6. Data Analysis, Research Findings and Suggestions

Transcript of 6. Data Analysis, Research Findings and Suggestions

6. Data Analysis, Research Findings and Suggestions

Introduction: In this chapter, analysis o f the prim ary data has been done.

R esearch learnings w ere noted. A nalysis was linked with the o b jectiv es and

hypothesis to gain further know ledge. In order to achieve o b jectiv es, hypotheses

were form ed. R esearch er conducted pilot survey to get prelim inary inputs from

custom ers, statistitians and experts about research area and fo r im provisation o f

questionnaire. T h e M ain survey was conducted with sam ple size o f 4 6 5 retail

custom ers and five store m anagers. In terview o f custom ers and store m anagers

w ere taken to get their view s on C R M and suggested fram ew ork. T o understand

view s o f opinions leaders on C R M , in terview s o f opinion leaders w ere taken.

Findings o f survey through questionnaire and analysis o f custom ers, store

m anagers and opinion leaders form the basis o f this analysis.

6.1 Linkage of Objectives- Hypothesis- Focus- Findings- Suggestions: T h is

linkage is shown in chart form at the start o f chapter^^O ^

6.2 Data Analysis and Interpretation

Cronbach alpha: R eliab ility o f questionnaire was tested with C ronbach alpha

test. T o know the authenticity and reliab ility o f the questionnaire, the researcher

has applied cronbach alpha test fo r the questionnaire. T h e C ronbach alpha score is

0.853. S o the questionnaire is 8 5 % correct and reliable for getting the responses

from the respondents.

Hi; Location and Distance from home are influencing factors and impacts visit to particular retail store.

R esearch applied B in o m ial test (z test o f proportion) to ch eck w hether the

proportion o f group 1 and group 2 is sam e or not. R esu lt shows that group 1 (9 4 % )

and group 2 (6 % ) has sign ificant d ifferen ce in proportion (as p value = 0 .0 0 is less

than 0 .0 5 ). S o the hypothesis i.e. “L o catio n and D istance from hom e are

Chapter 6

6. Data Analysis, Research Findings and Suggestions

134

(I

influencing factors and im pacts visit to particular retail store is accepted at 5 %

lev el” .

H2 : There is no signiflcance difference in customer total shopping (retail) experience across retail stores.

The scale used in questionnaire is from Extremely SatisHed to Extremely UnsatisHed. T h e coding fo r L ikert scale done as Extremely Satisfied as 1 to Extremely Unsatisfled as 5.

1. R elian ce Fresh

2. Food B azaar (B ig B azar)

3. Spencers

4 . M ore

5. V ish al M ega M art

T o ch eck hypothesis “T h ere is no sign ificant d ifferen ce in custom er total shopping

experience across retail stores”, the researcher has applied one w ay analysis o f

variance. From the table o f A N O V A test, it is observed that p value fo r Q 8 and

Q 9 and total o f Q 8 & Q 9 is less than 0 .0 5 , therefore the researcher re jects the

hypothesis at 5% level o f s ign ifican ce and 4 5 9 degrees o f freedom . It m eans there

is significant d ifferen ce in custom er total shopping exp erience across retail stores.

From the table o f descriptive statistics, it is observed that Food B azar (9 1 .9 6 ) is in

leading position fo llow ed by M ore (9 8 .0 8 ) in term s o f providing b etteT cu H om er

total shopping experience.

Chapter 6

I

135

H3 : There is significant gap between the expected and the existing customer relationship management.

T o ch eck the hypothesis “There is signiHcant gap between the expected and the existing customer relationship management” Paired t-test was applied. T h e

m eans fo r expected custom er relationship m anagem ent is 9 4 .0 3 and fo r existing

custom er relationship m anagem ent is 9 1 .2 4 . R esu lts show that there is sign ificant

d ifference betw een the expected custom er relationship m anagem ent and the

existing custom er relationship m anagem ent (as p-value is 0 .0 0 at 5 % level o f

sign ifican ce). S o based on above results, researcher concludes that there is

sign ificant gap betw een the expected and the existin g custom er relationship

m anagem ent. Further, the level o f expected cu stom er relationship m anagem ent is

m ore that the existing custom er relationship m anagem ent.

H4 : The better the total retail experience, the higher the Word of Mouth publicity i.e. recommendation to friends/neighbours/relatives/colleagues.

T o ch eck the hypothesis “the better the total retail exp erience, the h igher the word

to M outh publicity i.e . recom m endation to

friends/neighbours/relatives/colleagues” , the researcher has applied Pearson

correlation .The result shows that there is p ositive and statistically sign ifican t

correlation (p-value= 0 .3 5 9 at 0 .01 lev el o f sig n ifican ce) betw een total retail

experience and word to mouth publicity. Further, as the researcher has observed

the total retail experience is the sum o f retail m arketing m ix factors i.e . am bience,

fac ilities, m erchandise and custom er exp erien ce touch points (C E T P ). From the

above table, researcher concludes that there is statistically sign ificant correlation

betw een am bience, fac ilities, m erchandise and the W ord o f M outh publicity (as p-

value is 0 .3 5 7 is at 0 .0 1 level o f sign ifican ce). A lso there is statistically sign ificant

correlation betw een custom er experience touch points (C E T P ) and the W ord o f

M outh publicity (as p-value is 0 .2 6 6 is at 0 .0 1 level o f s ign ifican ce).

Chapter 6

136

H5 : The better the customer total retail experience, the higher the customer loyalty.

T o ch eck the hypothesis “the better the custom er total retail exp erience higher the

store loyalty” researcher has applied Pearson correlation test. T h e result show s that

there is positive and statistically sign ificant correlation (p-value = 0 .3 4 9 at 0 .01

level o f s ign ifican ce) betw een total shopping experience and store loyalty . Further,

the researcher has observed that the total retail exp erience is the sum o f am bience,

fac ilities, m erchandise and custom er exp erience touch points (C E T P ). From the

above table researcher concludes that there is statistica lly sign ifican t correlation

betw een custom er experience touch points and store loyalty (as p-value = 0 .6 3 7 at

0 .01 level o f s ign ifican ce). H ence hypothesis Better the customer total retail experience higher the store loyalty is accepted. A lso there is statistically

sign ificant correlation betw een custom er total shopping (reta il) exp erience

(C T R E ) and the store loyalty (as p-value= 0 .9 8 1 at 0 .0 1 lev el o f s ign ifican ce).

Hg: National level brands are preferred over the private labels (brands).

T o ch eck the hypothesis “National level brands are preferred over the private labels (brands)” researcher has applied b inom ial test (Z test o f proportion). T h e

m ean fo r group 1 i.e. national brands is 0 .7 7 and the m ean fo r group 2 i.e . private

brands is 0 .2 3 . From the d ifferen ce betw een the m eans o f group 1 and group 2,

con clu sion was drawn that there is d ifferen ce betw een the preference o f the

national brands and the private brands. Further researcher concludes that national

level brands are preferred over the private brands as m ean fo r group 1 (0 .7 7 ) > than

m ean for group 2 (0 .2 3 ) with the p -v a lu e= 0 .000 w hich is statistically sign ificant.

Thus hypothesis “National level brands are preferred over the private brands” is accepted.

Chapter 6

137

6.3 Data Analysis: Main Survey and Survey through Interview Mode6.3.1 Demographic Profile of retail store customers: U nderstanding custom ers

profile form s the basis o f the research. M arketing strategies can be planned w ell,

once dem ographic profile o f custom ers is understood. V arious param eters like,

age, gender, occupation , education and incom e level w ere co llected during a

research.

Chapter 6

Retail Store RespondentsFood B a z a r(B ig B azar) 103

R elian ce Fresh 102

M ore 101

Spencers 102

V ish al M ega M art 57

Total n -4 6 5 —

Table 6.01Title: Organized Retail Store Wise Respondents Distribution Source; Field Data

Follow ing data spells A ge-w ise distribution o f the respondents.

Respondents n=465Age Group Numbers Percentage

2 0 -2 5 33 7 .1 0

2 6 -3 5 185 3 9 .7 8

3 6 -4 5 173 3 7 .2 0

4 6 -5 5 7 0 15.05

5 6 -6 0 3 0 .6 5

6 0 onw ards 1 0 .2 2

Table 6.02Title: Age Group Wise Respondents Distribution Source: Field Data

138

C om bined data reflects age group-w ise distribution and percentage o f d ifferent

age-group respondents. Prim arily 3 9 .7 8 percent and 3 7 .2 0 percent w ere from age

group o f 2 6 -3 5 and 3 6 -4 5 . T h ese tw o groups form seventy seven percent o f

respondents. A ge group o f 4 6 -5 5 , the next group o f respondents with fifteen

percent, fo llow ed with young m arried ones with seven percentages. T h e age group

o f 5 6 -6 0 and sixty onwards have less than one percent. T h is show s that an age

group betw een tw enty six and forty five are the prim e respondents o f this survey.

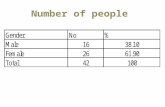

T h e gender-w ise classifica tio n is depicted in T ab le N o 5 .0 3 .

