2024428-Country-Risk-Analysis.ppt

-

Upload

lehoangthuchien -

Category

Documents

-

view

21 -

download

1

Transcript of 2024428-Country-Risk-Analysis.ppt

-

Multinational Finance Chapter 6: Country Risk AnalysisAlon RavivFIN-763, Spring 2008Boston University, The Metropolitan College

FIn 763: Lecture 2

-

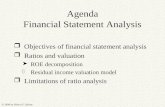

Todays plan

PART 1: THE MEASUREMENT OF POLITICAL RISKThe consequences of political riskQuantitative measures to evaluate Political StabilityEconomic FactorsSubjective Factors

PART II. ECONOMIC AND POLITICAL FACTORSEconomic and Political FactorsPrimary focus: How well is the country doing economically?

PART III. COUNTRY RISK ANALYSIS IN INTERNATIONAL BANKING

FIn 763: Lecture 2

-

PART I. THE MEASUREMENT OF POLITICAL RISKI. MEASURING POLITICAL RISKA. The consequences of political risk:

1. Expropriation 2. Currency or trade controls 3. Changes in tax 4. Changes in labor laws 5. Regulatory restrictions 6. Requirement for additional local production

Common denominator:Government intervention into the working of the economy that affect for good or ill the value of the firm

FIn 763: Lecture 2

-

THE MEASUREMENT OF POLITICAL RISKB.Quantitative measures to evaluate Political Stability 1. Measured by:a.Frequency of government changesb.Level of violencec.Number of armed insurrectionsd.Conflict with other states

FIn 763: Lecture 2

-

THE MEASUREMENT OF POLITICAL RISKC. Economic Factors1.Indicators of political unresta.Rampant inflationb.Balance of payment deficitsc.Slowed growth of per capita GDP

All this factors determine weather the economy is in good shape or requires a quick fix, such as expropriation to increase government revenues or currency inconvertibility to improve the balance of payments.

FIn 763: Lecture 2

-

THE MEASUREMENT OF POLITICAL RISKSubjective FactorsProfit Opportunity Recommendation: done by a panel of experts Political Risk and Uncertain Property Rights: Determine the general perception of the countrys attitude toward private enterprise Capital FlightDefinition: the export of savings by a nations citizens because of safety-of-capital fears. Measurement: use the balance-of- payment account

FIn 763: Lecture 2

-

THE MEASUREMENT OF POLITICAL RISKCauses of capital flightInappropriate economic policies Expectation of devaluationHigh political risk (Hong Kong 1997)The importance of capital flight as a measure: If the local citizens do not trust the government, then investment there is unsafe.

FIn 763: Lecture 2

-

THE MEASUREMENT OF POLITICAL RISKWhat is needed to halt capital flight?Cutting budget deficitsCutting taxesRemoving barrier to investments by foreignersSelling state owned enterprisesAvoiding currency over valuation

FIn 763: Lecture 2

-

THE MEASUREMENT OF POLITICAL RISK

FIn 763: Lecture 2

-

PART II. ECONOMIC AND POLITICAL FACTORSII. Economic and Political Factors Primary focus: How well is the country doing economically?A. Fiscal Irresponsibility The government deficit as a percentage of gross domestic product: the higher this figure, the more the government is promising to its citizens relative to its resources high government deficits lowers the possibility that the government can meet its promises without resorting to:Expropriation of property: Capital flight and dry up new investments.Raising taxes: affect incentive to work, save and take risksPrinting money: monetary instability, high inflation, high interest rates and currency depreciation

FIn 763: Lecture 2

-

PART II. ECONOMIC AND POLITICAL FACTORSB. Monetary instability Inflation is the logical outcome of expansion of the money supply in excess of real output growth. Expansion in the money supply is typical to large government deficits that the central bank monetizes (the example of Zimbabwe

FIn 763: Lecture 2

-

PART II. ECONOMIC AND POLITICAL FACTORSC. Controlled Exchange Rate SystemCurrency control is used to fix the exchange rate.Goes hand with hand with an overvalued local currency (equivalent of taxing exports and subsidizing imports)The risk of tighter currency controls and the treat of devaluation encourage capital flightLeaves the economy with little flexibility to respond to changing relative prices and wealth positions

