414 ft Mega-yacht OCTOPUS seen anchored in Maldives,...

Transcript of 414 ft Mega-yacht OCTOPUS seen anchored in Maldives,...

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 1

Number 092 *** COLLECTION OF MARITIME PRESS CLIPPINGS *** Friday 01-04-2016

News reports received from readers and Internet News articles copied from various news sites.

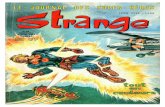

414 ft Mega-yacht OCTOPUS seen anchored in Maldives, close to Male.

Photo: Crew Blackbird ©

Due to travelling abroad this week the newsclippings may reach you irregularly

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 2

IN MEMORIAM

Op 75-jarige leeftijd is van ons heengegeaan

PIETER VERSPUIJ

PIET Apeldoorn 5 april 1940 Barendrecht 29 maart 2016 Piet was de laatste werkzame jaren Technical Superintendent bij Smit Harbour Towage in Rotterdam.

De crematie plechtigheid vindt plaats (vandaag) 1 april om 19:30 uur in de aula van crematorium Rotterdam , Maeterlinkweg 101 te Rotterdam-Zuid Na de plechtigheid is er gelegeheid tot condoleren

***** PIET, RUST ZACHT *****

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 3

Your feedback is important to me so please drop me an email if you have any photos or articles that may be of interest to the maritime interested people at sea and ashore

PLEASE SEND ALL PHOTOS / ARTICLES TO :

If you don't like to receive this bulletin anymore : To unsubscribe click here (English version) or visit the subscription page on our website.

http://www.maasmondmaritime.com/uitschrijven.aspx?lan=en-US

EVENTS, INCIDENTS & OPERATIONS

The 2007 delivered 110.7 mtr long and 14 mtr width JEANETTE,IMO 9357509 seen inbound for Rotterdam Photo: Krijn Hamelink (c)

RINA and Messina under investigation over irregular certifications

The Italian classification society RINA and Ignazio Messina & C. shipping company are being investigated by the local court in Genoa for some safety certifications released to the ships of the Genoa-based shipping company which appear not to be in compliance with the required safety rules according to the prosecutor. Five people including RINA surveyors and Messina’s top management are being investigated for forgery of a public deed. The case emerged in parallel to the investigations regarding the incident occurred on May 7 2013 when the Messina’s roro ship Jolly Nero, while maneuvering to leave the port of Genoa, bumped into the Coast Guard’s control tower causing the collapse of the structure and killing nine people The prosecutor of the court now is questioning the certifications RINA gave to four ships – Jolly Nero, Jolly Amaranto, Jolly Platino and Jolly Marrone – since 2008. Source: splash 24/7

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 4

Tampa shipping company to shutter doors, eliminate 55 jobs

By: Frances McMorris “It is anticipated that the closing of the location will result in a permanent employment loss for 55 employees…The positions will be eliminated on May 31, 2016,” said the letter signed by Lisa Sefranka, a senior manager in human resources for Hapag-Lloyd.The employees are not represented by a union and do not have “bumping rights,” the letter, dated March 18, said. The state's Department of Economic Opportunity website lists a worker adjustment and retraining notification, or WARN notice, filed by Hapag-Lloyd America LLC and Hapag-Lloyd USA. The shipping giant supplies end-to-end container transportation services to U.S. government agencies and their contractors. Its parent company is Hapag-Lloyd AG, which is based in Germany, has 177 modern container ships with 9,500 staff at more than 366 locations in 118 countries, according to its corporate website. In an effort to become a market leader in Latin America, Hapag-Lloyd took over the container shipping business of Chilean shipping company CSAV December 2014. Hapag-Lloyd was ranked No. 2 among TBBJ's top defense contractors in Tampa Bay in 2014 based on contracts from the Department of Defense in 2013. The company didn't respond by deadline to requests by phone and email for comment.These layoffs come on the heels of an announcement by the parent company of Everest University that it would lay off 127 workers at its Tampa location. Everest is owned by Zenith Education Group, a Minnesota-based provider of career-school training. A spokesperson for Zenith said the Everest University Brandon and Lakeland campuses, with a total of 343 students, will consolidate with Everest University Tampa Another company that recently announced layoffs was HSN, Inc. (NASDAQ: HSNI), a St. Petersburg-based multi-channel retailer. Last month, HSN announced that it eliminated about 2 percent of its local workforce in the last part of 2015, as the company dealt with a sales dip and a difficult retail climate.At the same time, Florida's unemployment rate continues to improve, hitting 5 percent in January, down from a revised 5.1 percent in December. The January jobless rate represents 492,000 Floridians being out of work from a labor force of 9.76 million. The state’s unemployment mark, which a year ago was at 5.7 percent, sits just behind the national mark of 4.9 percent. There were 36,000 jobs in the private sector created in January. Over the past year, jobs in construction have grown 7.3 percent, professional and business services have grown 5.5 percent, and positions in the leisure and hospitality fields are up 4.5 percent. Source: bizjournals

The HHL RIO DE JANEIRO outbound from le Havre Photo: Fabian Montreuil ©

Cosco Pacific Profit Beats Estimate on Write-Back of Provisions

Cosco Pacific Ltd., the container terminal operator of China’s biggest shipping company, reported a 30 percent increase in profit last year after the company wrote back a provision it made earlier.Net income rose to $382 million from $293 million a year earlier, the company said in a statement to the Hong Kong stock exchange Tuesday. That beat the $300 million average estimate of 12 analysts compiled by Bloomberg. Sales dropped 8.3 percent to $798.2 million, lagging behind an estimate for $825 million.Cosco Pacific wrote back provisions of $79.2 million from the sale of its 21.8 percent stake in China International Marine Containers (Group) Co. in 2013, helping lift net income. China reorganized its two biggest marine groups — China Ocean Shipping Group and China Shipping Group — as part of the

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 5

government’s efforts to overhaul inefficient state-run companies and bolster an economy that’s growing at its slowest pace in decades.Cosco Pacific’s terminals handled 19.3 million 20-foot containers last year, 1.1 percent more than in 2014, according to the statement. The company, which operates most of its container terminal business in China, signed an agreement with PSA International for an investment in Singapore Monday. The company’s shares fell 1.3 percent to HK$8.88 as of the midday trading break in Hong Kong Tuesday. The shares have gained 4 percent this year.Cosco Pacific said revenue from the terminals businesses fell by 5.8 percent to $487 million mainly due to the depreciation of the euro and the renminbi against the dollar. Source: Bloomberg

Taiyo Oil-chartered Aframax's Japan arrival delayed after minor collision

By Milton Stuards,

Japanese refiner Taiyo Oil confirmed that an Aframax tanker it had chartered was involved in a minor collision with another vessel Monday (Mar 28) while it was on its way to the port of Kikuma. The Aframax tanker, the 110,484-dwt Jag Lyall, was loaded with crude oil that was to be delivered to Taiyo Oil’s 118,000 b/d refinery in Kikuma. Taiyo Oil-chartered Aframax's Japan arrival delayed after minor collision A Taiyo Oil official could not immediately confirm the exact location and details of the collision but informed that the refiner expects to receive its cargo at the Western Japan refinery after some delays. The tanker was seen to have deviated from its original route Monday morning, and after sitting idle in the waters west of Tsushima it has continued its voyage to Kikuma.Taiyo Oil had fixed the Indian-flagged Jag Lyall to lift 100,000 mt of crude from Kozmino to Japan, loading March 24, at a lump sum rate of $710,000, according to Platts reports. Shipbrokers said the Jag Lyall had collided with a dry bulk carrier Monday morning.Great Eastern, the ship owner, could not be reached for comment Monday. A broker source said the incident could create significant delays for the vessel, including possible difficulty unloading the cargo due to damage and then dry docking for safety checks before it can be cleared to return to operation.The collision could also affect other commitments of the Jag Lyall. It had been fixed by Chinese charterer Day Harvest for a Kozmino-to-North China voyage loading April 6. The vessel was also fixed on a time charter to SK Energy for 24 months at $22,750/day and is yet to be delivered to the South Korean charterer, said shipping sources. Source: Platts