Chapter 6

Gender Numbers PercentM ale 195 4 1 .9 4

F em ale 2 7 0 5 8 .0 6

n = 465

Table 6.03:Title: Gender Wise Distribution Source: Field Data

D uring the data co llectio n care has been taken to keep a b alan ce ratio o f both the

gender, to avoid gender bias in research. F igures in bracket show percentage o f

gender distribution. T h e pattern em erged is 4 2 percent m ale and 5 8 percent

fem ale. T abulation based on education qualification is as fo llow s:

QualiHcation Numbers Percent10/12 +Pass 4 0 .8 6

U ndergraduate 3 0 6 .4 5

Graduate 2 5 9 5 5 .6 9

P ost Graduate 172 3 6 .9 8

n = 465

Table 6.04:Title: Education Qualification wise Distribution Source: Field Data

139

D ata shows graduate custom ers having been fifty six percent w hereas percentage

o f post-graduate custom ers is thirty seven percent. A nalysis show s that m ore than

ninety three percent custom ers are w ell-qualified . U ndergraduate cu stom ers’

percentage is around seven. Thus custom ers w alking in retail stores are w ell-

qualified. T h eir aw areness regarding trends and expectations from retailers is on

the higher side. Follow in g table no 6 .0 5 presents occu pation-w ise details o f

respondents.

Chapter 6

Occupation Numbers PercentServ ice 174 37 .41

Bu siness 3 4 7.31

H om e-M aker 142 3 0 .5 3

Part-T im e w orking 4 4 9 .4 6

Professional 71 1 5 .2 6

n = 465

Table 6.05Title: Occupation Wise Profile of Respondents Source: Field Data

O ccupation w ise respondents such as service, business and professional com bined

total stands at sixty five percent. H om e-m akers and part-tim e w orking respondents

constituting balan ce forty percent. E ach custom er having diverse occupation spells

out d ifferent expectations regarding service quality levels from retailers.

140

Chapter 6

200

180

160

140

120

100

80

60

40

20

0

174

34

71□ S e r ie s 1

'44

Se rv ice B u s in e s s H om e - Part-T im e P ro fe ss io n a l

IVIaker w orking

Figure 6 .0 !:Title: Respondents Occupation Wise Profile Source: Field Data

In order to plan pricing and other strategies, retailers need to know incom e profile

o f their custom ers. R esp ondents’ incom e p rofile was tabulated in the fo llow ing

table.

Income (In Rupees) Numbers Percent8 0 0 0 -1 5 0 0 0 13 3 .0

1 5 0 0 0 -3 0 0 0 0 138 3 0 .0

3 0 0 0 0 -7 0 0 0 0 2 5 6 5 5 .0

7 0 0 0 0 Plus 58 12.0

Table 6.06:Title: Income Bracket of Customers Source: Field Data

D ata show s that incom e bracket o f R s .3 0 0 0 0 -7 0 0 0 0 with fifty five percent. This

follow ed with thirty percent Rs. 1 5 0 0 0 -3 0 0 0 0 incom e bracket. Indian retailers need

to understand aspiration o f this m iddle class group. H igher incom e group i.e.

141

above R s .7 0 0 0 0 have tw elve percent w hereas, low er in com e group constituting

only three percent. In one way, it reconfirm s that percent o f low er incom e group is

still hesitant to v isit organized retailer. L o w er in com e group perceives organized

retailer as expensive stores than m om and pop stores (lo ca l kirana stores). D uring

the pilot and m ain survey, researcher understood that certain section o f custom ers

from a higher incom e group having global exposure, fee ls that Indian retailers

need to im prove their custom er-friendly practices.

Customers Shopping Pattern: In P ilo t and m ain survey, first part o f

questionnaire fram ed to understand shopping pattern o f respondents. T h is would

provide insight to the factors, w hich shape pattern o f shopping. S tore v isit pattern

is tabulated in the fo llow ing table.

Chapter 6

In Days Numbers PercentD aily visit 5 1.1

O n ce in a w eek 7 6 16 .35

O n ce in fortnight 133 2 8 .6 0

O n ce in m onth 2 2 0 4 7 .3 0

Others 31 6 .6 6

n = 465

Table 6.07Title: Store Visit Pattern Source: Field Data

D ata shows 4 7 .3 0 percent custom ers v isit once in a m onth, fo llow ed by 2 8 .6 0

percent once in a fortnight. T h is shows that Indian fam ily generally fills grocery

once in a month. A bove pattern reflects the sam e trend. O n ce in a w eek visit

stands at 16 .35 percent, show ing a w eekend shopping pattern. D aily visit to retail

stores is ju s t one percent. It m eans custom ers hardly v isit organized retail stores on

142

daily basis. O ther category show s 6 .6 percent. T h is pattern would guide retailers

for planning their special prom otions and pricing schem es days in advance.

Chapter 6

7 6

1 3 3

220

Daily visit Oncc in a week Oncc in forln ifih l

Once in m onth Others

Figure 6.02Title; Retail Store Visit Pattern (In Numbers)

C lassifica tion o f respondents on their shopping planning w as recorded in table

5 .0 8 . Understanding this pattern provide guidance to retailers in planning in-side

m erchandising and pricing strategies.

Planning of shopping Numbers PercentFully planned 133 2 8 .6 0

Partially planned 2 1 4 4 6 .0 0

N either planned-N or un-planned 75 16.15

U n-Planned 39 8 .4 0

T o ta lly un-planned 34 7 .35Table 6.08Shopping Planning Pattern Source: Field Data

Study show s 2 8 .6 0 percent o f custom ers fully plan their store visit w hereas 4 6 .0 0

percent partially plan their trip. C om bined percentage stands at seventy five

percent cu stom er’ s does plan for their trips for shopping at F & G stores. S ixteen

percent are having m id way pattern i.e. their shopping w as neither planned, nor

un-planned. P ercentage o f un-planned or totally un-planned custom ers stands at

143

sixteen percent. T h ese last three categories with 3 2 .0 0 percent can b e targeted by

retailers fo r im pulse buying. E n ticing the 7 6 .0 0 percent custom ers who do som e

kind o f planning, is a real challenge for retailers.

T h e im pact o f special schem es, pricing announced by retailers prom pts custom ers

to visit particular retail stores, as tabulated in table 6 .0 9 .

Chapter 6

Pull Impact Numbers PercentA lw ays 4 7 1 0 .1 0

U sually 192 4 1 .2 9

Som e-tim es 127 27 .31

N ot sure 6 9 14.83

N ever 3 0 6 .4 5

Table 6.09Title: Special Schemes, Pricing: Promotion Pull Impact Source: Field Data

D ata shows 1 0 .1 0 percent alw ays and 4 1 .2 9 percent usually get attracted to special

schem es and pricing announcem ent. 2 7 .31 p ercent responded with som e tim es as

their response. C ategory responded with never is 6 .4 5 percent. O verall, 7 8 .0 0

percent gets im pacted due to prom otion factor. R etailers need to focu s on

prom otional o ffers in order to attract custom ers to particular retail stores. T h e not-

sure category with 1 4 .8 3 percent reflects consu m er behaviour psychology factor

i.e . custom ers w ere not sure w hether they are attracted or not attracted towards

particular special schem e or pricing o ffer. W ith tod ay’ s urban lifesty le , availability

o f tim e fo r shopping plays a cru cial role. R esearch er is keen to understand w hether

tim e availability in flu en ces trips to retail stores. T ab le 6 .1 0 show s data co llected

on this aspect.

144

Chapter 6

Trips impacted Numbers PercentA lw ays 87 1 8 .70

U sually 2 6 9 5 7 .8 4

Som e-tim es 89 19.13

N ot sure 14 3 .0

N ever 6 1.30

n = 465

Table 6.10Title: Shopping Trips based on Availability of Time Source: Field Data

300 -

250 -X

200 -

150 -X

100 -

50 -

Figure 6.03Title: Shopping Trips based on Availability of Time

I Scricsl

Thus, it can be seen that trips to retail stores is usually based on availability o f

tim e.

Private Label (PL)-Data Interpretation: Private label products are reta ilers’

own brands. Private labels are retailers own product (B ran d ). Prim ary o b jectiv e o f

introducing P L is to gain leverage during negotiation with national level brand

m anufacturers for extra m argin. Increasing profitability by introduction o f low

145

co st and higher m argin private labels range is a key o b jectiv e . A private labels

category covers grocery item s and F M C G and processed food categories. T h e pilot

and m ain survey show s custom er preference towards national brands. N ational

brands preference is prim arily due to factors such as quality, reliab ility , trust. T o

understand aw areness and preferences o f private label m erchandise, respondents

w ere asked the questions. Finding and Interpretation regarding private label

(Q 1 2 _ l to Q 1 2 _ 5 ) is as follow s.

Chapter 6

ResponseY e sNo

N ot Sure

Numbers3 1 4916 0

n = 465

Percent6 7 .5 219 .531 2 .0 0

Table 6.11

Title: Awareness of Private Label

Source-Field Data

A w areness o f private label stands at 6 7 .5 2 percent. 1 9 .53 percent respondents

were not aw are o f P L category. Respondents who are not sure m ake tally o f 1 2 .0 0

percent. C om bined category o f ‘n o ’ and ‘not sure’ stands at 3 1 .5 3 percent.

