3Q Company Newsletter

-

Upload

cbc-atlantic -

Category

Documents

-

view

220 -

download

0

description

Transcript of 3Q Company Newsletter

October 2014

THE LOOP

Coldwell Banker Commercial Atlantic 3506 W Montague Ave. Charleston, SC 29418 Main: 843-744-9877 Fax: 843-744-9879

www.cbcatlantic.com

LOCAL KNOWLEDGE, GLOBAL PERSPECTIVE.

Coldwell Banker Commercial Atlantic Newsletter

Third Quarter

Coldwell Banker Commercial Atlantic 3506 W Montague Ave. Charleston, SC 29418 Main: 843-744-9877 Fax: 843-744-9879

www.cbcatlantic.com

LOCAL KNOWLEDGE, GLOBAL PERSPECTIVE.

• Isabelle Martinez of Coldwell Bank-er Commercial Atlantic Interna-tional, Inc. represented the Buyers,Rosa Marcela Rabens and JuliaNancy Valer Torres, in the purchaseof Office space located at 7403Rock Street.

• Tradd Varner and Brent Case, CCIMof Coldwell Banker Commercial At-lantic International, Inc. represent-ed the Seller, Dean Jones, in the saleof a 1000 SF Office Condo locatedat 18-B Leinbach Drive.

• Kristen Krause of Coldwell BankerCommercial Atlantic International, Inc. represented the Buyer, 13 Car-olina St. LLC, in the purchase of a 2story duplex located at 13 CarolinaStreet from BB&T Bank.

• Marlena Franklin, CCIM, of Cold-well Banker Commercial AtlanticInternational, Inc. represented theLandlord, Sangaree Center LLC,and Tenant, PT Transmission Parts, in the lease transaction of the retailflex space located at 1731 N. MainSt.

RECENTTRANSACTIONS

October 2014

Third Quarter

A WORD FROM OUR PRESIDENT, BRENT CASE

help create new marketing campaigns and expand our presence in the Charleston com-munity.

Lastly, Coldwell Banker Commercial Atlantic is embracing new technology within several of our systems. We transitioned to an updated MLS database. This will improve search en-gine optimization of our properties and create a user-friendly experience for our constit-uents. Also, to produce maximum efficiency our Information Technology department is upgrading our email system to Office 365. The portability aspect of Office 365 will allow our agents to access pertinent information on the go and at any time.

Please visit Coldwell Banker Commercial Atlantic’s website and submit any feedback.

The thirdquarter has proven to be a busy and productive time in our office. Charleston as a whole is leading the way in the com-mercial real estate industry. We have experienced first hand the increasing rental rates and overall decreasing vacancy rates. We are thrilled to welcome this quarter’s new clients, while exceeding the expectations of our long-standing clients.

The third quarter has proven to be a time of change, not only in season, but also in our office dynamic. We welcomed our new Mar-keting Coordinator, Amber Foster, to the Coldwell Banker family. She comes to us from Philadelphia, Pennsylvania. With a back-ground in Strategic Communication and Retail Marketing, she will

LOCAL KNOWLEDGE, GLOBAL PERSPECTIVE.

Coldwell Banker Commercial Atlantic 3506 W Montague Ave. Charleston, SC 29418 Main: 843-744-9877 Fax: 843-744-9879

www.cbcatlantic.com

LOCAL KNOWLEDGE, GLOBAL PERSPECTIVE.

MARKET WATCH:

5107 N. Rhett AveOffice Building

Sale Price: $249,000MSL: 1413772

Bobby Reece 843-744-9877

41 Line StRestaurant/ General Business Space

Sale Price: $599,000MSL: 1426586

Kristen Krause 310-699-2765

5335 Dorchester RdEvanston Plaza

Sale Price: $4,899,000MSL: 1423811

Isabelle Martinez 843-708-7169

October 2014

Third Quarter

Midtown Apartments, was traded for $64 million, which equals to $320,000 per-unit sale price. It is anticipated that demand will keep pace with rising supply levels going into 2015 and rent is expected to grow at a steady 3-4%.

For more information on the Charleston market or available property, please contact John True at [email protected] or by phone at 843-568-3140.