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 6

Hanjin Shipping sells London office building to repay debt

Facing a liquidity shortage and high debt ratio, Hanjin Shipping, a listed subsidiary of Korean Air, has sold its London office building to an undisclosed real estate investment company, according to a regulatory filing. The shipping company said that it would use the proceeds from the sale worth about 66.7 billion won ($57.4 million) to improve finances Industry sources say this means that Hanjin Shipping would use the cash it secured from the sale to repay its debt. It needs to refinance its debt worth over $400 million due in the first half of this year, according to news reports“Every year, the company goes through the same process of refinancing or rolling over its debt,” an industry source saidThe company is said to have sought loans from brokerages in the secondary market using its equities as collateral as the company was unable to secure loans from banks because of its high debt ratio, which stood at around 500 percent as of last year, well above the industry average of between 100 and 200 percent. “This is not a good sign,” the industry source said. A slowdown in China, in addition to decreasing oil prices that led to lower freight charges, has led to hardships in the shipping industryHowever, as Hanjin Group, whose subsidiaries include the country’s flag carrier Korean Air, is one of the big contributors to Korean exports, Hanjin Shipping is highly unlikely to default on its debt. Korean Air has a 33 percent stake in Hanjin Shipping. The 66.7 billion won proceeds are expected to be recorded under its assets on the balance sheet with an increase in non-operating income before interest expense in the income statement.“Much of its efforts will be put into using the proceeds to repay its debt to lower its debt ratio,” another industry source said. Source: The Korea Herald

Congratulations to Capt. Gujar, who has been with Teekay for 25 years!

Capt. Gujar started his cadet training in 1977 and joined the Merchant Fleet in August 1978. As a dedicated tanker-man, he joined Teekay in January 1991 as a Chief Officer. Seven year later, he assumed Command in June 1998 on board the MT Teekay Spirit. Between the years 2004 and 2005, Capt. Gujar became Commander of Teekay’s training vessel, the MT Torben SpiritDuring his 25 years at Teekay, he has trained and mentored numerous Officers and Crew who have advanced in their careers as a result of his dedication. But he has also learned a great deal in return – and feels it is his time to give back. Capt. Gujar is currently part of our global training and improvement team, continuing to share his knowledge by mentoring and coaching seafarers.Thank you Capt. Gujar for the hard work and efforts you have demonstrated throughout your career. We wish you many happy and fulfilling years ahead.

Republic of the Marshall Islands Maintains Qualitative Edge

The Republic of the Marshall Islands (RMI) received preliminary information regarding the United States Coast Guard’s (USCG’s) Qualship 21 list during Intertanko’s North American Panel meeting. The meeting, which took place on day one of the Connecticut Maritime Association’s (CMA’s) Shipping 2016 conference, was the largest attended North American Panel meeting to date. Rear Admiral Paul Thomas, Assistant Commandant for Prevention Policy, USCG presented the preliminary results showing the RMI on the Qualship 21 list for 2016. While these results are preliminary, the final results will be presented in the USCG’s 2016 Annual Report scheduled to be released in early summer. There were 26 eligible flag States in 2015 of which 13 fell off the 2016 Qualship 21 preliminary list. The RMI is the only flag State of the three largest that holds this status. The other flag States that continue on the list include Belgium, Bermuda, British Virgin Islands, Canada, Cayman Islands, Denmark, Gibraltar, Hong Kong, Japan, Republic of Korea, Switzerland, and the United Kingdom. Italy, Mexico and the Philippines are new to the 2016 Qualship 21 preliminary list.“I’ve been coming to CMA the past 16 years promoting the RMI flag and talking with our owners and operators and of course the other industry stakeholders that shape the maritime industry,” said Bill Gallagher, President of International Registries, Inc. which provides administrative and technical support to the RMI Maritime and Corporate Registries. “Even though the data is preliminary, getting the news during CMA that we will continue on

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 7

Qualship 21 for 12 consecutive years was timely and meant we could immediately share this information with our owners and operators in person,” continued Bill Gallagher.“The RMI fleet has more than 130 million gross tons and more than 50% of that tonnage was represented by attendees at the CMA conference this year,” said Mr. Gallagher. “Even with the growth of the Registry it is gratifying to note that we are maintaining our qualitative edge and based on the preliminary data will continue on Qualship 21 for what will now be 12 consecutive years,” concluded Mr. Gallagher. Source: International Registries, Inc. (IRI)

Red Box Energy Services PUGNAX left the builders for yard trials – Photo : REDBOX energy Services

Helm launches transformational software for harbor towage sector

Helm Operations, the global market-leader in harbor towage dispatch and billing software, has launched new software called simply Helm CONNECT Jobs, specifically designed to support tugboat owners and operators in a range of customer-facing tasks including contract management, tariffs, billing, dispatch and vessel logs. The Jobs software improves on the functionality of Helm’s market-leading program Helm Dispatch Manager for Harbor Towage, which is in constant use on around 400 vessels across the globe, and has been rebranded to reflect the transition to cloud-based storage. Jobs changes the way harbour towage companies operate their businesses. With Jobs, schedulers/dispatchers are doing much less data entry and have more time to focus on ensuring top-notch customer service. Management can view data in new ways either at a macro or micro level to make better business decisions. As well, Jobs is equally relevant for operators in the Americas, Australia, South East Asia, the Middle East and Europe.Cloud-based capability makes Jobs easy to deploy, with set up possible in offices ashore and/or on vessels. It is easily configured and tailored to meet individual clients’ requirements. It can also be integrated with other Helm software including Preventive Maintenance and Compliance in order to generate automatic warnings on out-of-date certificates, for example, or other non-compliances.A number of Helm’s current customers using the earlier software have already indicated that they plan to upgrade. Jobs is potentially also suitable for a whole range of new customers in the harbor towage sector. In addition, Helm Operations has plans to extend the Jobs market to other workboat

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 8

sectors including inland dry and liquid bulk transport firms, coastal ship operators, marine pilotage and ocean towage companies. the new software has been designed in close consultation with customers, with prototypes built and tested at customers’ own facilities to ensure the very best user experience. Jobs can be deployed in little more than a day and is easily customized. For ease of use and updates the software, much like Helm CONNECT Maintenance and Compliance, is cloud-based. Monthly fees are charged on a per vessel basis, with customers having unlimited users.Rodger Banister, VP Marketing at Helm Operations, says the company is pleased to be able to deliver significant benefits to any operator engaged in harbor towage. “Helm CONNECT Jobs’ automation of tariffs and contracts reduces credits and rebills, improves invoice turn-around time to 24 hours or better, and has shown in some cases to increase surcharge revenue by hundreds of thousands of dollars. What’s more, it’s much easier to set up than its predecessor and will provide substantial benefits to a wider range of operators – from the largest to some of the smallest,” he added.

Wallem Welcomes 3 Queens to Hong Kong The three cruise ships the QUEEN MARY 2 (QM2), the QUEEN VICTORIA (QV) and the QUEEN ELIZABETH

(QE) made a historic triple call to Hong Kong recently – all arriving in the city within a 24 hour period. The vessels, which were docked at both Ocean Terminal and Kai Tak Cruise Terminal, arrived carrying a total of 17,000 people onboard (including crew and guests).Photo showing the QUEEN VICTORIA coming into Hong Kong harbour with the QUEEN MARY 2 docked behind at Kai Tak Cruise Terminal. As their appointed

agent in Hong Kong, Wallem Ship Agency was proud to welcome the vessels to town.Despite our vast experience and knowledge in handling 500+ cruise calls a year, Wallem Ship Agency Managing Director Dickson Chin says that this triple call was quite a feat to plan and organize.“Berth reservations had to be made 2 years in advance and we worked very closely with Carnival UK and with all the relevant local Port and government authorities in the months, daysand hours leading up to the call to ensure that everything went smoothly,” said Mr Chin. The three vessels are operated by Cunard Line for Carnival UK which has been one ofWallem’s long term clients in Asia. They are now continuing their respective journeys to Singapore (QV) and to Nha Trang in Vietnam (QE and QM2) respectively.