R etailers need to create aw areness regarding their ow n products am ongst

custom ers in order to gain m ileage in private label strategy. Perform ance o f

private labels is another im portant criterion, w hich needs to be ascertained. D ata

was co llected to understand the sign ifican t aspect o f private labels perform ance

i.e. satisfaction o f respondents towards perform ance o f private labels. T h e

fo llow ing table no 6 .1 2 covers this aspect.

146

Chapter 6

Response Numbers PercentY e s 156 3 3 .5 4

No 78 16.77

N ot Sure 221 4 7 .5 2

N ot A pplicable 10 2 .1 5

n = 465

Table 6.12Title: Performance of Private Label Source-Field Data

3 3 .5 4 percent are satisfied with the perform ance o f private label. 1 6 .77 percent

respondents have responded as N o, w hereas 4 7 .5 2 percent are not sure about the

perform ance o f these products. O verall, about 65 percent o f respondents need to

approve the perform ance o f private label. T h is poses a challenge fo r retailers to

track satisfaction level o f respondents towards perform ance aspect in order to gain

advantage on this strategic aspect.

H ypothesis H 6 is accepted i.e. N ational Brands are preferred over private label

brands. Follow in g table 6 .1 3 depicts p reference o f respondents towards national

and private brands.

Response Numbers Percent

N ational 3 6 4 7 8 .2 7

Private 4 6 9 .8 9

B oth 55 11.85

n = 465

Table 6.13:Title: Preference of Respondents towards Brands Source-Field Data

147

Respondents prefer national brands. T h e p reference o f national brand is 7 8 .2 7

percent, w hereas 9 .8 9 percent custom er prefers private brands. A nother category

o f preference o f both the brands is 11 .85 percent. L ow er price is essen tia lly the

criterion fo r private brand selection . T h e prim ary reason fo r se lectin g national

brand is due to proven quality, trustw orthiness, and relib ility and brand experience

over the years, w hereas private label is preferred by a price- sensitive segm ent o f

custom ers.

Chapter 6

6.3.2: Retail Marketing Mix and Customer Experience Touch Points

Objective 2: T o m easure and assess the custom er satisfaction tow ards retail

m arketing m ix experience (R M M E ) and experience at serv ice touch points

(C E T P ) totaling to custom er total retail experience.

Findings: Findings o f all tw enty six param eters o f retail m arketing m ix factors

(Q 8 _ 4 to Q 8 _ 2 6 ) and custom er exp erience touch points (Q 9 _ A to Q 9 _ K ) are

given hereunder. T h is is based on dispersion show n in table 6 .1 1 to 6 .1 5 given in

A nnexure I . _____ __________ _— ---------- ^

Parking facility: R elian ce Fresh stood at num ber one position fo llow ed M ore. B ig

B azar, Sp en cers and V ish al stood at num bers 3 and 4 respectively .

Exterior design; B ig B azar is the m ost liked one and M ore stood at second

position. On this param eter. R e lian ce and Spencers are at num ber 3 and 4

respectively .

148

Safe baggage keeping facility: Food B azar leading with R elian ce Fresh as

num ber two in term s o f safe baggage keeping facility . T h ey are fo llow ed by M ore,

Sp en cer’ s and V ish al M ega M art.

Variety and range of merchandise: Food B azar keeps highest variety and range

o f m erchandise. It is subsequently follow ed by V ish al M ega M art, M ore, Sp en cer

and R elian ce Fresh . O ne o f the prim ary reasons is Food bazar is a part o f hyper

m arket where as rest are convenience stores.

Merchandise display; In m erchandise display o f R M M S , Food B a z a r is leading

follow ed by M ore. Sp en cers, R elian ce Fresh and V ish al M ega M art are at the next

ranks.

Quality of vegetables and fruits: Form s the part o f purchase basket. Respondents

ranked Spencers and M ore as num ber one and two respectively . Food B azar,

R eliance and V ish al M ega M art fo llow in order.

Loose grocery items: In Indian retail stores’ availability o f loose grocery item s

still m atters a lot. Food B azar and R elian ce Fresh stood at num ber one and two

positions. Subsequently , Spencers, M ore and V ish al M ega M art fo llow . In fact,

these three stores do not keep loose grocery item s.

Store Layout. In term s o f store layout. Food B azar is leading and is fo llow ed by

Spencers. M ore, V ish al and R elian ce Fresh fo llow subsequently.

Retail store proper signage/navigation boards: T h ese signages guide custom ers

and help to find out item s as per their need. Food B azar satisfies the m ost in this

respect follow ed by M ore, Spencers, R elian ce Fresh and V ishal M eg a M art.

Chapter 6

149

Music in side store: M u sic enhances m ood for shopping, esp ecia lly i f it is

pleasant. Food B a z a r leads on this area. M ore and Spencers fo llow at num ber two

and three. O bservation in this regard points out that Food Bazar, Sp en cers and

M ore outlet play m usic in side stores.

Shelves Arrangement: Shelves height and arrangem ent m akes shopping m ore

easy. C ustom er satisfaction is h igher fo r Food B azar shelves arrangem ent. M ore is

second best. Sp en cers, R elian ce and V ish al M eg a M art fo llow in order.

Promotion, Decoration inside the store: P rom otion at P O S (P oin t o f S a le )

m atters a lot and im pacts custom er p sychology. Food B azar and Sp en cers have

scored num ber one and two respectively . M ore, Spencers fo llow . V ish a l M eg a

M art scores poor on this param eter.

Flooring Cleanliness: H ygiene is m aintained by proper flooring clean lin ess. Food

B azar m aintains its leading position and M ore is the second best. O thers such as

R elian ce Fresh , V ish a l M eg a M art fo llow in ranking.

Store Ambience: C olou r and L igh ts arrangem ent is a part o f visual

m erchandising. C u stom er’ s first ch o ice is Food B a z a r fo llow ed by M ore.

Spencers, R elian ce F resh and V ish al M eg a M art com e next.

Drinking Water and Toilet Facility: R esearch show s that these b a sic facilities

such as drinking w ater and to ilet fac ilities are not avilable at convenient stores.

T h ese facilities at present are available at F oo d B a z a r hyperm arket.

Refrigerated System for Vegetables/Fruits: T h is fac ility im proves sh e lf life o f

perishable item s lik e vegetables and fruits. M ore stores score at first lev el fo llow s

Chapter 6

150

by Food B azar, Spencers, R elian ce Fresh. V ish al M ega M art does not have this

facility .

Major Credit/Debit card, Sodexho/Accor coupons: Paym ent m ode plays a

significant role fo r m onetary transaction. Food B azar leads in this regard fo llow ed

by M ore, R elian ce Fresh , Sp encers and V ish al M eg a M art.

Customer Care Desk (CCD): C ustom er care desk at store provide strong linkage

with custom ers in case o f answ ering queries, replacem ent o f m erchandise,

handling loyalty card m echanism and overall C R M system . A t present, Food

B azar is having custom er care desk w hereas the other retailers do not have

exclu sive C C D . C C D is to b e looked as an investm ent in relationship developm ent

rather than co st head.

Shopping Bags: A ll retailers presently provide th ick plastic bags.Food B a z a r and

M ore are fo llow ed in ranking by Sp en cers, V ish al M eg a M art and R elian ce Fresh .

Prices of Merchandise: E very retailer adopts different pricing strategies.

C ustom ers rated Food B azar, M ore as the m ost reasonably priced ones follow ed

by Sp encers, V ish al M eg a M art and R elian ce Fresh.

Staff Dress: D ress provides v isib ility to staff. In ranking. Food B a z a r is fo llow ed

by M ore, Spencers, R e lia n ce Fresh and V ish al M ega M art.

Customer Touch Points (CTP): Serv ice plays sign ificant im pact in creating

retailer’ s im age in cu stom er’ s mind. R espond ents’ exp erience at these touch points

show s the fo llow ing results:

Chapter 6

151

A. Polite and Friendly Staff Service: Food B azar scores on these regards

follow ed by M ore, Sp en cers, V ish a l M eg a M art and R elian ce Fresh .

B. Knowledge of Staff: T o d ay ’s retail stores are based on se lf-serv ice m odel.

C ustom er refers to s ta ff in case o f queries. K now ledge o f s ta ff m atters a lot at this

stage. Food B azar, M ore score high fo llow ed by Sp en cers, R e lian ce Fresh and

V ish al M ega M art.

C. Billing Speed: W aiting at b illin g counter is not preferred. Respondents are

satisfied with Food B azar the m ost, fo llow ed by Spencers. M ore, R elian ce Fresh

and V ish al M eg a M art fo llow in order.

D. Billing Counter Accuracy: E ven though com puterized system s are in p lace,

custom ers som e tim e face problem s on accu racy aspect esp ecia lly due to poor

linkage o f am ount on b ill and prom otion schem e prices inside the store. Food

B azar as num ber one and M ore at num ber tw o. On this account balan ce rankings

are R elian ce Fresh , Sp en cers fo llow ed by V ish a l M ega M art.

