3.Accounting Equation &Accounting Cycle

-

Upload

ankit-mohania -

Category

Documents

-

view

238 -

download

0

Transcript of 3.Accounting Equation &Accounting Cycle

-

8/8/2019 3.Accounting Equation &Accounting Cycle

1/134

The Accounting Equation

-

8/8/2019 3.Accounting Equation &Accounting Cycle

2/134

Resources

The Accounting EquationThe Accounting Equation

What are an organizations resources called?

-

8/8/2019 3.Accounting Equation &Accounting Cycle

3/134

Assets

Resources = Sources

The Accounting EquationThe Accounting Equation

What are thesources of theassets?

Resources usedin the business

-

8/8/2019 3.Accounting Equation &Accounting Cycle

4/134

Assets

Liabilities

OwnersEquity

Resources = Sources

Resources usedin the business

Resources

supplied bycreditors and

owners

The Accounting EquationThe Accounting Equation

-

8/8/2019 3.Accounting Equation &Accounting Cycle

5/134

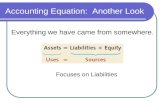

T he Accounting Equation

EconomicResources

Claims toEconomicResources

Assets = Liabilities + Owners Equity

At any point of time, the resources of a businessentity must be equal to the claims of the personswho have financed these resources.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

6/134

The Accounting equation is the equation whichshows the relationship among the three elements of the balance sheet namely-

Assets,Liabilities andOwners equity of a business.(capital)

The equation must be in balance after every recorded transaction in the system.

The Basic Accounting Equation The Basic Accounting Equation

Assets = Liabilities + Capital

-

8/8/2019 3.Accounting Equation &Accounting Cycle

7/134

a. Sachin deposits RS 25,000 in a bank accountfor ABC Ltd

ASSETS

=

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

OWNERS EQUITY

LIABILITIES

-

8/8/2019 3.Accounting Equation &Accounting Cycle

8/134

a. Sachin deposits RS 25,000 in a bank accountfor ABC Ltd.

ASSETS

=

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

OWNERS EQUITYCashCash

25,00025,000

LIABILITIES

-

8/8/2019 3.Accounting Equation &Accounting Cycle

9/134

a. Sachin deposits RS 25,000 in a bank accountfor ABC Ltd.

ASSETS

=

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

OWNERS EQUITYCashCash

25,00025,000

LIABILITIES

Sachin, CapitalSachin, Capital25,00025,000

TotalTotal25,00025,000

TotalTotal25,00025,000

-

8/8/2019 3.Accounting Equation &Accounting Cycle

10/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

b. ABC Ltd. buys land for Rs 20,000.

ASSETS

= OWNERS EQUITY

LIABILITIES

-

8/8/2019 3.Accounting Equation &Accounting Cycle

11/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

b. ABC Ltd. buys land for Rs 20,000.

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash(20,000)(20,000)

-

8/8/2019 3.Accounting Equation &Accounting Cycle

12/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

b. ABC Ltd buys land for RS 20,000.

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash(20,000)(20,000)

LandLand

20,00020,000

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

b. ABC Ltd buys land for RS 20,000.

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash(20,000)(20,000)

LandLand20,00020,000

TotalTotal25,00025,000

TotalTotal25,00025,000

-

8/8/2019 3.Accounting Equation &Accounting Cycle

13/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

c. ABC Ltd buys goods for RS1,350, agreeing topay the supplier in the near future.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

14/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

c. ABC Ltd buys goods for RS1,350, agreeing topay the supplier in the near future.

Accounts PayableAccounts Payable1,3501,350PurchasesPurchases

1,3501,350

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

c. ABC Ltd buys goods for RS1,350, agreeing topay the supplier in the near future.

Accounts PayableAccounts Payable1,3501,350PurchasesPurchases

1,3501,350

TotalTotal26,35026,350

TotalTotal26,35026,350

-

8/8/2019 3.Accounting Equation &Accounting Cycle

15/134

d. Receive fees for services performed, Rs.7,500

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

= OWNERS EQUITY

LIABILITIES

Fees earnedFees earned

7,5007,500

ASSETS

CashCash7,5007,500

TotalTotal33,85033,850

TotalTotal33,85033,850

-

8/8/2019 3.Accounting Equation &Accounting Cycle

16/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

e. ABC Ltd paid: wages Rs 2,125; rent, Rs 800;utilities, Rs 450; and miscellaneous, Rs 275.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

17/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash(3,650)(3,650)

e. ABC Ltd paid: wages Rs 2,125; rent, Rs 800;utilities, Rs 450; and miscellaneous, Rs 275.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

18/134

-

8/8/2019 3.Accounting Equation &Accounting Cycle

19/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

f. ABC Ltd pays Rs 950 to creditors on account.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

20/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash(950)(950)

f. ABC Ltd pays Rs 950 to creditors on account.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

21/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash(950)(950)

Accounts PayableAccounts Payable(950)(950)

f. ABC Ltd pays Rs 950 to creditors on account.

TotalTotal29,25029,250

TotalTotal29,25029,250

-

8/8/2019 3.Accounting Equation &Accounting Cycle

22/134

g. Sold goods worth Rs.800 for Rs 900

ASSETS

=

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

OWNERS EQUITY

LIABILITIES

-

8/8/2019 3.Accounting Equation &Accounting Cycle

23/134

g. Sold goods worth Rs.800 for Rs 900

ASSETS

=

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

OWNERS EQUITY

LIABILITIES

PurchasesPurchases(800)(800)

-

8/8/2019 3.Accounting Equation &Accounting Cycle

24/134

g. Sold goods worth Rs.800 for Rs 900

ASSETS

=

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

OWNERS EQUITY

LIABILITIES

PurchasesPurchases(800)(800)

CashCash900900

-

8/8/2019 3.Accounting Equation &Accounting Cycle

25/134

g. Sold goods worth Rs.800 for Rs 900

ASSETS

=

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

OWNERS EQUITY

LIABILITIES

PurchasesPurchases(800)(800)

CashCash900900

ProfitProfit

100100

TotalTotal29,35029,350

TotalTotal29,35029,350

-

8/8/2019 3.Accounting Equation &Accounting Cycle

26/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

h. Sachin withdraws Rs 2,000 in cash.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

27/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash(2,000)(2,000)

h. Sachin withdraws Rs 2,000 in cash.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

28/134

Business TransactionsBusiness TransactionsBusiness TransactionsBusiness Transactions

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash(2,000)(2,000)

Sachins, DrawingSachins, Drawing(2,000)(2,000)

h. Sachin withdraws Rs 2,000 in cash.

