244 - islamibankbd.com · accounting policies and other explanatory information. In our opinion,...

Transcript of 244 - islamibankbd.com · accounting policies and other explanatory information. In our opinion,...

243

244

Independent Auditors’ Report toThe Shareholders of

Islami Bank Bangladesh Limited

Report on the Audit of the Consolidated and Separate Financial StatementsOpinionWe have audited the consolidated financial statements of Islami Bank Bangladesh Limited and its subsidiaries (the “Group”) as well as the separate financial statements of Islami Bank Bangladesh Limited (the “Bank”), which comprise the consolidated and separate balance sheets as at 31 December 2019 and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash flow statements for the year then ended, and notes to the consolidated and separate financial statements, including a summary of significant accounting policies and other explanatory information.In our opinion, the accompanying consolidated financial statements of the Group and separate financial statements of the Bank give a true and fair view of the consolidated financial position of the Group and the separate financial position of the Bank as at 31 December 2019 and of its consolidated and separate financial performance and its consolidated and separate cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs) as explained in note 2 and 3 and comply with the Banking Company Act, 1991 (as amended up to date), the Companies Act, 1994, the Rules and Regulations issued by the Bangladesh Bank, the Rules and Regulations issued by the Bangladesh Securities & Exchange Commission (BSEC) and other applicable Laws and Regulations.

Basis for OpinionWe conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Consolidated and Separate Financial Statements section of our report. We are independent of the Group and the Bank in accordance with the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants (IESBA Code), Bangladesh Securities and Exchange Commission (BSEC) and Bangladesh Bank, and we have fulfilled our other ethical responsibilities in accordance with the IESBA Code and the Institute of Chartered Accountants of Bangladesh (ICAB) Bye Laws. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Key Audit MattersKey audit matters are those matters that, in our professional judgement, were of most significance in the audit of the consolidated and separate financial statements for 2019. These matters were addressed in the context of the audit of the consolidated and separate financial statements, and in forming the auditor’s opinion thereon, and we do not provide a separate opinion on these matters. For each matter below our description of how our audit addressed the matter is provided in that context. We have fulfilled the responsibilities described in the auditor’s responsibilities for the audit of the consolidated and separate financial statements section of our report, including in relation to these matters. Accordingly, our audit included the performance of procedures designed to respond to our assessment of the risks of material misstatements of the consolidated and separate financial statements. These results of our audit procedures, including the procedures performed to address the matters below, provide the basis for our audit opinion on the accompanying consolidated and separate financial statements.

Description of key audit matters Our response to key audit mattersMeasurement of provision for investmentThe process for estimating the provision for investments portfolio associated with credit risk is significant and complex.

For the individual analysis for large exposure, provisions calculation consider the estimates of future business performance and the market value of collateral provided for credit transactions.

For the collective analysis of exposure on portfolio basis, provision calculation and reporting are manually processed that deals with voluminous databases, assumptions and estimates.

At year end the Group reported total gross Investments of BDT 894,223 million (2018: BDT 800,969 million) and provision for investments of BDT 42,108 million (2018: BDT 34,762 million).

We tested the design and operating effectiveness of key controls focusing on the following:� Credit appraisal, investments disbursement procedures, monitoring and

provisioning process; � Identification of loss events, including early warning and default warning

indicators; and � Reviewed quarterly Classification of Investments;

Our substantive procedures in relation to the provision for investments portfolio comprised the following:� Reviewed the adequacy of the general and specific provisions in line with related

Bangladesh Bank guidelines; � Assessed the methodologies on which the provision amounts are based,

recalculated the provisions and tested the completeness and accuracy of the underlying information;

� Evaluated the appropriateness and presentation of disclosures against relevant accounting standards and Bangladesh Bank guidelines.

� Finally, compared the amount of provision requirement as determined by Bangladesh Bank inspection team to the actual amount of provision maintained.

See note no 11 and 17 to the financial statements

245

Description of key audit matters Our response to key audit mattersImplementation of IFRS 16 LeasesIFRS 16 modifies the accounting treatment of operating leases at inception, with the recognition of a right of use (ROU) on the leased asset and of a liability for the lease payments over the lease contract term. With respect to operating leases of premises used by the Bank, at inception of the lease, the lessor receives a right of using the premises, in exchange of a lease debt, using an implicit discount rate.

Our key audit matter was focused on all leasing arrangements within the scope of IFRS 16 are identified and appropriately included in the calculation of the transitional impact and specific assumptions applied to determine the discount rates for lease are inappropriate

In responding to the identified key audit matter, we completed the following audit procedures:

Assessed the design and implementation of key controls pertaining to the determination of the IFRS 16 Leases impact on the financial statements of the Bank;

Assessed the appropriateness of the discount rates applied in determining lease liabilities;

Verified the accuracy of the underlying lease data by agreeing to original contract and checked the accuracy of the IFRS 16 calculations through recalculation of the expected IFRS 16 adjustment; and

Assessed whether the disclosures within the financial statements are appropriate in light of the requirements of IFRS.

See note no 12, 17, 38 to the financial statementsImpairment assessment of unquoted investmentsIn the absence of a quoted price in an active market, the fair value of unquoted shares and bonds, especially any impairment is calculated using valuation techniques which may take into consideration direct or indirect unobservable market data and hence require an elevated level of judgment.

We have assessed the processes and controls put in place by the Company to ensure all major investment decisions are undertaken through a proper due diligence process.

We tested a sample of investments valuation as at 31 December 2019 and compared our results to the recorded value.

Finally, we assessed the appropriateness and presentation of disclosures against relevant accounting standards and Bangladesh Bank guidelines.

See note no 10 to the financial statementsIT systems and controlsOur audit procedures have a focus on IT systems and controls due to the pervasive nature and complexity of the IT environment, the large volume of transactions processed in numerous locations daily and the reliance on automated and IT dependent manual controls.

Our areas of audit focus included user access management, developer access to the production environment and changes to the IT environment. These are keys to ensuring IT dependent and application-based controls are operating effectively.

We tested the design and operating effectiveness of the Bank’s IT access controls over the information systems that are critical to financial reporting.

We tested IT general controls (logical access, changes management and aspects of IT operational controls). This included testing that requests for access to systems were appropriately reviewed and authorized.

We tested the Bank’s periodic review of access rights and reviewed requests of changes to systems for appropriate approval and authorization.

We considered the control environment relating to various interfaces, configuration and other application layer controls identified as key to our audit.

Legal and regulatory mattersWe focused on this area because the Bank and its subsidiaries (the “Group”) operates in a legal and regulatory environment that is exposed to significant litigation and similar risks arising from disputes and regulatory proceedings. Such matters are subject to many uncertainties and the outcome may be difficult to predict.

These uncertainties inherently affect the amount and timing of potential outflows with respect to the provisions which have been established and other contingent liabilities.

Overall, the legal provision represents the Group’s and the Bank’s best estimate for existing legal matters that have a probable and estimable impact on the Group’s financial position.

We obtained an understanding, evaluated the design and tested the operational effectiveness of the Bank’s key controls over the legal provision and contingencies process.

We enquired to those charged with governance to obtain their view on the status of all significant litigation and regulatory matters.

We enquired of the Bank’s internal legal counsel for all significant litigation and regulatory matters and inspected internal notes and reports.

We assessed the methodologies on which the provision amounts are based, recalculated the provisions, and tested the completeness and accuracy of the underlying information.

We also assessed the Bank’s provisions and contingent liabilities disclosure.

Other mattersThe financial statements of the Group and the Bank for the year ended 31 December 2018 were audited by other auditors who expressed an unmodified opinion on those financial statements on 24 April 2019.

Other informationManagement is responsible for the other information. The other information comprises all of the information in the Annual Report other than the consolidated and separate financial statements and our Auditor’s report thereon. The Annual Report is expected to be made available to us after the date of this Auditor’s report.