FIn 763: Lecture 2

-

PART II. ECONOMIC AND POLITICAL FACTORSD. Wasteful Government Spendinginability to service foreign debt E. Resource baseConsists of: Natural, human and financial resources lack of strong work ethicA highly skilled productive workers: ScientistEngineersManagement talent

FIn 763: Lecture 2

-

ECONOMIC AND POLITICAL FACTORSE.Country Risk and Adjustment to External Shocks1.What are the impacts of external shocks:- how well a nation responds varies

FIn 763: Lecture 2

-

ECONOMIC AND POLITICAL FACTORSKey Indicators of Country RiskRelative size of government (debt as % of GDP)Money expansionSubstantial government expenditures yielding low rate of return.Price controls, interest rate ceiling, trade restrictions rigid labor laws and other imposed barriers to market forces that made by the governmentLevel of tax ratsAmount of government-owned firmsAmount and extend of corruption.Political and fiscal responsibility

FIn 763: Lecture 2

-

ECONOMIC AND POLITICAL FACTORS3. Key indicators of economic healtha. Structural incentivesb.Legal structurec.Clear incentives to saved.Open economye.Stable macroeconomic policies

FIn 763: Lecture 2

-

PART III. COUNTRY RISK ANALYSIS IN INTERNATIONAL BANKINGCountry Risk and the Terms of TradeWhat ultimately determines a nations ability to repay foreign loans? - Its ability to generate U.S dollars and other hard currencies which based on a nations terms of trade. When the terms improved foreign goods becomes relatively less expensive and the standard of living rises and consumers and business become more dependent on imports- the speed of adjustment

FIn 763: Lecture 2

-

COUNTRY RISK ANALYSIS IN INTERNATIONAL BANKINGII. The Governments Cost/Benefit Calculus- debt to wealth ratio- cost of default: the likelihood of being cut off from international creditA bailout decision: depend on the : - nations geopolitical importance to the US - The probability that the necessary adjustment will result in unacceptable political turmoil -fluctuations in the terms of trade depends on- degree of product diversification

FIn 763: Lecture 2

-

COUNTRY RISK ANALYSIS IN INTERNATIONAL BANKINGLessons from the International Debt Crisis of 1982

The crises began in Aug 1982, when Mexico announced that it was not able to met its regulatory scheduled payments to international creditors. The crises began in Aug 1982, when Mexico announced that it was not able to met its regulatory scheduled payments to international creditors. Soon Argentina and Brazil found themselves in a similar situationEconomic reforms that work:Strong head of stateViable economic planCompetent economic teamSupport at the topSell the program to all levels of society

FIn 763: Lecture 2

-

Quiz-11. One good indicator of political risk isa.the seriousness of capital flightb.the level of local interest ratesc.the level of local tax ratesd.a large middle class population

FIn 763: Lecture 2

-

Quiz-2: key indicators of country riskThe states best strategy is to provide basic _________ in order to promote economic growth.health care serviceslifelong pensions for its workerseconomic and political stabilitynatural resources

FIn 763: Lecture 2

-

Quiz-3: key indicators of country riskThe economic experiences of Mexico, Chile, and Argentina in the recent past show that they all possessed a_________.a political party system of many factionsa loosely drawn economic plan that is allowed to evolve over timea political lead who is more of a manager than a leadera head of state who demonstrates strong will and leadership

FIn 763: Lecture 2

-

Quiz-4: capital flightTo halt capital flight, which one of the following would NOT be a constructive measure governments may take? a.cutting budget deficits b.impose comprehensive capital controls c.sell off stateowned enterprises d.allowing for freer trade

FIn 763: Lecture 2

-

Quiz-5: Measuring political riskWhich one of the following is NOT a form of direct political risk to the multinational corporation?currency controlsprivatization of public utilitieschanges in tax or labor lawsregulatory restrictions

FIn 763: Lecture 2

-

Quiz-6: Measuring political riskDuring the 1980s many Latin American countries believed in a policy that economic growth was best promoted by extensive state ownership which led to capital flightincreased growth in GDPrampant deflationsimport subsidies