TotalTotal27,35027,350

TotalTotal27,35027,350

-

8/8/2019 3.Accounting Equation &Accounting Cycle

29/134

Transaction SummaryTransaction SummaryTransaction SummaryTransaction Summary

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash 6,8006,800PurchasesPurchases 550550LandLand 20,00020,000

-

8/8/2019 3.Accounting Equation &Accounting Cycle

30/134

Transaction SummaryTransaction SummaryTransaction SummaryTransaction Summary

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash 6,8006,800PurchasesPurchases 550550LandLand 20,00020,000

Accts. PayableAccts. Payable 400400

-

8/8/2019 3.Accounting Equation &Accounting Cycle

31/134

Transaction SummaryTransaction SummaryTransaction SummaryTransaction Summary

ASSETS

= OWNERS EQUITY

LIABILITIES

CashCash 6,8006,800PurchasesPurchases 550550LandLand 20,00020,000

Accts. PayableAccts. Payable 400400

Sachin, CapitalSachin, Capital 25,00025,000

Sachin, DrawingSachin, Drawing (2,000)(2,000)Fees EarnedFees Earned 7,5007,500Wages ExpenseWages Expense (2,125)(2,125)Rent ExpenseRent Expense (800)(800)Commission (450)Commission (450)Misc. ExpenseMisc. Expense (275)(275)

Profit 100Profit 100

-

8/8/2019 3.Accounting Equation &Accounting Cycle

32/134

Accounting Equation ExampleAccounting Equation Example

Anil started business with cash Rs. 2,50,000Purchased goods on credit worth Rs. 24,000

Purchased goods for cash Rs. 4,000

Purchased furniture for cash Rs. 1,500

Withdrew cash for private use Rs. 1,000

Paid rent Rs. 3,000

Received interest Rs. 1,000Sold goods on credit (cost Rs. 1,500) Rs.1,700

Paid to creditors Rs. 4,000

Paid salaries Rs. 2s,000

-

8/8/2019 3.Accounting Equation &Accounting Cycle

33/134

Accounting Equation ExampleAccounting Equation Example

Anil started business with cash Rs. 2,50,000Purchased goods on credit worth Rs. 24,000

Purchased goods for cash Rs. 4,000

Purchased furniture for cash Rs. 1,500

Withdrew cash for private use Rs. 1,000

Paid rent Rs. 3,000

Received interest Rs. 1,000

Sold goods on credit (cost Rs. 1,500) Rs.1,700Paid to creditors Rs. 4,000

Paid salaries Rs. 2s,000

-

8/8/2019 3.Accounting Equation &Accounting Cycle

34/134

The Double Entry System The Double Entry System

-

8/8/2019 3.Accounting Equation &Accounting Cycle

35/134

DoubleDouble- -Entry AccountingEntry AccountingDoubleDouble- -Entry AccountingEntry Accounting

Double entry accounting is the orderlyrecording of financial transactions of abusiness in a systematic manner wherebyeach transaction is recorded in its 2-fold aspects:i. Aspect of receiving i.e. debitii. Aspect of giving i.e. credit

Every debit has an equal and oppositecredit.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

36/134

On e debit On e credit

Each tra n sactio n is recorded with at least:

Total debits must equal total credits.

The

Double-Entry System The Double Entry System The Double Entry System

-

8/8/2019 3.Accounting Equation &Accounting Cycle

37/134

DoubleDouble- -Entry AccountingEntry AccountingDoubleDouble- -Entry AccountingEntry Accounting

In the Double entry system, both these aspects are

recorded in terms of accounts, such that at least twoaccounts are always affected by each transaction.

The T account is a representation of a scale or balance.

The total of the debit entries and total of the creditentries in the various accounts must be equal

Scale or Balance

Receive

DEBIT

Give

CREDIT

T account

Left SideReceiveDEBIT

Right SideGive

CREDIT

Luca PacioliDeveloper of Double-EntryAccounting

-

8/8/2019 3.Accounting Equation &Accounting Cycle

38/134

Adva n tage of Double E n try System

1) A complete record of the financial transactions ismaintained because it records both the aspects of every financial transaction.

2) It gives accurate information of amou n t due fromvarious debtors a n d amou n t due to variouscreditors by maintaining personal accounts of

debtors and creditors.3) Provides a check o n Arithmetical accuracy of the

account books.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

39/134

Adva n tage of Double E n try System(Co n t.)

4 ) It is helpful in preve n ti n g frauds a n d errors . tolocate the errors.

5) Helpful in ascertai n in g profit or loss of a particular period by preparing the Profit and Loss Account.

6) Fi n a n cial positio n of the business entity can beascertained by preparing the Balance Sheet.

7) It provides readily available information to be sentto in come tax a n d sales tax authorities .

8) It is helpful in filing accurate claim for loss of stock as a result of fire to the in sura n ce compa n y

because a complete record of stock is kept.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

40/134

Disadva n tage of Double E n try System

1) This system requires the mai n te n a n ce of an umber of books of accounts which is n otpractical in small concerns.

2) The system is costly because a number of records are to be maintained.

3) There is n o guara n tee of absolute accuracy of the books of account because trial balance mayagree in spite of errors .

-

8/8/2019 3.Accounting Equation &Accounting Cycle

41/134

Classification of Accounts According toTraditional Approach

Impersonal Accounts

Personal Accounts

ACCOUNTS

Real

Accounts

Nominal

AccountsNatural

Persons Accounts

ArtificialPersons

Accounts

RepresentativePersons

AccountsTangible

AccountsIntangible

Accounts

-

8/8/2019 3.Accounting Equation &Accounting Cycle

42/134

A: PERS ON ALACC OUN T:1. N atural Perso n s Perso n al Accou n t. An account recording transactions with anindividual human being is known as a natural persons Personal Account, e.g., AneeshsAccount.2. Artificial Perso n s Perso n al Accou n t. An account recording financial transactionswith an artificial person created by law or otherwise is called an artificial persons personalaccount, e.g., ABC Industries Ltd., Bank Account, S &. Co. etc.3. Represe n tative Perso n al Accou n t . An account indirectly representing a person or

persons is known as a representative personal account. When accounts are of a similar nature and their number is large, it is better to group them under one head and open a

representative personal account. Examples of such types of accounts can be: RentOutstanding Account, Interest Outstanding Account, Prepaid Salary Account etc. RentOutstanding Account is a personal account representing rent payable to. .