246

Our opinion on the consolidated and separate financial statements does not cover other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the consolidated and separate financial statements, our responsibility is to read the other information identified above when it becomes available and, in doing so, consider whether the other information is materially inconsistent with the consolidated and separate financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated.

Responsibilities of management and those charged with governance for the consolidated and separate financial statements and internal controls

Management is responsible for the preparation and fair presentation of the consolidated financial statements of the Group and also separate financial statements of the Bank in accordance with IFRSs as explained in note 2 and 3, and for such internal control as management determines is necessary to enable the preparation of consolidated and separate financial statements that are free from material misstatement, whether due to fraud or error. The Bank Company Act, 1991 and the Bangladesh Bank Regulations require the Management to ensure effective internal audit, internal control and risk management functions of the Bank. The Management is also required to make a self-assessment on the effectiveness of anti-fraud internal controls and report to Bangladesh Bank on instances of fraud and forgeries.

In preparing the consolidated and separate financial statements, management is responsible for assessing the Group’s and the Bank’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Group and the Bank or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Group’s and the Bank’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Consolidated and Separate Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated and separate financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated and separate financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgement and maintain professional skepticism throughout the audit. We also:

� Identify and assess the risks of material misstatement of the consolidated and separate financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

� Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances.

� Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

� Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group’s and the Bank’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our Auditor’s report to the related disclosures in the consolidated and separate financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our Auditor’s report. However, future events or conditions may cause the Group and the Bank to cease to continue as a going concern.

� Evaluate the overall presentation, structure and content of the consolidated and separate financial statements, including the disclosures, and whether the consolidated and separate financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

� Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

247

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditors’ report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Report on other Legal and Regulatory Requirements

In accordance with the Companies Act, 1994, the Securities and Exchange Rules 1987, the Bank Company Act, 1991 and the rules and regulations issued by Bangladesh Bank, we also report that:

(i) we have obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purpose of our audit and made due verification thereof;

(ii) to the extent noted during the course of our audit work performed on the basis stated under the Auditor’s Responsibility section in forming the above opinion on the consolidated financial statements and considering the reports of the Management to Bangladesh Bank on anti-fraud internal controls and instances of fraud and forgeries as stated under the Management’s Responsibility for the financial statements and internal control:

(a) internal audit, internal control and risk management arrangements of the Group as disclosed in the financial statements appeared to be materially adequate;

(b) nothing has come to our attention regarding material instances of forgery or irregularity or administrative error and exception or anything detrimental committed by employees of the Group and its related entities {other than matters disclosed in these financial statements};

(iii) Consolidated financial statements of the Bank include two subsidiaries, namely Islami Bank Securities Limited and Islami Bank Capital Management Limited reflect total assets of BDT 1,142,181 million as at 31 December 2019 and total revenue of BDT 88,741 million for the year ended 31 December 2019. The results of these subsidiaries have been properly reflected in the Group’s consolidated financial statements;

(iv) in our opinion, proper books of account as required by law have been kept by the Group and the Bank so far as it appeared from our examination of those books;

(v) the records and statements submitted by the branches have been properly maintained and consolidated in the financial statements;

(vi) the consolidated balance sheet and consolidated profit and loss account together with the annexed notes dealt with by the report are in agreement with the books of account and returns;

(vii) the expenditures incurred were for the purpose of the Bank’s business for the year;

(viii) the consolidated financial statements have been drawn up in conformity with prevailing rules, regulations and accounting standards as well as related guidance issued by Bangladesh Bank;

(ix) adequate provisions have been made for investment and other assets as per DBI letter no. BDI-4/42(7)/2020-346 which are in our opinion, doubtful of recovery;

(x) the information and explanations required by us have been received and found satisfactory;

(xi) we have reviewed over 80% of the risk weighted assets of the Bank and spent over 9,800 person hours; and

(xii) Capital to Risk-weighted Asset Ratio (CRAR) as required by Bangladesh Bank has been maintained adequately during the year.

Dated: Dhaka;27 June 2020

A. Qasem & Co.Chartered Accountants

Hoda Vasi Chowdhury & Co.Chartered AccountantsShowkat Hossain FCAEngagement Partner

248

249

Islami Bank Bangladesh Limited and its SubsidiariesConsolidated Balance Sheet

As at 31 December 2019

Particulars Notes31.12.2019

Taka31.12.2018

TakaProperty and AssetsCash in hand 7(a) 75,853,653,790 67,463,919,812 Cash in hand (including foreign currency) 7(a)(i) 15,024,007,850 14,816,623,264 Balance with Bangladesh Bank & its agent bank(s) (including foreign currency) 7(a)(ii) 60,829,645,940 52,647,296,548

Balance with other banks & financial institutions 8(a) 91,425,373,838 63,398,992,795 In Bangladesh 8(a)(i) 71,323,380,899 56,624,322,168 Outside Bangladesh 8(a)(ii) 20,101,992,939 6,774,670,627

Placement with banks & other financial institutions 9.0 - -

Investments in shares & securities 10(a) 54,098,466,625 41,192,523,514 Government 10(a)(i) 40,111,029,770 32,103,637,770 Others 10(a)(ii) 13,987,436,855 9,088,885,744

Investments 894,223,206,248 800,969,926,216 General investments etc. 11.1(a) 861,458,730,969 759,570,154,266 Bills purchased & discounted 11.2(a) 32,764,475,279 41,399,771,950

Fixed assets including premises 12(a) 16,199,274,493 15,347,979,149 Other assets 13(a) 10,381,912,393 9,585,961,564 Non - banking assets - - Total property and assets 1,142,181,887,387 997,959,303,050

Liabilities and CapitalLiabilitiesPlacement from banks & other financial institutions 14(a) 28,849,020,000 37,814,360,564

Deposits & other accounts 15(a) 945,908,084,051 822,200,715,600 Mudaraba savings deposits 313,110,479,503 277,804,695,122 Mudaraba term deposits 335,259,771,889 272,833,581,050 Other mudaraba deposits 207,026,042,105 188,286,430,847 Al- wadeeah current and other deposit accounts 83,863,846,939 79,147,915,842 Bills payable 6,647,943,615 4,128,092,739

Mudaraba bond 16.0 21,000,000,000 15,000,000,000 Mudaraba perpetual bond 3,000,000,000 3,000,000,000 Mudaraba redeemable subordinated bond 16.1 18,000,000,000 12,000,000,000

Other liabilities 17(a) 85,369,987,077 65,789,768,627 Deferred tax liabilities 18(a) 1,680,571,950 1,687,851,558 Total liabilities 1,082,807,663,078 942,492,696,349

Capital/shareholders' equity 59,374,224,309 55,466,606,701 Paid - up capital 19.2 16,099,906,680 16,099,906,680 Statutory reserve 21.0 18,735,466,258 17,735,466,258 Other reserves 22.0 22,206,310,080 19,450,939,844 Retained earnings 40(a) 2,332,280,365 2,180,043,654 Non-controlling interest 40(b) 260,926 250,265 Total liabilities & shareholders' equity 1,142,181,887,387 997,959,303,050

250

Islami Bank Bangladesh Limited and its SubsidiariesConsolidated Balance Sheet

As at 31 December 2019

Particulars Notes31.12.2019

Taka31.12.2018

Taka

Off-balance sheet itemsContingent liabilities

Acceptances & endorsements - - Letters of guarantee 23.0 34,566,514,299 18,849,311,457 Irrevocable letters of credit (including back to back bills) 113,823,281,324 126,911,641,579 Bills for collection 26,285,503,243 27,230,744,011 Other contingent liabilities 959,400 959,400 Total 174,676,258,266 172,992,656,447

Other commitments

Documentary credits, short term and trade related transactions - - Forward assets purchased and forward deposits placed - - Undrawn note issuance, revolving and underwriting facilities - - Undrawn formal standby facilities, credit lines and other commitments - - Total - -

Total off-balance sheet items including contingent liabilities 174,676,258,266 172,992,656,447

The annexed notes form an integral part of these financial statements.