E. Welcome at Entry/Exit/Cash Counter: G reeting at these points is tough to

fo llow but would alw ays b e a pleasant and m em orable experience fo r custom ers.

Food B azar scores here fo llow ed by Sp en cers, R elian ce Fresh , M ore and V ish al

M ega mart.

F. Customer Care Desk (CCD): C ustom er care desk would provide a strong

linkage to C R M platform . Food B azar has exclu siv e C C D . R elian ce Fresh scores

is at second position, fo llow ed by Spencers, M ore and V ish al M ega M art.

Chapter 6

152

G. Complaint Handling: T h is is a part o f entire process and governed by

retailer’ s policy . Food B azar score the first rank, follow ed by M ore, Spencers,

R elian ce Fresh and V ish al M eg a M art.

H. Experience while making complaints: It is a process part and essentially

incident-based. Food B a z a r and M ore are leading with a narrow gap betw een

them. R anking closely fo llow ed by Sp en cers and R elian ce Fresh . V ish al M ega

M art the last one with a b ig gap on this account.

I . Experience while replacement/return: T h is show s w hether retailer fo llow

their policy in practice. Food B azar and Sp en cers stand at num ber one and two

respectively . T h is ranking fo llow ed with R e lia n ce Fresh , M ore and V ish al M ega

M art.

J. Overall Store Ambience: Food B azar leads with M ore at second slot. T h is is

closely fo llow ed by Spencers, R e lian ce Fresh .

K.Total Shopping Experience; Food B a z a r is num ber one with M ore at num ber

two. Sp encers, R e lian ce Fresh and V ish al M ega M art fo llow in order.

Customer Total Retail Experience (CTRE): Store am bience, visual

m erchandise, fa c ilities and experience at touch point m akes C T R E . C T R E is very

sign ificant and a deciding factor in cu stom er’ s next visits to particular store. Food

B azar, M ore is at num ber one and tw o positions. Th is is fo llow ed by Spencers,

R elian ce Fresh . V ish al M ega M art needs substantial im provem ent on this account.

Chapter 6

153

6.3.3: GAP Analysis: The Expected and The Existing Customer Relationship

Management: T h is Study was done to identify the gap betw een the expected and

the existing C R M practiced at retail stores. T h e graphs in this chapter depict this

gap for each param eter o f C R M (Q IO & Q 1 1 o f Q uestionnaire).

In order to understand this gap, statistical analysis was done to find out the gap

betw een expected and existing C R M p ractices. T o ch eck the hypothesis “T h ere is

significant gap betw een expected and existin g custom er relationship

m anagem ent” , the researcher has applied Paired t-test. T h e m eans fo r exp ected

custom er relationship m anagem ent is 5 0 .4 7 and for existing custom er relationship

m anagem ent is 9 1 .2 4 . A result show s that there is sign ificant d ifferen ce betw een

expected custom er relationship m anagem ent and existing custom er relationship

m anagem ent (as p-value is 0 .0 0 at 5 % lev el o f s ign ifican ce). Further the level o f

existing custom er relationship m anagem ent is m ore that the expected custom er

relationship m anagem ent. T h e fo llow in g section show s graphic representation

betw een the expected and the existing C R M practices fo r each param eter o f C R M .

T h is section would help to understand vital gap against each param eter.

Suggestions to reduce gap fo r various C R M areas are provided in Suggestions

Chapter.

Chapter 6

154

Chapter 6

1] N ew sletter, Special le tte r fro m R e ta i le r -E x p e c te d and E xistin g P ra c tic e

N ew sletter from R etailer

0% 4 %

4 2 % 3 7 %

17%

1 o Not important at all ■ Not Important o Neutral o Important ■ Extrem ely Important

Figure 6.04: Expected Practice: Newsletter from Retailers

Interpretation: 4 2 .0 percent respondents feel that it is im portant to get new sletter

from retailers, w here as overall 4 1 .0 feels it ’s not im portant. 17 .0 Percent prefers

to rem ain n eu tral.76 .0 percent com bined population disagrees that they receive

new sletter from retailers w hereas only 3 .0 percent respondents agrees about

getting new sletter from retailers. It show s w ide gap betw een the expected and the

existing practice regarding new sletter, special

letter.

Newsletter Receipt

0%

21%

68%

□ Strongly Agree ■ A gree □ Neutral a D isagree ■ Strongly D isagree

Figure 6.05: Existing Practice: Receipt of Newsletter

155

Chapter 6

2] A n n iv e rsa ry /G re e tin g c a rd fro m R e ta ile rs : E x p e cte d and E x istin g

P ra c tice

3 % 4 %

37%2 9 %

2 7 %

□ Not important at all ■ Not Important □ Neutral □ Important ■ Extremely Important

Figure 6.06: Greeting Card: Expectation from retailer

Interpretation: O verall 4 0 .0 percent respondents feel it ’s im portant to get

greeting cards and 3 3 .0 percent com bined population do not feel this is important.

8 5 .0 percent responded o f not getting greeting card from retailers.

Figure 6.07: Existing Practice: Greeting Card

156

3] Special offers/ZSchemes -Getting E-mail/SMS from Retailers

Chapter 6

Figure 6.08; Expectation: Special Offers via E-Mail/SMS

Interpretation: F or 7 0 .0 percent respondents, it is im portant to get

com m unication from retailers regarding special schem es/offers. O verall 8 7 .0 per

respondents confirm s o f not getting any com m unication in this regards. This

show s a wide gap in this sign ificant arena.

Figure 6.09: Existing Practice: Special Offers Receipt via E-mai!/SMS

157

Chapter 6

4] F re q u e n t S h o p p er: Special B en efits E x p e cta tio n fro m R etailers

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.10: Frequent Shopper Expectation: Special Benefits

Interpretation: 9 2 .0 percent custom er feels that they should get ben efit as a

frequent shopper w hereas 7 3 .0 percent respondents disagree o f getting any benefit

as a regular buyer. Only 10.0 percent custom ers are getting som e benefit. Th is

shows a large gap betw een expectation and existing practice.

0%

■ Strongly Agree ■Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.11: Existing Frequent Shopper Programs

158

Chapter 6

5] Loyalty Card and Reward Point Scheme: The Expected and The Existing

Practice Of Retailers

0 % 3 %

■ Not Important At All ■ Not Important ■ NeutralII ■ Important ■ Extremely Important

Figure 6.12: Loyalty Card and Reward Point Expectation

Interpretation: O verall 8 9 .0 percent respondents feel that that loyalty card is

either im portant or extrem ely im portant. W here as 4 9 .0 percent disagrees o f

having any existin g loyalty card schem e. R etailers need to im prove in order to

have better relationship with custom ers.

1%

■ Strongly Agree ■Agree ■ Neutral ■ Disagree ■ Strongly Disagree

Figure 6.13: Loyalty Card & Reward Point Scheme: Existing Practice

159

6 ] Savings of Customers Money due to Loyalty Card: Expected & Existing Practice of Retailers

Chapter 6

%

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.14: Expectation: Money Saving from Reward Point Scheme

Interpretation: 8 9 .0 percent custom ers responded that it ’s very im portant to get

savings benefit due to loyalty card. W hereas, only 3 0 .0 percent agrees on getting

benefit o f saving v is-a -v is 3 9 .0 percent disagrees o f getting any benefit.

2%

■ Strongly Agree ■ Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.15: Existing Practice: Reward Point Scheme Saves Money

160

Chapter 6

7] Shopping on P h on e F a cility : E x p e cta tio n and E xistin g P ra c tic e

1%

B Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.16: Expectation Regarding Phone Shopping Facility

Interpretation: O verall 7 2 .0 percent it is im portant to get facility o f shop over

phone. W hereas, 8 4 .0 percent custom ers denies that this facility is so far not

started by retailers in proper manner.

1%

■ Strongly Agree ■ Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.17: Existing Facility: Shop on Phone

161

Chapter 6

8] L o y a lty C a rd w ith F re e In su ra n ce B en efit

1%

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

F i g u r e 6 . 1 8 : E x p e c t a t i o n : L o y a l t y C a r d w i t h I n s u r a n c e B e n e f i t

Interpretation: F or 19 .0 percent insurance benefit is not im portant v is-a -v is 5 2 .0

percent feels it is im portant. 8 0 .0 denies to have loyalty card with any insurance

benefit, w here as 17 .0 rem ain neutral on this param eter.

1% 2%

■ Strongly Agree ■ Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.19: Existing Practice: Loyalty Card with Insurance Benefit

'v v L'-t-

I i

162

Chapter 6

9] Frequent Shopper Beneflt-Invitation for Event/Movie/Concert from Retailers [Expected and Existing Practice]

1%

■ Not Iniportanl At AM ■ Not Importont ■ Neutral

■ Important ■ Extremely Irnportant

Figure 6.20: Frequent Shopper Expectation:Invitation for Movie/Concert

Interpretation: 7 0 .0 percent respondent’s feels that it is in im portant b r a c k ^

w here as only 8 .0 percent put it as not im portant c a te g o ^ . 8 8 .0 percent disagrees

o f getting any such invitation from retailer in any m anner. O n lj^ ^ O ^ ercen t agrees.