Thousands of jobs at risk as India's Tata Steel seeks British exit

India's Tata Steel (TISC.NS) is seeking to sell Britain's biggest steelmaking business, putting thousands of jobs at risk in an industry that once dominated Britain but has been brought low by falling prices, high costs and Chinese competition.After a marathon board meeting in Mumbai, Tata said it would draw a line under its almost decade-long foray into Britain's steel industry, exiting the country entirely. The move could have an impact on Britain's closely fought vote in three months over whether to stay in the European Union. Britain's traditionally anti-EU media have blamed Brussels for preventing London from taking greater steps to protect the industry, although supporters of membership say EU policy is not responsible for the industry's plight.Tata, which employs about 15,000 people in Britain at sites including the giant Port Talbot plant in Wales, said its financial performance in Britain had deteriorated sharply in recent months and it wanted to exit as quickly as possible. The British government and the Welsh authorities said they were looking at all viable options to protect the steel industry, which has already shed thousands of jobs in just the last year."We are, and have, and continue to look at all options, and I mean all options. But what we first want to achieve from Tata is this period of time to allow a proper sale process," Anna Soubry, a minister for business, told BBC radio. She said she could not rule out the possibility of the government buying the plants until a new owner could be found.

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 9

The sale ramps up pressure on Prime Minister David Cameron's right-leaning Conservative government, which has sought to cultivate closer ties with China.Cameron's fate hangs in the balance when Britain votes on whether to stay in the EU in May, and his government has sought to avoid controversies during the runup to the vote.The Conservatives are resented in Britain's industrial heartlands for the demise of mining and manufacturing under former prime minister Margaret Thatcher in the 1980s.The government has said it is taking measures to help the steel sector but the fundamental problem remained the halving of steel prices in the past year, caused by overcapacity in China.Once a driver of the economy through the 19th and 20th centuries, many of Britain's former steel towns have been decimated by the industry's decline since its peak in the 1970s.The leader of the opposition Labour party, Jeremy Corbyn, called on the government to take a public stake in the industry which he called "the cornerstone of our manufacturing sector".Tata Steel bought Anglo-Dutch steelmaker Corus in 2007 and has since struggled to turn the giant around. Port Talbot, though far from its 1960s peak, still employs about 4,000 people, and Tata is one of the most significant private companies in Wales.Unions welcomed the decision not to shutter the plants but called on Tata to be a "responsible seller" and on the government to play its role."We don't just want more warm words. We want a detailed plan of action to find buyers and build confidence in potential investors in UK steel," Roy Rickhuss, general secretary of steelworkers' trade union Community, said.Steelmakers in Britain pay some of the highest energy costs and green taxes in the world and are also struggling to compete with record Chinese steel imports, which they say have been unfairly subsidised by Beijing.Most steel companies, including top producer ArcelorMittal (ISPA.AS), have been hit by plunging prices due to overcapacity in China, the world's biggest steel market, making Tata's task of finding a buyer all the more difficult.Tata Steel is the second-largest steel producer in Europe with a diversified presence across the continent. It has a crude steel production capacity of over 18 million tonnes per annum in Europe, but only 14 mtpa is operational.Two of its three main European units, Port Talbot and Scunthorpe, are in Britain, with the remaining operations in the Netherlands.Its share price has halved in the past five years, a period in which it recorded asset impairment of more than $2.88 billion (£2.0 billion) related to the UK business. The stock opened about 2 percent higher in Mumbai on Wednesday, as investors welcomed the decision to shed a burden on its Indian operation.For the year ending March 2015, the company took a write-down of a little over a billion dollars in its consolidated numbers. However, the tide seems to be turning for the India operations.Tata also said it was still in talks with investment firm Greybull Capital over the sale of its British long products unit, which makes steel for use in construction.source: Reuters (Additional reporting by Clara Ferreira Marques; editing by Stephen Coates, William Schomberg and Peter Graff)

Seen in the Port of Muscat, Oman.The SPLENDOUR OF THE SEAS (RCL) and next to her the EUROPA 2 (Hapag Lloyd) seen from the AMSTERDAM (HAL). 3 Cruise ships in one day must make the local souvenir shops very happy Photo: Mr. A.Nonymous ©

Norwegian offshore owners brace for more woe

Norwegian offshore owners expect access to capital to get even tighter in the coming months, according to a report just out from the Norwegian Shipowners’ Association.In 2016, only 15% of the firms questioned by the association consider the access to capital as good, compared to 25% last year and 50% in 2014.One out of every third company now considers the access to capital to be very tight, against less than 10% last year, the report said. “We expect that about half of the Norwegian rig fleet and every sixth Norwegian-controlled offshore vessel will not be employed as we approach summer this year. This is a serious situation”, the CEO of the Norwegian Shipowners’ Association, Sturla Henriksen, told Reuters in an interview. “We are going to see a restructuring in ownership because we cannot expect

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 10

that every shipowner will be capable to contribute with new capital”, he added.Some 111 offshore supply vessels and 23 oil rigs are expected to be taken out of operation by the end of June, an increase of 10 vessels and seven rigs respectively compared with February, the report said. Source: Splash 24/7

MS Aurora longest cruise ship to berth in Seychelles' Port Victoria

By: Julia Malbrook and Betymie Bonnelame Seychelles’ Port of Victoria made history on Monday when the MS AURORA became the longest cruise ship to berth there. Measuring 273 metres in length, the MS AURORA docked here following visit to Colombo, the capital of the island nation of Sri Lanka in Southeast Asia. The visit is part of the cruise ship’s world tour that began in Southampton, UK. In welcoming the MS AURORA, Seychelles’ Minister for Tourism and Culture Alain St. Ange said the arrival of cruise ships are now picking up after a lull due to the former piracy threat in the Indian Ocean.“It is good to note that four years ago cruise ships did not come to Seychelles. It is only for the past three years that we have started intensive work to encourage vessels to come to Seychelles,” said St. Ange. St. Ange added that cruise ship passengers contribute to the Seychelles’ economy, which is largely dependent on tourism, the top economic pillar, through activities they undertake during their visits. During its 10-hour stay in Seychelles, a group of 115 islands in the western Indian Ocean, the 1,700 passengers and 800 crew members on boardhad a chance to visit Mahe, the main island, before proceeding t Port-Louis, the capital of Mauritius.The Chief Executive of the Seychelles Port Authority, Colonel Andre Ciseau, said Seychelles is looking forward to continued success in making the Indian Ocean island nation a cruise ship and super yacht hub. MS AURORA, which is part of the British P&O cruise line, is a classicocean-going vessel built in 2000 at a cost of $375 million and can Carry a maximum of 2000 passengers.Port of Victoria will welcome another cruise ship, MS QUEEN VICTORIA, on April 11. Source; Seychelles News Agency

Customs Rotterdam Invest in Drying Systems for Survival Suits

The Dutch customs authorities are active every day with the imports, exports and transit of goods. The Netherlands in

particular is a distribution country. Every year more than 12 million loaded containers enter the harbour of Rotterdam. Already last year Pronomar delivered Top

Trock drying systems to the Dutch customs authorities in Leeuwarden and the Eemsharbour for Frisc-suits and boots.

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 11

After receiving numerous positive reactions from within the customs offices, also customs Rotterdam decided to join forces with Pronomar. The recently placed mobile drying system is very easy to transport between ship and shore. It will mainly be used for drying survival and diving suits, but will also be of importance for working and protection clothes of people who work outside the offices.While customs office Rotterdam can fully concentrate on the smooth proceeding of the big amount of goods to be transferred, the suit dryers will contribute to dry and functional work wear at all times.

