26TH ON INTERNATIONAL TRADE ANNUAL BAFT ......Concurrent Session A: Physical Supply Chain Chicago...

Transcript of 26TH ON INTERNATIONAL TRADE ANNUAL BAFT ......Concurrent Session A: Physical Supply Chain Chicago...

ANNUAL BAFT CONFERENCE ON INTERNATIONAL TRADE26THOctober 26-28, 2016 | Chicago Marriott Downtown | Chicago, IL

Driving Growth Through Partnership

2 | 26th Annual BAFT Conference on International Trade October 26-28, 2016 | Chicago Marriott Downtown | Chicago, IL | 3

Wednesday, October 26WiFi for the meeting sponsored by

7:30AM – 5:30PM

Registration Chicago Ballroom Foyer

3:00PM – 3:15PM

WelcomeChicago Ballroom E

Stacey FacterSenior Vice President, Trade BAFT

Daniel PinhoSenior Vice President and Assistant Group Manager PNC Bank

Gayle RoenbaughSr. Trade Sales Manager Global Trade & Receivables Finance Group HSBC

3:15PM – 4:00PM

Export Credit AgencyChicago Ballroom E

Join us in a global ECA discussion with senior level executives.

PanelistsSophie DumoulinDirector of the Contract Insurance & Bonding EDC

Peter LuketaSenior Advisor, Export Finance & Specialized Finance HSBC Bank

Michael WhalenVice President, Structured Finance Division Export-Import Bank of the United States

4:00PM – 5:00PM

Insurance Update Chicago Ballroom E

Topic to cover the “economics” of today’s insurance market with regard to increased default rates, protracted defaults. What do these insurers see going forward? How can lenders and corporates use TCI to mitigate risk in this current environment? What are the effects of Brexit on TCI? Whatever broker could maybe bring in the underwriters of their choice?

Moderator Al GiandomenicoFounder and President EIA-Global

Panelists Brett HalseySenior Vice President, Head of Credit and Surety QBE

Peter HunterVice President, Trade Credit Chubb

Paul KunzerDivisional Executive AIG

Byron ShoultonInternational Economist FCIA

5:00PM – 5:30PM

Regulatory Update Chicago Ballroom E

A discussion regarding major regulatory developments affecting the contours of international trade at the national and supranational levels. John Collins will provide an update and answer questions regarding on going concerns with the Bank Recovery and Resolution Directive (BRRD) in Europe, expected reforms from the Basel Committee, and expectations for the upcoming negotiations between the UK and European authorities in response to June’s Brexit vote.

SpeakerJohn CollinsVice President, International Policy BAFT

5:30PM – 6:15PM

Cross Border Factoring/Receivables Finance Chicago Ballroom E

A discussion to take a deeper dive into growing cross border factoring/RF. What are the fastest growing international markets? What are the challenges and how to mitigate risk from the perspective of an insurance broker and non-bank financial institution?

Moderator Samuel Moore

Panelists David A. Ciancuillo Partner Mayer Brown LLP

Zoran KanlicDirector, Supplier Finance Deutsche Bank

Michael KornblauUS Trade Credit Practice Leader Marsh

6:15PM – 7:30PM

Opening ReceptionChicago Ballroom Foyer

Bootcamp and full conference attendees are welcome to join the opening reception.

Sponsored by

2 3

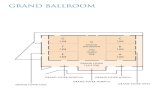

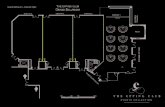

ProgramHotel Floor Plan

Wednesday, Thursday and Friday General Sessions

Wednesday and Thursday Receptions

Registration and Tabletop Displays

Board of Directors Meeting

Regional Bank Council / North American Council

SCF Boot Camp

Thursday and Friday Lunch and Concurrent Session B

4 | 26th Annual BAFT Conference on International Trade October 26-28, 2016 | Chicago Marriott Downtown | Chicago, IL | 5

ProgramThursday, October 27ARS is available during all general session presentations.

Thursday ARS sessions sponsored by

WiFi for the meeting sponsored by

7:30AM – 8:30AM

Registration and Networking BreakfastChicago Ballroom Foyer

Breakfast sponsored by

8:30AM – 9:00AM

Welcome and IntroductionChicago Ballroom E

Chris BozekConference Planning Co-Chair Global Trade and Supply Chain Product Head Bank of America Merrill Lynch

John AhearnChair, BAFT Global Head of Trade Citi

Tod BurwellPresident and CEO BAFT

9:00AM – 9:30AM

Opening AddressChicago Ballroom E

Keynote SpeakerTed DeanActing Assistant Secretary of Commerce International Trade Administration US Department of Commerce

9:30AM – 10:30AM

Roundtable Discussion on the State of the Trade Industry Chicago Ballroom E

Join an engaging exchange about the international trade industry’s current challenges and future opportunities straight from several of the global trade heads in the industry.

ModeratorVivek Ramachandran Global Head of Trade Product & Propositions Management HSBC

PanelistsPercy Batliwalla Global Head of Trade & Supply Chain Finance, Global Transaction Services Bank of America Merrill Lynch

Manoj MenonGlobal Head of Transaction Services & Financial Institutions First Gulf Bank

Michael VrontamitisHead of Trade Standard Chartered Bank

10:30AM – 10:45AM

Morning Coffee BreakChicago Ballroom Foyer

Sponsored by

10:45AM – 11:45AM

Challenges Related to Trade Compliance Chicago Ballroom E

Banks face a complex trade environment, driven by compliance issues, new technologies and the need for trustworthy correspondents. Consequently, many banks wonder how best to find optimal solutions and to reduce risk and network size while effectively facilitating trade transactions for their clients in the normal course of business. In this session, banks and FinTech experts will explore ways banks can manage the compliance, technology, cost, and regulatory issues associated with trade, and discuss innovative solutions and approaches that can help digitize the overall trade value chain.

ModeratorJoon KimConference Planning Co-Chair Head - Global Trade Product & Portfolio Management BNY Mellon

PanelistsHenry BalaniHead of Global Strategic Affairs Accuity

Madhav Goparaju Executive Director, Financial Services Advisory Ernst & Young

Sandra MarroneSenior Vice President Product & Innovation Group, Enterprise Commercial Payments KeyBank NA

11:45AM – 12:45PM

Distributed Ledger Technology and Transactional Banking: From Hype to Execution Chicago Ballroom E

From proof-of-concepts, industry consortiums, and numerous white papers, 2016 has seen accelerated interest in how to best apply distributed ledger technology to drive a more transparent and efficient supply chain. What have banks, corporates, and technology providers learned, and where do all go from here? This panel provides practical insights from all parties in the trade transaction on how to use blockchain technology to solve inefficiencies in the paper-driven/complex world of Trade Finance. Participants will discuss their journey to date as well as where they see the greatest opportunities to leverage this technology for the digitization of trade finance globally.

4 5

ModeratorGrainne McNamaraPrincipal PwC

PanelistsKitt CarswellVice President, Senior Offering Manager CGI

Ann McCormickDirector, Trade Product Manager Group Bank of America Merrill Lynch

Hillary WardDirector Industry Manager, US Financial Services Enterprise & Partner Group Microsoft

12:45PM – 2:00PM

Lunch with Guest Speaker Chicago Ballroom D

SpeakerDavid JacobsonVice Chairman BMO Financial Group

Sponsored by

2:00PM – 2:50PM

The Route Towards Digital Trade and Efficient eDocs Chicago Ballroom E

This session will embrace the thought of a more efficient paperless trade industry whereby both FI and corporate players adopt digital trade solutions as a strategy forward. A key obstacle for the international trade industry to evolve towards digitalization has been centered on the traditional Bill of Lading. This session will discuss a successful pilot on digital Bills of Lading as it relates to electronic presentations of trade instruments such as Export Letters of Credit, fully leveraging the eUCP guidelines. A few of the topics to be covered include: the role corporate executives play in such shift and how domestic & international banks may contribute assisting our clients shift from paper to electronic trade processes.

