212013 14398 f013_credit rating

-

Upload

sumit-sharma -

Category

Documents

-

view

253 -

download

0

description

Transcript of 212013 14398 f013_credit rating

Credit ratingCredit rating

Functions, origins, benefits, Functions, origins, benefits, methodology and regulationsmethodology and regulations

Concept Concept

It is essentially a symbolic indicator It is essentially a symbolic indicator of the current opinion of the rating of the current opinion of the rating agency regarding the relative ability agency regarding the relative ability and willingness of the issuer of a and willingness of the issuer of a financial instrument (debt) to meet financial instrument (debt) to meet the service obligations as and when the service obligations as and when they arise.they arise.

It reduces the informational It reduces the informational asymmetry between the investor and asymmetry between the investor and the issuing company.the issuing company.

Continue.Continue.

It is only an opinion expressed by an It is only an opinion expressed by an independent professional organization, independent professional organization, on the basis of a detailed study of all on the basis of a detailed study of all relevant factors, the rating does not relevant factors, the rating does not amount to any recommendation to amount to any recommendation to buy, hold, or sell an instruments as it buy, hold, or sell an instruments as it does not take into consideration does not take into consideration factors such as market prices and factors such as market prices and personal risk preference of the investorpersonal risk preference of the investor

Continue..Continue..

It is done for specific debt security It is done for specific debt security and not for a company as a whole and not for a company as a whole

A debt rating is not an one time A debt rating is not an one time evaluation of the credit risk, which evaluation of the credit risk, which can be regarded as valid for the can be regarded as valid for the entire life of the security.entire life of the security.

Functions Functions

Superior informationSuperior informationLow cost informationLow cost informationQuick investment decisionQuick investment decision Independent investment decisionIndependent investment decision Investor protectionInvestor protection

Benefits to rated companiesBenefits to rated companies

Sources of additional certificationSources of additional certification Increase the investor populationIncrease the investor population Forewarns risksForewarns risks Encourages financial disciplineEncourages financial discipline Merchant bankers job made easyMerchant bankers job made easy Foreign collaboration made easyForeign collaboration made easy Benefits the industry as a wholeBenefits the industry as a whole Low cost of borrowingLow cost of borrowing Rating as a marketing toolRating as a marketing tool

Methodology Methodology

Any debt obligation and the issuer is Any debt obligation and the issuer is evaluated on the basis of :evaluated on the basis of :

1.1. Business risk analysisBusiness risk analysis Industry riskIndustry risk Market position of the companyMarket position of the company Operating efficiency of the companyOperating efficiency of the company Management evaluation Management evaluation

Continue Continue

1.1. Financial risk analysisFinancial risk analysis Earnings protectionEarnings protection Leverage and asset protectionLeverage and asset protection Cash flow adequacyCash flow adequacy Financial flexibilityFinancial flexibility Accounting qualityAccounting quality Indenture Indenture

A .Business risk analysisA .Business risk analysis Industry risk Industry risk 1.1. Is the industry in a growth, stable or declining Is the industry in a growth, stable or declining

phase?phase?2.2. Is the business cycle independent of economy or it Is the business cycle independent of economy or it

moves with economy in generalmoves with economy in general3.3. What is the nature of the competition? Is it What is the nature of the competition? Is it

regional, national, or international?regional, national, or international?4.4. What is the nature of govt regulation and policies?What is the nature of govt regulation and policies?5.5. What is the labour situation? Is it unionisedWhat is the labour situation? Is it unionised6.6. Does the industry have good control of key raw Does the industry have good control of key raw

materialmaterial7.7. To what extent the industry is fixed capital or To what extent the industry is fixed capital or

working capital intensive?working capital intensive?8.8. Ease of entry or exitEase of entry or exit

Market position of the Market position of the companycompany

The rating company would evaluate a The rating company would evaluate a company’s sales position in terms of:company’s sales position in terms of:

Market shareMarket share

Marketing Marketing

DistributionDistribution

Strengths and weaknessesStrengths and weaknesses

Diversity of products and customer Diversity of products and customer basebase

Operating efficiency Operating efficiency

This is assessed from the operating This is assessed from the operating margins of the company and its margins of the company and its ability to maintain or improve them ability to maintain or improve them based upon pricing or cost based upon pricing or cost advantages.advantages.

Management evaluationManagement evaluation

Management is assessed for its role in Management is assessed for its role in determining operational success and also determining operational success and also for its risk tolerance.for its risk tolerance.

A company’s earning performance, financial A company’s earning performance, financial structure and business mix are all a function structure and business mix are all a function of management.of management.

Evaluation of management emphasises past Evaluation of management emphasises past performance, fulfillment of earlier plans and performance, fulfillment of earlier plans and debt usage policies. It has also concern with debt usage policies. It has also concern with the philosophy, experience, maturity, the philosophy, experience, maturity, capability and depth of management capability and depth of management

B. Financial risk analysisB. Financial risk analysis

Earning protection can be viewed fromEarning protection can be viewed from

1.1. Profit potential angleProfit potential angle

2.2. Break even analysisBreak even analysis

the most significant measures of the most significant measures of profitability are profitability are

1.1. Return on capital (pre-tax)Return on capital (pre-tax)

2.2. Profit marginProfit margin

Finally the aim is to find out the source of Finally the aim is to find out the source of future earning growth.future earning growth.