Chairman Director

Director Managing Director & CEOThis is the consolidated balance sheet referred to in our separate report of even date.

A. Qasem & Co. Hoda Vasi Chowdhury & Co.Chartered Accountants Chartered Accountants

Dated: Dhaka;27 June 2020

251

Islami Bank Bangladesh Limited and its SubsidiariesConsolidated Profit & Loss Account

For the year ended 31 December 2019

Particulars Notes2019Taka

2018Taka

Operating incomeInvestment income 24(a) 75,612,499,933 67,027,735,199 Profit paid on mudaraba deposits 25(a) (44,927,564,177) (37,987,070,365)Net investment income 30,684,935,756 29,040,664,834 Income from investments in shares & securities 26(a) 1,809,246,731 1,682,558,731 Commission, exchange & brokerage income 27(a) 6,194,591,221 5,507,380,150 Other operating income 28(a) 5,102,524,416 3,958,434,585 Total operating income 43,791,298,124 40,189,038,300

Operating expensesSalary & allowances 29(a) 15,123,405,576 14,168,923,507 Rent, taxes, insurances, electricity etc. 30(a) 1,519,647,957 1,460,955,284 Legal expenses 31(a) 16,823,524 15,191,362 Postage, stamps and telecommunication etc. 32(a) 59,116,769 55,613,969 Stationery, printing and advertisement etc. 33(a) 256,174,010 254,138,242 Chief executive's salary & fees 34.0 14,320,000 14,320,000 Directors' fees & expenses 35(a) 20,657,363 11,804,222 Shari'ah supervisory committee's fees & expenses 36.0 3,147,721 2,927,575 Auditors' fees 37(a) 4,509,500 3,129,375 Depreciation and repair to bank's assets 38(a) 969,566,980 834,385,031 Zakat expenses 17.8 719,191,449 601,558,332 Other expenses 39(a) 2,621,818,723 1,980,373,441 Total operating expenses 21,328,379,572 19,403,320,340 Profit/ (loss) before provision 22,462,918,552 20,785,717,960 Provision for investments & off- balance sheet exposures 17.1.4 7,335,195,972 6,250,686,742 Provision for diminution in value of investments in shares 17.2(a) 654,521,588 383,893,101 Other provisions 17.4 63,580,044 67,746,642 Total provision 8,053,297,604 6,702,326,485 Total profit/(loss) before taxes 14,409,620,948 14,083,391,475 Provision for taxation for the period 8,928,979,426 7,773,091,420 Current tax 17.7(a) 8,902,530,645 7,769,683,190 Deferred tax 18(b) 26,448,781 3,408,230 Net profit/ (loss) after tax 5,480,641,522 6,310,300,055 Net profit after tax attributable to: 5,480,641,522 6,310,300,055 Equity holders of IBBL 5,480,630,861 6,310,283,177 Non-controlling interest 40(b) 10,661 16,878

Retained earnings from previous year 2,180,043,654 1,944,903,975 Add: Net profit after tax (attributable to equity holders of IBBL) 5,480,630,861 6,310,283,177 Add: Excess depreciation on revalued amount of building transferred from assets revaluation reserve to retained earnings

22.2 91,913,571 94,270,327

Profit available for appropriation 7,752,588,086 8,349,457,479

Appropriation: 7,752,588,086 8,349,457,479 Statutory reserve 21.0 1,000,000,000 1,000,000,000 General reserve 22.1 2,810,317,053 3,559,423,157 Dividend (previous year) 40.0 1,609,990,668 1,609,990,668 Retained earnings 40(a) 2,332,280,365 2,180,043,654

Consolidated earnings per share 42(a) 3.40 3.92

The annexed notes form an integral part of these financial statements.

Chairman Director

Director Managing Director & CEOThis is the consolidated profit & loss account referred to in our separate report of even date.

A. Qasem & Co. Hoda Vasi Chowdhury & Co.Chartered Accountants Chartered Accountants

Dated: Dhaka;27 June 2020

252

Islami Bank Bangladesh Limited and its SubsidiariesConsolidated Cash Flow Statement

For the year ended 31 December 2019

Particulars Note2019Taka

2018Taka

Cash flows from operating activitiesInvestment income 68,216,045,165 61,532,658,063 Profit paid on mudaraba deposits (41,388,448,320) (37,367,761,710)Income/ dividend receipt from investments in shares & securities 881,761,005 1,333,389,575 Fees & commission receipt in cash 6,194,591,221 5,507,380,150 Recovery from written off investments 82,128,286 37,379,857 Payments to employees (15,874,015,278) (12,431,117,568)Cash payments to suppliers (376,966,397) (320,702,700)Income tax paid (7,231,569,815) (6,460,341,447)Receipts from other operating activities 5,143,694,109 4,010,097,230 Payments for other operating activities (4,207,654,831) (3,564,827,667)(i) Operating profit before changes in operating assets 11,439,565,145 12,276,153,783

Changes in operating assets and liabilities Increase/(decrease) of statutory deposits - - (Increase)/decrease of net trading securities (4,870,064) - (Increase)/decrease of placement to other banks - - (Increase)/decrease of investments to customers (88,463,230,032) (90,240,995,848)(Increase)/decrease of other assets (783,846,900) (3,046,078,258)Increase/(decrease) of placement from other banks (8,965,340,564) 8,585,034,656 Increase/(decrease) of deposits from other banks 84,265,490 (431,212,723)Increase/(decrease) of deposits received from customers 123,249,581,562 67,608,576,810 Increase/(decrease) of other liabilities account of customers - - Increase/(decrease) of trading liabilities - - Increase/(decrease) of other liabilities 10,230,339,659 499,328,684 (ii) Cash flows from operating assets and liabilities 35,346,899,151 (17,025,346,679)Net cash flows from operating activities (A)=(i+ii) 46,786,464,296 (4,749,192,896)

Cash flows from investing activitiesProceeds from sale of securities (8,689,414,296) (1,076,036,240)Payment for purchase of securities/BGIIB (4,450,954,914) (3,545,132,367)Placement to Islamic Refinance Fund Account - - Payment for purchase of securities/membership - - Purchase/sale of property, plants & equipments (1,615,835,762) (552,357,449)Purchase/sale of subsidiaries - - Net Cash flows from investing activities (B) (14,756,204,972) (5,173,526,056)

Cash flows from financing activitiesReceipts from issue of debt instruments 6,000,000,000 7,000,000,000 Payment for redemption of debt instruments - - Receipts from issuing ordinary share/ right share - - Dividend paid in cash (1,609,990,668) (1,609,990,668)Net cash flows from financing activities (C) 4,390,009,332 5,390,009,332

Net increase/(decrease) in cash (A+B+C) 36,420,268,656 (4,532,709,620)Add/(less): effects of exchange rate changes on cash & cash equivalent (4,153,635) (11,930,199)Add: cash & cash equivalents at beginning of the year 130,862,912,607 135,407,552,426 Cash & cash equivalents at the end of the year 45(a) 167,279,027,628 130,862,912,607

The annexed notes form an integral part of these financial statements.

Chairman Director

Director Managing Director & CEOThis is the consolidated cash flow statement referred to in our separate report of even date.

