2957 Old Rocky Ridge Road Birmingham, Alabama …Dec...The great Austrian economist Ludwig von Mises...

Transcript of 2957 Old Rocky Ridge Road Birmingham, Alabama …Dec...The great Austrian economist Ludwig von Mises...

www.infinitebanking.org [email protected]

Monthly Newsletter - December 2015

Banknotes

2957 Old Rocky Ridge Road Birmingham, Alabama 35243

BankNotes archives:

infinitebanking.org/banknotes

Nelson Nash, Founder [email protected]

David Stearns, Editor [email protected]

There's No Such Thing as Excessive ProfitsProblems with a "Fair Rate of Return"

ByRobertP.Murphy

If youwant to do business inVenezuela, youwillhavetoletthegovernmentdoyourbookkeepingtomakesureyouaren’tmakingtoomuch.Venezuelanpresident Nicolás Maduro’s decree, called the“OrganicLawofFairPrices,”setsamaximum“fair”profitat30percentofcosts.

Besidesthepracticalproblemsofimplementingsuchameasure,theceilingrestsonabasicmisconception:the idea that there is such a thing as “fair” or“excessive” profits misunderstands the function ofprofit—andloss—inamarketeconomy.

To bemoan a capitalist earning high profits is likecomplainingaboutasurgeonsavingtoomanylives.

The Profit-and-Loss Test

The great Austrian economist Ludwig von Misescherished the market process because he thoughtitwasawonderfulinstitutionforusingtheworld’sscarce resources in the way that best servesconsumers.Themarketpricesofvariousresources,fromlaborhourstotonsofirontoacresoffarmland,show entrepreneurs how valuable those resourcesareinthemostvaluableactivity—asjudgedbythespendingdecisionsofconsumers—andthusprovidetherightincentivestodeploythemrationally.

As I detail inmy new book onMisesian thought,Choice: Cooperation, Enterprise, and Human Action,wecanunderstandMises’sperspectivebyimagining

asillyscenariowhereabuildingcontractordecidesto coat apartment interiors with solid gold. Surelytenantswouldbewillingtopayalotmoreinrentiftheirapartmenthadgold-coatedcountertops.Sowhywouldthisbeafoolishmoveforourentrepreneur?

Theanswer,ofcourse,isthateventhoughrevenuesmightbemuchhigher,theuseofgoldwoulddrivethemonetary costs of the project higher still. Thedecisiontostartusinglargeamountsofgoldwouldtransformthepreviouslyprofitableoperationintoaloser.

Ultimately, value is subjective, so maybe theentrepreneurwouldgoforwardwithhisplan.Perhapsit’sapublicitystunt,orperhapshewantstousesomeofhispersonalwealthtotakeapublicstandforsoundmoney. Nonetheless, his accountant would informhimofthemonetaryimplicationsofhisplan.Totheextentthatthebuilderisinconstructioninorderto“makemoney,”themarketpriceswillguidehimtoabandonthefoolishideaofcoatingapartmentswithgold.

Now here’s the important element: notice thatalthoughthehighmarketpriceofgoldkeepsitfrombeingwasted inover-the-topapartmentdecoration,therearelinesofproductionthatcanprofitablyusegold. For example, jewelers who sell necklacescandoasimilarcalculationanddecide,“Theextraamountmy customerswouldbewilling to pay fora gold necklace rather than, say, a silver necklacejustifies the extra expense of putting gold intonecklacesratherthansilver.”

Indeed,ithastobethecasethatsome entrepreneurcanultimatelyaffordtouseagivenresource,because

BankNotes -NelsonNash’sMonthlyNewsletter-December2015

2www.infinitebanking.org [email protected]

otherwiseitsownerscouldn’tmakemoneyfromit.ToparaphraseYogiBerra,itwouldn’tmakesensetosayofaresource,Nobody uses that input anymore — it’s too expensive.

Perils of Cost-Plus Pricing

ThegreatthingaboutMises’sviewofprofitsisthathis conception shines when we enter the world ofdynamicuncertainty.Themathematicalneoclassicalmodels of “general equilibrium” are elegant, butthey really only work well to describe a situationonce everything settles down.Mises recognized theimportanceofprofitsinadjustingplanstoreality.

Inparticular,ifaninvestormakesan“abovenormal”rate of profit, it means that she anticipated futureconditionsbetterthanothersdid.Sherecognizedthatintheoriginalconfiguration,themarketprocesswasnotcorrectlyidentifyingthescarcityofcertaininputs;theyweretoocheap.Sothisfarsightedentrepreneurspotted thediscrepancyand swooped in to reap thebargain. In theprocess, shebidup thepricesof thetoo-cheapinputsand(bysupplyingmoreoutputdowntheroad)pusheddownthepriceofthetoo-expensiveoutput.

Incontrast,astaticconceptionleadstoabsurditiessuchasrecommendingthatlocalgovernmentsmonopolizeutilitieslikeretailelectricityprovidersandthenallowtheirinvestorstoearna“fair”rateofreturnthroughcost-pluspricing.