MULTIFAMILY BY JOHN TRUE

to increase, up 13% since third quarter 2013, Boeing is ramping up production, and industrial land purchases are as abundant as they have been in over 5 years. This strongly indicates Charleston will see new industrial facilities within the coming years especially in the North Charleston, Summerville, and Daniel Island submarkets. Newer facilities, lack of options, relocation desires and continued general growth of the Charleston area will push industrial lease rates and purchase prices up in the coming years.

For more information on the Charleston market or available property, you can reach Ben-jamin Poblano at [email protected] or by phone at 843-566-5822.

INDUSTRIAL BY BENJAMIM POBLANO

The demand in the Charleston apartment marketplace has remained very strong with a record number (1,853) of units that were ab-sorbed over the past six months. All submarkets are seeing consis-tent activity with Mount Pleasant leading the way in construction starts for apartments. Currently Mount Pleasant has 1,120 units under-construction and 1,617 units in the pipeline. The overall Charleston area is staying bullish for development with 3,140 units under-construction and 3,971 units in the pipeline. With such strong demand and activity we have seen rental rates grow by almost 5% since last February and occupancy rates hover around 94%. Charles-ton saw a record sale on the Peninsula for the entire Charleston Region. Greystar Partner’s 200-unit development, Elan

The third quarter 2014 has seen Charleston’s industrial vacancy rates return to pre recession levels for the first time as demands remain constant and steady. In a major development the world’s largest producer of outdoor power products, Husqvarna, will be filling the recently vacated 450,000 square foot former American La France facility in Summerville. This quick turn around is a result of the lack of available industrial space within the area and high demand to be in South Carolina, especially in buildings over 100,000 square feet. Still, asking lease rates per square foot have yet to increase signifi-cantly in turn as one might think. However, port volumes continue

Coldwell Banker Commercial Atlantic 3506 W Montague Ave. Charleston, SC 29418 Main: 843-744-9877 Fax: 843-744-9879

www.cbcatlantic.com

LOCAL KNOWLEDGE, GLOBAL PERSPECTIVE.

MARKET TRENDS

MULTI-FAMILY

OFFICE

RETAIL

INDUSTRIAL

The data re-flects regional and local demands for commercial real estate, devel-oping multi-year forecasts of rent growth, vacancy rates, new con-struction, and absorption.Source: Reis

Vacancy:

Absorption:

Rental Rates:

Vacancy:

Absorption:

Rental Rates:

Vacancy:

Absorption:

Rental Rates:

Vacancy:

Absorption:

Rental Rates:

^

^

^^

^

^

^

October 2014

Third Quarter

^

Through the end of the third quarter the office market has bounced back from a relatively flat second quarter in both the number of sale and lease transactions. According to CMLS Data, office sales totaled $9,945,000 (22 transactions) 36%, representing 70,421 square feet at an average of $141.22 per foot. During the same period a total of 239,113 square feet of office (95 transactions) were leased, up 14% in transactions and up 23.5% in square footage absorbed from the previous quarter.

For more information on the Charleston market or available property, you can reach Tradd Varner at [email protected] or by phone at 843-725-6897.

OFFICE BY TRADD VARNER

The graph above compares and breaks down the office vacancy rates in the Charleston market, South Atlantic region and nation. Source: Integra Realty Resources

^

Charleston continues to be an attractive option for Technology, Bio-medical, Manufacturing, Tourism and Trade related industries. Charles-ton’s real estate market is very much in the expansion phase of the cycle; we are seeing decreasing vacancy rates, new construction and moderate rental rate growth. Charleston is below the national aver-age for office vacancy rates at approximately 9.3% with the national average of 15.29% within Central Business Districts. As office space continues to be absorbed at an impressive rate, I believe we will contin-ue to see rental rates continue to climb. This should lead to an increase in activity of development and a green light to those already slated.

^

^^

LOCAL KNOWLEDGE, GLOBAL PERSPECTIVE.

October 2014

Third Quarter

Coldwell Banker Commercial Atlantic 3506 W Montague Ave. Charleston, SC 29418 Main: 843-744-9877 Fax: 843-744-9879

www.cbcatlantic.com

LOCAL KNOWLEDGE, GLOBAL PERSPECTIVE.

suggested “frugal innovation” as a way to reach emerging economies. Lower cost container shipping helps South Carolina product manufac-turers grow organically and attract similar companies – clean industries that means higher skill, higher paying jobs for South Carolinians – a good thing. This is the very kind of workforce that creates the greatest need for the best commercial real estate: industrial, retail, multifamily and office.