B: REALACC OUN T:1. Ta n gible Real Accou n t. Such type of account relates to an asset which can be

touched, Felt, seen and measured e.g., Plant Account, Cash Account, BuildingAccount,Stock Account etc.2. In ta n gible Real Accou n t. Such type of account relates to an asset which cannot betouched physically but can be measured in value. For example, Goodwill Account, PatentsAccount, Trade Marks Account, Copy Rights Account etc.C. NOM IN ALACC OUN TS.

These accounts deal with expenses, incomes, profits and losses.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

43/134

Rules For Double Entry Systemon the Basis of Traditional Classification

Real Account = D ebit What comes in

Credit- what goes out

Personal Account = D ebit Receiver

Credit - Giver

Nominal Account = D ebit Expenses/ Losses

Credit- Incomes/Gains

-

8/8/2019 3.Accounting Equation &Accounting Cycle

44/134

Classification of Accounts According toAccounting Equation

Assets Accou n ts Relates to tangible and intangible assets

Liabilities Accou n ts Eg. Creditors, bills payable, unearned revenue, other

short-term liabitlities, long term liabilities(secured andunsecured )

Equity Accou n ts Eg capital/share capital a/c, drawings a/c, retained

earnings,Revenue Accounts, Expense Accounts,

dividends

-

8/8/2019 3.Accounting Equation &Accounting Cycle

45/134

Regardi n g assets:Increases in assets - DEBITDecreases in assets - CREDIT

Regardi n g Liabilities:Increases in liabilities - CREDIT

Decreases in liabilities - DEBITRegardi n g Capital:Increases in capital - CREDITDecreases in capital - DEBIT

Regardi n g Expe n ses a n d Reve n ue:Expenses, Drawings, Dividends - DEBITRevenue - CREDIT

Regardi n g I n comes or Profits a n d Losses :Incomes or profits - CREDIT

Losses - DEBIT

Rules For Double E n try System o n Basis of Accou n ti n g Equatio n

-

8/8/2019 3.Accounting Equation &Accounting Cycle

46/134

Analysis of transactions is necessary for correctrecording of transactions.Steps:

Identify the accounts involved in the transaction to

be recorded.Classify the accounts identified as personal, real or nominal; or as asset, liabilities, capital, revenue or expenseDetermined the rules of debit and credit applicable tothe accounts involvedFinally determine the account(s ) to be debited and

the account(s ) to be credited.

Analysis of Transactions

-

8/8/2019 3.Accounting Equation &Accounting Cycle

47/134

1. Started business with Rs. 50,000

2. Purchased furniture for Rs. 1,000 on credit fromPankaj

3. Goods purchased for cash Rs. 20,0004 . Goods sold to Rahul Niwas for Rs. 5,000 on credit

5. Paid salaries to staff Rs. 1,800

6. Goods worth Rs. 500 returned by Rahul Niwas

7. Rs. 1,000 commission received

Example

-

8/8/2019 3.Accounting Equation &Accounting Cycle

48/134

-

8/8/2019 3.Accounting Equation &Accounting Cycle

49/134

Accounting cycle includes:(a) Recordi n g: First, all transactions should be recorded inthe Journal or Books of Original Entry known as subsidiary

books as and when they take place.(b) Classifyi n g: All entries in the Journal or Books of

Original Entry should be posted to the appropriate ledger accounts to find out at a glance the total effect of all suchtransactions in a particular account.(c) Summarizi n g: Last stage is to prepare the trial balanceand final accounts with a view to ascertaining the profit or

loss made during a trading period and the financial position of the business on a particular date.(d) In terpreti n g : The financial statements are interpreted in amanner useful to the users ,so as to enable them to makedecisions.

Accou n ti n g Cycle

-

8/8/2019 3.Accounting Equation &Accounting Cycle

50/134

1. Analyze the transaction

2. Journalize the transaction3. Post the transaction to accounts in ledger

4 . Prepare the trial balance

5. Prepare financial statements

The Accounting Cycle: Steps The Accounting Cycle: Steps

-

8/8/2019 3.Accounting Equation &Accounting Cycle

51/134

Accou n ti n g Cycle

The sequence of steps in recordingtransactions:

Tra n sactio n s Docume n tatio n J our n al

Fi n a n cialStateme n ts

TrialBala n ce

Ledger

The Accounting Cycle: Steps The Accounting Cycle: Steps

-

8/8/2019 3.Accounting Equation &Accounting Cycle

52/134

Accou n ti n g Cycle

Analysis of transactions from source documentsJournalising the transactionsPosting of journal entries into the ledger accountsBalancing of each ledger accountPreparation of a trial balance to establish equality of debits and credits in the ledger accounts.

Recording of adjusting entries in the journalRecording of adjusting entries in the Ledger account.Recording of closing entries in the journalPreparation of financial statements/final accounts

The Accounting Cycle: Steps The Accounting Cycle: Steps

-

8/8/2019 3.Accounting Equation &Accounting Cycle

53/134

Accou n ti n g Cycle

The process starts with sourcedocuments, which are the supportingoriginal records of any transaction.

Examples are sales slips or invoices,check stubs, purchase orders, bankdeposit slips, and cash receipt slips.

1. A n alyze the tra n sactio n

The Accounting Cycle: Steps The Accounting Cycle: Steps

-

8/8/2019 3.Accounting Equation &Accounting Cycle

54/134

2 . J our n alize the tra n sactio n In the second step, an analysis of the

transaction is placed in the book of

original entry, journal , which is achronological record of how thetransactions affect the balances of applicable accounts. T he most common example is the

general journal - a diary of all events(transactions) in an entitys life.