A. Qasem & Co. Hoda Vasi Chowdhury & Co.Chartered Accountants Chartered Accountants

Dated: Dhaka;27 June 2020

253

Isla

mi B

ank

Bang

lade

sh L

imite

d an

d its

Sub

sidi

arie

sC

onso

lidat

ed S

tate

men

t of C

hang

es in

Equ

ityFo

r the

yea

r end

ed 3

1 D

ecem

ber 2

019

(Am

ount

in T

aka)

Part

icul

ars

Paid

-up

capi

tal

Shar

e pr

emiu

mSt

atut

ory

rese

rve

Gen

eral

/ oth

er

rese

rves

(*)

Asse

ts

reva

luat

ion

rese

rve

Reva

luat

ion

rese

rve o

f se

curit

ies

Reta

ined

ea

rnin

gsN

on-c

ontr

ollin

g in

tere

stTo

tal

12

34

56

78

910

(2+3

+4+

5+6+

7+8+

9)Ba

lance

as at

01 Ja

nuar

y 201

9 16

,099,9

06,68

0 1,

989,6

33

17,73

5,466

,258

10,14

8,965

,139

9,23

9,361

,072

60,62

4,000

2,

180,0

43,65

4 25

0,265

55

,466,6

06,70

1 De

ferre

d ta

x on

reva

luati

on su

rplu

s -

- -

- -

(739

,200)

- -

(739

,200)

Defer

red

tax i

mpa

ct on

exce

ss d

epre

ciatio

n -

- -

- 34

,467,5

89

- -

- 34

,467,5

89

Depr

eciat

ion

adju

stmen

t on

reva

lued

fixe

d as

sets

- -

- -

(91,9

13,57

1) -

91,91

3,571

-

- Su

rplu

s/ (d

eficit

) on

acco

unt o

f rev

aluati

on

- -

- -

- 7,

392,0

00

- -

7,39

2,000

Cu

rrenc

y tra

nslat

ion

diffe

renc

es -

- -

(4,15

3,635

)-

- -

- (4

,153,6

35)

Net g

ain an

d los

ses n

ot re

cogn

ized i

n th

e inc

ome s

tatem

ent

- -

- -

- -

- -

- Ne

t pro

fit fo

r the

per

iod

- -

- -

- -

5,48

0,630

,861

10,66

1 5,

480,6

41,52

2 Tr

ansfe

r to (

from

) res

erve

- -

1,00

0,000

,000

2,81

0,317

,053

- -

(3,81

0,317

,053)

- -

Divi

dend

: -

- -

- -

- -

- -

B

onus

shar

es -

- -

- -

- -

- -

C

ash

divi

dend

- -

- -

- -

(1,60

9,990

,668)

- (1

,609,9

90,66

8)Iss

ue of

shar

e cap

ital

- -

- -

- -

- -

- To

tal s

hare

hold

ers'

equi

ty as

on 31

Dec

embe

r 201

9 16

,099,9

06,68

0 1,

989,6

33

18,73

5,466

,258

12,95

5,128

,557

9,18

1,915

,090

67,27

6,800

2,

332,2

80,36

5 26

0,926

59

,374,2

24,30

9 Ad

d: M

udar

aba p

erpe

tual

bond

- -

- -

- -

- -

3,00

0,000

,000

Add:

Mud

arab

a red

eem

able

subo

rdin

ated

bond

- -

- -

- -

- -

18,00

0,000

,000

Add:

Gen

eral

prov

ision

for u

nclas

sified

inve

stmen

ts an

d off

- bala

nce s

heet

item

s (N

ote-

3.14.7

) -

- -

8,85

8,401

,318

- -

- -

8,85

8,401

,318

Adju

stmen

t for

inta

ngib

le as

sets

- -

- (1

74,55

1,449

) -

- -

- (1

74,55

1,449

)Ad

justm

ent f

or cu

rrenc

y tra

nslat

ion

diffe

renc

es -

- -

(6,62

9,823

)-

- -

- (6

,629,8

23)

Less

: Ass

ets re

valu

ation

rese

rve

(Not

e-3.1

4.4)

- -

- -

(9,18

1,915

,090)

- -

- (9

,181,9

15,09

0)Le

ss: R

evalu

ation

rese

rve o

f sec

uriti

es (N

ote-

3.14.5

) -

- -

- -

(67,2

76,80

0) -

- (6

7,276

,800)

Tota

l equ

ity as

on 31

Dec

embe

r 201

9 16

,099,9

06,68

0 1,

989,6

33

18,73

5,466

,258

21,63

2,348

,603

- -

2,33

2,280

,365

260,9

26

79,80

2,252

,465

(*)N

ote :

Gen

eral

/ oth

er re

serv

es

Parti

cular

s01

.01.20

1901

.01.20

18Ge

nera

l res

erve

10,

106,

181,

681

6,5

46,7

58,5

24

Divi

dend

equa

lizati

on ac

coun

t 3

2,00

0,00

0 3

2,00

0,00

0

Curre

ncy t

rans

latio

n di

ffere

nces

10,

783,

458

22,

713,

657

Tota

l 1

0,14

8,96

5,13

9 6

,601

,472

,181

254

Isla

mi B

ank

Bang

lade

sh L

imite

d an

d its

Sub

sidi

arie

sC

onso

lidat

ed S

tate

men

t of C

hang

es in

Equ

ityFo

r the

yea

r end

ed 3

1 D

ecem

ber 2

018

(Am

ount

in T

aka)

Part

icul

ars

Paid

-up

capi

tal

Shar

e pr

emiu

mSt

atut

ory

rese

rve

Gen

eral

/ oth

er

rese

rves

Asse

ts

reva

luat

ion

rese

rve

Reva

luat

ion

rese

rve o

f se

curit

ies

Reta

ined

ea

rnin

gs

Non

-co

ntro

lling

in

tere

stTo

tal

12

34

56

78

910

(2+3

+4+

5+6+

7+8+

9)Ba

lance

as at

01 J

anua

ry 20

18 16

,099,9

06,68

0 1,

989,6

33

16,73

5,466

,258

6,60

1,472

,181

9,20

4,009

,700

76,14

7,200

1,

944,9

03,97

5 23

3,387

50

,664,1

29,01

4 De

ferre

d ta

x on

reva

luati

on su

rplu

s -

- -

- -

1,72

4,800

-

- 1,

724,8

00

Defer

red

tax i

mpa

ct on

exce

ss d

epre

ciatio

n -

- -

- 12

9,621

,699

- -

- 12

9,621

,699

Depr

eciat

ion

adju

stmen

t on

reva

lued

Fixe

d As

sets

- -

- -

(94,2

70,32

7) -

94,27

0,327

-

- Su

rplu

s/ (d

eficit

) on

acco

unt o

f rev

aluati

on

- -

- -

- (1

7,248

,000)

- -

(17,2

48,00

0)Cu

rrenc

y tra

nslat

ion

diffe

renc

es -

- -

(11,9

30,19

9)-

- -

- (1

1,930

,199)

Net g

ain an

d los

ses n

ot re

cogn

ized i

n th

e inc

ome s

tatem

ent

- -

- -

- -

- -

- Ne

t pro

fit fo

r the

per

iod

- -

- -

- -

6,31

0,283

,177

16,87

8 6,

310,3

00,05

5 Tr

ansfe

r to (

from

) res

erve

- -

1,00

0,000

,000

3,55

9,423

,157

- -

(4,55

9,423

,157)

- -

Divi

dend

: -

- -

- -

- -

-

Bon

us sh

ares

- -

- -

- -

- -

-

Cas

h di

vide

nd -

- -

- -

- (1

,609,9

90,66

8) -

(1,60

9,990

,668)

Issue

of sh

are c

apita

l -

- -

- -

- -

- -

Tota

l sha

reho

lder

s' eq

uity

as on

31 D

ecem

ber 2

018

16,09

9,906

,680

1,98

9,633

17

,735,4

66,25

8 10

,148,9

65,13

9 9,

239,3

61,07

2 60

,624,0

00

2,18

0,043

,654

250,2

65

55,46

6,606

,701

Add:

Mud

arab

a per

petu

al bo

nd -

- -

- -

- -

- 3,

000,0

00,00

0 Ad

d: M

udar

aba r

edee

mab

le su

bord

inate

d bo

nd -

- -

- -

- -

- 12

,000,0

00,00

0 Ad

d: G

ener

al pr

ovisi

on fo

r unc

lassifi

ed in

vestm

ents

and

off- b

alanc

e she

et ite

ms

(Not

e-3.1

4.7)

- -

- 7,

936,8

51,31

8 -

- -

- 7,

936,8

51,31

8

Adju

stmen

t for

inta

ngib

le as

sets

- -

- (6

1,852

,089)

- -

- -

(61,8

52,08

9)Ad

justm

ent f

or cu

rrenc

y tra

nslat

ion

diffe

renc

es -

- -

(10,7

83,45

8)-

- -

- (1

0,783

,458)

Less

: Ass

ets re

valu

ation

rese

rve

(Not

e-3.1

4.4)

- -

- -

(8,08

9,463

,940)

- -

- (8

,089,4

63,94

0)Le

ss: R

evalu

ation

rese

rve o

f sec

uriti

es (N

ote-

3.14.5

) -

- -

- -

(52,4

74,00

0) -

- (5

2,474

,000)

Tota

l equ

ity as

on 31

Dec

embe

r 201

8 16

,099,9

06,68

0 1,

989,6

33

17,73

5,466

,258

18,01

3,180

,910

1,14

9,897

,132

8,15

0,000

2,

180,0

43,65

4 25

0,265

70

,188,8

84,53

2

Cha

irm

anD

irec

tor

Dir

ecto

rM

anag

ing

Dir

ecto

r & C

EOTh

is is

the c

onso

lidat

ed st

atem

ent o

f cha

nges

in eq

uity

refe

rred

to in

our

sepa

rate

repo

rt o

f eve

n da

te.

A. Q

asem

& C

o.C

hart

ered

Acc

ount

ants

Hod

a Vas

i Cho

wdhu

ry &

Co.

Cha

rter

ed A

ccou

ntan

tsD

ated

, Dha

ka;

27 Ju

ne 2

020

255

Islami Bank Bangladesh LimitedBalance Sheet

As at 31 December 2019

Particulars Notes31.12.2019

Taka31.12.2018

TakaProperty and Assets

Cash in hand 7.0 75,853,433,326 67,463,910,602 Cash in hand (including foreign currency) 7.1 15,023,787,386 14,816,614,054 Balance with Bangladesh Bank & its agent bank(s) (including foreign currency) 7.2 60,829,645,940 52,647,296,548

Balance with other banks & financial institutions 8.0 86,136,492,545 57,874,994,226 In Bangladesh 8.i 66,034,499,606 51,100,323,599 Outside Bangladesh 8.ii 20,101,992,939 6,774,670,627

Placement with banks & other financial institutions 9.0 - -

Investments in shares & securities 10.0 54,137,642,576 41,610,654,658 Government 10.1 40,111,029,770 32,103,637,770 Others 10.2 14,026,612,806 9,507,016,888

Investments 11.0 899,013,206,248 805,759,976,216 General investments etc. 11.1 866,248,730,969 764,360,204,266 Bills purchased & discounted 11.2 32,764,475,279 41,399,771,950

Fixed assets including premises 12.0 16,186,646,562 15,346,415,834

Other assets 13.0 10,165,550,110 9,373,649,939

Non - banking assets - -

Total property and assets 1,141,492,971,367 997,429,601,475

Liabilities and CapitalLiabilities

Placement from banks & other financial institutions 14.0 28,849,020,000 37,814,360,564

Deposits & other accounts 15.0 946,291,525,243 822,573,124,545 Mudaraba savings deposits 15.1 313,114,645,635 277,829,620,039 Mudaraba term deposits 335,626,192,223 273,163,556,050 Other mudaraba deposits 15.2 207,034,165,684 188,291,340,751 Al- wadeeah current and other deposit accounts 15.3 83,868,578,086 79,160,514,966 Bills payable 15.4 6,647,943,615 4,128,092,739

Mudaraba Bond 16.0 21,000,000,000 15,000,000,000 Mudaraba perpetual bond 3,000,000,000 3,000,000,000 Mudaraba redeemable subordinated bond 16.1 18,000,000,000 12,000,000,000

Other liabilities 17.0 85,017,777,078 65,455,556,853

Deferred tax liabilities 18.0 1,682,975,360 1,690,256,063

Total liabilities 1,082,841,297,681 942,533,298,025

Capital/ shareholders’ equity 58,651,673,686 54,896,303,450 Paid - up capital 19.2 16,099,906,680 16,099,906,680 Statutory reserve 21.0 18,735,466,258 17,735,466,258 Other reserves 22.0 22,206,310,080 19,450,939,844 Retained Earnings 40.0 1,609,990,668 1,609,990,668 Total liabilities & shareholders’ equity 1,141,492,971,367 997,429,601,475

256

Islami Bank Bangladesh LimitedBalance Sheet

As at 31 December 2019

Particulars Notes31.12.2019

Taka31.12.2018

TakaOff-balance sheet itemsContingent liabilities

Acceptances & endorsements - - Letters of guarantee 23.0 34,566,514,299 18,849,311,457 Irrevocable letters of credit (including back to back bills) 113,823,281,324 126,911,641,579 Bills for collection 26,285,503,243 27,230,744,011 Other contingent liabilities 959,400 959,400

Total 174,676,258,266 172,992,656,447

Other commitments

Documentary credits, short term and trade related transactions - - Forward assets purchased and forward deposits placed - - Undrawn note issuance, revolving and underwriting facilities - - Undrawn formal standby facilities, credit lines and other commitments - - Total - - Total off-balance sheet items including contingent liabilities 174,676,258,266 172,992,656,447

The annexed notes form an integral part of these financial statements.

Chairman Director

Director Managing Director & CEOThis is the balance sheet referred to in our separate report of even date.

A. Qasem & Co. Hoda Vasi Chowdhury & Co.Chartered Accountants Chartered Accountants

Dated: Dhaka;27 June 2020

257

Islami Bank Bangladesh LimitedProfit & Loss Account

For the year ended 31 December 2019

Particulars Notes2019Taka

2018Taka

Operating incomeInvestment income 24.0 75,748,836,764 67,166,193,512 Profit paid on mudaraba deposits 25.0 (44,941,325,781) (37,999,261,544)Net investment income 30,807,510,983 29,166,931,968

Income from investments in shares & securities 26.0 1,626,837,630 1,487,397,415 Commission, exchange & brokerage income 27.0 6,177,483,389 5,479,551,190 Other operating income 28.0 4,577,955,123 3,462,949,905 Total operating income 43,189,787,125 39,596,830,478

Operating expenses

Salary & allowances 29.0 15,091,747,421 14,141,947,156 Rent, taxes, insurances, electricity etc. 30.0 1,513,496,044 1,455,147,090 Legal expenses 31.0 16,823,524 15,133,862 Postage, stamps and telecommunication etc. 32.0 58,934,588 55,470,176 Stationery, printing and advertisement etc. 33.0 255,760,614 253,896,273 Chief executive's salary & fees 34.0 14,320,000 14,320,000 Directors' fees & expenses 35.0 19,818,963 10,865,822 Shari'ah supervisory committee's fees & expenses 36.0 3,147,721 2,927,575 Auditors' fees 37.0 4,360,000 3,008,625 Depreciation and repair to bank's assets 38.0 966,181,093 832,170,473 Zakat expenses 17.8 719,191,449 601,558,332 Other expenses 39.0 2,612,392,077 1,970,800,698 Total operating expenses 21,276,173,494 19,357,246,082 Profit/ (loss) before provision 21,913,613,631 20,239,584,396 Provision for investments & off- balance sheet exposures 17.1.4 7,335,195,972 6,250,686,742 Provision for diminution in value of investments in shares 17.2 415,085,114 220,104,084 Other provisions 17.4 63,580,044 67,746,642 Total provision 7,813,861,130 6,538,537,468