Th is show s the wide gap betw een expected and existing frequent shopper benefit.

0% 2%

■ Strongly Agree ■ Agree ■ Neutral ■ Disagree ■ Strongly Disagree

Figure 6.21: Existing Practice: Frequent Shopper Benefit regarding Movie/Concert

163

Chapter 6

10] G ift ag ain st M on th ly P u rch a se s -E x p e c te d and E xistin g P ra c tic e o f

R etailers

0% 2%

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.22: Expectation Regarding Gift against Monthly Purchase

In te r p r e ta t io n : 8 2 .0 percent respondents expect som e kind o f gifts against their

m onthly purchase. A s o f now , overall 12 .0 percent agrees o f getting som e kinds o f

g ifts. R etailers need to w ork upon for reduction o f this gap.

Figure 6.23: Existing Practice of Gift against Monthly Purchase

164

Chapter 6

11] Attractive Prices/Schemes from Retailers-Expected and Existing Practice

■ Not Important At All ■ Not Important ■Neutral

■ Important ■ Extremely Important

Figure 6.24; Expectation regarding Attractive Schemes/Prices

Interpretation: 9 1 .0 percent definitely expects that retailer should float attractive

schem es. 6 9 .0 percent respondents agree that retailer does the sam e and 14.0

percent disagrees. N arrow gap identified on this param eter.

2%

■ Strongly Agree ■ Agree ■Neutral ■Disagree ■ Strongly Disagree

Figure 6.25: Existing Practice Regarding Attractive Schemes/Prices

165

Chapter 6

12] R e w a rd P oin t C o m m u n icatio n by E -M a il/S M S -E x p e cte d an d E xistin g

P ra ctice s o f R etailers

1%

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.26: Reward Point Communication: Expectation

In te rp re ta tio n : 7 2 .0 percent respondents expect to get com m unication from

retailer how ever, only 8 .0 percent agrees that they receive com m unication.

R etailer needs to adapt internet/mobile m ode to reduce this gap, w hich w ill benefit

them as w ell as regular custom ers.

0%

■ Strongly Agree ■ Agree ■ Neutral ■ Disagree ■ Strongly Disagree

Figure 6.27: Existing Practice: Reward Point Communication

166

Chapter 6

13] C o m m u n ity A ctivities fo r W o m e n -E x p e cte d and E xistin g P ra c tice s o f

R etailers

3% 2%

■ Not Important At All ■ Not Importanl ■ Neutral

■ Important ■ Extremely Important

Figure 6.28: Community Activities for Women: Expectation

In te rp re ta tio n : 5 8 .0 percent feels, this is sign ificant activ ity w hereas for 12.0

percent respondents it is not. O verall, 8 6 .0 percent dis agrees that retailer conducts

any such com m unity built up activity for w om en. O nly 1.0 percent agrees that

retailer does such social com m unity activity .

0% 1%

■ Strongly Agree ■ Agree ■ Neutral ■ Disagree ■ Strongly Disagree

Figure 6.29: Existing Practice: Community Activities for Women

167

Chapter 6

14] C o m m u n ity A ctivities fo r K id s-E x p e cte d an d E x istin g P ra c tice s o f

R etailers

1%

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.30: Community Activities for Kids: Expectation

In te rp re ta tio n : F or 7 7 .0 percent respondents this is im portant activ ity .8 8 .0

percent disagrees that retailers conducts such activ ity for kids. O nly 2 .0 percent

agrees for the sam e. T h is shows the w ide gap betw een expectation and existing

one.

0% 2%

■ Strongly Agree ■ Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.31: Existing Practice: Community Activities for Kids

168

Chapter 6

15] Social A ctiv itie s/P ro g ra m s by R etailers

0 % 3 %

■ Not Important At All ■ Not Important ■Neutral

■ Important ■ Extremely Important

Figure 6.32: Expectations: Social Activities of Retailers

In te r p r e ta t io n : 7 5 .0 percent respondents say socia l activ ities are im portant and

7 .0 percent feels it is very im portant. 7 7 .0 percent respondent’ s says that these

activities are not being carried out by retailers. S o c ia l activities im proves im age o f

retailer and is very im portant.

0% 2%

■ Strongly Agree ■ Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.33: Existing Practice: Social Activities of Retailers

169

Chapter 6

16] Customer Feedback Form-Availability in Store [Expected and Existing Practices]

2% 1%

■ Not Important Al All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.34: Expectation Regarding Customer Feedback Form Availability

Interpretation: 8 8 .0 percent definitely expects that form s should be available

inside store w hereas 5 6 .0 percent disagrees. 2 1 .0 percent agrees that form s are

available. A vailab ility o f form s at v isib le location would reduce this gap.

0%

■ Strongly Agree ■ Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.35: Customer Feedback Form Availability in Store: Existing Practice

170

17] Customer Feedback Form-Response from Retailers -Expected and Existing Scenario

Chapter 6

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.36: Response to Filled Customer Feedback Form: Expectation

Interpretation: 7 9 .0 percent respondent feels that retailers need to respond to

them once they fill the feedback fo rm .4 6 .0 percent disagrees with the sam e. For

14 .0 percent respondents, this activity is not applicable, since they have not filled

the form . Ju st 3 .0 percent agreed, show ing the vital gap.

I Strongly Agree ■Agree ■ Neutral

I Disagree ■ Strongly Disagree ■ Not Applicable

Figure 6.37: Customer Feedback Form Response: Existing Practice

171

Chapter 6

18] L o y alty C a rd H o ld e r-S e p a ra te C ash C o u n te r -E x p e c te d and E xistin g

P ra c tice

0%

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.38: Separate Cash Counter for Loyalty Card Holders: Expectation

In te r p r e ta t io n : C om bined 7 2 .0 percent respondent’ s rates o f having separate cash

counter for card h old er.76 .0 disagrees that any such facility is existing. 16.0

percent respondent how ever, feels that it is not im portant to have such facility .

19 .0 percent rem ain neutral w hile responding.

0%

■ Strongly Agree ■ Agree ■Neutral ■Disagree ■ Strongly Disagree

Figure 6.39: Existing Practice: Separate Cash Counter for Loyalty Card Holders

172

Chapter 6

19] G ift W ra p p in g F a cility -E x p e cte d an d E xistin g P ra c tic e o f R eta ilers

0%

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.40: Gift W rapping Facility: Expectation

In te r p r e ta t io n : 5 6 .0 percent g ives im portance o f having gift facility only 15.0

percent rates it as not im portant. 5 5 .0 percent disagrees that retailers have gift

w rapping facility at store.

2%

I Strongly Agree ■ Agree ■ Neutral ■Disagree

Figure 6.41: Existing Practice: Gift wrapping facility

173

Chapter 6

20] F re e H om e D elivery -E x p e c te d and E x istin g P ra c tic e o f R eta ilers

0%

■ Not Imporlanl Al All ■ Not Imporlant ■ Neutral

■ Important ■ Extremely Important

Figure 6.42: Expectation Regarding Free Home Delivery

In te rp re ta tio n : In tod ay’s urban life , tim e is an essence. F or 6 3 .0 percent

respondents it as im portant and 2 5 .0 percent rates it as m ost im portant service.

7 7 .0 percent disagrees that presently retailers have free hom e fac ility w here as 7 .0

percent does agrees that retailers does have this facility .

0%

■ Strongly Agree ■ Agree ■ Neutral ■ Disagree ■ Strongly Disagree

Figure 6.43: Existing Practice of Free Home Delivery

174

Chapter 6

21] C all C e n te r/T o ll F re e T elephone F a cility -E x p e cte d and E xistin g

P ra c tic e o f R etailers

3%

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.44: Call Center/Toll Free Number Service: Expectation

In te r p r e ta t io n : E xp ectancy o f this facility is 5 7 .0 percent w here as 2 2 .0 feels it is

not m uch o f an im portance. A s o f now , retailers do not provide any such service.

T h is can be value added service by retailer.

3% 2%

■ Strongly Agree ■Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.45: Existing Call Center/Toll Free Number Facility

175

Chapter 6

22] W ell T ra in in g to R eta ilers S ta ff-E x p e cte d and E xistin g P ra c tic e o f

R etailers

0% 0%

B Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.46: Training to Retailers Staff: Expectation

In te rp re ta tio n : 9 5 .0 percent respondents regarding criticality o f having training

to s ta ff where as only 2 5 .0 percent agrees that retailers s ta ff is w ell trained. B e in g

in service industry, focus on this crucial area is a must.

0%

■ Strongly Agree ■Agree ■ Neutral ■Disagree ■ Strongly Disagree

Figure 6.47; Existing Practice of Staff Training

176

Chapter 6

23] In te ra c tiv e W eb S ite : E x p e cte d and E xistin g P ra c tic e o f R eta ilers

2%

■ Not Important At All ■ Not Important ■Neutral

■ Important ■ Extremely Important

Figure 6.48: Expectation Regarding Interactive Web Site

In te rp re ta tio n : 5 2 .0 percent respondents rated it as im portant area w hereas

interestingly 8 2 .0 percent says it ’s as not applicable category. E -C o m m erce is yet

not developed in India. O nline grocery purchase w ould take tim e to becom e a

reality.