ModeratorAlex Thompson Global Product Manager Wells Fargo Bank NA

PanelistsJennifer DavidsonTrade Finance Coordinator Cargill Incorporated

Richard HellingVice President Commodities Trade Division Wells Fargo Bank NA

Marisa McGuire MartinVice President Americas essDOCS

CONCURRENT SESSIONS2:55PM – 3:45PM

Concurrent Session A: Physical Supply Chain Chicago Ballroom E

“Partnering for Growth” speaks to the vital role of participants across many industries, including logistics and infrastructure in global trade. In 2016, we have seen the completion of the project to expand the Panama Canal to accommodate ever larger container vessels, and the consequent raising of bridges and dredging of ports as well. As trade volumes and patterns grow and shift, what does this mean for the movement of goods around the world? This panel will address:• Trends in transportation and the distribution of goods• Panama Canal project• Importance of information and the role of technology

ModeratorAndrea Ratay, CICPVice President, Global Trade Finance TD Bank NA

PanelistsKen Roberts CEO WorldCity

Mark Szakonyi Executive Editor Journal of Commerce

CONCURRENT SESSION B: Standard Definitions for Techniques of Supply Chain Finance Chicago Ballroom D

Learn about the publication of a cross industry glossary for supply chain. Finance Products: Who? What? Why? And next steps.

SpeakersStacey FacterSenior Vice President, Trade BAFT

Michael J McDonough Head of Corporate Trade & Supply Chain Product JPMorgan

3:45PM – 4:00PM

Coffee BreakChicago Ballroom Foyer

Sponsored by

6 | 26th Annual BAFT Conference on International Trade October 26-28, 2016 | Chicago Marriott Downtown | Chicago, IL | 7

4:00PM – 5:00PM

International Working Capital Alternatives for Middle Market CompaniesChicago Ballroom E

Longer transit times and cross-border risk put pressure on a company’s working capital cycle. Large corporates have adopted Supply Chain Finance programs for their vendors, but how are middle-market companies handling the impact of longer accounts receivable and shorter payable cycles as terms move increasingly to open account? Our panelists will discuss trends and solutions from credit insurance to purchase order financing and supply chain finance.

ModeratorDan Fisher Head of Global Trade Finance TD Securities (USA) LLC

PanelistsMark RegenhardtPartner International Risk Consultants, Inc.

Paul SchuldinerSenior Vice President Rosenthal Trade Capital

Christine SnoufferGlobal Manager, Treasury & Risk Fellowes Brands

5:00PM – 6:00PM

Partnering in the New Correspondent Banking Paradigm Chicago Ballroom E

Join a lively interactive discussion among global and regional banks as they exchange views on the challenges and impact of compliance regulations and de-risking on their access to correspondent banking services.

ModeratorNelson de CastroHead of Corporate ITS Americas Global Trade Finance Solutions Wells Fargo Bank NA

PanelistsJohn Anello Director Trade Finance Financial Institutions, North America Deutsche Bank

Kimberly BurdetteSenior Vice President, International Financial Institutions PNC Bank

Angelina Grado Juarez, CDCSVice President & Manager of International Operations UMB Bank

6:00PM

Day One Wrap UpChicago Ballroom E

Joon KimConference Planning Co-Chair Head - Global Trade Product & Portfolio Management BNY Mellon

Tod BurwellPresident and CEO BAFT

6:00PM – 7:00PM

Networking Cocktail ReceptionChicago Ballroom Foyer

Sponsored by

Friday, October 28WiFi for the meeting sponsored by

7:00AM – 8:15AM

Registration and Continental BreakfastChicago Ballroom Foyer

8:15AM – 8:30AM

Welcome Chicago Ballroom E

Joon KimConference Planning Co-Chair Head - Global Trade Product & Portfolio Management BNY Mellon

Tod BurwellPresident and CEO BAFT

8:30AM – 9:15AM

Fireside Chat: Trans Pacific Partnership Chicago Ballroom E

SpeakersFormer US Ambassador David CardenPartner Jones Day

Robert G. Reiter, Jr.Secretary-Treasurer Chicago Federation of Labor

Program

6 7

9:15AM – 10:00AM

BREXIT – United Kingdom Votes “Leave”: What’s Next? Chicago Ballroom E

The United Kingdom’s decision to leave the European Union will likely have major implications for the future of both the UK and Europe. Join industry experts and business professionals for a panel discussion on the immediate and future potential business impacts of Brexit for financial services providers and their corporate clients.

ModeratorClarissa Dann Editor in Chief Trade & Forfaiting Review

PanelistsIngrid GardnerManaging Director UK/US Tax Desk BDO USA, LLP

Mark Compton Partner Mayer Brown International LLP

Chris SpeddingManaging Director Head of North America and Asia, Global Transaction Banking Lloyds Bank Commercial Banking

10:00AM – 10:15AM

Morning Coffee Break Chicago Ballroom Foyer

10:15AM – 11:15AM

Bridging the SME Trade Finance Gap—Challenges and Solutions Chicago Ballroom E

The so called “Trade Finance Gap” continues to put a brake on economic growth and job creation, particularly in the small and medium-size enterprise (SME) segment. Banks are constrained by new regulatory capital requirements and the increased KYC/AML compliance burden associated with financing SME’s. In this session, we’ll discuss the state of financial and technological innovation that’s enabling non-banks to offer transactional, event driven, and corporate development finance in what has traditionally been a bank-dominated field. Each of the panelists brings a different perspective and insight into developments that promise to have a wide-ranging, long term impact.

ModeratorChris BozekConference Planning Co-Chair Global Trade and Supply Chain Product Head Bank of America Merrill Lynch

PanelistsDr. Kati SuominenFounder and CEO TradeUp Capital Fund and Nextrade Group, LLC

Alan BeardManaging Director ExWorks

Gary MendellPresident Meridian Finance

11:15M – 12:30PM

Solution Showcase Chicago Ballroom E

Selected providers will present how their solution can solve a trade industry problem identified by the Global Trade Industry Council (GTIC) member. Trade problem: How to identify a “real” receivable and perfect interest in that receivable?• Is there a way to prevent double financing?• Since the way to perfect interest in the receivable differs from country to

country, is there a way to identify differences?• Given those differences is there a way to automate the process?

Featured Providers: › Fluent› IBM› LiquidX, Inc./Broadridge Financial › Newgen Software, Inc. › Tradle

12:30PM – 2:00PM

Awards and Networking LunchChicago Ballroom D

Enjoy lunch and another networking opportunity with your colleagues and fellow attendees, plus celebrate with awardees as the TFR Standards of Excellence Awards 2015 are presented. Awards and Networking lunch is included with full conference registration.

2:00PM

Closing RemarksChicago Ballroom D

Chris BozekConference Planning Co-Chair Global Trade and Supply Chain Product Head Bank of America Merrill Lynch

Tod BurwellPresident and CEO BAFT

Follow us during the conference via Twitter @BAFT_Global. If you tweet or share photos about the event, please add the hashtag, #BAFT, to your message.