The fundamental problemwith this approach (froman economic perspective) is that it views “costs ofproduction” as given. If a company knows that itcan charge its “cost” plus amargin for profit, thenthereisnoincentivetofigureoutwaysofdeliveringmegawatt-hoursmorecheaply.

Gaming the System

Here’s another twist, which I just recently learnedfrom an expert on energy markets: if the officiallyallowedprofitmarginishigherthanthegoingrateofinterest,thentheownersofapubliclyregulatedutilitycanborrowtobecomeleveraged,thusmagnifyingtheactualrateofreturntheirshareholdersenjoy.

Forexample,supposethegovernmentoversightboard

allows theutility toearn5percenton itsoperation.Butsupposetheownersvotetohavetheutilityissuebonds at 3 percent, and they raise asmuch outsidedebt as they themselves put into the companywiththeir original investment. So if the utility is fundedwith,say,$50millionfrominitialinvestorsand$50million in bonds, then the regulatorsmight think itsatisfiestheruletoletthemearnatotalof$5millioninaccountingprofit.(That’sa5percentreturnonthe$100millionputintothecompany.)

But after paying 3 percent to the bondholders ontheir loans of $50 million (which is $1.5 million),theownersoftheutilityareleftwith$3.5millionofearnings, tobedistributedon thebasisof theirout-of-pocket$50millioninvestment.That’sa7percentreturn,notthe5percentreturnthepublicutilityboardthoughtitwasbestowing.

Themarket process uses the tool of profit-and-lossaccounting to steer entrepreneurs into economicaldecisions. Attempts to substitute another systemfor genuine capitalism will lead to unintendedconsequences.

RobertP.Murphy

RobertP.MurphyisauthorofChoice: Cooperation, Enterprise, and Human Action (IndependentInstitute,2015).

Comment by R. Nelson Nash – This article first appeared in a publication by The Foundation for Economic Education.

No More "Free Trade" Treaties: It's Time for Genuine Free TradeOCTOBER7,2015—FerghaneAzihari&LouisRouanet

It is erroneous to believe that free traders havebeen historically in favor of free trade agreementsbetween governments. Paradoxically, the oppositeis true. Curiously,many laissez-faire advocates fallinto thegovernment-made trapbysupporting“free-trade” treaties. However, as Vilfredo Pareto statedin thearticle“Traitésdecommerceof theNouveau

www.infinitebanking.org [email protected]

BankNotes -NelsonNash’sMonthlyNewsletter-December2015Dictionnaired’EconomiePolitique”(1901):

Ifwe accept free trade, treatisesof commercehavenoreasontoexistasagoal.Thereisnoneedtohavethemsincewhattheyaremeanttofixdoesnotexistanymore, each nation letting come and go freelyanycommodityatitsborders.Thiswasthedoctrineof J.B. Say and of all the French economic schooluntil Michel Chevalier. It is the exact model LéonSayrecentlyadopted.ItwasalsothedoctrineoftheEnglish economic schooluntilCobden.Cobden,bytaking the responsibilityof the1860 treatybetweenFranceandEngland,movedclosertotherevivaloftheodiouspolicyofthetreatiesofreciprocity,andcameclosetoforgettingthedoctrineofpoliticaleconomyforwhichhehadbeen,inthefirstpartofhislife,theintransigentadvocate.

In 1859, the French liberal economist MichelChevalierwent toseeRichardCobden toproposeafree trade treaty between France and England. Forsure, this treaty, enacted in 1860, was a temporarysuccessforfreetraders.Whatislessknownhowever,is that at first,Cobden, in accordancewith the freetradedoctrine,refusedtonegotiateorsignany“freetrade”treaty.Hisargumentwasthatfreetradeshouldbe unilateral, that it consists not in treaties but incompletefreedomininternationaltrade,regardlessofwhereproductscomefrom.

Chevalier eventually succeeded in obtainingCobden’s support. But Cobdenwas puzzled by thecompletesecrecysurroundingthenegotiationsand,inalettertoLordPalmerston,heattributedthissecrecyto the“lackof courage”of theFrenchgovernment.Similarly,today,thelackoftransparencyconcerningfreetradenegotiationsisproblematicandit isoftenhardtoknowwhatthecontentofatreatywillbe.

Today, while some of these treaties are currentlybeing negotiated, there are already examples ofsimilaragreementsenforced.Onecould refer to theGeneralAgreementonTariffsandTrade(GATT),theGeneralAgreementonTradeinServices(GATS),theAgreementonTrade-RelatedAspectsof IntellectualPropertyRights(TRIPS)ormoreregionalagreementslike the North American Free Trade Agreement

(NAFTA)ortheEuropeanEconomicArea(EEA).