0% 0%

I strongly Agree

I Disagree

I Agree ■ Neutral

I Strongly Disagree ■ Not Applicable

Figure 6.49: Web Site Inter-activeness: Existing Scenario

177

Chapter 6

24] O nline Shopping F a cility -E x p e cta tio n an d E x istin g P ra c tic e o f R eta ilers

■ Not Important At All ■ Not Important ■ Neutral

■ Important ■ Extremely Important

Figure 6.50: Online Shopping Facility: Expectation

In te rp re ta tio n : 4 0 .0 percent respondents rated it as im portant area w hereas

interestingly 8 5 .0 percent says it’ s as not applicable category. E -C o m m erce is yet

not developed in India. O nline grocery purchase would take tim e to becom e a

reality.

0% 0%

I Strongly Agree

I Disagree

I Agree ■ Neutral

I Strongly Disagree ■ Not Applicable

Figure 6.51: Applicability & Satisfaction of Web site: Existing Scenario

178

R esearcher has interacted and interview ed store/Area m anagers from national

level organised retail chain stores on training and custom er orientation front.

6.3.4 Interview of Store/Area Managers on CRM

M r.R upesh Sin gh - S tore Incharge- B ig B azar Supercenter

M r.V inayak Pandharpure- C luster M anager- M ore

M r.A m aya - A rea M anager- Spencers

M r. Sun il- S tore M anager - R e lian ce Fresh

M r.V ikas - S tore M anager- V ish al M eg a M art

How would you d escribe “C ustom er F o cu s” o f your organization?

Big Bazar- W e are extrem ely^ orcu sed fo r 3 6 5 days. A ll our schem es and

practices are oriented towards custom ers.

More- A ll our activ ities and orientation is based upon custom er. Our

various program s revolve keeping custom ers in mind.

Spencers- Our M ission is to becom e “m ost respected retailer” . A t spencers,

we do not com prom ise custom er focu s at any cost.

Reliance Fresh- O ur goal is satisfying custom er in a ll respect.

Vishal - W e provide value fo r m oney fo r our custom ers.

How do you train & em pow er your store em ployees & sta ff?

Big Bazar- B ig B a z a r has separate in house training division called Future

Human D evelopm ent L td (F H D L ). F H D L hire and train em ployees. F or

m anagerial staff, w e have S E E K H O program , enabling them to do M B A in

retail m anagem ent. F o r s ta ff m em bers, w e have flex ib ility o f jo b rotation.

F H D L sets a panel, w hich selects team leader from team m em bers.

179

More- Our each sta ff m em ber undergoes 15 days training program . This

im m ediately follow ed with on jo b training. C oncept called ‘standing b r ie f

is given by cluster m anager to store m anager on store m anagem ent

regularly.

Spencers- H as got inhouse training center called Pragati. F or s ta ff

m em bers four day training program called foundation program is

conducted. F o r m anagerial level, w e have ‘star fu sion ’ program . M anagers

are trained on process and operational aspects o f store.

Reliance Fresh- Our em phasis is on jo b training. F o r m anagerial position,

w e provide training on operational and display aspect. T rain ing on

custom er orientation is given fo r s ta ff and m anagers.

Vishal- W e provides and equips s ta ff and store m anagers w ith on floo r

training. H andling and responding custom ers, are given special em phasis.

A ny sp ecific m ajor C R M program/activity executed by your organization?

Big Bazar- H afte ka sab se sasta din, m onthly bazar, m ahabachat w eek

are all m eant fo r custom ers. W e do track custom er flow and ticket size

(b illing am ount).

More- W e have tied up with insurance firm . Our regular custom ers are

given coupons, w hich would be useful fo r carrying out free blood test and

routine ch eck ups. W e provide value addition through our large basket o f

private labels.

Spencers- H as “Happy T ie s ’ program . W e have tied up with H S B C so that

custom er w ill have added benefit. O verall business im proved after this

program how ever our m argins suffered to som e extent. A s o f today this

program is not operational.

180

Reliance Fresh- Our Reliance One loyalty card is quite a su ccess. It

provides m ultiple benefits for the custom ers. Our value proposition is

through o ffering wide range o f private labels.

Vishal- W e have a tie up with S B I , to o ffer credit card. T h is acts as a

loyalty card fo r custom ers. L o t o f b e n e f its js^offered through this card.

W hich C R M areas, you would like to address in near future?

Big Bazar - W e definitely plan to com e out with innovative program s

based on custom er feed backs. I fee l that technology upgradation is critical

for C R M platform success.

More- W e w ould like to focus on cluster m arketing. M a jo r plans to get

custom er feed backs are in offing .

Spencers- A doption o f database, data-m ining technology would certainly

help. W e w ill soon announce an innovative C R M program on a nationw ide

basis.

Reliance Fresh- T ech n o lo gy im plem entation coupled with

personallization based prom otion o ffers is lined up in near future.

Vishal- W e are in a consolid ation phase. Internet based operation is

planned consid ering penetration o f digitalization.

181

6.3.5 Analysis of Opinion Leader InterviewsOpinion leaders are carefu lly chosen from corporate and education sectors. Top

level professionals having global exposure are selected as opinion leaders.

Interaction and interview s o f fo llow ing opinion leaders has been quite interesting.

Th ese opinion leaders have shared their exp erience, thoughts and view s on C R M

platform and C R M practices on g lobal and lo ca l level.

■ M r.K u m ar R ajgopalan- C E O - R eta iler A ssociation o f India (R A I)

■ M r. D hananjay K eskar- C hairm an- A dvertising C ouncil o f India (A S C I)

■ Dr. B a n erjee P K - V ice C han cellor - IC F A I U niversity

■ M r. M ukesh M alhotra- President- M aratha C ham ber o f C om m erce &

Industries and A gricultural (M C C IA ), M anaging D irector- W eik filed

■ M s. T ara Prabhakaran- S en ior V ice President (R etail & Shopper

co n su ltin g )-T N S India

■ M r. N itin R aval- Sen ior V ice President - IM R B International I , -t—'\ t d 'w VL

1. W hat is your opinion about C R M and its s ign ifican ce fo r organizations?

N o second thought as far as the sign ifican ce is concerned. Tod ay organizations

can not ex ist w ithout C R M . “R epeat cu stom er’ is o f great sign ifican ce

esp ecia lly in serv ice sector. R etention o f a custom er needs to b e pursued

vigoursousely. C R M has becom e m ore form alized and structured today with the

advent o f IT .

2. D o you think Indian retail organizations have b ecom e “C ustom er oriented” ?

In India, organized retail is com paritively still at an inception stage. R etailers

are slow ly catching up understanding C R M and its true sign ifican ce.

O rganizations m ust incu lcate custom er oriented culture and it has to be top- to-

182

down approach i.e. top m anagem ent’ s ro le to build custom er oriented culture is

critical. A s on today, retailers need it m ost since they are not m aking m uch o f

a profit. R elev an ce o f C R M has gone up considering today’ s m arket

com petition.

3. How do you com pare your experience in Indian store and developed countries retail food and grocery stores?

In developed countries like U S A , Europe, A ustralia retailers are extrem ely

particular about cleanliness and hygiene aspects. C ustom er’s participation is

equally im portant to m aintain the sam e. Thrust on shopping as an exp erience is

high in developed countries. In India, organized retailers have to im prove on

custom er experience front. In U S A , fresh food buying is low and infrequent.

A verage ticket size (b illin g ) is high. In India, average ticket size is low.

“R eplacem ent w ithout questions” is the norm in the developed countries. Th ey

believe and trust their custom ers. R ep lacem ent is possible across their other

chain stores. T h is is rem arkable. In India, custom ers are also sm art and it needs

to be understood that “relationship is a two w ay p rocess”

4. A ny sp ecific suggestions fo r custom er relationship im provem ent fo r Indian food and grocery retail stores?

R etailers approach and attitude towards cu stom er’s needs m indset change.

Im provem ent in all the areas including IT cap abilities needs to b e done.

R etailers need m ajo r im provem ent on hom e delivery front. C ertainly

custom er’ s expectations (esp ecia lly in urban area) are high w hereas retailers

are yet to catch up with them . T h ey need to find out the gap betw een

custom er’ s expectation and existin g C R M practices.

183

6.4 Suggestions and Implementation: Integrated Framework of CEM and CRM

Customer Experience Management: T h e study in chapter 2 reveals that

Custom er T o ta l R eta il E xp erience (C T R E ) a ffects W O M and im proves store

im age. R esearch er suggests Customer Engagement Mix based on 2 E approaches

nam ely [1] E vent (U nique Prom otion T h em e) and [2] Entertainm ent. R esearch er

coins the term Indian R eta il as an Indi-tail in order to re flect country sp ecific

culture. Literature review and case studies show the sign ifican ce o f lo ca l culture. It

also reveals the linkage o f custom er and strong relationship through understanding

o f local culture. C ustom er E xp erience M anagem ent (C E M ) is depicted in figure

n o .6 .5 3 . F igure no. 6 .5 2 shows entire shopping process reflected through three

phases such as pre-shopping phase, shopping phase and post shopping phase.