FIn 763: Lecture 2

-

Statistical ModelsCommonly used economic ratios:Debt service ratio: (Interest + amortization on debt)/ExportsImport ratio: Total imports / Total FX reservesInvestment ratio: Real investment / GNPVariance of export revenueDomestic money supply growth**

FIn 763: Lecture 2

-

The Supervisor of Banking Attitude to Country RiskThe Office of the Comptroller of the Currency

Board of Governors of the Federal Reserve System Federal Deposit Insurance Corporation

FIn 763: Lecture 2

-

Definition of country risk"country risk" -- the risk that economic, social, and political conditions and events in a foreign country will adversely affect an institution's financial interests. The adverse effect that deteriorating economic conditions and political and social unrest may have on the rate of default by obligors in a country. Country risk includes the possibility of: nationalization or expropriation of assets government repudiation of external indebtednessexchange controlscurrency depreciation or devaluation.

FIn 763: Lecture 2

-

Elements of an Effective Country Risk Management ProcessA sound country risk management process includes: Effective oversight by the board of directors, Adequate risk management policies and procedures An accurate system for reporting country exposures An effective process for analyzing country risk A country risk rating system Established country exposure limits Regular monitoring of country conditions Periodic stress testing of foreign exposuresAdequate internal controls and audit function.

FIn 763: Lecture 2

-

Policies and Procedures for Managing Country RiskBank management is responsible for implementing sound, well-defined policies and procedures for managing country risk that: Establish risk tolerance limits; Delineate clear lines of responsibility and accountability for country risk management decisions; Specify authorized activities, investments and instruments; and Identify both desirable and undesirable types of business.Management should also ensure that country risk management policies, standards and practices are clearly communicated to the affected offices and staff

FIn 763: Lecture 2

-

Country Exposure Reporting System To effectively manage country risk, the institution must have a reliable system for capturing and categorizing the volume and nature of foreign exposures The board of directors should regularly receive reports on the level of foreign exposures. If the level of foreign exposures in an institution is significant,If a country to which the institution is exposed is considered to be high risk, exposures should be reported to the board at least quarterly. More frequent reporting is appropriate when a deterioration in foreign exposures would threaten the soundness of the institution.

FIn 763: Lecture 2

-

Country Risk RatingsCountry risk ratings summarize the conclusions of the country risk analysis process. The ratings provide a framework for establishing country exposure limits that reflect the institution's tolerance for risk.

FIn 763: Lecture 2

-

Country Exposure Limitsinstitutions should adopt a system of country exposure limits. Because the limit-setting process often involves divergent interests within the institution (such as the country managers, the institution's overall country risk manager, and the country risk committee), country risk limits will usually reflect a balancing of several considerations, including:The overall strategy guiding the institution's international activities; The country's risk rating and the institution's appetite for risk Perceived business opportunities in the countryThe desire to support the international business needs of domestic customers.

FIn 763: Lecture 2

-

Stress TestingInstitutions should periodically stress-test their foreign exposures and report the results to the board of directors and senior management. Stress testing does not necessarily refer to the use of sophisticated financial modeling tools, but rather to the need for all institutions to evaluate in some way the potential impact of different scenarios on their country risk profiles.

FIn 763: Lecture 2

-

Factors Affecting Country RiskMacroeconomic FactorsThe first of these factors is the size and structure of the country's external debt in relation to its economy. More specifically: The current level of short-term debt and the potential effect that a liquidity crisis would have on the ability of otherwise creditworthy borrowers in the country to continue servicing their obligations. To the extent the external debt is owed by the public sector, the ability of the government to generate sufficient revenues, from taxes and other sources, to service its obligations.

FIn 763: Lecture 2

-

Social, Political and Legal ClimateThe analysis of country risk should also take into consideration the country's social, political and legal climate, including:The country's natural and human resource potential. The willingness and ability of the government to recognize economic or budgetary problems and implement appropriate remedial action. The degree to which political or regional factionalism or armed conflicts are adversely affecting government of the country. Any trends toward government-imposed price, interest rate, or exchange controls. The degree to which the country's legal system can be relied upon to fairly protect the interests of foreign creditors and investors. The accounting standards in the country and the reliability and transparency of financial information. The extent to which the country's laws and government policies protect parties in electronic transactions and promote the development of technology in a safe and sound manner.

