxable incomeOver $12,350 but not over $16,950.............................................................................. $494 plus 4.50% of excess over $12,350Over $16,950 but not over $20,050.............................................................................. $701 plus 5.25% of excess over $16,950Over $20,050 but not over $30,850.............................................................................. $864 plus 5.90% of excess over $20,050Over $30,850 but not over $102,900 ........................................................................... $1,501 plus 6.45% of excess over $30,850Over $102,900 but not over $257,300......................................................................... $6,148 plus 6.65% of excess over $102,900Over $257,300 but not over $1,543,900 ..................................................................... $16,416 plus 6.85% of excess over $257,300Over $1,543,900 ................................................................................................................... $104,548 plus 8.82% of excess over $1,543,900

_______________* Tax year 2013 marks the first year of tax bracket inflation adjustment, based on tax year 2012 brackets. Income and tax amounts for tax years2014 and beyond may change due to cost of living adjustments.† A supplemental income tax recaptures the savings due to graduated marginal tax rates such that, for example, when a taxpayer’s AGI exceeds

$2,108,550 for married filing jointly taxpayers in 2013, all taxable income becomes effectively subject to a flat 8.82 percent tax rate.

New York State Personal Income Tax Rates for Tax Years After 2017*Married Filing Jointly Tax†Taxable Income:

Not over $16,450.................................................................................................................. 4% of taxable incomeOver $16,450 but not over $22,600.............................................................................. $658 plus 4.50% of excess over $16,450Over $22,600 but not over $26,750.............................................................................. $935 plus 5.25% of excess over $22,600Over $26,750 but not over $41,150.............................................................................. $1,153 plus 5.90% of excess over $26,750Over $41,150 ......................................................................................................................... $2,002 plus 6.85% of excess over $41,150

Single, Married Filing Separately, Estates and TrustsTaxable Income: