4 FACTORS INFLUENCING SUCCESSFUL CROSS ......EXCHANGE RATE 4 In general, literature on determinants...

Transcript of 4 FACTORS INFLUENCING SUCCESSFUL CROSS ......EXCHANGE RATE 4 In general, literature on determinants...

4 FACTORS INFLUENCINGSUCCESSFUL CROSS-BORDER

MERGERS & ACQUISITIONS

In light of cross-border acquisitions becoming an increasingly popular means forfirms expanding internationally with Europe being a center of US-dominated

transactions, this whitepaper discusses four distinct factors influencing the success ofcross-border Mergers & Acquisition (M&A).

ABSTRACT

Cross-border M&A is – like greenfield investments or joint ventures - an equity-basedmode of entry into a foreign market (Shimizu, Hitt, Vaidyanath, & Pisano, 2004).

Thereby, the acquiring firm obtains the resources, such as knowledge, technology andhuman capital, of a foreign firm and therefore gains access to a new market (Shimizu,

Hitt, Vaidyanath, & Pisano, 2004).

Since the 1990s, cross-border M&As have become increasingly important as an entrystrategy for foreign direct investment and it is likely that this trend will continue along

with growing globalization (Humpgery-Jenner, Sautner, & Suchard, 2012).

In fact, in 2016, around $1.04 trillion of the $3.2 trillion worth of announced M&Adeals were cross-border, accounting for 36% of total global M&A deals, the highestproportion since 2012 (Prakash, 2017). As major economies strike agreements andalliances to increase trade, cross-border deal flow is expected to be a key theme in

the coming years (Deloitte, 2015). In the past, Europe has been the center of cross-border deals, dominated by the North America-Europe deal corridor. With acquisitionsworth $79 billion, the U.S. was the biggest inbound force in Europe in 2016 (Prakash,2017; Mergermarket, 2016). With the U.S. economy accelerating and a strong dollar,it is expected that U.S. companies continue to seek assets in Europe and elsewhere

(Prakash, 2017).

International M&As are normally motivated by the same strategic considerations asforeign direct investment decisions, for example a better exploitation of the firms’assets, a strategical enhancement of its competitive advantages, the realization ofeconomies of scale or scope and the diversification of risks (Li, Li, & Wang, 2016).Furthermore, studies show that firms do not only expand internationally for asset

exploitation, but also for asset seeking as acquirers can obtain new knowledge andgain new capabilities (Chang, 1995; Makino, Lau, & Yeh, 2002). Therefore,

international expansion through acquisitions offers value-creation opportunities forfirms (Aybar & Ficici, 2009).

However, it is generally known that M&As do not come without challenges. Thereby,

the dynamics of cross-border M&As are largely similar to those of domestic M&As(Shimizu, Hitt, Vaidyanath, & Pisano, 2004). However, they also involve unique risks

and are therefore considered to be more complicated as different countries havedifferent economic, legal, institutional and cultural structures. Besides, uncertainty

and information asymmetry in the foreign country make it more difficult for theacquirer to adjust to the local market and learn from the target (Zaheer, 1995).

BACKGROUND: CROSS-BORDER M&A

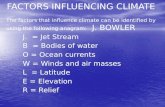

FACTORS ANALYSED

Cultural distance between the target’s and the acquirer’scountry

Previous international experience of the acquirer

Target country’s economic size and condition

Exchange rate and its volatility

#1

#2

#3

#4

CULTURAL DISTANCE

Cultural difference occurs between two different cultural groups, usually differentcountries, and can originate from many sources, such as religion, language and

history. According to Hofstede, Hofstede & Minkov (2010), cultural differences haveseveral dimensions, which are power distance, individualism vs. collectivism,

uncertainty avoidance, masculinity vs. femininity, and long- term vs. short-termorientation.

It is generally known that cultural distance plays an important role in influencingthe performance of cross-border M&A (Datta & Puia, 1995; Morosini, Shane, &

Singh, 1998; Li, Li, & Wang, 2016). Kongut & Singh (1998) argue that “due to thedifficulty of integrating an already existing foreign management, cultural differences

are likely to be especially important”. Davis, Shore & Thompson (1991) follow asimilar argumentation. Madura, Vasconcellos & Kish (1991) point out that cultural

and language differences may lead to difficulties in doing international acquisitions.

Research has been done on how cultural differences affect cross-border M&A deals;however, there are contradictory results regarding whether it has a positive or

negative effect.

Morosini, Shane & Singh (1998) examined a sample of 52 cross-border acquisitionsthat took place between 1987 and 1992. The authors found a positive association

between national cultural distance and cross-border acquisition performance.Chakrabarti, Gupta-Mukherjee & Jayaraman (2009) came to the same conclusion.They used a sample of over 800 cross-border acquisitions that took place between

1991 and 2004 and found out that they perform better in the long run if theacquirer and the target come from countries that are culturally more disparate

(Chakrabarti, Gupta-Mukherjee, & Jayaraman, 2009).

However, other researchers, for example Hofstede, Hofstede & Minkov (2010),argue that there are negative effects on shareholder value creation when strong

cultural differences exist. This is in line with findings from Datta & Puia (1995) thatshow that acquisitions with high cultural distance led to lower wealth effects for

acquiring firm shareholders. According to Doney, Cannon & Mullen (1998), peoplefrom different national cultures trust each other less than people who share a

common cultural background. As a result, knowledge transfer gets more difficultand affects post-acquisition integration. Moreover, Brock (2005), who studied 103

acquisitions, found that cultural distance has a negative impact on the realization ofintended synergies, because it influences the integration process, managerial

commitment, and ease of resource sharing. Li, Li, & Wang (2016) used a sample of367 cross-border M&As between 2000 and 2011 involving Chinese companies asacquirers. They also found evidence that cultural distance is negatively related to

the extent of value creation for the acquirer’s shareholders measured in changes instock price (Li, Li, & Wang, 2016).

In summary, the majority of the studies argues that a lack of cultural fit betweenthe acquiring and acquired firm has a negative impact on the success of cross-

border M&As.

1

A lack of cultural fit between the acquiring

and acquired firm has a negative impact on thesuccess of cross-border M&As

The level of international experience in cross-border acquisitions of the acquiring firm iswidely discussed in literature (Markides & Ittner, 1994; Barkema & Schijven, 2008;

Brouthers, 2002; Kogut & Singh, 1988). Thereby, the majority of studies found that priorinternational experience influences the success of the acquisition in a positive way and is

associated with positive changes in stock price of the acquirer (Harzing, 2002). In contrast,Doukas & Travlos (1988) found that shareholders of multinational corporations operating

already in the target firm’s country experience insignificant negative abnormal returnsbased on the stock price whereas domestic firms expanding internationally for the first

time experience insignificant positive abnormal returns based on the stock price.

In general, it is plausible to argue that firms who have prior international M&A experienceare more familiar with the specific hurdles associated with cross-border M&As and thus,

are less likely to pay high premiums for the acquisition (Aybar & Ficici, 2009). It isexpected that prior experience may reduce the post-acqusition costs and that the

acquisitions are less risky compared to when a firm expands for the first time into anunnown market (Aybar & Ficici, 2009).

INTERNATIONAL EXPERIENCE

2

Evenett (2003), who performed a study on the effect of cross-border M&As on thebanking sector, looked at U.S. acquisitions in 13 OECD countries. He found evidencethat the success of the acquisitions depends on the GDP of the target country. This isin line with findings from Moosa (2002), who states that the volume of FDI (foreign

direct investment) inflow into a country is related to its market size meaning thelarger the size in terms of GDP, the larger the FDI inflow. Moreover, Anand & Kogut

(1997) and Globerman & Shapiro (2005) argue that countries with a higher GDPattract more FDI. Additionally, di Giovanni (2005), who used the gravitational model

to estimate the macroeconomic determinants in international M&As during 1990-1999, found that M&A flows tend to increase when directed to large economies.