The Accounting Cycle: Steps The Accounting Cycle: Steps

-

8/8/2019 3.Accounting Equation &Accounting Cycle

55/134

In the third step, transactions are entered into

the ledger. Remember that a transaction is not

entered in just one place; it must beentered in each account that it affects.

D epending on the nature of theorganization, analysis of the transactionscould occur continuously or periodically.

3 . Post the tra n sactio n to accou n ts i n ledger

The Accounting Cycle: Steps The Accounting Cycle: Steps

-

8/8/2019 3.Accounting Equation &Accounting Cycle

56/134

Accou n ti n g Cycle

The fourth step includes the preparationof the trial balance, which is a simplelisting of all accounts from the ledger with their balances. Aids in verifying accuracy and

in preparing the financial statements Prepared periodically as necessary

4. Prepare the trial bala n ce

The Accounting Cycle: Steps The Accounting Cycle: Steps

-

8/8/2019 3.Accounting Equation &Accounting Cycle

57/134

Accou n ti n g Cycle

In the final step, the financial statements

are prepared. Financial statements may be prepared

after each quarter of the year. the companies may prepare

financial statements atvarious other intervals tomeet the needs of their users.

December 2007

5 . Prepare fi n a n cial stateme n ts

The Accounting Cycle: Steps The Accounting Cycle: Steps

-

8/8/2019 3.Accounting Equation &Accounting Cycle

58/134

J OURNAL

-

8/8/2019 3.Accounting Equation &Accounting Cycle

59/134

J ournal

It is a list in chronological order of all the

transactions for a business.

What is a journal?

ItIt isis thethe book book of of originaloriginal (first )(first ) entryentryItIt hashas thethe followingfollowing columnscolumns::

DateDate

ParticularsParticulars

Ledger Ledger FolioFolio

Voucher Number Voucher Number

Amount (DEB IT)Amount (DEB IT)

Amount (CRED IT)Amount (CRED IT)

-

8/8/2019 3.Accounting Equation &Accounting Cycle

60/134

Date Particulars V.NO. L.F Debit Credit

Format of J

ourn

al

-

8/8/2019 3.Accounting Equation &Accounting Cycle

61/134

-

8/8/2019 3.Accounting Equation &Accounting Cycle

62/134

Types of journal entriesSimple e n try - an entry for a transaction thataffects only two accounts

Compou n d e n try - an entry for a transactionthat affects more than two accounts

R emember: whether the entry is simple or compound, the debits (left side) and credits (right side) must always be equal.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

63/134

-

8/8/2019 3.Accounting Equation &Accounting Cycle

64/134

Recording transactionsin the journal.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

65/134

J ournalizing

It is the process of entering transactionsinto the journal

Steps:1. Identify transaction from source documents.

2.Specify accounts affected.

3.Apply debit/credit rules.

4.Record transaction with description.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

66/134

Steps Involved in J ournalizingTransactions

Analyse the transaction in source document to identifyappropriate accounts affected

Determine which accounts are to be debited and thoseto be credited based on rules of debit and credit

Enter date in first column( date colum n )

In particulars column enter the name of the accountdebited at extreme left of column and abbreviation Dr.at right end of particulars column.

Write amount in Debit column

-

8/8/2019 3.Accounting Equation &Accounting Cycle

67/134

Steps Involved in J ournalizingTransactions

In particulars column enter the title of the account to be credited indented to right preceded by the word

To and write amount in Credit column.Insert a narration which is a brief description of transaction

Draw a line across particulars column

-

8/8/2019 3.Accounting Equation &Accounting Cycle

68/134

J ournalizing

On April 1, Garge invested Rs 30,000 inGillen T ravel.

J ournal entryD ate Particulars D ebit Credit

April 1 Cash Account D r 30,000

To Garge Capital 30,000(Received initial investment

from owner)

-

8/8/2019 3.Accounting Equation &Accounting Cycle

69/134

Subsidiary Books

Subsidiary books, or books of prime entry or original entryare those where business transactions are recorded in the books in the first instance and then posted to the ledger from these books.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

70/134

Types of J our n als

1) Cash Book.2) Purchase (or Bought or Invoice ) Book.3) Sales (or day ) Book.4 ) Purchases Returns (or Return Outwards ) Book.5) Sales return (or Return Outwards ) Book.6) Bills Receivable Book.7) Bill Payable Book.

8) Journal Proper (General Journal )**First seven journals are special Journals while journal

proper is general journal

T f J l

-

8/8/2019 3.Accounting Equation &Accounting Cycle

71/134

Types of J ournals1) Cash Book -records cash (and bank) receipts and

paymentsShows balance of cash in hand and at bank.May also show discount allowed or received etc.

2) Purchases Day (or Bought or I n voice) Book -records all transactions of credit purchases of all merchandise

Shows the total credit purchases of goods and materials madeduring a particular period.

Credit purchases of goods, dealt in or of the materials andstores required in the factory

3) Sales (or day) Book- records all credit sales (of goods dealt in)

Shows total sales made during a particular period.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

72/134

Types of J ournals

4 ) Purchases Retur n s (or Retur n O utwards) Book-records all returns of goods and materials previously

purchased Shows total returns during a particular period.

5) Sales retur n (or Retur n O utwards) Book - recordsall sales returns made by the customersShows the total returns inwards during a particular period..

6) Bills Receivable Book- records all bills received from the customers.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

73/134

Types of J ournals7) Bill Payable Book- records all acceptances of bills made

by the firmIndicates the various dates on which payments of various billsare to be made.

8) J our n al Proper (Ge n eral J our n al) - records all residual transactions

Records all those transactions which could not be recorded inany of the above subsidiary books will be recorded in this book such as

i. Credit purchase and sale of assetsii. Opening entriesiii. Adjustment and Rectification Entriesiv. Closing Entriesv. Any other non-cash transaction not recorded elsewhere

-

8/8/2019 3.Accounting Equation &Accounting Cycle

74/134

3/2 615 MyMusicClub.com 2,2003/6 616 RapZone.com 1,7503/18 617 Web Cantina 2,6503/27 618 MyMusicClub.com 3,000

Totals 9,600

Sales J ournalInvoice

Date No. Particulars Details Amount

Page 35

The Sales J ournalThe Sales J ournal

All sales on credit are recorded in this journal. Each

sales invoice is listed in numerical order. This journal is often referred to as an invoice register.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

75/134

3/3 Howard Supplies 6003/7 Donnelly Supplies 4203/19 Donnelly Supplies 1,4503/27 Howard Supplies 960

Totals 3,430

Purchases J ournal Page 11

The Purchases J ournalThe Purchases J ournal

All purchases on account are recorded in this journal.