Butwhywouldprotectionistgovernmentswhospendtheir timehamperingmarketsbygivingmonopoliesandotherkindsofprivilegesatnational level,openmarketsattheinternationallevel?Theveryfactthatgovernments are negotiating in the name of freetradeshouldbesuspiciousforanylibertarianortrueadvocateoffreetrade.

Intergovernmental Agreements Enhance Government Power

Murray Rothbard opposed NAFTA and showedthatwhat theOrwellianswerecallinga“freetrade”agreement was in reality a means to cartelize andincrease government control over the economy.Severalcluesleadustotheconclusionthatprotectionistpoliciesoftenhidebehindfreetradeagreements,forasRothbardsaid,“genuinefreetradedoesn’trequireatreaty.”

Thefirstclueistheintergovernmentalandtopdownapproach. Intergovernmentalism is nothing morethan a process governments use to mutualize theirrespective sovereignties in order to complete taskstheyarenotable toaccomplishalone.Nation-statesare entitieswhich rarelygiveuppower.When theyfinalize agreements, it is to strengthen their power,nottoweakenit.Onthecontrary,freetraderequiresadeclineofgovernments’regulatorypower.

Also,freetradedoesnotrequireinterstatecooperation.Onthecontrary,freetradecanbeandhastobedoneunilaterally. As freedom of speech does not needinternational cooperation, freedom to trade withforeigners does not need governments and treaties.Similarly, our government should not rob theirpopulationwithcorporatistandprotectionistpoliciesjustbecauseothersdo.Anyonewhobelievesinfreetradedoesnotfearunilateralism.Thesimplefactthatbureaucrats and politicians do not conceive of theinternationaleconomyoutsideofalegalframesettledbyintergovernmentalagreementsissufficienttoshowthemistrusttheyexpresstowardindividualfreedom.Thisreinforcestheconvictionthattheseagreementsaredrivenbymercantilistpreoccupationsratherthangenuinefreetradegoals.

BankNotes -NelsonNash’sMonthlyNewsletter-December2015

4www.infinitebanking.org [email protected]

Extending Regulatory Control Beyond Your Own Borders

Thesecondclueconcernstheintenseconflictsbetweengovernments on these agreements characterized bya high degree of technicality. History shows thatmultilateralism leads toward deadlock. The failureof theDohaRound is thecauseof theproliferationofbilateraland regional initiatives.Thecontentiousrelationsbetweengovernmentscomefromthewillofsomestatestodictatetheirnormstoothercountries’producers through an international harmonizationprocess.Butthisistheexactoppositeoffreetrade.Aseconomictheoryshowsus,exchangeandthedivisionof labor isnotbasedonequalityandharmonizationbutratherondifferencesandinequality.Furthermore,the technicality and secrecy surrounding free-tradeagreementsfavormercantilismandprotectionismtotheextentthattechnicalregulationsareusedtofavorproducerswhoarepoliticallywellconnected.

The Trans Pacific Partnership (TPP) is a goodillustration of this balance of power. It was at firstanagreementbetweenfourcountries(Brunei,New-Zealand,Singapore,andChile.)whichtriedtoresistsome neighbors’ commercial influence, especiallyChina.Then theUnitedStates came and convincedmorecountries (Australia,Malaysia,Peru,Vietnam,Canada,Mexico,andJapan)tojointhenegotiations.Let’salsonoticethatmostofthecountriesinvitedarealreadyboundbyregionalorbilateralagreementswiththeUnitedStates.Chinaremainsexcludedfromtheprocess.This governmental drive toward regulatoryhegemonyisobviouslythecompleteoppositeoffreetrade. Indeed, free tradesupposes lettingconsumerspeacefullychoosewhatproductstheywanttopromoterather than determining what is available throughbureaucraticcoercion.

Consolidation of Monopolies

The third clue concerns the vigor with whichgovernments have tried over several decades toimposeattheinternationallevelamoreconstraininglegalframeworkforso-called“intellectualproperty.”The first initiatives appear in 1883 and 1886 withtheParisConventionfortheProtectionofIndustrial

PropertyandtheBernConventionfortheProtectionofLiteraryandArtisticWorks.Amendedseveraltimesduringthetwentiethcentury,theinitiativesembrace,respectively,176and168 states.TheseconventionsareplacedundertheauspicesoftheWorldIntellectualProperty Organization (WIPO), an internationalbureaucracywhichjoinedtheUnitedNationssystemin 1974. A turning point came in 1994 with thesignatureoftheAgreementonTrade-RelatedAspectsofIntellectualPropertyRights(TRIPS)administratedby theWorldTradeOrganization (WTO). It is nowincorporatedasanessentialpartoftheadministrationof international commerce and benefits from theWTO’ssanctionmechanisms.

In2012weenduredafreshattemptbyourgovernmentstoreduceourfreedomtocreateandshareintellectualworkswiththeAnti-CounterfeitingTradeAgreement(ACTA).And,ifwelookatthenegotiationsmandatesofthesetradeagreements,wecanseetheyallincludea chapter on the reinforcement of “intellectualproperty” rights. Intellectualpropertyhasbecomeakey concept of the international economy. But thismustnothideitsillegitimacy.