8 | 26th Annual BAFT Conference on International Trade October 26-28, 2016 | Chicago Marriott Downtown | Chicago, IL | 98 9

John Ahearn Chairman of the Board, BAFTGlobal Head of Trade, Citi

Mr. John Ahearn, a Managing Director in Citi’s Transaction Services (CTS) business, is currently responsible for global supply chain and trade finance, including export and agency financing, as well as asset optimization. Prior to joining Citi, Mr. Ahearn was with ABN Amro for eight years and was responsible for Financial Institutions and Head of Sales globally for the trade business. He also had senior roles at Bank of New York and started his banking career at JP Morgan as a management trainee. Mr. Ahearn is also on the Board of Directors for BAFT and the Pacific Rim Bankers Association.

John Anello Director, Trade Finance Financial Institutions, North America Deutsche Bank

Mr. John Anello has 30+ years of experience, in Trade Finance, in both the banking and corporate sectors. He is currently responsible for Trade Finance Financial Institution sales, for Deutsche Bank New York, covering the United States and Canada. Mr. Anel-lo’s role is to deliver the banks trade finance global network, products and solutions to client banks, as well as placing DB originated deals through our correspondent FI network. Prior to his role in TFFI sales, John spent 12 years as Regional Americas Head of Trade Operations and Services for DB.

Henry BalaniHead of Global Strategic AffairsAccuity

Mr. Henry Balani is currently Global Head of Strategic Affairs for Accuity, responsible for driving thought leadership in the financial services industry. In his prior role as Head of Innovation, he helped pioneer new AML sanction screening solutions related to Trade Finance compliance. He was previously Managing Director with responsi-bility for managing Accuity’s Compliance Group that includes Product Management and Professional Services related to all Compliance Risk solutions. Accuity is a global provider of payments and compliance solutions with clients in the Financial Services and Corporate sectors, including banks, money services businesses, insurance, ship-ping and manufacturing firms. Prior to joining Accuity, Mr. Balani managed consulting practices with some of the largest professional services organizations in the world, including Accenture and IBM.

Percy Batliwalla Global Head of Trade & Supply Chain Finance, Global Transaction ServicesBank of America Merrill Lynch

Mr. Percy Batliwalla is managing director and head of Global Trade and Supply Chain Finance in Global Transaction Services (GTS) at Bank of America Merrill Lynch. He is based in New York. Prior to assuming his current position, he was based in Singapore where he held various sales leadership roles at Bank of America Merrill Lynch, most recently as the head of Global Sales for GTS. Mr. Batliwalla is a career banker with 25 years of experience spanning transaction banking, corporate banking, corporate finance, structured trade and audit. He has served in a variety of leadership roles covering corporate, financial institutions and public sector clients. Mr. Batliwalla joined Bank of America Merrill Lynch in May 2010, from JP Morgan.

Alan BeardManaging DirectorExWorks

Mr. Alan Beard has over 20 years of international finance and business development experience. Previously, he was the COO of Delphos International, a Washington, DC-based consulting firm that arranged several billion dollars in government grants, equity, guarantees and loans for more than 700 companies. He also headed merchant banking for Bank One Capital Corporation (now JP Morgan Chase), served as an official in both ExIm Bank and the Department of Commerce’s International Trade Administration. Currently, he is an adjunct professor at Georgetown University for undergraduate and graduate international business courses. He has edited and contributed to the writing of more than 20 books and is a frequent speaker on international finance issues.

Chris BozekConference Planning Co-ChairGlobal Trade and Supply Chain Product HeadBank of America Merrill Lynch

Mr. Chris Bozek is managing director and head of Global Product and head of North America for Global Trade and Supply Chain Products in Global Transaction Services at Bank of America Merrill Lynch. In this position, Mr. Bozek leads the Global Trade and Supply Chain product team that is focused on delivering processing and financing

solutions that improves a client’s end-to-end global supply chain, while optimizing working capital. In March this year, he also assumed responsibility for the North Amer-ica business for Trade and Supply Chain Finance. During his career, Mr. Bozek has led treasury and trade product teams to successfully build out e-invoicing, global trade, and procure-to-pay product offerings targeted to middle-market and global corpo-rates. Prior to joining Bank of America Merrill Lynch, Mr. Bozek held global product management, general management, and business development positions with Fortune 500 companies, leading-edge start-up businesses, and global financial institutions.

Kimberly BurdetteSenior Vice President, International Financial InstitutionsPNC Bank

Ms. Kimberly Burdette is a Senior Vice President in Capital Markets for PNC Bank and the manager of its International Financial Institutions business. She has responsibility for the relationship, credit and compliance management of international banks with which PNC engages. PNC provides a wide range of trade, treasury management, bal-ance sheet management and capital markets solutions and services to international financial institutions operating in the US and abroad. Ms. Burdette has worked for PNC Bank and its predecessor, Pittsburgh National Bank, for 30 years. Mrs. Burdette is currently EVP of PNC’s edge act subsidiary, PNC Bank International. She also serves as a director for BAFT. She received her BS in languages and international business from Georgetown University.

Tod BurwellPresident and CEOBAFT

Mr. Tod Burwell is the President and Chief Executive Officer of BAFT. Prior to being promoted to CEO, he served as the Senior Vice President of Trade Products with over-sight of all trade-related initiatives including the Global Trade Industry Council, Trade Committees, and other strategic initiatives of the organization. Mr. Burwell has over 25 years of trade, supply chain, and cash management experience as a banking practi-tioner, as well as serving as a consultant to global corporations and suppliers of stra-tegically integrated trade solutions. Prior to joining BAFT, Mr. Burwell was a Managing Director at JPMorgan Chase and held senior global management roles responsible for trade operations, launching the logistics business and managing global product sales for trade finance and logistics management.

David CardenPartnerJones Day

Ambassador (Ret.) David Carden returned to Jones Day in 2014 after serving as the first resident US Ambassador to the Association of South East Asian Nations (ASEAN). He is Partner-in-Charge of Asia. As US Ambassador, Mr. Carden oversaw the broad-ening engagement of the United States in Southeast Asia, which included the Obama Administration’s 2011 “pivot” or “rebalance” to the region. Based in the US Mission to ASEAN in Jakarta, he traveled throughout ASEAN’s 10 member states and Asia. His responsibilities included supporting ASEAN as it moved toward economic integration in 2015 and advocating for the systemic changes necessary to promote peaceful and prosperous growth in the region. Prior to his ambassadorship, he was a partner in the Firm’s New York Office where he co-chaired the Securities Litigation & SEC Enforce-ment Practice. He has represented clients in some of the largest securities fraud class actions ever litigated, including the defense of Lehman Brothers in the Enron Litigation and Union Excess in the In Re AIG Securities Litigation.

Nelson de CastroHead of Corporate ITS Americas Global Trade Finance SolutionsWells Fargo Bank NA

Mr. Nelson de Castro is a senior vice president and head of corporate ITS Americas, for Wells Fargo International Group. He leads a client-centric nationwide team located from Seattle to Miami to best deliver Wells Fargo’s extensive suite of trade finance solutions to all wholesale banking clients located in the USA, Canada, Mexico, and Brazil. He is responsible for strengthening and deliver our global trade value proposition on both ends of our clients trade flows (Import & Export). With more than 18 years of international business, global trade finance, and management experience, he has worked for several companies including Quaker Oats, American National Bank, J.P. Morgan Chase, and RBS Group in areas such as commercial banking, asset-based finance, financial institutions, sales and international banking. A few areas of expertise include how to mitigate international risk exposure, empower customers to grow their international business, reduce international DSO, enhance DPO, and strengthen supply chain relationships.

SpeakersKittredge CarswellVice President, Senior Offering ManagerCGI

Mr. Kitt Carswell has 30-plus years’ experience providing trade technology for banks and their corporate customers globally, including five years running Corporate Banking for Europe. As Senior Offering Manager for CGI’s Trade and Supply Chain Solutions group, he is responsible for the strategic direction of CGI’s Trade360 glob-al transaction platform and strategic business partnerships. Mr. Carswell has lead Trade360’s evolution from a global traditional trade solution into a fully integrated global platform with front-to-back and end-to-end solutions for traditional trade, payables, receivables, collateral management and cash management. Mr. Carswell was an early advocate of the supply chain centric view of trade banking to align bank offerings and solutions with corporate customers’ changing needs driven by the forces of globalization, working capital optimization and liquidity. He has advanced this perspective through industry groups, publications, Webinars, numerous speak-ing engagements, white papers, over 25 published articles and frequents quotes in industry journals. Mr. Carswell is now engaged in the exploration of blockchain solutions for trade finance.

John CollinsVice President, International PolicyBAFT

Mr. John Collins is Vice President of International Policy for BAFT, overseeing the de-velopment and execution of its global policy and advocacy efforts. Prior to BAFT, Mr. Collins served as Head of Policy for Coinbase, a leading blockchain company, where he led the company’s discussions and relationships with governments worldwide. Prior to Coinbase, he served as Senior Professional Staff Member for the US Senate Committee on Homeland Security and Governmental Affairs for Chairman Tom Carper (D-DE). Mr. Collins was the Chairman’s primary advisor on emerging issues related to digital currencies and blockchain technology, leading the first Congressional hearing on the subject in the fall of 2013.

Mark ComptonPartner Mayer Brown International LLP

Mr. Mark Compton is a partner in the Financial Services Regulatory & Enforcement practice of the London office. The Legal 500 UK directory has also praised his “fan-tastic knowledge” and his “very clear” advice. Mark advises a wide range of clients on all aspects of UK and EU financial services legislation and on legislation and sys-tems and controls relating to bribery, money laundering and economic sanctions. Prior to joining Mayer Brown in 2011, he was senior regulatory lawyer at BP plc and previously spent over five years in Enforcement and General Counsel’s Divisions at the UK’s Financial Services Authority. Mr. Compton has been interviewed and quoted frequently on Brexit-related issues in both US and UK media.

David CiancuilloPartner Mayer Brown International LLP

Mr. David Ciancuillo practices banking law, with an emphasis on securitization, asset-based lending, trade and supply chain finance and other structured finance products. Mr. Ciancuillo regularly represents banks, borrowers, investment vehicles and other finance companies in various transactions, including: asset-based lending facilities; subscription facilities; securities offerings; and the purchase and financing of trade receivables, student loans, mortgages, equipment and automobile loans, insurance related products and a variety of other assets. He has a great deal of experience in reviewing, negotiating and helping clients to create complex financing, refinancing, cross-border and investment programs designed to address a wide vari-ety of legal issues and strategic goals, including matters relating to secured lending; global trade and supply chain finance; insurance related products; and accounting and regulatory matters. He also has substantial experience in the workout, restruc-turing and settlement of many forms of transaction and asset types, as well as bank-ruptcy related issues in connection with such transactions. In addition, he has been involved in a variety of matters, and represents a diverse group of participants, in the insurance and life settlement industry.

Clarissa DannEditorTrade & Forfaiting Review

Ms. Clarissa Dann is editor of Trade & Forfaiting Review (TFR), the specialist trade and receivables finance information service now in its 19th year. TFR includes a monthly magazine, an online information service, events, trade finance books and two annual awards competitions. Ms. Dann’s former roles have included running

legal and regulatory publishing teams at Thomson Reuters and Lexis Nexis before completing her MBA in 2004 from Cass Business School in London and retraining as a financial journalist. Based in the UK, she is regular participant in and reporter on trade and commodity finance events around the world. She is a contributor to TFR’s Guide on Financial Crime Prevention in Trade Finance, and is studying for the Certif-icate in International Trade and Finance. In her limited spare time she plays double bass in various UK amateur orchestras.

Jennifer DavidsonTrade Finance CoordinatorCargill, Incorporated

Ms. Jennifer Davidson has over 25 years international trade experience. She began her career with Cargill in 1995 as a Forwarder in Cargill’s Latin American Grain Divi-sion. She has held various positions since in Trade & Structured Finance, Corporate Treasury, Cargill Cotton, Corporate Audit and most recently as Trade Finance Coor-dinator in Grain & Oilseed Supply Chain/North America. Ms. Davidson has been a featured panelist at the Institute for International Banking Law & Practice and Guest Faculty/Letter of Credit Instructor at the American Cotton Shipper’s Institute. She also serves on Cargill’s Letter of Credit Center of Expertise.

Ted DeanDeputy Assistant Secretary for ServicesUS Department of Commerce International Trade Administration

Mr. Dean directs the Department of Commerce’s efforts to enhance the competitive-ness of the US services industries, which account for approximately 80 percent of the private sector economy of the United States. In that capacity he leads his divi-sion’s efforts to develop trade policies, initiatives and programs aimed at ensuring the long term competitiveness of the US services industry. He also directs the analysis of trends affecting US businesses across the full services spectrum ranging from digital to finance, logistics supply chain and professional services. Additionally, Mr. Dean works to ensure that US businesses have competitive access to export finance through the Department of Commerce’s representation on the Export-Import Bank and the Overseas Private Investment Corporation and the World Bank.

Sophie DumoulinDirector of the Contract Insurance & BondingEDC

Ms. Sophie Dumoulin has been Director of the Contract Insurance & Bonding program at EDC since April 2015. She joined EDC’s Insurance Group in 2001 and assumed positions of increasing responsibility in underwriting and management both in the Credit Insurance and Contract Insurance & Bonding programs. Before assuming her current role, Ms. Dumoulin was a Manager in the same program and prior to that, she spent the previous six years managing an underwriting team in Credit Insur-ance for Extractive Industries. Before joining EDC, she worked for AIESEC Canada as Vice-President Finance in Toronto and for Deutsche Bank in Frankfurt, Germany, as a reporting analyst.

Stacey FacterSenior Vice President, Trade ProductsBAFT

Ms. Stacey Facter is a Senior Vice President, Trade Products, where she has over-sight of all trade-related advocacy, education and product-related initiatives for the association and its membership. She participates in BAFT trade committees and regional councils to advance the trade finance agenda of member institutions, includ-ing working toward standardizing trade definitions, documentation and regulations for industry adoption and consistent use. She has more than 25 years of experience in international banking, including over 20 years with JP Morgan Chase, covering emerging markets, international trade finance, cash and risk management, and se-curities collateral management.

Dan FisherHead of Global Trade FinanceTD Securities (USA) LLC

Mr. Dan Fisher is the Director and Regional Head of Global Trade Finance in North America for TD Bank Group. He has over 30 years experience in International banking and has had the opportunity to interact with many diverse cultures in multiple coun-tries, providing insight to corporate globalization. Mr. Fisher has worked for major international banks in San Francisco, Portland, Seattle, New York, London, Toronto, Montreal, Vancouver and Hong Kong. Throughout his career he has assisted compa-nies to provide Financial Supply Chain Management, Receivable and Payable Finance, Working Capital Solutions, Trade Cycle Finance and Risk Mitigation.

10 | 26th Annual BAFT Conference on International Trade October 26-28, 2016 | Chicago Marriott Downtown | Chicago, IL | 1110 11

SpeakersIngrid GardnerManaging Director UK/US Tax DeskBDO

Ms. Ingrid Gardner is Managing Director of BDO’s UK/US Tax desk, based in New York. She has more than 20 years international tax experience working with UK and US mul-tinational companies on cross border structuring, including: financing and IP planning; foreign tax credit management/repatriation planning; CFC planning; treaty planning; and value chain transformation. Prior to joining BDO, she was a principal in the value chain transformation practice of PwC US and prior to that, an international tax structuring part-ner in PwC UK. PROFESSIONAL AFFILIATIONS: FCA – Institute of Chartered Accountants in England & Wales, CTA – Institute of Taxation, Enrolled Agent

Al GiandomenicoPresidentEIA Global

Mr. Al Giandomenico is the Founder and President of EIA Global. He began his career in banking at Chemical Bank in New York City and later worked at the Foreign Credit Insur-ance Association (FCIA). He left FCIA in 1979 and returned to the Boston area to launch EIA Global. EIA Global has grown into one of the most successful and respected trade credit and political risk insurance brokerage firms in the United States. Mr. Giandomeni-co has served two terms on the advisory boards of the Export-Import Bank of the United States (EXIM) and the Overseas Private Investment Corporation (OPIC).Al graduated from The Choate School and is a magna cum laude graduate of Harvard University.

Madhav GoparajuExecutive Director, Financial Services AdvisoryErnst & Young

Mr. Madhav Goparaju is a transaction banking expert with over 15 years of experience both in industry and consulting. He has worked in various global roles within Product Management, Product Development delivering products such as Trade Services, Supply Chain Finance, and Working Capital Solutions for Corporates and Banks. Mr. Goparaju has led global strategic line of business assessment programs across product operations client service and technology for one of the largest international banks across 80 coun-tries. He has also managed the build out and execution of Global Transaction strategy for Channels and Distribution spanning Mobile, Online and Direct Channels. Mr. Goparaju is a regular keynote speaker and panelist at leading industry conferences.

Brett HalseySenior Vice President, Head of Trade, Credit and Surety

QBE

Mr. Brett Halsey is the SVP and Head of Trade Credit & Surety for QBE North America. He joined QBE’s Global Credit & Surety Leadership team in 2010 to lead the Trade Credit practice for the Americas. He spearheaded the launch of QBE’s Surety product line in the US in 2014, and led the development of QBE’s Trade Credit practice in Sao Paulo, Brazil. Prior to joining QBE, Mr. Halsey was the President, CEO and NAFTA Commercial Director at Atradius Trade Credit Insurance Inc. During his time with Atradius, he also served as VP of Risk Management before being promoted to President. A seasoned and highly experienced executive, he has over 25 years of buyer risk underwriting and executive management experience in the trade credit and political risk insurance industry.

Richard HellingVice President, Commodities Trade DivisionWells Fargo Bank NA

Mr. Richard Helling has 36 years of international trade finance experience with Wells Fargo Bank, N.A. As an Ag Commodity Trade Finance specialist, he provides focused expertise in supporting a select number of high value Wells Fargo clients engaged in ag-riculture commodities trade finance. General international banking experience includes both operations and sales and marketing. In Trade Operations, he handled import and export letters of credit, standby LCs, documentary collections and developed a cus-tomer service team. In his current position, Mr. Helling’s role in sales and marketing is to support the products and servicing needs of Wells Fargo large corporate and middle market Ag commodity clients engaged in importing and exporting. This includes bring-ing together Wells Fargo’s resources in structuring transactions, assessing risk, and being the communications channel between the client and various other Wells Fargo International Groups.

Peter Hunter Vice President, Trade CreditChubb

Mr. Peter Hunter has worked in the credit risk sector for 20 years and currently heads Chubb’s Trade Credit office in Chicago. Peter has also managed AIG Trade Credit’s Mid-

west office after moving from New York, where he was a credit officer for AIG Trade Credit. His responsibilities have included managing multinational programs and other major accounts.

David JacobsonVice-ChairBMO Financial Group

Mr. David Jacobson is Vice-Chair of BMO Financial Group. Prior to joining BMO, Mr. Ja-cobson served as the 22nd United States Ambassador to Canada, holding the role from 2009 to 2013. As Ambassador, Mr. Jacobson worked to expand the bilateral trading rela-tionship between the United States and Canada, which resulted in a 43 percent increase in two-way trade, raising it to the highest level between any two countries in history. Ambassador Jacobson led the Beyond the Border and Regulatory Cooperation efforts to improve the security and efficiency of the border between the two countries. He worked to strike a balance between using North America’s energy resources and preserving the environment, and to foster the shared values of the United States and Canada around the world. For his efforts, Ambassador Jacobson received the State Department’s 2012 Sue M. Cobb Award for Exemplary Diplomatic Service. Before becoming Ambassador, he served in the White House as Special Assistant to the President for Presidential Per-sonnel. Before joining government service, he was a corporate lawyer in Chicago, where he was active in civic and political affairs.

Angelina Grado Juarez Vice President & Manager of International OperationsUMB Bank, n.a.

Ms. Angelina Grado Juarez has been in the business of International Banking for over 30 years in the Kansas City area, the majority of her tenure with UMB Bank. Ms. Juarez pro-vides consultation and training relating to international trade products and is a frequent speaker on this topic. She has achieved and maintains the CDCS (Certified Documentary Credit Specialist) professional certification and currently sits on the Board of Directors of the International Trade Council of Greater Kansas City.

Zoran Kanlic Director, Supplier FinanceDeutsche Bank

Mr. Zoran Kanlic is a Director and Global Product Head of Supplier Finance for Deutsche Bank’ Global Transaction Banking. Joining the bank twelve years ago, he pioneered Deutsche Bank’s Financial Supply Chain business into today’s global suite of products. His current responsibilities include product strategy and development, risk management and compliance as well as product lifecycle and profitability management. He is the Vice-Chair of BAFT’s Supply Chain Finance Committee. Prior to joining Deutsche Bank, Mr Kanlic spent three years at Paymentor.com as a Product Manager, where he focused on the Web-based invoice presentment and payment acceleration offering. He was also principle and founder at Barter for three years where he managed the Web-based barter exchange.

Joon KimHead of Global Trade Product and Portfolio Management in Treasury ServicesBNY Mellon

Mr. Joon Kim has 25-plus years of experience. He has held various senior positions at Standard Chartered Bank and American Express Bank, most recently as Managing Director and Head of Transaction Banking Sales for Corporate and Commodities for the Americas region. His various experiences include leading Trade Sales, Trade Product Management and Relationship Management teams, with an emphasis on development and sales of trade finance, supply chain financing, receivable services, trade processing and cross-border cash and liquidity management solutions to global financial institutions and corporations.

Michael Kornblau Senior Vice President, US Trade Credit Practice LeaderMarsh

Mr. Michael Kornblau is the US Trade Credit Practice leader responsible for the practice across the four US offices and 14 trade credit professionals. Mr. Kornblau is located in the New York office while the practice also has offices in Los Angeles, Philadelphia and Greater Miami region. Mr. Kornblau joined our firm in 2010 after nine years at another major trade credit insurance broker, seven years at a credit insurance underwriter and four years in the banking industry. He has provided expertise in structuring large and middle market solutions for corporate clients along with major financial institutions.

Paul Kunzer Divisional ExecutiveAIG

Mr. Paul Kunzer began his career at AIG in June 2000. He started underwriting in AIG New York, then moved on to underwriting and managerial roles for AIG Trade Credit in the Midwest and Southwest US regions out of Chicago. In May 2010, he was named Divisional Executive of AIG Trade Credit–Americas. Prior to joining AIG, he worked in the Trade Credit insurance industry for the Export-Import Bank of the United States in Washington, DC. His previous experience in finance includes positions with T. Rowe Price Investment Services and The Monitor Group. Mr. Kunzer has a Bachelors Degree in Business Administration from the University of Richmond and a Masters of Business Administration degree from Georgetown University.

Peter LuketaSenior Advisor, Export Finance & Specialised Finance, Product & Innovation Group, Enterprise Commercial PaymentsHSBC Bank

Mr. Peter Luketa is a Senior Advisor to the Export Finance and Global Specialised Fi-nance (formerly Forfaiting), a division of HSBC Bank plc. Since 2009, he has been Global Head of the business. After a career in International Banking, Mr. Luketa specialised in the project business in the mid-80’s focusing on Middle Eastern and European projects. .He then completed a period in Germany as Head of the Chairman’s office in Trinkaus und Burkhardt Düsseldorf, followed by two years as Head of European Corporate Bank-ing, HSBC Bank plc before returning to Export Finance in 1995 at HSBC Investment Bank. Mr. Luketa has advised on and arranged finance for projects in Kazakhstan, Rus-sia, Czech Republic, Azerbaijan, Romania, Turkey, Iraq, Brazil, Mexico and Chile as well as structured projects in Germany and Italy. (Sectors include transportation, airports, power, infrastructure and telecoms). He assumed the role of Global Head of Export Fi-nance from the 1st January 2009 and in October 2010 took over as Global Head of GSF (formerly known as HSBC Forfaiting). He then became Senior Advisor to the Export Finance and GSF business on 1 July 2016.

Sandra MarroneSenior Vice PresidentProduct & Innovation Group, Enterprise Commercial PaymentsKeyBank NA

Ms. Sandra Marrone, Senior Vice President, manages the Foreign Exchange & Interna-tional Trade Product team within the Product & Innovation Group for Key’s Enterprise Commercial Payments business. Ms. Marrone’s team provides product management and sales support for the bank’s global trade, foreign exchange and international payment services. This set of product offerings includes traditional documentary trade services, FX and international treasury management solutions for KeyBank’s corporate clients. Ms. Marrone has been involved in the trade finance business during her entire 35-year career at KeyBank and its predecessor banks beginning with global trade operations. Later she held various positions in international credit and portfolio management, busi-ness development, product management and technology support for the business. In 2001 she moved to the bank’s Corporate Product Management group where she as-sumed additional responsibility for a suite of global cash management products. In 2009 Sandy became Manager of the FX and Trade Product Group.

Marisa McGuire MartinVice President AmericasessDOCS

Ms. Marisa Martin began her maritime career with KPI Bridge Oil, working for the firm in both Chile and New York as a Bunker Broker. In her role there, she was responsible for negotiating fuel and lubricant contracts for a diverse portfolio of global customers in the dry bulk, tanker, barge and liner segments, gaining significant industry knowledge and expertise in the process. Since joining essDOCS in 2015, Ms. Martin is focused on maintaining relationships with existing Americas-based customers and developing new opportunities for essDOCS throughout the region.

Ann McCormickDirector, Global Trade and Supply Chain ProductBank of America Merrill Lynch

Ms. Ann F. McCormick is Director, Trade and Supply Chain Product Enablement and Solutioning at Bank of America Merrill Lynch. She is responsible for delivering a glob-ally consistent client platform experience for all Trade Finance products. Additionally, she leads the strategy and execution of all global Trade product platform innovation as well as ensuring ongoing scale, compliance and flexibility to support the global product roadmap and client needs. Prior to this role, she was a Line of Business Executive at Bottomline Technologies responsible of the overall profitability, growth and operational execution for the Paymode-X supply chain automation network.

Grainne McNamaraPrincipalPwC

Ms. Grainne McNamara specializes in effectively delivering large transformation pro-grams at top tier banks. She is currently focusing on helping banks transform by lever-aging new technology, collaborating on shared services and, most especially, by more effective use of human capital and expert talent with the banks. She plays a leadership role for PwC’s financial services blockchain efforts. In this role, she works with FinTech companies as well as financial services providers to help harness the power of the blockchain eco-system to drive competitive advantage as well as to promote efficiency in the financial system. She has over 20 years of experience in implementing regulatory change, managing people, and providing strategic direction across divisions at firms such as Goldman Sachs and Morgan Stanley. Ms. McNamara has designed and man-aged large-scale implementations through the entire lifecycle, from design through build, test, and adoption/conversion.

Michael McDonoughHead of Corporate Trade & Supply Chain ProductJP Morgan

Mr. Michael McDonough is the global product head for J.P. Morgan’s Corporate Trade & Supply Chain Finance business. He is based in New York and serves on the Management Team for the Global Trade Finance business. He leads a global function working with multinational corporate clients around the world. Working with teams across the J.P. Morgan network, the trade business structures and puts in place solutions for working capital optimization and risk mitigation. Previously, he held global supply chain man-agement positions with J.P. Morgan, RBS and ABN Amro in London and Amsterdam.

Gary MendellPresidentMeridian Finance

Mr. Gary Mendell is President of Meridian Finance Group, a company providing credit, insurance, and trade finance tools that companies use to expand their US and interna-tional sales. A graduate of the University of Pennsylvania in 1976, Mr. Mendell has over 35 years of experience in domestic and international sales, distribution, and finance. Prior to Meridian Finance Group, he held positions managing international business development for companies in the pharmaceutical, aerospace, and plastics industries. Gary has received the President’s “E” Award and recognition from the US Department of Commerce, Ex-Im Bank, and the Small Business Administration for Meridian’s contri-butions to international trade.

Samuel MooreMr. Samuel Moore has been Managing Director, Global Transaction Banking (Fifth Third Bank), and leader of the Special Risk Group of the insurance broker International Risk Consultants for 20 years in his 26-year career in international banking and trade credit and political risk insurance. He has served as chair of the BAFT Trade Finance and Structured Trade Finance Committees and as a board member of the Association of Trade and Forfaiting in the Americas (ATFA). He began his career in various staff posi-tions in the US Senate in Washington DC.

Daniel PinhoSenior Vice President and Assistant Group ManagerPNC Bank

Mr. Daniel Pinho is senior vice president and assistant group manager at PNC’s Trade Finance group. He has over 20 years of experience in structured trade financing pro-grams. Prior to joining PNC, he was a Manager at UPS Capital Business Credit where he supervised the Export Credit Agency Operations group. He also served as the Director of Trade Finance at a consulting firm in Brazil. Mr. Pinho also serves on BAFT’s North Amer-ican Council and co-chairs the Structured Trade and Export Finance Committee. He is a member of the Association of Latino Professionals in Finance and Accounting and is chair of the board of Ten Thousand Villages in Pittsburgh, a fair trade nonprofit organization.

Vivek RamachandranGlobal Head of Trade Product & Propositions ManagementHSBC

Mr. Vivek Ramachandran, previously co-founder and CEO of VTA, a boutique advisory firm working with banks across Europe and Asia. He was previously Managing Director of International Product at Barclays, responsible for the full suite of Corporate Banking products outside the UK. He was responsible for integrating and growing the Corporate Banking business across 14 markets in Africa, establishing new operations in Asia and the US, and restructuring the legacy portfolios across Europe and the Middle East. He has a PhD in Economics from Carnegie Mellon University, where he taught MBA and undergraduate students.