Hence, literature shows consistent evidence for a positive relation between a

country’s economic size and M&A inflow. It can be expected that a larger economicmarket can offer more advantageous opportunities for the acquiring firm andtherefore, that acquisitions in countries with a large economic size and a good

economic condition are more likely to generate positive wealth effects forshareholders of the acquiring firm.

TARGET COUNTRY’S ECONOMIC SIZE AND CONDITION

3

The exchange rate is expected to have an influence on premiums paid for the target,how the deal is financed, and the value of the repatriated returns to the acquiringfirm (Kiymaz, 2004). Research conducted by Harris & Ravenscraft (1991) on theeffect of the relative strength or weakness of the currency on wealth gains for theshareholders of the target company shows that wealth gains for U.S. targets are

positively related to the weakness of the U.S. dollar. This indicates a significant roleof exchange rate movements in cross-border M&As. Besides, Kiymaz & Mukherjee(2000), who examined the wealth effects of U.S. targets and bidders involved incross-border M&As, found that the target’s shareholders benefit from a relatively

strong currency in the acquirer’s home market compared to the target currency. Apotential reason is that with a stronger currency, the bidding firm tends to pay a

higher premium for the target.

However, the impact of the exchange rate on the bidding firm is unclear because“the expected future cash flows would be a function of future exchange rates”

(Kiymaz, 2004). It can be expected that acquirers would benefit from a strong homecurrency at the time of the transaction. However, at the time of the repatriation of

dividendes and cash flow, a weaker home currency would be of advantage (Kiymaz,2004).

Since a higher volatility of the exchange rate would lead to higher uncertainty aboutthe value of cash flows, it can be assumed that shareholder wealth gains decrease

with increasing exchange rate volatility (Kiymaz, 2004).

EXCHANGE RATE

4

In general, literature on determinants in M&A is broad. Within this whitepaper, thefocus was put on distinct factors influencing international M&A: cultural distance,

acquirer’s international experience, the target country’s economic size and conditionas well as the exchange rate. The following could be concluded:

CONCLUSION

• The majority of the research states that a lack of cultural fit between the acquiringand acquired firm has a negative impact on the success of cross-border M&As.

• Companies that have prior international experience can complete a cross-borderacquisition more successfully than companies without such prior experience.

• Acquisitions in countries with a large economic size and a good economic conditionare more likely to generate positive wealth effects for shareholders of the acquiringfirm.

• The exchange rate influences cross-border M&A: Bidders benefit from a stronghome currency at the time of the transaction and a weak home currency at the timeof repatriation of dividends and cash flows

ABOUT EURODEV M&A

This white paper is collected and presented to you by EuroDev M&A, part of the EuroDevGroup. EuroDev M&A offers buy-side M&A advisory services to North American PrivateEquity Groups and their portfolio companies that want to acquire a business in Europe.

© Nothing in this document can be copied or quoted without permission of EuroDev B.V. For more information please contact us. EuroDev

cannot be held responsible for the content of this text.

Gerben Groothuis Managing Director M&A

linkedin.com/gerbengroothuis

EuroDev M&A

+31 (0) 546 660 000

SOURCES

Anand, J., & Kogut, B. (1997). Technological capabilities of countries, firm rivalry and foreign direct investment. Journal of International

Business Studies, 28(3), pp. 445-467.

Asquith, P., Bruner, R. F., & Mullins Jr., D. W. (1983). The Gains to Bidding Firms from Merger. Journal of Finance Economics, 11, pp. 121-139.

Aybar, B., & Ficici, A. (2009, November). Cross-Border Acquisitions and Firm Value: An Analysis of Emerging-Market Multinationals. Journal of

International Business Studies, 40(8), pp. 1317-1338.

Barkema, H. G., & Schijven, M. (2008). How Do Firms Learn To Make Acquisitions? A Review of Past Research and an Agenda for the Future.Journal of Management, 34(3rd), 594-634.

Bieshaar, H., Knight, J., & van Wassenaer, A. (2001). Deals That Create Value. McKinsey Quarterly, 1, pp. 64-73.