AsVilfredoParetoremarked,“Fromthepointofviewoftheprotectionist,treatiesofcommerceare…whatismost important foracountry’seconomic future.”Eachtimeanew“freetrade”treatyisenacted,whatisseenistheattenuationoftariffbarriers,butwhatisnotseenisthesneakyproliferationandharmonizationof non-tariff barriers impeding free enterprise andcreatingmonopolies at an international scale at theexpense of the consumer. It’s time for genuine freetrade.

Comment by R. Nelson Nash – This article first appeared in a publication by The Mises Institute.

www.infinitebanking.org [email protected]

BankNotes -NelsonNash’sMonthlyNewsletter-December2015possiblefornooneeverhasoreverwillassessitintotality.Forinstance,theenergyweearthlingsenjoyis generally assumed tot have its origin in our star.Accordingtomydictionarythesunis:

…the incandescent body of gases about which the earth and other planets revolve and which furnishes light, heat and energy for the solar system.

Here is another assumptionwhich,until now, I hadnotquestioned;

Although less than half of the earth’s sunlight entering the earth’s atmosphere reaches its surface, just 4 minutes of that solar input equals all the energy mankind consumes in an entire year.

Threequestionspopintomind:

1.Isn’tispossiblethatthereissomethinginCreationthatprecedesthesunassource?Wedon’tknowonemillionthofonepercentofanything,letalonethis.

2.Are therenotuntold formsofenergybeyond therangeofsolarenergy?

3.Whyhastherenotbeenagreateruseofsolarenergyinthelightpresentenergysources?

Asasamplingofthethousandandonekindsofenergy,reflectonelectricalenergy.Thereisnotapersonwhoisevenawareofitsmanyuses.Theyrangefromtinyserviceslikeelectrictoothbrushesandelectricrazorstosuchenormousoutpouringsofkilowatt-hoursasinmetalmelting–steel,aluminumandthelike.

Until1864thehumanvoicecouldbetransmittedthedistanceashoutercouldbeheard–aboutthelengthof a football field – at the speed that sound couldtravel.Now?Aroundtheworldinthattimefractionofasecond–atthespeedoflight.Thephenomenonofelectricalenergy!

To repeat, electrical energyhas a thousandandoneusesandnotalivingpersonunderstandsasingleoneof them. Why this bald assertion? No one knows what electricity is!Thus,whereisthepersonwhocansolveourincreasingelectricalshortages?Wiseacresgalore, but not one remotely wise enough! Thatshouldbeself-evident.

VISION byLeonardE.Read

Note - Frequent readers of BANKNOTES are aware of my relationship with Leonard E. Read and my admiration for his works during his lifetime. In the following issues I will be sharing his book, VISION, one chapter per month. It was written in 1978. What a privilege it was for me to know this great man! -- R. Nelson Nash

ChapterSix

SOLVINGTHEENERGYCRISISISSIMPLE

TheDelphic oracle said Iwas thewisest of alltheGreeks. It isbecause that Ialoneofall theGreeks,knowthatIknownothing.—SOCRATES

TheU.S.A.isfacedwithanenergycrisis–nodoubtaboutit.Countlessthousandsofbureaucrats,involvedbusinessmen,“economists,”andothersareadvancingso-calledsolutionsthey“think”areright–nodoubtaboutthat!Exceptthatnearlyeveryoneoverlooksthesimpleandonlysolution,otherwise,theyalldiffer–notwoalike.

Why arewe in an energy crisis? It is because the“solutions”arefoundedonafalseassumption,namely,“I know the answer.” For the truth, hear ThomasAlva Edison: “No one knows more that millionthof one per cent of anything.” It’s these egotisticalassumption that brought on the crisis and it’s thesevery sameassumptions thatwillworsen rather thanbetter the mess we’re in unless the simple remedygainsunderstanding.

Thesimpleremedy?BothSocratesandEdisongaveustheanswerwhich,iffollowed,wouldreadlikethis:“ItisbecauseI,amongmillionsofAmericans,amonewho knows nothing and knows it.” It is necessary,however,thatneitheryounorIshouldbealoneinthewiseconfession.Lettherebeareasonablenumberofusandthen,loandbehold,themiracle–therescue–bythatfantasticwisdomwhichexistsaloneinthefreeandunfetteredmarket.

Withtheaboveasanintroduction,let’shaveaglanceattheenormityofenergy.Nomorethanaglanceis

BankNotes -NelsonNash’sMonthlyNewsletter-December2015

6www.infinitebanking.org [email protected]

The above is no more than a glance at the energyproblem.Supposesomeoneweretowriteabookonall theformshecouldbringtomind:Energystoredinsuchknownfuelsasgas,oil,coal,wood;magneticenergy, solar energy, gravitational forces, wind,waterpower,heatlight,sound,electricalandchemicalenergy; nuclear energy, tension, motion, friction,animalpower,humanenergy. Still,nomore thanaglance!