The HAI YANG HAI YOU 278 spotted submerged off Singpore Photo: Capt. Jelle de Vries – Sunshine offshore services ©

see also : https://www.youtube.com/watch?v=1R4Hb0S7Ikc#t=101

US, Hong Kong bust huge smuggling operation United States and Hong Kong authorities have smashed a massive operation smuggling Chinese-made clothing, believed to be the largest such find ever uncovered on the US West Coast. United States and Hong Kong authorities have smashed a massive operation smuggling Chinese-made clothing, believed to be the largest such find ever uncovered on the US West Coast.The elaborate scheme involved more than US$600 million worth of Chinese-made apparel being illegally imported into the US under the guise that the merchandise was destined to companies in Mexico, when in fact it was delivered to buyers throughout the United States.The multi-national operation was aimed at avoiding US import duties and quotas, officials said.An investigation launched by the US and Hong Kong governments in 2000 revealed that more than 7,000 shipping containers of clothing had been imported into the United States as a result of the smuggling ring, whose operatives were based in China, Hong Kong and the US.The US Immigration and Customs Enforcement agency said on Tuesday that investigators believe the scheme led to more than US$60 million in lost customs revenue. The US and Hong Kong governments will share out US$20.5 million in forfeited assets seized as part of the probe. "This payout has been a long time coming, but it is a testament to the perseverance of the personnel on two continents who were involved in dismantling this scheme," said Joseph Macias, special agent in charge of the Los Angeles office of Home Security Investigations."Commercial smuggling is a multibillion-dollar global industry that robs governments of vital revenues and undermines our economy."Five people, including the owner of a Los Angeles area trucking company, have been charged in the case.Armando Salcedo, 53, owner of Friends Global Logistics trucking company, pleaded guilty in 2008 to smuggling charges and making false customs declarations and was sentenced to 18 months in prison. The remaining four defendants fled and remain at large, authorities said. Source: channelnewsasia

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 12

ICS Represents Shipowners in UN Ocean Battle The International Chamber of Shipping (ICS) has represented the interests of shipowners at the opening session of a UN Preparatory Committee starting work on a new legal instrument under the United Nations Convention on the Law of the Sea (UNCLOS). The establishment of the new UN Preparatory Committee, under the auspices of the Division for Ocean Affairs and the Law of the Sea, follows the decision of the United Nations General Assembly, in 2015, that UNCLOS should be expanded to include a new legally binding instrument on the conservation of marine life in areas beyond national jurisdiction. This is particularly relevant to shipping because the new UN instrument could include area-based management tools such as Marine Protected Areas on the high seas. ICS is keen to ensure that the interests of shipping will not be unwittingly affected by this new UN work stream. The ICS has emphasised to government negotiators that shipping already enjoys a long established and comprehensive framework of global Conventions and regulations that have been developed by the International Maritime Organization (IMO). UNCLOS provides the basic legal framework for protecting the oceans, and under the authority of UNCLOS the shipping industry is regulated by IMO. But the regulation of other ocean activities, especially on the high seas, is not so well developed. The intention behind the proposed new UN instrument is to develop solutions to the vacuum that exists with respect to issues such as preserving global fish stocks from unregulated fishing, and damage to marine ecosystems caused by land based agriculture and industry. ICS Director of Policy and External Relations, Simon Bennett, commented: “This is undoubtedly an important and legitimate exercise. “But whatever might be decided in the future with respect to UNCLOS, great care should be taken by governments with regard to the maintenance of freedom of the high seas, rights of navigation currently enshrined within UNCLOS, and the current balance that exists between the rights and obligations of flag states, coastal states and port states. “In the context of regulating international shipping, the current balance has worked very well, as demonstrated by the reduction in the number of maritime accidents and pollution incidents. “It will therefore be important for the UN Committee to take account of any potential overlap or duplication of existing IMO Conventions.” The work of the UN Preparatory Committee is eventually expected to lead, at some point after 2018, to a Diplomatic Conference which will adopt a new UNCLOS implementation agreement. ICS will continue to monitor these important developments in oceans governance closely, in co-operation with the World Ocean Council and in liaison with IMO. Source: porttechnology

AILEEN M towing tug MEHARI en route Rimini Italy. Both vessels will be working on a project in Italy.

Photo: Maritime Photo Maassluis © CLICK at the Photo !

Oil Volatility Leading Up to OPEC Meeting, Market Rebalance Afterward: Mirabaud

Vaqar Zuberi says supply reduction is necessary to have a "meaningful impact" on prices.While he predicts oil price volatility leading up to the Doha meeting between members of the Organization of the Petroleum Exporting Countries (OPEC) and non-member producers, Vaqar Zuberi, portfolio manager & senior analyst with Mirabaud Asset Management, believes the supply-demand gap will begin to close in the second half of this year. In this regard, Zuberi joins the growing list of analysts who suspect the worst may be over for oil and that a market balance – which critics say the OPEC/non-member meeting to discuss a price freeze will not be able to achieve – is in the offing.

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 13

Of the weeks leading up to the April 17 summit (which Iran and Libya have pledged not to attend because they are intent on restoring their own output), Zuberi was quoted by Gulf news as saying, "We think for time being oil prices would remain volatile, subject to the release of data." He added: "We believe in the interest of all parties to stabilize the prices of oil and we believe that comments alone won't have a meaningful impact on prices till we see a clear trend of supply coming down."Zuberi is far more optimistic about the second half of this year: "We believe that the supply demand gap will reverse in the second half of 2016 and early 2017. "The demand from U.S. is well bid, amid demand from the emerging markets; there is supply destruction going on as large number of producers have become unprofitable." Meanwhile, analysts at Commerzbank added to the voluminous criticism of the proposed OPEC/non-member output freeze by stating in a new report, "The meeting is turning more and more into a farce."It is hardly surprising that Libya is not interested in the Doha meeting: like Iran, it first wants to increase output and then talk about a freeze."Indeed, Bijan Namdar Zanganeh, oil minister for the Islamic Republic, complained to the press last month that "It is very ridiculous, they come up with the proposal on freezing oil production and call for this freeze to take place in their 10 million barrels a day production vis-a-vis Iran's 1 million barrels a day" planned production boost. Source: Ship & Bunker News Team

63 Months Jail, $34 Million in Restitution Payments for Singapore National's Role in

GDMA Scandal The US Department of Justice has handed down another sentence in the Glenn Marine scandal.

Singapore national Alex Wisidagama, former global manager of government contracts, Glenn Defense Marine Asia (GDMA), has been sentenced to 63 months in jail for his part in a fraudulent billing scheme that saw the Navy over charged $34 million for ship husbandry services, including through artificially inflated bunker prices, the US Department of Justice has said. In addition to the jail sentence, U.S. District Judge for the Southern District of California, Janis L. Sammartino, in the March 18 ruling also ordered Wisidagama to pay $34.8 million in restitution to the Navy.Wisidagama is the third defendant to be sentenced in the long-running GDMA fraud and corruption scheme. According to admissions made as part of his plea agreement, Wisidagama and his cousin, Malaysian national, Leonard Glenn Francis, CEO, GDMA, perpetrated a scheme to defraud the U.S. Navy on ship husbanding contracts by, among other things, over-billing for the sale of goods, fuel, and port tariffs. Records were said to show that GDMA's contracts with the U.S. Navy allowed it to sell certain categories of supplies for which GDMA was the lowest bidder. To make it appear that GDMA's prices were competitive, Wisidagama admitted that he and others created false price quotations purporting to be from third-party vendors and submitted them to the U.S. Navy.Because the contracts forbade GDMA from making up the price of fuel that it supplied to U.S. Navy ships, Wisidagama admitted that he and his conspirators created false invoices purporting to show that GDMA paid more to purchase fuel than was actually the case, allowing GDMA to build undisclosed markups into the prices at which it supplied fuel to the U.S. Navy.Wisidagama pleaded guilty in March of 2014, having admitted that the scheme caused more than $34 million in total losses to the U.S. Navy.To date ten individuals have been charged in connection with this scheme; of those, nine have pleaded guilty, including Malaki, Commander Michael Vannak Khem Misiewicz, Captain Daniel Dusek, NCIS Special Agent John Beliveau, Commander Jose Luis Sanchez and U.S. Navy Petty Officer First Class Dan Layug. As Ship & Bunker reported