Brock, D. (2005, February). Mulinational acquisition integration: The role of national culture in creating synergies. International Business

Review, 14, pp. 269-288.

Brouthers, K. D. (2002). Institutional, cultural and transaction cost influences on entry mode choice and performance. Journal of InternationalBusiness Studies, 33(2), pp. 203-221.

Chakrabarti, R., Gupta-Mukherjee, S., & Jayaraman, N. (2009, February). Mars-Venus marriages: Culture and cross-border M&A. Journal of

International Business, 40(2), pp. 216-236.

Chang, S. (1995, April). International expansion strategy of Japanese firms: Capability building through sequential entry. Academy ofManagement Journal, 38(2), pp. 383-407.

Datta, D. K., & Puia, G. (1995). Cross-border Acquisitons: An Examination of the Influence of Relatedness and Cultural Fit on Shareholder

Value Creation in U.S. Acquiring Firms . Management International Review , 35(4), 337-359.

Datta, D., Pinches, G., & Narayanan, V. (1992, January). Factors influencing wealth creation from mergers and acquisitions: A meta-analysis.Strategic Management Journal, 13(1), pp. 67-84.

Davis, E., Shore, G., & Thompson, D. (1991). Continental mergers are different. Business Strategy Review, 2(1), pp. 49-70.

Deloitte. (2015). The Deloitte M&A Index 2016: Opportunities amidst divergence . Deloitte.

Doney, P., Cannon, P., & Mullen, M. (1998). Understanding the influence of national culture on the development of trust. Academy ofManagement Review, 23(3rd), 601-620.

Doukas, J. (1995, June). Overinvestment, Tobin's q and gains from foreign acquisitions. Journal of Banking & Finance, 19, pp. 1285-1303.

Doukas, J., & Travlos, N. G. (1988, December). The Effect of Corporate Multinatonalism on Shareholders' Wealth: Evidence from International

Acquisitions. The Journal of Finance, 43(5), pp. 1161-1175.

Doukas, J., Holmen, M., & Travlos, N. (2002, September). Diversification, Ownership and Control of Swedish Corporations. European FinancialManagement, 8(3), pp. 281-314.

Evenett, S. J. (2003). The Cross-Border Mergers and Acquisitions Wave of the late 1990s. Cambridge: National Bureau of Economic Research.

Flanagan, D. J. (1996, December 1). Announcement of Purely Related and Purely Unrelated Mergers and Shareholder Returns: Reconciling the

Relatedness Paradox. Journal of Management, 22(6), pp. 823-835.

Fuller, K., Netter, J., & Stegemoller, M. (2002). What Do Returns To Acquiring Firms Tell Us? Evidence from Firms That Make ManyAcquisitions. Journal of Finance, 57(4), pp. 1763-1793.

Globerman, S., & Shapiro, D. (2005). Assessing International Mergers and Acquisitions as a mode of Foreign Direct Investment. In L. Eden, &W. Dobson (Eds.), Governance, Multinationals and Growth 2005 - New Horizons in International Business (pp. 68-99). Northampton, United

Kingdom: Edward Elgar Publishing.

Gubbi, S., Aulakh, P., Ray, S., Sarkar, M., & Chittoor, R. (2010, April). Do international acquisitions by emerging-economy firms createshareholder value? The case of Indian firms. Journal of International Business Studies, 41(3), pp. 397-418.

Haleblian, J., & Finkelstein, S. (1999). The Influence of Organizational Acquisition Experience on Acquisition Performance: A Behaviorial

Learning Perspective. Administrative Science Quarterly, 44(1), 29-56.

Harris, R., & Ravenscraft, D. (1991). The role of acquisitions in foreign direct investment: evidence from the U.S. stock market. Journal ofFinance, 46, pp. 825-844.

Harzing, A.-W. (2002). Acquisitions versus Greenfield Investments: International Strategy and Management of Entry Modes. Strategic

Management Journal, 23, pp. 211-227.

Hofstede, G., Hofstede, G. J., & Minkov, M. (2010). Cultures and Organizations: Software of the Mind (3rd ed.). McGraw-Hill Education.

