3 Reasons Why SandRidge Energy is Still a Buy at $7 a Share

-

Upload

the-motley-fool -

Category

Business

-

view

10.650 -

download

0

description

Transcript of 3 Reasons Why SandRidge Energy is Still a Buy at $7 a Share

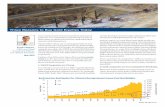

3 Reasons Why SandRidge Energy is Still a Buy at $7 a Share

Photo credit: SandRidge Energy

SandRidge Energy is off to a strong start in 2014.

2014 Highlights: Started 2014 by exiting the Gulf of Mexico. Delivered a surprisingly strong first-quarter as

earnings blew past Wall Street’s estimates. New plan has the company doing the

little things to create value. Company continues to pursue a plan to

unlock the value of its assets.

Despite the strong start to the year, SandRidge

Energy still has plenty of growth left in its tank.

Photo credit: SandRidge Energy

Reason to Buy No. 1: Actionable Growth

Simple growth formula:

1. Base decline rate begins to flatten.2. $1.55 billion average annual capital spending

plan on core focus areas.3. Steady improvement in well costs.

Reason to Buy No. 1: Actionable Growth

Results: 20-25% compound annual production growth

rate through 2016. Effectively doubles production in three years.

30%+ compound annual EBITDA growth rate through 2016. Operating leverage yields higher EBITDA growth.

Reason to Buy No. 1: Actionable Growth

SandRidge Energy also has compelling upside beyond it core focus

areas.

Photo credit: SandRidge Energy

Reason to Buy No. 2: Upsides

Up to six oily plays stacked underneath SandRidge Energy’s acreage:1. Company currently developing the Upper,

Middle and Lower Mississippian formations as part of its focused development plan.

2. Three additional areas are beginning to emerge: Marmaton, Chester and Woodford.

Reason to Buy No. 2: Upsides

Results: SandRidge Energy has added two new focus

areas over the past two quarters. Sumner County, KS added to focus area in fourth

quarter of 2013. 10 townships in northern Garfield County, OK

added in the first quarter.

Reason to Buy No. 2: Upsides

Results: SandRidge Energy is appraising the potential of

the Marmaton, Chester and Woodford. Drilled vertical appraisal well in the Marmaton.

30 day IP rate of 425 BOE/d. Drilled five horizontal wells in the Chester.

Average 30 day IP rate of 337 BOE/d.

Reason to Buy No. 2: Upsides

Results: SandRidge Energy is appraising the potential of

the Marmaton, Chester and Woodford. Drilled nine appraisal wells in the Woodford.

First well set had avg. 30 day IP rates of 30 BOE/d. Second well set had avg. 30 day IP rates of 143 BOE/d. Company is refining its geologic model for next set of

appraisal wells.

Reason to Buy No. 2: Upsides

Competitor focus:Chesapeake Energy sees great potential in the Mid-Continent.

Competitor focus:Devon Energy sees a lot of potential in the Woodford.

Finally, investors are undervaluing SandRidge energy’s assets, growth potential and upsides.

Photo credit: SandRidge Energy

Current CEO James Bennett sees shares worth upwards of $15.50 each.1. Base value of the company’s proved reserves

(PV-10).2. Assigning a value to the company’s probable

and possible reserves.3. Assigning a value to the saltwater disposal

system.

Reason to Buy No. 3: Undervalued

Valuation 1 (Conservative):

1. Proved Reserves (PV-10) = $4.1 billion

2. Probable and Possible Reserves (PV-15) = $2 billion

3. Assigning book value to SWD assets = $470 million

Reason to Buy No. 3: Undervalued

Valuation 1: Adjust for cash and the value of the three

Royalty Trusts. Under this conservative valuation Bennett sees

the value of the company’s net assets being $6 billion.

That’s roughly $10 per share.

Reason to Buy No. 3: Undervalued

Valuation 2 (Full Potential):

1. Proved Reserves (PV-10) = $4.1 billion

2. Probable and Possible Reserves (PV-10) = $6.2 billion

3. Assigning MLP EBITDA value to SWD assets = $1.15 billion (at 9 times EBITDA)

Reason to Buy No. 3: Undervalued

Valuation 2: Again, adjust for cash and the Trusts. Under this full potential valuation Bennett sees

the value of the company’s net assets being $9 billion.

That’s roughly $15.50 per share.

Reason to Buy No. 3: Undervalued

Investor takeawayEven at $7 per share SandRidge Energy still is a buy. It has

actionable growth and untapped growth, both of which are being undervalued by investors.

Photo credit: SandRidge Energy

Even SandRidge Energy wants to profit from this tax

“loophole”