Date Particulars Details Amount

-

8/8/2019 3.Accounting Equation &Accounting Cycle

76/134

Cash journals

Single column Cash Book = Simple cash Book

Double column Cash Book = Cash Book with bank column

Triple column Cash Book

=Cash Book with Bank & Discount ColumnPetty Cash Book

= Record small cash payouts

-

8/8/2019 3.Accounting Equation &Accounting Cycle

77/134

-

8/8/2019 3.Accounting Equation &Accounting Cycle

78/134

Ledger

Ledger - a group of related accountskept current in a systematic manner

T hink of a ledger as a book withone page for each account.

Ledger

-

8/8/2019 3.Accounting Equation &Accounting Cycle

79/134

Ledger

Ledger is a register having a number of pageswhich are numbered consecutively.

One account is usually assigned one page in theledger.

However, if the transactions, pertaining to a

particular account are more, it may be assignedmore than one page in the ledger.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

80/134

Ledger

A ledger is a secondary book.The secondary books may be classified as:

M ai n Ledger (Ge n eral Ledger)

Contains all accounts except those of individual tradedebtors and trade creditors.

Subsidiary LedgerDebtors Ledger (Sales Ledger ) -contains individual

customers accountsCreditors Ledger ( Purchases Ledger ) -containsindividual accounts of trade creditors

-

8/8/2019 3.Accounting Equation &Accounting Cycle

81/134

Ledger Ledger

Creditors Ledger

Ledger

A B C D

Customer AccountsDebtors Ledger

A B C D

Creditor Accounts

General Ledger

-

8/8/2019 3.Accounting Equation &Accounting Cycle

82/134

Ledger Ledger

Cash Book

Creditors Ledger

Ledger

A B C D

Customer AccountsDebtors Ledger

A B C D

Creditor Accounts

General Ledger

-

8/8/2019 3.Accounting Equation &Accounting Cycle

83/134

Ledger Account

A ledger account may be defined as a summary

statement of all the transactions relating to a person,

asset, expense or income which have taken placeduring a given period of time and shows their net

effect.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

84/134

The common form of an account is the T account.

The account is divided into two sides for recording

increases and decreases in the accounts.

The T account has 3 parts:

1. A title that describes the name of the asset,liability, or equity account

2. A left side, or the Debit side .

3. A right side, or the Credit side .

The T Account

-

8/8/2019 3.Accounting Equation &Accounting Cycle

85/134

Date Particulars L.f Amt. Date Particulars L.f Amt.

Debit Title of the account CreditProforma for Accou n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

86/134

In practice, accountants draw up accounts in a formknown as the standard form.

The standard form shows the balance after everytransaction and is therefore more useful and efficientto use than the T-form.

Sta n dard Form of Accou n t

Date Expla n atio n Post

Ref.

Debit Credit Bala n ce

2008Mar 1

2

3

50,00020,000

58,000

50,00070,000

12,000

-

8/8/2019 3.Accounting Equation &Accounting Cycle

87/134

Posting

What is posting?It is the transfer of information from the

journal to the appropriate accounts in theledger.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

88/134

Posting

The account debited in the journal should also bedebited in the ledger and account credited should also

be credited in the ledger Steps:Enter dateEnter name of the other account being debited or credited.

Enter amount in proper debit or credit columnEnter journal source info U sually the words to and by are used on the

debit and credit side of the account respectively.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

89/134

Date Particulars Debit CreditApril 2 Cash 30,000

Garge Capital 30,000(Received initial

investment from owner )

Journal Page 1

Recording and Posting an EntryRecording and Posting an Entry

-

8/8/2019 3.Accounting Equation &Accounting Cycle

90/134

Date Ref. Particulars Amount Date Ref Particulars Amount

April 2 1 To G. Cap 30,000

Debit Cash Account Credit

Insert the number of the journal page.

Recording and Posting an EntryRecording and Posting an Entry

Recording and Posting an EntryRecording and Posting an Entry

-

8/8/2019 3.Accounting Equation &Accounting Cycle

91/134

L.F.Date Description Debit Credit

12/1 Prepaid Insurance 2,400Cash 2,400

J ournal Page 1

1. Analyze and record the transaction as shown.2. Post the debit side of the transaction.

3. Post the credit side of the transaction.

Recording and Posting an EntryRecording and Posting an Entry

Recording and Posting an EntryRecording and Posting an Entry

-

8/8/2019 3.Accounting Equation &Accounting Cycle

92/134

L.f Date Description Debit Credit

12/1 Prepaid Insurance 15 2,400Cash 2,400

J ournal

Ledger

Dr. Prepaid Insurance Account Cr.

Page 1

Recording and Posting an EntryRecording and Posting an Entry

D ate Particulars J .F. Amt. D ate Particulars J .F. Amt.

12/1 To Cash 1 2400

Recording and Posting an EntryRecording and Posting an Entry

-

8/8/2019 3.Accounting Equation &Accounting Cycle

93/134

Recording and Posting an EntryRecording and Posting an Entry

Date Description L.f. Debit Credit

12/1 Prepaid Insurance 15 2,400Cash 11 2,400

J ournal Page 1

13

4

Ledger Page No.15

Dr. Prepaid Insurance Account Cr.D ate Particulars J .F. Amt. D ate Particulars J .F. Amt.

12/1 To Cash 1 2400

2 5

-

8/8/2019 3.Accounting Equation &Accounting Cycle

94/134

Balancing of Accounts

Balance - difference between total left-sideamounts and total right-side amounts at anyparticular time Assets have left-side balances.

Increased by entries to the left side Decreased by entries to the right side

Liabilities and Owners Equity have right-sidebalances.

Decreased by entries to the left side Increased by entries to the right side

Various accounts in the ledger are balanced witha view to preparing the final accounts.