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 14

last year, former Department of Defense civilian employee Paul Simpkins was the ninth person to be charged in the case; he currently awaits trial. source: Ship & Bunker

Three Die After Inhaling Hydrogen Sulfide Three men died and three others were injured on Monday after inhaling hydrogen sulfide on a fishing trawler at Sabah port, Malaysia.Two of the men, identified as Sundrianto Julkepli, 22, and Imran Ladia, 41, died on board the vessel while the third died in hospital. Two others are in a critical condition.Local media reports that the incident happened around 7am when there were eight people on the vessel. One crew member apparently fell into a barrel used for storing fish after opening the lid and accidentally inhaling the fumes. He died soon after. A colleague went to his aid and also succumbed to the fumes and died.The men are believed to have inhaled the gas while loading barrels of rotten fish destined to be processed into fertilizer. Source: MAREX

SEAJACKS SCYLLA seen loading in the Eemsharbour (The Netherlands) Photo : Flying Focus Aerial Photography www.flyingfocus.nl ©

Sevan Drilling Ltd amends drilling contracts and secures new employment for Sevan Driller Reference is made to the Fourth Quarter Earnings Release on February 25, 2016, Sevan Drilling Limited amended contracts for the Sevan Driller and Sevan Brasil with Petroleo Brasileiro SA and secured short-term employment for Sevan Driller in Brazil with Shell do Brasil commencing in the second quarter 2016. In December 2015, the Sevan Driller contract was suspended by Petrobras as part of the ongoing commercial negotiations for both of Sevan Drilling's units employed with Petrobras. Today, Petrobras and Sevan Drilling executed an early termination of the Sevan Driller contract and reduction of the contract dayrate on the Sevan Brasil. The Company determined on balance that this was the preferred alternative to potentially having both contracts terminated and exposing the Company to a protracted legal challenge with an uncertain outcome. As a result, the Company was able to preserve $220 million of contracted revenue backlog for the Sevan Brasil contract and to allow the Sevan Driller to obtain alternative employment.The Sevan Brasil contract dayrate has been reduced to US$250,000 per day effective 26 February 2016 through the remaining term of the contract, ending July 2018 and a portion of the dayrate continues to be denominated in Brasilian Reals. The Sevan Driller contract was mutually agreed to be cancelled effective from 1 December 2015.Subsequent to the effective cancellation of the contact for the Sevan Driller, the unit has been awarded a well intervention contract

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 15

by Shell in Brazil for 60 days with two 30 day options commencing in the second quarter of 2016, adding approximately US$11 million in revenue backlog. Daily operating cost is expected to be significantly lower as the rig will perform non-drilling activities for Shell.As of 26 February 2016, the Company's total contracted revenue backlog is now estimated at $509 million, including the extension of the Sevan Louisiana contract amended in November 2014. For more information, please visit: http://www.sevandrilling.com

Big volume shipping no longer means big value rates, reveals Xeneta

Xeneta, the leading benchmarking and market intelligence platform for containerized ocean freight, has utilised its data of global shipping rates to make a startling, and counterintuitive, claim – big volume shippers are not paying the best shipping rates. According to the Oslo-based company, over the course of the last 18 months, high-volume shippers are actually being locked in to unfavourable long-term agreements, leaving others to take advantage of the advent of low fuel prices, megaship capacities and hyper efficient supply change management. “Volume no longer necessarily translates to savings,” comments Patrik Berglund, Xeneta CEO. “In fact, in many cases, big volume shippers are paying far above the current Asia-Europe or Asia-US rates. “These businesses, which are often related to consumer goods, typically sign annual supply contracts with large vendors in order to keep merchandise in their stores, or to supply the giant EU and/or American retail chains. This provides them with supply chain stability, and predictability, but it also locks them into agreements that are fixed, and don’t always deliver value.” To illustrate this, Berglund points towards the 2015 Far East Main Port – North West Europe Main Port Rates in the Xeneta platform. Here, he notes, there are major differences between long- and short-term contracts. For a 40’ container shipped as part of a long-term contract the mean market low was USD 1175 and the average USD 1696. Short-term prices were markedly lower, with a mean market low of USD 857 and an average of USD 1355. There was an even greater disparity between minimum prices, with the long-term low at USD 807 and an average of USD 1535. Compare this to the same short-term rates of USD 240 and USD 571. “It’s a startling difference,” Berglund states. “One that suggests that the big volume shippers are essentially leaving money on the table with every container shipped.” He also has a clear opinion of who is on hand to pocket it: “We have to look to who the companies are signing these agreements with. Some shipping lines are benefitting of course, but it seems the third party logistics (3PLs) firms are arguably becoming the real winners here.“It’s become more common for shippers to cut their logistics staff, and overheads, and look to outsourcing. This has fuelled a boom in 3PLs and 4PLs. These firms, which typically work with smaller volume shippers, also sign long-term agreements with some big volume shippers and use those volumes to negotiate lower ocean freight rates. 3PLs are making their significant margins from short- and long-term agreements and carrier kickbacks.”Berglund concedes that business is business, but notes that all parties need to be aware of the reality of the rates and a disparity that, given the influences of factors such as fuel price, could be set to grow wider and wider. He adds that as rates began to drop in 2014, and oil prices collapsed in 2015, the result was a widening gap between short-term and long-term contract rates.“We make it our job to have a detailed global picture of containerized freight rates. Any business that ships large volumes of goods should be aware of this prior to engaging in negotiations. Knowledge translates to bargaining power, and if the shippers are going to get the rates that their volume of business deserves then they need to have access to the best market intelligence.” Source: Xeneta

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 16

China Shipping Development reports improved 2015 results on tanker market bonanza

Facing the complicated market environment, the Group adhered to the “strategic guidance and innovation-driven” general keynotes of work and to continue to deepen the strategy of “major clients, great co-operation and comprehensive services”. The Company actively innovated its business ideas and modes, pushed forward a transformation in an orderly manner and obtained breakthroughs in all aspects including marketing, cost control, safety management, management upgrade and capital operation, maintaining an overall stable development trend. In 2015, the volume of cargo shipped by the Company accumulated to approximately 184 million tonnes, up 1.1% year-on-year; transport turnover were approximately 470.9 billion tonne-nactical miles, increased by 9.5% year-on-year; revenue derived from operations (after business tax and surcharge) was approximately RMB12,213 million, decreased by 0.5% year-on-year; operating costs were approximately RMB9,867 million, decreased by 9.4% year-on-year. The profit for the year attributable to owners of the Company was RMB417 million, and the basic earnings per share was RMB10.49 cents. In 2015, the oil shipping market was better than in 2014 in general. Affected by beneficial factors such as the higher shipping prices, significant decrease in fuel prices and gradual realisation of results from various innovative measures of the Company, oil shipping business obtained a good result. For domestic oil shipment, due to the opening up of the domestic crude oil market, the Company further established the operating strategy and goal of “leading the innovation of the operating mode of the domestic crude oil market, becoming the leading force to safeguard the market order and continuously consolidating and enhancing its leading position in the market”. Centered on this strategy objective, the Company strengthened strategic layout, strategically exited the refined oil market, innovated the integrated logistical service modes and seized the opportunities of capital injection into Beihai Shipping to establish a close partnership with China National Offshore Oil Corporation. The Company actively promoted the new “competition and cooperation” mode to undergo cooperation of various kinds with the domestic shipping companies, such as exchanging the anchors, the routes, the cargo and short-and-long term rental. They not only brought a win-win solution to the shipping companies, but also increased protection for the shipping customers, realising a win-win situation for both the shipment owner and the shipping company. In 2015, the Company’s domestic oil transport turnover was 15.54 billion tonne-nautical miles, increased by 5.1% year-on-year; revenue derived from operations was RMB2,158 million, increased by 8.6% year-on-year; gross profit rate was 40.5%, increased by 6.5% year-on-year.The Company’s market share in the domestic shipping market remained at around 54%. In particular, with the year-on-year decrease by 2.9% of the freight rates for coastal crude oil, the Company’s domestic crude shipping business continued to maintain a relatively high profitability level with a gross profit rate of 43.7%, realising gross profit of RMB860 million, increased by 31.0% year-on-year. In the international oil shipment market, the Company actively carried out the strategies of “globalisation”, “following” and “diversification”, which greatly enhanced the Company’s ability to study the market, to bargain, to resist market fluctuation and its profitability. In aspects of client diversification, market diversification, route diversification and business diversification combining self-operation and term lease, or long-term lease and short-term lease, comprehensive breakthrough has been achieved to significantly lower dependency on single clients, single markets and single routes. Profitability is further strengthened. In 2015, the Company completed exported oil shipment turnover of 152.2 billion tonne-nautical miles, decreased by 13.4% year-on-year (mainly because part of the self-operating vessels changed to vessels for lease); transport income was RMB3,921 million, increased by 11.6% year-on-year; gross profit rate was 32.8% and gross profit was RMB1,284 million, increased by RMB1,140 million year-on-year, representing an increase of 786.6%. In 2015, the Group achieved a shipping volume of approximately 167.7 billion tonne-nautical miles of oil, representing a decrease of approximately 12.0% year-on-year; revenue derived from oil transportation was approximately RMB6,079 million, representing an increase of 10.5% year-on-year. Shipping business — Dry bulk shipment For domestic bulk cargo shipment, in 2015, China Shipping Bulk Carrier Co., Limited (“CS Bulk”) strengthened marketing on domestic big customers by advanced arrangement of Contract of Aftreightment (“COA Contract”) contract negotiations early in the year, and strived to increase the fulfilment rate of the contracts. In 2015, CS Bulk signed COA contracts for domestic dry bulk cargoes with a shipping volume of 50.95 million tonnes. Through early disposal and seal of its coastal transport capacity, the Company decreased its loss by RMB168 million during the whole year. For international dry bulk shipment, the Company actively adjusted the market structure to transform it from the traditional coastal shipping market to ocean cargo market; strengthened the cooperation with Baosteel Group Corporation (“Baosteel”) and Wuhan Iron And Steel (Group) Corporation (“Wugang”), actively pushed forward the cooperation with Valley in Brazil. Foreign trading capacity took up 77%, with a foreign turnover of 82%. Foreign