12 | 26th Annual BAFT Conference on International Trade October 26-28, 2016 | Chicago Marriott Downtown | Chicago, IL | 13

Andrea RatayVP, Global Trade FinanceTD Bank NA

Ms. Andrea Ratay, having started her banking career with Irving Trust, has covered corporates in a cross-section of industries, structuring risk management and work-ing capital solutions for importers and exporters. She is currently a Regional Global Trade Sales Manager with TD Bank. Ms. Ratay is the Vice Chair of the New York District Export Council, and an adjunct instructor with NYU’s School of Professional Studies. Prior to banking, she worked on a Presidential campaign and at the U.S. Department of Commerce. Ms. Ratay earned her undergraduate degree from Georgetown University’s School of Foreign Service, and an MBA from NYU Stern School of Business.

Mark RegenhardtPartnerInternational Risk Consultants, Inc. (IRC)

Mr. Mark Regenhardt is a partner in the firm of International Risk Consultants, Inc. (IRC), a leading global company that specializes in domestic, export credit and political risk insurance products. Prior to joining IRC he worked for Motorola Inc., where he held vari-ous positions. He was Worldwide Controller for the Consumer Solutions Accessory Group located in Chicago. Mr. Regenhardt also lived in Sao Paulo, Brazil, and was Operations Controller for the Cellular Division in Brazil and the Southern Cone. Prior to that role, he was Motorola’s Credit and Trade Finance Manager for Latin America. In this position, he was responsible for the formation of two international credit departments and for the implementation of several credit insurance supported trade finance programs.

Robert G. Reiter, Jr.Secretary-TreasurerChicago Federation of Labor

As the Secretary-Treasurer, Mr. Robert Reiter, Jr. is the voice of every CFL affiliated union on big picture issues. One of his responsibilities is to represent the interests of labor throughout the Chicago and Cook County. Through his work as a Board member for the Metropolitan Pier and Exposition Authority, he is helping to strengthen the economy of Chicago by bring tradeshows, conventions and other public events to Chicago. His involvement with various community groups, such as Chicago Jobs with Justice’s Exec-utive Committee and Arise Chicago’s Executive Board, allows him to fight for the rights of workers through education, organizing and shaping public discourse. As a member of the Citizen Action/Illinois Policy Council, Mr. Reiter has the opportunity to influence the organization’s public policy positions, the legislative agenda and any candidate en-dorsements for public office. On the Metropolitan Planning Council Resource Board, he is helping to build a strong economy and reinvigorate Chicago’s neighborhoods. Mr. Reiter is also lending his voice to issues related to international trade, meeting periodically with dignitaries from various European countries and by serving as a panelist on the TTIP Chi-cago Summit with experts from the agricultural, manufacturing and financial industries.

Ken RobertsPresidentWorldCity

Mr. Ken Roberts is the founder of WorldCity Inc., a Miami, Florida-based media com-pany focused on the impact of globalization and trade on local economies. Mr. Roberts speaks locally and around the country, including to Fortune 500 companies, the Federal Reserve, chambers of commerce and trade associations. The company has produced a wide range of annual TradeNumbers publications, from Miami to Seattle, Los Angeles to New York, Perishables to Mexico and more. In addition, at ustradenumbers.com, he is a member of the Federal Reserve’s Transportation and Trade advisory committee, wrote a weekly import-export trade column in the Miami Herald for two years, was honored in 2012 by the Doral Business Council with its first-ever “Game Changer” Award, is on the Steering Committee at the Technology of the Americas, and has served on a number of internationally focused committees at the Beacon Council and the Greater Miami Chamber, among others.

Gayle RoenbaughSenior Trade Sales ManagerGlobal Trade & Receivables Finance GroupHSBC

Ms. Gayle Roenbaugh is a Senior Trade Sales Manager in HSBC Bank’s Trade & Receiv-ables Finance Group. She joined HSBC in May 2007 and is responsible for origination and structuring of receivables finance and supply chain transactions to large multina-tional corporates. She also manages the bank’s Delegated Authority Lending Program with the Export Import Bank of the US for the United States. Ms. Roenbaugh has more than 20 years experience in a variety of trade services roles including sales, product management and operations.

Paul SchuldinerSenior Vice PresidentRosenthal Trade CapitalThe Purchase Order Finance Division of Rosenthal & Rosenthal

Mr. Paul D. Schuldiner is Senior Vice President at Rosenthal & Rosenthal, a commercial finance company specializing in factoring and asset based lending. He leads the firm’s newest division, Rosenthal Trade Capital, and is responsible for driving the overall busi-ness strategy for Rosenthal’s purchase order financing and alternative inventory financ-ing solutions. He is a seasoned financial executive with nearly 20 years of experience in the purchase order and trade finance business and has previously held senior leadership roles at King Trade Capital, Wells Fargo Capital Finance and Transcap Associates. Mr. Schuldiner has been featured in Women’s Wear Daily, Entrepreneur, TIME, Forbes and Bobbin Magazine and is a regular contributor to The Secured Lender and ABF Journal.

Byron ShoultonInternational EconomistFCIA

Mr. Byron Shoulton cut his teeth on global trade finance at the Irving Trust Company, New York in the Letter of Credit Department. As a leading trade bank intimately involved in trade with Latin America, Europe and Asia at the time, the Irving was a training ground for future leaders in the industry globally. He later joined the Ministry of Foreign Affairs, Kingston, Jamaica¬—upon completion of graduate school at John’s Hopkins University. He co-chaired a team tasked with the management of a foreign exchange regime, in partnership with the central bank to ensure adequate allocation of FX to the vital tourism sector. He returned to New York (at the end of his contract) in the midst of the Latin American debt crisis and joined FCIA.

Christine SnoufferGlobal Manager, Treasury & RiskFellowes Brands

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent consequat risus non vulputate hendrerit. Cras ut fringilla sapien, sed malesuada nibh. Sed egestas euismod augue, sed consectetur sem pellentesque vitae. Etiam et diam in purus pretium blandit. Nunc finibus turpis mauris, et elementum lorem posuere ut. Donec ullamcorper blandit tincidunt. Quisque in bibendum mi. Cum sociis natoque penatibus et magnis dis parturi-ent montes, nascetur ridiculus mus. Morbi ut blandit velit. Sed in leo non eros convallis feugiat ac ac erat. In pellentesque eu quam a consectetur. Nulla ut fringilla sem, eu lacinia metus. Phasellus neque neque, aliquam in dapibus vitae.

Chris SpeddingManaging DirectorHead of North America and Asia, Global Transaction BankingLloyds Bank Commercial Banking

Mr. Chris Spedding has had a diverse career at Lloyds Bank since joining in 1999. He has held a number of client relationship management positions supporting multinational cor-porates including the role of Global Head of Aerospace and Defense. Prior to his current role, Mr. Spedding was a member of the Bank’s Financial Markets Executive Committee in his capacity as Director, Ring Fencing where he led the approach for optimizing the Group’s business model in preparation for the implementation of the UK’s Ring Fencing regulations. He has a Joint B.A. (Hons) in Modern Languages from the University of Nottingham, England.