[1] Event: Unique Promotion Theme (UPT) - India is a country o f d iversity and

a land o f festivals. U rban India boasts cosm opolitan culture. R etailers need to

celebrate all national, regional, state and lo ca l festivals and special days in their

stores. U P T needs to be created in-side and out-side the store. U P T can b e created

in the form o f them atic display, signage, and art w ork. U P T needs to link with

festivals as w ell as sp ecia l days such as environm ent day, pow er conservation

days, friendship day.

I I ] Entertainment - Shoptainm ent i.e . entertainm ent w hile shopping. E xcitem en t

and en joym ent are em otional states and have a linkage with happiness.

Entertainm ent activ ities such as fun, gam es, contests, lucky draw s and gam es fo r

kids need to b e execu ted in the store. T h ese activ ities would create participatory

environm ent and induce fam ily involvem ent and participation. Entertainm ent acts

as a pull fac to r and becom e a store ch o ice in fluencer. It would influence

custom ers to stay m ore tim e inside the store.

184

Beneflts of 2 E Approaches: U P T would create a bond betw een custom ers and

retailers and act as a differentiation factor. E vent and entertainm ent would

influence custom ers to spend m ore tim e inside the store. L iterature survey

supports this sign ifican t aspect o f custom er shopping behavioral pattern. Thus,

retailer would get ben efit o f getting added custom er share o f w allet (C S O W ). 2 E

approaches would essentially m ake shopping a fun activ ity instead o f chore.

The Customer Relationship Management Framework: T h e CRM fram ew ork

depicted in figu re 6 .5 3 is based on fo llow in g six areas o f relationship m anagem ent

and CEM. T h is CRM fram ew ork is further im proved with added elem ent to levels

o f relationship strategies as suggested by Leonard B erry and A . Parsuram an

(figure 3 .1 1 ). T h e suggested fram ew ork im plem entation in an integrated m anner

would yield desired results.

1] Financial Rewards: Is one o f the b asic relationship developm ent strategy

adopted by all the retailers. F in ancial rew ards can be in the form o f keeping prices

below M R P . B en efits such as discounts, sp ecial prices fo r bundled products, g ift

against h igher b ill value are offered.

2] Loyalty Programs: L oyalty card program developm ent based on system atic

segm entation o f custom ers needs to b e done based on their need, wants and

expenditure patterns. Frequent shopper program s, loyalty club establishm ent are

part o f such loyalty program s. R etailers need to adopt m odem tech nology platform

such as database and data m ining in order to keep m ost updated custom er

database. Integration o f this database with organization inform ation system s would

prove to b e b en efic ia l in relationship developm ent.

3 ] Value Added Services (VAS): V A S m eans a lot to custom ers. S erv ices such as

free hom e delivery, ca ll center/toll free help line, g ift wrapping, and in teractive

185

w eb site add lot o f value fo r the custom ers. V A S im plem ented in an e ffic ie n t and

effectiv e m anner w ould be b en efic ia l in enhancing business proposition.

4] Relationship Development Programs [Communication Platform]:R elationship developm ent is based on digital and m obile m arketing

com m unication. T h is com m unication would help to target com m unication on 1:1

basis. Program covers com m unication through m onthly / or quarterly new sletter

inform ing custom ers about various prom otion schem es, o ffers, program s in

advance. A nniversary/Birth day card forw arded through e-m ail can be cost

e ffectiv e and goodw ill generator. E -m ail/SM S about special prom otional schem es

would reach and hit the targeted custom er base. R esp on se to custom ers feed b ack

form generates reta iler’ s im age as a responsive retailer.

5] Social/Community Development Activities: A s o f today, retailers are

conducting certain social/com m unity activ ities. H ow ever, frequency, aw areness

and reach o f such activ ities are very low . Contests/activities/com petition for

w om en, kids form the part o f relationship m anagem ent. A ctive ro le o f retailer in

notew orthy socia l and charitable cause, event would certainly im prove reta iler’s

im age in the m arket.

6] Collaborative Marketing: C ollaborative m arketing as the nam e depicts, is a

collaborative efforts betw een different parties to ach ieve certain goals. U nder this

relationship m anagem ent level, retailer needs to take an initiative to form a tie-up.

T h e tie-up can b e done with various service providers such as beauty parlors,

travel agencies, m ultip lexes, health & fitness clubs, air lines, pet houses and

catering services. C ustom ers can redeem their loyalty card points to avail services

o f such tied up serv ice providers as an added benefit. R etailers need to b e selective

in term s o f tie-up duration i.e . whether to have a tie up on short term to long term

basis. R etailers should se lect service providers based on their brand im age,

186

reputation and serv ice quality. Such tie-ups can be made for sp ecific city as w ell

as on state or national level basis.

A n eye fo r detail is a m ust for such tie-ups. T ie up com ponent details, term s and

conditions, list o f m utual benefits need to be w orked out in detail. In depth

planning and sm ooth execu tion o f various schem es under collaborative m arketing

need to be done. T h ese tie ups need to be nurtured. Sch em es should prom ote free

or extra offers, redem ption o f reward points (based on shopping value at retail

stores). S u ccess and sustenance o f such tie ups would depend upon the gain o f

w in-w in benefits to all the concerned parties i.e. retailer, service provider and

custom ers. K ey to su ccess lies in an e ffectiv e im plem entation o f the C R M

fram ew ork in an integrated manner. Im plem entation o f C E M -C R M needs to be

done in an increm ental m anner. In itially retailer needs to im plem ent C E M -C R M

fram ew ork on test basis across few stores. Im plem entation hurdles, obstacles

requires corretion with new processes. Subsequently , the im proved m odel can be

rolled out on nation w ide basis.

187

Oiro

Q.I•MIrtoOL-Ocro(UCOro

3O.<U</)ni

Q.I0)

10<UtoroQ.U>_c’5 .Q.O

s :toCMinid

CO<XQ.lu</)<IuQCDa.

188

0

01E«j

u

UJu•a+->

&o0)

c<

o0̂Ero

■aOJ■Ml/>VCUDtXO3tominVC

189

0 a>

1 Io>

a2

11h

12

u-o

ic«• • 0>

s

V©• •oZ£

. 1

190

6.4.1 Analysis of Store/Area Managers’ Interviews on Implementation of Suggested Framework

One o f the o b jectives o f this research w as to contribute to retail industry in a

practical manner. R esearch er has suggested an integrated C E M -C R M fram ew ork

in this research w ork. It is im portant to ch eck the validity and sign ifican ce o f such

fram ew ork from a practitioner’s point o f view . R esearch er has interacted with and

interview ed follow ing Store/Area m anagers from national level organised retail

chain stores. T h ese m anagers have p ractical experience in running and

im plem enting innovative practices in retail chain stores. R esearch er is keen to

know and understand their view s on the valid ity o f the suggested fram ew ork

im plem entation.

■ M r.A m aya - A rea M anager- Sp encers

■ M r.R upesh S in gh - S tore Incharge- B ig B azar Supercenter

■ M r.V in ay ak Pandharpure- C luster M anager- M ore

■ M r. Sun il- S tore M anager - R e lian ce Fresh

■ M r.V ikas - S tore M anager- V ish al M eg a M art

1. W hat do you think about suggested 2 E approach o f custom er exp erience

m anagem ent?

C E M - 2 E A pproach is a novel idea. In Indian m arket, festivals are celebrated

on local, regional and national level basis. T h e them e w ould involve

particpation from custom ers. C E M approach needs to b e handled carefu lly .

2. W h ich area is m ost im portant factor in 2 E approaches? W h y?

O pinions d iffer on this point. U nique Prom otion Th em e (U P T ) im plem entaion

requires know ledge on festivals, rituals. W hereas, another E i.e . entertainm ent

191

m ix is like opening a pandora’ s box. T o what extent, retailer can execu te is a

question mark. S trateg ic decision, such as w hat kind o f autonom y would be

given to store/area m anager also needs to be looked into. It can b e executed at

selected store branches, w here footfa lls and business is high.

3. W hat is your view/opinion about suggested relationship m anagem ent

fram ew ork?

C R M areas are w ell laid down. C ertain ly it w ould im prove relationship with

custom ers. W e agree with research er’ s view that im plem entation needs to be

done at selected outlets and in an increm ental m anner. B u siness results need

to be tallied with the expected one. H ow ever, capital investm ent would

equally b e huge to im plem ent all the areas. It m ay not b e possib le to execu te

all the areas at this developing stage o f Indian F & G retail. 2 -3 critica l areas

can be executed looking towards business prospects.

4 . A ccord ing to you, in w hich way relationship m anagem ent fram ew ork would

ben efit custom ers as w ell as retailers?