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 17

transport income took up 75% of the total income.Meanwhile, the Company adjusted the supply structure to transform it from traditional thermal coal shipment to non-coal shipment of high added-value including grain and chemical fertiliser. Non-coal shipping capacity took up 75%, while the non-coal shipping volume reached 58%. For strengthening of international cargo shipment, the Company strived to improve very large ore carriers (“VLOC”) operation and completed 56 routes, turnover of 14.17 million tonnes during the whole year and achieved operating income of RMB1,252 million. Meanwhile, the Company enhanced its ability to study the market for better cargo capacity layout. The Company increased capacity to the third country, and its capacity input in the third countries during the whole year increased by 7.9% year-on-year and the third countries’ turnover increased by 11.6% year-on-year. In addition, the Company developed cargo rental business, achieving cargo rental income of RMB186 million during the whole year. In 2015, the Group achieved a shipping volume of approximately 303.2 billion tonne-nautical miles of dry bulk cargo, representing an increase of approximately 26.6% year-on-year; operating revenue derived from dry bulk cargo transportation was approximately RMB6,134 million, representing a decrease of 9.5% year-on-year. Progress made in Liquefied natural gas (“LNG”) shipment In 2015, the Company steadily pushed forward the phase 1 vessel construction of the Mobil DES project and the APLNG project, and actively worked better on the negotiation and development of the relevant projects. The Company strengthened coordination with its business partners, accelerated the construction of a team of talents. As of December 2015, there were 13 vessels in total owned by the Mobile DES project, APLNG project and YAMAL project which the Company participated or directed. In 2015, the Company’s LNG business entered the stage of garnering profits. The 3 LNG vessels of the Mobile DES project were put into operation and completed 13 voyages with shipment of 990,000 tonnes, turnover of 4,300 million tonne-nautical miles. The Company achieved net profits of approximately USD7.13 million, and investment profits of RMB13.33 million under the equity method. Source: China Shipping Development

The INDEPENDENT PERSUIT navigating the Westerschelde photo: Walter de Groot ©

MPI Adventure contracted for commissioning works on the Sandbank OSS

We are pleased to announce that MPI ADVENTURE has been contracted to assist with the commissioning works on the offshore substation of the Sandbank Offshore Wind Farm. MPI ADVENTURE will provide accommodation services, lifting operations and provision of supplies. The Sandbank Offshore Wind Farm is located approximately 90km west of the island of Sylt in the German Bight. It will consist of 72 4.0MW turbines which will also be installed by MPI ADVENTURE as of summer 2016. We are confident that MPI Adventure will make a valuable contribution to the commissioning works of the Sandbank offshore substation. We wish the vessel andcrew safe and successful operations. Vroon’s activities in the wind offshore-support sector operate under the MPI banner. MPI is active in the offshore wind-turbine-installation and -maintenance markets with a range of vessels, equipment and service offerings. MPI Offshore, based in Stokesley (UK) and Breskens (the Netherlands), has beenpioneering the offshore wind-turbine-installation business since 2003, when the firstdedicated wind-turbine-installation vessel, MPI RESOLUTION, was delivered. During thepast 12 years MPI has been involved in numerous windfarm construction projects in nearly all countries around the North and Baltic Seas. MPI operates four dedicated wind-turbine-installation vessels, as well as a fleet of 14 workboats. In addition, MPI provides a range of engineering, consulting, manpower and equipment rental services.For more information on MPI and its wide-ranging capabilities please visit: www.mpioffshore.com. MPI is a subsidiary of Vroon Group, a Dutch-based, diversified ship-owning group with an extensive North Sea offshore fleet. For more details please visit: www.vroon.nl.

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 18

30-03-2016 : ICE HAWK approaching the Ijmuiden locks Photo: Simon Wolf.(c)

Propulsion's Composite Future The driving force behind shipping can be attributed to many factors, but the driving force behind the ships themselves is arguably their propellers. Research into improving this vital component has been virtually constant since its

inception. While their size and shape may have changed over the years, NAB (Nickel Aluminum Bronze) is still by far the material of choice. The use of NAB as a material provides many advantages in terms of strength, however there are other factors to consider. Copper itself is an exhaustible mineral, and the reserve-production ratio for copper that is available in the mining industry is estimated to reach its limit over the next few decades. Demand from increased construction in emerging countries and futures trading of the material have also driven up the price of copper worldwide. The economic aspect

alone provides enough of an impetus to search for a new raw material that can provide a substitute. At the same time, the industry is also looking at ways to improve operational efficiency. Although owners are now enjoying lower oil prices, they are faced with increasingly stringent environmental regulations that require substantial reductions in emissions. Cutting fuel consumption through improved efficiency continues to be the most sustainable option for the industry. Composite materials are increasingly being used for their strength and corrosion resistant properties, proving to be a feasible alternative to NAB. In particular, glass fiber reinforced plastic (GFRP) and carbon fiber reinforced