Balancing of Acco nts

-

8/8/2019 3.Accounting Equation &Accounting Cycle

95/134

Balancing of AccountsThe procedure of balancing accounts is as follows:

1) Take the totals of the two sides of the account concerned.2) Ascertain the difference between the totals of two sides. If the

debit side is more then the balance is a Debit bala n ceIf the credit side is more than the balance is a credit bala n ce

3) Enter the difference in the amount column of the side showingless total.Write against the difference in the particulars column To

Bala n ce c/d (c/d means carried down ) if debit side of the accountis less (credit balance ) and By Bala n ce c/d on the credit side of the account. In this way, the total of two sides will agree.

4 ) The balance is brought forward at the beginning of the next period.If To Balance c/d is written on the debit side before balancing, itis brought forward on the credit side and By Balance b/d (b/dmeans brought down ) is written against the balance in the

particulars column and vice versa.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

96/134

T R I AL B ALANCE

TR IAL BALANCE

-

8/8/2019 3.Accounting Equation &Accounting Cycle

97/134

A trial B alance may be defined as a statement

of debit and credit totals or ledger balances

extracted from the various accounts in the

ledger with a view to test the arithmetical

accuracy of the books.

TR IAL BALANCE

TR IAL BALANCE

-

8/8/2019 3.Accounting Equation &Accounting Cycle

98/134

It is a listing of all the accounts with their related balances at the end of the accounting period after all transactions have journalized and posted

It is an internal document.

Thus, at the end of the financial year or at any other time, the balance of all the ledger accounts are extracted

and are written up in a statement known as TrialBalance and finally totaled up to see if the total of debit

be is equal to the total of credit balances.

TR IAL BALANCE

The purposes of the Trial

-

8/8/2019 3.Accounting Equation &Accounting Cycle

99/134

The purposes of the TrialBalance

It provides a check o n accuracy by showing whether total debits equal total credits.

Source document for preparing external financial

statements-To establish a convenient summary of balances in all accounts for the preparation of formalfinancial statements

To identify accounts to be adjusted

To have an overview of operations

-

8/8/2019 3.Accounting Equation &Accounting Cycle

100/134

T he Financial Statements

The financial statements are a pictureof the company in financial terms.

Each financial statement relates to a specificdate or covers a particular period.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

101/134

Information Reported on the

Financial Statements

1. How well did thecompa n y perform(or operate) duri n gthe period?

Reven

ues Direct Expe n sesGross i n come (Gross loss)

Tradi n gAccou n t

Question Answer Financial

Statement

2 . How well did thecompa n y perform(or operate) duri n gthe period?

Gross Profit I n direct Expe n ses

N et i n come ( N et loss)

Profit a n dLoss

Accou n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

102/134

-

8/8/2019 3.Accounting Equation &Accounting Cycle

103/134

Income Statement

The income statement,reports the companys revenues,

expenses, and net incomeor net loss for the period.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

104/134

-

8/8/2019 3.Accounting Equation &Accounting Cycle

105/134

Tradi n g Accou n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

106/134

Tradi g Accou tThis account is prepared to know the tradi n g results or

gross profit (gross margin ) on trading of the business, i.e., buying and selling of goods during a particular period.

The differe n ce betwee n the sales a n d cost of goods soldis gross profit.

The balance of this account represents gross profit or lossand is transferred to the profit and loss account.

Only the transactions in goods and expenses related to

purchase of goods and manufacturing of goods (directexpenses ) are included and indirect expenses (admin.Expenses, selling & distrib expenses, financial expenses )are ignored

Gross Profit

-

8/8/2019 3.Accounting Equation &Accounting Cycle

107/134

Gross profit = Sales cost of goods sold

Cost of goods sold = Opening Stock + Net Purchases (i.e.Purchases Return outwards ) + Direct Expenses - ClosingStock Therefore,

Gross Profit = Sales ( O pe n in g Stock + N et Purchases +Direct Expe n ses - Closi n g Stock)Gross Profit = Sales Opening Stock - Net Purchases -Direct Expenses + Closing Stock

O pe n in g Stock + N et Purchases + Direct Expe n ses +Gross Profit = Sales + Closi n g Stock T he left hand side of this equation depicts debit sided and right hand side depicts credit side of the T rading Account.

Example

-

8/8/2019 3.Accounting Equation &Accounting Cycle

108/134

Example1. Compute the cost of goods sold from the following

information:Opening stock, Rs. 11 ,000; Purchases, Rs 2 10,000;

purchase returns Rs 7,000, Carriage inwards 18,000,closing stock Rs 17,000.

2. For the year ended March 3 1, 2009, V ishal Companysold goods for Rs 7 17,000. The average gross marginon sale was 4 0%. The following information is

available : Sales Returns Rs 17000, Opening Stock Rs4 0,000, Purchases Rs 4 ,18,000; Purchase Returns Rs6,000 and carriage inwards Rs 23,000. Calculateclosing stock.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

109/134

Proforma for the TradingAccount for the year ending

on 31.12.2005

Particulars Amount Particulars Amount

-

8/8/2019 3.Accounting Equation &Accounting Cycle

110/134

Opening stock

Purchases

Less:- Returns Outwards:-Drawings

Direct Expenses:-

Carriage inward

WagesFuel & Power

Customs/Import duty

Gross profit c/d(bal)

Sales

Less: Returns Inwards

Closing stock

Goods Lost by fire

(Gross Loss c/d)

Trading accountFor the year ended 31st March, 20XX

Partic lars Amo nt Partic lars Amo nt

-

8/8/2019 3.Accounting Equation &Accounting Cycle

111/134

Particulars Amount(Rs.)

Particulars Amount(Rs.)

To Opening Stock Purchases

Less : Purchases ReturnsTo D irect Expenses

Carriage InwardWagesFuel and Power

Manufacturing ExpensesCoal, Water and GasMotive Power

OctroiImport dutyCustom D uty

Consumable StoresForeman/ Works ManagersSalary

Royalty on ManufacturedGoods

To *Gross Profit c/d

B y SalesLess : Sales ReturnsB y Closing StockB y Gross Loss* c/d

Closi n g E n tries of Tradi n g Accou n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

112/134

Closi g E tries of Tradi g Accou tFor closing of Debit Accounts

Trading A/c Dr.To Opening Stock To Purchases A/cTo Sales Return A/cTo Direct Expenses (eg. Wages, carriage inwards,

freight inwards )For Closing of Credit Accounts

Sales A/c Dr.Closing Stock A/c Dr.Loss of goods by fire A/c Dr.