Countlesskindsofenergysupplementhumanenergy,Andnotehowvariable the latter– fromallsortsofphysicalexertionstosuchmentaleffortsasthinkingand writing. No two persons are identical in thisrespect;indeed,eachofusvariesfromdaytoday.

TheonlypointIamattemptingtoemphasizeisthatnoonehastheslightestideahow,byhimself,tosolvetheenergy crisis, egotistical pretensions to the contrarynotwithstanding!AmIcontendingthattheproblemhasno solution? No, the solution is so simple thatnearlyeveryoneignoresit.

Here are several thoughts that pave theway to thesimple answer. Even though no one knows whatelectricityis,countlessindividualswiththeirtinybitsofexpertise–whenfreelyflowing–havediscoveredhowtoharnessit.Likewise,noonereallyknowswhatsolarenergyisbutthemeansofharnessingithavebeendiscoveredinafewminorinstances. Whynotonalargerscale?Becausethegovernmenthasintervenedtothepointthatprivateeffortisdiscouraged,leavingthewisdomofthemarketdormant.

Toillustrate:SomeyearsagowehadawatershortagealongtheHudsonRiver.Carwashing,lawnsprinklingand the like were forbidden. Restaurants, short ofspecial requests, were not allowed to serve a glassof water. Why that economic crisis? Governmentpreempted – socialism – instead of the freemarketwherethewisdomis.

EvenmorestrikingwasanexperiencesomemonthsagoontheMonterreyPeninsula.Ineverybathroomwere printed instructions: flush toilets only whenabsolutelynecessary,confineshowerstooneminute,andsoon.Therewewereontheshoreoftheworld’slargest body; the PacificOcean. Awater shortage!

And for precisely the same reason as our watershortageontheHudson.

The art of desalination has been known for severaldecades. However,theprocesslieslargelydormantduetoapreponderanceofthosewhosay,“Iknowtheanswer.” They have convinced themselves and themassesthatnoothersolutionsthantheirwonwouldbeworthtrying–blindleadersoftheblind.

I am confident that if the market were trusted tooperate, water would be abundantly available, notonlyalongthePacificCoastbutmilesinlandaswell,atasurprisinglowprice.Thewisdomonthemarketisfarandmoreproductivethancanbemusteredthroughplannedcoercion.

Howexplainthesimplesolutiontotheenergycrisis:It’sassimpleastwotimestwoisfour.

In1958 Iwroteanarticleentitled,“I,Pencil.”Thisexplainedthatnopersonknowshowtomakesuchasimplethingasanordinarywoodenleadpencil.ThearticlehassincebeendistributedandreadthroughouttheUnitedStatesandothercountries,withoutasinglecontradictioninall theseyears. In1958therewereproducedinourcountry1,600,000,000woodenleadpencils,despitethefactthatnotapersononearthhadthecombinationofknowledgeandskilltomakeone!

It may be true that no one knows more than onemillionthofonepercentofanything. Butapencilconsistsofmanymillionsofsomethings–tinybitsofexpertise–flowingandconfigurating.Thefreeandunfettered market has indeed a wisdom trillions oftimesgreaterthanthewisdomofonewhoclaims,“Iknowtheanswer.”

Themakingofapencilisasimpleoperationcomparedto the desalination ofwater or to any of themajorphasesofourso-calledenergyproblems. So, leavethesolutiontothemarketwherethewisdomis.

Socrates’ secret was the knowledge that he didn’tknoweverything.Therefore,letusrecognizewithhimthevitalpossibilitythateveryoneknowsafractionofthisorthat.Howevertinyone’sportionmaybe,letitbefreelyproductive,forinfreedomdowebestserveourselvesandothers.

www.infinitebanking.org [email protected]

BankNotes -NelsonNash’sMonthlyNewsletter-December2015especiallyinJanuaryandFebruary,beingthedepthofwinter,andwantinghousesandothercomforts;beinginfectedwiththescurvyandotherdiseases,soastherediedsometimes2or3ofaday,intheaforesaidtime;thatof100andoddpersons,scarce50remained.

Theyspent theirfirstwinterbuildinghousesso thattheycouldmoveofftheMayflowerandbyMarchallsettlershadlefttheship.

Scurvyandfeverhadtakentheir toll,asbythen15of18wiveshaddiedaswellas19of29hiredmenand servants and half of the 30 sailors. When theMayflowerdepartedsheleft23childrenand27adultsbehind,butnotonePilgrimreturnedtoEngland.

ThePilgrimshadplacedalltheirfoodandprovisionsinwhattheycalledthe“commonstore”whichwassetuponthesocialistprincipleof“Fromeachaccordingtohisability,toeachaccordingtohisneed.”