Continue Continue

Leverage and asset protectionLeverage and asset protection

1.1. Long term debt/total capitalisationLong term debt/total capitalisation

2.2. Total debt/total capitalisationTotal debt/total capitalisation

The concept of asset protection refers The concept of asset protection refers to measurement of the relative to measurement of the relative amount of equity supporting the amount of equity supporting the asset base asset base

Cash flow adequacy:Cash flow adequacy:

Earnings may be the best long-term Earnings may be the best long-term determinant of creditworthiness.determinant of creditworthiness.

The principal ratio computed is the debt The principal ratio computed is the debt service coverage ratio.service coverage ratio.

Financial flexibilityFinancial flexibilityIt is an evaluation of a company’s financing It is an evaluation of a company’s financing

needs, plans and alternatives and its needs, plans and alternatives and its flexibility to accomplish its financing flexibility to accomplish its financing program under adverse condition without program under adverse condition without damaging creditworthinessdamaging creditworthiness

Accounting qualityAccounting quality

The various aspects reviewed in this The various aspects reviewed in this category would include:category would include:

1.1. Auditor’s qualificationAuditor’s qualification2.2. Method of income recognitionMethod of income recognition3.3. Inventory valuation policiesInventory valuation policies4.4. Depreciation policiesDepreciation policies5.5. Interconnection with subsidiariesInterconnection with subsidiaries6.6. Undervaluation/overvaluation of assetsUndervaluation/overvaluation of assets7.7. Off-balance sheet liabilitiesOff-balance sheet liabilities

Indenture Indenture

Whether the provision of indenture deviate Whether the provision of indenture deviate the standard practice?the standard practice?

Whether the indenture allow the company Whether the indenture allow the company to issue other bonds with equal or greater to issue other bonds with equal or greater claim on the assets of the company?claim on the assets of the company?

Whether creation of sinking fund for Whether creation of sinking fund for redemption of principal is stipulated?redemption of principal is stipulated?

Are bonds senior or subordinated to other Are bonds senior or subordinated to other bonds.bonds.

Is the indenture too restrictive in terms of Is the indenture too restrictive in terms of payments of dividends, further borrowings, payments of dividends, further borrowings, etc.etc.

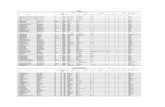

Credit rating for advance accounts with fund Credit rating for advance accounts with fund based working capital limits of Rs. 1 cr and above based working capital limits of Rs. 1 cr and above

from the banking systemfrom the banking system

PARAMETERSPARAMETERS

1.1. financial standing (actual) financial standing (actual)

Current ratio Current ratio scorescore

1.33 and above 101.33 and above 10

1.25 to 1.32 081.25 to 1.32 08

1.34 to 1.24 051.34 to 1.24 05

1.00 to 1.10 031.00 to 1.10 03

below 1.00 00 below 1.00 00

Continue..Continue..

D/E ratioD/E ratio

3.0 and below 103.0 and below 10

above 3.00 and upto 4.00 08above 3.00 and upto 4.00 08

Above 4.00 and upto 5.00 05Above 4.00 and upto 5.00 05

Above 5.00 00 Above 5.00 00

Continue Continue

Sales Sales increasing trendincreasing trendAchievement more than 90% 05Achievement more than 90% 05Achievement between 75% and 90% 03Achievement between 75% and 90% 03Achievement less than 75% 02Achievement less than 75% 02 Tangible net worthTangible net worth increasing trend for last 3 yrs 03increasing trend for last 3 yrs 03 stangant 01stangant 01 decreasing 00 decreasing 00

Continue ..Continue ..

PARAMETERS SCORE PARAMETERS SCORE II Information systemII Information systema. various statements a. various statements Timely submission 03Timely submission 03 delayed upto 30 days 01delayed upto 30 days 01 non submission 00non submission 00b.Renewal datab.Renewal data timely submission 06timely submission 06 delayed 03delayed 03Non submission 00Non submission 00

Continue..Continue..

III financial discipline III financial discipline

prompt compliance 06prompt compliance 06

Delayed 03Delayed 03

Non 00Non 00

Continue..Continue..

Credit rating aggregate scoreCredit rating aggregate score

AAA 50 and aboveAAA 50 and above

AA 40 to 49AA 40 to 49

A 30 to 39A 30 to 39

B Below 30 B Below 30

CRISIL RATING SYMBOLSCRISIL RATING SYMBOLS

High investment gradeHigh investment gradeAAA-Highest securityAAA-Highest securityAA-High safetyAA-High safety

Investment gradeInvestment gradeA- Adequate safetyA- Adequate safetyBBB-Moderate safetyBBB-Moderate safety

Continue..Continue..

Speculative gradeSpeculative gradeBB-Inadequate safetyBB-Inadequate safetyB-High riskB-High riskC-Substantial riskC-Substantial riskD -DefaultD -Default

THANK YOU …..THANK YOU …..

![ACHIEVING OPERATIONAL EXCELLENCE AND …eprints.dinus.ac.id/14398/1/[Materi]_laudon_-_management... · Cannondale Belajar Mengelola Rantai Pasokan Global ... and tracking direct-marketing](https://static.fdocuments.in/doc/165x107/5a73e1497f8b9a9c548b7fdf/achieving-operational-excellence-and-materilaudon-management-cannondale.jpg)