To Trading Account

Closi n g E n tries of Tradi n g Accou n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

113/134

Closi g E tries of Tradi g Accou t

For closing Trading AccountTrading A/c Dr.To Profit and Loss A/c

(Gross Profit, if credit side exceeds the debit side )

OR Profit and Loss A/c Dr.

To Trading Account(Gross Loss, if debit side exceeds the credit side )

-

8/8/2019 3.Accounting Equation &Accounting Cycle

114/134

Proforma for theProfit and Loss Account

for the year ending on

Profit a n d Loss Accou n tDebit for the period e n di n g o n ----- Credit

-

8/8/2019 3.Accounting Equation &Accounting Cycle

115/134

p gParticulars Amou n t Particulars Amou n tGross loss b/dAdmi n istratio n Expe n sesRe n t, Rates & TaxesO ffice salariesPri n ti n g & Statio n ery

Telepho n e chargesIn sura n ceAudit feesSelli n g & Dist Exp :-Advertiseme n t

Traveller s Salary, exp. &commissio nBad Debts

Carriage outwardsBa n k charges

N et Profit c/d (bal)

Gross Profit b/dIn terest ReceivedDiscou n t ReceivedComm. ReceivedDivide n d from shares

Re n t from propertyProfit o n sale of fixedassets/i n vestme n tsN et Loss c/d

Closi n g E n tries For Profit a n d Loss Accou n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

116/134

Closi g E tries For Profit a d Loss Accou tFor transfer of various expenses to Profit and Loss A/c

Profit and Loss A/c Dr.To V arious Expenses A/c(eg. Salaries, carriage outwards, Insurance,

advertisement )

For transfer of various incomes and gains to Profit andLoss A/cV arious Incomes and Gains A/c Dr.

To Profit and Loss AccountFor Net ProfitProfit and Loss A/c Dr.

To Capital A/c

For Net Loss

Capital A/c Dr.

To Profit and Loss A/c

Income StatementFor the year ended. (All figures in Rs. 000)

Sales 16 000

-

8/8/2019 3.Accounting Equation &Accounting Cycle

117/134

Sales 16,000Less: Cost of Goods Sold:

Raw materials consumed 7,800

Consumables 800D irect Labour 750Other D irect Expenses 480 9830Gross Profit 6170

Less: Operating Expenses

Administration Expenses 1200Selling Expenses 260D epreciation 700 2160

Operating Profit 4010 Add: Non Operating Income 50

4060Less:Non-Operating Expenses 100Net Profit before Interest & Tax 3960Less: Interest Paid 360Net Profit B efore Tax 3600Less: Income Tax @ 50% 1800

Net profit after tax 1800

. .Revenue from SalesGross Sales XXXXL S l R XXXX

-

8/8/2019 3.Accounting Equation &Accounting Cycle

118/134

Less: Sales Returns XXXXNet Sales XXXXLess: Cost of Goods Sold:

Opening Stock XXXXPurchases XXXXLess: Purchase Returns (XXXX)

XXXX Add Carriage Inwards XXXX

Net cost of Purchases XXXX

Cost of goods available for sale XXXXLess: Closing Stock (XXXX)Cost of Goods Sold XXXXGross Profit XXXXLess: Operating Expenses

Administration Expenses XXXX

Selling Expenses XXXXD epreciation XXXX XXXX

Operating Profit/ Profit B efore Interest and Taxes XXXXLess: Interest Paid (XXXX)Net Profit B efore Tax XXXXLess: Income Tax (XXXX)

Net profit after tax XXXX

The Accou n ti n g Terms I n come Stateme n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

119/134

The Accou n ti n g Terms- I n come Stateme n t

Reve n ue - the proceeds that come from sales tocustomers

Cost of Goods Sold (C O GS) - an expense that reflectsthe cost of the product or good that generates revenue.

Gross profit (gross margi n ) - excess of sales revenueover the cost of inventory that was sold. This is revenueminus COGS

O perati n g expe n ses - a group of recurring expenses that pertain to a firms routine operations. It includes anyexpense that doesn't fit under COGS such asadministration and marketing expenses.

The Accou n ti n g Terms I n come Stateme n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

120/134

O perati n g i n come (operati n g profit) - gross profit lessall operating expensesO ther reve n ues a n d expe n ses - items not directly relatedto the main operations of a firmN et I n come before I n terest a n d Tax - net income beforetaking interest and income tax expenses into account. It isthe remainder after all expenses have been deducted from

revenueN et loss - the excess of expenses over revenues

The Accou n ti n g Terms- I n come Stateme n t

The Accou n ti n g Terms I n come Stateme n t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

121/134

In terest Expe n se - the payments made on the company'soutstanding debt.

In come Tax Expe n se - the amount payable togovernment.

N et I n come the final profit after deducting all expenses(including income taxes ) from revenue.

Often seen as the bottom line

The Accou n ti n g Terms- I n come Stateme n t

Th B l n Sh t

-

8/8/2019 3.Accounting Equation &Accounting Cycle

122/134

The Bala n ce Sheet

A balance sheet is a statement that shows thefinancial position of a business entity at agiven date, usually the last date of theaccounting period.

A balance sheet is a financial statement which shows the

assets and liabilities of an enterprise as on a particular date.

Definition

The Bala n ce Sheet

-

8/8/2019 3.Accounting Equation &Accounting Cycle

123/134

The Balance sheet shows the financial position of acompany at a particular point in time. The balance sheet is also referred to as the statement

of financial position or the statement of financialcondition.

The financial position of a concern is indicated by itsassets on a given date and its liabilities on that date.Excess of assets over liabilities represent the capital andis indicative of the financial soundness of a company.A balance Sheet is also described as a statementshowing the sources and application of capital.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

124/134

Classificatio n of Assets

-

8/8/2019 3.Accounting Equation &Accounting Cycle

125/134

1. Fixed assets: Acquired for long term use in the business and not for resale

2. Current assets: acquired with the intention of converting them into cash or for consumption during

the normal business operations.3. Liquid assets: are assets which are immediately

convertible into cash without much loss. Liquid assets= Current assets Stock Prepaid expenses

4 . Intangible assets: eg. goodwill5. Fictitious assets: Are assets not represented by tangible

possession or property.eg. Formation expenses, debit balance of P & L A/c, discount on issue of shares.