Asspringcame theybegan to farmandbyOctobertookintheirfirstharvestwhichwenttothecommonstore. It was a time to be thankful for their verysurvival.Theyhadspent67daysontheAtlanticwith132peopleaboardaship thatwas128ft. long,andsurvivedtoestablishthemselvesandreapaharvest.

InNovemberof1621theshipFortunearrivedwithmorethan30newsettlers,mostlyyoungmen.Theyapparentlybrought“notsomuchasabisket-cake”withthem, thus providing another drain on the commonstoreforthecomingwinter.Thefuturelookedbleakas foodsupplies ranoutand the“plannedsocialist”community began to starve again. The commonstore was practiced for a second year. The harvestwas poor in spite of the added manpower and thecolonists starved in the ensuingwinterdramaticallydemonstrating once again that collective ownershipinasocialisteconomywasunworkableandcouldnotkeepthemalive.

RichardGrantinThe Incredible Bread Machine writes,

TheexperienceofthefirstPlymouthcolonyprovideseloquenttestimonytotheunworkabilityofcollectiveownershipofproperty.InhishistoryofthePlymouthcolonyGovernorBradforddescribedhowthePilgrims

Thanksgiving Is a Celebration of Free EnterpriseNovember26,2015JudyThommesen

[Every year at Thanksgiving-time I resurrect a column written by a fellow teacher, Kent Dillon, about the real reason we celebrate this holiday. It is a story no longer told in the textbooks because it is thoroughly unPC, and undermines the idea that government is the solver of all problems. We were teachers, as well as part of the crew, at The Flint School, a private, academic boarding school aboard two large sailing ships, and we used the world as a campus. Kent wrote this for the students’ parents 45 years ago, so they would know what their children were learning and experiencing.

Thanksgiving Day was a special day aboard the ships and we actively celebrated it as the birth of private property and the demise of collectivism. Our celebration wasn’t one of sleeping in or playing games with each other. We celebrated by working a specific task until completed, and then, when tired and hungry, we sat down to a huge feast of fresh cooked turkey, dressing, pumpkin pie, and shared camaraderie.

Even now in 2015, I can tell you that those Thanksgiving Day dinners of turkey, pies, and all the trimmings, after a day of meaningful labor, are still the tastiest I have ever eaten.]

Thanksgiving Celebrated as the Birthday of Free Enterprise

ByKentDillon

The celebrationofThanksgiving is a celebrationofplenty and appreciation of the abundance that hascharacterized the free enterprise, individualistic,capitalistic systems of the US. This why Americagrew into the most productive, highest standard oflivingareaintheworld.ThePilgrimshadarrivedinwhatisnowProvincetown,Mass.,onNovember11,1620,butitwaslateinDecemberbeforetheyfinallysettledinPlymouth.InthewordsofGov.Bradford,

that which was most sad and lamentable was, thatin 2 or 3months time half of their company died,

BankNotes -NelsonNash’sMonthlyNewsletter-December2015

8www.infinitebanking.org [email protected]

farmedthelandincommon,withtheproducegoingintoacommonstorehouse.FortwoyearsthePilgrimsfaithfullypracticedcommunalownershipofthemeansof production.And for two years nearly starved todeath,rationedattimesto“butaquarterofapoundof bread aday to eachperson.”GovernorBradfordwrotethat“faminemuststillensuethenextyearalsoif not someway prevented.”He described how thecolonists finally decided to introduce the institutionofprivateproperty:

“[Thecolonists]begantothinkhowtheymightraiseasmuchcornastheycould,andobtainabettercropthantheyhaddone,thattheymightnotstillthuslanguishinmisery.[In1623]aftermuchdebateofthings,theGov.(withtheadviceofthechiefestamongstthem)gavewaythattheyshouldsetdowneverymanforhisown…andtotrustthemselves...soassignedtoeveryfamilyaparcelofland.Thishadverygoodsuccess;for it made all hands very industrious, so asmuchmore corn was planted than otherwise would havebeenbyanymeanstheGov.oranyothercoulduse,…andgavefarbettercontent.Thewomennowwentwillinglyintothefield,andtooktheirlittle-oneswiththemtosetcorn,whichbeforewouldallegeweakness,and inability;whom tohavecompelledwouldhavebeenthoughtgreattyrannyandoppression.”