According to a Post and Courier article, Ports Authority CEO, Jim Newsome indicated the results of the study and deepening project “…are that we will achieve the deepest harbor on the East Coast of the United States at the most reasonable cost with a very minimal amount of environmental mitigation.” Please encourage local and regional leaders to support this vital effort.

Please also help to underscore the need for this project. Submit your comments in favor of the Draft Integrated Feasibility Report and Envi-ronmental Impact Statement for the Charleston Harbor on the Charles-ton District’s website, via email, or mail sent to: Post 45 Comments, 69A Hagood Ave., Charleston, SC 29403. Feel free to use quotes from this article to indicate your support for this project.

For more information on the Charleston market or available property, you can reach David Eshleman at [email protected] or by phone at 843-725-6884.

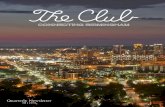

The Charleston Harbor is one of the most active ports along the East Coast.

Many companies and areas depend on the Charleston Harbor as a port of access. Photo Credit: The Post and Couier

The Charleston Port deepening is predicted to attract companies to South Carolina. Photo Credit: The Digital.com

CURRENT EVENTS BY DAVID ESHLEMANThe U.S. Army Corps of Engineers, Charleston District, recently proposed deepening the major shipping channels within Charleston Harbor from 45 to 52 feet to permit port access for Post Pana-max vessels at any tide. This means 24-hour access to and from our port for the largest of all container ships.

This is a significant benefit for South Carolina. The deepening means our manufacturers will have di-rect and more economical access to any port in the world. A past Economist article on innovation

Coldwell Banker Commercial Atlantic 3506 W Montague Ave. Charleston, SC 29418 Main: 843-744-9877 Fax: 843-744-9879

www.cbcatlantic.com

LOCAL KNOWLEDGE, GLOBAL PERSPECTIVE.

By: Warren L. Wise [email protected]

Thousands of new homes planned forGreater Charleston. Fifteen thousand

new residents each year. Low vacancy rates for retail, office and industrial buildings.

That all adds up to the Charleston re-gion being on the cusp of a time of new construction for commercial properties, according to the latest Commercial Real Estate Market Forecast from the Charles-ton Trident Association of Realtors.

“Growth” appeared to be the takeaway word from the annual look ahead.

“I think you will continue to see growth,” said Margaret Brockinton, president of Carolina Retail Property, who focuses on the retail sector. “The market is robust, to say the least. We are running out of property. All areas are having a good bit of activity.”

In the office segment, Terry Ansley with Landmark Enterprises, said, “I believe we are early in the growth cycle and chasing the demand.”

On industrial space, large speculative buildings are rising, but smaller ones are needed, said Alec Bolduc with Avison Young real estate.

The large suppliers for Boeing have not yet materialized, he said, but 74 percent of the aerospace-related firms in South Carolina have fewer than five employees.

“They are going to be growing and expanding and looking for spaces we don’t have today,” Bolduc said.

He added that the trend toward more rail-served buildings will continue to grow, and the refrigerated warehouse business will change the market and allow for more opportunities.

On the hospitality front, Michael Tall with Charlestowne Hotels said hotel room growth averaged about 100 keys a year over the past five years, but that will change during the next three years when more than 1,500 rooms will be added in the Charleston Metro area, many of them downtown through the twin Midtown Hyatt hotels opening next spring and the new high-rise hotel slated for the former Charleston County Library site near Mari-on Square.

With the number of tourists continuing to climb and the number of smaller, boutique hotels scheduled to be built, Tall believes downtown room rates will continue to be higher than the rest of Charleston County simply because the demand will be there to fill the supply.

Overall hotel occupancy throughout Charleston County, which has nearly 17,000 rooms, was 72 percent last year, above the healthy level of 70 percent. On the peninsula, occupancy has hovered around 80 percent this year and is expect-ed to continue that pace in 2015...For the entire article visit here.

Charleston Region on Cusp of New Growth for Commercial Real Estate

October 2014

Third Quarter

Employee Spotlight:

Name: Marlena Franklin

Title: CCIM

Specialty: General Brokerage

Experience: 21 years in the biz

Favorite News Publication: Charleston Regional Business Journal

“Outside of work, you’re most likey to find me...”:Gardening or being an active member of Women in Motion

Let’s Chat:[email protected]