-

8/8/2019 3.Accounting Equation &Accounting Cycle

126/134

Groupi n g a n d M arshalli n g of the

-

8/8/2019 3.Accounting Equation &Accounting Cycle

127/134

p g gBala n ce Sheet

The arrangement of assets and liabilities incertain groups and in a particular order is calledGrouping and Marshalling of the Balance Sheetof a business.

Groupi n g a n d M arshalli n g of the

-

8/8/2019 3.Accounting Equation &Accounting Cycle

128/134

Assets and liabilities can be arranged in the BalanceSheet into two ways:

1. In order of permanence

2. In order of liquidity

Bala n ce Sheet

Liabilities Rs. Assets Rs.Current Liabilities Current Assets:

B alance sheet, as at ____________

-

8/8/2019 3.Accounting Equation &Accounting Cycle

129/134

Current LiabilitiesB ank Overdraft

B ill Payable

Outstanding ExpensesSundry CreditorsIncome received in advanceLong Term Liabilities:

Loan from B ankD ebentures

Capital:Opening balance

Add: Net ProfitOr

Less: Net Loss Add capital introduced during theyear Less: D rawings

Total

Current Assets:Cash in H andCash at B ankB ills ReceivableSundry debtorsStock in T radePrepaid Expenses

Accrued incomeInvestments:Fixed Assets:Furniture & Fixtures

Motor Car Plant & MachineryB uildingLandIntangible AssetsPatents,CopyrightLicensesGoodwillFictitious Assets:

AdvertisementMisc. ExpensesProfit & Loss A/c

Total

Liabilities Rs. Assets Rs.Fixed Liabilities: Intangible Assets

Balance sheet, as at ____________

-

8/8/2019 3.Accounting Equation &Accounting Cycle

130/134

Fixed Liabilities:Capital

Opening balance

Add: net profit(-net loss)Capital introducedLess: D rawingsLong Term Liabilities:Loan from B ankD ebenturesCurrent Liabilities andProvisions:Income received in advanceSundry Creditor Outstanding ExpensesB ill PayableB ank OverdraftProvisions:Provision for taxProposed dividend

Total

Intangible AssetsGoodwillPatents

CopyrightLicensesFixed Assets:

B uildingMachineryFurniture & FixturesMotor Car

Investments:Current Assets:

Stock in T radeSundry debtorsInvestmentsB ills ReceivableCash at B ankCash in H andPrepaid Expenses

Fictitious Assets: AdvertisementMisc. ExpensesProfit & Loss A/c

Total

-

8/8/2019 3.Accounting Equation &Accounting Cycle

131/134

rom e o ow ng r a a ance prepare ra ng, ro oss ccoun an a ance eeD r (Rs.) Cr (Rs.)

Capital - 108,900Opening Stock 46,800 -

Notes:1. Closing stock as on 30 J une,

-

8/8/2019 3.Accounting Equation &Accounting Cycle

132/134

Sales & Sales return 8600 2,89,600Purchases & Pur. Returns 243100 5800Freight and Carriage Inward 18600 -Rent and Taxes 5700 -Salaries & wages 9300 -S/ D ebtors & creditors 24,000 14,800B ank loan @6% - 20,000B ank Interest 900 -Printing & Advertising 14600 -Income from Investment - 250Cash at bank 8200 -D iscount received - 3690Investments 5000 -Furniture & fittings 1800 -D iscount paid 7340 -General Expenses 3160 -

Audit Fees 500 -Insurance 800 -T ravelling Expenses 2130 -Postage & telegram 870 -Cash in hand 830 -D eposit with x @ 10% 30,000 -D rawings account 10,000 -

442230 442230

2007 was Rs. 786002. 50% of Printing and

Advertisement is to becarried forward as a chargein the following year.

3. D epreciate Furniture andFittings by 10%.

4. Create 5% reserve for doubtful debts on D ebtors,and Reserve 2% for discount of D ebtors andcreditors.

5. Insurance prepaid amountsto Rs 200.

6. Salaries outstanding Rs 500and Carriage outstanding Rs100.

7. Charge full years interest ondeposit with X

-

8/8/2019 3.Accounting Equation &Accounting Cycle

133/134

PR O F O R M ABALA N CE SHEET

LIABILITIES ASSETS

SHARE CAPITALAuthorised

FIXED ASSETSa) Land b ) Buildings c ) Goodwill

-

8/8/2019 3.Accounting Equation &Accounting Cycle

134/134

AuthorisedIssuedSubscribed

Less:- Calls unpaidAdd:- Forfeited sharesRESERVES A N D S U RPL U SSEC U RED L O AN SUN SEC U RED L O AN S:

C U RRE N T LIABILITIES A N D

PR O VISI ON S:A. C U RRE N T LIABILITIES:a) Acceptances.

b) Sundry Creditorsc) Subsidiary companies.d) Advance Paymentse) U nclaimed dividends

f ) Other liabilities (if any )g) Interest accrued but not due on loans.B. PR O VISI ON Sa) Provision for taxation.

a) Land , b ) Buildings, c ) Goodwill,d) Plant and Machinery e ) Furniture and fittingsf) Patents, trade marks and designs.

IN VEST M E N TS:a) Investments in Government or TrustSecurities, in shares, debentures or bonds,

b) Immovable Properties.C U RRE N T ASSETS, L O AN S A N D

ADVA N CES:(A) Curre n t Assets:

a) Interest accrued on Investments. b) Stores and Spare Parts,c ) Loose Toolsd) Stock in trade, e ) Works in progress.f ) Sundry Debtors, g ) Cash balance on handh) Bank balances(B) L O AN S A N D ADVA N CES:a) Advances and loans to subsidiaries.

b) Bills of Exchange.c) Advances recoverable in cash or in kindM ISCELLA N E OU S EXPE N DIT U RE:a) Preliminary expenses.