Reflectingontheexperienceoftheprevioustwoyears,Bradfordgoesontodescribethefollyofcommunalownership:

“Theexperiencethatwashadinthiscommoncourseand condition, tried sundryyears, and that amongstgodlyandsobermen,maywellevincethevanityofthat conceitofPlatosandotherancients, applaudedby some of later times;— that the taking away ofproperty,andbringingincommunityintoacommonwealthwouldmake themhappy andflourishing; asiftheywerewiserthanGod.Forthiscommunity(sofarasitwas)wasfoundtobreedmuchconfusionanddiscontent,andretardmuchemploymentthatwouldhavebeentotheirbenefitandcomfort.Fortheyoung-menthatweremostableandfitforlaborandservicedid repine that they should spend their time andstrengthtoworkforothermen’swivesandchildren,withoutanyrecompense.Thestrong,ormanofparts,

hadnomoreindivisionofvictualsandcloths,thanhethatwasweakandnotabletodoaquartertheothercould;thiswasthoughtinjustice…”

TheColonistslearnedabout“thewaveofthefuture”the hard way. However, once having discoveredthe principle of private property, the results weredramatic.Bradfordcontinues:

“By this time harvest was come, and instead offamine,nowGodgave themplenty,and thefaceofthingswaschanged,totherejoicingoftheheartsofmany,forwhichtheyblessedGod.Andintheeffectof their particular [private] plantingwaswell seen,for all had, onewayandother, prettywell tobringtheyearabout,andsomeoftheablersortandmoreindustrioushadtospare,andselltoothers.”

The Jamestown colony in Virginia had similarexperiencesastheystartedunderthesamerules:

1.Theyweretoownnothing.

2. They were to receive only as much food andclothingastheyneeded.

3. Everything that the men secured from trade orproduced from the landhad togo into thecommonstorehouse.

Ofthe104menthatstartedtheJamestowncolonyin1607only38survived thefirstyearandeven thosehadtobemarchedtothefields“tothebeatofadrum”simply togrowfood tokeep themalive in thenextyear. Captain John Smith writes after the commonstoreconceptwasabandoned:

Whenourpeoplewerefedoutofthecommonstore,and labored jointly together,gladwashecould slipfrom his labor, or slumber over his task he carednot how, nay, the most honest among them wouldhardlytakesomuchtruepainsinaweek,asnowforthemselvestheywilldoinaday.…Wereapednotsomuchcornfromthelaborsofthirty,asnowthreeorfourdoprovideforthemselves.

TheThanksgivingwecelebrateisforthesuccessofthe Pilgrims after establishing property rights andfree enterprise as that event laid the foundation forthegrowthofAmerica.

www.infinitebanking.org [email protected]

BankNotes -NelsonNash’sMonthlyNewsletter-December2015WereourPilgrimandJamestowncolonyforefatherstowakeupfromthedeadandlookatthegraduatedtaxation (from each according to his ability) andwelfareprograms(toeachaccordingtohisneed)wehavetodaytheymightofferusalessoninhistorybysimplyquotingGoethe,“Thosewhodonotlearnfromthelessonsofhistoryaredoomedtorelivethem.”

Nolongerdothetextbooksmentiontheeffectsofthecommonstoreandthecontinuedstarvationuntilthesystem of free enterprise and private property wasestablished.Don’t youwonderwhy the idea of theGreatAmericanExperiment is a forgotten concept?AndwhythewritingsofdeTocquevillearea“forgottenanalysis”intoday’seducation?AsAmericanamovesinto the “planned socialist economy,” those whohavemovedourcountryinthatdirectionhavemadesurethattheearlylessonsofthe“policestate”forceneededtomaintainJamestown’ssocialplan(CaptainJohn Smith’s guns) and of the starvation and deaththatresultedfromthelackofmotivationinspiredbythe“commonstorehouse”havebeeneliminatedfromourchildren’sinstruction.

Thanksgivingisn’tjustabreakfromwork,atimetostuffourselveswithturkey,dressing,andpumpkinpie,it isa timetorememberthe truesignificanceof theholiday,andpassonthelessonsfromourforefathersto our children who won’t learn these lessons inschool,andthusmustlearnthemelsewhere.

Comment by R. Nelson Nash – This story can’t be told enough. Make a copy and share it with your family and friends every year. It is the only way to preserve the truth.

Nelson’s Newly Added Book Recommendations

https://infinitebanking.org/books/

Thomas Jefferson and the Tripoli Pirates: The Forgotten War That Changed American History byBrianKilmeadeandDonYaeger

The Wisdom of Henry Hazlitt (LvMI) byHenryHazlittandHansSennholz

Nelson’s Favorite Quotes

“ItisbettertotakerefugeintheLordthantotrustinman.”Psalm118:8

“Thegreatmissionary,likethegreatartist,isabletoconvincesomepeopleofthetruthofideasthyalreadyhalfhold,buthavebeenimpedebypropagandaorrestraintsfromadopting.Thusheliberatedthemtobecomewhattheyhavepartlywantedtobeallalong,andsotheymoveinthenewdirectionnotonlywithoutregretsbutwithjoy.---JohnU.Nef.