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 19

plastic (CFRP), both of which are composite materials, have already been used in fields such as aerospace, automobiles and wind power generation, and their scope of application has been further expanded due to their advantages. Fiber reinforced plastics offer another key advantage: their lower mass make them significantly lighter than their conventional metal counterparts. On the face, the benefits seem fairly obvious, lighter materials are cheaper to transport and assemble. Most importantly however, if this material could be applied to propellers, would its lower mass produce any reductions in operational costs? Are there any other benefits that could be gained using this material? The first question can be easily answered. Lightweight composition allows for larger blades which increase propulsive efficiency and consequently save fuel. ClassNK has been at the heart of efforts to see if the advantages of fiber reinforced plastics could be transformed into a workable reality for commercial shipping, as part of its overall research and development program. Within its Joint R&D for Industry Program Nakashima Propeller Co., Ltd. led a project with partners including the University of Tokyo, Japan’s National Maritime Research Institute (NMRI), Imabari Shipbuilding, NYK Line, and Monohakobi Technology Institute (MTI), to develop a propeller using CFRP as its main blade material. After a variety of tests on a newly proposed design, the CFRP propeller was approved for use on commercial vessels. The CFRP propeller was first fitted as part of the side thruster installation on the 499 gt chemical tanker Taiko Maru in 2012. Based on the successful performance of the CFRP propellers installed on the vessel, shipowner Sowa Kaiun YK decided to extend the use of the CFRP propeller technology to its main propulsion system, making the vessel the first merchant ship in the world to use a CFRP propeller for its main propulsion system. Taiko Maru’s new CFRP main propeller features an enlarged diameter (2.12m in place of 1.95m diameter of the original NAB propeller) thanks to its ultra-lightweight composition (60 percent less than conventional NAB propellers), providing the chemical tanker with higher propulsion efficiency. While the use of CFRP propellers as a solution for the very largest of ships remains to be seen, the early signs are promising. Sea trials on Taiko Maru confirmed that the shaft power required by a merchant ship featuring a CFRP propeller was reduced by 9 percent compared to conventional metal propellers at the same cruising speed. It was also reported that the use of the propeller resulted in a noticeable decrease of onboard noise caused by hull vibration, most likely attributable to the greater flexibility of the propeller blades which distribute flow pressure evenly across their surface to greatly lower the occurrence of cavitation.Based on the knowledge obtained through this joint R&D project, ClassNK also summarized the requirements for the approval of the manufacturing process for composite propellers and the testing/ inspections in the world’s first Guidelines on Composite Propellers (Part on Manufacturing/ Product Inspection). With further research and data on how the propeller works in real operations, the uses of CFRP propellers could be extended to larger vessels in the future. While no assumptions can be made yet, the future is bright for CFRP propellers. Source: ClassNK customer magazine

British Royal Navy to head Gulf anti-piracy force since April

Britain is to lead a joint maritime force in the Gulf to deter piracy, tackle terrorism and disrupt smuggling, British Defense Secretary Michael Fallon announced on Tuesday.A statement issued by the Ministry of Defense (MOD) in London said that from April, Britain will lead the Combined Task Force (CTF150) which covers about 5.18 square km, including the Red Sea, the Gulf of Aden, Indian Ocean and the Gulf of Oman. The MOD describes the area as a vital

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 20

artery of world trade.Fallon said: "We are looking forward to leading this important joint force.This underlines our commitment to working with allies to fight Daesh (IS) and tackle terrorism across the region."He said the presence of the British Royal Navy in the Middle East helps keep maritime trade flowing and safeguards Britain's economy by countering piracy and policing the flow of oil and gas into British ports.Fallon added that leading CTF150 will see Britain alongside international partners, including those that make up the Combined Maritime Forces. CTF150 vessels will also assist mariners in distress and undertake humanitarian work as required.Last week, a new defense cooperation arrangement between Qatar and Britain was signed in London. The agreement will enable closer coordination on training and exercises, said the MOD.Fallon added: "Last week's attacks in Brussels are a reminder that all of us, the Gulf and Europe, must stand together to defeat Daesh (IS) and disrupt its attack planning. The new agreement will enhance the security of both countries." Source: shanghaidaily

The MSC FANTASIA seen aproaching the the port of Haifa – Photo : Peter Szamosi ©

Scots rig decommissioning industry top get boost from university work

LABORATORY testing which will produce “invaluable knowledge” to help with the decommissioning of oil rigs out at sea is being carried out by a Scottish university.Staff from Dundee University’s School of Science and Engineering have

teamed up with the Aberdeen-based Oil and Gas Innovation Centre (OGIC) for the work.A series of small-scale tests will be carried out in a bid to a provide guidance for the oil and gas industry on how best to remove subsea structures. The work is being done by engineering consultancy firm

Xodus, who hope it will help produce “significant cost savings and operational efficiencies” in future decommissioning projects.OGIC chief executive officer Ian Phillips said: “Decommissioning is a relatively new industry in the UK continental shelf and offers significant opportunities for the supply chain to develop new processes and technology which will be needed globally. “The University of Dundee and Xodus project has the potential to ensure that costly decommissioning projects are carried out efficiently. “Carrying out research in a controlled laboratory environment will produce data which would be challenging to gather in the field.“The fact that the University of Dundee has the R&D capabilities to support this work is testament to the expertise which exists in Scottish universities.”Dr Andrew Brennan, senior lecturer in civil engineering at the University of Dundee, said removing structures from the seabed “poses major engineering challenges due to the number of variables”.He added: “By performing a series of small-scale model tests, we can understand better how each of these variables controls the process and hence improve the efficiency of

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 21

foundation extraction in the future.“At the University of Dundee we have world-class laboratory facilities and a long history of testing geotechnical models.”Andy Small, principal geotechnical engineer with Xodus, said: “Decommissioning of subsea structures presents significant challenges. The potential for overall project cost increases due to unknowns is high, especially with regard to seabed uncertainty.“This research will produce invaluable knowledge and understanding of the recovery process and associated risks, and will likely result in significant cost savings and operational efficiencies.“The transfer of knowledge and experiences through projects like this is crucial to enable the industry to continue to develop efficient and effective decommissioning.”A report from energy consultancy Douglas-Westwood last month predicted up to 150 platforms could be decommissioned between 2019 and 2026. The firm said the collapse of the oil price had been bad news but that specialist decommissioning companies could actually benefit from it.“For these companies there is an opportunity to be part of removing the huge tonnage of infrastructure in the North Sea. With oil prices forecast to remain low, life extension work that has kept many North Sea platforms producing long past their design life no longer makes commercial sense,” it said.The Scottish Greens backed that view, but Alex Russell and Peter Strachan, professors at Aberdeen’s Robert Gordon University, said such a measure would effectively sound the death knell for the North Sea oil industry. Source: thenational.scot

Brand op kolen schip Dinsdag om 22.15 uur gepaged, brand aan boord van kolen carrier gemeerd bij de Lemaireweg. Belangrijkste taak van de KNRM bleek het

overzetten van brandweerlieden van de RPA14 naar de carrier SEA TRIUMPH.Tijdens het uitvaren geïnformeerd aan welke kant (haven) van de Lemairreweg het bewuste schip lag. Een vaartuig van de RPA14 was al ter plaatse en in samenwerking met de brandweer fungeerde deze als pompschip om een schuimdeken op de kolenbroei te leggen. Een opstapper overgezet op de RPA om te fungeren als Coördinators Incident Schip en de KNRM reddingboot heeft brandweerlieden naar de kolencarrier gebracht. Even na middernacht bemanningswissel gehouden in de Berghaven en de opstappers die ruimer in de tijd zaten bleven paraat. Nadat alles onder controle was de brandweerlieden naar de wal gebracht. Rond 02.00 uur woensdagochtend gemeerd in de Berghaven. De communicatie tussen de hulpdiensten verliep gesmeerd, compliment aan allen.