FIn 763: Lecture 2

-

What Factors do Ratings include? Standard & Poors and Moodys are the two largest rating agencies. Other agencies: Duff & Phelps, Fitch, Political Risk Services, Beri S&P concentrates on 8 categories to come up with their ratingsEach of this categories is related to the two major sources of risk: economic and political risk

FIn 763: Lecture 2

-

What Factors do Ratings include? Standard & Poors and Moodys are the two largest rating agencies. Other agencies: Duff & Phelps, Fitch, Political Risk Services, Beri S&P concentrates on 8 categories to come up with their ratingsEach of this categories is related to the two major sources of risk: economic and political risk

FIn 763: Lecture 2

-

Sovereign Ratings Methodology ProfilePolitical RiskIncome and Economic StructureEconomic Growth ProspectsFiscal FlexibilityPublic Debt BurdenPrice StabilityBalance of Payments FlexibilityExternal Debt and Liquidity

FIn 763: Lecture 2

-

FIn 763: Lecture 2

-

Sovereign Credit Ratings

S&PMoodysAAAAaaHighest qualityAAAaHigh qualityAAStrong payment capacityBBBBaaAdequate payment capacityBBBaLikely to fullfill obligations,uncertainBBHigh-risk obligationsCCCCaaCCCaCCDDDefault

Invest-ment-grade

Specu-lative-gradeJunk bonds

-

Major ImpactsSignalling: refers to providing new information to the market to lower cost of capitalCertification:refers to eligibility with regard to portfolio standards issued by public regulatorsImportance of splitting ratings intoinvestment gradespeculative grade: junk bonds

FIn 763: Lecture 2

-

Sovereign Ratings: Impact on Capital Flows and Other Rated InstitutionsInternational pool of investors: private capital inflows - liquidity Usually, no corporation higher rated than sovereignAgencies: all entities are influenced by same macroeconomic situationPressure on corporations ability to raise money

FIn 763: Lecture 2

-

Sovereign Ratings: Basic ConsiderationsTwo-way causualityRatings influence spreads and vice versaAnticipation versus ReactionAre ratings able to anticipate financial crises or do they just react on changed indicators?Reinforcement of business cyclesInformation processing into one figure: Are agencies able to process more information than the market?

FIn 763: Lecture 2

-

Can Sovereign Ratings Anticipate Financial Crises?Response mixedAsian Crises (97/98): no anticipation by ratings: reluctant graduate downrating but after begin of crisis drops to junk-bond status

FIn 763: Lecture 2

-

Sovereign Ratings: Argentina

FIn 763: Lecture 2

Date

Local Currency Rating

Long Term/Outlook/Short-Term

Foreign Currency Rating

Long Term/Outlook/Short Term

06.11.01

SD/Not Meaningful/C

SD/Not Meaningful/C

30.10.01

CC/Negative/C

CC/ Negative/C

09.10.01

CCC+/Negative/C

CCC+/Negative/C

12.07.01

B-/Negative/C

B-/Negative/C

06.06.01

B/Negative/C

B/Negative/C

08.05.01

B/CW Neg./C

B/CW Neg./C

26.03.01

B+/CW Neg./B

B+/CW Neg./B

19.03.01

BB/CW Neg./B

BB-/CW Neg./B

14.11.00

BB/Stable/B

BB-/Stable/B

31.10.00

BBB-/CW-Neg./A-3

BB/CW-Neg./B

10.02.00

BBB-/Stable/A-3

BB/Stable/B

22.07.99

BBB-/Negative/A-3

BB/Negative/B

Source: Standard & Poors

-

Differences Between Sovereign and Corporate RatingsInformation Publicly available versus private informationPolitical riskWillingness to repayAbsence of a supranational regulating bodyImportance of non-quantitative factors in assessing country risk (Emerging markets!)Crises