Dr. Kati SuominenFounder and CEOTradeUp Capital Fund

Dr. Kati Suominen is the founder and CEO of Nextrade Group, helps governments and Fortune 500s optimize public policies and investment in driving trade and ecommerce worldwide; the founder and Chairwoman of TradeUp Capital Fund, a growth capital plat-form for globalizing tech companies to raise debt and equity from institutional investors; and an Adjunct Professor at UCLA Anderson School of Management. She is the idea woman behind international initiatives such as eTrade for All, now championed by the United Nations; and RTA Exchange, a global dialogue forum on regional trade agree-ments led by the Inter-American and Asian Development Banks. Dr. Suominen has done several high-level speaking engagements on trade, e.g. Davos, World Trade Symposium, Global Trade Review conference WOT’s. In addition, she is a Senior Advisor to theB20-backed World SME Forum and a Life Member of the Council on Foreign Relations.

Mark SzarkonyiExecutive Editor Journal of Commerce

Mr. Mark Szakonyi leads JOC.com, the world’s most visited news, analysis and data portal serving the container shipping and international supply chain industry. The JOC.com team of more a dozen editors and global correspondents provides business-critical

Speakersnews and data-heavy analysis nearly 24/7. Aside from editing, Mr. Szakonyi also reports on a variety of issues, ranging from container shipping alliances to trade economics. His analysis and work have been quoted in mainstream news media including the BBC, The Economist, NPR and USA Today. Mr. Szakonyi, a Chicago native now living in Washington DC, is an avid reader, traveler and vinyl record collector.

Alex Thompson Global Product Manager Wells Fargo Bank

Mr. Alex Thompson is Product Manager for the design and implementation of the propri-etary Wells Fargo TradeWorks trade processing platform, and supports the build out of its front office trade platform. He manages Trade Payables Finance solutions, digital trade initiatives and relationships with third party trade solution providers. He serves on BAFT and R3 Trade Finance Working Groups, and supports the Wells Fargo Enterprise Innovation Group. Prior to joining Wells Fargo, Mr. Thompson served as Chief Solution Architect, Vice President of Product Management, and Director of Implementation for TradeBeam, a cloud-based Global Trade Management software company.

Michael VrontamitisHead of Trade, Product Management Transaction BankingStandard Chartered Bank

Mr. Michael Vrontamitis, as Head of Trade, Product Management, Transaction Banking at Standard Chartered Bank is responsible for the P&L and delivery of the Bank’s Trade

Finance capabilities globally in Documentary Trade, Receivables Finance, Supply Chain Finance, and working capital solutions, to all of the Bank’s clients across Corporate & Institutional, Commercial and Business clients. He is also accountable for the Bank’s Trade Finance distribution. He is a member of the BAFT Global Trade Industry Council and the ICC Banking Commission Advisory Board. Most recently he was the Head of Product Management for Asia, Transaction Banking where he had product oversight and P&L re-sponsibilities across the suite of solutions for Cash Management, Trade Finance, Securities Services and Clearing for the bank’s clients in the region.

Michael WhalenVice President, Structured Finance DivisionExport-Import Bank of the United States

Mr. Whalen joined Ex-Im Bank in 2015 to lead the Bank’s structured and project finance division. His experience includes leadership roles in the global banking and energy sec-tors, and in public service. Prior to Ex-Im Bank, Mr. Whalen served as vice president of structured finance at the Overseas Private Investment Corporation. In the finance sector, he led teams at HSBC and Bank of America in New York, London and Hong Kong focusing on raising debt capital for oil & gas, power, petrochemical and industrial ventures. Mr. Whalen’s experience in the energy industry includes both conventional and alternative sectors. He was chief financial officer of SolarReserve, a solar development company and held various roles at Mobil Corporation in Fairfax, Virginia, London and Singapore.

Solutions ShowcaseAccuity, part of RELX group, provides innovative solutions for payments and compliance professionals, from comprehensive data and software that manage risk and compliance, to flexible tools that optimize payments pathways. With deep expertise and industry-leading data-enabled solutions from the Fircosoft, Bankers Almanac and NRS brands, our portfolio delivers protection for individual and organizational reputations.

Founded in 1969, Cibar provides end-to-end trade finance software to our banking clients.Cibar’s applications allow the bank and corporate client the ability to process: Letters of Credit, Collections, Assignments, Accruals, Imaging, Participations, Guarantees, Reimbursements, Acceptances, Loans, and Cash Letters. Contact Nick Mayer at [email protected] for more information.

Coastline Solutions is the world’s leading online information and training provider in International Trade Finance providing courses in all of the traditional trade products. Coastline has recently launched a global online service dedicated to Trade Based Financial Crimes News. Also coming soon: Online Training in Trade Based Financial Crimes Compliance.

Misys provides the broadest portfolio of banking, capital markets, investment management and risk management solutions available on the market. Misys FusionBanking delivers the most complete and connected suite of corporate banking solutions on the market with a unified platform for enterprise digital enablement, combined with front-to-back processing across trade finance, treasury services, payments, cash management and commercial lending.

NextAngles™ is an Mphasis venture building a new breed of disruptive solutions for regulatory risk and compliance, spanning across diverse areas, such as AML Alert Investigations, KYC, Trade-Based Money Laundering and Financial Crimes. Our smart compliance approach reduces the burden, cost, and stress of compliance substantially; and scales to meet enterprise-class business and regulatory challenges.

14 | 26th Annual BAFT Conference on International Trade

Event Sponsors

Institutional Sponsors Affiliate Sponsors:Platinum Sponsor

Standard Chartered Bank

Gold SponsorsBNY Mellon, Deutsche Bank

Silver SponsorsBank of Montreal, BNP Paribas, HSBC Bank, PNC Bank, RBC Bank, Societe Generale, State Bank of India, Wells Fargo Bank

Thank You to Our 26th Annual Conference on International Trade Program Committee

Conference Co-ChairsChris Bozek, Bank of America Merrill LynchJoon Kim, BNY Mellon

MembersMazen Afarat, JPMorganNelson de Castro, Wells Fargo Bank, NAStacey Facter, BAFTSamuel Moore, ConsultantDaniel Pinho, PNC Bank, NAAndrea Ratay, TD BankGayle Roenbaugh, HSBCPriyamvada Singh, HSBC

2016 Events

November 3-4 Canada Trade Finance Workshop Toronto, Canada

2017 Events

January 16–18 Europe Bank to Bank Forum Madrid, Spain

February 16 – 17 Southeast Trade Finance Workshop Tampa, Florida

March India Executive Forum Scottsdale, AZ

March 22 – 23 MENA Forum Dubai, UAE

April 30 – May 3 North America Annual Conference Miami, Florida

May 16 (invite only) BAFT Asia Briefing Singapore

(at Asian Banker Summit)

May* Europe Compliance Forum London

June 22 – 23 New York Trade Finance Workshop New York, New York

July Global Payments Symposium New York, New York

July Indonesia Trade Finance Workshop Jakarta, Indonesia

August West Coast Trade Finance Workshop Los Angeles, California

August India Trade Finance Workshops India

September 27th Annual Conference on International Trade Chicago, Illinois

October 15 (invite only) 9th Annual Global Councils Forum Toronto, Canada

(at SIBOS)

November Canada Trade Finance Workshop Toronto, Canada

Save the Date on Upcoming BAFT Conferences and Workshops!

*Dates/location subject to change. Contact [email protected] for additional event information.

October 26-28, 2016 | Chicago Marriott Downtown | Chicago, IL | 15

27th BAFT Annual Conference on International Trade

September 2017 Chicago, Illinois

baft.org/events

SAVE THE DATE