Humphery-Jenner, M., Sautner, Z., & Suchard, J.-A. (2017, August). Cross-border mergers and acquisitions: The role of private equity firms.Strategic Management Journal, 38(8), pp. 1688-1700.

Kiymaz, H. (2004). Cross-border acquisitions of US financial institutions: Impact of macroeconomic factors. Journal of Banking & Finance, 28,

pp. 1413-1439.

Kiymaz, H., & Mukherjee, T. (2000). The Impact of Country Diversification on Wealth Effects in Cross-Border Mergers. The Financial Review,35, pp. 37-58.

Kogut, B., & Singh, H. (1988). The effect of national culture on the choice of entry mode. Journal of International Business Studies, 19(3), pp.

145-432.

Li, J., Li, P., & Wang, B. (2016). Do cross-border acquisitons create value? Evidence from overseas acquisitions by Chinese firms. InternationalBusiness Review(25), 471-483.

Madura, J., Vasconcellos, G. M., & Kish, R. J. (1991). A valuation model for international acquisitions. Management Decision, 29(4), pp. 31-38.

Makino, S., Lau, C.-M., & Yeh, R.-S. (2002, September). Asset-Exploitation Versus Asset-Seeking: Implications for Location Choice of Foreign

Direct Investment from Newly Industrialized Economies. Journal of International Business Studies, 33(3), pp. 403-421.

Markides, C., & Ittner, C. (1994, June). Shareholder Benefits from Corporate International Diversification: Evidence from U.S. InternationalAcquisitions. Jornal of International Business Studies, 25(2), pp. 343-366.

Mergermarket. (2016). Deal Drivers EMEA. The comprehensive review of mergers and acquisitions in

Moeller, S. B., Schlingemann, F. P., & Stulz, R. M. (2005, April). Wealth Destruction on a Massive Scale? A study of acquiring-firm returns inthe recent merger wave. The Journal of Finance, pp. 757-782.

Moeller, S., & Schlingemann, F. (2005). Global diversification and bidder gains: A comparison between cross-border and domestic acquisitions.

Journal of Banking & Finance, 29, pp. 533-564.

Moosa, I. (2002). Foreign Direct Investment Theory, Evidence and Practice (1 ed.). United Kingdom: Morosini, P., Shane, S., & Singh, H. (1998). National Cultural Distance and Cross-Border Acquisition Performance. Journal of International

Business Studies, 29(1), pp. 137-158.

Prakash, S. (2017). Dealing with the future. Deloitte M&A Index. Outlook for 2017. Deloitte LLP. Rau, P. R., & Vermaelen, T. (1998). Glamour, value and the post-acquisiton performance of acquiring firms. Journal of Financial Economics,

49(2), pp. 223-253.

Shimizu, K., Hitt, M., Vaidyanath, D., & Pisano, V. (2004, October). Theoretical foundations of cross-border mergers and acquisitions: Areview of current research and recommendations for the future. Journal of International Management, pp. 307-353.

Sudarsanam, S., & Mahate, A. (2003, January). Glamour Acquirers, Method of Payment and Post-Acquisition Performance: The UK Evidence.

Journal of Business Finance & Accounting, 30(1-2), pp. 299-342.

Sudarsanam, S., Holl, P., & Salami, A. (1996). Shareholder Wealth Gains In Mergers: Effect of Synergy and Ownership Structure. Journal ofBusiness Finance & Accounting , 23(5), 306-586.

Tuch, C., & O'Sullivan, N. (2007, June). The Impact of Acquisitions on Firm Performance: A Review of the Evidence. International Journal of

Management Reviews, 9(2), pp. 141-170.

Yook, K. C. (2003). Larger Returns to Cash Acquisitions: Signaling Effect or Leverage Effect? The Journal of Business, 76(3), pp. 477-498.

Zaheer, S. (1995). Overcoming the liability of foreignness. Acad. Manage., pp. 341-363.

![Factors influencing[1]](https://static.fdocuments.in/doc/165x107/54be1c8d4a795948378b4597/factors-influencing1.jpg)