Total profit/(loss) before taxes 14,099,752,501 13,701,046,928

Provision for taxation for the period 8,771,358,351 7,625,903,430 Current tax 17.7.1 8,744,910,665 7,622,240,042 Deferred tax expense/(income) 18.0 26,447,686 3,663,388 Net profit/(loss) after tax 5,328,394,150 6,075,143,498 Retained earnings from previous year 1,609,990,668 1,609,990,668 Add: Net profit after tax 5,328,394,150 6,075,143,498 Add: Excess depreciation on revalued amount of building transferred from assets revaluation reserve to retained earnings

22.2 91,913,571 94,270,327

Profit available for appropriation 7,030,298,389 7,779,404,493

Appropriation: 7,030,298,389 7,779,404,493 Statutory reserve 21.0 1,000,000,000 1,000,000,000 General reserve 22.1 2,810,317,053 3,559,423,157 Dividend (previous year) 40.0 1,609,990,668 1,609,990,668 Retained earnings 40.0 1,609,990,668 1,609,990,668

Earnings per share (EPS) 42.0 3.31 3.77

The annexed notes form an integral part of these financial statements.

Chairman Director

Director Managing Director & CEOThis is the profit & loss account referred to in our separate report of even date.

A. Qasem & Co. Hoda Vasi Chowdhury & Co.Chartered Accountants Chartered Accountants

Dated: Dhaka;27 June 2020

258

Islami Bank Bangladesh LimitedCash Flow Statement

For the year ended 31 December 2019

Particulars Note2019Taka

2018Taka

Cash flows from operating activitiesInvestment income 68,352,381,996 61,671,116,376 Profit paid on mudaraba deposits (41,402,209,924) (37,379,952,889)Income/ dividend receipt from investments in shares & securities 699,631,725 1,138,228,259 Fees & commission receipt in cash 6,177,483,389 5,479,551,190 Recovery from written off investments 82,128,286 37,379,857 Payments to employees (15,843,682,501) (12,404,141,217)Cash payments to suppliers (376,553,001) (320,460,731)Income tax paid (7,078,331,739) (6,359,942,891)Receipts from other operating activities 4,618,809,908 3,514,612,550 Payments for other operating activities (4,189,545,726) (3,548,186,287)(i) Operating profit before changes in operating assets 11,040,112,413 11,828,204,217

Changes in operating assets and liabilities

Increase/(decrease) of statutory deposits - - (Increase)/decrease of net trading securities - - (Increase)/decrease of placement to other banks - - (Increase)/decrease of investments to customers (93,253,230,032) (95,031,045,848)(Increase)/decrease of other assets (791,900,171) (3,067,427,525)Increase/(decrease) of placement from other banks (8,965,340,564) 8,585,034,656 Increase/(decrease) of deposits from other banks 84,269,990 (431,212,723)Increase/(decrease) of deposits received from customers 123,634,130,708 67,982,091,309 Increase/(decrease) of other liabilities account of customers - - Increase/(decrease) of trading liabilities - - Increase/(decrease) of other liabilities 14,650,031,112 4,808,684,841 (ii) Cash flows from operating assets and liabilities 35,357,961,043 (17,153,875,290)Net cash flows from operating activities (A)=(i+ii) 46,398,073,456 (5,325,671,073)

Cash flows from investing activities

Proceeds from sale of securities/BGIIB (12,526,987,918) (3,667,041,028)Payment for purchase of securities/BGIIB - - Placement to Islamic Refinance Fund Account - - Payment for purchase of securities/membership - - Purchase/sale of property, plants & equipments (1,605,920,192) (552,060,327)Purchase/sale of subsidiaries - - Net cash flows from investing activities (B) (14,132,908,110) (4,219,101,355)

Cash flows from financing activities

Receipts from issue of debt instruments 6,000,000,000 7,000,000,000 Payment for redemption of debt instruments - - Receipts from issuing ordinary share/ right share - - Dividend paid in Cash (1,609,990,668) (1,609,990,668)Net cash flows from financing activities (C) 4,390,009,332 5,390,009,332

Net increase/(decrease) in cash (A+B+C) 36,655,174,678 (4,154,763,096)

Add/(Less): effects of exchange rate changes on cash & cash equivalent (4,153,635) (11,930,199)Add: cash & cash equivalents at beginning of the year 125,338,904,828 129,505,598,123

Cash & cash equivalents at the end of the year 45.0 161,989,925,871 125,338,904,828

The annexed notes form an integral part of these financial statements.

Chairman Director

Director Managing Director & CEOThis is the cash flow statement referred to in our separate report of even date.

A. Qasem & Co. Hoda Vasi Chowdhury & Co.Chartered Accountants Chartered Accountants

Dated: Dhaka;27 June 2020

259

Isla

mi B

ank

Bang

lade

sh L

imite

dSt

atem

ent o

f Cha

nges

in E

quity

For t

he y

ear e

nded

31

Dec

embe

r 201

9(A

mou

nt in

Tak

a)

Part

icul

ars

Paid

-up

capi

tal

Shar

e pr

emiu

mSt

atut

ory

rese

rve

Gen

eral

/ oth

er

rese

rves

(*)

Ass

ets

reva

luat

ion

rese

rve

Reva

luat

ion

rese

rve

of

secu

ritie

s

Reta

ined

ea

rnin

gsTo

tal

12

34

56

78

9 (2+

3+ 4+

5+6+

7+ 8)

Bala

nce a

s at

01 Ja

nuar

y 201

916

,099

,906

,680

1

,989

,633

17

,735

,466

,258

10

,148

,965

,139

9

,239

,361

,072

6

0,62

4,00

0 1

,609

,990

,668

54

,896

,303

,450

Def

erre

d ta

x on

reva

luat

ion

surp

lus

- -

- -

- (7

39,2

00)

- (7

39,2

00)

Def

erre

d ta

x im

pact

on

exce

ss d

epre

ciat

ion

- -

- -

34,

467,

589

- -

34,

467,

589

Dep

reci

atio

n ad

just

men

t on

reva

lued

fixe

d as

sets

-

- -

- (9

1,91

3,57

1) -

91,

913,

571

-

Surp

lus/

(defi

cit)

on

acco

unt o

f rev

alua

tion

- -

- -

- 7

,392

,000

-

7,3

92,0

00

Curr

ency

tran

slatio

n di

ffere

nces

- -

- (4

,153

,635

) -

- -

(4,1

53,6

35)

Net

gai

n an

d lo

sses

not

reco

gniz

ed in

the i

ncom

e sta

tem

ent

- -

- -

- -

- -

Net

pro

fit fo

r the

per

iod

- -

- -

- -

5,3

28,3

94,1

50

5,3

28,3

94,1

50

Tran

sfer

to (f

rom

) res

erve

- -

1,0

00,0

00,0

00

2,8

10,3

17,0

53

- -

(3,81

0,317

,053)

-

Div

iden

d: -

Bonu

s sha

res

- -

- -

- -

- -

Cas

h di

vide

nd -

- -

- -

(1,60

9,990

,668)

(1,6

09,9

90,6

68)

Issu

e of s

hare

capi

tal

- -

- -

- -

- -

Tota

l sha

reho

lder

s' eq

uity

as o

n 31

Dec

embe

r 201

916

,099

,906

,680

1

,989

,633

18

,735

,466

,258

12

,955

,128

,557

9

,181

,915

,090

6

7,27

6,80

0 1

,609

,990

,668

58

,651

,673

,686

Add

: Mud

arab

a pe

rpet

ual b

ond

- -

- -

- -

- 3

,000

,000

,000

Add

: Mud

arab

a re

deem

able

subo

rdin

ated

bon

d -

- -

- -

- -

18,0

00,0

00,0

00

Add

: Gen

eral

pro

visio

n fo

r unc

lass

ified

inve

stm

ents

and

off-

ba

lanc

e she

et it

ems

(Not

e-3.