FIn 763: Lecture 2

-

Sovereign RatingAfricaAsiaEuropeMid EastAmericasA1AustraliaSwitzerlandCanadaUKA2BotswanaHK JapanGermanyKuwaitUSAS. KoreaItalyUAEA3MauritiusChinaCyprusIsraelChileNamibiaThailandCzech RepTrinidadA4Egypt IndiaLatviaSaudi MexicoS. AfricaPhilippinesPoland ArabiaPanamaBAlgeriaBangladeshSlovakiaEgyptBrazil PeruUgandaSri LankaRussiaJordanVenezuelaCCongoIndonesiaAzerbaijanIran SyriaHaitiKenya VietnamRomaniaTurkeyJamaicaDNigeriaAfghanistanAlbaniaIraqArgentinaSudanN. KoreaUkraineCubaZimbabwePakistanYugoslaviaEcuador

FIn 763: Lecture 2

-

Credit Spread as a measure for country risk

One convenient measure of country risk is provided by yields on sovereign debt. The difference in the yields on the public debt of two countries reflects a country risk premium

FIn 763: Lecture 2

-

Country or Sovereign Risk

FIn 763: Lecture 2

Sovereign Debt Spread over U.S. Treasury Securities

Country

Spread

(basis points)

Country

Spread

(basis points)

China

138

Mexico

441

Russia

188

Indonesia

539

Philippines

226

Brazil

1151

South Africa

254

Venezuela

1201

Poland

258

Argentina

1581

Uruguay

341

Nigeria

1973

Source : Bloomberg, August 30, 2001

-

Strategies for managing country riskNegotiate the environment with the host country prior to investment

The investment environment:

Taxes Labor issues Concessions Obligations and restrictions Provisions for planned investment divestiture Performance assurances and remedies International arbitration of disputes

FIn 763: Lecture 2

-

Strategies for managing country riskNegotiate the environment with the host country prior to investment

The investment environment

The financial environment

Structure foreign operations to minimize country risk while maximizing return

Obtain political risk insurance

FIn 763: Lecture 2

-

Political risk insuranceInsurable political risks include

Expropriation due to warrevolutioninsurrectioncivil disturbanceterrorism

Currency inconvertibility

FIn 763: Lecture 2

-

Political risk insurersGovernment export credit agenciesU.S. Overseas Private Investment CorporationU.K. Export Credits Guarantee Department

InternationalWorld Bank Multilateral Investment Guarantee Agency

PrivateLloyds of London American International Group (AIG)

FIn 763: Lecture 2

-

Political risk insurance MNCs are self-insured if their risk exposures are diversified across a large number of countries

FIn 763: Lecture 2

-

*Debt-equity swaps

Example: Citibank sells $100 million Chilean loan to Merrill Lynch for $91 million.Merrill Lynch (market maker) sells to IBM at $93 million.Chilean government allows IBM to convert the $100 million face value loan into pesos at a discounted rate to finance investments in Chile.*

FIn 763: Lecture 2

-

The evidence on country risks and investors required returns An increase (decrease) in country risk tends to be followed by a stock market fall (rise)

Countries with high country risk have more volatile returnslower betas (systematic risks)

Claude Erb, Campbell Harvey and Tadas Viskanta,Political Risk, Financial Risk and Economic Risk,Financial Analysts Journal, 1996.

FIn 763: Lecture 2

-

Resources Human development reporthttp://hdr.undp.org/en/statistics/

FIn 763: Lecture 2

-

Resources: S&P Defining Sovereign Defaults Sovereign Ratings Before The interest Equalization Tax Sovereigns' Path To Default Sovereign Ratings History Since 1975

FIn 763: Lecture 2

-

Resources: S&P

FIn 763: Lecture 2

-

S&P Criteria for rating

FIn 763: Lecture 2

-

Moodys Criteria for rating Ten Year Average Cumulative Default RatesAaa 0.7%Aa 0.8%A 1.8%Baa 4.7%Ba 18.4%B 36.7%Investment Grade 2.4%Speculative Grade 24.8%

FIn 763: Lecture 2

-

The BIS Report of the BIS: Bank for international settlements

http://www.bis.org/forum/research.htm

FIn 763: Lecture 2