Welcome the newest IBC Practitionershttps://www.infinitebanking.org/finder/

ThefollowingproducersjoinedorrenewedtheirmembershiptoourAuthorized Infinite Banking Concepts Practitioners teamthismonth:

• MattZimmer-Olathe,KS• WilliamMora-Houston,TX• MiguelChinea-Bayamon,PR• WillMoran-Edmonton,AB

You can view the entire practitioner listing on our website using the Practitioner Finder.IBC Practitioner’shavecompletedtheIBC Practitioner’s Program and have passed the program exam to ensurethat they possess a solid foundation in the theory andimplementation of IBC, as well as an understandingofAustrian economics and its unique insights into ourmonetaryandbanking institutions.TheIBC Practitionerhasabroadbaseofknowledgetoensureaminimallevelofcompetencyinalloftheareasafinancialprofessionalneeds,inordertoadequatelydiscussIBCwithhisorherclients.

10www.infinitebanking.org [email protected]

BankNotes -NelsonNash’sMonthlyNewsletter-December2015

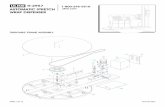

Announcing Three Upcoming IBC Training Opportunities

10-11-12-13 February, Birmingham, AL

1. The Whole Truth About Money SeminarExamining the Pros & Cons of Common Financial Vehicles

February, 10th, Birmingham, ALThisseminarisopentoeveryone,sospacewillbelimited!

Listen toToddLangford thedeveloperofTruth Concepts software,withKimButler, foradaylongseminarlookingindepthatThe Whole Truth About Money – Examining the Pros & Cons of Common Financial Vehicles.Thisseminarisaimedatthefinancialprofessional.

Click Here to connect with the Whole Truth About Money seminar landing page for more details.

2. The IBC Work ShopFebruary, 13th, Birmingham, AL

TheWorkShopisafour-hourIBCintroductoryseminarforthepublic.

Click Here to to connect with the IBC Work Shop landing page for more details.

ListentoR.NelsonNash,thecreatoroftheInfinite Banking Concept,andbest-sellingauthoroftheclassicBecoming Your Own BankerliveinBirmingham!

Nelsonwillbe joinedonstagebyRobertP.Murphy,Ph.Deconomist,andL.CarlosLara,authorsofthebookHow Privatized Banking Really Works.

Doyouhavethefeelingthatthereissomethingwrongwithtoday’sfinancialenvironment?

Doyoufeelthatyouarenotincontrolofyourmoney,andwonderwhois?

Ifyoucoulddosomethingaboutit,thenwouldyou?

Ifyouanswered“yes”totheseimportantquestions,thenyouarenotgoingtowanttomisstheIBCWorkShop!

Click Here to to connect with the IBC Work Shop landing page for more details.

11www.infinitebanking.org [email protected]

BankNotes -NelsonNash’sMonthlyNewsletter-December2015

3. The IBC Practitioners Think Tank SymposiumFebruary 11th and 12th, Birmingham AL

TheIBC Practitioner Think Tank SymposiumisaninvitationonlyeventforMemberIBCPractitioners.

BecauseNelsonhaspubliclyannouncedthathewillnolongerleadhisground-breakingBecoming Your Own Banker Seminar after November, 2016, I encourage all IBCPractitionerstomakeeveryefforttoattendthisyear'sThinkTankandspendsomequalitytimewithNelson.

This yearwe are encouraging IBCPractitionerStudents to attend as long as they alsoregisterfor,andtakethecoursefinalexampriortothestartoftheeventortaketheexamat theThinkTank event venue during one of two exam sessions offered either on theafternoonofthe10thorthemorningofthe11th.Oncetheexamiscompletedandgraded(passingscoreis80%),annualmembershipapplicationswillbetaken,thennewmemberswillattendtheThinkTank.AnyIBCPractitionerStudentthatdecidestotakeadvantageofthisopportunitywillhavetoregisterandpayfortheThinkTankandregisterforthefinalexamsessionbeforearrivinginBirmingham.

IBC Practitioners and Students, please use your restricted website dashboard page to access the Think Tank landing page which contains the agenda, registration pages and

discount coupons.

NOTE:WeareofferingdiscountstoIBCPractitionersandstudentsforThe Whole Truth About Money seminar that enable them to attend the seminar for $200 single, or $250couples.Theregularcostfortheseminaris$499forsingleattendanceor$599forcouples.ThediscountcouponsareontheIBCPractitionerorStudentrestricteddashboardwebsitepage;signinthewww.infinitebanking.orgthengotoyourstudentorpractitionerdashboardand look forThe Whole Truth About Money discount coupons. If you are planningonattending theThinkTankandwould like to takeadvantageof thisopportunity to learnfromToddandKim,Iencourageyoutoregisterfortheseminarquickly.

NOTE:WeencourageIBCPractitionerstostayoverinBirminghamonSaturday,the13thtojoinNelson,DrRobertMurphyandCarlosLaraattheIBC Work Shop atnoadditionalcost.WearealsoofferingourPractitionersdiscountcouponsfortheWork Shopthatcanbeused for clients or prospects.Thediscount coupon is onyour restricted dashboardwebsitepage;signinthewww.infinitebanking.orgthengotoyourstudentorpractitionerdashboardandlookforPractitioner IBC Work Shop Discount Coupons.