14.7

) -

- -

8,8

58,4

01,3

18

- -

- 8

,858

,401

,318

Adj

ustm

ent f

or in

tang

ible

ass

ets

(174

,551

,449

) (1

74,5

51,4

49)

Adj

ustm

ent f

or c

urre

ncy

tran

slatio

n di

ffere

nces

- -

- (6

,629

,823

) -

- -

(6,6

29,8

23)

Less

: A

sset

s rev

alua

tion

rese

rve

(Not

e-3.

14.4

) -

- -

- (9

,181,9

15,09

0) -

- (9

,181

,915

,090

)

Less

: Re

valu

atio

n re

serv

e of s

ecur

ities

(Not

e-3.

14.5

) -

- -

- -

(67,

276,

800)

- (6

7,27

6,80

0)

Tota

l equ

ity a

s on

31 D

ecem

ber 2

019

16,0

99,9

06,6

80

1,9

89,6

33

18,7

35,4

66,2

58

21,6

32,3

48,6

03

- -

1,6

09,9

90,6

68

79,0

79,7

01,8

42

(*)N

ote :

Gen

eral

/ ot

her r

eser

ves

Part

icula

rs01

.01.

2019

01.0

1.20

18

Gen

eral

rese

rve

10,10

6,181

,681

6,5

46,7

58,5

24

Div

iden

d eq

ualiz

atio

n ac

coun

t 3

2,00

0,00

0 3

2,00

0,00

0

Curr

ency

tran

slatio

n di

ffere

nces

10,

783,

458

22,

713,

657

Tota

l10

,148

,965

,139

6

,601

,472

,181

260

Isla

mi B

ank

Bang

lade

sh L

imite

dSt

atem

ent o

f Cha

nges

in E

quity

For t

he y

ear e

nded

31

Dec

embe

r 201

8(A

mou

nt in

Tak

a)

Part

icul

ars

Paid

-up

capi

tal

Shar

e pr

emiu

mSt

atut

ory

rese

rve

Gen

eral

/ oth

er

rese

rves

Ass

ets

reva

luat

ion

rese

rve

Reva

luat

ion

rese

rve

of

secu

ritie

s

Reta

ined

ea

rnin

gsTo

tal

12

34

56

78

9 (2+

3+ 4+

5+6+

7+

8) B

alan

ce a

s at 0

1 Ja

nuar

y 20

18

16,0

99,9

06,6

80

1,9

89,6

33

16,7

35,4

66,2

58

6,6

01,4

72,1

81

9,2

04,0

09,7

00

76,

147,

200

1,6

09,9

90,6

68

50,3

28,9

82,3

20

Def

erre

d ta

x on

reva

luat

ion

surp

lus

- -

- -

- 1

,724

,800

-

1,7

24,8

00

Def

erre

d ta

x im

pact

on

exce

ss d

epre

ciat

ion

--

--

129

,621

,699

-

- 1

29,6

21,6

99

Dep

reci

atio

n ad

just

men

t on

reva

lued

Fix

ed A

sset

s -

- -

- (9

4,27

0,32

7) -

94,

270,

327

- Su

rplu

s/ (d

efici

t) o

n ac

coun

t of r

eval

uatio

n -

- -

- -

(17,

248,

000)

- (1

7,24

8,00

0)Cu

rren

cy tr

ansla

tion

diffe

renc

es -

- -

(11,

930,

199)

- -

- (1

1,93

0,19

9)N

et g

ain

and

loss

es n

ot re

cogn

ized

in th

e inc

ome s

tate

men

t -

- -

- -

- -

- N

et p

rofit

for t

he p

erio

d -

- -

- -

- 6

,075

,143

,498

6

,075

,143

,498

Tr

ansf

er to

(fro

m) r

eser

ve -

- 1

,000

,000

,000

3

,559

,423

,157

-

- (4

,559,4

23,15

7) -

Div

iden

d:-

--

--

- -

Bonu

s sha

res

- -

- -

- -

- -

Cas

h di

vide

nd-

- -

- -

- (1

,609,9

90,66

8)(1

,609,9

90,66

8)Is

sue o

f sha

re ca

pita

l -

- -

- -

- -

- T

otal

shar

ehol

ders

' equ

ity a

s on

31 D

ecem

ber 2

018

16,0

99,9

06,6

80

1,9

89,6

33

17,7

35,4

66,2

58

10,1

48,9

65,1

39

9,2

39,3

61,0

72

60,

624,

000

1,6

09,9

90,6

68

54,8

96,3

03,4

50

Add

: Mud

arab

a pe

rpet

ual b

ond

- -

- -

- -

- 3

,000

,000

,000

A

dd: M

udar

aba

rede

emab

le su

bord

inat

ed b

ond

- -

- -

- -

- 12

,000

,000

,000

A

dd: G

ener

al p

rovi

sion

for u

ncla

ssifi

ed in

vest

men

ts a

nd o

ff-

bala

nce s

heet

item

s (N

ote-

3.14

.7)

- -

- 7

,936

,851

,318

-

- -

7,9

36,8

51,3

18

Adj

ustm

ent f

or in

tang

ible

ass

ets

--

- (6

1,85

2,08

9)-

- (6

1,85

2,08

9)A

djus

tmen

t for

cur

renc

y tr

ansla

tion

diffe

renc

es -

- -

(10,

783,

458)

- -

- (1

0,78

3,45

8)Le

ss:

Ass

ets r

eval

uatio

n re

serv

e (N

ote-

3.14

.4)

- -

- -

(8,08

9,463

,940)

- -

(8,08

9,463

,940)

Less

: Re

valu

atio

n re

serv

e of s

ecur

ities

(Not

e-3.

14.5

) -

- -

- -

(52,

474,

000)

- (5

2,47

4,00

0) T

otal

equ

ity a

s on

31 D

ecem

ber 2

018

16,0

99,9

06,6

80

1,9

89,6

33

17,7

35,4

66,2

58

18,0

13,1

80,9

10

1,1

49,8

97,1

32

8,1

50,0

00

1,6

09,9

90,6

68

69,6

18,5

81,2

81

Cha

irm

anD

irec

tor

Dir

ecto

rM

anag

ing

Dir

ecto

r & C

EOTh

is is

the s

tate

men

t of c

hang

es in

equi

ty re

ferr

ed to

in o

ur se

para

te re

port

of e

ven

date

.

A. Q

asem

& C

o.C

hart

ered

Acc

ount

ants

Hod

a Vas

i Cho

wdhu

ry &

Co.

Cha

rter

ed A

ccou

ntan

tsD

ated

, Dha

ka;

27 Ju

ne 2

020

261

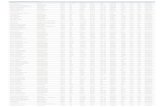

Isla

mi B

ank

Bang

lade

sh L

imite

dLi

quid

ity S

tate

men

tA

sset

s & L

iabi

litie

s Ana

lysi

sA

s at 3

1 D

ecem

ber 2

019

(Am

ount

in T

aka)

Part

icul

ars

Up

to 1

Mon

th1

- 3 M

onth

s3

- 12

Mon

ths

1 - 5

yea

rsM

ore

than

5

year

sTo

tal 3

1.12

.201

9To

tal 3

1.12

.201

8

12

34

56

7=(2

+ 3

+ 4

+ 5

+

6)8

ASS

ETS

Cas

h in

han

d 1

8,46

9,73

1,04

5 -

- -

57,

383,

702,

281

75,

853,

433,

326

67,

463,

910,

602

Bala

nce w

ith o

ther

ban

ks &

fina

ncia

l ins

titut

ions

(Not

e-8.