U.S. says it will not recognize South China Sea exclusion zone

By Andrea Shalal The United States has told China it will not recognize an exclusion zone in the South China Sea and would view such a move as "destabilizing," U.S. Deputy Secretary of Defense Robert Work said on Wednesday. U.S. officials have expressed concern that an international court ruling expected in the coming weeks on a case brought by the Philippines against China over its South China Sea claims could prompt Beijing to declare an air defense identification zone, or ADIZ, in the region, as it did in the East China Sea in 2013. Work told an event hosted by the Washington

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 22

Post that the United States would not recognize such an exclusion zone in the South China Sea, just as it did not recognize the one China established in the East China Sea.China claims most of the South China Sea, through which more than $5 trillion in global trade passes every year."We don't believe they have a basis in international law, and we've said over and over (that) we will fly, sail and go wherever international law allows," Work said."We have spoken quite plainly to our Chinese counterparts and said that we think an ADIZ would be destabilizing. We would prefer that all of the claims in the South China Sea be handled through mediation and not force or coercion," he said.Work spoke as Chinese President Xi Jinping prepared to visit Washington for a nuclear security summit this week.The United States has accused China of raising tensions in the South China Sea by its apparent deployment of surface-to-air missiles on a disputed island, a move China has neither confirmed nor denied. China, for its part, has repeatedly accused the United States of militarizing the South China Sea through its freedom of navigation patrols in the region and the expansion of military alliances with countries such as the Philippines. In February, Chinese Foreign Minister Wang Yi said his country's South China Sea military deployments were no different from U.S. deployments on Hawaii.Tensions between China and its neighbors Vietnam, Malaysia, Brunei, the Philippines and Taiwan over sovereignty in the South China Sea have risen after Beijing embarked on significant reclamations on disputed islands and reefs in the area. Source: Reuters

Yarmouth ferry deal could cost $100 million Nova Scotia taxpayers will be on the hook for another $5 million U.S. if the private operator of the Yarmouth-Maine ferry defaults on its deal with the American navy. An Order of Council dated March 24, released Tuesday, approved a $5-million letter of credit through the Royal Bank of Canada to secure the U.S. navy against a default by Bay Ferries Limited.Last week, the province announced it is re-launching a highspeed ferry service between Yarmouth and Maine under a 10-year deal with Bay Ferries Limited. The company is chartering the vessel from the U.S. navy. The province will provide $19.6 million in operating money in the first two seasons, a one-time start-up payment of $4.1 million and an additional $9 million to remodel the vessel. On top of that, in its contract with Bay Ferries the province has agreed to cover any deficits incurred by the company each year it operates the ferry service, as well as pay an undisclosed management fee. The letter of credit is not mentioned in the contract.The vessel the new ferry is replacing, Nova Star, received a total of $41.5 million from the province over the two years it was in operation, and missed passenger goals both years.Opposition leader Jamie Baillie said he believes taxpayers got “hosed" in the new deal, and said it should have come before the legislature “As a taxpayer, I think it’s appalling,” he told The Chronicle Herald. “Even after we underwrite every dollar of their losses, even after we pay them a guaranteed profit through the management fee, if they still can’t make a go of it and they default on their boat lease, we have to pay that too.” Transport minister Geoff MacLellan was not available for an interview but said in an emailed statement that security was required in the event of a default as part Bay Ferries’ agreement with the U.S. navy. A spokesperson from the department later clarified that putting the responsibility for that security on the province was part of the negotiations with the operator. “The structure of the agreement makes it unlikely this mechanism would be used. The agreement with the operator stipulates the province would cover costs beyond the revenue for the service, this is what makes up the payment from the province,” MacLellan said. Baillie called the contract the “worst deal” the government could have made, and said it will cost taxpayers at least $100 million over the next 10 years. Moreover, he said he fears the inability of the new vessel to accommodate transport trucks could have consequences for export industries “The ferry was never only about tourism, it was also about getting our exports — our lobster, our seafood, our lumber — to the American market, and this deal . . . makes it harder.” While Baillie said the Tories do want to see a ferry from

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 23

Yarmouth to the U.S., this deal won’t be sustainable and calls into question the Grits’ financial credibility. Source: helifax chronicle

R/V JOHN LETHBRIDGE, Panamanian flag, built 1965 (ex Marbella, ex Northern Horizon, ex Ocean Boomer) used as deep water research vessel, entering Falmouth UK on 30th March.Named after the inventor (1675 - 1759) of the underwater diving machine i.e. a wooden barrel shaped device with two seal-able openings for his arms and fitted with a thick glass viewing port. Lethbridge was able to dive in his invention to 21m using lowering ropes, and carried out salvage on the Dutch vessel Slot ter Hooge which had sunk off Madeira whilst carrying 3 Tonnes of silver bullion. John Lethbridge clearly had other skills as he reportedly fathered 17 children. Further successful salvage work was carried out on the Slot ter Hooge in 1974 by Robert Stenuit (after having found a wreck location map engraved on a tankard). Photo: Tim Mark ©

ALSO INTERESTED IN THIS FREE MARITIME NEWSCLIPPINGS ? CLICK HERE AND REGISTER FOR FREE !

Asia Dry Bulk-Capesize rates to firm as owners resist downward pressure

Freight rates for large capesize dry cargo ships on key Asian routes are set to firm next week as owners resist charterers attempts to push rates lower, ship brokers said on Thursday.That came as revenue from freight rate income remains below the cost of operating the iron ore and coal carriers."There is a lot of tonnage in the market available for charter, but owners are slowly resisting," a Singapore-based capesize broker said on Wednesday."Owners are slowly pushing the numbers up. It's as positive as it has been in recent times," the broker said. The broker forecast rates could climb to $3.10/$3.15 per tonne to charter a 180,000 deadweight tonne capesize ship to haul iron ore from Australia to China.Capesize earnings are around $1,579 per day, less than daily operating costs of around $7,300, according to data from British shipping services firm Clarkson and accountancy firm Moore Stephens."Until we get a more stable flow of cargo it is difficult to see the capesize market really moving higher," the Singapore broker said Owners of capesize ships have been hit by a drop in coal imports into China which are set to fall 8 percent to 150.7 million tonnes on an annualised basis this year compared with 163.8 million tonnes last year, according to Clarkson. Iron ore imports to China are more resilient, estimated at 921.6 million tonnes this year, a 2 percent fall compared with 939.7 million tonnes in 2015, according to Clarkson. The poor state of the sector has led to an increase in the number of delayed ship deliveries.Some 28 capesize ships were due to join the global fleet in the first quarter this year, but delivery of 14 of these has been pushed back to later in the year or beyond, according to maritime data company VesselsValue in a note on Wednesday.Capesize charter rates for the Western Australia-China route held around $3.08 per tonne on Wednesday, against $3.03 a week earlier.Rates for the Brazil-China route were steady at $5.80 a tonne on Wednesday, compared with $5.82 on the same day last week. Panamax rates for a north Pacific round-trip voyage fell to $3,850 per day on Wednesday, from $4,169 per day last week, as tonnage supply outpaced cargo demand. Rates have been falling since hitting $4,807 per day on March 14, the highest since Nov. 2, 2015.

DAILY COLLECTION OF MARITIME PRESS CLIPPINGS 2016 – 092

Distribution : daily to 34.000+ active addresses 01-04-2016 Page 24

Freight rates for smaller supramax vessels have slipped with rates below $5,000 per day for a voyage from Singapore to India, Norwegian ship broker Fearnley said in a note on Wednesday.The Baltic Exchange's main sea freight index rose to 414 on Wednesday, from 401 the same day last week. Source; reuters (Reporting by Keith Wallis; Editing by Anand Basu)

BSM LAUNCHES NEW LAY-UP AND GREEN

RECYCLING SERVICES Bernhard Schulte Shipmanagement (BSM) is further expanding the scope of ship management services it offers with the addition of two new service offerings – Lay-up Services and Green Recycling. Both services have been developed to meet changing needs amid the tough economic environment that the shipping industry is facing.BSM’s Lay-up Services have been designed to support customers where continued operation of the vessel is deemed uneconomical. BSM will advise the owner of the best options for lay-up and the appropriate procedures that need to be followed for different types of lay-up, whether warm or cold.From its nine Ship Management Centres around the world, BSM will manage the lay-up process, performing duties such as location selection, declaration for shareholders, ship inspections and on-board watches.With both warm or cold lay-up options, the objective is to ensure that the vessel remains secure and well preserved during the idle period whilst reducing ship owners’ costs.BSM’s Green Recycling service supports customers with the responsible demolition of their assets. Fully complying with the IMO’s Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships, 2009, the service will be provided by BSM’s project focused business, Schulte Marine Concept.BSM can carry out recycling management and supervision in any ship yard with the correct and compliant resources for dismantling a vessel. During the process, Schulte Marine Concept’s class-approved experts will also share their expertise by performing an audit of the ship yard and ensuring that a safe working environment is maintained throughout. Both services are now available for new and existing customers, further enhancing BSM’s position as a leading provider of maritime solutions throughout a vessel’s life-cycle.

NAVY NEWS UK Navy vessel, which helps fight narco-trafficking