C ustom er - W ould b e happier to com e b a ck to retail stores and en joy

shopping. It needs to be seen, esp ecia lly how senior citizens w ould react to

entertainm ent approach in retail stores.

R etailer- C ollaborative m arketing im plem entation requires careful planning o f

schem es and partners selection . A dding serv ices can benefit in term s o f added

revenue. S tore im age and brand would get a booster.

192

6.4.2 Analysis of Customer Interviews on Implementation of Suggested

Framework

R esearch er has su ggested an integrated C E M -C R M fram ew ork in this research

w ork. One o f the beneficiaries o f such im plem entation is the cu sto m er. It is

im portant to ch eck validity and sig n ifican ce o f such fram ew ork from cu sto m e r’s

point o f view . R e se a rch e r has in teracted w ith and interview ed tw en ty cu stom ers.

R e search er has kept open app roach in ord er to learn from cu sto m ers. T his has

helped in understanding sh opper’ s v iew s, opinions regard in g im plem entation o f

su ggested fram ew ork .

a. D o yo u think su ggested E n g ag em en t M ix 2 E ap p roach w ould enh an ce

cu sto m er exp erien ce inside the sto re?

S trongly A g re e □ A g re e □ N eutral □ D isagree □ S tron gly D isagree □

Chapter 6

Custo

10 -rQ

imer F'eedback on Suggcstcd C EM -2 E A pproach

Q07 6 - 5 - 4 - 3 - 2 -1 -■ nU 1

□ Strongly Agree ■ Agree □ Neutral □ Disagree ■S tong ly Disagree

Figure No: 6.55Title: Customer Feedbaci< on Suggested CEM- 2E Approach Source: Interview Sessions

193

Chapters

b. W h eth er the su ggested C R M fram ew ork w ould en h an ce relationship

betw een cu sto m er and retailer?

S trongly A g re e □ A g re e □ N eu tral □ D isagree □ S trongly D isag ree □

Customer Feedback on Suggested CRM Areas Implementation

Customers

Response

□ Strongly Agree □ Agree □ Neutral □ Strongly Disagree ■ Disagree

Figure No: 6.55Title: Customer Feedback on Suggested CRM Areas Implementation Source: Interview Sessions

1. W h at do y ou think about su ggested 2 E ap p roach o f cu sto m er exp erien ce

m an agem en t?

It w ould be a w onderful exp erien ce to have an entertainm ent inside the store.

W ith unique p rom otion th em e (U P T ), cu sto m ers w ill be able to link their

culture, festivals w ith the re ta iler’ s them e display. Special days such as E arth

D ay, E n viron m en t D ay , and P o w er C on servation day w ill crea te so cial cau se

aw aren ess am on gst cu stom ers. R e ta ile r’s im ag e w ould get a boost.

194

Chapter 6

2 . W h ich area is m ost im portant fa c to r in 2 E ap p ro ach es? W h y ?

O verall cu stom ers are divided on im p ortan ce facto r. F e w cu sto m ers felt that

entertainm ent through con tests and lu ck y draw s w ould en g ag e cu stom ers.

O thers felt that U P T , esp ecially festival celeb ratio n display can cre a te p erfect

am b ien ce. It w ould provid e a unique shopping exp erien ce .

3 . W h at is you r view /opinion about su ggested relationship m an agem en t

fram ew o rk ?

F ram ew o rk is good . H ow ever, how m an y retailers w ould be able to

im plem ent it fully is a question m ark. Im p lem en tation o f 3 - 4 areas fully

w ould definitely help to im p rove relation sh ip w ith cu stom ers. Intended

benefits should reach cu stom ers. C on sid erin g cu rren t inflation, financial

areas in term s o f cu sto m er savin g is im portant.

4 . A cco rd in g to you, in w hich w ay relationship m an ag em en t fram ew o rk w ould

benefit cu sto m ers as w ell as re ta ilers?

R e ta i^ rs - M o re C u stom ers can b eco m e frequent shoppers. R etailers w ould

be able to retain cu sto m ers. W o rd o f M ou th p u b licity w ill help to a ttract new

cu stom ers. R etailer nam e w ould be know n w ithin v icin ity o f a store.

C u stom ers - C u stom ers w ould greatly benefit fro m free h om e d eliv ery and

value added serv ice such as receip t o f e -m ail/sm s about prom otion al sch em e.

“ S avin gs” w ould go up. C u stom ers can en joy benefits through co llab o rativ e

m arketing. G etting benefits due to co llab o rativ e m arketing w ould be really

great.

195

V ) ' ' ' ‘̂ ' 1

6.5.1 Conclusion of the Study: T h e research study m ade a sy stem atic e ffo rt to

fulfill the research o b jectiv es. T he retailing industry is on exp an sion m o d e. A n

indication clearly show s that global retail giants w ould enter Indian m ark et in n ear

future. In this hyper co m p etitiv e scen ario , focu s o f e v ery retailer w ou ld be on how

to acquire new cu sto m ers and retain relationship w ith existin g cu sto m ers. T h e

application o f retail m ark etin g m ix has to be done effectiv ely . D ep loym en t o f IT

solutions w ould b e co m e im p erative fo r retailers in o rd er to su rvive , grow and

expand. A su ggested C R M m odel w ould guide retailers in ach ievin g th eir targets

effectiv ely in this d y n am ic phase. T h e study con clu d e that the gap e x ists betw een

the exp ected and the existin g C R M p ractices im p lem en ted in organ ized natjional

level food and g ro ce ry retail ch ain stores. R etailers need to adopt in n ovative

strategies to acq u ire n ew set o f cu sto m ers and retain existin g cu sto m ers. R etailers

Im age and W o rd -o f-M o u th (W o M ) publicity facto rs are also im p ortan t store

ch o ice influencing facto rs . C u sto m e r’ s total retail exp erien ce depends upon

im plem entation o f retail m arketing m ix inside the store as w ell as en h an cin g

serv ice levels at to u ch points. T h e research findings proved the lin k age o f

cu sto m er total retail exp erie n ce w ith W o M p u blicity and store loyalty . R e se a rch e r

con clu d es that im p lem en tation o f su ggested C R M fram ew ork m odel i.e . C E M -2 E

app roach and C R M areas w ould help in acq uisition o f new cu sto m ers and en h an ce

relationship w ith ex istin g cu sto m ers.

6.5.2 Research Limitations: T h e title o f the research “A C ritical Study o f

C u sto m er R elation sh ip M an ag em en t (C R M )-W ith R eferen ce to O rgan ized

N ational L e v e l F o o d and G ro ce ry C hain R etailers , o f Pune city ( 2 0 0 4 - 2 0 0 9 ) ” is

very w ide and has ex ten siv ely larg e scop e. R e se a rch e r understands this and puts

up the lim itations w ith resp ect to the study as follow s.

6.5 O verview o f the Study

196

‘ *V'

I. L im itation s with resp ect to S co p e and D ata

II. L im itation s regard in g R esearch T o p ic

III.L im itation s related to O verall Study

6.5.2.1 Limitations with respect to Scope and Data:

a. S co p e : S co p e o f the research is defined as organ ized N ational level F & G

retailers o f Pune city . H o w ev er, only tw o b ranch stores o f each re ta iler h ave

been con sid ered fo r the study p urpose. T h ese retailers h ave m ore than 15

stores e x ce p t V ish al M e g a M art. T h is itself, lim its the scop e defined to a

large exten t. S trategizin g based on 4 6 5 respondents o f Pune city m ay not be

con sid ered as the right step to co n cep tu alize and im plem ent C R M p latform

on cou n try w ide basis.

ii. S am p le S ize: Q uestionnaire filled by 4 6 5 respondents is con sid ered as

optim um and rep resen tative for research purpose. C on sid erin g un iverse and

sam pling unit, th ese num bers o f respondent m ay not rep resen t large

population o f cu sto m ers w ho visit these retail stores on ev ery day basis.

iii. P erio d 2 0 0 4 - 2 0 0 9 : R e se a rch undertaken in the m onth o f F eb ru ary 2 0 0 8 .

T w o nation w ide re ta ilers ’ i.e .S u b h ik sha and T ru e M art o p erative in 2 0 0 8 w ere no

m ore op eration al during the research period. T hus, it low ered sam pling fram e to

five retailers only.

iv .H yp erm ark et and C o n v en ien ce S to res: F o o d B a z a r is op erating in B ig B a z a r

hyper m arket m all w h ereas others retailers are con v en ien ce stores. R ese a rch study

con sid ers th em as co m p etito rs sin ce they are op erating in F o o d and G ro ce ry

retailing. C on clu sion draw n fro m this research m ay not be acce p te d b y som e

research ers and profession als as com p etition on sam e p latform level. R etailers like

197

R elian ce, S p en cers, M o re have planned opening hyper m all in Pune city in near

future. This w ould ch an g e the co m p etitiv e scen ario in Pune city to a large exten t.

V. D ata: S ign ifican ce o f research largely depends upon the availab le o r co llected

data. A s the ca se o f m ajority o f research is co n cern ed , despite re se a rch e r’ s

keenness data obtained m ay not be in depth. T his research is no excep tio n to this.