2) 3

4,91

1,49

2,54

5 4

9,55

5,00

0,00

0 1

,670

,000

,000

-

- 8

6,13

6,49

2,54

5 5

7,87

4,99

4,22

6 Pl

acem

ent w

ith B

anks

& o

ther

Fin

anci

al In

stitu

tions

- -

- -

- -

- In

vest

men

ts (i

n sh

ares

& se

curit

ies)

(Not

e-10

.4)

6,4

13,7

72,3

07

18,

950,

491,

502

19,

681,

944,

211

3,8

22,7

37,8

25

5,2

68,6

96,7

31

54,

137,

642,

576

41,

610,

654,

658

Gen

eral

inve

stm

ents

etc.

(Not

e-11

.1.1

) 1

68,4

29,3

21,5

09

141

,251

,232

,932

2

08,6

14,6

30,1

31

168

,971

,364

,215

1

78,9

82,1

82,1

82

866

,248

,730

,969

7

64,3

60,2

04,2

66

Bills

pur

chas

ed &

disc

ount

ed (N

ote-

11.2

.1)

9,1

85,6

47,2

14

9,4

57,2

53,3

87

14,

121,

574,

678

- -

32,

764,

475,

279

41,

399,

771,

950

Fixe

d as

sets

incl

udin

g pr

emise

s (la

nd &

bui

ldin

g), f

urni

ture

an

d fix

ture

s (N

ote-

12.3

) -

- 7

12,5

64,9

84

2,7

18,5

33,7

51

12,

755,

547,

827

16,

186,

646,

562

15,

346,

415,

834

Oth

er a

sset

s (N

ote-

13.1

) 1

,753

,163

,297

5

,713

,069

,864

1

,975

,073

,871

5

24,5

51,2

54

199

,691

,824

1

0,16

5,55

0,11

0 9

,373

,649

,939

N

on -

bank

ing

asse

ts -

- -

- -

- -

Tota

l Ass

ets

239

,163

,127

,917

2

24,9

27,0

47,6

85

246

,775

,787

,876

1

76,0

37,1

87,0

45

254

,589

,820

,845

1

,141

,492

,971

,367

9

97,4

29,6

01,4

75

LIA

BILI

TIES

Plac

emen

t fro

m b

anks

& o

ther

fina

ncia

l ins

titut

ions

8,1

04,1

45,6

24

10,

264,

150,

000

10,

480,

724,

376

- -

28,

849,

020,

000

37,

814,

360,

564

Dep

osits

(Not

e-15

.5)

197

,920

,703

,449

1

72,9

07,9

09,9

50

217

,988

,994

,871

1

50,9

63,3

72,1

89

206

,510

,544

,784

9

46,2

91,5

25,2

43

822

,573

,124

,545

O

ther

acc

ount

s -

- -

- -

- -

Prov

ision

& o

ther

liab

ilitie

s (N

ote-

17.1

0) 6

,445

,576

,302

2

4,51

7,06

9,05

7 7

,456

,906

,318

8

,671

,154

,294

3

7,92

7,07

1,10

7 8

5,01

7,77

7,07

8 6

5,45

5,55

6,85

3 D

efer

red

tax

liabi

lity/

(ass

ets)

- -

- -

1,6

82,9

75,3

60

1,6

82,9

75,3

60

1,6

90,2

56,0

62

Mud

arab

a pe

rpet

ual b

ond

- -

- -

3,0

00,0

00,0

00

3,0

00,0

00,0

00

3,0

00,0

00,0

00

Mud

arab

a Re

deem

able

Sub

ordi

nate

d Bo

nd -

- -

14,

200,

000,

000

3,8

00,0

00,0

00

18,

000,

000,

000

12,

000,

000,

000

Tota

l Lia

bilit

ies

212

,470

,425

,375

2

07,6

89,1

29,0

07

235

,926

,625

,565

1

73,8

34,5

26,4

83

252

,920

,591

,251

1

,082

,841

,297

,681

9

42,5

33,2

98,0

25

Net

Liq

uidi

ty G

ap 2

6,69

2,70

2,54

2 1

7,23

7,91

8,67

9 10

,849

,162

,311

2,

202,

660,

562

1,6

69,2

29,5

94

58,

651,

673,

686

54,

896,

303,

450

Cha

irm

anD

irec

tor

Dir

ecto

rM

anag

ing

Dir

ecto

r & C

EOTh

is is

the l

iqui

dity

stat

emen

t ref

erre

d to

in o

ur se

para

te re

port

of e

ven

date

.

A. Q

asem

& C

o.C

hart

ered

Acc

ount

ants

Hod

a Vas

i Cho

wdhu

ry &

Co.

Cha

rter

ed A

ccou

ntan

tsD

ated

, Dha

ka;

27 Ju

ne 2

020

262

Islami Bank Bangladesh Limited and its SubsidiariesNotes to the financial statements

As at and for the year ended 31 December 2019

1.0 The Bank and its activities

1.1 IntroductionIslami Bank Bangladesh Limited [IBBL] (hereinafter referred to as "the Bank") was established as a public limited banking company in Bangladesh in 1983 as the first Shari’ah based scheduled commercial bank in the South East Asia. Naturally, its modus operandi is substantially different from those of other conventional commercial banks. The Bank conducts its business on the Shari'ah principles of Mudaraba, Musharaka, Bai-Murabaha, Bai-Muajjal, Hire Purchase under Shirkatul Melk, Bai-Salam, Bai-as-Sarf and Ujarah etc. There is a Shari'ah Supervisory Committee in the Bank which ensures that the activities of the Bank are being conducted on the precepts of Islam.

The shares of the Bank are listed with both Dhaka Stock Exchange (DSE) Limited and Chittagong Stock Exchange (CSE) Limited. The Bank carries out its business activities through its Head Office in Dhaka, 16 Zonal Offices, 357 Branches including 60 Authorised Dealer (AD) Branches, 21 Sub Branches, 1012 Agent Banking Outlets and 3 Off-shore Banking Units (OBUs) in Bangladesh. The Principal place of business is the Registered Office of the Bank situated at Islami Bank Tower, 40, Dilkusha Commercial Area, Dhaka-1000, Bangladesh. These financial statements as at and for the year ended 31 December 2019 include the consolidated and separate financial statements of the Bank. The consolidated financial statements comprise the financial statements of the Bank and its subsidiaries (mentioned in Note - 1.4, together referred to as "the Companies"). The current number of employes are 16,807 (2018:14,698)

1.2 Nature of business/ Principal activities of the Bank

1.2.1 Commercial banking servicesAll kinds of commercial banking services are provided by the Bank to the customers following the principles of Islamic Shari’ah, the provisions of the Bank Companies Act, 1991 as amended, Bangladesh Bank’s directives and directives of other regulatory authorities.

1.2.2 Islamic micro-financeIslamic micro-finance represents micro-finance of the Islamic finance industry. Under Islamic micro-finance, major focus is given on improvement of living standard of poor people. The projects are closely monitored so that the members are really benefited. The Bank provides this services under the umbrella of Rural Development Scheme (RDS) and Urban Poor Development Scheme (UPDS).

1.2.3 Mobile financial services -"mCash"The bank has launched mobile financial services on 27 December 2012 under the name "Islami Bank mCash" as per Bangladesh Bank approval (reference no. DCMPS/PSD/37/(W)/2012-321 dated 14 June 2012). Islami Bank mCash offers different services through Mobile phone that include deposit and withdrawal of cash money, fund transfer from one account to another, receiving remittance from abroad, knowing account balance and mini-statement, giving and receiving salary, mobile recharge and payment of utility bill, merchant bill payment etc.