70 Franklin Street

-

Upload

rudyparker -

Category

Education

-

view

1.192 -

download

2

description

Transcript of 70 Franklin Street

70 Franklin Street70 Franklin Street

FIN G217 – REAL ESTATE FINANCE AND INVESTMENTS

Matt O’Hearn

Adam Cohen

Rudolph Parker

Joshua Pierce

December 3, 2007

AgendaAgenda

-Boston Economy-Building Overview-Investment Strategy-Investment Opportunities and Risks-Market Overview and Comparable Properties-Tenant Profiles- Financial Analysis and Underwriting Assumptions- Conclusion and Recommendation

Boston EconomyBoston Economy

•Boston economy is in the midst of a comeback

•Employment growth (job creation & payrolls) is expanding

Negative Job Growth Positive Job Growth2002 -2.2% 2005 +0.8%2003 -2.2% 2006 +1.52004 -.02% 2007 +1.6 (YTD)

•In Boston, as of August 2007:Job growth for professional and business services = 2.8% annualized

•Nationally, as of August 2007:Job growth for all industries = less than 1% annualized

Source: Moody’s Economy.com

Boston Economy, ContBoston Economy, Cont

Monster.com’s Employment Index for Boston for 2006

The national leader in demand for high paying employees

Demand for employees by employers +20% from October 2006 to October 2007

•Expansion of the Boston economy

•Demand is high, Vacancy (supply) is low•Puts upward pressure on rents and availability

70 Franklin Street70 Franklin Street

70 Franklin Street70 Franklin Street

•Class B property

•Between the Financial District and Downtown Crossing

•On a 12,258 square foot lot

•84,400 square feet of office and retail space on 9 floors

•Optimum space for most small or mid-sized businesses

•Offers 4 store front locations for retail services

70 Franklin Street, Cont70 Franklin Street, Cont Part of an exclusive group known as “jewel box” buildings

A unique architectural style and were built in the late 1800’s

This exclusive group includes buildings such as: 84 State Street, One Liberty Square, and 45 Milk Street

Tenants are attracted to the attractive look of “jewel box” buildings Design offers a more “boutique-like” feel for its tenants No designated parking Location proves favorable to retailers

– Positioned between the financial district and the Downtown Crossing shopping district

– As well as on routes for major public transportation centers Downtown Crossing and Park Street T

Investment StrategyInvestment Strategy Add value through leaseup of currently vacant space at market rates Projected to take 12-24 months Leasing Goals

– Lease vacant office space on 2nd, 4th and 5th floors totaling 33,878 sf (40% of GLA) at market rates of $33

– Lease vacant retail space totaling 2,189 sf at $50– Renew Rasky Bearlin (11,425 sf) at market rate prior to Dec.

2008 lease expiration Upon stabilization, assess market conditions for opportunistic sale

or long term hold

Positive Considerations/Upside Positive Considerations/Upside OpportunitiesOpportunities

Below Market Rents– Average in-place rent is $26.50 vs. most recent lease at $33.50 – a 20%

differential

Leaseup of Vacant Space– Currently 51% leased, with little comparable vacancy in the Financial District

Leaseup/Upgrade Retail Tenancy– Finagle-A-Bagel and Papyrus both strong local draws– Potential to upgrade FFCU to national tenant – BoA, Citi, Citizen’s

Location– Highly desirable to small to mid-size service providers (PR, law/accounting

firms, government agencies) requiring close proximity to downtown clients

Investment Issues/RisksInvestment Issues/Risks

Increasing Uncertainty– Tenant caution leads to slower than expected leaseup of vacant space– Cautious underwriting and low vacancy in submarket offset this risk

Upcoming Rollover– Rasky Baerlin is largest tenant, expires in Dec. 2008– Single 5 year option at market rates– Proactively work with tenant to secure extension ahead of expiration

Capital Market Factors– Significant pullback in financing, particularly for riskier/value-add properties– Reduced competition in bidding process, could reduce buyer pool upon exit– Plan to stabilize asset prior to exit will broaden buyer pool at exit

Market OverviewMarket OverviewBoston’s Financial District consists of 34 million square feet of Class A and Class B office space.

At the end of the second quarter 2007, the Boston Office market had a vacancy rate of 11.0%.

Rental rates ended the second quarter at $23.66, an increase over the previous quarter.

Market OverviewMarket OverviewIn the first three months of 2007, 49 office sales transactions with a total volume of $1,360,564,976.

The price per square foot averaged $230.30.

2007 Cap rates averaging 7.57%

Tenant ProfilesTenant Profiles PAPYRUS SQUARE FEET: 900 SF LED: July 2010

FILENE FEDERAL CREDIT UNION SQUARE FEET: 2,229 SF LED: June 2011

FINAGLE A BAGEL SQUARE FEET: 2,582 SF LED: July 2011

RASKY BAERLEIN SQUARE FEET: 11,425 SF LED: December 2008

COMMONWEALTH OF MASSACHUSETTS DIVISION OF CAPITAL ASSET MANAGEMENT SQUARE FEET: 10,047 SF LED: May 2010

ADVENT SOFTWARE SQUARE FEET: 8,061 SF LED: September 2010

HARTFORD STEAM BOILER INSPECTION AND INSURANCE CO.

SQUARE FEET: 8,061 SF LED: January 2016

Assumptions*•Cost Price $15,000,000 ($177/sf)•$5,000,000 Equity, WACC @ 10 %•$10,000,000 Debt @ 6% for 30 Yrs•Debt Balance of $8,332,764 @ Year 10•$32 $/SFT•Used broker basic assumptions from Year 1 (Occupancy 90%)•Revenue growth rate of 3%•Expenses as given – Incl Cleaning, repairs & maintenance, utilities, insurance, administrative, management fees•Depreciation only $150,000 per annum (1%) •But Tennant improvements averaged at $304,424 per annum (2%)•PV of Cash flows $6,282,708•NPV = $1,282,708, IRR 13%* See Spreadsheet

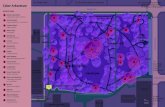

Monte Carlo Simulation

Questions ?Questions ?